Excess Catastrophe Reinsurance Contract Effective: July 1, 2019 FedNat Insurance Company Sunrise, Florida and Monarch National Insurance Company Sunrise, Florida and Maison Insurance Company Baton Rouge, Louisiana _______________________ Certain...

Excess Catastrophe Reinsurance Contract Effective: July 1, 2019 FedNat Insurance Company Sunrise, Florida and Monarch National Insurance Company Sunrise, Florida and Maison Insurance Company Baton Rouge, Louisiana _______________________ Certain identified information has been omitted from this exhibit because it is not material and would be competitively harmful if publicly disclosed. Redactions are indicated by [***]. 19\F7V1099

Table of Contents Article Page 1 Classes of Business Reinsured 1 2 Commencement and Termination 1 3 Territory 2 4 Exclusions 3 5 Retention and Limit 4 6 Florida Hurricane Catastrophe Fund 5 7 Other Reinsurance 5 8 Reinstatement 6 9 Definitions 6 10 Loss Occurrence 8 11 Loss Notices and Settlements 10 12 Cash Call 10 13 Salvage and Subrogation 10 14 Reinsurance Premium 10 15 Sanctions 11 16 Late Payments 11 17 Offset 13 18 Severability of Interests and Obligations 13 19 Access to Records 14 20 Liability of the Reinsurer 14 21 Net Retained Lines (BRMA 32E) 14 22 Errors and Omissions (BRMA 14F) 14 23 Currency (BRMA 12A) 15 24 Taxes (BRMA 50B) 15 25 Federal Excise Tax (BRMA 17D) 15 26 Foreign Account Tax Compliance Act 15 27 Reserves 15 28 Insolvency 17 29 Arbitration 17 30 Service of Suit (BRMA 49C) 18 31 Severability (BRMA 72E) 19 32 Governing Law (BRMA 71B) 19 33 Confidentiality 19 34 Non-Waiver 20 35 Agency Agreement 20 36 Notices and Contract Execution 21 37 Intermediary 21 Schedule A 19\F7V1099

Excess Catastrophe Reinsurance Contract Effective: July 1, 2019 entered into by and between FedNat Insurance Company Sunrise, Florida and Monarch National Insurance Company Sunrise, Florida and Maison Insurance Company Baton Rouge, Louisiana (hereinafter collectively referred to as the "Company" except to the extent individually referred to) and The Subscribing Reinsurer(s) Executing the Interests and Liabilities Agreement(s) Attached Hereto (hereinafter referred to as the "Reinsurer") Article 1 - Classes of Business Reinsured By this Contract the Reinsurer agrees to reinsure the excess liability which may accrue to the Company under its policies in force at the effective time and date hereof or issued or renewed at or after that time and date, and classified by the Company as Property business, including but not limited to, Dwelling Fire, Inland Marine, Mobile Home, Commercial and Homeowners business (including any business assumed from Citizens Property Insurance Corporation), subject to the terms, conditions and limitations set forth herein and in Schedule A attached hereto. Article 2 - Commencement and Termination A. This Contract shall become effective at 12:01 a.m., Eastern Standard Time, July 1, 2019, with respect to losses arising out of loss occurrences commencing at or after that time and date, and shall remain in force until 12:01 a.m., Eastern Standard Time, July 1, 2020. B. Notwithstanding the provisions of paragraph A above, the Company may terminate a Subscribing Reinsurer's percentage share in this Contract at any time by giving written notice to the Subscribing Reinsurer in the event any of the following circumstances occur: 1. The Subscribing Reinsurer's A.M. Best's rating has been assigned or downgraded below A- and/or Standard & Poor's rating has been assigned or downgraded below BBB+; or 19\F7V1099 Page 1 [A]

