SECURITIES PURCHASE AGREEMENT by and among DGE GROUP SERIES HOLDCO, LLC, and each of its three designated series, DGE GROUP SERIES HOLDCO, LLC, SERIES I, DGE GROUP SERIES HOLDCO, LLC, SERIES II, DGE GROUP SERIES HOLDCO, LLC, SERIES III, and KOSMOS...

Exhibit 10.1

by and among

DGE GROUP SERIES HOLDCO, LLC,

and each of its three designated series,

DGE GROUP SERIES HOLDCO, LLC, SERIES I,

DGE GROUP SERIES HOLDCO, LLC, SERIES II,

DGE GROUP SERIES HOLDCO, LLC, SERIES III,

and

KOSMOS ENERGY GULF OF MEXICO, LLC

KOSMOS ENERGY GULF OF MEXICO, LLC

and, solely for purposes of Section 8.1 and Article 14 (to the extent related to the performance of the obligations of the Drum Entities under Section 8.1),

DEEP GULF ENERGY LP,

DEEP GULF ENERGY MANAGEMENT LLC,

DEEP GULF ENERGY II, LLC,

DGE II MANAGEMENT, LLC,

DEEP GULF ENERGY III, LLC,

and

DGE III MANAGEMENT, LLC

Dated as of August 3, 2018

DEEP GULF ENERGY MANAGEMENT LLC,

DEEP GULF ENERGY II, LLC,

DGE II MANAGEMENT, LLC,

DEEP GULF ENERGY III, LLC,

and

DGE III MANAGEMENT, LLC

Dated as of August 3, 2018

TABLE OF CONTENTS | |||

Page | |||

ARTICLE 1 DEFINITIONS | 2 | ||

Section 1.1 | Certain Definitions | 2 | |

Section 1.2 | Interpretation | 34 | |

ARTICLE 2 PURCHASE AND SALE | 35 | ||

Section 2.1 | Purchase and Sale | 35 | |

Section 2.2 | Purchase Price | 36 | |

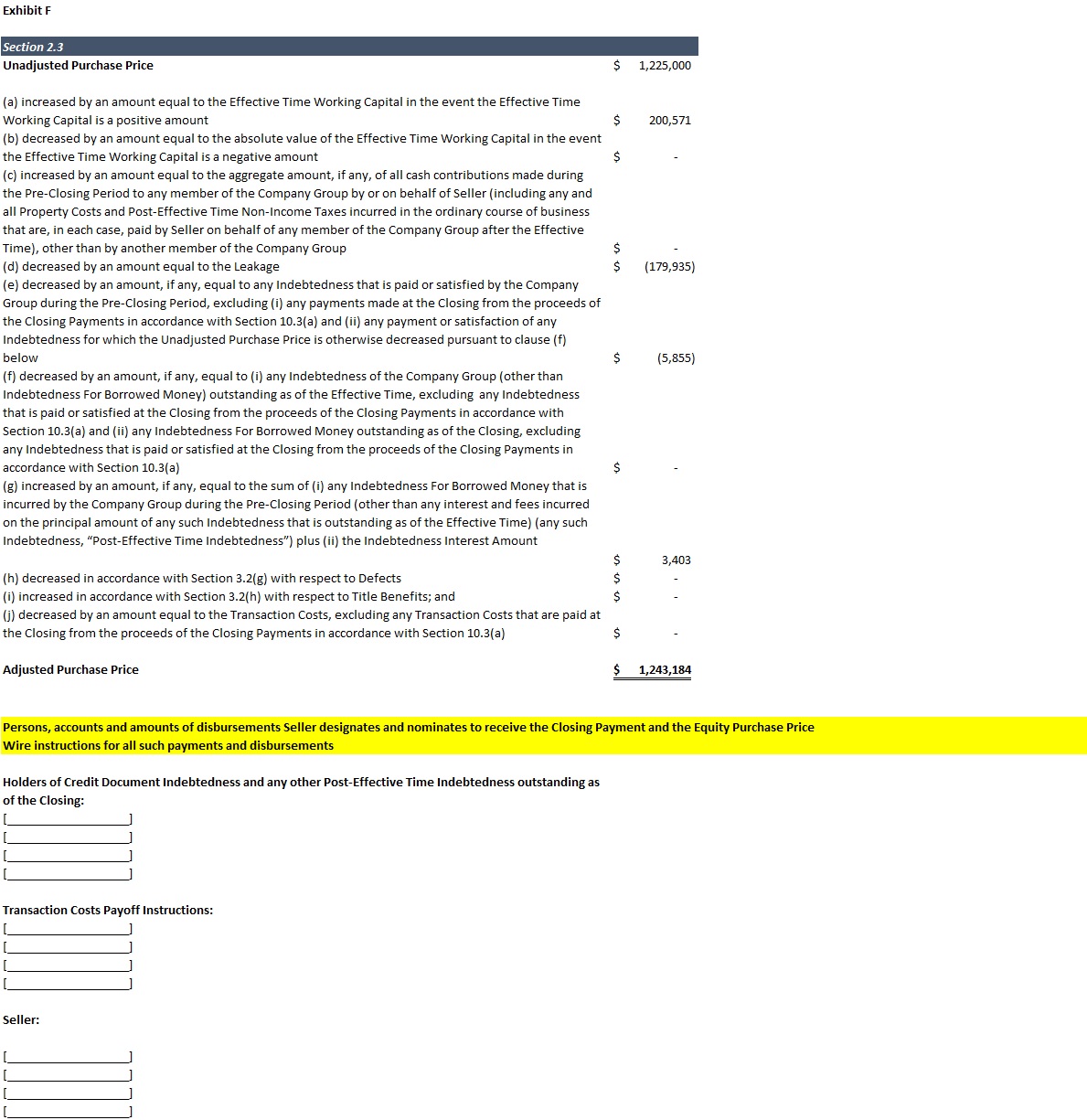

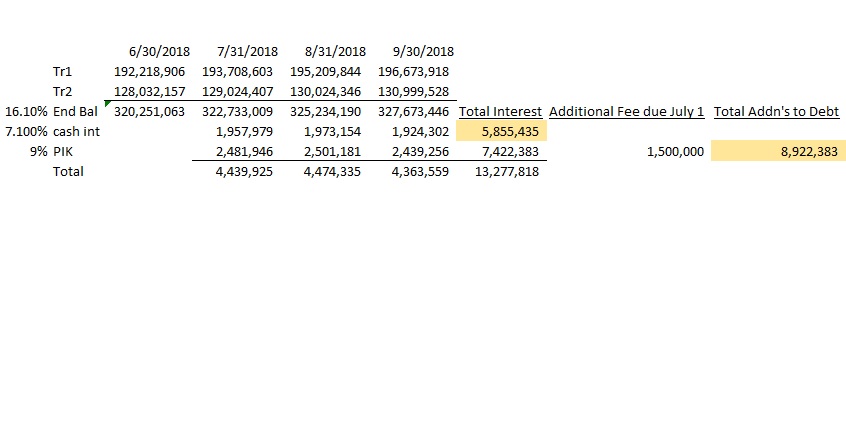

Section 2.3 | Adjustments to the Unadjusted Purchase Price | 37 | |

Section 2.4 | Adjustment Procedures | 38 | |

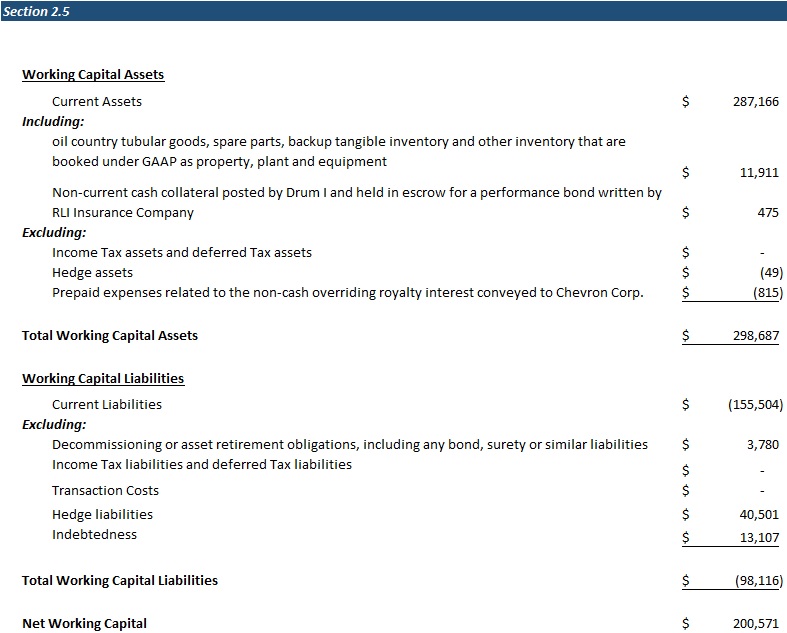

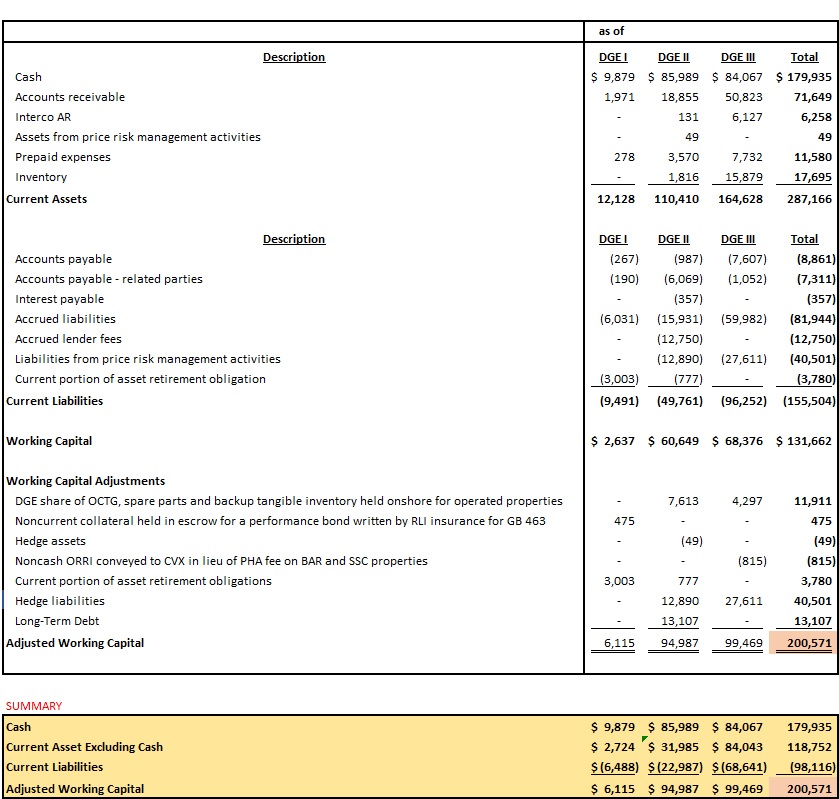

Section 2.5 | Closing Payment and Post-Closing Adjustments | 40 | |

Section 2.6 | Allocation of Purchase Price | 42 | |

Section 2.7 | Withholding | 42 | |

ARTICLE 3 TITLE MATTERS | 43 | ||

Section 3.1 | Title Matters | 43 | |

Section 3.2 | Defects; Adjustments | 43 | |

ARTICLE 4 REPRESENTATIONS AND WARRANTIES REGARDING SELLER | 49 | ||

Section 4.1 | Organization, Existence and Qualification | 49 | |

Section 4.2 | Power | 49 | |

Section 4.3 | Authorization and Enforceability | 49 | |

Section 4.4 | No Conflicts | 50 | |

Section 4.5 | Litigation | 50 | |

Section 4.6 | Bankruptcy | 50 | |

Section 4.7 | Ownership of Subject Securities | 50 | |

Section 4.8 | Broker’s Fees | 51 | |

Section 4.9 | Investment Intent; Accredited Investor | 51 | |

Section 4.10 | Leakage | 51 | |

Section 4.11 | Independent Evaluation | 51 | |

ARTICLE 5 REPRESENTATIONS AND WARRANTIES REGARDING THE COMPANY GROUP | 52 | ||

Section 5.1 | Existence and Qualification | 52 | |

Section 5.2 | Power | 52 | |

Section 5.3 | Authorization and Enforceability | 53 | |

Section 5.4 | No Conflicts | 53 | |

Section 5.5 | Capitalization | 53 | |

Section 5.6 | Financial Statements | 54 | |

Section 5.7 | No Undisclosed Liabilities; No Company Liabilities | 55 | |

Section 5.8 | Absence of Changes | 55 | |

Section 5.9 | Litigation | 55 | |

Section 5.10 | Bankruptcy | 55 | |

Section 5.11 | Taxes | 55 | |

Section 5.12 | Labor and Employee Benefits | 57 | |

i

Section 5.13 | Compliance with Laws | 59 | |

Section 5.14 | Contracts | 60 | |

Section 5.15 | Outstanding Capital Commitments | 60 | |

Section 5.16 | Environmental Matters | 60 | |

Section 5.17 | Preferential Purchase Rights | 61 | |

Section 5.18 | Royalties and Expenses | 61 | |

Section 5.19 | Insurance | 61 | |

Section 5.20 | Bank Accounts | 62 | |

Section 5.21 | Imbalances | 62 | |

Section 5.22 | Intellectual Property | 62 | |

Section 5.23 | Decommissioning | 63 | |

Section 5.24 | Related Party Transactions | 63 | |

Section 5.25 | Suspense Funds | 64 | |

Section 5.26 | Assets | 64 | |

Section 5.27 | Broker’s Fees | 64 | |

ARTICLE 6 REPRESENTATIONS AND WARRANTIES OF PURCHASER | 64 | ||

Section 6.1 | Existence and Qualification | 64 | |

Section 6.2 | Power | 64 | |

Section 6.3 | Authorization and Enforceability | 65 | |

Section 6.4 | No Conflicts | 65 | |

Section 6.5 | Bankruptcy | 65 | |

Section 6.6 | Litigation | 65 | |

Section 6.7 | Financing | 66 | |

Section 6.8 | Investment Intent | 66 | |

Section 6.9 | Independent Evaluation | 66 | |

Section 6.10 | Capitalization | 67 | |

Section 6.11 | Valid Issuance | 67 | |

Section 6.12 | SEC Documents; Financial Statements; No Liabilities | 68 | |

Section 6.13 | Investment Company | 68 | |

Section 6.14 | Internal Controls; Listing Exchange | 69 | |

Section 6.15 | Form S-3 | 69 | |

Section 6.16 | Absence of Changes | 69 | |

Section 6.17 | Compliance with Law | 70 | |

Section 6.18 | Regulatory | 70 | |

Section 6.19 | No Stockholder Approval | 70 | |

Section 6.20 | Broker’s Fees | 70 | |

Section 6.21 | Takeover Laws | 71 | |

ARTICLE 7 DISCLAIMERS AND ACKNOWLEDGEMENTS | 71 | ||

Section 7.1 | General Disclaimers | 71 | |

Section 7.2 | Environmental Disclaimers | 73 | |

Section 7.3 | Calculations, Reporting and Payments | 74 | |

Section 7.4 | Waiver of Louisiana Rights in Redhibition | 74 | |

ARTICLE 8 COVENANTS OF THE PARTIES | 75 | ||

ii

Section 8.1 | Obligations of Seller; Joint and Several Liability | 75 | |

Section 8.2 | Access | 75 | |

Section 8.3 | Operation of Business of the Company Group | 77 | |

Section 8.4 | Operation of Business of the Purchaser | 80 | |

Section 8.5 | Closing Efforts and Further Assurances | 81 | |

Section 8.6 | Amendment of the Disclosure Schedule | 86 | |

Section 8.7 | Press Releases | 86 | |

Section 8.8 | Expenses | 87 | |

Section 8.9 | Records | 87 | |

Section 8.10 | Change of Name; Removal of Name | 87 | |

Section 8.11 | Seismic Licenses | 88 | |

Section 8.12 | Employee Matters | 89 | |

Section 8.13 | Xxxxxx | 92 | |

Section 8.14 | Restructuring | 92 | |

Section 8.15 | Listing Application | 92 | |

Section 8.16 | Termination of Related Party Agreements and Intercompany Accounts | 92 | |

