DATED 29 SEPTEMBER 2005 EASTERN PACIFIC CIRCUITS HOLDINGS LIMITED AND MERIX CORPORATION

Exhibit 10.1

DATED 29 SEPTEMBER 2005

EASTERN PACIFIC CIRCUITS HOLDINGS LIMITED

AND

MERIX CORPORATION

SUPPLEMENTAL AGREEMENT RELATING TO

THE MASTER SALE AND PURCHASE AGREEMENT

dated 14 April 2005

Xxxxx & XxXxxxxx

00xx Xxxxx Xxxxxxxxx Xxxxx

Xxxx Xxxx

Telephone: (000) 0000-0000

Fax: (000) 0000-0000

CONTENTS

| Number |

Clause Heading |

Page | ||

| 1. | Interpretation |

1 | ||

| 2. | Amendments To The SPA |

2 | ||

| 3. | General |

2 | ||

| 4. | Governing Law and Jurisdiction |

3 | ||

| Execution | 4 | |||

| Annex | Form of Amended and Restated Master Sale and Purchase Agreement |

5 | ||

THIS SUPPLEMENTAL AGREEMENT is made on 29 September 2005

BETWEEN:

| (1) | EASTERN PACIFIC CIRCUITS HOLDINGS LIMITED, a company incorporated under the laws of the Cayman Islands, whose registered office is at Century Yard, Cricket Square, Xxxxxxxx Drive, P.O. Box 2681GT, Xxxxxx Town, Grand Cayman, British West Indies (the “Seller”); and |

| (2) | MERIX CORPORATION, a company incorporated in the State of Oregon, whose registered office is at 0000 Xxxxxx Xxxx, P.O. Box 3000, X0-000, Xxxxxx Xxxxx, XX 00000, Xxxxxx Xxxxxx of America (the “Buyer”). |

| (A) | By a master sale and purchase agreement dated 14 April 2005, as varied by letter agreements dated 28 July 2005 and 16 September 2005 (the “SPA”) between the Seller and the Buyer, the Seller has agreed to sell and the Buyer has agreed to acquire certain businesses and assets/shares of certain subsidiaries directly and indirectly owned by the Seller, upon the terms and subject to the conditions set out in the SPA (the “Acquisition”). |

| (B) | As at the date hereof, Completion of the Acquisition has not taken place. Prior to Completion, the Seller and the Buyer have agreed to amend certain terms of the SPA on the terms and subject to the conditions set out herein. |

THE PARTIES AGREE as follows:

| 1. | INTERPRETATION |

| 1.1 | Capitalised terms used, but not defined, herein shall have the meaning given to them in the SPA. |

| 1.2 | The provisions of Clauses 1.2.5, 1.2.7 and 1.4 of the SPA shall apply mutatis mutandis to the terms of this Supplemental Agreement. |

1

| 2. | AMENDMENTS TO THE SPA |

| 2.1 | It is agreed by the parties hereto that, with effect from the date of this Supplemental Agreement (the “Effective Date”) the SPA shall be amended and restated by the terms of the Amended and Restated Master Sale and Purchase Agreement in the form set out in the Annex to this Supplemental Agreement. |

| 2.2 | The Seller and the Buyer hereby confirm that the accrued rights and obligations of the parties under the terms of the SPA remain in full force and effect following the execution of this Supplemental Agreement and that, save as amended by this Supplemental Agreement, the terms of the SPA will remain in full force and effect from the Effective Date. |

| 2.3 | Nothing in this Supplemental Agreement shall reduce or limit any right of the Seller or the Buyer or any liability of the Seller or the Buyer under the SPA. |

| 3. | GENERAL |

| 3.1 | This Supplemental Deed may be executed in any number of counterparts and by different parties on separate counterparts which when taken together shall be deemed to constitute one instrument. The parties agree that the execution of this Supplemental Agreement may be effected by the exchange of facsimile signature pages, with the exchange of the executed originals as soon as reasonably possible thereafter. |

| 3.2 | Neither party shall assign, transfer or in any other way alienate any of its rights under this Supplemental Agreement whether in whole or in part without the prior written consent of the other party. |

| 3.3 | A variation of this Supplemental Agreement is only valid if it is in writing and signed by or on behalf of each party. |

| 3.4 | Any notice or other communication under or in connection with this Supplemental Agreement shall be served in accordance with Clause 28 of the SPA. |

| 3.5 | If any provision or part of a provision of this Supplemental Agreement shall be, or be found by any authority or court of competent jurisdiction to be, invalid or unenforceable, such invalidity or unenforceability shall not affect the other provisions or parts of such provisions of this Supplemental Agreement, all of which shall remain in full force and effect. |

2

| 3.6 | No failure of a party to exercise, and no delay or forbearance in exercising, any right or remedy in respect of any provision of this Supplemental Agreement shall operate as a waiver of such right or remedy. |

| 4. | GOVERNING LAW AND JURISDICTION |

This Supplemental Agreement is governed by the laws of the Hong Kong Special Administrative Region of the People’s Republic of China. Any dispute arising under this Supplemental Agreement shall be resolved in accordance with Clause 29 of the SPA.

3

IN WITNESS WHEREOF the parties hereto have executed this Supplemental Agreement on the date first above written.

| Signed by NG LAK CHUAN and XXXXXXX XX duly authorised representatives of EASTERN PACIFIC CIRCUITS HOLDINGS LIMITED |

) | /s/ NG LAK CHUAN |

||||

| ) | /s/ XXXXXXX XX |

|||||

| ) | ||||||

| ) |

| Signed by XXXX X. XXXXXXXXX, Chairman and Chief Executive Officer and a duly authorised representative of MERIX CORPORATION |

) | /s/ XXXX X. XXXXXXXXX |

||||

| ) | ||||||

| ) | ||||||

| ) |

4

ANNEX

Form of Amended and Restated Master Sale and Purchase Agreement

5

DATED 14 APRIL 2005

EASTERN PACIFIC CIRCUITS HOLDINGS LIMITED

AND

MERIX CORPORATION

AMENDED AND RESTATED

MASTER SALE AND PURCHASE AGREEMENT

Xxxxx & XxXxxxxx, Hong Kong

00xx Xxxxx, Xxxxxxxxx Xxxxx

00 Xxxxxxxx Xxxx

Xxxx Xxxx

CONTENTS

| Clause |

Page | |||

| 1. | Interpretation | 1 | ||

| 2. | Sale And Purchase | 16 | ||

| 3. | Initial Consideration | 17 | ||

| 4. | Conditions | 17 | ||

| 5. | Completion | 20 | ||

| 6. | Post-Completion Working Capital Adjustments | 21 | ||

| 7. | Settlement Of Payments By Reduction Of Principal | 23 | ||

| 8. | Pro-Forma Accounts And Ebitda Earnout Consideration | 24 | ||

| 9. | The Seller’s Warranties And Pre-Completion Conduct | 28 | ||

| 10. | The Buyer’s Remedies | 29 | ||

| 11. | The Buyer’s Warranties And Undertakings | 30 | ||

| 12. | Release Of Security | 32 | ||

| 13. | Transfer Of Businesses (Protection Of Creditors) Ordinance | 32 | ||

| 14. | Responsibility For Liabilities | 32 | ||

| 15. | Accounts Receivable | 34 | ||

| 16. | Third Party Consents | 34 | ||

| 17. | Transferring Employees And Pensions | 36 | ||

| 18. | Insurance | 42 | ||

| 19. | Post-Completion Undertakings | 43 | ||

| 20. | Tax Matters | 43 | ||

| 21. | Records | 45 | ||

| 22. | Confidential Information | 45 | ||

| 23. | Announcements | 47 | ||

| 24. | Assignment | 47 | ||

| 25. | Costs | 48 | ||

| 26. | Entire Agreement | 48 | ||

| 27. | General | 49 | ||

| 28. | Notices | 50 | ||

| 29. | Governing Law Arbitration And Service Of Process | 51 | ||

| Schedule 1 | 53 | |||

i

| Schedule 2 COMPLETION REQUIREMENTS | 68 | |

| Schedule 3 SELLER’S WARRANTIES | 72 | |

| Schedule 4 LIMITATIONS ON THE SELLER’S LIABILITY | 85 | |

| Schedule 5 ACTION PENDING COMPLETION | 89 | |

| SCHEDULE 6 CAPITAL EXPENDITURE | 92 | |

| SCHEDULE 7 INTENTIONALLY DELETED | 93 | |

| SCHEDULE 8 AGREED FORM OF NOTE | 94 | |

| SCHEDULE 9 LIABILITY CAP | 99 | |

| SCHEDULE 10 WORKING CAPITAL | 101 | |

| SCHEDULE 11 EPCI HK GROUP | 102 | |

| SCHEDULE 12 EPCI SINGAPORE GROUP | 105 | |

| SCHEDULE 13 TAX DEED | 108 | |

| SCHEDULE 14 | 116 | |

| PART A - Determination Of Actual Adjusted 2005 Ebitda | 116 | |

| PART B - Operation Of The Business During The Relevant Period | 118 | |

ii

B&M comments: 28 September 2005

THIS AGREEMENT is made on 14 April 2005

BETWEEN:

| (1) | EASTERN PACIFIC CIRCUITS HOLDINGS LIMITED, a company incorporated under the laws of the Cayman Islands, whose registered office is at Century Yard, Cricket Square, Xxxxxxxx Drive, P.O. Box 2681GT, Xxxxxx Town, Grand Cayman, British West Indies (the “Seller”); and |

| (2) | MERIX CORPORATION, a company incorporated in the State of Oregon, whose registered office is at 0000 Xxxxxx Xxxx, P.O. Box 3000, X0-000, Xxxxxx Xxxxx, XX 00000, Xxxxxx Xxxxxx of America (the “Buyer”). |

| (A) | Each of the companies listed in part 1 of schedule 1 (the “Business Sellers”), Eastern Pacific Circuits (Cayman) Limited (“EPC Cayman”), a company incorporated under the laws of the Cayman Islands, and Eastern Pacific Circuits Limited (“EPCL”), a company incorporated under the laws of the Cayman Islands, is a direct or indirect wholly-owned subsidiary of the Seller. |

| (B) | EPC Cayman is the beneficial owner of all of the issued shares in the capital of Eastern Pacific Circuits Investments Limited (“EPCI HK”), a company incorporated under the laws of Hong Kong, and EPCL is the registered holder and beneficial owner of all of the issued shares in the capital of Eastern Pacific Circuits Investments (Singapore) Pte Ltd (“EPCI Singapore”), a company incorporated under the laws of Singapore. |

| (C) | The Seller has agreed to procure (a) the sale by each of the Business Sellers of its business and assets, (b) the sale by EPC Cayman of all of the issued shares in the capital of EPCI HK (the “HK Shares”) and (c) the sale by EPCL of all of the issued shares in the capital of EPCI Singapore (the “Singapore Shares”), in each case on the terms and subject to the conditions set forth in this Agreement. |

THE PARTIES AGREE as follows:

| 1. | INTERPRETATION |

| 1.1 | In this Agreement: |

“Accepting Employees -HK” has the meaning set forth in clause 17.2.4;

“Accounts Receivable” means, in relation to each Business, all the book and trade debts, notes, receivables and other debts and amounts owing to the relevant Business Seller in connection with the relevant Business (and whether or not yet due and payable) at Completion (including, without limitation, trade debts, deposits, prepayments, retrospective rebates and overpayments) all rights in relation thereto and the benefit of all guarantees or other security in respect thereof and interest thereon;

“Acquiring Buyer Company” has the meaning set forth in clause 11.1.2;

“Actual Closing Cash Amount” means the aggregate amount of the bank balances, cash, cash on deposit, short-term securities and investment accounts, including amounts for which cheques have been received by the relevant member of the EPCI HK Group and the EPCI Singapore Group or deposited in the bank accounts of the relevant member of the EPCI HK Group and the EPCI Singapore Group for which cheques have not cleared the drawer’s bank accounts at Completion and which were collected prior to the delivery of the Completion Statement, of each member of the EPCI HK Group and the EPCI Singapore Group as at the close of business on the day immediately before the Completion Date provided that there shall be deducted from such aggregate amount amounts for which cheques have been written by the relevant member of the EPCI HK Group and the EPCI Singapore Group, which cheques have not cleared the bank account as of Completion;

“Actual Adjusted 2005 EBITDA” means the audited consolidated profit before taxation, interest, depreciation and amortisation in respect of each Business and each member of the EPCI HK Group and EPCI Singapore Group for the financial year ended 31 December 2005 less all payments made or accrued in respect of capital leases (as defined in HK GAAP) determined in accordance with clause 8.3 and adjusted in accordance with Part A of schedule 14;

“Amount Claimed” has the meaning set out in clause 7.1.1;

“Approval” has the meaning set forth in paragraph 8 of Schedule 3;

“Assumed Liabilities” means all Liabilities of the Business Sellers as at Completion (including accounts payable) in connection with the relevant Business and/or the Business Assets, including, without limitation, those Liabilities set out in part 4 of schedule 1 and excluding the Excluded Liabilities;

“Auditors” means PricewaterhouseCoopers, the auditors of the Group and the Buyer;

“Available Records” has the meaning set out in clause 21.1;

“Borrowings” means all sums outstanding under (a) the credit agreement dated 10 August 2000 (as amended and supplemented from time to time) between, inter alia, (i) Eastern Pacific Circuits Limited (formerly known as Pacific Circuits Limited) as parent borrower, (ii) Eastern Pacific Circuits (HK) Ltd (formerly known as Xxxx’x Circuits Limited) as subsidiary borrower, (iii) Standard Chartered Bank (Hong Kong) Limited as administrative agent and a group of lenders, pursuant to which the lenders agreed to provide US$150,000,000 to Eastern Pacific Circuits Limited and Eastern Pacific Circuits (HK) Limited; and (b) a facility agreement dated 28 April 2004 between Eastern Pacific Investments (Singapore) Pte Limited and Standard Chartered Bank (Hong Kong) Limited as administrative agent, and a group of lenders pursuant to

2

which the lenders agreed to provide a US$5,100,000 facility to Eastern Pacific Circuits Investments (Singapore) Pte Limited, being all interest bearing borrowings and Indebtedness in the nature of borrowings of the Group from financial institutions;

“Business” means, in relation to each Business Seller, the business carried on by that Business Seller as at Completion, and excluding only the Excluded Assets;

“Business Assets” means, in relation to each Business, all the property, undertaking, benefits, title, rights and assets of the relevant Business Seller, including, without limitation, the categories of assets set out in part 2 of schedule 1 and excluding only the Excluded Assets;

“Business Claims” means the benefit of all rights and claims arising from, or coming into existence as a result of, the carrying on of any Business by a Business Seller whether arising on, prior to or after Completion, other than rights and claims relating to the Excluded Assets or the Excluded Liabilities;

“Business Goodwill” means the goodwill relating to each Business, together with the right for the Buyer or relevant Buyer’s Group Company to represent itself as carrying on that Business in succession to the relevant Business Seller;

“Business IP” means, in relation to each Business, the Intellectual Property owned by the relevant Business Seller which is used in connection with the Business;

“Business Contracts” means, in relation to each Business Seller, all the contracts, engagements, licences, guarantees, sale and purchase orders and other commitments relating to the relevant Business at Completion, which have been entered into or undertaken by or on behalf of, or the benefit of which are held on trust for or have been assigned to, that Business Seller which in any case are current uncompleted or unperformed or in respect of which that Business Seller has any rights, claims, benefits entitlements, Liabilities or obligations relating to the Business, including the Business Insurance Policies, the Hong Kong Lease (provided that consent of assignment of the Hong Kong Lease is obtained from the Hong Kong Science and Technology Park Corporation) and agreements or other documents relating to ownership or occupation of the Business Properties, but excluding all employment contracts;

“Business Day” means a day other than a Saturday or Sunday or public holiday in Hong Kong, Canada, Singapore, the Cayman Islands or the United States of America;

“Business Insurance Policies” means the insurance policies set out in part 8 of schedule 1;

“Business Motor Vehicles” means, in relation to each Business, the motor vehicles owned by the relevant Business Seller and used by it for the purposes of that Business;

3

“Business Plant and Equipment” means, in relation to each Business, all the loose plant, machinery, equipment, tooling and furniture of the relevant Business Seller (not being business fixtures and fittings forming part of the Business Properties) used for the purposes of that Business;

“Business Properties” means the properties owned by and occupied by the Business Sellers, details of which are set out in part 6A of schedule 1;

“Business Records” means, in relation to each Business, any lists of present and former customers and suppliers, business plans and forecasts, notices, enquiries, orders, correspondence, computer disks, tapes or other machine readable or other records of a financial or marketing nature to the extent that they relate to the Business and are owned by the Business Seller but excluding any of the foregoing to the extent that they are Excluded Assets;

“Business Sellers” has the meaning set forth in Recital (A);

“Business Tax” means, all forms of taxation, deductions, withholdings, duties, imposts, levies, fees, charges and rates imposed, levied, collected, withheld or assessed by any Government Authority and any interest, additional taxation penalty, surcharge or fine in connection therewith payable by any Business Seller relating to the use and ownership of the Business Assets and the operation of the Business prior to the Completion Date;

“Buyer MPF Scheme” means the mandatory provident fund scheme established by the Buyer or the relevant Buyer’s Group Company for its Hong Kong employees;

“Buyer Obligation” means any representation, warranty or undertaking to indemnify given by the Buyer to the Seller under this Agreement or any of the Other Documents;

“Buyer’s Completion Documents” has the meaning set out in clause 11.1.4;

