ICC17 VA790 Thank you for choosing Jackson National Life Insurance Company®, hereinafter also referred to as "the Company" or "Jackson®." READ YOUR CONTRACT CAREFULLY. This annuity contract is issued by the Company and is a legal agreement between the...

ICC17 VA790

Thank you for choosing ▇▇▇▇▇▇▇ National Life Insurance Company®, hereinafter also referred to as "the Company" or "▇▇▇▇▇▇▇®." READ YOUR CONTRACT CAREFULLY. This annuity contract is issued by the Company and is a legal agreement between the Owner ("You") and ▇▇▇▇▇▇▇. AMOUNTS YOU ALLOCATE TO THE INVESTMENT DIVISIONS ARE NOT GUARANTEED AND MAY INCREASE OR DECREASE IN VALUE BASED UPON THE PERFORMANCE OF THE UNDERLYING MUTUAL FUNDS. THE COMPANY WILL RE-DETERMINE THE CONTRACT'S FIXED ACCOUNT MINIMUM INTEREST RATE EACH JANUARY ON THE REDETERMINATION DATE. THE FIXED ACCOUNT OPTIONS ARE SUBJECT TO A MARKET VALUE ADJUSTMENT WHICH MAY INCREASE OR DECREASE AMOUNTS TRANSFERRED, WITHDRAWN OR ANNUITIZED, BUT THE FIXED ACCOUNT CONTRACT VALUE WILL NEVER DECREASE TO AN AMOUNT LESS THAN THE FIXED ACCOUNT MINIMUM VALUE. THE COMPANY MAY RESTRICT FUTURE PREMIUM PAYMENTS, WHICH WOULD LIMIT YOUR ABILITY TO INVEST IN THE CONTRACT AND COULD AFFECT YOUR VALUES AND BENEFITS. NOTICE OF RIGHT TO EXAMINE CONTRACT YOU MAY RETURN THIS CONTRACT TO THE SELLING PRODUCER OR THE COMPANY NO LATER THAN 10 DAYS AFTER YOU RECEIVE IT (30 DAYS AFTER YOU RECEIVE IT IF YOU PURCHASED THE CONTRACT AS A REPLACEMENT CONTRACT). [IF THIS CONTRACT WAS PURCHASED AS A REPLACEMENT FOR A ▇▇▇▇▇▇▇ NATIONAL LIFE INSURANCE COMPANY CONTRACT, YOU MAY RETURN IT NO LATER THAN 45 DAYS AFTER YOU RECEIVE IT.] THE COMPANY WILL REFUND THE FULL PREMIUM ALLOCATED TO THE FIXED ACCOUNTS LESS ANY WITHDRAWALS FROM THE FIXED ACCOUNT, PLUS THE SEPARATE ACCOUNT CONTRACT VALUE, WITHOUT DEDUCTION FOR ANY FEES AND CHARGES, CALCULATED ON THE BUSINESS DAY ON WHICH THE COMPANY RECEIVES THE CONTRACT AT ITS SERVICE CENTER. RETURNED CONTRACTS ARE VOID. Please Note: The Company reserves the right to allocate all Premium received during the "Notice of Right to Examine Contract" period to a money market Investment Division or the Fixed Account. After the "Notice of Right to Examine Contract" period expires, the Company will allocate the Contract Value to the Contract Options You have specified. The Telephone Number for the [Issue State] Department of Insurance is [Insurance Department telephone number].

INDIVIDUAL DEFERRED VARIABLE AND FIXED ANNUITY CONTRACT WITH MARKET VALUE ADJUSTMENT. (FLEXIBLE PREMIUM). DEATH BENEFIT AVAILABLE. INCOME OPTIONS AVAILABLE. NONPARTICIPATING.

This Contract is signed by the Company

President

Secretary

[Home Office: [Service Center: ▇ ▇▇▇▇▇▇▇▇▇ ▇▇▇ P.O. Box 24068 Lansing, Michigan 48951] Lansing, MI 48909-4068 1-800-644-4565 ▇▇▇.▇▇▇▇▇▇▇.▇▇▇]

ICC17 VA790 2

TABLE OF CONTENTS Provision Page Number Contract Data Pages [3a Definitions 4 General Provisions 7 Accumulation Provisions 12 Withdrawal Provisions 15 Death Benefit Provisions 16 Income Provisions 18 Termination Provision 22] If You have questions about this Contract or require information about coverage or complaint resolutions, You may contact the Company's Service Center identified on the Contract's cover page.

ICC17 VA790-T1 3a

CONTRACT DATA PAGES Contract Number: [1234567890] Owner: [▇▇▇▇ ▇▇▇] Owner Issue Age: [35] Joint Owner: [▇▇▇▇ ▇▇▇] Joint Owner Issue Age: [35] Annuitant: [▇▇▇▇ ▇▇▇] Annuitant Issue Age: [35] Joint Annuitant: [▇▇▇▇ ▇▇▇] Joint Annuitant Issue Age: [35] Initial Premium: [$200,000] Issue Date: [November 1, 2017] Issue State: [Michigan] Income Date: [November 1, 2076] Primary Beneficiary(ies): [▇▇▇▇▇ ▇▇▇] Contingent Beneficiary(ies): [▇▇▇▇ ▇▇▇]

ICC17 VA790-T1 3b

CONTRACT DATA PAGES (CONT'D)

FIXED ACCOUNT, INTEREST RATE AND CONTRACT CHARGE INFORMATION: Initial Fixed Account Minimum Interest Rate: [1.00%] The Company will re-determine the Fixed Account Minimum Interest Rate each January on the Redetermination Date. The Fixed Account Minimum Interest Rate is the guaranteed minimum interest rate under the Contract and may change each year on the Redetermination Date. Fixed Account Minimum Value Percentage: [87.5%] Fixed Account Minimum Value Annual Expense Allowance: [$50] Fixed Account Minimum Value Expense Load: [12.5%] Misstatement of Age or Sex Interest Rate for Adjustments: [1.00%] Annual Contract Maintenance Charge: [$35.00] The Company will deduct the Annual Contract Maintenance Charge from the Contract Value on each Contract Anniversary that occurs on or before the Income Date and when You withdraw the Contract Value in full on a date other than the Contract Anniversary. The Company will deduct the Annual Contract Maintenance Charge from Contracts with a Contract Value less than [$50,000] on each Contract Anniversary. Core Contract Charge: [0.3500%] The Core Contract Charge is an annual percentage of the daily Separate Account Contract Value. The Company will reduce the Core Contract Charge to [0.3000%] if the Contract Value on the later of the Issue Date or the most recent Contract Quarterly Anniversary is greater than or equal to [$1,000,000]. If the Contract Value subsequently falls below [$1,000,000] on any Contract Quarterly Anniversary, the Company will reinstate the charge of [0.3500%]. Total Asset-Based Charges: [0.3500%] The Total Asset-Based Charges are an annual percentage of the daily Separate Account Contract Value. The Company will deduct asset-based charges daily as part of the Accumulation Unit Value calculation. Total asset-based charges include the Core Contract Charge and asset-based charges for optional benefits. Transfer Charge: [$25.00] The Company charges a fee for each transfer between Contract Options You make in excess of [25] in any Contract Year. The Company deducts Transfer Charges from the amount You seek to transfer before allocation to the new Contract Option. The Company does not assess Transfer Charges on transfers You make pursuant to any of the Company's systematic investment programs, and the Company does not count those transfers against the [25] free transfers the Company allows in a Contract Year. Free transfers not utilized during a given Contract Year cannot be carried forward to subsequent Contract Years. Optional Benefit Charges. If applicable, refer to any attached endorsements and supplemental contract data pages for additional charges and fees associated with Your Contract.

