LEASE

Exhibit 10.18

THIS LEASE (this “Lease”) is executed this 21st day of March, 2016, by and between XXXX XXXXXX, LLC, a Delaware limited liability company (“Landlord”), and BLUE APRON, INC., a Delaware corporation (“Tenant”).

ARTICLE 1 - LEASE OF PREMISES

Section 1.01. Basic Lease Provisions and Definitions.

(a) (i) “Leased Premises” means the Building Land, together with the Improvements (as defined below) thereon, as shown outlined on Exhibit A attached hereto and made a part hereof.

(ii) “Building” shall mean the building in the process of being constructed (in accordance with the provisions of Article 2 hereof) on the Building Land, together with all permanent fixtures that, at the commencement of or during the Lease Term, are thereto attached, and any and all renewals and replacements thereof, additions thereto and substitutes therefor made in accordance with the provisions of this Lease.

(iii) “Building Land” shall mean that certain parcel of land located in the City of Linden, County of Union, State of New Jersey, commonly known as 000 Xxxx Xxxxxx Xxxxxx, Xxxxxx, Xxx Xxxxxx 00000.

(iv) “Improvements” shall mean all buildings (including, without limitation, the Building), appurtenant structures and other improvements of any kind located on the Building Land from time to time, whether existing now or in the future, and whether above, on or below the Leased Premises surface, including, without limitation, outbuildings, loading areas, canopies, walls, waterlines, sewer, electrical and gas distribution facilities, parking facilities, walkways, streets, curbs, roads, rights-of-way, fences, xxxxxx, exterior plantings, poles and signs.

(b) “Rentable Area”: approximately 495,121 square feet, subject to adjustment in accordance with the provisions of this Section 1.01(b). Within thirty (30) days after the Commencement Date, Tenant shall have the right to have the Leased Premises measured by an architect reasonably acceptable to Landlord using accepted BOMA Standards. The square footage so certified by such architect shall conclusively determine the rentable square footage of the Leased Premises. If the rentable square footage of the Leased Premises differs from 495,121 square feet by more than one percent (1%), then (i) the Minimum Annual Rent (and Monthly Rental Installments) shall be adjusted on the basis of the rentable square footage of the Leased Premises so certified by such architect, using the rental rates set forth in Section 1.01(d) below on a square foot basis, and (ii) the Tenant Allowance set forth in Exhibit B hereto shall be adjusted accordingly on a square foot basis. If Tenant does not elect to have the Leased Premises remeasured in accordance with this Section 1.01(b), then the rentable square footage of the Leased Premises shall be deemed to be as set forth above.

(c) “Tenant’s Proportionate Share”: 100% (provided, however, Tenant’s Proportionate Share with respect to the Shared Areas, defined below, shall be 50%).

(d) “Minimum Annual Rent” (subject to adjustment in accordance with the provisions of Section 1.01(b) above):

|

Year 1 |

|

$ |

2,792,482.44 |

|

|

Year 2 |

|

$ |

3,779,159.57 |

|

|

Year 3 |

|

$ |

3,854,742.76 |

|

|

Year 4 |

|

$ |

3,931,837.62 |

|

|

Year 5 |

|

$ |

4,010,474.37 |

|

|

Year 6 |

|

$ |

4,090,683.86 |

|

|

Year 7 |

|

$ |

4,172,497.53 |

|

|

Year 8 |

|

$ |

4,255,947.48 |

|

|

Year 9 |

|

$ |

4,341,066.43 |

|

|

Year 10 |

|

$ |

4,427,887.76 |

|

|

Year 11 |

|

$ |

1,112,425.00 |

|

(e) “Monthly Rental Installments”:

|

Months 1 – 3 |

|

$ |

0.00 |

|

|

Months 4 – 15 |

|

$ |

310,275.83 |

|

|

Months 16 – 27 |

|

$ |

316,481.34 |

|

|

Months 28 – 39 |

|

$ |

322,810.97 |

|

|

Months 40 – 51 |

|

$ |

329,267.18 |

|

|

Months 52 – 63 |

|

$ |

335,852.54 |

|

|

Months 64 – 75 |

|

$ |

342,569.60 |

|

|

Months 76 – 87 |

|

$ |

349,421.00 |

|

|

Months 88 – 99 |

|

$ |

356,409.43 |

|

|

Months 100 – 111 |

|

$ |

363,537.60 |

|

|

Months 112 – 123 |

|

$ |

370,808.37 |

|

The parties agree that Month 4 shall run from the day after the date that is three (3) months following the Commencement Date and end on the last day of the first full month following the day after the date that is three (3) months following the Commencement Date and Tenant shall pay, in addition to the standard Monthly Rental Installment for such month, a prorated amount pursuant to Section 3.01 below. For example purposes only, if the Commencement Date is June 15, 2016, Month 4 will begin on September 16, 2016 and end on October 31, 2016 and Tenant will pay a Monthly Rental Installment of $465,413.75 for such period (as may be adjusted pursuant to subsection (b) above).

(f) Intentionally Omitted.

(g) “Target Commencement Date”: June 1, 2016.

(h) “Lease Term”: Ten (10) years and three (3) months.

(i) “Security Deposit”: $1,671,033.38, subject to adjustment as set forth in Article 4 below.

(j) “Broker(s)”: Duke Realty Services, LLC representing Landlord and CBRE, Inc. representing Tenant.

(k) “Permitted Use”: General office, commercial kitchen, cafeteria for Tenant’s employees, warehousing, storage, and the manufacturing, processing, packing, preparation, transportation and/or distribution of food, food products, wine and kitchenware, and any purposes related or incidental thereto.

(l) Address for notices and payments are as follows:

|

Landlord: |

|

Xxxx Xxxxxx, LLC |

|

|

|

c/o Duke Realty Corporation |

|

|

|

Attn: New Jersey Market, Vice President, |

|

|

|

Asset Management & Customer Service |

|

|

|

0000 Xxxxxxxx Xxxx, Xxxxx 000 |

|

|

|

Xxxxxxxxxx, XX 00000 |

|

|

|

|

|

With Payments to: |

|

Xxxx Xxxxxx, LLC |

|

|

|

00 Xxxxxxxxxx Xxxxx, Xxxxx 0000 |

|

|

|

Xxxxxxx, XX 00000-0000 |

|

|

|

|

|

Tenant: |

|

Blue Apron, Inc. |

|

|

|

0 Xxxxxx Xxxxxx, 0xx Xxxxx |

|

|

|

Xxx Xxxx, XX 00000 |

|

|

|

Attn.: General Counsel |

|

|

|

|

|

And for notices under Article 13 only, | ||

|

with a copy to: |

|

Xxxxx Danzig Xxxxxxx Xxxxxx & Xxxxxxxx, LLP |

|

|

|

Headquarters Plaza |

|

|

|

One Speedwell Avenue |

|

|

|

Morristown, New Jersey 07962-1981 |

|

|

|

Attn.: Xxxxx Xxxxxxxx, Esq. |

(m) “Guarantor(s)”: None.