2. The Subscribing Reinsurer has become, or has announced its intention to become, merged with, acquired by or controlled by any other entity or individual(s) not controlling the Subscribing Reinsurer's operations previously; or 3. A State Insurance Department or other legal authority has ordered the Subscribing Reinsurer to cease writing business; or 4. The Subscribing Reinsurer has become insolvent or has been placed into liquidation, receivership, supervision, administration, winding-up or under a scheme of arrangement, or similar proceedings (whether voluntary or involuntary) or proceedings have been instituted against the Subscribing Reinsurer for the appointment of a receiver, liquidator, rehabilitator, supervisor, administrator, conservator or trustee in bankruptcy, or other agent known by whatever name, to take possession of its assets or control of its operations; or 5. The Subscribing Reinsurer has reinsured its entire liability under this Contract without the Company's prior written consent; or 6. The Subscribing Reinsurer has ceased assuming new or renewal property or casualty treaty reinsurance business; or 7. The Subscribing Reinsurer has hired an unaffiliated runoff claims manager that is compensated on a contingent basis or is otherwise provided with financial incentives based on the quantum of claims paid; or 8. The Subscribing Reinsurer has failed to comply with the funding requirements set forth in the Reserves Article. C. The "term of this Contract" as used herein shall mean the period from 12:01 a.m., Eastern Standard Time, July 1, 2019 to 12:01 a.m., Eastern Standard Time, July 1, 2020. However, if this Contract is terminated, the "term of this Contract" as used herein shall mean the period from 12:01 a.m., Eastern Standard Time, July 1, 2019 to the effective time and date of termination. D. If this Contract is terminated or expires while a loss occurrence covered hereunder is in progress, the Reinsurer's liability hereunder shall, subject to the other terms and conditions of this Contract, be determined as if the entire loss occurrence had occurred prior to the termination or expiration of this Contract, provided that no part of such loss occurrence is claimed against any renewal or replacement of this Contract. Article 3 - Territory The territorial limits of this Contract shall be identical with those of the Company's policies. 19\F7V1099 Page 2 [A]

connected thereto, including Declaratory Judgment Expense; and d) expenses and a pro rata share of salaries of the Company field employees, and expenses of other Company employees who have been temporarily diverted from their normal and customary duties and assigned to the field adjustment of losses covered by this Contract. Loss adjustment expense as defined above does not include unallocated loss adjustment expense. Unallocated loss adjustment expense includes, but is not limited to, salaries and expenses of employees, other than in (d) above, and office and other overhead expenses. B. "Loss in excess of policy limits" and "extra contractual obligations" as used in this Contract shall mean: 1. "Loss in excess of policy limits" shall mean 90.0% of any amount paid or payable by the Company in excess of its policy limits, but otherwise within the terms of its policy, such loss in excess of the Company's policy limits having been incurred because of, but not limited to, failure by the Company to settle within the policy limits or by reason of the Company's alleged or actual negligence, fraud or bad faith in rejecting an offer of settlement or in the preparation of the defense or in the trial of an action against its insured or reinsured or in the preparation or prosecution of an appeal consequent upon such an action. Any loss in excess of policy limits that is made in connection with this Contract shall not exceed 25.0% of the actual catastrophe loss. 2. "Extra contractual obligations" shall mean 90.0% of any punitive, exemplary, compensatory or consequential damages paid or payable by the Company, not covered by any other provision of this Contract and which arise from the handling of any claim on business subject to this Contract, such liabilities arising because of, but not limited to, failure by the Company to settle within the policy limits or by reason of the Company's alleged or actual negligence, fraud or bad faith in rejecting an offer of settlement or in the preparation of the defense or in the trial of an action against its insured or reinsured or in the preparation or prosecution of an appeal consequent upon such an action. An extra contractual obligation shall be deemed, in all circumstances, to have occurred on the same date as the loss covered or alleged to be covered under the policy. Any extra contractual obligations that are made in connection with this Contract shall not exceed 25.0% of the actual catastrophe loss. Notwithstanding anything stated herein, this Contract shall not apply to any loss in excess of policy limits or any extra contractual obligation incurred by the Company as a result of any fraudulent and/or criminal act by any officer or director of the Company acting individually or collectively or in collusion with any individual or corporation or any other organization or party involved in the presentation, defense or settlement of any claim covered hereunder. C. "Policies" as used in this Contract shall mean all policies, contracts and binders of insurance or reinsurance. D. "Ultimate net loss" as used in this Contract shall mean the sum or sums (including loss in excess of policy limits, extra contractual obligations and loss adjustment expense, as defined herein) paid or payable by the Company in settlement of claims and in satisfaction of judgments rendered on account of such claims, after deduction of all salvage, all recoveries and all claims on inuring insurance or reinsurance, whether collectible or not. 19\F7V1099 Page 7 [A]

