SECURITIES PURCHASE AGREEMENT BY AND AMONG CRYOLIFE, INC., CRYOLIFE GERMANY HOLDCO GMBH, JOLLY BUYER ACQUISITION GMBH, JOTEC AG, THE SECURITYHOLDERS LISTED ON SCHEDULE 1 HERETO, AND LARS SUNNANVÄDER, as the Securityholder Representative Dated as of...

Exhibit 2.1

BY AND AMONG

CRYOLIFE, INC.,

CRYOLIFE GERMANY HOLDCO GMBH,

JOLLY BUYER ACQUISITION GMBH,

JOTEC AG,

THE SECURITYHOLDERS LISTED ON SCHEDULE 1 HERETO, AND

LARS SUNNANVÄDER, as the Securityholder Representative

Dated as of October 10, 2017

TABLE OF CONTENTS

|

|

Page |

|

|

Article I |

DEFINITIONS |

|

|

1.1 |

||

|

Article II |

PURCHASE AND SALE |

|

|

2.1 |

||

|

2.2 |

Shareholder Loans, Shares of Minority Shareholders, Shareholder Options and Bonuses |

|

|

2.3 |

Closing |

|

|

2.4 |

Purchase Price |

|

|

2.5 |

Consideration Schedule |

|

|

2.6 |

Exchange Procedures |

|

|

Article III |

ACQUISITION CONSIDERATION ADJUSTMENT |

|

|

3.1 |

Acquisition Consideration Adjustment |

|

|

Article IV |

REPRESENTATIONS, WARRANTIES AND COVENANTS OF THE SECURITYHOLDERS |

|

|

4.1 |

Authority; Non-Contravention; Approvals |

|

|

4.2 |

Title to Sold Shares |

|

|

4.3 |

Litigation |

|

|

4.4 |

Interest in Intellectual Property |

|

|

4.5 |

||

|

4.6 |

||

|

4.7 |

||

|

4.8 |

Tax Status |

|

|

4.9 |

Lock-Up Period |

|

|

4.10 |

Restrictive Legends |

|

|

4.11 |

Fair Disclosure |

|

|

Article V |

REPRESENTATIONS AND WARRANTIES REGARDING THE COMPANY AND THE COMPANY SUBSIDIARIES |

|

|

5.1 |

Organization of the Company |

|

|

5.2 |

Company Capital Structure |

|

|

5.3 |

Subsidiaries |

|

|

5.4 |

Authority |

|

|

5.5 |

No Conflict |

|

|

5.6 |

Governmental Consents |

|

|

5.7 |

Company Financial Statements |

|

|

5.8 |

No Undisclosed Liabilities |

|

|

5.9 |

Internal Controls |

|

|

5.10 |

No Changes |

|

|

5.11 |

Tax Matters |

|

|

5.12 |

Restrictions on Business Activities |

-1-

|

5.13 |

Title to Properties; Absence of Liens and Encumbrances |

|

|

5.14 |

Intellectual Property |

|

|

5.15 |

Agreements, Contracts and Commitments |

|

|

5.16 |

Related Party Transactions |

|

|

5.17 |

Health Care Legal Compliance |

|

|

5.18 |

Company Authorizations |

|

|

5.19 |

Litigation |

|

|

5.20 |

Corporate and Business Records |

|

|

5.21 |

Environmental Matters |

|

|

5.22 |

||

|

5.23 |

Employee Benefit Plans and Compensation |

|

|

5.24 |

Insurance |

|

|

5.25 |

Compliance with Laws |

|

|

5.26 |

||

|

5.27 |

||

|

5.28 |

Customers and Suppliers |

|

|

5.29 |

Warranties to Customers |

|

|

5.30 |

Products |

|

|

5.31 |

Utilization of Assets |

|

|

5.32 |

Disclosure |

|

|

5.33 |

Fair Disclosure |

|

|

Article VI |

REPRESENTATIONS AND WARRANTIES OF CRYOLIFE, PARENT, AND BUYER |

|

|

6.1 |

Organization, Standing and Power |

|

|

6.2 |

Authority |

|

|

6.3 |

No Conflict |

|

|

6.4 |

Capitalization |

|

|

6.5 |

Litigation |

|

|

6.6 |

Consents |

|

|

6.7 |

Issuance of CryoLife Common Stock |

|

|

6.8 |

Private Placement |

|

|

6.9 |

||

|

6.10 |

SEC Documents |

|

|

6.11 |

Solvency |

|

|

6.12 |

Financing |

|

|

6.13 |

CryoLife Operational Representations |

|

|

6.14 |

Disclosure |

|

|

Article VII |

ADDITIONAL AGREEMENTS |

-2-

|

7.1 |

Preservation of Business |

|

|

7.2 |

Exclusivity |

|

|

7.3 |

Confidentiality |

|

|

7.4 |

Expenses |

|

|

7.5 |

Transfer Taxes |

|

|

7.6 |

[Intentionally omitted] |

|

|

7.7 |

Public Disclosure |

|

|

7.8 |

Consents |

|

|

7.9 |

Additional Documents and Further Assurances; Reasonable Efforts |

|

|

7.10 |

Section 338(g) Election |

|

|

7.11 |

Indirect Partial Liquidation |

|

|

7.12 |

||

|

7.13 |

No Claims against Directors and Officers; Release. |

|

|

7.14 |

Securityholder Release |

|

|

7.15 |

Squeeze-Out Merger |

|

|

7.16 |

Restrictions on Other Share Transfers |

|

|

7.17 |

Escrow Agent |

|

|

Article VIII |

CONDITIONS TO THE ACQUISITION |

|

|

8.1 |

Conditions to Obligations of Each Party to Effect the Acquisition |

|

|

8.2 |

Conditions to the Obligations of Parent and Buyer |

|

|

8.3 |

Conditions to Obligations of the Company and the Securityholders |

|

|

Article IX |

SURVIVAL OF REPRESENTATIONS, WARRANTIES AND COVENANTS |

|

|

9.1 |

Survival of Representations, Warranties and Covenants |

|

|

9.2 |

Indemnification |

|

|

9.3 |

Escrow Arrangements |

|

|

9.4 |

Indemnification Claims |

|

|

9.5 |

Securityholder Representative |

|

|

9.6 |

Maximum Payments; Remedy |

|

|

9.7 |

Purchase Price Adjustments |

|

|

9.8 |

Sole Remedy |

|

|

9.9 |

Termination |

|

|

Article X |

AMENDMENT AND WAIVER |

|

|

10.1 |

Amendment |

|

|

10.2 |

Extension; Waiver |

|

|

Article XI |

GENERAL PROVISIONS |

|

|

11.1 |

Notices |

|

|

11.2 |

Interpretation |

-3-

|

11.3 |

Counterparts |

|

|

11.4 |

||

|

11.5 |

Severability |

|

|

11.6 |

||

|

11.7 |

Governing Law; Venue |

|

|

11.8 |

Rules of Construction |

|

|

11.9 |

Successors and Assigns |

|

|

11.10 |

Taking of Necessary Action |

|

|

11.11 |

Third Party Beneficiaries |

|

|

11.12 |

||

|

11.13 |

Waiver of Jury Trial |

|

|

|

|

Schedules: |

|

|

Securityholders |

|

|

Company Subsidiaries |

|

|

Company Products |

|

|

Consideration Schedule |

|

|

Defined Terms |

|

|

Excluded Contracts |

|

|

Third Party Consents and Notices |

|

|

Liens to be Released |

|

|

Contracts to be Terminated |

|

|

Contracts to be Amended |

|

|

Special Indemnification Matters |

|

|

Already Considered Purchase Price Reductions |

|

|

Exhibits: |

|

|

Escrow Agreement |

|

|

Securityholder Agreement |

-4-

This SECURITIES PURCHASE AGREEMENT (the “Agreement”) is made and entered into as of October 10, 2017 by and among CryoLife, Inc., a Florida corporation (“CryoLife”), CryoLife Germany HoldCo GmbH, a German GmbH (“Parent”), Jolly Buyer Acquisition GmbH, a Swiss GmbH (“Buyer”), JOTEC AG, a Swiss AG (the “Company”), the securityholders of the Company listed on Schedule 1 hereto (the “Securityholders”) who have signed this Agreement below, and Lars Sunnanväder (the “Securityholder Representative”). Each person or entity noted above is referred to as a “Party” and collectively as the “Parties”, and references to Schedules and Exhibits refer to the Schedules and Exhibits attached to this Agreement, unless otherwise noted.

