21VIANET GROUP, INC. 21VIANET DRP INVESTMENT HOLDINGS LIMITED AND MARBLE STONE HOLDINGS LIMITED

DATE: 24 July 2019

21VIANET DRP INVESTMENT HOLDINGS LIMITED

AND

MARBLE STONE HOLDINGS LIMITED

RESTRUCTURING AGREEMENT

TABLE OF CONTENTS

|

1. |

INTERPRETATION |

2 | |

|

|

|

| |

|

2. |

JV COS RESTRUCTURING |

2 | |

|

|

|

| |

|

3. |

JV CO 4 INVESTMENT |

11 | |

|

|

|

| |

|

|

(I) |

INCORPORATION OF JV CO 4 |

11 |

|

|

|

|

|

|

|

(II) |

JV CO 4 MASTER SERVICE ARRANGEMENT |

13 |

|

|

|

|

|

|

|

(III) |

JV CO 4 EXIT |

14 |

|

|

|

| |

|

4. |

REPRESENTATIONS AND WARRANTIES |

16 | |

|

|

|

| |

|

5. |

ADDITIONAL COVENANTS |

17 | |

|

|

|

| |

|

6. |

INDEMNITY |

19 | |

|

|

|

| |

|

7. |

TERMINATION |

19 | |

|

|

|

| |

|

8. |

MISCELLANEOUS |

20 | |

EXHIBITS, APPENDICES AND SCHEDULES

|

Exhibit 1.1 |

Definitions |

|

|

|

|

Exhibit 2.2(a)(ii) |

Form of JV Co 2 Distribution SPA |

|

|

|

|

Exhibit 2.2(a)(vi) |

JV Co 2 Asset Distribution Roadmap |

|

|

|

|

Exhibit 3.7 |

JV Co 4 Related Provisions |

|

|

|

|

Exhibit 3.13(b) |

Appraisal Principles |

|

|

|

|

Exhibit 8.7 |

Address of Notices |

|

|

|

|

Appendix 1.2 |

Form of Capital Call Notice |

|

|

|

|

Appendix 3.3 |

Reserved Matters |

|

|

|

|

Appendix 3.5 |

Investor’s Information and Inspection Rights |

|

|

|

|

Appendix 4.6 |

Form of Deed of Adherence |

|

|

|

|

Schedule A |

List of JV Co 2 Projects |

|

|

|

|

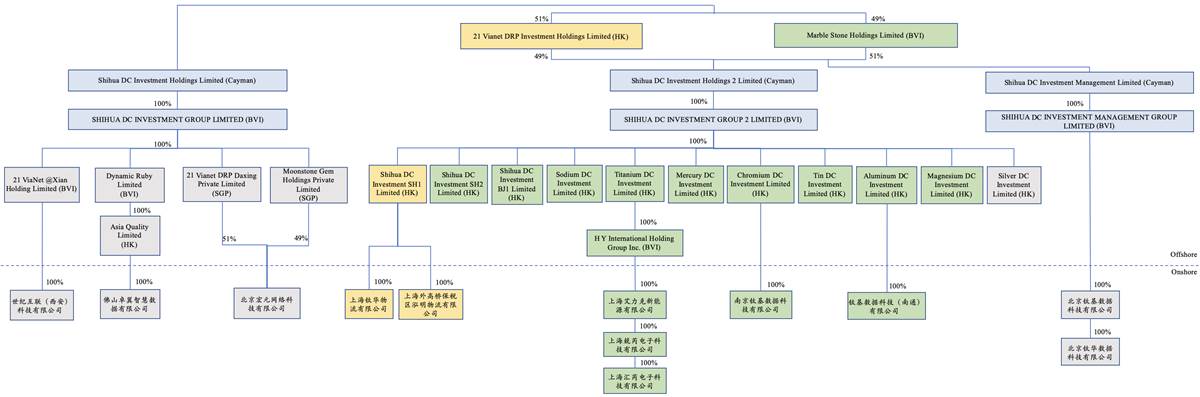

Schedule B |

Existing Structure |

|

|

|

|

Schedule C |

Annual Business Plan and Budget |

THIS RESTRUCTURING AGREEMENT (this “Agreement”) is entered into on 24 July 2019,

BY AND AMONG:-

(1) 21VIANET GROUP, INC. (Company Number: MC-232198), a NASDAQ listed company duly incorporated and validly existing under the laws of the Cayman Islands with its registered office address at the offices of Xxxxxx Corporate Services Limited, XX Xxx 000, Xxxxxx Xxxxx, Xxxxx Xxxxxx, XX0-0000, Cayman Islands (“VNET”);

(2) 21VIANET DRP INVESTMENT HOLDINGS LIMITED (Company Number: 2476123), a private company limited by shares duly incorporated and validly existing under the laws of Hong Kong with its registered office address at the offices of Xxxx/Xxxx 000, 0/X., 00X Xxxxx 0 Xxxx Xxxx Science Park, Pak Xxxx Xxx, Shatin, New Territories, Hong Kong (“Vianet”); and

(3) MARBLE STONE HOLDINGS LIMITED (Company Number: 1923409), a business company duly incorporated and validly existing under the laws of the British Virgin Islands with its registered office address at X.X. Xxx 0000, Xxxx Xxxx, Xxxxxxx, Xxxxxxx Xxxxxx Xxxxxxx (“WP” or the “Investor”).

Vianet and WP are hereinafter collectively referred to as the “Shareholders”, and individually as a “Shareholder”. VNET, Vianet and WP are hereinafter collectively referred to as the “Parties”, and individually as a “Party”.

RECITALS

WHEREAS:-

(A) The Parties hereto have entered into an Investment Agreement on 5 March 2017 (the “Original Investment Agreement”, and “Investment Agreement” shall mean the Original Investment Agreement as amended, restated or supplemented from time to time).

(B) Pursuant to the Original Investment Agreement, the Shareholders have incorporated Shihua DC Investment Holdings Limited (“JV Co 1”), Shihua DC Investment Holdings 2 Limited (“JV Co 2”) and Shihua DC Investment Management Limited (“JV Co 3”); and have consummated (i) the Xi’an Closing, the Foshan Closing and the Daxing Closing (each as defined under the Original Investment Agreement), (ii) the Tranche Closings (as defined under the Original Investment Agreement) corresponding to the Xi’an Closing, the Foshan Closing and the Daxing Closing respectively, and (iii) the subscription of additional shares in JV Co 1 following the Daxing Closing (as provided under Section 4.1(h) of the Original Investment Agreement).

(C) JV Co 2 has consummated the acquisition of Waigaoqiao #1 Project and is in the progress of consummating the acquisition of Fengxian Project and Nanjing Project, and JV Co 2 has entered into investment agreement (or agreement of a similar nature) with local government in respect of Nantong Project and Wuxi Project (details of the above Projects are set out in Schedule A).

(D) As at the date of this Agreement, the structure of the Group Companies is as set forth in Schedule B.

(E) On or about the even date herewith, the Parties executed a First Amended and Restated Investment Agreement to amend and restate the Original Investment Agreement, which First Amended and Restated Investment Agreement shall not become effective unless and until pursuant to Section 2.4 (First Amended and Restated Investment Agreement) hereof.

(F) The Parties intend to restructure JV Co 1, JV Co 2 and JV Co 3 and incorporate JV Co 4 (defined as below) (collectively, the “Transaction”) upon the terms and subject to the conditions of this Agreement.

NOW, THEREFORE, in consideration of the mutual promises, agreements and covenants set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties, intending to be legally bound, hereby agree as follows:-

1. INTERPRETATION

1.1 Definitions. Unless otherwise defined in this Agreement, capitalized terms used in this Agreement shall have the meanings set forth Exhibit 1.1 (Definitions).

1.2 Interpretation. For all purposes of this Agreement, except as otherwise expressly provided, (a) the terms defined herein shall include the plural as well as the singular, (b) all accounting terms not otherwise defined herein have the meanings assigned under US GAAP, (c) all references in this Agreement to designated “Sections” and other subdivisions are to the designated Sections and other subdivisions of the body of this Agreement, (d) pronouns of either gender or neuter shall include, as appropriate, the other pronoun forms, (e) the words “herein,” “hereof” and “hereunder” and other words of similar import refer to this Agreement as a whole and not to any particular Section or other subdivision, (f) all references in this Agreement to designated exhibits, annexes, appendices or schedules are to the exhibits, annexes, appendices or schedules attached to this Agreement unless explicitly stated otherwise, (g) unless the context otherwise requires, “onshore” means in the PRC, and “offshore” means outside the PRC, (h) “include,” “including,” “are inclusive of” and similar expressions are not expressions of limitation and shall be construed as if followed by the words “without limitation”, and (i) if a period of time is specified and dates from a given day or the day of a given act or event, such period shall be calculated exclusive of that day.

1.3 Foreign Exchange Rate. Unless otherwise specified herein, the arithmetic average of the intermediate exchange rates between US Dollars and RMB as promulgated by the People’s Bank of China (or its authorized agency) respectively in the ten (10) Business Days immediately prior to the actual payment date of any payment shall apply with respect to any conversion between US Dollars and RMB.

