LEASE AGREEMENT by and between 8180 GREENSBORO, L.L.C. (“Landlord”) and CVENT, INC. (“Tenant”) Property: 8180 Greensboro Drive McLean, Virginia 22102

Exhibit 10.2

Execution Version

by and between

8180 GREENSBORO, L.L.C.

(“Landlord”)

and

CVENT, INC.

(“Tenant”)

Property:

0000 Xxxxxxxxxx Xxxxx

XxXxxx, Xxxxxxxx 00000

TABLE OF CONTENTS

| PAGE | ||||||||

| 1. |

Demised Premises |

1 | ||||||

| 2. |

Term; Lease Year |

2 | ||||||

| 2.1 |

Term |

2 | ||||||

| 2.2 |

Lease Year |

2 | ||||||

| 3. |

Rent |

3 | ||||||

| 3.1 |

Monthly Base Rent |

3 | ||||||

| 3.2 |

Cost of Living Adjustment |

3 | ||||||

| 3.3 |

Abatement |

4 | ||||||

| 4. |

Additional Rent; Increases in Operations and Real Estate Tax Expenses |

4 | ||||||

| 4.1 |

Tenant’s Share |

4 | ||||||

| 4.2 |

Amount of Tenant’s Share |

4 | ||||||

| 4.3 |

Statements |

4 | ||||||

| 4.4 |

Retroactive Adjustments |

5 | ||||||

| 4.5 |

Tenant’s Review of Records |

5 | ||||||

| 5. |

Definitions |

6 | ||||||

| 5.1 |

Operating Expenses |

6 | ||||||

| 5.2 |

Real Estate Tax-Expenses |

8 | ||||||

| 5.3 |

Real Estate Tax Contests |

9 | ||||||

| 6. |

Additional Rent: Sales, Use or Gross Receipt Taxes |

9 | ||||||

| 7. |

Additional Rent; Personal Property and Other Taxes |

10 | ||||||

| 7.1 |

Levied On Tenant |

10 | ||||||

| 7.2 |

Levied On Landlord |

10 | ||||||

| 8. |

Payment of Additional Rent; Late Charges; Interest |

10 | ||||||

| 9. |

Deposits |

10 | ||||||

| 9.1 |

First Installment of Monthly Base Rent |

10 | ||||||

| 9.2 |

Security Deposit |

11 | ||||||

| 9.3 |

Transfer of Landlord’s Interest |

11 | ||||||

| 9.4 |

Landlord Remedies |

12 | ||||||

| 10. |

Hazardous Materials |

12 | ||||||

| 10.1 |

Definition |

12 | ||||||

| 10.2 |

General Prohibition |

12 | ||||||

| 10.3 |

Notice |

12 | ||||||

| 10.4 |

Survival |

13 | ||||||

| 11. |

Laws and Ordinances |

13 | ||||||

i

| 12. |

Use of Demised Premises |

13 | ||||||

| 13. |

Repairs by Tenant |

14 | ||||||

| 14. |

Repairs by Landlord |

14 | ||||||

| 15. |

Furniture; Fixtures; Electrical Equipment |

15 | ||||||

| 15.1 | Floor Loading |

15 | ||||||

| 15.2 | Office Equipment |

15 | ||||||

| 16. |

Alterations |

16 | ||||||

| 16.1 | Initial Work |

16 | ||||||

| 16.2 | Alterations by Tenant |

17 | ||||||

| 16.3 | Compliance with Codes; No Liens |

18 | ||||||

| 17. |

Ownership of Alterations and Equipment and Other Property; Removal of Tenant’s Personal Property |