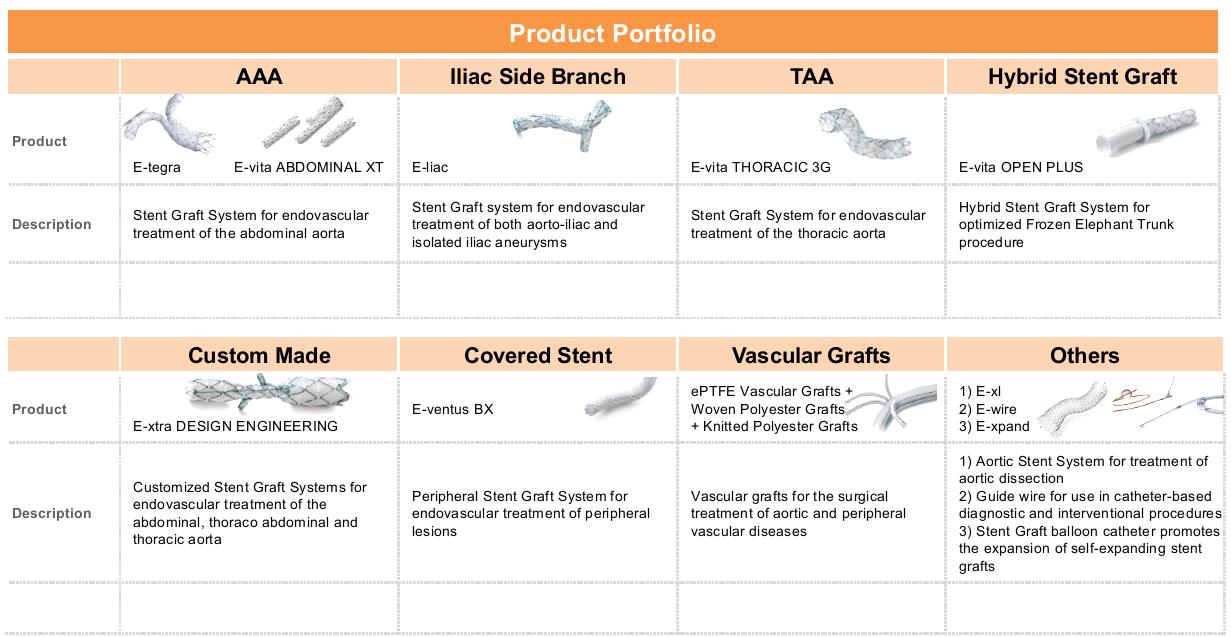

A.The Company and each of the subsidiaries of the Company listed in Schedule 2 (each, a “Company Subsidiary” and, collectively, the “Company Subsidiaries”) design, develop, market and sell aortic and vascular surgical and endovascular medical devices and accessories (including but not limited to thoracic medical devices and accessories) (the “Business”), including the Company Products (as defined in this Agreement), all of which are listed and described in Schedule 3.

B.The Securityholders are currently the holders of 101,923 of all issued and outstanding Shares (as defined in this Agreement), representing approximately 94.4% of the Shares. Upon the terms and subject to the conditions set forth in this Agreement, at the Closing, the Securityholders desire to sell to Buyer and Buyer desires to purchase from the Securityholders, all of the Shares held by the Securityholders immediately prior to Closing (the “Acquisition”).

C.Upon the terms and subject to the conditions set forth in this Agreement, the $225,000,000 in consideration payable by Buyer for 100% of the Shares, subject to adjustments set forth in this Agreement and the escrow amount described below, will be paid partially in U.S. Dollars and partially in shares of CryoLife Common Stock, to be allocated among the Securityholders as described in Schedule 4 which schedule shall be updated prior to Closing (the “Consideration Schedule”).

X.Xx connection with the Acquisition, (i) at the Closing, the holders of the Shareholder Loans (as defined in this Agreement) desire to sell and transfer the Shareholder Loans to Buyer for the amount of principal and interest then outstanding under the Shareholder Loans (the “Consideration for the Shareholder Loans”) and Buyer desires to purchase the Shareholder Loans to be allocated among the holders of the Shareholder Loans as described in the Consideration Schedule, (ii) prior to the Closing, the Securityholders desire to purchase the Shares they do not own from the other shareholders of the Company (each a “Minority Shareholder” and collectively the “Minority Shareholders”); (iii) prior to the Closing, the Securityholders who granted the Shareholder Options (each an “Option Grantor” and

-1-

collectively the “Option Grantors”) desire to redeem the Shareholder Options (as defined in this Agreement) from the holders of such Shareholder Options; and (iv) following Closing, subject to Closing occurring, certain Securityholders shall pay the bonus or change of control payments (subject to the terms of the respective Contracts between the recipients of such bonuses and such Securityholders) to Employees of the Company or any Company Subsidiaries in connection with the Acquisition.

E.Contemporaneously with the execution and delivery of this Agreement, Buyer and the Securityholder Representative are entering into the escrow agreement attached as Exhibit A (the “Escrow Agreement”), to be effective as of the Closing Date subject to Closing occurring, and a portion of the cash consideration otherwise payable in connection with the Acquisition shall be placed in an escrow account with U.S. Bank, N.A., in its capacity as escrow agent (the “Escrow Agent”), pursuant to the Escrow Agreement as partial security for any amounts payable for indemnification claims and other payment obligations, as described in this Agreement.

F.Contemporaneously with the execution and delivery of this Agreement by the Parties, the Key Employee (as defined in this Agreement) is executing one or more documents with CryoLife or one of its subsidiaries (each a “Key Employee Document” and collectively, the “Key Employee Documents”), each to be effective as of the Closing Date subject to Closing occurring.

G.Contemporaneously with the execution and delivery of this Agreement, as a material inducement to Candy, Parent and Buyer to enter into this Agreement, each of the Securityholders is entering into a Contract not to compete with the Business or solicit employees or customers of the Business following the Acquisition, in substantially the form of Exhibit B (the “Securityholder Agreement”), each to be effective as of the Closing Date subject to Closing occurring.

NOW, THEREFORE, in consideration of the mutual agreements, covenants and other promises set forth herein, the mutual benefits to be gained by the performance thereof, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged and accepted, the Parties hereby agree as follows:

1.1Definitions. For all purposes of this Agreement, the defined terms set forth on Schedule 5 are hereby incorporated in this Agreement.

-2-

2.1Sale and Purchase of the Shares. On the terms and subject to the conditions of this Agreement, at the Closing, (a) the Securityholders shall sell, transfer, assign, convey and deliver to Buyer all of the Shares owned by the Securityholders as of the Closing Date immediately prior to Closing (the “Sold Shares”; each a “Sold Share”) free and clear of any Liens, and (b) Buyer shall purchase and acquire all Sold Shares, free and clear of any Liens, for the consideration described in Section 2.4.

2.2Shareholder Loans, Shares of Minority Shareholders, Shareholder Options and Bonuses.

(a)Shareholder Loans: On the terms and subject to the conditions of this Agreement, at the Closing, the holders of the Shareholder Loans shall sell and transfer to Buyer and CryoLife shall or shall cause Buyer to acquire the Shareholder Loans from the holders thereof, for the consideration described in Section 2.4.

(b)Shares of Minority Shareholders. Between the date of this Agreement and the Closing and at such time as the Securityholders reasonably believe will enable as many Shares as possible not owned by the Securityholders, yet, to be acquired from the Minority Shareholders prior to the Closing Date subject to Closing occurring, the Securityholders shall acquire as many Shares as possible not owned by the Securityholders as of the date hereof from the Minority Shareholders subject to Closing occurring.

(c)Shareholder Options. On the terms and subject to the conditions of this Agreement, prior to the Closing, the Option Grantors shall redeem the Shareholder Options subject to the Closing occurring and shall terminate prior to the Closing subject to Closing occurring all rights under or related to the Shareholder Options.

(d)Shareholder Bonuses. On the terms and subject to the conditions of this Agreement, any Securityholders who committed to pay or otherwise pay a bonus or change of control payment to Employees of the Company or any Company Subsidiaries (each a “Bonus Payor” and collectively the “Bonus Payors”) in connection with the Acquisition shall pay subject to Closing occurring such bonuses or change of control payments at the latest one (1) Business Day following the Closing.

(e)Documentation. The Securityholders, including each of the holders of the Shareholder Loans, the Option Grantors and Bonus Payors, shall execute and shall apply commercially reasonable efforts to have the recipients of the Shareholder Options and the bonus or change of control payments execute all such documents and take all such other actions as may be necessary to confirm the foregoing actions to occur at or prior to the Closing, as applicable.

