HOTEL LEASE / PURCHASE AGREEMENT

Exhibit 10.1

This

Hotel Lease / Purchase Agreement (this “Lease”)

is dated 15 day of August, 2013 (“Effective

Date”), by and between Rising Sun/Ohio County First, Inc., an Indiana non-profit corporation

(hereinafter “Landlord” or “Owner”),

and Gaming Entertainment (Indiana) LLC, a Nevada limited liability company (hereinafter “Tenant”).

The parties hereby agree as follows:

|

|

A.

|

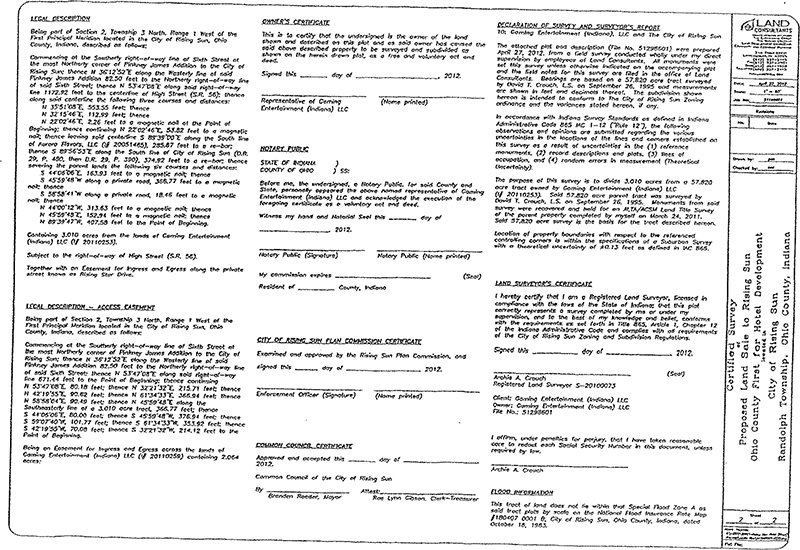

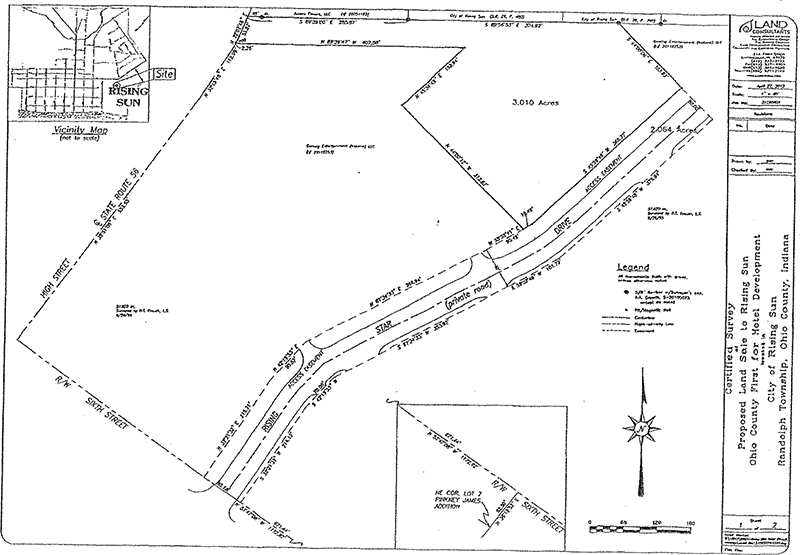

Landlord is the Owner (“Owner”) of certain real property located on XXX Rising Star Drive, located in Rising Sun, Indiana and more particularly described in Exhibit A (“ Premises”);

|

|

|

B.

|

The Premises as described in Exhibit A shall include a one hundred and four (104) room hotel (“Hotel”) to be constructed in accordance with this Lease;

|

|

|

C.

|

Tenant, together with its parent company, Full House Resorts, Inc., (“FHR”) is engaged in the ownership, development, management and operation of casinos, hotels and resorts and is experienced in various phases of hotel development, operations and management;

|

|

|

D.

|

Landlord is desirous of utilizing the services and experiences of Tenant in connection with the operation of the Hotel, all upon the terms and conditions set forth herein;

|

|

|

E.

|

Landlord and Tenant now desire to enter into this Lease with respect to the operations of the Hotel and the lease and purchase of the Hotel by Tenant in accordance with the terms and conditions set forth.

|

NOW, THEREFORE, in consideration of the mutual promises set forth herein, Landlord and Tenant agree as follows that the foregoing recitals are true and correct and incorporated into this Lease and the parties further agree that Landlord will lease and have the option to sell the Premises to Tenant, and Tenant will lease and have the option to purchase the Premises from Landlord, on the following terms and conditions:

ARTICLE I

APPROVALS

|

1.1

|

Approvals.

|

|

1.1.1

|

Tenant acknowledges and agrees that it will at all times during the Term (as defined below) maintain in full force and effect, and in good standing, at its sole cost and expense, all applicable permits, licenses and approvals (“Approvals”) to operate and manage the Hotel in the State of Indiana required by all federal, state and local laws, statutes, regulations, rules, ordinances, codes, licenses, permits, inspections and orders, from time to time in existence, of all courts of competent jurisdiction and governmental agencies, and all applicable judicial and administrative and regulatory decrees, judgments and orders that now or hereafter are required to be obtained for the operation of the Hotel, including, without limitation, the sale of alcoholic beverages, employees, health , safety and environmental matters and accessibility of public facilities (collectively, “Applicable Laws”).

|

| 1 |

|

1.1.2

|

Except as otherwise expressly provided herein, it is understood and agreed that Landlord shall deliver possession of the Premises and Hotel to Tenant upon the date on which the Hotel is first open to the public (the “Open Date”) and at such time, Landlord shall be responsible for delivering the Premises and Hotel to Tenant in compliance with all federal, state and local laws, regulations, rules, ordinances, codes, licenses, permits and orders, in all material aspects as it relates to the building structure, parking areas, and surrounding facilities on the Premises. Tenant hereby agrees not to do anything to cause the Premises or Hotel to be in material non-compliance with all applicable federal, state and local laws, regulations, rules, ordinances, codes, licenses, permits and orders.

|

ARTICLE II

LEASESD PROPERTY

2.1 Lease of Premises and Grant of Easements through Public Areas. Landlord hereby leases the Premises located on Rising Xxxx Xxxxx, Xxxxxx Xxx, XX 00000, inclusive of the Hotel, to Tenant and Tenant hereby leases the Premises from Landlord. Further, the parties have agreed to certain construction plans, design, materials and specifications. Exhibit B attached hereto shall include the construction and architectural plans and specifications, which shall not be modified without the consent of Tenant, which shall not be unreasonably withheld. Landlord anticipates an Open Date of November 13, 2013. However, pursuant to the Amended and Restated Real Estate Purchase Agreement, effective May 2, 2012, Landlord shall cause the Hotel to be constructed and open to the public and ready for an Open Date of no later than February 19, 2014. Landlord shall provide at least fifteen (15) days’ notice of the Open Date to Tenant.

2.2 Use of Public Areas. The parties have previously entered into a Grant of Easement and Agreement, dated the 26th day of October, 2012 and recorded at the Ohio County Recorder’s Office on November 9, 2012, Document Record Number 20120973 (“Easement Agreement”). The Easement Agreement shall be incorporated herein by reference.

| 2 |

ARTICLE III

TERM OF LEASE

3.1 Initial Term. The initial term of this Lease shall begin on the Open Date, and unless extended as provided below, shall end at 11:59 p.m. on the date immediately preceding the tenth (10th) anniversary of the Open Date (“Initial Term”).

3.2 Possession. Tenant shall be entitled to possession of the Premises, including the Hotel, no later than thirty (30) days prior to the Open Date for purposes of employee training and other similar purposes, but will have unfettered access to Premises and Hotel any time after the Effective Date and as agreed upon by Landlord and Tenant. The period of time during which Tenant is entitled to possession of the premises prior to the Open Date is referred to in this Lease as the “Pre-Open Possession Period”. Tenant shall exercise its right of possession during the Initial Term and any Additional Term (as defined below) (the Initial Term and any such Additional Term collectively, the “Term”).

