EX-10.A 2 d663731dex10a.htm EX-10(A) EXECUTION COPY CONSOLIDATED, RESTATED AND AMENDED CANPOTEX SHAREHOLDERS’ AGREEMENT EIGHTH MEMORANDUM OF AGREEMENT made as of and to take effect as of and from the 1st day of January, 2014. A M O N G: AGRIUM INC. OF...

Exhibit 10(a)

EXECUTION COPY

CONSOLIDATED, RESTATED AND AMENDED

CANPOTEX SHAREHOLDERS’ AGREEMENT

EIGHTH MEMORANDUM OF AGREEMENT made as of and to take effect as of and from the 1st day of January, 2014.

A M O N G:

AGRIUM INC.

OF THE FIRST PART

MOSAIC CANADA CROP NUTRITION, LP,

by its general partner, 4379934 CANADA LTD.

OF THE SECOND PART

POTASH CORPORATION OF SASKATCHEWAN INC.

OF THE THIRD PART

(with the parties of the First to Third Parts being sometimes hereinafter

individually called a “Shareholder” and collectively the “Shareholders”)

- and -

CANPOTEX LIMITED

(hereinafter referred to as “Canpotex”)

OF THE FOURTH PART

(with the parties of the First to Fourth Parts being sometimes hereinafter

individually called a “Party” and collectively the “Parties”)

WHEREAS Canpotex was incorporated as a company under the Canada Corporations Act, by Letters Patent dated the 21st day of July, 1970, for the purpose of marketing Potash outside Canada and the United States, and thereby to enter into contracts for the export of Potash from Canada to purchasers for ultimate delivery to destinations outside Canada and the United States;

| SHAREHOLDERS’ AGREEMENT - EXECUTION COPY | Page 2 |

AND WHEREAS Canpotex was continued as a corporation by Articles of Continuance under the CBCA pursuant to a Certificate of Continuance dated October 21, 1980;

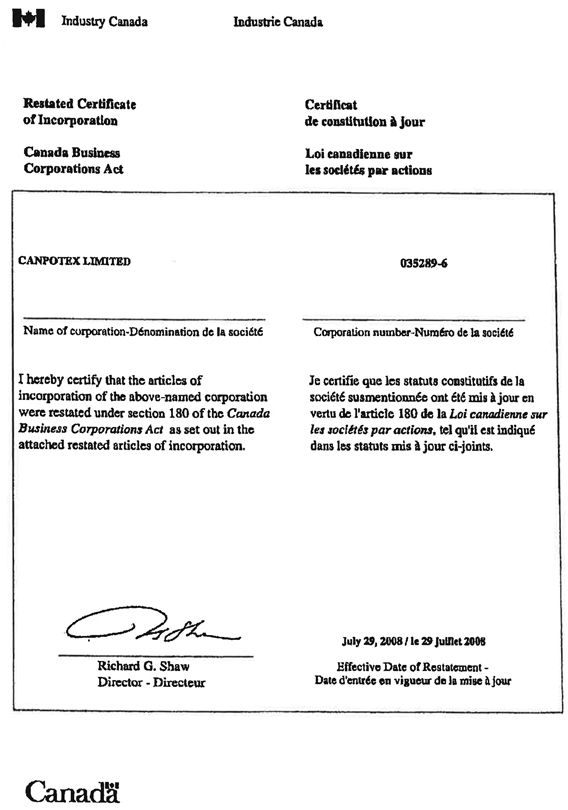

AND WHEREAS Canpotex’s Articles were restated by Restated Articles of Incorporation under the CBCA pursuant to a Certificate of Restated Articles dated July 29, 2008;

AND WHEREAS the Articles contain provisions restricting the sale and transfer of shares by Shareholders requiring that such shares shall first be offered to the existing Shareholders, as set out in Schedule I of this Agreement (Restrictions on Transfer);

AND WHEREAS each of the Shareholders produces Potash or produces Potash through an affiliated, associated, parent or subsidiary company, and the Shareholders have entered into this Agreement to provide for the operations of Canpotex and to have certain rights as Shareholders in Canpotex;

AND WHEREAS Canpotex has allotted and issued thirty (30) shares to each of the Shareholders;

AND WHEREAS the Shareholders, together with certain former shareholders of Canpotex and with Canpotex, had collectively previously entered into the Seventh Shareholders’ Memorandum of Agreement made as of and to take effect as of and from the 21st day of April, 1978, as subsequently amended, and the Shareholders and the former shareholders of Canpotex had each individually or through one or more nominees thereof as a Participating Member Producer(s) entered into with Canpotex a Producer Agreement dated as of and from the same date in the form of the Seventh Producer Agreement annexed to the said Seventh Shareholders’ Memorandum of Agreement as Schedule II, as subsequently amended;

AND WHEREAS the Shareholders and Canpotex are now desirous by this Agreement of replacing the said Seventh Shareholders’ Memorandum of Agreement with respect to matters which arise on or after the Effective Date;

AND WHEREAS Canpotex proposes to enter into the Producer Agreement with each of the Shareholders in their capacity as Participating Member Producers on terms that are substantially identical to the form annexed as Schedule II to this Agreement (Consolidated, Restated and Amended Producer Agreement Eighth Memorandum of Agreement);

| SHAREHOLDERS’ AGREEMENT - EXECUTION COPY | Page 3 |

AND WHEREAS the Shareholders, together with certain predecessors or former shareholders of Canpotex, have previously been parties to certain agreements with respect to matters related to voting, including most recently a Sixth Voting Agreement made as of and to take effect as of and from the 22nd day of April 1978, as subsequently amended, and are desirous of incorporating the pertinent provisions of the said Voting Agreement into this Agreement;

AND WHEREAS the Shareholders in replacing the prior agreements referenced above and executing this Agreement and the Producer Agreement annexed hereto have incorporated the same definitions of Shareholders, Producers and related definitional terms in this Agreement and the Producer Agreement as in said prior agreements referenced above so as to ensure continuity and identical scope of application;

NOW THEREFORE THIS AGREEMENT WITNESSETH THAT in consideration of the premises and the mutual covenants hereinafter contained, the Parties agree as follows:

DEFINITIONS

1. In this Agreement:

(a) “Agreement” means this Consolidated, Restated and Amended Canpotex Shareholders’ Agreement Eighth Memorandum of Agreement, including the schedules annexed hereto, as such may be amended or amended and restated from time to time;

(b) “Articles” means the Articles of Continuance of Canpotex issued under the CBCA, pursuant to a Certificate of Continuance dated October 21, 1980, as amended or amended and restated from time to time, and all other articles of Canpotex within the meaning of ‘articles’ as defined therein;

(c) “Board of Directors” means the Board of Directors of Canpotex;

(d) “By-laws” means the by-laws of Canpotex duly adopted and approved by resolutions of the Board of Directors and Shareholders, as the same may be amended or amended and restated from time to time, in accordance with the CBCA and the provisions of paragraph 12 hereof;

| SHAREHOLDERS’ AGREEMENT - EXECUTION COPY | Page 4 |

(e) “CBCA” means the Canada Business Corporations Act, R.S.C. 1985, C-44, and any statute that may be substituted therefor, including the regulations thereunder, as from time to time amended;

(f) “Effective Date” of this Agreement means the 1st day of January, 2014;

(g) “Fiscal Year” means the period of time for which the accounts for the business of Canpotex are ordinarily made up, being the period of one (1) year beginning on the 1st day of January in each calendar year and ending on the 31st day of December of such calendar year;

(h) “for export” means for sale to a purchaser for ultimate delivery to any destination outside Canada and the United States;

(i) “New Shareholder” means any person, firm or corporation who becomes a Shareholder after the Effective Date in accordance with the provisions of paragraph 2 hereof, or any person, firm or corporation to whom a Shareholder transfers any of its shares of Canpotex in accordance with the Articles, and “New Shareholders” means all of the New Shareholders collectively;

(j) “Participating Member Producer” means each party to the Producer Agreement which is in force at the relevant time and which party is a Shareholder and produces Potash itself or through an affiliated, associated, parent or subsidiary company;

(k) “Participating Non-Member Producer” means a party to a potash purchase agreement with Canpotex which is in force at the relevant time and which party produces Potash itself or through an affiliated, associated, parent or subsidiary company, but which party is not a Shareholder;

(l) “Potash” shall mean only muriate of potash or potassium chloride produced in Canada expressed in metric tons of KCL;

(m) “Producer Agreement” means the agreement between Canpotex and the Participating Member Producers on substantially identical terms and conditions as the form of the Consolidated, Restated and Amended Producer Agreement Eighth Memorandum of Agreement

| SHAREHOLDERS’ AGREEMENT - EXECUTION COPY | Page 5 |

annexed hereto as Schedule II, as such may be amended or amended and restated from time to time;

(n) “Shareholders” means, as of the Effective Date, Agrium Inc., Mosaic Canada Crop Nutrition, LP and Potash Corporation of Saskatchewan Inc., and includes, after the Effective Date and as the context may require, any New Shareholders, in each case for so long as any of such persons, firms or corporations own shares of Canpotex; and “Shareholder” means any one of the Shareholders or New Shareholders (as the context may require) individually; and

(o) “ton” shall mean a metric ton or metric tonne which equals 1,000 kilograms.