(f)Required Withholding Tax. Half of the amount payable to holders of Shareholder Options pursuant to this Section 2.2 will be withheld by the Option Grantors on

-3-

behalf of the holders of Shareholder Options who are employees of any of the Company Subsidiaries and paid by the Option Grantors on behalf of the holder of the Shareholders Option to the relevant Company Subsidiary at the latest one (1) Business Day following the Closing to satisfy the employee and employer portion of any associated Taxes, social security or similar obligations required to be deducted or withheld therefrom under any provision of applicable Law (a “Required Withholding Tax”) and the Bonus Payors shall withhold half of the bonus or change of control amount payable to each of the Employees any of the Company Subsidiaries pursuant to this Section 2.2 and pay such withheld amounts on behalf of the Employees receiving such bonuses or change of control payments to the relevant Company Subsidiary at the latest one (1) Business Day following the Closing to satisfy any associated Required Withholding Tax. In the event that the amount so withheld and paid falls short of the amount required to be paid to the applicable Governmental Authority with respect to (A) a Shareholder Option or (B) a bonus or change of control amounts payable by the Bonus Payors, the shortfall of such Required Withholding Tax shall be paid upon demand of the Buyer at the option of the Buyer either to the Company or applicable Company Subsidiary directly by the former holder of a Shareholder Option or the applicable Employee to the applicable Governmental Authority. The Company will cause the relevant Company Subsidiary to release any excess amount not used to pay the Required Withholding Tax (the “Excess Withholding Amount”) to the applicable Employee or former holder of a Shareholder Option upon the relevant Company Subsidiary’s receipt of reasonable satisfactory evidence as to the existence and calculation of an Excess Withholding Amount.

2.3Closing. Unless the Securityholders holding a majority of the Shares Representative and Buyer mutually agree in writing to a different date and time, the Acquisition will take place at 12:01 a.m. Eastern Time on the fifth (5th) Business Day following the date on which the satisfaction or written waiver (to the extent legally permissible) of the conditions precedent set forth in Article VIII occurs and continues. The Acquisition shall take place remotely by facsimile, e-mail or other electronic communication, unless another method is mutually agreed upon in writing by Buyer and the Securityholder Representative. The consummation of the Acquisition is referred to as the “Closing.” The date and time upon which the Closing is effective shall be referred to herein as the “Closing Date.”

(a)Payments of Closing Consideration and Consideration for Shareholder Loans. On the terms and subject to the conditions of this Agreement, including the provisions of Section 2.2 and Section 2.4(b) and the adjustment set forth in Section 3.1, in full consideration for the transfer of all of the Sold Shares to Buyer and the purchase of the Shareholders Loans by Buyer, at the Closing, CryoLife shall pay or cause Buyer to pay to the Paying Agent for further distribution by the Paying Agent to each of the Securityholders their respective portion of (i) the Closing Consideration and (ii) the Consideration for Shareholder Loans as set forth on the Consideration Schedule and, in the case of the CryoLife Common Stock comprising a portion of the Closing Consideration, CryoLife shall irrevocably instruct American Stock Transfer & Trust Company, LLC (the “Transfer Agent”) to reflect in book entry form the issuance of shares of CryoLife Common Stock to such Securityholders, as set forth on the Consideration Schedule.

-4-

The Paying Agent shall distribute the cash portion of the Closing Consideration and the Consideration for Shareholder Loans by an irrevocable bank wire transfer of immediately available funds to accounts designated in writing by the Securityholders, as set forth on the Consideration Schedule. For the avoidance of doubt, when the parties determined the Closing Consideration, they agreed that the items mentioned in Schedule 12 are already reflected in the Closing Consideration and shall thus not be further considered whatsoever, neither for purposes of the net debt Acquisition Consideration adjustment, nor for any breach of representation or warranty, nor for any indemnification or otherwise.

(b)Escrow. On the Closing Date and subject to the terms and conditions of this Agreement, including the provisions of Section 9.3, CryoLife shall or shall cause Buyer to deposit with the Escrow Agent an amount in cash equal to the Escrow Amount. The Securityholders’ respective Pro Rata Portions of the Escrow Amount shall equal in the aggregate the Escrow Amount.

(c)Withholding Taxes. Notwithstanding any other provision in this Agreement, Buyer, the Company, the Paying Agent and the Escrow Agent shall have the right to deduct and withhold from any payments to be made hereunder such amounts as are required to be deducted or withheld therefrom under any provision of applicable Law, and to reasonably request any necessary Tax forms, as applicable, and any similar information. To the extent that any such amounts are so withheld and paid over to the appropriate Governmental Authority, such withheld and paid amounts shall be treated for all purposes of this Agreement as having been paid to the Person in respect of which such deduction and withholding was made. To the extent that any payment pursuant to this Agreement is not reduced by such required deductions or withholdings, such Person shall indemnify Buyer, the Company and the Escrow Agent for any liability to any Governmental Authority for such required deductions or withholdings together with all related Losses. None of the Company or any other Party shall be liable to a holder of the Shareholder Loans or the Shareholder Options or any bonuses or change of control payments for any amount properly paid to a Governmental Authority pursuant to any applicable abandoned property, escheat or similar Law. Notwithstanding anything to the contrary in this Section 2.4(c), the Buyer shall be responsible for any deductions or withholdings from payments to be made to Securityholders pursuant to this Agreement that are imposed by a jurisdiction other than Switzerland or Germany (or, in each case, any political subdivision thereof) solely as a result of the Buyer acquiring, or being deemed to have acquired, the Company through an entity organized under the laws of the jurisdiction imposing such deduction or withholding and, for the avoidance of doubt, not as the sole result of the status of any Securityholder as a citizen or Tax resident of the jurisdiction imposing such deduction or withholding, and in such case the amount of the payment due shall be increased to an amount which (after making any Tax deductions) leaves an amount equal to the payment which would have been due if the Tax deductions made had not been required.

2.5Consideration Schedule. No later than three (3) Business Days before the Closing, the Company shall deliver to Buyer and Paying Agent the updated Consideration Schedule (to reflect the purchase by one or several of the Securityholders of Shares from the Minority Shareholders) setting forth (i) the name and mailing address of each Securityholder; (ii)

-5-

the Sold Shares and the sold Shareholder Loans held by each Securityholder, in each case as of immediately prior to the Closing; (iii) each Securityholder’s Pro Rata Portion of the Escrow Amount; (iv) the Estimated Net Debt and each Securityholder’s Pro Rata Portion of Estimated Net Debt; (v) each Securityholder’s Pro-Rata Portion of the Closing Consideration (including the amount of cash and number of shares of CryoLife Common Stock to which such Securityholder is entitled), payable to each such Securityholder with respect to their respective Sold Shares; (vi) each Securityholders’ share of the Consideration for the Shareholder Loans and (vii) as applicable, with respect to any Shares issued on or after January 1, 2011 or any other Shares, in each case constituting a “covered security” under Treasury Regulation § 1.6045-1(a)(15), the cost basis and date of issuance of such Shares or Shares. The Paying Agent shall be responsible for the distribution of such amounts delivered to the Paying Agent. Upon (i) paying the Escrow Amount to the Escrow Agent, (ii) payment of the Consideration for the Shareholder Loans and the cash portion of the Closing Consideration to the Paying Agent, and (iii) instructing the Transfer Agent to reflect in book entry form the issuance of the CryoLife Common Stock issuable as Closing Consideration to the Securityholders as set forth in the Consideration Schedule, CryoLife, Parent and Buyer shall have fulfilled their respective obligations with respect to the Closing, subject to the Acquisition Consideration adjustment set forth in Article III.

(a)Shares. At Closing, the Company and each of the Securityholders shall take such steps that are required for Buyer to be registered as the owner of all of the Sold Shares in the share register of the Company and deliver to Buyer such other notices and documentation, duly executed on behalf of the Company if necessary, confirming that Buyer is entered in the register as sole owner of the Sold Shares, accompanied by a copy of such register duly signed by the Company’s board of directors (the “Board of Directors”) or such other evidence as is necessary, customary and appropriate that Buyer has been registered as the sole owner of all Sold Shares, free and clear of any Liens. In particular, the Securityholders shall deliver or cause to be delivered to the Buyer at Closing: (i) the original share certificates representing the Sold Shares, each duly endorsed in blank by the respective Securityholder; (ii) the original minutes of the meeting of the Board of Directors approving the acquisition of the Sold Shares by the Buyer and the entry of the Buyer as owner of the Sold Shares with full voting rights in the share register of the Company; and (iii) the original share register of the Company as of the Closing Date, duly signed by the Board of Directors, in which the Buyer is registered as the owner of the Sold Shares with full voting rights, free and clear of any Liens. Upon Closing, the Buyer shall be recorded as the sole owner of all Sold Shares in the Company’s share register, and in accordance with the terms and subject to the conditions set forth in this Agreement, each Securityholder shall receive from Buyer in exchange therefor the Pro Rata Portion of the Closing Consideration to which each such Securityholder is entitled pursuant to Section 2.5, as set forth on the Consideration Schedule, which for purposes of clarification shall be subject to adjustment as provided in Section 3.1.