3.3 Additional Terms. Provided that Tenant is not then in material default under this Lease, and subject to the provisions of Sections 5.13.1 and 5.13.2, Tenant shall have the option to extend this Agreement for one ten (10) year additional term (“Additional Term”) by giving the Landlord written notice of exercise of such option at least six (6) months prior to the expiration of the then-expiring Initial Term. In the event the Tenant does not provide such notice, the Lease will terminate as provided herein. Except as expressly provided in this Lease, or as Landlord and Tenant may otherwise agree, the terms and conditions applicable to the Additional Term will be the same as the terms and conditions of the Initial Term, with the exception of Rent, which shall be negotiated and mutually agreed upon by Landlord and Tenant during the time period in which Tenant provides notice to Landlord. In the event that Landlord and Tenant cannot reach mutual agreement for Rent during Additional Term: (a) this Lease shall not automatically terminate and Tenant shall continue to make Base Rent (as hereinafter defined) payments in an amount equal to the amount of Base Rent paid by Tenant during the last year of the Term plus an additional amount equal to the Base Rent paid by Tenant during the last year of the Term multiplied by the percentage change in the CPI plus one percent (1%) (as defined below) over the most recent preceding twelve (12) month period for which the CPI has been calculated and reported; (b) Landlord and Tenant agree that the amount of Base Rent payable during the Additional Term shall be presented to an arbitrator who shall be experienced in management of hotels in Southern Indiana who shall determine the Base Rent to be paid by Tenant during the Additional Term; and (c) any payments made after the Initial Term and prior to a determination by the arbitrator shall be credited as Base Rent during the Additional Term.

3.4 Holding Over. In the event Tenant remains in possession of the Premises after the expiration of the Term or earlier termination of this Lease, after written objection from Landlord, Tenant shall, at the option of the Landlord, be considered a month-to-month tenant at the monthly rate equal to the amount of Base Rent paid by Tenant during the last year of the Term plus an additional amount equal to the Base Rent paid by Tenant during the last year of the Term multiplied by an amount equal to one percent (1%) in excess of the a percentage change in the CPI in the manner prescribed herein in this Lease.

| 3 |

ARTICLE IV

RENT

4.1.1 Rent.

Tenant shall pay to Landlord Base rent payments, in the amounts set forth in the attached Base Rent Schedule (Exhibit C) in monthly installments, with the first payment being due on January 1, 2014, payable in arrears, in the manner prescribed herein (“Base Rent”). All references to Rent in this Lease shall collectively mean Base Rent payable during the Initial Term and any Additional Term and all other amounts payable by Tenant to Landlord as additional Rent. The parties acknowledge that the attached Base Rent Schedule calculation is based upon the Landlord’s contracted Guaranteed Maximum Price (“GMP”) with its general contractor and predetermined, reasonable and necessary architectural, pre-approved legal, financial, and approved construction services (“Soft Costs”), collectively, “Project GMP” and that the Base Rent Schedule will be updated within forty-five (45) days following the Open Date to reflect actual Construction Costs and Soft Costs, as defined herein. Notwithstanding the foregoing, Base Rent shall be based upon the lesser of the Project GMP or the sum of actual Construction Costs and actual Soft Costs (such sum collectively, “Actual Costs”).

4.1.2 Construction Costs. Construction Costs shall include Soft Costs and capitalized interest rendered to Landlord for the purpose of constructing Hotel. The parties have attached the Hotel Budget and Soft Cost Budget, as previously approved by Landlord’s lender as Exhibit D hereto. Landlord shall provide Tenant additional supporting documentation of Construction Costs and Soft Costs and such documentation shall include, but not be limited to: disbursement of funds to Landlord from its lender, construction agreements, change orders, invoices for professional services related to Hotel approval (including but not limited to legal and architectural services), proof of payment by Landlord to third parties, and any other documentation reasonably requested by Tenant (“Construction Documentation”). Landlord shall have an obligation to provide Tenant satisfactory Construction Documentation within forty-five (45) days following the Open Date, unless Landlord requests to Tenant in writing an extension of time, not to exceed an additional thirty (30) days, to provide Construction Documentation, which Tenant shall not unreasonably withhold such consent.

4.2.1 Rent Calculation. The Parties hereby agree that the Base Rent payable pursuant to Section 4.1.1 during the Initial Term commencing upon the Open Date of this Lease, shall be calculated (“Base Rent Calculation”) using a standard financial amortization schedule. The amortization schedule shall calculate the principal and interest of the actual Construction Cost of Hotel, over a ten (10) year period using the following annual interest rates: Year One (1) and Year Two (2): two and one half percent (2.5%); Year Three (3) and Year Four (4): three and one half percent (3.5%); Year five (5) through Year Ten (10): four and one half percent (4.5%). For purposes of the Base Rent Calculation, Construction Costs and Soft Costs shall not exceed Landlord’s Project GMP of eight million two hundred eighteen thousand nine hundred forty-eight dollars and forty-six cents ($8,218,948.46) . The Base Rent Calculation for Year One (1) shall commence on the Hotel Open Date, but the first Base Rent payment shall not be due until January 1, 2014, as reflected in the Base Rent Schedule.

| 4 |

Tenant further agrees that as part of the Base Rent Calculation, Tenant shall pay an amount equal to two percent (2%) per annum of the Construction Costs from October 24, 2011, until the Open Date, and such payment shall be included in the calculation of the amortized Base Rent Schedule and shall be paid as part of the Base Rent on a monthly basis during the Initial Term of this Lease;

For any Additional Term, the parties agree that Base Rent shall be adjusted annually on the anniversary of the Open Date by an amount equal to one percent (1%) in excess of the percentage change in the CPI (as defined below) over the most recent twelve (12) month period preceding such anniversary date for which the CPI has been calculated and reported. For purposes of this Lease, the Term “CPI” shall mean the Consumer Price Index for the geographic area that includes Rising Sun, Indiana, as calculated and reported by the Bureau of Labor Statistics of the U.S. Department of Labor.

Tenant shall be entitled to a credit on any Base Rent payments made based on the Project GMP if actual Construction Costs or Soft Costs are determined to be less than accounted for in Project GMP. Should Tenant be entitled to a credit, the monthly Base Rent payment(s) following such determination shall be reduced by the difference of the previously paid Base Rent and the revised Base Rent Calculation (as defined in 4.2.1) based on actual Construction Costs.

4.2.2 Base Rent Payable. Tenant shall pay Landlord Base Rent, payable in arrears in the amount as calculated pursuant to Section 4.2.1. The Base Rent shall accrue beginning as of the Open Date; however, payment of Base Rent shall be deferred until January 1, 2014, on which date monthly installment payments of Base Rent on (1st) calendar day of each consecutive month shall begin. Base Rent through December 31, 2013, shall be considered in the calculation of the amortized Base Rent Schedule and shall be paid as part of the Base Rent on a monthly basis during the Initial Term of this Lease.

4.2.3 Remittance to Landlord. All Base Rent and other payments owed to Landlord pursuant to this Lease shall be made to the Landlord, Rising Sun/Ohio County First, Inc. c/o Xxx Xxxxxx, 000 Xxxxx Xxxxxx Xx., Xxxxxx Xxx, Xxxxxxx 00000, which address may be changed from time to time by the Landlord upon prior written notice to Tenant. In the event the Tenant exercises the Option to Purchase as defined herein, the Landlord agrees to credit all Base Rent payments made during the Term towards the Purchase Price of the Hotel as provided in Section 5.13.2.

| 5 |

4.2.4 Late Charges and Interest. Notwithstanding anything in this Lease to the contrary, if Tenant fails to pay any Rent within seven (7) days following the due date of said Rent, then Tenant shall pay, as additional Rent, a late charge of five per cent (5%) of the amount due. In addition to any late charges provided herein, any amount not paid by Tenant within ten (10) days after its due date in accordance with the terms of this Lease shall bear interest from such date until paid in full at twelve percent (12%) per year, payable as additional Rent. It is expressly the intent of Landlord and Tenant at all times to comply with applicable law governing the maximum rate or amount of any interest payable on or in connection with this Lease. If applicable law is ever judicially interpreted so as to render usurious any interest called for under this Lease, or contracted for, charged, taken, reserved, or received with respect to this Lease, then it is Landlord’s and Tenant’s express intent that all excess amounts theretofore collected by Landlord be credited on the applicable obligation (or, if the obligation has been or would thereby be paid in full, refunded to Tenant), and the provisions of this Lease immediately shall be deemed reformed and the amounts thereafter collectible hereunder reduced, without the necessity of the execution of any new document, so as to comply with applicable law, but so as to permit the recovery of the fullest amount otherwise called for hereunder.

ARTICLE V

USE OF PREMISES; PURCHASE OF PREMISES

5.1 Use of Premises. Tenant shall use the Premises as a hotel. Said Hotel will serve as an amenity to Tenant’s existing casino, existing hotel and other existing facilities located at 000 Xxxxxx Xxxx Xxxxx, Xxxxxx Xxx, Xxxxxxx 00000, commonly known as Rising Star Casino Resort (“Rising Star”). Tenant shall, at its sole discretion, to operate the Hotel in a similar fashion as its existing hotel management.

