Contract

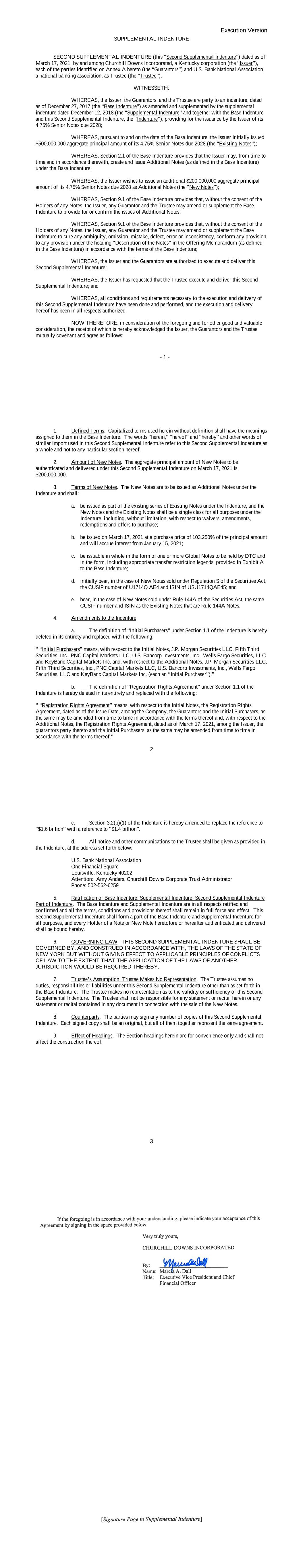

Execution Version - 1 - SUPPLEMENTAL INDENTURE SECOND SUPPLEMENTAL INDENTURE (this “Second Supplemental Indenture”) dated as of March 17, 2021, by and among Xxxxxxxxx Xxxxx Incorporated, a Kentucky corporation (the “Issuer”), each of the parties identified on Annex A hereto (the “Guarantors”) and U.S. Bank National Association, a national banking association, as Trustee (the “Trustee”). WITNESSETH: WHEREAS, the Issuer, the Guarantors, and the Trustee are party to an indenture, dated as of December 27, 2017 (the “Base Indenture”) as amended and supplemented by the supplemental indenture dated December 12, 2018 (the “Supplemental Indenture” and together with the Base Indenture and this Second Supplemental Indenture, the “Indenture”), providing for the issuance by the Issuer of its 4.75% Senior Notes due 2028; WHEREAS, pursuant to and on the date of the Base Indenture, the Issuer initially issued $500,000,000 aggregate principal amount of its 4.75% Senior Notes due 2028 (the “Existing Notes”); WHEREAS, Section 2.1 of the Base Indenture provides that the Issuer may, from time to time and in accordance therewith, create and issue Additional Notes (as defined in the Base Indenture) under the Base Indenture; WHEREAS, the Issuer wishes to issue an additional $200,000,000 aggregate principal amount of its 4.75% Senior Notes due 2028 as Additional Notes (the “New Notes”); WHEREAS, Section 9.1 of the Base Indenture provides that, without the consent of the Holders of any Notes, the Issuer, any Guarantor and the Trustee may amend or supplement the Base Indenture to provide for or confirm the issues of Additional Notes; WHEREAS, Section 9.1 of the Base Indenture provides that, without the consent of the Holders of any Notes, the Issuer, any Guarantor and the Trustee may amend or supplement the Base Indenture to cure any ambiguity, omission, mistake, defect, error or inconsistency, conform any provision to any provision under the heading “Description of the Notes” in the Offering Memorandum (as defined in the Base Indenture) in accordance with the terms of the Base Indenture; WHEREAS, the Issuer and the Guarantors are authorized to execute and deliver this Second Supplemental Indenture; WHEREAS, the Issuer has requested that the Trustee execute and deliver this Second Supplemental Indenture; and WHEREAS, all conditions and requirements necessary to the execution and delivery of this Second Supplemental Indenture have been done and performed, and the execution and delivery hereof has been in all respects authorized. NOW THEREFORE, in consideration of the foregoing and for other good and valuable consideration, the receipt of which is hereby acknowledged the Issuer, the Guarantors and the Trustee mutually covenant and agree as follows: 2 1. Defined Terms. Capitalized terms used herein without definition shall have the meanings assigned to them in the Base Indenture. The words “herein,” “hereof” and “hereby” and other words of similar import used in this Second Supplemental Indenture refer to this Second Supplemental Indenture as a whole and not to any particular section hereof. 2. Amount of New Notes. The aggregate principal amount of New Notes to be authenticated and delivered under this Second Supplemental Indenture on March 17, 2021 is $200,000,000. 3. Terms of New Notes. The New Notes are to be issued as Additional Notes under the Indenture and shall: a. be issued as part of the existing series of Existing Notes under the Indenture, and the New Notes and the Existing Notes shall be a single class for all purposes under the Indenture, including, without limitation, with respect to waivers, amendments, redemptions and offers to purchase; b. be issued on March 17, 2021 at a purchase price of 103.250% of the principal amount and will accrue interest from January 15, 2021; c. be issuable in whole in the form of one or more Global Notes to be held by DTC and in the form, including appropriate transfer restriction legends, provided in Exhibit A to the Base Indenture; d. initially bear, in the case of New Notes sold under Regulation S of the Securities Act, the CUSIP number of U1714Q AE4 and ISIN of USU1714QAE45; and x. xxxx, in the case of New Notes sold under Rule 144A of the Securities Act, the same CUSIP number and ISIN as the Existing Notes that are Rule 144A Notes. 