FOURTH AMENDED AND RESTATED CREZ LEASE AGREEMENT between SHARYLAND DISTRIBUTION & TRANSMISSION SERVICES, L.L.C. and SHARYLAND UTILITIES, L.P. November 9, 2017

Exhibit 10.1

Execution Version

FOURTH AMENDED AND RESTATED

between

SHARYLAND DISTRIBUTION & TRANSMISSION SERVICES, L.L.C.

and

SHARYLAND UTILITIES, L.P.

November 9, 2017

CREZ LEASE AGREEMENT

TABLE OF CONTENTS

| Page | ||||||

| ARTICLE I LEASE | 1 | |||||

| 1.1. |

Lease of CREZ Assets | 1 | ||||

| 1.2. |

Exclusive Rights | 3 | ||||

| 1.3. |

Absolute Net Lease | 3 | ||||

| 1.4. |

Waiver by Lessee | 4 | ||||

| 1.5. |

Quiet Enjoyment | 4 | ||||

| ARTICLE II TERM OF LEASE | 4 | |||||

| 2.1. |

Term | 4 | ||||

| 2.2. |

Approvals upon Expiration or Termination | 4 | ||||

| 2.3. |

Purchase Option upon Expiration or Termination | 5 | ||||

| ARTICLE III RENT | 5 | |||||

| 3.1. |

Rent | 5 | ||||

| 3.2. |

Rent Supplements | 6 | ||||

| 3.3. |

Validation | 9 | ||||

| 3.4. |

Confirmation of Percentage Rent | 10 | ||||

| 3.5. |

Additional Obligations | 11 | ||||

| 3.6. |

No Set Off | 11 | ||||

| 3.7. |

Late Payment Penalty | 11 | ||||

| 3.8. |

Credit Support | 12 | ||||

| 3.9. |

Survival | 12 | ||||

| ARTICLE IV LESSEE’S REPRESENTATIONS, WARRANTIES AND COVENANTS | 12 | |||||

| 4.1. |

Maintenance, Operation and Repair of the CREZ Assets | 12 | ||||

| 4.2. |

Licenses and Permits | 13 | ||||

| 4.3. |

Property Taxes and Other Assessments and Fees | 13 | ||||

| 4.4. |

Requirements of Governmental Agencies and Regulatory Authorities | 14 | ||||

| 4.5. |

Liens | 14 | ||||

| 4.6. |

Hazardous Materials | 14 | ||||

| 4.7. |

Indebtedness | 15 | ||||

| 4.8. |

Records | 15 | ||||

| 4.9. |

Surrender | 16 | ||||

| 4.10. |

Cooperation; Transition Services | 16 | ||||

| 4.11. |

Lessee’s Authority; Enforceability | 17 | ||||

| 4.12. |

Litigation | 17 | ||||

| 4.13. |

Financing | 17 | ||||

| ARTICLE V LESSOR’S REPRESENTATIONS, WARRANTIES AND COVENANTS | 20 | |||||

| 5.1. |

Lessor’s Authority | 20 | ||||

| 5.2. |

Liens and Tenants | 20 | ||||

| 5.3. |

Condition of Assets | 21 | ||||

| CREZ LEASE AGREEMENT |

TABLE OF CONTENTS

| Page | ||||||

| 5.4. |

Performance Under Operational Agreements | 21 | ||||

| 5.5. |

Requirements of Governmental Agencies | 21 | ||||

| 5.6. |

Hazardous Materials | 21 | ||||

| 5.7. |

Litigation | 21 | ||||

| 5.8. |

Records | 21 | ||||

| 5.9. |

Limitation | 21 | ||||

| ARTICLE VI LOSS AND DAMAGE; INSURANCE | 22 | |||||

| 6.1. |

Loss and Damage to the CREZ Assets | 22 | ||||

| 6.2. |

Insurance | 23 | ||||

| ARTICLE VII REPORTING | 24 | |||||

| 7.1. |

Financing Arrangements | 24 | ||||

| 7.2. |

Public Company and Regulatory Information and Cooperation | 25 | ||||

| 7.3. |

Mutual Obligations | 26 | ||||

| ARTICLE VIII ASSIGNMENT | 26 | |||||

| 8.1. |

Assignment by Lessee | 26 | ||||

| 8.2. |

Assignment by Lessor | 26 | ||||

| ARTICLE IX DEFAULT | 27 | |||||

| 9.1. |

Lessee Default | 27 | ||||

| 9.2. |

Lessor Default | 28 | ||||

| 9.3. |

Right to Cure | 28 | ||||

| 9.4. |

Remedies | 29 | ||||

| ARTICLE X CAPITAL EXPENDITURES | 29 | |||||

| 10.1. |

Capital Expenditures Generally | 29 | ||||

| 10.2. |

Capital Expenditures Funded by Lessor | 30 | ||||

| 10.3. |

Additional Agreements Regarding Capital Expenditures | 30 | ||||

| 10.4. |

Footprint Project Construction Activities | 31 | ||||

| 10.5. |

Ownership of Footprint Projects | 31 | ||||

| 10.6. |

Asset Acquisitions | 31 | ||||

| 10.7. |

Reimbursements | 32 | ||||

| ARTICLE XI REGULATORY COOPERATION | 32 | |||||

| 11.1. |

Jurisdiction | 32 | ||||

| 11.2. |

Cooperation | 32 | ||||

| ARTICLE XII INDEMNITY | 33 | |||||

| 12.1. |

General Indemnity | 33 | ||||

| 12.2. |

Environmental Indemnity | 33 | ||||

| 12.3. |

Survival; Limitations | 34 | ||||

| CREZ LEASE AGREEMENT |

TABLE OF CONTENTS

| Page | ||||||

| ARTICLE XIII MISCELLANEOUS | 34 | |||||

| 13.1. |

Limitation of Damages | 34 | ||||

| 13.2. |

Condemnation | 34 | ||||

| 13.3. |

Confidentiality | 35 | ||||

| 13.4. |

Successors and Assigns | 36 | ||||

| 13.5. |

Rent Obligations Not Excused by Force Majeure, Etc. | 36 | ||||

| 13.6. |

Further Assurances; Policies and Procedures | 36 | ||||

| 13.7. |

Arbitration | 37 | ||||

| 13.8. |

Notices | 38 | ||||

| 13.9. |

Entire Agreement; Amendments | 39 | ||||

| 13.10. |

Legal Matters | 39 | ||||

| 13.11. |

Partial Invalidity | 39 | ||||

| 13.12. |

Recording | 39 | ||||

| 13.13. |

Intention of Parties; True Lease | 40 | ||||

| 13.14. |

Rules of Construction | 40 | ||||

| APPENDICES: | ||

| Appendix A | Definitions | |

| EXHIBITS: | ||

| Exhibit A | Form of CFO Certificate Statement | |

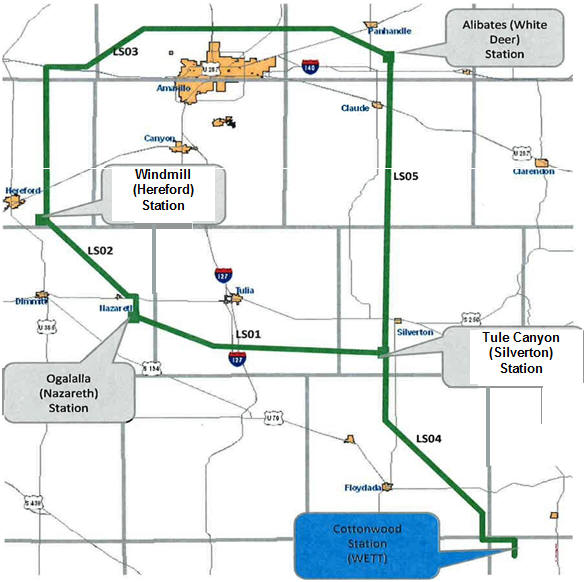

| Exhibit B | Panhandle Assets | |

| Exhibit C | Subordinated Debt Terms | |

| Exhibit D | Insurance | |

| Exhibit E | Gross Revenues | |

| SCHEDULES: | ||

| Schedule 3.2 | Form – Rent Supplement | |

| CREZ LEASE AGREEMENT |

FOURTH AMENDED AND RESTATED

This FOURTH AMENDED AND RESTATED CREZ LEASE AGREEMENT (this “Agreement”) is entered into effective as of November 9, 2017 (the “Effective Date”), between Sharyland Distribution & Transmission Services, L.L.C. (together with its permitted transferees, successors and assigns, “Lessor”), and Sharyland Utilities, L.P. (together with its permitted transferees, successors and assigns, “Lessee”), and, in connection herewith, Lessor and Lessee agree, covenant and contract as set forth in this Agreement. Lessor and Lessee are sometimes referred to in this Agreement as a “Party” or collectively as the “Parties.”

Certain capitalized terms used in this Agreement have the meaning assigned to them in Appendix A attached hereto.

