TOWER INSURANCE COMPANY OF NEW YORK TOWER NATIONAL INSURANCE COMPANY PRESERVER INSURANCE COMPANY NORTH EAST INSURANCE COMPANY CASTLEPOINT INSURANCE COMPANY HERMITAGE INSURANCE COMPANY KODIAK INSURANCE COMPANY CASTLEPOINT FLORIDA INSURANCE COMPANY...

Exhibit 10.2

TOWER INSURANCE COMPANY OF NEW YORK

TOWER NATIONAL INSURANCE COMPANY

PRESERVER INSURANCE COMPANY

NORTH EAST INSURANCE COMPANY

CASTLEPOINT INSURANCE COMPANY

HERMITAGE INSURANCE COMPANY

KODIAK INSURANCE COMPANY

CASTLEPOINT FLORIDA INSURANCE COMPANY

CASTLEPOINT NATIONAL INSURANCE COMPANY

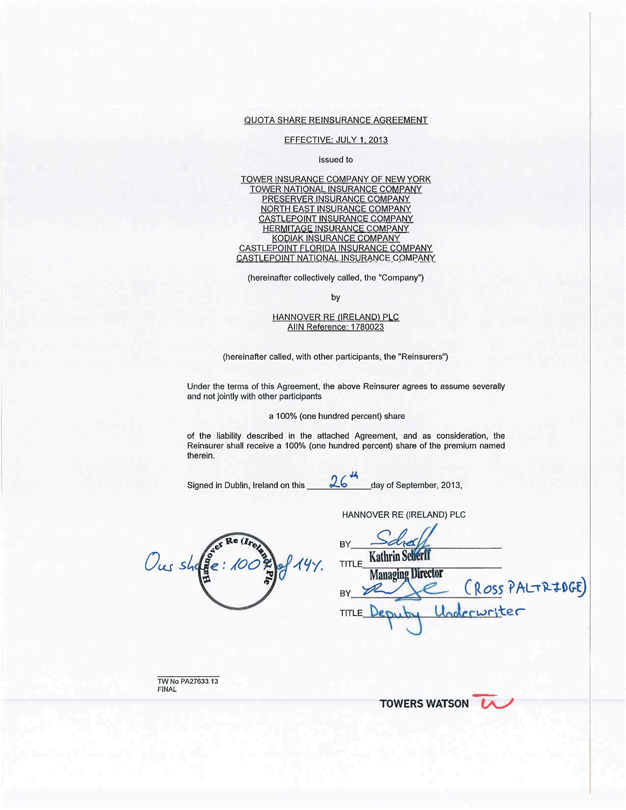

QUOTA SHARE REINSURANCE AGREEMENT

EFFECTIVE JULY 1, 2013

INDEX

| ARTICLE 1 |

BUSINESS COVERED |

1 | ||||

| ARTICLE 2 |

FOLLOW THE FORTUNES |

1 | ||||

| ARTICLE 3 |

COMMENCEMENT AND TERMINATION |

2 | ||||

| ARTICLE 4 |

TERRITORY |

2 | ||||

| ARTICLE 5 |

EXCLUSIONS |

2 | ||||

| ARTICLE 6 |

REINSURANCE COVERAGE, LIMITS AND AGGREGATE LIMIT |

3 | ||||

| ARTICLE 7 |

DEFINITIONS |

4 | ||||

| ARTICLE 8 |

NET RETAINED LINES |

7 | ||||

| ARTICLE 9 |

REINSURANCE PREMIUM AND REINSURERS’ MARGIN |

8 | ||||

| ARTICLE 10 |

CEDING COMMISSION |

9 | ||||

| ARTICLE 11 |

FUND HELD ACCOUNT AND INTEREST CREDIT |

10 | ||||

| ARTICLE 12 |

TRUST ACCOUNT |

11 | ||||

| ARTICLE 13 |

ACCOUNTS, REMITTANCES AND ULTIMATE NET LOSS SETTLEMENTS |

13 | ||||

| ARTICLE 14 |

SPECIAL TERMINATION |

14 | ||||

| ARTICLE 15 |

COMMUTATION |

17 | ||||

| ARTICLE 16 |

CURRENCY |

17 | ||||

| ARTICLE 17 |

FEDERAL EXCISE TAX AND OTHER TAXES |

17 | ||||

| ARTICLE 18 |

RESERVES |

18 | ||||

| ARTICLE 19 |

EXTRA CONTRACTUAL OBLIGATIONS/LOSS EXCESS OF POLICY LIMITS |

20 | ||||

| ARTICLE 20 |

OFFSET |

21 | ||||

| ARTICLE 21 |

ERRORS AND OMISSIONS |

21 | ||||

| ARTICLE 22 |

ACCESS TO RECORDS |

22 | ||||

| ARTICLE 23 |

INSOLVENCY |

23 | ||||

| ARTICLE 24 |

CONFIDENTIALITY AND PRIVACY AND PROTECTION OF DATA |

23 | ||||

| ARTICLE 25 |

ARBITRATION |

25 | ||||

| ARTICLE 26 |

SERVICE OF SUIT |

27 | ||||

| ARTICLE 27 |

LATE PAYMENTS |

28 | ||||

| ARTICLE 28 |

REPRESENTATIONS AND WARRANTIES |

29 | ||||

| ARTICLE 29 |

MODE OF EXECUTION |

30 | ||||

| ARTICLE 30 |

VARIOUS OTHER TERMS |

30 | ||||

| ARTICLE 31 |

INTERMEDIARY |

31 |

ATTACHMENTS:

NUCLEAR INCIDENT EXCLUSION CLAUSE – LIABILITY – REINSURANCE – U.S.A.

NUCLEAR INCIDENT EXCLUSION CLAUSE – LIABILITY – REINSURANCE – CANADA

NUCLEAR INCIDENT EXCLUSION CLAUSE – PHYSICAL DAMAGE – REINSURANCE – (BRMA35B)

NUCLEAR, BIOLOGICAL AND CHEMICAL EXCLUSION

WAR RISK EXCLUSION CLAUSE (REINSURANCE)

INSOLVENCY FUND EXCLUSION CLAUSE

POOLS, ASSOCIATIONS AND SYNDICATES EXCLUSION CLAUSE

TOWER INSURANCE COMPANY OF NEW YORK

TOWER NATIONAL INSURANCE COMPANY

PRESERVER INSURANCE COMPANY

NORTH EAST INSURANCE COMPANY

CASTLEPOINT INSURANCE COMPANY

HERMITAGE INSURANCE COMPANY

KODIAK INSURANCE COMPANY

CASTLEPOINT FLORIDA INSURANCE COMPANY

CASTLEPOINT NATIONAL INSURANCE COMPANY

(hereinafter, collectively the “Company”)

QUOTA SHARE REINSURANCE AGREEMENT

EFFECTIVE JULY 1, 2013

(hereinafter the “Agreement”)

WHEREAS the Tower Insurance Company of New York is the Pool Manager for the following companies: Tower National Insurance Company, a Massachusetts corporation (for its own direct business and the business it assumes from Massachusetts Homeland Insurance Company, a Massachusetts corporation), Preserver Insurance Company, a New Jersey corporation, (for its own direct business and the business it assumes from Kodiak Insurance Company, a New Jersey corporation), North East Insurance Company, a Maine corporation, (for its own direct business and the business it assumes from York Insurance Company of Maine, a Maine corporation), CastlePoint Insurance Company, a New York corporation, (for its own direct business and the business it assumes from CastlePoint Florida Insurance Company, a Florida corporation), Hermitage Insurance Company, a New York corporation, and CastlePoint National Insurance Company, an Illinois corporation;

NOW, THEREFORE, intending to be legally bound hereby, the Company and the Reinsurer agrees as follows:

ARTICLE 1

BUSINESS COVERED

This Agreement shall apply to all Policies written directly by the Company and classified by the Company as Brokerage Business only in respect of Business Automobile Liability, Commercial Multiple Peril Liability (both property and casualty), Other Liability, and Workers’ Compensation lines of business all subject to the terms, conditions and exclusions of this Agreement. “Brokerage Business” shall have the meaning defined in the Article entitled DEFINITIONS.

ARTICLE 2

FOLLOW THE FORTUNES

The Reinsurers’ liability shall attach simultaneously with that of the Company and shall be subject in all respects to the same risks, terms, conditions, interpretations, and to the same modifications, alterations, and cancellations as the respective Policies issued by the Company, the true intent of this Agreement being that the Reinsurers shall, in every case to which this Agreement applies, follow the underwriting fortunes of the Company, subject always to the limits, terms, conditions and exclusions set forth in this Agreement.

1.