18 | ||||||

| 17.1 | Landlord’s Property |

18 | ||||||

| 17.2 | Removal |

19 | ||||||

| 18. |

Damage or Destruction |

19 | ||||||

| 18.1 | Notice |

19 | ||||||

| 18.2 | Restoration |

19 | ||||||

| 18.3 | Termination |

20 | ||||||

| 18.4 | No Liability |

20 | ||||||

| 19. |

Condemnation |

20 | ||||||

| 19.1 | Compensation Award |

20 | ||||||

| 19.2 | Termination |

21 | ||||||

| 20. |

Defaults; Landlord’s Remedies |

21 | ||||||

| 20.1 | Events of Default |

21 | ||||||

| 20.2 | Landlord’s Right to Cure |

22 | ||||||

| 20.3 | Right to Termination |

22 | ||||||

| 20.4 | Right to Enter |

23 | ||||||

| 20.5 | Extent of Liabilities |

23 | ||||||

| 20.6 | Liquidated Damages |

24 | ||||||

| 20.7 | Tenant’s Waiver |

24 | ||||||

| 20.8 | Right to Enjoin |

24 | ||||||

| 20.9 | Landlord’s Lien |

24 | ||||||

| 20.10 | Remedies Cumulative |

25 | ||||||

| 20.11 | Tenant’s Agent for Process |

25 | ||||||

| 20.12 | No Waiver |

25 | ||||||

| 21. |

Utilities and Services |

25 | ||||||

| 21.1 | Landlord to Furnish |

25 | ||||||

| 21.2 | Charges to Tenant |

26 | ||||||

| 21.3 | Repairs; Interruptions |

26 | ||||||

ii

| 21.4 | Tenant’s Obligation |

26 | ||||||

| 21.5 | Governmental Requirements |

27 | ||||||

| 21.6 | Access |

27 | ||||||

| 22. |

Insurance |

27 | ||||||

| 22.1 | Liability Insurance |

27 | ||||||

| 22.2 | Tenant’s Property Insurance |

28 | ||||||

| 22.3 | Policy Requirements |

28 | ||||||

| 22.4 | No Risk Increase |

28 | ||||||

| 23. |

Waiver of Subrogation |

28 | ||||||

| 24. |

Property at Tenant’s Xxxx |

00 | ||||||

| 00. |

Assignment and Subletting |

29 | ||||||

| 25.1 | Consent Required |

29 | ||||||

| 25.2 | Change of Controlling Interest in Tenant |

29 | ||||||

| 25.3 | Tenant’s Notice |

29 | ||||||

| 25.4 | Landlord’s Election |

30 | ||||||

| 25.5 | Excess Rental |

30 | ||||||

| 25.6 | Costs |

31 | ||||||

| 25.7 | No Waiver |

31 | ||||||

| 25.8 | Tenant’s Liability |

31 | ||||||

| 26. |

Signs |

32 | ||||||

| 27. |

Rules and Regulations |

32 | ||||||

| 28. |

Landlord Access |

32 | ||||||

| 29. |

Subordination |

33 | ||||||

| 29.1 | Automatic Subordination |

33 | ||||||

| 29.2 | Instruments of Subordination |

33 | ||||||

| 30. |

Estoppel Certificate; Financial Statements |

33 | ||||||

| 30.1 | Estoppel Certificate |

33 | ||||||

| 30.2 | Attorney-in-Fact |

34 | ||||||

| 30.3 | Financial Statements |

34 | ||||||

| 31. |

Delay |

34 | ||||||

| 32. |

Surrender and Hold-Over |

34 | ||||||

| 32.1 | Surrender |

34 | ||||||

| 32.2 | Hold-Over |

34 | ||||||

| 33. |

Quiet Enjoyment |

35 | ||||||

| 34. |

Certain Rights Reserved by Landlord |

35 | ||||||

iii

| 35. |

Landlord’s Successors |

36 | ||||||

| 36. |

Relocation of Tenant |

36 | ||||||

| 37. |

Attorneys’ Fees; Homestead |

37 | ||||||

| 38. |

Notices |

37 | ||||||

| 39. |

Remedies Cumulative; No Waiver |

38 | ||||||

| 40. |

Modification |

38 | ||||||

| 41. |

Modification Due to Financing |

38 | ||||||

| 42. |

Waiver of Jury Trial |

38 | ||||||

| 43. |

Force Majeure |

39 | ||||||

| 44. |

No Option |

39 | ||||||

| 45. |

Gender; Assigns and Successors; Joint and Several Liability |

39 | ||||||

| 46. |

Severability |

39 | ||||||

| 47. |

Time is of the Essence |

39 | ||||||

| 48. |

Limitation on Landlord Liability |

39 | ||||||

| 48.1 | Liability Standard |

39 | ||||||

| 48.2 | Limitation on Total Liability |

39 | ||||||

| 49. |

No Partnership |

40 | ||||||

| 50. |

Brokerage |

40 | ||||||

| 51. |

Tenant’s Corporate Authority |

40 | ||||||

| 52. |

Indemnifications |

41 | ||||||

| 53. |

Time of Payment |

42 | ||||||

| 54. |

Parking |

42 | ||||||

| 55. |

Delegation by Landlord |

42 | ||||||

| 56. |

Headings |

42 | ||||||

| 57. |

Applicable Law |

42 | ||||||

| 58. |

Fitness Center |

42 | ||||||

iv

EXHIBITS AND ADDENDA

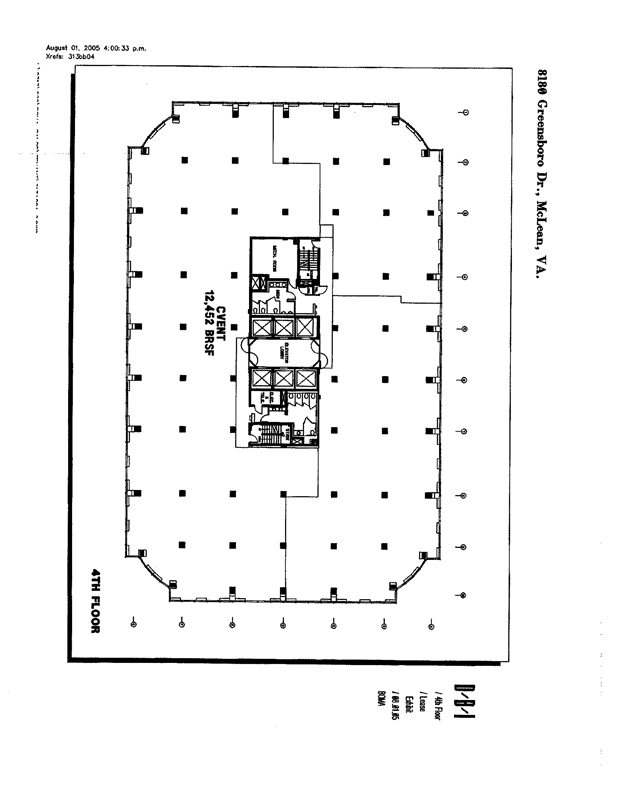

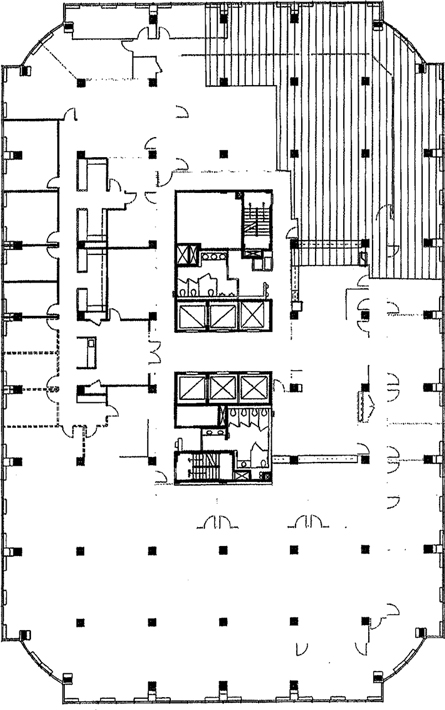

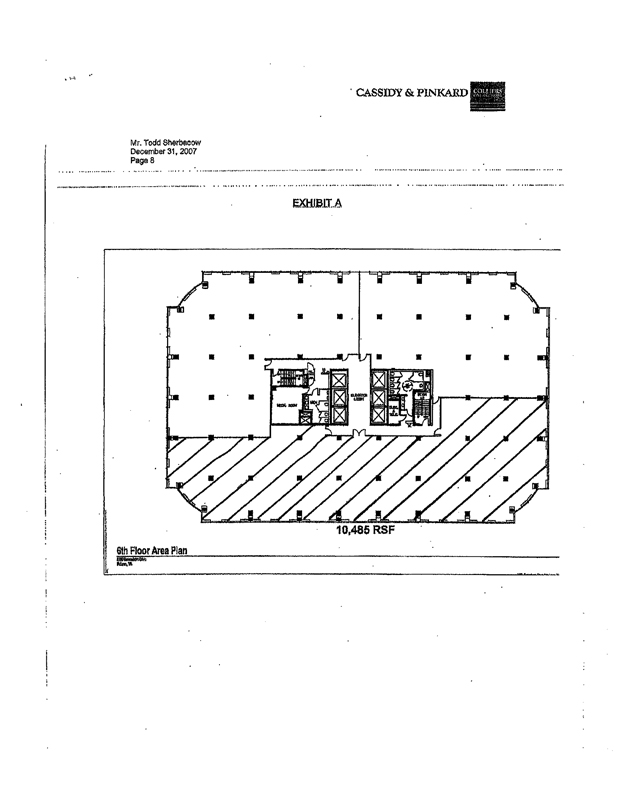

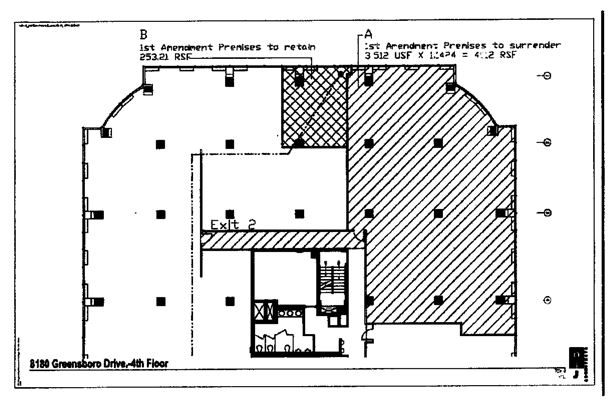

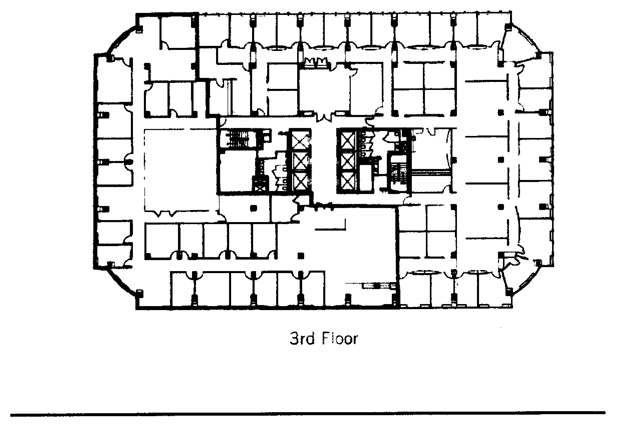

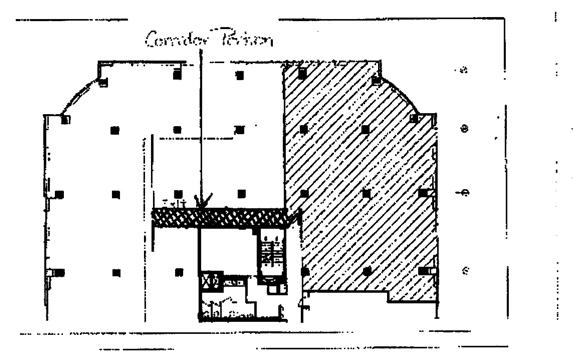

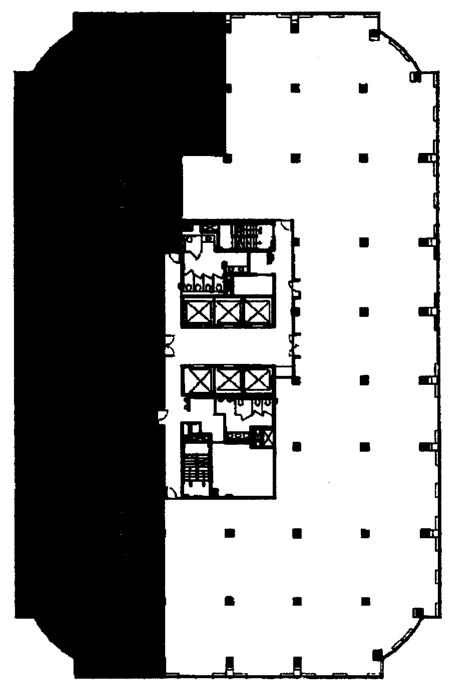

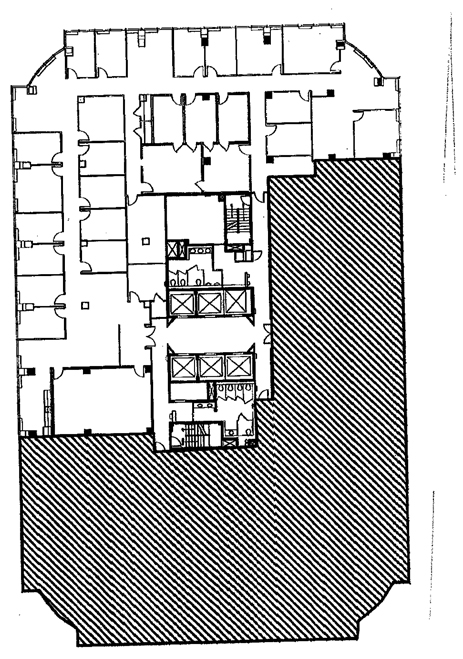

| Exhibit A: | Floor Plan of the Demised Premises | |

| Exhibit B: | Declaration to Confirm Lease Commencement Date | |

| Exhibit C: | [Intentionally Deleted] | |

| Exhibit D: | Method of Measurement | |

| Exhibit E: | Rules and Regulations | |

| Exhibit F: | Parking | |

| Addendum No. 1: | Right to Renew | |

| Addendum No. 2: | Right of First Offer | |

v

DEED OF LEASE

THIS DEED OF LEASE (“Lease”) is made as of this 2nd day of August, 2005 (the “Effective Date”), by and between 8180 GREENSBORO, L.L.C., a Virginia limited liability company (“Landlord”) and CVENT, INC., a Delaware corporation (“Tenant”).

W I T N E S S E T H:

