the Aggregator LLC Agreement, and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties covenant and agree as follows: 1. Capitalized Terms. The following capitalized terms, as used in this...

EXHIBIT 10.11 INCENTIVE UNIT AGREEMENT This INCENTIVE UNIT AGREEMENT (this “Agreement”), dated effective as of the IPO Closing Date (as defined below), is entered into by and between Cure Aggregator, LLC, a Delaware limited liability company (“Aggregator”), Cure TopCo, LLC, a Delaware limited liability company (“Cure TopCo”) and Bradford Xxxx Xxxxxxxxxx (“Executive”). WHEREAS, on February 14, 2020 (the “Date of Grant”), Aggregator issued to Executive 181,085 Class C Common Units of Aggregator (the “Incentive Units”), each of which corresponded to a Class C Common Unit of Cure TopCo (the “Corresponding Units”), pursuant to the terms of (1) that certain Incentive Unit Award Agreement, dated as of February 14, 2020, between Aggregator, Cure TopCo and Executive (the “Incentive Unit Agreement”), (2) the Third Amended and Restated Limited Liability Company Agreement of Aggregator, dated as of February 12, 2020 (the “Third Amended and Restated Aggregator LLC Agreement”), and (3) the Second Amended and Restated Limited Liability Company Agreement of Cure TopCo, dated as of November 27, 2019 (the “Second Amended and Restated LLC Agreement”); WHEREAS, pursuant to that certain Reorganization Agreement, dated as of February 10, 2021 (the “Reorganization Agreement”), by and among Cure TopCo, Signify Health, Inc., a Delaware corporation (“Pubco”), and the other parties thereto, the parties thereto are engaging in the Reorganization Transactions (as defined in the Reorganization Agreement) in connection with the IPO; WHEREAS, as part of the Reorganization Transactions, and pursuant to the Third Amended and Restated Limited Liability Company Agreement of Cure TopCo adopted on or around the IPO Closing Date (as defined in the Reorganization Agreement) (as amended from time to time, the “Cure TopCo LLC Agreement”) and the Fourth Amended and Restated Limited Liability Company Agreement of Aggregator adopted on or around the IPO Closing Date (as amended from time to time, the “Aggregator LLC Agreement”), all of the units of membership interest in Cure TopCo existing immediately prior to the Reorganization Transactions, including the Corresponding Units, are being reclassified and converted into LLC Units (as defined in the Cure TopCo LLC Agreement) of Cure TopCo, and all of the units of membership interest in Aggregator existing immediately prior to the Reorganization Transactions, including the Incentive Units, are being reclassified and converted into Units (as defined in the Aggregator LLC Agreement) of Aggregator; and WHEREAS, to the extent that the Incentive Units and Corresponding Units are unvested and/or subject to forfeiture under the terms of the Incentive Unit Agreement, the Third Amended and Restated Aggregator LLC Agreement and the Second Amended and Restated LLC Agreement, as applicable, as of the IPO Closing Date, then such restrictions, as amended pursuant to this Agreement, shall continue to apply to the Units of Aggregator and the LLC Units of Cure TopCo issued in exchange for the Incentive Units and Corresponding Units, respectively, as reflected in this Agreement. NOW, THEREFORE, in consideration of the mutual promises, covenants, and conditions contained in this Agreement, the Reorganization Agreement, the Cure TopCo LLC Agreement and