Except as otherwise specifically limited under this Lease, Tenant shall have control and discretion in the operation of the Hotel. Tenant shall also have the sole and exclusive right to determine the Hotel’s hours of operation, room rates, promotional offerings and policies for the Hotel. Tenant shall have the right, in its discretion and at its expense, to place or install signage on the exterior of the Hotel.

5.1.1 Construction Phase and Pre-Opening of Hotel. Upon the Effective Date of this Lease, Tenant shall provide Landlord its expertise and experience during the final construction phases and pre-opening planning of the Hotel. Tenant shall cooperate with Landlord and provide supervision for the Hotel development in its final stages. Tenant shall provide guidance and recommendations to Landlord related to the construction, development, improvements, and other activities related to the final phases of Hotel construction. In providing pre-opening and construction related services, Tenant hereby agrees not to do anything to cause Landlord, Tenant, or activities related to the Premises and Hotel to be in non-compliance with all Applicable Laws. Landlord and Tenant agree that Tenant may work directly with Landlord’s general contractor to make day-to-day construction decisions and approve change orders subject to the following: (a) Landlord shall be notified promptly in writing of any such change orders; (b) any substantive change orders shall require and be subject to Landlord’s prior written consent; and (c) without Landlord’s written consent, no such change order shall cause the Hotel construction to exceed the GMP agreed upon by Landlord and its general contractor or otherwise cause Landlord, Tenant, or activities related to the Premises and Hotel to be in non-compliance with all Applicable Laws. Pre-opening expenses contemplated in the Hotel Budget shall be the responsibility of the Landlord, and Tenant shall not have the authority to exceed Hotel Budget without the prior written consent of the Landlord. All costs and expenses of Tenant’s use and possession of the Premises and Hotel during the Pre-Open Possession Period, or otherwise incurred by Tenant during the Pre-Open Possession Period, shall be paid by Tenant and any such costs or expenses paid by Landlord shall be promptly (and in any event within fifteen (15) business days reimbursed to Landlord upon Landlord’s request.

| 6 |

Upon the Effective Date, Tenant may take actions to prepare to take possession of Hotel on the Open Date, including, but not limited to planning and preparing for the hiring and training of employees, and planning and preparing for, which may include, but not be limited to, executing contractual supplier agreements, and other services such as janitorial services, building maintenance, housekeeping, waste disposal/removal, cleaning supplies, internet connectivity and telecommunications, utilities, snacks and vending contracts, a hotel reservation system, marketing and advertising and any other services which Tenant is required herein or otherwise deems necessary and appropriate.

5.1.2 Revenues, Profits and Losses from Use of Premises; No Right of Offset. Tenant shall have the sole and absolute right to retain any and all revenues and profits resulting from its use of Premises and Hotel during the Term of this Lease. Further, Tenant shall bear any operating losses as it relates to its use of the Premises and Hotel during the Term of this Lease. Nothing contained herein shall give the Landlord the right to offset any Rent or other monies owed as a result of Tenant’s revenues and/or profits resulting from its use of Premises and Hotel. Further, Tenant shall not have the right to offset any obligations owed by Landlord to Tenant against any Rent or other monies owed by Tenant under the provisions of this Lease.

5.2 Operating Services. Tenant shall be responsible for providing and paying for all operating services as it relates to the Premises and Hotel, which Tenant, from time to time, and in its sole discretion utilizing reasonable business judgment elects to provide (“Operating Services”). For these purposes, Operating Services shall not include any obligations of Tenant or Landlord under any other provision of this Lease.

The sole responsibility and authority for the management of the Hotel is vested in Tenant, and the Tenant shall have the complete right and authority to manage the business and affairs of the Hotel. The rights, duties and obligations of Tenant with respect to its Use of the Premises and Hotel as Tenant are personal to Tenant and based on Tenant and its executive management’s unique knowledge and experiences. Landlord may request other Operating Services as it relates to the use of the Premises and Hotel, and Tenant shall consider such recommendations in good faith and in a manner reasonably believed to be in the best interests of ensuring profitable Hotel operations and with the same care as a prudent person would exercise in the management of its own hotel.

| 7 |

5.3 Furnishings. Landlord shall provide all furniture, fixtures and equipment (“FF&E”) for the Hotel, and all FF & E shall be installed prior to Open Date. Landlord shall work with its general contractor and Tenant to provide Tenant a complete descriptive list of FF & E Inventory prior to Open Date and such list shall be incorporated herein as Exhibit E. Tenant shall be responsible at its expense for repair and replacement of FF&E as necessary, upon normal wear and tear; such determination shall be made at the sole discretion of Tenant utilizing reasonable business judgment. In no event shall Landlord be responsible for any repair and replacement of FF&E.

5.4.1 Employees. Tenant shall have the sole right to hire, promote, discharge and supervise all employees engaged, directly or indirectly in Tenant’s operation of Hotel, all of whom shall be employees of Tenant. Tenant shall be solely responsible for determining and paying the wages and other compensation of all personnel employed by Tenant in connection with operation of the Hotel, including medical and health insurance, pension plans, social security taxes, worker’s compensation insurance, and shall comply with all applicable laws with respect to such employees. Tenant shall be solely liable for all employment and personnel actions (including but not limited to wrongful termination and discrimination claims) and all claims arising out of injuries occurring at the Premises regarding Tenant’s employees. Tenant shall have the right to apply its existing hiring and human resources practices, policies and procedures (“Rising Star Policies”) as it currently applies to Rising Star employees, which may be modified, from time to time, at the sole discretion of Tenant, so long as such modifications to Rising Star Policies are not in conflict with Tenant’s responsibilities and obligations contained in this Lease or otherwise prohibited by law.

5.4.2 Employee Hiring. Tenant may hire employees as it deems necessary in order to fulfill its obligations under this Lease. During the Term of this Lease, the hiring, management and separation of employees shall be at Tenant’s sole discretion. Prospective employees must be qualified and satisfy all Rising Star Policies and screening requirements. Tenant will make demonstrable good faith efforts to hire at least fifty percent (50%) of Hotel employees who are individuals residing in Ohio County, State of Indiana (“Hotel Hires”). Tenant will continue to make demonstrable good faith efforts to hire at least fifty percent (50%) of its Hotel Hires from Ohio County, State of Indiana, for the Hotel operation during the Term of this Lease; however, failure by Tenant to hire or continue to employ at least fifty percent (50%) of the Hotel employees be residents of Ohio County, Indiana, despite such demonstrable good faith efforts, does not constitute a default under this Lease. Tenant shall have all appropriate Hotel Hires (that is, all Hotel employees who interact with Hotel guests as part of their customary employment responsibilities) complete the Hospitality/Tourism Program offered by the Education Center of Rising Sun as part of each such employee’s training, so long as such program is offered. Should the Hospitality/Tourism Program be discontinued, or fails to meet Tenant’s training needs, based on Tenant’s reasonable business judgment, Tenant may elect to conduct such hospitality training in-house. Tenant shall provide Landlord with thirty (30) days notification if Tenant decides to discontinue utilization of the Hospitality/Tourism Program.

| 8 |

5.4.3 Additional Obligations. Tenant shall, and shall direct all of its employees and other personnel to, use commercially reasonable efforts to keep the Premises clean and in good working order, subject to ordinary wear and tear.

5.4 Use of Premises. The use of the Premises by Tenant, its agents, employees, customers or business invitees, shall at all times be in compliance, in all material respects, with all covenants, conditions and restrictions, easements, reciprocal easement agreements, rights of access, and other matters presently of public record which affect the Premises or the Hotel, or any part thereof. Tenant’s rights under this Lease shall be subordinate to the usual and customary covenants, conditions, restrictions, reciprocal easement agreements, rights of access and other comparable encumbrances that are intended to encumber or benefit the Hotel, subject in all cases to Article X, Landlord’s Covenant of Quiet Enjoyment.

5.5 Hazardous Materials. Tenant shall not without the prior consent of Landlord, which consent shall not be unreasonably withheld, except to the extent that such materials are consistent with materials used in the ordinary course of business for the Hotel operations, keep, use or store or allow to be kept, used or stored, upon or about the Premises any Hazardous Materials. “Hazardous Materials” shall mean and include any substance or material containing one or more of any of the following: “hazardous material,” “hazardous waste,” “hazardous substance,” “regulated substance,” “petroleum,” “pollutant,” “contaminant,” “polychlorinated biphenyls,” “lead or lead-based paint,”, “mold,” or “asbestos” as such terms are defined in any applicable Environmental Laws in such concentration(s) or amount(s) as may impose clean-up, removal, monitoring or other responsibility under the Environmental Laws, as the same may be amended from time to time, or which may present a risk of harm to guests, invitees or employees at the Premises. “Environmental Laws” shall mean all federal, state and local laws, rules and regulations, (now or hereafter in effect) dealing with the use, generation, treatment storage, disposal, or abatement of Hazardous Materials.