1. Demised Premises.

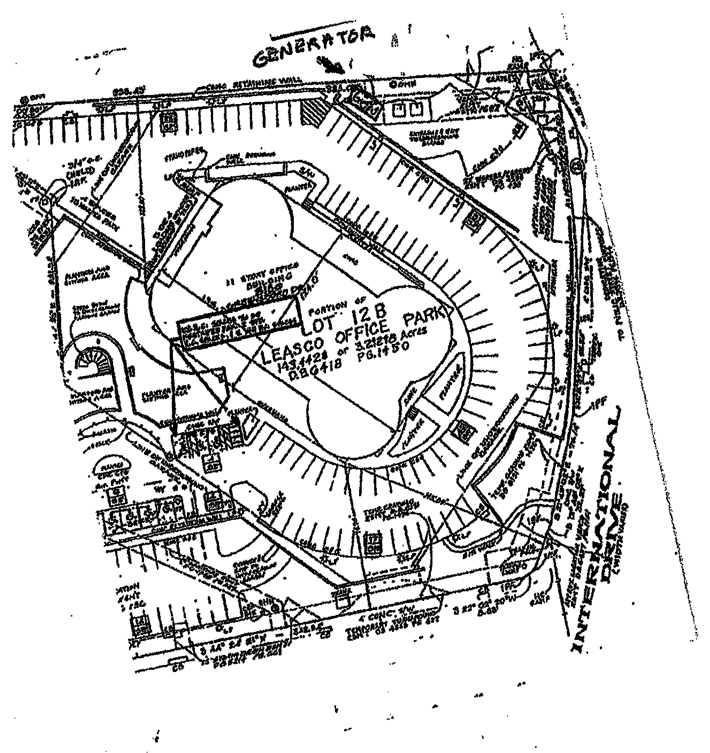

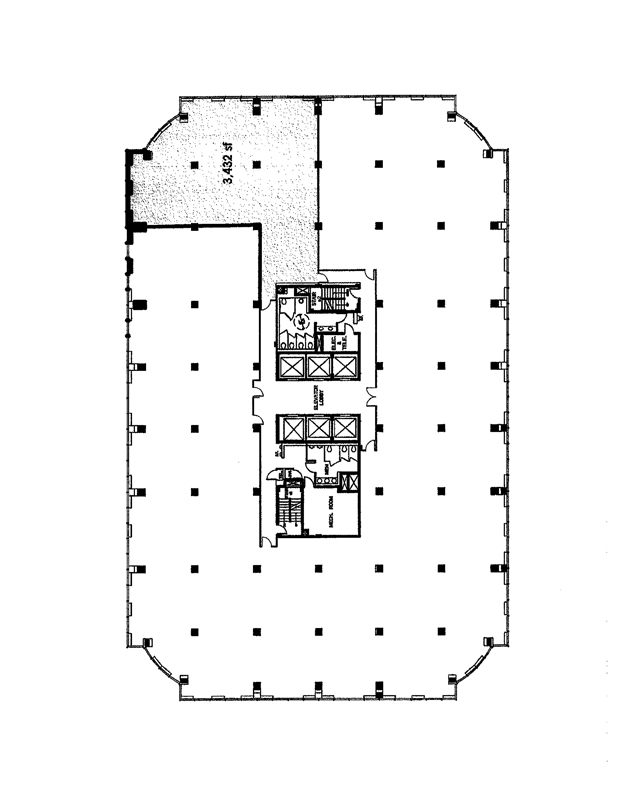

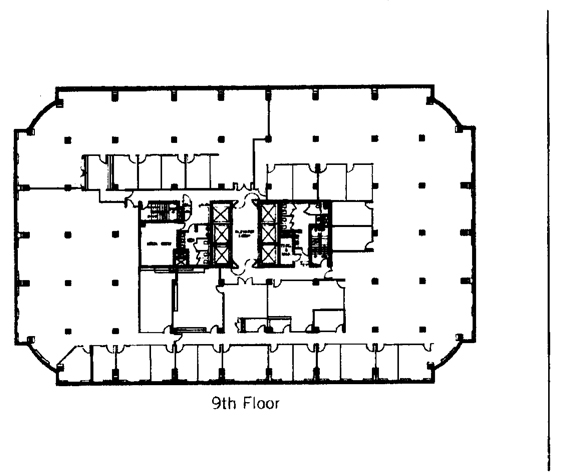

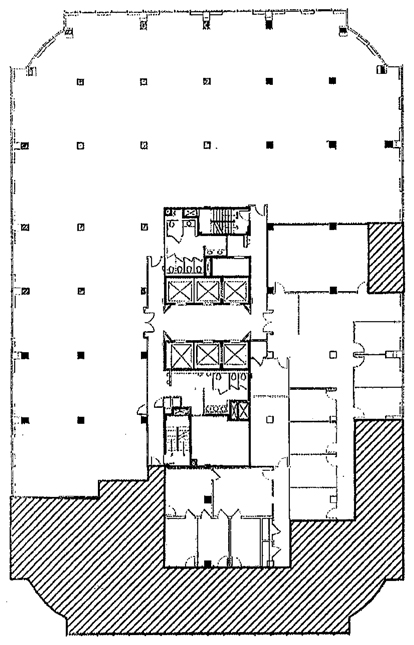

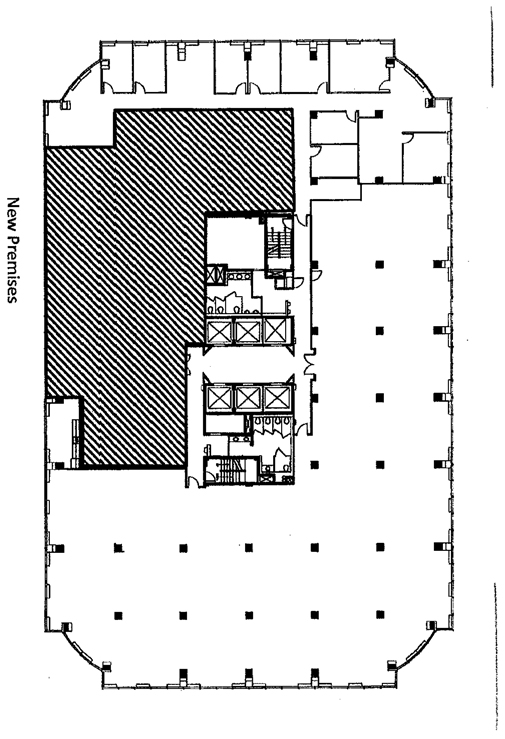

1.1 For and in consideration of the rent hereinafter reserved and the mutual covenants hereinafter set forth, Landlord does hereby lease and demise unto Tenant, and Tenant does hereby hire, lease and accept from Landlord for the Term (as defined in Section 2), upon the terms and conditions hereinafter set forth, approximately twelve thousand four hundred fifty- two (12,452) rentable square feet of office space (such space being hereinafter referred to as the “Demised Premises”) as measured in accordance with the method of measurement set forth in Exhibit D attached hereto and incorporated herein, on the Fourth (4th) floor of the building located at 0000 Xxxxxxxxxx Xxxxx, XxXxxx, Xxxxxxxx 00000 the “Building”). The Demised Premises are outlined on the floor plan set forth in Exhibit A attached hereto and incorporated herein. Upon Landlord’s approval of the final space plan for the Initial Work (as defined below), Landlord’s architect will issue a certificate to Tenant (the “Architect’s Certificate”) which specifies the number of rentable square feet in the Demised Premises.

1.2 The rentable square footage of the Demised Premises is subject to confirmation by Tenant’s architect prior to the Commencement Date. If the rentable square footage of the Demised Premises determined by Tenant’s architect differs by no more than three percent (3%) (higher or lower) from the figure set forth in this Lease, then the figure in this Lease shall be controlling. If the rentable square footage of the Demised Premises determined by Tenant’s architect differs by more than three percent (3%) (higher or lower) from the figure set forth in this Lease, then Landlord and Tenant (in coordination with their respective architects) shall endeavor in good faith to resolve the discrepancy, and if they are not able to resolve such discrepancy, then Landlord and Tenant shall jointly appoint an independent architect to resolve such discrepancy and the determination of such independent architect shall be binding on both Landlord and Tenant. During the pendency of any such dispute, Tenant shall pay Base Rent to Landlord based on Landlord’s determination. The cost of any such independent architect shall be shared equally by Landlord and Tenant. The rentable square footage of the Demised Premises determined in accordance with this Section 1.2 shall be set forth in a Declaration of Lease Commencement in form attached hereto as Exhibit B and shall be binding on both Landlord and Tenant, and all relevant terms of this Lease shall be adjusted in accordance therewith. If Tenant makes any payment of Base Rent prior to the final determination of the rentable square footage of the Demised Premises and such square footage subsequently is adjusted, then the Base Rent and other amounts based on square footage shall be retroactively adjusted to reflect such square footage as of the Commencement Date. If the amount of Base Rent payable for such period exceeds the amount theretofore paid by Tenant, Tenant shall pay the amount of such excess to Landlord within thirty (30) days of written demand thereof from Landlord. If the amount of Base Rent payable for such period is less than the amount theretofore paid by Tenant, Landlord shall credit the same to the next payment of Base Rent due hereunder.

1.3 This Lease includes the right of Tenant to use the Common Building Facilities (as defined below) in common with other tenants in the Building. The term “Common Building Facilities” means all of the common facilities in or around the Building designed and intended for use by all tenants in the Building in common with Landlord and each other, including but not limited to hallways, elevators, fire stairs, telephone and electric closets (for purposes of connecting to existing equipment), aisles, walkways, truck docks, plazas, courts, restrooms, service areas, lobbies, landscaped areas, and all other common and service areas of the Building and the Land (as defined in Section 5.1) intended for such use.

1.4 Tenant shall have (a) the non-exclusive right, in common with Landlord, to use the space above the hung ceiling within the Demised Premises, and (b) the non-exclusive right, in common with other tenants of the Building, to access and use the Building’s vertical ground risers and main electric service ground, and to construct and install conduits, fiber optics, trenches, poles, backboards, slots, sleeves, risers and riser systems, shafts, chaseways, raceways, utility spaces, and distribution areas, including associated cabling and wiring (collectively, the “Conduit System”), to serve or connect with Tenant’s equipment, which access to, and use of, the Conduit System shall require the Landlord’s prior written consent. Tenant shall be required to remove all cabling in the Building installed by Tenant or on Tenant’s behalf.

1.5 Except as expressly set forth in this Lease, the Landlord shall not have the right to change the location (or configuration) of the Demised Premises or of any of Tenant’s equipment or other personal property. The rentable square footage set forth in the Architect’s Certificate shall not change at any time during the Term without the written consent of Landlord and Tenant.

2. Term; Lease Year.

2.1 Term. The term of this Lease (the “Term”) shall commence on the date that Landlord shall tender possession of the Leased Premises to Tenant, broom clean and with the work to be performed by Landlord pursuant to Section 16.1 substantially completed (the “Lease Commencement Date”) and shall terminate at midnight on the last day of the month that completes sixty-five (65) months from the Rent Commencement Date (as such term is defined below), or such earlier date on which this Lease is terminated pursuant to the provisions hereof (the “Lease Expiration Date”). If the Lease Commencement Date has not occurred on or prior to September 1, 2005, then Tenant shall have the right to terminate this Lease by written notice to Landlord, and if the Lease Commencement Date has not occurred on or prior to September 1, 2006, then Landlord shall have the right to terminate this Lease by written notice to Tenant; in the event of either such termination, (a) Landlord shall refund to Tenant, within ten (10) days following the effective date of such termination, any Security Deposit and Base Rent previously paid by Tenant to Landlord pursuant to Section 9 of this Lease, and (b) this Lease shall terminate and neither party shall have any further obligations or liability to the other.

2.2 Lease Year. The term “Lease Year” shall mean that period of twelve (12) consecutive calendar months beginning on the Rent Commencement Date (as such term is defined below) and each consecutive twelve-(12) month period thereafter, except that if the Lease Commencement Date is not the first day of the month, then the first Lease Year shall commence on the Rent Commencement Date and shall continue for the balance of the month in

2

which the Rent Commencement Date occurs and for a period ending on the last day of the twelfth (12th) full calendar month after the Rent Commencement Date, and each Lease Year after the first Lease Year shall be the twelve (12) full calendar months thereafter. The earliest such period shall be referred to as the “First Lease Year”, and each of the following Lease Years shall similarly be numbered for identification purposes.

