AMENDED AND RESTATED CONTRIBUTION AGREEMENT by and between LN Hospitality Denver, LLC, a Colorado limited liability company and Lodging Fund REIT III OP, LP, a Delaware limited partnership Dated as of January 29, 2021

Exhibit 10.84

AMENDED AND RESTATED

by and between

LN Hospitality Denver, LLC,

a Colorado limited liability company

and

Lodging Fund REIT III OP, LP,

a Delaware limited partnership

Dated as of January 29, 2021

TABLE OF CONTENTS

| | | Page |

|---|---|---|---|

| | | |

1. | Defined Terms | 1 | |

| | | |

2. | Contribution; Total Consideration; Inspection and Title | 5 | |

| 2.1 | Contribution of Property | 5 |

| 2.2 | Contribution of Assets | 5 |

| 2.3 | Inventory | 5 |

| 2.4 | Excluded Assets | 6 |

| 2.5 | Assumed Liabilities | 6 |

| 2.6 | Excluded Liabilities | 6 |

| 2.7 | Existing Loans and Creditors | 6 |

| 2.8 | Consideration and Exchange of Series T Limited Units | 7 |

| 2.9 | Treatment as Contribution | 7 |

| 2.10 | Allocation of Total Consideration | 7 |

| 2.11 | Terms of Series T Limited Units | 7 |

| 2.12 | Term of Agreement | 7 |

| 2.13 | Risk of Loss | 7 |

| 2.14 | Escrow | 8 |

| 2.15 | Title | 8 |

| 2.16 | Due Diligence Period | 8 |

| | | |

3. | Closing | 9 | |

| 3.1 | Conditions Precedent | 9 |

| 3.2 | Time and Place | 10 |

| 3.3 | Closing Deliveries | 10 |

| 3.4 | Closing Costs | 11 |

| | | |

4. | Representations and Warranties and Indemnities | 11 | |

| 4.1 | Representations and Warranties of the Operating Partnership | 11 |

| 4.2 | Representations and Warranties of the Contributor | 13 |

| | | |

5. | Indemnification | 19 | |

| 5.1 | Survival of Representations and Warranties; Remedy for Breach | 19 |

| 5.2 | General Indemnification | 19 |

| 5.3 | Notice and Defense of Claims | 20 |

| 5.4 | Limitations on Indemnification Under Section 5.2.1 | 20 |

| 5.5 | Indemnification | 20 |

| 5.6 | Matters Excluded from Indemnification | 21 |

| 5.7 | Offset | 21 |

| | | |

6. | Covenants | 21 | |

| 6.1 | Covenants of the Contributor | 21 |

| 6.2 | Prorations | 22 |

| 6.3 | Tax Covenants | 24 |

| 6.4 | Capital Contribution | 24 |

| | | |

7. | Termination | 24 | |

| 7.1 | Termination | 24 |

| 7.2 | Default by the Operating Partnership | 25 |

| 7.3 | Default by the Contributor | 25 |

| | | |

8. | Miscellaneous | 25 | |

| 8.1 | Further Assurances | 25 |

| 8.2 | Counterparts | 25 |

| 8.3 | Governing Law | 25 |

| 8.4 | Amendment; Waiver | 25 |

-i-

TABLE OF CONTENTS

(continued)

| | | Page |

|---|---|---|---|

| | | |

| 8.5 | Entire Agreement | 25 |

| 8.6 | Assignability | 25 |

| 8.7 | Titles | 26 |

| 8.8 | Third Party Beneficiary | 26 |

| 8.9 | Severability | 26 |

| 8.10 | Reliance | 26 |

| 8.11 | Survival | 26 |

| 8.12 | Days | 26 |

| 8.13 | Calculating Time Periods | 26 |

| 8.14 | Incorporation of Exhibits | 26 |

| 8.15 | Notice | 26 |

| 8.16 | Force Majeure | 27 |

| 8.17 | Impracticability | 27 |

| 8.18 | Equitable Remedies | |

EXHIBITS

ALegal Description of the Properties

BContribution and Assumption Agreement

CAssignment of Warranties

DTotal Consideration

ENon-Competition and Non-Solicitation Agreement

FConfidentiality and Non-Disclosure Agreement

GTax Information

SCHEDULES

2.2List of Contributed Assets, Assumed Agreements and Leases

2.4List of Excluded Assets

2.5List of Assumed Liabilities; Permitted Liens

2.6List of Excluded Liabilities

2.10Allocation of Total Consideration

3.1.83-05 Audit

APPENDICES

ADisclosure Schedule

-ii-

AMENDED AND RESTATED CONTRIBUTION AGREEMENT

This Amended and Restated Contribution Agreement (this “Agreement”) is made and entered into as of January 29, 2020 (the “Effective Date”) by and between Lodging Fund REIT III OP, LP, a Delaware limited partnership (the “Operating Partnership”), and LN Hospitality Denver, LLC, a Colorado limited liability company (the “Contributor”).

RECITALS

NOW, THEREFORE, in consideration of the foregoing premises, and the mutual undertakings set forth below, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree and restate as follows:

The following terms have the meanings set forth below:

“Act” shall have the meaning as set forth in Section 4.2.10.

“Actions” mean all actions, litigations, complaints, charges, accusations, investigations, petitions, suits, arbitrations, mediations or other proceedings, whether civil or criminal, at law or in equity, or before any arbitrator or Governmental Entity.

“Agreement” shall have the meaning as set forth in the Preamble.

“Amendment” shall have the meaning as set forth in Section 2.8.

“Assumed Agreements” shall have the meaning as set forth in Section 2.2.

“Assumed Liabilities” shall have the meaning as set forth in Section 2.5.

“Basket” shall have the meaning as set forth in Section 5.4.

“Closing” shall have the meaning as set forth in Section 3.2.

“Closing Agent” shall have the meaning as set forth in Section 2.15.

“Closing Date” shall have the meaning as set forth in Section 3.2.

“Closing Documents” shall have the meaning as set forth in Section 3.3.

“Code” shall mean the Internal Revenue Code of 1986, as amended.

“Common Limited Units” shall have the meaning set forth in the OP Agreement.

“Company” shall mean Lodging Fund REIT III, Inc., a Maryland corporation.

“Contributed Assets” shall have the meaning as set forth in Section 2.2.

1

“Contributor” shall have the meaning as set forth in the Preamble.

“Contributor Point of Contact” shall have the meaning as set forth in Section 2.17.3(d).

“Contributor’s Breakage Fee” shall have the meaning as set forth in Section 7.3.

“Deed” shall have the meaning as set forth in Section 3.3.2.

“Due Diligence Review” shall have the meaning as set forth in Section 2.17.3.

“Xxxxxxx Money” shall have the meaning as set forth in Section 2.15.

“Environmental Law” means all applicable statutes, regulations, rules, ordinances, codes, licenses, permits, orders, demands, approvals, authorizations and similar items of any Governmental Entity and all applicable judicial, administrative and regulatory decrees, judgments and orders relating to the protection of human health or the environment as in effect on the Closing Date, including but not limited to those pertaining to reporting, licensing, permitting, investigation, removal and remediation of Hazardous Materials, including without limitation (i) the Comprehensive Environmental Response, Compensation and Liability Act (42 U.S.C. Section 9601 et seq.), the Resource Conservation and Recovery Act (42 U.S.C. Section 6901 et seq.), the Clean Air Act (42 U.S.C. Section 7401 et seq.), the Federal Water Pollution Control Act (33 U.S.C. Section 1251), the Safe Drinking Water Act (42 U.S.C. 300f et seq.), the Toxic Substances Control Act (15 U.S.C. 2601 et seq.), the Endangered Species Act (16 U.S.C. 1531 et seq.), the Emergency Planning and Community Right-to-Know Act of 1986 (42 U.S.C. 11001 et seq.), and (ii) applicable state and local statutory and regulatory laws, statutes and regulations pertaining to Hazardous Materials.

