CUMULUS MEDIA INC. NONSTATUTORY STOCK OPTION AGREEMENT

Exhibit 10.9

(Senior Executive Form)

NONSTATUTORY STOCK OPTION AGREEMENT

THIS AGREEMENT is made this ____ day of ________, 2018 (the “Grant Date”),1 between Cumulus Media Inc., a Delaware corporation (the “Company”), and __________ (the “Optionee”).

WHEREAS, the Company desires to grant to the Optionee an option to purchase shares of Class A common stock (the “Shares”) under the Company’s Long-Term Incentive Plan (the “Plan”); and

WHEREAS, the Company and the Optionee understand and agree that any capitalized terms used herein, if not otherwise defined, shall have the same meanings as in the Plan (the Optionee being referred to in the Plan as a “Participant”).

NOW, THEREFORE, in consideration of the following mutual covenants and for other good and valuable consideration, the parties agree as follows:

| 1. | GRANT OF OPTION |

The Company grants to the Optionee the right and option to purchase all or any part of an aggregate of _______ Shares (the “Option”) on the terms and conditions and subject to all the limitations set forth herein and in the Plan, which is incorporated herein by reference. The Optionee acknowledges receipt of a copy of the Plan and acknowledges that the definitive records pertaining to the grant of this Option, and exercises of rights hereunder, shall be retained by the Company. The Option granted herein is intended to be a Nonstatutory Option as defined in the Plan.

| 2. | EXERCISE PRICE |

The purchase price of the Shares subject to the Option shall be $ per Share (the “Exercise Price”). The foregoing notwithstanding, the Optionee acknowledges that the Company cannot and has not guaranteed that the Internal Revenue Service (“IRS”) will agree that the per Share Exercise Price of the Option equals or exceeds the fair market value of a Share on the Grant Date in a later determination. The Optionee agrees that if the IRS determines that the Option was granted with a per Share Exercise Price that was less than the fair market value of a Share on the Grant Date, the Optionee shall be solely responsible for any costs or tax liabilities related to such a determination.

| 1 | To be the Emergence Date. |

| 3. | EXERCISE OF OPTION |

Subject to the Plan and this Agreement, the Option shall vest and be exercisable as follows:

| EXERCISE PERIOD | ||||

| Number of Shares |

Commencement Date |

Expiration Date | ||

| 30% of the total Option Shares | 1st Anniversary of Grant Date | Five Years from Grant Date | ||

| An additional 30% of the total Option Shares | 2nd Anniversary of Grant Date | Five Years from Grant Date | ||

| An additional 20% of the total Option Shares | 3rd Anniversary of Grant Date | Five Years from Grant Date | ||

| Remaining 20% of the Option Shares | 4th Anniversary of Grant Date | Five Years from Grant Date | ||

The Optionee must be employed by the Company at all times from the Grant Date through the applicable annual vesting date set forth above in order to vest in the tranche of Option Shares vesting on such date. Upon a termination of the Optionee’s employment with the Company for any reason or no reason, all vesting of the Option shall cease. The foregoing notwithstanding, if the Optionee’s employment with the Company terminates by virtue of the Optionee’s (i) termination by the Company without Cause; (ii) voluntary resignation for Good Reason; (iii) death; or (iv) Disability (a termination of employment for any of the reasons set forth in the immediately preceding subsections (i) through (iv) to be referred to herein as a “Qualifying Termination”), then fifty percent (50%) of the Option Shares that are otherwise unvested pursuant to the annual vesting schedule set forth above shall become vested as of the date of the Qualifying Termination; provided, however, that if the Qualifying Termination occurs prior to the first anniversary of the Grant Date, then seventy-five percent (75%) of the Option Shares that are otherwise unvested pursuant to the annual vesting schedule set forth above shall become vested as of the date of the Qualifying Termination. Further, following a Qualifying Termination, vested Option Shares shall continue to be exercisable until the fifth (5th) anniversary of the Grant Date.

Notwithstanding the foregoing, if the Optionee’s services are terminated by the Company without Cause or as the result of the Optionee’s voluntary resignation for Good Reason, in either instance at any time within the three (3) month period immediately preceding, or the twelve (12) month period immediately following, a Change in Control, one hundred percent (100%) of the Option Shares that are (or were) otherwise unvested Shares as of the date the Optionee’s employment terminates shall thereafter become vested Shares. For purposes of this Agreement, a “Change in Control” shall be deemed to occur on the earliest of (a) the purchase or other acquisition of outstanding shares of the Company’s capital stock by any entity, person or group of beneficial ownership, as that term is defined in rule 13d-3 under the Securities Exchange Act of 1934 (other than the Company or one of its subsidiaries or employee benefit plans), in one or more transactions, such that the holder, as a result of such acquisition, then owns more than 50% of the outstanding capital stock of the Company entitled to vote for the election of directions (“Voting Stock”); (b) the completion by any

2

entity, person, or group (other than the Company or one of its subsidiaries or employee benefit plans) of a tender offer or an exchange offer for more than 50% of the outstanding Voting Stock of the Company; and (c) the effective time of (1) a merger or consolidation of the Company with one or more corporations as a result of which the holders of the outstanding Voting Stock of the Company immediately prior to such merger or consolidation hold less than 50% of the Voting Stock of the surviving or resulting corporation immediately after such merger or consolidation, or (2) a transfer of all or substantially all of the property or assets of the Company other than to an entity of which the Company owns at least 80% of the Voting Stock, or (3) the approval by the stockholders of the Company of a liquidation or dissolution of the Company.