(n) Exhibits:

|

Exhibit A: |

|

Site Plan of Leased Premises |

|

Exhibit B: |

|

Workletter |

|

Exhibit B-1: |

|

Building Specifications |

|

Exhibit B-2: |

|

Preliminary Plans |

|

Exhibit C: |

|

Form of Letter of Understanding |

|

Exhibit D: |

|

Rules and Regulations |

|

Exhibit E: |

|

Form of Hazardous Substances Certificate |

|

Exhibit F: |

|

Form of Irrevocable Letter of Credit |

|

Exhibit G: |

|

Intentionally Omitted |

|

Exhibit H: |

|

Form of Subordination, Nondisturbance and Attornment Agreement |

|

Exhibit I: |

|

Floor Load |

|

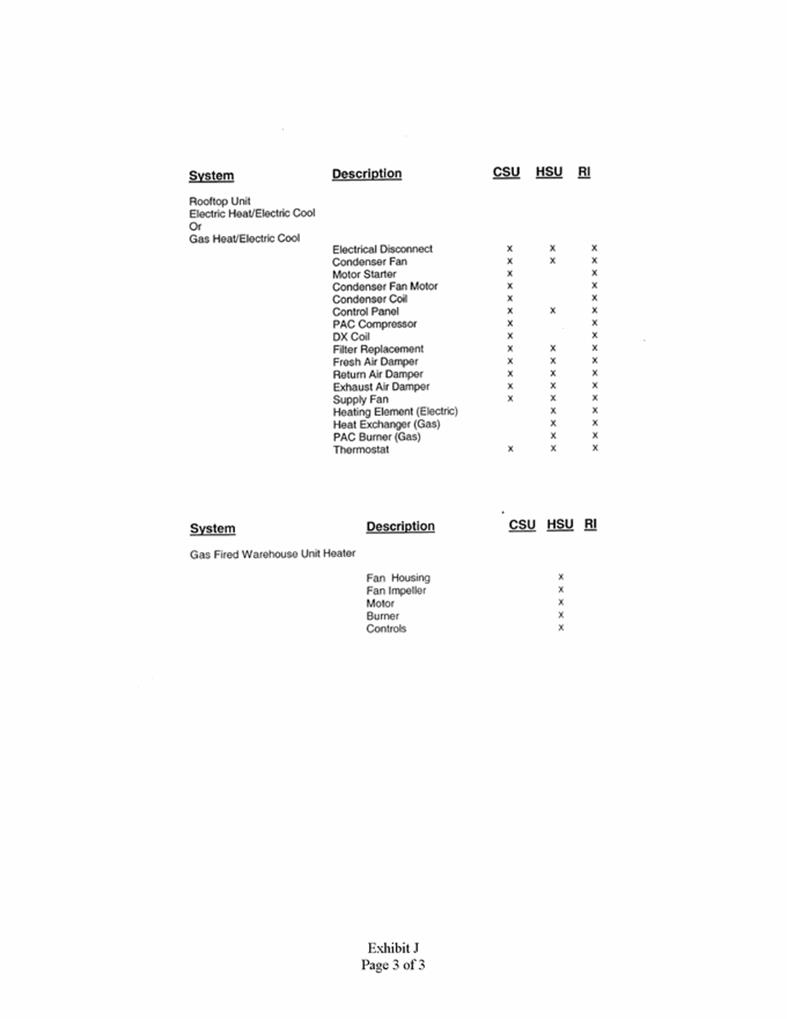

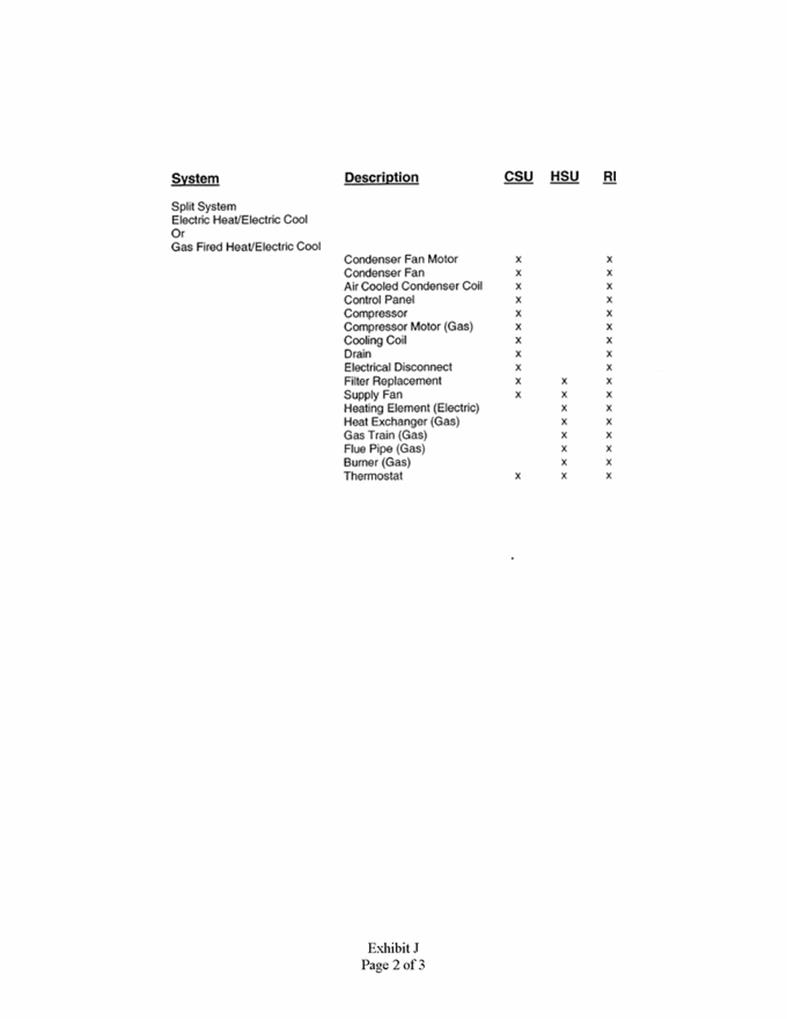

Exhibit J: |

|

HVAC Maintenance Criteria |

Section 1.02. Lease of the Leased Premises. Landlord hereby leases to Tenant and Tenant hereby leases from Landlord the Leased Premises, under the terms and conditions herein. Notwithstanding anything to the contrary contained herein, Tenant acknowledges that the Leased Premises include a non-exclusive right to use the following: (a) the shared drive between 000 Xxxx Xxxxxx Xxxxxx and the Leased Premises and all improvements thereon, including, without limitation, the monument sign (the “Shared Drive”), (b) the shared light poles between the trailer storage areas for 801

Xxxx Xxxxxx Xxxxxx and the Leased Premises (the “Shared Light Poles”; the Shared Drive and the Shared Light Poles being referred to hereinafter, collectively, as the “Shared Areas”).