ARTICLE 3

COMMENCEMENT AND TERMINATION

A. This Agreement shall take effect 12:00:01 a.m., Eastern Standard Time, July 1, 2013 (the “Effective Date”) and shall apply to all losses occurring on or after the Effective Date in respect of all (i) Policies that are Business Covered and in force at that time and (ii) all new and renewal Policies written with Policy period effective dates on and after the Effective Date, and shall remain in force until 11:59:59 p.m., Eastern Standard Time, December 31, 2013 (the “Term”).

B. Upon expiration or termination of the Agreement, as applicable, the Reinsurers shall be liable for all losses occurring on and after in respect of all in force Policies until the earlier of the expiration or the anniversary date of the Company’s Policies, but not to exceed a period of twelve (12) months plus odd time (maximum eighteen (18) months in total) from the date the policy incepted. In the event that any Policy is required by statute or regulation or order to be continued in force, the Reinsurers will continue to remain liable with respect to each such Policy until the Company may legally cancel, non-renew or otherwise eliminate liability under such Policy, but not to exceed twelve (12) months plus odd time (maximum eighteen (18) months in total) from the date the policy incepted.

ARTICLE 4

TERRITORY

This Agreement shall cover wheresoever the Company’s original Policies cover within the United States of America.

ARTICLE 5

EXCLUSIONS

A. This Agreement shall not cover Ultimate Net Loss in respect of the following:

| 1. | Liability arising out of all aircraft and airport risks including ownership, maintenance or use of any aircraft or flight operations; |

| 2. | Professional Liability, when written as such; |

| 3. | Insolvency and Financial Guarantee; |

| 4. | Asbestos liabilities of any nature; |

| 5. | Pollution liabilities of any nature; |

| 6. | Assumed reinsurance with the exception of inter-affiliate reinsurance; |

| 7. | Ex gratia payments; |

| 8. | Credit and warranty business; |

| 9. | Liability arising from Lead Paint; |

| 10. | Liability arising from drywall manufactured in Asia; |

| 11. | Any acquisitions of companies or books of business without the prior written consent of the Reinsurers hereon. |

2.

B. The following Exclusion Clauses are attached hereto and form part of this Agreement:

| 1. | Nuclear Incident Exclusion Clause – Liability – Reinsurance – U.S.A. – NMA 1590; |

| 2. | Nuclear Incident Exclusion Clause – Liability – Reinsurance – Canada – NMA 1979; |

| 3. | Nuclear Incident Exclusion Clause – Physical Damage – Reinsurance – (BRMA 35B); |

| 4. | Nuclear, Biological, and Chemical Risks in accordance with the Nuclear, Biological and Chemical Exclusion attached hereto; |

| 5. | War Risks, in accordance with the War Risks Exclusion Clause attached hereto; |

| 6. | Insolvency, in accordance with the Insolvency Funds Exclusion Clause attached hereto; |

| 7. | Liability assumed by the Company as a member of any pool, association or syndicate, in accordance with the Pools, Associations and Syndicates Exclusion Clause attached hereto. |

ARTICLE 6

REINSURANCE COVERAGE, LIMITS AND AGGREGATE LIMIT

A. Reinsurance Coverage – The Reinsurers shall indemnify and reinsure the Company for the Cession Percentage of the Company’s net retained liability for all Ultimate Net Loss on the Business Covered, subject to the terms, conditions, and exclusions of this Agreement. The Reinsurers shall only be obligated to indemnify and reinsure the Company for underlying Policies where the Reinsurers have been paid, or deemed paid via credit to the Funds Held Account, respective premiums for such underlying Policies by the Company.

B. Terrorism Occurrence Limit – The maximum contribution to Ultimate Net Loss in respect of Ultimate Net Loss arising from Terrorism shall be limited to two (2) Ultimate Net Loss Ratio points from any one Loss Occurrence and two (2) Ultimate Net Loss Ratio points for all Loss Occurrences combined during the Term of this Agreement.

C. PCS Catastrophe Occurrence Limit – In no event shall the Reinsurers’ aggregate limit of liability for Ultimate Net Loss from a PCS Catastrophe Occurrence exceed ten million dollars ($10,000,000) per PCS Catastrophe Occurrence for Business Covered hereunder and ten million dollars ($10,000,000) in the aggregate for all PCS Catastrophe Occurrences combined for Business Covered hereunder.

D. Per Risk, Per Loss Occurrence Limits – In no event shall the Reinsurers’ aggregate limit of liability for Ultimate Net Loss exceed the following limitations:

| 1) | five million dollars ($5,000,000) per Loss Occurrence in respect of Business Automobile Liability, Commercial Multiple Peril Liability and Other Liability Business Covered; |

3.

| 2) | two million dollars ($2,000,000) per Loss Occurrence in respect of Workers’ Compensation Business Covered; and |

| 3) | five million dollars ($5,000,000) per risk and ten million dollars ($10,000,000) per Loss Occurrence in respect of Commercial Multiple Peril Property. |

E. Allocated Loss Adjustment Expense Limit – The maximum contribution to Ultimate Net Loss arising from Allocated Loss Adjustment Expense shall be limited as follows:

| Line of Business |

Percentage of Net Earned Premium | |||

| Auto Liability |

6.75 | % | ||

| Commercial Multiple Peril Liability |

11,00 | % | ||

| Other Liability |

11.12 | % | ||

| Workers’ Compensation |

11.50 | % | ||

F. Extra Contractual Obligations, Loss Excess of Policy Limits and Mass Tort Limits – The maximum aggregate contribution to Ultimate Net Loss arising from the combination of Extra Contractual Obligations and Loss Excess of Policy Limits, as defined under the Article entitled EXTRA CONTRACTUAL OBLIGATIONS/LOSS EXCESS OF POLICY LIMITS, and Mass Tort claims, as defined below, shall be limited to five (5) Ultimate Net Loss Ratio points for the Term of this Agreement.

For purposes herein, “Mass Tort” shall mean an event or product or series of related events or products which injure a number of people or their property and cause one or more claims, arbitrations, lawsuits or legal proceedings asserting personal injury or property damage.

G. Aggregate Limit – In no event shall the Reinsurers’ maximum limit of liability under this Agreement exceed one hundred ten percent (110%) Ultimate Net Loss Ratio for the Term of this Agreement.

ARTICLE 7

DEFINITIONS

A. “Allocated Loss Adjustment Expenses” as used in this Agreement shall mean all costs and expenses that are incurred by the Company in the investigation, appraisal, adjustment, settlement, litigation, defense or appeal of a specific claim, including court costs and costs of supersedeas and appeal bonds and including a) pre-judgment interest, unless included as part of the award or judgment; b) post-judgment interest and c) legal expenses and costs incurred in connection with coverage questions and legal actions connected thereto, including Declaratory Judgment Expenses.

Allocated Loss Adjustment Expenses shall include defense attorneys, and other claims and legal personnel of Tower Insurance Company of New York/Tower Risk Management and other costs allocated to the defense and adjustment of a specific claim. Allocated Loss Adjustment Expense shall also include expenses of independent third parties, including but not limited to coverage attorneys and appraisers, retained, assigned and/or employed by the Company in the settlement of claims.

Allocated Loss Adjustment Expense shall not include Unallocated Loss Adjustment Expenses. For purposes of this definition, “Unallocated Loss Adjustment Expenses” shall mean the salaries and overhead of the Company’s employed claims adjusting staff other than the in-house legal staff assigned to the defense of specific claims which are covered under Allocated Loss Adjustment Expense.

4.

For purposes of this Agreement, Allocated Loss Adjustment Expense and Unallocated Loss Adjustment Expense shall be treated in accordance with the definitions herein, regardless of how the Company classifies Allocated Loss Adjustment Expense and Unallocated Loss Adjustment Expense in their claims systems.

B. “Brokerage Business” as used in this Agreement shall mean all classes of business that are underwritten on an individual Policy basis by the Company’s underwriting staff through wholesale and retail agents and most or all of the services are provided by the Company as part of the overall product offering that are Business Covered hereunder.

C. “Cession Percentage” as used in this Agreement shall be a rate of fourteen percent (14%) for both (i) the Unearned Premium Reserve and (ii) new and renewal Business Covered written during the Term of this Agreement.

It shall be deemed for purposes of this Agreement that the Company shall retain net and unreinsured at least twenty five percent (25%) of Business Covered hereunder.

D. “Company” as used in this Agreement shall mean Tower Insurance Company of New York (operating as Tower Select Insurance Company in California), Tower National Insurance Company, Preserver Insurance Company, North East Insurance Company, CastlePoint Insurance Company, Hermitage Insurance Company, Kodiak Insurance Company, CastlePoint Florida Insurance Company, and CastlePoint National Insurance Company (formerly known as SUA Insurance Company) (each company individually referred to as a “reinsured company”). Any affiliated insurance companies which may hereafter come under the management of the Tower Group Companies shall only be covered hereunder with mutual written consent of the Company and the Reinsurers.