5.6 Maintenance by Tenant. During the Term, Tenant shall maintain the Premises and Hotel in a tenantable and attractive condition, consistent with the terms hereof, and Tenant shall with commercially reasonable promptness and diligence make all necessary and appropriate repairs and replacements thereto. Tenant shall be responsible for all maintenance, including the roof, outside walls, and other structural parts of the building, and the heating and air conditioning system, the parking lot, driveways, and sidewalks, including snow and ice removal, the sewer, water pipes, and other matters related to plumbing, the electrical wiring, all other items of maintenance, repair and improvement work as is reasonably necessary. Tenant shall be responsible for cleaning, painting, decorating, carpeting and all other interior maintenance, repair and improvement work as is reasonably necessary. All repairs shall be made in a good, workmanlike manner, consistent with industry standards and in accordance with all applicable laws and in accordance with all directions, rules and regulations of all governmental authorities having jurisdiction over the Premises and Hotel. Tenant will operate and maintain the Hotel in substantially similar standards and methods as its existing Rising Star hotel.

| 9 |

5.7 Compliance with Applicable Laws. Tenant shall comply with all Applicable Laws during the Term affecting the Premises or Hotel or Tenant’s use thereof in all material respects. Tenant shall not use the Premises so as to create a waste or constitute a nuisance or disturbance. Tenant shall keep all of the furniture, fixtures and equipment located on the Premises neat and clean and in good working order, condition and repair. All such repairs shall be made in good, workmanlike manner, consistent with industry standards, in accordance with all Applicable Laws.

5.8 Alterations. Tenant shall not make any material structural alterations or replacements or other capital expenditures, excluding alterations or replacements as a result of routine maintenance and/or ordinary wear and tear, to the Premises without having first obtained Landlord’s prior written approval which approval shall not be unreasonably withheld or delayed.

5.9 Signs. Tenant shall be permitted to place or install signs on the interior and exterior of the Premises and Hotel, without Landlord’s prior written approval. Tenant shall have the right to place customary signs on the interior and exterior of the Premises and Hotel which might facilitate Tenant’s business and integrate the Hotel with Tenant’s existing Rising Star hotel and casino operations, provided the sign is in accordance with applicable law, ordinances, and statutes. Tenant shall be responsible for and shall pay all costs related to signage at the Premises and Hotel.

5.10 Surrender of Improvements. All additions, improvements and FF &E which may be installed by either Landlord or Tenant, upon the Premises or within the Hotel during the Term, shall remain upon the Premises, and at the expiration or termination of this Lease, shall be surrendered with the Premises as part thereof and shall be property of the Landlord, unless Tenant exercises its Option to Purchase pursuant to Section 5.13 or 5.14. Should Tenant exercise its Option to Purchase, any Improvements shall be included in the Purchase of said Premises and Hotel.

5.11 Personal Property and Use Tax. Tenant shall be responsible for and shall pay when due all federal, state and local income, innkeepers, employment, sales, excise and all other fees and/or taxes due and owing upon Tenant’s income from use of Premises and Hotel, property, employee and other fees and costs arising or assessed as a result of Tenant’s use and occupation of Premises and Hotel. Tenant shall provide Landlord with notification of the payment of property tax within fifteen (15) business days of such payments being made.

5.12 Surrender of Premises. Upon expiration or earlier termination of this Lease, Tenant shall surrender the Premises to Landlord general in the same condition as at the commencement of the Term, ordinary wear and tear excepted. Upon such expiration or earlier termination of this Lease, except as provided in Section 5.13 or 5.14, Tenant shall surrender the Premises and Hotel in “broom clean” condition.

| 10 |

5.13.1 Tenant’s Option and Obligation to Purchase. Tenant shall have the exclusive right and option to purchase the Premises and said improvements, namely the Hotel and any other improvements made on the Premises during the Initial Term on the terms and conditions set forth in this Lease (“Option to Purchase Premises”), conditioned upon Tenant not being in default beyond any applicable grace and/or cure period of the Lease at the time in which it elects to exercise the Option to Purchase Premises.

Upon expiration of the Initial Term or at any time thereafter (including, without limitation, at any time during any Additional Term and, if Tenant does not extend the Term for any Additional Term, within one (1) year following expiration of the Initial Term), if Tenant has not exercised its Option to Purchase Premises, Landlord shall have the right and option to sell the Premises and said improvements, namely the Hotel and any other improvements made on the Premises, to Tenant and upon exercise of such right and option by Landlord, Tenant shall have the duty and obligation to purchase the Premises and all of said improvements from Landlord, on the terms and conditions set forth in this Lease (“Option to Sell Premises”).

Should Tenant desire to exercise its Option to Purchase Premises, or should Landlord desire to exercise its Option to Sell Premises, the party desiring to exercise such Option shall provide the other party written notice of its desire to exercise its Option to Purchase Premises or Option to Sell Premises, as the case may be, at least forty-five (45) days preceding its proposed closing date to transfer legal deed of Premises. Said notice shall contain a proposed closing date, which may be modified upon mutual agreement by the parties.

5.13.2 Premises Purchase Price. Should Tenant provide notice of its desire to exercise its Option to Purchase Premises at any time, or should Landlord provide notice of its desire to exercise its Option to Sell Premises, the Parties have agreed that the purchase price (“Premises Purchase Price”) shall be equal to the fair market value of the Premises, which the parties hereby agree shall be equal to (i) the lesser of the Project GMP or the Actual Costs reduced by (ii) the aggregate “principal” payments included in the Base Rent paid by Tenant, such amount being shown as the unamortized “Balance” amount on the attached Base Rent Schedule as of the date next following the closing date of such option purchase (“Exhibit C”). The Parties agree to update Exhibit C to reflect Actual Costs within forty-five (45) days of the Open Date. The Premises Purchase Price shall not exceed the unamortized value of the lesser of (a) the balance of the Project GMP; or (b) the balance of the Actual Costs, which shall be updated within forty-five (45) days of Open Date. In addition to payment of the Premises Purchase Price, Tenant shall pay all closing costs, including without limitation reasonable attorneys’ fees which have been mutually agreed upon in advance, incurred in connection with sale of the Premises by Landlord to Tenant pursuant exercise of Tenant’s Option to Purchase Premises or Landlord’s Option to Sell Premises, as the case may be.

| 11 |

Within twenty (20) days following receipt by Landlord of notice from Tenant of Tenant’s election to exercise Tenant’s Option to Purchase Premises or receipt by Tenant of notice from Landlord of Landlord’s election to exercise Landlord’s Option to Sell Premises, as the case may be (or such longer period as may reasonably be required by Landlord using diligent, commercially reasonable efforts), Landlord shall deliver to Tenant, at Tenant’s expense, a binder for an ALTA owner’s policy of title insurance (the “Policy”), together with legible photocopies of all exceptions to title identified therein, (“Title Binder”) issued by a title insurer satisfactory to Tenant in its reasonable discretion (“Title Insurer”), and thereafter the Policy, by which Title Insurer will agree to insure, in the full amount of the Premises Purchase Price, good and marketable title to the Premises and easements rights in all appurtenant easements, subject only to (i) the matters of record at the time Tenant conveyed the Premises to Landlord, (ii) any liens created by the Real Estate Construction Mortgage, Security Agreement, Assignment of Lease and Rents and Fixture Filing and the Security Agreement (collectively, the “Security Documents”) by and between Landlord and its lender; (iii) any liens, encumbrances and defects created by Tenant during the Term and (iv) the lien of current taxes and assessments (the “Permitted Exceptions”), upon delivery of a general warranty deed thereto from Landlord to Tenant. Within twenty (20) days after receipt of the Title Binder, Tenant shall give Landlord written notice of any exceptions enumerated in the Title Binder that are not Permitted Exceptions and are unacceptable to Tenant. Landlord shall have twenty (20) days after receipt of that notice (or such longer period as may reasonably be required by Landlord using diligent, commercially reasonable efforts) to have those exceptions removed, and if Landlord is unable to do so: (A) any election of Tenant’s Option to Purchase Premises, at the option of Tenant, shall (i) terminate and all obligations and liabilities of the parties pursuant to the election of the Option to Purchase Premises shall cease and Tenant shall continue as a Tenant under the Lease which Lease shall remain in full force and effect or (ii) continue and Tenant shall purchase the Premises in accordance with the Option to Purchase Premises; and (B) any election of Landlord’s Option to Sell Premises shall remain in effect and at the option of Tenant shall (i) have the closing of such sale of the Premises to Tenant postponed until such exceptions have been removed, during which time Tenant shall continue as a Tenant under the Lease which shall remain in full force and effect or (ii) continue and Tenant shall purchase the Premises in accordance with the Option to Sell Premises.