ARTICLE 2 - LEASE TERM AND POSSESSION

Section 2.01. Lease Term. The Lease Term shall commence (the “Commencement Date”) as of the later of (i) June 1, 2016, and (ii) the date that Substantial Completion (as defined in Exhibit B hereto) of the Building Improvements (as defined in Exhibit B attached hereto and made a part hereof) occurs.

Section 2.02. Construction of the Building and Tenant Improvements.

(a) Landlord shall construct and install the Building Improvements in accordance with the workletter attached hereto as Exhibit B and made a part hereof (the “Workletter”).

(b) Tenant shall construct and install all leasehold improvements to the Building (collectively, the “Tenant Improvements”) in accordance with the Workletter.

Section 2.03. Surrender of the Leased Premises. Upon the expiration or earlier termination of this Lease, Tenant shall, at its sole cost and expense, immediately (a) surrender the Leased Premises to Landlord in broom-clean condition and in good order, condition and repair, reasonable wear and tear and damage by casualty or condemnation excepted, (b) remove from the Leased Premises or where located (i) Tenant’s Property (as defined in Section 8.01 below), (ii) all data and communications equipment, wiring and cabling (including above ceiling, below raised floors and behind walls), (iii) any striping applied to the floors of the Building, and (iv) any alterations required to be removed pursuant to Section 7.03 below, and (c) repair any damage caused by any such removal. Notwithstanding the foregoing, Tenant shall not be required to remove epoxy floor coverings installed within the Building. Upon the expiration or earlier termination of this Lease, all of Tenant’s Property that is not removed within ten (10) days following Landlord’s written demand therefor shall be conclusively deemed to have been abandoned and Landlord shall be entitled to dispose of Tenant’s Property at Tenant’s cost, without incurring any liability to Tenant. This Section 2.03 shall survive the expiration or any earlier termination of this Lease.

Section 2.04. Holding Over. If Tenant retains possession of the Leased Premises after the expiration or earlier termination of this Lease, Tenant shall be a tenant at sufferance at one hundred fifty percent (150%) of the Monthly Rental Installments and Annual Rental Adjustment (as hereinafter defined) for the Leased Premises in effect upon the date of such expiration or earlier termination, and otherwise upon the terms, covenants and conditions herein specified, so far as applicable. Acceptance by Landlord of Rent (as defined in Section 3.03 below) after such expiration or earlier termination shall not result in a renewal of this Lease, nor shall such acceptance create a month-to-month tenancy. In the event a month-to-month tenancy is created by operation of law, either party shall have the right to terminate such month-to-month tenancy upon thirty (30) days’ prior written notice to the other, whether or not said notice is given on the date that any Rent is due. This Section 2.04 shall not be deemed a consent by Landlord to any holding over by Tenant upon the expiration or earlier termination of this Lease, nor limit Landlord’s remedies in such event.

ARTICLE 3 - RENT

Section 3.01. Rent. Tenant shall pay to Landlord the Minimum Annual Rent in the amounts of the Monthly Rental Installments set forth in Section 1.01(e) above, in advance, without demand, abatement, counterclaim, recoupment, deduction or offset (except as otherwise expressly set forth

herein), on the Commencement Date, and, thereafter, on or before the first day of each and every calendar month thereafter during the Lease Term. The Monthly Rental Installments for partial calendar months shall be prorated on the basis of the total number of days in the applicable calendar month. Tenant shall be responsible for delivering the Monthly Rental Installments to the payment address set forth in Section 1.01(l) above in accordance with this Section 3.01.

Section 3.02. Annual Rental Adjustment Definitions.

(a) “Annual Rental Adjustment”: the amount of Tenant’s Proportionate Share of Operating Expenses for a particular calendar year.

(b) “Operating Expenses”: the amount of all of Landlord’s actual costs and expenses paid or incurred in operating, repairing, replacing and maintaining the Leased Premises in good condition and repair in accordance with the provisions of this Lease, including by way of illustration and not limitation, the following: all Real Estate Taxes (as defined in Section 3.02(d) below), insurance premiums and commercially reasonable deductibles; water, sewer, electrical and other utility charges other than the separately billed electrical and other utility charges paid by Tenant pursuant to this Lease; exterior painting; stormwater discharge fees; tools and supplies (to the extent used exclusively for the maintenance and repair of the Leased Premises); repair costs; landscape maintenance costs; access patrols; license, permit and inspection fees (except those incurred in connection with Landlord’s initial construction of the Building); management fees (which shall not exceed two percent (2%) of the Rent for any period); costs, wages and related employee benefits payable for the management, maintenance and operation of the Leased Premises (not to exceed $7,500 per calendar year); subject to Section 7.01 below, maintenance, repair and replacement of the driveways, parking areas, curbs and sidewalk areas (including snow and ice removal), landscaped areas, drainage strips, sewer lines, exterior walls, foundation, structural frame, roof, gutters and lighting; and maintenance and repair costs, dues, fees and assessments incurred under any easements or covenants (subject to Section 5.02 below). The cost of any Operating Expenses that are capital in nature (“Capital Expenses”) shall be amortized on a straight-line basis over the useful life of the improvement (using generally accepted accounting principles, or successor accounting standards, consistently applied in good faith), and in each calendar year of the Lease Term only the amortized portion of such Capital Expenses shall be included, and such amortized portion shall be prorated with respect to any partial calendar year during the Lease Term. Notwithstanding anything to the contrary contained herein, Operating Expenses will in no event include the following:

(i) cost of repairs or replacements incurred by reason of (A) fire or other casualty to the extent reimbursed by insurance proceeds (or would have been reimbursed by insurance proceeds had Landlord complied with the insurance requirement imposed upon it under the terms of this Lease), or (B) condemnation to the extent reimbursed by condemnation proceeds;

(ii) legal, accounting, leasing commission, advertising and promotional expenditures related to procuring tenants;

(iii) fines or penalties incurred by Landlord due to violations of or non-compliance with any Laws other than those that are the responsibility of Tenant hereunder;

(iv) any principal or interest on borrowed money or debt amortization;

(v) any costs incurred by Landlord associated with payment of damages as a result of any breach of this Lease by Landlord;