“Buyer’s Group” means the Buyer or a company which is its ultimate parent company and each subsidiary of the Buyer and of its ultimate parent company from time to time and includes, for the avoidance of doubt, after Completion, each of EPCI HK, EPCI Singapore and their subsidiaries, and “Buyer’s Group Company” means any one of them;

“Canadian Property” means all of Eastern Pacific Circuits (Canada) Limited’s rights, title and interest in the property situated at Xxxxx 00, 00 xxx 00, Xxxxx 0, Xxxx Xxxxxx Condominium Corporation No. 711, 000 Xxxxx Xxxxx Xxxxx, Xxxxxxx, Xxxxxxx, Xxxxxx;

“Cash” means, in relation to each Business, all cash (including cash in-hand and cash at bank), cash on deposit and short-term securities and investment accounts held by the relevant Business Seller for the purposes of the Business;

4

“Closing Working Capital” means Working Capital as at the Completion Date;

“Completion” means completion of the sale and purchase of the Businesses, the Business Assets, the HK Shares and the Singapore Shares in accordance with this Agreement;

“Completion Date” means the later of: (i) 15 June 2005; and (ii) the date which is five (5) Business Days after the date on which the last of the Conditions is satisfied or waived provided that this date shall not be earlier than the date which is 60 days after the date on which the Condition in clause 4.1.1(a) is satisfied or waived or such other date as may be agreed by both parties in writing;

“Completion Statement” has the meaning set out in clause 6.1;

“Condition” means a condition set out in clause 4.1 and “Conditions” means all those conditions;

“Consent” has the meaning set out in clause 16.3;

“Costs” means obligations, Liabilities, losses, damages, costs (including reasonable legal costs) and expenses (including interest and Tax), actions, proceedings, claims, demands, penalties and compensation awards in each case of any nature whatsoever;

“Debt Amount” means the Borrowings of the Group on the Completion Date, as determined by the Lenders and notified in writing to the parties no later than three (3) Business Days before the Completion Date and, for the avoidance of doubt, such amount shall be expressed in US$;

“Deduction” has the meaning set out in clause 7.1.1;

“Defaulting Party” has the meaning set out in clause 5.4;

“Desay Land Premium Payment” means 50% of RMB5,915,133

being the amount payable to

(Desay) pursuant to the contribution of the land use right agreement dated 18 November 2004 between Eastern Pacific Circuits Investments (Singapore) Pte Limited,

(Desay) pursuant to the contribution of the land use right agreement dated 18 November 2004 between Eastern Pacific Circuits Investments (Singapore) Pte Limited,

(Desay) and Eastern Pacific Circuits (Huiyang) Ltd

(Desay) and Eastern Pacific Circuits (Huiyang) Ltd

in respect of the transfer by

in respect of the transfer by

(Desay) of the land to Eastern Pacific Circuits (Huiyang) Ltd. by way of capital contribution less the aggregate of any instalment payments made by Eastern Pacific Circuits (Huiyang) Ltd to

(Desay) of the land to Eastern Pacific Circuits (Huiyang) Ltd. by way of capital contribution less the aggregate of any instalment payments made by Eastern Pacific Circuits (Huiyang) Ltd to

(Desay) during the period from and including 1 January 2005 up to and including the Completion Date provided that where this results in a negative figure then, for the purposes of clause 6.6.1, the

negative amount shall be added to the Closing Working Capital rather than subtracted from the Closing Working Capital;

(Desay) during the period from and including 1 January 2005 up to and including the Completion Date provided that where this results in a negative figure then, for the purposes of clause 6.6.1, the

negative amount shall be added to the Closing Working Capital rather than subtracted from the Closing Working Capital;

5

“Disclosed” means referred to in the Disclosure Letter;

“Disclosed Financial Statements” has the meaning given to it in paragraph 6.2 of schedule 3;

“Disclosure Letter” means a letter of the date hereof from the Seller to the Buyer making disclosures in respect of the Warranties;

“EA Transferring Employees - Singapore” means the Transferring Employees-Singapore who fall within the ambit of the Singapore Employment Act;

“Earnout Statement” has the meaning set out in clause 8.1;

“EBITDA Earnout Consideration” shall be determined in accordance with clause 8.4;

“Encumbrance” means a lien, charge, pledge, any interest or equity of any persons (including, without limitation, any right to acquire, option or right of pre-emption) and any charge, pledge, mortgage, security interest, assignment, power of sale or other encumbrance or right exercisable by a third party (whether or not perfected) having similar effect but excluding the Permitted Encumbrances;

“Environmental Laws” means any statute, ordinance, regulation, rule, policy, interpretation, guideline or decree (including consent decrees, guidance documents and administrative orders) in effect as of Completion, applicable to any Target Group Company, its business, or the real property from which it conducts its business, enacted or promulgated by any Government Authority having jurisdiction over any Target Group Company for the activities it conducts that (i) regulates the exposure to, the amount, form, presence, emission, discharge, release, threat of release, processing, use, treatment, storage, disposal, handling, generation or production of any hazardous substance, including any permit, license, approval, consent or authorization required therefor; (ii) requires any reporting or dissemination of or access to information regarding hazardous substances, including warnings or notices to employees; or (iii) relates to or addresses human health or safety, including occupational health and safety;

“EPC Cayman” has the meaning set forth in Recital (A);

“EPCI HK” has the meaning set forth in Recital (B);

“EPCI HK Group” means EPCI HK, Eastern Pacific Circuits (Dongguan) Ltd and Xxxxxx Circuits (Huizhou) Limited;

“EPCI Singapore” has the meaning set forth in Recital (B);

6

“EPCI Singapore Group” means EPCI Singapore, Eastern Pacific Circuits (Huiyang) Limited and Eastern Pacific Circuits (Huizhou) Limited;

“EPCL” has the meaning set forth in Recital (A);

“Estimated Closing Cash Amount” means the aggregate amount estimated by the Seller of the bank balances, cash, cash on deposit, short-term securities and investment accounts, including amounts for which cheques have been received by the relevant member of the EPCI HK Group and the EPCI Singapore Group or deposited in the bank accounts of the relevant member of the EPCI HK Group and the EPCI Singapore Group which cheques have not cleared the drawer’s bank accounts, of each member of the EPCI HK Group and the EPCI Singapore Group as at the close of business on the day immediately before the Completion Date provided that there shall be deducted from such aggregate amount amounts for which cheques have been written by the relevant member of the EPCI HK Group and the EPCI Singapore Group, which cheques have not cleared the bank account as of Completion;

“Event” means an event, act, transaction or omission including, without limitation, a receipt or accrual of income or gains, distribution, failure to distribute, acquisition, disposal, transfer, payment, loan or advance;

“Excluded Assets” means the assets set out in part 3 of schedule 1;

“Excluded Liabilities” means the liabilities set out in part 5 of schedule 1;

“Expert” means an independent firm of chartered accountants mutually appointed by the parties hereto or by the President of the Hong Kong Society of Accountants for the time being, as the case may be, in accordance with clause 6.3 and/or clause 8.5;

“Financial Statements” means the audited consolidated financial statements of the Group for each of the financial years ended 31 December 2004, 31 December 2003, 31 December 2002 and 31 December 2001 (such financial statements including without limitation, in each case a balance sheet, profit and loss account and cash flow statement together with the notes thereon);

“Fundamental Warranty” means a statement contained in paragraphs 1, 2, 2A, 3, 4 and 5.2 in schedule 3 and “Fundamental Warranties” means all those statements;

“Fundamental Warranty Cap” means at any given time, the liability cap determined in accordance with the table set out in Part 1 of Schedule 9 by reference to the relevant Total Consideration set out in Column 1 of Part 1 of Schedule 9 on the relevant date referred to in sub-columns 2(a), (b), (c) or (d) of Part 1 of Schedule 9;

“Fundamental Warranty Claim” means a claim by the Buyer under or pursuant to the provisions of clause 9.1 in respect of any Fundamental Warranty;

7

“FY2003 Audited Accounts” means the Financial Statements of the Group for the year ended 31 December 2003;

“FY2004 Audited Accounts” means the Financial Statements of the Group for the year ended 31 December 2004;

“FY2004 EBITDA” means the audited consolidated profit before taxation, interest, depreciation and amortisation of the Group for the financial year ended 31 December 2004 and derived from the FY2004 Audited Accounts, adjusted to add back all costs and expenses relating to or incurred in connection with the restructuring of the Debt Amount;

“FY2004 Working Capital” means the Working Capital as at 31 December 2004, derived from the FY2004 Audited Accounts;

“FY2005 Monthly Management Accounts” means the unaudited consolidated monthly management accounts of the Group, together with the notes thereon (if any), and the consolidation worksheets of the Group for the period from 1 January 2005 to the last day of the calendar month immediately preceding the Completion Date, provided that if the Completion Date is less than four (4) weeks after the end of any calendar month, then the unaudited consolidated monthly management accounts of the Group together with the notes thereon (if any) and the consolidation worksheets of the Group shall be delivered in respect of the period from 1 January 2005 to the last day of the calendar month immediately preceding such month end;