50% or more of the total voting power of the stock of Pubco; provided that the provisions of this subsection (i) are not intended to apply to or include as a Change in Control any transaction that is specifically excepted from the definition of Change in Control under subsection (iii) below; (ii) the consummation of a merger, amalgamation or consolidation of Pubco with any other corporation or other entity, or the issuance of voting securities in connection with such a transaction pursuant to applicable stock exchange requirements; provided that immediately following such transaction the voting securities of Pubco outstanding immediately prior thereto do not continue to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity of such merger or consolidation or parent entity thereof) 50% or more of the total voting power of Pubco’s stock (or, if Pubco is not the surviving entity of such transaction, 50% or more of the total voting power of the stock of such surviving entity or parent entity thereof); and provided, further, that such a transaction effected to implement a recapitalization of Pubco (or similar transaction) in which no Person is or becomes the “beneficial owner” (as such term is defined in Rule 13d-3 under the Securities Exchange Act of 1934), directly or indirectly, of securities of Pubco (not including in the securities beneficially owned by such Person any securities acquired directly from Pubco or its Affiliates other than in connection with the acquisition by Pubco or its Affiliates of a business) representing 50% or more of either the then-outstanding shares of Class A Common Stock or the combined voting power of Pubco’s then- outstanding voting securities shall not be considered a Change in Control; or (iii) the sale or disposition by Pubco of Pubco’s assets in which any Person acquires (or has acquired during the 12-month period ending on the date of the most recent acquisition by such Person) assets from Pubco that have a total gross fair market value equal to more than 50% of the total gross fair market value of all of the assets of Pubco immediately prior to such acquisition or acquisitions. Notwithstanding the foregoing, (A) no Change in Control shall be deemed to have occurred if there is consummated any transaction or series of integrated transactions immediately following which the record holders of the Class A Common Stock immediately prior to such transaction or series of transactions continue to have substantially the same proportionate ownership in an entity which owns substantially all of the assets of Pubco immediately prior to such transaction or series of transactions, and (B) no Change in Control shall be deemed to have occurred upon the acquisition of additional control of Pubco by any Person that, prior to such transaction, directly or indirectly controls, is controlled by, or is under common control with, Pubco. “Company Group” means, at any given time, Pubco, Cure TopCo, Aggregator and their Affiliates. “Compensation Committee” means the Compensation Committee of the Board. “Corresponding Class B Share” means, with respect to an Incentive LLC Unit, the share of Class B Common Stock that was issued to Executive pursuant to the Class B Securities Purchase Agreement entered into between Pubco and Executive and that corresponds to the Corresponding Incentive Unit (as defined below).

“Employment Agreement” means the applicable employment, retention or other employment letter agreement entered into between Executive and a member of the Company Group (or any predecessor entity). “IPO Closing Date” has the meaning given to such term in the Reorganization Agreement. “NM Members” shall mean (i) New Mountain Partners V, L.P. and its Affiliates in respect of their investment in Remedy Acquisition, LP, (ii) New Mountain Partners V (AIV-C), L.P., and (iii) New Mountain Partners V (AIV-C2), L.P., and their respective Affiliates, in each case, other than Pubco and its direct or indirect subsidiaries. “Person” means any individual, corporation, partnership, limited liability company, trust, estate, joint venture, governmental authority or other entity. “Terminated” or “Terminates” means, with respect to Executive, a Termination of Employment or Service, as applicable. “Termination of Employment or Service” means a termination of employment or service (for reasons other than a military or personal leave of absence granted by Cure TopCo) of Executive from the Company Group. Notwithstanding the foregoing, if no rights of Executive are reduced or adversely affected, the Compensation Committee may otherwise define Termination of Employment or Service thereafter, provided that any such change to the definition of the term “Termination of Employment or Service” does not subject the applicable Incentive LLC Units to Section 409A of the Code. 2. 83(b) Elections. After the issuance of the Corresponding Incentive Units and the Incentive LLC Units as contemplated by this Agreement, Aggregator shall execute and deliver to the Internal Revenue Service (the “IRS”) an election under Section 83(b) of the Code with respect to the Corresponding Incentive Units and Executive shall execute and deliver to the IRS an election under Section 83(b) of the Code in the form attached hereto as Appendix A with respect to the Incentive LLC Units (together the “83(b) Elections”). Executive understands that under Section 83(b) of the Code, regulations promulgated thereunder, and certain IRS administrative announcements, in the absence of an effective election under Section 83(b) of the Code, the excess of the fair market value of any Incentive LLC Units, on the date on which any forfeiture restrictions applicable to such