4. Amendments to the Indenture a. The definition of “Initial Purchasers” under Section 1.1 of the Indenture is hereby deleted in its entirety and replaced with the following: “ “Initial Purchasers” means, with respect to the Initial Notes, X.X. Xxxxxx Securities LLC, Fifth Third Securities, Inc., PNC Capital Markets LLC, U.S. Bancorp Investments, Inc., Xxxxx Fargo Securities, LLC and KeyBanc Capital Markets Inc. and, with respect to the Additional Notes, X.X. Xxxxxx Securities LLC, Fifth Third Securities, Inc., PNC Capital Markets LLC, U.S. Bancorp Investments, Inc., Xxxxx Fargo Securities, LLC and KeyBanc Capital Markets Inc. (each an “Initial Purchaser”).” b. The definition of “Registration Rights Agreement” under Section 1.1 of the Indenture is hereby deleted in its entirety and replaced with the following: “ “Registration Rights Agreement” means, with respect to the Initial Notes, the Registration Rights Agreement, dated as of the Issue Date, among the Company, the Guarantors and the Initial Purchasers, as the same may be amended from time to time in accordance with the terms thereof and, with respect to the Additional Notes, the Registration Rights Agreement, dated as of March 17, 2021, among the Issuer, the guarantors party thereto and the Initial Purchasers, as the same may be amended from time to time in accordance with the terms thereof.” 3 c. Section 3.2(b)(1) of the Indenture is hereby amended to replace the reference to “$1.6 billion” with a reference to “$1.4 billion”. d. All notice and other communications to the Trustee shall be given as provided in the Indenture, at the address set forth below: U.S. Bank National Association Xxx Xxxxxxxxx Xxxxxx Xxxxxxxxxx, Xxxxxxxx 00000 Attention: Xxx Xxxxxx, Xxxxxxxxx Xxxxx Corporate Trust Administrator Phone: 000-000-0000 5. Ratification of Base Indenture; Supplemental Indenture; Second Supplemental Indenture Part of Indenture. The Base Indenture and Supplemental Indenture are in all respects ratified and confirmed and all the terms, conditions and provisions thereof shall remain in full force and effect. This Second Supplemental Indenture shall form a part of the Base Indenture and Supplemental Indenture for all purposes, and every Holder of a Note or New Note heretofore or hereafter authenticated and delivered shall be bound hereby. 6. GOVERNING LAW. THIS SECOND SUPPLEMENTAL INDENTURE SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK BUT WITHOUT GIVING EFFECT TO APPLICABLE PRINCIPLES OF CONFLICTS OF LAW TO THE EXTENT THAT THE APPLICATION OF THE LAWS OF ANOTHER JURISDICTION WOULD BE REQUIRED THEREBY. 7. Trustee’s Assumption; Trustee Makes No Representation. The Trustee assumes no duties, responsibilities or liabilities under this Second Supplemental Indenture other than as set forth in the Base Indenture. The Trustee makes no representation as to the validity or sufficiency of this Second Supplemental Indenture. The Trustee shall not be responsible for any statement or recital herein or any statement or recital contained in any document in connection with the sale of the New Notes. 8. Counterparts. The parties may sign any number of copies of this Second Supplemental Indenture. Each signed copy shall be an original, but all of them together represent the same agreement. 9. Effect of Headings. The Section headings herein are for convenience only and shall not affect the construction thereof.

