FORBEARANCE AGREEMENT

THIS FORBEARANCE AGREEMENT (this “Agreement”) is made and entered into as of June 27, 2016, by and among CATERPILLAR FINANCIAL SERVICES CORPORATION (“CFSC”), XXXXXXXX MINING INC. (“Xxxxxxxx”) and XXXXXXXX MININC, LLC (“CML,” and together with Xxxxxxxx, “Obligor”).

WHEREAS, CFSC and Obligor are parties to certain finance and lease agreements set forth in greater detail in Exhibit A attached hereto, as they may have been amended from time to time (collectively, the “Equipment Contracts”), pursuant to which Obligor financed its purchase and lease of Caterpillar equipment with CFSC;

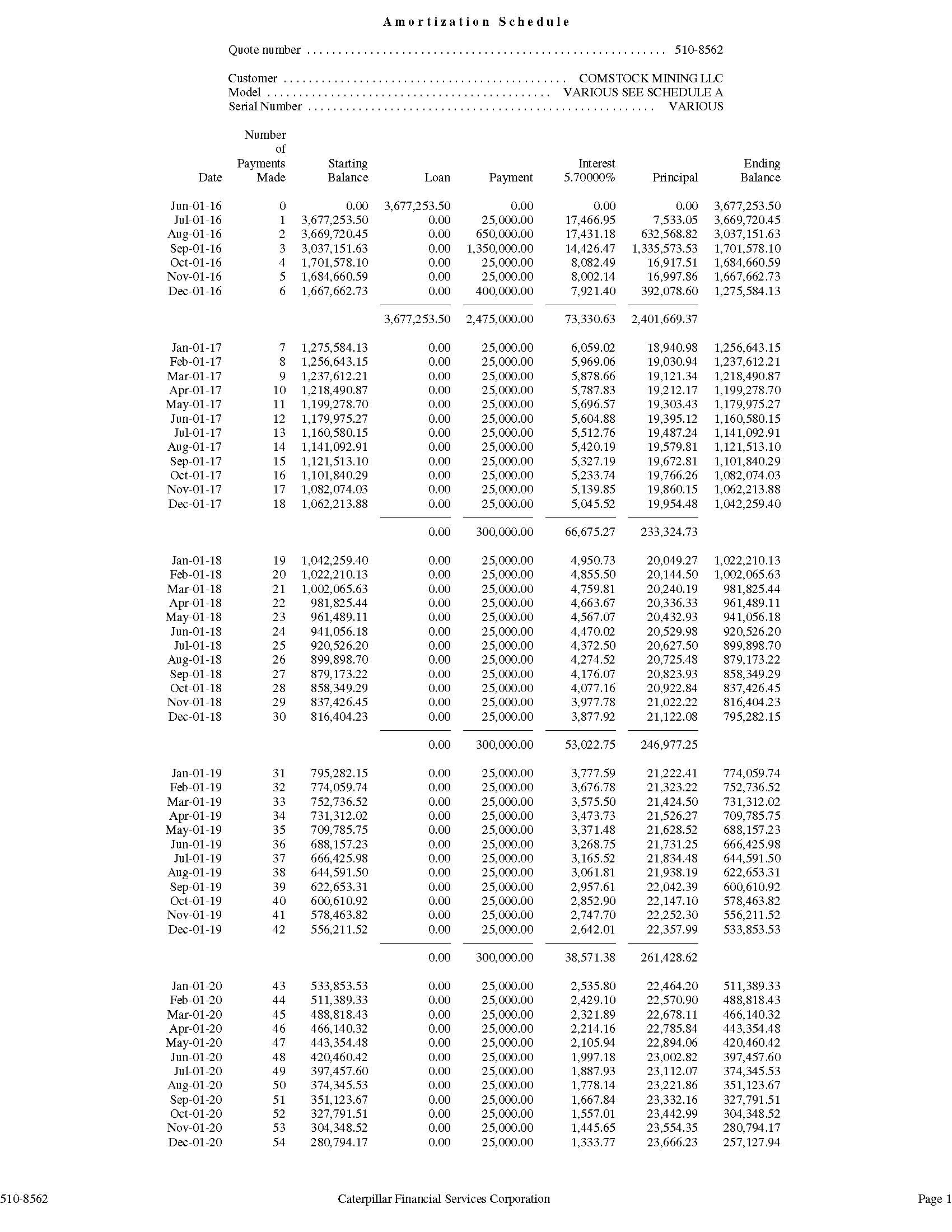

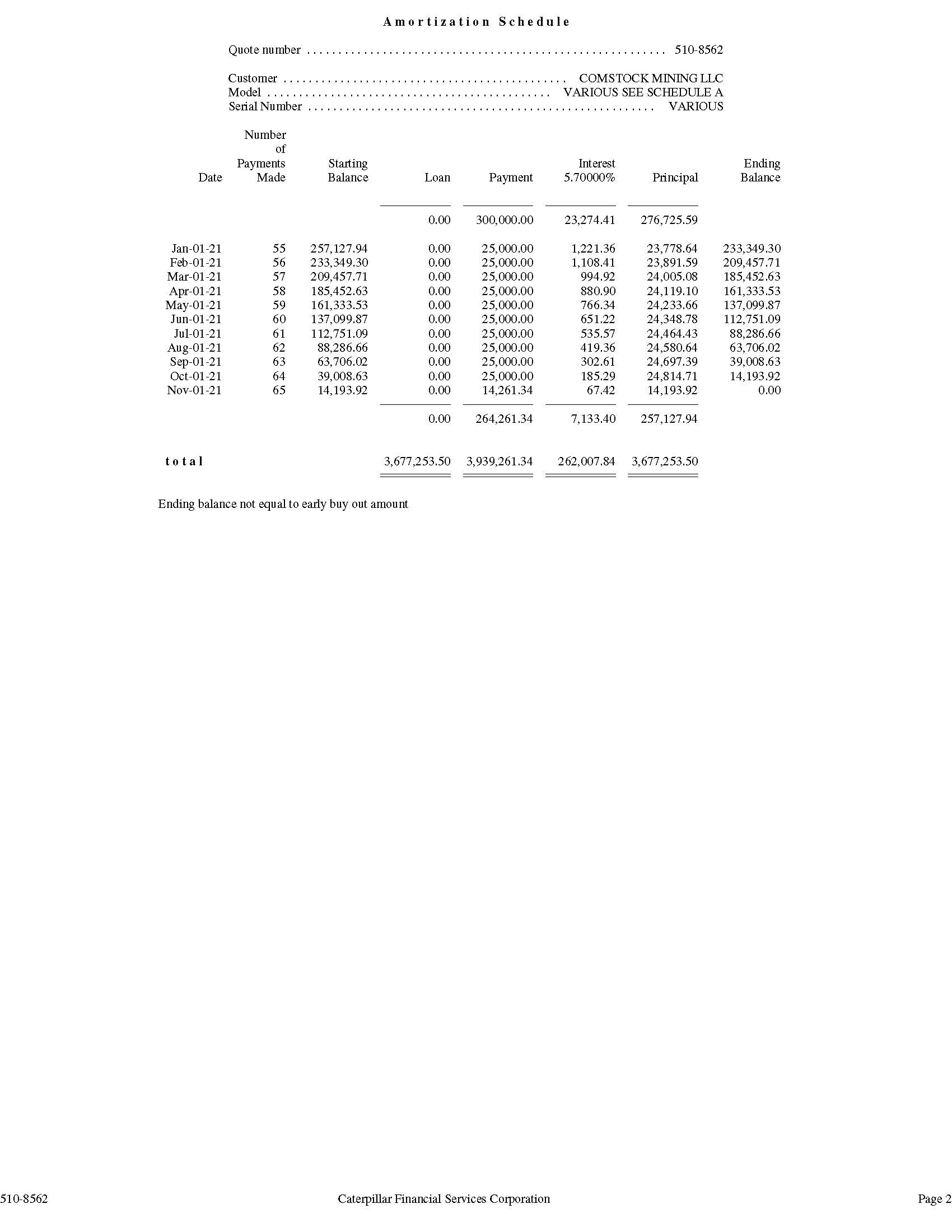

WHEREAS, Obligor has requested that CFSC forbear from declaring the Equipment Contracts to be in default and that CFSC forbear from pursuing its rights and remedies at this time;

NOW, THEREFORE, in consideration of the good and valuable consideration, the sufficiency of which is hereby acknowledged, and in order to induce CFSC to forbear from declaring a default under the Equipment Contracts and pursuing its remedies at this time, the parties agrees as follows:

1. | Forbearance Period. Subject to Sections 2 and 4 below, CFSC agrees to forbear from declaring a default under the Equipment Contracts and from exercising its rights and remedies under the Equipment Contracts until the earlier to occur of (“Forbearance Period”): |

(a) | November 1, 2021, unless extended at the sole discretion of CFSC, or |

(b) The occurrence of a Termination Event (defined below).