(b)Resignation of Officers and Directors. At the Closing, the Securityholders shall deliver to Buyer a written resignation from each of the officers and

-6-

directors of each of the Company and the Company Subsidiaries in form and substance that will allow Buyer to cause such resignations to be effective as of or promptly following the Closing.

(c)Declaration of Beneficial Owner. At the Closing, the Buyer shall deliver to the Company a notification of beneficial ownership regarding the Sold Shares in accordance with article 697j of the Swiss Code of Obligations.

(d)Joint Closing Actions / Deemed Occurrence of the Closing Actions. All actions to be taken and documents to be delivered by the Parties at Closing as set forth in this Agreement are deemed to have (i) been taken, executed and delivered simultaneously and (ii) occurred only if and when all such actions and documents have been taken, executed and delivered. In case Closing does not occur, the Parties undertake to use their commercially reasonable best efforts to unwind all Closing actions initiated or taken.

Article III

ACQUISITION CONSIDERATION ADJUSTMENT

3.1Acquisition Consideration Adjustment.

(a)No later than three (3) Business Days prior to Closing, the Company shall deliver to Buyer a written statement of its reasonable good faith estimate of the Net Company Debt as at the Closing Date (the “Estimated Net Debt”), together with a reasonably detailed explanation of the calculation thereof. The amount of the Estimated Net Debt shall be reflected in the calculation of the Closing Consideration to be paid by Buyer at Closing pursuant to Section 2.4.

(b)Within sixty (60) days after the Closing Date, CryoLife shall cause to be prepared and delivered to the Securityholder Representative a statement setting forth the calculation of the Net Company Debt as of the Closing Date, together with a reasonably detailed explanation of the calculation thereof (the “Company Net Debt Statement”) and a statement setting forth the calculation of the adjustment amount to the Acquisition Consideration (if any) based on the difference between the Estimated Net Debt and the Company Net Debt determined pursuant to the Company Net Debt Statement (this statement, collectively with the Company Net Debt Statement, the “Closing Adjustment Statement”).

(c)Within sixty (60) days following receipt by the Securityholder Representative of the Closing Adjustment Statement, the Securityholder Representative shall deliver written notice to CryoLife of any dispute it has with respect to the preparation or content of the Closing Adjustment Statement. If the Securityholder Representative does not notify CryoLife in writing of a dispute with respect to the Closing Adjustment Statement within such sixty (60)-day period, pursuant to a written notice describing in reasonable detail the specific calculations that are disputed and the basis for such dispute, such Closing Adjustment Statement will be final, conclusive and binding on the Parties. If the Securityholder Representative notifies CryoLife in writing of a dispute with respect to the Closing Adjustment Statement within such sixty (60)-day period, pursuant to a written statement describing in reasonable detail the specific

-7-

calculations that are disputed and the basis for such dispute, CryoLife and the Securityholder Representative shall negotiate in good faith to resolve such dispute. If CryoLife and the Securityholder Representative, notwithstanding such good faith effort, fail to resolve such dispute within thirty (30) days after the Securityholder Representative advises CryoLife of its objections, then CryoLife and the Securityholder Representative jointly shall be entitled to engage the Arbitration Firm to resolve such dispute. As promptly as practicable thereafter (and, in any event, within fifteen (15) days after the Arbitration Firm’s engagement), the Securityholder Representative shall submit any unresolved elements of its objection to the Arbitration Firm in writing (with a copy to CryoLife), supported by any documents and arguments upon which it relies. As promptly as practicable thereafter (and, in any event, within fifteen (15) days following the Securityholder Representative’s submission of such unresolved elements), CryoLife shall submit its response to the Arbitration Firm (with a copy to the Securityholder Representative) supported by any documents and arguments upon which it relies. CryoLife and the Securityholder Representative shall request that the Arbitration Firm render its determination within fifteen (15) days following its receipt of CryoLife’s response. The scope of the disputes to be resolved by the Arbitration Firm shall be limited to the unresolved items to which the Securityholder Representative objected. In resolving any disputed item, the Arbitration Firm may not assign a value to any item greater than the greatest value claimed for such item by either Party or less than the smallest value claimed for such item by either Party. All determinations made by the Arbitration Firm will be final, conclusive and binding on the Parties. The Arbitration Firm shall have the authority to allocate all fees and costs of the Arbitration Firm in resolving any disputed item to the non-prevailing party, as determined by the Arbitration Firm.

(d)If Net Company Debt (as finally determined after the Closing pursuant to Section 3.1(c)) exceeds the Estimated Net Debt delivered prior to the Closing by the Company to Buyer pursuant to Section 3.1(a), then the Acquisition Consideration will be adjusted downward by such excess amount and the Securityholders shall, within (10) Business Days, pay Buyer an amount of cash by wire transfer of immediately available funds an amount equal to (i) the Net Company Debt (as finally determined after the Closing pursuant to Section 3.1(c)) minus (ii) the Estimated Net Debt (such amount described in clauses (i) and (ii) collectively, the “Downward Adjustment Amount”) in accordance with their respective Pro Rata Portion of the Downward Adjustment Amount or, at Buyer’s request, the Securityholder Representative and Buyer shall deliver a joint written authorization to the Escrow Agent within two (2) Business Days from the date on which Net Company Debt is finally determined pursuant to Section 3.1(c) authorizing the Escrow Agent to release to Buyer from the Indemnity Escrow Fund, within three (3) Business Days from the date of such authorization an amount equal to the Downward Adjustment Amount. Any fees and costs of the Arbitration Firm to be borne by the Securityholders pursuant to Section 3.1(c) shall be paid directly by the Securityholders in accordance with their respective Pro Rata Portion.

(e)If Net Company Debt (as finally determined after the Closing pursuant to Section 3.1(c)) is below the Estimated Net Debt delivered prior to the Closing by the Company to Buyer pursuant to Section 3.1(a), then the Acquisition Consideration will be adjusted upward by such excess amount and CryoLife shall or shall cause Buyer to, within ten (10) Business

-8-

Days, pay the Paying Agent for further distribution to each of the Securityholders, as if such amount had been distributed at Closing, by wire transfer of immediately available funds an amount equal to (i) the Estimated Net Debt Net minus (ii) Net Company Debt (as finally determined after the Closing pursuant to Section 3.1(c)) (such amount described in clauses (i) and (ii) collectively, the “Upward Adjustment Amount”) in accordance with their respective Pro Rata Portions of the Upward Adjustment Amount, or at Buyer’s request (ii) the Securityholder Representative and Buyer shall deliver a joint written authorization to the Escrow Agent within two (2) Business Days from the date on which Net Company Debt is finally determined pursuant to Section 3.1(c) authorizing the Escrow Agent to release from the Indemnity Escrow Fund, within three (3) Business Days from the date of such authorization to the Paying Agent, for further distribution to each of the Securityholders in proportion to their respective Pro Rata Portions, an amount of cash equal to the Upward Adjustment Amount. Any fees and costs of the Arbitration Firm to be borne by the Securityholders pursuant to Section 3.1(c) shall be paid directly by the Securityholders in accordance with their respective Pro Rata Portion.

(f)The adjusted payment obligations contemplated in this Section 3.1 shall be treated for all purposes as adjustments to the Acquisition Consideration, except as otherwise required by applicable Law.