For purposes of this Agreement, including sending and receiving notices and payments required by this Agreement, other than in respect of the Service of Suit and Reserves articles herein, Tower Insurance Company of New York is deemed and authorized to be the agent of all other reinsured companies referenced herein. In no event, however, shall any reinsured company be deemed the agent of another with respect to the terms of the Insolvency article. The retention of the Company and the liability of the Reinsurers and all other benefits accruing to the Company as provided in this Agreement or any amendments hereto, shall apply to the reinsured companies comprising the Company as a group and not separately to each of the reinsured companies.

E. “Declaratory Judgment Expenses” as used in this Agreement shall mean legal expenses paid by the Company in the investigation, analysis, evaluation or litigation of a coverage action between the Company and any other party to determine if there is coverage under a Policy or Policies issued by the Company in respect of Business Covered under this Agreement or which would be reinsured under this Agreement had the Company not been successful in the coverage action.

F. “Effective Date” as used in this Agreement shall mean 12:00:01 a.m., Eastern Standard Time, July 1, 2013.

G. “Ex-gratia Payments” as used in this Agreement shall mean all settlements of losses not covered under the express terms of the Policies. Ex-gratia Payments will not include settlement of losses which (i) arise from court decisions or other judicial acts or orders nor (ii) settlements made to avoid costs that could be incurred in connection with potential or actual litigation relating to coverage issues arising under the Policies.

H. “Gross Written Premium” as used in this Agreement shall mean the subject gross premium on Policies written by the Company that are Business Covered hereunder.

5.

I. “Loss Occurrence” as used in this Agreement shall mean any one accident, disaster, casualty or happening, or series of accidents, disasters, casualties or happenings arising out of or following on one event, regardless of the number of interests insured or the number of Policies responding.

Except where specifically provided otherwise in this Agreement, each Loss Occurrence shall be deemed to take place as of the earliest date of loss as determined by any original Policy responding to the Loss Occurrence.

As respects liability losses (bodily injury and property damage), “Loss Occurrence” shall mean the sum of all damages sustained by each insured (i) arising or resulting from the same event or (ii) arising out of a continuous or repeated injurious exposure to substantially the same general conditions. For purposes of this Agreement, the date of loss shall be deemed to be the inception or renewal date of the original Policy of insurance to which payment is charged.

J. “Net Earned Premium” as used in this Agreement shall mean the Net Written Premium of the Company’s Business Covered less the unearned premium reserve as calculated as at the respective date of calculation.

K. “Net Written Premium” as used in this Agreement shall mean gross premium of the Company on the Business Covered less cancellations and returns and less premium paid for all treaty and facultative inuring reinsurances.

Net Written Premium (“NWP”) for the Term of this Agreement is estimated to be five hundred thirty five million, nine hundred sixty thousand dollars ($535,960,000), of which two hundred eighty four million, six hundred forty five thousand dollars ($284,645,000) is estimated in respect of the Unearned Premium Reserve and two hundred fifty one million, three hundred fifteen thousand dollars ($251,315,000) is estimated in respect of new and renewal Business Covered hereunder.

In no event shall the ultimate ceded Net Written Premium exceed five hundred fifty million dollars ($550,000,000) for the Term of this Agreement.

L. “Policy” or “Policies” as used in this Agreement shall mean all policies, binders, contracts, certificates, or other obligations of insurance or reinsurance that are Business Covered hereunder.

M. “PCS Catastrophe Occurrence” as used in this Agreement shall mean a loss that has been assigned a catastrophic code number by the Property Claim Services division of American Insurance Services Group, Inc. (PCS) or by the organization responsible for assigning such designation for the geographic area in which the loss event occurred. Such loss amount shall include the sum of all individual losses (net of original Policy deductibles) directly occasioned by any one disaster, accident or loss or series of disasters, accidents or losses arising out of one event which occurs within the area of one state of the United States and states contiguous thereto and to one another. However, the duration and extent of any one Loss Occurrence shall be limited to all individual losses sustained by the Company occurring during any period of one hundred sixty eight (168) consecutive hours arising out of and directly occasioned by the same event.

N. “Reinsurer” or “Reinsurers” as used in this Agreement shall mean each reinsurer subscribing to its respective signing pages attached to and forming part of this Agreement. Each Reinsurer shall participate severally and not jointly in this Agreement and participation of each Reinsurer in this Agreement shall be deemed a separate agreement between the Company and that Reinsurer. In the event of any failure or default by any Reinsurer to perform any of its obligations hereunder, no other Reinsurer shall have any obligation with respect to such failure or default.

6.

O. “Terrorism” as used in this Agreement shall mean any act, or preparation in respect of action, or threat of action designed to influence the government de jure or de facto of any nation or any political division thereof, or in pursuit of political, religious, ideological, or similar purposes to intimidate the public or a section of the public of any nation by any person or group(s) of persons whether acting alone or on behalf of or in connection with any organization(s) or government(s) de jure or de facto, and which:

| (i) | involves violence against one or more persons; or |

| (ii) | involves damage to property; or |

| (iii) | endangers life other than that of the person committing the action; or |

| (iv) | creates a risk to health or safety of the public or a section of the public; or |

| (v) | is designed to interfere with or to disrupt an electronic system. |

Loss, damage, cost or expense arising out of or in connection with any action in controlling, preventing, suppressing, retaliating against, or responding to any act of terrorism shall be considered part of terrorism Ultimate Net Loss.

Notwithstanding the above, this Agreement shall not cover loss, damage, cost or expense arising out of or in connection with nuclear, biological or chemical contamination due to an act of Terrorism.

P. “Term” as used in this Agreement shall mean the period incepting 12:00:01 a.m., Eastern Standard Time, July 1, 2013 and expiring 11:59:59 p.m., Eastern Standard Time, December 31, 2013.

Q. “Ultimate Net Loss” as used in this Agreement shall mean, subject to all limitations in this Agreement, actual loss or losses arising out of Business Covered hereunder sustained by the Company in respect of Business Covered under this Agreement, including Allocated Loss Adjustment Expense and eighty percent (80%) of Extra Contractual Obligations and eighty percent (80%) of Excess Policy Limits, in accordance with the Article entitled EXTRA CONTRACTUAL OBLIGATIONS/LOSS EXCESS OF POLICY LIMITS, subject to all other terms and conditions in this Agreement, after making deductions for all recoveries and salvages and inuring excess of loss treaty and facultative reinsurance, whether collectible or not.

R. “Ultimate Net Loss Ratio” as used in this Agreement shall mean the ratio of aggregate Ultimate Net Loss incurred divided by Net Earned Premium as of the date of calculation.

S. “Unearned Premium Reserve” as used in this Agreement shall mean the Net Written Premium, as defined in this Article, on Policies that are Business Covered and in force as of the Effective Date of this Agreement, that is unearned as of the Effective Date.

ARTICLE 8

NET RETAINED LINES

A. This Agreement applies only to that portion of any Policy which the Company retains net for its own account, and in calculating the amount of any Ultimate Net Loss hereunder and also in computing the amounts in the Article entitled REINSURANCE COVERAGE, LIMITS AND AGGREGATE LIMIT, to which this Agreement applies, only Ultimate Net Loss in respect of that portion of any Policy which the Company retains net for its own account shall be included.

7.

B. Recoveries from any form of insurance or reinsurance that protects the Company against claims which are Business Covered hereunder shall inure to the benefit of the Reinsurers and shall be deducted to arrive at the amount of the Company’s Ultimate Net Loss.

C. The cost of Inuring reinsurance shall be limited to a maximum of three percent (3%) of Gross Written Premium in the aggregate for all Business Covered hereunder Net Written Premium under this Agreement shall be reduced by one hundred percent (100%) of the reinsurance premium for such inuring reinsurance (regardless of the percentage actually purchased by the Company).

D. Inter-company reinsurance among the reinsured companies shall be entirely disregarded for all purposes of this Agreement.

E. The amount of the Reinsurers’ liability hereunder in respect of any Ultimate Net Loss shall not be increased by reason of the inability of the Company to collect from any other reinsurer, whether specific or general, any amounts which may have become due from such reinsurer, whether such inability arises from the insolvency of such reinsurer or otherwise.

