SHOPPING CENTER LEASE Between Regency Centers, L.P. (Landlord) And Wilshire State Bank (Tenant) At Woodman Van Nuys Shopping Center Arleta, CA

Exhibit 10.32

Between

Regency Centers, L.P.

(Landlord)

And

Wilshire State Bank

(Tenant)

At

Woodman Van Nuys Shopping Center

Arleta, CA

Dated November 19, 2009

|

|

|

REGENCY |

INITIAL |

|

|

|

|

|

|

|

|

/s/ [ILLEGIBLE] |

|

|

|

|

/s/ [ILLEGIBLE] |

WOODMAN VAN NUYS

SHOPPING CENTER LEASE

THIS LEASE, made as of the 19th day of November, 2009, by and between Regency Centers, L.P., a Delaware Limited Partnership (herein called “Landlord”), and Wilshire State Bank, a California corporation (herein called “Tenant”).

In consideration of the obligations of Tenant to pay rent and other charges as herein provided and in consideration of the other terms, covenants and conditions hereof, Landlord hereby leases to Tenant and Tenant hereby leases from Landlord the premises described herein for the term and subject to the terms and conditions set forth herein.

ARTICLE 1. INTRODUCTORY PROVISIONS

1.1 FUNDAMENTAL LEASE PROVISIONS.

Certain fundamental provisions are presented in this Section in summary form to facilitate convenient reference by the parties hereto:

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

(a) Tenant’s Trade Name |

Wilshire

State Bank |

||||||||||||||||

|

|

|

||||||||||||||||

|

(b) Term |

Sixty

(60) months |

||||||||||||||||

|

|

|

||||||||||||||||

|

(c) Premises Space Number |

0000

Xxxxxxx Xxxxxx, Xxxxx X-0 |

||||||||||||||||

|

|

|

||||||||||||||||

|

(d) GLA in Premises |

1,150

square feet |

||||||||||||||||

|

|

|

||||||||||||||||

|

(e) GLA in Landlord’s Building |

107,614

square feet |

||||||||||||||||

|

|

|

||||||||||||||||

|

(f) Tenant’s Proportionate Share |

Tenant’s

proportionate share shall be defined as the percentage that the gross

leasable area (“GLA”) of the Premises bears to the entire gross leasable area

of Landlord’s Building except as hereinafter provided. In determining

Tenant’s Proportionate Share of Common Area Costs and contribution for Taxes

and Insurance, Landlord may exclude from the GLA of the Landlord’s Building

any premises containing |

||||||||||||||||

|

|

|

||||||||||||||||

|

(g) Minimum Annual Rent: |

|

|

|

|

Minimum Rent |

|

|

|

|||||||||

|

|

|

|

Minimum Rent |

|

(Per Sq.ft. of |

|

Minimum Rent |

|

|||||||||

|

|

Months |

|

(Monthly) |

|

GLA) |

|

(Annual) |

|

|||||||||

|

|

1 - 12 |

|

$ |

2,242.50 |

|

$ |

23.40 |

|

$ |

26,910.00 |

|

||||||

|

|

13 - 24 |

|

$ |

2,287.54 |

|

$ |

23.87 |

|

$ |

27,450.50 |

|

||||||

|

|

25 - 36 |

|

$ |

2,333.54 |

|

$ |

24.35 |

|

$ |

28,002.50 |

|

||||||

|

|

37 - 48 |

|

$ |

2,379.54 |

|

$ |

24.83 |

|

$ |

28,554.50 |

|

||||||

|

|

49 - 60 |

|

$ |

2,427.46 |

|

$ |

25.33 |

|

$ |

29,129.50 |

|

||||||

|

|

|

||||||||||||||||

|

|

plus applicable sales tax, if any (Section 4.2) |

||||||||||||||||

|

|

|

||||||||||||||||

|

(h) Percentage Rent |

N/A |

||||||||||||||||

|

|

|

||||||||||||||||

|

(i) Commencement Date |

One

hundred twenty (120) days after the date of Landlord’s delivery of the

Premises to Tenant. |

||||||||||||||||

|

|

|

||||||||||||||||

|

(j) Use |

The

Premises shall be used for retail banking and general office. |

||||||||||||||||

|

|

|

||||||||||||||||

|

(k) Guarantor(s) (if none, so state) |

N/A |

||||||||||||||||

|

|

|

||||||||||||||||

|

(l) Default Rate: |

The lesser of twelve percent (12%) per annum or the maximum lawful rate of interest permitted by applicable law |

||||||||||||||||

|

|

|

||||||||||||||||

|

(m) Security Deposit |

N/A |

||||||||||||||||

|

|

|

||||||||||||||||

|

(n) Brokers |

Regency Centers, L.P. representing Landlord and Transwestem representing Tenant (Section 25.5) |

||||||||||||||||

|

|

|

REGENCY |

INITIAL |

|

|

|

|

|

|

|

|

/s/ [ILLEGIBLE] |

|

|

|

|

/s/ [ILLEGIBLE] |

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

(o) Estimated Common Area Costs for 2009 |

$4.16 per square foot per annum (Article 8) (Subject to annual adjustment) |

|||||||||||||||||

|

|

|

|||||||||||||||||

|

(p) Estimated Taxes for 2009 |

$1.65 per square foot per annum (Article 5) (Subject to annual adjustment) |

|||||||||||||||||

|

|

|

|||||||||||||||||

|

(q) Estimated Insurance for 2009 |

$0.58 per square foot per annum (Article 11) (Subject to annual adjustment) |

|||||||||||||||||

|

|

|

|||||||||||||||||

|

(r) Advertising and Promotion Fund (if none, so state) |

N/A |

|||||||||||||||||

|

|

|

|||||||||||||||||

|

(s) Estimated Initial Monthly Payments Required |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

Minimum Rent |

|

|

|

|

|

$2,242.50 |

|||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

Additional Rent |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

Common Area Costs |

|

$ |

398.67 |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

Taxes |

|

$ |

158.13 |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

Insurance |

|

$ |

55.58 |

|

|

|

|||||||||||

|

|

|

|

||||||||||||||||

|

Advertising and Promotion Fund (if none, so state) |

N/A |

|||||||||||||||||

|

Pylon Signage Fee (if none, so state) |

N/A |

|||||||||||||||||

|

Satellite Fee (if none, so state) |

N/A |

|||||||||||||||||

|

|

|

|||||||||||||||||

|

Total Monthly Additional Rent |

$612.38 |

|||||||||||||||||

|

|

|

|||||||||||||||||

|

State and County Sales Tax |

N/A |

|||||||||||||||||

|

|

|

|||||||||||||||||

|

Total Monthly Payment at Commencement Date |

$2,854.88 |

|||||||||||||||||

|

|

|

|||||||||||||||||

|

(t) Address for Notice |

|

|||||||||||||||||

|

|

|

|||||||||||||||||

|

To Landlord |

c/o Regency Centers Corporation Xxxxxxxxxxxx, Xxxxxxx 00000-0000

With a copy to: c/o Regency Centers Corporation Xxx Xxxxxxxxxxx Xxxxx Xxxxx 000 Xxxxxxxxxxxx, Xxxxxxx 00000-0000 Attention: Legal Department

With a copy to: c/o Regency Centers Corporation |

|||||||||||||||||

|

|

|

|||||||||||||||||

|

To Tenant: |

Wilshire State Bank 0000 Xxxxxxxx Xxxxxxxxx, Xxxxx 0000 Xxx Xxxxxxx, Xxxxxxxxxx 00000 |

|||||||||||||||||

|

|

|

|||||||||||||||||

|

(u) Tenant Allowance |

$10.00 per square foot of the Premises; subject, however, to the terms and conditions of the Tenant Allowance provision of this Lease |

|||||||||||||||||

|

|

|

REGENCY |

INITIAL |

|

|

|

|

|

|

|

|

/s/ [ILLEGIBLE] |

|

|

|

|

/s/ [ILLEGIBLE] |

LEASE PROVISIONS

1.2 REFERENCES AND CONFLICTS.

References appearing in Section 1.1 are to designate some of the other places in this Lease where additional provisions applicable to the particular Fundamental Lease Provisions appear. Each reference in this Lease to any of the Fundamental Lease Provisions contained in Section 1.1 shall be construed to incorporate all of the terms provided for under such provisions, and such provisions shall be read in conjunction with all other provisions of this Lease applicable thereto. If there is any conflict between any of the Fundamental Lease Provisions set forth in Section 1.1 and any other provision of this Lease, the latter shall control.