Section 8.17 | Indemnification of Directors and Officers | 93 | |

Section 8.18 | Section 16(b) Matters | 94 | |

Section 8.19 | Takeover Laws | 94 | |

Section 8.20 | Indebtedness | 94 | |

Section 8.21 | Section 280G Matters | 95 | |

Section 8.22 | Mechanical Integrity | 95 | |

Section 8.23 | Financial Statements | 99 | |

Section 8.24 | Form S-3 | 99 | |

ARTICLE 9 CONDITIONS TO CLOSING | 99 | ||

Section 9.1 | Conditions of Seller to the Closing | 99 | |

Section 9.2 | Conditions of Purchaser to the Closing | 101 | |

ARTICLE 10 CLOSING | 102 | ||

Section 10.1 | Time and Place of Closing | 102 | |

Section 10.2 | Obligations of Seller at the Closing | 102 | |

Section 10.3 | Obligations of Purchaser at the Closing | 104 | |

ARTICLE 11 TAX MATTERS | 105 | ||

Section 11.1 | Transfer Taxes and Recording Fees | 105 | |

Section 11.2 | Tax Returns | 105 | |

Section 11.3 | Straddle Period Income Taxes | 106 | |

Section 11.4 | Non-Income Taxes | 106 | |

Section 11.5 | Tax Cooperation and Contests | 107 | |

Section 11.6 | Amended Returns | 108 | |

Section 11.7 | Tax Refunds | 108 | |

Section 11.8 | Tax Sharing Agreements | 108 | |

Section 11.9 | Intended Tax Treatment | 108 | |

Section 11.10 | Section 754 Election | 108 | |

ARTICLE 12 TERMINATION | 109 | ||

iii

Section 12.1 | Termination | 109 | |

Section 12.2 | Effect of Termination | 110 | |

ARTICLE 13 INDEMNIFICATION; LIMITATIONS | 111 | ||

Section 13.1 | Seller’s Indemnification Rights | 111 | |

Section 13.2 | Purchaser’s Indemnification Rights | 111 | |

Section 13.3 | Survival; Limitation on Actions | 112 | |

Section 13.4 | Exclusive Remedy and Certain Limitations | 115 | |

Section 13.5 | Indemnification Actions | 117 | |

Section 13.6 | Holdback Amount | 119 | |

Section 13.7 | Express Negligence/Conspicuous Manner | 122 | |

ARTICLE 14 MISCELLANEOUS | 122 | ||

Section 14.1 | Notices | 122 | |

Section 14.2 | Specific Performance | 123 | |

Section 14.3 | Governing Laws | 124 | |

Section 14.4 | Venue and Waiver of Jury Trial | 124 | |

Section 14.5 | Headings and Construction | 125 | |

Section 14.6 | Waivers | 125 | |

Section 14.7 | Severability | 126 | |

Section 14.8 | Assignment | 126 | |

Section 14.9 | Entire Agreement | 126 | |

Section 14.10 | Amendment | 127 | |

Section 14.11 | Seller Release | 127 | |

Section 14.12 | No Third-Person Beneficiaries | 127 | |

Section 14.13 | Limitation on Damages | 128 | |

Section 14.14 | Deceptive Trade Practices Act | 128 | |

Section 14.15 | Time of the Essence; Calculation of Time | 128 | |

Section 14.16 | Non-Recourse Persons | 129 | |

Section 14.17 | Certain Waivers | 129 | |

Section 14.18 | Counterparts | 130 | |

iv

EXHIBITS: | |

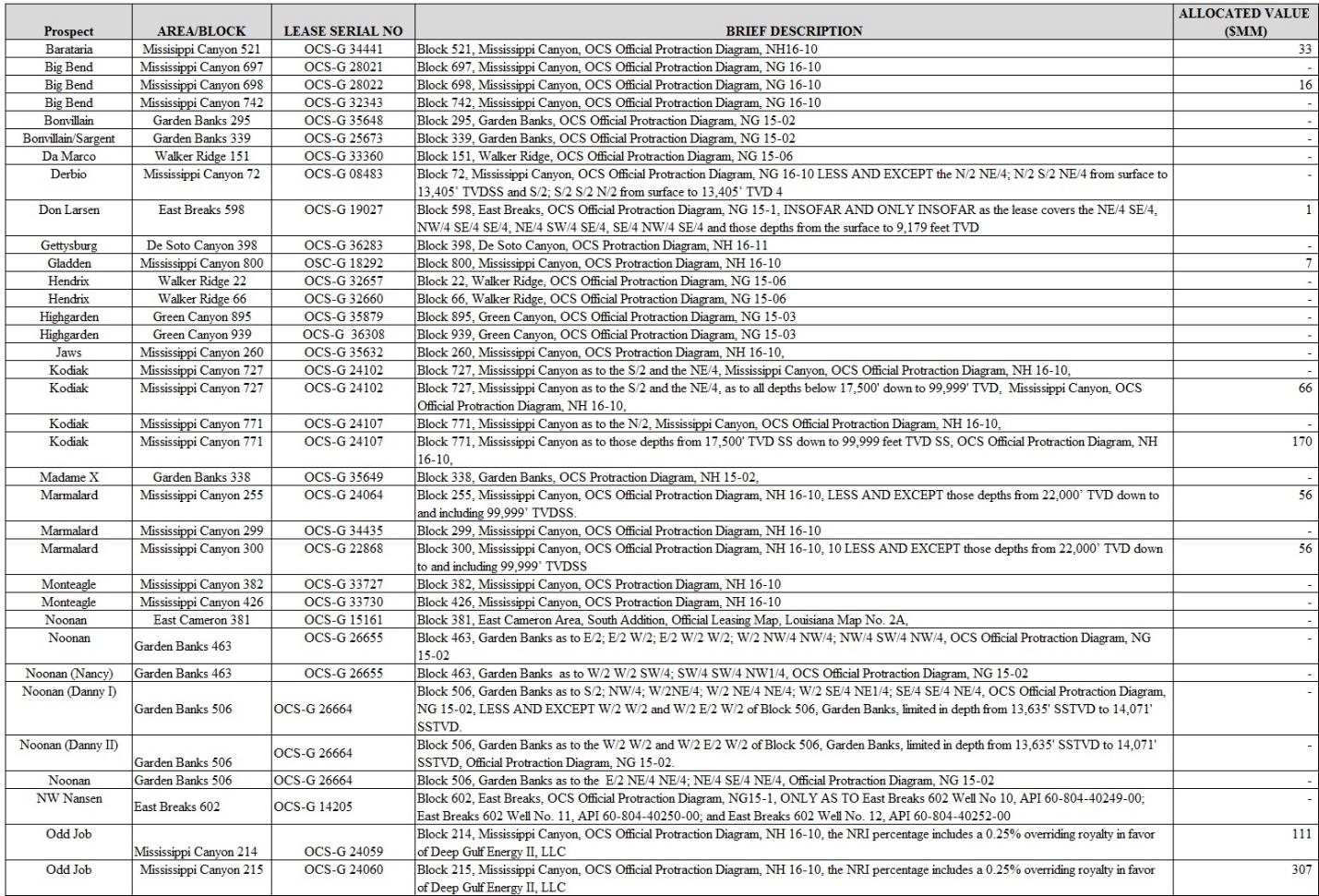

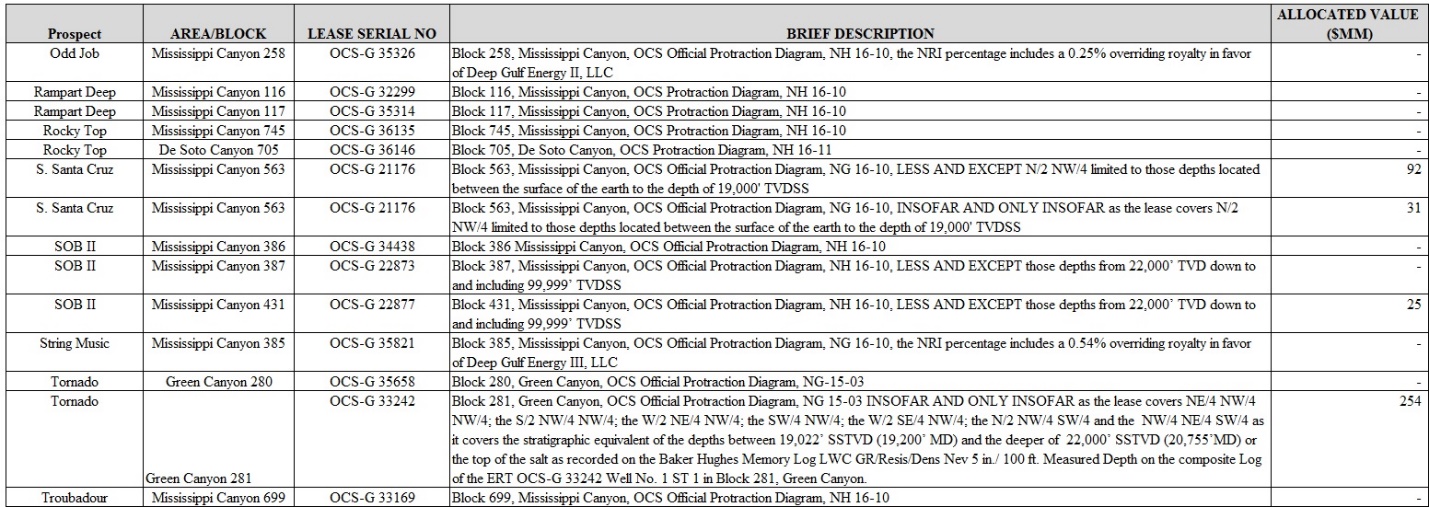

Exhibit A | Assets |

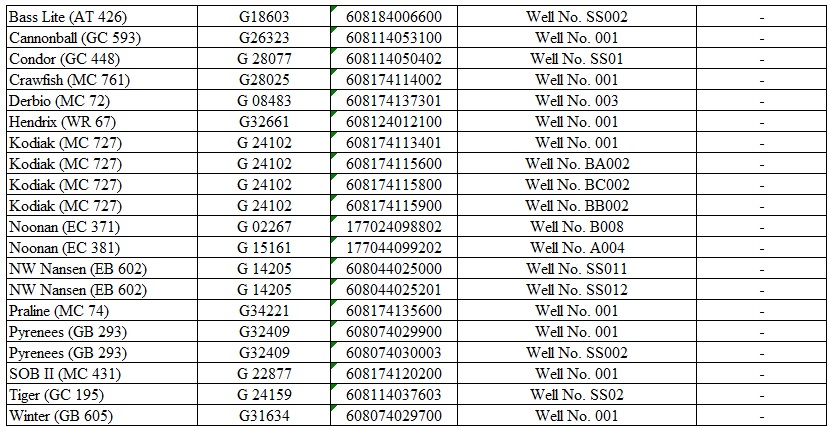

Exhibit A-1 | Leases |

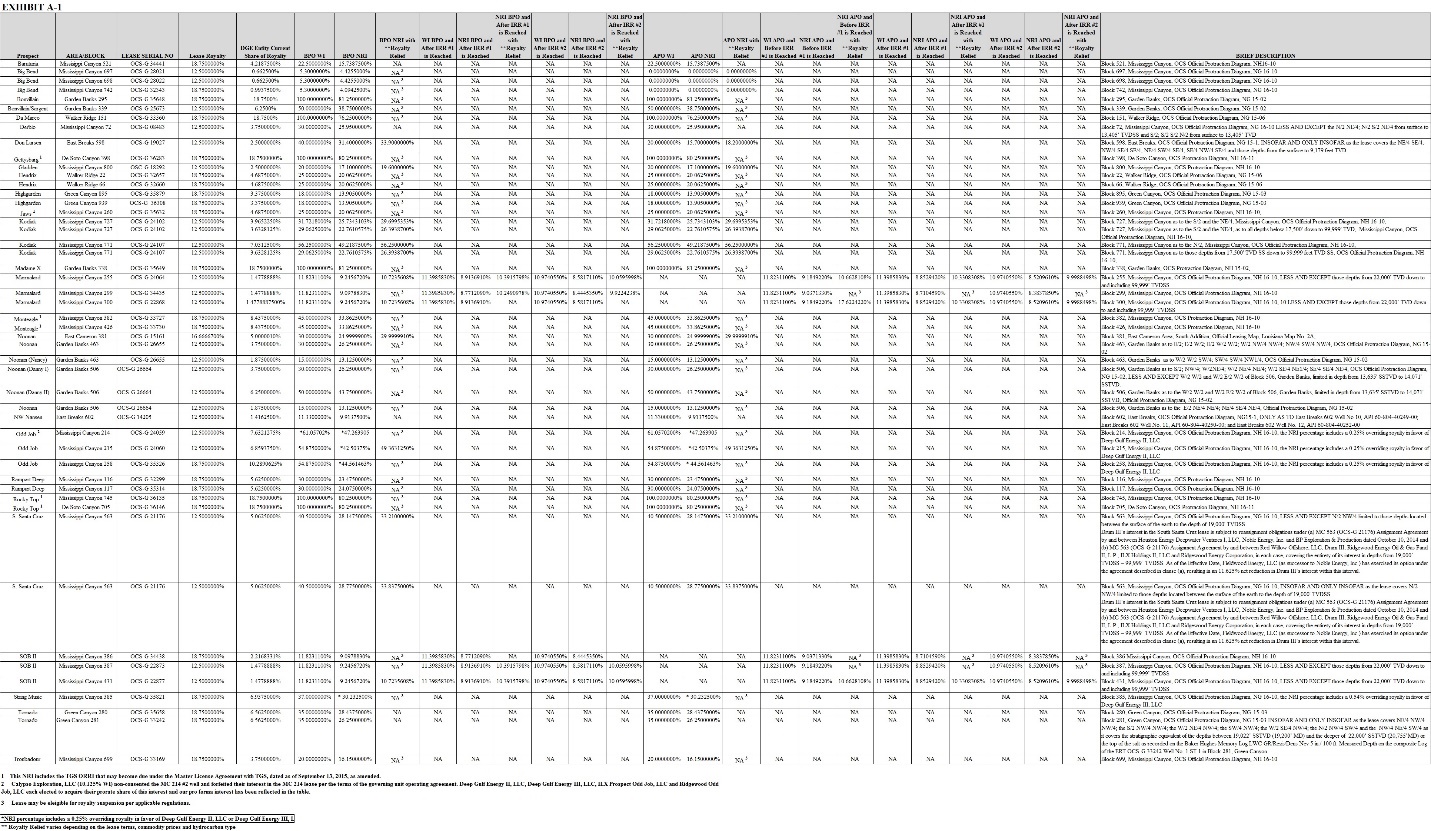

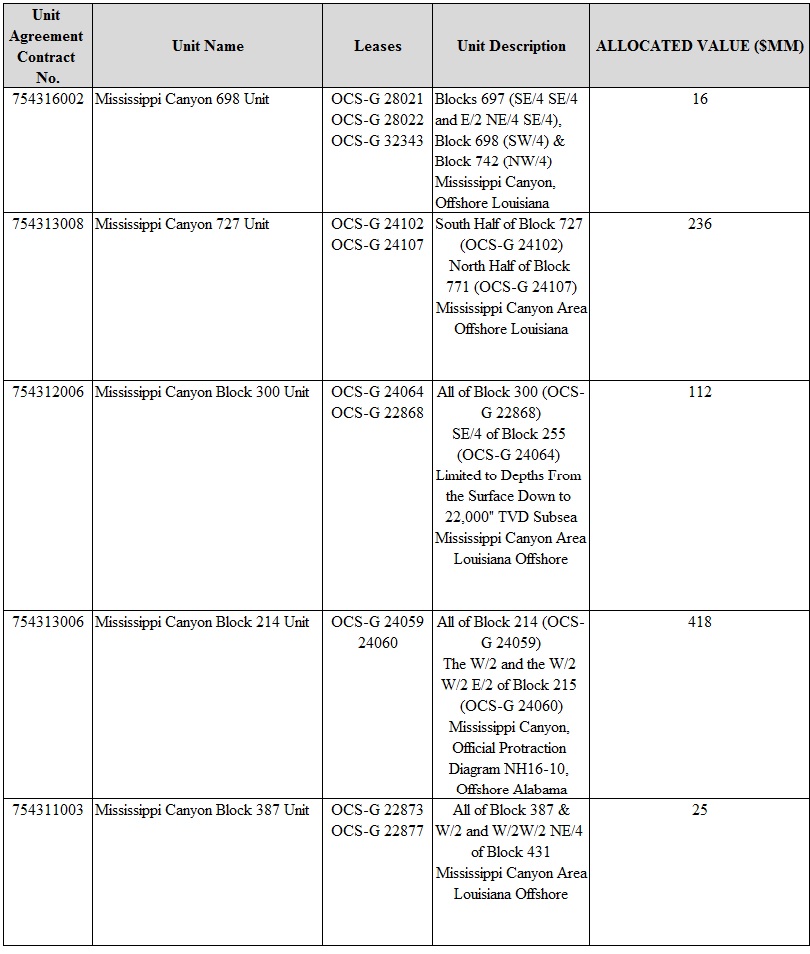

Exhibit A-2 | Units |

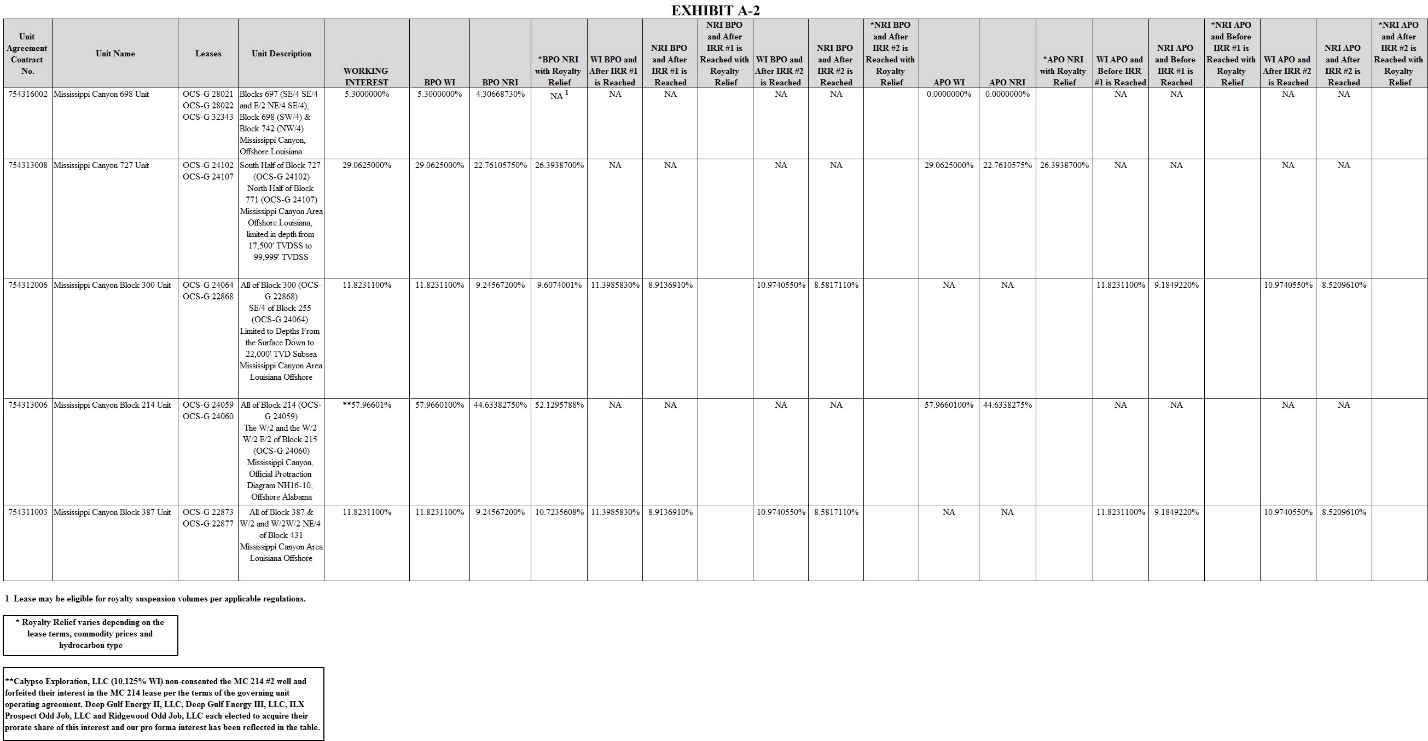

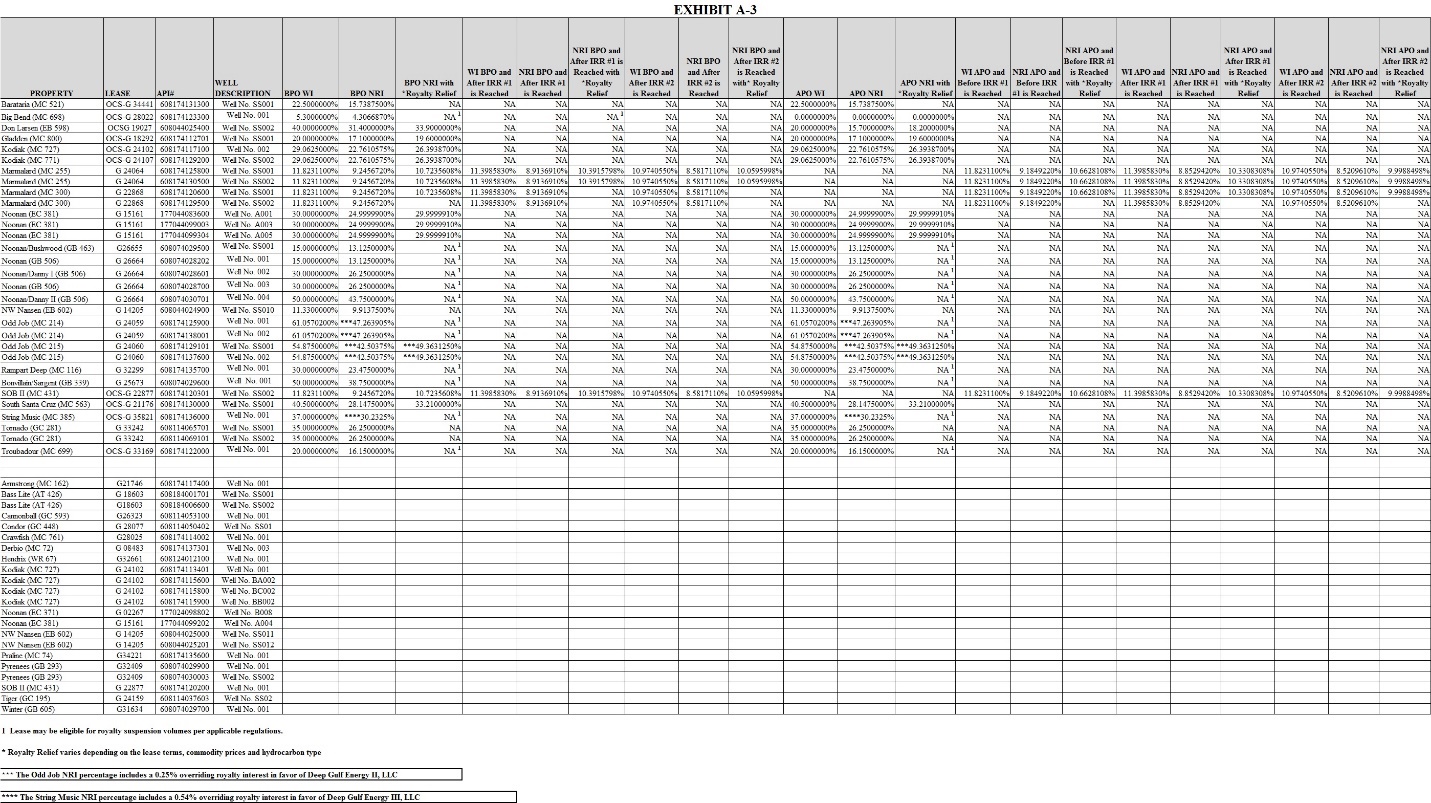

Exhibit A-3 | Xxxxx |

Exhibit A-4 | Rights of Way and Right-of-Use and Easements |

Exhibit B | Form of Assignment of Subject Securities |

Exhibit C | Form of Certificate of Non-Foreign Status |

Exhibit D | Form of Assignment of Excluded Assets |

Exhibit E | Form of Registration Rights Agreement |

Exhibit F | Sample Preliminary Settlement Statement |

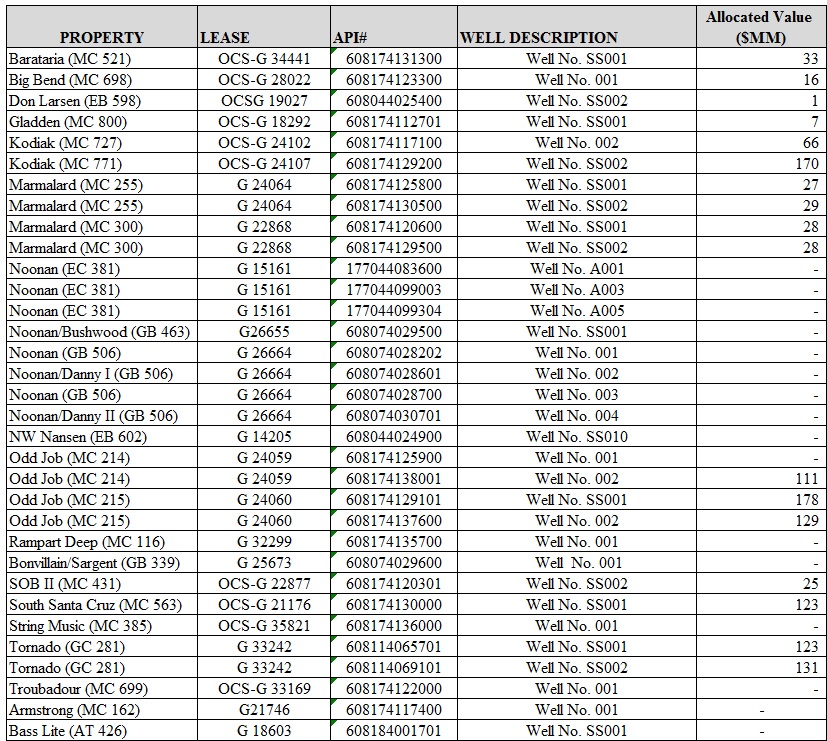

Exhibit G | Allocated Values |

SCHEDULES: | |

Schedule 1.1(a) | Seller Knowledge Persons |

Schedule 1.1(b) | Purchaser Knowledge Persons |

Schedule 1.1(c) | Permitted Leakage |

Schedule 1.1(d) | Required Owners |

Schedule 1.1(e) | Settlement Price |

Schedule 1.1(f) | Indebtedness |