3. Rent.

3.1 Monthly Base Rent. The parties intend that the Base Rent payable by Tenant to Landlord hereunder shall be totally net to Landlord, and that Tenant shall pay all costs, expenses and charges arising from the maintenance, use and operation of the Demised Premises during the Term, other than as set forth elsewhere in this Lease. Commencing on the date (the “Rent Commencement Date”) that is the earlier of: (a) the date Tenant commences occupancy of any portion of the Demised Premises for its intended business purpose, or (b) the date that is twenty (20) weeks from the Lease Commencement Date, Tenant shall pay, in lawful money of the United States, as minimum annual rent for the Demised Premises, the Base Rent. The Base Rent, which Tenant hereby agrees to pay to Landlord at Landlord’s address stated herein or as otherwise provided to Tenant from time to time upon not less than thirty (30) days prior written notice, shall be the sum of Twenty-Six and No/100 Dollars ($26.00) per square foot per annum, plus the amount determined by the computation made pursuant to the provisions of Section 3.2 hereof, which Base Rent shall be payable in equal monthly installments (the “Monthly Base Rent”). The Monthly Base Rent shall be paid on the first day of each calendar month during the Term, without notice, demand, offset, deduction or counter-claim whatsoever except as otherwise expressly set forth in this Lease. If the Rent Commencement Date of this Lease begins on a date other than the first day of a month, then Tenant shall pay on the Rent Commencement Date the Base Rent for the month in which the Rent Commencement Date occurs calculated on a per diem basis (based on the number of days in the relevant month) of the Base Rent payable during the First Lease Year.

Promptly following the Rent Commencement Date, Landlord and Tenant will execute a Declaration, substantially in the form set forth in Exhibit B attached hereto and incorporated herein, to confirm the Lease Commencement Date, the Rent Commencement Date, the Lease Expiration Date and other matters therein contained. Failure to execute said Declaration shall not affect the commencement or expiration of the Term.

3.2 Cost of Living Adjustment. Commencing on the first day of the second Lease Year, and on the first day of each subsequent Lease Year (the “Adjustment Date”), the Base Rent shall be increased by two and one-half percent (2.5%) of the Base Rent payable for the Lease Year immediately preceding the Lease Year for which the Base Rent (as theretofore increased hereunder) is then being increased (the “Cost of Living Adjustment”). It is the intention of the parties that increases in the Base Rent shall be cumulative. (For example, if the initial Base Rent is $100.00 per square foot per annum, then the Base Rent during the second Lease Year would be $102.50 per square foot per annum, and the Base Rent during the third Lease Year would be $105.06 per square foot per annum.) Commencing on the first Adjustment Date and on each Adjustment Date thereafter, the Monthly Base Rent shall be increased by one- twelfth (1/12th) of the Cost of Living Adjustment.

3

3.3 Abatement. Notwithstanding the provisions of Section 3.1, provided no default has occurred beyond any applicable notice and cure period, Landlord shall xxxxx one hundred percent (100%) of the Monthly Base Rent, excluding any Additional Rent, for the first five (5) complete months following the Rent Commencement Date (the “Abatement Period”).

4. Additional Rent; Increases in Operations and Real Estate Tax Expenses.

4.1 Tenant’s Share. In addition to all other payments required of Tenant hereunder, for each calendar year or fraction thereof during the Term, Tenant shall pay as Additional Rent to Landlord, in the manner provided for in this Section, Tenant’s Share of Increased Operating Expenses and Tenant’s Share of Increased Real Estate Tax Expenses (each as hereinafter defined) for such calendar year; provided, however, for any partial calendar year during which the Term begins or ends, Tenant’s Share of the aforesaid sums shall be prorated based upon the greater of (i) the number of days during such calendar year this Lease is in effect, or (ii) the number of days Tenant actually occupies the Demised Premises or any portion thereof

4.2 Amount of Tenant’s Share. As used herein, “Increased Operating Expenses” shall equal the amount by which Operating Expenses, as such term is hereinafter defined, incurred during such calendar year exceed the actual Operating Expenses for calendar year 2006 (the “Base Year”), and “Increased Real Estate Tax Expenses” shall equal the amount by which Real Estate Tax Expenses, as such term is hereinafter defined, incurred during such calendar year exceed the actual Real Estate Tax Expenses for the Base Year. “Tenant’s Share of Increased Operating Expenses” shall be that percentage of Increased Operating Expenses which is the equivalent of the number of square feet of rentable area in the Demised Premises as determined in the Architect’s Certificate divided by the number of square feet of rentable area (both office and retail space, but excluding roof and garage space) in the Building (245,543 rentable square feet on the Lease Commencement Date). “Tenant’s Share of Increased Real Estate Tax Expenses” shall be that percentage of Increased Real Estate Tax Expenses that is calculated in the same manner as the Tenant’s Share of Increased Operating Expenses described herein.

4.3 Statements. For each calendar year of the Term commencing January 1, 2007, Landlord shall deliver to Tenant a categorized statement in reasonable supporting detail estimating Tenant’s Share of Increased Operating Expenses and Tenant’s Share of Increased Real Estate Tax Expenses for such calendar year, which Tenant shall pay in equal monthly installments in advance on the first of each calendar month during each calendar year. Tenant shall continue to pay such estimated Increased Operating Expenses and Increased Real Estate Tax Expenses until Tenant receives the next such statement from Landlord, at which time Tenant shall commence making monthly payments pursuant to Landlord’s new statement. With the first payment of Additional Rent herein which is due at least thirty (30) days after Tenant’s receipt of a statement from Landlord specifying the estimate of Tenant’s Share of Increased Operating Expenses and Tenant’s Share of Increased Real Estate Tax Expenses payable during the calendar year, Tenant shall pay the difference between its monthly share of such sums for the preceding months of the calendar year and the monthly installments which Tenant has actually paid for said preceding months.

4

4.4 Retroactive Adjustments. After the end of each calendar year commencing on January 1, 2008, Landlord shall determine the actual Increased Operating Expenses and the actual Increased Real Estate Tax Expenses for such calendar year. Landlord shall calculate the foregoing sums and shall provide to Tenant a statement in reasonable supporting detail of Tenant’s Share of Increased Operating Expenses and Tenant’s Share of Increased Real Estate Tax Expenses for such calendar year. Within thirty (30) days after Tenant’s receipt of any such statement, Tenant shall pay to Landlord any deficiency between each amount shown as Tenant’s Share of Increased Operating Expenses and Tenant’s Share of Increased Real Estate Tax Expenses for the calendar year and the estimated payments for each of Operating Expenses and Real Estate Tax Expenses made by Tenant. If such statement indicates that the aggregate amount of such estimated payments exceeds Tenant’s actual liability, then Landlord shall credit the net overpayment toward Tenant’s next payment(s) of Base Rent and estimated payment(s) pursuant to this Section or, in the case of the reconciliation for the calendar year in which the Lease Term expires, then Landlord shall pay Tenant the net overpayment (after deducting therefrom any amounts then due from Tenant to Landlord) within thirty (30) days after the expiration of the Term or the completion of the reconciliation for such year, if completed after the expiration of the Term.

4.5 Tenant’s Review of Records. Within one hundred eighty (180) days after receipt of an annual expense statement, Tenant shall have the right, exercisable upon not less than ten (10) business days prior notice by Tenant to Landlord, to review, at its own expense (including all photocopying charges but excluding the cost of Landlord’s employees to locate any requested information), Landlord’s records relating to the expenses covered by such statement, which audit shall take place at Landlord’s management agent’s office; provided, however, that Tenant or Tenant’s agent shall have the right to audit Landlord’s books and records pertaining to Operating Expenses for the Base Year during Tenant’s first audit of any of Landlord’s Operating Expenses, regardless when such first audit occurs within the Term. Landlord shall, at no expense to Tenant, cooperate with any such audit. Tenant shall keep confidential all information provided by, or on behalf of, Landlord in connection with such review or audit. Any such review shall be made only by Tenant’s employees and/or by an independent, certified public accountant designated by Tenant (who is hired by or on behalf of Tenant on a noncontingency basis and provides a full range of accounting services, or who is a national or regional full-service accounting firm that is hired by or on behalf of Tenant on a noncontingency basis, or who is a with a reputable firm other than a national or regional full- service accounting firm that is hired by or on behalf of Tenant on a noncontingency basis that is reasonably approved by Landlord). Upon completion of any such audit, Tenant shall provide a copy of such audit to Landlord. If any such audit results in a determination that an annual expense statement contained a discrepancy of more than five percent (5%) in Landlord’s favor, then Landlord shall (i) bear the reasonable cost of such audit, provided that the amount of such reimbursement shall be based on a reasonable hourly rate and reasonable out-of-pocket expenses and not on any contingent fee, (ii) credit Tenant for the amount of any such overpayment against the Monthly Base Rent next coming due or refund to Tenant within thirty (30) days of notice from Tenant, as Tenant may elect, and (iii) if the overstatement involves an error in the calculation or amount of Operating Expenses, then Landlord shall reasonably make a corresponding adjustment in the estimated payments of Tenant’s Share of Increased Operating Expenses and recalculate and re-adjust any one or more prior year’s reconciliations.