2. JV COS RESTRUCTURING

2.1 JV Co 1 Restructuring.

(a) Shareholding Structure of JV Co 1. The Parties agree that the shareholding structure of JV Co 1 and its Subsidiaries shall maintain intact after the execution date hereof unless otherwise provided herein or in the Investment Agreement.

(b) Restructuring of JV Co 1. The Parties agree that JV Co 1 shall be restructured as follows (each a “JV Co 1 Restructuring Action”):-

(i) within the nine (9) months period following the execution date hereof, the Shareholders shall procure that (A) the LTV Ratio of JV Co 1 be increased to forty percent (40%) or higher, or (B) even though the LTV Ratio of JV Co 1 fails to reach forty percent (40%) or higher, JV Co 1 achieves another financing plan accepted by both Shareholders;

(ii) Vianet shall (and shall procure its Affiliates to), as soon as possible (but in no event later than one month) after the execution date hereof, pay off in full all the payables due from Vianet (or its Affiliates) to JV Co 1 (or its Subsidiaries), and any outstanding payables due from Vianet (or its Affiliates) to JV Co 1 (or its Subsidiaries) as of each Distribution Cut-off Date (as defined below) shall be deducted from the Available Cash (as defined below) distributable to Vianet;

(iii) on the thirtieth (30th) day following the execution date hereof the Shareholders shall procure JV Co 1 (and its Subsidiaries) to distribute, via entrustment loans (unless the Shareholders otherwise agree on any other manner of distribution), all the Available Cash (as defined below) in JV Co 1 (and its Subsidiaries) as of 30 June 2019 (the “First Distribution Cut-off Date”) to the Shareholders (or their respective designated Affiliates) on a pro rata basis based on their then respective Shareholding Percentages in JV Co 1;

(iv) within fifteen (15) Business Days after every 31 December during the term of JV Co 1 (each an “Annual Distribution Cut-off Date”), the Shareholders shall procure JV Co 1 (and its Subsidiaries) to distribute, via entrustment loans (unless the Shareholders otherwise agree on any other manner of distribution), all the Available Cash (as defined below) in JV Co 1 (and its Subsidiaries) as of the relevant Annual Distribution Cut-off Date to the Shareholders (or their respective designated Affiliates) on a pro rata basis based on their then respective Shareholding Percentages in JV Co 1; and

(v) the entrustment loans via which the Available Cash in JV Co 1 (and its Subsidiaries) is distributed to the Shareholders (or their respective designated Affiliates) shall bear interest at a rate equal to the PBOC benchmark lending rate for one (1)-year term loan, and the initial term of each entrustment loan shall be one (1) year, automatically renewed for another one (1) year upon expiry of each one (1)-year term. The Shareholders agree that upon either Shareholder’s full exit from its investment in JV Co 1 (including without limitation to WP’s exit upon its exercise of the exit rights pursuant to Section 13 (Exit) of the Investment Agreement), the entrustment loans having been distributed to such exiting Shareholder shall be repaid in full, which repayment shall be completed via set off mechanisms permitted under Applicable Law to minimize actual cash flow.

If item (i) of the JV Co 1 Restructuring Action provided above fails to be completed by the expiry of nine (9) months following the execution date hereof (such expiry date, the “Ad hoc Distribution Cut-off Date”, together with the First Distribution Cut-off Date and the Annual Distribution Cut-off Dates, each a “Distribution Cut-

off Date”), then, at the request of WP, the Shareholders shall procure JV Co 1 (and its Subsidiaries) to immediately distribute (and in no event later than fifteen (15) Business Days after the Ad hoc Distribution Cut-off Date), via entrustment loans (unless the Shareholders otherwise agree on any other manner of distribution), all the Available Cash (as defined below) in JV Co 1 (and its Subsidiaries) as of the Ad hoc Distribution Cut-off Date to the Shareholders (or their respective designated Affiliates) on a pro rata basis based on their then respective shareholding percentages in JV Co 1.

(c) Determination of Available Cash.

(i) “Available Cash” shall be calculated pursuant to the following formula:-

Available Cash = A — B

Where,

“A” = Cash and Cash Equivalent Investments on the book of JV Co 1 as of the relevant Distribution Cut-off Date + receivables due from Vianet (or its Affiliates) to JV Co 1 (or its Subsidiaries) under the Master Service Agreements (as defined under the Investment Agreement) — payables due from JV Co 1 (or its Subsidiaries) to Vianet (or its Affiliates) under the Sub-contracting Agreements (as defined under the Investment Agreement)); and

“B” = RMB40,000,000 cash buffer.

(ii) The Shareholders shall arrange for the Available Cash of JV Co 1 (and its Subsidiaries) to be determined as follows:-

(A) within five (5) days after the execution date hereof, the Shareholders shall jointly appoint Ernst & Young (the “Restructuring Auditor”) to determine the Available Cash of JV Co 1 as of each Distribution Cut-off Date; and the Restructuring Auditor may be replaced upon mutual written consent of the Shareholders;

(B) the Restructuring Auditor shall submit a report setting out the amount of Available Cash of JV Co 1 (and its Subsidiaries) as of the First Distribution Cut-off Date and the calculation thereof within fifteen (15) days of its appointment and shall submit a report setting out the amount of Available Cash of JV Co 1 (and its Subsidiaries) as of the Ad hoc Distribution Cut-off Date (if applicable) and each Annual Distribution Cut-off Date and the calculation thereof within fifteen (15) days of the relevant Distribution Cut-off Date; and

(C) the Available Cash as determined by the Restructuring Auditor in the foregoing report shall be final and binding on the Parties in the absence of manifest error.

The Shareholders shall (and shall cause JV Co 1 and its Subsidiaries to) provide the Restructuring Auditor with all information reasonably required for the purposes of determining the Available Cash of JV Co 1 (and its Subsidiaries). The cost of such auditor shall be paid and borne by JV Co 1.

(d) Amendment to the Original Investment Agreement. With effect from the date hereof,

(i) the first paragraph of Section 13 (Exit) of the Original Investment Agreement shall be deleted and replaced in its entirety to read as follows:

“If: (a) neither an IPO nor a REIT of JV Cos and/or its assets occurs by the end of four (4) years (or any other time period mutually agreed to by the Shareholders in writing) after the execution date of the Restructuring Agreement then, at any time after expiry of the foregoing four (4) years (or any other time period mutually agreed to by the Shareholders in writing); (b) any Material Breach under this Agreement or other Transaction Documents or any RA Material Breach occurs; or (c) JV Co 4 fails to undertake any new Project for a period of any consecutive twenty-four (24) months following the JV Co 4 Establishment Date, then the Investor shall be entitled to, in its sole discretion, exit from its investments in the Group Companies via one or more of the following exit mechanisms:-”

(ii) the following definitions shall be added to Exhibit 1.1 (Definitions) of the Original Investment Agreement:

“JV Co 4” shall have the meaning as defined under the Restructuring Agreement.

“JV Co 4 Establishment Date” shall have the meaning as defined under the Restructuring Agreement.

“RA Material Breach” shall have the meaning ascribed to the term “Material Breach” under the Restructuring Agreement.

“Restructuring Agreement” shall mean a restructuring agreement entered into by and among the same Parties hereto on 24 July 2019.”

(iii) the Shareholders agree that they will no longer proceed with the Yizhuang Closing (as defined under the Original Investment Agreement), nor the Tranche Closing (as defined under the Original Investment Agreement) corresponding to the Yizhuang Closing.

(e) WP’s Exit Rights with respect to JV Co 1. In the event WP elects to exit from its investment in JV Co 1 by exercising the Dissolution Exit Option pursuant to Section 13.4(b) (Dissolution Exit) of the Original Investment Agreement, then, within thirty (30) Business Days (the “Exit Put/Call Exercise Period”) after the fair market value of JV Co 1 is determined pursuant to the provisions of Section 13.4(b) (Dissolution Exit) of the Original Investment Agreement (assuming the principal of the entrustment loans extended to the Shareholders pursuant to this Agreement and the interest accrued thereon have been repaid in full),

(i) WP is entitled to, by serving a written notice to Vianet (the “WP Put Notice”), require Vianet to purchase all (but not less than all) the shares then held by WP in JV Co 1 (the “WP Put Shares”) at a price equal to the product of such fair market value multiplied by WP’s then Shareholding Percentage in JV Co 1 (the “WP Put Price”) (the “WP Put Option”), and Vianet shall be obligated to purchase all the WP Put Shares at the WP Put Price, which WP Put Price shall be paid by Vianet to an account designated by WP no later than twenty (20) Business Days after delivery of the WP Put Notice; and

(ii) Vianet is entitled to, by serving a written notice to Vianet (the “Vianet Call Notice”), require WP to sell all (but not less than all) the shares then held by WP in JV Co 1 (the “Vianet Call Shares”) at a price equal to the product of such fair market value multiplied by WP’s then Shareholding Percentage in JV Co 1 (the “Vianet Call Price”) (the “Vianet Call Option”), and WP shall be obligated to sell all the Vianet Call Shares at the Vianet Call Price, which Vianet Call Price shall be paid by Vianet to an account designated by WP no later than twenty (20) Business Days after delivery of the Vianet Call Notice.