ICC17 VA790-T1 3c

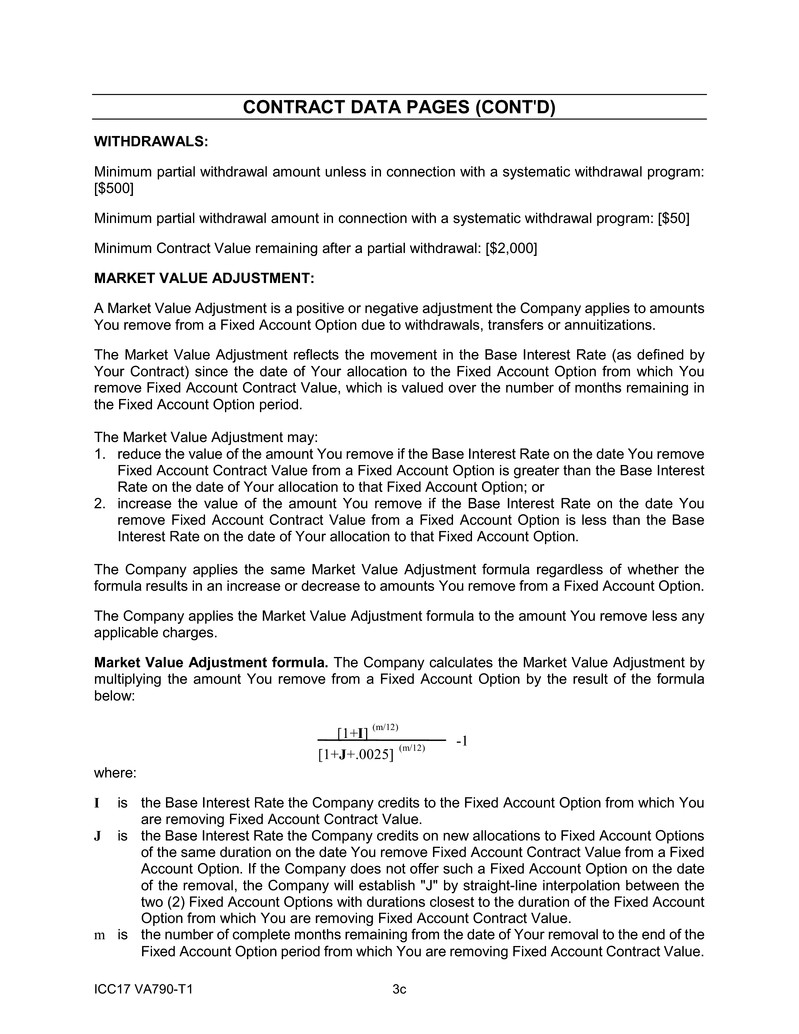

CONTRACT DATA PAGES (CONT'D)

WITHDRAWALS: Minimum partial withdrawal amount unless in connection with a systematic withdrawal program: [$500] Minimum partial withdrawal amount in connection with a systematic withdrawal program: [$50] Minimum Contract Value remaining after a partial withdrawal: [$2,000] MARKET VALUE ADJUSTMENT: A Market Value Adjustment is a positive or negative adjustment the Company applies to amounts You remove from a Fixed Account Option due to withdrawals, transfers or annuitizations. The Market Value Adjustment reflects the movement in the Base Interest Rate (as defined by Your Contract) since the date of Your allocation to the Fixed Account Option from which You remove Fixed Account Contract Value, which is valued over the number of months remaining in the Fixed Account Option period. The Market Value Adjustment may: 1. reduce the value of the amount You remove if the Base Interest Rate on the date You remove Fixed Account Contract Value from a Fixed Account Option is greater than the Base Interest Rate on the date of Your allocation to that Fixed Account Option; or 2. increase the value of the amount You remove if the Base Interest Rate on the date You remove Fixed Account Contract Value from a Fixed Account Option is less than the Base Interest Rate on the date of Your allocation to that Fixed Account Option. The Company applies the same Market Value Adjustment formula regardless of whether the formula results in an increase or decrease to amounts You remove from a Fixed Account Option. The Company applies the Market Value Adjustment formula to the amount You remove less any applicable charges. Market Value Adjustment formula. The Company calculates the Market Value Adjustment by multiplying the amount You remove from a Fixed Account Option by the result of the formula below: -1 [1+ I ] (m/12) [1+ J +.0025] (m/12) where: I is the Base Interest Rate the Company credits to the Fixed Account Option from which You are removing Fixed Account Contract Value. J is the Base Interest Rate the Company credits on new allocations to Fixed Account Options of the same duration on the date You remove Fixed Account Contract Value from a Fixed Account Option. If the Company does not offer such a Fixed Account Option on the date of the removal, the Company will establish "J" by straight-line interpolation between the two (2) Fixed Account Options with durations closest to the duration of the Fixed Account Option from which You are removing Fixed Account Contract Value. m is the number of complete months remaining from the date of Your removal to the end of the Fixed Account Option period from which You are removing Fixed Account Contract Value.

ICC17 VA790-T1 3d

CONTRACT DATA PAGES (CONT'D)

MARKET VALUE ADJUSTMENT (continued): The 0.0025 adjustment accounts for direct and indirect costs to the Company associated with liquidating general account assets prior to the end of the Fixed Account Option period. The Company makes no Market Value Adjustment when J is less than I by 0.0025 or less. In no event will a total withdrawal from a Fixed Account Option be less than the Fixed Account Minimum Value. Unavailability of Base Interest Rate. In the event that the Base Interest Rate cannot be determined on the date You remove Fixed Account Contract Value from a Fixed Account Option, the Company may substitute a comparable index subject to approval by the Interstate Insurance Product Regulation Commission (IIPRC). In this case, the Company will base the values of I and J on the substitute index. The Company will notify You and any assignee before using a substitute external rate or index to calculate the Market Value Adjustment. See the Market Value Adjustment section of the Accumulation Provisions for additional information about the Market Value Adjustment. TRANSFER: Transfer among Investment Divisions. At any time, You may transfer all or a portion of Your Contract Value in any Investment Division to any available Investment Division(s). Transfer from Investment Division to a Fixed Account Option. Before the Income Date, You may transfer all or a portion of Your Contract Value in an Investment Division to any available Fixed Account Option(s) unless the Company has restricted this type of transfer. Transfer from a Fixed Account Option to an Investment Division or to a Fixed Account Option. Before the Income Date, You may transfer all or a portion of Your Contract Value in a Fixed Account Option to any available Investment Division(s) or any available Fixed Account Option(s), subject to any applicable Market Value Adjustment, unless the Company has restricted this type of transfer. Transfer Effective Date: Transfers You request are effective at the end of the Business Day upon which the Company receives Your transfer request in Good Order at the Service Center. Additional details on transfer restrictions are outlined in the Transfer of Funds Restrictions section of the General Provisions. PREMIUM(S): This is a flexible Premium Contract. You may change the amount, frequency and timing of Premium payments, subject to the minimum and maximum Premium payment amounts and the Company's reserved rights specified below. Your initial Premium payment must be not less than [$200,000] for Non-Qualified Plan Contracts and [$200,000] for Qualified Plan Contracts. Any subsequent Premium payments must be not less than [$500] ([$50] if made in connection with an automatic payment plan). You may not make total Premium payments to this Contract in excess of [$2,500,000] or such lesser amount the Company establishes pursuant to its reserved rights specified below. The Company may waive the minimums or maximums at any time.

ICC17 VA790-T1 3e

CONTRACT DATA PAGES (CONT'D)

PREMIUM(S) (continued): The Company reserves the right at any time to limit, restrict, suspend or reject any or all subsequent Premium payments. The Company will send You Written Notice at least thirty (30) days in advance of any such limitation, restriction, suspension or rejection. You may allocate Premium payments among Fixed Account Option(s) and Investment Divisions available at the time of payment, subject to the Company's approval, in amounts not less than [$100]. The Company reserves the right to restrict or refuse any Premium allocation to a Fixed Account Option(s) at any time. The Company will allocate any Premium payment subsequent to issue according to Your most recent instructions on file with the Company, provided that each allocation complies with the Company's then current minimum amounts and restrictions. The Company reserves the right to require that amounts You allocate to the 1-Year Fixed Account Option be automatically transferred to the Investment Division(s) of Your choice, in scheduled installments over a period that the Company shall specify. The scheduled transfers will continue until such time that all amounts in the 1-Year Fixed Account Option have been transferred out. You may change the Investment Division(s) You select at any time. These automatic transfers will not count against the [25] free transfers the Company allows in a Contract Year. Systematic Investment Allocation Amount. The minimum Contract Value required to participate in the enhanced interest rate dollar cost averaging program is [$15,000]. Minimum Investment Return to Avoid Decrease in Variable Annuity Payments. The minimum investment return earned by the Investment Division(s) so that the dollar amount of Variable Annuity Payments will not decrease is [1.35%], is equal to the assumed net investment rate and Core Contract Charge identified on the Contract Data Page. Variable Annuity Payments are further described under the Income Provisions. CONTRACT OPTIONS: Separate Account. [▇▇▇▇▇▇▇ National Separate Account - I] Investment Division(s). Available Investment Division(s) are identified in the current prospectus and any supplements. The Company may offer new Investment Divisions, or eliminate, substitute, or combine Investment Divisions. Fixed Account Options. [1-Year Period; 3-Year Period; 5-Year Period; and 7-Year Period; the availability of each option will be determined by the Company.] Available Fixed Account Options are identified in the current prospectus and any supplements. Maximum Contract Option Allocations Allowed. The number of allocations to the Contract Options may not exceed [99] at any time. The Company will identify the Contract Options You select in a confirmation the Company sends You on or after the Issue Date.

