AMENDMENT NO. 1 TO AMENDED AND RESTATED REGISTRATION RIGHTS AGREEMENT

Exhibit 99-2

AMENDMENT NO. 1 TO AMENDED AND RESTATED

REGISTRATION RIGHTS AGREEMENT

REGISTRATION RIGHTS AGREEMENT

This Amendment No. 1 to the Amended and Restated Registration Rights Agreement ("Amendment"), dated as of August 28, 2014, amends that certain Amended and Restated Registration Rights Agreement, dated July 11, 2014 (the "Agreement"), by and among Star Bulk Carriers Corp., a Xxxxxxxx Islands corporation (the "Company"), and the Persons party thereto. Unless otherwise indicated, capitalized terms used herein shall have the meanings ascribed to such terms in the Agreement.

WHEREAS, the Company and certain shareholders of the Company are party to the Agreement;

WHEREAS, pursuant to the Vessel Purchase Agreement, dated as of August 19, 2014 (the "Vessel Purchase Agreement"), by and between the Company and Excel Maritime Carriers Ltd. ("Excel"), Excel will receive, as consideration for the sale of certain vessels to the Company, shares of common stock, par value $0.01 per share, of the Company (the "Common Stock"), which, following the closing of the transactions contemplated under the Vessel Purchase Agreement, will be distributed by Excel to Excel Maritime Holding Company LLC ("Excel Holding"), which in turn will be distributed to the holders of equity interests in Excel Holding (the "Excel Holders") based on their pro rata ownership of such equity interests on the date of such distribution (the "Investor Distribution");

WHEREAS, in conjunction with the Vessel Purchase Agreement and the transactions contemplated thereby and the Investor Distribution, the Company has agreed to offer the Excel Holders the opportunity to receive registration rights upon delivery of a duly executed signature page to the Agreement (such electing Excel Holders, the "New Holders"); and

WHEREAS, pursuant to Section 3.05 of the Agreement, the Company, the Monarch Holders Majority and the Oaktree Holders Majority desire to amend the Agreement as provided herein to provide for, among other things, the grant of registration rights with respect to the shares of Common Stock issued to the New Holders.

NOW, THEREFORE, in consideration of the mutual premises contained herein and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the undersigned does hereby agree as follows:

1. Section 1.01 of the Agreement is hereby amended as follows:

| a. | The following definitions are added to Section 1.01: |

""Excel" means Excel Maritime Carriers Ltd."

""Excel Holders" means those holders of equity interests in Excel."

""Excel Holding" means Excel Maritime Holding Company LLC."

""Investor Distribution" means the distribution to the Excel Holders based on their pro rata ownership of such equity interests on the date of such distribution."

""New Holders" means, (a) prior to the distribution to Excel Holding, Excel, (b) prior to the first Investor Distribution, Excel Holding, and (c) after the first Investor Distribution, those Holders listed on Schedule I hereof, as may be updated from time to time after the date hereof to reflect additional Excel Holders that deliver a duly executed signature page to this Agreement, and their respective Affiliates that are direct or indirect holders of Common Stock as a result of the Investor Distribution, subject at all times to Section 3.06."

""Silver Oak Holder" means, after the first Investor Distribution, Silver Oak Capital, L.L.C. and any successor funds thereto, and their respective Affiliates that are direct or indirect equity investors in the Company."

b. The following definitions are hereby amended and restated as follows:

""Closing Date" shall mean the date on which the initial closing occurs pursuant to the Vessel Purchase Agreement, dated as of August 19, 2014, by and between the Company and Excel."

""Investor" means each of the Monarch Holders, each of the Oaktree Holders, each of the Xxxxxx Holders and each of the New Holders."

""Oaktree Holders" means Oaktree Value Opportunities Fund, L.P., Oaktree Opportunities Fund IX Delaware, L.P., Oaktree Opportunities Fund IX (Parallel 2), L.P., Oaktree Dry Bulk Holdings LLC, OCM XL Holdings, L.P. and any successor funds thereto, and their respective Affiliates that are direct or indirect equity investors in the Company."

2. Section 2.01(a) of the Agreement is hereby amended by adding the following proviso at the end of the first sentence of the section:

"; provided, that, if the Company shall have filed a Shelf Registration Statement covering the resale of certain Registrable Securities owned by the Investors, then the Company shall not be required to prepare and file a Shelf Registration Statement covering such Registrable Securities on or prior to the Filing Date."