2. | Conditions of Forbearance. CFSC’s agreement to forbear from declaring a default and pursuing any of its rights and remedies is conditioned upon and subject to timely satisfaction (subject in each case to a 10 day grace period pursuant to which any payment within 10 days of the due dates set forth below shall be deemed timely) of each of the following conditions (“Conditions of Forbearance”): |

(a)Prior to or on July 1, 2016, Obligor will remit to CFSC $25,000.00 (Twenty Five Thousand Dollars);

(b) Prior to or on August 1, 2016, Obligor will remit to CFSC the net proceeds from any and all equipment sold at the auction of the equipment set forth on Exhibit B that Obligor pledged to CFSC as collateral under certain Equipment Contracts, but not less than $650,000.00 (Six Hundred and Fifty Thousand Dollars);

(c) Prior to or on September 1, 2016, Obligor will remit to CFSC the net proceeds from any and all equipment sold at the auction of the equipment set forth on Exhibit C that Obligor pledged to CFSC as collateral under certain Equipment Contracts, and when combined with the net proceeds referenced in 2(b) above in the cumulative amount of not less than $2,000,000.00 (Two Million Dollars for August 1, and September 1, combined);

(d) Prior to or on October 1, 2016, Obligor will remit to CFSC $25,000.00 (Twenty Five Thousand Dollars);

(e) Prior to or on November 1, 2016, Obligor will remit to CFSC $25,000.00 (Twenty Five Thousand Dollars);

(f) Prior to or on December 1, 2016, Obligor will remit to CFSC $400,000.00 (Four Hundred Thousand Dollars);

(g) Prior to or on the first day of each month thereafter until all amounts due under the Equipment Contracts have been paid in full, Obligor will remit to CFSC $25,000.00 (Twenty Five Thousand Dollars); and

(h) Obligor will provide CFSC with a copy of Xxxxxxxx’x prospectus supplement filed with the U.S. Securities and Exchange Commission during the Forbearance Period as soon as it is publicly available and such prospectus supplement will address the raising of capital necessary for Obligor to fulfill its obligations under Section 2(f) of this Agreement.

3. | Payments Made as Conditions of Forbearance. As of the date of this Agreement, Obligor’s obligations to CFSC under the Equipment Contracts total Three Million Six Hundred Seventy Seven Thousand Two Hundred Fifty Three Dollars and Fifty Cents ($3,677,253.50) (the “Obligation”). Each payment that Obligor remits to CFSC as a Condition of Forbearance will be comprised of a part of the Obligation and applicable interest, as set forth in greater detail in Exhibit D, which may be amended from time to time as prepayments and excess payments are remitted from Obligor to CFSC. If any of Obligor’s payments that are remitted to CFSC as a Condition of Forbearance are in excess of the amount required, CFSC agrees to apply such excess payments to reduce the Obligation, provided however, that such excess payments will not reduce the amount of the required monthly payments but will reduce the duration of payments required under Section 2(f). |

4. | Interest. Interest on the outstanding Obligation will be computed from the date of this Agreement at the rate equal to 5.70% per annum. All interest payable hereunder shall be calculated on the basis of a thirty (30) day month in a year of three hundred sixty (360) days. CFSC and Obligor agree to conform strictly to applicable usury laws as presently in effect. Accordingly, CFSC and Obligor agree that all sums that constitute interest under applicable law which is contracted for, charged, or received under this Agreement will under no circumstance exceed the maximum lawful rate of interest permitted by applicable law. Any excess interest shall be applied to the reduction of the Obligation owning under this Agreement or refunded to Obligor by CFSC, at CFSC’s sole discretion. |

5. | Termination Event. The occurrence of any of the following will be deemed events that terminate this Agreement (“Termination Event”): |

a. | Obligor fails to comply in a timely manner with any of the Conditions of Forbearance set forth above; |

b. | Obligor breaches any of the representations, warranties and covenants contained in Section 7 of this Agreement; |

c. | An event of default occurs under any of the Equipment Contracts; and |

d. | CML or Xxxxxxxx voluntarily files a petition for relief or has an involuntary petition filed against it under the applicable bankruptcy laws, or any kind of receivership or insolvency proceeding is commenced by or against CML or Xxxxxxxx. |

Upon the occurrence of a Termination Event, this Agreement will terminate automatically without any further action or inaction on the part of CFSC or Obligor, unless CFSC executes a written waiver. CFSC may, but is not obligated to, provide Obligor with a written notice of default or a cure period.