1.3 EXHIBITS.

The following drawings and special provisions are attached hereto as exhibits and hereby made a part of this Lease:

|

(a) |

Exhibit “A” |

Legal Description of the Shopping Center Land as presently constituted |

|

|

|

|

|

(b) |

Exhibit “B” |

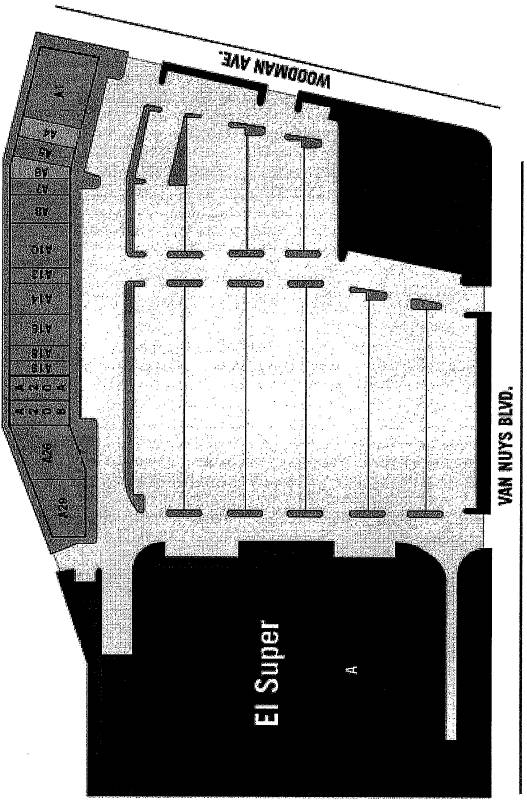

Part 1 - Site plan of Shopping Center Land; and |

|

|

|

Part 2 - Leasing Plan. (The Premises is identified on the Leasing Plan.) |

|

|

|

|

|

(c) |

Exhibit “C” |

Description of Tenant’s Work and Work to be performed by Landlord, if any, in the Premises; and “C-1” Shopping Center Signage Criteria |

|

|

|

|

|

(d) |

Exhibit “D” |

Intentionally Omitted |

|

|

|

|

|

(e) |

Exhibit “E” |

Requirements & Restrictions |

|

|

|

|

|

(f) |

Exhibit “F” |

Tenant Improvements |

|

|

|

|

|

(g) |

Exhibit “G” |

Signage |

|

|

|

|

|

(h) |

Exhibit “H” |

Intentionally Omitted |

|

|

|

|

|

(i) |

Exhibit “I” |

Intentionally Omitted |

|

|

|

|

|

(j) |

Exhibit “J” |

Existing Exclusives granted by Landlord at Shopping Center |

1.4 THE SHOPPING CENTER; LANDLORD’S BUILDING.

The “Shopping Center” means the land described in Exhibit “A” and improvements thereon constituting an integrated retail shopping center, as the same may be modified from time to time throughout the Term of this Lease. The structure or structures shown on Exhibit “B” as “Landlord’s Building,” as the same may be altered, reduced or expanded from time to time throughout the Term of this Lease, is hereinafter called the “Landlord’s Building.” Landlord may at any time and from time to time change the shape, size, location, number, height and extent of the improvements in the Shopping Center and eliminate or add any improvements to any portion of the Shopping Center and add land thereto or eliminate land therefrom.

1.5 GROSS LEASABLE AREA.

At the Commencement Date, GLA is estimated to be, with respect to the Premises, the number of square feet set forth in Section 1.1(d) and, with respect to the Landlord’s Building, the number of square feet set forth in Section 1.1(e). GLA will change with additions or deletions to the Landlord’s Building and/or the Premises. The GLA is measured from the exterior face of exterior walls, the exterior face of service corridor walls and the centerline of interior demising walls. No deduction shall be made for columns, stairs, elevators or any internal construction or equipment. Unless another provision of this Lease expressly grants to Tenant a right to certify and/or remeasure the GLA of the Premises, Tenant shall have no such right to certify and/or remeasure or otherwise dispute the GLA of the Premises set forth in Section 1.1(d) above.

ARTICLE 2. PREMISES

2.1 LEASE OF PREMISES.

Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, the Premises for the Term, at the rent, and upon the terms, covenants and conditions herein set forth.

2.2 PREMISES DEFINED.

The term “Premises” means the space situated in the Landlord’s Building in the location marked on Exhibit “B” and shall consist of the space thereat within the walls, structural floor and the bottom of the roof of Landlord’s Building. The demised Premises shall include only the appurtenances specifically granted in this Lease, Landlord specifically excepting and reserving for itself the roof, the air space above the roof, the space below the floor, the exterior portions of the demised Premises (other than the store front), and the right to install pipes, ducts, conduits, wire, solar panels and other mechanical equipment serving other portions, tenants and occupants of the Shopping Center under or above the Premises, without the same constituting and actual or constructive eviction of Tenant.

|

|

|

REGENCY |

INITIAL |

|

|

|

|

|

|

|

|

/s/ [ILLEGIBLE] |

|

|

|

|

/s/ [ILLEGIBLE] |

2.3 DELIVERY OF PREMISES.

Landlord

agrees to deliver to Tenant, and Tenant agrees to accept from Landlord,

possession of the Premises when Landlord advises Tenant in writing that the

Landlord’s Work in the Premises (if any) has been sufficiently completed to

permit Tenant’s Work to begin or when Tenant takes possession of the Premises,

whichever first occurs. Landlord’s notice thereof shall constitute delivery of

the Premises without further act by either party. Landlord will deliver

possession of the Premises to Tenant with the

heating, ventilation and air conditioning (HVAC) unit, plumbing, and electrical

systems in good working order with the rest of the Premises

in its current “as-is” condition with the addition of only those items

of work (if any) described on Exhibit “C”. If Landlord encounters delays

in delivering possession of the Premises to Tenant, this Lease will not be void

or voidable, nor will Landlord be liable to Tenant for any loss or damage

resulting from such delay. If the delay in possession is caused by Tenant

(including delays caused by Tenant’s failure to supply the information referred

to in the following sentence), then the date of Landlord’s delivery of the

Premises to Tenant shall be deemed to be the date such delivery would have

occurred but for Tenant’s delay. Notwithstanding the foregoing, Landlord will not be obligated to shall deliver

possession of the Premises to Tenant until within

thirty (30) days after Landlord has received from

Tenant all of the following: (i) a copy of this Lease fully executed by

Tenant, and a Guaranty, if any, executed by the Guarantor(s); (ii) the

Security Deposit and the first installment of Minimum Annual Rent; and (iii)

copies of policies or certificates of insurance as required under

Article 11 of this Lease. If Tenant occupies the Premises prior to the Commencement

Date, such early occupancy shall be subject to all of the terms and conditions

of this Lease, and Tenant will not interfere with Landlord in the completion of

Landlord’s Work (if any). Landlord will give Tenant access for locks to be

changed upon: (i) Tenant’s acceptance of the Premises,

(ii) Landlord’s receipt of two sets of plans and specifications set forth

in Exhibit “C”, and (iii) Landlord’s receipt of a copy of the

contractor’s insurance certificate. Tenant will pay all expenses associated

with changing the locks.

2.4 OPENING OF PREMISES.

On or before ten (10) days after delivery of possession of the Premises to Tenant, Tenant shall commence the Tenant’s Work specified in Exhibit “C”, diligently and continually proceed to completion, and open for business on or before the Commencement Date specified in Section 1.1(i). In relation to Tenant’s Work, Tenant shall execute the Notice of Commencement as Owner identifying Landlord only as the fee simple titleholder for purposes of permitting. By opening for business, Tenant shall be deemed to have acknowledged that all work (if any) required to be performed by Landlord in connection with the Premises and any and all other obligations to be performed by Landlord on or before the opening of the Premises have been fully performed, and that the Premises are at such time complete and in good, sanitary and satisfactory condition and repair without any obligation on Landlord’s part to make any alterations, upgrades or improvements thereto.