Article IV

REPRESENTATIONS, WARRANTIES AND COVENANTS OF THE SECURITYHOLDERS

Each of the Securityholders severally (and not jointly) hereby represents and warrants to CryoLife, Parent, and Buyer, subject to such exceptions as are disclosed in the Company Disclosure Schedule (as defined below) (specifically referencing the appropriate section (e.g. 4.7), subsection (e.g. 4.7(b)) and paragraph (e.g. 4.7(b)(i), as applicable) (it being understood and hereby agreed that (i) a matter is deemed to be disclosed in the Company Disclosure Schedule for the purposes of this Article IV if such matter is included in the Company Disclosure Schedule in sufficient detail to enable Buyer, Parent and CryoLife, upon a diligent review of the Company Disclosure Schedule (together with documents and information included therein, which have been made available to Buyer), to reasonably understand the appropriate sections, subsections and paragraphs, as applicable, of the Company Disclosure Schedule to which such disclosure applies and to reasonably assess the nature, scope, importance and relevance of the disclosed matter and the impact of such disclosure on the Company, the Company Subsidiaries, CryoLife, Parent and Buyer and (ii) except with respect to Fundamental Representations, the fair disclosure statement in Section 4.11 shall apply for the purposes of this Article IV), on the date hereof and as of the Closing Date (other than the representations and warranties which are made as of a specified date, which speak only as of such date), and covenants and agrees, as follows:

4.1Authority; Non-Contravention; Approvals.

(a)Such Securityholder has all requisite power and authority to execute and deliver this Agreement and the Related Agreements to which such Securityholder is a party, and

-9-

to perform the transactions contemplated in this Agreement and the Related Agreements to which such Securityholder is a party. This Agreement has been, and upon the execution of the Related Agreements to which such Securityholder is a party, the Related Agreements will be, duly executed and delivered by such Securityholder and, assuming the due authorization, execution and delivery of this Agreement by CryoLife, Parent, and Buyer, constitutes and upon CryoLife’s, Parent’s and Buyer’s execution of the applicable Related Agreements will constitute, valid and binding obligations of such Securityholder, enforceable against such Securityholder in accordance with their respective terms.

(b)The execution and delivery by such Securityholder of this Agreement and the Related Agreements to which he, she or it is a party and the performance of the transactions contemplated in this Agreement and the Related Agreements to which he, she or it is a party do not and will not (i) result in a material violation or breach of or constitute a default (or an event which, with or without notice or lapse of time or both, would constitute a default) under, or result in the termination of, or the loss of a benefit under or accelerate the performance required by, or result in a right of termination, modification, cancellation or acceleration under, the terms, conditions or provisions of any Contract or other instrument of any kind to which such Securityholder or such Securityholder’s Affiliates is now a party or by which such Securityholder or any of its assets may be bound or affected; or (ii) result in a material violation of any order, writ, injunction, decree, statute, treaty, rule or regulation applicable to such Securityholder.

(c)No declaration, filing or registration with, or notice to, or authorization, consent, order or approval of, any Governmental Authority is required to be obtained by or made such Securityholder in connection with or as a result of the execution and delivery of this Agreement and the Related Agreements to which such Securityholder is a party or the performance by such Securityholder of the transactions contemplated in this Agreement and the Related Agreements to which such Securityholder is a party.

4.2Title to Sold Shares. Such Securityholder has, and will deliver to Buyer at Closing, good and marketable title, free and clear of all Liens, to the Sold Shares that the Consideration Schedule indicates are owned by such Securityholder. If such Securityholder holds a Shareholder Loan, the principal and interest due under such Shareholder Loan is accurately reflected in the Consideration Schedule. Other than as provided for in this Agreement and that certain shareholders agreement dated May 1, 2005, by and among the Company and the other parties thereto (the “Shareholders Agreement”), such Securityholder is not a party to any voting trust, proxy, or other Contract or understanding with respect to any of the Shares or other Company Securities held by such Securityholder. Such Securityholder is party to the Shareholders Agreement, and prior to the Closing, shall comply or shall have complied with their obligations under the Shareholders Agreement with respect to the transactions contemplated hereby. As of the date hereof, the Sold Shares set forth on Section 5.2(a) of the Company Disclosure Schedule opposite such Securityholder’s name represent such Securityholder’s entire right, title and interest in and to the shares of the share capital of the Company as of the date hereof. As of the Closing Date, the Sold Shares set forth in the Consideration Schedule opposite such Securityholder’s name represent such Securityholder’s entire right, title and interest in and

-10-

to the shares of the share capital of the Company as of the Closing Date. Such Securityholder has not breached or violated any provision of the Shareholders Agreement.

4.3Litigation. There is no proceeding pending that relates to this Agreement or the transactions contemplated in this Agreement or, to the knowledge of such Securityholder, threatened, against or affecting such Securityholder that challenges the validity or enforceability of this Agreement with respect to such Securityholder or seeks to enjoin or prohibit consummation of, or seek other material equitable relief with respect to, the transactions contemplated in this Agreement with respect to such Securityholder or that could reasonably be expected to impair or delay such Securityholder’s ability to consummate the transactions contemplated in this Agreement.

4.4Interest in Intellectual Property. Neither such Securityholder nor any of its Affiliates has any rights, title or interest in, or right or permission to use, any Intellectual Property of the Company or any of its Subsidiaries or Intellectual Property used by the Company or any Company Subsidiary or necessary for the operation of the Business as currently conducted.

4.5Brokers’ and Finders’ Fees. Such Securityholder has not, directly or indirectly, entered into any Contract that will cause the Company, any Company Subsidiary or Buyer to incur, any liability for brokerage or finders’ fees or agents’ commissions, fees related to investment banking or similar advisory services or any similar charges in connection with this Agreement or any transaction contemplated in this Agreement. Such Securityholder is not, nor has such Securityholder engaged any intermediary that is, a registered Swiss securities dealer for the purposes of Swiss securities transfer tax.

4.6Interested Party Transactions.Except as set forth in Section 5.16 of the Company Disclosure Schedule and other than (i) standard benefits generally made available to all Employees, (ii) standard director, manager and/or officer indemnification Contracts approved by the Company or the relevant Company Subsidiary, and (iii) the purchase of Shares and the issuance of Company Options, in each case pursuant to Contracts that have been made available to Buyer or its counsel, there are no Contracts, or understandings between such Securityholder or any Affiliate or family member thereof, on the one hand, and the Company or any Company Subsidiary, on the other. Other than pursuant to the Shareholder Loans, neither the Company nor any Company Subsidiary has any obligation for indebtedness for borrowed money to such Securityholder or any Affiliate or family member thereof.

4.7Investment Representations, Warranties and Covenants.

(a)This Agreement is made by Parent, CryoLife, Buyer, the Company and each of the Company Subsidiaries with such Securityholder in reliance upon such Securityholder’s representations, warranties and covenants made in this Section 4.7.

-11-

(b)Such Securityholder has been advised and acknowledges that:

(i)the shares of CryoLife Common Stock issuable pursuant to this Agreement have not been, and when issued, will not be registered under the Securities Act, the securities laws of any State of the United States or the securities laws of any other country;

(ii)in issuing and selling the shares of CryoLife Common Stock issuable pursuant to this Agreement to such Securityholder pursuant hereto, CryoLife is relying upon the “safe harbor” provided by Regulation S and/or on Section 4(a)(2) under the Securities Act;

(iii)it is a condition to the availability of the Regulation S “safe harbor” that the shares of CryoLife Common Stock issuable pursuant to this Agreement not be offered or sold in the United States or to a U.S. person until the expiration of a six-month “distribution compliance period,” if CryoLife is a “reporting issuer,” as defined in Regulation S (or a one-year “distribution compliance period” if CryoLife is not a “reporting issuer” as defined in Regulation S) following the Closing Date; and

(iv)notwithstanding the foregoing, prior to the expiration of the six-month “distribution compliance period,” if CryoLife is a “reporting issuer,” as defined in Regulation S (or the one-year “distribution compliance period,” if CryoLife is not a “reporting issuer,” as defined in Regulation S), after the Closing (the “Restricted Period”), the shares of CryoLife Common Stock issuable pursuant to this Agreement may be offered and sold by the holder thereof only if such offer and sale is made in compliance with the terms of this Agreement, and either: (A) if the offer or sale is within the United States or to or for the account of a U.S. person (as such terms are defined in Regulation S), the securities are offered and sold pursuant to an effective registration statement or pursuant to Rule 144 under the Securities Act or pursuant to an exemption from the registration requirements of the Securities Act; or (B) the offer and sale is outside the United States and to a person other than a U.S. person.

(c)As used herein, the term “United States” means the United States of America, its territories and possessions, any State of the United States, and the District of Columbia, and the term “U.S. person” (as defined in Regulation S) means:

(i)a natural person resident in the United States;

(ii)any partnership or corporation organized or incorporated under the laws of the United States;

(iii)any estate of which any executor or administrator is a U.S. person;

(iv)any trust of which any trustee is a U.S. person;

(v)any agency or branch of a foreign entity located in the United States;

-12-

(vi)any nondiscretionary account or similar account (other than an estate or trust) held by a dealer or other fiduciary for the benefit or account of a U.S. person;

(vii)any discretionary account or similar account (other than an estate or trust) held by a dealer or other fiduciary organized, incorporated and (if an individual) resident in the United States; and

(viii)a corporation or partnership organized under the laws of any foreign jurisdiction and formed by a U.S. person principally for the purpose of investing in securities not registered under the Securities Act, unless it is organized or incorporated, and owned, by accredited investors (as defined in Rule 501(a) under the Securities Act) who are not natural persons, estates or trusts.