WITNESSETH:

WHEREAS, Lessor and Lessee entered into that certain Third Amended and Restated Lease Agreement (CREZ Assets), effective as of December 4, 2015 (as amended, restated, supplemented or otherwise modified from time to time, the “Amended and Restated Lease”), pursuant to which Lessee leases the Panhandle Assets from Lessor;

WHEREAS, on or around the Effective Date, pursuant to an Agreement and Plan of Merger among Lessor, Lessee, Oncor Electric Delivery Company LLC (“Oncor”) and certain other parties thereto, Lessor is disposing of certain transmission and distribution assets that are subject to the Xxxxxxx/Xxxxx/Xxxxxxx Lease and McAllen Lease and, in exchange therefor, is acquiring certain transmission assets (the “Acquired Transmission Assets”) and cash from Oncor (the “Exchange Transaction”); and

WHEREAS, Lessor and Lessee desire to amend and restate the Amended and Restated Lease in its entirety to provide for the lease by Lessee of the Acquired Transmission Assets and to make such other changes as are set forth herein.

NOW, THEREFORE, in consideration of the premises and for other good and valuable consideration, the receipt of which is hereby acknowledged, the Parties hereby amend and restate the terms of the Amended and Restated Lease as follows:

ARTICLE I

LEASE

1.1. Lease of CREZ Assets.

(a) Upon the terms and conditions set forth in this Agreement, Lessor hereby grants to Lessee the exclusive right to use and operate the CREZ Lease Assets. Subject to any necessary regulatory approvals and Section 1.1(b), this Agreement is intended by Lessor and Lessee to be a master lease of the CREZ Lease Assets, as they existed as of the Original Lease Date, as they have been altered by the completion of the construction of the CREZ Project and as they have been or may continue to be altered or expanded thereafter by Footprint Projects in which Lessor has an interest, which may include:

| CREZ LEASE AGREEMENT |

(i) towers and poles affixed to the land, and all necessary and proper foundations, footings, crossarms and other appliances and fixtures for use in connection with said towers and poles;

(ii) overhead, underground and underwater electrical transmission and communications lines, together with related ductwork and insulators;

(iii) electric substation and switching facilities, including all associated transformers, circuit breakers, resistors, capacitors, buses, interconnection and switching facilities, control and protection equipment which monitors the CREZ Assets, and the building housing the foregoing items;

(iv) all facilities associated with any high-voltage direct current interconnections, including alternating current/direct current converter stations;

(v) electric meters required to operate the CREZ Assets;

(vi) real estate assets, including real property, interests in real property or real property rights (as defined in Section 856(c)(5)(B) of the Code and the regulations promulgated thereunder, and not otherwise included in Section 1.1(a)(i)–(v) above) owned or leased by Lessor and underlying the CREZ Assets, including related easements, licenses, rights of way and other real property interests; and

(vii) all other assets, facilities, systems or property owned or leased by Lessor that physically comprise part of the CREZ Assets and that are (x) identified in the uniform system of accounts for major electric utilities, 18 C.F.R. Part 101, as adopted and amended from time to time by FERC (the “FERC Uniform System of Accounts”) and (y) not otherwise included in Section 1.1(a)(i)–(vi) above).

For the avoidance of doubt, the CREZ Assets shall (x) exclude the Transmission Operation Center and the transmission and distribution related assets included in the Backup Operations Center located in Amarillo, Texas, which are currently owned by Lessor and leased to Lessee pursuant to the McAllen Lease and (y) include any components of the CREZ Assets that are repaired or replaced pursuant to Section 6.1.

(b) Notwithstanding anything to the contrary in this Agreement, the Parties do not intend or agree to enter into a lease with respect to any Footprint Project or other alteration, expansion or addition to the CREZ Assets (and Lessee shall not be authorized to use or operate such Footprint Project, alteration, expansion or addition to the CREZ Assets) unless and until such time as the Parties first execute a Rent Supplement for the underlying Footprint Project and such Footprint Project is placed in service, and such Rent Supplement together with this Agreement shall be treated as a new lease with respect to such Footprint Project. The Parties further agree and acknowledge that a Rent Supplement will be executed with respect to each Footprint Project before such Footprint Project is placed in service, and references in this Agreement to “CREZ Assets” rely on the assumption that this is the case.

| 2 | CREZ LEASE AGREEMENT |

(c) Notwithstanding anything to the contrary in this Section 1.1, for so long as Lessor is in compliance with its obligation to fund Capital Expenditures pursuant to Article X, Lessor may notify Lessee of its intention to transfer certain assets that would otherwise constitute CREZ Assets under this Agreement (the “Transferred Assets”) to a TRS. Upon any such notification, the TRS and Lessee shall negotiate in good faith a lease agreement with respect to such Transferred Assets, on terms and conditions that are comparable to those contained herein, and, upon the execution of such lease, the Transferred Assets shall no longer constitute CREZ Assets hereunder.

1.2. Exclusive Rights.

(a) Throughout the Term of this Agreement, Lessee shall have the exclusive right (i) to operate and use the CREZ Lease Assets for the transmission of electricity in accordance with applicable rules and regulations of all regulatory agencies having regulatory jurisdiction over the CREZ Assets, including the PUCT, as well as applicable rules and regulations of ERCOT, TRE, NERC and other Regulatory Authorities, and (ii) to utilize the CREZ Lease Assets for other uses (provided that such other uses do not interfere with the current or future transmission and delivery of electricity, Good Utility Practice or Applicable Laws and do not adversely affect the reliability and safety of the CREZ Assets or the ERCOT electric grid). Further, subject to Section 4.1(b), Lessor hereby grants to Lessee a limited royalty-free non-transferable, non-exclusive sublicense under the Licensed Intellectual Property (as defined in the Tower License Agreement) to use the Licensed Technology (as defined in the Tower License Agreement); provided that such sublicense is limited to the operational scope set forth in Section 2.1 of the Tower License Agreement and strictly limited to the Applicable Transmission Systems (as defined in the Tower License Agreement). This sublicense shall terminate automatically at such time as Lessee ceases to operate the Acquired Transmission Assets on the terms set forth in this Agreement. For the avoidance of doubt, Lessee has executed an undertaking pursuant to Section 3 of the Tower License Agreement, and nothing in this Section 1.2(a) shall limit Lessee’s rights or obligations by virtue thereof.

(b) Throughout the Term of this Agreement, Lessor shall have access to the CREZ Assets at all reasonable times for purposes of inspection and for the purposes of evaluating potential improvements, expansions or modernizations of the CREZ Assets in accordance with Article X. Except in the case of emergency, prior to Lessor’s access of the CREZ Assets, Lessor will provide written notification to Lessee’s operations personnel.

1.3. Absolute Net Lease. This Agreement is intended by the Parties to be an absolute net lease (and, except as otherwise specified herein, the expenses and costs associated with the lease, license, servicing, insuring, maintenance, repair and operation of the CREZ Assets and the performance of Lessee’s obligations under this Agreement shall be for the account of Lessee, unless expressly stated that such expenses or costs are for the account of Lessor or some other Person). Other than as expressly provided herein, (a) Lessee’s obligation to make all payments of Rent as and when the same shall become due and payable in accordance with the terms of this Agreement shall be absolute, irrevocable and unconditional and shall not be affected by any

| 3 | CREZ LEASE AGREEMENT |

circumstance or subject to any abatement or diminution by set-off, deduction, counterclaim, recoupment, agreement, defense, suspension, deferment, interruption or otherwise, and (b) until such time as all Rent required to be paid has been paid, Lessee shall have no right to terminate this Agreement or to be released, relieved or discharged from its obligation to make, and shall not suspend or discontinue, any payment of Rent for any reason whatsoever.

1.4. Waiver by Lessee. Lessee hereby waives, to the extent permitted by Applicable Law, any and all rights which it may now have or which at any time hereafter may be conferred upon it, by statute or otherwise, to modify, terminate, cancel, quit or surrender this Agreement except in accordance with the express terms hereof.

1.5. Quiet Enjoyment. Lessee shall be entitled to the peaceful and quiet enjoyment of the CREZ Lease Assets, subject to the terms of this Agreement, so long as Lessee is not in default of this Agreement beyond applicable notice and cure periods.

ARTICLE II

TERM OF LEASE

2.1. Term. Subject to the provisions of Section 2.2 of this Agreement, or as otherwise stated herein, this Agreement became effective on the Original Lease Date and shall continue through December 31, 2020 unless otherwise terminated in a manner consistent herewith (the “Existing Term”). Thereafter, this Agreement may be renewed for subsequent terms (each, a “Renewal Term” and, collectively with the Existing Term, the “Term”) by mutual agreement of the Parties; provided, however, that the Rent for any Renewal Term shall be targeted to provide Lessor with a Comparable Rate of Return on the then-current Rate Base of the CREZ Assets.

2.2. Approvals upon Expiration or Termination.

(a) Notwithstanding anything to the contrary contained in this Agreement, Lessee shall not surrender, resign, transfer, assign or otherwise cease to be the operator of the CREZ Assets at any time, including upon the termination of this Agreement or at the expiration of the Term, without first acquiring any necessary regulatory approvals from the PUCT or other Regulatory Authorities regarding such surrender, resignation, transfer, assignment or cessation of such operatorship; provided that, in the event of expiration or termination, the Parties shall use commercially reasonable efforts to obtain all necessary regulatory approvals of the transfer of such operatorship as soon as reasonably practicable.