municipalities or counties contiguous thereto arising out of and directly occasioned by the same event. The maximum duration of 96 consecutive hours may be extended in respect of individual losses which occur beyond such 96 consecutive hours during the continued occupation of an assured's premises by strikers, provided such occupation commenced during the aforesaid period. 4. As regards earthquake (the epicenter of which need not necessarily be within the territorial confines referred to in the introductory portion of this paragraph) and fire following directly occasioned by the earthquake, only those individual fire losses which commence during the period of 168 consecutive hours may be included in the Company's loss occurrence. 5. As regards freeze, only individual losses directly occasioned by collapse, breakage of glass and water damage (caused by bursting frozen pipes and tanks) may be included in the Company's loss occurrence. 6. As regards firestorms, brush fires and any other fires or series of fires, irrespective of origin (except as provided in subparagraphs 3 and 4 above), all individual losses sustained by the Company which commence during any period of 168 consecutive hours within the area of one state of the United States or province of Canada and states or provinces contiguous thereto and to one another may be included in the Company's loss occurrence. B. For all loss occurrences hereunder, the Company may choose the date and time when any such period of consecutive hours commences, provided that no period commences earlier than the date and time of the occurrence of the first recorded individual loss sustained by the Company arising out of that disaster, accident, or loss or series of disasters, accidents, or losses. Furthermore: 1. For all loss occurrences other than those referred to in subparagraphs A.1., A.2., and A.3. above, only one such period of 168 consecutive hours shall apply with respect to one event. 2. As regards those loss occurrences referred to in subparagraphs A.1. and A.2., only one such period of consecutive hours (as set forth therein) shall apply with respect to one event, regardless of the duration of the event. 3. As regards those loss occurrences referred to in subparagraph A.3. above, if the disaster, accident, or loss or series of disasters, accidents, or losses occasioned by the event is of greater duration than 96 consecutive hours, then the Company may divide that disaster, accident, or loss or series of disasters, accidents, or losses into two or more loss occurrences, provided that no two periods overlap and no individual loss is included in more than one such period. C. It is understood that losses arising from a combination of two or more perils as a result of the same event may be considered as having arisen from one loss occurrence. Notwithstanding the foregoing, the hourly limitations as stated above shall not be exceeded as respects the applicable perils, and no single loss occurrence shall encompass a time period greater than 168 consecutive hours, except as regards those loss occurrences referred to in subparagraphs A.1., A.4. and A.6. above. 19\F7V1099 Page 9 [A]