(d)As used herein, the term “Non-U.S. person” means any person who is not a U.S. person or is deemed not to be a U.S. person under Rule 902(k)(2) of the Securities Act.

(e)Such Securityholder agrees that with respect to the shares of CryoLife Common Stock issuable pursuant to this Agreement, until the expiration of the Restricted Period:

(i)such Securityholder, its agents or its representatives have not and will not solicit offers to buy, offer for sale or sell any of the shares of CryoLife Common Stock issuable pursuant to this Agreement, or any beneficial interest therein in the United States or to or for the account of a U.S. person; and

(ii)notwithstanding the foregoing, the shares of CryoLife Common Stock issuable pursuant to this Agreement may be offered and sold by the holder thereof only if such offer and sale is made in compliance with the terms of this Agreement and either: (A) if the offer or sale is within the United States or to or for the account of a U.S. person (as such terms are defined in Regulation S), the securities are offered and sold pursuant to an effective registration statement or pursuant to Rule 144 under the Securities Act or pursuant to an exemption from the registration requirements of the Securities Act; or (B) the offer and sale is outside the United States and to other than a U.S. person; and

(iii)such Securityholder shall not engage in hedging transactions with regard to the shares of CryoLife Common Stock issuable pursuant to this Agreement unless in compliance with the Securities Act.

The foregoing restrictions are binding upon subsequent transferees of the shares of CryoLife Common Stock issuable pursuant to this Agreement, except for transferees pursuant to an effective registration statement or valid exemption from registration. Such Securityholder agrees that after the Restricted Period, the shares of CryoLife Common Stock issuable pursuant to this Agreement may be offered or sold within the United States or to or for the account of a U.S. person only pursuant to applicable securities laws.

(f)Such Securityholder has not engaged nor is he, she or it aware that any party has engaged, or that any Non-U.S. person will engage or cause any third party to engage, in

-13-

any directed selling efforts (as such term is defined in Regulation S) in the United States with respect to the shares of CryoLife Common Stock issuable pursuant to this Agreement.

(g)Such Securityholder: (i) is domiciled and, if applicable, has its principal place of business outside the United States; (ii) certifies it is not a U.S. person and is not acquiring the shares of CryoLife Common Stock issuable pursuant to this Agreement for the account or benefit of any U.S. person; and (iii) at the time of the Closing Date, such Securityholder or persons acting on such Securityholder’s behalf in connection with the transactions contemplated by this Agreement will be located outside the United States.

(h)At the time of offering to such Securityholder and communication of such Securityholder’s order to purchase the shares of CryoLife Common Stock issuable pursuant to this Agreement and at the time of such Securityholder’s execution of this Agreement, such Securityholder or persons acting on such Securityholder’s behalf in connection therewith were located outside the United States.

(i)Such Securityholder person is not a “distributor” (as defined in Regulation S) or a “dealer” (as defined in the Securities Act).

(j)Such Securityholder acknowledges that CryoLife shall make a notation in its stock books regarding the restrictions on transfer set forth in this Section 4.7 and shall transfer such shares on the books of Parent only to the extent consistent therewith.

In particular, such Securityholder acknowledges that CryoLife shall refuse to register any transfer of the shares of CryoLife Common Stock issuable pursuant to this Agreement not made in accordance with the provisions of Regulation S, pursuant to registration under the Securities Act or pursuant to an available exemption from registration.

(a)Such Securityholder certifies that it is not a U.S. Tax Person.

(b)As used herein, the term “U.S. Tax Person” means:

(i)an individual who is a citizen of the United States;

(ii)an individual who is a resident of the United States for U.S. federal income tax purposes;

(iii)a corporation (or other entity treated as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States, any state thereof or the District of Columbia;

(iv)a partnership (or other entity treated as a partnership for U.S. federal income tax purposes) created or organized in or under the laws of the United States, any state thereof or the District of Columbia;

-14-

(v)an estate the income of which is subject to U.S. federal income tax regardless of its source; or

(vi)a trust (i) the administration of which is subject to the primary supervision of a U.S. court and which has one or more United States persons who have the authority to control all substantial decisions of the trust or (ii) which has made a valid election under applicable U.S. Treasury regulations to be treated as a United States person.

4.9Lock-Up Period. Such Securityholder hereby agrees that such Securityholder shall not offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend, or otherwise transfer or dispose of, directly or indirectly, any securities of CryoLife or enter into any swap, hedging or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of any securities of CryoLife held by such Securityholder from the Closing Date through the date that is six (6) months following the Closing Date. Parent may impose stop-transfer instructions with respect to securities subject to the foregoing restriction until the end of such period. Such Securityholder agrees that during such time when this Section 4.9 is applicable to any of Securityholder’s shares of CryoLife Common Stock, any transferee of such Securityholder’s shares of CryoLife Common Stock or other securities of Parent shall be bound by this Section 4.9.

4.10Restrictive Legends. Such Securityholder understands and agrees that each book entry or certificate held by such Securityholder representing the shares of CryoLife Common Stock issuable pursuant to this Agreement, or any other securities issued in respect of the shares of CryoLife Common Stock issuable pursuant to this Agreement upon any stock split, stock dividend, recapitalization, merger, consolidation or similar event, shall bear the following legends (in addition to any legend required by this Agreement or under applicable state securities laws):

THE SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND MAY NOT BE SOLD, TRANSFERRED, ASSIGNED, PLEDGED OR HYPOTHECATED EXCEPT IN ACCORDANCE WITH THE PROVISIONS OF REGULATION S PROMULGATED UNDER THE SECURITIES ACT, PURSUANT TO REGISTRATION UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM REGISTRATION. HEDGING TRANSACTIONS INVOLVING THE SHARES REPRESENTED HEREBY MAY NOT BE CONDUCTED UNLESS IN COMPLIANCE WITH THE SECURITIES ACT. THIS CERTIFICATE MUST BE SURRENDERED TO THE ISSUER OR ITS TRANSFER AGENT AS A CONDITION PRECEDENT TO THE SALE, PLEDGE, HYPOTHECATION OR ANY OTHER TRANSFER OF ANY INTEREST IN ANY OF THE SHARES REPRESENTED BY THIS CERTIFICATE.

-15-

THE SHARES REPRESENTED BY THIS CERTIFICATE ARE SUBJECT TO RESTRICTIONS ON TRANSFER FOR A PERIOD OF TIME SET FORTH IN AN AGREEMENT BETWEEN THE ISSUER AND THE ORIGINAL HOLDER OF THESE SHARES AND MAY NOT BE SOLD OR OTHERWISE DISPOSED OF BY THE HOLDER PRIOR TO THE EXPIRATION OF SUCH PERIOD WITHOUT THE CONSENT OF THE ISSUER.

Any transferee of a holder of CryoLife Common Stock acquired hereby shall take such CryoLife Common Stock subject to the restrictions set forth in this Section 4.10.

4.11Fair Disclosure. Solely with respect to the Securityholders’ representations and warranties in this Article IV that are not Fundamental Representations (it being understood and agreed that this Section 4.11 shall not apply to the Fundamental Representations):

(a)Such representations and warranties that are not Fundamental Representations are subject to the matters that are fairly disclosed in the Company Disclosure Schedule or the materials made available to Buyer in the electronic data room maintained by the Company at the folder titled “Project Jelly”, located at xxxxx://xx0.xxxxxxxxxxx.xxx/xxxxxx/xxxxx_xxxxx.xx?xxxxxxxXxx000000 (the “VDR”); provided, however, that, in so far as the VDR is concerned, only matters that were fairly disclosed in the VDR as of 11:59 p.m. Eastern Time on August 31, 2017 shall receive the benefit of the fair disclosure treatment set forth in this Section 4.11, and materials subsequently added to the VDR shall not qualify such representations or warranties;

(b)Any document to the extent included in the VDR (as of 11:59 p.m. Eastern Time on August 31, 2017) is deemed to be disclosed generally for the purposes of this Article IV and will be deemed an exception for the applicable representations and warranties contained in this Article IV that are not Fundamental Representations, solely with respect to the portion of the document included in the VDR;

(c)Except with respect to Fundamental Representations, as to which this Section 4.11 shall not apply, a matter is deemed to be fairly disclosed for the purposes of this Article IV if such matter is included in the VDR (as of 11:59 p.m. Eastern Time on August 31, 2017) or in the Company Disclosure Schedule in sufficient detail to enable Buyer, Parent and CryoLife, upon a diligent review of the documents included in the VDR or included in the Company Disclosure Schedule (together with documents and information included therein that have been made available to Buyer), to reasonably assess the nature, scope, importance and relevance of the disclosed matter and the impact of such disclosure on the Company, the Company Subsidiaries, CryoLife, Parent and Buyer; and

(d)In the event that the Company Disclosure Schedule omits disclosure with respect to the applicable representations and warranties provided in this Article IV, but fair disclosure is provided in the VDR (as of 11:59 p.m. Eastern Time on August 31, 2017), the materials in the VDR will take precedence.