Schedule 4.4 | Conflicts of Seller |

Schedule 5.1 | Company Group Existence and Qualification |

Schedule 5.4 | Conflicts of the Company Group |

Schedule 5.5(a) | Ownership Structure |

Schedule 5.6 | Financial Statements |

Schedule 5.7 | Undisclosed Liabilities |

Schedule 5.9 | Litigation of the Company Group |

Schedule 5.11 | Taxes |

Schedule 5.12(a) | Employee Benefit Plans |

Schedule 5.12(h) | Certain Employee Benefit Plans Matters |

Schedule 5.13(a) | Compliance with Laws |

Schedule 5.13(b) | Governmental Authorizations |

Schedule 5.14(a) | Material Contracts |

Schedule 5.14(b) | Certain Material Contract Matters |

Schedule 5.15 | Outstanding Capital Commitments |

Schedule 5.16 | Environmental Matters |

Schedule 5.17 | Preferential Purchase Rights |

Schedule 5.18 | Royalties and Expenses |

Schedule 5.19 | Insurance |

Schedule 5.20 | Bank Accounts |

v

Schedule 5.21 | Imbalances |

Schedule 5.22(a) | Registered IP |

Schedule 5.23 | Decommissioning |

Schedule 5.24 | Excluded Arrangements |

Schedule 5.25 | Suspense Funds |

Schedule 6.10(e) | Registration Right Obligations |

Schedule 6.14(b) | Internal Controls |

Schedule 8.3(b) | Operation of Business of Company Group |

Schedule 8.3(b)(xii) | Budget |

Schedule 8.11 | Seismic Licenses |

Schedule 8.16 | Related Party Agreements |

vi

This SECURITIES PURCHASE AGREEMENT (this “Agreement”), is dated as of August 3, 2018 (the “Execution Date”), by and among DGE Group Series Holdco, LLC, a Delaware series limited liability company (“Series Holdco”), and each of its three designated series, DGE Group Series Holdco, LLC, Series I (“Series I Seller”), DGE Group Series Holdco, LLC, Series II (“Series II Seller”), and DGE Group Series Holdco, LLC, Series III (“Series III Seller” and, together with Series I Seller and Series II Seller, the “Series Sellers” and the Series Sellers with Series Holdco, collectively referred to as the “Seller”), Kosmos Energy Gulf of Mexico, LLC, a Delaware limited liability company (“Purchaser”), and, solely for purposes of Section 8.1 and Article 14 (to the extent related to the performance of the obligations of the Drum Entities under Section 8.1), Deep Gulf Energy LP, a Texas limited partnership (“Drum I”), Deep Gulf Energy Management LLC, a Delaware limited liability company (“Drum I Management”), Deep Gulf Energy II, LLC, a Delaware limited liability company (“Drum II”), DGE II Management, LLC, a Delaware limited liability company (“Drum II Management”), Deep Gulf Energy III, LLC, a Delaware limited liability company (“Drum III”) and DGE III Management, LLC, a Delaware limited liability company (“Drum III Management” and together with Drum I, Drum I Management, Drum II, Drum II Management and Drum III, collectively, the “Drum Entities”). Seller and Purchaser and, solely for purposes of Section 8.1 and Article 14 (to the extent related to the performance of the obligations of the Drum Entities under Section 8.1), the Drum Entities, are sometimes referred to individually as a “Party” and collectively as the “Parties”.

WHEREAS, (1) Series I Seller desires to sell, and Purchaser desires to purchase, 100% of the issued and outstanding Securities (other than the non-economic general partnership interest in Drum I) in Drum I and all of the issued and outstanding Securities of Drum I Management (the “Drum I Subject Securities”), (1) Series II Seller desires to sell, and Purchaser desires to purchase, 100% of the issued and outstanding Securities of Drum II Management (the “Drum II Subject Securities”) and (1) Series III Seller desires to sell, and Purchaser desires to purchase, 100% of the issued and outstanding Securities of Drum III Management (the “Drum III Subject Securities” and, together with the Drum I Subject Securities and the Drum II Subject Securities, the “Subject Securities”) (Drum I, Drum I Management, Drum II Management and Drum III Management are sometimes referred to individually as an “Acquired Company” and collectively as the “Acquired Companies”);