B. In the event any premium, loss or other payment due either party is not received by the intermediary named in the Intermediary Article (hereinafter referred to as the "Intermediary") by the payment due date, the party to whom payment is due may, by notifying the Intermediary in writing, require the debtor party to pay, and the debtor party agrees to pay, an interest charge on the amount past due calculated for each such payment on the last business day of each month as follows: 1. The number of full days which have expired since the due date or the last monthly calculation, whichever the lesser; times 2. 1/365ths of the six-month United States Treasury Bill rate as quoted in The Wall Street Journal on the first business day of the month for which the calculation is made; times 3. The amount past due, including accrued interest. It is agreed that interest shall accumulate until payment of the original amount due plus interest charges have been received by the Intermediary. C. The establishment of the due date shall, for purposes of this Article, be determined as follows: 1. As respects the payment of routine deposits and premiums due the Reinsurer, the due date shall be as provided for in the applicable section of this Contract. In the event a due date is not specifically stated for a given payment, it shall be deemed due 30 days after the date of transmittal by the Intermediary of the initial billing for each such payment. 2. Any claim or loss payment due the Company hereunder shall be deemed due 10 days after the proof of loss or demand for payment is transmitted to the Reinsurer. If such loss or claim payment is not received within the 10 days, interest will accrue on the payment or amount overdue in accordance with paragraph B above, from the date the proof of loss or demand for payment was transmitted to the Reinsurer. 3. As respects a "cash call" made in accordance with the Cash Call Article, payment shall be deemed due 10 days after the demand for payment is transmitted to the Reinsurer. If such loss or claim payment is not received within the 10 days, interest shall accrue on the payment or amount overdue in accordance with paragraph B above, from the date the demand for payment was transmitted to the Reinsurer. 4. As respects any payment, adjustment or return due either party not otherwise provided for in subparagraphs 1, 2, and 3 of this paragraph C, the due date shall be as provided for in the applicable section of this Contract. In the event a due date is not specifically stated for a given payment, it shall be deemed due 10 days following transmittal of written notification that the provisions of this Article have been invoked. For purposes of interest calculations only, amounts due hereunder shall be deemed paid upon receipt by the Intermediary. D. Nothing herein shall be construed as limiting or prohibiting a Subscribing Reinsurer from contesting the validity of any claim, or from participating in the defense of any claim or suit, 19\F7V1099 Page 12 [A]

unreported from known loss occurrences) (hereinafter referred to as "Reinsurer's Obligations") by: 1. Clean, irrevocable and unconditional letters of credit issued and confirmed, if confirmation is required by the insurance regulatory authorities involved, by a bank or banks meeting the NAIC Securities Valuation Office credit standards for issuers of letters of credit and acceptable to said insurance regulatory authorities; and/or 2. Escrow accounts for the benefit of the Company; and/or 3. Cash advances; if the Reinsurer: 1. Is unauthorized in any state of the United States of America or the District of Columbia having jurisdiction over the Company and if, without such funding, a penalty would accrue to the Company on any financial statement it is required to file with the insurance regulatory authorities involved; or 2. Has an A.M. Best Company's rating equal to or below B++ at the inception of this Contract. The Reinsurer, at its sole option, may fund in other than cash if its method and form of funding are acceptable to the insurance regulatory authorities involved. B. With regard to funding in whole or in part by letters of credit, it is agreed that each letter of credit will be in a form acceptable to insurance regulatory authorities involved, will be issued for a term of at least one year and will include an "evergreen clause," which automatically extends the term for at least one additional year at each expiration date unless written notice of non-renewal is given to the Company not less than 30 days prior to said expiration date. The Company and the Reinsurer further agree, notwithstanding anything to the contrary in this Contract, that said letters of credit may be drawn upon by the Company or its successors in interest at any time, without diminution because of the insolvency of the Company or the Reinsurer, but only for one or more of the following purposes: 1. To reimburse itself for the Reinsurer's share of unearned premiums returned to insureds on account of policy cancellations, unless paid in cash by the Reinsurer; 2. To reimburse itself for the Reinsurer's share of losses and/or loss adjustment expense paid under the terms of policies reinsured hereunder, unless paid in cash by the Reinsurer; 3. To reimburse itself for the Reinsurer's share of any other amounts claimed to be due hereunder, unless paid in cash by the Reinsurer; 4. To fund a cash account in an amount equal to the Reinsurer's share of amounts, including but not limited to, the Reinsurer's Obligations as set forth above, funded by means of a letter of credit which is under non-renewal notice, if said letter of credit has not been renewed or replaced by the Reinsurer 10 days prior to its expiration date; 19\F7V1099 Page 16 [A]