“General Claim Cap” means at any given time, the liability cap determined in accordance with the table set out in Part 2 of Schedule 9 by reference to the relevant Total Consideration set out in Column 1 of Part 2 of Schedule 9 on the relevant date referred to in sub-columns 2(a), (b) or (c) of Part 2 of Schedule 9;

“Government Authority” means any nation or government, any state, municipality, or other political subdivision thereof, and any agency, bureau, board commission, department or other entity exercising executive, legislative, judicial, regulatory, administrative or other similar functions;

“Group” means EPCL and each of its subsidiaries and “Group Company” means any one of them;

“HK GAAP” means the generally accepted accounting standards, principles and practices applicable in Hong Kong;

“HK Shares” has the meaning set forth in Recital (C);

“HKIAC” has the meaning set out in clause 29.2;

8

“Hong Kong” means the Hong Kong Special Administrative Region of the People’s Republic of China;

“Hong Kong Lease” means the lease for the property situated at Section F of Xxxxxx Xxxx O Town Lot Xx. 00 xxx Xxxxxxxxxx xxxxxxx, Xxx Xxxxxxxxxxx, Xxxx Xxxx dated 17 July 2000 between The Hong Kong Science and Technology Park Corporation and Eastern Pacific Circuits Property Limited, as amended;

“Indebtedness” means, in relation to the Target Group, any borrowings and indebtedness (including by way of acceptance credits, finance leases, loan stocks, bonds, debentures, notes, debt or inventory financing or sale and lease back arrangements, overdrafts or any other arrangements the purpose of which is to borrow money) owed to any banking, financial, acceptance credit, lending or other similar institution or organisation and any institutional investor which is not another member of the Target Group;

“Initial Consideration” has the meaning set forth in clause 3.1;

“Intellectual Property” means (a) all patents, trademarks, service marks, logos, and corporate names registered designs, applications and rights to apply for any of those rights, internet domain names, copyrights and unregistered trade marks and service marks; (b) research and development information, financial, marketing and business data, pricing and costs information, trade secrets and confidential business information; and (c) the right to xxx for past infringements of any of the foregoing rights;

“Intellectual Property Rights” means the all Intellectual Property owned or used by the Target Group (including the Business IP);

“Intra-Group Indebtedness” means all outstanding amounts owing immediately prior to Completion to or from the Target Group, on the one hand, and the EPC Group (which for the purposes of this definition shall mean the Seller’s Group excluding the Target Group) on the other hand;

“Inventory” means, in relation to each Business, all raw materials, supplies, work in progress, parts and components and finished goods held, used or owned by the relevant Business Seller at Completion;

“Law” means any law, rule, regulation, order, writ, judgment, decree, injunction, determination or award;

“Lenders” means the financial institutions to which the Borrowings are owed;

“Liabilities” means all liabilities, duties and obligations of every description, whether deriving from contract, common law, statute or otherwise, whether present or future, actual or contingent or ascertained or unascertained and whether owed or incurred severally or jointly or as principal or surety;

9

“Management Accounts” means the unaudited consolidated financial statements of the Group for each of the financial years ended 31 December 2003 and 31 December 2004 (such financial statements including without limitation, in each case a balance sheet, profit and loss account and cash flow statement together with the notes thereon, (if any));

“Material Adverse Change” means any event, condition, circumstance, incident or fact that is or would reasonably be expected to have a material adverse effect on the business or financial position of the Target Group as a whole, or the assets (including intangible assets) or liabilities of the Target Group as a whole;

“Material Contracts” has the meaning set forth in paragraph 13.1 of schedule 3;

“Merix Caymans” means Merix Caymans Trading Company Limited, an indirect wholly owned subsidiary of Buyer;

“Minority Dividend” means the dividend(s) declared by

Eastern Pacific Circuits (Huizhou) Ltd. of US$1,600,000 that is payable to

“Non-EA Transferring Employees - Singapore” means the Transferring Employees-Singapore who do not fall within the ambit of the Singapore Employment Act;

“Non-Defaulting Party” has the meaning set out in clause 5.4;

“Note” means the promissory note to be issued by Merix Caymans to the Seller in accordance with clause 5.2.3, in the form set out in schedule 8;

“Notice” has the meaning set out in clause 28.1;

“Other Documents” means all other documents, agreements and certificates that are, or are required to be, executed pursuant to this Agreement;

“Permitted Encumbrances” means the Retained Security or security interests or liens arising by operation of law or pursuant to title retention provisions under sales contracts, equipment leases or hire purchase agreements with third parties entered into in the ordinary course of business;

“Policies” has the meaning set out in paragraph 16.1 of schedule 3;

“Post-Cash Working Capital Shortfall” has the meaning set out in clause 6.8.

“PRC” means the People’s Republic of China excluding, for the purposes of this Agreement, Hong Kong, the Macau Special Administrative Region of the People’s Republic of China and Taiwan;

10

“Property” means the property or properties of the Target Group, details of which are set out in part 6B of schedule 1;

“Principal” has the meaning set forth in the Recital of the Note;

“Principal Payment” has the meaning set forth in paragraph 3(c) of the Note;

“Recipient” has the meaning set forth in clause 20.6;

“Reference Banks” means The Hongkong and Shanghai Banking Corporation Limited and Standard Chartered Bank;

“Relevant Claim” means a claim by the Buyer under or pursuant to the provisions of clause 9.1 or the Tax Deed or any other provision of this Agreement or the Other Documents;

“Relevant Element” has the meaning set out in clause 16.3;

“Relevant Period” means the period from the Completion Date up to and including 31 December 2005;

“Representation” has the meaning set out in clause 26;

“Retained Group” means the Group excluding the EPCI HK Group and the EPCI Singapore Group and “Retained Group Company” means any one of them;

“Retained Security” means the Security relating to the EPCI HK Group and the EPCI Singapore Group which, pursuant to the Buyer’s request, will not be released by the Lenders upon Completion;

“Rules” has the meaning set out in clause 29.2;

“Sale Business and Assets” has the meaning set forth in clause 3.1;

“Security” means any surety, guarantee and security provided by the Group to the Lenders to secure the obligations of the relevant Group Companies in respect of the Borrowings;

“Security Release Documents” means the documents required to be executed by the Lenders and the relevant Seller’s Group Companies for the purposes of releasing the Security other than the Retained Security upon the repayment of the Debt Amount to the Lenders on Completion;

“Seller MPF Scheme” means the mandatory provident fund scheme established by or on behalf of the Seller or Eastern Pacific Circuits (HK) Limited in respect of the Transferring Employees - HK;

11

“Seller Obligation” means any representation, warranty or undertaking to indemnify given by the Seller to the Buyer under this Agreement or any of the Other Documents, including, without limitation, pursuant to a Relevant Claim;

“Seller’s Group” means the Seller and each subsidiary of the Seller from time to time and includes, for the avoidance of doubt, each of the Business Sellers and, before Completion, each member of the EPCI HK Group and the EPCI Singapore Group, and “Seller’s Group Company” means any one of them;

“Seller’s Group RRSP” has the meaning set forth in clause 17.1.4;

“Singapore Employment Act” means the Singaporean Employment Act (Cap 91);

“Singapore Shares” has the meaning set forth in Recital (C);

“Singapore Statutory Transfers” means the transfers of employees contemplated under Section 18A of the Singapore Employment Act;

“Stock” means, in relation to each Business, the Inventory, stock-in-trade and work-in-progress owned or agreed to be purchased by the relevant Business Seller in connection with the Business at Completion, wherever held;

“Target Group” means the EPCI HK Group, the EPCI Singapore Group and the Business Sellers, and “Target Group Company” means any company that is a member of the EPCI HK Group or the EPCI Singapore Group or that is a Business Seller;

“Tax” or “Taxes” means all (i) forms of taxation, taxes, deductions, withholdings, duties, imposts, levies, fees, charges and rates or other like assessments or charges of any kind (including, without limitation, net income, gross income, receipts, profit, business and occupation, license, excise, registration, franchise, employment, payroll, withholding, ad valorem, transfer, gains, stamp duty, capital, paid-up capital, profits, premium, value-added, business tax, real property, personal property, inventory and merchandise, commercial rent or environmental tax) imposed, levied, collected, withheld or assessed by any Government Authority and any interest, additional taxation, penalty, surcharge or fine in connection therewith, (ii) liability in respect of any items described in clause (i) payable by any member of the EPCI HK Group or the EPCI Singapore Group with respect to any period (or portion thereof) prior to the Completion Date by reason of being a member of any affiliated, combined, unitary, consolidated or similar group (including any arrangement for group or similar relief within a jurisdiction), and (iii) liability in respect of any items described in clause (i) or (ii) payable by reason of contract, assumption, transferee liability, operation of Law or otherwise;