“Environmental Permits” means any and all licenses, certificates, permits, directives, requirements, registrations, government approvals, agreements, authorizations, and consents that are required under or are issued pursuant to any Environmental Laws.

“Effective Date” shall have the meaning as set forth in the Preamble.

“Excluded Assets” shall have the meaning as set forth in Section 2.4.

“Excluded Liabilities” shall have the meaning as set forth in Section 2.6.

“Existing Loan” shall have the meaning as set forth in Section 2.7.1.

“Existing Loan Documents” shall have the meaning as set forth in Section 2.7.1.

“Fixtures and Personal Property” shall mean all fixtures, furniture, furnishings, apparatus and fittings, equipment, machinery, appliances, building supplies, business supplies, software, tools, services and amenities including without limitation paper goods, brochures, office supplies, unopened food and beverage inventory, chinaware, glassware, flatware, soap, gasoline, fuel oil, inventory held for sale, engineering, pool, maintenance and housekeeping supplies, TV, phone, and internet services, software and hardware, and other operation and guest supplies (each of which shall be maintained and transferred in accordance with brand standards), merchandise, goods, electronics, customer lists and records (including but not limited to customer, supplier, advertising, promotional material, sales, services, delivery and/or operations lists and records), goodwill, intellectual and/or proprietary information and property and applications therefor or licenses thereof and other items of personal property used in connection with the ownership, operation or maintenance of the Property, including all assets located off site from the Property but owned and used by the Contributor in connection with operation of the Property; excluding, however, all fixtures, furniture, furnishings, apparatus and fittings, equipment, machinery, appliances, building supplies, business supplies, software, tools, linens, merchandise, goods, electronics and other items of personal property owned by tenants, subtenants, guests, invitees, employees, easement holders, service contractors and other Persons who own any such property located on the Property. The unpaid invoice from Luminosity for computer hardware shall be paid by Operating Partner.

“Franchise Agreement” shall have the meaning as set forth in Section 3.1.10.

2

“Governmental Entity” means any governmental agency or quasi-governmental agency, bureau, board, commission, court, department, official, political subdivision, tribunal or other instrumentality of any government, whether federal, state or local, domestic or foreign.

“Hazardous Material” means any substance:

“Indemnified Contributor Party” shall have the meaning as set forth in Section 5.5.

“Indemnified OP Party” shall have the meaning as set forth in Section 5.5.

“Indemnified Party” shall have the meaning as set forth in Section 5.2.1.

“Independent Consideration” shall have the meaning as set forth in Section 2.15.

“Intangible Personal Property” shall mean all, right, title and interest relating to the Property in and to all intangible personal property now or hereafter used in connection with the operation, ownership, maintenance, management, or occupancy of the Property, including without limitation: all trade names and trademarks associated with the ownership of the Property; the plans and specifications for the Improvements; warranties; guaranties; indemnities; claims against third parties; claims against tenants for tenant improvement reimbursements; all contract rights related to the construction, operation, ownership or management of the Property; certificates of occupancy; applications, permits, approvals and licenses; insurance proceeds and condemnation awards or claims thereto to be assigned to the Operating Partnership hereunder; all books and records relating to the Property; any existing computer software or programs; any franchise agreements which shall not be terminated at the Closing and are to be assigned to the Operating Partnership, if any; any records, files, lists, and other tangible assets that pertain to the Property, including lists and records pertaining to any one or more of the following: the Contributor’s customers, suppliers, advertising, promotional material, sales, services, delivery, and/or operations, except those items, if any, required to be retained by law, including accounting records and returns.

“Knowledge” means with respect to any representation or warranty so indicated, the knowledge of Xxxxxxx Xxxxx and Xxxxxxx Xxxxx, including the knowledge the foregoing individuals would be reasonably expected to have if, as a result of the position such individual holds, such person made a reasonable inquiry in light of the circumstances.

“Land Lease” shall have the meaning as set forth in Section 2.11.

“Leases” shall have the meaning as set forth in Section 4.2.22.

“Lender(s)” shall have the meaning as set forth in Section 2.7.1.

“Liens” means with respect to any real and personal property, all mortgages, pledges, liens, options, charges, security interests, mortgage deed, restrictions, prior assignments, encumbrances, covenants, encroachments,

3

assessments, purchase rights, rights of others, licenses, easements, voting agreements, liabilities or claims of any kind or nature whatsoever, direct or indirect, including, without limitation, interests in or claims to revenues generated by such property.

“Losses” shall have the meaning as set forth in Section 5.2.1.

“Material Adverse Effect” shall have the meaning as set forth in Section 4.2.4.

“Maximum Per Property Total Consideration Adjustment” shall have the meaning as set forth in Section 2.14.

“Name” shall have the meaning as set forth in Section 4.2.20(c).

“NDA” shall have the meaning as set forth in Section 6.1.8.

“OFAC” shall have the meaning as set forth in Section 4.2.31.

“Offering Documents” shall have the meaning as set forth in Section 2.17.2.

“OP Agreement” shall mean the Amended and Restated Limited Partnership Agreement of Lodging Fund REIT III OP, LP, a Delaware limited partnership, as may be amended.

“Operating Partnership” shall have the meaning as set forth in the Preamble.

“Original Agreement” shall mean a certain Contribution Agreement and First Amendment between Operating Partnership and Contributor.

“Other Taxes” means Taxes other than income Taxes.

“Person” means any individual, corporation, limited liability company, partnership, joint venture, association, joint-stock company, trust, unincorporated organization or governmental entity.

“Property” shall have the meaning as set forth in the Recitals.

“Property Deposits” shall have the meaning as set forth in Section 6.2.1(b)(i).

“Property Reports” means the property condition assessment reports, appraisals, zoning reports and other similar reports prepared for the Property.

“Proprietary Rights” shall have the meaning as set forth in Section 4.2.20(a).

“REIT Shares” shall have the meaning set forth in the OP Agreement.

4

“Release” shall have the same meaning as the definition of “release” in the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA) at 42 U.S.C. Section 9601(22), but not including the exclusions identified in that definition, at subparts (A) through (D).

“Series T Limited Units” shall have the meaning set forth in the OP Agreement.

“Service Contracts” shall have the meaning as set forth in Section 4.2.24.

“Subscription Agreement” shall mean the Subscription Agreement to be entered into by Contributor with respect to the acquisition of the Series T Units.

“Tax” or “Taxes” means any federal, state, provincial, local or foreign income, gross receipts, license, payroll, employment-related, excise, goods and services, harmonized sales, severance, stamp, occupation, premium, windfall profits, environmental, customs duties, capital stock, franchise, profits, withholding, social security, unemployment, disability, real property, personal property, sales, use, transfer, registration, value added, alternative or add-on minimum, estimated, or other tax of any kind whatsoever, including any interest, penalty, or addition thereto, whether disputed or not.

“Tax Return” means any return, declaration, report, claim for refund, or information return or statement related to Taxes, including any schedule or attachment thereto, and including any amendment thereof.

“Tenants” shall have the meaning as set forth in Section 4.2.22.

“Terminated” shall mean that as of the Effective Date the Original Agreement has no force or effect and is replaced herein by this Agreement.

“Title Company” shall have the meaning as set forth in Section 2.16.

“Title Policy” shall have the meaning as set forth in Section 3.1.6.