ICC17 VA790-T1 3f

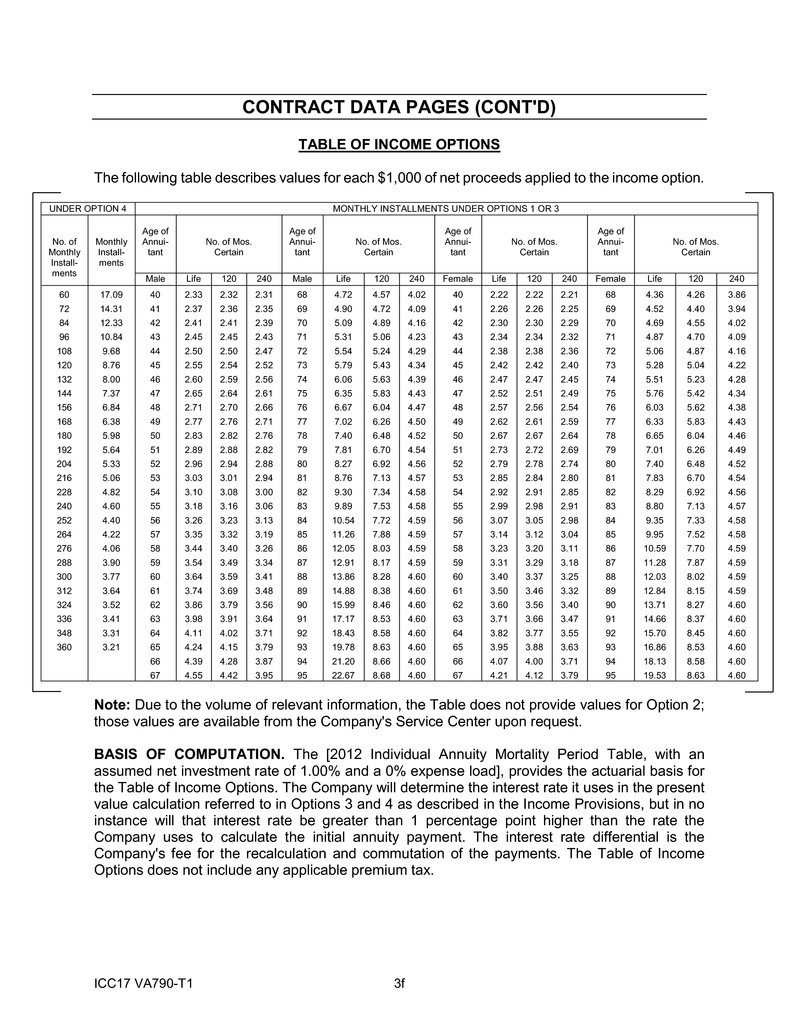

CONTRACT DATA PAGES (CONT'D) TABLE OF INCOME OPTIONS The following table describes values for each $1,000 of net proceeds applied to the income option. UNDER OPTION 4 MONTHLY INSTALLMENTS UNDER OPTIONS 1 OR 3 No. of Monthly Install-ments

Monthly Install-ments

Age of Annui- tant

No. of Mos. Certain

Age of Annui- tant

No. of Mos. Certain

Age of Annui- tant

No. of Mos. Certain

Age of Annui- tant

No. of Mos. Certain

Male Life 120 240 Male Life 120 240 Female Life 120 240 Female Life 120 240

60 17.09 40 2.33 2.32 2.31 68 4.72 4.57 4.02 40 2.22 2.22 2.21 68 4.36 4.26 3.86

72 14.31 41 2.37 2.36 2.35 69 4.90 4.72 4.09 41 2.26 2.26 2.25 69 4.52 4.40 3.94

84 12.33 42 2.41 2.41 2.39 70 5.09 4.89 4.16 42 2.30 2.30 2.29 70 4.69 4.55 4.02

96 10.84 43 2.45 2.45 2.43 71 5.31 5.06 4.23 43 2.34 2.34 2.32 71 4.87 4.70 4.09

108 9.68 44 2.50 2.50 2.47 72 5.54 5.24 4.29 44 2.38 2.38 2.36 72 5.06 4.87 4.16

120 8.76 45 2.55 2.54 2.52 73 5.79 5.43 4.34 45 2.42 2.42 2.40 73 5.28 5.04 4.22

132 8.00 46 2.60 2.59 2.56 74 6.06 5.63 4.39 46 2.47 2.47 2.45 74 5.51 5.23 4.28

144 7.37 47 2.65 2.64 2.61 75 6.35 5.83 4.43 47 2.52 2.51 2.49 75 5.76 5.42 4.34

156 6.84 48 2.71 2.70 2.66 76 6.67 6.04 4.47 48 2.57 2.56 2.54 76 6.03 5.62 4.38

168 6.38 49 2.77 2.76 2.71 77 7.02 6.26 4.50 49 2.62 2.61 2.59 77 6.33 5.83 4.43

180 5.98 50 2.83 2.82 2.76 78 7.40 6.48 4.52 50 2.67 2.67 2.64 78 6.65 6.04 4.46

192 5.64 51 2.89 2.88 2.82 79 7.81 6.70 4.54 51 2.73 2.72 2.69 79 7.01 6.26 4.49

204 5.33 52 2.96 2.94 2.88 80 8.27 6.92 4.56 52 2.79 2.78 2.74 80 7.40 6.48 4.52

216 5.06 53 3.03 3.01 2.94 81 8.76 7.13 4.57 53 2.85 2.84 2.80 81 7.83 6.70 4.54

228 4.82 54 3.10 3.08 3.00 82 9.30 7.34 4.58 54 2.92 2.91 2.85 82 8.29 6.92 4.56

240 4.60 55 3.18 3.16 3.06 83 9.89 7.53 4.58 55 2.99 2.98 2.91 83 8.80 7.13 4.57

252 4.40 56 3.26 3.23 3.13 84 10.54 7.72 4.59 56 3.07 3.05 2.98 84 9.35 7.33 4.58

264 4.22 57 3.35 3.32 3.19 85 11.26 7.88 4.59 57 3.14 3.12 3.04 85 9.95 7.52 4.58

276 4.06 58 3.44 3.40 3.26 86 12.05 8.03 4.59 58 3.23 3.20 3.11 86 10.59 7.70 4.59

288 3.90 59 3.54 3.49 3.34 87 12.91 8.17 4.59 59 3.31 3.29 3.18 87 11.28 7.87 4.59

300 3.77 60 3.64 3.59 3.41 88 13.86 8.28 4.60 60 3.40 3.37 3.25 88 12.03 8.02 4.59

312 3.64 61 3.74 3.69 3.48 89 14.88 8.38 4.60 61 3.50 3.46 3.32 89 12.84 8.15 4.59

324 3.52 62 3.86 3.79 3.56 90 15.99 8.46 4.60 62 3.60 3.56 3.40 90 13.71 8.27 4.60

336 3.41 63 3.98 3.91 3.64 91 17.17 8.53 4.60 63 3.71 3.66 3.47 91 14.66 8.37 4.60

348 3.31 64 4.11 4.02 3.71 92 18.43 8.58 4.60 64 3.82 3.77 3.55 92 15.70 8.45 4.60

360 3.21 65 4.24 4.15 3.79 93 19.78 8.63 4.60 65 3.95 3.88 3.63 93 16.86 8.53 4.60

66 4.39 4.28 3.87 94 21.20 8.66 4.60 66 4.07 4.00 3.71 94 18.13 8.58 4.60

67 4.55 4.42 3.95 95 22.67 8.68 4.60 67 4.21 4.12 3.79 95 19.53 8.63 4.60 Note: Due to the volume of relevant information, the Table does not provide values for Option 2; those values are available from the Company's Service Center upon request. BASIS OF COMPUTATION. The [2012 Individual Annuity Mortality Period Table, with an assumed net investment rate of 1.00% and a 0% expense load], provides the actuarial basis for the Table of Income Options. The Company will determine the interest rate it uses in the present value calculation referred to in Options 3 and 4 as described in the Income Provisions, but in no instance will that interest rate be greater than 1 percentage point higher than the rate the Company uses to calculate the initial annuity payment. The interest rate differential is the Company's fee for the recalculation and commutation of the payments. The Table of Income Options does not include any applicable premium tax.