If (x) neither WP exercises the foregoing WP Put Option nor Vianet exercises the foregoing Vianet Call Option within the Exit Put/Call Exercise Period or (y) each Shareholder has indicated in writing to the other Shareholder that it will not exercise the WP Put Option or the Vianet Call Option (as applicable) (and if the circumstances described in this item (y) occurs, the Exit Put/Call Exercise Period shall be deemed as early terminated upon such occurrence), WP shall be entitled to trigger the asset distribution pursuant to Section 13.4(c) (Asset Distribution) of the Original Investment Agreement immediately upon the expiry or early termination (whichever is earlier) of the Exit Put/Call Exercise Period. For the avoidance of doubt, WP shall not be allowed to trigger the asset distribution under Section 13.4(c) (Asset Distribution) of the Original Investment Agreement during the Exit Put/Call Exercise Period (or the early terminated Exit Put/Call Exercise Period, as applicable).

(f) Amendment to MSA upon WP’s Exit. The Parties acknowledge and agree that upon WP’s exercise of its exit rights with respect to its investment in JV Co 1 pursuant to Section 13 (Exit) of the Investment Agreement (as amended hereby), WP shall use commercially reasonable efforts to procure the Master Service Agreement between the relevant Project Company and Vianet’s relevant Affiliate be amended to allow such Project to satisfy the requirements of VNET’s finance lease accounting treatment, provided that the amendments will not impose any negative economic impact on the relevant Project Company (including any additional Tax burden), nor impair the marketability or value of the Projects upon WP’s (or its Affiliates’) direct or indirect sale thereof via sale of shares, asset sale or a combination of both (comparing to the situation where there is no amendment to satisfy the finance lease treatment).

(g) Cooperation of the Parties. The Parties agree to cooperate with each other to complete the distribution of the Available Cash of JV Co 1 pursuant to the provisions of Section 2.1(b) (Restructuring of JV Co 1), including without limitation that the Shareholders shall duly authorize the payment of the distributed JV Co 1 Available Cash and do all such thing to give effect to such distribution and payment. In the event any Available Cash of JV Co 1 fails to be distributed to any Shareholder in

such amount and at such time as provided under Section 2.1(b) (Restructuring of JV Co 1) above and such failure is neither due to any Force Majeure Event, nor reasons attributable solely to any Government Entity or the relevant entrusted bank, the overdue sum shall bear an interest at the rate of 0.05% per diem accrued from the applicable due date until the date when all the overdue sum and interest accrued thereon is paid in full to the relevant Shareholder, which interest shall be distributed to the Shareholders together with the Available Cash.

2.2 JV Co 2 Restructuring.

(a) Asset Distribution of JV Co 2. The Parties agree that JV Co 2 shall distribute its assets to the Shareholders on a pro rata basis based on their respective then prevailing Shareholding Percentages in JV Co 2, which distribution shall comply with the following:-

(i) Waigaoqiao #1 Project shall be distributed to Vianet, which distribution shall be completed by leaving Vianet’s shareholding in JV Co 2 intact but having all other Projects of JV Co 2 transferred to WP according to the provisions in item (ii) below;

(ii) all other Projects owned by JV Co 2 (i.e., Fengxian Project, Nanjing Project, Nantong Project and Wuxi Project) together with all other Hong Kong incorporated Subsidiaries of JV Co 2 (except for (A) the Subsidiary that indirectly hold Waigaoqiao #1 Project, i.e., Shihua DC Investment SH1 Limited; and (B) Silver DC Investment Limited) (collectively, the “HK SPVs”) shall be distributed to WP, and WP or its designated Affiliate shall enter into a share sale and purchase agreement with JV Co 2 (or the relevant Subsidiary of JV Co 2) in form and substance as set forth in Exhibit 2.2(a)(ii) (Form of JV Co 2 Distribution SPA) in relation to the transfer of each of Fengxian Project, Nanjing Project and Nantong Project to WP (each a “Distribution SPA”), with the transfer of Wuxi Project and the HK SPVs to be completed pursuant to the procedures set forth in Exhibit 2.2(a)(vi) (JV Co 2 Asset Distribution Roadmap);

(iii) if, upon completing the distribution of Projects provided in items (i) and (ii) above, the following inequality is obtained:

![]()

Where,

A = the amount received by WP from the distribution of Projects provided in item (ii) above, which equals the original investment cost paid by JV Co 2 and/or any Subsidiary of JV Co 2 that directly or indirectly owns the Projects (the “Project Cost” of each Project) with respect to the Projects received by WP (the “WP Project Distribution Amount”);

B = the amount received by Vianet from the distribution of Project provided in item (i) above, which equals the Project Cost with

respect to the Project received by Vianet (the “Vianet Project Distribution Amount”);

C = WP’s Shareholding Percentage in JV Co 2 as of the execution date hereof; and

D = Vianet’s Shareholding Percentage in JV Co 2 on the same date

(the Shareholder whose Project distribution amount constitutes a larger portion of the total Project distribution by JV Co 2 than its Shareholding Percentage in JV Co 2 shall be referred to as the “More Favored Shareholder”, whereas the other Shareholder shall be referred to as the “Less Favored Shareholder”),

then, the actions provided in items (1) and (2) below shall be taken in sequence so that the following equation (the “JV Co 2 Distribution Equation”) is obtained:

Where,

E = WP Project Distribution Amount (or the Vianet Project Distribution Amount, as applicable) received by the Less Favored Shareholder;

F = the sum of JV Co 2/3 Net Cash and Cash Compensation (in each case as defined below);

G = WP Project Distribution Amount (or the Vianet Project Distribution Amount, as applicable) received by the More Favored Shareholder;

H = the amount of Cash Compensation (as defined below);

I = the Less Favored Shareholder’s Shareholding Percentage in JV Co 2 as of the time immediately prior to the asset distribution provided under this Section 2.2(a) (Asset Distribution of JV Co 2); and

J = the More Favored Shareholder’s Shareholding Percentage in JV Co 2 as of the same date.

(1) The Net Cash of JV Co 2 and JV Co 3 (on a consolidated basis) (the “JV Co 2/3 Net Cash”) shall be distributed (or deemed as distributed pursuant to Exhibit 2.2(a)(vi) (JV Co 2 Asset Distribution Roadmap)) to the Less Favored Shareholder, and

(2) the More Favored Shareholder shall pay cash in US Dollars to the Less Favored Shareholder (via PropCo 2) (such cash paid by the More Favored Shareholder, the “Cash Compensation”).

The JV Co 2/3 Net Cash and the Cash Compensation shall be paid to the Less Favored Shareholder or its Affiliates (including JV Co 2 and its Subsidiaries) within fifteen (15) Business Days following the earlier of:

(I) completion of the JV 2/3 Audit (as defined under Exhibit 2.2(a)(vi) (JV Co 2 Asset Distribution Roadmap)); and

(II) expiry of one (1) month following the last Completion Date of Formalities under the Distribution SPAs;

(iv) The Shareholders shall arrange for the Net Cash of JV Co 2 and JV Co 3 (on a consolidated basis), the Cash Compensation and the Project Cost with respect to each Project owned directly or indirectly by JV Co 2 be determined as follows:-

(A) the estimated Project Cost with respect to each Project (the “Estimated Project Cost” of such Project) owned directly or indirectly by JV Co 2, the estimated JV Co 2/3 Net Cash (the “Estimated JV Co 2/3 Net Cash”) and the estimated Cash Compensation (the “Estimated Cash Compensation”), in each case as of 30 April 2019 shall be as set forth in Exhibit 2.2(a)(vi) (JV Co 2 Asset Distribution Roadmap);

(B) the Restructuring Auditor shall be appointed to determine (1) the Project Cost of each Project owned directly or indirectly by JV Co 2 as of the Closing Date (as defined under the Distribution SPA regarding such Project) and (2) the JV Co 2/3 Net Cash and the Cash Compensation as of the Audit Reference Date (as defined under Exhibit 2.2(a)(vi) (JV Co 2 Asset Distribution Roadmap)), in each case based on the principles set forth in Exhibit 2.2(a)(vi) (JV Co 2 Asset Distribution Roadmap);

(C) the Restructuring Auditor shall submit an Audit Report (as defined under Exhibit 2.2(a)(vi) (JV Co 2 Asset Distribution Roadmap)) in accordance with the provisions set forth in Exhibit 2.2(a)(vi) (JV Co 2 Asset Distribution Roadmap) ;

(D) the Project Cost, the JV 2/3 Net Cash and the Cash Compensation as determined by the Restructuring Auditor in the Audit Report shall be final and binding on the Parties in the absence of manifest error; and