At the closing of any such purchase, Tenant shall deliver to Landlord payment in full of the Premises Purchase Price by wire transfer or other immediately available funds. In addition, at the closing of the purchase, Landlord shall deliver to Tenant (i) a properly executed general warranty deed conveying the fee simple estate in the Premises to Tenant free and clear of any and all liens, leases, encumbrances and restrictions of any kind or nature whatsoever, except the Permitted Exceptions, current taxes not delinquent and any exceptions resulting from Tenant’s failure to perform any of its obligations under this Lease, (ii) an affidavit stating that Landlord has not executed, or authorized anyone in Landlord’s behalf to execute any conveyance, mortgage, lien, lease, security agreement, financings statement or encumbrance of or upon the Premises or any fixtures attached thereto that is then outstanding or enforceable against the Premises, nor has Landlord made any contract to sell, or given to any person other than Tenant, an option to purchase, all or any part of the Premises, (iii) a certification of non-foreign status with respect to Landlord as required by Section 1445 of the Internal Revenue Code, and (iv) the Policy.

| 12 |

If the Premises are destroyed by fire or other casualty, or all or any portion thereof becomes the subject of a condemnation, following notice of exercise of the Option to Purchase Premises or the Option to Sell Premises, as the case may be and prior to Closing, the parties shall remain obligated to proceed with the purchase and sale of the Premises and Tenant shall be entitled to all insurance proceeds payable to Landlord under any and all policies of insurance, or any award for the condemnation or payment in lieu thereof, and Landlord shall assign all of its right, title, and interest in and to any future proceeds, awards or payments to Tenant.

Without limiting the foregoing, the Premises Purchase Price shall be reduced by the amount of any condemnation proceeds received by Landlord and not applied to restoration of the Premises as provided in Section 9 of this Lease or otherwise paid over to Tenant.

Notwithstanding any other provision of this Lease, in no event shall the Premises Purchase Price (as reduced by any amounts provided for above in this Section 5.13.2) be less than the amount required for Landlord to pay the balance of its mortgage indebtedness to Rising Sun Regional Foundation, Inc. so long as such indebtedness does not exceed Actual Costs as defined herein.

5.14 Intentionally Omitted.

5.15 Certain Notices by Tenant to Landlord. Tenant shall promptly (and in any event within ten (10) business days) notify Landlord in writing following the earliest of the occurrence of, Tenant or any of its direct or indirect parent entities entering into an agreement to, or Tenant otherwise becoming aware of any one of the following during the Term: (i) a Change of Control (as defined below) of Tenant or its parent company, FHR; or (ii) Tenant or FHR entering into a license or other contractual agreement for a third party to manage or brand (“flag”) its existing hotel at Rising Star; or (iii) the Indiana Gaming Commission approval of the transfer of Tenant’s gaming license to operate Rising Star’s casino, hotel and related amenities.

| 13 |

ARTICLE VI

INDEMNITY AND LIABILITY

6.1 Indemnification of Landlord. Except to the extent directly arising from the gross negligence or intentional misconduct of Landlord, or any of its agents, independent contractors or employees, Tenant hereby agrees to defend (with counsel reasonably acceptable to Landlord), indemnify and save and hold harmless Landlord from and against all claims of whatever nature (a) arising from or in connection with the operation of the Hotel or any wrongful act, omission or negligence of Tenant or the contractors, licensees, agents, servants or employees of Tenant (collectively, the “Tenant Parties”), or arising from any accident, injury or damage whatsoever caused to any person, or to the property of any person, including that of Landlord or any Tenant Party, occurring during the Term or the Pre-Open Possession Period as a result of Tenant’s use or operation of the Premises and Hotel, including any claim by a third person in connection with damage to the Premises or Hotel or any of Tenant Party’s property located therein or property of any person located therein, (b) arising from any accident, injury or damage occurring outside of the Premises, where such accident, injury or damage results from a wrongful act, omission or negligence on the part of Tenant or any Tenant Party, (c) arising from any and all claims by any Tenant Party’s employees, including, without limitation, wrongful termination and/or other claims resulting from the termination of any Tenant Party’s employees, (d) arising due to the failure of any Tenant Party to obtain or maintain any necessary Approvals during the Term or Additional Term, (e) arising due to any breach or violation of this Lease by Tenant, including, without limitation, any holdover at the Premises or the presence of any Hazardous Materials on or about the Premises as a result of the acts or omissions of any Tenant Party, or (f) arising as a result of Landlord or any of its respective agents, contractors or employees taking any direction from any Tenant Party. The parties further agree that Tenant shall not be liable to Landlord for, and has no obligation to indemnify and save and hold harmless Landlord from and against, any and all claims related to the design and construction of the Hotel, whether such claim is caused or occasioned prior to or after the Effective Date of this Lease. In furtherance of the responsibilities set forth herein, the parties agree that Tenant shall obtain and pay for all insurance as set forth in Article VII hereof, and have Landlord named as an additional insured or loss payee, as applicable, under all such policies.

6.2 Tenant’s Own Risk. Except as provided in Sections 6.3 and 6.4 of this Lease, Tenant agrees to use and occupy the Premises and Hotel as it is herein given the right to use, at its own risk, and Landlord shall have no responsibility or liability for any loss of or damage to fixtures or other property of Tenant or any property leased to Tenant (including property leased hereunder) or for use and operations relating to the Premises and Hotel.

6.3 Liability of Landlord. Landlord shall not be responsible or liable to Tenant, or to those claiming by, through or under Tenant, for any loss or damage that may be occasioned by or through the acts or omissions, negligent or otherwise, of third persons or for any loss or damage resulting to Tenant or Tenant’s agents, employees, or invitees, or those claiming by, through or under Tenant, except for acts caused by the intentional or grossly negligent acts or omissions of Landlord or Landlord agents, contractors, licensees or employees.

| 14 |

6.4 Indemnification by Landlord. Except to the extent directly arising from the gross negligence or intentional misconduct of Tenant or any of its agents, contractors or employees, Landlord hereby agrees to defend (with counsel reasonably acceptable to Tenant), indemnify and save and hold harmless Tenant from and against all claims of whatever nature (a) arising from any accident, injury or damage occurring outside of the Premises, where such accident, injury or damage results from a wrongful act, omission or negligence on the part of Landlord or Landlord’s agents or employees, or (b) arising from any and all claims by Landlord’s contractors, licensees, agents, servants or employees, including such claims arising due to the failure of Landlord to obtain or maintain any necessary permits, licenses or other required approvals. Landlord further covenants and agrees to defend, indemnify and save and hold harmless Tenant: (i) from any and all claims in connection with or arising out of the design and construction of the Hotel subject to the limitations set forth in, and only in accordance with the provisions of, Section 13.2 of this Lease; and (ii) any obligations assumed by Landlord and accruing after the termination of this Lease

6.5 Survival. All indemnities set forth herein shall survive expiration or earlier termination of this Lease.

ARTICLE VII

INSURANCE

7.1 Tenant Insurance. Tenant shall obtain, maintain in force and pay for during the Term of this Lease a policy or policies of insurance covering loss or damage to the Premises and Hotel by fire and other such risks as are customarily covered by extended coverage endorsements, in an amount not less than one hundred percent (100%) of the replacement cost of Premises. Such policy or policies of insurance shall name Landlord as an additional insured as its respective interests may appear and shall contain an agreed amount endorsement waiving any co-insurance requirements. Upon exercise of Tenant’s Option to Purchase Premises contained in Section 5.13.1 of this Lease, Tenant shall be named as a loss payee of such policy or policies of insurance. Such policy or policies of insurance shall be issued by insurance companies satisfactory to both Landlord and Tenant and having an A.M. Best Rating of A or better.

Tenant shall obtain, maintain, or cause to be maintained, and pay for at all times during the Term the following insurance coverages with insurance companies possessing a minimum A.M. Best Rating of A-XII and in form and at sufficient levels to adequately protect Landlord and Tenant’s interest in the Premises and Hotel.