Incentive LLC Units lapse, over the price paid for such Incentive LLC Units, could be reportable as ordinary income at that time. For this purpose, the term “forfeiture restrictions” includes the restrictions on transferability and the vesting and reversion conditions imposed under Sections 3 and 4 of this Agreement. Executive understands that (i) in making an 83(b) Election, Executive may be taxed at the time the Incentive LLC Units are received hereunder to the extent the fair market value of the Incentive LLC Units exceeds the price for such Incentive LLC Units and (ii) in order to be effective, the 83(b) Elections must be filed with the IRS within thirty (30) days after February 12, 2021. Executive hereby acknowledges that: (x) the foregoing description of the tax consequences of the 83(b) Elections is not intended to be complete and, among other things, does not describe state, local or foreign income and other tax consequences;

4.1. Executive may not offer or Transfer or agree to offer or Transfer, grant any call option with respect to, borrow against, or enter into any swap or derivative transaction with respect to any Incentive LLC Unit or any interest therein, unless such action is taken in accordance with Article VI of the Aggregator LLC Agreement. Any attempted or purported Transfer or other agreement in violation of this Agreement will be void ab initio. 4.2. Notwithstanding anything to the contrary in the Aggregator LLC Agreement, Executive shall not have the right to exercise (and agrees not to exercise or purport to exercise) the “Member Exchange” under the Aggregator LLC Agreement with respect to any Unvested Units. 4.3. If any Vested Units are purchased pursuant to the call right described in Section 3.2, then each Corresponding Class B Share shall simultaneously be forfeited to Pubco for no consideration in accordance with Article 4 of the Cure TopCo LLC Agreement. If any Unvested Units or Vested Units are forfeited upon Executive’s Termination of Employment or Service under Section 3, then each such Unvested Unit (and its Corresponding Class B Share) or Vested Unit (and its Corresponding Class B Share), as applicable, shall be immediately and automatically forfeited to Aggregator or Cure TopCo, as applicable (or, in the case of a Corresponding Class B Share, to Pubco), in each case free and clear of any liens, encumbrances or restrictions, concurrently with the Termination of Employment or Service, and shall no longer be deemed outstanding, without the payment of consideration or notice from Aggregator, Cure TopCo or Pubco and without the need for further action on the part of any Person. 