ALLOTMENT AND ISSUANCE OF SHARES AND NEW SHAREHOLDERS

2. Further shares of the capital of Canpotex over and above the shares now allotted and issued to the Shareholders may be allotted and issued pro rata to the Shareholders and allotted and issued pro rata to persons, firms or corporations which may become New Shareholders to ensure that all Shareholders shall thereafter each beneficially own an equal number of allotted and issued shares in the capital of Canpotex, but only if the following conditions have been complied with at or upon the issuance of such shares:

| (i) | No shares in the capital of Canpotex shall be issued to any person, firm or corporation except a person, firm or corporation which in the reasonable opinion of the Board of Directors expressed by a unanimous resolution is or will at the date of issuance of such shares be a producer of Potash either alone or in conjunction with others as a partner, co-tenant or otherwise, and which is determined by the Board of Directors by such unanimous resolution to be suitably qualified to become a shareholder in Canpotex with such financial, product supply and other capabilities as the Board of Directors in its absolute discretion and by such unanimous resolution may require; and |

| (ii) | For these purposes, “producer of Potash” shall, subject to paragraph (i) above, conclusively be deemed to include as one entity all present and future affiliates, associates or subsidiaries owned or controlled, directly or indirectly, whether through the ownership of shares or assets or through |

| SHAREHOLDERS’ AGREEMENT - EXECUTION COPY | Page 6 |

| contract or debt, or otherwise, in any manner whatsoever, whether in law or in equity, of any such person, firm or corporation seeking to be allotted and issued shares of the capital of Canpotex regardless of the capacity to produce Potash from any Canadian source of such person, firm or corporation and its present and future affiliates, associates or subsidiaries, taken individually or together in any combination; and |

| (iii) | No shares in the capital of Canpotex shall be issued unless the person, firm or corporation to which the shares are to be issued shall have entered into (1) this Agreement (thereby becoming a Party hereto), and (2) the Producer Agreement; provided, however, that the Board of Directors may by unanimous resolution recommend such changes or additional provisions to the agreements to be executed by a proposed New Shareholder as it may deem appropriate, subject to approval of such changes or additions by the Shareholders expressed by unanimous resolution. |

BORROWINGS BY CANPOTEX

3. In the discretion of the Board of Directors, expressed by resolution passed by the unanimous vote thereof, Canpotex may borrow funds from such sources, in such amounts and on such terms and conditions as the Board of Directors may from time to time in its absolute discretion determine, including borrowing from any one or more of the Shareholders. Repayment, whether currently or in the future, of principal, interest and all other expenses and charges of whatever nature or kind in connection with such borrowed funds shall be included in and deemed Expenses (as defined in subparagraph 22(a)(v) below).

PRODUCER AGREEMENT

4. (a) Each of the Shareholders severally agrees to enter into the Producer Agreement with Canpotex and the other Shareholders, subject to such changes, if any, as are not inconsistent with the provisions of this Agreement and shall be approved by the Board of Directors expressed by unanimous resolution and confirmed by the Shareholders expressed by unanimous resolution.

(b) Each of the Shareholders severally agrees that Canpotex may enter into a potash purchase agreement with a Participating Non-Member Producer pursuant to which Canpotex

| SHAREHOLDERS’ AGREEMENT - EXECUTION COPY | Page 7 |

agrees to purchase from the Participating Non-Member Producer which agrees to sell to Canpotex Potash for export on such terms and conditions, which shall not be inconsistent with the terms and conditions of the Producer Agreement, as may be approved by the Board of Directors expressed by unanimous resolution and confirmed by the Shareholders expressed by unanimous resolution.

SALE OF SHARES ON TERMINATION OF SHAREHOLDER’S OBLIGATIONS UNDER THE PRODUCER AGREEMENT

5. (a) In the event that any Shareholder gives notice of withdrawal from the Producer Agreement in accordance with the terms thereof and hereof, the Shareholder shall immediately give notice of sale of all of its shares in the capital of Canpotex in accordance with the provisions of the Articles and By-laws. In the event that any Shareholder withdraws from the Producer Agreement, or the Producer Agreement between Canpotex and such Shareholder shall terminate by reason of any other cause whatsoever, and no notice of sale of shares has been given at the date of termination or withdrawal, a notice of sale shall be deemed to have been given to the Secretary of Canpotex in accordance with the provisions of the Articles and By-laws on the date of termination or withdrawal of or from the Producer Agreement and the Secretary of Canpotex shall be the agent of the said Shareholder for all purposes under the provisions of the Articles and By-laws relating to the sale and transfer of shares under such circumstances.

(b) No Shareholder shall be entitled to give notice of withdrawal from the Producer Agreement, or thereafter to give notice of sale of all of its shares in the capital of Canpotex, nor shall such notice of sale be deemed to be given, all as is more particularly described in paragraph 5(a) above, unless at the relevant time such Shareholder is in good standing both under this Agreement (including specifically paragraph 21 hereof) and the Producer Agreement which is then in force and is not then in default in the observance and performance of any of its covenants or agreements contained in this Agreement or the Producer Agreement on its part to be observed and performed.

REPLACEMENT OF THE CANPOTEX SHAREHOLDERS’ SEVENTH MEMORANDUM OF AGREEMENT, AS AMENDED, AND SIXTH VOTING AGREEMENT, AS AMENDED

6. The Shareholders and Canpotex agree that upon the execution hereof and as to the parties hereto:

| SHAREHOLDERS’ AGREEMENT - EXECUTION COPY | Page 8 |

(a) as and from the Effective Date hereof the Canpotex Shareholders’ Seventh Memorandum of Agreement made as of the 21st day of April, 1978 (including the schedules annexed thereto), as amended from time to time prior to the Effective Date, shall be of further force and effect only with respect to rights, obligations and liabilities which have arisen thereunder or will arise thereunder as a consequence of material events occurring and material facts taking place prior to the Effective Date hereof, and is otherwise hereby replaced, superseded and supplanted by this Agreement; and

(b) as and from the Effective Date hereof the Sixth Voting Agreement made as of the 22nd day of April, 1978, as amended from time to time, shall be of further force and effect only with respect to rights, obligations and liabilities which have arisen thereunder or will arise thereunder as a consequence of material events occurring and material facts taking place prior to the Effective Date hereof, and is otherwise hereby replaced, superseded and supplanted by this Agreement; and

(c) as of and from and after the Effective Date hereof, this Agreement (including the schedules annexed hereto) shall constitute the entire agreement among the Shareholders and Canpotex relating to the matters referred to in this Agreement which arise on or after the Effective Date hereof, and the Shareholders and Canpotex hereby covenant and agree with each of the others to execute and deliver such further and other assurances, instruments and documents as may be reasonably necessary or desirable from time to time to give effect thereto in that regard.

CONSTITUTION OF THE BOARD OF DIRECTORS

7. The Shareholders and Canpotex agree that:

(a) upon the Effective Date hereof, until otherwise determined by the Board of Directors and confirmed by the Shareholders, both acting by unanimous resolution, the Board of Directors shall consist of two (2) members to be appointed by each Shareholder and, in addition, the President of Canpotex if so elected by the unanimous consent of the Shareholders;

(b) in the event that the number of Shareholders shall be less or more than three (3), the Board of Directors shall be reduced or increased so that each Shareholder shall have not less than two (2) members, subject to the provisions of subparagraph 21(b)(i) below, and all necessary

| SHAREHOLDERS’ AGREEMENT - EXECUTION COPY | Page 9 |

corporate action shall be taken by the Shareholders and Canpotex to amend the Articles, if required, to effect such reduction or increase;

(c) each Shareholder shall have the right to substitute a nominee for election to the Board of Directors in replacement of any nominee of such Shareholder who shall cease to serve on the Board of Directors for any reason and the other parties hereto shall elect, and, so long as nominated, re-elect the nominee of each Shareholder to the Board of Directors subject always to paragraph 9 below;

(d) a quorum for the transaction of business at any meeting of the Board of Directors shall be at least one (1) director representing each Shareholder and no business shall be transacted at any such meeting without the presence of at least one (1) director representing each Shareholder;

(e) the President of Canpotex shall not be entitled to cast a vote or determine any decision made by the Board of Directors other than in respect of resolutions adopted by written consent in accordance with the By-Laws; and

(f) in the event that any Shareholder has two (2) or more nominees on the Board of Directors in attendance at any meeting thereof, only one such nominee shall vote thereat other than in respect of resolutions adopted by written consent in accordance with the By-Laws.

SHAREHOLDER NOMINEES AS DIRECTOR

8. The Shareholders agree that, subject to the provisions of paragraphs 7 above and 9 below:

(a) on and from the Effective Date hereof, each Shareholder shall be represented on the Board of Directors by no less than two (2) directors nominated by such Shareholder; and

(b) no member of the Board of Directors shall be elected or appointed as both President and Managing Director or as the Managing Director of Canpotex, howsoever designated, except in accordance with paragraph 11 below.

| SHAREHOLDERS’ AGREEMENT - EXECUTION COPY | Page 10 |

LOSS OF ENTITLEMENT TO REPRESENTATION ON THE BOARD OF DIRECTORS

9. In the event that a Shareholder withdraws from the Producer Agreement, such Shareholder shall cease to be entitled pursuant to the foregoing paragraph 8 to representation on the Board of Directors and shall cause its nominees on the Board of Directors to resign forthwith.

SHAREHOLDERS’ AND DIRECTORS’ ACTION

10. (a) Each Shareholder agrees to take all such corporate action and to give all such consents as may be necessary in order to carry out the provisions of the foregoing paragraphs 7, 8 and 9. Directors may be elected or appointed to the Board of Directors in addition to those provided for in paragraphs 7, 8 and 9 above with the approval of the Board of Directors expressed by unanimous resolution and the confirmation of the Shareholders expressed by unanimous resolution.