(a) Commercial general liability insurance, covering bodily injury (including personal injury) and property damage, however occasioned in or about the Hotel or Premises and to the extent caused by Tenant or Tenant’s employees, agents or independent contractors, in an amount not less than $5,000,000 per occurrence. The insurance shall include contractual liability coverage. Such limit may be satisfied through any combination of primary and umbrella liability policies, provided that if umbrella liability coverage is obtained, said umbrella limits should also be excess over any auto liability policy;

(b) Property, Casualty and Business Interruption (“BI”) Insurance on an all-risk or special risk form covering all of the furniture, fixtures, equipment and any other personal property owned or used in Tenant’s operation of the Hotel and found in, on or about the Hotel and Premises, and any leasehold improvements to the Hotel, in an amount not less than the full replacement cost. Tenant shall have all right, title and interest in and to the proceeds of any BI payments or reimbursements. All property insurance policy proceeds shall be used for the repair or replacement of the property damaged or destroyed;

| 15 |

(c) Business income insurance (i) with loss payable to Tenant; (ii) covering all risks covered by the insurance provided for in subsection (a) above; and (iii) in such amounts and for such terms of loss as Tenant shall determine in its discretion;

(d) Workers’ compensation, subject to the statutory limits of the State of Indiana, and employer’s liability insurance relating to Tenant’s employees in respect of any work or operations on or about the Hotel or Premises; and

(e) If Tenant operates owned, hired or non-owned vehicles as a normal part of its operations and activities at the Hotel or Premises, automobile liability insurance covering bodily injury and property damage with a combined single limit of not less than $1,000,000.

7.2 Insurers. All insurance provided for in this Lease shall be obtained under valid and enforceable policies (collectively, the “policies” or in the singular, the “policy”), and shall be issued by financially sound and responsible insurance companies, authorized to do business in the State of Indiana and reasonably acceptable to both Landlord and Tenant. All policies maintained by Tenant hereunder (except Workers’ Compensation insurance) shall name Landlord and Landlord’s mortagagee, Rising Sun Regional Foundation, Inc. as “Additional Insureds”. All policies maintained by Tenant shall provide thirty (30) days prior written notice to the Additional Insureds of any termination, cancellation or material change to such policies. All policies maintained by Tenant shall be written as primary policies, not contributing with or supplemental to the coverage maintained for any of the Additional Insureds. Prior to the commencement of the Term hereunder, and from time to time during the Term hereof promptly on the request of Landlord, Tenant shall furnish to Landlord certificates of insurance, naming Landlord as certificate holder, and otherwise evidencing continuously current compliance with the provisions of this Lease. Not less than ten (10) days prior to the expiration dates of the policies evidenced by such certificates of insurance, revised certificates evidencing renewal policies shall be delivered by Tenant to Landlord.

7.3 Blanket Coverage. Any blanket insurance policy shall specifically allocate to the Premises and Hotel the amount of coverage from time to time required hereunder and shall otherwise provide the same protection as would a separate policy insuring only the Premises and Hotel in compliance with these provisions. The terms, provisions, limits, types of coverage and issuer of any such blanket insurance policy shall be subject to the approval of Landlord, which approval Landlord shall not unreasonably withhold.

| 16 |

7.4 Clauses. All policies provided shall contain clauses or endorsements to the effect that:

(a) no act or negligence of the insured, or anyone acting for the insured, or any tenant or other occupant, or failure to comply with the provisions of any policy, which might otherwise result in a forfeiture of the insurance or any part thereof, shall in any way affect the validity or enforceability of the insurance insofar as any party named as additional insured is concerned;

(b) the policies shall not be materially changed (other than to increase the coverage provided thereby) or canceled without at least thirty (30) days’ prior written notice to each party named therein as an insured or additional insured;

(c) any party named therein as an additional insured shall not be liable for any insurance premiums thereon or subject to any assessments thereunder; and

(d) the policies shall not contain an exclusion for acts of terrorism or similar acts of sabotage if such exclusion may be deleted at commercially-reasonable cost.

If at any time Landlord is not in receipt of written evidence that all insurance required hereunder to be maintained by Tenant is in full force and effect, Landlord shall have the right, after reasonable prior notice to Tenant, to take such action as Landlord deems necessary to protect its interests, including, without limitation, obtaining such insurance coverage as Landlord in its reasonable discretion deems appropriate. All premiums incurred by Landlord in connection with such action or in obtaining such insurance and keeping it in effect shall be paid by Tenant as additional Rent within ten (10) days upon demand by Landlord.

7.5 Payment of Premiums. Tenant shall pay all premiums for each policy of insurance required herein to be maintained when due and shall forward a certificate of insurance evidencing the aforesaid coverage together with all appropriate endorsements and riders to Landlord, showing the such party as an additional insured therein, as applicable. Should Landlord pay directly for any insurance premiums as agreed upon and consistent with the terms of this Lease, Landlord shall submit such invoice and proof of payment to Tenant, and Tenant shall reimburse Landlord the cost of such premiums within ten (10) days of receipt of such invoice.

7.6 Hazardous Activities. Tenant shall not use or occupy or permit the Premises or Hotel to be occupied or used in a manner which will materially increase the rates of any insurance for Premises or Hotel or that will make void or voidable any insurance then in force with respect to Premises or Hotel, or which will make it impossible to obtain fire or other insurance with respect to the Premises or Hotel. If Tenant shall fail to comply with the provisions of this Section 7.6, Tenant shall reimburse Landlord for any increases in insurance premium charged to Landlord as a result of Tenant’s non-compliance with this Section 7.6 as additional Rent.

7.7 No Prohibited Activity. Tenant agrees that it will not keep, use, sell or offer for sale in or upon the Premises any article or permit any activity which may be prohibited by any standard form of insurance policy.

| 17 |

7.8 Waiver of Subrogation. Landlord and Tenant each waive any and all rights to recover against the other, or against any of the related parties or patrons or the other, for any loss of damage to such waiving party arising from any cause covered by any property insurance required to be carried by Tenant pursuant to this Article VII or any property insurance actually carried by Landlord, to the extent of the limits of such policy. Landlord and Tenant, from time to time, shall cause their respective insurers to issue appropriate waiver of subrogation rights endorsements to all property insurance policies carried in connection with the Premises, the Hotel and any contents contained therein.

7.9 Adequacy of Coverage. The Additional Insureds, and their respective employees, representatives and agents make no representation or warranty that the limits of liability specified to be carried by Tenant pursuant to this Article VII are adequate to protect Tenant. If Tenant believes that any of such insurance coverage is inadequate, Tenant shall obtain such additional insurance coverage as Tenant deems adequate, at Tenant’s sole cost and expense.

7.10 No Co-Insurer. The parties do not intend for the Landlord to be a co-insurer of the Tenant, and to that end, if the Tenant’s insurance proceeds are not adequate to cover Tenant’s loss, Tenant, and not Landlord or Landlord’s insurance, will bear the difference between the proceeds obtained and any legal or contractual obligation for the actual amount of the loss. Further, the parties do not intend for the Tenant to be a co-insurer of the Landlord, and to that end, if the Landlord’s insurance proceeds are not adequate to cover Landlord’s loss, Landlord, and not Tenant or Tenant’s insurance, will bear the difference between the proceeds obtained and any legal or contractual obligation for the actual amount of the loss.

ARTICLE VIII

DELIVERY OF PREMISES AND COMPLIANCE WITH APPLICABLE LAWS

8.1 Delivery of Premises. Landlord and Tenant agree that upon Open Date Landlord shall deliver the Premises under this Lease in a clean, sanitary and safe condition in accordance with the Applicable Laws.