(E) notwithstanding the foregoing provisions in Section 2.2(a)(iv)(D), the Estimated Project Cost, the Estimated JV Co 2/3 Net Cash and the Estimated Cash Compensation shall be deemed as the final Project Cost, the final JV Co 2/3 Net Cash and the final Cash Compensation respectively until submission of the Audit Report by the Restructuring Auditor; and in the event the final Project Cost of any Project, the final JV Co 2/3 Net Cash and/or the final Cash Compensation as determined in the Audit Report does not equal the Estimated Project Cost of such Project, the Estimated JV Co

2/3 Net Cash and/or the Estimated Cash Compensation (as applicable), the Shareholders shall (and shall procure JV Co 2 and its Subsidiaries to) settle the difference in the manner provided under Exhibit 2.2(a)(vi) (JV Co 2 Asset Distribution Roadmap) such that the JV Co 2 Distribution Equation shall be (or remain) obtained;

(v) the Shareholders shall use Best Efforts to procure: (A) the Closing contemplated under each of the Distribution SPAs be closed within five (5) Business Days following the execution date hereof pursuant to the provisions hereof and thereof, and (B) the Completion Date of Formalities under each of the Distribution SPAs shall occur within fifteen (15) days after the Closing contemplated under such Distribution SPA; and

(vi) the JV Co 2 asset distribution described above in this Section 2.2(a) (Asset Distribution of JV Co 2) shall be implemented pursuant to the steps set forth in Exhibit 2.2(a)(vi) (JV Co 2 Asset Distribution Roadmap).

(b) Cooperation of the Parties. The Parties agree to cooperate with each other to complete the foregoing distribution of JV Co 2 assets pursuant to the provisions of Section 2.2(a) (Asset Distribution of JV Co 2), Exhibit 2.2(a)(vi) (JV Co 2 Asset Distribution Roadmap) and the Distribution SPAs, including without limitation that the Shareholders shall cooperate with each other in the payment of the distributed JV Co 2 assets (including the payments made pursuant to Section 2.2(a)(iii) above). Commencing from the execution date hereof, the Shareholders shall cooperate with each other to prepare for the handover of the assets, management and operation of each Project of JV Co 2 to the Shareholder who receives such Project in the asset distribution, and during the period commencing from the execution date hereof and ending on the completion of transfer of all Projects of JV Co 2, the Shareholder who receives certain Project shall be solely entitled to operate such Project.

(c) JV Co 2/3 Accounts Payable and Receivable. The Shareholders shall procure that all of the receivables and payables of JV Co 2, JV Co 3 and their respective Subsidiaries (including those resulting from Related Party Transactions, and loans between JV Co 2, JV Co 3 (or any of their respective Subsidiaries) and its Related Parties) shall be fully repaid, settled and cleared as soon as practicable pursuant to the arrangements set forth in Exhibit 2.2(a)(vi) (JV Co 2 Asset Distribution Roadmap).

2.3 JV Co 3 Restructuring.

(a) Allocation of Employees.

(i) The Shareholders shall use their respective Best Efforts to terminate employment relationship with all existing employees of JV Co 3 and its Subsidiaries as soon as possible (but in no event later than one (1) month after the execution date hereof) so that JV Co 3 and its Subsidiaries shall no longer have any employee; provided that certain employees (as agreed by both Shareholders) will stay for an additional three (3) months following the expiry of the foregoing one (1) month period (or other time period as

mutually agreed by both Shareholders) to take care of the work in relation to the restructurings contemplated by this Agreement.

(ii) Despite the foregoing employee allocation, WP shall remain entitled to assign a finance representative to JV CO 1 and its Subsidiaries to exercise the rights entitled to the Chief Financial Officer that WP is entitled to appoint under the Investment Agreement, including continuing to enjoy the approval rights over matters of JV Co 1 that WP (or its designated Persons) enjoys as at the date hereof under the OA approval system of JV Co 1; provided that such approval rights shall not be inconsistent with the Reserved Matters as provided under the Investment Agreement and shall reflect WP’s right to appoint the Chief Financial Officer of JV Co 1 and its Subsidiaries.

(iii) The Shareholders shall each bear its own cost and expenses incurred in receiving the JV Co 3 employees. The Parties further agree that any terminated employees of JV Co 3 with severance compensation paid by JV Co 3 shall not be rehired by the Shareholders or their respective Affiliates. The cost and expenses (including without limitation severance compensation paid by JV Co 3) incurred in terminating employees of JV Co 3 (except for Shareholders’ own cost and expenses incurred in receiving the JV Co 3 employees) shall be borne by each Shareholder pursuant to its Shareholding Percentage in JV Co 3.

(b) Liquidation of JV Co 3. The Parties agree that upon completion of employee termination pursuant to Section 2.3(a) (Allocation of Employees) above, the Shareholders shall immediately liquidate and terminate JV Co 3 and its Subsidiaries (but in no event later than three (3) months after such completion) with any remaining assets of JV Co 3 or its Subsidiaries (if any) distributed to the Shareholders on a pro rata basis based on their respective then prevailing Shareholding Percentages in JV Co 3. Any and all Taxes arising from the liquidation provided under this Section 2.3(b) (Liquidation of JV Co 3) shall be borne by the Shareholders pro rata according to their respective Shareholding Percentages in the corresponding JV Co as at the execution date hereof.

2.4 First Amended and Restated Investment Agreement. The Parties agree that immediately upon the Major Project Closing Date (as defined under Exhibit 2.2(a)(vi) (JV Co 2 Asset Distribution Roadmap)), the First Amended and Restated Investment Agreement that the Parties have executed on or about the even date herewith shall take effect.

2.5 Cost of Restructuring. The cost of the restructuring of the JV Cos provided hereunder shall be borne by the Shareholders pro rata according to their respective Shareholding Percentages in the corresponding JV Co as at the execution date hereof, except as otherwise expressly provided in this Agreement or other Transaction Documents.

3. JV CO 4 INVESTMENT

(I) INCORPORATION OF JV CO 4

3.1 Incorporation.

(a) As at the execution date hereof, SHIHUA DC INVESTMENT GROUP 2 LIMITED (“PropCo 2”), a wholly owned Subsidiary of JV Co 2, has established a wholly owned Subsidiary in Hong Kong named Silver DC Investment Limited (company number 2758697, “JV Co 4”) and PropCo 2 holds 1 share of a single class issued by JV Co 4.

(b) As soon as practicable after the execution date hereof, (i) PropCo 2 shall sell and transfer to WP, and WP shall purchase from PropCo 2, 1 share in JV Co 4 at the transfer price of US$1.00; (ii) JV Co 4 shall issue and allot to WP, and WP shall purchase and subscribe from JV Co4, 48 fully-paid shares at an aggregate subscription of US$48.00; and (iii) JV Co 4 shall issue and allot to Vianet, and Vianet shall purchase and subscribe from JV Co4, 51 fully-paid shares at an aggregate subscription of US$51.00 (transactions set forth in items (i) through (iii), collectively, the “JV Co 4 Establishment Transactions”). Upon closing of the JV Co 4 Establishment Transactions (the “JV Co 4 Closing”), the issued shares of JV Co 4 shall be 100 shares of a single class, among which Vianet shall hold 51 shares representing 51% of all the issued share capital of JV Co 4, and WP shall hold 49 shares representing 49% of all the issued share capital of JV Co 4.

(c) On the execution date hereof (the “JV Co 4 Establishment Date”), the Shareholders shall and shall procure the relevant JV Cos Group Companies to execute all such agreements, instruments, resolutions and other documents necessary to effect the JV Co 4 Establishment Transactions.

3.2 Articles. The Shareholders shall take any and all actions to procure that the articles of association of JV Co 4 (the “JV Co 4 Articles”) shall duly reflect the provisions hereof and shall be in such form and substance as mutually agreed upon by the Shareholders.

3.3 Intermediate Companies. Subject to approval of the JV Co 4 Board, one or more tiers of intermediate companies may be added into the JV Co 4 Group to hold, directly or indirectly, the companies incorporated for the Projects of JV Co 4.

3.4 Board of Directors. The Shareholders shall ensure that upon the JV Co 4 Closing, the board of directors of JV Co 4 shall consist of five (5) directors, three (3) of which shall be appointed, removed or replaced (with or without cause) by Vianet and the other two (2) of which shall be appointed, removed or replaced (with or without cause) by the Investor.

3.5 Shareholders’ Actions.

(a) The Shareholders shall procure JV Co 4 to engage a Hong Kong company secretary satisfactory to each Shareholder to complete any and all procedures required for the JV Co 4 Establishment Transactions and shall cause such company secretary to, immediately upon or as soon as practicable after the JV Co 4 Closing, deliver to the Shareholders documents in respect of the their respective shareholding in JV Co 4 (including without limitation, share certificate, copies of register of members and register of directors).

(b) Any and all costs in connection with the JV Co 4 Establishment Transactions (including any stamp duty in relation thereto, the “Incorporation Costs”) shall be advanced by JV Co 3 and borne by the Shareholders on a pro rata basis pursuant to their respective Shareholding Percentages in JV Co 3.