ICC17 VA790 4

DEFINITIONS ACCUMULATION UNIT. A unit of measure the Company uses before the Income Date to calculate the value in an Investment Division. ANNUITANT. The natural person(s) so designated on the Contract Data Page, or by subsequent designation, on whose life the Company bases annuity payments provided by the Contract. References to the Annuitant include all Joint Annuitants, if applicable. ANNUITY UNIT. A unit of measure the Company uses to calculate the amount of each Variable Annuity Payment. BASE INTEREST RATE. The rate of interest the Company declares for a specified Fixed Account Option period. BENEFICIARY(IES). The natural person(s) or entity(ies) You initially or subsequently designate as Primary and Contingent Beneficiary(ies) to receive any death benefit provided by the Contract. The initial designated Beneficiary(ies) are identified on the Contract Data Page. BUSINESS DAY. Any day that the New York Stock Exchange (NYSE) is open for business. The Business Day ends when the NYSE closes for the day. CONTRACT. The Individual Deferred Variable and Fixed Annuity Contract described herein. CONTRACT ANNIVERSARY. Each one-year anniversary of the Issue Date. CONTRACT OPTION(S). The allocation options the Contract offers. Each Contract Option is more fully explained in the Accumulation Provisions. CONTRACT QUARTERLY ANNIVERSARY. Each three-month anniversary of the Issue Date. CONTRACT VALUE. The sum of the Separate Account Contract Value and the Fixed Account Contract Value. CONTRACT YEAR. The twelve-month period beginning on the Issue Date and on any Contract Anniversary thereafter while the Contract remains in force. CURRENT INTEREST RATE. The Base Interest Rate plus any additional interest rate the Company credits, but never less than the Fixed Account Minimum Interest Rate. DESIGNATED OPTION(S). The Investment Division(s) and/or Fixed Account Option(s) You select to which amounts will be transferred from a Source Option pursuant to one of the Company's systematic investment programs.

ICC17 VA790 5

DEFINITIONS (CONT'D) DUE PROOF. Evidence of a death, including but not limited to a certified death certificate issued by the governmental authority for the location of the death, or other evidence the Company requires. FIXED ACCOUNT. Part of the Company's general account, to which You may allocate Premium and Contract Values unless the Company has restricted such allocations. FIXED ACCOUNT CONTRACT VALUE. The larger of the Fixed Account Minimum Value or the sum of all amounts allocated to the Fixed Account Options reduced by withdrawals and transfers from the Fixed Account Options and applicable charges and taxes, plus all interest credited to the Fixed Account Options. FIXED ACCOUNT MINIMUM INTEREST RATE. The guaranteed minimum interest rate the Company uses to determine the Fixed Account Minimum Value. The Initial Fixed Account Minimum Interest Rate is shown on the Contract Data Page. FIXED ACCOUNT MINIMUM VALUE. A percentage of all amounts allocated to the Fixed Account Options, reduced by withdrawals and transfers from the Fixed Account Options, any applicable optional benefit charges, taxes, and the Fixed Account Minimum Value Annual Expense Allowance accumulated at the Fixed Account Minimum Interest Rate. The Fixed Account Minimum Value percentage is shown on the Contract Data Page FIXED ACCOUNT MINIMUM VALUE ANNUAL EXPENSE ALLOWANCE. An annual deduction from the Fixed Account Minimum Value to allow for the cost of maintaining Your Contract. On each Contract Anniversary, the Company will deduct the Fixed Account Minimum Value Annual Expense Allowance from the Fixed Account Minimum Value. The Fixed Account Minimum Value Annual Expense Allowance is shown on the Contract Data Page. FIXED ACCOUNT MINIMUM VALUE EXPENSE LOAD. A percentage of Premium load applied in calculating the Fixed Account Minimum Value. This rate will not change unless the Fixed Account Minimum Value calculation changes. The Fixed Account Minimum Value Expense Load is shown on the Contract Data Page. FIXED ACCOUNT OPTION. A Contract Option within the Fixed Account that specifies a fixed period for which the Company credits the Current Interest Rate. GOOD ORDER. The Company's receipt of all information, documentation, instructions and/or Premium the Company requires before it will issue the Contract or execute any transaction. INCOME DATE. The date on which Income Payments are to begin as described in the Income Provisions. INCOME PAYMENTS. Fixed Annuity Payments and Variable Annuity Payments offered by the Company at the Income Date. INVESTMENT DIVISIONS. Separate and distinct divisions of the Separate Account, each of which invests in a specific Underlying Mutual Fund, and for which Accumulation Units and Annuity Units are separately maintained. The Separate Account Contract Value in the Investment Divisions will go up or down depending on the performance of the Underlying Mutual Funds.

ICC17 VA790 6

DEFINITIONS (CONT'D) ISSUE DATE. The date the Company issued the Contract. The Issue Date is shown on the Contract Data Page. JOINT OWNER. Each of multiple Contract Owners. LATEST INCOME DATE. The Contract Anniversary on or next following the Owner's 95th birthday or such earlier date required by a Qualified Plan, law or regulation. NON-QUALIFIED PLAN. A retirement plan which does not qualify for favorable tax treatment under Sections 401, 403, 408, 408A or 457 of the Internal Revenue Code, as amended. OWNER ("YOU," "YOUR"). The natural person(s) or entity(ies) so designated on the Contract Data Page, or by subsequent designation. In this Contract, "You" and "Your" also mean the Owner. References to the Owner include all Joint Owners, if applicable. PREMIUM(S). Money paid into this Contract for allocation into a Contract Option. QUALIFIED PLAN. A retirement plan which qualifies for favorable tax treatment under Sections 401, 403, 408, 408A or 457 of the Internal Revenue Code, as amended. REDETERMINATION DATE. The date the Fixed Account Minimum Interest Rate is reset as described in the Fixed Account Minimum Interest Rate provision. It is the date each January that coincides with the Issue Date. For example, if Your Contract's Issue Date is May 23, the Redetermination Date will be January 23 each year following the Issue Date. REDETERMINATION PERIOD. The twelve-month period that begins on each Redetermination Date. SEPARATE ACCOUNT. An asset account the Company has established and maintains in accordance with Michigan law. The Company has allocated a portion of the Company's assets to this account for this Contract and certain other contracts. The name of the Separate Account is shown on the Contract Data Page. SEPARATE ACCOUNT CONTRACT VALUE. The current value of the amounts under this Contract allocated to the Separate Account's Investment Divisions. SERVICE CENTER. The Company's administrative address and telephone number as identified on the Contract's cover page or as the Company may designate from time to time. SOURCE OPTION. The Investment Division or Fixed Account Option You select from those the Company makes available, from which amounts will be transferred to a Designated Option(s) pursuant to one of the Company's systematic investment programs. UNDERLYING MUTUAL FUNDS. The registered management investment companies in which the assets of the Investment Divisions will be invested. WITHDRAWAL VALUE. The Contract Value, less any tax payable, Annual Contract Maintenance Charges, and charges due under any optional endorsement(s) to the Contract, adjusted for any applicable Market Value Adjustment.