ARTICLE IX

DAMAGE AND CONDEMNATION

9.1 Damage or Destruction. In the event that during the Term of this Lease, and prior to notice of exercise of Tenant’s Option to Purchase Premises or Landlord’s Option to Sell Premises, the Premises or Hotel shall be partially or substantially damaged or destroyed by fire or other casualty or by a Force Majeure Event (as defined herein), Tenant shall, within sixty (60) days after the occurrence of such damage or destruction, elect to either (i) proceed as soon as reasonably practicable to repair such damage and restore the Premise and Hotel to substantially the same condition they were in at the time of such damage, in which case all insurance proceeds shall be paid to Tenant, and any such repair or restoration shall be subject, to zoning laws and building codes then in existence, or (ii) terminate this Lease, in which event the insurance proceeds shall be paid to Landlord’s mortgagee to pay in full Landlord’s indebtedness to such mortgagee, and any balance thereafter remaining shall be paid to Tenant, and Landlord shall convey the Premises and Hotel to Tenant in accordance with Section 5.13.2 hereof (except Tenant shall not be required to pay the Premises Purchase Price). If and to the extent such insurance proceeds are insufficient to pay in full Landlord’s indebtedness to its mortgagee and other related costs, Tenant shall remain obligated to pay such amount to Landlord or Landlord’s mortgagee upon demand by Landlord. Upon completion of such conveyance, neither party shall have any continuing or further obligation to the other.

| 18 |

9.2 Eminent Domain. If the whole or any part of the Hotel or Premises shall be taken by eminent domain, or if a conveyance or other acquisition in lieu of such exercise of eminent domain is made (all of which are referred to herein as “condemnation”) prior to notice of exercise of Tenant’s Option to Purchase Premises or Landlord’s Option to Sell Premises, this Lease shall terminate as to the part condemned as of the date title vests in the condemning authority or it takes possession, whichever first occurs. If any portion of the floor area of the improvements of the Hotel that would materially interfere with Tenant’s continued use and operation of the Hotel, more than thirty percent (30%) of the land area of the Premises that is not occupied by any improvements, or more than twenty-five percent (25%) of the on-Premises parking is taken by condemnation, Tenant may, if it so elects by written notice delivered to Landlord within ten (10) days after Landlord shall have given Tenant written notice of such taking (or in the absence of such notice, within ten (10) days after the condemning authority shall have taken possession), terminate this Lease in its entirety as of the date the condemning authority takes such possession.

If Tenant does not terminate this Lease in its entirety in accordance with the foregoing, this Lease shall remain in full force and effect as to the portion of the Premises and Hotel remaining. Subject to the rights of the parties pursuant to Section 5.13.2 and this Section 9.2, any award for the condemnation of all or any part of the Premises or Hotel or any payment made under threat of condemnation shall be the property of Landlord, whether such award shall be made as compensation for diminution in value of the leasehold or for the taking of the fee, or as severance damages, but Tenant shall be entitled to any award for loss of or damage to Tenant’s trade fixtures and removable personal property, and moving expenses. In the event that this Lease is not terminated by reason of such condemnation, and any damage to the portion of the Premises or Hotel remaining can be repaired, Landlord shall pay over to Tenant all proceeds received by Landlord and Tenant shall, to the extent such proceeds paid over to Tenant are sufficient, repair any damage to the Premises or Hotel caused by such condemnation. In the event this Lease is not terminated by reason of such condemnation, but the Premises or Hotel cannot be restored to their condition existing prior thereto, all proceeds thereof shall be paid to Landlord’s mortgagee to reduce Landlord’s indebtedness to such mortgagee and the Premises Purchase Price shall be reduced by the amount of such proceeds.

In the event this Lease is terminated as a result of a condemnation, (i) the proceeds shall be applied first to payment to Landlord’s mortgagee to the extent of the outstanding indebtedness of Landlord to such mortgagee, and then any balance of such proceeds remaining thereafter shall be paid to Tenant to reimburse Tenant the portion of all Base Rent payments paid during the Term or any Additional Term of this Lease attributable to the principal amount of Landlord’s Construction Costs, exclusive of any interest earned by Landlord at the rates agreed upon herein and (ii) any portion of the Hotel and Premises remaining shall be conveyed to Tenant as provided in Section 5.13.2 hereof (except Tenant shall not be required to pay any of the Premises Purchase Price).

| 19 |

9.3 Effect of Exercise of Tenant’s Option to Purchase Premises or Landlord’s Option to Sell Premises. In the event of damage or destruction or a condemnation occurring after notice of exercise of Tenant’s Option to Purchase or Landlord’s Option to Sell Premises, the terms of Sections 5.13.1 and 5.13.2, respectively shall govern.

ARTICLE X

LANDLORD’S COVENANT OF QUIET ENJOYMENT

10.1 Quiet Enjoyment. Tenant, on payment of the Rent and observing, keeping and performing all of the terms and provisions of this Lease on its part to be observed, kept and performed, shall lawfully, peaceably and quietly have, hold, occupy and enjoy the Premises and Hotel during the Initial Term and any Additional Term without hindrance by Landlord or by any persons lawfully claiming under Landlord; provided, however, it is understood and agreed that this covenant and any and all other covenants of Landlord contained in this Lease shall be binding upon Landlord and its successors only with respect to breaches occurring during its and their respective ownership of Landlord’s interest hereunder.

10.2 Conduct of Gaming Operations. Landlord understands and agrees that Tenant maintains a riverboat owner’s license from the State of Indiana Gaming Commission (“IGC”) in order to operate a casino at Rising Star (“Gaming Operations”), and said license is a privilege, not a statutory right. As such, Tenant must maintain its suitability to operate its Gaming Operations at Rising Star. Landlord understands that Tenant shall have exclusive and complete control over Gaming Operations at Rising Star, as well as any other gaming operations owned or managed by Tenant, its parent company or affiliates, and shall have full authority to hire, discharge or discipline any and all of Tenant’s employees, including employees who may have responsibilities for the Premises and Hotel. Pursuant to 68 Indiana Administrative Code (“IAC”) 1-4-1, upon demand, the IGC may review this Lease, and may subsequently disapprove this Lease should it determine that it does not comply with Indiana Code (“IC”) 4-33, 4-35, IAC Title 68 or otherwise fails to maintain the integrity of the casino gambling industry.

Landlord understands and agrees that Tenant shall be free to conduct the Gaming Operations, including any casino marketing to Hotel guests, security and surveillance measures, any contracts that may provide services to Hotel or any other matters that IGC or other gaming authorities having jurisdiction over Tenant, its parent company or affiliates may have the right to request or direct Tenant on such matter, without interference from or direction by Landlord or any of its representatives or agents. Neither Landlord nor any agent or representative of Landlord shall exercise, either directly or indirectly, management or control of any kind whatsoever, over the conduct of Tenant’s Gaming Operations or management and operation of the Premises and Hotel subject to this Lease. Further, Landlord shall not take any action, or attempt to take any action which could reasonably be expected to jeopardize Tenant’s gaming license or good standing with applicable regulatory authorities.

| 20 |

ARTICLE XI

LIENS

11.1 Liens. Tenant shall at all times indemnify, save and hold Landlord, the Premises and Hotel and the leasehold created by this Lease free, clear and harmless from any and all claims, liens, demands, charges, encumbrances, litigation and judgments arising directly or indirectly out of any use, occupancy or activity of Tenant or out of any work performed, material furnished or obligations incurred by Tenant in, upon or otherwise in connection with the Premises and Hotel (collectively, “Liens”). Landlord shall have no obligation to pay for or obtain the discharge or release of any such Liens; but nothing contained herein shall prevent Landlord, at the cost and for the account of Tenant, from obtaining said discharge or release and any discharge or release so obtained by Landlord shall be subject to Tenant’s reimbursement of same as additional Rent payable within fifteen (15) business days following written demand by Landlord. Notwithstanding anything herein to the contrary, Tenant shall have no obligation to indemnify Landlord against any liens arising out of the initial Hotel construction by Landlord or from any improvements or repairs subsequently made by Landlord. Upon written request to Landlord, Landlord hereby consents to subordinate any leasehold interest in the Lease to Tenant’s primary lenders during the Term or any Additional Term of this Lease. Upon the Effective Date of this Lease, Tenant’s Primary Lenders are Capital One National Association, 000 Xx. Xxxxxxx Xxxxxx, 00xx Xxxxx, Xxx Xxxxxxx, XX 00000 and ABC Funding, as administrative agent and collateral trustee c/o, Summit Partners Credit Advisors, L.P., 000 Xxxxxxxx Xxxxxx, 00xx xxxxx, Xxxxxx, XX 00000, and such lenders may change from time to time at Tenant’s sole and exclusive discretion.

ARTICLE XII

EVENTS OF DEFAULT; REMEDIES; TERMINATION RIGHTS

12.1 Event of Default. The occurrence of any of the following events shall constitute events of default by Tenant under the terms of this Lease, individually, an “Event of Default”, and, collectively, “Events of Default”.