5

5. Definitions.

5.1 Operating Expenses. The term “Operating Expenses” shall mean any and all expenses incurred by Landlord in connection with the operation, management, maintenance and repair of the Building and the real estate which supports the Building and all associated easements, rights and appurtenances thereto (“Land”) to the extent such expenses (i) are not the result of the gross negligence or willful misconduct of Landlord or Landlord’s employees, agents, or contractors, and (iii) are not otherwise expressly excluded in this Section 5.1. By way of example, but without limitation, Operating Expenses shall include any and all of the following: salaries, wages, medical, surgical and general welfare benefits (including health, accident and group life insurance), pension payments for employees of Landlord at or below the grade of building manager engaged in the operation, management, maintenance or repair of the Building; license fees; worker’s compensation insurance; compliance with governmental laws, rules, regulations and orders (subject, however, to the limitations hereinafter set forth to the extent such amounts constitute capital expenditures); electricity and other utilities (except as charged directly to tenants); repairs and maintenance, but not costs of preparing, improving or altering any space in preparation for occupancy of any new or renewal tenant; cost of materials; any local or state surcharges or special charges; utility taxes; water and sewer charges; amortization over the Approved Period (with interest at Landlord’s cost of funds or (if the improvement is not financed) at the prime rate reported in The Wall Street Journal plus 400 basis points) for capital expenditures made by Landlord (a) to the extent such capital expenditures are reasonably expected to decrease Operating Expenses or improve the efficiency or safety of the operation of the Building, or (b) to comply with Laws (as hereinafter defined) that are enacted after the Lease Commencement Date; premiums for casualty, liability, elevator, worker’s compensation, boiler and machinery, sprinkler leakage, rent loss, use and occupancy or other insurance; security services and costs; uniforms and dry cleaning; payroll taxes; building supplies; cleaning and janitorial services; window cleaning; trash removal; snow removal; repair and maintenance of the grounds, including costs of landscaping, gardening and planting; service or management contracts with independent contractors, including, but not limited to security and energy management services; usual and customary management fees for the relevant market area; legal and accounting fees; telephone, telegraph, postage, stationery supplies and other materials and expenses required for the routine operation of the Building; and any other customary or reasonable expense or charge of any nature whatsoever, whether or not herein mentioned, which would be included in Operating Expenses in accordance with sound accounting and management principles generally accepted with respect to the operation of first-class office buildings in the Washington Metropolitan Area. The “Approved Period” shall mean the time period equal to the number of years in the estimated useful life of the improvement, except that with respect to an improvement made for the purpose of reducing Operating Expenses, Landlord may reduce such time period to the number of years that it will take to fully amortize the cost of the capital expenditure if the yearly amortization amount (including interest as aforesaid) is equal to the projected annual savings as reasonably estimated by Landlord. “Laws” shall mean collectively governmental laws and regulations applicable to the Building or Tenant’s use and occupancy of the Demised Premises, including, without limitation, life, fire and safety codes, seismic codes, and/or federal, state or local laws or regulations relating to disabled access, including, without limitation, the Americans With Disabilities Act (ADA) and any similar state or local law or any regulation, directive or guideline relating thereto.

6

Operating Expenses shall not include any of the following expenses:

| (1) | reserves for repairs, maintenance and replacements; |

| (2) | salaries, wages, or other compensation paid to employees of any property management organization whose salaries are covered by a management fee (i.e., property manager, accounting or clerical personnel). |

| (3) | amounts paid to any partners, shareholder, officer or director of Landlord, for salary or other compensation; |

| (4) | costs of electricity sold to tenants of the Building by Landlord or any other special service to tenants or service in excess of that furnished to Tenant to the extent Landlord receives reimbursement from such tenants as an additional charge; |

| (5) | any amounts paid to any person, firm or corporation related or otherwise affiliated with Landlord or any general partner, officer or director of Landlord or any of its general partners, to the extent same exceeds arms-length competitive prices paid in the Northern Virginia area for the services or goods provided; |

| (6) | accounting or legal fees incurred in tenant disputes, or for fees not related to the operation and maintenance of the Building but personal to Landlord; |

| (7) | costs of repairs incurred by reason of fire or other casualty or condemnation to the extent Landlord receives compensation therefor through proceeds of insurance or condemnation awards; |

| (8) | costs relating to maintaining Landlord’s existence, either as a corporation, partnership, or other entity, such as trustee’s fees, annual fees, partnership organization or administration expenses, deed recordation expenses, legal and accounting fees (other than with respect to Building operations); |

| (9) | depreciation of the building or any equipment, machinery, fixtures or improvements therein; |

| (10) | management fees, in excess of the usual and customary rate in Northern Virginia area for managing agents of comparable buildings and they are either (a) actually paid to an unaffiliated managing agent or (b) actually paid to an affiliated managing agent, but if to an affiliated managing agent then (i) the managing agent shall pay, without reimbursement and without being included in Operating Expenses, all of its own overhead costs and the wages, salaries and fringe benefits of its own officers, members and employees, and (ii) no wages, salaries or fringe benefits of its own officers, members and employees, and (ii) no wages, salaries or fringe benefits of any persons who would normally be paid by a managing agent as a non- reimbursable expense will be included in Operating Expenses; |

| (11) | capital expenditures, except to the extent expressly allowed above; |

7

| (12) | Ground rent or similar payments to a ground lessor; |

| (13) | Costs and expenses incurred in connection with any transfer of an interest in the Building or the Land; |

| (14) | Costs or expenses incurred in connection with any bankruptcy proceedings; |

| (15) | Mortgage refinancing costs, including attorneys’ fees, title insurance premiums, and recording costs; |

| (16) | interest or penalties arising by reason of Landlord’s intentional failure to timely pay any Operating Expenses other than in connection with a contest thereof; |

| (17) | The cost of any repair made by Landlord because of any fire or other casualty or the total or partial destruction or condemnation of the Building or any portion of the Building to the extent Landlord actually receives compensation therefor through insurance or condemnation proceeds; and |

| (18) | Any other cost for which Landlord is actually reimbursed by insurance proceeds, warranties, service contracts, condemnation proceeds or otherwise. |

If the occupancy rate for the Building during any calendar year (including the Base Year) is less than ninety-five percent (95%), or if any office tenant is separately paying for services furnished to its premises, then Operating Expenses for such calendar year shall be deemed to include all additional expenses with respect to those Operating Expenses that vary in accordance with the occupancy of the Building, as reasonably estimated by Landlord, that would have been incurred during such calendar year if the occupancy rate for the Building had been ninety-five percent (95%) and if Landlord paid for the services furnished to such premises.

5.2 Real Estate Tax-Expenses. The term “Real Estate Tax Expenses” shall mean all taxes and assessments, general or special, ordinary or extraordinary, foreseen or unforeseen, assessed, levied or imposed upon the Building or the Land, or assessed, levied or imposed upon the fixtures, machinery, equipment or systems in, upon or used in connection with the operation of the Building or the land upon which the Building is located (“Land”) under the current or any future taxation or assessment system or modification of, supplement to, or substitute for such system, and whether or not based on or measured by the receipts or revenues from the Building or the Land (including all taxes and assessments for public improvements or any other governmental purpose). For the purposes of this Section, (i) Real Estate Tax Expenses shall include the reasonable expenses (including but not limited to reasonable attorneys’ fees) incurred by Landlord in obtaining or attempting to obtain a reduction of such taxes, rates or assessments; (ii) Real Estate Tax Expenses shall not include any sales or excise tax imposed by any governmental authority upon the rent payable by Tenant under this Lease; and (iii) Real Estate Tax Expenses shall not include any taxes on Tenant’s personal property. Landlord shall pay any special assessment by installments to the extent permitted by the assessing authority, and, in such event, Real Estate Tax Expenses shall include such installments and interest paid on the unpaid balance of the assessment. In addition, Real Estate Tax Expenses shall not include any

8

income, franchise, transfer, inheritance, capital stock or other tax unless, due to a future change in the method of taxation, such a tax shall be levied against Landlord in substitution for or in lieu of any tax which would otherwise constitute “real estate tax expenses”, in which event such income, franchise, transfer, inheritance, capital stock or other tax shall be deemed to be included in the term “real estate tax expenses” to the extent and only to that extent that such tax is ascertained to be in lieu of or a substitute for what were previously “real estate tax expenses”; provided, that the amount of such income, franchise, transfer, inheritance, capital stock or other tax deemed to be included in the term “real estate taxes” shall be determined as if the Building and the land upon which the Building is located were the only assets of Landlord and as if the rent paid hereunder were the only income of Landlord. In no event shall Real Estate Tax Expenses include the amount of any special taxes or special assessments actually paid by Landlord in any calendar year in excess of the minimum installment of special taxes or special assessments required to be paid by Landlord during such calendar year (it being agreed that Landlord shall elect the longest period of time allowed by the authority imposing the tax or assessment in which to pay installments of special taxes or special assessments that are to be prorated over several years). The definition of “Real Estate Tax Expenses” should assume that the Building is the only building on the Land. If, however, either assumption is not correct, then the “Real Estate Tax Expenses” attributable to the Building shall be those allocated to the Building on the tax rolls or the records of the tax assessor.

5.3 Real Estate Tax Contests. In the event of any change by the taxing body in the period for which any of the Real Estate Tax Expenses are levied, assessed or imposed, Landlord shall have the right, in its sole discretion, to make appropriate adjustments with respect to computing increases in Real Estate Tax Expenses provided Tenant is not thereby unduly prejudiced. Real Estate Tax Expenses which are being contested by Landlord shall be included for purposes of computing Tenant’s Share of Increased Operating and Real Estate Tax Expenses under this Section, but if Tenant shall have paid an amount of Additional Rent because of such inclusion of contested Real Estate Tax Expenses and Landlord thereafter receives a refund of such taxes, Tenant shall be credited with the excess toward estimated payments of Real Estate Tax Expenses proportionate with the refund of real estate taxes, reduced by the proportionate cost of obtaining such refund. If Landlord receives such refund after the Term has expired, Tenant’s share shall be refunded. Landlord shall have no obligation to contest, object to or litigate the levy, assessment or imposition of Real Estate Tax Expenses, and may settle, compromise, consent to, waive or otherwise determine any such Real Estate Tax Expenses without consent of Tenant.

6. Additional Rent: Sales, Use or Gross Receipt Taxes. If during the Term, any governmental authority having jurisdiction levies, assesses or imposes any tax on Landlord, the Demised Premises, the Land or the Building or the rents payable hereunder, in the nature of a sales tax, a use tax (including a gross receipts tax) or any other tax except (a) income taxes (including corporate franchise or unincorporated business taxes); (b) estate or inheritance taxes; or (c) those taxes included in Real Estate Tax Expenses, Tenant shall pay its proportionate share of the same to Landlord as additional rent at the time of, and together with, the first payment of Monthly Base Rent due, following receipt by Tenant of written notice of the amount of such tax. If any such tax is levied, assessed or imposed in such manner that the amount of the tax required to be paid by Tenant is not ascertainable because the tax relates to more than the Demised Premises or the rents payable hereunder, then Tenant shall pay such share of the total taxes that Landlord shall reasonably estimate.