2.5 TENANT’S WORK.

In addition to Tenant’s obligations set forth in Exhibit “C”, it shall be Tenant’s responsibility and obligation to obtain all building, occupancy, use and other governmental permits and/or approvals required in connection with the construction of the Tenant’s Work, a certificate of occupancy for the Premises upon completion thereof and Tenant’s use thereof, including, without limitation, the payment of all utility connection/hookup/meter fees and charges and any development impact fees, transportation uniform mitigation fees and/or school mitigation fees assessed with respect to the Premises and/or Tenant’s use and/or Tenant’s Work as opposed to the Shopping Center. In the event Landlord pays any such fees on Tenant’s behalf, Tenant shall reimburse Landlord for such fees as Additional Rent within ten (10) days of Tenant’s receipt of an invoice therefor from Landlord.

ARTICLE 3. TERM

3.1 TERM OF THIS LEASE.

The Term of this Lease shall commence on the Commencement Date specified in Section 1,1(i) and shall continue for the number of months set forth in Section 1.1 (b).

ARTICLE 4. RENT

4.1 TENANT’S AGREEMENT TO PAY RENT.

Tenant hereby agrees to pay Minimum Annual Rent and Additional Rent. The term “Rent” includes the Minimum Annual Rent and Additional Rent.

4.2 MINIMUM RENT.

The minimum amount of rent Tenant shall pay Landlord for each Lease Year is the amount set forth in Section 1.1(g) (the “Minimum Annual Rent”). Minimum Annual Rent for the period from the Commencement Date to the first day of the month following such date shall be prorated on a daily basis and shall be payable with and in addition to the first installment of Minimum Annual Rent.

The Minimum Annual Rent for each Lease Year shall be payable in twelve (12) equal monthly installments, in advance, on the first day of each calendar month. The first installment of Rent shall be due on Tenant’s execution and delivery of this Lease to Landlord.

4.3 LEASE YEAR DEFINED.

The “First Lease Year” means the period beginning on the Commencement Date and ending on the last

|

|

|

REGENCY |

INITIAL |

|

|

|

|

|

|

|

|

/s/ [ILLEGIBLE] |

|

|

|

|

/s/ [ILLEGIBLE] |

day of the twelfth full calendar month thereafter. “Lease Year” means each successive twelve (12) month period after the First Lease Year occurring during the Term.

4.4MONTHLY REPORTING.

Tenant

shall furnish to Landlord within twenty (20) days after the end of each

calendar month during the Term a complete statement, certified by Tenant (or a

responsible officer thereof if Tenant is a corporation or limited liability

company), of the amount of Gross Sales made from the Premises during said

month, the statement to be in such form and style and contain such details and

breakdown as Landlord may require. Tenant shall also furnish to Landlord with

each such monthly statement a copy of any sales tax report filed with any

taxing authority.

4.5GROSS SALES.

(a)”Gross Sales” means the actual prices of all goods, wares, internet

based sales and merchandise sold and-the actual charges for all services

performed by Tenant or by any subtenant, licensee, concessionaire or other

person in, at, from, or arising out of the use of the Premises, whether

wholesale or retail, whether for cash or credit, or otherwise, and includes the

value of all consideration received or promised for any of the foregoing,

without reserve or deduction for inability or failure to collect, including,

but not limited to, sales and services:—(i) where the orders therefor

originate in, at, from or arising out of the use of the Premises, whether

delivery or performance is made from the Premises or from some other place and

regardless of the place of bookkeeping for, payment of, or collection of any

account; or (ii) made or performed by mail; telephone, or telecopy orders

received or filled in, at or from the Premises; or (iii) made or performed

by means of mechanical and other vending devices in the Premises; or

(iv) which Tenant, or any subtenant, licensee, concessionaire or other

person, in the normal and customary course of its business, would credit or

attribute to its operation at the Premises or any part thereof. Any deposit

not-refunded shall be included in Gross Sales in the month in which such

deposit is received.

(b)The following shall be excluded from Gross Sales: (i) any

exchange of merchandise between stores of Tenant when such exchange is made

solely for the convenient operation of Tenant’s business and not for the

purpose of consummating a sale made in, at or from the Premises; (ii) returns

to shippers or manufacturers; (iii) cash or credit refunds to customers on

transactions previously reported as Gross Sales; (iv) sales of fixtures,

machinery and equipment, which are not stock in trade, after use thereof in the

conduct of Tenant’s business; and (v) amounts which are separately stated

and collected from customers and which are paid by Tenant to any government for

any sales or excise tax. No franchise, capital stock tax, tax based upon assets

or net worth or gross receipts tax, and no income or similar tax based on

income or profits shall be deducted from Gross Sales.

4.64.4 ADDITIONAL RENT.

Tenant shall pay, as additional rent (herein sometimes collectively called “Additional Rent”), all sums of money or charges of whatsoever nature (except Minimum Annual Rent and Percentage Rent, if any) required to be paid by Tenant to Landlord pursuant to this Lease, whether or not the same is designated as “Additional Rent.”

4.74.5 WHERE RENT PAYABLE AND TO WHOM;

NO DEDUCTION; LATE CHARGE.

All

Rent payable by Tenant under this Lease shall be paid to Landlord on or before

the first fifth (5th) day of each

month without prior notice or demand therefor (except where such prior demand

is expressly provided for in this Lease), without any deductions, set offs or

counterclaims whatsoever, at the place to which notices are to be sent to

Landlord or to such payee and at such place as may be designated by Landlord.

If any payment of Rent or other charges due hereunder is not received by

Landlord in good funds on its due date, Tenant will pay to Landlord a late

charge of five percent (5%) of the amount due.

ARTICLE 5. TAXES AND ASSESSMENTS

5.1 TENANT’S PROPORTIONATE SHARE OF TAXES AND PAYMENT.

Tenant shall pay to Landlord, as Additional Rent, Tenant’s Proportionate Share of all real estate taxes, current and future, and other ad valorem taxes and assessments of every kind and Tenant’s Proportionate Share of any reasonable costs and expenses (such as real estate tax consultant fees) that are incurred by Landlord in a good faith effort to reduce the amount assessed by the taxing authority (“Taxes”). In the event any assessments may be paid in annual installments, only the amount of such annual installment and statutory interest shall be included within the computation of the annual Taxes for the Lease Year in question. Tenant shall pay its Proportionate Share of Taxes at the times and in the manner provided in Section 8.6.

5.2 RENT TAX.

Should any governmental taxing authority acting under any present or future law, ordinance or regulation levy, assess or impose a tax, excise or assessment (other than an income or franchise tax) upon or against or measured by the Rent, or any part of it, Tenant shall pay such tax, excise and/or assessment when due or shall on demand reimburse Landlord for the amount thereof, as the case may be.

5.3 PERSONAL PROPERTY TAXES.

Tenant shall be liable for, and shall pay before delinquency, all taxes and assessments (real and personal) levied against (a) any personal property or trade fixtures placed by Tenant in or about the

|

|

|

REGENCY |

INITIAL |

|

|

|

|

|

|

|

|

/s/ [ILLEGIBLE] |

|

|

|

|

/s/ [ILLEGIBLE] |

Premises (including any increase in the assessed value of the Premises based upon the value of any such personal property or trade fixtures), and (b) any Tenant improvements or alterations in the Premises (whether installed and/or paid for by Landlord or Tenant). If any such taxes or assessments are levied against Landlord or Landlord’s property, Landlord may, after written notice to Tenant (and under proper protest if requested by Tenant), pay such taxes and assessments, and Tenant shall reimburse Landlord therefor within ten (10) days after demand by Landlord; provided, however, Tenant, at its sole cost and expense, shall have the right, with Landlord’s cooperation, to bring suit in any court of competent jurisdiction to recover the amount of any such taxes and assessments so paid under protest.