-16-

Article V

REPRESENTATIONS AND WARRANTIES REGARDING THE COMPANY AND THE COMPANY SUBSIDIARIES

Each of the Securityholders severally (and not jointly) hereby represents and warrants to CryoLife, Parent and Buyer on the date hereof and as of the Closing Date (other than the representations and warranties which are made as of a specified date, which speak only as of such date), subject to such exceptions as are disclosed in the disclosure schedule (specifically referencing the appropriate section (e.g. 5.11), subsection (e.g. 5.11(b)) and paragraph (e.g. 5.11(b)(iii), as applicable) supplied by the Company to CryoLife, Parent and Buyer on the date hereof (the “Company Disclosure Schedule”) (it being understood and hereby agreed that (i) a matter is deemed to be disclosed in the Company Disclosure Schedule for the purposes of this Article V if such matter is included in the Company Disclosure Schedule in sufficient detail to enable Buyer, Parent and CryoLife, upon a diligent review of the Company Disclosure Schedule (together with documents and information included therein, which have been made available to Buyer), to reasonably understand the appropriate sections, subsections and paragraphs, as applicable, of the Company Disclosure Schedule to which such disclosure applies and to reasonably assess the nature, scope, importance and relevance of the disclosed matter and the impact of such disclosure on the Company, the Company Subsidiaries, CryoLife, Parent and Buyer and (ii) except with respect to Fundamental Representations, the fair disclosure statement in Section 5.33 shall also apply for the purposes of this Article V), as follows:

5.1Organization of the Company. The Company is a Swiss AG duly organized and validly existing under the Laws of Switzerland. Each of the Company Subsidiaries is duly organized, validly existing and in (to the extent such phrase is recognized in the applicable jurisdiction) good standing under the Laws of the applicable jurisdiction noted for such entity in Schedule 2. The Company and each of the Company Subsidiaries have the corporate power to own its properties and to carry on its business as currently conducted. The Company and each of the Company Subsidiaries is duly qualified or licensed to do business and (to the extent such phrase is recognized in the applicable jurisdiction) in good standing as a foreign corporation in each jurisdiction in which such qualification or licensure is required by Law, except for those jurisdictions where the failure to be so qualified or licensed and in good standing would not reasonably be expected to have, individually, or in the aggregate, a Company Material Adverse Effect. The Company and each of the Company Subsidiaries has made available a true and correct copy of its certificate of incorporation and bylaws or comparable governing documents, each as amended to date and in full force and effect on the date hereof (collectively, the “Charter Documents”), to Buyer. Section 5.1 of the Company Disclosure Schedule lists the directors, officers, and managers of the Company and each of the Company Subsidiaries as of the date hereof. The Business and the operations now being conducted by the Company and the Company Subsidiaries are not now and have never been conducted by the Company or any of the Company Subsidiaries under any other name. Section 5.1 of the Company Disclosure Schedule lists (a) each jurisdiction in which the Company is qualified or licensed to do business, to the extent required by Law (b) each jurisdiction in which each of the Company Subsidiaries is qualified or licensed to do business, to the extent required by Law and

-17-

(c) every state or foreign jurisdiction in which the Company or any of the Company Subsidiaries has employees or facilities.

(a)The Shares set forth on Section 5.2(a)(i) of the Company Disclosure Schedule are the only shares of the share capital of the Company issued and outstanding, and, as of the Closing Date, the Company has no shares of the share capital of the Company, other than such Shares, authorized, issued or outstanding. As of the date hereof, the Company Securities are held by the Persons with the registered addresses and in the numbers as set forth on Section 5.2(a)(ii) of the Company Disclosure Schedule. All issued and outstanding Shares are duly authorized, validly issued, fully paid and non-assessable and are not subject to preemptive rights created by statute, the Charter Documents of the Company, or any Contract to which the Company is a party or by which it is bound (save for the Shareholders Agreement which will be terminated with regard to the Securityholders on the Closing Date subject to Closing occurring), and have been issued in compliance with all applicable Laws. All certificates representing Shares have been correctly and validly issued and not been cancelled. Neither the Company nor any of the Company Subsidiaries has or will have suffered or incurred any Liability, arising out of the issuance, redemption, or repurchase of any Company Securities or the repayment, conversion or purported conversion of the Company Promissory Notes, or out of any Contracts or arrangements relating to any of the Company Securities (including any amendment of the terms of any such Contract or arrangement). Except as contemplated in this Agreement, there are no declared or accrued but unpaid dividends with respect to any of the Shares. A complete and detailed description of the capitalization of each of the Company Subsidiaries, including the names and amounts held by the holders of interests in each of the Company Subsidiaries as of the date hereof, is set forth on Section 5.2(a)(iv) of the Company Disclosure Schedule. All issued and outstanding shares or equity interests in the Company Subsidiaries are duly authorized, validly issued, fully paid and non-assessable and are not subject to preemptive rights created by statute, the organizational documents of the Company Subsidiaries, or any Contract to which a Company Subsidiary is a party or by which it is bound, and have been issued in compliance with all applicable Laws.

(b)Section 5.2(b) of the Company Disclosure Schedule lists each stock option plan and each other plan for equity compensation maintained or sponsored by the Company or any of the Company Subsidiaries. Other than the Shareholder Options to be redeemed as provided in Section 2.2(c), there are no options, warrants, calls, rights, Convertible Securities, commitments or Contracts of any character, written or oral, to which the Company or any Company Subsidiary is a party or by which the Company or any Company Subsidiary is bound obligating the Company or any Company Subsidiary to issue, deliver, sell, repurchase or redeem, or cause to be issued, delivered, sold, repurchased or redeemed, any shares of the share capital of the Company or any of the Company Subsidiaries. Other than the Shareholder Options to be redeemed as provided in Section 2.2(c), there are no outstanding or authorized stock appreciation, phantom stock, profit participation, or other rights, rights of any type, the value of which is determined by reference in whole or in part to the value of the share capital of the Company or any of the Company Securities (whether payable in cash, property or otherwise).

-18-

Except as provided in Section 5.2(b) of the Company Disclosure Schedule, each of the Shareholder Options was granted to and is held by Employees of JOTEC GmbH who currently reside in Germany. Other than the Shareholder Loans provided on the Consideration Schedule, there are no Company Promissory Notes. Except as set forth in Section 5.2(b) of the Company Disclosure Schedule (such schedule to contain the Shareholders Agreement), there are no voting trusts, proxies, or other Contracts or understandings with respect to the voting securities of the Company or any of the Company Subsidiaries. Except as set forth in Section 5.2(b) of the Company Disclosure Schedule (such schedule to contain the Shareholders Agreement), there are no Contracts to which the Company or any of the Company Subsidiaries is a party relating to the registration, sale or transfer (including Contracts relating to rights of first refusal, co-sale rights or “drag-along” rights) of any Company Securities or any securities of any of the Company Subsidiaries. The Consideration Schedule is complete and correct. At the Closing, the allocation of Acquisition Consideration set forth in the Consideration Schedule will comply with the Charter Documents of the Company and applicable Law and will not result in any violation of any Contract between the Company on the one hand and any of the Securityholders, on the other hand. All Securityholders that hold a share of the share capital of the Company are parties to the Shareholders Agreement. To the Knowledge of the Company, none of the Securityholders has breached or violated any provision of the Shareholders Agreement. As a result of the Acquisition, and assuming the satisfaction of the payment obligations of CryoLife, Parent and Buyer herein, Buyer will be the sole record and beneficial holder of all Sold Shares of the Securityholders, which will represent at least ninety-four percent (94%) of the issued and outstanding shares of the Company’s share capital.