(vi) costs incurred to test, survey, cleanup, contain, xxxxx, remove, or otherwise remedy asbestos-containing materials or other materials from the Leased Premises that have been classified as Hazardous Substances under Environmental Laws (as those terms are defined under Section 15.01(a) of the Lease) as of the date of this Lease;

(vii) fees in connection with disputes between Landlord and any mortgagee;

(viii) any amounts paid to a person, firm, corporation, or other entity related to Landlord which is materially in excess of the amount charged by unaffiliated parties for comparable goods or services;

(ix) any debt service (including principal and interest) or payments of any judgments or other liens against Landlord;

(x) sums incurred as late payment fees, penalties or interest;

(xi) ground rent;

(xii) costs for which Landlord is actually reimbursed by a third party;

(xiii) costs arising from Landlord’s political or charitable contributions;

(xiv) promotional gifts, events, parties, celebrations, entertainment, dining or travel expenses;

(xv) depreciation;

(xvi) costs and fees associated with the sale or refinancing of the Leased Premises and any associated debt;

(xvii) reserves for anticipated future expenses, bad debts or rental loss;

(xviii) all costs to the extent resulting from the gross negligence or willful misconduct of Landlord or its agents, contractors or employees;

(xix) costs of all Tenant Improvements constructed and installed by Tenant; and

(xx) repair and replacement costs for which Landlord is responsible pursuant to the warranty set forth in Section 1(d) of the Workletter.

(c) “Tenant’s Proportionate Share of Operating Expenses”: an amount equal to the product obtained by multiplying Tenant’s Proportionate Share by the Operating Expenses for the applicable calendar year.

(d) “Real Estate Taxes”: any form of real estate tax or assessment or service payments in lieu thereof or water or sewer tax or charges, and any license fee, commercial rental tax, improvement bond, charges in connection with an improvement district or other similar charge or tax imposed upon the Leased Premises, or against Landlord’s business of leasing the Building and/or Leased Premises, by any

authority having the power to so charge or tax, together with costs and expenses of contesting the validity or amount of the Real Estate Taxes. Notwithstanding anything to the contrary contained herein, Real Estate Taxes shall not include:

(i) income, excise, profits, estate, inheritance, succession, gift, transfer, or capital tax imposed upon Landlord;

(ii) fine, penalty, cost or interest for any tax or assessment, or part thereof, which Landlord or its lender failed to timely pay (except if same are caused by Tenant’s default hereunder);

(iii) assessment for a public improvement arising from the initial construction or expansion of the Building (it being agreed that all assessments imposed during the Lease Term which are permitted to be included within Real Estate Taxes hereunder shall, for the purposes of computing Tenant’s Proportionate Share of Operating Expenses, be deemed to have been paid in the maximum number of installments permitted by the applicable taxing authority); and

(iv) fees imposed upon Landlord in connection with Landlord’s development of the Leased Premises (including, without limitation, trip generation fees).

If Landlord elects to contest Real Estate Taxes applicable to the Leased Premises for a particular tax period during the Lease Term, Landlord shall, at least thirty (30) days prior to initiating such contest, inform Tenant of such contest (the “Tax Notice”), and Tenant shall have the right, but not the obligation, to cooperate in such contest. If Landlord does not elect to contest Real Estate Taxes applicable to the Leased Premises for a particular tax period during the Lease Term, Tenant may request that Landlord contest such taxes by written notice to Landlord. Landlord may then elect either to contest such taxes or to allow Tenant to so contest such taxes (such election to be delivered by Landlord to Tenant within ten (10) business days after Landlord’s receipt of Tenant’s request). If Landlord allows Tenant to contest such taxes, then (x) such tax contest shall be conducted at Tenant’s sole cost and expense, (y) the firm or individual hired to conduct such contest shall be subject to Landlord’s prior approval, and (z) Landlord shall reasonably cooperate with Tenant, including, without limitation, by executing any and all documents required in connection therewith and, if required by any governmental authority having jurisdiction, join with Tenant in the prosecution thereof (at no cost to Tenant). If, as a result of any contest or otherwise, any rebate or refund of Real Estate Taxes is received, Tenant shall be entitled to Tenant’s Proportionate Share thereof (after reasonable and documented out-of-pocket expenses incurred by Landlord and/or Tenant in connection with such contest are paid to the party that incurred such expense). If Landlord elects to contest Real Estate Taxes applicable to the Leased Premises for a particular tax period during the Lease Term and Tenant notifies Landlord within ten (10) business days after Tenant’s receipt of the Tax Notice that it does not wish to contest Real Estate Taxes for such tax period and Landlord elects to proceed with the contest of such taxes, Tenant shall not be responsible for the cost of such contest to the extent such costs exceed the savings actually realized by Tenant in connection with such contest.

Section 3.03. Payment of Additional Rent.

(a) Any amount required to be paid by Tenant hereunder (other than Minimum Annual Rent) and any charges or expenses incurred by Landlord on behalf of Tenant under the terms of this Lease shall be considered “Additional Rent” payable in the same manner and upon the same terms and conditions as the Minimum Annual Rent reserved hereunder, except as set forth herein to the contrary. Minimum Annual Rent and Additional Rent are sometimes referred to herein, collectively, as “Rent”. The total rent

reserved under this Lease shall equal all Minimum Annual Rent and Additional Rent referred to in this Lease. This Section 3.03(a) shall survive the expiration or any earlier termination of this Lease.