(b) It is agreed by the Parties that they will cause their nominees on the Board of Directors of Canpotex to vote and discharge their respective duties as directors so as to observe and perform and comply with the terms, conditions and provisions of this Agreement, subject to the requirements of applicable law.

OFFICERS

11. No person shall be elected or appointed as both President and Managing Director or as Managing Director of Canpotex, howsoever designated, except with the approval of the Board of Directors expressed by unanimous resolution.

BY-LAWS

12. The By-laws shall not be rescinded, amended or otherwise altered except with the unanimous consent in writing of the holders of all of the shares in the capital of Canpotex which are issued and outstanding at the date of such rescission, amendment or other dealing.

EXPORT BUSINESS ONLY

13. (a) Canpotex shall not sell or contract for the sale of any Potash to purchasers for ultimate delivery in Canada or the United States. Canpotex shall not engage in any business other than the business of exporting Potash from Canada and such other commodities as may be approved by the Board of Directors, expressed by unanimous resolution, such business to include

| SHAREHOLDERS’ AGREEMENT - EXECUTION COPY | Page 11 |

all such activities as are reasonably and necessarily ancillary to such exporting, and shall engage in such business solely to the extent permitted by subsections 45(5) and 90.1(8) of the Competition Act, R. S. C., 1985, c. C-34, as amended, or as the same may be further amended or repealed, re-enacted or substituted from time to time.

(b) Subject always to sub-paragraph (a) immediately above, Canpotex shall undertake in as efficient a manner as reasonably possible the active marketing of Potash for export and the development of export markets for Potash.

POTASH FOR EXPORT

14. (a) This Agreement relates only to the export of Potash for ultimate delivery to destinations outside Canada and the United States, and no provisions of this Agreement shall be deemed to relate to any business of any of the Shareholders, Participating Member Producers or Participating Non-Member Producers except the export of Potash from Canada as aforesaid.

(b) Each of the Shareholders and Participating Member Producers, except as may be otherwise agreed between Canpotex and any relevant Shareholder or Participating Member Producer (which agreement by Canpotex shall be expressed by unanimous resolution of the Board of Directors), shall utilize Canpotex exclusively for all sales of Potash for export, and shall supply Potash to Canpotex for such export sales on and subject to such terms, provisions, conditions and exclusions as shall be provided by, or pursuant to, the Producer Agreement.

(c) No Shareholder or Participating Member Producer shall export any Potash with respect to which it has committed to utilize Canpotex for ultimate delivery to any destination outside Canada and the United States other than pursuant to the terms hereof.

ARBITRATION

15. (a) All disputes arising out of or in connection with this Agreement, or in respect of any legal relationship associated with or derived from this Agreement, shall be finally resolved by arbitration pursuant to the National Arbitration Rules (the “Rules”) of the ADR Institute of Canada, Inc. (the “Institute”). The place of arbitration shall be Saskatoon, Saskatchewan. The language of the arbitration shall be English.

| SHAREHOLDERS’ AGREEMENT - EXECUTION COPY | Page 12 |

(b) Every such dispute arising shall be referred to an Arbitration Panel (“Panel”) of three arbitrators, one to be appointed by each of the two parties to the arbitration (and a group of parties having a common interest shall be treated as being one party for the purpose hereof) and the two arbitrators so appointed shall appoint the third arbitrator. The Panel Chair shall be selected by the Panel. Should the appointed arbitrators fail to agree on the appointment of a third arbitrator within the 15 day period following the date on which the last Panel member has been appointed, any party to the arbitration may apply to the Institute to make the required appointment. Should the parties in a group of parties having a common interest fail to agree to their choice of an arbitrator to represent such group within the 15 day period following the date on which the first Panel member has been appointed, any party to the arbitration may apply to the Institute to make the required appointment for such group.

(c) In any case involving a dispute between more than two parties to this Agreement (and a group of parties having a common interest shall be treated as being one party for the purpose hereof) shall be referred to a Panel of three arbitrators, each of whom shall be appointed by the Institute. Such appointments by the Institute shall be in accordance with the procedures specified in Rule 15, provided that any list delivered by the Institute to the parties shall contain not less than 9 names.

(d) The arbitration shall be conducted upon such terms and conditions as may be prescribed by the arbitrators who shall not be bound by the rules of evidence nor by The Arbitration Act, 1992 of Saskatchewan, and the arbitrators shall be free to consider any evidence deemed to be relevant. The decision of the arbitrators shall not be subject to appeal, or subject to judicial review by Writ of Certiorari or otherwise, or subject to review or appeal by any other process by any tribunal whatsoever. The parties to such arbitration shall share equally the cost of the arbitrators and shall bear their own expenses incurred in such arbitration proceedings.

NOTICE

16. Any notice, demand, request, declaration or communication required or permitted to be made or given hereunder shall be given in writing and shall be given by personal service upon an officer of the Party for whom it is intended or shall be mailed by prepaid registered mail, faxed or e-mailed to the following addresses (which addresses may be changed or revised by each Party upon written notice to all other Parties in the manner set forth herein):

| SHAREHOLDERS’ AGREEMENT - EXECUTION COPY | Page 13 |

| (a) | To Agrium Inc.: |

Agrium Inc.

00000 Xxxx Xxxxxx Xxxxx XX

Xxxxxxx XX X0X 0X0

XXXXXX

Attention: President

Fax No.: (000) 000-0000

e-mail: xxxxx.xxxxx@xxxxxx.xxx

with a copy to:

Agrium Inc.

00000 Xxxx Xxxxxx Xxxxx X.X.

Xxxxxxx, XX X0X 0XX

XXXXXX

Attention: Senior Vice President & Chief Legal Officer

Fax No.: (000) 000-0000

E-mail: xxxx.xxxxxx@xxxxxx.xxx

| (b) | To Mosaic Canada Crop Nutrition, LP, |

by its general partner, 4379934 Canada Ltd.:

Mosaic Canada Crop Nutrition, LP

by its general partner, 4379934 Canada Ltd.

c/o XX Xxx 0000

Xxxxxx XX X0X 0X0

XXXXXX

Attention: President

Fax No: (000) 000-0000

e-mail: xxx.xxxxxxxxxx@xxxxxxxx.xxx

with a copy to:

The Mosaic Company

0000 Xxxxxx Xxxxx

Xxxxx X000

Xxxxxxxx XX 00000

XXXXXX XXXXXX

Attention: Executive Vice President, General Counsel & Corporate Secretary

Fax No.: (000) 000-0000

e-mail: xxxxxxx.xxxx@xxxxxxxx.xxx

| (c) | To Potash Corporation of Saskatchewan Inc.: |

| SHAREHOLDERS’ AGREEMENT - EXECUTION COPY | Page 14 |

Potash Corporation of Saskatchewan Inc.

PCS Tower, Suite 500

000 0xx Xxxxxx Xxxxx

Xxxxxxxxx XX X0X 0X0

XXXXXX

Attention: President

Fax No: (000) 000-0000

e-mail: xxxx.xxxxx@xxxxxxxxxx.xxx

with a copy to:

Potash Corporation of Saskatchewan Inc.

PCS Tower, Suite 500

000 0xx Xxxxxx Xxxxx

Xxxxxxxxx XX X0X 0X0

XXXXXX

Attention: Senior Vice President, General Counsel & Corporate Secretary

Fax No.: (000) 000-0000

e-mail: xxxxxxxxx@xxxxxxxxxx.xxx

| (d) | To Canpotex Limited: |

Canpotex Limited

000 - 0xx Xxxxxx Xxxxx

Xxxxx 000

Xxxxxxxxx XX X0X 0X0

XXXXXX

Attention: President

Fax No: (000) 000-0000

e-mail: xxxxx.xxxxxx@xxxxxxxx.xxx

with a copy to:

Canpotex Limited

000 0xx Xxxxxx Xxxxx

Xxxxx 000

Xxxxxxxxx, XX X0X 0X0

XXXXXX

Attention: Senior Vice President, General Counsel & Secretary

Fax No.: (000) 000-0000

E-mail: xxx.xxxxxx@xxxxxxxx.xxx

| SHAREHOLDERS’ AGREEMENT - EXECUTION COPY | Page 15 |

For these purposes, any notice to be mailed shall be mailed by prepaid registered mail addressed to the recipient at the address above set forth or at such other address and/or to the attention of any such person or officer as any of the Parties may from time to time or at any time advise by notice in writing to all of the other Parties. The date of receipt of any notice shall be deemed to be the tenth business day next following the date of such mailing, provided that if at the date of such mailing, interruption in the operation of the postal service in Canada or in the United States has or is likely to delay the mailing and receipt of such notice, the same shall be served personally on an officer or duly authorized representative of the intended recipient of the Parties. Notice given in the manner aforesaid shall be effective upon the actual date of receipt or the deemed date of receipt, whichever is the sooner, or upon personal service, as the case may be.

As an alternative to the above, any of the Parties may give notice by fax or e-mail to the recipients at the fax number or e-mail address above set forth in which case, if so sent, shall be deemed to have been received on the day next following the date of actual transmission and shall thereby be sufficient notice given hereunder.

APPLICABLE LAW

17. This Agreement shall be construed and interpreted in accordance with the laws of the Province of Saskatchewan and the federal laws of Canada applicable therein.