ARTICLE 9

REINSURANCE PREMIUM AND REINSURERS’ MARGIN

A. Reinsurance Premium – The Company shall pay to the Reinsurers, Reinsurance Premium equal to the following:

1. the Cession Percentage of the Unearned Premium Reserve calculated by the Company and due as of the Effective Date of this Agreement, deemed credited to the Funds Held Account at the Effective Date for Interest Credit purposes; plus

2. the Cession Percentage of the Credited Portion of cumulative Net Written Premium for new and renewal business effective during the Term of this Agreement, paid via credit to or debit from the Funds Held Account. The Company shall determine and report the Cession Percentage of the Credited Portion of cumulative Net Written Premium for new and renewal business on a quarterly basis forty five (45) days in arrears of each quarter end, in accordance with the table below. Reinsurance Premium, as determined above, less the cumulative Reinsurance Premium previously paid, shall be deemed credited to or debited from the Funds Held Account, as applicable, sixty (60) days in arrears of each respective quarter end.

The Credited Portion to be Applied to Cumulative NWP over four quarters for each Respective Calendar Quarter of Coverage to Determine Reinsurance Premium

| 0xx Xxxxxxx | 0xx Xxxxxxx | 0xx Xxxxxxx | 0xx Quarter | Total Credit | ||||||||||||||

| 40 | % | 75 | % | 90 | % | 100 | % | 100 | % | |||||||||

The Cession Percentage of Cumulative Net Written Premium (“NWP”) for each calendar quarter of coverage will be paid, via debit or credit to the Funds Held Account, as applicable, in four installments over four quarters, i.e., for the coverage period 7/1/13 – 09/30/13, 40% of cumulative NWP for the coverage period will be paid for the quarter ending 9/30/13; 75% of cumulative NWP for the coverage period (less amounts previously paid for this coverage period) will be paid for the quarter ending 12/31/13; 90% of cumulative NWP for the coverage period (less amounts previously paid for this coverage period) will be paid for the quarter ending 3/31/14; and 100% of cumulative NWP for the coverage period (less amounts previously paid for this coverage period) will be paid for the quarter ending 6/30/14.

8.

For example:

Within forty five (45) days of 9/30/13, the Company will provide a report in accordance with this Article, and within fifteen (15) days thereafter will credit or debit the Funds Held Account, as applicable, Reinsurance Premium to the Reinsurer in the amount of:

1) the Cession Percentage * (40% Credited Portion of cumulative NWP for the coverage period 07/01/13 – 09/30/13).

Within forty five (45) days of 12/31/13, the Company will provide a report in accordance with this Article, and within fifteen (15) days thereafter will credit or debit to the Funds Held Account, as applicable, Reinsurance Premium to the Reinsurer in the amount of:

1) the Cession Percentage * (75% Credited Portion of cumulative NWP for the calendar quarter of coverage 7/1/13 – 09/30/13); less

2) Reinsurance Premium previously paid for the calendar quarter of coverage 7/1/13 – 9/30/13; plus

3) the Cession Percentage * (40% Credited Portion of cumulative NWP for the calendar quarter of coverage 10/1/13 – 12/31/13).

Future Reinsurance Premium calculations will be made accordingly.

B. Reinsurers’ Margin – The Company shall pay to the Reinsurers an initial Reinsurers’ Margin equal to six percent (6%) of the ceded Reinsurance Premium (“Initial Reinsurers’ Margin”) in cash via wire transfer at the time Reinsurance Premium is credited to or debited from the Funds Held Account, as applicable. Initial Reinsurers’ Margin is deemed part of Reinsurance Premium and not in addition to Reinsurance Premium.

Notwithstanding the above, Initial Reinsurers’ Margin in respect of the Unearned Premium Reserve shall be paid to the Reinsurers on September 30, 2013.

The ultimate Reinsurers’ Margin under this Agreement shall be based upon the Ultimate Net Loss Ratio and Ceding Commission paid by the Reinsurers and the actual investment income credited to the Funds Held Account and earned by the Reinsurers on withdrawals, if any, and not the Initial Reinsurers’ Margin paid hereunder.

ARTICLE 10

CEDING COMMISSION

A. The Reinsurers shall allow the Company a provisional and maximum Ceding Commission equal to thirty point six percent (30.6%) of the Reinsurance Premium ceded hereon. The provisional Ceding Commission shall be credited to or debited from the Funds Held Account, as applicable, as Reinsurance Premiums are credited to or debited from the Funds Held Account and adjusted as the Ultimate Net Loss Ratio is re-determined quarterly.

B. The first adjustment of Actual Ceding Commission shall be calculated at December 31, 2014. Thereafter the Actual Ceding Commission shall be recalculated annually at each December 31st and based upon the Ultimate Net Loss Ratio, including incurred but not reported amounts as recorded by the Company in its financial statements, re-determined each year, in accordance with the following table:

| Ceding Commission Rate | Ultimate Net Loss Ratio | |||||||||||

| Provisional/Maximum |

30.6 | % | 62.0% or less | |||||||||

| .8 for 1 | ||||||||||||

| Minimum |

25.0 | % | 69.0% or greater | |||||||||

9.

If the Ultimate Net Loss Ratio is greater than sixty two point zero percent (62.0%), the Ceding Commission shall be decreased by zero point eight percent (0.8%) and any portion thereof for each one percent (1%) and any portion thereof that the Ultimate Net Loss Ratio is greater than sixty two point zero percent (62.0%), down to a minimum Ceding Commission of twenty five point zero percent (25.0%) at an Ultimate Net Loss Ratio of sixty nine point zero percent (69.0%) or greater.

Adjustments to Ceding Commission shall be credited to or debited from the Funds Held Account at the end of the respective calendar year for which the calculation is made. In the event the Funds Held Account becomes depleted, the Reinsurers shall pay any adjustments to Ceding Commission out of other funds of the Reinsurers. Any adjustment to Ceding Commission shall result in a special interest credit calculation from the time of adjustment back to December 31, 2014 at an annual effective interest rate of three percent (3%). Such special interest credit shall be paid by the debtor party to the creditor party at the time of the calculation.

ARTICLE 11

FUND HELD ACCOUNT AND INTEREST CREDIT

A. Funds Held Account – For purposes of this Agreement, the Company shall establish on its books and maintain a cumulative Funds Held Account comprised of the following:

1. The Funds Held Account at June 30, 2013 shall be equal to zero dollars ($0);

2. The Funds Held Account at each subsequent quarter end shall be comprised of the following cumulative amounts:

| a) | The Funds Held Account at the end of the prior quarter; plus |

| b) | Reinsurance Premium ceded for such quarter; less |

| c) | Ceding Commission and adjustments to Ceding Commission for such quarter; less |

| d) | Initial Reinsurers’ Margin for such quarter; less |

| e) | Ceded Ultimate Net Losses paid for such quarter; plus |

| f) | Interest Credit for such quarter; less |

| g) | Interest Credit Payments paid to the Reinsurers for such quarter, if applicable, in accordance with section B. below. |

The Company shall determine and report the balance and activity of the Funds Held Account quarterly within forty five (45) days of the quarter end.

B. Interest Credit – The Funds Held Account shall be credited quarterly, as of the end of each calendar quarter, with an Interest Credit rate multiplied by the average daily balance of the

10.

Funds Held Account for the respective quarter. The Interest Credit rate shall be equal to zero point seven four one seven one percent (0.74171%) of the average daily balance of the Funds Held Account for the respective quarter, to achieve an annual effective yield of three point zero percent (3.0%).

Interest Credit shall continue even in the event of the Company’s insolvency.

Beginning December 31, 2015 and quarterly thereafter, the Reinsurers may request that the Company transfer all or a portion of the accumulated Interest Credit credited to the Funds Held Account to the Reinsurers (“Interest Credit Payment”), subject to two such requests per calendar year. Payment shall be made at the end of the respective calendar quarter of such request, and debited from the Funds Held Account at the end of the respective calendar quarter of such request as per subsection g. of Section A. 2. of this Article.

In the event a Reinsurer suffers any of the circumstances under section A. of ARTICLE 14, SPECIAL TERMINATION (except, for purposes of this Article only, in respect of circumstance A.4., the U.S. Reinsurer’s A.M. Best’s rating is less than “A” or non-U.S. Reinsurer’s S&P Rating is less than “AA”), then any further requests for Interest Credit Payment must be approved by the Company. In no event shall this affect the economic position of the Reinsurers under this Agreement.

ARTICLE 12

TRUST ACCOUNT

A. The Company shall establish a segregated account (“Segregated Account”) and maintain assets with a market value equal to the Funds Held Account balance. The Company shall deposit Reinsurance Premium less provisional Ceding Commission less Initial Reinsurers’ Margin into the Segregated Account and shall be permitted to pay from the Segregated Account Ceding Commission adjustments, ceded paid portion of Ultimate Net Loss and Interest Credit Payment(s) (In accordance with section B. of the Article entitled FUNDS HELD ACCOUNT AND INTEREST CREDIT) when amounts are contractually due from the Reinsurers.

B. If the market value of the assets in the Segregated Account at any calendar quarter end is less than the balance of the Funds Held Account at such quarter end, then the Company shall deposit assets to achieve the required Funds Held Account balance at such quarter end. In the event of any excess funding, such excess amount shall remain in the Segregated Account.