ARTICLE 6. TENANT’S CONDUCT OF BUSINESS

6.1 HOURS.

Tenant

agrees that, from and after the Commencement Date, Tenant will continuously and

uninterruptedly keep open and operate its entire store for no less than forty (40) hours per week in the Premises

for the purpose specified in Section 1,1(j) and under the trade name

specified in Section 1.1(a) with the public daily during such hours as are

customary in the Shopping Center. However, if Tenant is unable to comply with

the provisions of this Section by reason of national holidays, strikes,

act of God, destruction of the Premises by fire, or any other reason or cause

beyond Tenant’s control. Tenant shall not be deemed to be in default under this

Lease. Tenant shall be allowed access to the Premises twenty-four (24) hours

each day.

ARTICLE 7. USE OF PREMISES

7.1 SOLE USE AND TRADE NAME.

Tenant shall use the Premises for the purpose specified in Section 1.1(j) and for no other purpose whatsoever and shall conduct its business in the Premises solely under the trade name specified in Section 1.1(a). Nothing in this Lease shall be construed to grant Tenant an exclusive right to the purpose specified in Section 1.1(j) or any other purpose or use. Tenant shall procure, at Tenant’s sole expense, any permits or licenses required for the transaction of business in the Premises.

7.2 REQUIREMENTS AND RESTRICTIONS.

Tenant agrees to comply with the Requirements and Restrictions set forth on Exhibit “E” attached hereto.

ARTICLE 8. COMMON AREAS

8.1 MAINTENANCE.

Landlord agrees to maintain, as part of Common Area Costs, the Common Areas including the roof in good condition; provided, however, that the manner in which the Common Areas shall be maintained shall be solely determined by Landlord. If any owner or tenant of any portion of the Shopping Center maintains Common Areas located upon its parcel or premises (Landlord shall have the right, in its sole discretion, to allow any purchaser or tenant to so maintain Common Areas located upon its parcel or premises and to be excluded from participation in the payment of Common Area Costs), Landlord shall not have any responsibility for the maintenance of that portion of the Common Areas and Tenant shall have no claims against Landlord arising out of any failure of such owner or tenant to so maintain its portion of the Common Areas.

8.2 COMMON AREAS DEFINED.

“Common Areas” means all areas, facilities, and improvements provided in the Shopping Center for the convenience and use of patrons of the Shopping Center, and shall include, but not be limited to, all areas, all parking areas and facilities, sidewalks, stairways, service corridors, truckways, ramps, loading docks, delivery areas, landscaped areas, access and interior roads, lighting facilities and similar areas and facilities situated within the Shopping Center which are not reserved for the exclusive use of any Shopping Center occupants.

8.3 LANDLORD’S CONTROL.

Landlord shall at all times have the sole and exclusive control, management and direction of the Common Areas and the right to make reasonable changes to the Common Areas, and may at any time exclude and restrain any person from use or occupancy thereof. The rights of Tenant in and to the Common Areas are subject to the rights of others to use the same in common with Tenant. Landlord may at any time and from time to time close all or any portion of the Common Areas to make repairs, improvements, alterations or changes and, to the extent necessary in the opinion of Landlord, to prevent a dedication thereof or the accrual of any rights to any person or to the public therein.

8.4 EMPLOYEE PARKING.

Landlord may from time to time designate a particular parking area or areas to be used by its tenants and their employees. If Tenant or any of its employees fail to park their vehicle in any such designated parking areas, Landlord, in its sole discretion, may give Tenant notice of such violation and, if the violation is not corrected within two (2) days after said notice is given, Tenant shall pay to Landlord an amount equal to Ten Dollars ($10.00) per day for each violating vehicle calculated from and including the day on which notice was given, to and including the day when all violations by Tenant and its employees cease. In no event, however, shall Landlord be required to enforce any parking obligation stated herein.

|

|

|

REGENCY |

INITIAL |

|

|

|

|

|

|

|

|

/s/ [ILLEGIBLE] |

|

|

|

|

/s/ [ILLEGIBLE] |

8.5 COMMON AREA COSTS.

“Common Area Costs” means all costs incurred in a manner deemed by Landlord to be reasonable and appropriate and for the best interests of the Shopping Center in connection with the management, operation, maintenance, replacement and repair of the Common Areas, including but not limited to security, landscaping, utilities, painting, striping, lighting, management fee of four percent (4%) of gross revenues and pest control among other items.

8.6 TENANT’S PROPORTIONATE SHARE OF COMMON AREA COSTS, TAXES AND INSURANCE.

Tenant agrees to pay to Landlord, as Additional Rent, Tenant’s Proportionate Share of Common Area Costs, Taxes and Insurance (as hereinafter defined) in the following manner:

(a) Tenant shall pay Landlord on the Commencement Date and on the first day of each calendar month of the Term thereafter an amount estimated by Landlord to be Tenant’s monthly Proportionate Share of the Common Area Costs, Taxes and Insurance. Landlord may adjust said amount at the end of any calendar month on the basis of Landlord’s experience and reasonably anticipated costs.

(b) Within ninety (90) days following the end of each calendar year, or as soon as reasonably possible thereafter, Landlord shall endeavor to furnish Tenant a statement covering such year just ended, showing the Common Area Costs, Taxes and Insurance and the amount of Tenant’s Proportionate Share of such costs for such year and the payments made by Tenant with respect to such year. If Tenant’s Proportionate Share of such costs is less than Tenant’s payments so made, Tenant shall be entitled to a credit of the difference or, if such share is greater than Tenant’s said payments, Tenant shall pay Landlord the difference within thirty (30) days after receipt of such statement.

(c) Any failure or delay by Landlord in delivering any estimated or final statement pursuant to this Section 8.6 shall not constitute a waiver of Landlord’s right to receive Tenant’s payment of Tenant’s Proportionate Share of Common Area Costs, Taxes and Insurance.

ARTICLE 9. HAZARDOUS SUBSTANCES

9.1 RESTRICTION ON USE.

Tenant shall not use or permit the use of the Premises for the generation, storage, treatment, use, transportation, handling or disposal of any chemical, material or substance which is regulated as toxic or hazardous or exposure to which is prohibited, limited or regulated by any governmental authority, or which, even if not so regulated, may or could pose a hazard to the Premises, Shopping Center or property adjacent thereto or to the health or safety of persons on the Premises or other tenants or occupants of the Shopping Center or property adjacent thereto, and no such chemical, material or substance shall be brought onto the Premises without the Landlord’s express written approval. Tenant agrees that it will at all times observe and abide by all laws and regulations relating to the handling of such materials and will promptly notify Landlord of (a) the receipt of any warning notice, notice of violation, or complaint received from any governmental agency or third party relating to environmental compliance, and (b) any release of hazardous materials on the Premises and/or Shopping Center. In addition, Tenant shall immediately notify Landlord concerning any water intrusion or leakage in the Premises. Tenant shall provide Landlord with immediate access to the Premises in order to assess the damage. Repairs to the Premises shall be made by the party responsible. Should Tenant be responsible for the repairs and fail to correct immediately, Landlord shall make the repairs at Tenant’s expense. Tenant shall, in accordance with applicable laws, carry out, at its sole cost and expense, any remediation required as a result of the release of any hazardous substance by Tenant or by Tenant’s agents, employees, contractors or invitees, from the Premises and/or Shopping Center. Notwithstanding the foregoing, Tenant shall have the right to bring on to the Premises reasonable amounts of cleaning materials and the like necessary for the operation of Tenant’s business, but Tenant’s liability with respect to such materials shall be as set forth in this Article. The term “Hazardous Material” includes, without limitation (i) those substances included within the definitions of “hazardous substances”, “hazardous materials”, “toxic substances” or “solid waste” under all present and future federal, state and local laws (whether under common law, statute, rule, regulation or otherwise) relating to the protection of human health or the environment, including, without limitation, California Senate Xxxx 245 (Statutes of 1987, chapter 1302), the Safe Drinking Water and Toxic Enforcement Act of 1986 (commonly known as Proposition 65) and the Comprehensive Environmental Response, Compensation and Liability Act of 1980 and the Hazardous Materials Transportation Act, 49 U.S.C. Sections 1801. et seq., all as heretofore and hereafter amended, or in any regulations promulgated pursuant to said laws; (ii) those substances defined as “Hazardous Wastes” in Section 25117 of the California Health & Safety Code or as “Hazardous Substances” in Section 25316 of the California Health & Safety Code, or in any regulations promulgated pursuant to said laws; (iii) such other substances, materials and wastes which are or become regulated under applicable local, state or federal law or by the United States government or which are or become classified as hazardous or toxic under federal, state or local laws or regulations, including, without limitation, California Health & Safety Code, Division 20, and Title 26 of the California Code of Regulations; and (iv) any material, waste or substance which contains petroleum, asbestos or polychlorinated bipheyls, designated as a “hazardous substances” pursuant to Section 311 of the Clean Water Act of 1977, 33 U.S.C. Sections 1251, et seq. (33 U.S.C.§1321) or listed pursuant to Section 307 of the Clean Water Act of 1977 (U.S.C.§1317) or contains any flammable, explosive or radioactive material.