(a) Tenant shall neglect or fail to perform or observe any of the covenants, terms, provisions or conditions contained in this Lease on its part to be performed or observed, except for payment of Rent or any other monetary charges due hereunder or any of the events described in clauses (c)-(g). below, within sixty (60) days after written notice thereof from Landlord, or such additional time as is reasonably required to correct any such default so long as Tenant commences the correction within such thirty (30) day period and proceeds thereafter with due diligence and in good faith to cure same within no more than sixty (60) days after such written notice from Landlord; in no event shall additional time to cure apply in cases where the Event of Default in question may be cured on a timely basis by the payment of money in the amount due; or

| 21 |

(b) Tenant shall neglect or fail to pay Rent, as provided for in Article IV, or any other monetary obligation at any time owing from Tenant to Landlord, whether or not expressed as additional Rent, within twenty (20) days after written notice thereof from Landlord; provided, however, that Landlord need not give more than three (3) such notices in any twelve (12) month period for the payment of Rent and after the giving of such third (3rd) notice, any further failures to pay Rent within five (5) days after due during the remainder of such twelve (12) month period will be an Event of Default without any notice, cure or grace period; or

(c) the leasehold estate created by this Lease shall be taken on execution or by other process of law; or

(d) Tenant fails to keep Hotel open for business without the Consent of Landlord, which consent shall not be unreasonably withheld, conditioned or delayed, and such failure continues for more than seven (7) days in any sixty (60) day period, except when due to or caused by failure or lack of utility service, construction or other disruption by repair or maintenance, a Force Majeure Event or any act or omission of Landlord or Landlord’s employees, representatives or agents; or

(e) there is filed any petition in bankruptcy by Tenant, or Tenant is adjudicated as a bankrupt or insolvent, or there is appointed a receiver or trustee to take possession of Tenant or of all or substantially all of the assets of Tenant, or there is a general assignment by Tenant for the benefit of creditors, or any action is taken by Tenant under any state of federal insolvency or bankruptcy act, or any similar law now or hereafter in effect; or

(f) there is filed any petition in bankruptcy or for the appointment of a receiver or an action for execution or attachment is filed against Tenant and such petition, action or levy against Tenant is not dismissed within ninety (90) days after the filing thereof ; or

(g) Tenant shall fail to maintain all necessary Approvals within grace periods provided by applicable law; or

(h) In the event that any one of the following events occurs at any time during the Term: (i) a Change of Control (as defined below) of Tenant or its parent company, FHR, or (ii) in the event the Indiana Gaming Commission approves the transfer of Tenant’s gaming license to operate Rising Star’s casino, hotel and related amenities, unless in any such case the acquiring party or transferee in any such Change of Control or transfer of Tenant’s gaming license acknowledges and agrees in writing to Tenant’s assignment of this Lease.

| 22 |

12.2 Remedies. Upon the occurrence of any Event of Default, Landlord may: (i) immediately, or at any time thereafter, without further demand or notice, terminate this Lease and Tenant’s right of possession under this Lease without any further liability of Landlord hereunder in accordance with Applicable Law, at which time all Rent and other sums payable by Tenant to Landlord hereunder shall immediately become due and payable up to the time of termination, and Tenant shall remain liable to Landlord for the continued payment of all Rent subject to the further provisions of this Section; (ii) re-let the Premises and Hotel, either in Landlord’s name or otherwise, for a term or terms which may, at Landlord’s option, be less than or exceed the remaining Term; (iii) recover its reasonable and necessary attorneys’ fees, other litigation expenses and all other costs and expenses incurred in enforcing this Lease and/or Landlord’s rights and/or remedies hereunder; and (iv) exercise any and all other remedies available to Landlord at law or in equity under the laws of the State of Indiana, including, without limitation, damages resulting from such Event of Default, provided that such damages expressly exclude any consequential damages and the parties hereby agreed that any claim of damages is limited to Landlord’s costs of retaking and re-leasing the Premises and any documented expenses to maintain the Premises prior to re-leasing the Premises. In the event Landlord re-lets the Premises and Hotel, the proceeds of such re-letting in excess of Landlord’s costs of retaking, re-letting and maintaining the Premises and Hotel shall be applied, as and when received by Landlord, to reduce Tenant’s continuing liability hereunder to Landlord. All of Landlord’s remedies provided herein or at law or in equity are cumulative with and non-exclusive of each other.

12.3 Waiver. It is covenanted and agreed that no waiver at any time of any of the provisions hereof shall be construed as a waiver at any subsequent time of the same provisions. The consent or approval of Landlord of any action by Tenant requiring Landlord’s consent or approval shall not be deemed to waive or render unnecessary Landlord’s consent or approval to or of any subsequent similar act by Tenant.

12.4 Default of Landlord. Landlord shall be in default under this Lease in the event Landlord fails to perform any of the covenants, terms, provisions or conditions contained in this Lease on its part to be performed within thirty (30) days after written notice thereof from Tenant, or such additional time as is reasonably required to correct any such default, but in no event more than an additional thirty (30) days. In the event of a default of Landlord, Tenant may exercise any and all remedies available to Tenant at law or in equity under the laws of the State of Indiana.

12.5 Remedies Cumulative. The various rights, options, elections and remedies of the parties hereunder shall be cumulative and no one of them shall be construed as exclusive of any other, or of any right, priority or remedy allowed or provided for by law and not expressly waived in this Lease.

| 23 |

ARTICLE XIII

REPRESENTATIONS AND WARRANTIES

13.1 Representations and Warranties of Landlord. Landlord hereby makes the following representations and warranties to Tenant as of the Effective Date of this Lease:

(a) Landlord has the full right, power and lawful authority to enter into and to carry out the terms and provisions of the Lease and consummate the transactions contemplated by this Lease, including, without limitation, and at all times during the Term or, no Approval of any Governmental Authority or any other third person is required in connection therewith; and this Lease constitutes the legal, valid and binding Lease of Landlord, enforceable in accordance with its terms, except to the extent that enforcement may be affected by laws relating to bankruptcy, reorganization, insolvency and creditors’ rights and by the availability of injunctive relief, specific performance and other equitable remedies;

(b) neither the execution and delivery of this Lease, nor the consummation of the transactions contemplated hereby, will conflict with or result in a violation or breach of term or provision of, or constitute a default under (i) any order, judgment, writ, injunction, decree, license, permit, statute, rule or regulation of any court, governmental, regulatory or public body; or (ii) any license, franchise, permit, indenture, mortgage, deed of trust, lease, contract, instrument, commitment or other lease or arrangement to which Landlord is a party or by which Landlord, is bound;

(c) to the best of Landlord’s knowledge, as of the Open Date, in all material respects: (i) the Premises has the necessary utilities, including electricity, water, sewerage, gas, cable and telecommunications available at the Hotel sufficient in nature and scope for Tenant’s operation of Hotel, and (ii) the Premises otherwise is in compliance with Applicable Laws; and

(d) no representation or warranty by Landlord contained in this Lease contains any untrue statement of a material fact or omits to state a material fact necessary in order to make the statement and facts contained herein not misleading.

13.2 Warranties and Construction Defects. Tenant accepts Premises and Hotel in “as is” condition, without representation of any kind, including warranty of fitness for a particular purpose. Notwithstanding the foregoing, Landlord affirmatively represents that to the best of its knowledge the Hotel has been constructed in a good and xxxxxxx-like manner, in conformance with industry standards, and in compliance with all Applicable Laws. Further, Landlord shall have an affirmative obligation to use commercially reasonable efforts to enforce any existing warranties provided by its general contractor, sub-contractors or architects provided for during the construction of Hotel and any such warranties will be assigned to Tenant upon Tenant’s purchase of the Premises. Further, Landlord shall have an affirmative obligation to use commercially reasonable efforts to exercise any rights Landlord has under any insurance policy held by its general contractor, sub-contractors or architects on which Landlord is listed as an additional insured and pursuant to which Landlord can assert a claim with respect to the design and/or construction of the Premises. Within ten (10) business days of identifying a suspected construction defect, Tenant shall provide written notice to Landlord of any suspected construction defects. Upon written notice, Landlord shall work cooperatively with Tenant to inspect, investigate and respond within commercially reasonable timeframes as to whether the suspected defect is covered by any existing warranty. Notwithstanding any other provision of this Lease, Landlord’s indemnification and other obligations with respect to the design and/or construction of the Premises shall be limited to any warranty and/or insurance proceeds recovered or obtained by Landlord, and Landlord shall have no other duties or obligations to Tenant with respect to design and/or construction of the Premises.

| 24 |

13.3 Representations and Warranties of Tenant. Tenant hereby makes the following representations and warranties to Landlord as of the Effective Date.

(a) Tenant has the full right, power and lawful authority to enter into and to carry out the terms and provisions of the Lease and consummate the transactions contemplated by this Lease, including, without limitation, and at all times during the Initial Term or Additional Term, no Approval of any Governmental Authority or any other third person is required in connection therewith; and this Lease constitutes the legal, valid and binding Lease of Tenant, enforceable in accordance with its terms, except to the extent that enforcement may be affected by laws relating to bankruptcy, reorganization, insolvency and creditors’ rights and by the availability of injunctive relief, specific performance and other equitable remedies;