WHEREAS, prior to or concurrently with the execution and delivery of this Agreement, and as a condition and inducement to Purchaser’s willingness to enter into this Agreement, Purchaser has entered into, or is entering into, a support agreement with each Required Owner (the “Support Agreements”); and

WHEREAS, pursuant to that certain Contingent Business Combination Agreement, dated as of the date hereof (the “Restructuring Agreement”), by and among Seller, each member of the Company Group and the other parties named therein, Seller and the members of the Company Group will, immediately prior to Closing, undergo certain restructuring transactions (collectively, the “Restructuring”), following which, (1) Series I Seller will directly own 100% of the issued and outstanding limited partner interests in Drum I and all of the issued and outstanding Securities of

1

Drum I Management, and Drum I Management will directly own the non-economic general partner interest in Drum I, (1) Series II Seller will directly own 100% of the issued and outstanding Securities of Drum II Management, and Drum II Management will directly own 100% of the issued and outstanding Securities of Drum II; and (1) Series III Seller will directly own 100% of the issued and outstanding Securities of Drum III Management, and Drum III Management will directly own 100% of the issued and outstanding Securities of Drum III.

NOW, THEREFORE, in consideration of the premises and of the mutual promises, representations, warranties, covenants, conditions, and agreements contained herein, and for other valuable consideration, the receipt and sufficiency of which are hereby acknowledged and confessed, the Parties agree as follows:

Article 1

DEFINITIONS

DEFINITIONS

Section 1.1 Certain Definitions. As used herein:

“280G Stockholder Approval Requirements” is defined in Section 8.21(a)(i).

“AAA” means the American Arbitration Association.

“Accounting Principles” is defined in Section 2.4(a).

“Accounting Referee” means PricewaterhouseCoopers LLP, or such other nationally recognized independent accounting firm or consulting firm mutually acceptable to both Purchaser and Seller.

“Acquired Company” is defined in the recitals.

“Action” means any action, claim, audit, suit, investigation, litigation, proceeding (including any civil, criminal, administrative or appellate proceeding), arbitral action or criminal prosecution.

“Adjusted Cash Purchase Price” is defined in Section 2.4(b).

“Adjusted Purchase Price” is defined in Section 2.2(b).

“Affiliate” means, with respect to any Person, any other Person that directly or indirectly controls, is controlled by or is under common control with such Person, with control in such context meaning the ability, directly or indirectly, to direct the management or policies of a Person through ownership of voting shares or other securities, pursuant to a Contract, or otherwise; provided, however, each member of the Company Group shall be deemed to be Affiliates of Seller for all periods prior to the Closing, each member of the Company Group shall be deemed to be controlled Affiliates of Purchaser for all periods after the Closing (for so long as the Purchaser, Parent or any of their Affiliates control such member) and Affiliates of Parent and Purchaser shall only include Parent and its controlled Affiliates (other than in the case of the first sentence of Section 8.5(e)(i) and Section 8.7).

2

“Agreement” is defined in the introductory paragraph hereof.