The Company alone shall bear all expenses related to the Segregated Account, including trustee’s fees.

C. If the Company experiences a Triggering Event, as defined below, then the Reinsurers may request that the Company transfer all assets from the Segregated Account into a Trust Account (“Trust Account”) established by the Reinsurers in accordance with the provisions of section E. of this Article below. The Company and the Reinsurers shall mutually agree the type of investments to be deposited.

If the market value of the assets in the Trust Account at any calendar quarter end is less than the balance of the Funds Held Account at such quarter end, then the Company is required to deposit additional assets into the Trust Account to equal the balance of the Funds Held Account at such quarter end. If the market value of the assets in the Trust Account at any calendar quarter end is greater than the balance of the Funds Held Account at such quarter end, then such excess amount shall remain in the Trust Account. If the Company fails to deposit additional assets into the Trust Account to equal the balance of the Funds Held Account, then paid Ultimate Net Loss due from the Reinsurers will be reduced by the amount of such under-funding.

11.

The Company shall be solely responsible for all expenses related to the Trust Account, including trustee’s fees.

A “Triggering Event” is any one of the following:

1. a downgrade of the A.M. Best’s rating of any reinsured company below “A-”, or the rating is withdrawn;

2. a reduction of more than twenty five percent (25%) of the Company’s statutory surplus from the Company’s statutory surplus level at the calendar quarter end preceding the Effective Date of the Agreement;

3. the Company has: a) become insolvent, b) been placed under supervision (voluntarily or involuntarily), c) been placed into liquidation or receivership, or d) had instituted against it proceedings for the appointment of a supervisor, receiver, liquidator, rehabilitator, conservator or trustee in bankruptcy, or other agent known by whatever name, to take possession of its assets or control of its operations.

D. The parties shall execute, within sixty (60) days of request by either party, a mutually acceptable trust agreement in respect of the Segregated Account and, if applicable, upon transfer of funds, a trust agreement in respect of the Trust Account.

E. In the event of a cash transfer of the Funds Held Account or Segregated Account to the Reinsurers due to a Triggering Event by the Company, as defined in section C. of this Article, the Reinsurers shall provide a letter of credit or trust account, in a manner and form described below, for the benefit of the Company, equal to the cumulative balance of the sum of (i) ninety four percent (94%) of Reinsurance Premium received less (ii) one hundred percent (100%) Ceding Commission paid less (iii) one hundred percent (100%) Ultimate Net Loss (including Allocated Loss Adjustment Expenses) paid (the “cumulative balance”). Such letter of credit or trust fund shall be increased or decreased, as applicable, on a quarterly basis until the final expiration of liability under this Agreement.

The Reinsurers shall provide either (i) a clean, irrevocable, and unconditional evergreen letter(s) of credit issued by a qualified United States financial institution as defined under the Insurance Law of the Company’s domiciliary state and acceptable to the Company or (ii) in respect of an admitted Reinsurer, a trust account mutually acceptable to the Company and the Reinsurer; or in respect of a non-admitted Reinsurer, a New York Regulation 114 Credit for Reinsurance compliant trust account. For purposes herein, an “admitted Reinsurer” shall mean any Reinsurer which under applicable law qualifies for the Company to receive full credit with the insurance regulatory authority having jurisdiction over the Company’s reserves. In the event of a trust account, the Company and the Reinsurer agree (i) to execute a mutually acceptable trust agreement and (ii) that the Reinsurer shall manage the assets in the trust account in consultation with the Company.

The Company may drawdown on the letter of credit or the trust account to reimburse the Company for amounts due from the Reinsurer that have not been disputed by the Reinsurer and have not been paid by the Reinsurer within sixty (60) days of a non-disputed claim being submitted by the Company to the Reinsurer, and the Reinsurer is the subject of an insolvency, liquidation, or conservation proceeding, or has ceased underwriting operations or has lost more than fifty percent (50%) of its policyholders’ surplus or has made a general assignment of its assets for the benefit of creditors.

12.

Any interest earned on the balance of the trust account shall be paid to the Reinsurer.

ARTICLE 13

ACCOUNTS, REMITTANCES AND ULTIMATE NET LOSS SETTLEMENTS

A. Within forty five (45) days following the end of each quarter, the Company shall report to the Reinsurers the amount of the following with regards to such quarter and on a cumulative basis:

| 1. | Gross Written Premium, Net Written Premium and ceded Net Written Premium by line of business; |

| 2. | Gross Earned Premium, Net Earned Premium and ceded Net Earned Premium by line of business; |

| 3. | Ceding Commission paid and unpaid; |

| 4. | Ultimate Net Loss and Ceded Ultimate Net Loss paid by line of business; |

| 5. | Ultimate Net Loss and Ceded Ultimate Net Loss outstanding, including incurred but not reported amounts, by line of business; |

| 6. | Ultimate Net Loss and Ceded Ultimate Net Loss in respect of the Terrorism Occurrence Limit, PCS Catastrophe Occurrence Limit, Allocated Loss Adjustment Expense Limit and Extra Contractual Obligations, Loss Excess of Policy Limits and Mass Tort Limits; |

| 7. | Salvage recovered and ceded Salvage recovered by line of business; |

| 8. | Premium amounts calculated in accordance with the Article entitled REINSURANCE PREMIUM AND REINSURERS’ MARGIN; |

| 9. | Ceded Unearned Premium Reserve; |

| 10. | Funds Held Account balance. |

In addition to the above, if the Company experiences any of the Triggering Events under section C. of Article 12, the Company shall immediately notify the Reinsurers in writing.

Reports shall continue until the final settlement of all Ultimate Net Loss hereunder.

B. Ultimate Net Loss settlements by the Reinsurers to the Company shall be made within fifteen (15) days following the Reinsurers’ receipt of the Company’s quarterly report or sixty (60) days in arrears of the respective quarter end, whichever is later.

C. Ultimate Net Loss recoverable hereunder shall be first settled by debit to the Funds Held Account. However, in the event the Funds Held Account becomes depleted through payment of amounts contractually due from the Reinsurers in accordance with this Agreement only and not a positive amount, the Reinsurers shall remit to the Company Ultimate Net Loss recoverable hereunder from other funds of the Reinsurer. However, in no event shall the Reinsurer be liable for amounts exceeding the Reinsurers’ maximum limits of liability as set forth in the Article entitled REINSURANCE COVERAGE, LIMITS AND AGGREGATE LIMIT.

In the event of the diminution of the Funds Held Account for any reason other than in accordance with this Agreement, including insolvency of the Company, or by the Company’s failure to establish and/or maintain the Funds Held Account, the liability of the Reinsurers shall be reduced by an amount equal to such reduction in the Funds Held Account.

13.

D. Notwithstanding the above, the Company shall advise the Reinsurer promptly (but no later than thirty [30]) days from the date the Company determines that a loss may result in a claim hereunder or may materially affect the position of the Reinsurers) of all Ultimate Net Losses, which, in the opinion of the Company, may result in a claim hereunder and of all subsequent developments thereto which, in the opinion of the Company, may materially affect the position of the Reinsurers. Inadvertent omission or oversight in dispatching such advises shall in no way affect the liability of the Reinsurer. However, the Company shall notify the Reinsurers of such omission or oversight promptly upon its discovery.

E. All Ultimate Net Loss settlements made by the Company on Business Covered, whether under Policy terms and conditions or by way of compromise, shall be in the sole discretion of the Company and shall be unconditionally binding on the Reinsurers, subject always to the terms conditions and exclusions of this Agreement. Upon reasonable evidence of the amount due, the Reinsurers shall pay or allow, as applicable, their proportional share of each such settlement in accordance with this Agreement. Reasonable evidence of the amount due shall consist of a certification by the Company, accompanied by proof of loss documentation the Company customarily presents with its claims payment requests, that the amount requested to be paid and submitted by the certification is, upon information and belief, due and payable to the Company by the Reinsurers under the terms and conditions of this Agreement.

F. When so requested in writing, the Company shall afford the Reinsurers or their representatives an opportunity to be associated with the Company, at the expense of the Reinsurers, in the defense of any claim, suit or proceeding involving this Agreement, and the Company and the Reinsurers shall cooperate in every respect in the defense of such claim, suit or proceeding, provided that the Company shall have the right to make any decision in the event of disagreement over any matter of defense or settlement.