(b) During any period of time after the expiration of the Term or termination of this Agreement but prior to Lessee’s acquisition or receipt of any necessary regulatory approvals with respect to Lessee’s surrender, resignation, transfer, assignment or other cessation of its operation of the CREZ Assets (such period of time being herein referred to as the “Extended Period of Operatorship”), Lessee shall continue to operate the CREZ Assets and shall continue to pay all Extended Period Rent and perform all of Lessee’s other obligations under this Agreement; provided, however, that if regulatory approval is not obtained within twelve (12) months of initiation of the approval process and such delay is (i) due to Lessor’s failure to reasonably pursue such approval, then the amounts payable as Rent will be eighty percent (80%) of such amount, or (ii) due to Lessee’s failure to reasonably pursue such approval, then the amounts payable as Rent will be one hundred five percent (105%) of such amount.

| 4 | CREZ LEASE AGREEMENT |

(c) Upon the expiration of the Term or termination of this Agreement, Lessee shall (i) use commercially reasonable efforts to obtain all necessary regulatory approvals as soon as reasonably practicable from the PUCT or other Regulatory Authorities to transfer or assign the Operating CCNs for the CREZ Assets to Lessor or Lessor’s transferee or designee and (ii) upon receipt of such approvals, transfer or assign, to the extent permitted by Applicable Law, such Operating CCNs to Lessor or Lessor’s transferee or designee.

(d) The obligations of Lessee and Lessor contained in this Section 2.2 shall survive the expiration of the Term or termination of this Agreement.

2.3. Purchase Option upon Expiration or Termination. Upon the later of (a) the expiration of the Term or termination of this Agreement and (b) the expiration of the Extended Period of Operatorship (if any), Lessor shall have the option to purchase, or cause such other Person as Lessor may direct to purchase, from Lessee any equipment or other property, tangible or intangible, including any regulatory assets, owned by Lessee and principally used in connection with and necessary for the operation of the CREZ Assets (including any Nonseverable Footprint Projects owned by Lessee, if any), subject to any required regulatory approvals. The purchase price for such property or equipment shall be the greater of (i) the net book value thereof plus 10% and (ii) the fair market value thereof as determined by mutual agreement of Lessor and Lessee.

ARTICLE III

RENT

3.1. Rent. Lessee will pay to Lessor in lawful money of the United States of America which shall be legal tender for the payment of public and private debts, at Lessor’s address set forth in Section 13.8 or at such other place or to such other Person, as Lessor from time to time may designate in a written notice to Lessee, all Rent contemplated hereby during the Term or any Extended Period of Operatorship on the basis hereinafter set forth. If there is a dispute as to the amount of Rent to be paid by Lessee, either Party may submit the dispute to arbitration pursuant to Section 13.7. However, Lessee shall be required to pay, as and when Rent is due and payable hereunder, the Undisputed Rent until such time as the dispute is resolved by agreement between the Parties or by arbitration pursuant to Section 13.7.

(a) Lessee will pay Lessor Base Rent for each Lease Month, payable in arrears forty-five (45) days after the conclusion of the Lease Month.

(b) In addition to the Base Rent set forth above, Lessee covenants and agrees to pay to Lessor, as percentage rent, an annual amount at the Percentage Rent Rate on Gross Revenues during the applicable Lease Year that are in excess of the Annual Percentage Rent Breakpoint for such Lease Year (“Percentage Rent”). Percentage Rent owed by Lessee under this Agreement shall be calculated quarterly, and, if any Percentage Rent is due, shall be paid not later than the date that is forty-five (45) days after the end of each Lease Quarter as follows:

| 5 | CREZ LEASE AGREEMENT |

(i) Percentage Rent will only be payable with respect to a particular Lease Quarter if the aggregate Gross Revenues for the Lease Year through the end of the applicable Lease Quarter (the “Year-to-Date Revenues”) exceed the Applicable Quarterly Breakpoint. If so, then the Percentage Rent payable with respect to a Lease Quarter will be an amount equal to:

(1) the product of (x) the amount by which Year-to-Date Revenues exceed the Applicable Quarterly Breakpoint multiplied by (y) the Percentage Rent Rate; minus

(2) any Year-to-Date Payments;

provided that, except as provided in Section 3.1(b)(ii), if the foregoing calculation results in a negative number, Lessee shall not be entitled to a refund of any Percentage Rent previously paid.

(ii) If, at the end of the Lease Year, the Year-to-Date Payments made by Lessee to Lessor with respect to such Lease Year exceed the annual amount of Percentage Rent payable by Lessee to Lessor for such Lease Year pursuant to the first sentence of Section 3.1(b), then Lessor shall refund any excess amounts to Lessee by March 31 of the year following the applicable Lease Year.

(iii) Within forty-five (45) days after the end of each Lease Quarter, or, if earlier, concurrently with the payment by Lessee of any Percentage Rent owed pursuant to this Section 3.1(b), Lessee shall deliver to Lessor a CFO Certificate, in the form attached as Exhibit A, setting forth Lessee’s calculation of Gross Revenues as determined in accordance with Exhibit E and the resulting Percentage Rent payable hereunder. The CFO Certificate shall be delivered to the place where Rent is then payable, or to such other place or places as Lessor may from time to time direct by written notice to Lessee.

3.2. Rent Supplements.

(a) The Parties have executed a Rent Supplement with respect to the Rent in effect as of the Effective Date (the “Effective Date Rent Supplement”) with respect to the estimated Effective Date Rate Base and Expected Incremental CapEx through the end of 2017. Prior to the beginning of each Lease Year (and, if applicable, at such other times during the Lease Year if the Parties expect Incremental CapEx and the Parties have not yet entered into a Rent Supplement with respect to such Expected Incremental CapEx), the Parties will negotiate in good faith to supplement, in the form of Schedule 3.2, Rent and other matters in accordance with this Section 3.2 (each, a “Rent Supplement”) to reflect the amount of Incremental CapEx, if any, that the Parties expect to be placed in service during such Lease Year (“Expected Incremental CapEx”). The following will apply to the determination of the matters set forth on the Rent Supplement:

(i) The Parties will supplement Base Rent and Percentage Rent in a manner intended to provide a Comparable Rate of Return for Lessor on the Expected Incremental CapEx. Such Comparable Rate of Return may be achieved by a split between Base Rent and Percentage Rent, in such case in the proportions requested by Lessor and agreed to by Lessee.

| 6 | CREZ LEASE AGREEMENT |

(ii) Unless the Parties agree otherwise based on appropriate factors at the time of the negotiation, Capital Expenditures will qualify as Incremental CapEx on the date the assets developed with such Capital Expenditures are placed in service (notwithstanding that Capital Expenditures that are included in CapEx Budgets pursuant to Article X are for such purposes measured based on the date the related Capital Expenditures are incurred).

(iii) Notwithstanding anything to the contrary contained in this Agreement, such supplement shall be determined solely to provide a Comparable Rate of Return on such Expected Incremental CapEx and shall not be determined with reference to, or with any intention to true up, the effect of any difference between the initially anticipated and the actual return of or on, or the Rent payable with respect to, the CREZ Assets as in place prior to the additions resulting from such Expected Incremental CapEx.

(b) The Parties contemplate that there may be Capital Expenditures for assets that are placed in service and that are related and fairly allocable to the CREZ Assets and are classified as Lessee CapEx. The following will apply to the determination of Revenues Attributable to Lessee CapEx:

(i) Revenues Attributable to Lessee CapEx shall be targeted to equal that portion of the amounts collected by Lessee with respect to the CREZ Assets which equals the amount needed to provide Lessee with the equivalent of a Comparable Rate of Return on any such Lessee CapEx (except that, in determining such Comparable Rate of Return, the Parties will not consider Lessee’s creditworthiness and there will be no Agreed-to-Discount). For the avoidance of doubt, Revenues Attributable to Lessee CapEx shall not include any ERCOT Transmission Revenues.

(ii) Unless the Parties agree otherwise based on appropriate factors at the time of the negotiation, Capital Expenditures that qualify as Lessee CapEx will qualify as Lessee CapEx on the date that the assets developed with such Capital Expenditures are placed in service. Further, the Parties understand that there may be Capital Expenditures that relate to both the CREZ Assets and to other assets owned or operated by Lessee or an affiliate thereof, and, in such circumstance, the Parties will negotiate in good faith to determine the portion of such Capital Expenditures that constitutes Lessee CapEx hereunder.

(iii) Notwithstanding anything to the contrary contained in this Agreement, the Revenues Attributable to Lessee CapEx shall be determined solely to provide a Comparable Rate of Return on such Lessee CapEx and shall not be determined with reference to, or with any intention to true up, the effect of any difference between the initially anticipated and the actual return of or on the Lessee CapEx as in place prior to the additions resulting from such Lessee CapEx.

| 7 | CREZ LEASE AGREEMENT |

(iv) Lessee agrees to provide Lessor with sufficient information regarding Lessee CapEx so that Lessor can monitor amounts actually spent on Lessee CapEx. If Lessee expects there will be any Lessee CapEx and the Parties have not yet entered into a Rent Supplement with respect to such Lessee CapEx, Lessee may request, no more frequently than annually, that the Parties determine the Revenues Attributable to Lessee CapEx that relate to such Lessee CapEx for each subsequent Lease Year. Lessee will use reasonable efforts to make such request coincide with a Rent Supplement pursuant to Section 3.2(a).