|

|

|

REGENCY |

INITIAL |

|

|

|

|

|

|

|

|

/s/ [ILLEGIBLE] |

|

|

|

|

/s/ [ILLEGIBLE] |

9.2 INDEMNIFICATION.

To the fullest extent permitted by law, Tenant agrees to promptly indemnify, protect, defend and hold harmless Landlord and Landlord’s partners, officers, directors, employees, agents, successors and assigns (collectively, “Landlord Parties”) from and against any and all claims, damages, judgments, suits, causes of action, losses, liabilities, penalties, fines, expenses and costs (including, without limitation, clean-up, removal, remediation and restoration costs, sums paid in settlement of claims, attorneys’ fees, consultant fees and expert fees and court costs) which arise or result from any environmental contamination on, in, under or about the Premises, Landlord’s Building or any other portion of the Shopping Center and which are caused or permitted by Tenant or any of Tenant’s agents, employees, subtenants, assignees, licensees, contractors or invitees (collectively, “Tenant Parties”).

9.3 SURVIVAL.

The provisions of this Article shall survive the termination of this Lease.

ARTICLE 10. ALTERATIONS TO PREMISES

10.1 ALTERATIONS; DAMAGES.

Tenant

shall make no structural alterations, additions or changes in or to the

Premises without Landlord’s prior written consent. In no event shall Tenant

make or cause to be made any penetration through any roof, floor or exterior or

corridor wall without the prior written consent of Landlord. Tenant shall be

responsible for any and all damages resulting from any alteration, addition or

change Tenant makes, whether or not Landlord’s consent therefor was obtained.

Any and all alterations, additions and changes made to the Premises which are

consented to by Landlord shall be made under the supervision of a licensed

architect or licensed structural engineer and in accordance with plans and

specifications approved in writing by the Landlord before the commencement of

the work and all necessary governmental approvals and permits, which approvals

and permits Tenant shall obtain at its sole expense. All contractors and

subcontractors utilized by Tenant shall be subject to Landlord’s prior written

approval. Prior to proceeding with any alteration, Tenant shall provide

Landlord with at least fifteen (15) days prior written notice. In the event

that Tenant makes any alterations, Tenant agrees to carry “Builder’s All Risk”

insurance in a customary and reasonable amount approved by Landlord covering

the construction of such alterations. In addition, Landlord may, in its

discretion, require Tenant to obtain a lien and completion bond or some

alternate form of security satisfactory to Landlord in an amount sufficient to ensure

the lien-free completion of such alterations and naming Landlord as a

co-obligee. Upon completion of any alterations, Tenant agrees to cause a Notice

of Completion to be recorded in the office of the Recorder of the county in

which the Shopping Center is located in accordance with Section 3093 of

the Civil Code of the State of California or any successor statute, and Tenant

shall deliver to the Shopping Center management office a reproducible copy of

the “as built” drawings of the alterations. All work with respect to any

alterations, additions and changes must be done in a good and workmanlike

manner and diligently prosecuted to completion to the end that the Premises

shall at all times be a complete unit except during the period of the work.

Subject to the terms hereof, any work done by Tenant without Landlord’s consent

shall be returned to its original condition at Tenant’s expense upon request by

Landlord. Tenant shall pay to Landlord, as Additional Rent, the reasonable

costs of Landlord’s engineers and other consultants for review of all plans,

specifications and working drawings for Tenant’s alterations, within ten

(10) business days after Tenant’s receipt of invoices either from Landlord

or such consultants. In addition to such costs, Tenant shall pay to

Landlord, within ten (10) twenty

(20) business days after completion of any alterations, the actual,

reasonable costs incurred by Landlord for services rendered by Landlord’s

management personnel and engineers to coordinate and/or supervise any of the

alterations to the extent such services are provided in excess of or after the

normal on-site hours of such engineers and management personnel, and such amount shall not exceed Two Thousand

Five Hundred Dollars ($2,500,00).

10.2 COMPLIANCE WITH LAWS.

Any permitted changes, alterations and additions made by Tenant shall be performed strictly in accordance with applicable laws, rules, regulations and building codes relating thereto including, without limitation, the provisions of Title III of the Americans with Disabilities Act of 1990. Tenant shall have the work performed (i) in such a manner so as not to obstruct the access to the Premises or to the premises of any other tenant or obstruct the Common Areas, (ii) so as not to interfere with the occupancy of any other tenant of the Shopping Center, and (iii) at such times, in such manner and subject to such rules and regulations as Landlord may from time to time reasonably designate. Throughout the performance of Tenant’s alterations, Tenant shall obtain, or cause its contractors to obtain, workers compensation insurance and commercial general liability insurance in form and substance satisfactory to Landlord and naming Landlord an additional insured thereunder.

10.3 INSURANCE AND RECONSTRUCTION.

In the event Tenant shall make any alterations, additions or changes to the Premises, none of such alterations, additions or changes need be insured by Landlord under such insurance as Landlord may carry upon the Landlord’s Building, nor shall Landlord be required under any provisions of this Lease to reconstruct or reinstall any such alterations, additions or changes in the event of casualty loss, it being understood and agreed that all such alterations, additions or changes shall be insured by Tenant pursuant to Article 11 and reconstructed by Tenant (at Tenant’s sole expense) in the event of a casualty loss pursuant to Article 12.

|

|

|

REGENCY |

INITIAL |

|

|

|

|

|

|

|

|

/s/ [ILLEGIBLE] |

|

|

|

|

/s/ [ILLEGIBLE] |

ARTICLE 11. LIABILITY, INDEMNITY AND INSURANCE

11.1 LANDLORD’S LIABILITY.

Landlord shall not be liable for any damage or liability of any kind or for any injury to or death of any persons or damage to any property on or about the Premises from any cause whatsoever, except to the extent any such matter is not covered by insurance required to be maintained by Tenant under this Lease and is attributable to Landlord’s gross negligence or willful misconduct.

11.2 INDEMNIFICATION BY TENANT.

Tenant hereby agrees to indemnify and save Landlord harmless from all claims, actions, judgments, suits, losses, fines, penalties, demands, costs and expenses and liability whatsoever, including reasonable attorneys’ fees, expert fees and court costs (“Indemnified Claims”) on account of (i) any damage or liability occasioned in whole or in part by any use or occupancy of the Premises or by any act or omission of Tenant or the Tenant Parties, (ii) the use of the Premises and Common Areas and conduct of Tenant’s business by Tenant or any Tenant Parties, or any other activity, work or thing done, permitted or suffered by Tenant or any Tenant Parties, in or about the Premises, Landlord’s Building or elsewhere on the Shopping Center; and/or (iii) any default by Tenant of any obligations on Tenant’s part to be performed under the terms of this Lease. In case any action or proceeding is brought against Landlord or any Landlord Parties by reason of any such Indemnified Claims, Tenant, upon notice from Landlord, shall defend the same at Tenant’s expense by counsel approved in writing by Landlord, which approval shall not be unreasonably withheld. Tenant shall not be liable for damage or injury occasioned by the gross negligence or willful acts of Landlord or its agents, contractors, servants or employees unless such damage or injury arises from perils against which Tenant is required by this Lease to insure and then only to the extent of such insurance. Tenant’s indemnification obligation under this Section 11.2 shall survive the expiration or earlier termination of this Lease. Tenant’s covenants, agreements and indemnification in Sections 11.1, 11.2 and 11.7, are not intended to and shall not relieve any insurance carrier of its obligations under policies required to be carried by Tenant pursuant to the provisions of this Lease.