For purposes of this Agreement, “Good Reason” shall have the meaning ascribed to such term under any employment agreement between the Optionee and the Company and, absent any such definition, Good Reason shall mean the occurrence of any of the following events without the Optionee’s consent: (i) a material diminution in the Optionee’s base salary, other than in connection with an across the board reduction affecting the Company’s senior management team; (ii) a material diminution in the Optionee’s duties, authority or responsibilities; or (iii) a change of greater than fifty (50) miles in the geographic location from which the Optionee primarily performs his or her services on behalf of the Company. The foregoing notwithstanding, no event described above shall constitute Good Reason unless (1) the Optionee gives written notice to the Company specifying the condition or event relied upon for the Good Reason termination within ninety (90) days following the initial existence of such condition or event; (2) the Company fails to cure the event or condition constituting Good Reason within thirty (30) days following receipt of the Optionee’s written notice; and (3) the Optionee actually terminates his or her employment within thirty (30) days of the end of such cure period.

| 4. | ISSUANCE OF STOCK |

The Option may be exercised in whole or in part (to the extent that it is exercisable in accordance with its terms) by giving written notice (or any other approved form of notice) to the Company. Such notice shall be signed by the person exercising the Option, shall state the number of Shares with respect to which the Option is being exercised, shall contain the warranty, if any, required under the Plan and shall specify a date (other than a Saturday, Sunday or legal holiday) not less than five (5) nor more than ten (10) days after the date of such written notice, as the date on which the Shares will be purchased, at the principal office of the Company during ordinary business hours, or at such other hour and place agreed upon by the Company and the person or persons exercising the Option, and shall otherwise comply with the terms and conditions of this Agreement and the Plan. On the date specified in such written notice (which date may be extended by the Company if any law or regulation requires the Company to take any action with respect to the Option Shares prior to the issuance thereof), the Company shall accept payment for the Option Shares.

3

The Exercise Price shall be payable at the time of exercise as determined by the Company in its sole discretion either:

| (a) | in cash, by certified check or bank check, or by wire transfer; |

| (b) | in whole shares of the Company’s Class A common stock (including, without limitation, by the Company delivering to the Optionee a lesser number of Shares having a Fair Market Value on the date of exercise equal to the amount by which the Fair Market Value of the Shares for which the Option is exercised exceeds the Exercise Price of such Shares), provided, however, that, (i) if the Optionee is subject to the reporting requirements of Section 16 of the Securities Exchange Act of 1934, as amended from time to time, and if such shares were granted pursuant to an option, then such option must have been granted at least six (6) months prior to the exercise of the Option hereunder, and (ii) the transfer of such shares as payment hereunder does not result in any adverse accounting consequences to the Company; |

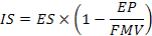

| (c) | in lieu of the Optionee’s being required to pay the Exercise Price in cash or another method specified in (a) or (b) above, by the Company delivering to the Optionee a lesser number of Shares determined as follows (a so-called “net” exercise): |

Where:

IS = the number of Shares to be issued upon such exercise (rounded down to a number of whole shares, with the remaining fractional Share paid in cash)

ES = the number of Shares for which this Option is exercised

EP = the Exercise Price per Share

FMV = the Fair Market Value of one Share, as determined in good faith by the Committee in its sole discretion as of the date of exercise of the Option;

| (d) | through the delivery of cash or the extension of credit by a broker-dealer to whom the Optionee has submitted notice of exercise or otherwise indicated an intent to exercise an Option (a so-called “cashless” exercise); or |

| (e) | in any combination of (a), (b), (c) and/or (d) above. |

The Fair Market Value of any stock to be applied toward the Exercise Price shall be determined as of the date of exercise of the Option.

The Company shall pay all original issue taxes with respect to the issuance of Shares pursuant hereto and all other fees and expenses necessarily incurred by the Company in connection therewith. The holder of this Option shall have the rights of a stockholder only with respect to those Shares covered by the Option that have been registered in the holder’s name in the share register of the Company upon the due exercise of the Option.