9

7. Additional Rent; Personal Property and Other Taxes.

7.1 Levied On Tenant. Tenant shall pay, before delinquency, all business taxes, assessments, license fees and other charges levied and/or assessed upon Tenant’s use or occupancy of the Demised Premises, the conduct of Tenant’s business at the Demised Premises, or against Tenant’s personal property installed or located in or on the Demised Premises, and against the value of leasehold improvements in the Demised Premises. On demand by Landlord (not to occur more than two times each calendar year), Tenant shall furnish Landlord with satisfactory evidence of these payments.

7.2 Levied On Landlord. If any taxes on Tenant’s personal property are levied against Landlord or Landlord’s property, or if the assessed value of the Land, the Building and other improvements in which the Demised Premises are located is increased by the inclusion of a value placed on Tenant’s personal property, Tenant shall pay such taxes and if Landlord pays the taxes on any of these items or the taxes based on the increased assessment of these items, Tenant, not later than thirty (30) days following Landlord’s written demand therefor, shall reimburse Landlord for the sum of the taxes levied against Landlord, or the proportion of the taxes resulting from the increase in Landlord’s assessment. Landlord shall have the right to pay these taxes regardless of the validity of the levy and the amount of such taxes shall be considered Additional Rent.

8. Payment of Additional Rent: Late Charges; Interest. Any amounts required to be paid by Tenant under the terms of this Lease (including but not limited to the payments to be made pursuant to Sections 4, 5, 6 and 7, but not including Monthly Base Rent) and any charges or expenses incurred by Landlord on behalf of Tenant under the terms of this Lease shall be considered additional rent (“Additional Rent”). All payments of Additional Rent shall be paid to Landlord, without setoff or deduction not later than thirty (30) days after written demand therefor, in the same manner as Monthly Base Rent is payable pursuant to Section 3 hereof. Nothing contained in Xxxxxxxx 0, 0, 0 xxx 0 xxxxx xx construed at any time to reduce the amount of Monthly Base Rent as increased each Lease Year. Notwithstanding any dispute that may arise in connection with the computation or estimate of the amount of Additional Rent due, Tenant shall be obligated to pay the amount specified by Landlord, without setoff or deduction, pending the resolution of any dispute. Any Monthly Base Rent or Additional Rent not paid within five (5) days after the due date thereof, shall be subject to a late charge of five percent (5%) of such payment. In addition, such unpaid installment shall bear interest until paid at the rate of fifteen percent (15%) per annum. Notwithstanding anything in this Lease to the contrary, Tenant shall not be required to pay such late charge and interest unless Tenant defaults in paying Base Monthly Rent or Additional Rent for a period of five (5) or more days on more than one (1) occasion during any consecutive twelve (12) month period.

9. Deposits.

9.1 First Installment of Monthly Base Rent. Landlord acknowledges receipt of one (1) installment of Monthly Base Rent as prepayment for the first full installment of Monthly Base Rent. Prior to its being applied to the first installment of Monthly Base Rent due and payable after the end of the Abatement Period, said sum shall be held without interest by Landlord as security for the payment and performance by Tenant of all of Tenant’s obligations, covenants, conditions and agreements under this Lease.

10

9.2 Security Deposit. Landlord also acknowledges receipt from Tenant of one (1) installment of Monthly Base Rent as prepayment (the “Security Deposit”) to be held as collateral security and not prepaid rent, for the payment of Monthly Base Rent, Additional Rent and any other sums payable by Tenant under this Lease, and for the faithful performance by Tenant of all other covenants, conditions and agreements of this Lease. The amount of said Security Deposit shall be repaid without interest to Tenant not later than sixty (60) days after the expiration or earlier termination of the Term to the extent not applied to cure any Event of Default. The Security Deposit shall not be mortgaged, assigned, transferred or encumbered by Tenant without the prior written consent of Landlord and any such act on the part of Tenant shall be without force and effect and shall not be binding upon Landlord. If any of the Base Rent, Additional Rent and/or any other sum payable by Tenant to Landlord shall be overdue and unpaid beyond any applicable notice and cure period, or should Landlord make payments on behalf of Tenant following an Event of Default involving Tenant’s responsibility to make such payments, or should Tenant fail to perform any of the terms of this Lease and such failure continues beyond any applicable notice and cure period, then Landlord, at its option and without prejudice to any other remedy which Landlord may have on account thereof, may appropriate and apply so much of the Security Deposit as may be necessary to compensate Landlord toward the payment of Base Rent, Additional Rent or any other sums due Landlord pursuant to this Lease, or loss or damage sustained by Landlord due to such failure on the part of Tenant including, without limitation, any damage or deficiency arising in connection with the reletting of the Demised Premises; and Tenant upon demand shall forthwith restore the Security Deposit to the original sum deposited. In the event of bankruptcy or other creditor-debtor proceedings against Tenant, the Security Deposit shall be deemed to be applied first to the payment of Base Rent, Additional Rent and other sums due Landlord under the terms and conditions contained in this Lease.

9.3 Transfer of Landlord’s Interest. In the event of a sale or transfer of Landlord’s estate or interest in the Building, Landlord shall transfer the Security Deposit to the vendee or transferee (or provide such vendee or transferee with a credit reflecting the amount of such Security Deposit), and upon receipt by Tenant of written notice of such transfer, Landlord shall be considered released by Tenant from all liability for the return of the Security Deposit. Upon receipt by Tenant of written notice of such transfer, Tenant shall look solely to the vendee or transferee for the return of the Security Deposit, and it is agreed that all of the foregoing shall apply to every transfer or assignment made of the Security Deposit to a new vendee or transferee. No mortgagee or purchaser of any or all of the Building at any foreclosure proceeding brought under the provisions of any mortgage shall (regardless of whether the Lease is at the time in question subordinated to the lien of any mortgage) be liable to Tenant or any other person for any or all of the Security Deposit (or any other or additional security deposit or other payment made by Tenant under the provisions of this Lease), unless Landlord has actually delivered it in cash to such mortgagee or purchaser, as the case may be. In the event of any rightful and permitted assignment of Tenant’s interest in this Lease, the Security Deposit shall be deemed to be held by Landlord as a deposit made by the assignee, and Landlord shall have no further liability to the assignor with respect to the return of the Security Deposit.

11

9.4 Landlord Remedies. No right or remedy available to Landlord as provided in this Section shall preclude or extinguish any other right to which Landlord may be entitled. In furtherance of the foregoing, it is understood that, in the event Tenant fails to perform its obligations and to take possession of the Demised Premises as provided in this Lease, the first installment of Monthly Base Rent and the Security Deposit shall not be deemed liquidated damages. Landlord may apply such sums to reduce Landlord’s damages and such application of funds shall not preclude Landlord from recovering from Tenant all additional damages incurred by Landlord.

10. Hazardous Materials.

10.1 Definition. As used in this Lease, the term “Hazardous Material”, means any flammable items, explosives, radioactive materials, hazardous or toxic substances, material or waste or related materials, including any substances defined as or included in the definition of “hazardous substances”, “hazardous wastes”, “infectious wastes”, “hazardous materials” or “toxic substances” now or subsequently regulated under any Laws, including without limitation, oil, petroleum-based products, paints, solvents, lead, cyanide, DDT, printing inks, acids, pesticides, ammonia compounds and other chemical products, asbestos, PCBs and similar compounds, and including any different products and materials which are subsequently found to have adverse effects on the environment or the health and safety of persons.

10.2 General Prohibition. Tenant shall not cause or permit any Hazardous Material to be generated, produced, brought upon, used, stored, treated, discharged, released, spilled or disposed of on, in, under or about the Demised Premises, the Building, or the Land (hereinafter referred to collectively as the “Property”) by Tenant, its affiliates, agents, employees, contractors, subtenants, assignees or, solely with respect to the Demised Premises, invitees (collectively, “Tenant’s Agents”).

10.3 Notice. In the event that Hazardous Materials are discovered upon, in, or under the Property, and any governmental agency or entity having jurisdiction over the Property requires the removal of such Hazardous Materials, Tenant shall be responsible for removing those Hazardous Materials arising out of or related to the use or occupancy of the Property by Tenant or Tenant’s Agents. Notwithstanding the foregoing, Tenant shall not take any remedial action in or about the Property, or any portion thereof without first notifying Landlord of Tenant’s intention to do so and affording Landlord the opportunity to protect Landlord’s interest with respect thereto. Tenant immediately shall notify Landlord in writing of any of the following of which Tenant has actual knowledge: (i) any spill, release, discharge or disposal of any Hazardous Material in, on or under the Property or any portion thereof; (ii) any enforcement, cleanup, removal or other governmental or regulatory action instituted, contemplated, or threatened (if Tenant has notice thereof) pursuant to any Laws respecting Hazardous Materials; (iii) any claim made or threatened by any person against Tenant or the Property or any portion thereof relating to damage, contribution, cost recovery, compensation, loss or injury resulting from or claimed to result from any Hazardous Materials; and (iv) any reports made to any governmental agency or entity arising out of or in connection with any Hazardous Materials in, on under or about or removed from the Property or any portion thereof, including any complaints, notices, warnings, reports or asserted violations in connection therewith. Tenant also shall supply to Landlord as promptly as possible, and in any event within five (5) business days

12

after Tenant first receives or sends the same, copies of ail claims, reports, complaints, notices, warnings or asserted violations relating in any way to the Demised Premises, the Property or Tenant’s use or occupancy thereof.

10.4 Tenant shall have no obligation to remove Hazardous Materials brought onto the Demised Premises by Landlord or that existed in the Demised Premises as of the Lease Commencement Date and were not brought onto the Property by Tenant or any of Tenant’s Agents, nor shall Tenant be required to cure the violation of any environmental law that is caused by Landlord or that existed as of the Lease Commencement Date and was not caused by Tenant or any of Tenant’s Agents. If Landlord is advised, or it shall come to Landlord’s attention, that Hazardous Materials exist in the Property in violation of any Laws that were not introduced therein by Tenant or any of Tenant’s Agents, Landlord shall take all commercially reasonable steps necessary to promptly remove or remediate (or cause to be removed or remediated) in compliance with all applicable Laws at Landlord’s expense, all such Hazardous Materials, and in doing so, Landlord shall use its reasonable efforts not to interfere with the conduct of Tenant’s business.