4.4. Except as provided in this Agreement, from and after the IPO Closing Date, Executive shall have all the rights of a member of Aggregator with respect to the Incentive LLC Units and as a stockholder of Pubco with respect to the Corresponding Class B Shares, including the right to vote the Corresponding Class B Share in respect of a Vested Unit; provided, that any capital stock or securities of Aggregator or Pubco that Executive receives with respect to the Incentive LLC Units or Corresponding Class B Shares through a stock dividend, stock split, reverse stock split, recapitalization, or similar transaction will be subject to the same restrictions applicable to the Incentive LLC Units or Corresponding Class B Shares with respect to which such capital stock or other securities was distributed or received, as set forth in this Agreement. Executive will be the record owner of each Incentive LLC Unit until or unless such Incentive LLC Unit reverts to Aggregator as provided under this Agreement or is Transferred in accordance with the terms of this Agreement and the Aggregator LLC Agreement, and as record owner will be entitled to all rights granted to owners of the LLC Units of Aggregator, except as expressly provided under this Agreement or the Aggregator LLC Agreement. 4.5. The Corresponding Incentive Units and Incentive LLC Units shall be uncertificated unless otherwise determined by Cure TopCo, in the case of the Corresponding Incentive Units, or Aggregator, in the case of the Incentive LLC Units. 4.6. If Executive is not already a party to the Aggregator LLC Agreement, then Executive agrees that upon execution of this Agreement, Executive agrees to join and become a party to the Aggregator LLC Agreement and be fully bound by, and subject to all of the covenants,

10.1. This Agreement shall be governed by, and construed in accordance with, the laws of the State of Delaware, without giving effect to any choice of law or conflict of law rules or provisions (whether of the State of Delaware or any other jurisdiction) that would cause the application of the laws of any jurisdiction other than the State of Delaware. Any dispute relating hereto shall be heard in the state or federal courts of Delaware, and the parties agree to jurisdiction and venue therein (it being understood and agreed that any order from any such court may be enforced in any other jurisdiction). Each of the parties hereto hereby waives, to the fullest extent permitted by law, any right to trial by jury of any claim, demand, action, or cause of action arising under or related to this Agreement whether now existing or hereafter arising, and whether in contract, tort, equity, or otherwise. The parties hereto each hereby agrees and consents that any such claim, demand, action, or cause of action shall be decided by court trial without a jury and that the parties hereto may file an original counterpart of a copy of this Agreement with any court as written evidence of the consent of the parties hereto to the waiver of their right to trial by jury. 10.2. Executive (i) agrees that service of process in any such claim, demand, action, proceeding or cause of action arising under this Agreement may be effected by mailing a copy of such process by registered or certified mail (or any substantially similar form of mail), postage prepaid, to such party, in the case of Executive, at Executive’s address shown in the books and records of Aggregator or Cure TopCo, in the case of Aggregator, at Aggregator’s principal offices, attention General Counsel, or in the case of Cure TopCo, at Cure TopCo’s principal offices, attention General Counsel, and (ii) agrees that nothing in this Agreement shall affect the right to effect service of process in any other manner permitted by the laws of the State of Delaware. 