11.3 INSURED’S WAIVER.

In the event of loss or damage to the property of Landlord or Tenant, each party will look first to its own insurance before making any claim against the other. To the extent possible, each party shall obtain, for all policies of insurance required by this Lease, provisions permitting waiver of subrogation against the other party, and each party, for itself and its insurers, hereby waives the right to make any claim against the other (or its agents, employees or insurers) for loss or damage covered by the insurance requirements of this Lease.

11.4 TENANT’S INSURANCE.

(a) Tenant agrees that, from and after the date of delivery of the Premises to Tenant, Tenant will carry at its sole cost and expense the following types of insurance, in the amounts specified and in the form hereinafter provided for:

1. Public Liability and Property Damage Insurance covering the Premises and Tenant’s use thereof against claims for personal injury or death and property damage occurring upon, in or about the Premises, such insurance to afford protection to the limit of not less than $1,000,000.00 in respect of injury or death of any number of persons arising out of any one occurrence and such insurance against property damage to afford protection to the limit of not less than $500,000.00 in respect to any instance of property damage. The insurance coverage required under this Section 11.4(a)1 shall, in addition, extend to any liability of Tenant arising out of the indemnities provided for in Section 11.2; and

2. Tenant Improvements and Property Insurance covering all of the items included in Tenant’s Work, Tenant’s leasehold improvements including those constructed as part of Tenant’s Work and Landlord’s Work (if any), heating, ventilating and air conditioning equipment, trade fixtures, signage and personal property from time to time in, on or upon the Premises and, to the extent not covered by Landlord’s similar insurance, alterations, additions or changes made by Tenant pursuant to Article 10, in an amount not less than their full replacement cost, providing protection against perils included within standard forms of all risk coverage insurance policy, together with such other coverage the Landlord deems appropriate (i.e. flood and/or earthquake). Any policy proceeds from such insurance shall be held in trust by Tenant for the repair, reconstruction, restoration or replacement of the property damaged or destroyed, unless this Lease shall cease and terminate under the provisions of Article 12.

(b) All policies of insurance provided for in Section 11.4(a) shall be issued in form acceptable to Landlord by sound and reputable insurance companies with general policyholder’s rating of not less than A and a financial rating of Class VI as rated in the most currently available “Best’s Insurance Reports” and qualified to do business in the state in which the Premises is located. Each such policy shall be issued in the names of Landlord and Tenant and any other parties in interest from time to time designated in writing by notice by Landlord to Tenant. Said policies shall be for the mutual and joint benefit and protection of Landlord and Tenant and executed copies of each such policy of insurance or a certificate thereof shall be delivered to Landlord upon delivery of possession of the Premises to Tenant and thereafter within thirty (30) days prior to the expiration of each such policy. As often as any such policy shall expire or terminate, renewal or additional policies shall be procured and maintained by Tenant in like manner and to like extent. All such policies of insurance shall contain a provision that the company writing said policy will give Landlord at least thirty (30) days’ notice in writing in advance of any cancellation, or lapse, or the effective date of any reduction in the amounts, or insurance. All such public liability, property damage and other casualty policies shall be written as primary policies which do not

|

|

|

REGENCY |

INITIAL |

|

|

|

|

|

|

|

|

/s/ [ILLEGIBLE] |

|

|

|

|

/s/ [ILLEGIBLE] |

contribute to any policies which may be carried by Landlord. All such public liability and property damage policies shall contain a provision that Landlord, although named as an insured, shall nevertheless be entitled to recover under said policies for any loss occasioned to it, its servants, agents and employees by reason of the negligence of Tenant. Any insurance provided for in Section 11.4(a) may be effected by a policy of blanket insurance, covering additional items or locations or insureds; provided, however, that (i) Landlord shall be named as an additional insured thereunder as its interest may appear; (ii) the coverage afforded Landlord will not be reduced or diminished by reason of the use of such blanket policy of insurance; (iii) any such policy or policies (except any covering the risks referred to in Section 11.4(a)(1) shall specify therein (or Tenant shall furnish Landlord with a written statement from the insurers under such policy specifying) the amount of the total insurance allocated to the “Tenant Improvements and Property” more specifically detailed in Section 11.4(a)(2); and (iv) the requirements set forth herein are otherwise satisfied. Tenant agrees to permit Landlord at all reasonable times to inspect the policies of insurance of Tenant covering risks upon the Premises for which policies or copies thereof are not delivered to Landlord.

11.5 LANDLORD’S INSURANCE.

(a) Landlord shall, as part of the Common Area Costs, at all times during the Term maintain in effect a policy or policies of insurance covering the Landlord’s Building and the Common Areas (excluding Tenant improvements and property required to be insured by Tenant pursuant to Section 11.4(a)) in an amount not less than the full replacement cost (exclusive of the cost of excavations, foundations and footings), providing protection against perils included within standard forms of fire and extended coverage insurance policies, together with insurance against sprinkler damage, vandalism, and malicious mischief, and such other risks as Landlord may from time to time determine and with any such deductibles as Landlord may from time to time determine and public liability insurance in such amounts as Landlord deems to be reasonable. Any insurance provided for in Sections 11.5(a) or (b) may be effected by a policy or policies of blanket insurance, covering additional items or locations or insureds, provided that the requirements of Section 11.5(a) are otherwise satisfied. In addition, at Landlord’s option, Landlord may elect to self-insure all or any part of such required insurance coverage. Landlord may, but shall not be obligated to, carry any other form or forms of insurance as Landlord or the mortgagees or ground lessors of Landlord may reasonably determine is advisable. All insurance required hereunder may be referred to as “Insurance”.

(b) Landlord may carry rent insurance with respect to the Premises in an aggregate amount equal to eighteen (18) or more times the sum of (i) the monthly requirement of Minimum Annual Rent, plus (ii) the sum of the amounts estimated by Landlord to be payable by Tenant for Additional Rent and Percentage Rent for the month immediately prior to the month in which the policy is purchased or renewed.

(c) Tenant agrees to pay Tenant’s Proportionate Share of premiums for the Insurance provided pursuant to Section 8.6 of this Lease. Tenant shall have no rights in any Insurance maintained by Landlord nor shall Tenant be entitled to be a named insured thereunder.

11.6 COMPLIANCE WITH INSURANCE AND GOVERNMENTAL REQUIREMENTS.

Tenant agrees at its sole cost and expense, to comply with all reasonable recommendations and requirements with respect to the Premises, or its use or occupancy, of the insurance underwriters and any similar public or private body, and any governmental authority having jurisdiction over insurance rates with respect to the use or occupancy of the Shopping Center. Tenant shall not do or suffer to be done anything upon or in the Premises which will contravene Landlord’s policies of insurance or cause an increase in Landlord’s insurance rates.

11.7 LIMIT OF LANDLORD’S RESPONSIBILITY.

Except to the extent such matter is not covered by the insurance required to be maintained by Tenant under this Lease and is attributable to the gross negligence or willful misconduct of Landlord, Landlord shall not, without limiting the generality of Section 11.1 hereof, be responsible or liable to Tenant or the Tenant Parties for any loss or damage that may be occasioned by or through the acts or omissions of persons occupying space in any other part of the Shopping Center, or for any loss or damage resulting to the Tenant or its property from bursting, stoppage or leaking of water, gas, sewer or steam pipes or for any damage caused by water leakage from any part of the Premises or from the pipes, appliances or plumbing works or from the roof, street or subsurface or from any other places or by dampness or by any other cause of whatsoever nature, or loss of property within the Premises from any cause whatsoever or any damage caused by other tenants or persons in the Premises, occupants of adjacent property of the Shopping Center, or the public, or caused by construction of any private, public or quasi-public work.