ARTICLE 14

SPECIAL TERMINATION

A. The Company may terminate this Agreement upon the happening of any one of the following circumstances at any time by the giving of thirty (30) days prior written notice to the subscribing Reinsurer and may also commute this Agreement in accordance with section C. below:

1. The Reinsurer ceases active underwriting operations or a State Insurance Department or other legal authority orders the Reinsurer to cease writing business in all jurisdictions. Or

2. The Reinsurer has filed a plan to enter into a Scheme of Arrangement or similar procedure. “Scheme of Arrangement” is defined as a legislative or regulatory process that provides a solvent Reinsurer the opportunity to settle its obligations with the Company either (i) without the Company’s unrestrained consent or (ii) prior to the Company having the ability to determine, with exact certainty, the actual amount of the obligations still outstanding and ultimately due to the Company. Or

3. The Reinsurer has: a) become insolvent, b) been placed under supervision (voluntarily or involuntarily), c) been placed into liquidation or receivership, or d) had instituted against it proceedings for the appointment of a supervisor, receiver, liquidator, rehabilitator, conservator or trustee in bankruptcy, or other agent known by whatever name, to take possession of its assets or control of its operations. Or

14.

4. A reduction in the Reinsurer’s surplus, or financial strength rating occurs:

a. As respects Reinsurers domiciled in the United States of America, (i) the Reinsurer’s policyholders’ surplus (“PHS”) has been reduced by, whichever is greater, twenty five percent (25%) of the amount of PHS at the inception of this Agreement or twenty five percent (25%) of the amount of PHS stated in its last filed quarterly or annual statutory statement with its state of domicile; notwithstanding, this provision shall not apply should the Reinsurer’s remaining PHS be greater than one billion dollars ($1,000,000,000); or (ii) the Reinsurer’s A.M. Best’s insurer financial strength rating becomes less than “A-”.

b. As respects Reinsurers domiciled outside the United States of America, other than Lloyd’s Syndicates (i) the Reinsurer’s Capital & Surplus (“C&S”) has been reduced by, whichever is greater, twenty five percent (25%) of the published currency amount of C&S at the inception of this Agreement or twenty five percent (25%) of the published currency amount of C&S stated in its last filed financial statement with its local regulatory authority; or (ii) as respects Lloyd’s Syndicates, the Syndicate’s total stamp capacity has been reduced by more than twenty five percent (25%) of the amount of total stamp capacity which stood at the inception of this Agreement. (This provision does not apply to any Lloyd’s Syndicate that voluntarily reduces its total stamp capacity.) or (iii) the Reinsurer’s A.M. Best’s insurer financial strength rating becomes less than “A-” or the Reinsurer’s Standard & Poor’s Insurance Rating becomes less than “A”. Or

5. The Reinsurer has entered into a definitive agreement to (a) become merged with, acquired or controlled by any company, corporation or individual(s) not controlling or affiliated with the party’s operations previously; or (b) directly or indirectly assign all or essentially all of its entire liability for Obligations under this Agreement to another party, other than with affiliated companies with substantially the same or greater net worth, without the Company’s prior written consent. Or

6. There is a severance or obstruction of free and unfettered communication and/or normal commercial or financial intercourse between the United States of America and the country in which the Reinsurer is incorporated or has its principal office as a result of war, currency regulations or any circumstances arising out of political, financial or economic uncertainty.

In the event that notice of termination is given by reason of an event described in A4 above (the “Termination Notice”) and prior to the effective date of the termination (the “Termination Date”), the Chief Financial Officer of the Reinsurer represents and certifies in writing to the Company that (i) the deterioration of the Reinsurer’s financial condition is the direct and sole result of a recent major property catastrophe(s) or the result of an Act(s) of Terrorism (either the “Event”) and (ii) that it is actively seeking and has a high probability of successfully obtaining additional capital to substantially replace the capital loss because of the Event (the “Extension Notice”), the Termination Date shall be extended an additional thirty (30) days from the Termination Date (the “Extended Termination Date”). If prior to the Extended Termination Date, the Chief Financial Officer of the Reinsurer represents and certifies in writing to the Company that (a) it has raised sufficient capital so as to return its PHS or C&S to within ten percent (10%) of the Reinsurer’s PHS or C&S last filed with its domiciliary regulatory authorities prior to the Event, (b) obtained reinstatement of its AM Best rating of “A-” or higher and (c) as respects Reinsurers domiciled in the United States of America, raised its adjusted capital to at least two hundred fifty percent (250%) of its authorized control level risk-based capital, the Termination Notice shall be null and void. Otherwise, this Agreement shall terminate on the Extended Termination Date in the manner described in the Termination Notice.

15.

B. In the event the Company elects to terminate this Agreement, the Company shall, with the notice of termination, specify that termination will be on a cut-off basis, in which event the Company shall relieve the Reinsurer for losses occurring subsequent to the specified termination date, and the Reinsurer shall return to the Company the Reinsurer’s portion of the unearned premium reserve for all in force Policies less previously paid Ceding Commission on such unearned premium reserve.

C. The Company may elect to commute this Agreement, in accordance with sections B. C. and D. of the Article entitled COMMUTATION, if the Reinsurer has suffered one of the circumstances listed in section A. above and if the present value commutation payment, as calculated in accordance with subsection 1 of section B of the Article entitled COMMUTATION, is less than or equal to the sum of (i) ninety four percent (94%) of Reinsurance Premium received less (ii) one hundred percent (100%) Ceding Commission paid on such Reinsurance Premium less (iii) one hundred percent (100%) ceded paid Ultimate Net Loss. Otherwise, the Company may only commute under this Special Termination Article with mutual agreement of the Reinsurer.

D. The Reinsurers may terminate this Agreement upon the happening of any one of the following circumstances at any time by the giving of thirty (30) days prior written notice to the Company:

1. The Company ceases active underwriting operations or a State Insurance Department or other legal authority orders the Company to cease writing business in all jurisdictions. Or

2. The Company has: a) become insolvent, b) been placed under supervision (voluntarily or involuntarily), c) been placed into liquidation or receivership, or d) had instituted against it proceedings for the appointment of a supervisor, receiver, liquidator, rehabilitator, conservator or trustee in bankruptcy, or other agent known by whatever name, to take possession of its assets or control of its operations. Or

3. The financial strength rating of any reinsured company hereunder becomes less than “A-” or is no longer rated by A.M. Best. Or

4. The Company’s statutory policyholders’ surplus (“PHS”) has been reduced by, whichever is greater, twenty-five percent (25%) of the amount of statutory PHS at the Effective Date of this Agreement or twenty-five percent (25%) of the amount of statutory PHS stated in its last filed quarterly or annual statutory statement with its state of domicile; however, this event shall not trigger termination if the reduction in statutory PHS is due to a capital management reorganization of the Company. Or

5. The Company fails to pay Initial Reinsurers’ Margin or Interest Credit Payment to the Reinsurers within thirty (30) days of the Reinsurers’ written request to pay such Initial Reinsurers’ Margin or Interest Credit Payment that is past due hereunder.

In the event the Reinsurers elect to terminate, the Reinsurers shall, with the notice of termination, terminate this Agreement on a run-off basis. The Reinsurers shall be liable for all losses occurring in respect of all in force Policies until the earlier of the expiration or the anniversary date of the Company’s Policies, but not to exceed twelve (12) months plus odd time. In the event that any Policy is required by statute or regulation or order to be continued in force, the Reinsurers will continue to remain liable with respect to each such Policy until the Company may legally cancel, non-renew or otherwise eliminate liability under such Policy but not to exceed (12) months plus odd time.

16.

ARTICLE 15

COMMUTATION

A. This Agreement shall be commuted at one hundred twenty (120) months from the expiration or termination of this Agreement, or earlier as mutually agreed by the Company and the Reinsurers (the “Commutation Date”).

B. Upon the Commutation Date,

1. the Reinsurers shall pay to the Company the present value of ceded Ultimate Net Loss outstanding and Incurred But Not Reported Ultimate Net Loss and any Ceding Commission adjustment along with special interest, calculated in accordance with the Article entitled CEDING COMMISSION as of the Commutation Date, utilizing an annual effective interest rate of three percent (3%);

2. the Company shall pay to the Reinsurers one hundred percent (100%) of the balance of the Funds Held Account, which may be held in either a Segregated Account or Trust Account, as applicable, at the Commutation Date. If funds are held in a Segregated Account, any amount remaining in the Segregated Account, after payment of the Funds Held Account balance to the Reinsurers at the Commutation Date, shall be retained by the Company; if funds are held in a Trust Account, any amount remaining in the Trust Account, after payment of the Funds Held Account balance to the Reinsurers at the Commutation Date, shall be returned to the Company.

C. If the Reinsurers and the Company are not able to agree on such present value determination, such calculation shall be performed by an independent actuarial firm as mutually agreed by the Company and the Reinsurers. If the parties cannot mutually agree on an independent actuarial firm, each party shall nominate one firm and the decision shall be made by drawing lots. The cost of such actuarial firm will be split evenly between the Company and the Reinsurers.