3.6 Cash Sweep. The Shareholders agree that to the extent (i) there is any Available Cash in JV Co 1 (or its Subsidiaries) and (ii) any funds are required by JV Co 4 or its Subsidiaries to engage in any new project as approved by the Shareholders, the Shareholders shall, upon request of the JV Co 4 Board, cause JV Co 1 (or a Subsidiary of JV Co 1) to extend to JV Co 4 (or a Subsidiary of JV Co 4) certain Available cash (excluding requisite reserve to ensure the normal operation and sufficient working capital of JV Co 1 and its Subsidiaries) at an interest rate equal to LIBOR to satisfy the funding need of JV Co 4. For the avoidance of doubt, the JV Co 4 Board may elect to address the funding need of JV Co 4 either via requesting for cash sweep as provided in this Section 3.6 (Cash Sweep) and/or via making Capital Call pursuant to Section 1.2 (Capital Call) of Exhibit 3.7 (JV Co 4 Related Provisions).

3.7 Other JV Co 4 Related Provisions. Except for the provisions set forth in this Section 3 (JV Co 4 Investment), the other provisions in relation to JV Co 4 are set forth in Exhibit 3.7 (JV Co 4 Related Provisions).

(II) JV CO 4 MASTER SERVICE ARRANGEMENT

3.8 Vianet’s ROFO and Group Company’s ROFO.

(a) Vianet’s ROFO Mechanism. With respect to any future Project to be undertaken by JV Co 4, the Shareholders shall cause JV Co 4 to, before the earlier of (i) entering into a definitive binding wholesale lease or master service agreement with a third party in respect of 50% or more of the area or capacity of such future Project and (ii) three (3) months prior to the time when such future Project becomes ready to use, issue a written notice to Vianet requesting Vianet’s decision on whether to lease such future Project. Vianet shall reply in writing to JV Co 4 within two (2) months after receipt of the foregoing written notice issued by JV Co 4. If Vianet decides to lease such future Project, Vianet shall reply in writing within the foregoing two (2)-month period with an express rate of rental (the “Vianet Offered Rental”), and JV Co 4 may elect to lease such future Project to Vianet or to any third party at a rate of rental no less than the Vianet Offered Rental (and if such Group Company elects to lease such future Project to Vianet, Vianet and such Group Company shall enter into a definitive agreement within two (2) months after such election). If Vianet fails to make the foregoing reply to JV Co 4 within the foregoing two (2)-month period or a definitive agreement fails to be entered into within the foregoing subsequent two (2)-month period, JV Co 4 shall be entitled to lease to or otherwise cooperate with any third party in respect of such future Project at any rate of rental as JV Co 4 may deem fit. For the avoidance of doubt, Vianet shall (and shall cause its appointed directors to) exercise its rights as a shareholder (or a director, as applicable) of JV Co 4 towards the best interest of JV Co 4.

(b) Exemptions. The provisions of Section 3.8(a) (Vianet’s ROFO Mechanism) shall not apply to: (i) any future Project to be acquired by any JV Co 4 Group Company already occupied or engaged with leases and tenants; (ii) any future Project under any joint venture or other similar cooperation methods between any JV Co 4 Group Company, on one hand, and one or more third parties, on the other hand; or (iii) any lease of any future Project in respect of less than 50% of the area or capacity of such future Project.

3.9 Master Service Agreement. For each future Project that Vianet leases and receives master services from the relevant JV Co 4 Group Company, Vianet shall (or shall cause its Affiliates

to) enter into a master service agreement with such JV Co 4 Group Company (each a “JV Co 4 Master Service Agreement”) in such form and substance as mutually agreed upon by the Shareholders with reference to the form mutually agreed upon by the Shareholders for the Existing Projects.

3.10 Sub-Contracting Agreement. For each future Project that Vianet leases in the entirety of such Project and receives master services from the relevant JV Co 4 Group Company, Vianet shall have a priority right to be sub-contracted with certain services under the JV Co 4 Master Services Agreement under equal terms and conditions, and if Vianet (of its Affiliates) is selected as a sub-contractor pursuant to the preceding sentence, Vianet shall (or shall cause its Affiliates to) enter into a sub-contracting agreement with such JV Co 4 Group Company in such form and substance as mutually agreed upon by the Shareholders (any amendment thereto or termination thereof without the prior consent of WP or its nominated director shall be deemed as a Material Breach by Vianet). Each such service agreement so executed shall be referred to as a “JV Co 4 Sub-Contracting Agreement”.

(III) JV CO 4 EXIT

The relevant Shareholder shall be entitled to exit rights with respect to its investment in JV Co 4 upon (i) JV Co 4’s failure to undertake any new Project for a period of any consecutive twenty-four (24) months following the JV Co 4 Establishment Date, (ii) expiry of four (4) years after execution date hereof or (iii) Vianet (or WP) commits any Material Breach or IA Material Breach (or Investor Material Breach or IA Investor Material Breach, as applicable) (provided that with respect to the exit event set forth in this item (iii), the breaching Shareholder may not exercise its exit rights relying on such breach), in one or more of the following ways:-

3.11 Exit ROFO.

(a) Sale Notice. Either Shareholder shall be entitled to give a Sale Notice to the Non-Transferring Shareholder pursuant to Section 4.3(a) (Sale Notice) of Exhibit 3.7 (JV Co 4 Related Provisions) and the Non-Transferring Shareholder shall be entitled to the right of first offer pursuant to the provisions of Section 4.3 (Right of First Offer) of Exhibit 3.7 (JV Co 4 Related Provisions).

(b) Negative Decision Notice. If (i) the Non-Transferring Shareholder elects not to exercise its right of first offer pursuant to Section 4.3 (Right of First Offer) of Exhibit 3.7 (JV Co 4 Related Provisions); or (ii) the Non-Transferring Shareholder fails to pay the non-refundable deposit pursuant to the provisions of Section 4.3(b) (Completion Period) of Exhibit 3.7 (JV Co 4 Related Provisions), then, (x) the Transferring Shareholder is at liberty to Transfer its Subject Shares to any third party, at a price no less than the price set forth in the Sale Notice, and (y) (only in the event the Investor is the Transferring Shareholder) the Transferring Shareholder shall be entitled to trigger the Trade Sale pursuant to the provisions of Section 3.12 (Trade Sale). Furthermore, in the event Vianet is the Transferring Shareholder, the Investor shall be entitled to exercise its tag-along right pursuant to the provisions of Section 4.4 (Tag Along Right) of Exhibit 3.7 (JV Co 4 Related Provisions).

3.12 Trade Sale. If and only if the Investor is entitled to trigger this Section 3.12 (Trade Sale) pursuant to Section 3.11(b) (Negative Decision Notice) above, the Investor may appoint an investment bank of international repute or a property broker to procure a sale by JV Co 4 of all or substantially all of their assets and undertakings (whether by way of a share sale, an asset

sale or a combination of both) at a valuation acceptable to WP (a “Trade Sale”); provided that each buyer in such Trade Sale shall be a bona fide third party, and the Shareholders shall extend all necessary cooperation and assistance to facilitate the sale (including providing assistance to the potential purchasers and their advisers in the conduct of any due diligence investigation in respect of the JV Co 4 Group Companies). Upon completion of the trade sale, the Shareholders shall take the necessary steps to distribute the sale proceeds from the sale of JV Co 4 to the Shareholders on a pro rata basis pursuant to their respective then-current Shareholding Percentages in JV Co 4. For the avoidance of doubt, any sale or transfer in connection with the Trade Sale shall not be subject to the Transfer restrictions set forth in Section 4 (Transfer Restrictions) of Exhibit 3.7 (JV Co 4 Related Provisions).

3.13 Dissolution Exit.

(a) Dissolution Notice. If the Investor has not fully exited from its investment in JV Co 4 pursuant to Section 3.11 (Exit ROFO) or 3.12 (Trade Sale) above within three (3) months after the Investor issues a Sale Notice pursuant to Section 3.11(a) (Sale Notice), the Investor may (but is not obligated to), in its sole discretion, elect to exit (the “Dissolution Exit Option”) from its investment in JV Co 4 pursuant to Section 3.13(b) (Dissolution Exit) by serving a written notice to Vianet (the “Dissolution Notice”). For the avoidance of doubt, any sale or transfer in connection with the exercise of the Dissolution Exit Option shall not be subject to the Transfer restrictions set forth in Section 4 (Transfer Restrictions) of Exhibit 3.7 (JV Co 4 Related Provisions).

(b) Dissolution Exit. After serving the Dissolution Notice, the Investor may initiate the break-up of JV Co 4 (the “Dissolution Exit”) and arrange for the fair market value of JV Co 4 to be determined as follows:-

(A) Each of the Shareholders shall appoint an Appraiser within five (5) days after the date of service of the Dissolution Notice to each determine the fair market value of JV Co 4, based on the principles set forth in Exhibit 3.13(b) (Appraisal Principles);

(B) The Appraisers shall submit a valuation report setting out the fair market value within one (1) month of their respective appointment; and

(C) The fair market value of JV Co 4 shall be the arithmetic average of the fair market values submitted by the two (2) Appraisers.