“Total Consideration” shall have the meaning as set forth in Section 2.8.

“Transfer” shall have the meaning as set forth in Section 4.2.10(a).

5

6

operation of the Property by the Contributor prior to the Closing. If the creditor holds or obtains a lien on the Contributed Assets, then the following shall apply:

7

the management company’s management and operation of the Property or the Property’s performance after the Closing Date.

8

9

satisfy itself prior to the expiration of the Due Diligence Period that the Title Company will be willing to issue such extended coverage and endorsements at Closing.

Any or all of the foregoing conditions may be waived by the Operating Partnership in its sole and absolute discretion.

10

jurisdiction in which the Operating Partnership is required to file its partnership documentation or the recording of the Contribution and Assumption Agreement or Deed or other Property transfer documents as required;

11

this Agreement, no consent, waiver, approval or authorization of any third party or governmental authority or agency is required to be obtained by the Operating Partnership in connection with the execution, delivery and performance of this Agreement and the transactions contemplated hereby, except any of the foregoing that shall have been satisfied prior to the Closing Date and except for those consents, waivers and approvals or authorizations, the failure of which to obtain would not have a material adverse effect on the Operating Partnership.

12

insurance from an insurer reasonably acceptable to Contributor in at least the amount of $3,000,000 with combined single limit for personal injury or property damage per occurrence of at least $1,000,000, personal and advertising injury in at least the amount of $1,000,000 including a General Aggregate of at least $1,000,000, and (2) umbrella/excess liability in an amount of not less than $2,000,000 excess of the underlying commercial general, auto and employer liability insurance, such policies to name Contributor, which insurance shall provide coverage against any claim for personal injury or property damage caused by Operating Partnership or any Operating Partnership Parties.

13

Property and states that all parties who have furnished labor or materials on or at the Property within the last 90 days whether for repair, improvement, or otherwise shall have been fully compensated and/or shall have provided a written release of any mechanic’s Lien on the Property as of the Closing Date. Further, the Contributor has not contracted for nor is liable for obligations related to repairs, services, and other items that will not be paid in full at Closing, however, the Contributor will provide the Title Company with such documents requested by Title Company for the issuance of without the standard exception for liens.

14

Units for an indefinite period and is able to afford the complete loss of its investment in the Series T Limited Units; the Contributor has received and reviewed all information and documents about or pertaining to the Company, the Operating Partnership, the business and prospects of the Operating Partnership and the issuance of the Series T Limited Units as the Contributor deems necessary or desirable, has had cash flow and operations data for the Property made available by the Operating Partnership upon request and has been given the opportunity to obtain any additional information or documents and to ask questions and receive answers about such information and documents, the Operating Partnership, the Property, the business and prospects of the Operating Partnership and the Series T Limited Units which the Contributor deems necessary or desirable to evaluate the merits and risks related to its investment in the Series T Limited Units and to conduct its own independent valuation of the Property.

15

of any court, Governmental Entity or arbitration against or affecting all or any portion of its Property or the Contributed Assets, which in any such case would impair the Contributor ability to enter into and perform all of its obligations under the Agreement or would have a Material Adverse Effect. The Contributor is not involved in any proceeding by or against the Contributor in any court under the Bankruptcy Code or any other insolvency or debtor’s relief act, whether state or federal, or for the appointment of a trustee, receiver, liquidator, assignee, or other similar official of the Contributor or the Contributor’s property.

16

17

Contributor’s Knowledge, no material event of default exists (which remains uncured) under any of the Service Contracts. All prepaid Service Contracts being assigned have been fully paid by Contributor.

18

Liabilities and the Assumed Agreements to the Operating Partnership and the receipt of Series T Limited Units and the Total Consideration, as consideration therefor. The Contributor further represents and warrants that it has not relied on the Operating Partnership or its affiliates, representatives, counsel or other advisors and its respective representatives for legal or tax advice and the Contributor acknowledges that it has not relied upon any other such representation or warranty with respect to legal and tax matters.

19

20

required to be performed pursuant to any contract or obligation assigned to and assumed by the Operating Partnership (including the Assumed Agreements), and (iii) the Assumed Liabilities. The Contributor shall indemnify and hold harmless the Operating Partnership and the Operating Partnership’s directors, officers, managers, members, employees, agents and representatives, as well as its affiliates (each of which is an “Indemnified OP Party”) from and against Losses asserted against, imposed upon or incurred by the Indemnified OP Party in connection with or as a result of: (i) any breach of a representation, warranty or covenant of the Contributor contained in this Agreement and (ii) all fees, costs and expenses of the Contributor in connection with the transactions contemplated by this Agreement.

21

22

23

of the Contributor’s Total Consideration to be delivered pursuant to this Agreement. Any other proration adjustments made following the Closing shall be made in cash; and

24

25

consent of the other parties, and any attempted assignment without such consent shall be void and of no effect except that the Operating Partnership may assign this Agreement to an Affiliate.

To the Contributor:

LN Hospitality Denver, LLC

0000 Xxx Xxxxx Xxxx Xxxx

Xxxxxxxxxx, Xxxxxxxxxx 00000

Attention:Xxxxxxx Xxxxx, Manager

E-mail: xxxxx00@xxxxx.xxx

26

with a copy to:

Xxxxx Xxxxx LLP

000 Xxxxxxx Xxx., Xxxxx 000

Xxxxxx Xxxxx, XX 00000

Attention: Xxxxxx Xxxxxx, Esq.

Phone: (000) 000-0000

Fax: (000) 000-0000

Email: xxxxxxx@xxxxxxxxxx.xxx

To the Operating Partnership:

Lodging Fund REIT III OP, LP

c/o Xxxx Xxxxxx

000 Xxxxxx X.X., Xxxxx X

Xxxxx Xxxxxx, XX 00000

[signature page follows]

27

IN WITNESS WHEREOF, the parties have executed this Contribution Agreement as of the date first written above.

| OPERATING PARTNERSHIP: | ||

| | ||

| Lodging Fund REIT III OP, LP, a Delaware limited partnership | ||

| | ||

| By: | Lodging Fund REIT III, Inc., a Delaware corporation, its General Partner | |

| | | |

| | | |

| | By: | /s/ Xxxxx X. Xxxxxx |

| | Name: Xxxxx X. Xxxxxx | |

| | Title: Authorized Officer | |

| | | |

| | ||

| CONTRIBUTOR: | ||

| | ||

LN Hospitality Denver, LLC, a Colorado limited liability company | |||

| | ||

| | ||

| By: | /s/ Xxxxxx Xxxxx | |

| Name: | Bharathbhai (Xxxxxx) Xxxxx | |

| Title: | Managing Member | |

28

EXHIBIT A

TO

LEGAL DESCRIPTION OF THE PROPERTY

The Land referred to herein below is situated in the County of Arapahoe, State of Colorado, and is described as follows:

PARCEL ONE:

Xxx 0, Xxxxx 0, XXXXXXX XXXXXXX SUBDIVISION FILING NO. 1, recorded June 9, 2015 at Reception Xx. X0000000, Xxxxxx xx Xxxxxxxx, Xxxxx of Colorado.

PARCEL TWO:

Beneficial easements in Master Declaration of Covenants, Conditions and Restrictions for Abilene Station recorded July 31, 2015 at Reception Xx. X0000000, Xxxxxx xx Xxxxxxxx, Xxxxx of Colorado.