3. Section 2.01(d) of the Agreement is hereby amended by replacing the first proviso with the following:

"; provided, however, that the Company, unless otherwise approved in writing by each of (i) the Monarch Holders Majority, (ii) the Oaktree Holders Majority, and (iii) the Silver Oak Holder (for so long as the Monarch Holders, the Oaktree Holders, and the Silver Oak Holder hold any Registrable Securities, respectively), shall not be permitted to exercise a Shelf Suspension more than twice, or for more than an aggregate of 60 days, in each case, during any 12-month period;"

2

4. Section 2.06 of the Agreement is hereby amended by replacing it in its entirety with the following:

"SECTION 2.06. No Inconsistent Agreements; Additional Rights. The Company is not currently a party to, and shall not hereafter enter into without the prior written consent of (i) the Monarch Holders Majority, (ii) the Oaktree Holders Majority, and (iii) the Silver Oak Holder (for so long as the Monarch Holders, the Oaktree Holders, and the Silver Oak Holder hold any Registrable Securities, respectively), any agreement with respect to its securities that is inconsistent with the rights granted to the Holders by this Agreement, including allowing any other holder or prospective holder of any securities of the Company (a) registration rights in the nature or substantially in the nature of those set forth in Section 2.01 or Section 2.02 that would have priority over the Registrable Securities with respect to the inclusion of such securities in any Registration (except to the extent such registration rights are solely related to Registrations of the type contemplated by Section 2.02(a)(ii) through (iv)) or (b) demand registration rights in the nature or substantially in the nature of those set forth in Section 2.01 that are exercisable prior to such time as the Requesting Investors can first exercise their rights under Section 2.01.

5. Section 2.10 of the Agreement is hereby amended by replacing it in its entirety with the following:

"SECTION 2.10. Limitation on Registrations and Underwritten Offerings. Notwithstanding the rights and obligations set forth in Section 2.01, in no event shall the Company be obligated to take any action to (i) effect more than one Underwritten Offering per calendar quarter or (ii) effect any Marketed Underwritten Shelf Take-Down, unless (A) the Investor initiating such Underwritten Offering proposes to sell Registrable Securities in an amount of at least the lesser of one percent (1%) of the then-outstanding Company Shares or 100% of the Registrable Securities then held by such Investor and (B) with respect to any New Holder, the aggregate proceeds expected to be received from the sale of the Registrable Securities in such offering equals or exceeds $50,000,000 determined by the Company in good faith as of the date the Company receives the Underwritten Shelf Take-Down Notice."

6. Section 3.01 of the Agreement is hereby amended by replacing it in its entirety with the following:

"SECTION 3.01. Term. This Agreement shall terminate with respect to any Holder, (i) with the prior written consent of each of (A) the Monarch Holders Majority, (B) the Oaktree Holders Majority, and (C) the Silver Oak Holder (for so long as the Monarch Holders, the Oaktree Holders, and the Silver Oak Holder hold any Registrable Securities, respectively), (ii) if such Holder and its Affiliates beneficially own less than 5% of the outstanding Company Shares, if all of the Registrable Securities then owned by such Holder and its Affiliates could be sold in any ninety (90)-day period pursuant to Rule 144 without restriction as to volume or manner of sale or (iii) if all of the Registrable Securities held by such Holder have been sold in a Registration pursuant to the Securities Act or pursuant to an exemption therefrom."

3

7. Section 3.05 of the Agreement is hereby amended by adding the following proviso at the end of the section:

"; provided that any amendment, modification or waiver that has a materially and disproportionately adverse effect on any new Holder as compared with the effect on other Holders shall require the prior written consent of such Holder."

8. Section 3.06 of the Agreement is hereby amended by replacing it in its entirety with the following:

"SECTION 3.06. Successors, Assigns and Transferees. The rights and obligations of each party hereto may not be assigned, in whole or in part, without the written consent of the Company, the Monarch Holders Majority, the Oaktree Holders Majority, and the Silver Oak Holder (for so long as the Monarch Holders, the Oaktree Holders, and the Silver Oak Holder hold any Registrable Securities, respectively); provided, however, that notwithstanding the foregoing, the rights and obligations set forth herein may be assigned, in whole or in part, by any Investor to any transferee of Registrable Securities that holds (after giving effect to such transfer) in excess of one percent (1%) of the then-outstanding Company Shares and such transferee shall, with the consent of the transferring Investor, be treated as an "Investor" for all purposes of this Agreement (it being understood that, without such consent from the transferring Investor, such transferee shall be treated as a "Holder" for all purposes of this Agreement) (each Person to whom the rights and obligations are assigned in compliance with this Section 3.06 is a "Permitted Assignee" and all such Persons, collectively, are "Permitted Assignees"); provided, further, that such transferee shall only be admitted as a party hereunder upon its, his or her execution and delivery of a joinder agreement, in form and substance acceptable to each Investor, agreeing to be bound by the terms and conditions of this Agreement as if such Person were a party hereto (together with any other documents the Investors determine are necessary to make such Person a party hereto), whereupon such Person will be treated as a Holder for all purposes of this Agreement, with the same rights, benefits and obligations hereunder as the transferring Holder with respect to the transferred Registrable Securities (except that if the transferee was a Holder prior to such transfer, such transferee shall have the same rights, benefits and obligations with respect to such transferred Registrable Securities as were applicable to Registrable Securities held by such transferee prior to such transfer).