PERFORMANCE OF AGREEMENT

18. The Shareholders agree at all times to vote as shareholders of Canpotex and to take all other steps that reasonably may be necessary in order that the terms of this Agreement may be carried out and observed by Canpotex and for the purpose of carrying out the intent and purposes of this Agreement; and each of the Parties hereby covenants and agrees with each of the other parties hereto to be bound by, observe, perform and do all things and take all action, steps, proceedings and execute such further and other assurances, documents and agreements as are necessary to implement and give effect to all of the terms and provisions of this Agreement.

CAPACITY OF CANPOTEX

19. Canpotex agrees to carry out the terms of this Agreement to the full extent that it has the capacity and power at law to do so. The obligations of Canpotex as a Party to this Agreement shall be severable from the obligations of the other Parties and the lack of capacity or power in

| SHAREHOLDERS’ AGREEMENT - EXECUTION COPY | Page 16 |

Canpotex to perform any terms of this Agreement shall not affect the obligations of the other Parties.

TERM OF AGREEMENT AND RIGHT TO WITHDRAW

20. (a) Any Shareholder shall have the right to withdraw from this Agreement upon giving no less than one (1) year’s written notice of intent to withdraw to Canpotex and to all of the other Shareholders, which notice may be given at any time in any calendar year, with such notice to be effective on the same day and month in the calendar year following the year such notice is given (or March 1 of the following year if notice is given on February 29), subject, however, to:

| (i) | the withdrawing Shareholder being, as at the effective date of withdrawal |

| (A) | in good standing both under this Agreement, including specifically paragraph 21 hereof, and under the Producer Agreement which is then in force; and |

| (B) | not in material default in the observance and performance of any of its covenants and agreements contained in both this Agreement and the Producer Agreement on its part to be observed and performed; and |

| (ii) | the withdrawing Shareholder before the effective date of withdrawal first entering into a collateral agreement in form and content satisfactory to Canpotex and the continuing Shareholders (1) adopting such operational and informational protocols as may be required in order to safeguard the confidentiality of forward Canpotex decisions in a manner that appropriately transitions the withdrawing Shareholder to withdrawn status, and (2) pursuant to which the withdrawing Shareholder covenants and agrees for itself and covenants and agrees to cause any transferee, assignee or purchaser of the Potash mine and mining assets of the withdrawing Shareholder to be bound by and to perform and pay all of the obligations, covenants, agreements and liabilities under this Agreement of the withdrawing Shareholder, including specifically the provisions of paragraphs 21(a) and 22 arising after the effective date of withdrawal but relating to the period during which the withdrawing Shareholder was a Shareholder. |

| SHAREHOLDERS’ AGREEMENT - EXECUTION COPY | Page 17 |

(b) Should any withdrawal be effective other than at the end of a Fiscal Year, the withdrawing Shareholder’s Basic Entitlement (as defined in the Producer Agreement) for its last full Fiscal Year (or, as applicable, the actual tonnage supplied to Canpotex by such withdrawing Shareholder during such last full Fiscal Year as a proportion of the total actual tonnage supplied by all Shareholders during such year) shall be used as the basis for computing any obligations or rights under this Agreement or any other agreement entered in connection herewith or pursuant thereto; provided however, that if the Basic Entitlement of such withdrawing Shareholder for the last full Fiscal Year such withdrawal is effective (or, as applicable, the proportional actual tonnage supplied to Canpotex by such withdrawing Shareholder during such year of withdrawal) yields a greater percentage obligation share, such greater percentage shall be used as the basis for such computations.

(c) Any Shareholder exercising its right to withdraw from the Producer Agreement and providing notice of such withdrawal in accordance therewith shall also provide concurrent notice of withdrawal from this Agreement.

TERMINATION OF AGREEMENT

21. (a) In the event that any Shareholder shall at any time withdraw from this Agreement in the manner provided for withdrawal in paragraph 20 above or shall cease to hold any shares of the capital of Canpotex, then this Agreement shall be terminated with respect to such withdrawing Shareholder save as to:

| (i) | rights and obligations arising under this Agreement prior to the effective date of such withdrawal, or prior to such cessation of shareholding, to which rights or for which obligations such withdrawing Shareholder shall remain entitled or bound, respectively, as the case may be; |

| (ii) | all of the provisions of paragraphs 5, 20 and 22 of this Agreement for which such withdrawing Shareholder shall remain bound; and |

| (iii) | the provisions of the Producer Agreement which is in force immediately prior to the effective date of any such withdrawal, or prior to such cessation of shareholding, and for which the withdrawing Shareholder shall remain bound. |

| SHAREHOLDERS’ AGREEMENT - EXECUTION COPY | Page 18 |

(b) Upon the termination of this Agreement from time to time with respect to any Shareholder as aforesaid:

| (i) | the number of the Board of Directors shall be reduced by the number of members of the Board of Directors who, pursuant to this Agreement, are nominees of the said withdrawing or terminating Shareholder; provided that the Board of Directors shall not be reduced below the number required by law, and all necessary corporate actions shall be taken, including in respect of amending the Articles, if required, to effect such reduction; and |

| (ii) | this Agreement shall continue in force as to all remaining Shareholders. |

CANPOTEX BUSINESS TO BE CARRIED ON NOT FOR PROFIT AND INDEMNITIES

22. (a) For the purposes of this paragraph 22, the following words and terms shall have the following meanings:

| (i) | “Accounting Deficit” means the extent, if any, by which the retained earnings of Canpotex as of the end of any Fiscal Year (after giving effect to the receipt by Canpotex of all amounts payable to Canpotex pursuant to subparagraph 22(b) hereof with respect to such Fiscal Year) is lower than the retained earnings of Canpotex as of the end of the immediately preceding Fiscal Year (after giving effect to the receipt by Canpotex of all amounts payable to Canpotex under subparagraph 22(b) hereof with respect to such preceding Fiscal Year); |

provided, however, that each Shareholder’s obligation to make any payment to Canpotex in respect of an Accounting Deficit in any Fiscal Year shall be reduced on a dollar-for-dollar basis by any amount separately paid by such Shareholder to or on behalf of Canpotex during that Fiscal Year in respect of any Expenses, which amount otherwise would be included in calculating the Accounting Deficit for such Fiscal Year, it being the intent of the Parties that Canpotex not be paid twice for the same

| SHAREHOLDERS’ AGREEMENT - EXECUTION COPY | Page 19 |

Expenses; and provided, further, that all Claims against Canpotex shall be disregarded in computing the Accounting Deficit in any Fiscal Year;

| (ii) | “Canpotex Group” means Canpotex and each of its direct or indirect wholly-owned subsidiaries; |

| (iii) | “Claims” means any disputed claims (including, without limitation, third party claims), demands, judgments, orders, binding arbitration awards or determinations, penalties or fines, of every nature and kind made, sustained, issued, levied or assessed against any one or more of the Canpotex Group; |

| (iv) | “Contribution Percentage” means, unless otherwise agreed, in respect of any Fiscal Year, the percentage that the quantity (on a KCL metric ton basis) of potash supplied to Canpotex by a Shareholder in such Fiscal Year bears to the total quantity (on a KCL metric ton basis) of potash supplied to Canpotex in such Fiscal Year by all Shareholders. Such percentage shall be determined by the management of Canpotex as soon as practicable before the beginning of such Fiscal Year, or, if necessary, as adjusted or re-calculated, from time to time; |

| (v) | “Expenses” means any contractual or other obligations or liabilities of any nature or kind paid or payable by any one or more of the Canpotex Group in the course of their business operations, including, without limiting the generality of the foregoing, all principal payments, interest payments and all other expenses or charges of whatever nature or kind in connection with or with respect to any indebtedness which has been approved in accordance with Section 3 hereof, provided, however, that Claims shall be excluded from Expenses and exclusively dealt with and subject to subparagraph 22(e); |

| (vi) | “Indemnitor” means any of the Shareholders and “Indemnitors” means more than one of them, or all of them, as the context requires; and |

| SHAREHOLDERS’ AGREEMENT - EXECUTION COPY | Page 20 |

| (vii) | “Insurance Proceeds” means any proceeds paid under any applicable policy or policies of insurance placed by the Canpotex Group or under which the Canpotex Group is a beneficiary or loss payee. |

(b) The Parties agree that the business and operations of Canpotex shall be carried out without pecuniary gain or profit to the Shareholders as such and that the equity of the Shareholders in Canpotex shall never be less than the aggregate amount of the issued and fully paid-up share capital in Canpotex from time to time. To ensure that this is the case, each of the Shareholders covenants and agrees, with respect to any Fiscal Year in which they are or were Shareholders, upon the final calculation by the management of Canpotex of the amount of each such person’s Contribution Percentage for such Fiscal Year, to pay within fifteen (15) business days to Canpotex an amount equal to its Contribution Percentage of the total amount needed to maintain such aggregate capital. To the extent that there are retained earnings or other accretions available to Canpotex, if any, they shall be used in promoting the objects and purposes of Canpotex.

(c) If any Expenses of the Canpotex Group shall be unpaid, or if the audited consolidated financial statements of Canpotex establish that Canpotex had an Accounting Deficit as at the end of any Fiscal Year, the amount of any such Expenses or Accounting Deficit shall be allocated among the Shareholders for each Fiscal Year each was a Shareholder in accordance with their respective Contribution Percentage for each such Fiscal Year and the amount thereof shall be paid to Canpotex upon request within fifteen (15) business days.