ICC17 VA790 7

GENERAL PROVISIONS ANNUITANT. You may change the Annuitant at any time before the Income Date, unless You are not a natural person. If You are not a natural person, the Company will use the oldest Annuitant's age for all Contract purposes unless otherwise specified in the Contract. The Company reserves the right to limit the number of Joint Annuitants to two (2). ASSIGNMENT. You may assign ownership of this Contract subject to the interests of assignees and irrevocable Beneficiaries, but the Company will be bound by an assignment only if submitted in a form acceptable to the Company, received in Good Order at the Company's Service Center and recorded. Unless You specify otherwise, an assignment will take effect on the date the request is signed by You, subject to any payments the Company has made or other actions the Company has taken before the Company receives and records the request. The Company may refuse assignments if required to comply with applicable laws or regulations. The Company assumes no responsibility for the validity or tax consequences of any assignment. If You make an assignment, You may have to pay taxes. The Company encourages You to seek legal and/or tax advice. BENEFICIARY. You may change Beneficiaries, subject to the interests of assignees and irrevocable Beneficiaries, by submitting a written, signed and dated request in a form acceptable to the Company in Good Order to the Company's Service Center. Any previously designated irrevocable Beneficiary must consent in writing to any change in Beneficiary. Unless You specify otherwise, a change in Beneficiary will take effect on the date the request is signed by You, subject to any payments the Company has made or other actions the Company has taken before the Company receives and records Your request, and while You are alive. CHARGES AND FEES. The Contract permits the Company to assess certain charges and fees. Charges and fees associated with Your Contract are described on the Contract Data Page. CONFORMITY WITH INTERSTATE INSURANCE PRODUCT REGULATION COMMISSION (IIPRC) STANDARDS. This Contract is approved under the authority of the IIPRC and is issued under the IIPRC standards. Any provision of this Contract that, on the Issue Date or the provision's effective date, is in conflict with the applicable IIPRC standards on that date is hereby amended to conform to the IIPRC standards in effect as of the Issue Date or the provision's effective date. DEFERRAL OF FIXED ACCOUNT PAYMENTS. If approved in writing by the chief insurance regulator of the Company's state of domicile, the Company may defer payment of Your request for a partial and/or total withdrawal from a Fixed Account Option for a period not exceeding six (6) months. The Company will credit interest on deferred amounts as required by law. The Company will not defer payment of death benefits.

ICC17 VA790 8

GENERAL PROVISIONS (CONT'D) ENTIRE CONTRACT. The Contract, the application, and any attached endorsements, riders and amendments make up the entire Contract between You and the Company. All the applicant's statements made to procure the Contract will, in the absence of fraud, be deemed representations and not warranties. INCONTESTABILITY. The Company may contest this Contract only when an applicant has procured the Contract by fraud (and only if permitted by law in the state in which the Company delivered the Contract or issued the Contract for delivery). MINIMUM BENEFITS. No Withdrawal Value or death benefit provided by this Contract shall be less than the minimum benefits required by Section 7 of the Model Variable Annuity Regulation, Model 250, Standard Nonforfeiture Law for Individual Deferred Annuities, Model No. 805 or applicable successor provision, as amended. MISSTATEMENT OF AGE AND/OR SEX. If Your or the Annuitant's age and/or sex is misstated at the time the Contract's Income Payments become payable, the Company will adjust the payments to reflect income consistent with the correct age and/or sex. Immediately upon discovery, the Company will adjust the next payment due as a credit or charge, as appropriate, for any underpayments or overpayments using the Misstatement of Age or Sex Interest Rate shown on the Contract Data Page. MODIFICATION OF CONTRACT. No producer or financial representative has authority to change or waive any of this Contract's provisions. No change to or waiver of this Contract's terms is valid unless in writing and signed by the Company's President, a Vice President, Secretary or Assistant Secretary; provided, however, that the Company may amend any Contract term, and administer the Contract, to conform to the Internal Revenue Code. NONPARTICIPATING. This Contract is nonparticipating and does not share in the Company's surplus or earnings. OWNER. You may change the Owner or any Joint Owner, but the Company will be bound by a change of ownership only if submitted in a form acceptable to the Company, received in Good Order at the Company's Service Center and recorded. No person whose age exceeds the maximum issue age the Company had set as of the Issue Date may become a new Owner. Unless You specify otherwise, a change of ownership will take effect on the date the request is signed by You, subject to any payments the Company has made or other actions the Company has taken before the Company receives and records the request. Joint Owners have equal ownership rights; therefore, each Owner must authorize any exercise of Contract rights unless the Joint Owners instruct the Company in writing to act upon authorization of an individual Joint Owner. The Company reserves the right to limit the number of Joint Owners to two (2). The Company assumes no responsibility for the validity or tax consequences of any ownership change. If You make an ownership change, You may have to pay taxes. The Company encourages You to seek legal and/or tax advice. PROOF OF AGE, SEX AND/OR SURVIVAL. The Company at any time may require proof of age and/or sex satisfactory to the Company. If any payment required by this Contract depends on a living Annuitant, Owner or Beneficiary, the Company may require proof of that person's survival satisfactory to the Company.

ICC17 VA790 9

GENERAL PROVISIONS (CONT'D) PROTECTION OF PROCEEDS. A Beneficiary may not assign Contract proceeds before the proceeds are payable. Contract proceeds are not subject to the claims of creditors or to legal process unless required by applicable law. REPORTS. The Company will send a report to Your last address in the Company's records at least annually before the Income Date. In the case of Joint Owners, the Company will send reports only to the primary Owner's address. The report will provide at least the following information: 1. the dates that begin and end the reporting period; 2. the Contract Value at the beginning and end of the reporting period prior to the application of any Market Value Adjustment; 3. the Market Value Adjustment amount the Company used to determine the Withdrawal Value; 4. the amounts the Company has credited to and deducted from the Contract Value during the reporting period; 5. the Withdrawal Value at the end of the reporting period; 6. the amount of the death benefit at the end of the reporting period; and 7. any other information state and federal law require. You may receive copies of reports the Company provides upon request at no additional charge. SUBSTITUTION OF UNDERLYING MUTUAL FUND(S). If the Company determines that an Underlying Mutual Fund is no longer available or appropriate for Contract purposes, the Company may replace that Underlying Mutual Fund with another Underlying Mutual Fund without Your consent but upon notice to You. Changes of the Underlying Mutual Fund(s) are subject to the federal securities laws and the laws of the state where the Company issued the Contract for delivery. In the event the Company replaces an Underlying Mutual Fund, consistent with Your rights under the Contract, You are permitted to transfer Your Contract Value and allocate future Premiums among the available Investment Divisions. SUSPENSION OF SEPARATE ACCOUNT PAYMENTS. The Company may suspend or delay withdrawals of Separate Account Contract Value or transfers to or from an Investment Division for any period when: 1. the NYSE is closed (other than customary weekend and holiday closings); 2. under applicable Securities and Exchange Commission (SEC) rules, trading on the NYSE is restricted; 3. under applicable SEC rules, an emergency exists such that it is not reasonably practicable to dispose of securities in the Investment Division or to determine the value of its assets; or 4. the SEC, by order, so permits for the protection of Contract Owners. TAXES. The Company may deduct any taxes attributed to the Contract and payable to a government entity from the Contract Value. The Company reserves the right to deduct any amounts the Company might advance to pay taxes from the Contract Value. The Company will withhold taxes required by law from any amounts payable from this Contract.

ICC17 VA790 10

GENERAL PROVISIONS (CONT'D) TRANSFER OF FUNDS. The Contract Data Page describes the conditions for transfers of funds between Contract Options. TRANSFER OF FUNDS RESTRICTIONS. The Company may restrict the number and frequency of transfers into and between Contract Options in certain circumstances. This includes, but is not limited to, circumstances in which the Company determines, at its sole discretion, that a reasonably designed restriction is required to prevent transfers that would disadvantage an Owner. The Company may impose a restriction including, but not limited to: 1. a minimum time between transfers; 2. a limitation on transfer requests of an agent acting for one or more Owners; and 3. a limitation on the dollar amount of any transfer. The Company may also impose restrictions on Your ability to make transfers to or from the 1-Year Fixed Account Option. This includes a restriction that transfers from the 1-Year Fixed Account Option in any Contract Year may not exceed the maximum amount, as defined below: 1. In the first Contract Year that transfer restrictions are in effect, or if in the prior Contract Year, the maximum amount was not transferred out of the 1-Year Fixed Account Option, the maximum amount You may transfer out of the 1-Year Fixed Account Option is equal to 1/3 of the Contract Value in the 1-Year Fixed Account Option at the beginning of the current Contract Year; 2. If the maximum amount (1/3 of the value of the 1-Year Fixed Account Option at the beginning of the prior Contract Year) was transferred from the 1-Year Fixed Account Option in the prior Contract Year, the maximum amount You may transfer out of the 1-Year Fixed Account Option in the current Contract Year is equal to 1/2 of the Contract Value in the 1-Year Fixed Account Option at the beginning of the current Contract Year. Any transfers out of the 1-Year Fixed Account Option cannot begin until twelve (12) calendar months after the last transfer of the prior Contract Year; 3. If the maximum amount (1/3 and then 1/2 of the value of the 1-Year Fixed Account Option at the beginning of each of the two (2) prior Contract Years, respectively) was transferred from the 1-Year Fixed Account Option in each of the two (2) prior Contract Years, You may transfer the remaining Contract Value in the 1-Year Fixed Account Option. Any transfers out of the 1-Year Fixed Account Option cannot begin until twelve (12) calendar months after the last transfer of the prior Contract Year. If the 1-Year Fixed Account Option restriction is imposed, the Company may: 1. limit Your ability to transfer into or allocate new Premium to the 1-Year Fixed Account Option in any Contract Year in which You make a transfer from the 1-Year Fixed Account Option. 2. limit Your ability to transfer from the 1-Year Fixed Account Option in any Contract Year in which You make a transfer into or allocate new Premium to the 1-Year Fixed Account Option. 3. offer an optional automated systematic transfer program to allow for systematic transfers out of the 1-Year Fixed Account Option. If the 1-Year Fixed Account Option restriction is imposed, systematic investment programs may be excluded; transfers under such programs do not count against the maximum amount, and the Contract Value under such programs is excluded from the determination of the maximum amount.