10.5 Survival. The respective rights and obligations of Landlord and Tenant under this Section 10 survive the expiration or earlier termination of this Lease.

11. Laws and Ordinances.

11.1 Subject to Section 11.2, Tenant shall, at its own cost, promptly comply with and carry out all orders, requirements or conditions now or hereafter imposed by Laws in which the Demised Premises are located, and relating in any way to the Demised Premises and all machinery, equipment and furnishings therein, Tenant’s use and occupancy of the Demised Premises or the conduct of Tenant’s business, whether required of Landlord or otherwise. It is expressly understood that, if any present or future Law requires an occupancy or use permit for the Demised Premises, Tenant shall obtain such permit at Tenant’s sole expense, and shall promptly deliver a copy thereof to Landlord.

11.2 Landlord represents and warrants that as of the date hereof, it has received no written notice that the Property is in violation of any Laws. Notwithstanding anything to the contrary contained in this Lease, it is agreed that Landlord shall be responsible for complying with all present and future Laws with respect to (i) those elements and components of the base- building structure and systems that are situated outside the perimeter of the Demised Premises or are within vertical penetrations running through the Demised Premises; and (ii) the common areas of the Buildings.

12. Use of Demised Premises. The Demised Premises shall be used and occupied by Tenant, solely for the purpose of general office use and uses ancillary thereto (collectively, the “Permitted Uses”) and for no other purpose whatsoever. The Demised Premises shall not be used for any illegal, disorderly or hazardous purpose; in violation of any Law; or in any manner to (i) create any nuisance, waste or trespass; (ii) unreasonably annoy or disturb Landlord or any other tenant of the Building; (iii) vitiate any insurance; or (iv) alter the classification or increase the rate of insurance on the improvements.

13

13. Repairs by Tenant. Tenant agrees to maintain the Demised Premises and the fixtures, improvements and other property therein in a neat, clean and safe condition and in good order and repair, during the Term, at its sole cost and expense, and shall, at the expiration or earlier termination of the Term, surrender and deliver up the same and all keys, locks and other fixtures connected therewith (except only office furniture and business equipment) in like good order, repair and condition, as the same is now or shall be at the Lease Commencement Date, except as repaired, rebuilt, restored, altered or added to as permitted or required by this Lease, ordinary wear and tear excepted. Notwithstanding any other provision of this Lease which may limit Tenant’s responsibility for repair, replacement or maintenance of items which are within and serve the Demised Premises, but subject to Sections 22 and 23, all injury to the Demised Premises or the Building, caused by moving the property of Tenant into, in or out of the Building and all breakage, damage or injury to the Demised Premises, Building or the Land caused by Tenant or any of Tenant’s Agents shall be repaired by Tenant, at the sole cost and expense of Tenant, except that Landlord shall have the right, at Landlord’s option if Tenant has not made such repairs within five (5) business days after notice to Tenant of such damage (the “Cure Period”) (except that in the event of emergency, no prior notice or Cure Period shall be required and Landlord shall have the right to immediately cause any repair to be completed), to make such repairs, alterations and replacements (structural, nonstructural or otherwise) at Tenant’s expense, with the right on the part of Landlord to elect in its discretion to regard the same as Additional Rent, in which event such cost or charge shall become Additional Rent payable not later than thirty (30) days following Tenant’s receipt of a reasonably detailed statement with respect thereto. Notwithstanding the foregoing, if such damage is the type that cannot be repaired within five (5) business days, then provided Tenant begins such repair within such five (5) business day period and proceeds diligently and in good faith thereafter to cure such damage until completion, the Cure Period shall be extended by that period as is reasonably necessary to effect such repair (which extension shall not exceed thirty (30) days if Landlord reasonably determines that such damage (i) affects other tenants or the operation of the Building or (ii) is not contained within the Demised Premises) to make such repairs and to charge Tenant for all costs and expenses incurred in connection therewith as additional rent hereunder. The liability of Tenant for such costs and expenses shall be reduced by the amount of any insurance proceeds for which Landlord is entitled (or for which Landlord would have been entitled had Landlord obtained and maintained the insurance required pursuant to the terms of this Lease) on account of such injury, breakage or damage. This right of Landlord to effect the repairs shall be construed as an additional remedy granted to Landlord and not in limitation of any other rights or remedies which Landlord has or may have in said circumstances. Tenant shall notify Landlord promptly of any injury, breakage or damage for which Tenant is liable hereunder and of which Tenant has actual knowledge.

14. Repairs by Landlord. Except for responsibility expressly allocated to Tenant under Section 13, Landlord shall keep, maintain, repair and replace as appropriate, the foundation, roof, exterior walls, structural portions (including columns within the Demised Premises and the vertical sprinkler loop through the Building), and exterior glass and windows of the Building (specifically excluding the interior walls, doors, partitions, locks, and door jambs in the Demised Premises), as well as all base building standard mechanical, plumbing, heating, air conditioning, perimeter card-key access control, fire/life/safety, sprinkler and electrical systems and utility service lines therein, the plumbing system to and from the Demised Premises and core area restrooms within the Demised Premises, driveways, garage and parking areas and grounds

14

adjacent to the Building in good condition and repair. Landlord shall maintain the Common Areas in accordance with the standards customarily maintained for comparable office buildings in Tysons Xxxxx, Virginia (“Comparable Buildings”). Except as otherwise provided for in Section 16.1 hereof, Landlord shall have no duty to Tenant to maintain or to make any repairs or improvements to the Demised Premises except structural repairs to the Building as required by law or necessary for safety and tenantability, provided that if such structural repairs are required as a result of any negligence or willful misconduct of Tenant or any of Tenant’s Agents, such repairs shall be at the sole cost of Tenant to the extent such repairs exceed the amount of insurance proceeds received by Landlord. Landlord shall not be liable for any damage caused to the person or property of Tenant or Tenant’s Agents, due to the Demised Premises or the Building or any part or appurtenance thereof being improperly constructed or repaired, or arising from the leaking of gas, water, sewer or steam pipes, or from electricity, or from any other cause whatsoever. Tenant agrees to report immediately in writing to Landlord any defective condition in or about the Demised Premises of which Tenant has actual knowledge.

15. Furniture; Fixtures; Electrical Equipment.

15.1 Floor Loading. Tenant shall not place a load upon the floor of the Demised Premises contrary to the weight, method of installment and position prescribed by Landlord. Business machines, mechanical equipment and materials belonging to Tenant which cause vibration, noise, cold, heat or fumes that may be transmitted to the Building or to any other leased space therein to such a degree as to be objectionable to Landlord or to any other tenant in the Building shall be placed, maintained, isolated, stored and/or vented by Tenant at its sole expense so as to absorb and prevent such vibration, noise, cold, heat or fumes. No furniture, equipment or other bulky matter of any description shall be received into the Building or carried in the elevators except as approved by Landlord (and, if the Landlord so instructs under Landlord’s observation), and all such furniture, equipment and other bulky matter shall be delivered only through the designated delivery entrance of the Building and the designated freight elevator. Tenant shall remove promptly from sidewalks adjacent to the Building and from common areas within and outside the Building, any of Tenant’s furniture, equipment or other material there delivered or deposited.

15.2 Office Equipment. Landlord shall provide to Tenant, without additional charge, electrical facilities to furnish up to the electrical capacity sufficient to support Tenant’s balanced consumption of five (5) xxxxx per square foot of rentable area of demand load averaged over the entire Demised Premises for lighting and incidental usage, exclusive of HVAC (“Premises’ Standard Electricity Capacity”). Tenant shall not install or operate in the Demised Premises any electrically operated equipment, computers or other machinery, other than electric typewriters, copiers, computer equipment (such as servers, printers and any other equipment that is normally found in typical office), kitchen equipment, personal computers or adding machines and such other small electrically operated office equipment as is used in modem offices (specifically excluding electrically operated equipment using more than five (5) xxxxx per square foot), without first obtaining the prior written consent of Landlord (which consent shall not be unreasonably withheld, conditioned or delayed), who may condition such consent upon (i) the requirement that the electrical consumption of any such equipment, computers or machinery be separately metered, and/or (ii) the payment by Tenant of Additional Rent in compensation for any consumption of water and/or electricity in excess of Premises

15

Standard Electricity Capacity, or wiring as may be occasioned by the operation of said equipment or machinery; nor shall Tenant install any other equipment whatsoever which will or may cause noise or vibrations that may be transmitted to areas outside of the Demised Premises to such a degree as to be reasonably objectionable to Landlord or any other tenant at the Building, or which will or may necessitate any changes, replacements or additions to or require the use of the water system, plumbing system, heating system, air conditioning system, security system or the electrical system of the Demised Premises or the Building without the prior written consent of Landlord, who may withhold its consent in its absolute discretion. Notwithstanding anything in this Lease to the contrary, if Landlord reasonably and in good faith believes that Tenant’s equipment shall result in electrical demand in excess of the Demised Premises’ standard electrical capacity, Landlord shall have the right, in its sole discretion, after at least three (3) business days’ prior written notice, to install checkmeters to verify that Tenant’s electricity consumption is not excessive or cause a survey to be made by an independent electrical engineer or consulting firm to determine the amount of electricity consumed by Tenant beyond the Demised Premises’ standard electrical capacity. If such checkmeters indicate (based on a reading over a reasonable period of time, as opposed to a “spot check”) or if the independent survey shows that such consumption is excessive, then (a) Landlord may install at Tenant’s expense submeters to ascertain Tenant’s actual electricity consumption, as well as additional transformers, distribution panels, wiring and other applicable equipment at the expense of Tenant, and (b) Tenant shall reimburse Landlord for the reasonable, direct, out-of- pocket cost of the installation of said meter(s) or completion of said meter(s) or survey, and shall pay as Additional Rent the cost of any electricity in excess of an average of the Demised Premises’ standard electrical capacity, at the rate charged by the utility company providing such electricity, assuming continuous business hours, within ten (10) days after receipt of any xxxx therefor from Landlord Landlord and Tenant acknowledge that Tenant’s planned Alterations include a data center, not to exceed one thousand (1,000) rentable square feet in area, the design, installation and operation of which shall be subject to the provisions of this Lease, provided that the equipment, machinery and computers in such data center and any supplemental heating or air conditioning provided therefor shall be separately metered and paid for by Tenant as set forth in this Section 15.2.