Arbiter shall be chosen by the Company, the other by the Reinsurer, and an Umpire shall be chosen by the two Arbiters before they enter upon arbitration, all of whom shall be active or retired disinterested executive officers of insurance or reinsurance companies or Lloyd's London Underwriters. In the event that either party should fail to choose an Arbiter within 30 days following a written request by the other party to do so, the requesting party may choose two Arbiters who shall in turn choose an Umpire before entering upon arbitration. If the two Arbiters fail to agree upon the selection of an Umpire within 30 days following their appointment, each Arbiter shall nominate three candidates within 10 days thereafter, two of whom the other shall decline, and the decision shall be made by drawing lots. B. Each party shall present its case to the Arbiters within 30 days following the date of appointment of the Umpire. The Arbiters shall consider this Contract as an honorable engagement rather than merely as a legal obligation and they are relieved of all judicial formalities and may abstain from following the strict rules of law. The decision of the Arbiters shall be final and binding on both parties; but failing to agree, they shall call in the Umpire and the decision of the majority shall be final and binding upon both parties. Judgment upon the final decision of the Arbiters may be entered in any court of competent jurisdiction. C. If more than one Subscribing Reinsurer is involved in the same dispute, all such Subscribing Reinsurers shall, at the option of the Company, constitute and act as one party for purposes of this Article and communications shall be made by the Company to each of the Subscribing Reinsurers constituting one party, provided, however, that nothing herein shall impair the rights of such Subscribing Reinsurers to assert several, rather than joint, defenses or claims, nor be construed as changing the liability of the Subscribing Reinsurers participating under the terms of this Contract from several to joint. D. Each party shall bear the expense of its own Arbiter, and shall jointly and equally bear with the other the expense of the Umpire and of the arbitration. In the event that the two Arbiters are chosen by one party, as above provided, the expense of the Arbiters, the Umpire and the arbitration shall be equally divided between the two parties. E. Any arbitration proceedings shall take place at a location mutually agreed upon by the parties to this Contract, but notwithstanding the location of the arbitration, all proceedings pursuant hereto shall be governed by the law of the state in which the Company has its principal office. Article 30 - Service of Suit (BRMA 49C) (Applicable if the Reinsurer is not domiciled in the United States of America, and/or is not authorized in any State, Territory or District of the United States where authorization is required by insurance regulatory authorities) A. It is agreed that in the event the Reinsurer fails to pay any amount claimed to be due hereunder, the Reinsurer, at the request of the Company, will submit to the jurisdiction of a court of competent jurisdiction within the United States. Nothing in this Article constitutes or should be understood to constitute a waiver of the Reinsurer's rights to commence an action in any court of competent jurisdiction in the United States, to remove an action to a 19\F7V1099 Page 18 [A]

In Witness Whereof, the Company by its duly authorized representatives has executed this Contract as of the dates specified below: This _______9________ day of __October____________________ in the year _2019_______. FedNat Insurance Company /s/ Xxxxxxx Xxxxx_____________________________________________________ This _______9________ day of __October____________________ in the year _2019_______. Monarch National Insurance Company /s/ Xxxxxxx Xxxxx_____________________________________________________ This _______9________ day of __October____________________ in the year _2019_______. Maison Insurance Company /s/ Xxxx Xxxxx_______________________________________________________ 19\F7V1099 Page 22 [A]