The Shareholders shall (and shall cause the JV Co 4 Group Companies to) provide the Appraisers with all information reasonably required for the purposes of determining the fair market value of JV Co 4. The cost of such appraisal shall be paid and borne by JV Co 4.

(c) Asset Distribution. The Shareholders shall take turns to select project companies of JV Co 4 to be transferred to itself or its Affiliates until each of the Shareholders (or their respective Affiliates, as applicable) receives its share in the fair market value of JV Co 4 based on its Shareholding Percentage in JV Co 4; provided, however, that (i) the Investor shall have the right to the first selection, and Vianet shall have the right to the second selection; and (ii) the Investor shall be entitled to a priority to be distributed all available cash of JV Co 4. If, after completion of the foregoing

selection, there is any shortfall between the fair market value of the Project Companies selected by any Shareholder and the amount that should be distributed to such Shareholder pursuant to this Section 3.13(c) (Asset Distribution), such shortfall shall be made up for in cash by the other Shareholder that receives any excess distribution. The Shareholders shall use their respective Best Efforts to cause the transfer or disposal of each project company of JV Co 4 to be completed within 180 days after the date of service of the Dissolution Notice.

3.14 Amendment to JV Co 4 MSA. The Parties acknowledge and agree that upon the Investor’s exercise of its exit rights with respect to its investment JV Co 4 pursuant to this Section 3(III) (JV Co 4 Exit), the Investor shall use commercially reasonable efforts to procure the JV Co 4 Master Service Agreement (if any) between the relevant project company and Vianet’s relevant Affiliate be amended to allow such Project to satisfy the requirements of VNET’s finance lease accounting treatment, provided that (i) the amendments will not impose any negative economic impact on the relevant project company (including any additional Tax burden), nor impair the marketability or value of the Projects upon WP’s (or its Affiliates’) direct or indirect sale thereof via sale of shares, asset sale or a combination of both (comparing to the situation where there is no amendment to satisfy the finance lease treatment); and (ii) Vianet shall, as soon as possible after WP’s exercise of its aforementioned exit right, notify WP in writing setting forth in reasonable detail the amendments necessary to satisfy such finance lease treatment.

3.15 Actions to Effectuate Investor’s Exit. Vianet shall, and shall cause its Affiliates, appointed directors, permitted successors, transferees or assignees to, procure the JV Co 4 Group Companies take any and all necessary actions to effectuate the Investor’s exit pursuant to the provisions of this Section 3(III) (JV Co 4 Exit).

3.16 Late Payment Fee. If either Shareholder fails to pay to the other Shareholder any due and payable amount in a timely manner under this Section 3(III) (JV Co 4 Exit), such default Shareholder shall pay to the other Shareholder a late payment fee at a daily interest rate of 0.05%.

3.17 Taxes. Without prejudicing the rights and interests of the Investor under this Section 3(III) (JV Co 4 Exit), each Shareholder shall pay and bear the Taxes arising from or in connection with the exit mechanism set forth in this Section 3(III) (JV Co 4 Exit) payable by said Shareholder pursuant to the Applicable Law; provided, however, that the Shareholders shall use their respective Best Efforts to ensure that the exit mechanism set forth in this Section 3(III) (JV Co 4 Exit) be implemented in the most tax-efficient way.

4. REPRESENTATIONS AND WARRANTIES

4.1 Mutual Representations and Warranties. As at date of this Agreement and each Closing Date, each Party hereby represents and warrants to the other Parties as follows:-

(a) Incorporation. It is duly incorporated, validly existing and (where applicable) in good standing under the laws of the place of its incorporation and it has the requisite power and authority to conduct its business in accordance with its business license, certificate of incorporation, memorandum and articles of association, or similar constitutional documents;

(b) Authority. It has all requisite power, authority, approval and third-party consent required to enter into this Agreement and other Transaction Documents and has all

requisite power, authority, approval and third-party consent to fully perform each of its obligations hereunder and under other Transaction Documents;

(c) Corporate Actions. It has taken all necessary internal corporate actions to authorize it to enter into this Agreement and other Transaction Documents, and its representative whose signature is affixed hereto is given full authority to sign this Agreement and other Transaction Documents, if applicable; and

(d) No Violation. Neither the execution of this Agreement and other Transaction Documents, if applicable, nor the performance of its obligations hereunder and thereunder, will conflict with, or result in a breach of, any provision of its constitutional documents, or any law, rule, regulation, authorization, or approval of any Government Entity, or of any contract or agreement to which it is a party or is subject.

5. ADDITIONAL COVENANTS

5.1 Further Assurances. The Parties shall act in good faith to take any and all actions necessary or advisable to consummate the Transactions contemplated hereby, including without limitation, to (a) procure that each of the JV Cos Group Companies and their respective directors, officers and employees shall fulfill their respective obligations under this Agreement and other Transaction Documents; and (b) provide all reasonably necessary and advisable assistance to the JV Cos Group Companies and WP in obtaining all applicable Government Approvals, and complete the Transactions.

5.2 Confidentiality and Publicity.

(a) Confidentiality. From the date hereof, each Party shall, and shall cause each Person who is Controlled by such Party to, keep confidential the terms, conditions and existence of this Agreement, any related documentation, the identities of any of the Parties and any other information of a non-public nature received from any other Party or prepared by such Party exclusively in connection herewith or therewith (collectively, the “Confidential Information”) except as the Parties otherwise mutually agree; provided, however, that any Party may disclose the Confidential Information or permit the disclosure of the Confidential Information (i) to the extent required by Applicable Law so long as, where such disclosure is to a Government Entity, such Party shall use all reasonable efforts to obtain confidential treatment of the Confidential Information so disclosed, (ii) to the extent required by the rules of any stock exchange, (iii) to its officers, directors, employees and professional advisors, and in the case of the Investor, its Affiliates, as necessary for the performance of its obligations in connection herewith so long as such Party advises each Person to whom any Confidential Information is so disclosed as to the confidential nature thereof, and (iv) to its investors, prospective investors and any Person otherwise providing substantial debt or equity financing to such Party so long as the Party advises each Person to whom any Confidential Information is so disclosed as to the confidential nature thereof. Each Party shall ensure that any of the foregoing permitted disclosed Persons to which such Party discloses the Confidential Information shall have the same confidentiality obligation and liability as such Party.

Further, the Investor acknowledges that it is aware that VNET is a NASDAQ listed company and is subject to the securities laws and regulations of the Securities and Exchange Commission of the United States of America (“SEC”). Therefore, the Investor and/or its Subsidiaries that receive non-public information from VNET about VNET will be subject to inside trading provisions under the rules of SEC.

For the avoidance of doubt, the Confidential Information does not include information that (i) was already in the possession of the receiving Party (the “Receiving Party”) before such disclosure by the disclosing Party (the “Disclosing Party”), (ii) is or becomes available to the public other than as a result of disclosure by the Receiving Party in violation of this Section 5.2 (Confidentiality and Publicity) or (iii) is or becomes available to the Receiving Party from a third party not known by the Receiving Party to be in breach of any legal or contractual obligation not to disclose such information to it; and in each case, if the Receiving Party determines that the foregoing information may have any material adverse effect on the JV Co 4 Group Companies, the Receiving Party shall immediately notify the other Parties and take reasonable and necessary measures to avoid further disclosure of the foregoing information.

(b) Publicity. No public announcement or disclosure (including any general announcement to employees, customers or suppliers) will be made by any Party with respect to the subject matter of this Agreement or the Transaction without the prior written consent of the other Parties; provided that the provisions of this Section 5.2(b) (Publicity) shall not prohibit (i) any disclosure required by any Applicable Law (in which case the disclosing Party will provide the other Parties with the opportunity to review and comment in advance of such disclosure if legally permitted and practicable) or (ii) any disclosure made in connection with the enforcement of any right or remedy relating to this Agreement or the Restructuring.

Each of the Parties shall not, and shall procure that their respective Affiliates will not, without the prior written consent of the other Parties, (i) use in advertising, publicity, or otherwise the name of the other Parties or their respective Affiliates, nor any trade name, trademark, trade device, service xxxx, symbol or any abbreviation, contraction or simulation thereof owned by the other Parties or their respective Affiliates, or (ii) represent, directly or indirectly, that any product or any service provided by any JV Co 4 Group Company has been approved or endorsed by the other Parties or their respective Affiliates.