(c) The Parties will memorialize the results of all Rent negotiations pursuant to Section 3.2(a) and Lessee CapEx supplement negotiations pursuant to Section 3.2(b) by executing and delivering a Rent Supplement, which will set forth, in each case to the extent applicable, (i) the amount and projected depreciation rate of the Expected Incremental CapEx and Lessee CapEx; (ii) the estimated weighted average placed-in-service date of the Expected Incremental CapEx and Lessee CapEx; (iii) the projected effective date of the Regulatory Order(s) related to the Expected Incremental CapEx and Lessee CapEx; (iv) the new Base Rent; (v) a new Percentage Rent Schedule; (vi) new Revenues Attributable to Lessee CapEx; (vii) a new TCOS Allocation and (viii) the effective date of the new Rent Supplement. Upon the execution and delivery of any such Rent Supplement, this Agreement will be deemed amended thereby. In no event will any new Base Rent or new Percentage Rent be payable, or any Revenues Attributable to Lessee CapEx be taken into account, before the assets funded by the related Incremental CapEx or Lessee CapEx are placed in service. Further, the Percentage Rent Rates and Annual Percentage Rent Breakpoints reflected on such new Rent Supplement with respect to the Rate Base covered by such prior Rent Supplement shall be as set forth on the Percentage Rent Schedule of such prior Rent Supplement.

(d) Either Party may request a revision to the TCOS Allocation utilized to calculate Allocated ERCOT Transmission Revenues pursuant to Exhibit E based on the most recent available monthly balance sheet in connection with any Rent Supplement executed and delivered by the Parties under Section 3.2(c) or, if earlier, no more frequently than once every sixty (60) days.

(e) If Lessee receives or expects to receive any fees, charges or Other Revenue (other than de minimis amounts not to exceed $100,000 in any calendar year), then, unless Lessee reasonably believes that such Other Revenue will not operate to reduce Lessee’s tariff within the State of Texas, Lessee and Lessor will negotiate in good faith to amend the then-effective Rent Supplement related to this Agreement or a similar lease to characterize the portion of such Other Revenue which Lessor reasonably expects will operate to reduce Lessee’s tariff within the State of Texas as Allocated Other Revenue hereunder or under such other similar lease.

(f) In connection with the foregoing provisions of this Section 3.2, Lessor and Lessee shall use good faith efforts to agree to a Rent Supplement within sixty (60) days of a request therefor by either Party.

| 8 | CREZ LEASE AGREEMENT |

3.3. Validation.

(a) Following the conclusion of each Lease Year (and, if applicable, at such other times during a Lease Year as a Party may request), the Parties will:

(i) review and determine whether there is a difference in:

(1) with respect to the Effective Date Rent Supplement, the actual Effective Date Rate Base compared to the Effective Date Rate Base contemplated by the Effective Date Rent Supplement; or

(2) the actual (A) amount of Incremental CapEx or Lessee CapEx, as applicable, placed in service during such Lease Year, (B) weighted average placed-in-service date of and/or effective date of the Regulatory Order(s) related to such Incremental CapEx or Lessee CapEx, as applicable and/or (C) depreciation rate, in each case as compared to what was contemplated by the Rent Supplement in effect as of the end of such Lease Year; and

(ii) if there has been such a difference, execute and deliver a revised Rent Supplement, which will set forth:

(1) a revised Base Rent, Percentage Rent Schedule and TCOS Allocation, reflecting what they would have been, at the time of the Rent Supplement, based on the actual (A) Effective Date Rate Base (with respect to the Effective Date Rent Supplement), (B) amount of Incremental CapEx or Lessee CapEx, as applicable, (C) weighted average placed-in-service date of or effective date of the Regulatory Order(s) related to such Incremental CapEx or Lessee CapEx, as applicable and/or (D) depreciation rate, but keeping fixed all other relevant assumptions and inputs, including the Comparable Rate of Return; and

(2) the amount of any lump sum payment that one Party must make to the other Party as a result of excess or deficient Rent that Lessee paid, as applicable (which payment must be made within thirty (30) days of the execution and delivery of such revised Rent Supplement and shall be treated as Rent by the Parties).

Upon the execution and delivery of any revised Supplement pursuant to Section 3.3(a)(ii), this Agreement will be deemed amended thereby. The process described in this Section 3.3(a) is referred to as a “Rent Validation.”

(b) For the avoidance of doubt, in no circumstance will a Rent Validation occur to account for any difference between the initially anticipated and the actual return of or on the Incremental CapEx and/or Lessee CapEx, and no such difference will be taken into account as part of such Rent Validation.

| 9 | CREZ LEASE AGREEMENT |

(c) For the avoidance of doubt, notwithstanding anything to the contrary contained herein, following any expiration or termination of this Agreement pursuant to Article II, the Parties will conduct a Rent Validation in accordance with Section 3.3(a) with respect to the final Lease Year (or applicable portion thereof) ending immediately prior to the effective date of such expiration or termination and determine whether one Party should make a lump sum payment to the other Party as a result of excess or deficient Rent paid by Lessee. If any amount is determined to be due based upon such Rent Validation, the payment of such amount must be made within thirty (30) days of the finalization of such Rent Validation and, if applicable, shall be treated as Rent by the Parties.

(d) In connection with the foregoing provisions of this Section 3.3, Lessor and Lessee shall use good faith efforts to agree to a Rent Validation within sixty (60) days of the conclusion of the applicable Lease Year or a request therefor by either Party.

3.4. Confirmation of Percentage Rent.

(a) In the event that Lessee determines that the Percentage Rent paid with respect to any Lease Year (after giving effect to any refund that has or will be paid pursuant to Section 3.1(b)(ii)) exceeded the amount of Percentage Rent actually due for such Lease Year (such overage being the “Excess Percentage Rent”), Lessee shall promptly notify Lessor of such fact and shall deliver a new CFO Certificate (the “Revised Certificate”) setting forth the corrected calculations of the Percentage Rent due for such Lease Year and identifying the amount of the Excess Percentage Rent. Upon Lessor’s reasonable verification of the information set forth in the Revised Certificate, Lessor shall refund to Lessee the Excess Percentage Rent. Notwithstanding anything to the contrary contained herein, in no event shall Lessor have any obligation under this Section 3.4(a) to refund any Excess Percentage Rent if Lessor has not received the Revised Certificate by March 31 of the year following the Lease Year for which the Excess Percentage Rent was paid.

(b) Lessee shall record Gross Revenues in order to provide an audit trail and shall utilize, or cause to be utilized, an accounting system for the CREZ Assets in accordance with the FERC Uniform System of Accounts that will accurately record all data necessary to compute Percentage Rent. Lessee shall retain and shall allow Lessor and its representatives to have reasonable access to, for at least five (5) years after the expiration of each Lease Year, reasonably adequate records conforming to such accounting system showing all data necessary to conduct Lessor’s Audit and to compute Percentage Rent for the applicable Lease Years and to otherwise file or defend tax returns and reports to any Regulatory Authority.

(c) Lessor shall have the right from time to time to cause its accountants or representatives to conduct an inspection, examination and/or audit (a “Lessor’s Audit”) of all of Lessee’s records, including supporting data, sales and excise tax returns and the records described in Section 3.4(b), reasonably required to complete such Lessor’s Audit and to verify Percentage Rent, subject to any prohibitions or limitations on disclosure of any such data under Applicable Laws and governmental requirements. If any Lessor’s Audit discloses a deficiency in the payment of Percentage Rent, and either Lessee agrees with the result of Lessor’s Audit or the matter is otherwise determined or compromised, Lessee shall forthwith pay to Lessor the amount of the

| 10 | CREZ LEASE AGREEMENT |

deficiency, as finally agreed or determined, together with interest at the Overdue Rate from the date when said payment should have been made to the date of payment thereof. In addition to the amounts described above in this Section 3.4(c), if any Lessor’s Audit discloses a deficiency in the payment of Percentage Rent which, as finally agreed or determined, exceeds three percent (3%) of the amount paid, Lessee shall pay the costs of Lessor’s Audit. In no event shall Lessor undertake a Lessor’s Audit after March 31 of the second (2nd) year following the Lease Year for which such audit is requested.

(d) Any proprietary information obtained by Lessor pursuant to the provisions of this Section 3.4 shall be treated as confidential, except that such information may be used, subject to appropriate confidentiality safeguards, in any litigation or arbitration between the Parties and except further that Lessor may disclose such information to lenders and investors, including prospective lenders or investors and to any other persons to whom disclosure is necessary or appropriate to comply with Applicable Laws and governmental requirements and to comply with any reporting requirements applicable to Lessor or Lessee under any applicable securities laws or regulations or any listing requirements of any applicable securities exchange.