Exhibit A

1

EXHIBIT B

TO

CONTRIBUTION AND ASSUMPTION AGREEMENT

FOR GOOD AND VALUABLE CONSIDERATION, the receipt and sufficiency of which are hereby acknowledged, the undersigned hereby assigns, transfers and conveys to Lodging Fund REIT III OP, LP, a Delaware limited partnership (the “Operating Partnership”), its entire legal and beneficial right, title and interest (other than any Excluded Assets) in, to all of the Contributed Assets and the Assumed Agreements, including but not limited to those listed on Schedule 2.2 of the Agreement, together with all amendments, waivers, supplements and other modifications of and to such agreements, contracts, licenses and other instruments through the date hereof, in each case to the fullest extent assignment thereof is permitted by applicable law,

TO HAVE AND TO HOLD the same unto the Operating Partnership, its successors and assigns, forever.

Upon the execution and delivery hereof, the Operating Partnership absolutely and unconditionally accepts the foregoing assignment of each Contributed Asset and Assumed Agreement and assumes all Assumed Liabilities in respect of the Assumed Agreements, and agrees to be bound by the terms, conditions and covenants thereof, and to perform all duties and obligations of the Contributor thereunder from and after the date hereof.

The Contributor for itself, its successors and assigns hereby covenants and agrees that, at any time and from time to time after the date hereof upon the written request of the Operating Partnership, the Contributor will, without further consideration, do, execute, acknowledge and deliver or cause to be done, executed, acknowledged and delivered, each and all of such further acts, deeds, assignments, transfers, conveyances and assurances as may reasonably be required by the Operating Partnership in order to assign, transfer, set over, convey, assure and confirm unto and vest in the Operating Partnership, its successors and assigns, title to the Assumed Agreements (other than the Excluded Assets) granted, transferred, conveyed and delivered by this Agreement. Except as set forth in the immediately preceding sentence and in the Amended & Restated Contribution Agreement by and between the Operating Partnership and the Contributor, dated as of January 29, 2021, Contributor makes no warranties or representations as to the Contributed Asset. The Contributed Asset is transferred “AS IS,” “WHERE IS” and “WITH ALL FAULTS,” and ALL WARRANTIES OF QUALITY, FITNESS AND MERCHANTABILITY BEING HEREBY EXCLUDED.

Capitalized terms used herein, but not defined have the meanings ascribed to them in the Contribution Agreement, dated as of February 3, 2021, between the Operating Partnership and the Contributor.

IN WITNESS WHEREOF, the parties hereto have duly executed and delivered the Agreement as of the date first above written.

| CONTRIBUTOR: | |

| | |

| LN Hospitality Denver, LLC, a Colorado limited liability company | |

| | |

| | |

| By: | |

| Name: Xxxxxxxxxx (Xxxxxx) Xxxxx | |

| Title: Managing Member | |

Exhibit B

1

ACKNOWLEDGEMENT

STATE OF | | ) | | | |

|---|---|---|---|---|---|

| ) ss.: | | | ||

COUNTY OF | | ) | | | |

On ______________________, before me, the undersigned, a Notary Public in and for said State, personally appeared, personally known to me or proved to me on the basis of satisfactory evidence to be the individual whose name is subscribed to the within instrument and executed before me the same in his capacity, and that by his signature on the instrument, the individual, or the person upon behalf of which the individual acted, executed the instrument.

| | |

| Notary Public | (SEAL) |

Exhibit B

2

EXHIBIT C

TO

CONTRIBUTION AGREEMENT

ASSIGNMENT OF WARRANTIES

Axia Contracting Texas, LLC | General Contractor |

Cherry Valley Concrete | Concrete Footings, Foundation, & Slab |

Gypsum Floors of Denver, LLC | Gypcrete |

Independent Roofing Specialists, LLC | TPO Roofing, Sheet metal flashing & Trim, ACM Wall Panels |

Xxxxxx Windows and Doors | Hotel Room Windows |

Clean Designs | Commercial Laundry labor & material |

Fargo Glass & Paint Co | Store Front & Spandrel Windows & Doors |

Old Castle Building Envelope | Glass |

Aluminum Material Products | |

Anodize Class I Finish | |

Security Fire Sprinkler | Sprinkler System |

Intellihot | Hot Water Heaters |

Kohler | Toilets and Toilet Seats |

JCH Mechanical | |

Greenheck | |

Panasonic Appliances Air Conditioning | Split Air Conditioner |

Trane US Inc. | Compressor, Coil, & Parts |

Simplex | Fire Equipment |

Xxxx Emergency Products | Emergency Phones & Call Boxes |

Exhibit C

1

EXHIBIT D

TO

CONTRIBUTION AGREEMENT

TOTAL CONSIDERATION

Total Consideration pursuant to Section 2.8 of the Agreement shall be $27,900,000, consisting of:

$15,000,000 via Access Point Financial, Inc. loan to cover a portion of Contributor’s current financing

1,103,757.7 Series T Limited Units

$1,862,423 in cash at Closing ($412,423 of which shall be paid to vendors to cover operational equipment, linens, supplies, and computer software; $173,417.99 of which shall be paid to an affiliate of the Operating Partnership; $300,000 of which shall be paid to Access Point on behalf of an affiliate of the Operating Partnership at $25,000 monthly for 12 months per separate agreement with Access Point Financial, LLC; and $788,000 of which shall be multiplied by 1.5 at the time of re-valuation and conversion). Accordingly, the Series T Value will be reduced at the time of re-valuation and conversion by $2,256,423 for cash infused at Closing.

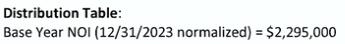

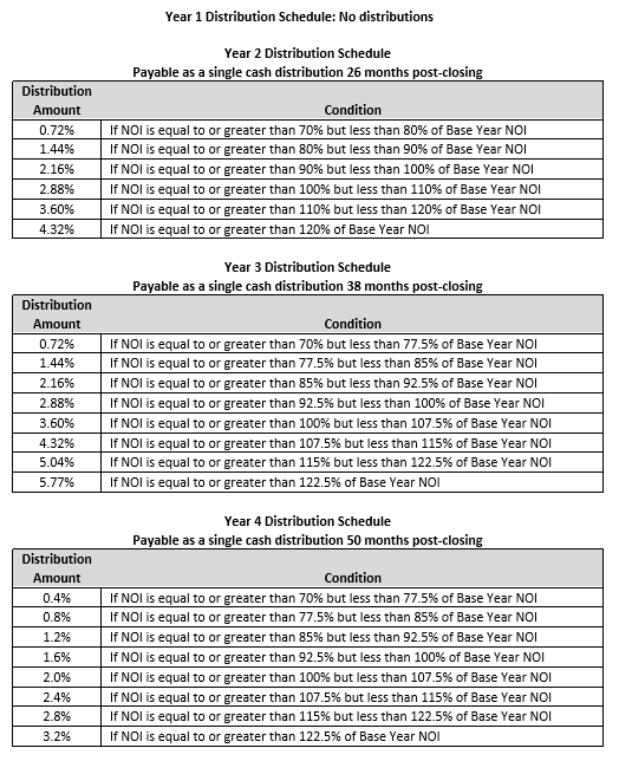

Distributions1 pursuant to Section 2.11 of the Agreement shall be:

1 The Contributor has obtained certain financing from Access Point Financial, LLC at an original loan balance of $5,200,000 (the “B Note”). The B Note shall remain as debt between Access Point and the Contributor. Subject to this Exhibit and the conditions and limitations herein, the Operating Partnership (after this Agreement is assigned to an affiliate, the “Lender” and such affiliate, the “SPE” or the “Borrower”) consents to assign payment of any distributable cash that becomes available as distributions to Contributor (the “Limited Top Guaranty”) as follows in (a) and (b) below. The Contributor consents, agrees, and directs that during the term of the B Note, the Operating Partnership shall pay any and all distributions due to the Contributor directly to Access Point.