“Allocated Value” means, with respect to each Oil and Gas Property, the portion of the Unadjusted Purchase Price allocated on Exhibit G as to each such Oil and Gas Property, as such amount shall be increased or decreased by the portion of each adjustment to the Unadjusted Purchase Price under Section 2.3.

“Assets” means, other than the Excluded Assets, all of the Company Group’s collective right, title, and interest in and to the following:

(a) all Hydrocarbon leases described on Exhibit A-1, subject to any depth limitations set forth on Exhibit A-1, including all operating rights, record title interests, leasehold or working interests, carried interests, and Royalties, whether such right, title, and interest are legal or equitable, vested or contingent (collectively, the “Leases”);

(b) all pooled, communitized, unitized or joint development acreage or rights, including those described on Exhibit A-2 (the “Units”), and all tenements, hereditaments, and appurtenances arising out of or derived from the Leases and the Units (collectively, the “Lands”);

(c) any and all Hydrocarbon xxxxx, including those described on Exhibit A-3 (the “Xxxxx” and together with the Leases, the Units and the Lands the “Oil and Gas Properties”), in each case whether producing, non-producing, permanently or temporarily Decommissioned;

(d) all surface fee interests, easements, right-of-use and easements, licenses, permits, servitudes, rights-of-way, surface and/or subsurface leases and other rights to use the surface or seabed appurtenant to, used or held primarily for use in connection with, the ownership and operation of the Assets, including the operated rights of way and the operated right-of-use and easements described on Exhibit A-4 (the “Rights of Way”);

(e) all Contracts, including joint operating agreements;

(f) all Hydrocarbons in, on, under or that may be produced from or attributable to the Leases, Units or Xxxxx on or after the Effective Time, including all gas, oil, condensate and scrubber liquids inventories and butane, propane, iso-butane, nor-butane and gasoline inventories of Seller from the Oil and Gas Properties in storage or constituting linefill as of the Effective Time, and all Imbalances as of the Effective Time; and

(g) all other assets and properties of every kind, nature, character and description (whether real, personal or mixed, whether tangible or intangible and wherever situated), including the goodwill related thereto, Securities and Cash and Cash Equivalents.

“Assignment” is defined in Section 10.2(b).

“Audited Financial Statements” is defined in Section 5.6(a).

“Balance Sheet Date” is defined in Section 5.6(b).

3

“Barrel” means 42 United States standard gallons of 231 cubic inches per gallon at 60 degrees Fahrenheit.

“Benefit Deadline” shall have the same meaning as the Defect Deadline.

“BOEM” means the U.S. Bureau of Ocean Energy Management, as a partial successor agency to the Bureau of Ocean Energy Management, Regulation and Enforcement and the Minerals Management Service, or any subsequent successor agency thereto.

“BSEE” means U.S. Bureau of Safety and Environmental Enforcement, as a partial successor agency to the Bureau of Ocean Energy Management, Regulation and Enforcement and the Minerals Management Service, or any subsequent successor agency thereto.

“BTU” means a British Thermal Unit, which is the amount of energy required to raise the temperature of one pound avoirdupois of water from 59 degrees Fahrenheit to 60 degrees Fahrenheit at a constant pressure of 14.73 pounds per square inch absolute.

“Burdensome Condition” means any undertakings, divestitures, terms, conditions, liabilities, obligations, commitments, sanctions or other measures (including any Regulatory Remedial Action or CFIUS Remedial Action) that would reasonably be expected to be, individually or in the aggregate, material to the condition, assets, liabilities, businesses or results of operations of Parent and its Subsidiaries, taken as a whole (after giving effect to the transactions contemplated by this Agreement) treating Parent and its Subsidiaries as if it were a company that is the same size and scale of the Company Group, taken as a whole.

“Business” means the business of the Company Group and the ownership and operation by the Company Group of the Assets and other activities conducted by the Company Group that are incidental thereto.

“Business Day” means any day other than a Saturday, a Sunday or a day on which banks are closed for business in Houston, Texas or New York, New York.

“Cash and Cash Equivalents” means money, currency or a credit balance in a deposit account at a financial institution, net of checks outstanding as of the time of determination, marketable direct obligations issued or unconditionally guaranteed by the United States Government or issued by any agency thereof and backed by the full faith and credit of the United States, marketable direct obligations issued by any state of the United States of America or any political subdivision of any such state or any public instrumentality thereof, commercial paper issued by any bank or any bank holding company owning any bank, and certificates of deposit or bankers’ acceptances issued by any commercial bank organized under the applicable Laws of the United States of America, in each case, only to the extent constituting cash equivalents in accordance with GAAP; provided that, Cash and Cash Equivalents shall be calculated net of 1) restricted balances that are not freely usable, distributable or transferable (including security deposits, bond guarantees, collateral reserve accounts and amounts held in escrow or held by the Company Group on behalf of third parties), other than any Liens arising under the Credit Documents, 1) outstanding

4

outbound checks, draws, ACH debits and wire transfers and 1) the restricted balances under the agreements set forth on Schedule 1.1(f).

“Cash Purchase Price” is defined in Section 2.2(a)(i).

“CERCLA” means the Comprehensive Environmental Response, Compensation and Liability Act, 42 U.S.C. § 9601 et seq.

“CFIUS” is defined in Section 8.5(e)(i).

“CFIUS Approval” defined in Section 8.5(e)(v).

“CFIUS Notice” defined in Section 8.5(e)(i).

“CFIUS Remedial Action” defined in Section 8.5(e)(i).

“Claim Notice” is defined in Section 13.5(b).

“Closing” is defined in Section 10.1.

“Closing Date” is defined in Section 10.1.

“Closing Distribution” means a distribution to be made by the Company Group at the Closing to Seller in an amount equal to all of the Cash and Cash Equivalents of the Company Group as of the close of business two Business Days prior to the Closing Date; provided, however, in no event shall the Closing Distribution be less than zero.

“Closing Payment” means the amount of cash consideration payable by Purchaser to Seller at the Closing, which shall be an amount equal to the estimate of the Adjusted Cash Purchase Price determined in accordance with Section 2.4(a).

“Code” means the United States Internal Revenue Code of 1986.

“Commission” is defined in Section 6.12(a).

“Company Group” means the Drum Entities and any of their respective Subsidiaries (after giving effect to the Restructuring).

“Company Group Indemnified Parties” is defined in Section 8.17(a).

“Company Intellectual Property” is defined in Section 5.22(b).

“Company Material Adverse Effect” means any fact, effect, development, occurrence, event, change, or circumstance that has had, or is reasonably expected to have, a material adverse effect on the business, results of operations or condition (financial or otherwise) of the Company Group, taken as a whole, or Seller’s or any Drum Entity’s ability to consummate the transactions contemplated hereby or otherwise perform their respective obligations under this Agreement or any other Transaction Documents; provided, however, that for purposes of clause (a), the following

5

shall not be considered in determining whether a Company Material Adverse Effect has occurred or would be reasonably expected to occur: general changes in Hydrocarbon prices; changes in condition or developments generally applicable to the oil and gas industry in the United States or any area or areas where the Assets are located, including any increase in operating costs or capital expenses or any reduction in drilling activity or production; general economic, financial, credit, or political conditions and general changes in markets, including changes generally in supply, demand, price levels or interest or exchange rates; civil unrest or similar disorder, terrorist acts, embargo, sanctions or interruption of trade, or any outbreak, escalation or worsening of hostilities or war, act of God, hurricane, tornado, meteorological event, storm, weather event, earthquake, landslide or other act of nature; changes in Laws, GAAP or XXXXX or the interpretation thereof; any effect resulting from any action taken by Purchaser or any Affiliate of Purchaser; any effect resulting from any action taken by Seller or any Affiliate of Seller (including the Company Group) that is expressly required hereunder; natural declines in well performance; any failure to meet any projections, budgets, forecasts, estimates, plans predictions, performance metrics or operating statistics or the inputs into such items (provided that this clause (ix) shall not prevent an assertion that any fact, effect, development, occurrence, event, change or circumstance that may have contributed to such failure constitutes or contributed to a Company Material Adverse Effect); or any effects or changes resulting from entering into this Agreement or the announcement of the transactions contemplated hereby (it being understood that this clause (x) shall not apply to a breach of any representation or warranty related to the entering into or announcement or consummation of the transactions contemplated by this Agreement or the other Transaction Documents) except to the extent and then only to the extent any of the events, changes or circumstances referred to in clauses (i) through (v) above disproportionately affect the Company Group as compared to other participants in the industries and areas in which the Company Group operates.

“Company Plan” means any “employee benefit plan” as defined in Section 3(3) of ERISA, compensation, employment, consulting, severance, termination protection, change in control, transaction bonus, retention or similar plan, agreement or arrangement or other plan, agreement, arrangement, program or policy providing for compensation, bonuses, profit-sharing, equity or equity-based compensation or other forms of incentive or deferred compensation, vacation benefits, insurance (including any self-insured arrangement), medical, dental, vision, prescription or fringe benefits, life insurance, relocation or expatriate benefits, disability or sick leave benefits, employee assistance program, supplemental unemployment benefits or post-employment or retirement benefits (including compensation, pension, health, medical or insurance benefits), in each case, whether or not written, (1) that is sponsored, maintained, administered, contributed to or entered into by any member of the Company Group for the current or future benefit of any current or former Service Provider or (1) for which any member of the Company Group, directly or indirectly, has or would reasonably be expected to have any actual or contingent Liability.

“Confidentiality Agreement” means that certain Confidentiality Agreement dated as of February 5, 2018 among Parent, Kosmos Energy Mauritania, Kosmos Energy Investments Senegal Limited, Kosmos Energy Equatorial Guinea, Kosmos Energy Sao Tome and Principe, Kosmos Energy Cote DʼIvoire, and Kosmos Energy Suriname and Deep Gulf Energy Management LLC, Deep Gulf Energy LP, DGE II Management, LLC, Deep Gulf Energy II, LLC, DGE III Management, LLC and Deep Gulf Energy III, LLC.

6

“Consent” means any consent, approval, authorization, ratification, permission, waiver or permit of, or filing with, or notification to, any Governmental Authorities or any other Person which are required to be obtained, made, or complied with for or in connection with the sale, assignment and transfer of the Subject Securities and the other transactions contemplated by this Agreement and the other Transaction Documents.

“Continuing Employee” is defined in Section 8.12(a).

“Contract Legend” means the following restrictive legend to be placed on the Parent Common Equity constituting the Holdback Amount:

THIS SECURITY IS ALSO SUBJECT TO ADDITIONAL RESTRICTIONS ON TRANSFER AS SET FORTH IN THE SECURITIES PURCHASE AGREEMENT DATED AS OF AUGUST 3, 2018, AS AMENDED FROM TIME TO TIME, BY AND AMONG DGE GROUP SERIES HOLDCO, LLC AND EACH OF ITS SERIES, KOSMOS ENERGY GULF OF MEXICO, LLC, AND THE OTHER PARTIES THERETO, AND THIS SECURITY MAY NOT BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED EXCEPT IN COMPLIANCE THEREWITH.

“Contracts” means any contracts, agreements, licenses, sublicenses, subcontracts, commitments, sale or purchase orders, indentures, notes, bonds, loans, mortgages, deeds of trust, instruments, operating agreements, unitization, pooling, and communitization agreements, joint development agreements, exploration agreements, participation agreements, declarations and orders, area of mutual interest agreements, joint venture agreements, farmin and farmout agreements, exchange agreements, purchase and sale agreements, and similar agreements to those referenced above and all other arrangements or undertakings of any nature, whether written or oral, including any exhibits, annexes, appendices or attachments thereto, and any amendments, modifications, supplements, extensions or renewals thereof; provided, however, without limiting the instruments included in the Assets, the defined term “Contracts” shall not include the Leases, Rights of Way or other instruments, of record, constituting any member of the Company Group’s chain of title to the Oil and Gas Properties.

“XXXXX” means, with respect to any operations conducted under an applicable operating agreement, the accounting procedures attached and governing such operating agreement and, with respect to any operations that are not conducted under an applicable operating agreement, the XXXXX 2005 Deepwater Accounting Procedure recommended by the Council of Petroleum Accountants Societies.

“Credit Document Indebtedness” means the Indebtedness of the Company Group incurred and outstanding pursuant to the Credit Documents.

“Credit Documents” means that certain Second Amended and Restated Credit Agreement, dated as of May 14, 2015, by and among Drum II, as borrower, Drum II Management, as guarantor, Xxxxx Fargo Energy Capital, Inc., as administrative agent and a lender, and the other lenders party thereto and that certain Credit Agreement, dated as of December 15, 2016, by and among Drum

7

III, as borrower, Xxxxx Fargo Energy Capital, Inc., as administrative agent and a lender, and Macquarie Bank Limited, as a lender.