11. Severability. Whenever possible, each provision of this Agreement shall be interpreted in such manner as to be effective and valid under applicable law, but if any provision of this Agreement is held to be invalid, illegal or unenforceable in any respect under any applicable law or rule in any jurisdiction, such invalidity, illegality or unenforceability shall not affect any other provision or any other jurisdiction, but this Agreement shall be reformed, construed and enforced in such jurisdiction as if such invalid, illegal or unenforceable provision had never been contained herein. 12. Notice. Unless otherwise provided herein, all notices, requests, demands, claims and other communications to be given or delivered under or by reason of the provisions of this Agreement shall be in writing and shall be deemed to have been duly received (a) upon receipt by hand delivery, (b) upon receipt after being mailed by certified or registered mail, postage prepaid, (c) the next business day after being sent via a nationally recognized overnight courier, or (d) upon confirmation of delivery if transmitted by electronic mail electronic mail in portable document format (PDF format) with an electronic read receipt requested, to the email address indicated (provided a copy thereof is also sent by one of the other methods described in this Section 12. Such notices, demands and other communications shall be sent to the address, email address or facsimile number indicated below: (a) If to Aggregator or Cure TopCo:

16. Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed to be an original but all of which together will constitute one and the same instrument. A facsimile or portable document format (PDF) copy of a counterpart signature page to this Agreement shall be deemed an original for all purposes. 17. Entire Agreement. This Agreement sets forth the entire agreement of the parties hereto with respect to the subject matter contained herein and supersede all prior agreements, promises, covenants, arrangements, communications, representations or warranties, whether oral or written, by any officer, member, manager or representative of any party hereto in respect of such subject matter. Without limiting the forgoing, this Agreement supersedes and replaces the Incentive Unit Agreement (other than with respect to any restrictive covenants set forth therein) which shall be of no further force and effect as of the IPO Closing Date. 18. Transfer of Personal Data. Executive authorizes, agrees and unambiguously consents to the transmission by Cure TopCo or Aggregator (or any Affiliate of Cure TopCo or Aggregator) of any personal data information related to the Incentive LLC Units awarded under this Agreement for legitimate business purposes. This authorization and consent is freely given by Executive. 