ARTICLE 12. DESTRUCTION

12.1 DESTRUCTION.

Subject to the provisions of 12.2, 12.3 and 12.4 below, if the Premises shall be damaged or destroyed by any casualty, Landlord shall promptly restore same to their condition immediately prior to the occurrence of the damage to the extent of insurance proceeds received, and the Minimum Rent and other charges shall be abated proportionately as to that part of the Premises rendered untenantable.

|

|

|

REGENCY |

INITIAL |

|

|

|

|

|

|

|

|

/s/ [ILLEGIBLE] |

|

|

|

|

/s/ [ILLEGIBLE] |

12.2 LANDLORD’S ELECTION.

If the Premises (i) are rendered wholly untenantable; (ii) are substantially damaged (i.e., the cost to repair or replace exceeds 50% of their value) as a result of a risk which is not covered by Landlord’s insurance; (iii) are substantially damaged during the last year of the term or of any renewal term hereof, regardless of insurance coverage; (iv) or the building of which they are a part (whether the Premises are damaged or not), or all of the buildings which then comprise the Shopping Center, are damaged to the extent of fifty percent (50%) or more of the value thereof, so that the Shopping Center cannot in the reasonable judgment of Landlord be operated as an integral unit; or (v) are damaged and the holder of any mortgage, deed of trust or other lien requires the use of all or any part of Landlord’s insurance proceeds in satisfaction of all or a part of this indebtedness secured by any such mortgage, deed of trust or other lien, then or in any of such events, Landlord may either elect to repair the damage to the extent of insurance proceeds received or may cancel this Lease by notice of cancellation within ninety (90) days after such event (whereupon this Lease shall expire and Tenant shall vacate and surrender the Premises to Landlord). Tenant’s liability for rent, subject to the provisions regarding abatement of minimum rent contained above, shall continue until the date of termination of this Lease.

12.3 TENANT’S RIGHT TO TERMINATE.

This Lease sets forth the terms and conditions upon which this Lease may be terminated in the event of any damage or destruction. Accordingly, Tenant hereby waives any right to terminate the Lease by reason of damage or casualty loss, including without limitation the provision of California Civil Code Section 1932(2) and 1933(4) and any present or future laws or case decisions to the same effect unless otherwise provided in this Section. If Landlord fails to commence the restoration within two hundred ninety (290) days after the casualty and such delay is not caused by Tenant (or any Tenant Parties) or any events described in Section 25.6, Tenant shall have the right to terminate this Lease by notice to Landlord given prior to Landlord’s commencement of construction. In addition, Tenant shall have the right to terminate this Lease by giving written notice to Landlord of exercise thereof within one hundred twenty (120) days after the date Landlord’s Building is damaged or destroyed if:

(a) no part of the Premises remains tenantable after damage or destruction thereof from any cause; or,

(b) the damage or destruction of the Landlord’s Building occurs within the last twelve (12) months of the Term.

12.4 REPAIR. ETC.

In the event Landlord elects to repair the damage, any abatement of rent shall end the earlier of (i) sixty (60) days after notice by Landlord to Tenant that the Premises have been repaired or (ii) the date Tenant reopens the damaged Premises for business. Unless this Lease is terminated by Landlord, Tenant shall refixture the Premises in a manner and to a condition equal to that existing prior to its destruction or casualty, and the proceeds of all insurance carried by Tenant on its property and improvements shall be held in trust by Tenant for the purpose of said repair and replacement.

ARTICLE 13. MAINTENANCE OF PREMISES

13.1 LANDLORD’S DUTY TO MAINTAIN.

Landlord will, as part of the Common Area Costs, keep the exterior walls, structural columns and structural floor or floors (excluding outer floor and floor coverings, walls installed at the request of Tenant, doors, windows and glass) in good repair. Notwithstanding the foregoing provisions of this Section, Landlord shall not in any way be liable to Tenant on account of its failure to make repairs unless Tenant shall have given Landlord written notice of the necessity for such repairs and has afforded Landlord a reasonable opportunity to effect the same after such notice and provided that any damage arising therefrom shall not have been caused by the negligence or willful act or omission of Tenant or Tenant Parties (in which event Tenant shall be responsible therefor) or have been caused to any of the items Tenant is required to insure pursuant to Article 11. Without limiting the foregoing, Tenant waives the right to make repairs at Landlord’s expense under any law, statute or ordinance now or hereafter in effect (including the provisions of California Civil Code Section 1942 and any successor sections or statutes of similar nature).

13.2 TENANT’S DUTY TO MAINTAIN.

Tenant will, at its own cost and expense, maintain the Premises (except that part Landlord has agreed to maintain) in good and tenantable condition, and make all repairs to the Premises and every part thereof as needed. Tenant’s obligations under this Section shall include, but not be limited to, modifying, repairing, replacing and maintaining items as are required by any governmental agency having jurisdiction thereof (whether the same is ordinary or extraordinary, foreseen or unforeseen), interior walls and glass, and the interior portions of exterior walls, ceilings, utility meters, pipes and conduits within the Premises, and all utility meters, and all pipes and conduits outside the Premises between the Premises and the service meter, all fixtures, HVAC equipment (whether such HVAC equipment is located inside or outside the Premises) in compliance with all Laws including environmental, sprinkler equipment and other equipment within the Premises, the store fronts and all exterior glass, all of Tenant’s signs, locks and closing devices, and all window sashes, casement or frames, doors and door frames; provided that Tenant shall make no adjustment, alteration or repair of any part of any sprinkler or sprinkler alarm system in or serving the Premises without Landlord’s prior approval. Tenant shall contract with a service company approved by Landlord for the preventive maintenance of the HVAC and a copy of the service

|

|

|

REGENCY |

INITIAL |

|

|

|

|

|

|

|

|

/s/ [ILLEGIBLE] |

|

|

|

|

/s/ [ILLEGIBLE] |

contract (which contract shall be subject to Landlord’s approval) shall be furnished by Tenant to Landlord within ten (10) days after Tenant’s opening for business, and a copy of any subsequent contract shall be furnished by Tenant to Landlord within ten (10) days after the same becomes effective. Such service contract must provide for at least four (4) visits, inspections and services each year and the regular changing of filters. All broken glass, both exterior and interior, shall be promptly replaced by Tenant with glass of the same kind, size and quality. Tenant shall permit no waste, damage or injury to the Premises and Tenant shall initiate and carry out a program of regular maintenance and repair of the Premises, including the painting or refinishing of all areas of the interior and the store front, so as to impede, to the extent possible, deterioration by ordinary wear and tear and to keep the same in attractive condition. Tenant will not overload the electrical wiring serving the Premises and will install, at its expense, with Landlord’s written approval, any additional electrical wiring required in connection with Tenant’s apparatus. Landlord shall be under no obligation to make any repairs, replacements, reconstruction, alterations, or improvements to or upon the Premises or the mechanical equipment exclusively serving the Premises except as expressly provided for herein.

13.3 LANDLORD’S RIGHT OF ENTRY AND USE.

Upon at least twenty-four (24) hours prior verbal or written notice to Tenant (except in an emergency in which event no notice shall be required), Landlord and/or its agents, representatives, and contractors shall have the right to enter into or upon any part of the Premises at any reasonable time (except in an emergency in which event entry may be at any time) to inspect the condition, occupancy or use thereof and to maintain, make repairs and/or perform other work or improvements to the Premises and/or the Shopping Center or any part or component thereof including without limitation any spaces adjacent to or adjoining the Premises. Upon at least twenty-four (24) hours prior verbal or written notice to Tenant, Landlord and Landlord’s representatives may enter the Premises during business hours for the purpose of showing the Premises to purchasers, mortgagees or insurers of all or a portion of the Shopping Center or, during the last year of the Term of this Lease, to prospective tenants of the Premises. During the last year of the Term of this Lease, Landlord may erect a suitable sign on the Premises stating the Premises are available to let. Landlord has the right to lock any tenant space that has begun construction without Landlord’s authority or approval.

13.4 CONFLICTS.

If there is a conflict between the provisions of this Article 13 and Article 12, the provisions of Article 12 shall govern.