(d) Each of the Shareholders does hereby agree, severally, to indemnify and save harmless the Canpotex Group from and against and to reimburse and pay to the Canpotex Group such payments in respect of subparagraph 22(b) and/or in respect of any Accounting Deficit, Expenses or Claims as are payable by such Shareholder in accordance with this Agreement or as otherwise required by any collateral agreement entered into by such Shareholder pursuant to paragraph 20 hereof; provided, however, that the indemnification obligation of such Shareholder shall be limited to the extent of the Contribution Percentage of the individual Indemnitor for each such Fiscal Year; and provided further that indemnification obligations arising from or related to a Claim shall be subject to subparagraph 22 (e).

| SHAREHOLDERS’ AGREEMENT - EXECUTION COPY | Page 21 |

(e) Notwithstanding anything else to the contrary in this Agreement, each of the Shareholders covenants and agrees to and with Canpotex and Canpotex acknowledges that the payment and satisfaction of any Claim, to the extent that it is not discharged or satisfied by any Insurance Proceeds, shall be subject to receiving the prior approval of the Board of Directors acting unanimously. If the Board of Directors unanimously so approves, the amount of the Claim shall be allocated among the persons who were Shareholders during the Fiscal Year or Fiscal Years during which the material events giving rise to the Claim took place, in accordance with their respective Contribution Percentages for such Fiscal Year or Fiscal Years, and each such Shareholder hereby severally agrees to indemnify and save harmless the Canpotex Group from and against and upon request within fifteen (15) business days to reimburse the Canpotex Group in respect of such allocable share of such Claim.

(f) If any Indemnitor (the “Paying Indemnitor”) has paid an amount, in respect of any Expenses, Accounting Deficit or Claim, in excess of the amount it would have otherwise been obligated to pay pursuant to the terms and provisions of this paragraph 22 (such excess amount being referred to as the “Excess Payment”), then each of the other Indemnitors with respect to such Expenses, Accounting Deficit or Claim severally agrees to indemnify and save harmless and reimburse the Paying Indemnitor for the full amount of the Excess Payment with the intent and result that each Indemnitor shall pay only its respective Contribution Percentage of such Expenses, Claim or Accounting Deficit. The Excess Payment shall include all legal fees, interest expenses and other costs incurred by the Paying Indemnitor in relation to the payment of the Excess Payment, which legal fees, interest expenses and other costs shall be allocated using the same Contribution Percentage for the applicable Fiscal Year or Fiscal Years.

(g) It is expressly understood and agreed that the indemnity given under subparagraphs 22(d) and (e) shall not extend to, and shall expressly exclude therefrom, any amount(s) that any Shareholder is called upon to pay, discharge or honour pursuant to any separate or independent commitment, guarantee or obligation it may have undertaken in respect of the obligations or liabilities of the Canpotex Group which is to be paid, performed or observed by such Shareholder otherwise than pursuant to the terms and provisions of this Agreement.

(h) It is expressly understood and agreed that the indemnity given under subparagraphs 22(d) and (e) may be invoked directly by Canpotex against the Indemnitors;

| SHAREHOLDERS’ AGREEMENT - EXECUTION COPY | Page 22 |

provided that the provisions of this Agreement may only be enforced by a Party and this Agreement is neither intended to nor shall it be construed as providing any benefit upon any person not a Party.

(i) Notwithstanding the withdrawal of any Shareholder from membership in Canpotex or the failure of a withdrawing Shareholder to enter into a collateral agreement as contemplated by paragraph 20 hereof, such withdrawing Shareholder shall, subsequent to such withdrawal and in addition to any other obligations undertaken pursuant to this Agreement or any other agreement, continue to be bound by and be subject to the obligations of such Shareholder contained in this paragraph 22, pursuant to which such Shareholder shall be responsible and shall pay the Canpotex Group for:

| (A) | any amounts owing or payable by such Shareholder in accordance with subparagraph 22(b) hereof or in respect of any Expenses, Accounting Deficit or Claim payable in accordance with subparagraphs 22(c), (d) and (e) hereof and attributable to the last Fiscal Year of such Shareholder’s shareholding (or any prior Fiscal Year or part thereof during which it was a Shareholder), and |

| (B) | in respect of such other amounts as may be payable by Canpotex in any and all Fiscal Years following such Shareholder’s withdrawal, including without limitation any amounts owing or payable by such Shareholder in respect of any Claim owing or payable in accordance with subparagraph 22(e) hereof, any Expenses or any Accounting Deficit (collectively, “Future Amounts”) that are attributable to any act or omission, or any obligation undertaken, or any event giving rise to any liability, which occurred while it was a Shareholder; such Shareholder shall be responsible only for the percentage of such Future Amounts that is equal to such Shareholder’s Contribution Percentage for the last Fiscal Year during which it was a Shareholder. |

(j) Notwithstanding anything to the contrary contained elsewhere in this Agreement, the covenants, agreements and obligations of the Parties contained in subparagraph 20(b),

| SHAREHOLDERS’ AGREEMENT - EXECUTION COPY | Page 23 |

subparagraph 21(a) and this paragraph 22 shall survive the modification or termination, for whatever reason, of this Agreement.

(k) As a condition of becoming a Participating Non-Member Producer, in addition to any other requirements set out herein, each such Participating Non-Member Producer, shall specifically first covenant and agree to be bound by all the terms and provisions contained in this paragraph 22, and all Contribution Percentages applicable in respect of subparagraphs 22(c), (d), (e) and (f) hereof shall thereupon be calculated so as to reflect actual shipments of Potash by such Participating Non-Member Producer during each Fiscal Year as if it were a Shareholder.

(l) The Parties agree to do, execute, acknowledge and deliver such further acts, agreements and other assurances as may be required from time to time for the better implementation and performance of all the terms and provisions of this paragraph 22, including the making of any payments provided for or required by this paragraph 22.

ENTIRE AGREEMENT

23. (a) Except as provided in paragraph 6 hereof, this Agreement supersedes any and all other agreements previously entered into between the Parties with respect to the operations of Canpotex and the participation therein by each of the Shareholders, and this Agreement (including the schedules annexed hereto) contains the entire agreement between the Parties; and none of the provisions, terms or conditions contained herein shall be waived, altered, or abridged, modified or amended except by written agreement executed between the Parties.

(b) The entering into of the Producer Agreement shall not be construed as waiving, altering, abridging or amending any of the provisions, terms or conditions contained herein. None of the provisions, terms or conditions contained in the Producer Agreement shall be waived, altered, or abridged, modified or amended unless the Parties agree by written agreement executed by all of the parties thereto. In the event of any conflict between the terms and conditions of this Agreement and the Producer Agreement, or between this Agreement and any Product Supply Agreement (as defined and entered into pursuant to the Producer Agreement) the terms and conditions of this Agreement shall govern.

| SHAREHOLDERS’ AGREEMENT - EXECUTION COPY | Page 24 |

TERMS OF ASSIGNMENT

24. This Agreement may not be assigned in whole or in part by any of the Parties without the express written consent of all of the other parties hereto, which consent may be arbitrarily withheld.

SEVERABILITY

25. It is hereby agreed that in the event any clause, provision, paragraph, subparagraph, section or article of this Agreement is held invalid as contrary to any statute or regulation or law in that regard by a court of competent jurisdiction or arbitration tribunal, the invalidity of such shall in no way effect the validity of any other clause, provision, paragraph, subparagraph, section or article of this Agreement and each and every such clause, provision, paragraph, subparagraph, section or article of this Agreement shall be severable from each and every other.

ENUREMENT AND BENEFIT

26. This Agreement shall be binding upon and enure to the benefit of the Parties, and their successors and permitted assigns.

EXECUTION IN COUNTERPARTS

27. The Parties hereby covenant and agree that this Agreement may be executed simultaneously in two or more counterparts each of which shall be deemed to be an original but all of which when taken together shall constitute one and the same instrument.

CONFIDENTIALITY

28. All communications and all documents, data or other information, whether written or oral, between or among the Parties regarding the business or affairs of any one or more of the Parties (collectively “Information”) obtained or received in any capacity by any one or more of the Parties and whether done formally or informally or directly or indirectly and for whatever purpose or reason including the performance or administration of this Agreement before, during or after the term hereof, and whether pursuant to the provisions hereof or otherwise, shall be kept private and confidential and in strict confidence and, except as may be required by a court, governmental or regulatory authority or otherwise by law, shall not be released to any other party without the express prior written approval of all of the Parties, not to be unreasonably withheld.

| SHAREHOLDERS’ AGREEMENT - EXECUTION COPY | Page 25 |

In the event of any release, filing or disclosure of Information required as aforesaid, the Party or Parties so compelled hereby covenant and agree notwithstanding to promptly take all such actions and steps as are reasonable in the circumstances to assert and maintain a claim for privacy and confidentiality to the maximum extent permissible at law. The obligations of confidentiality set forth in this paragraph 28 shall continue subsequent to, and survive any withdrawal from, or termination of, this Agreement.