19. Effectiveness. This Agreement shall be effective as of the IPO Closing Date (contingent on the closing of the IPO). If the IPO Closing Date does not occur for any reason, then (a) this Agreement shall be null and void, and (b) Executive shall continue to own the Incentive Units subject to the Third Amended and Restated Aggregator LLC Agreement, the Second Amended and Restated LLC Agreement and the Incentive Unit Agreement. [Signature Page Follows]

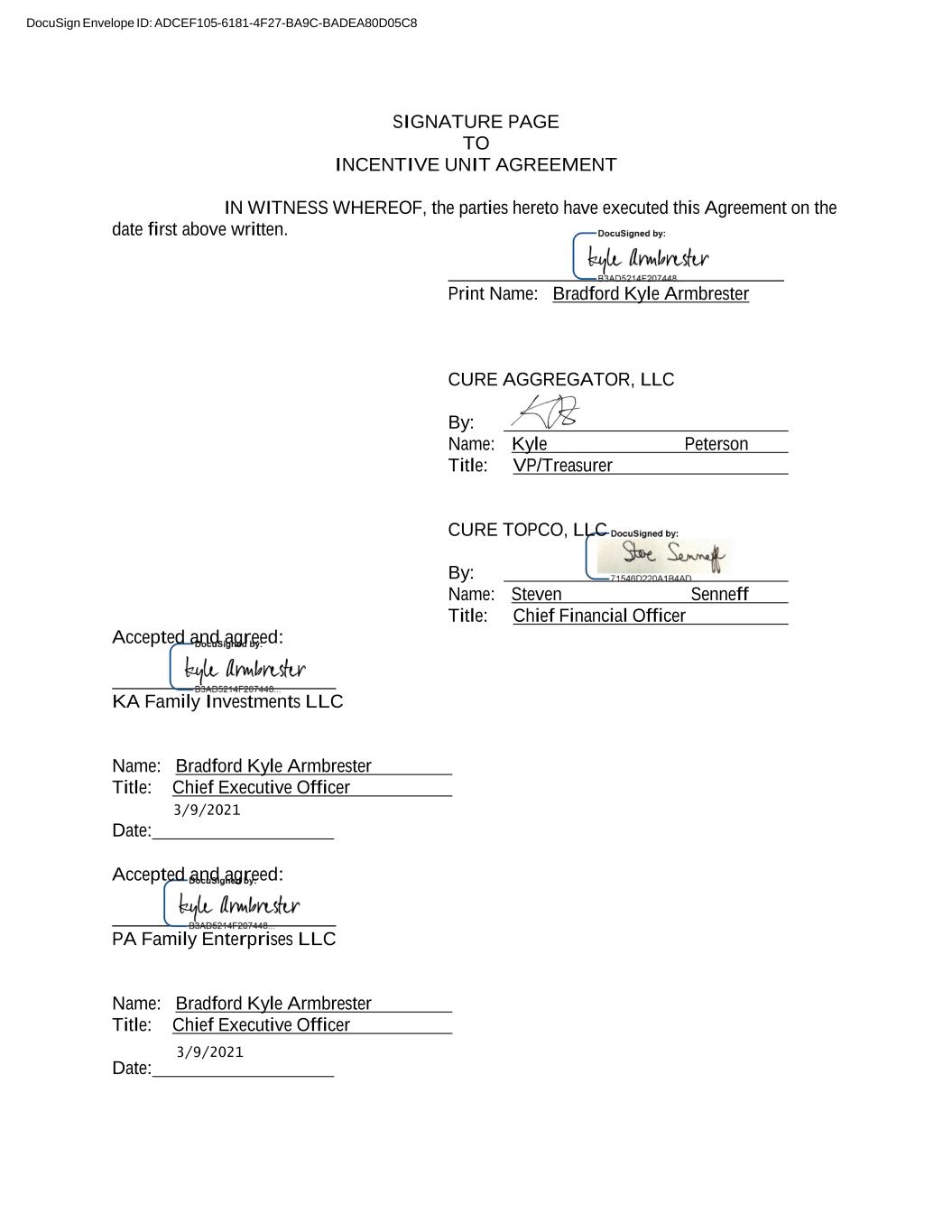

DocuSign Envelope ID: ADCEF105-6181-4F27-BA9C-BADEA80D05C8 SIGNATURE PAGE TO INCENTIVE UNIT AGREEMENT IN WITNESS WHEREOF, the parties hereto have executed this Agreement on the date first above written. Print Name: Bradford Xxxx Xxxxxxxxxx CURE AGGREGATOR, LLC By: Name: Xxxx Xxxxxxxx Title: VP/Treasurer CURE TOPCO, LLC Accepted and agreed: By: Name: Xxxxxx Xxxxxxx Title: Chief Financial Officer KA Family Investments LLC Name: Bradford Xxxx Xxxxxxxxxx Title: Chief Executive Officer 3/9/2021 Date: Accepted and agreed: PA Family Enterprises LLC Name: Bradford Xxxx Xxxxxxxxxx Title: Chief Executive Officer 3/9/2021 Date:

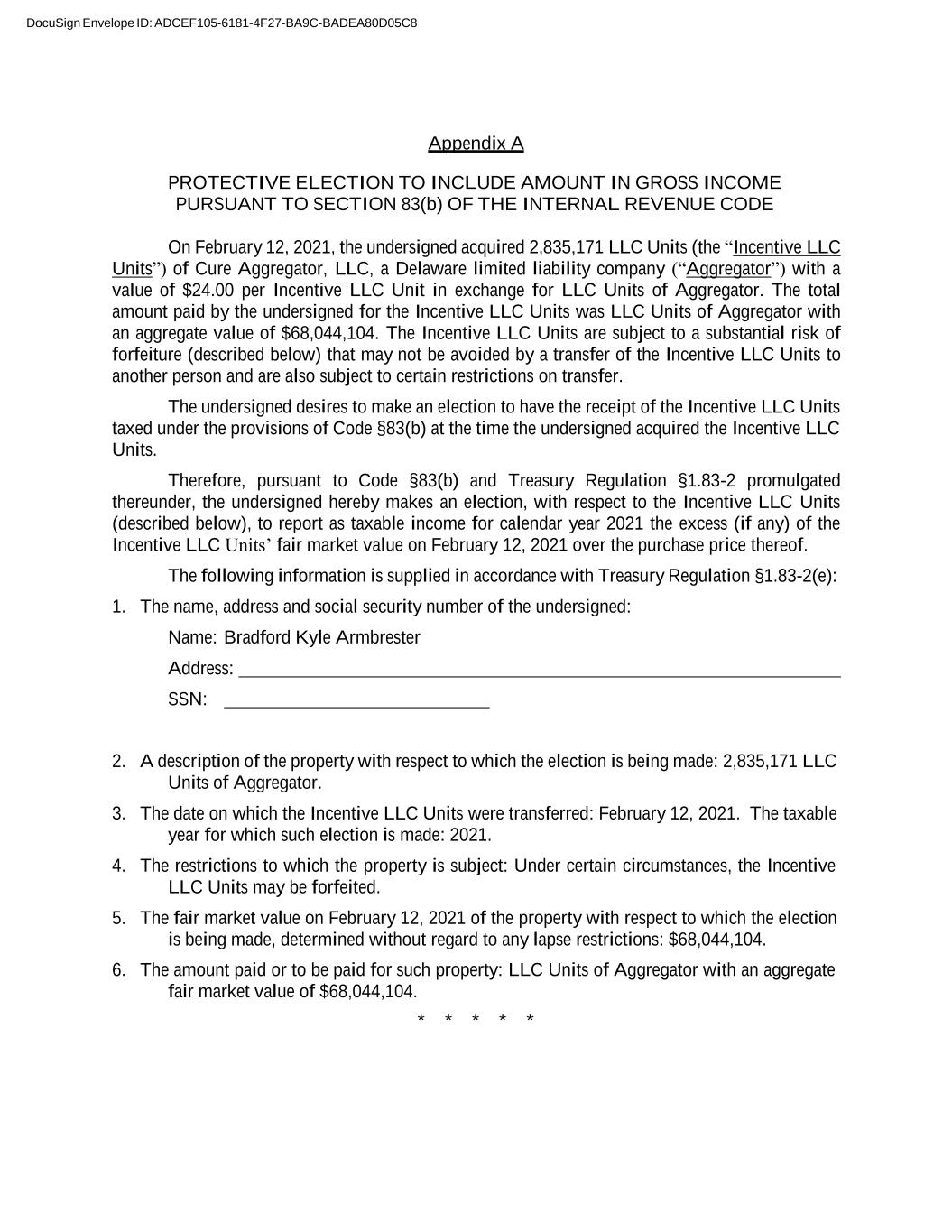

DocuSign Envelope ID: ADCEF105-6181-4F27-BA9C-BADEA80D05C8 Appendix A PROTECTIVE ELECTION TO INCLUDE AMOUNT IN GROSS INCOME PURSUANT TO SECTION 83(b) OF THE INTERNAL REVENUE CODE On February 12, 2021, the undersigned acquired 2,835,171 LLC Units (the “Incentive LLC Units”) of Cure Aggregator, LLC, a Delaware limited liability company (“Aggregator”) with a value of $24.00 per Incentive LLC Unit in exchange for LLC Units of Aggregator. The total amount paid by the undersigned for the Incentive LLC Units was LLC Units of Aggregator with an aggregate value of $68,044,104. The Incentive LLC Units are subject to a substantial risk of forfeiture (described below) that may not be avoided by a transfer of the Incentive LLC Units to another person and are also subject to certain restrictions on transfer. The undersigned desires to make an election to have the receipt of the Incentive LLC Units taxed under the provisions of Code §83(b) at the time the undersigned acquired the Incentive LLC Units. Therefore, pursuant to Code §83(b) and Treasury Regulation §1.83-2 promulgated thereunder, the undersigned hereby makes an election, with respect to the Incentive LLC Units (described below), to report as taxable income for calendar year 2021 the excess (if any) of the Incentive LLC Units’ fair market value on February 12, 2021 over the purchase price thereof. The following information is supplied in accordance with Treasury Regulation §1.83-2(e): 1. The name, address and social security number of the undersigned: Name: Bradford Xxxx Xxxxxxxxxx Address: SSN: 2. A description of the property with respect to which the election is being made: 2,835,171 LLC Units of Aggregator. 3. The date on which the Incentive LLC Units were transferred: February 12, 2021. The taxable year for which such election is made: 2021. 4. The restrictions to which the property is subject: Under certain circumstances, the Incentive LLC Units may be forfeited. 5. The fair market value on February 12, 2021 of the property with respect to which the election is being made, determined without regard to any lapse restrictions: $68,044,104. 6. The amount paid or to be paid for such property: LLC Units of Aggregator with an aggregate fair market value of $68,044,104. * * * * *