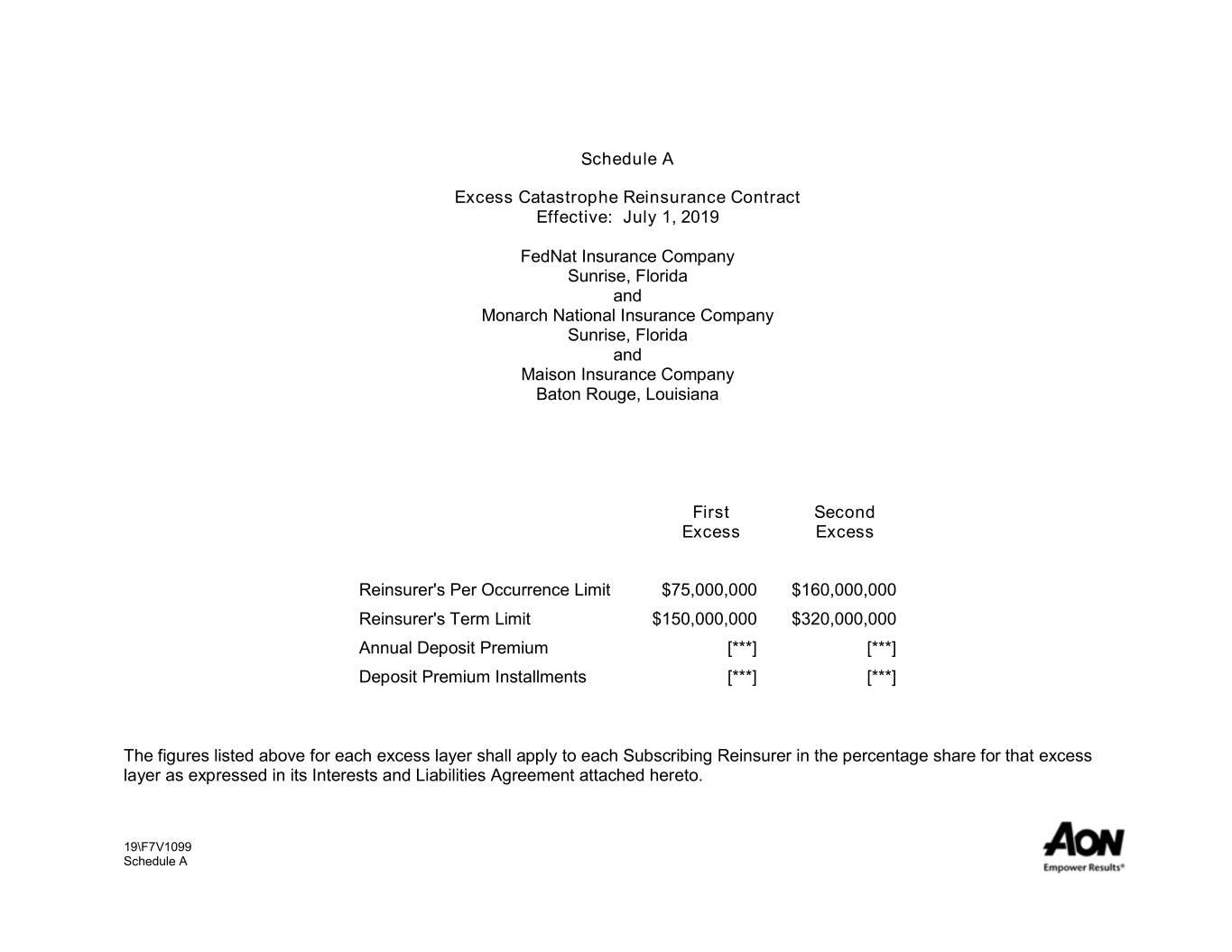

Schedule A Excess Catastrophe Reinsurance Contract Effective: July 1, 2019 FedNat Insurance Company Sunrise, Florida and Monarch National Insurance Company Sunrise, Florida and Maison Insurance Company Baton Rouge, Louisiana First Second Excess Excess Reinsurer's Per Occurrence Limit $75,000,000 $160,000,000 Reinsurer's Term Limit $150,000,000 $320,000,000 Annual Deposit Premium [***] [***] Deposit Premium Installments [***] [***] The figures listed above for each excess layer shall apply to each Subscribing Reinsurer in the percentage share for that excess layer as expressed in its Interests and Liabilities Agreement attached hereto. 19\F7V1099 Schedule A

War Exclusion Clause As regards interests which at time of loss or damage are on shore, no liability shall attach hereto in respect of any loss or damage which is occasioned by war, invasion, hostilities, acts of foreign enemies, civil war, rebellion, insurrection, military or usurped power, or martial law or confiscation by order of any government or public authority. 19\F7V1099