EXECUTION

IN WITNESS WHEREOF the Parties have hereunto affixed their corporate seals attested by their proper officers duly authorized for such purpose effective from the Effective Date.

| AGRIUM INC. | ||

| Per: | /s/ X. Xxxxx | |

| Per: | /s/ X. Xxxxxxxxx | |

| MOSAIC CANADA CROP NUTRITION, LP, by its general partner, 4379934 CANADA LTD. | ||

| Per: | /s/ X. Xxxxxxxxxx | |

| Per: | /s/ X. Xxxx | |

| POTASH CORPORATION OF SASKATCHEWAN INC. | ||

| Per: | /s/ X. Xxxxx | |

| Per: | /s/ X. Xxxxxx | |

| CANPOTEX LIMITED | ||

| Per: | /s/ X. Xxxxxx | |

| Per: | /s/ X. Xxxxxx |

SCHEDULE I

TO THE

CONSOLIDATED, RESTATED AND AMENDED

CANPOTEX SHAREHOLDERS’ AGREEMENT

effective as of and from January 1, 2014

Restriction on Transfer

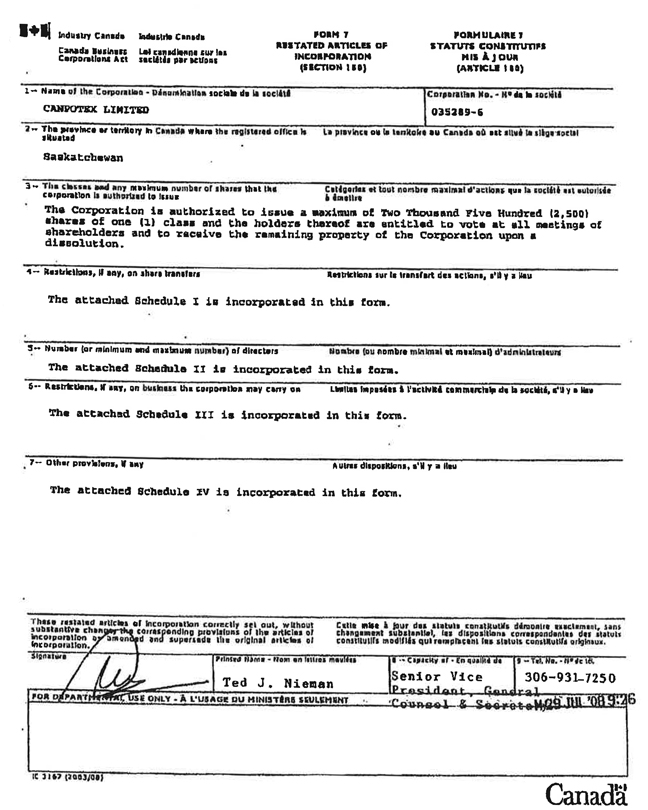

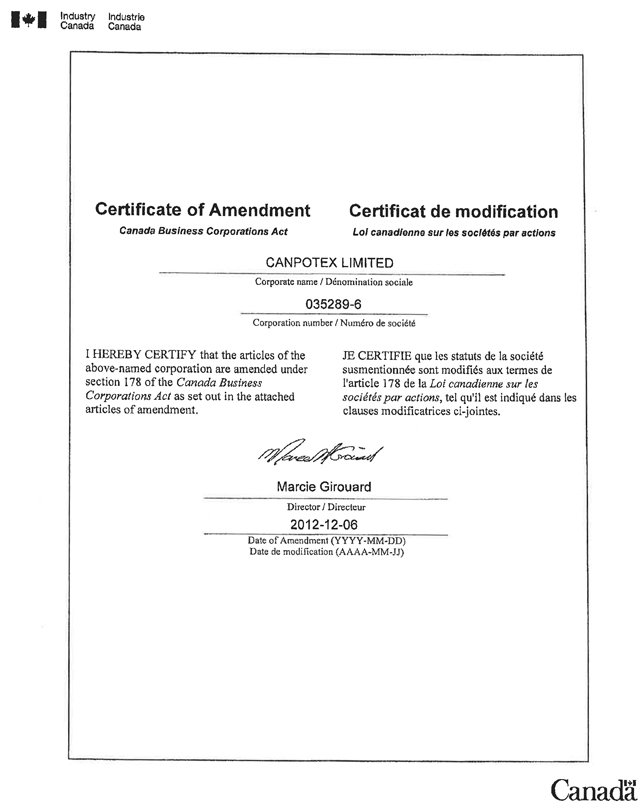

Attached are the Canpotex Limited Restated Articles of Incorporation under the Canada Business Corporations Act, R.S.C. 1985, C-44, as filed with Industry Canada on July 29, 2008, as amended by further filing with Industry Canada on December 6, 2012, including Restrictions on the Transfer of Shares and other related provisions, the text of which is hereby incorporated as Schedule I to the Consolidated, Restated and Amended Canpotex Shareholders’ Eighth Memorandum of Agreement made as of and to take effect from the 1st day of January 2014.

Industry Canada Restated Certificate of Incorporation Canada Business Corporations Act CANPOTEX LIMITED 035289-6 Name of corporation- Corporation number- I hereby certify that the articles of incorporation of the above-named corporation were restated under section 180 of the Canada Business Corporations Act as set out in the attached restated articles of incorporation. July 29, 2008 / Xxxxxxx X. Xxxx Director - Effective Date of Restatement - Canada

Industry Canada Canada Business Corporations Act FORM 7 RESTATED ARTICLES OF INCORPORATION (SECTION 159) 1-Name of the Corporation Corporation No. CANPOTEX LIMITED 035289-6 2-The province or territory in Canada where the registered office is situated Saskatchewan 3-This classes and any maximum number of shares that the corporation is authorized to issue The Corporation is authorized to issue a maximum of Two Thousand Five Hundred (2,500) shares of one (1) class and the holders thereof are entitled to vote at all meetings of shareholders and to receive the remaining property of the Corporation upon a dissolution. 4-Restrictions, if any, on share transfers The attached Schedule I is incorporated in this form. 5-Number (or minimum and maximum number) of directors The attached Schedule II is incorporated in this form. 6-Restrictions, if any, on business the corporation may carry on The attached Schedule III is incorporated in this form. 7-Other provisions, if any The attached Schedule IV is incorporated in this form. These restated articles of incorporation correctly set out, without substantive change, the corresponding provisions of the articles of incorporation or amended and supersede the original articles of incorporation. Signature Printed Name 8-Capacity of 9-Tel. No. Xxx X. Xxxxxx Senior Vice President, General Counsel & Secretary 000-000-0000 FOR DEPARTMENTAL USE ONLY M 29 JUL ‘08 9:26 Canada

SCHEDULE I

RESTRICTIONS ON SHARE TRANSFERS

| 1. | No shareholder shall have the right to sell or otherwise dispose of any of his shares in the capital stock of the Corporation unless and until he (the selling shareholder) shall have given notice in writing (notice of sale) to the secretary of the Corporation of his desire to sell, whereupon the secretary shall forthwith notify (first notification) the other shareholders (continuing shareholders) of the receipt of such notice and each of the continuing shareholders shall have the right, exercisable by the delivery of a written acceptance and a certified cheque in favour of the selling shareholder in the appropriate amount hereinafter specified to the secretary of the Corporation, for a period of thirty (30) days from the date of mailing of such first notification, to purchase such shares or such portion or number thereof as they may desire pro rata to the number of shares in the Corporation already held by them. |

| 2. | In case any one or more of the continuing shareholders does not within the said period of thirty (30) days purchase the pro rata number of shares which he is entitled to purchase then the secretary shall forthwith notify (second notification) the remaining continuing shareholders and the remaining continuing shareholders shall have the right, exercisable in the manner aforesaid, for a period of thirty (30) days from the date of mailing of such second notification to purchase the balance of such shares or such portion or number thereof as they may desire pro rata to the number of shares in the Corporation already held by them, including the shares which they have purchased following the first notification. |

| 3. | The price to be paid for each such share shall be the book value thereof determined by the auditors of the Corporation as at the end of the fiscal year which most closely precedes the date of the notice of sale, without any allowance for goodwill. |

| 4. | In case the continuing shareholders fail within the aforesaid periods to purchase the said shares or if they purchase only a part of the said shares, then the selling shareholder may, within six (6) months from the giving of the notice of sale, sell, transfer or dispose of the shares referred to in such notice, or such portion thereof as shall not have been purchased by a shareholder or shareholders, to any other person at a price not less than and on terms not more favourable than those upon which they were offered to the other shareholders. |

| 5. | Upon delivery to the secretary of the Corporation of the share certificates, duly endorsed in blank for transfer, representing the shares which the selling shareholder has sold pursuant to the foregoing provisions the secretary of the Corporation shall deliver to the selling shareholder the cheques of the continuing shareholders tendered in payment for the shares purchased by such shareholders. |

| 6. | Notwithstanding the provisions of the foregoing paragraphs 1, 2, 3, 4 and 5, the transfer of a single share to a person who is not then a shareholder to qualify such person for election as a director shall be valid and duly recorded in the books of the Corporation upon the surrender of the certificate therefore duly endorsed provided that any share so transferred |

| Page 2 |

| shall not be further transferred except back to the original bolder or to the corporate shareholder for whom the original holder acted as nominee without the approval of the board of directors first obtained, provided, however, that the foregoing restrictions and limitations on transfer shall not apply to or govern any transfer of shares in the capital stock of the Corporation which has been approved by the consent in writing of all shareholders of the Corporation. |

| 7. | The Corporation may from time to time by bylaw enact regulations not inconsistent herewith to implement the foregoing transfer provisions. |

Canpotex Limited Articles

| Page 3 |

SCHEDULE II

NUMBER (OR MINIMUM AND MAXIMUM NUMBER) OF DIRECTORS

A minimum of five (5) directors and a maximum of eighteen (18) directors, the number of which shall be determined from time to time by the Board of Directors of the Corporation and confirmed by the Shareholders of the Corporation.