a. Subject to Section (b) below, during the current term of the B Note and after the Operating Partnership has obtained a 10% annual return on all capital contributed into the project (the “Preferential Return”), the Operating Partnership shall make distributions to the Contributor, to be applied toward the principal balance of the B Note, equal to 30% of annual Net Cash Flow from Property. In the event that the Operating Partnership refinances the assumed debt on the Property (the “A Note”) during the current term of the B Note, if such refinance provides proceeds in excess of A Note balance, the Operating Partnership shall make an additional distribution to the Contributor, to be applied toward the principal balance of the B Note, equal to the amount of any excess proceeds from the new loan balance in excess of 60% LTV with respect to the Property but not to exceed the existing principal balance of the B Note.

b. The distributions to be made by the Operating Partnership to the Contributor is Section (a) above are subject to the following additional restrictions:

1. The total capital contribution by the Operating Partnership will not to exceed $3 million. Any capital contribution amounts above $3 million shall be evidenced by a promissory note in favor of the Borrower by the Lender on terms to be defined in then-executed loan documents . The Loan Documents shall require interest only debt service payments until the Lender achieves a Combined Yield of 20% on its total invested equity. Once such 20% Combined Yield is achieved, principal and interest payments shall be required by the Loan Documents.

Exhibit D

1

The number of Common Limited Partnership Units in the Operating Partnership received upon conversion of the Series T Limited Units shall be determined based on the formula below, which shall constitute the Series T Value. The Series T Value shall be determined upon the first to occur of (i) 36 months after the Closing Date or, at the option of the Contributor, up to 48 months after the Closing Date or (ii) the sale of (a) the Property or (b) sale of substantially all of the Operating Partnership’s assets.

The Applicable Cap Rate when applied to the then current trailing 12 month net operating income of the Property, less amounts incurred or accrued by the Partnership for (i) $512,423 contribution towards closing costs, (ii) the loan balance outstanding as of the Closing Date as assumed by Operating Partnership, (iii) loan assumption fees and related expenses, (iv) if applicable, costs of defeasance and related expenses, (v) PIP and capital expenditures, (vi) operating cash infused by the Partnership, (vii) any shortfall of the 10% minimum cumulative yield on General Partner’s invested capital, and (viii) any other unrealized or unreimbursed costs of operating the Property.

“Applicable Cap Rate” shall mean: 9.5%

“12 month net operating income of the Contributed Asset” shall mean: (a) the Gross Revenue of the Property, minus (b) Operating Expenses for the Property, for the current trailing twelve (12)-month period.

“Gross Revenue” shall include the following amounts recorded in accordance with generally accepted accounting principles consistently applied:

Exhibit D

2

(a)The entire amount of the price charged, whether wholly or partly for cash or on credit, or otherwise, for the rental of all rooms, suites, conference rooms, restaurants, banquet facilities, and any other facilities and for all goods, wares, and merchandise sold, leased, licensed, or delivered, and all charges for services sold or performed in, at, upon, or from any part of, the Property;

(b)All gross income from parking fees and valet service fees billed to guests of or visitors to the Property or any transient use of parking facilities by anyone;

(c)Without duplication, all deposits received and not refunded to the person or entity making the deposit in connection with any transactions at such time as the Operating Partnership becomes entitled to such deposit or the expiration of one (1) year from the date of such deposit, whichever first occurs;

(d)In-room entertainment services, communication services, Internet services, in-room masseur/masseuse services, and the like, if charged to a guest of the Property.

“Operating Expenses” shall mean: all of the ordinary and normal expenses of operation of the Property, determined on an annualized accrual basis, including annualized property taxes and property assessed clean energy (“PACE”) loan payments, insurance premiums (or taxes and/or insurance impounds, if taxes and/or insurance are impounded by Lender), reserve account equal to 4 percent (4%) of Gross Revenue for furniture, fixtures and equipment reserves, franchise fees and royalties, telephone and internet expenses, administrative and general expenses, management fees, utilities, repair and maintenance, salaries and wages, and advertising and marketing expenses; provided, however, that Operating Expenses will not include:

| a. | depreciation and amortization; |

| b. | non-cash items; |

| c. | all capital items or expenditures, including construction costs and professional fees and other expenses relating thereto and any amortization thereof; |

| d. | costs of repair or restoration after a casualty or condemnation; |

| e. | debt service payments made to lenders; |

| f. | income or franchise taxes; and |

| g. | extraordinary one-time expenses that are not reasonably expected to be incurred in future periods. |

“Distributable Cash” shall mean the Operating Partnership’s payment of 30% net cash flow toward debts holding a secondary position as contemplated in the Existing Loans, but only after 10% minimum return to the Operating Partnership. Such satisfaction of this payment may be paid with funds obtained in a loan to value over the contemplated 60% loan to value.

“Net Cash Flow” means the Property Net Operating Income (including any FF&E Reserves) less Principal and Interest, less any distributions provided on T-Unit Equity, less Borrower’s Fund Level Expenses attributable to Property.

“Combined Yield” defined as the sum of Borrower’s 10% annual returns plus Borrower’s share of Distributable Cash, divided by all of Borrower’s invested capital, annualized.

Exhibit D

3

EXHIBIT E

TO

CONTRIBUTION AGREEMENT

NON-COMPETITION AGREEMENT AND NON-SOLICITATION AGREEMENT

This NON-COMPETITION AND NON-SOLICITATION AGREEMENT (this “Agreement”) is dated as of January 29, 2021 (the “Effective Date”), between Lodging Fund REIT III OP, LP a Delaware limited partnership with an address of 0000 00xx Xxxxxx Xxxxx, Xxxxx 000, Xxxxx, Xxxxx Xxxxxx 00000 (“Operating Partnership”), L N Hospitality Denver LLC, a Colorado limited liability company, with an address of 0000 Xxx Xxxxx Xxxx Xxxx, Xxxxxxxxxx, XX 00000 (“Contributor”), and Xxxxxxxxxx (Xxxxxx) Xxxxx, its Managing Member, Xxxxxxx Xxxxx, Mahendra (Xxxx) Xxxxx,, operating officers of the Contributor (the “Interested Parties”). The Contributor and Interested Parties are collectively referred to herein as the “Restricted Parties.”

R E C I T A L S:

A.The Operating Partnership and Contributor have entered into an Amended & Restated Contribution Agreement, dated as of September 1, 2020, (the “Contribution Agreement”), pursuant to which the Contributor has agreed to contribute property to the Operating Partnership, such property located at 000 Xxxxx Xxxxxxxxx Xxxxxx, Xxxxxx, XX 00000 (the “Hotel”).

B.The agreement of the Restricted Parties to deliver this Agreement was a material inducement to Operating Partnership in entering into the Purchase Agreement.

C.The Operating Partnership, as the owner of the Hotel from and after the date of closing of the Contribution Agreement, desires to preclude the Restricted Parties from competing against it during the term of this Agreement.

A G R E E M E N T

For valuable consideration, the parties agree to the following covenants and agreements set forth in this Agreement and in the Contribution Agreement:

1.1Non-Competition. The Restricted Parties covenant and agree that, for a period of 4 years beginning on the closing date of the Purchase Agreement (the “Closing Date”), neither the Restricted Parties, nor any entity controlled by the Restricted Parties (an “Affiliate”) will, without the prior written consent of the Operating Partnership, directly or indirectly, own, manage, operate, join, control, or engage or participate in the ownership, management, operation, construction, renovation, or control of, or be connected as a shareholder, director, officer, agent, partner, joint venturer, lender, employee, consultant or advisor with, any business or organization any part of which engages in the business of hotel or motel ownership or management or is in competition with any of the business activities of the Operating Partnership, or any affiliate of the Operating Partnership within the Non-Competition Area.