5.3 U.S. Tax Matters. The Parties shall procure that JV Co 4, together with any other JV Co 4 Group Companies shall use commercially reasonable Best Efforts to assist WP in (1) determining annually whether any of the JV Co 4 Group Companies is a passive foreign investment company (“PFIC”) within the meaning of IRC Section 1297 and the Treasury Regulations promulgated thereunder, (2) providing WP with any information necessary for WP to comply with annual reporting requirements in respect of such PFIC, (3) obtaining (i) PFIC Annual Information Statements as described in Treasury Regulation Section 1.1295-1(g)(1) so as to permit WP (or its direct or indirect investors) to timely make and maintain at all times a qualified electing fund election in accordance with IRC Section 1295 or (ii) information necessary to make a xxxx-to-market election on the PFIC in accordance with IRC Section 1296. The aforesaid assistance is limited to providing necessary information or documents to WP for it to comply with obligations in respect of PFIC, and shall under no

circumstances be taken as agreement to submit or file any documents to any U. S. government authorities on behalf of WP.

6. INDEMNITY

6.1 General. If there occurs any misrepresentation, breach of warranty, breach of covenant, or other violation by any Party under this Agreement or any other Transaction Documents, such Party shall indemnify and hold harmless other Parties, their respective Affiliates, together with the senior management, directors, employees thereof, from and against any and all Indemnifiable Losses suffered by such other Parties, such Affiliates, such senior management, directors or employees, directly or indirectly, in relation to the foregoing.

6.2 Non-Exclusive. The foregoing indemnity provisions are not in derogation of other contractual and statutory remedies and rights any Party may have under this Agreement, other Transaction Documents and Applicable Law. For the avoidance of doubt, no Party is entitled to any repetitive payment and indemnity arising from or in relation to the same breach or default by any other Party.

7. TERMINATION

7.1 Termination of Agreement. This Agreement may be terminated:-

(a) by all the Parties upon their unanimous written consent;

(b) by the Investor if the Investor elects to exercise the Dissolution Exit Option pursuant to Section 3.13 (Dissolution Exit);

(c) by any Shareholder upon the winding up of JV Co 4 and completion of the distribution of proceeds, if any, from such winding up;

(d) with respect to a Shareholder, upon the date on which such Shareholder ceases to hold any shares in JV Co 4; provided, however, that such Shareholder’s cessation to hold any shares shall not be a breach of this Agreement;

(e) by the Investor if Vianet fails to pay any tranche of the Vianet Subscription Price and such failure is not cured within forty (40) days;

(f) by Vianet if the Investor fails to pay any tranche of the WP Subscription Price, and such failure is not cured within forty (40) days;

(g) by the Investor if there is a Material Breach or an IA Material Breach;

(h) by Vianet if there is an Investor Material Breach or an IA Investor Material Breach; or

(i) by either Shareholder if any Government Entity having relevant jurisdiction or power mandatorily requires that the Transaction contemplated hereby be terminated and the Shareholders fail to resolve such requirement by such Government Entity after using Best Efforts within 180 days after the date of such requirement by such Government Entity.

7.2 Effects of Termination. If this Agreement is terminated pursuant to the provisions of Section 7.1 (Termination of Agreement):-

(a) No Further Effect. This Agreement shall become invalid and have no further effect; provided, however, that termination of this Agreement (howsoever occasioned) shall not affect any accrued rights or liabilities to any Shareholder, nor shall it affect the effect of any provision hereof which is expressly or by implication intended to come into or continue in force on or after such termination, including those sections set out in Section 7.3 (Survival) below;

(b) Termination of Ancillary Agreements. The Parties hereby agree that they shall take any and all necessary actions to terminate any ancillary agreements entered into in connection with this Agreement; and

7.3 Survival. Notwithstanding any other provisions, the provisions of Section 3(III) (JV Co 4 Exit), Section 5.2 (Confidentiality and Publicity), Section 6 (Indemnity), this Section 7 (Termination) and Section 8 (Miscellaneous) shall survive any expiration or termination of this Agreement.

8. MISCELLANEOUS

8.1 Taxes and Expenses.

(a) Taxes. Each of the Parties shall bear all Taxes arising from the Transaction contemplated hereby pursuant to the requirements of Applicable Laws.

(b) Expenses. In the event that the Transaction contemplated hereby are not consummated, each of the Parties shall bear its own due diligence costs, advisory fees and costs and expenses incurred in connection with their respective negotiation and preparation of this Agreement and any other related agreements.

8.2 Binding Effect; Assignment. This Agreement shall be binding upon and shall be enforceable by each Party, its successors and permitted assigns. Subject to Section 4.2 (Permitted Transfers) of Exhibit 3.7 (JV Co 4 Related Provisions), no Party may assign any of its rights or obligations hereunder without the prior written approval of the other Parties.

8.3 Governing Law. This Agreement shall be governed by, and construed in accordance with, the laws of Hong Kong without regard to conflict of laws principles thereunder.

8.4 Dispute Resolution.

(a) Dispute. Any dispute, controversy or claim (each, a “Dispute”) arising out of or relating to this Agreement, or the interpretation, breach, termination or validity hereof, shall be referred to and finally resolved by arbitration administered by the Hong Kong International Arbitration Center (“HKIAC”) in accordance with the HKIAC Administrated Arbitration Rules (the “Rules”) in effect when the Notice of Arbitration is submitted, which Rules are deemed to be incorporated by reference into this Section 8.4 (Dispute Resolution). The seat of arbitration shall be Hong Kong. Before resolving the Dispute by way of arbitration as provided in this Section 8.4 (Dispute Resolution), the Dispute shall be resolved at the first instance through consultation between the Parties to such Dispute. Such consultation shall

begin immediately after any Party has delivered written notice to any other Party to the Dispute requesting such consultation (the “Notice of Escalation of Dispute”). If the Dispute is not resolved within thirty (30) days following receipt of the Notice of Escalation of Dispute in accordance with Section 8.7 (Notices), the Dispute shall be submitted to arbitration by any of the Parties in accordance with this Section 8.4 (Dispute Resolution). The thirty (30)-day consultation period set out in this Section 8.4(a) (Dispute) shall not apply to applications seeking conservatory or interim relief.

(b) Arbitration Tribunal. The arbitral tribunal shall be composed of three (3) arbitrators. The arbitration proceedings shall be conducted in English. If the Rules are in conflict with the provisions of this Section 8.4 (Dispute Resolution), including but not limited to the provisions concerning the appointment of arbitrators, the provisions of this Section 8.4 (Dispute Resolution) shall prevail. The arbitrators shall decide any Dispute submitted by the Parties strictly in accordance with the substantive law of Hong Kong.

(c) Matters Not in Dispute. When any Dispute occurs and when any Dispute is under arbitration, except for the matters in dispute, the Parties shall continue to fulfill their respective obligations and shall be entitled to exercise their rights under this Agreement. The award of the arbitral tribunal shall be final and binding upon the Parties and shall be enforceable in any court of competent jurisdiction. The costs of arbitration shall be borne by the losing Party on full indemnity basis, unless otherwise determined by the arbitral tribunal.

(d) Exclusive Remedy. The Dispute resolution provisions of this Section 8.4 (Dispute Resolution) shall be the sole and exclusive remedy and process to resolve any Disputes under or pursuant to this Agreement. Nothing in this Section 8.4 (Dispute Resolution) shall be construed as preventing any Party from seeking conservatory or interim relief (including injunction, specific performance or other similar or comparable forms of equitable relief) from any court of competent jurisdiction. For the avoidance of doubt, the thirty (30)-day consultation period set out in Section 8.4(a) (Dispute) shall not apply to applications seeking conservatory or interim relief.

8.5 Language. This Agreement shall be executed in English, provide that Exhibit 2.2(a)(vi) (JV Co 2 Asset Distribution Roadmap) shall be in Chinese.

8.6 Effectiveness and Amendments. Except as otherwise permitted herein, this Agreement and its provisions may be amended, changed, waived or terminated only by a writing signed by each of the Parties. This Agreement shall enter into effect from the date when this Agreement is executed by all of the Parties or their respective duly authorized representatives.

8.7 Notices. All notices, claims, requests, demands and other communications under this Agreement shall be made in writing and shall be delivered to any Party hereto by hand or sent by facsimile, or sent, postage prepaid, by reputable overnight courier services at the address given for such Party on Exhibit 8.7 (Address of Notices) (or at such other address for such Party as shall be specified by like notice), and shall be deemed given when so delivered by hand, or if sent by facsimile, upon receipt of a confirmed transmission receipt, or if sent by overnight courier, seven (7) days after delivery to or pickup by the overnight courier service. Any of the foregoing notices and other communications may be accompanied with (but not replaced by) email to the email address given for a Party on Exhibit 8.7 (Address of Notices) (or at such other email address for such Party as shall be specified by like notice). Each Party

shall promptly (and in any event within fourteen (14) days of the event taking place) notify the other Parties shall there be a change in the address of service.

8.8 Entire Agreement. This Agreement and all other Transaction Documents (together with documents mentioned herein and therein) constitute the entire agreement among the Parties with respect to the subject matter hereof and supersedes all prior written or oral understandings or agreements.

8.9 Severability. If any provision of this Agreement shall be held invalid or unenforceable to any extent, the remainder of this Agreement shall not be affected thereby and shall be enforced to the greatest extent permitted by Applicable Law.