ICC17 VA790 11

GENERAL PROVISIONS (CONT'D) Systematic Investment. The Company may provide systematic investment programs that allow You to transfer funds among the Investment Divisions and the Fixed Account Options. These programs may include dollar cost averaging, portfolio rebalancing, and the automatic monthly transfer of earnings from the 1-Year Fixed Account Option and/or money market Investment Division to other Investment Divisions and Fixed Account Options. You may contact the Company's Service Center to obtain materials and forms that describe, and are required to participate in, these programs. The Company makes no guarantee that these programs will result in a profit or protect against loss in a declining market. The Company's dollar cost averaging program permits You to authorize the automatic monthly, quarterly, semiannual, or annual transfer of a fixed dollar amount or selected percentage of the value of a Source Option to one (1) or more Designated Option(s). The Company may offer an enhanced interest rate on Premium which an Owner that selects dollar cost averaging allocates to the 1-Year Fixed Account Option (Source Option). You may participate in the enhanced interest rate dollar cost averaging program only if Your Contract Value is at least equal to the minimum amount specified on the Contract Data Page. Under an enhanced interest rate dollar cost averaging program, amounts You allocate to the Source Option are automatically transferred to the Designated Option(s) of Your choice in scheduled installments over a specified period prescribed by the Company until all amounts in the 1-Year Source Option have been transferred. You may contact the Company's Service Center to request the interest rates and the specified periods applicable to the enhanced interest rate dollar cost averaging program. In the event You cancel participation in the enhanced interest rate dollar cost averaging program, the Company will transfer the Source Option balance, including any interest, into the Designated Option(s) You selected. WRITTEN NOTICE. Written information or instructions You intend to give the Company must be in Good Order and delivered to the Company's Service Center, unless the Company advises You otherwise. Instructions included in the Written Notice will take effect on the date the Company receives the notice in Good Order at the Company's Service Center, unless otherwise provided in the notice or in this Contract, or unless the Company advises You otherwise. The Company will deliver any notice or communication to Your last address in the Company's records unless You request otherwise in writing. You are responsible for promptly providing the Company notice of any address change or any error in a Company notice sent to You. In the case of Joint Owners, the Company will send notices and other communications to the primary Owner's address.

ICC17 VA790 12

ACCUMULATION PROVISIONS You may not allocate funds to more Contract Options than the maximum number of Contract Options specified on the Contract Data Page at any one time. The Company may waive this maximum. SEPARATE ACCOUNT. The Separate Account is an asset account shown on the Contract Data Page. The Separate Account consists of assets the Company has set aside and has kept separate from the Company's general account assets and other separate accounts. The Separate Account assets will not be charged with liabilities arising out of any other Company business. The Company credits or charges all the income, gains, and losses resulting from the Separate Account assets exclusively to the contracts supported by the Separate Account. The Separate Account assets will be available to cover the liabilities of the Company's general account only to the extent that the Separate Account assets exceed the Separate Account liabilities arising from the Contracts supported by the Separate Account. The Separate Account is divided into several Investment Divisions. The Company will value the Separate Account assets at their fair market value at least monthly. Accumulation Units. The Separate Account Contract Value may increase or decrease depending on the performance of the Investment Divisions. The Company uses a unit of measure called an Accumulation Unit to measure the Separate Account Contract Value during the accumulation phase. The value of an Accumulation Unit may increase or decrease from Business Day to Business Day. Adjustments to the Separate Account Contract Value, such as withdrawals, transfers, and certain charges, result in the redemption of Accumulation Units but do not change the value of the Accumulation Units. When You make an allocation to the Investment Divisions, the Company credits Your Contract with Accumulation Units. The Company determines the number of Accumulation Units credited to Your Contract by dividing the amount You allocate to any Investment Division by the Accumulation Unit Value for that Investment Division at the close of the Business Day on which You make the allocation. Accumulation Unit Value. The Company determines the value of an Accumulation Unit for each of the Investment Divisions by: 1. determining the total amount of money allocated to the particular Investment Division; 2. subtracting from that amount any applicable Core Contract Charge and taxes; and 3. dividing the result by the number of outstanding Accumulation Units. FIXED ACCOUNT. Allocations You make to Fixed Account Options are included in the Company's general account. The Company's general account consists of all the Company's assets, other than those in the Separate Account and other asset accounts. You may select from the Fixed Account Options made available by the Company. Amounts in the Fixed Account Option You select will earn interest at that option's Current Interest Rate, compounded annually during the entire Fixed Account Option period. The Company may declare Base Interest Rates higher or lower than any Base Interest Rates the Company previously declared.

ICC17 VA790 13

ACCUMULATION PROVISIONS (CONT'D) You may allocate Premium, or make transfers from the Investment Divisions, to the Fixed Account Options at any time before the Income Date, subject to the provisions of this Contract. You may not select any Fixed Account Option, other than the 1-Year Fixed Account Option, that extends beyond the Income Date. When Your selected Fixed Account Option ends: 1. If the option ends within one (1) year of the Income Date, the Company will renew You into the 1-Year Fixed Account Option. 2. If the option ends more than one (1) year before the Income Date, You may specify a new Fixed Account Option that does not extend beyond the Income Date within thirty (30) days of the end of the expired Fixed Account Option. 3. If You do not specify a Fixed Account Option within thirty (30) days of the end of the expired Fixed Account Option: a. if the same option is available at the time and does not extend beyond the Income Date, the Company will renew You into the same Fixed Account Option. b. if the same option is available at the time but extends beyond the Income Date, the Company will select the available Fixed Account Option that ends closest to but before the Income Date. c. if the same option is not available at the time but would not extend beyond the Income Date were it available, the Company will select the available Fixed Account Option with the duration closest to but less than the Fixed Account Option that just ended. Market Value Adjustment. The Market Value Adjustment is described in detail on the Contract Data Page and applies to withdrawals, transfers, and annuitizations from a Fixed Account Option. Amounts You remove from a Fixed Account Option no more than thirty (30) days following the end of the Fixed Account Option period are not subject to a Market Value Adjustment. The Company will mail You Written Notice at least fifteen (15) but not more than forty-five (45) days before the end of the Fixed Account Option period to which You have allocated amounts. The Company will not apply a Market Value Adjustment to: 1. death benefit proceeds; 2. amounts You allocate to an income option that is life contingent or results in payments spread over at least five (5) years; 3. amounts the Company withdraws for Contract charges; 4. amounts You remove from the 1-Year Fixed Account Option; 5. amounts You remove from any Fixed Account Option on the Latest Income Date; and 6. amounts You remove from any Fixed Account Option in the 30-day period following the end of a Fixed Account Option.

ICC17 VA790 14

ACCUMULATION PROVISIONS (CONT'D) Fixed Account Minimum Interest Rate. The Initial Fixed Account Minimum Interest Rate established on the Issue Date is shown on the Contract Data Page. The Company will re-determine the Fixed Account Minimum Interest Rate on each subsequent Redetermination Date for the following Redetermination Period. The Fixed Account Minimum Interest Rate on each Redetermination Date will be equal to: 1. the average of all the daily reported five-year Constant Maturity Treasury Rates during October of the year then ended, rounded to the nearest 1/20th of one (1) percent; 2. less 1.25 percentage points; 3. but never less than 1.0% or greater than 3.0%. The Fixed Account Minimum Interest Rate is the guaranteed minimum interest rate under the Contract and may change each year on the Redetermination Date. The Company will send You notice of the re-determined Fixed Account Minimum Interest Rate annually.