1.2Geographic Restriction. The term “Non-Competition Area” in this Agreement means the area within a 25-mile radius of the Hotel. This provision will not apply to any property that was owned by the Contributor or the Interested Parties, either directly or indirectly through an affiliated entity, prior to the Effective Date of the Contribution Agreement, and will not restrict the Interested Parties, individually or as owners or employees of an entity from managing or consulting regarding one or more hotel(s) or motel(s) under management agreement for owner(s) or lender(s) which either or both Interested Parties: (a) do business with prior to the Effective Date, (b) are part of a multi-property management relationship with owner(s); or a lender(s); or (c) is a property in receivership or foreclosure controlled by a lender.

1.3Confidential Information.

(a)On and after the Closing Date, the Restricted Parties will not use or disclose to anybody, and will cause all of their respective Affiliates to refrain from disclosing, any Confidential Information except: (a) where necessary to comply with any legal obligation, such as a court order or subpoena, provided the Restricted Parties will

Exhibit E

1

first promptly notify the Operating Partnership prior to any such disclosure and permit Operating Partnership to intervene to block such disclosure; (b) where necessary, to the Restricted Parties’ attorneys and accountants, provided that they will have first been apprised of the limitations of this Agreement and will have agreed to be comply with and be bound by such limitations; or (c) where the Restricted Parties have obtained the express, prior written consent from the Operating Partnership.

(b)The term “Confidential Information” includes but is not limited to information specific to the Hotel, including but not limited to: customer lists, contact information, needs, preferences and history of service; business operations and methods; training materials; marketing plans; customer relations information; service and operations forms; practices, procedures, policies and guidelines; sales information; supplier/vendor agreements and information; and all other information, lists, records and data relating to or dealing with the business operations or activities of the Hotel, the disclosure of which may provide valuable benefits to any other person or entity or which would embarrass or damage the Hotel, Operating Partnership or their affiliates, monetarily or otherwise. Furthermore, the term “Confidential Information” is intended to be construed broadly, including information in all forms, written or oral, on paper or stored electronically or in any other medium, and includes all originals, summaries, portions and copies of any such information. Confidential Information does not include information that: (i) was widely known in the industry at the time of disclosure to the Restricted Party, or (ii) becomes widely known or readily available other than by a breach of this Agreement.

1.4Non-Solicitation; Non-Interference. Except with the prior written approval of the Operating Partnership, for a period of 4 years after the Closing Date, neither the Restricted Parties nor their respective Affiliates will (a) employ or offer to employ any person who was principally employed at the Hotel on the Closing Date, (b) solicit, recruit, or encourage any employee or independent contractor of the Hotel or Operating Partnership to leave his or her employment, (c) hire, employ or cause to be hired, or establish a business with, any person who was employed at the Hotel, within the 12-month period preceding the Closing Date, (d) solicit any business clients of the Hotel or encourage them to terminate any contracts, and (e) interfere with or encourage any adjustments to long term negotiated rate clientele. In addition, any attempt by any Restricted Party to induce others to terminate any contracts, employment, or independent contractor relationship with Operating Partnership or the Hotel, or any effort by any Restricted Party to interfere with any of the relationships between each of the Operating Partnership and the Hotel and any of their business clients, employees, or independent contractors, would be harmful and damaging to the Operating Partnership. For purposes of this Section 1.3, an “employee” will include any person who is a common law employee or who is an independent contractor providing personal services.

1.5Non-Disparagement. The Restricted Parties will not: (a) make any disparaging or defamatory statements about Operating Partnership, the Hotel or their affiliates, or (b) authorize, encourage or participate with anyone to make such statements.

1.6Reasonableness; Independent Covenants. The Restricted Parties acknowledge that the restrictions set forth in this Agreement are reasonable and necessary to protect the legitimate business interests of Operating Partnership and the Hotel from and after the Closing Date. The Restricted Parties further acknowledge that all restrictions in this Agreement are reasonable in all respects, including duration, territory and scope of activity restricted.

1.7Remedies.

(a)The Restricted Parties agree that if they or any of their Affiliates engage or threaten to engage in any activity that constitutes a violation of any of the provisions of this Agreement, Operating Partnership will have the right and remedy to have the provisions of this Agreement specifically enforced by law or by any court having jurisdiction.

(b)The Restricted Parties agree a breach of this Agreement would cause immediate irreparable injury to Operating Partnership and/or the Hotel and that money damages would not provide an adequate remedy at law for any breach. Further, without limiting any other legal or equitable remedies available to it, Operating Partnership will be entitled to obtain equitable relief by temporary restraining order, preliminary and permanent injunction or otherwise from any court of competent jurisdiction (without the requirement of posting a bond or other security), including, without limitation, injunctive relief to prevent the Restricted Parties’ failure to comply with the terms and conditions of Section 1 of this Agreement. Such right and remedy will be in addition to, and not in lieu of,

Exhibit E

2

any other rights and remedies available to Operating Partnership at law or in equity, including the right to seek monetary damages.

(c)The applicable 4-year period of the covenants contained in Section 1.4 above will be extended on a day for day basis for each day during which a Restricted Party is in violation of the covenant, so that each Restricted Party is restricted from engaging in the activities prohibited by the covenant for the full 4-year time period.

(d)The Restricted Parties agree that the existence of any claim or cause of action by a Restricted Party against Operating Partnership, whether predicated on this Agreement or otherwise, will not constitute a defense to the enforcement by Operating Partnership of the covenants and restrictions in this Agreement.

1.8Construction. The parties acknowledge that the parties and their counsel have reviewed and revised this Agreement and that the normal rule of construction to the effect that any ambiguities are to be resolved against the drafting party will not be employed in the interpretation of this Agreement or any exhibits or amendments hereto.

1.9Severability. If any provision of this Agreement will, for any reason, be adjudged by any court of competent jurisdiction to be invalid or unenforceable, such judgment will not affect, impair or invalidate the remainder of this Agreement but will be confined in its operation to the provision or provisions hereof directly involved in the controversy in which such judgment will have been rendered, and this Agreement will be construed as if such provision had never existed, unless such construction would operate as an undue hardship on Contributor or Operating Partnership or would constitute a substantial deviation from the general intent of the parties as reflected in this Agreement.

1.10Notices. All notices, requests, demands, and other communications under this Agreement will be in writing and will be sent by hand messenger, electronic facsimile transmission, electronic mail (e-mail), reputable overnight courier, or certified mail, postage prepaid, return receipt requested. Notices and other communications will be deemed to have been duly given, as applicable (i) if by hand delivery, on the date of delivery, if such date is a business day (or if such date is not a business day, then on the first business day following such date), (ii) if by electronic facsimile transmission, the date of transmission as evidenced by automated date and time confirmation from sender’s machine, (iii) if given by e-mail, the communication is instantaneous and the day of receipt can be designated to be the same day as sending and a written copy must also be sent via certified mail, (iv) if given by overnight courier, 1 business day after deposit with the overnight courier, or (v) if given by certified mail, 1 business day after deposit with the United States Post Office. Notices will be addressed as set forth below, or to any other address that the parties will designate in writing:

If to the Restricted Parties:

___________________________

___________________________

___________________________

Fax:

Email:

With copy to:

____________________________

____________________________

____________________________

____________________________

If to Operating Partnership:

Lodging Fund REIT III OP, LP

Attn: Xxxxxx Xxxxxxxx

0000 00xx Xxxxxx X, Xxxxx 000

Xxxxx, XX 00000

Fax: (000) 000-0000

Exhibit E

3

Email: xxxxxxxxx@xxxxxxxxxxx.xxx

With copy to:

Legendary Capital

Attn: Xxxxx Xxxxxx

000 Xxxxxx XX, Xxxxx X

Xxxxx Xxxxxx, XX 00000

Fax: (000) 000-0000

Email: xxxxxxx@xxxxxxxxxxx.xxx

1.11Other Legal Obligations. Nothing in this Agreement shall be construed to limit or otherwise waive any other legal obligations of the Restricted Parties in favor of the Operating Partnership.