Canpotex Limited Articles

| Page 4 |

SCHEDULE III

RESTRICTIONS, IF ANY, ON BUSINESS THE CORPORATION MAY CARRY ON

The business of the Corporation shall be limited to the following:

| 1. | to buy, sell and deal in potash and associated, allied or derivative products for export trade only to destinations other than the Dominion of Canada and the United States of America; |

| 2. | to own, lease, maintain and operate warehouses, docks, buildings and other erections, constructions and equipment for the storage, transportation and care generally of the goods, wares and merchandise of the Corporation for use in connection with the business and property of the Corporation; and |

| 3. | to act as representatives, agents and brokers for any persons, firms or corporations for export trade only to destinations other than the Dominion of Canada and the United States of America. |

Canpotex Limited Articles

| Page 5 |

SCHEDULE IV

OTHER PROVISIONS, IF ANY

| 1. | The number of shareholders of the Corporation shall be limited to fifty (50), not including persons who are in the employment of the Corporation and persons, who, having been formerly in the employment of the Corporation, were, while in that employment, and have continued after the determination of that employment to be shareholders of the Corporation, two (2) or more persons holding one (1) or more shares jointly being counted as a single shareholder. |

| 2. | Any invitation to the public to subscribe for any shares or debentures of the Corporation shall be prohibited. |

| 3. | If authorized by a bylaw which is duly enacted by the directors and sanctioned by at least two-thirds (2/3) of the votes cast a special meeting of the shareholders of the Corporation duly called for considering the bylaw, the directors of the Corporation may from time to time: |

| (a) | borrow money upon the credit of the Corporation; |

| (b) | issue, reissue, sell or pledge debt obligations of the Corporation; and |

| (c) | mortgage, hypothecate, pledge or otherwise create a security interest in all or any of the property of the Corporation, owned or subsequently acquired to secure any debt obligation of the Corporation. |

Any such bylaw may provide for the delegation of such powers by the directors to such officers or directors of the Corporation to such extent and in such manner as may be set out in the bylaw.

Nothing herein limits or restricts the borrowing of money by the Corporation on bills of exchange or promissory notes made, drawn, accepted or endorsed by or on behalf of the Corporation.

Canpotex Limited Articles

Industry Canada Certificate of Amendment Canada Business Corporations Act CANPOTEX LIMITED 035289-6 Corporation number I HEREBY CERTIFY that the articles of the above-named corporation are amended under section 178 of the Canada Business Corporations Act as set out in the attached articles of amendment. Xxxxxx Xxxxxxxx Director / 2012-12-06 Date of Amendment (YYYY-MM-DD) Canada

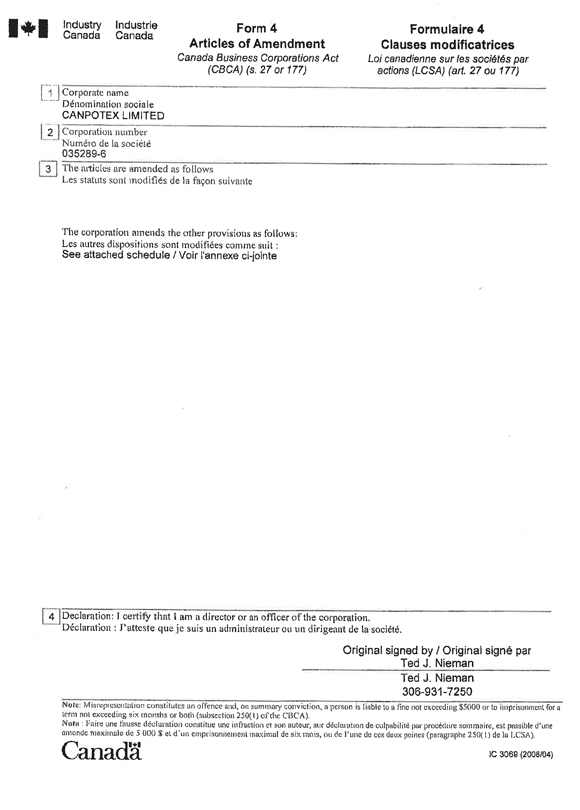

Industry Canada Form 4 Articles of Amendment Canada Business Corporations Act (CBCA) (s. 27 or 177) 1 Corporate name CANPOTEX LIMITED 2 Corporation number 035289-6 3 The articles are amended as follows The corporation amends the other provisions as follows: See attached schedule 4 Declaration: I certify that I am a director or an officer of the corporation. Original signed by / Xxx X. Xxxxxx Xxx X. Xxxxxx 000-000-0000 Note: Misrepresentation constitutes an offence and, on summary conviction, a person is liable to a fine not exceeding $5000 or to imprisonment for a term not exceeding six months or both (subsection 250(1) of the CBCA). Canada IC 3069 (2008/04)

Schedule / Annexe

Other Provisions / Autres dispositions

The existing wording of clause 7 of the Restated Articles of Incorporation is deleted and replaced with the word “None.”

Schedule IV attached to the Restated Articles of Incorporation is deleted in its entirety.

SCHEDULE II

TO THE

CONSOLIDATED, RESTATED AND AMENDED

CANPOTEX SHAREHOLDERS’ AGREEMENT

effective as of and from January 1, 2014

Producer Agreement

Attached is the Consolidated, Restated and Amended Eighth Producer Agreement, made as of the 1st day of January 2013, the text of which is hereby incorporated as Schedule II to the Consolidated, Restated and Amended Canpotex Shareholders’ Eighth Memorandum of Agreement made as of and to take effect from the 1st day of January 2014.

EXECUTION COPY

CONSOLIDATED, RESTATED AND AMENDED PRODUCER AGREEMENT

EIGHTH MEMORANDUM OF AGREEMENT made as of and to take effect as of and from the 1st day of January, 2014,

BETWEEN:

CANPOTEX LIMITED, a company incorporated under the laws of Canada,

(hereinafter called “Canpotex”)

OF THE FIRST PART

- and -

AGRIUM INC.

OF THE SECOND PART

MOSAIC CANADA CROP NUTRITION, LP,

by its general partner, 4379934 CANADA LTD.

OF THE THIRD PART

POTASH CORPORATION OF SASKATCHEWAN INC.

OF THE FOURTH PART

(each of the parties of the Second, Third and Fourth Parts being sometimes individually hereinafter referred to as the “Producer” and all of whom are sometimes collectively hereinafter referred to as the “Producers”)

WHEREAS Canpotex was incorporated as a company under the Canada Corporations Act, by Letters Patent dated the 21st day of July, 1970, carrying on the business of purchasing Potash from Canadian Potash producers and selling such Potash for export (i.e., to purchasers for ultimate delivery to any destination outside Canada and the United States), in the manner more particularly hereinafter set forth;

AND WHEREAS Canpotex was continued as a corporation by Articles of Continuance under the Canada Business Corporations Act (the “CBCA”) pursuant to a Certificate of Continuance dated October 21, 1980;

AND WHEREAS Canpotex’s Articles were restated by Restated Articles of Incorporation under the CBCA pursuant to a Certificate of Restated Articles dated July 29, 2008 (such articles, as amended and restated, being the “Articles”);

| PRODUCER AGREEMENT - EXECUTION COPY | Page 2 |

AND WHEREAS Canpotex conducts its operations on a basis whereby the full proceeds of sales of Potash, after deduction of the costs and expenses, as set out in Article XI below, incurred by Canpotex, are paid to the Producers as the purchase price for Potash purchased by Canpotex;

AND WHEREAS Canpotex and each Producer, or its predecessor in interest, entered into agreements made as of the 21st day of April, 1978, as subsequently amended, with respect to matters substantially the same as this Agreement, and the Producers are now desirous of replacing these agreements with this Agreement with respect to matters which arise on or after the Effective Date hereof;

AND WHEREAS each of the Producers produces Potash or produces Potash through an affiliated, associated, parent or subsidiary company in the Province of Saskatchewan, Canada and may produce Potash at other locations in Canada during the term of this Agreement, and desires to market such Potash for export in accordance with the terms and conditions of this Agreement.

NOW THEREFORE THIS AGREEMENT WITNESSETH THAT in consideration of the premises and the mutual covenants hereinafter contained, the parties hereto agree as follows:

| I. | DEFINITIONS |

| 1.01 | In this Agreement: |

| (a) | “Additional Suspension Period” means a two year period immediately following the last day of a Suspension Period; |

| (b) | “Affected Producer” means a Producer that has had one or more of its Mines affected by a Disaster or affected by an event or series of related events that any Producer believes has caused a Disaster at such Mine or Mines; |

| (c) | “Aggregate Productive Capacity” or “APC” is a measurement intended to approximate the total of the productive capacities of the Mines of a Producer and shall be adjusted from time to time as provided for in this Agreement. However, because only certain changes in productive capacity qualify as provided herein for an adjustment of APC, it is acknowledged that the actual total of the Individual Productive Capacities of the Mines of a Producer, as calculated from time to time for purposes of this Agreement, may differ from the APC of the Producer, as calculated from time to time for purposes of this Agreement. The Aggregate Productive Capacities of the Producers as of the Effective Date are as follows: |

| Agrium Inc. | - | 1,959,272 Product Tonnes per annum | ||||

| Mosaic Group | - | 10,129,953 Product Tonnes per annum | ||||

| Potash Corporation of Saskatchewan Inc. (“PCS”) | - | 11,724,393 Product Tonnes per annum |

| PRODUCER AGREEMENT - EXECUTION COPY | Page 3 |

For convenience, the Aggregate Productive Capacities of the Producers are also set forth in Schedule 1 appended to this Agreement, which schedule shall be modified and reconfirmed by each Producer by written agreement based upon such adjustments as may be required after audits conducted pursuant to and in accordance with Articles VI, VII or VIII of this Agreement.