9. Each New Holder hereby accedes to and ratifies the Agreement and covenants and agrees with the Company to be bound by the terms of the Agreement as a "Holder" and to duly and punctually perform and discharge all liabilities and obligations whatsoever from time to time to be performed or discharged by it under or by virtue of the Agreement in all respects as if named as a party therein.

10. The Company covenants and agrees that each New Holder shall be entitled to all the benefits of the terms and conditions of the Agreement to the intent and effect that the New Holder shall be deemed, with effect from the date on which the New Holder executes this instrument, to be a party to the Agreement as a "Holder."

4

11. The Agreement, as amended by this Amendment, is and shall continue to be in full force and effect.

12. This Amendment may be executed in any number of counterparts and by the parties hereto in separate counterparts each of which when so executed shall be deemed to be an original and all of which when taken together shall constitute one and the same agreement. Delivery of an executed counterpart of a signature page to this Amendment by facsimile shall be effective as delivery of manually executed counterpart of this Amendment.

13. This Amendment shall be governed by and construed in accordance with the laws of the State of New York, without regard to the conflicts of law principles thereof.

[Remainder of page intentionally left blank]

5

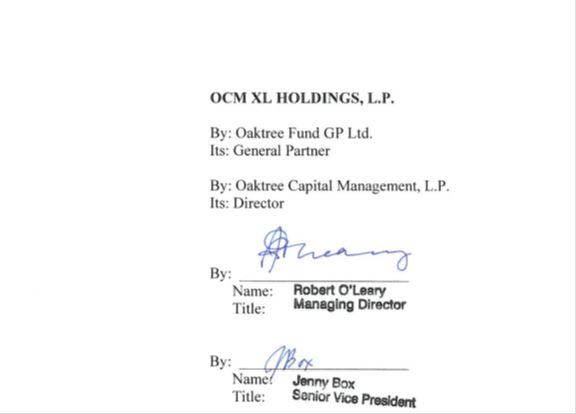

[Signature Page to Amendment No. 1 to Amended and Restated Registration Rights Agreement]

6

8

9

10

[Signature Page to Amendment No. 1 to Amended and Restated Registration Rights Agreement]

11

[Amendment No. 1 to the Amended and Restated Registration Rights Agreement]

12

Schedule I

New Holders

|

Silver Oak Capital, L.L.C.

|

|

ELQ Investors II Ltd.

|

|

Xxxxxxx Lynch, Pierce, Xxxxxx & Xxxxx Incorporated

|

|

Barclays Bank PLC

|

|

Caspian Select Credit Master Fund, Ltd.

|

|

P Xxxxxx Ltd

|

|

CO Xxxxx, XX

|

|

Silverback Arbitrage Master Fund Limited

|

|

Xxxxxx Credit Opportunities Master Fund, XX

|

|

Xxxxxxx Xxxxx

|

|

Xxxxx Xxxxxxxx Capital Income Partners, LP

|

|

Virginia Retirement System

|

|

Barclays Capital Inc

|

|

Caspian HLSC1, LLC

|

|

Zazove Aggressive Growth Fund, L.P.

|

|

Caspian SC Holdings, L.P.

|

|

Wingspan Master Fund, LP

|

|

Super Caspian Cayman Fund Limited

|

|

Mariner LDC

|

|

Value Works Limited Partners LP

|

|

Caspian Solitude Master Fund, L.P.

|

|

Imap Matterhorn PLC

|

|

Zazove Convertible Securities Fund, Inc

|

|

Lockheed Xxxxxx Corporation Master Retirement Trust

|

|

Centurylink, Inc. Defined Benefit Master Trust

|

|

Eurobank

|

|

Zazbond LLC

|

|

Xxxxx Xxxxxx

|

|

Xxxxx Xxxxxxxx Income Partners, XX

|

|

Xxxxxx High Yield Convertible Securities Fund, L.P.

|

|

Deseret Mutual Employee Pension Trust

|

|

Deseret Mutual Retiree Medical & Life Plan Trust

|

|

Deseret Healthcare Employee Benefits Trust

|