Nuclear Incident Exclusion Clause - Physical Damage - Reinsurance (U.S.A.) 1. This Reinsurance does not cover any loss or liability accruing to the Reassured, directly or indirectly and whether as Insurer or Reinsurer, from any Pool of Insurers or Reinsurers formed for the purpose of covering Atomic or Nuclear Energy risks. 2. Without in any way restricting the operation of paragraph (1) of this Clause, this Reinsurance does not cover any loss or liability accruing to the Reassured, directly or indirectly and whether as Insurer or Reinsurer, from any insurance against Physical Damage (including business interruption or consequential loss arising out of such Physical Damage) to: I. Nuclear reactor power plants including all auxiliary property on the site, or II. Any other nuclear reactor installation, including laboratories handling radioactive materials in connection with reactor installations, and "critical facilities" as such, or III. Installations for fabricating complete fuel elements or for processing substantial quantities of "special nuclear material," and for reprocessing, salvaging, chemically separating, storing or disposing of "spent" nuclear fuel or waste materials, or IV. Installations other than those listed in paragraph (2) III above using substantial quantities of radioactive isotopes or other products of nuclear fission. 3. Without in any way restricting the operations of paragraphs (1) and (2) hereof, this Reinsurance does not cover any loss or liability by radioactive contamination accruing to the Reassured, directly or indirectly, and whether as Insurer or Reinsurer, from any insurance on property which is on the same site as a nuclear reactor power plant or other nuclear installation and which normally would be insured therewith except that this paragraph (3) shall not operate (a) where Reassured does not have knowledge of such nuclear reactor power plant or nuclear installation, or (b) where said insurance contains a provision excluding coverage for damage to property caused by or resulting from radioactive contamination, however caused. However on and after 1st January 1960 this sub-paragraph (b) shall only apply provided the said radioactive contamination exclusion provision has been approved by the Governmental Authority having jurisdiction thereof. 4. Without in any way restricting the operations of paragraphs (1), (2) and (3) hereof, this Reinsurance does not cover any loss or liability by radioactive contamination accruing to the Reassured, directly or indirectly, and whether as Insurer or Reinsurer, when such radioactive contamination is a named hazard specifically insured against. 5. It is understood and agreed that this Clause shall not extend to risks using radioactive isotopes in any form where the nuclear exposure is not considered by the Reassured to be the primary hazard. 6. The term "special nuclear material" shall have the meaning given it in the Atomic Energy Act of 1954 or by any law amendatory thereof. 7. Reassured to be sole judge of what constitutes: (a) substantial quantities, and (b) the extent of installation, plant or site. Note.-Without in any way restricting the operation of paragraph (1) hereof, it is understood and agreed that (a) all policies issued by the Reassured on or before 31st December 1957 shall be free from the application of the other provisions of this Clause until expiry date or 31st December 1960 whichever first occurs whereupon all the provisions of this Clause shall apply. (b) with respect to any risk located in Canada policies issued by the Reassured on or before 31st December 1958 shall be free from the application of the other provisions of this Clause until expiry date or 31st December 1960 whichever first occurs whereupon all the provisions of this Clause shall apply. 12/12/57 N.M.A. 1119 BRMA 35B 19\F7V1099

Pools, Associations and Syndicates Exclusion Clause (Catastrophe) It is hereby understood and agreed that: A. This Contract excludes loss or liability arising from: 1. Business derived directly or indirectly from any pool, association, or syndicate which maintains its own reinsurance facilities. This subparagraph 1 shall not apply with respect to: a. Residual market mechanisms created by statute. This Contract shall not extend, however, to afford coverage for liability arising from the inability of any other participant or member in the residual market mechanism to meet its obligations, nor shall this Contract extend to afford coverage for liability arising from any claim against the residual market mechanism brought by or on behalf of any insolvency fund (as defined in the Insolvency Fund Exclusion Clause incorporated in this Contract). For the purposes of this Clause, the California Earthquake Authority shall be deemed to be a "residual market mechanism." b. Inter-agency or inter-government joint underwriting or risk purchasing associations (however styled) created by or permitted by statute or regulation. 2. Those perils insured by the Company that the Company knows, at the time the risk is bound, to be insured by or in excess of amounts insured or reinsured by any pool, association or syndicate formed for the purpose of insuring oil, gas, or petro-chemical plants; oil or gas drilling rigs; and/or aviation risks. This subparagraph 2 shall not apply: a. If the total insured value over all interests of the risk is less than $250,000,000. b. To interests traditionally underwritten as Inland Marine or Stock or Contents written on a blanket basis. c. To Contingent Business Interruption liability, except when it is known to the Company, at the time the risk is bound, that the key location is insured by or through any pool, association or syndicate formed for the purpose of insuring oil, gas, or petro-chemical plants; oil or gas drilling rigs; and/or aviation risks; unless the total insured value over all interests of the risk is less than $250,000,000. B. With respect to loss or liability arising from the Company's participation or membership in any residual market mechanism created by statute, the Company may include in its ultimate net loss only amounts for which the Company is assessed as a direct consequence of a covered loss occurrence, subject to the following provisions: 1. Recovery is limited to perils otherwise protected hereunder. 2. In the event the terms of the Company's participation or membership in any such residual market mechanism permit the Company to recoup any such direct 19\F7V1099 Page 1 of 2