ICC17 VA790 15

WITHDRAWAL PROVISIONS On or before the Income Date You may request a total or partial withdrawal of the Withdrawal Value by submitting a request to the Company's Service Center in a form acceptable to the Company. Amounts You withdraw from a Fixed Account Option may incur a Market Value Adjustment. Upon a total withdrawal, You will receive the Withdrawal Value. The Withdrawal Value will be based on values determined at the end of the Business Day on which the Company receives Your request for withdrawal in Good Order at the Company's Service Center. In the event You request a total withdrawal, You must return this Contract or a completed Affidavit of Lost Contract to the Company's Service Center. No withdrawal may exceed the Withdrawal Value. Any partial withdrawal must be either: 1. an amount not less than the minimum partial withdrawal amount specified on the Contract Data Page; or 2. an amount equal to Your entire interest in an Investment Division or Fixed Account Option. If the Contract Value is less than the minimum partial withdrawal amount specified on the Contract Data Page, the Company will treat any withdrawal as a total withdrawal and the Company will pay You the Withdrawal Value. The Company may vary the minimum withdrawal amount, specified on the Contract Data Page, in connection with a systematic withdrawal program. If a partial withdrawal is requested that would reduce the Contract Value below the minimum Contract Value specified on the Contract Data Page, the Company will treat the withdrawal request as a total withdrawal. The Company will take the withdrawal amount from each Investment Division and Fixed Account Option in proportion to the current value of those Contract Options, unless You specify otherwise. The Company will determine values at the end of the Business Day on which the Company receives the request for withdrawal in Good Order at the Company's Service Center. You may take systematic monthly, quarterly, semiannual, or annual withdrawals of a specific amount of the Contract Value, subject to the minimum partial withdrawal amount made in connection with a systematic withdrawal program specified on the Contract Data Page. Systematic withdrawals from a Fixed Account Option may incur a Market Value Adjustment.

ICC17 VA790 16

DEATH BENEFIT PROVISIONS PAYMENT OF DEATH BENEFIT. The Company will pay the death benefit to Your Beneficiary upon receipt of a request for payment with Due Proof of death in Good Order at the Company's Service Center. If any death benefit is due to an estate, the Company will pay that benefit in a single lump-sum payment. The Company will pay the death benefit in accordance with applicable laws and regulations governing death benefit payments and in accordance with the Company's administrative procedures. NATURAL OWNER'S DEATH BEFORE THE INCOME DATE. Upon the death of the Owner, or any Joint Owner, before the Income Date, the death benefit will be paid to the Beneficiary(ies) designated by the Owner. In the event of the death of a Joint Owner, the surviving Joint Owner, if any, will be the Primary Beneficiary. Any other Beneficiary designation on record at the Service Center at the time of death will be treated as a Contingent Beneficiary. DEATH BENEFIT BEFORE THE INCOME DATE. The death benefit before the Income Date is equal to the Contract Value. The Company will calculate the death benefit at the end of the Business Day on which the Company receives the first request for payment with Due Proof of death, an election identifying the death benefit option and state required forms, if any, in Good Order at the Company's Service Center. A Beneficiary entitled to the death benefit bears the investment risk associated with amounts allocated to any Investment Division until the Company calculates the death benefit. After the death benefit has been calculated, each Beneficiary will receive their portion of the remaining value, subject to market fluctuations, when the Company receives their death benefit option election form and any applicable state required forms, in Good Order at the Company's Service Center. DEATH BENEFIT OPTIONS BEFORE THE INCOME DATE. Unless the Owner has pre-selected a death benefit option, a Beneficiary entitled to the death benefit before the Income Date must request that the Company pay the death benefit according to one of the death benefit options described below: Option 1 - single lump-sum payment; or Option 2 - payment of the entire death benefit distributed within five (5) years of the date of the relevant death; or Option 3 - Income Payments (i) over the lifetime of the Beneficiary, or (ii) over a period not extending beyond the life expectancy of the Beneficiary, with distribution beginning within one (1) year of the date of the relevant death. The Company may make available other death benefit options. A Beneficiary that wishes to elect payment under the life income Option 3 must do so no later than sixty (60) days from the date the Company receives Due Proof of death in Good Order at the Company's Service Center.

ICC17 VA790 17

DEATH BENEFIT PROVISIONS (CONT'D) With the exception of Option 3 above, the Company will pay a Beneficiary that elects a death benefit payment within seven (7) calendar days of the date the Company receives request for payment provided the Company has received Due Proof of death in Good Order at the Company’s Service Center. Any portion of the death benefit not applied under the life income Option 3 must be distributed within five (5) years of the Owner's death. Spousal Continuation Option Instead of Death Benefit. Unless the Contract is subject to a Pre-selected Death Benefit Option, a Joint Owner who is the spouse or a Beneficiary who is the spouse of the deceased Owner may elect to decline the death benefit and instead continue the Contract as Owner according to its terms. For purposes of the Spousal Continuation Option, the "continuation date" is the date on which the Company receives the spouse's written request to elect the Spousal Continuation Option and Due Proof of the relevant death in Good Order at the Company's Service Center. The Spousal Continuation Option is void in the event of a change from the original Owner or an assignment of the Contract. In any event, the Spousal Continuation Option can only be exercised once. Pre-selected Death Benefit Option. Before the Income Date, You may designate from the death benefit options described in the Contract, or other death benefit options made available by the Company, the option according to which the Company will pay the death benefit. You may do so by submitting a designation acceptable to the Company in Good Order to the Company's Service Center. Pre-selected Death Benefit Options are effective only after recording by the Company. The Company will pay the death benefit consistent with Your Pre-selected Death Benefit Option unless the Internal Revenue Code requires different payment or Your election requires payment over a period that exceeds the life expectancy of a Beneficiary. Once You pre-select a death benefit option, only You may revoke or change the designation by submitting a request in a form acceptable to the Company to the Company's Service Center. Revocations and changes to a Pre-selected Death Benefit Option are effective only after recording by the Company. DEATH OF ANNUITANT BEFORE INCOME DATE. Upon the death of an Annuitant who is not an Owner before the Income Date, the Contract remains in force and the Owner will become the Annuitant. The Owner may designate a new Annuitant, subject to the Company's administrative rules then in effect. However, if the Owner is not a natural person, the death of any Annuitant will be treated as the death of the Owner and a new Annuitant may not be designated. BENEFICIARY'S ENTITLEMENT TO DEATH BENEFIT BEFORE THE INCOME DATE. The Company will pay the death benefit to any Primary Beneficiaries or, if none, to any Contingent Beneficiaries, in equal shares (the "default allocation") unless You have designated otherwise (the "designated allocation"). A Beneficiary that dies before or within ten (10) days (or different period as prescribed by applicable law) of Your death is not entitled to any death benefit. In that circumstance, the Company will pay the deceased Beneficiary's benefit to surviving Beneficiaries in the same proportion as the designated allocation or, if applicable, the default allocation. If no Beneficiary survives You, the Company will pay the death benefit to Your estate.

ICC17 VA790 18

INCOME PROVISIONS INCOME DATE. Income Payments will begin on the Income Date. If You do not select an Income Date, the Income Date is the Latest Income Date. You may change the Income Date You have selected to a different Income Date that is not later than the Latest Income Date at any time by submitting a form acceptable to the Company in Good Order to the Company's Service Center at least seven (7) days before the Income Date You wish to change. INCOME PAYMENT. On or before the Income Date, You can elect payment in a single lump-sum. A single lump-sum payment terminates the Contract. The Company will make payment to You or another payee You specify. Alternatively, You may elect an income option. The Company will apply the Contract Value, less any applicable taxes, Market Value Adjustment, and other Contract charges, to provide You Fixed Annuity Payments or Variable Annuity Payments according to Your selected income option. If You do not choose how to receive Your Income Payments, Your Income Payments will be Variable Annuity Payments based on the Investment Divisions. Income Options. You can elect payment as provided in Option 1, 2, 3 or 4 below. You can elect an income option at any time before the Income Date and You can change an income option up to seven (7) days before the Income Date by submitting Written Notice in Good Order to the Company's Service Center. The Company will make payment to You or another payee You specify. If You do not select an income option, the Company will make payments as provided in Option 3 below, with 120 months certain. The Company will make payments monthly, quarterly, semiannually or annually as You elect; provided that the Company may pay any amount less than $2,000 in one (1) lump-sum payment. If the first monthly payment provided would be less than $20, the Company may require payments to be made at quarterly, semiannual or annual intervals so as to result in an initial payment of at least $20, or the Company has the right to make one (1) single lump-sum payment. The Company will calculate Income Payments not less than the Income Payments determined by applying the Contract Value to purchase a single premium immediate annuity contract from the Company at purchase rates the Company offered on the Income Date to annuitants in the same class as the Annuitant. YOU MAY NOT TAKE WITHDRAWALS DURING ANY PERIOD THE COMPANY IS MAKING PAYMENTS FOR THE ANNUITANT'S LIFE. OPTION 1 - LIFE INCOME. A monthly payment for the Annuitant's lifetime. All payments end upon the Annuitant's death. However, in the event of the Annuitant's death before the first monthly payment, the Company will pay the amount allocated to this income option to You or, if You are deceased, to Your Beneficiary. No Market Value Adjustment applies to Contract Value applied to Option 1.