16. Alterations.

16.1 Initial Work. Tenant shall have the right to contract for, administer and complete reasonable improvements within the Demised Premises in accordance with plans and specifications approved in writing by the Landlord (the “Initial Work”). Tenant acknowledges that if Tenant uses an engineering firm other than GHT for plans and specifications for the Initial Work or any subsequent Alterations, such plans and specifications shall be reviewed by GHT on behalf of Landlord at the expense of Tenant, and that the cost of such review may be deducted from any allowance otherwise payable or reimbursable to or at the direction of Tenant The Initial Work shall be constructed pursuant to the terms of Sections 16.2 and 16.3 below and otherwise in compliance with the Landlord’s rules and regulations for construction activities in the Building. The space planner for the Initial Work shall be Fox Architects, and the engineer shall be Bansal Associates. Landlord shall have the right to approve all contractors performing any work in the Demised Premises prior to the commencement of any work by such contractors, and Landlord shall have the right to require that the Tenant use Landlord’s designated contractor for any Structural Work (as defined below). Landlord shall provide Tenant an allowance in

16

connection with the design and construction of the Initial Work not to exceed the sum of Twenty-five and No/100 Dollars ($25.00) per square foot of the Demised Premises (the “Tenant Allowance”), which Tenant Allowance shall be paid by Landlord to the Tenant (or the contractor) upon the presentation of approved invoices and waivers of mechanics and materialmen’s liens covering the portion of the Initial Work for which the Tenant seeks reimbursement. Reimbursements from the Tenant Allowance shall be made not more than once every month, and the amount of the Tenant Allowance shall be available to Tenant until March 31, 2006, at which time any amounts remaining in the Tenant Allowance shall be deemed forfeited and the Tenant shall receive no further reimbursement or credit for such amounts. In addition to providing the Tenant Allowance, Landlord shall pay to Tenant (or the contractor) the cost of installing all demising walls and corridor walls with 5/8” gypsum drywall, taped, spackled and sanded, ready to receive paint. Such work shall be performed by Tenant’s contractor, subject to Landlord’s prior written approval of the cost thereof. Such amounts shall be paid by Landlord to the Tenant (or the contractor) upon the presentation of approved invoices and waivers of mechanics and materialmen’s liens covering such work. Landlord shall demolish and remove, at Landlord’s expense, the following items located in the data center located on the Demised Premises prior to the Lease Commencement Date: (a) all raised floor panels, ramps, stairs and associated pedestals (including all mastic holding such pedestals in place), (b) four (4) Liebert air conditioning units (one (1) of which is located in the premises adjacent to the Demised Premises) with associated piping located under the existing raised floor, (c) uninterruptable power supply and associated batteries, (d) power distribution unit with associated wiring back to the existing electrical panel, (e) cable tray and all wiring under the existing raised floor, and (f) smoke detectors, fire alarm and fire alarm panel under the existing raised floor. In no event shall Landlord be obligated to perform any other work or expend any costs or sums in addition to the Tenant Allowance, Tenant acknowledges that Landlord has previously paid Tenant a test fit allowance as agreed by the parties. [data center in/on]

16.2 Alterations by Tenant. Tenant will not make or permit any improvements, additions, alterations, fixed decorations, substitutions, replacements or modifications, structural or otherwise, to the Demised Premises or to the Building (hereinafter referred to as “Alterations”) without the prior written consent of Landlord, which consent may be withheld or granted in Landlord’s sole and absolute discretion with respect to Structural Alterations and non-structural Alterations that are visible from the exterior of the Demised Premises, and which consent shall not be unreasonably withheld, conditioned or delayed with respect to all other non-structural Alterations. Notwithstanding the foregoing, Tenant shall have the right, after providing at least ten (10) days prior written notice to Landlord, but without the necessity of obtaining Landlord’s consent, to recarpet, repaint, or to make purely “cosmetic” or “decorative” nonstructural Alterations in and to the Demised Premises (including installation of voice and data cabling) (collectively, “Minor Alterations”) that (i) do not affect the base Building structure or systems, (ii) do not require the issuance of a building permit, and (iii) are not visible from outside the Demised Premises. “Structural Alterations” shall be deemed to include without limitation any Alterations that will necessitate any changes, replacements or additions to walls, ceilings, partitions (other than non-structural or free-standing partitions), columns, or floors or which in any way affect the water, electrical, mechanical, plumbing, fire and life safety or HVAC systems of the Demised Premises or the Building. If Landlord’s consent is required for any Alterations, Landlord may impose any reasonable conditions to such consent it deems appropriate, including, without limitation, the approval of plans and

17

specifications, supervision of the work by Landlord’s architect or contractor, the obtaining by Tenant of specified insurance and satisfactory evidence from Tenant of Tenant’s ability to pay for such Alterations. Landlord’s consent to any Alteration and approval of any plans and specifications constitutes approval of no more than the concept of such Alteration and not a representation or warranty with respect to the quality or functioning of such Alteration, plans and specifications. If Landlord fails to respond to a request for its consent to an Alteration within fifteen (15) business days following submission of such request, Tenant shall deliver a second written request for Landlord’s approval, which second request shall state in bold capital letters that the request will be deemed approved in accordance with Section 16.2 of the Lease if Landlord fails to respond within three (3) business days. If Landlord fails to respond to Tenant within three (3) business days after Landlord’s receipt of such second notice, then Landlord’s consent shall be deemed granted.

16.3 Compliance with Codes; No Liens. Alterations may be made only at Tenant’s expense by contractors or subcontractors reasonably approved in writing by Landlord, and only after Tenant has obtained any necessary permits from governmental authorities having jurisdiction, and furnished copies of such permits to Landlord. All Alterations must conform to all rules and regulations established from time to time by the Board of Fire Underwriters having jurisdiction or similar body exercising similar functions and to all laws, regulations and requirements of federal, state, county and municipal governments having jurisdiction. Tenant shall obtain and deliver to Landlord written, unconditional waivers of mechanic’s and materialmen’s liens against the Building and the Land from all contractors, subcontractors and material suppliers for all work performed and materials furnished in connection with the Alterations. Notwithstanding the foregoing, if any mechanic’s lien is filed against the Demised Premises, the Building or the Land for work done for or materials furnished to Tenant, or claimed to have been done for or furnished to Tenant, the lien shall be discharged by Tenant within ten (10) business days thereafter, solely at Tenant’s expense, by paying off or bonding the lien. If Tenant shall fail to discharge such lien Landlord may do so and treat the cost thereof as Additional Rent; but such discharge by Landlord shall not be deemed to waive the default of Tenant in not discharging the same. If any Alteration is made without the prior written consent of Landlord, Landlord may correct or remove the Alteration at Tenant’s expense, and all direct, out-of-pocket costs and expenses incurred by Landlord in connection with the removal of any mechanic’s lien or the correction or removal of any Alteration shall be payable as Additional Rent with the next due payment of Monthly Base Rent.

17. Ownership of Alterations and Equipment and Other Property; Removal of Tenant’s Personal Property.

17.1 Landlord’s Property. Any Alterations and other improvements, and any equipment, machinery, furniture, furnishings and other property, installed or located in the Demised Premises by or on behalf of either party (i) shall (except for Tenant’s Personal Property (as hereinafter defined)) immediately become the property of Landlord and be subject to this Lease, and (ii) shall remain upon and be surrendered to Landlord with the Demised Premises as a part thereof upon the expiration or earlier termination of the Term; provided, however, that if Tenant is not in default under this Lease, Tenant shall have the right to remove, prior to the expiration or earlier termination of the Term, Tenant’s Personal Property (as hereinafter defined), and provided further, that if Landlord shall elect at the time of their approval of the alteration that

18

any Alterations be removed at the expiration or earlier termination of the Term, Tenant shall cause the same to be removed at Tenant’s expense and shall surrender the Demised Premises to Landlord in the condition in which the Demised Premises were originally received from Landlord, except as repaired, rebuilt, restored, altered or added to as permitted or required under this Lease and except for ordinary wear, tear, insured damage or casualty or shall reimburse Landlord for doing so. “Tenant’s Personal Property” shall mean all equipment, machinery, improvements, furniture, furnishings and other property now or hereafter installed or placed in or on the Demised Premises by and at the sole expense of Tenant with respect to which Tenant has not been granted any credit or allowance by Landlord and which (a) are not used, or were not procured for use, in connection with the operation, maintenance or protection of the Demised Premises or the Building, (b) are removable without damage to the Demised Premises or Building, and (c) are not replacements of any property of Landlord, whether such replacement is made at Tenant’s expense or otherwise. Notwithstanding any other provision of this Lease, Tenant’s Personal Property does not include any Alterations or any improvements or other property installed or placed in or on the Demised Premises as part of the Initial Work, whether or not any of such Alterations, improvements, or other property were at Tenant’s expense.

17.2 Removal. Tenant shall remove all of Tenant’s Personal Property from the Demised Premises at the expiration or earlier termination of the Term. Any property belonging to Tenant or any other person, which is left in the Demised Premises after the date the Lease has expired or is terminated for any reason, shall be deemed to have been abandoned. In such event, Landlord shall have the right to declare itself owner of such property and to dispose of it in whatever manner Landlord considers appropriate without waiving its right to claim from Tenant all expenses and damages caused by Tenant’s failure to remove the property, and Tenant shall not have any right to compensation or claim against Landlord as a result thereof. All Alterations, including wall-to-wall carpet installed in accordance with Landlord’s requirements, within the Demised Premises upon the expiration or termination of this Lease shall remain upon and be surrendered with the Demised Premises, without disturbance, molestation or injury (other than reasonable wear and tear), except that Tenant shall remove any such Alterations where: (a) Landlord has consented to Tenant’s request to remove such Alterations, or (b) Landlord’s approval of such Alterations specified that such Alterations must be removed, or (c) such Alterations (other than Minor Alterations) were not approved by Landlord where Landlord’s approval was required.

18. Damage or Destruction.