(b) In addition to the Minimum Annual Rent specified in this Lease, commencing as of the Commencement Date, Tenant shall pay to Landlord as Additional Rent for the Leased Premises, in each calendar year or partial calendar year during the Lease Term, an amount equal to the Annual Rental Adjustment for such calendar year or partial calendar year, as the case may be. Landlord shall estimate the Annual Rental Adjustment annually, and written notice thereof shall be given to Tenant prior to the beginning of each calendar year. Tenant shall pay to Landlord each month, at the same time the Monthly Rental Installment is due, an amount equal to one-twelfth (1/12) of the estimated Annual Rental Adjustment. Tenant shall be responsible for delivering the Additional Rent to the payment address set forth in Section 1.01(l) above in accordance with this Section 3.03. If Operating Expenses increase during a calendar year, Landlord may, on not less than thirty (30) days’ notice to Tenant, increase the estimated Annual Rental Adjustment during such calendar year by giving Tenant written notice to that effect, and thereafter Tenant shall pay to Landlord, in each of the remaining months of such calendar year, an amount equal to the amount of such increase in the estimated Annual Rental Adjustment divided by the number of months remaining in such calendar year. Within one hundred twenty (120) days after the end of each calendar year, Landlord shall prepare and deliver to Tenant a statement showing the actual Annual Rental Adjustment for such calendar year. If the estimated Annual Rental Adjustment payments made by Tenant are less than the actual Annual Rental Adjustment, then Tenant shall pay to Landlord the difference between the actual Annual Rental Adjustment for the preceding calendar year and the estimated payments made by Tenant during such calendar year within thirty (30) days after receipt of the aforementioned statement; provided, however, in the event Landlord fails to deliver the aforementioned statement within one hundred eighty (180) days following the end of the applicable calendar year, Landlord shall be deemed to have waived its right to require that Tenant pay the difference between the actual Annual Rental Adjustment and the estimated payments made by Tenant for such calendar year. Notwithstanding the foregoing, such waiver (i) shall not apply to bills or invoices first received by Landlord after the end of the applicable calendar year (provided such bills or invoices are presented to Tenant within one (1) year after Landlord’s receipt of same), and (ii) shall not deprive Tenant of its right to recover from Landlord if Tenant’s estimated payments exceed the amounts actually due from Tenant for Operating Expenses pursuant to Section 3.06 below. In the event that the estimated Annual Rental Adjustment payments made by Tenant are greater than the actual Annual Rental Adjustment, then Landlord shall credit the amount of such overpayment toward the next Monthly Rental Installment(s) and the next monthly estimated Annual Rental Adjustment payment(s) due under this Lease until such overpayment is recovered by Tenant in full (or remit such amount to Tenant in the event that this Lease shall have expired or terminated). This Section 3.03 shall survive the expiration or any earlier termination of this Lease.

Section 3.04. Late Charges. Tenant acknowledges that Landlord shall incur certain additional unanticipated administrative and legal costs and expenses if Tenant fails to pay timely any payment required hereunder. Therefore, in addition to the other remedies available to Landlord hereunder, if any payment required to be paid by Tenant to Landlord hereunder shall become overdue, such unpaid amount shall bear interest from the due date thereof to the date of payment at the prime rate of interest, as reported in the Wall Street Journal (the “Prime Rate”) plus six percent (6%) per annum.

Section 3.05. Maximum Increase in Operating Expenses. Notwithstanding anything in this Lease to the contrary, Tenant will be responsible for Tenant’s Proportionate Share of Real Estate Taxes, insurance premiums, utilities, snow removal, and landscaping (“Uncontrollable Expenses”), without regard to the level of increase in any or all of the above in any year or other period of time. Tenant’s

obligation to pay Tenant’s Proportionate Share of Operating Expenses that are not Uncontrollable Expenses (herein “Controllable Expenses”) shall be limited to a five percent (5%) per annum increase over the amount the Controllable Expenses per square foot for the immediately preceding calendar year would have been had the Controllable Expenses per square foot increased at the rate of five percent (5%) in all previous calendar years beginning with the actual Controllable Expenses per square foot for the calendar year ending December 31, 2017.

Section 3.06. Inspection and Audit Rights.

(a) Tenant shall have the right to inspect, at reasonable times and in a reasonable manner, during the twelve (12) month period following the delivery of Landlord’s statement of the actual amount of the Annual Rental Adjustment, or, if Landlord fails to deliver such statement within one hundred twenty (120) days following the expiration of such calendar year, then during the twelve (12) month period following the expiration of such one hundred twenty (120) days (the “Inspection Period”), such of Landlord’s books of account and records as pertain to and contain information concerning the Annual Rental Adjustment for the prior calendar year in order to verify the amounts thereof. Landlord shall keep reasonably detailed records of all Operating Expenses for a given calendar year at least until the expiration of the Inspection Period with respect to such calendar year. Such inspection shall take place at Landlord’s office upon at least fifteen (15) days prior written notice from Tenant to Landlord. Only Tenant or a certified public accountant that is not being compensated for its services on a contingency fee basis shall conduct such inspection. Landlord and Tenant shall act reasonably in assessing the other party’s calculation of the Annual Rental Adjustment. Tenant shall provide Landlord with a copy of its findings within thirty (30) days after completion of the audit. Tenant’s failure to exercise its rights hereunder within the Inspection Period shall be deemed a waiver of its right to inspect or contest the method, accuracy or amount of such Annual Rental Adjustment.

(b) If Landlord and Tenant agree that Landlord’s calculation of the Annual Rental Adjustment for the inspected calendar year was incorrect, the parties shall enter into a written agreement confirming such undisputed error and then Landlord shall make a correcting payment in full to Tenant within thirty (30) days after the determination of the amount of such error or credit such amount against future Additional Rent if Tenant overpaid such amount, and Tenant shall pay Landlord within thirty (30) days after the determination of such error if Tenant underpaid such amount. In the event of any errors on the part of Landlord that Landlord agrees were errors costing Tenant in excess of two percent (2%) of Tenant’s actual Operating Expense liability for any calendar year, Landlord will also reimburse Tenant for the costs of an audit reasonably incurred by Tenant in an amount not to exceed $10,000 within the above thirty (30) day period. If Tenant provides Landlord with written notice disputing the correctness of Landlord’s statement, and if such dispute shall have not been settled by agreement within thirty (30) days after Tenant provides Landlord with such written notice, Tenant may submit the dispute to a reputable firm of independent certified public accountants (the “Third Party CPAs”) selected by Tenant and approved by Landlord, and the decision of such Third Party CPAs shall be conclusive and binding upon the parties. If such Third Party CPAs decide that there was an error, Landlord will make correcting payment if Tenant overpaid such amount, and Tenant shall pay Landlord if Tenant underpaid such amount. The fees and expenses involved in such decision shall be borne by the party required to pay for the audit.

(c) To the extent information is obtained through Tenant’s inspection with respect to financial matters (including, without limitation, costs, expenses and income) and any other matters pertaining to Landlord and/or the Leased Premises as well as any compromise, settlement or adjustment reached between Landlord and Tenant relative to the results of the inspection shall be held in strict

confidence by Tenant and its officers, agents, and employees; and Tenant shall cause its independent professionals to be similarly bound. The obligations within the preceding sentence shall survive the expiration or earlier termination of this Lease. Notwithstanding the foregoing, in the event that Tenant is legally compelled (by oral questions, interrogatories, requests for information, or documents, deposition, other discovery, subpoena, civil or other investigative demand, court order, or similar process) to make any disclosure that is prohibited by this Section 3.06(c), Tenant may make the required disclosure, provided that Tenant delivers reasonable prior notice to Landlord, unless such notice (i) would be prohibited by applicable law or regulation, or (ii) prohibited by the requirements of any regulatory authority or law enforcement agency.

ARTICLE 4 - SECURITY DEPOSIT

Section 4.01. Security Deposit.