D. Upon Commutation, the Company and the Reinsurers shall receive a full and final release of all current and future liability under this Agreement.

ARTICLE 16

CURRENCY

A. Whenever the word “dollars” or the “$” appears in this Agreement, they shall be construed to mean United States Dollars and all transactions under this Agreement shall be in United States Dollars.

B. Amounts paid or received by the Company in any other currency shall be converted to United States Dollars at the rate of exchange at the date such transaction is entered on the books of the Company.

ARTICLE 17

FEDERAL EXCISE TAX AND OTHER TAXES

A. To the extent that any portion of the Reinsurance Premium for this Agreement is subject to the Federal Excise Tax (as imposed under Section 4371 of the Internal Revenue Code) and a subscribing Reinsurer is not exempt therefrom, such Reinsurer shall allow for the purpose of paying the Federal Excise Tax, a deduction by the Company of the applicable percentage of the Reinsurance Premium payable hereon. In the event of any return of Reinsurance Premium

17.

becoming due hereunder, the Reinsurer shall deduct the same applicable percentage from the return Reinsurance Premium payable hereon and the Company or its agent should take steps to recover the tax from the United States Government. In the event of any uncertainty, upon the written request of the Company, the Reinsurer will immediately file a certificate signed by a senior corporate officer of the Reinsurer certifying to its entitlement to the exemption from the Federal Excise Tax with respect to one or more transactions.

B. In consideration of the terms under which this Agreement is issued, the Company undertakes not to claim any deduction of the Reinsurance Premium hereon when making Canadian tax returns or when making tax returns other than Income or Profits Tax returns, to any State or Territory of the United States of America or to the District of Columbia.

ARTICLE 18

RESERVES

(This Article shall apply to any Reinsurer who does not qualify for full credit with any insurance regulatory authority having jurisdiction over the Company’s reserves).

A. If, at any time during the period of this Agreement and thereafter the reinsurance provided by a Reinsurer participating in this Agreement does not qualify for full statutory accounting credit for reinsurance by regulatory authorities having jurisdiction over the Company (whether by reason of lack of license, accreditation or otherwise) such that a financial penalty to the Company would result on any statutory statement or report the Company is required to make or file with insurance regulatory authorities (or a court of law in the event of insolvency), the Reinsurer shall secure the Reinsurer’s share of Obligations for which such full statutory credit is not granted by those authorities in a manner, form, and amount described in B.2. below acceptable to all applicable insurance regulatory authorities in accordance with this Article.

B. The Reinsurer shall secure such obligations, within thirty (30) days after the receipt of the Company’s written request regarding the Reinsurer’s share of obligations under this Agreement (but not later than December 31) of each year by either:

1. Clean, irrevocable, and unconditional evergreen letter(s) of credit issued and confirmed, if confirmation is required by the applicable insurance regulatory authorities, by a qualified United States financial institution as defined under the Insurance Law of the Company’s domiciliary state and acceptable to the Company and to insurance regulatory authorities;

2. A trust account meeting at least the standards of New York’s Insurance Regulation 114 and the Insurance Law of the Company’s domiciliary state; or

3. Cash advances or funds withheld or a combination of both, which will be under the exclusive control of the Company (“Funds Deposit”).

C. The “Obligations” referred to herein means, subject to the preceding paragraphs, the then current (as of the end of each calendar quarter) sum of any:

1. amount of the ceded unearned premium reserve for which the Reinsurer is responsible to the Company;

2. amount of Ultimate Net Loss and other amounts paid by the Company for which the Reinsurer is responsible to the Company but has not yet paid;

3. amount of ceded reserves (including incurred but not reported) for Ultimate Net Loss for which the Reinsurer is responsible to the Company;

4. amount of return and refund premiums paid by the Company for which the Reinsurer is responsible to the Company but has not yet paid.

18.

D. The Company, or its successors in interest, may draw, at any time and from time to time, upon the:

1. Established letter of credit (or subsequent cash deposit);

2. Established trust account (or subsequent cash deposit); or

3. Funds Deposit;

without diminution or restriction because of the insolvency of either the Company or the Reinsurer for one or more of the following purposes set forth below.

E. Draws shall be made only for the following purposes:

1. To make payment to and reimburse the Company for the Reinsurer’s share of Ultimate Net Loss and other amounts paid by the Company under its Policies and for which the Reinsurer is responsible under this Agreement that is due to the Company but unpaid by the Reinsurer including but not limited to the Reinsurer’s share of premium refunds and returns; and

2. To obtain a cash advance of the entire amount of the remaining balance under any letter of credit in the event that the Company:

a) has received notice of non-renewal or expiration of the letter of credit or trust account;

b) has not received assurances satisfactory to the Company of any required increase in the amount of the letter of credit or trust account, or its replacement or other continuation of the letter of credit or trust account at least thirty (30) days before its stated expiration date;

c) has been made aware that others may attempt to attach or otherwise place in jeopardy the security represented by the letter of credit or trust account; or

d) has concluded that the trustee or issuing (or confirming) bank’s financial condition is such that the value of the security represented by the letter of credit or trust account may be in jeopardy;

e) and under any of those circumstances where the Reinsurer’s entire Obligations, or part thereof, under this Agreement remain un-liquidated and un-discharged at least thirty (30) days prior to the stated expiration date or at the time the Company learns of the possible jeopardy to the security represented by the letter of credit or trust account.

F. If the Company draws on the letter of credit or trust account to obtain a cash advance, the Company will hold the amount of the cash advance so obtained in the name of the Company in any qualified United States financial institution as defined under the Insurance Law of the Company’s domiciliary state in trust solely to secure the Obligations referred to above and for the use and purposes enumerated above and to return any balance thereof to the Reinsurer:

1. Upon the complete and final liquidation and discharge of all of the Reinsurer’s Obligations to the Company under this Agreement; or

2. In the event the Reinsurer subsequently provides alternate or replacement security consistent with the terms hereof and acceptable to the Company.

19.

G. The Company will prepare and forward at annual intervals or more frequently as determined by the Company, but not more frequently than quarterly to the Reinsurer a statement for the purposes of this Article, showing the Reinsurer’s share of Obligations as set forth above. If the Reinsurer’s share thereof exceeds the then existing balance of the security provided, the Reinsurer will, within fifteen (15) days of receipt of the Company’s statement, but never later than December 31 of any year, increase the amount of the letter of credit, (or subsequent cash deposit), trust account or Funds Deposit to the required amount of the Reinsurer’s share of Obligations set forth in the Company’s statement, but never later than December 31 of any year. If the Reinsurer’s share thereof is less than the then existing balance of the security provided, the Company will release the excess thereof to the Reinsurer upon the Reinsurer’s written request. The Reinsurer will not attempt to prevent the Company from holding the cash advance or Funds Deposit so long as the Company is acting in accordance with this Article. The Company shall pay interest earned on the deposited amounts to the Reinsurer as the parties shall have agreed.

H. Any assets deposited to a trust account will be valued according to their current fair market value and will consist only of cash (U.S. legal tender), certificates of deposit issued by a qualified United States financial institution as defined under the Insurance Law of the Company’s domiciliary state and payable in cash, and investments of the types no less conservative than those specified in Section 1404 (a)(1)(2)(3)(8) and (10) of the New York Insurance Law and which are admitted assets under the Insurance Law of the Company’s domiciliary state. Investments issued by the parent, subsidiary, or affiliate of either the Company or the Reinsurer will not be eligible investments. All assets so deposited will be accompanied by all necessary assignments, endorsements in blank, or transfer of legal title to the trustee in order that the Company may negotiate any such assets without the requirement of consent or signature from the Reinsurer or any other entity.

I. All settlements of account between the Company and the Reinsurer will be made in cash or its equivalent. All income earned and received by the amount held in an established trust account will be added to the principal.

J. The Company’s “successors in interest” will include those by operation of law, including without limitation, any liquidator, rehabilitator, receiver, or conservator.

K. The Reinsurer will take any other reasonable steps that may be required for the Company to take full credit on its statutory financial statements for the reinsurance provided by this Agreement.

L. The Company shall reimburse the Reinsurer for all actual annual costs arising out of the requirement to provide such collateral as outlined above. The annual security costs will not be deducted from the Funds Held Account.

ARTICLE 19

EXTRA CONTRACTUAL OBLIGATIONS/LOSS EXCESS OF POLICY LIMITS

A. “Extra-Contractual Obligations” means those liabilities not covered under any other provision of this Agreement, other than Loss Excess of Policy Limits, including but not limited to compensatory, consequential, punitive, or exemplary damages together with any legal costs and expenses incurred in connection therewith, paid as damages or in settlement by the Company arising from an allegation or claim of its insured, its insured’s assignee, or other third party, which alleges negligence, gross negligence, bad faith or other tortious conduct on the part of the Company in the handling, adjustment, rejection, defense or settlement of a claim under a Policy that is Business Covered hereunder.