1.12Benefit and Binding Effect. The Restricted Parties may not assign this Agreement without the prior written consent of Operating Partnership. The Operating Partnership may assign to an entity of which the Operating Partnership or one of its affiliates is a constituent. This Agreement will be binding upon and inure to the benefit of the parties and their respective successors and permitted assigns.

1.13Further Assurances. The parties will execute upon request any other documents that may be necessary and helpful for the effectiveness and enforceability desirable to the implementation and consummation of this Agreement.

1.14Governing Law. This Agreement will be governed by the laws of the State of New York, without giving effect to the conflict of laws provisions thereof.

1.15Entire Agreement. This Agreement constitutes the entire agreement and understanding between the parties hereto concerning the subject matter hereof.

1.16Headings. The headings herein are included for ease of reference only and will not control or affect the meaning or construction of the provisions of this Agreement.

1.17Amendments/Waivers. This Agreement cannot be amended except by an agreement in writing that makes specific reference to this Agreement and which is signed by the party against which enforcement of any such amendment is sought. Any waiver of any provision of this Agreement must be in writing and signed by the party granting the waiver.

1.18Counterparts. This Agreement may be signed in counterparts with the same effect as if the signature on each counterpart were upon the same instrument.

[signature page follows]

Exhibit E

4

IN WITNESS WHEREOF, the parties hereto have duly executed this Agreement as of the day and year first above written.

| OPERATING PARTNERSHIP: | |

| | |

| Lodging Fund REIT III OP, LP | |

| a Delaware limited partnership | |

| | |

| By: | |

| Its: | General Partner |

| | |

| | |

| | |

| By: | Xxxxxx X. Xxxxxxxxxx |

| Its: | Chief Operating Officer |

Exhibit E

5

IN WITNESS WHEREOF, the parties hereto have duly executed this Agreement as of the day and year first above written.

| CONTRIBUTOR: |

| |

| L N Hospitality Denver LLC |

| a Colorado limited liability company |

| |

| |

| |

| By: Xxxxxxxxxx (Xxxxxx) Xxxxx |

| Its: Managing Member |

| |

| |

| |

| RESTRICTED PARTIES: |

| |

| |

| |

| Xxxxxxx Xxxxx |

| |

| |

| |

| Xxxxxxxxxx (Xxxxxx) Xxxxx |

| |

| |

| |

| Mahendra (Xxxx) Xxxxx |

Exhibit E

6

EXHIBIT F

TO

CONTRIBUTION AGREEMENT

CONFIDENTIALITY AND NON-DISCLOSURE AGREEMENT

THIS AGREEMENT is made and entered into as of February 3, 2021 by and between Lodging Fund REIT III OP, LP (individually and collectively with its subsidiaries, owners and affiliates, the “Partnership”) and L N Hospitality Denver LLC (“Contributor”) (the Partnership and Contributor individually, a “Party” and collectively, the “Parties”).

The Parties intend to exchange Confidential Information to one another in connection with the possibility of engaging in the transaction described in the Contribution Agreement (the “Transaction”).

In consideration of the promises exchanged herein, the Parties hereto agree that the following terms and conditions shall apply when one Party discloses "Confidential Information" to the other Party:

1. | DEFINITION OF “CONFIDENTIAL INFORMATION”. As used in this Agreement, the term “Confidential Information” means all information relating to or used in the Partnership’s business, regardless of whether it is marked “confidential” or otherwise. Confidential Information includes, but is not limited to, all business processes and procedures, systems, methods of doing business, data, reports, specifications, formulae, proposals, strategies, business plans and analyses, financial information and projections, investment strategy, marketing, advertising, promotions, market research, plans, information about past, present or potential investors, information about past, present or potential vendors, information about existing or future technology, and proprietary software or models. Without limiting the foregoing, the term “Confidential Information” expressly includes: the Partnership’s investment strategies, including without limitation the possibility of entering into an umbrella real estate investment trust (“UPREIT”) transaction; and potential details related to the Transaction, including without limitation potential Transaction terms, provisions, and pricing. The foregoing notwithstanding, the term “Confidential Information” does not include information that: |

a) | Is or becomes known to the public through no fault of the receiving Party; |

b) | The receiving Party already rightfully possessed before the disclosing Party disclosed it to the receiving Party; |

c) | Is subsequently disclosed to the receiving Party by a third-party who is not under obligation of confidentiality to the disclosing Party; or |

d) | The receiving Party develops independently without using Confidential Information. |

2. | NON-DISCLOSURE OBLIGATIONS. Neither Party shall disclose Confidential Information of the other Party to any of its officers, directors, employees, contractors or agents or to any third-party without the disclosing Party’s written consent, except that (a) the receiving Party may disclose such information to its officers, directors, employees, contractors, attorneys, accountants, consultants and agents whose duties justify their need to know such Confidential Information, and who have been clearly informed of their obligation to maintain the confidential status of such Confidential Information; and (b) the receiving Party may disclose Confidential Information to the extent required by applicable federal, state or local law, regulation, court order, or other legal process, provided such Party has given the disclosing Party prior written notice of such required disclosure and, to the extent reasonably possible, has given the disclosing Party an opportunity to contest such required disclosure at the disclosing Party’s expense. |

3. | PROTECTION OF CONFIDENTIAL INFORMATION. The receiving Party shall use the same care to prevent the unauthorized use or disclosure of the Confidential Information as such Party uses with respect to its own confidential information of a similar nature, which shall not in any case be less than the care a reasonable business person would use under similar circumstances. Without limiting the foregoing, the receiving Party shall take reasonable action by instruction, agreement or otherwise with respect to such |

Exhibit F

1

Party’s employees or other persons permitted access to Confidential Information to cause them to comply fully with the receiving Party’s obligations hereunder.

4. | PERMITTED USE OF CONFIDENTIAL INFORMATION. The receiving Party may not use the Confidential Information directly or indirectly for any purpose other than the purpose for which it was originally disclosed, or for any purposes which could be deemed to be adverse to or competitive with the disclosing Party’s business. Notwithstanding the foregoing and anything to the contrary in this Agreement, nothing contained herein shall impair Buyer’s right (or the right of any permitted assignee or Lodging Fund REIT III, Inc. (“Parent”)) to disclose information relating to this Agreement, the Contribution Agreement, or the Property (a) to any due diligence representatives and/or consultants that are engaged by, work for or are acting on behalf of, any securities dealers, investment advisors and/or broker-dealers evaluating Buyer, its permitted assignees or Parent, (b) in connection with any filings with governmental agencies (including the Securities and Exchange Commission) by Parent, (c) to any broker-dealers or investment advisors in Parent’s selling group and any of Parent’s investors, including pursuant to the confidential offering memorandum used in connection with Parent’s ongoing private offering, and (d) to the public as long as such information does not specifically disclose the identity of the Contributor or the Property if such disclosure occurs before the end of the Due Diligence Period. |