(a) Upon execution and delivery of this Lease by Tenant, Tenant will deliver to Landlord, at Tenant’s option, either (i) an Irrevocable Letter of Credit (the “Letter of Credit”) in the amount of the Security Deposit, in substantially the form attached hereto as Exhibit F and made a part hereof or other form reasonably acceptable to Landlord, from a financial institution acceptable to Landlord, or (ii) a check in the amount of the Security Deposit.

(b) If Tenant elects to deliver the Letter of Credit under subsection (a) above, (i) Tenant shall cause the Letter of Credit to be maintained in full force and effect throughout the Lease Term and during the sixty (60) day period after the later of (A) the expiration of the Lease Term or (B) the date that Tenant delivers possession of the Leased Premises to Landlord, as security for the performance by Tenant of all of Tenant’s obligations contained in this Lease, and (ii) in the event that, during the Lease Term, Tenant fails to deliver to Landlord a renewal or replacement to the Letter of Credit by a date no later than thirty (30) days prior to its expiration date, Landlord shall have the right to demand and receive payment in full under the Letter of Credit and to hold the cash proceeds as the Security Deposit under this Lease. Tenant shall have the right to replace the Letter of Credit with a replacement Letter of Credit in form reasonably acceptable to Landlord, from a financial institution reasonably acceptable to Landlord, at any time and from time to time. At any time Tenant is entitled to the return of a Letter of Credit, including in the event Tenant provides a replacement Letter of Credit, Landlord will return such Letter of Credit and reasonably cooperate with Tenant in providing documentation authorizing the issuing bank of the Letter of Credit to terminate same.

(c) In the event of a Default by Tenant, Landlord may apply all or any part of the Security Deposit to cure all or any part of such Default; provided, however, that any such application by Landlord shall not be or be deemed to be an election of remedies by Landlord or considered or deemed to be liquidated damages. Tenant agrees to promptly deposit (either in cash or in the form of a Letter of Credit, at Tenant’s option), upon demand, such additional sum with Landlord as may be required to maintain the full amount of the Security Deposit. All sums held by Landlord pursuant to this Article 4 shall be without interest and may be commingled by Landlord. Provided that Tenant has fully and faithfully performed all of the provisions of this Lease, upon the expiration or earlier termination of this Lease, Landlord shall return the Letter of Credit or cash Security Deposit, as applicable, to Tenant, and with respect to a Letter of Credit, execute and deliver to the issuer of the Letter of Credit such instruments as may be reasonably required by such issuer to effectuate the termination of the Letter of Credit.

Section 4.02. Reduction of Security Deposit.

(a) Commencing as of the last day of the twelfth (12th) month of the Lease Term and continuing on the last day of each twelve (12) month period thereafter through and including the last day of the sixtieth (60th) month of the Lease Term, the Security Deposit shall be reduced by Two Hundred Seventy-Eight Thousand Five Hundred Five and 56/100 Dollars ($278,505.56), provided that Tenant is not in default hereunder (provided that if there is a default hereunder that has occurred, but the cure period related thereto has not expired, the Security Deposit shall be reduced so long as Tenant does cure such default within such cure period). Following each such reduction in the Security Deposit represented by the Letter of Credit, Landlord shall (at no cost to Landlord) (i) accept from the issuer of the Letter of Credit an amendment to the Letter of Credit reducing the Letter of Credit by Two Hundred Seventy-Eight Thousand Five Hundred Five and 56/100 Dollars ($278,505.56), but which does not otherwise amend or modify the same, and (ii) execute and deliver to the issuer of the Letter of Credit such instruments as may be reasonably required by such issuer to effectuate such reduction. Following each such reduction in the Security Deposit represented by cash, Landlord shall refund to Tenant, at Tenant’s option, by check or wire transfer or credit against the next Monthly Rental Installment(s) due, Two Hundred Seventy-Eight Thousand Five Hundred Five and 56/100 Dollars ($278,505.56).

(b) Notwithstanding the provisions of subsection (a) above, in no event shall the Security Deposit be reduced to an amount less than Two Hundred Seventy-Eight Thousand Five Hundred Five and 58/100 Dollars ($278,505.58).

(c) For illustrative purposes, the table below shows the schedule of Security Deposit reductions pursuant to this Section 4.02 provided Tenant has met all requirements set forth above.

|

Date of Reduction |

|

Amount of Reduction |

|

Remaining Security Deposit |

| ||

|

Last day of twelfth (12th) month of the Lease Term |

|

$ |

278,505.56 |

|

$ |

1,392,527.82 |

|

|

Last day of twenty-fourth (24th) month of the Lease Term |

|

$ |

278,505.56 |

|

$ |

1,114,022.26 |

|

|

Last day of thirty-sixth (36th) month of the Lease Term |

|

$ |

278,505.56 |

|

$ |

835,516.70 |

|

|

Last day of forty-eight (48th) month of the Lease Term |

|

$ |

278,505.56 |

|

$ |

557,011.14 |

|

|

Last day of sixtieth (60th) month of the Lease Term |

|

$ |

278,505.56 |

|

$ |

278,505.58 |

|

Section 4.03. Increase of Security Deposit. In the event Tenant exercises its option to amortize the cost of a portion of the Tenant Improvements in accordance with Section 5(e) of the Workletter, Tenant shall deposit with Landlord an amount equal to one-half (½) of the Amortized Amount (as defined in the Workletter) (the “Additional Security Deposit”), which Additional Security Deposit shall be deemed a part of the Security Deposit for all purposes under the Lease. The Additional Security Deposit shall accompany Tenant’s delivery of its written notice to Landlord exercising such amortization option. In the event the Security Deposit is increased as set forth in this Section 4.03, the amounts set forth in Sections 4.02(a), (b) and (c) above shall be adjusted accordingly.

ARTICLE 5 - OCCUPANCY AND USE

Section 5.01. Use. Tenant shall use the Leased Premises for the Permitted Use and for no other purpose without the prior written consent of Landlord.

Section 5.02. Covenants of Tenant Regarding Use.

(a) Tenant shall (i) use and maintain the Leased Premises and conduct its business thereon in a safe, careful, reputable and lawful manner, (ii) comply with all applicable laws, rules, regulations, orders, ordinances, directions and requirements of any governmental authority or agency, now in force or which may hereafter be in force (collectively, the “Laws”), including, without limitation, those Laws which shall impose upon Landlord or Tenant any duty with respect to or triggered by a change in the use or occupation of, or any improvement or alteration to, the Leased Premises, and (iii) comply with and obey all reasonable directions, rules and regulations of Landlord, including the Building rules and regulations attached hereto as Exhibit D and made a part hereof (the “Rules and Regulations”), as such Rules and Regulations may be reasonably modified from time to time by Landlord upon reasonable notice to Tenant. In the event of a conflict between the Rules and Regulations and the provisions of this Lease, the provisions of this Lease shall govern and control. Without limiting the foregoing, Landlord agrees that it will not voluntarily consent to any future covenants that would encumber the Leased Premises if such covenants will increase Tenant’s cost to operate in the Leased Premises for the Permitted Use by more than a nominal amount, or if such a covenant will materially and adversely affect Tenant’s use of the Leased Premises for the Permitted Use.