“Current Price” means the closing price per share of Parent Common Equity as reported by Bloomberg L.P., or any successor thereto, on the trading day immediately prior to the applicable release instructions or recovery date, as applicable.

“Cut-Off Date” means the date of the final settlement and determination of the Adjusted Purchase Price in accordance with Section 2.5(c).

“D&O Insurance” means a prepaid run-off or “tail” directors’ and officers’ liability insurance and indemnification policy or policies.

“Damages” means the amount of any and all loss, cost, costs of settlement, damage, fine, penalty, obligation, diminution in value, expense, claim, award or judgment, whether attributable to personal injury or death, property damage, contract claims, torts or otherwise, including reasonable fees and expenses of attorneys, consultants, accountants or other agents and experts reasonably incident to the applicable matter and the costs of investigation or monitoring of such matters, and the costs of enforcement of the indemnity; provided, however, that “Damages” shall not include any Income Taxes of the indemnified party that may be assessed on receipt of payments under Article 13 or any loss, cost, costs of settlement, damage, fine, penalty, obligation, diminution in value, expense, claim, award or judgment excluded and/or waived pursuant to Section 14.13.

“Decommissioning,” and “Decommissioned” and its derivatives mean all plugging, replugging, abandonment and re-abandonment, equipment removal, disposal, or restoration associated with the properties and assets included in or burdened by the Assets, including all plugging and abandonment, dismantling, decommissioning, removal (or abandonment in place, if applicable), surface and subsurface restoration, site clearance and disposal of the Xxxxx, well cellars, fixtures, platforms, spars, flowlines, pipelines, tie-backs, risers, structures, and personal property located on, under or associated with assets and properties included in the Assets and the lands burdened thereby, the removal (or abandonment in place, if applicable) and capping of all associated flowlines, risers, connections, tie-backs, transmission, and gathering lines, pit closures, the restoration of the surface or seabed, dry-stacking, site clearance, any disposal of related waste materials, excluding NORM and asbestos, and obligations to obtain plugging exceptions for any Well with a current plugging exception, all in accordance with all applicable Laws and the requirements of Governmental Authorities, the terms and conditions of the Leases, Rights of Way and Contracts.

“Defect” means any individual Lien, obligation, burden, or defect, including a discrepancy in Net Revenue Interest or Working Interest, that results in the failure of the Company Group, in the aggregate, to have Defensible Title to any individual Lease, Unit or Well; provided, however, in no event shall any of the following be considered or constitute a “Defect”: any Lien, obligation, burden, or defect arising solely out of lack of survey or lack of metes and bounds descriptions, unless a survey is expressly required by applicable Law; any Lien, obligation, burden, or defect arising solely out of lack of corporate or entity authorization, unless affirmative evidence shows that such corporate or entity action was not authorized and results in another party’s actual and superior claim of title to the Assets; any gap in the chain of title or presence of any stranger(s) to

8

title, unless affirmative evidence shows that another party has an actual and superior chain of title by an abstract of title, title or letter opinion, or xxxxxxx’x title chain or runsheet; any Lien, obligation, burden, or defect that is cured, released, or waived by any Law of limitation or prescription, including adverse possession and the doctrine of laches; any Lien, obligation, burden, or defect arising from any change in applicable Law after the Execution Date, including changes that would raise the minimum royalty; any Lien, obligation, burden, defect, or loss of title resulting from the Company Group’s conduct of business in compliance with this Agreement and applicable Law; and/or any Lien, obligation, burden, or defect that Purchaser has not asserted in a valid Defect Notice prior to the Defect Deadline.

“Defect Amount” is defined in Section 3.2(d).

“Defect Deadline” is defined in Section 3.2(a).

“Defect Notice” is defined in Section 3.2(a).

“Defect Referee” means a title attorney with at least 15 years’ experience in oil and gas titles involving properties in the Gulf of Mexico mutually acceptable to both Purchaser and Seller; provided that, Purchaser and Seller shall first attempt to select such Defect Referee from Liskow & Xxxxx, APLC.

“Defect Threshold” means an amount equal to 2% of the Unadjusted Purchase Price.

“Defensible Title” means that aggregate record and/or beneficial title of the Company Group in and to the Leases, Units and Xxxxx that, as of the Closing and subject to the Permitted Encumbrances:

(a) individually or in the aggregate entitles all or any member of the Company Group to receive a Net Revenue Interest as to Hydrocarbons in the case of any Lease (or portion thereof) listed on Exhibit A-1 that has a positive Allocated Value, not less than the Net Revenue Interest shown for such Lease (or portion thereof) in Exhibit A-1, in the case of any Unit listed on Exhibit A-2 that has a positive Allocated Value, not less than the Net Revenue Interest percentage shown for such Unit in Exhibit A-2, in the case of any Well that has a positive Allocated Value, not less than the Net Revenue Interest percentage shown for such Well in Exhibit A-3, except, in each case of subsections (i), (ii) and (iii) of this subsection (a), any decreases in connection with those operations in which any member of the Company Group may elect after the Execution Date to be a non-consenting co-owner, any decreases resulting from the establishment or amendment of pools or units after the Execution Date, any decreases required to allow other Working Interest owners to make up Imbalances, or as otherwise stated in Exhibit X-0, Xxxxxxx X-0 or Exhibit A-3;

(b) individually or in the aggregate obligates all or any member of the Company Group to bear a Working Interest no greater than the Working Interest shown for any Oil and Gas Property in Exhibit X-0, Xxxxxxx X-0 or Exhibit A-3, except as stated in Exhibit X-0, Xxxxxxx X-0 or Exhibit A-3, any increases resulting from contribution requirements with respect to a co-owner’s default occurring on or after the Execution Date under applicable Contracts or applicable Law, or any

9

increases that are accompanied by at least a proportionate increase in any member of the Company Group’s Net Revenue Interest; and

(c) is free and clear of Liens, other than the Permitted Encumbrances.

“Direct Claim” is defined in Section 13.5(i).

“Disclosure Schedules” means, with respect to Seller, the aggregate of all schedules that set forth exceptions, disclosures, or otherwise relate to or are referenced in any of the representations, warranties or agreements of Seller set forth in Article 4, Article 5 or Article 8 and with respect to Purchaser, the aggregate of all schedules that set forth exceptions, disclosures, or otherwise relate to or are referenced in any of the representations or warranties of Purchaser set forth in Article 6.

“Dispute” is defined in Section 14.4(a).

“Dispute Settlement Statement” is defined in Section 2.5(c).

“Disqualified Individual” is defined in Section 8.21(a).

“Dividend Adjustment” means a number of shares of Parent Common Equity (rounded up to the nearest whole share) equal to (a) the aggregate amount of dividends or distributions declared by Parent with respect to the shares of Parent Common Equity being released to Parent from the Holdback Amount (solely to the extent that the record date with respect to such dividend or distribution occurs prior to the release of such shares) divided by (b) the Current Price applicable to the applicable release.

“DOJ” is defined in Section 8.5(c).

“DPA” means the Defense Production Act of 1950, 50 U.S.C. 4565.

“Drum Entities” is defined in the introductory paragraph hereof.

“Drum I” is defined in the introductory paragraph hereof.

“Drum I Management” is defined in the introductory paragraph hereof.

“Drum I Subject Securities” is defined in the recitals.

“Drum II” is defined in the introductory paragraph hereof.

“Drum II Management” is defined in the introductory paragraph hereof.

“Drum II Subject Securities” is defined in the recitals.

“Drum III” is defined in the introductory paragraph hereof.

“Drum III Management” is defined in the introductory paragraph hereof.

10

“Drum III Subject Securities” is defined in the recitals.

“Drum Marks” is defined in Section 8.10(b).

“DTPA” is defined in Section 14.14.

“Effective Time” means 12:01 a.m. Central Standard Time on July 1, 2018.

“Effective Time Working Capital” means, as of the Effective Time, the positive or negative amount of the Working Capital Assets minus the Working Capital Liabilities.

“End Date” is defined in Section 12.1(d)(i).

“Environmental Claim” means any Action, claim, Order, directive, decree, proceeding, loss, cost, expense, liability, obligation, penalty or damage arising, incurred or otherwise asserted pursuant to any Environmental Law.

“Environmental Laws” means any and all Laws pertaining to prevention of pollution, protection of the environment (including natural resources, flora, fauna, threatened or endangered species or biological resources), Remediation of contamination or environmental restoration, health and safety (for purposes of Section 5.16 only, to the extent relating to exposure to Hazardous Substances), and all Orders, regulations or directives issued by a Governmental Authority to implement any of the foregoing.

“Environmental Liabilities” means any and all obligations or liabilities, including all Damages, Remediation obligations, environmental response costs, costs to cure, cost to investigate or monitor, restoration costs, costs of Remediation or removal, settlements, penalties and fines, in each case arising out of or related to any Environmental Laws or Releases of Hazardous Substances, including any contribution obligation under CERCLA or any other Environmental Law or matters incurred or imposed pursuant to any claim or cause of action by a Governmental Authority or other Person.

“Environmental Permit” means any Permit, registration, approval or other similar form of authorization required pursuant to Environmental Laws.

“Equity Excess Amount” is defined in Section 2.2(a)(ii).

“Equity Purchase Price” is defined in Section 2.2(a)(ii).

“ERISA” means the Employee Retirement Income Security Act of 1974.

“Excess Parachute Payments” is defined in Section 8.21(a)(i).

“Excess Parachute Waiver” is defined in Section 8.21(a)(i).

“Exchange Act” means the Securities and Exchange Act of 1934.

11

“Excluded Arrangements” is defined in Section 8.16(b).

“Excluded Assets” means the Subject Marks, the Excluded Records and the Seismic Licenses elected by Seller to be assigned to Seller or its designee in accordance with Section 8.11(c).

“Excluded Records” means any and all data, correspondence, materials, descriptions and records relating to the auction, marketing, sales negotiation or sale of the Subject Securities or the Assets, including the existence or identities of any prospective inquirers, bidders or prospective purchasers of any of the Assets, any bids received from and records of negotiations with any such prospective purchasers and any analyses of such bids by any Person, corporate, financial, Tax, and legal data and Records that relate exclusively to the businesses of any Affiliate of Seller other than the Business or the Company Group and all legal records and legal files of the Company Group generated prior to Closing with respect to or that relate to this Agreement, any Transaction Document or any of their communications with respect to the transactions contemplated thereby or hereby, including all work product of and attorney-client communications with any of Seller’s or the Company Group’s legal counsel with respect thereto (other than title opinions and any Contracts).

“Execution Date” is defined in the introductory paragraph hereof.

“Federal Ownership Qualifications” means any and all qualifications with BOEM, BSEE and/or any other applicable Governmental Authorities to directly and/or indirectly own the Securities of the Company Group and operate the Assets, including any qualifications required under 30 CFR 550 and 30 CFR 556.35.

“Final Settlement Statement” is defined in Section 2.5(c).

“Financial Statements” is defined in Section 5.6(b).

“First Holdback Deadline” means the date that is six months after the Closing Date.

“Fraud” means, with respect to any Person, any actual and intentional fraud of such Person with respect to the representations and warranties set forth in Article 4, Article 5 or Article 6, as applicable; provided, that (i) solely with respect to claims of Fraud against Seller, such actual and intentional fraud of Seller shall only be deemed to exist if any of the individuals identified in the definition of “Knowledge” with respect to Seller had actual knowledge (as opposed to imputed or constructive knowledge) that the representations and warranties made by Seller in Article 4 or 5 were actually breached when made, with the express intention that Purchaser rely thereon and (ii) solely with respect to claims of Fraud against Purchaser, such actual and intentional fraud of Purchaser shall only be deemed to exist if any of the individuals identified in the definition of “Knowledge” with respect to Purchaser had actual knowledge (as opposed to imputed or constructive knowledge) that the representations and warranties made by Purchaser in Article 6 were actually breached when made, with the express intention that Seller rely thereon.

“FTC” is defined in Section 8.5(c).

“GAAP” means generally accepted accounting principles in the U.S.

12

“Governing Documents” means with respect to any Person that is not a natural person, the articles of incorporation or organization, memorandum of association, articles of association and by-laws, certificate of formation, the limited partnership agreement, the partnership agreement or the limited liability company agreement or such other organizational documents of such Person which establish the legal personality of such Person.

“Governmental Authority” means any governmental or quasigovernmental, regulatory or administrative authority, commission, department, official, court, tribunal, agency, or other instrumentality of the United States, any foreign country or any local, domestic or foreign state, county, city, tribal, or other political subdivision or authority exercising or entitled to exercise any administrative, executive, judicial, legislative, regulatory, or taxing authority or power.