3.5. Additional Obligations.

(a) In addition to Base Rent and Percentage Rent, Lessee also will pay and discharge as and when due and payable all other amounts, liabilities, obligations and impositions that Lessee assumes or agrees to pay under this Agreement, including the expenses and costs described in Section 1.3 and any reimbursement for such amounts and other damages to Lessor in the event that Lessor pays such expenses or costs or performs such obligations on behalf of Lessee (collectively, but excluding any Transition Costs Payments under Section 3.5(b), “Additional Rent”).

(b) In addition to Lessee’s Rent obligations under this Agreement, within forty-five (45) days after the end of each Lease Month, Lessee shall make a payment to Lessor, in the amount set forth in the Effective Date Rent Supplement, as a payment to Lessor for its Transition Costs (a “Transition Costs Payment”). Upon Lessor’s receipt of the twenty-fourth (24th) Transition Costs Payment hereunder, Lessee shall no longer have any obligation to make any payments pursuant to this Section 3.5(b).

3.6. No Set Off. Any amount owed by Lessee pursuant to this Agreement shall be paid to Lessor without set off, deduction or counterclaim; provided, however, that Lessee shall have the right to assert any claim or counterclaim in a separate action brought by Lessee under this Agreement or to assert any mandatory counterclaim in any action brought by Lessor under this Agreement.

3.7. Late Payment Penalty. Except as otherwise provided in Section 9.1(b), if Lessee fails to make any payment to Lessor of any amount owed hereunder within five (5) days after it is due, interest shall accrue on the overdue amount, from the date overdue until the date paid, at the Overdue Rate.

| 11 | CREZ LEASE AGREEMENT |

3.8. Credit Support. If Lessor has reasonable grounds for insecurity regarding the performance of Lessee’s obligations hereunder, Lessor may require Lessee to provide credit support in the amount, form and for the term reasonably acceptable to Lessor, including a letter of credit, a prepayment, or a guaranty.

3.9. Survival. The obligations of Lessee and Lessor contained in this Article III with respect to the calculation, validation and payment, including late payment, of Rent applicable to periods prior to the end of the Term or during any Extended Period of Operatorship shall survive the expiration or earlier termination of this Agreement.

ARTICLE IV

LESSEE’S REPRESENTATIONS, WARRANTIES AND COVENANTS

4.1. Maintenance, Operation and Repair of the CREZ Assets.

(a) Lessee, at its own cost and expense, shall maintain (including both scheduled and unscheduled maintenance), operate, repair and make all modifications (other than the construction of Footprint Projects, which shall be subject to Article X) to the CREZ Assets and any components thereof (whether owned by Lessor or Lessee), including directing all operations of and supplying all personnel necessary for the operation of the CREZ Assets, in each case, as reasonable and prudent and consistent with Good Utility Practice and as required by Applicable Law or any Operational Agreement. Lessee shall carry out all obligations under this Agreement as reasonable and prudent and consistent with Good Utility Practice and in accordance with manufacturers’ warranty requirements (during any applicable warranty period) and Lessee’s established operating procedures and maintenance, rebuild and repair programs so as to keep the CREZ Assets in good working order, ordinary wear and tear excepted, and in such condition as shall comply in all material respects with all Applicable Laws. Lessee will operate the CREZ Assets in a reliable and safe manner in compliance with Applicable Laws. Lessee will not operate the CREZ Assets or any component thereof in any manner excluded from coverage by any insurance in effect as required by the terms hereof.

(b) Lessee acknowledges that Lessor has made certain covenants regarding the maintenance, operation and repair of certain of the Acquired CREZ Assets as set forth in the Tower License Agreement, the Fiber Sharing Agreement and the Joint Use Agreements (collectively, the “Operational Agreements”), copies of which have been provided to and reviewed by Lessee. Lessee covenants and agrees with Lessor that, during the term of the applicable Operational Agreement, Lessee will comply with the covenants set forth therein, to the extent that such covenants relate to matters for which Lessee is responsible by virtue of this Agreement and as operator of the Acquired CREZ Assets. Lessor agrees to consult with Lessee in the event of any amendment to the Operational Agreements, and Lessee agrees to comply with the as-amended terms of such agreements to the extent such amendments either (i) do not materially increase the obligations of Lessee or otherwise have a material and adverse effect on Lessee or (ii) are not objected to by Lessee in connection with the foregoing consultation; provided, however, that nothing in this Section 4.1(b) shall limit Lessor’s right to terminate any of the Operational Agreements; provided further that any such termination is not inconsistent with Good Utility Practice and does not interfere with Lessee’s ability to continue to perform its obligations under this Agreement.

| 12 | CREZ LEASE AGREEMENT |

(c) If inspections of the CREZ Assets by Lessor show that the CREZ Assets do not meet industry standards or Good Utility Practice for maintenance and repair and/or fail to meet the requirements of any Applicable Law, Lessee shall promptly, but in any event within thirty (30) days after such initial notification, (i) develop a plan for Lessor’s review by which the CREZ Assets can be modified or replaced to comply with industry standards, Good Utility Practice and any Applicable Law and (ii) complete any and all such modifications and/or replacements consistent with all applicable reliability and safety standards established by Good Utility Practice and Applicable Law.

4.2. Licenses and Permits. Lessee shall obtain and maintain any and all licenses, permits and other governmental and third-party consents and approvals required by Applicable Law in order to carry out its obligations under this Agreement.

4.3. Property Taxes and Other Assessments and Fees. Lessee shall bear (or collect from its customers, as applicable) and timely pay all ad valorem or property taxes, sales and use taxes, or other assessments, governmental charges or fees that shall or may during the Term (including, if applicable, any Extended Period of Operatorship) be imposed on, or arise in connection with, the ownership, lease, repair, maintenance and/or operation of, the CREZ Assets (including all Footprint Projects) (excluding any Lessor Taxes, “Lessee Taxes”); provided that such payment shall not be required with respect to any such tax, assessment, charge or fee to the extent the validity or amount thereof is being contested in good faith in accordance with Applicable Law (and in consultation with Lessor) by appropriate proceedings and Lessee sets aside on its books adequate reserves or other appropriate provisions with respect thereto in accordance with GAAP; provided further that Lessee shall not be obligated by reason of this Agreement to pay any income, franchise or similar taxes imposed upon Lessor, any consolidated, combined unitary or similar group that includes Lessor or any direct or indirect owner of an equity interest in Lessor, or any transfer, recordation, sales, use or similar taxes which arise in connection with Lessor’s acquisition of Footprint Projects, or the construction of Footprint Projects funded by Lessor (“Lessor Taxes”). For the avoidance of doubt, Lessee Taxes shall not include any amounts related to periods prior to the Original Lease Date. The Parties understand that Lessee collects certain Lessee Taxes from Lessee’s customers and remits such payments to the appropriate Regulatory Authority, and that nothing in this Section 4.3 is intended to impose liability on Lessee (instead of such customer) for the related tax liability beyond that imposed by Applicable Law with respect to such collection obligations. Upon the written request by Lessor, Lessee shall provide Lessor with evidence of the payment of any such Lessee Taxes, the failure of which to be paid would cause the imposition of a Lien upon the CREZ Assets or any component thereof or interest therein. Lessee shall assume full responsibility for preparing and furnishing to Lessor for execution all filings with any Regulatory Authority of or in the state and/or locality in which the CREZ Assets are located in respect of any and all Lessee Taxes; except that, where required or permitted by Applicable Law, Lessee shall make such filings on behalf of Lessor in the name of Lessor or in Lessee’s own name. In each case in which Lessee furnishes a tax return or any other form to be executed by Lessor for filing with or delivery to any taxing authority, Lessee shall certify to Lessor that such document is in the proper form, is

| 13 | CREZ LEASE AGREEMENT |

required to be filed under Applicable Law and does not impose any tax or other liability on Lessor or any of its affiliates which is not indemnified by Lessee. Lessee shall be permitted to contest, in its own name when permitted by Applicable Law but otherwise on behalf of Lessor, in good faith and upon consultation with Lessor, any taxes it is obligated to pay hereunder.

4.4. Requirements of Governmental Agencies and Regulatory Authorities. Lessee, at its expense, shall comply with all Applicable Laws, including all requirements of the Regulatory Authorities. Lessee shall have the right, in its reasonable discretion and at its cost and expense, to contest by appropriate legal or administrative proceedings the validity or applicability to the CREZ Assets of any Applicable Law made or issued by any federal, state, county, local or other Regulatory Authority. Any such contest or proceeding shall be controlled and directed by Lessee. Lessee shall provide Lessor with written notice of the commencement of any such legal or administrative proceedings that relate to or are a Lessor Material Matter. Thereafter, if requested by Lessor, Lessee will update Lessor, at reasonable intervals, of the progress of any such proceedings that relate to or are a Lessor Material Matter.

4.5. Liens. Lessee shall keep the CREZ Assets free and clear of all Liens other than Permitted Liens. If Lessee fails to promptly remove any Lien (other than Permitted Liens) that may be imposed on the CREZ Assets, Lessor may, after providing notice to Lessee, take reasonable action to satisfy, defend, settle or otherwise remove the Lien at Lessee’s expense.