assessment attributed to a loss occurrence by way of a specific policy premium surcharge or similar levy on policyholders, the amount received by the Company as a result of such premium surcharge or levy shall reduce the Company's ultimate net loss for such loss occurrence. 3. The result of any rate increase filing permitted by the terms of the Company's participation or membership in any such residual market mechanism following any assessment shall have no effect on the Company's ultimate net loss for any covered loss occurrence. 4. The result of any premium tax credit filing permitted by the terms of the Company's participation or membership in any such residual market mechanism following any assessment shall reduce the Company's ultimate net loss for any covered loss occurrence. 5. The Company may not include in its ultimate net loss any amount resulting from an assessment that, pursuant to the terms of the Company's participation or membership in the residual market mechanism, the Company is required to pay only after such assessment is collected from the policyholder. 6. The ultimate net loss hereunder shall not include any monies expended to purchase or retire bonds as a consequence of being a member of a residual market mechanism nor any fines or penalties imposed on the Company for late payment. 7. If, however, a residual market mechanism only provides for assessment based on an aggregate of losses in any one contract or plan year of said mechanism, then the amount of that assessment to be included in the ultimate net loss for any one loss occurrence shall be determined by multiplying the Company's share of the aggregate assessment by a factor derived by dividing the Company's ultimate net loss (net of the assessment) with respect to the loss occurrence by the total of all of its ultimate net losses (net of assessments) from all loss occurrences included by the mechanism in determining the assessment. 8/1/2012 19\F7V1099 Page 2 of 2

Terrorism Exclusion (Property Treaty Reinsurance) Notwithstanding any provision to the contrary within this Contract or any amendment thereto, it is agreed that this Contract excludes loss, damage, cost or expense directly or indirectly caused by, contributed to by, resulting from or arising out of or in connection with any act of terrorism, as defined herein, regardless of any other cause or event contributing concurrently or in any other sequence to the loss. An act of terrorism includes any act, or preparation in respect of action, or threat of action designed to influence the government de jure or de facto of any nation or any political division thereof, or in pursuit of political, religious, ideological or similar purposes to intimidate the public or a section of the public of any nation by any person or group(s) of persons whether acting alone or on behalf of or in connection with any organization(s) or government(s) de jure or de facto, and which: 1. Involves violence against one or more persons, or 2. Involves damage to property; or 3. Endangers life other than the person committing the action; or 4. Creates a risk to health or safety of the public or a section of the public; or 5. Is designed to interfere with or disrupt an electronic system. This Contract also excludes loss, damage, cost or expense directly or indirectly caused by, contributed to by, resulting from or arising out of or in connection with any action in controlling, preventing, suppressing, retaliating against or responding to any act of terrorism. Notwithstanding the above and subject otherwise to the terms, conditions, and limitations of this Contract, in respect only of personal lines, this Contract will pay actual loss or damage (but not related cost and expense) caused by any act of terrorism provided such act is not directly or indirectly caused by, contributed to by, resulting from or arising out of or in connection with radiological, biological, chemical, or nuclear pollution or contamination. 19\F7V1099

The Interests and Liabilities Agreements, constituting 2 pages in total, have been omitted from this exhibit because such agreements are not material and would be competitively harmful if publicly disclosed. 19\F7V1099