“Governmental Authorization” means any permit, license, franchise, certificate, registration, approval, consent, grant, award, concession, identification number, registration, order, decree or other authorization required by Law or any Governmental Authority or granted by any Governmental Authority.

“Hazardous Substances” means any chemical, pollutant, solid waste, contaminant, substance or waste defined, listed, regulated or classified as “solid waste”, “hazardous waste”, “hazardous substance”, “extremely hazardous substance”, “hazardous material”, “toxic substance” or words of similar import under Environmental Laws, and including hazardous substances under CERCLA.

“Hedge” means any future hedge, derivative, swap, collar, put, call, cap, option, or other contract that is intended to benefit from, relate to, or reduce or eliminate the risk of, fluctuations in interest rates, basis risk, or the price of commodities, including Hydrocarbons or securities, to which any member of the Company Group is bound.

“HEDV” means Houston Deepwater Ventures V, LLC, a Texas limited liability company.

“Holdback Amount” means a number of shares of Parent Common Equity (rounded up to the nearest whole share) equal to the quotient of 10% of the Unadjusted Purchase Price minus (a) the amount by which the Unadjusted Purchase Price is decreased pursuant to Section 2.3(h), plus (b) the amount by which the Unadjusted Purchase Price is increased pursuant to Section 2.3(i), and the Share Price, as such number of shares may be reduced from time to time by any disbursements required under Section 13.6.

“HSR Act” means the Xxxx-Xxxxx-Xxxxxx Antitrust Improvements Act of 1976.

“Hydrocarbons” means oil and gas and other hydrocarbons produced or processed in association therewith (whether or not such item is in liquid or gaseous form), or any combination thereof, and any minerals (whether in liquid or gaseous form) produced in association therewith, including all crude oil, gas, casinghead gas, condensate, natural gas liquids, and other gaseous or liquid hydrocarbons (including ethane, propane, iso-butane, nor-butane, gasoline, and scrubber liquids) of any type and chemical composition.

13

“Imbalance” means any over-production, under-production, over-delivery, under-delivery, or similar imbalance of Hydrocarbons produced from or allocated to the Assets, regardless of whether such over-production, under-production, over-delivery, under-delivery, or similar imbalance arises at the wellhead, pipeline, gathering system, transportation system, processing plant, or other location, including any imbalances under gas balancing or similar agreements, imbalances under processing agreements, and imbalances under gathering or transportation agreements.

“Income Taxes” means all Taxes based upon, measured by, or calculated with respect to gross or net income, gross or net receipts or profits (including franchise Taxes and any capital gains, alternative minimum, and net worth Taxes, but excluding ad valorem, property, excise, severance, production, sales, use, real or personal property transfer or other similar Taxes), Taxes based upon, measured by, or calculated with respect to multiple bases (including corporate franchise, doing business or occupation Taxes) if one or more of the bases upon which such Tax may be based, measured by, or calculated with respect to is included in clause (i) above, or withholding Taxes measured with reference to or as a substitute for any Tax included in clauses (i) or (ii) above.

“Indebtedness” means, with respect to any Person, at any date, in each case without duplication, all obligations of such Person for borrowed money, including all principal, interest, premiums, fees, expenses, overdrafts and, penalties (including prepayment penalties) with respect thereto (including with respect to a change in control and/or the transactions contemplated hereby), whether short-term or long-term, and whether secured or unsecured, or with respect to deposits or advances of any kind, all obligations of such Person evidenced by bonds, debentures, notes or other similar instruments or debt securities (including purchase money obligations, but excluding, for the avoidance of doubt, the bonding or surety obligations of any member of the Company Group required by applicable Law or securing Decommissioning obligations), all obligations of such Person to reimburse any bank or other Person in respect of amounts paid under a letter of credit or bankers’ acceptances or similar instruments, all obligations of such Person under conditional sale or other title retention agreements relating to property or assets purchased by such Person, deferred purchase price of property, assets, businesses, goods or services, including all seller notes and “earn-out” and purchase price adjustment payments, capitalized lease obligations or obligations that are required to be capitalized pursuant to GAAP, any underfunded post-retirement liabilities and any underfunded pension liabilities (in each case, including the employer portion of any payroll, employment or similar Taxes related thereto), all guarantees, whether direct or indirect, by such Person of Indebtedness (other than under this clause (h)) of others or Indebtedness (other than under this clause (h)) of any other Person secured by any assets of such Person, and all other obligations of a Person which would be required to be shown as indebtedness on a balance sheet of such Person prepared in accordance with the Accounting Principles; provided, however, “Indebtedness” shall not include the items set forth on Schedule 1.1(f).

“Indebtedness For Borrowed Money” means Indebtedness of the type referred to in clauses (a) and (b) of the definition of Indebtedness.

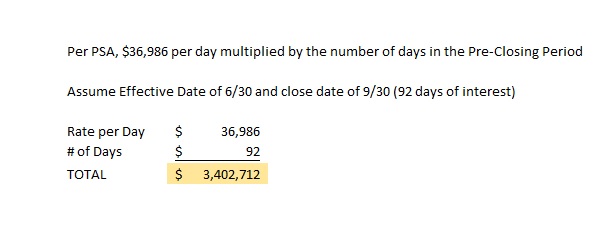

“Indebtedness Interest Amount” means an amount equal to $36,986 multiplied by the number of days in the Pre-Closing Period.

14

“Indemnified Person” is defined in Section 13.5(a).

“Indemnifying Party” is defined in Section 13.5(a).

“Individual Threshold” means an amount equal to $250,000.00.

“Intellectual Property Rights” means any and all intellectual property rights in any jurisdiction throughout the world, including the following to the extent subject to protection under applicable Law: Trademark Rights; statutory invention registrations, patents and patent applications (together with any and all renewals, divisionals, continuations, continuations-in-part, reissues, reexaminations, revisions, and extensions thereof) and all inventions disclosed in each such registration, patent or patent application; copyrights (whether or not registered), works of authorship, mask work rights and any and all renewals, extensions, reversions, restorations, derivative works and moral rights in connection with the foregoing, now or hereafter provided by applicable Law, regardless of the medium of fixation or means of expression; internet domain names; trade secrets, know-how and other proprietary and confidential information, including manufacturing and production processes and research and development information, technical data, algorithms, formulae, procedures, protocols, techniques and business information (including financial and marketing plans, customer and supplier lists and pricing and cost information); and any registrations or applications for registration for any of the foregoing.

“Intercompany Account Balances” means the balances of all intercompany accounts between Seller and each of its Affiliates (other than any member of the Company Group), on the one hand, and any member of the Company Group, on the other hand.

“Involuntary Termination” is defined in Section 8.12(d).

“IT Assets” means computers, software, firmware, middleware, servers, workstations, routers, hubs, switches, data communications lines and all other information technology equipment, including all documentation related to the foregoing, owned by any member of the Company Group or licensed or leased to any member of the Company Group.

“Jumper” is defined in Section 8.22(b)(i).

“Knowledge” means, with respect to Seller, the actual knowledge, after reasonable inquiry of direct reports, of only those Persons named on Schedule 1.1(a) and with respect to Purchaser, the actual knowledge, after reasonable inquiry of direct reports, of only those Persons named on Schedule 1.1(b).

“Lands” is defined in subsection (b) of the definition of “Assets”.

“Laws” means all laws (statutory, common or otherwise), constitutions, treaties, binding guidance or binding guidelines, statutes, rules, regulations, ordinances, orders, decrees, judgments, codes and other requirements of Governmental Authorities.

“Leakage” means any of the following arising after the Effective Time and on or prior to the Closing (including as a result of Section 8.16), in each case, excluding any Permitted Leakage:

15

(a) any dividend, interest on capital, advance or distribution (whether in cash or in kind) declared, paid or made, or any return of capital (whether by reduction of capital or redemption, amortization or purchase of shares or quotas) or other payment made on any share capital or other securities of any member of the Company Group, by any member of the Company Group to or on behalf of or for the benefit of, any Related Party, including the Closing Distribution;

(b) any Lien created over any of the Assets in favor of or for the benefit of any Related Party (but only to the extent such Lien will not be fully released prior to the Closing);

(c) any amount paid or incurred by, or any loan, advance or capital contribution made by, any member of the Company Group to any Related Party (including any premiums, make-whole premiums, prepayment penalties, breakage costs, fees, expenses or similar charges arising therefrom), including payments made pursuant to Section 8.16;

(d) any sale, transfer or surrender by any member of the Company Group of any asset or right to or for the benefit of any Related Party;

(e) any sale, transfer or surrender of any assets or rights from any Related Party to any member of the Company Group to the extent such sale, transfer or surrender of assets or rights is in excess of their fair market value;

(f) any Liabilities assumed, indemnified, guaranteed, incurred or paid by any member of the Company Group for the benefit of or on behalf of any Related Party (including, without limitation, any Tax or other liability for which any Related Party is responsible under this Agreement);

(g) any waiver, forgiveness or release by any member of the Company Group of any amount owed to it by (or any right or any claim against) any Related Party; and

(h) any agreement or arrangement entered into by any member of the Company Group to give effect to any matter referred to in (a) – (g) above. For purpose of calculating Leakage with respect to any non-cash dividend, payment or other distribution, Leakage shall be determined based on the fair market value thereof, determined at the time of such dividend, payment or distribution.

“Leases” is defined in subsection (a) of the definition of “Assets”.

“Liability” means any debt, liability, obligation or commitment of any kind or nature, whether known or unknown, asserted or unasserted, absolute or contingent, accrued or unaccrued, disclosed or undisclosed, liquidated or unliquidated, due or to become due, or determined, determinable or otherwise.

“Lien” means any lien, mortgage, hypothecation, charge, right of first refusal, option, rights of way, easement, restriction on transfer of title, encumbrance, pledge, collateral assignment, or security interest of any kind (including any agreement to give any of the foregoing, any conditional sale, capital lease or other title retention agreement), or any similar rights or interests, and any option, trust, or other preferential arrangement having the practical effect of any of the foregoing.

16

“Lock Up Legend” means the following restrictive legend to be placed on the Parent Common Equity:

THIS SECURITY IS ALSO SUBJECT TO ADDITIONAL RESTRICTIONS ON TRANSFER AS SET FORTH IN THE REGISTRATION RIGHTS AGREEMENT DATED AS OF _____________, 2018, AS AMENDED FROM TIME TO TIME, BY AND BETWEEN KOSMOS ENERGY LTD. AND THE HOLDERS PARTY THERETO, AND THIS SECURITY MAY NOT BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED EXCEPT IN COMPLIANCE THEREWITH.

“Material Contract” means, to the extent binding on the Company Group, the Assets or Purchaser’s ownership thereof after Closing, any Contract that is one or more of the following types:

(a) Contracts or group of related Contracts (including for the sale, license, lease or other disposition of materials, supplies, goods, services, equipment or other assets) that can reasonably be expected (based on current Company Group business plans) to result in gross revenue to Company Group per fiscal year in excess of $3,000,000, excluding Contracts for the sale, purchase, exchange, or other disposition of Hydrocarbons produced from the Leases, Units or Xxxxx;

(b) Contracts or group of related Contracts (including for the purchase or lease of materials, suppliers, goods, services, equipment or other assets) that can reasonably be expected (based on current Company Group business plans) to result in expenditures from Company Group per fiscal year in excess of $3,000,000, excluding 1) Contracts for the sale, purchase, exchange, or other disposition of Hydrocarbons produced from the Leases, Units or Xxxxx, 1) master service agreements not reasonably expected (based on current Company Group business plans or 1) Contracts relating to Transaction Costs) to result in expenditures from the Company Group in the current fiscal year in excess of $3,000,000;

(c) Contracts for the sale, purchase, exchange, or other disposition of Hydrocarbons produced from the Leases, Units or Xxxxx;

(d) to the extent currently pending, Contracts of any Company Group to sell, lease, farmout, exchange, or otherwise dispose of all or any part of the Oil and Gas Properties (other than Contracts that provide for sales, leases, farmouts, exchanges or dispositions permitted to be made after the date hereof pursuant to Section 8.3(b) and any right of reassignment upon intent to abandon any Assets);

(e) Contracts that contain drilling commitments;

(f) any Seismic License;

(g) Contracts that are joint operating agreements, unit operating agreements, unit agreements, exploration agreements, development agreements, participation agreements, or other similar agreements, including Contracts that relate to the formation of or participation in same;

(h) Contracts that contain an area of mutual interest provision or otherwise purport to limit or purport to prohibit the freedom of the Company Group (or, after the Closing that purports