4.6. Hazardous Materials.

(a) Lessee shall operate and maintain the CREZ Assets and conduct all of its other activities in respect thereof in compliance in all material respects with any Environmental Laws and other Applicable Laws relating to air, water, land and the generation, storage, use, handling, transportation, treatment or disposal of Hazardous Materials. Lessee shall promptly notify Lessor of any such violation that is a Lessor Material Matter. To the extent Lessee becomes aware of any environmental, health, safety or security matter that requires a corrective action, Lessee shall (in consultation with Lessor, in the case of any Lessor Material Matter) undertake and complete such corrective action. Lessee shall have the obligation to report any such violations to the appropriate Regulatory Authorities in accordance with Applicable Law and, if practicable, shall give notice thereof to Lessor prior to making such report with respect to any Lessor Material Matter.

(b) Without limiting the generality of the foregoing, Lessee shall not (i) place or locate any underground tanks on the property underlying the CREZ Assets (except in accordance with Good Utility Practice and in a manner that does not prevent Lessee from complying with its obligations pursuant to Section 6.2); (ii) generate, manufacture, transport, produce, use, treat, store, release, dispose of or otherwise deposit Hazardous Materials in or on the CREZ Assets, the property underlying the CREZ Assets or any portion thereof other than as permitted by Environmental Laws that govern the same or are applicable thereto; (iii) permit any other substances, materials or conditions in, on or emanating from the CREZ Assets, the property underlying the CREZ Assets or any portion thereof which may support a claim or cause of action under any Applicable Law; or (iv) undertake any action that would reasonably be expected to cause an unauthorized release of Hazardous Materials at the property underlying the CREZ Assets.

| 14 | CREZ LEASE AGREEMENT |

(c) Lessee shall periodically, at intervals determined in its reasonable discretion in accordance with Good Utility Practice or as required by Applicable Law, at Lessee’s expense, conduct inspections of all components of the CREZ Assets to ensure compliance with Applicable Laws and with this Section 4.6, and shall promptly notify Lessor of the results of any such inspections. Lessor may, at Lessor’s expense, conduct its own testing at times determined in its reasonable discretion, and after reasonable consultation with Lessee, to ensure Lessee’s compliance with Applicable Laws and with this Section 4.6; provided, however, that Lessor agrees to indemnify Lessee from and against any and all Claims suffered or incurred by Lessee and arising from Lessor’s testing in accordance with Section 12.2.

4.7. Indebtedness. Lessee shall not incur Indebtedness other than: (i) Indebtedness in an aggregate principal amount of up to the greater of (A) $5,000,000 and (B) an amount equal to one percent (1%) of the sum of, without duplication, (x) the total amount of the Consolidated Net Plant of Lessee, plus (y) the total amount of Leased Consolidated Net Plant of Lessee, in each case on a senior secured basis, (ii) Indebtedness in an aggregate principal amount of up to the greater of (A) $10,000,000 and (B) an amount equal to one-and-a-half percent (1.5%) of the sum of, without duplication, (x) the total amount of the Consolidated Net Plant of Lessee, plus (y) the total amount of Leased Consolidated Net Plant of Lessee, in each case on an unsecured subordinated basis on terms substantially similar to the terms set forth on Exhibit C and (iii) loans, in an aggregate principal amount not to exceed $10,000,000 at any time outstanding, made by InfraREIT Partners, LP or a subsidiary thereof to Lessee from time to time for the purpose of financing capital expenditures. For purposes of clauses (i) and (ii) of the preceding sentence, any Consolidated Qualified Lessees of Lessee will be treated as Lessee. In addition to the foregoing, Lessee shall cause its subsidiaries not to incur Indebtedness in an aggregate principal amount greater than the product of (x) Lessee’s aggregate Consolidated Net Plant multiplied by (y) the lesser of (A) the sum of Lessee’s then-current PUCT-regulated debt-to-equity ratio (expressed as a percentage) and five percent (5%) or (B) sixty-five percent (65%); provided, however, that such Indebtedness must be Non-Recourse Debt to Lessee. For purposes of this Section 4.7, Lessee’s Consolidated Net Plant will be derived from its most recently prepared consolidated balance sheet, prepared in accordance with GAAP but adjusted to reverse the effects of failed sale-leaseback accounting in a manner reasonably determined by Lessee in good faith. Without limiting the amount of Indebtedness permitted by the foregoing, Lessee may also incur Indebtedness (x) in the form of a pledge of equity interests in a subsidiary of Lessee as security for Non-Recourse Debt of such subsidiary and (y) in amounts otherwise permitted under the Debt Agreements.

4.8. Records. In addition to the records referred to in Section 3.4(b), Lessee shall maintain proper books of record and account in conformity with GAAP and all applicable Regulatory Authorities having legal or regulatory jurisdiction over Lessee. Additionally, Lessee shall maintain or cause to be maintained all logs, drawings, manuals, specifications and data and inspection, modification and maintenance records and other materials required to be maintained in respect of the CREZ Assets by Applicable Laws or by Good Utility Practice. Lessee shall allow Lessor and its representatives to have reasonable access to, for at least five (5) years after the expiration of each Lease Year, the records referred to in this Section 4.8.

| 15 | CREZ LEASE AGREEMENT |

4.9. Surrender. Upon the expiration or earlier termination of this Agreement in accordance with its terms (but subject to Section 2.2 and the requirements of all Applicable Laws), and in a manner calculated to avoid any disruption of electrical service, Lessee shall, at its expense, vacate and surrender possession of the CREZ Assets and all components thereof (other than in respect of Footprint Projects funded by Lessee as described in Section 10.3(b), and which are not purchased by Lessor) to Lessor, or to such other Person as Lessor may direct. At the time of such surrender, the CREZ Assets shall be free and clear of Liens and other rights of third parties (other than Permitted Liens set forth in clauses (i), (v), (vi) or (vii) of the definition thereof), and shall be in the same condition as on the Original Operations Date, ordinary wear and tear and subsequent Footprint Projects excepted. At the time of such surrender, Lessee shall, at its expense, deliver or cause to be delivered to Lessor, or to such other Person as Lessor may direct, copies of all title documents, logs, drawings, manuals, specifications and data and inspection, modification and maintenance records, billing records, reports and other documents in respect of the CREZ Assets which are necessary to determine the condition of the CREZ Assets or for the continued maintenance, repair or general operation of the CREZ Assets and are in Lessee’s possession or control at such time. In addition, Lessee shall cooperate with Lessor to identify any contractual arrangements to which Lessee is a party that relate to the CREZ Assets, including any interconnection agreements, fiber sharing agreements or similar arrangements, and, at Lessor’s option and expense, shall use commercially reasonable efforts to transfer, to the extent permitted by Applicable Law, in whole or in part applicable to such CREZ Assets, such agreements to Lessor or its designee. In connection with the surrender of the CREZ Assets, Lessor shall pay to Lessee the aggregate purchase price for any Footprint Projects, equipment or other property purchased by Lessor in accordance with Section 2.3 or Section 10.5(b).

4.10. Cooperation; Transition Services.

(a) During the period (i) after notice of termination and prior to the termination of the Agreement or (ii) after Lessor has notified Lessee that Lessor is considering a sale, lease or financing involving the CREZ Assets, with reasonable notice, Lessee will cooperate in all reasonable respects with the efforts of Lessor to sell, lease or finance the CREZ Assets (or any component thereof) or any interest therein, including permitting prospective purchasers, lessees or financing sources to fully inspect the CREZ Assets and any logs, drawings, manuals, specifications, data and maintenance records relating thereto; provided that such cooperation shall not unreasonably interfere with the normal operation of the CREZ Assets or cause Lessee to incur any additional expenses other than as specifically provided herein; provided further that such cooperation shall not include requiring Lessee to terminate this Agreement, surrender any rights under this Agreement or otherwise modify this Agreement in any manner. All information obtained in connection with such inspection shall be subject to confidentiality requirements at least as restrictive as those contained in Section 13.3.

(b) Upon expiration or termination of this Agreement, Lessee shall continue to lease and operate the CREZ Assets pursuant to the terms of Section 2.2, if required thereunder. During such period Lessee shall perform all duties and retain all obligations under this Agreement in all respects, as if the Agreement had not expired or been terminated, and will pay Extended Period Rent as and when due.

| 16 | CREZ LEASE AGREEMENT |

4.11. Lessee’s Authority; Enforceability. Lessee hereby represents and warrants as follows, as of the Effective Date:

(a) Lessee has all requisite power and authority to execute and deliver this Agreement and to perform its obligations hereunder. Lessee has taken all action necessary to execute and deliver this Agreement and to perform its obligations hereunder, and no other action or proceeding on the part of Lessee is necessary to authorize this Agreement.

(b) This Agreement constitutes the legally valid and binding obligation of Lessee, enforceable against Lessee in accordance with its terms, except as the enforceability thereof may be limited by applicable bankruptcy, insolvency, reorganization, moratorium or similar Applicable Laws affecting the enforcement of creditors’ rights generally and equitable principles.