8.10 Specific Performance. The Parties hereto acknowledge and agree that irreparable harm may occur for which money damages would not be an adequate remedy in the event that any of the provisions of this Agreement were not performed in accordance with their specific terms or were otherwise breached. It is accordingly agreed that the Parties shall be entitled to injunctive relief to address breaches of this Agreement and to enforce specifically the terms and provisions of this Agreement.

8.11 Counterpart Execution. This Agreement shall be executed in three (3) counterparts, each of which shall be deemed an original but all of which together shall constitute one and the same instrument. Each Party shall hold one (1) counterpart.

8.12 Drafting Presumption. This Agreement shall be construed fairly as to each Party regardless of which Party drafted it. Each Party acknowledges and agrees that each of them played a significant and essential role in the preparation, drafting and review of this Agreement.

8.13 Conflicts among Documents. In the case of any conflict between this Agreement and other Transaction Documents, this Agreement shall prevail as among the Parties only, and the Parties shall procure that the constitutional documents of the relevant JV Co 4 Group Companies are promptly amended, to the extent permitted by Applicable Laws, in order to remove such conflict. In the case of any conflict between this Agreement and the Original Investment Agreement, this Agreement shall prevail as among the Parties.

8.14 Limitation on Benefits of this Agreement. A person who is not a party (or the successor or assignee, immediate or otherwise, of a party, or the person becoming a party by novation) to this Agreement shall not have any rights under the Contracts (Rights of Third Parties) Ordinance (Cap. 623) to enforce any term of this Agreement.

[Remainder of this page intentionally left blank; signature pages to follow.]

Signature Page to the Restructuring Agreement

IN WITNESS WHEREOF, each of the Parties hereto has caused this Agreement to be executed by their duly authorized signatories on the date first set forth above.

|

|

|

|

|

|

|

| ||

|

By: |

/s/ Xxxxx Xxxx |

|

By: |

| ||||

|

|

Name: |

Xxxxx Xxxx |

|

|

Name: |

| ||

|

|

Title: |

Director |

|

|

Title: |

Director | ||

21VIANET DRP INVESTMENT HOLDINGS LIMITED

|

By: |

/s/ Xxxxx XXXX |

|

By: |

/s/ Xxxx XXX | ||

|

|

Name: |

Xxxxx XXXX |

|

|

Name: |

Xxxx XXX |

|

|

Title: |

Director |

|

|

Title: |

Director |

Signature Page to the Restructuring Agreement

IN WITNESS WHEREOF, each of the Parties hereto has caused this Agreement to be executed by their duly authorized signatories on the date first set forth above.

MARBLE STONE HOLDINGS LIMITED

|

By: |

/s/ Xxxxx Hoi Xxxx Xx |

| |

|

|

Name: |

Xxxxx Hoi Xxxx Xx |

|

|

|

Title: |

Director |

|

Exhibit 1.1

Definitions

1. The following terms shall have the following meanings:-

“Action” means any claim, action, suit, arbitration, inquiry, proceeding or investigation by or before any Government Entity.

“Affiliate” with respect to a specified Person means (a) in the case of an individual, such Person’s siblings, spouse and lineal descendants or antecedent (whether natural or adopted) and any trust formed and maintained solely for the benefit of such Person, such Person’s siblings, spouse and/or such lineal descendants or antecedent, and (b) in the case of any Person, a Person that directly, or indirectly through one or more intermediaries, Controls or is Controlled by, or is under common Control with, the Person specified, and with respect to each of the Parties, excludes JV Cos and any of their respective Subsidiaries or other Affiliates unless otherwise provided in this Agreement. In the case of any of the Parties being an investment fund (or a Subsidiary of an investment fund), the term “Affiliate” shall include, without limitation, any other investment fund (or a Subsidiary of any such investment fund) managed by the same manager of such investment fund (or, if such Party is a Subsidiary of an investment fund, the same manager of the investment fund of which such Party is a Subsidiary).

“Anti-Bribery Laws” means (a) the US Foreign Corrupt Practices Act of 1977, as amended, and the rules and regulations issued thereunder, (b) the PRC Criminal Law, the PRC Anti-Unfair Competition Law, the Interim Rules of the State Administration for Industry and Commerce on Prohibition of Commercial Bribery, and any other PRC law, rule, regulation, judicial interpretation, or other legally binding measure that contains anti-bribery or corruption provisions or that otherwise relates to bribery or corruption, and (c) any other law, rule, regulation, or other legally binding measure of any jurisdiction that relates to bribery or corruption.

“Applicable Law” or “Applicable Laws” means, with respect to any activities or matters conducted by or happen to any Person, any and all provisions of any law, regulation, code, rule, judgment, rule of common law, Order, decree, award, injunction, governmental approval, license, directive, or other governmental restriction or any similar form of decision of, or determination by, or any interpretation or administration of any of the foregoing by, any Government Entity, applicable to such Person or any of its assets or undertakings at the time when such activities are conducted or when such matters happen (as applicable).

“Appraiser” means any of Xxxxx Xxxx XxXxxxx, XX Xxxxxxx Xxxxx, Savills Property Services, DTZ Debenham Tie Xxxxx or Colliers International, or such other internationally reputable appraiser agreed by the Shareholders in writing.

“Best Efforts” means, in relation to a Person, taking all steps that a prudent Person desirous of achieving a result would take in similar circumstances to achieve that result as expeditiously as possible.

“Big Four Accounting Firm” means any of (i) Ernst & Young, (ii) PricewaterhouseCoopers, (iii) Deloitte & Touche Tohmatsu and (iv) KPMG.

“Borrowings” means, at any time, the aggregate outstanding principal, capital or nominal amount (and any fixed or minimum premium payable on prepayment or redemption) of any Indebtedness of members of the JV Co 1 Group for or in respect of (without double counting) moneys borrowed at banks or other financial institutions that bear interest (excluding, for the avoidance of doubt, any intercompany loan or balance owed by any member of the JV Co 1 Group to any other member of the JV Co 1 Group);

“Business Day” means a day (other than a Saturday or Sunday) when banks in China, Hong Kong, the Cayman Islands, the British Virgin Islands, Singapore and New York are open for business.

“Cash” means, at any time, cash in hand or at bank and (in the latter case) credited to an account in the name of any member of the JV Co 1 Group with a bank or financial institution and to which that member of the JV Co 1 Group is alone (or together with other members of the JV Co 1 Group) beneficially entitled and for so long as (a) that cash is repayable on demand or in any event within thirty (30) days after the relevant date of calculation; (b) repayment of that cash is not contingent on the prior discharge of any other Indebtedness of that member of the JV Co 1 Group or of any other person whatsoever or on the satisfaction of any other condition; and (c) there is no Encumbrance over that cash except for any Encumbrance created to secure repayment of any Borrowings of any member of the JV Co 1 Group or any Encumbrance constituted by a netting or set-off arrangement entered into by members of the JV Co 1 Group in the ordinary course of their banking arrangements.

“Cash Equivalent Investments” means investments that are short term investments (excluding equity investments) which are (a) readily convertible into cash without incurring any significant premium or penalty and (b) not subject to any Encumbrance except for any Encumbrance created to secure repayment of any Borrowings of any member of the JV Co 1 Group.

“Chairman” means the chairman of the board of JV Co 4 (or the relevant JV Co 4 Group Company, as applicable) from time to time.

“Control” (including the correlative meanings of the terms “Controlling”, “Controlled by” and “under common Control with”) means, with respect to any Person, direct or indirect possession of the power to direct or cause the direction of the management or policies of such Person, whether through the ownership of securities or title to properties, by contract or otherwise.

“EBITDA” means, with respect to any JV Cos Group Company, the earnings before interest, income taxes, depreciation and amortization. If the subject JV Cos Group Company is in operation for less than a full fiscal year, such EBITDA shall be annualized as if that JV Cos Group Company has been in operation for a full fiscal year. For the avoidance of doubt, business taxes and value added taxes (if applicable) shall be deducted for the calculation of the EBITDA and any extraordinary, non-cash or non-recurring revenues shall be explicitly excluded from the EBITDA. EBITDA shall be assumed to be zero if the calculated amount is less than zero.

“Encumbrance” means and includes, without limitation, any interest or equity of any person (including, without limitation to any right to acquire, option or right of pre-emption) or any mortgage, pledge, lien, option, charge, assignment, hypothecation, contractor’s lien, or other agreement or arrangement which has the same or a similar effect to the granting of security or a security interest over or in the relevant property.

“Existing Projects” shall have the meaning ascribed to it under the Original Investment Agreement.

“Force Majeure Event” means (a) any natural disaster such as typhoon, earthquake and seaquake, epidemic, fire, war, riot, strike, lockout (excluding any riot, strike or lockout initiated directly or indirectly by any Party), terrorism attack or expropriation or mandatory acquisition by any Government Entity, that (i) causes a material adverse impact on the conditions and operations of the JV Cos Group Companies (taken as a whole); AND (ii) directly causes a specific provision of this Agreement to be unable to be performed and such non-performance is not remedied in a timely manner, and/or (b) any change in laws, regulations, government policies or government orders (such policies and orders shall