17

to so limit or restrict Purchaser or any of its Affiliates) to, or the manner in which, or the locations in which, the Company Group may conduct the Business or engage or compete in any activity or line of business in any area (provided that a Contract shall not constitute a Material Contract pursuant to clause (h) solely because such Contract is a surface use agreement or similar Contract containing customary setback provisions or solely because such Contract is a confidentiality agreement or similar Contract containing customary confidentiality provisions);

(i) any Contract with any sole-source suppliers of material products or services or that includes any “most favored nations” terms and conditions, any exclusive dealing or minimum purchase or sale or “take or pay” obligations or arrangement or requirements to purchase substantially all of the output or production of a particular supplier;

(j) any Contract with any current Service Provider that requires aggregate annual payments equal to or exceeding $100,000, excluding employment or service Contracts that may be terminated on less than 30 days’ prior notice by any member of the Company Group or any of their respective Affiliates and without Liability to any member of the Company Group or any of their respective Affiliates, and Contracts with any current or former Service Provider providing for any severance, change in control, transaction, sale or retention bonus or similar payments or benefits;

(k) any collective bargaining agreement or similar Contract with any labor union or similar employee representative with respect to any current or former Service Providers;

(l) any Hedge;

(m) each Contract evidencing Indebtedness for borrowed money binding on the Company Group or the Assets;

(n) any Contract for the gathering, treatment, handling, processing, storage or transportation of Hydrocarbons guaranteed with minimum throughput requirements;

(o) any Contract for the purchase or sale by any member of the Company Group of any real property (other than Oil and Gas Properties) of more than $3,000,000;

(p) any Contract (including letters of intent but excluding confidentiality and non-disclosure agreements that do not contain any restrictions other than customary confidentiality and non-disclosure obligations) relating to the acquisition or disposition of any business or a material amount of stock or assets of any other Person (whether by merger, sale of stock, sale of assets or otherwise) pursuant to which any member of the Company Group has remaining obligations (other than customary confidentiality and non-disclosure obligations or customary covenants to provide reasonable access to books and records);

(q) any agency, dealer, distributor, reseller, sales representative or other similar Contract, or any Contract providing for commissions (other than any Contract with any investment bank relating to Transaction Costs);

18

(r) any stockholders, investors rights, registration rights or similar Contract (other than Governing Documents);

(s) any Contract granting any Person an option or a right of first refusal or first offer or similar preferential right to purchase or acquire any Securities or assets of the Company Group; and

(t) Contracts requiring the acquisition or use of any third party compressor equipment, drilling units, quarters or any third party service equipment arising out of or relating to the Assets with aggregate annual payments of greater than $3,000,000 which cannot be terminated by Seller without penalty on 60 days or less notice.

Notwithstanding the foregoing, a Contract shall not be deemed to be a Material Contract solely by virtue of the fact that a member of the Company Group owns any Securities of a Person that is not a member of the Company Group that is a party to such Contract.

“Mechanical Integrity Failure” is defined in Section 8.22(b)(ii).

“Mechanical Integrity Notice” is defined in Section 8.22(a).

“Mechanical Integrity Referee” is defined in Section 8.22(b)(iii).

“MMBtu” means 1,000,000 BTU.

“Net Revenue Interest” means, with respect to any Lease, Unit or Well, the percentage interest in and to all production of Hydrocarbons saved, produced and sold from or allocated to such Lease, Unit or Well, after giving effect to all Royalties.

“Non-Income Taxes” means any Taxes imposed on any member of the Company Group other than Income Taxes and Transfer Taxes.

“Non-Recourse Person” is defined in Section 14.16.

“NORM” means naturally occurring radioactive material and radon gas.

“Notice” is defined in Section 14.1.

“Oil and Gas Properties” is defined in subsection (c) of the definition of “Assets”.

“Order” means any order, award, decision, injunction, judgment, ruling, decree, writ, subpoena or verdict entered, issued, made or rendered by any Governmental Authority or arbitrator.

“Other Party” means as it relates to Seller, Purchaser, and as it relates to Purchaser, Seller.

“Other Severance Arrangement” is defined in Section 8.12(d).

“Parent” means Kosmos Energy Ltd.

19

“Parent Common Equity” means the common shares of Parent, par value $0.01 per share.

“Parent Equity Plan” means the Kosmos Energy Ltd. Long Term Incentive Plan (as amended from time to time).

“Parent Financial Statements” is defined in Section 6.12(a).

“Parent Guaranty” means the Guaranty of Parent dated the date hereof and issued to Seller.

“Parent SEC Documents” is defined in Section 6.12(a).

“Party” or “Parties” is defined in the introductory paragraph hereof.

“Permits” means all governmental (whether federal, state or local) permits, licenses, orders, authorizations, franchises and related instruments or rights (or waiver or exemptions in lieu thereof) related to the Business or the ownership, operation or use of the Oil and Gas Properties and Rights of Way.

“Permitted Encumbrances” means any or all of the following:

(a) all Royalties if the net cumulative effect of such burdens do not, individually or in the aggregate, reduce the Company Group’s aggregate Net Revenue Interest in any Lease, Unit or Well below that shown in Exhibit A for such Lease, Unit or Well;

(b) the terms of any Contract described on Schedule 5.14(a), Lease or Right of Way, including provisions for penalties, suspensions, or forfeitures contained therein, but only to the extent such Contracts, Leases or Rights of Way do not, individually or in the aggregate, reduce Company Group’s aggregate Net Revenue Interest in any Lease, Well or Unit below that shown in Exhibit A for such Lease, Well or Unit, or, individually or in the aggregate, obligate Company Group to bear a Working Interest in any Lease, Well or Unit above that shown in Exhibit A for such Lease, Well or Unit, unless the Net Revenue Interest for such Lease, Well or Unit is greater than the Net Revenue Interest set forth on Exhibit A in the same proportion as any increase in such Working Interest;

(c) rights of first refusal, preferential purchase rights, consents to assignment and similar rights with respect to the Assets or Consents;

(d) Liens created under joint operating agreements, Liens for Taxes, materialman’s Liens, warehouseman’s Liens, xxxxxxx’x Liens, carrier’s Liens, mechanic’s Liens, vendor’s Liens, repairman’s Liens, employee’s Liens, contractor’s, operator’s Liens, construction Liens, Liens pursuant to any applicable federal or state securities Law, and other similar Liens arising in the ordinary course of business that, in each case, secure amounts or obligations that are not yet delinquent (including any amounts being withheld as provided by Law), or, if delinquent, being contested in good faith by appropriate actions;

(e) rights of reassignment arising upon the expiration or final intention to abandon or release any of the Assets;

20

(f) any easement, right of way, right of use, covenant, servitude, permit, condition, restriction, and other rights included in or burdening the Assets for the purpose of surface or subsurface operations, pipelines, and other like purposes, or for the joint or common use of real estate, rights of way, facilities, and equipment, in each case, to the extent recorded in the applicable Governmental Authority recording office as of the Effective Time or that does not individually or in the aggregate materially interfere with the use, operation or ownership of the Assets (as owned and operated as of the Effective Time) subject thereto or affected thereby;

(g) all applicable Laws and rights reserved to or vested in any Governmental Authorities to control or regulate any of the Assets in any manner, to assess Tax with respect to the Assets, the ownership, use or operation thereof, or revenue, income, or capital gains with respect thereto (but not as a result of the failure to timely pay any such Taxes), by the terms of any right, power, franchise, grant, license, or permit, or by any provision of Law, to terminate such right, power, franchise grant, license, or permit or to purchase, condemn, expropriate, or recapture or to designate a purchaser of any of the Assets, to use such property in a manner which does not individually or in the aggregate materially interfere with the use, operation, ownership or value of such property (as owned and operated as of the Effective Time), or to enforce any obligations or duties affecting the Assets to any Governmental Authority with respect to any franchise, grant, license, or permit;

(h) failure of the records of any Governmental Authority to reflect any member of the Company Group as the owner of any Oil and Gas Property, provided that the instruments evidencing the conveyance of such title to the applicable member of the Company Group from its immediate predecessor in title are recorded in the real property, conveyance, or other records of the applicable county or parish records; failure to record Leases issued by any Governmental Authority (including BOEM) in the real property, conveyance, or other records of the county or parish in which such Leases are located (or with respect to federal leases are adjacent), provided that the instruments evidencing the conveyance of such title to any member of the Company Group from its immediate predecessor in title are recorded with the Governmental Authority that issued any such Lease, or delay or failure of any Governmental Authority to approve the assignment of any Oil and Gas Property to any member of the Company Group or any predecessor in title to Company Group unless such approval has been expressly denied or rejected in writing by such Governmental Authority;

(i) failure to file any instrument in any member of the Company Group’s chain of title in and to any Assets in the records of any adjacent county or parish, so long as the instrument in question is filed with the BOEM;

(j) any other Liens, defects, burdens or irregularities which are based on a lack of information in Seller’s or Company Group’s files or of record, references to any document if a copy of such document is not in Seller’s or Company Group’s files or of record, or inability to locate an unrecorded instrument of which Purchaser has constructive or inquiry notice by virtue of a reference to such unrecorded instrument in a recorded instrument (or a reference to a further unrecorded instrument in such unrecorded instrument), if no claim has been made under such unrecorded instruments within the last six years;

21

(k) calls on production under existing Contracts, provided that the holder of such right must pay an index-based price for any production purchased by virtue of such call on production;

(l) lack of Contracts or rights for the transportation or processing of Hydrocarbons produced from the Assets, any rights of way for gathering or transportation pipelines or facilities that do not constitute any of the Assets, or in the case of a well or other operation that has not been commenced as of the Closing, any permits, easements, rights of way, unit designations, or production or drilling units not yet obtained, formed, or created;

(m) any Liens, defects, irregularities, or other matters set forth or described on Exhibit A, described on the Disclosure Schedules but only to the extent they do not, individually or in the aggregate, reduce Company Group’s aggregate Net Revenue Interest in any Lease, Well or Unit below that shown in Exhibit A for such Lease, Well or Unit, or, individually or in the aggregate, obligate Company Group to bear a Working Interest in any Lease, Well or Unit above that shown in Exhibit A for such Lease, Well or Unit, unless the Net Revenue Interest for such Lease, Well or Unit is greater than the Net Revenue Interest set forth in Exhibit A in the same proportion as any increase in such Working Interest, or that are expressly waived (or deemed to have been waived), cured, assumed, bonded, indemnified for, or otherwise discharged at or prior to the Closing;

(n) the terms and conditions of this Agreement or any other Transaction Document;

(o) defects based on or arising out of the failure of a Lease to be maintained after the primary term of such Lease has expired after the Closing;

(p) lack of a division order or an operating agreement covering any Asset (including portions of an Asset that were formerly within a unit but which have been excluded from the unit as a result of a contraction of the unit) or failure to obtain waivers of maintenance of uniform interest, restriction on zone transfer, or similar provisions in operating agreements with respect to assignments in any chain of title of any member of the Company Group to the Asset unless there is an outstanding and pending, unresolved claim from a Third Party with respect to the failure to obtain such waiver; or

(q) prior to the Closing, any Liens arising under the Credit Documents; or

(r) to the extent not described under items (a) through (q) above, any Liens, defects, irregularities, or other matters which do not, individually or in the aggregate, materially detract from the value of or materially interfere with the use, operation, ownership or value of the Assets subject thereto or affected thereby, but only to the extent they do not, individually or in the aggregate, reduce Company Group’s aggregate Net Revenue Interest in any Lease, Well or Unit below that shown in Exhibit A for such Lease, Well or Unit, or, individually or in the aggregate, obligate Company Group to bear a Working Interest in any Lease, Well or Unit above that shown in Exhibit A for such Lease, Well or Unit, unless the Net Revenue Interest for such Lease, Well or Unit is greater than the Net Revenue Interest set forth in Exhibit A in the same proportion as any increase in such Working Interest, or that are expressly waived (or deemed to have been waived), cured, assumed, bonded, indemnified for, or otherwise discharged at or prior to the Closing or which

22

would be accepted by a reasonably prudent and sophisticated purchaser engaged in the business of owning, exploring, developing and operating Hydrocarbon producing properties.

“Permitted Leakage” means any Excluded Arrangement (or any payments in connection therewith) and any payment of the amounts set forth in Schedule 1.1(c).

“Person” means any individual, corporation, partnership, limited liability company, trust, estate, Governmental Authority, or any other entity.

“Phase I” is defined in Section 8.2(a).

“Phase II” is defined in Section 8.2(a).

“Post-Closing Income Tax Period” means, solely with respect to Income Taxes, any Tax period beginning after the Closing Date, and, with respect to a Straddle Tax Period, the portion of such Tax period beginning after the Closing Date.

“Post-Effective Time Indebtedness” is defined in Section 2.3(g).

“Post-Effective Time Non-Income Taxes” is defined in Section 11.4(a).