4.12. Litigation. If Lessee becomes aware of any actions, claims or other legal or administrative proceedings that are pending, threatened or anticipated with respect to, or which could materially and adversely affect, the CREZ Assets, Lessee shall promptly deliver notice thereof to Lessor.

4.13. Financing.

(a) Lessee acknowledges that Lessor has advised Lessee that Lessor has obtained financing secured by, among other things, the CREZ Assets and this Agreement. In connection with such financing, Lessor made certain representations, warranties and covenants set forth in that certain (i) Amended and Restated Note Purchase Agreement entered into by Lessor and dated as of September 14, 2010 (as amended, restated, supplemented or otherwise modified from time to time, the “2009 Note Purchase Agreement”), a copy of which has been provided to and reviewed by Lessee; (ii) Amended and Restated Note Purchase Agreement entered into by Lessor and dated as of July 13, 2010 (as amended, restated, supplemented or otherwise modified from time to time, the “2010 Note Purchase Agreement”), a copy of which has been provided to and reviewed by Lessee; (iii) Note Purchase Agreement entered into by Lessor dated as of December 3, 2015 (as amended, restated, supplemented or otherwise modified from time to time, the “2015 Note Purchase Agreement”), a copy of which has been provided to and reviewed by Lessee; (iv) Third Amended and Restated Credit Agreement entered into by Lessor and dated as of December 10, 2014 (as amended, restated, amended and restated, supplemented or otherwise modified from time to time, the “2014 Credit Agreement”), a copy of which has been provided to and reviewed by Lessee; (v) Amended and Restated Credit Agreement entered into by Lessor and dated as of December 3, 2015 (as amended, restated, amended and restated, supplemented or otherwise modified from time to time, the “2015 Credit Agreement”), a copy of which has been provided to and reviewed by Lessee; and (vi) Term Loan Credit Agreement entered into by Lessor and dated as of June 5, 2017 (as amended, restated, amended and restated, supplemented or otherwise modified from time to time, the “Term Loan Agreement”), a copy of which has been provided to and reviewed by Lessee.

| 17 | CREZ LEASE AGREEMENT |

(b) Lessee agrees with Lessor that, to the extent not otherwise covered by the terms of this Agreement, Lessee hereby makes on a continuous and ongoing basis the same representations and warranties to Lessor as Lessor makes to the Lender (as defined in the 2014 Credit Agreement) in Sections 6.3 (Disclosure), 6.5 (Financial Condition; Financial Instruments), 6.6 (Compliance with Laws, Other Instruments, Etc.), 6.7 (Governmental Authorizations, Etc.), 6.8 (Litigation; Observance of Agreements, Statutes and Orders), 6.9 (Taxes), 6.10 (Title to Property; Leases), 6.11 (Insurance), 6.12 (Licenses, Permits, Etc.; Material Project Documentation), 6.16 (Foreign Assets and Control Regulations, Etc.), 6.17 (Status under Certain Statutes), 6.18 (Environmental Matters), 6.19 (Force Majeure Events; Employees) and 6.20 (Collateral) of the 2014 Credit Agreement (or equivalent provisions), to the extent that such representations and warranties relate to (i) Lessee, whether in its capacity as Lessee or otherwise, including Lessee’s status or operations as a public utility, or (ii) Lessee’s ownership of the CREZ Assets on or before the date hereof.

(c) Lessee agrees with Lessor that, to the extent not otherwise covered by the terms of this Agreement, Lessee hereby makes on a continuous and ongoing basis the same representations and warranties to Lessor as Lessor makes to the Lender (as defined in the Term Loan Agreement) in Sections 6.3 (Disclosure), 6.5 (Financial Condition; Financial Instruments), 6.6 (Compliance with Laws, Other Instruments, Etc.), 6.7 (Governmental Authorizations, Etc.), 6.8 (Litigation; Observance of Agreements, Statutes and Orders), 6.9 (Taxes), 6.10 (Title to Property; Leases), 6.11 (Insurance), 6.12 (Licenses, Permits, Etc.; Material Project Documentation), 6.16 (Foreign Assets and Control Regulations, Etc.), 6.17 (Status under Certain Statutes), 6.18 (Environmental Matters), 6.19 (Force Majeure Events; Employees) and 6.20 (Collateral) of the Term Loan Agreement (or equivalent provisions), to the extent that such representations and warranties relate to (i) Lessee, whether in its capacity as Lessee or otherwise, including Lessee’s status or operations as a public utility, or (ii) Lessee’s ownership of the CREZ Assets on or before the date hereof.

(d) Lessee covenants and agrees with Lessor that:

(i) during the term of the 2009 Note Purchase Agreement, Lessee will comply with the covenants set forth in Sections 9.08 (Material Project Documents), 10.04 (Terrorism Sanctions Regulations), 10.10 (Sale of Assets, Etc.), 10.11 (Sale or Discount of Receivables), 10.12 (Amendments to Organizational Documents), 10.16 (Project Documents) and 10.17 (Regulation) of the 2009 Note Purchase Agreement;

(ii) during the term of the 2010 Note Purchase Agreement, Lessee will comply with the covenants set forth in Sections 9.8 (Material Project Documents), 10.4 (Terrorism Sanctions Regulations), 10.10 (Sale of Assets, Etc.), 10.11 (Sale or Discount of Receivables), 10.12 (Amendments to Organizational Documents), 10.16 (Project Documents) and 10.17 (Regulation) of the 2010 Note Purchase Agreement;

(iii) during the term of the 2015 Note Purchase Agreement, Lessee will comply with the covenants set forth in Sections 9.8 (Material Project Documents), 10.4 (Terrorism Sanctions Regulations), 10.6 (Sale of Assets, Etc.), 10.9 (Regulation), 10.10 (Amendments to Organizational Documents) and 10.11 (Project Documents) of the 2015 Note Purchase Agreement;

| 18 | CREZ LEASE AGREEMENT |

(iv) during the term of the 2014 Credit Agreement, Lessee will comply with the covenants set forth in Sections 7.10 (Material Project Documents), 8.4 (Terrorism Sanctions Regulations), 8.10 (Sale of Assets, Etc.), 8.11 (Sale or Discount of Receivables), 8.12 (Amendments to Organizational Documents), 8.16 (Material Projects Documents) and 8.17 (Regulation) of the 2014 Credit Agreement (or equivalent provisions);

(v) during the term of the 2015 Credit Agreement, Lessee will comply with the covenants set forth in Sections 6.10 (Material Project Documents), 7.4 (Terrorism Sanctions Regulations), 7.10 (Sale of Assets, Etc.), 7.11 (Sale or Discount of Receivables), 7.12 (Amendments to Organizational Documents), 7.16 (Project Documents) and 7.17 (Regulation) of the 2015 Credit Agreement (or equivalent provisions); and

(vi) during the term of the Term Loan Agreement, Lessee will comply with the covenants set forth in Sections 7.10 (Material Project Documents), 8.4 (Terrorism Sanctions Regulations), 8.10 (Sale of Assets, Etc.), 8.11 (Sale or Discount of Receivables), 8.12 (Amendments to Organizational Documents), 8.16 (Material Projects Documents) and 8.17 (Regulation) of the Term Loan Agreement (or equivalent provisions);

in each case to the extent that such covenants relate to (x) Lessee, whether in its capacity as Lessee or otherwise, including Lessee’s status or operations as a public utility, or (y) Lessee’s ownership of the CREZ Assets on or before the date hereof.

(e) Lessee may not lease, or agree or otherwise commit to lease, any transmission or distribution facilities other than pursuant to a Lease. Further, Lessee shall not permit Persons other than Xxxx Family Members to acquire any interest in Lessee, directly or indirectly, in a manner that would result in a Change of Control of Lessee.

(f) The Parties agree to amend, alter or supplement this Section 4.13, Section 6.2(b) or Exhibit D hereto from time to time, including through the delivery of a representation letter from Lessee or other form to which the Parties may agree, to give effect to the obligations under Lessor’s then-current Debt Agreements, including the credit arrangements of any successor to Lessor’s interest in this Agreement. Provided that the obligations or restrictions on Lessee are not materially increased from those provided for by Lessor’s then-current credit arrangements, such an amendment to this Agreement shall become automatically effective upon the delivery by Lessor to Lessee of a revised version of Section 4.13 and copies of the pertinent portions of the applicable Debt Agreements referenced therein.

| 19 | CREZ LEASE AGREEMENT |

ARTICLE V

LESSOR’S REPRESENTATIONS, WARRANTIES AND COVENANTS

5.1. Lessor’s Authority. Lessor hereby represents and warrants as follows, as of the Effective Date:

(a) Lessor has all requisite power and authority to execute and deliver this Agreement and to perform its obligations hereunder. Lessor has taken all action necessary to execute and deliver this Agreement and to perform its obligations hereunder, and no other action or proceeding on the part of Lessor is necessary to authorize this Agreement.

(b) This Agreement constitutes the legally valid and binding obligation of Lessor, enforceable against Lessor in accordance with its terms, except as the enforceability thereof may be limited by applicable bankruptcy, insolvency, reorganization, moratorium or similar Applicable Laws affecting the enforcement of creditors’ rights generally and equitable principles.