ICC17 VA790 19

INCOME PROVISIONS (CONT'D) OPTION 2 - JOINT AND SURVIVOR INCOME. A monthly payment for the longer of the Annuitant's lifetime or that of a second person You designate. Upon the occasion of the first person to die, monthly payments continue during the survivor's lifetime at either the full amount previously payable or as a percentage (either one-half or two-thirds) of the full amount, as You select at the time You elect the income option. The Company will calculate Variable Annuity Payments using either one-half or two-thirds of the number of each type of Annuity Unit credited if reduced annuity payments to the survivor are desired. The Company will calculate Fixed Annuity Payments equal to either one-half or two-thirds of the Fixed Annuity Payment payable during the joint life of the Annuitant and the designated second person. All payments end upon the death of the last surviving Annuitant. However, in the event of the deaths of the Annuitant and the designated second person before the first monthly payment, the Company will pay the amount allocated to this income option to You or, if You are deceased, Your Beneficiary. No Market Value Adjustment applies to Contract Value applied to Option 2. OPTION 3 - LIFE INCOME WITH 120 OR 240 MONTHLY PERIODS GUARANTEED. A monthly payment for the Annuitant's lifetime with the guarantee that the Company will make no fewer than 120 or 240 monthly payments to You. If, at the Annuitant's death, fewer than the guaranteed number of payments have been made, the remaining guaranteed payments will be made to You as previously scheduled. In the event You die before the Company makes the specified number of guaranteed payments, Your Beneficiary may elect to continue to receive the Income Payments according to the terms of this Contract, or alternatively may elect to receive the present value of any remaining guaranteed payments in a single lump-sum payment, the amount of which the Company will calculate using the interest rate the Company originally used to determine the benefit payments upon annuitization. No Market Value Adjustment applies to Contract Value applied to Option 3. OPTION 4 - INCOME FOR A SPECIFIED PERIOD. A monthly payment for any number of years ranging from 5 to 30. This election must be made for full 12-month periods. In the event You die before the Company makes the specified number of payments, Your Beneficiary may elect to continue to receive the Income Payments according to the terms of this Contract, or alternatively may elect to receive the present value of any remaining guaranteed payments in a single lump-sum payment, the amount of which the Company will calculate using the interest rate the Company originally used to determine the benefit payments upon annuitization. No Market Value Adjustment applies to Contract Value applied to payments spread over five (5) years or more under Option 4. ADDITIONAL INCOME OPTIONS. The Company may make available other income options.

ICC17 VA790 20

INCOME PROVISIONS (CONT'D) FIXED ANNUITY PAYMENTS. The Company will determine Fixed Annuity Payments by applying annuity rates consistent with the age and sex (unless unisex rates apply) of the Annuitant and, if applicable, the designated second person, to the Contract Value, less any applicable taxes and other Contract charges. Annuity rates applied will not be less than the rates provided in the Contract's Table of Income Options. Once begun, the Company will not change the amount of Fixed Annuity Payments. VARIABLE ANNUITY PAYMENTS. The Company will determine the initial Variable Annuity Payment by applying annuity rates consistent with the age and sex (unless unisex rates apply) of the Annuitant and, if applicable, the designated second person, to the Contract Value allocated to the Investment Divisions, less any applicable taxes and other Contract charges. Annuity rates applied will not be less than the rates provided in the Contract's Table of Income Options. The Company will determine the second and subsequent Variable Annuity Payments in two (2) steps. First, the Company will divide the initial Variable Annuity Payment by the Annuity Unit Value calculated on the Income Date to establish a number of Annuity Units. Second, the Company will multiply the number of Annuity Units by the Annuity Unit Value determined on the Business Day next preceding the date on which each payment is due. The result of each calculation determines the Variable Annuity Payment due. Once Variable Annuity Payments have begun, the number of Annuity Units remains constant absent a reallocation of the Investment Divisions. Variable Annuity Payments are not affected by expenses other than taxes. The Contract Data Page specifies the minimum investment return Your Investment Division(s) must earn to avoid a decrease in the dollar amount of Variable Annuity Payments. Annuity Unit Value. The Company sets the initial value of an Annuity Unit of each Investment Division when the Company establishes the Investment Division. The Annuity Unit Value reflects the investment performance of an Investment Division and may increase or decrease from one (1) Business Day to the next. The Contract's Table of Income Options assumes the net investment rates described in the Contract's Basis of Computation provision. Therefore, if an Investment Division's actual net investment rate is greater than or less than the assumed net investment rate, Variable Annuity Payments will increase or decrease accordingly over time. The Company calculates each Investment Division's Annuity Unit Value for any Business Day in two (2) steps: First, the Company multiplies the immediately preceding Business Day's Annuity Unit Value by the Business Day's "net investment factor" determined on the day of the calculation. The Company determines the "net investment factor", which reflects changes in the Investment Division's net asset value, by dividing the value established at (1) below by the value established at (2) below, and then subtracting the value established at (3) below, where:

ICC17 VA790 21

INCOME PROVISIONS (CONT'D) (1) Is the net result of: a. the Investment Division's net asset value at the end of the Business Day; plus b. the per share amount of any dividend or other distribution declared by the Investment Division if the "ex-dividend" date occurs on the Business Day; plus or minus c. a per share credit or charge with respect to any taxes paid or reserved for by the Company which are determined by the Company to be attributable to the operation of the Investment Division (no federal income taxes are applicable under present law); and (2) Is the Investment Division's net asset value at the end of the preceding Business Day; and (3) Is the asset charge factor the Company determines for the Business Day to reflect the applicable Core Contract Charge. Second, the Company multiplies the result by a factor equal to one over one plus the assumed net investment rate, raised to the number of calendar days between the previous Business Day and the current Business Day over the number of calendar days in the current year. The factor is expressed formulaically as follows:

? 11 + ????

??

where: AIR is the assumed net investment rate. t is the number of calendar days between the previous Business Day and the current Business Day. y is the number of calendar days in the current year. NATURAL OWNER'S DEATH AFTER THE INCOME DATE. Upon Your death or the death of any Joint Owner who is not also an Annuitant after the Income Date, Income Payments due continue as before. Upon the Owner's death after the Income Date, the Beneficiary becomes the Owner. ANNUITANT'S DEATH AFTER THE INCOME DATE. Upon the death of the Annuitant after the Income Date, the death benefit, if any, will be as specified in the income option elected. Death benefits will be paid at least as rapidly as under the method of distribution in effect at the Annuitant's death. BENEFICIARY'S ENTITLEMENT TO INCOME PAYMENTS AFTER THE INCOME DATE. The Company will pay any remaining Income Payments due to any Primary Beneficiaries or, if none, to the Contingent Beneficiaries, in equal shares (the "default allocation") unless You have designated otherwise (the "designated allocation"). A Beneficiary that dies before or within ten (10) days (or different period as prescribed by applicable law) of Your death is not entitled to any remaining Income Payments due; in that circumstance, the Company will pay any remaining Income Payments due the deceased Beneficiary to surviving Beneficiaries in the same proportion as the designated allocation or, if applicable, the default allocation. If no Beneficiary survives You, the Company will pay any remaining Income Payments to Your estate.

ICC17 VA790 22

TERMINATION PROVISION This Contract terminates and all Contract benefits, including those provided by any endorsements, end on the earlier of: 1. the date You take a total withdrawal; 2. the date the Contract Value is zero or insufficient to pay Contract expenses; or 3. the date upon which the Company receives Due Proof of the Owner's (or any Joint Owner's) death and a Beneficiary's election of a death benefit in Good Order at its Service Center, unless the Contract is continued by the spouse under the Spousal Continuation Option.