4

| 5. | FORFEITURE |

If the Optionee breaches any noncompetition, nonsolicitation, and/or assignment of inventions agreement or obligations with the Company, or breaches in any material respect any nondisclosure agreement (each, a “Protective Agreement”), the Company notifies the Optionee of such breach within one (1) year following the date on which it acquires actual knowledge thereof, and such breach is not cured within the time provided for such cure under such Protective Agreement, if applicable, then, absent a contrary determination by the Board (or its designee) (i) the Optionee shall immediately forfeit to the Company the Option granted hereunder, whether vested or unvested, and (ii) within ten (10) business days after receiving such notice from the Company, any Common Stock received pursuant to the exercise of the Option during the two (2) year period prior to the uncured breach of the Protective Agreement shall be subject to Clawback (as described herein).

If, while employed by or providing services to the Company or any Affiliate, the Optionee engages in activity that constitutes fraud or other intentional misconduct and that activity directly results in any financial restatements, then (i) the Optionee shall immediately forfeit to the Company the Option, whether vested or unvested, and (ii) within ten (10) business days after receiving notice from the Company, any Common Stock received pursuant to the exercise of the Option shall be subject to Clawback. In addition, the Company shall retain the right to bring an action at equity or law to enjoin the Optionee’s activity and recover damages resulting from such activity. Further, to the extent required by Company policy or applicable law (including, without limitation, Section 304 of the Xxxxxxxx-Xxxxx Act and Section 954 of the Xxxx-Xxxxx Xxxx Street Reform and Consumer Protection Act) and/or the rules and regulations of the NYSE or any other securities exchange or inter-dealer quotation service on which the Common Stock is listed or quoted, the Option granted under this Agreement shall also be subject (including on a retroactive basis) to clawback, forfeiture or similar requirements (and such requirements shall be deemed incorporated by reference into this Agreement).

With respect to any shares of Common Stock subject to “Clawback” hereunder, the Optionee shall (A) forfeit and pay to Company any gain realized on the prior sale or transfer of such Common Stock and (B) at the option of the Company, either (x) sell or transfer into the market any shares of such Common Stock then held by the Optionee and forfeit and pay to Company any gain realized thereon, or (y) sell or transfer to the Company any shares of such Common Stock for the lesser of the then-fair market value and the amount paid by the Optionee therefor. The Optionee’s failure to return to the Company any certificate(s) evidencing the shares of Common Stock required to be returned pursuant to this paragraph shall not preclude the Company from canceling any and all such certificate(s) and shares. Similarly, the Optionee’s failure to pay to the Company any cash required to be paid pursuant to this paragraph shall not preclude the Company from taking any and all legal action it deems appropriate to facilitate its recovery.

5

| 6. | NON-ASSIGNABILITY |

This Option shall not be transferable by the Optionee and shall be exercisable only by the Optionee, except as the Plan or this Agreement may otherwise provide.

| 7. | NOTICES |

All notices, requests or other communications provided for in this Agreement shall be made in writing either (a) by personal delivery to the party entitled thereto, (b) by facsimile with confirmation of receipt, (c) by mailing in the United States through the U.S. Postal Service, or (d) by express courier service, addressed as follows:

| To the Company: | Cumulus Media Inc. | |||

|

|

||||

|

|

||||

| Attention: General Counsel |

||||

| To the Optionee: |

|

|||

|

|

||||

|

|

||||

or to such other address or addresses where notice in the same manner has previously been given or to the last known address of the party entitled thereto. The notice, request or other communication shall be deemed to be received upon personal delivery, upon confirmation of receipt of facsimile transmission, or upon receipt by the party entitled thereto if by United States mail or express courier service; provided, however, that if a notice, request or other communication is not received during regular business hours, it shall be deemed to be received on the next succeeding business day of the Company.

| 8. | GOVERNING LAW |

This Agreement shall be construed and enforced in accordance with the laws of the State of Delaware.

6

| 9. | WAIVER OF JURY TRIAL |

Each of the parties hereto hereby irrevocably waives any and all right to trial by jury of any claim or cause of action in any legal proceeding arising out of or related to this Agreement or the transactions or events contemplated hereby or any course of conduct, course of dealing, statements (whether verbal or written) or actions of any party hereto. The parties hereto each agree that any and all such claims and causes of action shall be tried by a court trial without a jury. Each of the parties hereto further waives any right to seek to consolidate any such legal proceeding in which a jury trial has been waived with any other legal proceeding in which a jury trial cannot or has not been waived.

| 10. | BINDING EFFECT |

This Agreement shall (subject to the provisions of Paragraph 6 hereof) be binding upon the heirs, executors, administrators, successors and assigns of the parties hereto.

IN WITNESS WHEREOF, the Company and the Optionee have caused this Agreement to be executed on their behalf, by their duly authorized representatives, all on the day and year first above written.

| CUMULUS MEDIA INC. | OPTIONEE: | |||||

| By: |

| |||||

| Its: | ||||||

7