12

“Tax Deed” means the deed to be entered into among the Seller, the Buyer, EPCI HK and EPCI Singapore in the form set out in schedule 13;

“Tax Return” means any and all reports, returns, estimates, information statements or other information, including any schedules or attachments thereto and any amendment thereof, required to be supplied to a Government Authority in connection with any Taxes;

“Total Consideration” means the Initial Consideration plus the EBITDA Earnout Consideration less an amount equal to the Post-Cash Working Capital Shortfall;

“Transferring Employees” means the Transferring Employees – Canada, the Transferring Employees – HK, the Transferring Employees - Singapore, the Transferring Employees – UK and the Transferring Employees – US, and “Transferring Employee” means any of them;

“Transferring Employees – Canada” means the employees of Eastern Pacific Circuits (Canada) Limited set out in part 7.1 of schedule 1 and who continue to be employed by Eastern Pacific Circuits (Canada) Limited on the Completion Date and any person who becomes an employee of Eastern Pacific Circuits (Canada) Limited after the last practicable date prior to signing of this Agreement but before the Completion Date;

“Transferring Employees – HK” means the employees of Eastern Pacific Circuits (HK) Limited set out in part 7.2 of schedule 1 and who continue to be employed by Eastern Pacific Circuits (HK) Limited on the Completion Date and any person who becomes an employee of Eastern Pacific Circuits (HK) Limited after the last practicable date prior to signing of this Agreement but before the Completion Date;

“Transferring Employees – Singapore” means the employees of Eastern Pacific Circuits (Singapore) Pte Ltd set out in part 7.3 of schedule 1 and who continue to be employed by Eastern Pacific Circuits (Singapore) Pte Ltd on the Completion Date and any person who becomes an employee of Eastern Pacific Circuits (Singapore) Pte Ltd after the last practicable date prior to signing of this Agreement but before the Completion Date;

“Transferring Employees – UK” means the employees of Eastern Pacific Circuits (UK) Limited set out in part 7.4 of schedule 1 and who continue to be employed by Eastern Pacific Circuits (UK) Limited on the Completion Date and any person who becomes an employee of Eastern Pacific Circuits (UK) Limited after the last practicable date prior to signing of this Agreement but before the Completion Date;

“Transferring Employees – US” means the employees of Eastern Pacific Circuits (USA) Corporation set out in part 7.5 of schedule 1 and who continue to be employed by Eastern Pacific Circuits (USA) Corporation on the Completion Date and any person who becomes an employee of Eastern Pacific Circuits (USA) Corporation after the last practicable date prior to signing of this Agreement but before the Completion Date;

13

“UK Transfer Regulations” means the United Kingdom Transfer of Undertakings (Protection of Employment) Regulations 1981;

“Warranty” means a statement contained in schedule 3 and “Warranties” means all those statements;

“Warranty Claim” means a claim by the Buyer under or pursuant to the provisions of clause 9.1;

“Working Capital” means, as of a given date, the aggregated working capital of the Group as at that date and which shall be determined on the basis of and taking into account the line items set out in schedule 10.

| 1.2 | In this Agreement, a reference to: |

| 1.2.1 | “HK$” means the lawful currency of Hong Kong; |

| 1.2.2 | “US$” means the lawful currency of the United States of America; |

| 1.2.3 | “S$” means the lawful currency of Republic of Singapore; |

| 1.2.4 | a document in the “agreed form” is a reference to a document in a form approved and for the purposes of identification initialled by or on behalf of each party; |

| 1.2.5 | a law or statutory provision (or equivalent thereof) includes a reference to the law or statutory provision (or equivalent thereof) as modified or re-enacted or both from time to time before the date of Completion; |

| 1.2.6 | a “person” includes a reference to any individual, firm, company, corporation or other body corporate, government, state or agency of a state or any joint venture, association or partnership (whether or not having separate legal personality); |

| 1.2.7 | a “party” includes a reference to that party’s successors; |

| 1.2.8 | where any statement is to the effect that the Seller is not aware of a matter or circumstance or a statement is qualified by the expression “to the Seller’s knowledge” or “so far as the Seller is aware”, or any similar or like expression, that statement shall be deemed to include a further statement that the original statement was made after due and careful enquiry of the board of directors of the Seller and senior management of the Seller, EPCL and Eastern Pacific Circuits (HK) Limited; |

14

| 1.2.9 | a clause, paragraph, Recital, schedule or Annexure, unless the context otherwise requires, is a reference to a clause or paragraph of, or Recital, schedule or Annexure to, this Agreement; and |

| 1.2.10 | except where otherwise stated, all times of the day are to Hong Kong time. |

| 1.3 | In this Agreement: |

| 1.3.1 | a company shall be deemed to be a “subsidiary” of another company, its “holding company”, if that other company (a) holds a majority of the voting rights in it, or (b) is a member of it and has the right to appoint or remove a majority of its board of directors, or (c) is a member of it and controls alone, pursuant to an agreement with other shareholders or members, a majority of the voting rights in it; or if it is a subsidiary of a company which is itself a subsidiary of that other company; and |

| 1.3.2 | a person shall be deemed to be an “affiliate” of a company if that person is a subsidiary or a holding company of that company. |

| 1.4 | The headings in this Agreement do not affect its interpretation. |

| 1.5 | For the purposes of determining the amount of any payment under this Agreement, any monetary sum which is not in US$ shall be translated into US$ at the average of the spot rates of exchange quoted by the Reference Banks for the purchase of US$ with such foreign currency in the Hong Kong foreign exchange market at or about 11:00 a.m. (Hong Kong time) on the three (3) Business Days before the date on which the payment is due or such other exchange rate agreed between the Seller and the Buyer. |

| 1.6 | All payments to be made pursuant to clauses 3, 5.2.3, 5.2.4, 6.6, 6.7, and 8 shall be made in immediately available funds by transfer of funds for same day value to such accounts and in such amounts as shall be notified by the Seller, the Buyer or the Lenders, as the case may be, at least three Business Days before the date on which the payment is due. |

| 1.7 | If any payment is made pursuant to this Agreement in respect of a liability arising under a Seller Obligation or a Buyer Obligation, it shall be made on the following basis: |

| 1.7.1 | if such payment is specifically referable to any particular Business or Business Asset, it shall so far as possible adjust the price paid for the relevant Business or Business Asset; |

| 1.7.2 | if such payment is specifically referable to the EPCI HK Group or the EPCI Singapore Group, it shall so far as possible adjust the price paid for the HK Shares or the Singapore Shares, as applicable; and |

15

| 1.7.3 | if any payment is not so specifically referable, an adjustment shall be made pro rata to the price paid for all of the Businesses, Business Assets, HK Shares and Singapore Shares. |

| 2. | SALE AND PURCHASE |

| 2.1 | Subject to and in accordance with this Agreement: |

| 2.1.1 | the Seller shall procure the sale and transfer by the relevant Business Seller of, and the Buyer relying on the several representations, Warranties and undertakings contained in this Agreement shall purchase, or procure the purchase by the relevant Buyer’s Group Company, each Business (including the Business Assets in relation to each Business), in each case as a going concern with effect from Completion and free of any Encumbrance; |

| 2.1.2 | the Seller shall procure the sale by EPC Cayman of, and the Buyer shall procure the purchase by the relevant Buyer’s Group Company of, all of the HK Shares, and the sale by EPCL of all of the Singapore Shares, and each right attaching to the HK Shares and the Singapore Shares at or after Completion, free of any Encumbrance; and |

| 2.1.3 | the Buyer relying on the several representations, Warranties and undertakings contained in this Agreement shall, and shall procure that the relevant Buyers’ Group Company shall, assume and discharge any Assumed Liabilities in relation to each Business in accordance with clause 14.1. |

| 2.2 | Nothing in this Agreement or in any of the Other Documents shall transfer any of the Excluded Assets to the Buyer or any Buyer’s Group Company or make the Buyer or any Buyer’s Group Company liable for any of the Excluded Liabilities. |

| 2.3 | All title, rights, benefits, advantages and risks (including risk of loss or damage) to the Business Assets shall pass to the Buyer or the relevant Buyer’s Group Company on Completion, except as otherwise provided in this Agreement or as otherwise agreed in writing. |

| 2.4 | Without prejudice to any other rights or remedies of the Buyer, the Seller or a Business Seller under this Agreement, if any right, claim or asset which does not form part of a Business has been transferred to or is vested in a Buyer’s Group Company and the Seller gives written notice to the Buyer of the same at any time in the six months following Completion, the Buyer shall (and the Seller shall provide such assistance to the Buyer as the Buyer reasonably requires for this purpose), so far as it is able, transfer, or procure the transfer of, such right, claim or asset, together with any benefit or sum (net of Tax and other out of pocket expenses) accruing to any Buyer’s Group Company as a result of holding such right, claim or asset since Completion, as soon as practicable, to such person as the Seller shall direct on terms that no consideration is provided by any person for such transfer. |