6. | Effects of Termination Event. Upon the occurrence of a Termination Event, in addition to the termination of this Agreement, the Equipment Contracts will be declared to be in default. CFSC will be under no obligation to forbear in any respect and will be entitled to immediately accelerate the balances due under the Equipment Contracts and to exercise all of its rights and remedies under the Equipment Contracts and at law and equity. CFSC may accept any payments, partial payments |

2

or other performance from Obligor or any other person without being deemed to reinstate the Forbearance Period, decelerate the balance due under the Equipment Contracts or waive any of CFSC’s rights or remedies under this Agreement, the Equipment Contracts or at law and equity.

7. | Representations, Warranties and Covenants. The following representations, warranties and covenants are made to CFSC: |

a. | Obligor affirms each of the representations, warranties and covenants made to CFSC in the Equipment Contracts; |

b. | Obligor is duly authorized and empowered to enter into and perform under this Agreement and the execution and performance of this Agreement does not and will not violate any agreement to which Obligor is a party; |

c. | Until all obligations to CFSC are satisfied in full, without the prior written consent of CFSC, Obligor will not transfer or cause to be transferred any of their respective assets, or make distributions of dividends or other property outside of the ordinary course of business. For clarification, CFSC has consented to the auction of the equipment set forth in Exhibit B and Exhibit C and the auction of such equipment will not be deemed a breach under this Agreement or the Equipment Contracts; |

d. | Obligor acknowledges the truth and correctness of the recitals and Obligor affirms their respective obligations to CFSC under the Equipment Contracts; |

e. | Obligor agrees that they have no claim, defense, counterclaim, setoff and/or any other grounds of avoidance to its obligations under and in respect of the Equipment Contracts; |

f. | All financial and other information given to CFSC by Obligor or Obligor’s agents or representatives is and will be true and accurate; |

g. | As of the date hereof, all liens, security interests, assignments and pledges granted by Obligor to CFSC are first priority liens, security interests, assignments and pledges and continue unimpaired, are in full force and effect and will continue to secure all of the obligations described in the respective instruments in which such interests were granted until and unless CFSC agrees to release such liens, security interests, assignments and pledges; and |

h. | Obligor acknowledges that this Agreement represents an arms‑length transaction, and that each party has acted in good faith in the making of this Agreement. |

8. | Release and Waiver. Obligor acknowledges and stipulates that it has no claims or causes of action of any kind whatsoever against CFSC, its officers, directors, employees, agents, representatives, attorneys or consultants. Obligor releases CFSC, its officers, directors, employees, agents, representatives, attorneys and consultants, from any and all claims, causes of action, demands and liabilities of any kind whatsoever whether direct or indirect, fixed or contingent, liquidated or non‑liquidated, disputed or undisputed, known or unknown, which Obligor has or may acquire in the future relating in any way to this Agreement or the Equipment Contracts. |

9. | Costs and Expenses. Obligor agrees to pay, upon written demand by CFSC, all out‑of‑pocket costs and expenses of CFSC in connection with the enforcement or protection of CFSC’s rights under this Agreement and/or the Equipment Contracts. |

10. | No Obligation to Extend Future Forbearances; No Waiver. Obligor acknowledges and agrees that CFSC is not obligated and does not agree to extend any other or future forbearances or additional |

3

credit to Obligor. This Agreement will not constitute a waiver by CFSC of any of Obligor’s defaults under the Equipment Contracts. Except as expressly provided herein, CFSC reserves all of its rights and remedies under the Equipment Contracts. No action or course of dealing on the part of CFSC, its officers, employees, consultants, or agents, nor any failure or delay by CFSC with respect to exercising any right, power or privilege of CFSC under this Agreement or Equipment Contracts, will operate as a waiver or postponement thereof, except to the extent expressly provided herein.