(b) Tenant shall not do or permit anything to be done in or about the Leased Premises that will in any way cause a nuisance. Tenant shall not overload the floors of the Building beyond their designed weight-bearing capacity, as shown on Exhibit I attached hereto and made a part hereof. All damage to the floor structure or foundation of the Building due to improper positioning or storage of items or materials shall be repaired by Landlord at the sole expense of Tenant, who shall reimburse Landlord promptly therefor upon demand. Tenant shall not use the Leased Premises, nor allow the Leased Premises to be used, for any purpose or in any manner that would increase the rate of premiums payable on any such insurance policy unless Tenant reimburses Landlord for any such increase in premiums charged.

Section 5.03. Landlord’s Rights Regarding Use. In addition to Landlord’s rights specified elsewhere in this Lease, (a) Landlord shall have the right at any time, without notice to Tenant, to control, change or otherwise alter the Building Land or Improvements (excluding the Building) in such manner as it deems necessary or proper so long as any such control, change or alteration does not materially and adversely affect Tenant’s use of the Leased Premises for the Permitted Use, and (b) Landlord, its agents, employees, representatives, consultants, contractors and any mortgagees of the Leased Premises, shall have the right (but not the obligation) to enter any part of the Leased Premises (other than the Building) at any time without prior notice, and any part of the Building at reasonable times upon not less than two (2) business days’ notice (except in the event of an emergency where no notice shall be required), for the purposes of (i) examining or inspecting the same (including, without limitation, to perform any and all environmental inspections, testing and other environmental activities as Landlord may deem reasonably necessary or desirable and testing to confirm Tenant’s compliance with this Lease), (ii) showing the same to prospective purchasers or mortgagees, (iii) during the last twelve (12) months of the Lease Term and any time Tenant is in Default hereunder, showing the same to prospective tenants, and (iv) making such repairs, alterations or improvements to the Leased Premises as Landlord may reasonably deem necessary or desirable. Landlord shall incur no liability to Tenant for such entry, nor shall such entry constitute an eviction of Tenant or a termination of this Lease, or entitle Tenant to any abatement of rent therefor. In exercising any rights of entry to the Building, Landlord shall

use commercially reasonable efforts to minimize any disturbance to or interruption of Tenant’s use of the Leased Premises and the normal operation of Tenant’s business conducted therein, including reasonable efforts to coordinate with Tenant in the scheduling of such non-emergency entry. Landlord, and any third parties entering the Building at Landlord’s invitation or request shall at all times strictly observe Tenant’s rules relating to security and confidentiality at the Building (including, but not limited to, a requirement to execute a reasonable confidentiality agreement prior to entering the Building). Tenant shall have the right, in its sole discretion, to designate a representative to accompany Landlord, or any third parties, while they are at the Building.

Section 5.04. Signage. Tenant may, at its own expense, place (i) its identification sign on the exterior of the Building, and (ii) Tenant’s name on the monument sign to be constructed and installed by Landlord on the Building Land. All signage (including the signage described in the preceding sentence) in or about the Leased Premises shall be first approved by Landlord and shall be in compliance with applicable Laws. Tenant agrees to maintain any sign installed by or on behalf of Tenant in a good state of repair, and, upon the expiration of the Lease Term, Tenant agrees to promptly remove such signs and repair any damage to the Leased Premises.

Section 5.05. Parking. Tenant shall be entitled to the exclusive use of the parking spaces located on the Building Land (the “Parking Area”). Tenant shall have the right to designate certain parking spaces as assigned or reserved and to enforce same in accordance with applicable Laws. Tenant acknowledges and agrees that Landlord shall have no obligation to police or monitor the use of any parking. No vehicle may be repaired or serviced in the parking area and any vehicle brought into the parking area by Tenant, or any of Tenant’s employees, agents, representatives, contractors, customers, guests or invitees, and deemed abandoned by Landlord will be towed and all costs thereof shall be borne by the Tenant.

Section 5.06. Compliance with Law.

(a) Existing Governmental Regulations. If any federal, state or local laws, ordinances, orders, rules, regulations or requirements (collectively, “Governmental Requirements”) in existence as of the date of the Lease require an alteration or modification of the Leased Premises (a “Code Modification”) and such Code Modification (i) is not made necessary as a result of the specific use being made by Tenant of the Leased Premises (as distinguished from an alteration or improvement which would be required to be made by the owner of any warehouse building comparable to the Building irrespective of the use thereof by any particular occupant), and (ii) is not made necessary as a result of any alteration of the Leased Premises by Tenant, such Code Modification shall be performed by Landlord, at Landlord’s sole cost and expense.

(b) Governmental Regulations — Landlord Responsibility. If, as a result of one or more Governmental Requirements that are not in existence as of the date of this Lease, it is necessary from time to time during the Lease Term, to perform a Code Modification to the Leased Premises that (i) is not made necessary as a result of the specific use being made by Tenant of Leased Premises (as distinguished from an alteration or improvement which would be required to be made by the owner of any warehouse building comparable to the Building irrespective of the use thereof by any particular occupant), and (ii) is not made necessary as a result of any alteration of the Leased Premises by Tenant, such Code Modification shall be performed by Landlord and the cost thereof shall be included in Operating Expenses without being subject to any applicable cap on expenses set forth herein.

(c) Governmental Regulations — Tenant Responsibility. If, as a result of one or more Governmental Requirements, it is necessary from time to time during the Lease Term to perform a Code

Modification to the Leased Premises that is made necessary as a result of the specific use being made by Tenant of the Leased Premises or as a result of any alteration of the Leased Premises by Tenant, such Code Modification shall be the sole and exclusive responsibility of Tenant in all respects; provided, however, that Tenant shall have the right to retract its request to perform a proposed alteration in the event that the performance of such alteration would trigger the requirement for a Code Modification.

ARTICLE 6 - UTILITIES AND OTHER BUILDING SERVICES

Section 6.01. Services to be Provided. Landlord shall furnish to Tenant, except as noted below, the following utilities and other services:

(a) Water service for lavatory and drinking purposes;

(b) Sewer service;

(c) Maintenance, repair and replacement of the Improvements (other than the Building), including the removal of rubbish (which shall not include tenant dumpsters), ice and snow;

(d) Replacement of all lamps, bulbs, starters and ballasts for the lighting located on the Building Land as required from time to time as a result of normal usage; and

(e) Repair and maintenance to the extent expressly specified elsewhere in this Lease.