16

| 2.5 | Except as provided in clauses 15 and 16, and without prejudice to any other rights or remedies of the Buyer, the Seller or a Business Seller under this Agreement, if any right, claim or asset which forms part of the Business (other than an Excluded Asset) has not been transferred to or is not vested in a Buyer’s Group Company and the Buyer gives written notice to the Seller of the same at any time in the six months following Completion, the Seller shall (and the Buyer shall provide such assistance to the Seller as the Seller reasonably requires for this purpose), so far as it is able, transfer, or procure the transfer of, such right, claim or asset, together with any benefit or sum (net of Tax and other out of pocket expenses) accruing to any Seller’s Group Company as a result of holding such right, claim or asset since Completion, as soon as practicable, to such person as the Buyer shall direct on terms that no consideration is provided by any person for such transfer. |

| 2.6 | The Seller undertakes to the Buyer that it will procure the compliance of all Business Sellers with any obligation which is referred to in this Agreement as an obligation of a Business Seller, and will procure the compliance of each Seller’s Group Company with all Seller Obligations, including without limitation, the Tax Deed. |

| 2.7 | The Buyer undertakes to the Seller that it will procure the compliance of all Buyer’s Group Companies with any obligation which is referred to in this Agreement as an obligation of a Buyer’s Group Company and will procure the compliance of each Buyer’s Group Company with all Buyer Obligations, including without limitation, the Tax Deed. |

| 3. | INITIAL CONSIDERATION |

| 3.1 | The initial consideration payable by the Buyer to the Seller for the Business (with the Business Assets), the HK Shares and the Singapore Shares (collectively the “Sale Business and Assets”) shall be US$115,000,000 (the “Initial Consideration”). |

| 3.2 | As soon as reasonably practicable after signing of this Agreement, the Buyer and the Seller shall use their reasonable endeavours to agree in writing the apportionment of the Initial Consideration among the respective Sale Business and Assets. |

| 4. | CONDITIONS |

| 4.1 | Completion is conditional on the following Conditions being satisfied (or in the case of the Conditions in clause 4.1.1, 4.1.4, 4.1.5, 4.1.9, 4.1.10, 4.1.12 or 4.1.13 waived by the Buyer, or in the case of the Condition in clause 4.1.7, waived by the Seller) on or before 5.00 p.m. on 30 September 2005: |

17

| 4.1.1 | (a) the Seller having delivered to the Buyer a copy of the FY2003 Audited Accounts and the FY2004 Audited Accounts; and (b) that the financial position of the Group as reflected in the FY2003 Audited Accounts and the FY2004 Audited Accounts does not constitute a Material Adverse Change when compared with the financial position of the Group as reflected in the Management Accounts in respect of the same financial year; |

| 4.1.2 | the Seller having obtained the consent of the Lenders, conditional on the Buyer complying with clause 5.2.3, for the proposed sale of the HK Shares, the Singapore Shares, each Business and the Business Assets to the Buyer and for the release of the Security other than the Retained Security upon the repayment of the Debt Amount to the Lenders on Completion and such consent remaining in full force and effect and if such consent is given subject to any conditions then, in relation to any conditions that relate to the repayment of the Debt Amount, such conditions being acceptable to the Seller; |

| 4.1.3 | the Lenders having confirmed in writing that the Debt Amount does not exceed US$92,888,736.68; |

| 4.1.4 | the Warranties remaining true and accurate and not misleading in any material respect at Completion as if repeated at Completion, provided, however, that unless a breach of any Warranty is or is reasonably likely to amount to, when aggregated with all other breaches of any Warranty, a Material Adverse Change, the Seller shall be deemed to have satisfied the Condition in this clause 4.1.4; |

| 4.1.5 | EPCI HK having transferred the 5,468,040 shares in Xxxxxx Investments Limited held by it to Universal Enterprise Limited at book value; |

| 4.1.6 | the Seller and the Buyer having obtained the consent of The Hong Kong Science and Technology Park Corporation for the assignment of the Hong Kong Lease to a Buyer’s Group Company, or the surrender and replacement of that Hong Kong Lease with a new lease with a Buyer’s Group Company over the same property that is the subject of the Hong Kong Lease, on terms reasonably satisfactory to the Buyer; |

| 4.1.7 | the Buyer having delivered to the Seller a duly executed Note; |

| 4.1.8 | the Seller and the Buyer confirming in writing that neither party has had any claim notified to it in relation to the Excluded Liabilities in response to the notices served by it under the Transfer of Businesses (Protection of Creditors) Ordinance pursuant to clause 13, other than those claims in relation to the Excluded Liabilities which are paid, compromised, or settled with or by the Seller (at its own cost); |

18

| 4.1.9 | the Seller having delivered to the Buyer the FY2005 Monthly Management Accounts; |

| 4.1.10 | the Seller having delivered evidence which is reasonably satisfactory to the Buyer that the Tax Return for EPCI Singapore in respect of the financial year ended 31 December 2003 has been filed with the respective tax authority in Singapore and Hong Kong; |

| 4.1.11 | no order or judgement of any court or governmental, statutory or regulatory body having been issued or made prior to Completion, which has the effect of making unlawful or otherwise prohibiting the purchase of the Sale Business and Assets by the Buyer; |

| 4.1.12 | the FY2004 EBITDA being not less than US$13,000,000; |

| 4.1.13 | the Seller shall provide (at the same time when the Seller provides the Estimated Closing Cash Amount to the Buyer) to the Buyer a certificate containing reasonable details issued by a director of the Seller an estimate of the amount of the Working Capital as at the close of business on the day immediately before the Completion Date determined on the basis of and taking into account the line items set out in schedule 10 and such estimated amount shall not be less than negative US$2,000,000; and |

| 4.1.14 | the Minority Dividend having been declared. |

| 4.2 | The Seller shall make all reasonable efforts to achieve satisfaction of or procure the satisfaction of the Conditions in clauses 4.1.1(a), 4.1.2, 4.1.3, 4.1.5, 4.1.9 and 4.1.10 as soon as possible. |

| 4.3 | The Buyer shall make all reasonable efforts to achieve satisfaction of the Condition in clause 4.1.7 as soon as possible. |

| 4.4 | The Buyer and the Seller shall make all reasonable efforts to achieve satisfaction of the Conditions in clauses 4.1.6 and 4.1.8 as soon as possible. |

| 4.5 | If, at any time, the Seller or the Buyer becomes aware of a fact or circumstance that might prevent a Condition being satisfied, it shall immediately inform the other party of the matter. |

| 4.6 | At any time on or before 5.00 p.m. on 30 September, the Seller may waive the Condition set out in clause 4.1.7 by notice to the Buyer on any terms it decides. |

| 4.7 | At any time on or before 5.00 p.m. on 30 September 2005, the Buyer may waive any of the Conditions set out in clauses 4.1.1, 4.1.4, 4.1.5, 4.1.9, 4.1.10, 4.1.12 and 4.1.13 by notice to the Seller on any terms it decides. |

19

| 4.8 | If any of the Conditions has not been satisfied (or waived pursuant to clause 4.6 or 4.7) by 5.00 p.m. on 30 September 2005, this Agreement shall automatically terminate with immediate effect. |

| 4.9 | Each party’s further rights and obligations cease immediately on termination, other than in respect of clauses 1, 20.3 to 20.6, 22, 23, 24, 25, 26, 27.6, 28, and 29 which shall survive such termination, but termination does not affect a party’s accrued rights and obligations at the date of termination and, for the avoidance of doubt, any accrued rights of the parties in connection with any breach by each other of the warranties set out in this Agreement. |

| 5. | COMPLETION |

| 5.1 | Completion shall take place at the offices of Xxxxx & XxXxxxxx at 00xx Xxxxx, Xxxxxxxxx Xxxxx, 00 Xxxxxxxx Xxxx, Xxxx Xxxx on the Completion Date and shall be deemed to be effective as of 12.01 a.m. (Hong Kong time) on the Completion Date. |

| 5.2 | At Completion: |

| 5.2.1 | the Seller and the Buyer shall execute, and the Seller shall procure EPCI HK and EPCI Singapore to execute the Tax Deed; |

| 5.2.2 | the Seller and the Buyer shall do, and shall respectively procure that each Seller’s Group Company and Buyer’s Group Company shall do, all those things respectively required of them in schedule 2; |

| 5.2.3 | the Buyer shall pay the Initial Consideration as follows: |

| (a) | the Buyer shall pay the equivalent of the Debt Amount to the Lenders; |

| (b) | the Buyer shall pay US$11,111,263.32 to the Seller; and |

| (c) | the balance of the Initial Consideration (after deduction of the amount set out in sub-paragraphs (a) and (b) above) shall be satisfied by the issue of the Note by Merix Caymans to the Seller; |

| 5.2.4 | the Buyer shall pay the Estimated Closing Cash Amount less the amount of the Minority Dividend to the Seller. |

| 5.3 | The parties are not obliged to complete this Agreement unless: |

| 5.3.1 | the Buyer and each Buyer’s Group Company and the Seller and each Seller’s Group Company complies with all their respective obligations under this clause 5 and schedule 2; and |

| 5.3.2 | the sale and purchase of all of the Businesses, the Business Assets, the HK Shares and the Singapore Shares is completed simultaneously. |