DocuSign Envelope ID: ADCEF105-6181-4F27-BA9C-BADEA80D05C8 A copy of this election has been furnished to Aggregator pursuant to Treasury Regulations §1.83- 2(d). Dated: , 2021 Xxxxxxxx Xxxx Armbrestor

DocuSign Envelope ID: ADCEF105-6181-4F27-BA9C-BADEA80D05C8 Appendix B Number of Incentive LLC Units: 2,835,171 Number of Corresponding Incentive Units: 2,835,171 Time-Based Unit Vesting Schedule: • Twenty-five percent (25%) of the Incentive Units on the first anniversary of January 1, 2019 • Thereafter Incentive Units vest in equal monthly installments for thirty-six (36) months, such that one hundred percent (100%) of the Incentive Units shall be vested on the fourth anniversary of January 1, 2019.

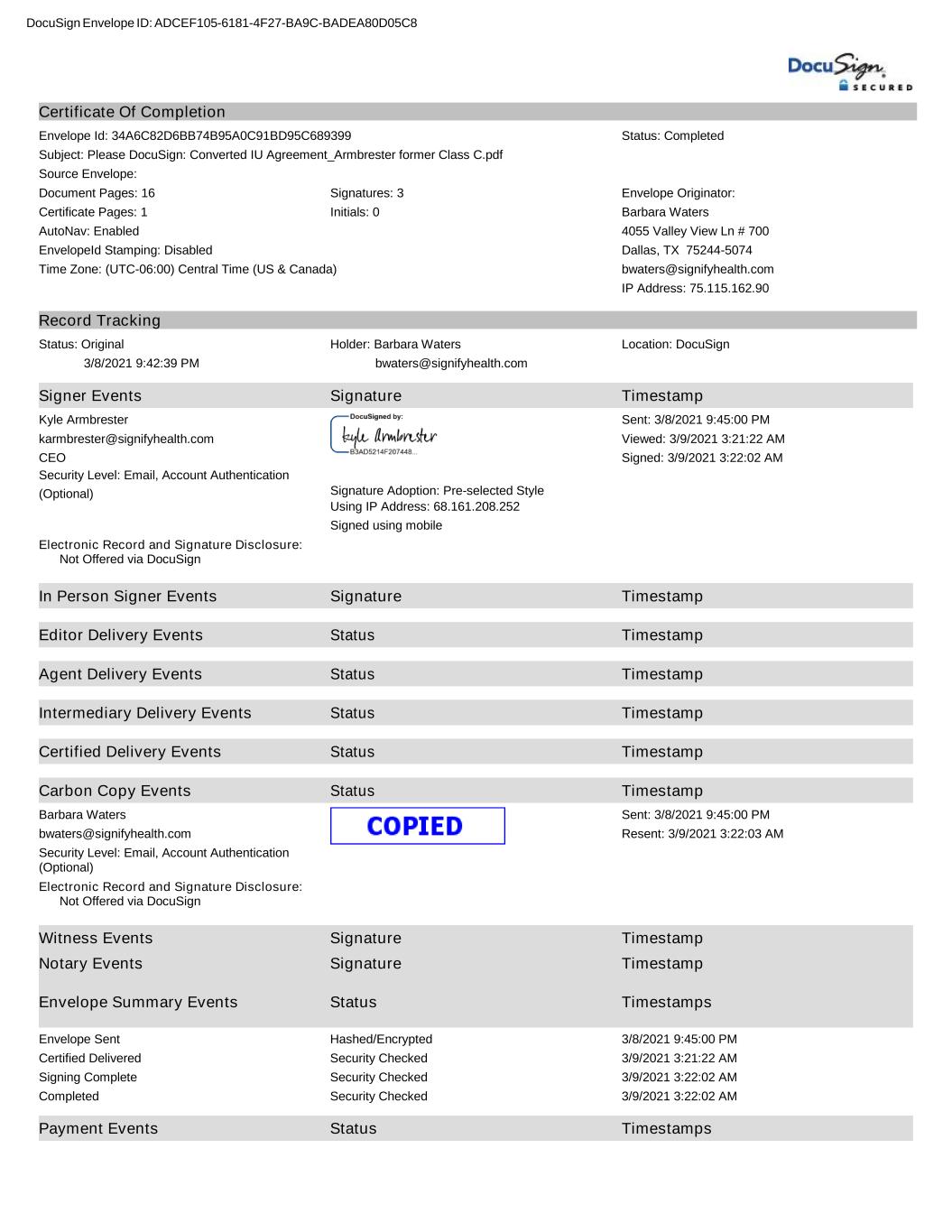

DocuSign Envelope ID: ADCEF105-6181-4F27-BA9C-BADEA80D05C8 Certificate Of Completion Envelope Id: 34A6C82D6BB74B95A0C91BD95C689399 Status: Completed Subject: Please DocuSign: Converted IU Agreement_Armbrester former Class C.pdf Source Envelope: Document Pages: 16 Signatures: 3 Envelope Originator: Certificate Pages: 1 Initials: 0 Xxxxxxx Xxxxxx AutoNav: Enabled EnvelopeId Stamping: Disabled Time Zone: (UTC-06:00) Central Time (US & Canada) 0000 Xxxxxx Xxxx Xx # 000 Xxxxxx, XX 00000-0000 xxxxxxx@xxxxxxxxxxxxx.xxx IP Address: 75.115.162.90 Record Tracking Status: Original 3/8/2021 9:42:39 PM Holder: Xxxxxxx Xxxxxx xxxxxxx@xxxxxxxxxxxxx.xxx Location: DocuSign Xxxx Xxxxxxxxxx xxxxxxxxxxx@xxxxxxxxxxxxx.xxx CEO Security Level: Email, Account Authentication (Optional) Signature Adoption: Pre-selected Style Using IP Address: 68.161.208.252 Signed using mobile Sent: 3/8/2021 9:45:00 PM Viewed: 3/9/2021 3:21:22 AM Signed: 3/9/2021 3:22:02 AM Electronic Record and Signature Disclosure: Not Offered via DocuSign Xxxxxxx Xxxxxx xxxxxxx@xxxxxxxxxxxxx.xxx Security Level: Email, Account Authentication (Optional) Electronic Record and Signature Disclosure: Not Offered via DocuSign Sent: 3/8/2021 9:45:00 PM Resent: 3/9/2021 3:22:03 AM Witness Events Signature Timestamp Notary Events Signature Timestamp Envelope Summary Events Status Timestamps Envelope Sent Certified Delivered Signing Complete Completed Hashed/Encrypted Security Checked Security Checked Security Checked 3/8/2021 9:45:00 PM 3/9/2021 3:21:22 AM 3/9/2021 3:22:02 AM 3/9/2021 3:22:02 AM Payment Events Status Timestamps Carbon Copy Events Status Timestamp Certified Delivery Events Status Timestamp Intermediary Delivery Events Status Timestamp Agent Delivery Events Status Timestamp Editor Delivery Events Status Timestamp In Person Signer Events Signature Timestamp Signer Events Signature Timestamp