5.2. Liens and Tenants.

(a) Lessor hereby represents and warrants, as of the Effective Date, that:

(i) Lessor has good and valid title to, or valid leasehold and easement interests in, or other valid rights to use and occupy the CREZ Assets; there are no unrecorded Liens (except for Permitted Liens or as disclosed to Lessee in writing or as arise by operation of Applicable Law) arising as a result of any acts or omissions to act of Lessor by, through or under Lessor covering Lessor’s right, title or interest in the CREZ Assets other than any such of the foregoing that does not materially impair Lessee’s use of the CREZ Assets; and, to Lessor’s knowledge, there exist no rights or interests of any third party relating to the CREZ Assets that are not contemplated herein; and

(ii) except for Permitted Liens or as may be disclosed in the applicable real property records in the State of Texas, or as disclosed by Lessor in writing to Lessee, there are no Liens encumbering all or any portion of the CREZ Assets;

provided that Lessor’s representations and warranties in this Section 5.2(a) shall not be deemed to relate to any inaccuracy of such representations and warranties arising as a result of any acts or omissions to act of Lessee, its personnel or contractors in carrying out Lessee’s obligations as the construction manager, operator and lessee of the CREZ Assets whether under this Agreement or any other similar agreement between Lessee or its affiliates on the one hand and Lessor or its affiliates on the other.

(b) Lessor shall fully cooperate and assist Lessee, at no out-of-pocket expense to Lessor, in efforts to obtain a subordination and non-disturbance agreement from each party that holds a Lien that might reasonably be expected to interfere in any material respect with Lessee’s rights under this Agreement. Notwithstanding the foregoing, Lessor and its affiliates shall have the right to incur Permitted Liens encumbering the CREZ Assets or any component thereof solely for the benefit of Lessor in connection with any existing or future financing or refinancing pursuant to which the CREZ Assets (or any component thereof) is pledged as collateral and Lessee agrees to enter into such acknowledgments and agreements in respect thereof with the lenders, or a trustee or agent for the lenders as Lessor may reasonably request.

| 20 | CREZ LEASE AGREEMENT |

5.3. Condition of Assets. Lessor hereby represents and warrants, as of the Effective Date, that Lessor has not taken any action or failed to take any action that would cause the CREZ Assets not to be in good operating condition and repair, ordinary wear and tear excepted, or adequate for the uses to which it is being put.

5.4. Performance Under Operational Agreements. Lessor covenants and agrees with Lessee that:

(a) during the term of the Fiber Sharing Agreement, Lessor will not take any actions that would cause Lessee to breach any provision thereunder; and

(b) except as would not reasonably interfere with Lessee’s ability to continue to perform its obligations under this Agreement and Good Utility Practice, Lessor will comply with its covenants pursuant to the Operational Agreements.

5.5. Requirements of Governmental Agencies. Lessor shall, at Lessee’s cost and expense, assist and fully cooperate with Lessee in complying with or obtaining any material land use permits and approvals, building permits, environmental impact reviews or any other approvals reasonably required for the maintenance or operation of the CREZ Assets, including execution of applications for such approvals, and including participating in any appeals or regulatory proceedings respecting the CREZ Assets, if requested by Lessee.

5.6. Hazardous Materials. Lessor shall conduct its activities in respect of the CREZ Assets in compliance in all material respects with applicable Environmental Laws.

5.7. Litigation. If Lessor becomes aware of any actions, claims or other legal or administrative proceedings that are pending, threatened or anticipated with respect to, or which could materially and adversely affect, the CREZ Assets, Lessor shall promptly deliver notice thereof to Lessee.

5.8. Records. Lessor shall maintain proper books of record and accounts in conformity with GAAP and in order to produce appropriate records for all applicable Regulatory Authorities and each other governmental agency or authority having legal or regulatory jurisdiction over Lessor.

5.9. Limitation. EXCEPT AS EXPRESSLY REPRESENTED OTHERWISE IN THIS ARTICLE V, LESSOR (A) MAKES NO, AND EXPRESSLY DISCLAIMS ANY, REPRESENTATION OR WARRANTY, EXPRESS OR IMPLIED, AS TO (I) TITLE TO THE CREZ ASSETS OR ANY PORTION THEREOF, (II) ANY ESTIMATES OF THE VALUE OF THE CREZ ASSETS OR FUTURE REVENUES THAT MIGHT BE GENERATED BY THE CREZ ASSETS, (III) THE MAINTENANCE, REPAIR, CONDITION, QUALITY, SUITABILITY, DESIGN OR MARKETABILITY OF THE CREZ ASSETS, (IV) INFRINGEMENT OF ANY INTELLECTUAL PROPERTY RIGHT OR (V) ANY OTHER MATERIALS OR INFORMATION THAT MAY HAVE BEEN MADE AVAILABLE OR COMMUNICATED TO LESSEE OR ITS AFFILIATES, OR ITS OR THEIR EMPLOYEES, AGENTS, CONSULTANTS, REPRESENTATIVES OR ADVISORS IN CONNECTION WITH THE TRANSACTIONS CONTEMPLATED BY THIS AGREEMENT OR ANY DISCUSSION OR PRESENTATION RELATING THERETO, AND (B) FURTHER

| 21 | CREZ LEASE AGREEMENT |

DISCLAIMS ANY REPRESENTATION OR WARRANTY, EXPRESS OR IMPLIED, OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE OR CONFORMITY TO MODELS OR SAMPLES OF MATERIALS OF ANY PORTION OF THE CREZ ASSETS, IT BEING EXPRESSLY UNDERSTOOD AND AGREED BY THE PARTIES THAT THE CREZ ASSETS ARE BEING LEASED “AS IS, WHERE IS,” WITH ALL FAULTS AND DEFECTS, AND THAT LESSEE HAS MADE OR CAUSED TO BE MADE SUCH INSPECTIONS AS LESSEE DEEMS APPROPRIATE.

ARTICLE VI

LOSS AND DAMAGE; INSURANCE

6.1. Loss and Damage to the CREZ Assets.

(a) In the event of any damage or loss to any component of the CREZ Assets, Lessee shall promptly repair or replace such component to the standards required by Section 4.1 (regardless of whether such repair or replacement constitutes a Repair or a Footprint Project and including any repair or replacement that is the responsibility of SDTS under any Operational Agreement). Notwithstanding anything to the contrary contained in this Agreement, any such repaired or replaced component will immediately become part of the CREZ Assets owned by Lessor and the cost of any repair or replacement shall be borne as described in Sections 6.1(b)-(d) below.

(b) If such repair or replacement constitutes a Repair, the cost of repairing or replacing such damage or loss, whether actually covered in whole or in part by insurance, shall be the responsibility of Lessee. In such circumstance, unless otherwise agreed by the Parties, (i) if the damage or loss is covered by insurance, Lessee shall be responsible for payment of any deductible, and (ii) any damage or loss not covered by insurance (exclusive of any deductible) shall be the responsibility of Lessee. If the sum of such deductible and insurance proceeds exceeds the cost of such Repair, then Lessee will retain such excess.

(c) If such repair or replacement constitutes a Footprint Project, then, as long as the related costs have been included in a CapEx Budget, the cost of repairing or replacing such damage or loss, whether actually covered in whole or in part by insurance, shall be the responsibility of Lessor. In such circumstance, unless otherwise agreed by the Parties, (i) if the damage or loss is covered by insurance, Lessor shall be responsible for payment of any deductible, and (ii) any damage or loss not covered by insurance (exclusive of any deductible) shall be the responsibility of Lessor. If the sum of such deductible and insurance proceeds exceeds the cost of such Footprint Project, then such excess will first reduce Lessor’s obligation to fund the deductible hereunder, and any excess thereafter will be retained by Lessor. If such repair or replacement constitutes a Footprint Project that is not included in a CapEx Budget, the provisions of Article X shall apply.

(d) Lessee shall be solely responsible for all costs of repairing or replacing any damaged property and equipment that is not part of the CREZ Assets and is owned by Lessee, whether covered by Lessee’s insurance under Section 6.2 or otherwise. Nothing in this provision shall preclude Lessee from seeking recovery of such costs in a rate proceeding at the PUCT.

| 22 | CREZ LEASE AGREEMENT |

(e) If Lessor funds Lessee’s Personal Property pursuant to Section 10.1(b) of this Agreement, then all such funded Personal Property will be treated as a Footprint Project, and not a Repair, for purposes of this Section 6.1.

6.2. Insurance. Lessee will maintain, with financially sound and reputable insurers, insurance with respect to its business and properties and the CREZ Assets against such casualties and contingencies, of such types, on such terms and in such amounts (including deductibles, co-insurance and self-insurance, if adequate reserves are maintained with respect thereto) as is customary in the case of entities of established reputations engaged in the same or a similar business and similarly situated, but in no event less than the insurance set forth in this Section 6.2 and Exhibit D.

(a) Lessee shall procure at its own expense and maintain in full force and effect at all times throughout the Term (including, if applicable, any Extended Period of Operatorship) insurance policies with insurance companies rated A-, 8 or higher by A.M. Best or acceptable to Lessor if not so rated, and authorized to do business in the State of Texas.