20

| 5.4 | If Completion does not take place immediately on the Completion Date because a party (the “Defaulting Party”) fails to comply with any of its obligations under this clause 5 and schedule 2 (whether such failure amounts to a repudiatory breach or not) and the other party (the “Non-Defaulting Party”) is otherwise in a position to comply with its obligations under this clause 5 and schedule 2, the Non-Defaulting Party may, without prejudice to any other right of or remedy available to the Non-Defaulting Party, by notice to the Defaulting Party: |

| 5.4.1 | proceed to Completion to the extent reasonably practicable; |

| 5.4.2 | postpone Completion to a date not more than five (5) Business Days after the Completion Date; or |

| 5.4.3 | terminate this Agreement. |

Each party’s further rights and obligations cease immediately on termination, other than in respect of clauses 1, 20.3 to 20.6, 22, 23, 24, 25, 26, 27.6, 28, and 29 which shall survive such termination, but termination does not affect a party’s accrued rights and obligations at the date of termination

| 5.5 | If the Non-Defaulting Party postpones Completion to another date in accordance with clause 5.4.2, the provisions of this Agreement apply as if that other date is the Completion Date. |

| 5.6 | Effective as at Completion: |

(a) each member of the Retained Group and the Seller hereby releases each Buyer’s Group Company from any liability in respect of Intra-Group Indebtedness; and

(b) each Buyer’s Group Company hereby releases each member of the Retained Group and the Seller from any liability in respect of Intra-Group Indebtedness.

| 6. | POST-COMPLETION WORKING CAPITAL ADJUSTMENTS |

| 6.1 | As soon as practicable following Completion, the Buyer and the Seller shall direct the Auditors to undertake a completion audit and to prepare its calculation of the FY2004 Working Capital, the Closing Working Capital and the Actual Closing Cash Amount (the “Completion Statement”) and to deliver, in any event no later than forty (40) Business Days after the Completion Date, the Completion Statement to the Seller and the Buyer. The Seller and the Buyer shall each pay one half of the Auditors’ costs in preparing the Completion Statement. |

| 6.2 | The FY2004 Working Capital and the Closing Working Capital shall be determined on the basis of and taking into account the line items set out in schedule 10 and shall be calculated on a basis consistent with the FY2004 Audited Accounts, using the same |

21

| accounting principles, policies and practices and, so far as consistent with the foregoing, applicable standards, principles and practices generally accepted in Hong Kong. |

| 6.3 | If either the Seller or the Buyer does not accept the Auditors’ calculation of the FY2004 Working Capital, the Closing Working Capital and/or the Actual Closing Cash Amount, the Seller or the Buyer shall notify the other party of such non-acceptance within ten (10) Business Days of receipt of the Completion Statement. The parties shall thereafter refer the determination of the FY2004 Working Capital, the Closing Working Capital and/or the Actual Closing Cash Amount to an independent firm of chartered accountants agreed by the parties in writing or, failing agreement on the identity of the partner or firm of chartered accountants, appointed, on the application of either party, by the President of the Hong Kong Society of Accountants for the time being. |

| 6.4 | The Expert shall act on the following basis: |

| 6.4.1 | the Expert shall act as an independent expert and not as an arbitrator; |

| 6.4.2 | the Expert shall be instructed to notify the Seller and the Buyer of his determination within ten (10) Business Days of his appointment; |

| 6.4.3 | the Expert’s determination shall, in the absence of fraud or manifest error, be final and binding on the parties and shall be deemed to constitute the FY2004 Working Capital, the Closing Working Capital and/or the Actual Closing Cash Amount for all purposes of this Agreement; and |

| 6.4.4 | the Seller and the Buyer shall each pay one half of the Expert’s costs. |

| 6.5 | For the purposes of determining the FY2004 Working Capital, the Closing Working Capital and the Actual Closing Cash Amount, the Seller and the Buyer shall give the Expert and each other all information relating to the FY2004 Working Capital, the Closing Working Capital and the Actual Closing Cash Amount which the Expert may reasonably require and the Expert shall be entitled (to the extent he considers appropriate) to base his opinion on such information and on the accounting and other records of the Group, provided always that the Closing Working Capital shall be determined on the basis of and taking into account the line items set out in schedule 10 and shall be determined on a basis consistent with the FY2004 Audited Accounts, using the same accounting principles, policies and practices and, so far as consistent with the foregoing, applicable standards, principles and practices generally accepted in Hong Kong. |

| 6.6 | Following the determination of the FY2004 Working Capital and the Closing Working Capital, the adjustment to the Initial Consideration shall be determined and paid as follows: |

22

| 6.6.1 | if the Closing Working Capital less the Desay Land Premium Payment is greater than the FY2004 Working Capital, an amount equal to the amount of the difference shall be paid by the Buyer to the Seller within five (5) Business Days; and |

| 6.6.2 | if the Closing Working Capital less the Desay Land Premium Payment is less than the FY2004 Working Capital, an amount equal to the amount of the difference shall be paid by the Seller to the Buyer within five (5) Business Days. Such amount shall be satisfied in accordance with clause 6.8. |

| 6.7 | Following the determination of the Actual Closing Cash Amount, the Seller or the Buyer (as the case may be) shall pay to the other an amount in cash determined as follows: |

| 6.7.1 | if the Actual Closing Cash Amount (less any deduction pursuant to clause 6.8) is greater than the Estimated Closing Cash Amount, an amount equal to the amount of the difference shall be paid by the Buyer to the Seller within five (5) Business Days. Such amount shall be payable in US$ in accordance with clause 1.5; and |

| 6.7.2 | if the Actual Closing Cash Amount (less any deduction pursuant to clause 6.8) is less than the Estimated Closing Cash Amount, an amount equal to the difference (but in any event not exceeding the Estimated Closing Cash Amount) shall be paid by the Seller to the Buyer within five (5) Business Days. Such amount shall be payable in US$ in accordance with clause 1.5. |

| 6.8 | If the Seller owes any amount to the Buyer pursuant to clause 6.6.2, such amount shall first be deducted from the Actual Closing Cash Amount less US$2,000,000 for the purposes of the payment to be made under clause 6.7. If such amount is not sufficient to pay the full amount due to the Buyer pursuant to clause 6.6.2 (the remaining unpaid amount being the “Post-Cash Working Capital Shortfall”), the Post-Cash Working Capital Shortfall shall be satisfied in accordance with paragraph 3(c) of the Note. |

| 7. | SETTLEMENT OF PAYMENTS IN ACCORDANCE WITH THE NOTE |

| 7.1 | Any amounts due from the Seller to the Buyer under this Agreement in relation to the Post-Cash Working Capital Shortfall and Relevant Claims shall be satisfied in accordance with the terms of the Note. |

| 7.2 | If any payment due from the Seller to the Buyer under this Agreement is satisfied in accordance with the terms of the Note, the Buyer agrees that the Seller’s liability in respect of such payment shall be fully discharged and satisfied to the extent of the amount so reduced. |

23

| 7.3 | The Seller shall not be wound up or liquidated until the later of: (i) 1 October 2007; and (ii) the date on which all Relevant Claims have been settled or otherwise determined. |

| 8. | PRO-FORMA ACCOUNTS AND EBITDA EARNOUT CONSIDERATION |

| 8.1 | As soon as practicable following 31 December 2005, the Buyer and the Seller shall direct the Auditors to perform agreed upon procedures on the consolidated pro-forma accounts in respect of each Business and each member of the EPCI HK Group and EPCI Singapore Group for the period from 1 January 2005 to 31 December 2005 on the basis as if Completion had taken place on 1 January 2005 (the “Pro-forma Accounts”) and to prepare a statement showing their calculation of the Actual Adjusted 2005 EBITDA and the EBITDA Earnout Consideration (the “Earnout Statement”) and to deliver by either: (i) seventy-five (75) Business Days after 31 December 2005; or (ii) if the Buyer gives written notice to the Seller within 30 days following 31 December 2005 that it shall take the option referred to in clause 8.10(b)(1) in respect of any Relevant Claim arising during the period referred to in clause 8.10(b) and such Relevant Claim has not been settled or otherwise determined prior to or on 31 December 2005, 5 Business Days following the date on which such Relevant Claim has been settled or otherwise determined, the Pro-forma Accounts and the Earnout Statement to the Seller and the Buyer. The Buyer shall pay the Auditor’s costs in preparing the Pro-forma Accounts and the Earnout Statement if the EBITDA Earnout Consideration is zero or a negative amount. If the EBITDA Earnout Consideration is a positive amount, the Seller shall be liable for the lesser of: (i) 50% of the Auditor’s costs in preparing the Pro-forma Accounts and the Earnout Statement; and (ii) the EBITDA Earnout Consideration and if such amount is less than 50% of the Auditor’s costs in preparing the Pro-forma Accounts and the Earnout Statement, the Seller shall not be liable to pay any further amount in respect of such costs. |

| 8.2 | The Buyer shall deliver to the Seller as soon as practicable after 31 December 2005, but in any event by 31 January 2006 unaudited consolidated management accounts in respect of each Business and the business of the EPCI HK Group and the EPCI Singapore Group for the period from 1 January 2005 to 31 December 2005. As soon as practicable following receipt by the Seller of such management accounts, and in any event prior to 14 February 2006, senior representatives of the Buyer and the Seller shall meet with a view to discussing and settling in good faith any Relevant Claims arising from any fact, matter, event or circumstance which occurred during the period from and including 1 January 2005 up to and including 31 December 2005, that have not been settled or otherwise determined prior to 31 December 2005. If the Buyer and the Seller are not able to reach agreement in respect of such Relevant Claims, or the amount claimed in respect of such Relevant Claim, by 31 March 2006, the matter shall be promptly be referred to arbitration by either party in accordance with clause 29. |