5.3Subsidiaries. The Company has never had, at any time during the ten (10) year period immediately preceding the date hereof, any subsidiaries other than the Company Subsidiaries and those that are listed in Section 5.3 of the Company Disclosure Schedule. Neither the Company nor any Company Subsidiary has agreed, is obligated to make, or is bound by any Contract under which it may become obligated to make, or is bound by any Contract under which it may become obligated to make any future investment in, or capital contribution to, any other Person. Except as set forth in Section 5.3 of the Company Disclosure Schedule, neither the Company nor any of the Company Subsidiaries directly or indirectly owns any equity or similar interest in, or any interest convertible, exchangeable or exercisable for any equity or similar interest in, any Person.

5.4Authority. The Company has all requisite power and authority to enter into this Agreement and any Related Agreements to which it is a party and to consummate the transactions contemplated in this Agreement and such Related Agreements. The execution and delivery of this Agreement and any Related Agreements to which the Company is a party and the consummation of the transactions contemplated in this Agreement and the Related Agreements have been duly authorized by all necessary corporate action on the part of the Company, and no further action is required on the part of the Company to authorize, execute and deliver the Agreement and any Related Agreements to which it is a party or the transactions contemplated in this Agreement or such Related Agreements. This Agreement has been approved by the Board of Directors. This Agreement and each of the Related Agreements to which the Company is a party have been duly executed and delivered by the Company and, assuming the due authorization,

-19-

execution and delivery by the other parties hereto and thereto, shall constitute the valid and binding obligations of the Company enforceable against it in accordance with their respective terms, except as such enforceability may be subject to the Laws of general application relating to bankruptcy, insolvency, and the relief of debtors and rules of Law governing specific performance, injunctive relief, or other equitable remedies.

(a)Except as set forth on Section 5.5(a) of the Company Disclosure Schedule, the execution and delivery by the Company of this Agreement and any Related Agreement to which the Company is a party, and the consummation of the transactions contemplated in this Agreement and such Related Agreements, will not conflict with or result in any violation of or default under (with or without notice or lapse of time, or both) or give rise to a right of termination, cancellation, modification or acceleration of any obligation or loss of any benefit under (any such event, a “Conflict”) (i) any provision of the Charter Documents, (ii) any Material Contract, or (iii) any Law applicable to the Company, any of the Company Subsidiaries or any of their respective properties (whether tangible or intangible) or assets, except in the case of (iii) for immaterial violations of a Law.

(b)Section 5.5(b) of the Company Disclosure Schedule identifies all consents, waivers and approvals of, and notices to parties to any Material Contract as are required thereunder in connection with the execution and delivery of this Agreement and any Related Agreement to which the Company or any such Company Subsidiary, is a party or the consummation of the transactions by the Company or any such Company Subsidiary, contemplated in this Agreement or the Related Agreements. Following the Closing, the Company and each Company Subsidiary will be permitted to exercise all of their respective rights under such Material Contracts without the payment of any additional amounts or consideration other than ongoing fees, royalties or payments which the Company or such Company Subsidiary would otherwise be required to pay pursuant to the terms of such Material Contracts had the transactions contemplated in this Agreement not occurred.

5.6Governmental Consents. No consent, notice, waiver, approval, order or authorization of, or registration, declaration or filing with any court, tribunal, judicial, legislative or administrative agency, body or commission or other federal, state, county, local or foreign, governmental or regulatory authority, instrumentality, agency, department, ministry, administrative body, or commission or other public or quasi-public legal authority (each, a “Governmental Authority”), is required by, or with respect to, the Company or any of the Company Subsidiaries, in connection with the execution and delivery of this Agreement and any Related Agreement to which the Company or any such Company Subsidiary is a party or the consummation of the transactions by the Company or any such Company Subsidiary, contemplated in this Agreement or the Related Agreements, except for immaterial consents, notices, waivers, approvals, orders or authorizations; provided, however, that this representation and warranty does not apply to the extent CryoLife, Parent or Buyer would be solely responsible for any filings with any Governmental Authority.

-20-

5.7Company Financial Statements.

(a)Section 5.7(a) of the Company Disclosure Schedule sets forth the Company’s (i) audited, consolidated balance sheets as of December 31, 2015 and December 31, 2016, and the audited, consolidated statements of income, cash flow and stockholders’ equity for the twelve (12) month periods ended December 31, 2015 and December 31, 2016 (the “Year-End Financials”), and (ii) unaudited, consolidated balance sheet at June 30, 2017 (the “Balance Sheet Date”), and the related unaudited, consolidated statements of income and cash flow for the six (6) month period ended June 30, 2017 (the “Interim Financials”). The Year-End Financials and the Interim Financials (collectively referred to as the “Financials”) have been prepared on a consistent basis throughout the periods indicated and consistent with each other. The Financials, prepared in accordance with GAAP, present in all material respects the Company’s financial condition, operating results and cash flows as of the dates and during the periods indicated therein. The Financials have been prepared in accordance with GAAP, provided that the Interim Financials are subject to ordinary year-end adjustments that are not expected to be material in the aggregate. The Company’s unaudited, consolidated balance sheet as of the Balance Sheet Date is referred to hereinafter as the “Current Balance Sheet.

(b)The Accounts Receivable of the Company and each of the Company Subsidiaries have or will have arisen from bona fide arm’s length transactions in the ordinary course of business of the Company or such Company Subsidiaries, consistent with their respective past practices. There has not been any material adverse change in the collectability of such Accounts Receivable during the twelve (12) month period ending on the Balance Sheet Date. Section 5.7(b) of the Company Disclosure Schedule sets forth a list of all such Accounts Receivable that are more than ninety (90) days past due as of the Balance Sheet Date, and of all such Accounts Receivable classified as doubtful accounts on the Current Balance Sheet. All Accounts Payable of the Company have or will have arisen from bona fide arm’s length transactions in the ordinary course of business of the Company and the Company Subsidiaries, consistent with their respective past practices. Since December 31, 2016, the Company and each of the Company Subsidiaries has paid its Accounts Payable in the ordinary course of business of the Company and the Company Subsidiaries consistent with their respective past practices.

(c)Except for usual consignment stocks consistent with past practice, the Company has no Company Products placed with its customers under an understanding permitting their return to the Company other than pursuant to a breach of warranty.

5.8No Undisclosed Liabilities. Neither the Company nor any of the Company Subsidiaries has any Liabilities that (a) as of the end of December 31, 2016, have not been reflected in the Year-End Financials if required by GAAP to be so reflected, or (b) have not arisen in the ordinary course of business of the Company or such Company Subsidiary, consistent with their respective past practices, since December 31, 2016 in an amount that exceeds €100,000 in any one case or €250,000 in the aggregate.

5.9Internal Controls. The Company maintains books and records reflecting the assets and Liabilities of the Company and the Company Subsidiaries that are in accordance with applicable Law and are in all material respects accurate. The Company maintains a system

-21-

of internal accounting controls designed to provide reasonable assurances (in light of the Company’s consolidated size and privately held status) that (a) transactions are executed with management’s authorization; (b) transactions are recorded as necessary to permit preparation of the consolidated financial statements of the Company in accordance with GAAP and to maintain accountability for the Company’s consolidated assets; and (c) account receivables are recorded accurately and adequate procedures are implemented to effect the collection thereof on a timely basis, provided, however, that the Parties agree that U.S. financial reporting and disclosure Laws are not applicable when evaluating the accuracy of this sentence. There are no significant deficiencies in the design or operation of the Company’s internal controls over financial reporting that could be reasonably expected to adversely affect in any material respect the Company’s ability to record, process, summarize and report consolidated financial data, provided, however, that the Parties agree that U.S. financial reporting and disclosure Laws are not applicable when evaluating the accuracy of this sentence. To the Knowledge of the Company, there has been no fraud, whether or not material, that involved management or other Employees who have a significant role in the Company’s internal control over financial reporting.

5.10No Changes. Except for immaterial changes or developments or actions in the ordinary course of business of the Company and the applicable Company Subsidiary consistent with their respective past practices, since December 31, 2016, there has not been, occurred or arisen any:

(a)other than as contemplated in this Agreement, transaction by the Company or any Company Subsidiary, except in the ordinary course of business of the Company and such Company Subsidiary, consistent with their respective past practices, as conducted on that date and consistent with past practices;

(b)amendments or changes to the Charter Documents, other than as contemplated in this Agreement;

(c)capital expenditure or commitment by the Company or any Company Subsidiary exceeding €100,000 individually or €250,000 in the aggregate (inclusive of all ordinary course capital expenditures and commitments);