20.

“Loss Excess of Policy Limits” means any amount of loss, together with any legal costs and expenses incurred in connection therewith, paid as damages or in settlement by the Company in excess of its Policy Limits, but otherwise within the coverage terms of the Policy, arising from an allegation or claim of its insured, its insured’s assignee, or other third party, which alleges negligence, gross negligence, bad faith or other tortious conduct on the part of the Company in the handling of a claim under a Policy or bond that is Business Covered hereunder, in rejecting a settlement within the Policy Limits, in discharging a duty to defend or prepare the defense in the trial of an action against its insured, or in discharging its duty to prepare or prosecute an appeal consequent upon such an action. For the avoidance of doubt, the decision by the Company to settle a claim for an amount within the coverage of the Policy but not within the Policy Limit when the Company has reasonable basis to believe that it may have liability to its insured or assignee or other third party on the claim will be deemed a Loss Excess of Policy Limits. A reasonable basis shall mean the opinion of counsel assigned to defend the insured or otherwise retained by the Company that a verdict excess of the Policy Limits would more likely than not result if the case should go to trial. If time allows, the Company will endeavor to provide Reinsurers an explanation relating to the Company’s motivation for settlement and obtain the Reinsurers’ prior counsel and concurrence in the Company’s action.

B. An Extra-Contractual Obligation or a Loss Excess of Policy Limits shall be deemed to have occurred on the same date as the loss covered under the Company’s original Policy and shall be considered part of the original loss (subject to other terms of this Agreement.)

C. Neither an Extra-Contractual Obligation nor a Loss Excess of Policy Limits shall include a loss incurred by the Company as the result of any fraudulent or criminal act directed against the Company by any officer or director of the Company acting individually or collectively or in collusion with any other organization or party involved in the presentation, defense, or settlement of any claim under this Agreement.

D. The Company shall be indemnified in accordance with this Article to the extent permitted by applicable law.

ARTICLE 20

OFFSET

The Company and the Reinsurers shall have the right to offset any balance or amounts due from one party to the other under the terms of this Agreement. The party asserting the right of offset may exercise such right any time whether the balances due are on account of Reinsurance Premiums, Ceding Commission, return Ceding Commission, Ultimate Net Loss, or any other balances due or owed between the Company and the Reinsurers and immediately inform the Intermediary. In the event of insolvency of either party to this Agreement, then offsets shall be as permitted by applicable law and must not be contrary to Sections 1308 and 7427 of the New York Insurance Law.

ARTICLE 21

ERRORS AND OMISSIONS

Inadvertent delays, errors or omissions made by either party in connection with this Agreement (including the reporting of claims) shall not relieve the other party from any liability which would have attached had such error or omission not occurred, provided always that such error or omission shall be rectified as soon as possible, that the liability of the Reinsurers shall

21.

not extend beyond the coverage provided by this Agreement nor extend coverage to Policies that are not Business Covered hereunder. This Article shall not apply to a sunset provision, if any, in this Agreement, nor to a commutation made in connection with this Agreement.

ARTICLE 22

ACCESS TO RECORDS

A. The Company shall place at the disposal of the Reinsurers at all reasonable times, and the Reinsurers shall have the right to inspect (and make reasonable copies at the Reinsurers’ expense), with prior written notice to the Company of not less than five (5) business days, through their designated representatives, during the Term of this Agreement and thereafter, all non-privileged books, records and papers of the Company directly related to any reinsurance hereunder, or the subject matter hereof, provided that if a Reinsurer has ceased active market operations, this right of access shall be subject to that Reinsurer being current in all payments owed the Company that are not currently the subject of a dispute. For the purposes of this Article, “non-privileged” refers to books, records and papers that are not subject to the Attorney-client privilege and Attorney-work product doctrine. The term “dispute” shall be as defined consistent with the NAIC Annual Statement Instructions.

B. “Attorney-client privilege” and “Attorney-work product” shall have the meanings ascribed to each by statute and/or the court of final adjudication in the jurisdiction whose laws govern the substantive law of a claim arising under a Policy reinsured under this Agreement.

C. Notwithstanding anything to the contrary in this Agreement, for any claim or loss under a Policy reinsured under this Agreement, should the Reinsurer assert, pursuant to the Common Interest Doctrine (“Doctrine”), that it has the right to examine any document that the Company alleges is subject to the Attorney-client privilege or Attorney-work product privilege, upon the Reinsurer providing to the Company substantiation of any law which reasonably supports the basis for the Reinsurer’s conclusion that the Doctrine applies and the Doctrine will be upheld as applying between the Company and the Reinsurer as against third parties pursuant to the substantive law(s) which govern the claim or loss, the Company shall give the Reinsurer access to such document.

D. Notwithstanding the foregoing, the Company shall permit and not object to the Reinsurer’s access to privileged documents in connection with the underlying claim reinsured hereunder following final settlement or final adjudication of the case or cases involving such claim; provided that the Company may defer release of such privileged documents if there are subrogation, contribution, or other third party actions with respect to that claim or case, which might jeopardize the Company’s defense by release of such privileged documents. In the event the Company shall seek to defer such release of such privileged documents, it will, in consultation with the Reinsurer, take other steps as reasonably necessary to provide the Reinsurer with the information it reasonably requires to evaluate exposure, establish reserves or indemnify the Company without causing a loss of such privileges. The Reinsurer, however, shall not have access to privileged documents relating to any dispute between the Company and the Reinsurer. Furthermore, in the event the Reinsurer demonstrates a need for information contained in the privileged documents prior to the resolution of the underlying claim, the Company agrees it will endeavor to undertake steps as reasonably necessary to provide the Reinsurer with the information it reasonably requires to indemnify the Company without causing a loss of such privilege.

22.

ARTICLE 23

INSOLVENCY

(This Article shall be deemed to read as required to meet the statutory insolvency clause requirements of the Company.)

A. In the event of insolvency or the appointment of a conservator, liquidator, or statutory successor of the Company, the portion of any risk or obligation assumed by the Reinsurers shall be payable to the conservator, liquidator, or statutory successor on the basis of claims allowed against the insolvent Company by any court of competent jurisdiction or by any conservator, liquidator, or statutory successor of the Company having authority to allow such claims, without diminution because of that insolvency, or because the conservator, liquidator, or statutory successor has failed to pay all or a portion of any claims.

B. Payments by the Reinsurers as above set forth shall be made directly to the Company or to its conservator, liquidator, or statutory successor, except where this Agreement of reinsurance specifically provides another payee of such reinsurance or except as provided by applicable law and regulation (such as subsection (a) of section 4118 of the New York Insurance laws) in the event of the insolvency of the Company.

C. In the event of the insolvency of the Company, the liquidator, receiver, conservator or statutory successor of the Company shall give written notice to the Reinsurers of the pendency of a claim against the insolvent Company on the Policy or Policies reinsured within a reasonable time after such claim is filed in the insolvency proceeding and during the pendency of such claim any Reinsurers may investigate such claim and interpose, at their own expense, in the proceeding where such claim is to be adjudicated any defense or defenses which it may deem available to the Company or its liquidator, receiver, conservator or statutory successor. The expense thus incurred by the Reinsurers shall be chargeable subject to court approval against the insolvent Company as part of the expense of liquidation to the extent of a proportionate share of the benefit which may accrue to the Company solely as a result of the defense undertaken by the Reinsurers.

D. Where two (2) or more Reinsurers are involved in the same claim and a majority in interest elect to interpose defense to such claim, the expense shall be apportioned in accordance with the terms of this Agreement as though such expense had been incurred by the Company.

ARTICLE 24

CONFIDENTIALITY AND PRIVACY AND PROTECTION OF DATA

A. Confidentiality – The information, data, statements, representations and other materials provided by the Company or the Reinsurers to the other arising from consideration and participation in this Agreement whether contained in the reinsurance submission, this Agreement, or in materials or discussions arising from or related to this Agreement, may contain confidential or proprietary information as expressly indicated by the disclosing party (“Disclosing Party”) in writing from time to time to the other party of the respective parties (“Confidential Information”). This Confidential Information is intended for the sole use of the parties to this Agreement (and their affiliates and any third party services providers providing services related to this Agreement or involved in management or operation of assumed reinsurance business, retrocessionaires, prospective retrocessionaires, intermediaries involved in such placements, respective auditors and legal counsel) as may be necessary in analyzing and/or accepting a participation in and/or executing their respective responsibilities under or related to this Agreement. Disclosing or using Confidential Information relating to this Agreement, without the prior written consent of the Disclosing Party, for any purpose beyond (i) the scope of this

23.