24

| 8.3 | The Actual Adjusted 2005 EBITDA shall be determined on the basis of and taking into account the principles set out in Part A of schedule 14 and on a basis consistent with the FY2004 Audited Accounts, using the same accounting principles, policies and practices and, so far as consistent with the foregoing, applicable standards, principles and practices generally accepted in Hong Kong in effect for the year ended 31 December 2004. For the avoidance of doubt, only Relevant Claims that can be recognised as an expense under such accounting principles, policies, practices, applicable standards, principles and practices generally accepted in Hong Kong and only Relevant Claims that have been settled or otherwise determined may be taken into account in the Actual Adjusted 2005 EBITDA amount. |

| 8.4 |

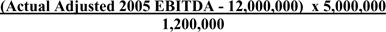

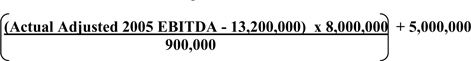

(a) | If the Actual Adjusted 2005 EBITDA is equal to any amount from and including US$12,000,000 and less than US$13,200,000, the EBITDA Earnout Consideration shall be determined in accordance with the following formula: |

provided that the EBITDA Earnout Consideration determined in accordance with the formula in this clause 8.4(a) shall in no event be (a) a negative amount; or (b) more than US$5,000,000; or

| (b) | If the Actual Adjusted 2005 EBITDA is equal to any amount in excess of US$13,200,000, the EBITDA Earnout Consideration shall be determined in accordance with the following formula: |

provided that the EBITDA Earnout Consideration determined in accordance with this clause 8.4(b) shall in no event be (a) a negative amount; or (b) more than US$13,000,000.

| 8.5 | If the Seller notifies the Buyer in writing that it is satisfied with the Pro-forma Accounts and the Earnout Statement, then the Actual Adjusted 2005 EBITDA and the EBITDA Earnout Consideration shall be determined on the basis of the Pro-forma Accounts and the Earnout Statement, as so agreed. If the Seller does not accept the Pro-forma Accounts or the Earnout Statement, the Seller shall notify the Buyer of such non-acceptance within ten (10) Business Days of receipt of the Pro-forma Accounts and the Earnout Statement. The parties shall thereafter refer the preparation of the Pro-forma Accounts and the determination of the Actual Adjusted 2005 EBITDA and/or the EBITDA Earnout Consideration to an independent firm of chartered accountants agreed by the parties in writing or, failing agreement on the identity of the partner or firm of chartered accountants, appointed, on the application of either party, by the President of the Hong Kong Society of Accountants for the time being. |

25

| 8.6 | The Expert shall act on the following basis: |

| 8.6.1 | the Expert shall act as an independent expert and not as an arbitrator; |

| 8.6.2 | the Expert shall be instructed to notify the Seller and the Buyer of his determination within ten (10) Business Days of his appointment; |

| 8.6.3 | the Expert’s determination shall, in the absence of fraud or manifest error, be final and binding on the parties and shall be deemed to constitute the Pro-forma Accounts and the Actual Adjusted 2005 EBITDA and the EBITDA Earnout Consideration for all purposes of this Agreement; and |

| 8.6.4 | the Seller and the Buyer shall each pay one half of the Expert’s costs. |

| 8.7 | For the purposes of preparing the Pro-forma Accounts and determining the Actual Adjusted 2005 EBITDA and the EBITDA Earnout Consideration, the Seller and the Buyer shall give the Expert and each other all information relating to or relevant for the preparation of the Pro-forma Accounts and the determination of the Actual Adjusted 2005 EBITDA and the EBITDA Earnout Consideration which the Expert may reasonably require and the Expert shall be entitled (to the extent he considers appropriate) to base his opinion on such information, provided always that the Pro-forma Accounts and the Actual Adjusted 2005 EBITDA and the EBITDA Earnout Consideration shall be determined on a basis consistent with the FY2004 Audited Accounts, using the same accounting principles, policies and practices and, so far as consistent with the foregoing, applicable standards, principles and practices generally accepted in Hong Kong and that the Actual Adjusted 2005 EBITDA shall be determined in accordance with the principles set out in Part A of schedule 14. |

| 8.8 | After deduction of any payment to the Auditors pursuant to clause 8.1, the Principal shall be increased by an amount equal to the EBITDA Earnout Consideration, or if the EBITDA Earnout Consideration is determined on or after 15 March 2009, the EBITDA Earnout Consideration shall be paid directly to the Seller. |

| 8.9 | The Buyer agrees that it will use its best endeavours to procure that each member of the Buyer’s Group which has acquired a Business and each member of the EPCI HK Group and EPCI Singapore Group shall be conduct its business at all times during the Relevant Period in accordance with the principles set out in Part B of schedule 14. |

| 8.10 | The Seller and the Buyer agree that: |

| (a) | in respect of any Relevant Claim arising from any fact, matter, event or circumstance which has occurred prior to and including 31 December 2004, (i) the amount that has been settled or otherwise determined in respect of any Relevant Claim; (ii) the amount of the loss suffered or incurred by the relevant Buyer’s Group Company in respect of which such Relevant Claim has been |

26

| settled or otherwise determined; or (iii) the Amount Claimed in respect of any Relevant Claim that has not been settled or otherwise determined during such period, shall not be taken into account in the calculation of the Actual Adjusted 2005 EBITDA but the amount settled or otherwise determined in respect of such Relevant Claim shall be satisfiedin accordance with the terms of the Note. |

| (b) | in respect of any Relevant Claim arising from any fact, matter, event or circumstance which occurs during the period from and including 1 January 2005 up to and including 31 December 2005, the Buyer shall have the option to either: (1) take into account in the calculation of the Actual Adjusted 2005 EBITDA the amount that has been settled or otherwise determined in respect of such Relevant Claim, provided that schedule 4 shall apply to limit or exclude, as the case may be, the liability determined in respect of such Relevant Claim (which for the avoidance of doubt shall include Relevant Claims made pursuant to the Tax Deed), with the exception of paragraph 1.1.2 of schedule 4 which shall not apply; or (2) to apply the amount that has been settled or otherwise determined in respect of such Relevant Claim in accordance with the terms of the Note. For the avoidance of doubt, if the Actual Adjusted 2005 EBITDA is determined to be equal to or less than US$12,000,000 when the amount referred to in clause 8.10(b)(1) is taken into account in the calculation of the Actual Adjusted 2005 EBITDA, the Buyer shall have the right to increase the Principal by an amount equal to the outstanding portion of the amount of such Relevant Claim which has not been settled hereunder, provided that such portion is not less than US$100,000 and, for the avoidance of doubt, the terms set out in schedule 4 shall apply to such outstanding portion. |

| 8.11 | If the Buyer shall take the option referred to in clause 8.10(b)(1) above, then at the same time when the Buyer provides the Pro-forma Accounts and the Earnout Statement in accordance with clause 8.1 above, the Buyer shall provide a certificate issued by a director of the Buyer containing reasonable details of the Relevant Claims that have been taken into account in the calculation of the Actual Adjusted 2005 EBITDA. |

| 8.12 | As soon as practicable following the end of each full calendar month during the Relevant Period, the Buyer shall deliver to the Seller unaudited consolidated monthly management accounts in respect of each Business and the business of the EPCI HK Group and the EPCI Singapore Group. Such monthly management accounts shall consist of a consolidated profit and loss account, balance sheet and cash flow statement together with the notes thereon (if any) for the Relevant Period. The Buyer shall promptly deliver to the Seller any management updates in respect of the business carried on by the Target Group as a whole as at Completion. During the Relevant Period, the Buyer shall allow the Seller and its representatives reasonable access, upon |

27