It is further acknowledged that the Aggregate Productive Capacity of a Producer, when such reference is to Mosaic Canada Crop Nutrition, LP, shall be understood to relate to the productive capacities of all of the Mines of the Mosaic Group, and that Canpotex shall at all times be entitled to treat the collective productive capacities of the Mines of the Mosaic Group as one APC for purposes hereof with one aggregate Basic Entitlement for purposes of this Agreement, and that it shall be the responsibility of Mosaic Canada Crop Nutrition, LP to ensure that the obligations set forth by or pursuant to this Agreement to deliver Potash to Canpotex consistent with such APC and Basic Entitlement are satisfied by the Mosaic Group;

| (d) | “Agreement” means this Consolidated, Restated and Amended Producer Agreement, including the premises and preamble, and any schedules hereto, but excludes any Product Supply Agreement; |

| (e) | “Assets” means Mines, mining property and other real and personal property, tangible or intangible, of every nature or kind used or capable of being used by a Producer for or in connection with the mining, refining, processing, production, transportation, storing or marketing of Potash which is the subject matter of this Agreement; |

| (f) | “Basic Entitlement” of a Producer means that percentage that such Producer’s Aggregate Productive Capacity bears to the total Aggregate Productive Capacities of all Producers multiplied by the total forecast sales of Potash, on a Grade Pool-by- Grade Pool basis, by Canpotex for each Fiscal Year pursuant to an approved Operating Plan and Budget, subject to adjustment in accordance with this Agreement; |

| (g) | “Board of Directors” means the board of directors of Canpotex; |

| (h) | “Canpotex Auditors” means the external auditors of Canpotex from time to time which, as at the Effective Date, are Deloitte LLP; |

| (i) | “commitment” means, with respect to any Fiscal Year and with respect to any Producer, the quantity of Potash agreed to be supplied to Canpotex pursuant to a Product Supply Agreement by such Producer pursuant to the provisions of Article V; |

| (j) | “Date of Commencement of the Major Expansion” means the date specified in a Notice of Expansion determined by a Producer as being the date of commencement of a Major Expansion; |

| PRODUCER AGREEMENT - EXECUTION COPY | Page 4 |

| (k) | “Dedicated Capital” means an amount not less than US $150,000,000 expended in respect of an existing Mine and allocated and committed on a permanent basis for capital improvements of an enduring nature designed to increase its Individual Productive Capacity, including equipment upgrades and modifications necessitated in connection therewith. “Dedicated Capital” shall include capital acquired through the entering into of a capital lease that qualifies as such under applicable accounting rules, provided that such capital otherwise satisfies the requirements as set out above and, provided further, that the aggregate amount of the payments to be paid by the lessee to the lessor under any such capital lease shall be considered expended during the months in which the capital lease is entered into by the applicable Producer, as lessee, and the lessor of the capital. |

There shall be excluded from “Dedicated Capital” all expenditures, regardless of (i) the amount thereof (either alone or in the aggregate), (ii) the time period over which such expenditures are made, and (iii) whether such expenditures are made on a one-time or on a recurring basis, that are made for maintenance, repairs or equipment upgrades and modifications (other than equipment upgrades and modifications referred to in the first sentence of this definition) and similar costs or other expenses for minor improvements, de-bottlenecking or adjustments to sustain, improve or increase the Individual Productive Capacity of that Mine on a limited basis;

| (l) | “Dedicated Capital Documentation” means all construction contracts, purchase orders, change orders, invoices, receipts, agreements, cancelled cheques, ledgers, statements and any other documents, instruments, information or materials which support or provide evidence of the expenditure of the applicable Dedicated Capital; |

| (m) | “Disaster” means any event or series of related events occurring with respect to a Mine that has or have the effect of reducing the productive capacity of such Mine by an amount equal to at least 50% of the Pre-Disaster Audit Amount of such Mine; |

| (n) | “Effective Date” means 12:01 a.m. (Saskatchewan time) on January 1, 2014; |

| (o) | “Fiscal Year” means the period of time for which the accounts for the business of Canpotex are ordinarily made up, beginning on the 1st day of January in each calendar year and ending on the 31st day of December of such calendar year; |

| (p) | “for export” means for sale to a purchaser for ultimate delivery to any destination outside Canada and the United States; |

| (q) | “Grade Pool” means any of the following pools of the individual grades of Potash: |

| (i) | Standard pool which includes all red standard, white standard, pink standard, red fine standard and white fine standard grades of Potash; |

| (ii) | Premium pool which includes all granular, superblend and coarse grades of Potash, as well as all industrial and chemical grades of Potash; and/or |

| PRODUCER AGREEMENT - EXECUTION COPY | Page 5 |

| (iii) | such other or different grade pools of Potash as may be established from time to time by the Board of Directors; |

and “Grade Pools” means all of them;

| (r) | “Individual Productive Capacity” or “IPC” means the individual productive capacity from time to time of a Mine expressed as a number of Product Tonnes per annum. The IPC of a Mine shall be adjusted as provided for in this Agreement. As of the Effective Date, the Individual Productive Capacity of each of the Mines of the Producers are as follows: |

| Agrium Xxxxxxx | 2,035,421 Product Tonnes per annum | |||

| Mosaic Belle Plaine | 2,761,800 Product Tonnes per annum | |||

| Mosaic Colonsay | 1,814,036 Product Tonnes per annum | |||

| Mosaic Esterhazy (K1 and K2) | 6,310,052 Product Tonnes per annum | |||

| PCS Xxxxx | 1,582,000 Product Tonnes per annum | |||

| PCS Xxxx | 3,022,356 Product Tonnes per annum | |||

| PCS Xxxxxxx | 3,452,500 Product Tonnes per annum | |||

| PCS Patience Lake | 1,049,600 Product Tonnes per annum | |||

| PCS Rocanville | 3,044,475 Product Tonnes per annum |

For convenience, the Individual Productive Capacities of the Producers of each of the Mines are also set forth in Schedule 1 appended to this Agreement, which schedule shall be modified and reconfirmed by each Producer by written agreement based upon such adjustments as may be required after audits conducted pursuant to and in accordance with Articles VI, VII or VIII of this Agreement.

| (s) | “Major Expansion” means any Dedicated Capital expansion undertaken by a Producer of an existing Mine, occurring after the Effective Date, provided that such expansion shall: |

| (i) | involve the expenditure of the Dedicated Capital; |

| (ii) | be of continuous duration and not be staged; and |

result in a Post-Expansion Audit Amount of such Mine of at least 200,000 Product Tonnes more than the greater of (a) the Individual Productive Capacity of the existing Mine, and (b) the Pre-Expansion Audit Amount of the existing Mine.

| (t) | “Measured Level of Product” has the meaning assigned thereto in section 6.08; |

| (u) | “Mid-Year Sales Forecast” means the mid-year sales forecast to cover the period July 1 through the close of the calendar year; |

| (v) | “Mine” means a single Potash mine and mill situated in Canada of a Producer, including a Solution Mine, and “Mines” means more than one Mine; and as of the Effective Date, currently operating Mines are as listed in section 1.01 (r); provided that in the case of PCS, Mine shall not include any mine in the Province of New |

| PRODUCER AGREEMENT - EXECUTION COPY | Page 6 |

| Brunswick, except to the extent that PCS has elected pursuant to section 3.02 hereof, and this Agreement has been amended pursuant to section 3.03 hereof, to include production from such mine in the Potash supplied by PCS to Canpotex under this Agreement; |

| (w) | “Mosaic Group” means, collectively, Mosaic Canada ULC, Mosaic Potash Colonsay ULC, Mosaic Potash Esterhazy Limited Partnership, and Mosaic Canada Crop Nutrition, LP; |

| (x) | “New Mine” means any new Mine of any of the Producers constructed after the Effective Date; |

| (y) | “New Mine Construction” means any construction of a New Mine; |

| (z) | “Notice of Expansion” means a notice provided for in section 6.01 hereof which shall be delivered in accordance with section 18.01 hereof and which shall be delivered only after a Major Expansion has become a matter of public record and in any event not more than 90 days nor less than 30 days before the Date of Commencement of the Major Expansion, which notice shall also state the date such Major Expansion shall commence; |

| (aa) | “Operating Days” with respect to a Mine means days that the Mine is operational and producing Potash of any grade. If the production schedule at a Mine is 10 days of production followed by 4 days of non-production for maintenance and other purposes, then only the 10 days of production would be considered as Operating Days for purposes hereof; accordingly, with such a production schedule, for purposes of this Agreement 90 Operating Days at a Mine would be achieved after 9 consecutive 10 and 4 cycles. Regardless of the production schedule used at a Mine, non-production days for maintenance or other purposes shall not be considered “Operating Days” for purposes hereof, provided that in the case of a Mine, other than a Solution Mine, operating on a continuous production schedule, any 90 Operating Day period must be completed within 122 days from and including the first Operating Day of such period; |

| (bb) | “Operating Plan and Budget” means the annual operating plan and budget of Canpotex prepared by Canpotex management and approved by the Board of Directors, as provided in section 5.02; |