11. | Governing Law; Venue. This Agreement will be governed by and construed in accordance with the laws of Tennessee. The parties agree that any legal action by either party against the other relating in any way to this Agreement, the Equipment Contracts, or any relationship between or conduct by the parties, whether at law or in equity, whether sounding in contract, tort or otherwise, will be commenced only in a court of competent subject matter jurisdiction located in Tennessee. |

12. | Amendments. This Agreement cannot be amended, rescinded, supplemented, or modified except in writing signed by the parties hereto. |

13. | Counterparts. This Agreement may be executed in more than one counterpart, all of which, taken together, will constitute one and the same instrument. |

14. | Time of the Essence. TIME IS OF THE ESSENCE OF THIS AGREEMENT. THE PARTIES TO THIS AGREEMENT HAVE READ AND UNDERSTAND ALL OF THE PROVISIONS OF THIS AGREEMENT. |

[Signature page follows.]

4

IN WITNESS WHEREOF, the parties have caused their duly authorized representatives to execute this Agreement as of the date first set forth above.

CATERPILLAR FINANCIAL XXXXXXXX MINING, LLC

SERVICES CORPORATION

By: /s/ Xxxxxx Xxxxxx III By: /s/ Xxxxxxx Xx Xxxxxxxx

Name: Xxxxxx Xxxxxx III Name: Xxxxxxx Xx Xxxxxxxx

Title: Special Accounts Manager Title: President & CEO

XXXXXXXX MINING INC.

By: /s/ Xxxxxxx Xx Xxxxxxxx

Name: Xxxxxxx Xx Xxxxxxxx

Title: President & CEO

5

EXHIBIT A

Equipment Contracts

Contract Number | Contract Type | Manufacturer | Model | Serial Number |

000-0000000-000 | Finance Lease | CAT | 740B Articulated Truck | T4R01054 |

000-0000000-000 | Finance Lease | CAT | 740B Articulated Truck | T4R00910 |

000-0000000-000 | Finance Lease | CAT | 740B Articulated Truck | T4R00968 |

000-0000000-000 | Finance Lease | CAT | 740B Articulated Truck | T4R01381 |

000-0000000-000 | ISC | CAT | D8T Track Type Xxxxxxx | XXX00000 |

000-0000000-000 | ISC | CAT | 988H Wheel Loader | BXY04526 |

000-0000000-000 | ISC | CAT | 966K Wheel Loader | TFS00798 |

000-0000000-000 | ISC | CAT | 740B Articulated Truck | T4R01577 |

000-0000000-000 | ISC | CAT | D8T Track Type Xxxxxxx | XXX00000 |

000-0000000-000 | ISC | CAT | D6NXL Track Type Tractor | LJR00664 |

000-0000000-000 | ISC | CAT | 14M Motor Grader | R9J00960 |

000-0000000-000 | ISC | CAT | 349E Excavator | TFG00382 |

6

EXHIBIT B

Equipment to be Auctioned under Section 2(b)

Contract Number | Contract Type | Manufacturer | Model | Serial Number |

000-0000000-000 | Finance Lease | CAT | 740B Articulated Truck | T4R00910 |

000-0000000-000 | Finance Lease | CAT | 740B Articulated Truck | T4R00968 |

000-0000000-000 | ISC | CAT | 966K Wheel Loader | TFS00798 |

000-0000000-000 | ISC | CAT | D6NXL Track Type Tractor | LJR00664 |

000-0000000-000 | ISC | CAT | 14M Motor Grader | R9J00960 |

7

EXHIBIT C

Equipment to be Auctioned under Section 2(c)

Contract Number | Contract Type | Manufacturer | Model | Serial Number |

000-0000000-000 | Finance Lease | CAT | 740B Articulated Truck | T4R01054 |

000-0000000-000 | Finance Lease | CAT | 740B Articulated Truck | T4R01381 |

000-0000000-000 | ISC | CAT | D8T Track Type Xxxxxxx | XXX00000 |

000-0000000-000 | ISC | CAT | 988H Wheel Loader | BXY04526 |

000-0000000-000 | ISC | CAT | 740B Articulated Truck | T4R01577 |

000-0000000-000 | ISC | CAT | D8T Track Type Xxxxxxx | XXX00000 |

000-0000000-000 | ISC | CAT | 349E Excavator | TFG00382 |

8

EXHIBIT D

Amortization Schedule

9

10