FIFTH AMENDMENT TO AMENDED AND RESTATED REVOLVING CREDIT AGREEMENT

FIFTH AMENDMENT TO AMENDED AND RESTATED

REVOLVING CREDIT AGREEMENT

REVOLVING CREDIT AGREEMENT

THIS FIFTH AMENDMENT TO AMENDED AND RESTATED REVOLVING CREDIT AGREEMENT (this “Fifth Amendment”) is made as of January 22, 2015 (the “Effective Date”), by and among ESSEX PORTFOLIO, L.P., a California limited partnership (“Borrower”), the lenders which are parties hereto (collectively, “Lenders”) and PNC BANK, NATIONAL ASSOCIATION, as administrative agent under the Credit Agreement (in such capacity, “Administrative Agent”) and L/C Issuer.

BACKGROUND

A. Administrative Agent, Lenders, and Borrower entered into that certain Amended and Restated Revolving Credit Agreement, dated as of September 16, 2011, as amended by that certain First Amendment to Amended and Restated Revolving Credit Agreement, dated as of May 31, 2012, as further amended by that certain Second Amendment to Amended and Restated Revolving Credit Agreement, dated as of August 30, 2012, as further amended by that certain Third Amendment to Amended and Restated Revolving Credit Agreement, dated as of January 22, 2013, and as further amended by that certain Fourth Amendment to Amended and Restated Revolving Credit Agreement, dated as of January 29, 2014 (as so amended, the “Credit Agreement”).

B. Borrower has requested that Lenders and Administrative Agent modify the Credit Agreement to extend the Original Maturity Date. Lenders and Administrative Agent are willing to make such modification to the Credit Agreement, all on the terms and subject to the conditions herein set forth.

NOW, THEREFORE, the parties hereto, intending to be legally bound hereby, agree as follows:

AGREEMENT

1. Terms. Capitalized terms used herein and not otherwise defined herein shall have the meanings given to such terms in the Credit Agreement.

2. Amendments to Credit Agreement. The Credit Agreement is hereby amended as follows:

(a) The definition of “Original Maturity Date” in Article 1 is hereby amended and restated to read in full as follows:

““Original Maturity Date” means December 31, 2018.”

3. Loan Documents. Except where the context clearly requires otherwise, all references to the Credit Agreement in any other Loan Document shall be to the Credit Agreement as amended by this Fifth Amendment.

4. Borrower’s Ratification. Borrower agrees that it has no defenses or set-offs against Lenders or their respective officers, directors, employees, agents or attorneys, with respect to the Loan Documents, all of which are in full force and effect, and that all of the terms and conditions of the Loan Documents not inconsistent herewith shall remain in full force and effect unless and until modified or amended in writing in accordance with their terms. Borrower hereby ratifies and confirms its obligations under the Loan Documents and agrees that the execution and delivery of this Fifth Amendment does not in any way diminish or invalidate any of its obligations thereunder.

5. Guarantor Ratification. Guarantor agrees that it has no defenses or set-offs against Lenders or their respective officers, directors, employees, agents or attorneys, with respect to the Guaranty, which is in full force and effect, and that all of the terms and conditions of the Guaranty not inconsistent herewith shall remain in full force and effect unless and until modified or amended in writing in accordance with their terms. Guarantor hereby ratifies and confirms its obligations under the Guaranty and agrees that the execution and delivery of this Fifth Amendment does not in any way diminish or invalidate any of its obligations thereunder.

6. Representations and Warranties. Borrower hereby represents and warrants to Lenders that:

(a) The representations and warranties made in the Credit Agreement, as amended by this Fifth Amendment, are true and correct in all material respects as of the date hereof;

(b) After giving effect to this Fifth Amendment, no Default or Event of Default under the Credit Agreement or the other Loan Documents exists on the date hereof;

(c) This Fifth Amendment has been duly authorized, executed and delivered by Borrower so as to constitute the legal, valid and binding obligations of Borrower, enforceable in accordance with its terms, except as the same may be limited by insolvency, bankruptcy, reorganization or other laws relating to or affecting the enforcement of creditors’ rights or by general equitable principles;

(d) The Joinder Pages to this Fifth Amendment have been duly authorized, executed and delivered by Guarantor; and

(e) No material adverse change in the business, assets, operations, condition (financial or otherwise) or prospects of Borrower, Guarantor or any of their subsidiaries or Affiliates has occurred since the date of the last financial statements of the afore-mentioned entities which were delivered to Administrative Agent.

All of the above representations and warranties shall survive the making of this Fifth Amendment.

2

7. Conditions Precedent. The effectiveness of the amendments set forth herein is subject to the fulfillment, to the satisfaction of Administrative Agent and its counsel, of the following conditions precedent:

(a) Borrower shall have delivered to Administrative Agent the following, all of which shall be in form and substance satisfactory to Administrative Agent and shall be duly completed and executed (as applicable):

(i) This Fifth Amendment;

(ii) Evidence that the execution, delivery and performance by Borrower and Guarantor, as the case may be, of this Fifth Amendment have been duly authorized by Borrower and Guarantor, as the case may be, and that this Fifth Amendment has been duly executed and delivered by Responsible Officers of Borrower and Guarantor, as the case may be; and

(iii) Such additional documents, certificates, opinions and information as Administrative Agent may require pursuant to the terms hereof or otherwise reasonably request.

(b) The representations and warranties set forth in the Credit Agreement shall be true and correct in all material respects on and as of the date hereof.

(c) After giving effect to this Fifth Amendment, no Default or Event of Default shall have occurred and be continuing as of the date hereof.