ARTICLE 14. UTILITIES AND GARBAGE DISPOSAL

14.1 GAS, GARBAGE DISPOSAL, WATER, SANITARY SEWER, TELEPHONE AND ELECTRIC SERVICE.

In addition to Tenant’s obligations under Section 2.5 of this Lease, Tenant shall pay for all utilities and sanitary services used within the Premises and make such deposits or pay such permits required by the utility or sanitary service company providing the same, including but not limited to: application and installation of temporary and permanent meters for the Premises. Landlord shall not be liable for any interruption or failure whatsoever in utility services, nor shall any such failure or interruption constitute an actual or constructive eviction of Tenant from the Premises or result in or give rise to any abatement in any Rent reserved hereunder. Upon written request from Landlord, Tenant will, at Tenant’s expense, contract with the service company designated by Landlord for the disposal of all trash and garbage from the Premises. Tenant will furnish to Landlord a copy of such contract prior to opening for business, and a copy of each renewal of such contract shall be furnished to Landlord at least seven (7) days prior to the expiration of the existing contract. Landlord shall have the right to designate vendors to provide utility services and garbage collection services to the Premises, provided that the cost of such service is generally competitive in the vicinity of the Shopping Center. Subject to the preceding sentence, if Landlord now or in the future has a master contract for waste removal and garbage collection services, then at Landlord’s election: (i) Tenant shall be billed directly by the service provider, and (ii) Tenant shall pay all charges attributable to the Premises pursuant to such contract directly to the service provider. Should Landlord provide utilities to the Shopping Center, Tenant shall pay its proportionate share for the use of the utilities in the manner described in Section 8.6 hereof.

ARTICLE 15. LIENS

15.1 NO LIENS PERMITTED; DISCHARGE.

Landlord’s

property shall not be subject to liens for work done or materials used on the

Premises made at the request of, or on order of or to discharge an obligation

of, Tenant. This paragraph shall be construed so as to prohibit, in accordance

with the provisions of State law, the interest of Landlord in the Premises or

any part thereof from being subject to any lien for any improvements made by

Tenant or any third party on Tenant’s behalf (except Landlord) to the Premises.

If any lien or notice of lien on account of an alleged debt of Tenant or any

notice of lien by a party engaged by Tenant or Tenant’s contractor or

materialmen to work on the Premises shall be filed against the Shopping Center

or any part thereof, Tenant, within ten (10) forty-five (45) days after notice of the filing thereof, will cause

the same to be discharged of record by payment, deposit, bond, order of a court

of competent jurisdiction or otherwise. If Tenant shall fail to cause such lien

or notice of lien to be discharged and released of record within the period

aforesaid, then, in addition to any other right or remedy, Landlord may

discharge the same either by paying the amounts claimed to be due or by

procuring the discharge of such lien by deposit or by bonding procedures. Any

amount so paid by Landlord and all costs and expenses, including attorneys’

fees and court costs, incurred by Landlord in connection therewith, and

including interest at the Default

|

|

|

REGENCY |

INITIAL |

|

|

|

|

|

|

|

|

/s/ [ILLEGIBLE] |

|

|

|

|

/s/ [ILLEGIBLE] |

Rate, shall constitute Additional Rent and shall be paid by Tenant to Landlord on demand, or be deducted from Tenant Allowance or Construction Allowance monies owed to Tenant by Landlord, if any.

ARTICLE 16. SIGNAGE

Tenant shall at its own expense erect a sign on the exterior sign band of the Premises, which sign shall: (i) conform to the general material, size and appearance of other tenants’ signs at the Shopping Center, (ii) be in strict conformity with any guidelines or sign criteria adopted by Landlord with respect to the Shopping Center, including, without limitation, the sign criteria set forth in Exhibit “C-1” attached hereto and made a part hereof, (iii) be in accordance with all applicable laws, (iv) be installed by a contractor or other party which meets with Landlord’s prior approval, and (v) be otherwise subject to Landlord’s prior written approval. Landlord will not be liable to Tenant or any Tenant’s contractor or city requirements pertaining to signage. If at any time during the Term, Landlord determines to replace the sign above the exterior of the Premises in connection with a general renovation of the Shopping Center or otherwise, then Tenant shall pay (or reimburse to Landlord, as the case may be) the cost of replacing such sign.

Landlord has constructed or will construct a pylon sign or signs at the Shopping Center (hereinafter each of said pylon signs is individually referred to as the “Pylon” and collectively referred to as “The Pylons”). Tenant desires to place a sign (“Tenant’s Sign”) on both sides of the Pylon or each of the Pylons and participate in the pylon sign program at the Shopping Center pursuant to the following terms:

1. Tenant shall contract with Tenant’s sign company for the design, in accordance with the sign criteria set forth in Exhibit “C-1” attached hereto and made a part hereof, and installation of Tenant’s Sign to be installed on the Pylons either: (a) in the location shown on Exhibit “G-1” attached hereto and made a part hereof, or (b) in a location to be designated by Landlord. Prior to the manufacture and installation of Tenant’s Sign, shop drawings prepared at Tenant’s expense shall be delivered to Landlord for Landlord’s prior written approval. All design, installation, relocation and/or removal costs of Tenant’s sign shall be borne solely by Tenant.

2. Tenant’s participation in the Pylon program shall commence on the Commencement Date and shall continue for the term of the Lease, including any extensions, renewals or options thereof, unless terminated by Landlord as set forth below.

3. Tenant shall pay Landlord, as a monthly Pylon sign fee for each Pylon, a sum of Fifty Dollars and No Cents ($50.00) due and payable on the first day of each month, which amount shall be subject to annual increases set by Landlord in its sole discretion and subject to applicable State sales tax (if any). Said amount shall also be and become Additional Rent.

4. Tenant shall indemnify and hold Landlord harmless from and against any and all claims and demands whether for injuries to persons or loss of life, or damage to property, occurring in connection with Tenant’s Sign.

5. Landlord hereby reserves the right to remove and/or

relocate the Pylons, Tenant’s Sign or any other individual panels at any time.

ARTICLE 17. ASSIGNMENT AND SUBLETTING

17.1 RESTRICTIONS ON ASSIGNMENT.

Tenant will not assign this Lease in whole or in part, nor sublet all or any part of the Premises or enter into any license or concession agreements (collectively or individually, a “Transfer”), without the prior written consent of Landlord, which consent Landlord will not unreasonably withhold. In no event may Tenant encumber or hypothecate this Lease. The consent by Landlord to any Transfer shall not constitute a waiver of the necessity for such consent to any subsequent Transfer. This prohibition against Transfers shall be construed to include a prohibition against any assignment or subletting by operation of law. Any attempted transfer, assignment, subletting, license or concession agreement, or hypothecation shall be void and confer no rights upon any third person and shall be a violation of this Section. Any transfer of this Lease from Tenant by merger, consolidation, liquidation or otherwise by operation of law, including, but not limited to, an assignment for the benefit of creditors, shall be included in the term “assignment” for the purposes of this Lease and shall be a violation of this Section. If this Lease is transferred by Tenant, or if the Premises or any part thereof are transferred or occupied by any person or entity other than Tenant, Landlord may collect rent from the assignee, subtenant or occupant, and apply the net amount collected to the rent herein reserved, but no such Transfer, occupancy or collection shall be deemed a waiver on the part of Landlord, or the acceptance of the assignee, subtenant or occupant as Tenant, or a release of Tenant from the further performance by Tenant of covenants on the part of Tenant herein contained unless expressly made in writing by Landlord. Irrespective of any Transfer, Tenant shall remain fully liable under this Lease and shall not be released from performing any of the terms, covenants and conditions of this Lease. Without limiting Landlord’s right to withhold its consent on any reasonable grounds, it is agreed that Landlord will not be acting unreasonably in refusing to consent to a Transfer if, in Landlord’s opinion, (i) the quality of the merchandising operation of the proposed assignee or subtenant is not equal to that of the Tenant, (ii) such assignee or subtenant may adversely affect (A) the business of the other tenants, (B) the tenant mix in the Shopping Center, or (C) Landlord’s ability to obtain percentage rent, (iii) the net worth and financial capabilities of such assignee or subtenant is less than that of Tenant and any of Tenant’s Guarantor(s) (if any) at the date hereof or at the time of the Transfer,

|

|

|

REGENCY |

INITIAL |

|

|

|

|

|

|

|

|

/s/ [ILLEGIBLE] |

|

|

|

|

/s/ [ILLEGIBLE] |