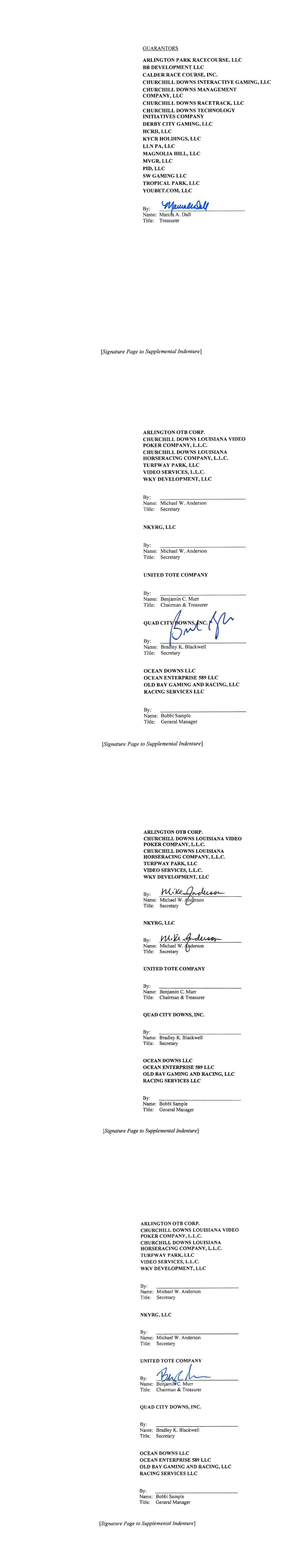

4 Annex A Arlington OTB Corp. Arlington Park Racecourse, LLC BB Development LLC d/b/a Oxford Casino Calder Race Course, Inc., d/b/a Calder Casino and Race Course Xxxxxxxxx Xxxxx Interactive Gaming, LLC Xxxxxxxxx Xxxxx Louisiana Horseracing Company, L.L.C. d/b/a Fair Grounds Race Course & Slots Xxxxxxxxx Xxxxx Louisiana Video Poker Company, L.L.C. Xxxxxxxxx Xxxxx Management Company, LLC Xxxxxxxxx Xxxxx Racetrack, LLC Xxxxxxxxx Xxxxx Technology Initiatives Company d/b/a Bloodstock Research Information Services, XxxXxxxxxx.xxx and XxxxXxxxxx.xxx Derby City Gaming, LLC HCRH, LLC KYCR Holdings, LLC LLN PA, LLC Xxxxxxxx Xxxx, LLC d/b/a Riverwalk Casino Hotel, LLC MVGR, LLC NKYRG, LLC Ocean Downs LLC Ocean Enterprise 589 LLC Old Bay Gaming and Racing, LLC PID, LLC Quad City Downs, Inc. Racing Services LLC 5 SW Gaming LLC d/b/a Harlow's Casino Resort & Spa Tropical Park, LLC Turfway Park, LLC United Tote Company Video Services, LLC WKY Development, LLC Xxxxxx.xxx, LLC