5. | DESTRUCTION OF CONFIDENTIAL INFORMATION. Upon the written request of the disclosing Party, the receiving Party shall cease using and arrange for the destruction of all copies of any Confidential Information then in the receiving Party’s possession or under such Party’s control. The receiving Party agrees to dispose of the Confidential Information in such a manner that the information cannot be read or reconstructed after destruction. Upon the written request of the disclosing Party, the receiving Party shall certify in writing that it has complied with the obligations set forth in this paragraph. |

6. | INFORMATION SECURITY. (a) The receiving Party shall take appropriate measures designed to protect the security, confidentiality, and integrity of Confidential Information; (b) the receiving Party shall restrict access to Confidential Information to those officers, directors, employees, contractors, agents or other third parties whose access the disclosing Party deems appropriate; (c) Confidential Information shall continue to be subject to the terms of this Agreement for a period of thirty (30) months following execution of this Agreement. The receiving Party agrees to indemnify the disclosing Party for all reasonable fees, costs, charges, and expenses resulting from any unauthorized access to Confidential Information. |

7. | OWNERSHIP OF CONFIDENTIAL INFORMATION. The disclosing Party shall retain all right, title and interest in and to its own Confidential Information. Neither this Agreement nor any disclosure of Confidential Information shall be deemed to grant the receiving Party any license or other intellectual property right. |

8. | DISCLAIMERS. The receiving Party acknowledges and agrees that the disclosing Party provides Confidential Information disclosed hereunder on an “AS IS” basis, without warranties of any kind, except as specified in Section 7 above. Without limiting the foregoing, the disclosing Party does not represent or warrant that Confidential Information is accurate, complete or current. The disclosure of Confidential Information containing business plans is for planning purposes only. The disclosing Party may change or cancel its plans at any time at such Party's sole discretion. The receiving Party further acknowledges and understands that disclosure of Confidential Information is not a representation that the parties will enter into any type of business relationship. |

9. | INJUNCTIVE RELIEF. The receiving Party acknowledges that the unauthorized use or disclosure by such Party of Confidential Information would cause immediate and irreparable damage that could not be fully remedied by monetary damages. The receiving Party therefore agrees that the disclosing Party may specifically enforce this Agreement and shall be entitled to injunctive or other equitable relief to prevent unauthorized use or disclosure without the necessity of proving actual damage. |

10. | TERMINATION. This Agreement shall remain in full force and effect until the earlier of (i) the Parties’ execution of a binding agreement superseding this Agreement, or (ii) a date two years after the conclusion of business discussions between the Parties. |

Exhibit F

2

11. | SEVERABILITY. If any provision of this Agreement is held invalid, illegal or unenforceable the validity, legality and enforceability of the remaining provisions shall not in any way be affected or impaired. |

12. | GENERAL. This Agreement supplements the LOI, and to the extent inconsistent, supersedes any other non-disclosure or confidentiality agreement between the Parties. The Parties may not amend this Agreement except in a writing that each party signs. The terms of such an amendment shall apply as of the effective date of the amendment, unless the amendment specifies otherwise. This Agreement shall be binding upon and inure to the benefit of the Parties and their respective successors and assigns. The laws of the State of Colorado shall govern this Agreement. No provision of this Agreement may be waived, except pursuant to a writing executed by the party against whom the waiver is sought to be enforced. No failure or delay in exercising any right or remedy or requiring the satisfaction of any condition under this Agreement operates as a waiver or estoppel of any right, remedy or condition. All remedies provided for in this Agreement shall be cumulative and in addition to and not in lieu of any other remedies available at law, in equity or otherwise. |

LODGING FUND REIT III OP, LP | | LN HOSPITALITY DENVER LLC | ||

on behalf of itself and its subsidiaries, | | | ||

owners and affiliates | | | ||

| | | ||

| | | ||

By: | /s/ Xxxxx X. Xxxxxx | | By: | Xxxxxx Xxxxx |

Name: | Xxxxx X. Xxxxxx | | Name: | Xxxxxxxxxx (Xxxxxx) Xxxxx |

Title: | Chief Investment Officer | | Title: | Managing Member |

Exhibit F

3

EXHIBIT G

TO

CONTRIBUTION AGREEMENT

TAX INFORMATION

Exhibit G

1

Schedule 2.4

List of Excluded Assets

| 1. | Contributor’s cash, cash equivalents and investments not relating to the operation of the Property. |

| 2. | Any Fixtures and Personal Property that contains hazardous materials that the Operating Partnership requires to be removed. |

3. | Any management agreement pertaining to the Property, which management agreements must be terminated at Closing. |

Schedule 2.4

2

Schedule 2.5

List of Assumed Liabilities; Permitted Liens

Assumed/New:

Access Point Financial: Loan in the amount of $15,000,000.00 to cover a portion of Contributor’s current financing

Permitted:

PACE: Loan in the amount of $3,817,000.00

Schedule 2.5

1

Schedule 2.6

List of Excluded Liabilities

Schedule 2.6

1

Schedule 2.10

Allocation of Total Consideration

Schedule 2.10

1

Schedule 3.1.8

3-05 Audit

Contributor acknowledges that under either Rule 3-05 or Rule 3-14 of Regulation S-X, the Operating Partnership is required to provide certain information in connection with reports the Company is required to file with the Securities and Exchange Commission.

Accordingly, Contributor agrees to:

(a)allow the Operating Partnership and its representatives which includes third party auditors, at the Operating Partnership’s sole cost and expense, to perform an audit of the Property, the Contributed Assets and business operations of and at the Property to the extent required under either Rule 3-05 or Rule 3-14 of Regulation S-X (hereinafter a “Rule 3-05 or 3-14 Audit”); and

(b)make available to the Operating Partnership and its representatives for inspection and audit following the Closing, at the Contributor’s offices the Contributor’s books and records relating solely to the Contributor’s operations that are reasonably requested by the Operating Partnership (but specifically excluding Contributor’s tax returns) for any full or partial years reasonably necessary to complete the Rule 3-05 or 3-14 Audit; and

(c)sign the management representation letter to be provided by the Operating Partnership’s independent auditors.

In connection with the foregoing, the Operating Partnership will give the Contributor no less than 10 business days’ prior written notice of the Operating Partnership’s plans to inspect and audit such books and records, and the Contributor’s obligation to perform herein shall extend beyond the Closing.

Notwithstanding the foregoing, the Contributor will not be required to (a) prepare or compile any materials, (b) incur any third-party costs or expenses in connection with the Rule 3-05 or 3-14 Audit, (c) provide any books, records or materials that could reasonably be expected to be books, records or materials in the possession or control of the tenant parties, (d) provide any books, records or materials that are not within the possession or control of the Contributor, or (e) make any representations or warranties with respect to such information beyond a customary management representation letter signed by the Contributor reasonably requested by any accounting firm engaged by the Operating Partnership to deliver its auditors report with respect to the Rule 3-05 or Rule 3-14 Audit. The Operating Partnership acknowledges and agrees that the foregoing accounting and financial materials to be provided by the Contributor does not include any information or materials related to the period prior to the date the Contributor acquired the Property and the Contributed Assets and is to be limited solely to information regarding the Property and the Contributed Assets after they were placed into operation by the Contributor. The Contributor acknowledges that the Rule 3-05 or Rule 3-14 Audit may require the Operating Partnership to perform a Rule 3-05 or 3-14 Audit both after the Effective Date and after the Closing Date and the Contributor agrees that the Contributor’s obligations under this Schedule 3.1.8 are material terms of this Agreement, and breach of this Schedule 3.1.8 will constitute a default under the terms of this Agreement. The Contributor further agrees, that the Operating Partnership’s sole and absolute remedy in the event of default is that of specific performance.

Schedule 3.1.8

1