(d) Borrower shall have paid to Administrative Agent all costs and expenses of Administrative Agent in connection with preparing and negotiating this Fifth Amendment, including, but not limited to, reasonable attorneys’ fees and costs.

8. Miscellaneous.

(a) All terms, conditions, provisions and covenants in the Loan Documents and all other documents delivered to Administrative Agent in connection therewith shall remain unaltered and in full force and effect except as modified or amended hereby. To the extent that any term or provision of this Fifth Amendment is or may be deemed expressly inconsistent with any term or provision in any Loan Document or any other document executed in connection therewith, the terms and provisions hereof shall control.

(b) Except as expressly provided herein, the execution, delivery and effectiveness of this Fifth Amendment shall neither operate as a waiver of any right, power or remedy of Administrative Agent or Lenders under any of the Loan Documents nor constitute a waiver of any Default or Event of Default thereunder.

(c) This Fifth Amendment constitutes the entire agreement of the parties with respect to the subject matter hereof and supersedes all prior and contemporaneous understandings and agreements.

3

(d) In the event any provisions of this Fifth Amendment shall be held invalid or unenforceable by any court of competent jurisdiction, such holding shall not invalidate or render unenforceable any other provision hereof.

(e) This Fifth Amendment shall be governed by and construed according to the laws of the State of California, without giving effect to any of its choice of law rules.

(f) This Fifth Amendment shall inure to the benefit of, and be binding upon, the parties hereto and their respective successors and assigns and may be executed in one or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

(g) The headings used in this Fifth Amendment are for convenience of reference only, do not form a part of this Fifth Amendment and shall not affect in any way the meaning or interpretation of this Fifth Amendment.

[Signatures commence on the next page]

4

IN WITNESS WHEREOF, Borrower, Administrative Agent and Lenders have caused this Fifth Amendment to be executed by their duly authorized officers as of the date first above written.

ESSEX PORTFOLIO, L.P.,

a California limited partnership

a California limited partnership

[Signatures Continue on the Next Page]

[Signature Page to Fifth Amendment to Amended and Restated Credit Agreement]

DMEAST #20754808

[Signatures Continue on the Next Page]

[Signature Page to Fifth Amendment to Amended and Restated Credit Agreement]

DMEAST #20754808

[Signatures Continue on the Next Page]

[Signature Page to Fifth Amendment to Amended and Restated Credit Agreement]

DMEAST #20754808

[Signatures Continue on the Next Page]

[Signature Page to Fifth Amendment to Amended and Restated Credit Agreement]

DMEAST #20754808

[Signatures Continue on the Next Page]

[Signature Page to Fifth Amendment to Amended and Restated Credit Agreement]

DMEAST #20754808

[Signatures Continue on the Next Page]

[Signature Page to Fifth Amendment to Amended and Restated Credit Agreement]

DMEAST #20754808

CAPITAL ONE, N.A.,

(successor by merger to Chevy Chase Bank, F.S.B.), as Lender

[Signatures Continue on the Next Page]

[Signature Page to Fifth Amendment to Amended and Restated Credit Agreement]

DMEAST #00000000

BANK OF THE WEST,

as Lender

as Lender

[Signatures Continue on the Next Page]

[Signature Page to Fifth Amendment to Amended and Restated Credit Agreement]

DMEAST #20754808

XXXXX FARGO BANK, NATIONAL ASSOCIATION,

as Lender

as Lender

[Signatures Continue on the Next Page]

[Signature Page to Fifth Amendment to Amended and Restated Credit Agreement]

DMEAST #00000000

BANK OF MONTREAL, as Lender

[Signatures Continue on the Next Page]

[Signature Page to Fifth Amendment to Amended and Restated Credit Agreement]

DMEAST #00000000

CITIBANK, N.A., as Lender

[Signatures Continue on the Next Page]

[Signature Page to Fifth Amendment to Amended and Restated Credit Agreement]

DMEAST #00000000

HSBC BANK USA, N.A., as Lender

[Signatures Continue on the Next Page]

[Signature Page to Fifth Amendment to Amended and Restated Credit Agreement]

DMEAST #20754808

JPMORGAN CHASE BANK, N.A., as Lender

[Signatures Continue on the Next Page]

[Signature Page to Fifth Amendment to Amended and Restated Credit Agreement]

DMEAST #20754808

CITY NATIONAL BANK, a national banking association,

as Lender

as Lender

[Signatures Continue on the Next Page]

[Signature Page to Fifth Amendment to Amended and Restated Credit Agreement]

DMEAST #20754808

[Signatures Continue on the Next Page]

[Signature Page to Fifth Amendment to Amended and Restated Credit Agreement]

DMEAST #00000000

BRANCH BANKING AND TRUST COMPANY, as Lender

[Signatures Continue on the Next Page]

[Signature Page to Fifth Amendment to Amended and Restated Credit Agreement]

DMEAST #20754808

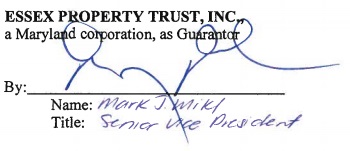

JOINDER PAGE

Essex Property Trust, Inc., a Maryland corporation, as the “Guarantor” under the Credit Agreement hereby joins in the execution of this Fifth Amendment to make the affirmations set forth in Section 5 of this Fifth Amendment and to evidence its agreement to be bound by the terms and conditions of this Fifth Amendment applicable to it. The party executing this Joinder Page on behalf of Guarantor has the requisite power and authority, and has been duly authorized, to execute this Joinder Page on behalf of Guarantor.

DMEAST #20754808