Section 6.02. Payment of Utilities. Tenant shall obtain in its own name and pay directly to the appropriate supplier the cost of all separately metered utilities or services serving the Building.

Section 6.03. Interruption of Services.

(a) Tenant acknowledges and agrees that any one or more of the utilities or other services identified in Sections 6.01 above or otherwise hereunder may be interrupted by reason of accident, emergency or other causes beyond Landlord’s control, or may be discontinued or diminished temporarily by Landlord or other persons until certain repairs, alterations or improvements can be made. Landlord shall not be liable in damages or otherwise for any failure or interruption of any utility or other Building service and, except as otherwise specifically set forth herein, no such failure or interruption shall entitle Tenant to terminate this Lease or withhold sums due hereunder.

(b) Notwithstanding the foregoing, in the event that (i) an interruption of utility service to the Leased Premises occurs, (ii) the restoration of such utility service is within Landlord’s reasonable control, and (iii) such interruption renders all or a portion of the Leased Premises untenantable (meaning that Tenant is unable to use, and does not use, such space in the normal course of its business for the Permitted Use) for more than three (3) consecutive business days, then Minimum Annual Rent shall xxxxx proportionately with respect to the portion of the Leased Premises rendered untenantable on a per diem basis for each day after such three (3) business-day period during which such portion of the Leased Premises remains untenantable. Except as otherwise expressly set forth in this Section 6.03 or in Section 13.03 below, such abatement shall be Tenant’s sole remedy for Landlord’s failure to restore service as set forth above, and Tenant shall not be entitled to damages (consequential or otherwise) as a result thereof.

(c) Notwithstanding the foregoing, in the event that (i) an interruption of utility service to the Leased Premises occurs, (ii) the restoration of such utility service is within Landlord’s reasonable

control, and (iii) such interruption renders all or a portion of the Leased Premises untenantable (meaning that Tenant is unable to use, and does not use, such space in the normal course of its business for the Permitted Use) for more than ninety (90) consecutive days, then Tenant shall have the right to elect to terminate this Lease within ten (10) days after the expiration of said ninety (90) day period without penalty, by delivering written notice to Landlord of its election thereof within said ten (10) day period. The foregoing termination right shall not apply if the interruption of utility service is due to fire or other casualty. Instead, in such an event, the terms and provisions of Article 9 of this Lease shall apply. Notwithstanding anything herein to the contrary, Tenant shall continue to be entitled to its abatement as described in this Section 6.03 during the period during which such portion of the Leased Premises remains untenantable until the effective date of termination of the Lease as described herein.

ARTICLE 7 - REPAIRS, MAINTENANCE AND ALTERATIONS

Section 7.01. Repair and Maintenance of Building. Landlord shall make all necessary repairs, replacements and maintenance to the roof, life-safety system, exterior walls, foundation, structural frame of the Building and the parking and landscaped areas. The cost of all replacements to the roof, exterior walls, foundation (including, without limitation, footings) and structural frame of the Building shall be at Landlord’s sole cost and expense, and the cost of all other such repairs, replacements and maintenance shall be included in Operating Expenses to the extent provided in Section 3.02; provided however, to the extent any such repairs, replacements or maintenance are required because of the negligence, misuse or default of Tenant, its employees, agents, contractors, customers or invitees, Landlord shall make such repairs at Tenant’s sole but reasonable expense. In addition, Landlord shall, at Landlord’s sole cost and expense, make all necessary repairs, replacements and maintenance to the Engineering Controls and vapor mitigation systems of the Building.

Section 7.02. Repair and Maintenance of Leased Premises. Subject to Landlord’s repair and replacement obligations set forth above, Tenant shall, at its own cost and expense, maintain the Building in good condition, regularly servicing and promptly making all repairs and replacements thereto, including but not limited to the electrical system, plumbing lighting, heating, ventilating and air conditioning (“HVAC”) system, plate glass, floors, windows and doors, and dock doors, dock levelers and dock locks. Tenant shall obtain a preventive maintenance contract on the HVAC system and provide Landlord with a copy thereof. The preventive maintenance contract shall meet or exceed Landlord’s standard maintenance criteria attached hereto as Exhibit J, and shall provide for the inspection and maintenance of the HVAC system on at least a semi-annual basis.

Section 7.03. Alterations.

(a) Except as otherwise expressly set forth in Section 7.03(b) below, Tenant shall not permit alterations in or to the Leased Premises unless and until Landlord has approved the plans therefor in writing. Landlord shall have five (5) business days after receipt of the plans for Tenant’s alterations (or twenty (20) business days after receipt of the plans for Tenant’s alterations if the alterations are structural or mechanical in nature) in which to review said plans and in which to give to Tenant notice of its approval or disapproval (and in the case of disapproval, reasonable detail for the disapproval) of said plans. In the event Landlord fails to respond within said five (5) (or twenty (20), if applicable) business day period, Tenant shall provide a second notice to Landlord. If Landlord fails to respond within five (5) business days following Landlord’s receipt of such second notice, the plans submitted by Tenant shall be deemed approved. As a condition of such approval, Landlord may require Tenant to remove the alterations and restore the Leased Premises to its pre-alterations condition upon termination of this Lease; otherwise, all such alterations shall, at Landlord’s option, become a part of the realty and the

property of Landlord and shall not be removed by Tenant. Tenant has the right, however, to remove Tenant’s Property at any time and from time to time during the Lease Term.

(b) Notwithstanding the foregoing, Tenant shall have the right to make alterations to the interior of the Building, without obtaining Landlord’s prior written consent provided that (i) such alterations do not exceed Five Hundred Thousand and No/100 Dollars ($500,000.00) in cost in any one instance during the Lease Term (exclusive of the cost of any equipment being installed in connection with such alteration); (ii) such alterations are non-structural and non-mechanical in nature; (iii) for alterations that will cost in excess of Two Hundred Thousand and No/100 Dollars ($200,000.00) (exclusive of the cost of any equipment being installed in connection with such alteration), Tenant provides Landlord with prior written notice of its intention to make such alterations, stating in reasonable detail the nature, extent and estimated cost of such alterations, and if plans and specifications are being prepared in connection with such alterations, then Tenant shall deliver a copy of such plans and specifications; and (iv) at Landlord’s option, Tenant must remove such alterations and restore the Leased Premises upon termination of this Lease.

(c) If (i) the City of Linden’s approval is required in connection with any alterations, and (ii) such alterations require (x) Landlord’s approval pursuant to Section 7.03(a), or (y) Tenant to notify Landlord of such alterations pursuant to Section 7.03(b), Tenant shall notify Landlord accordingly, and Landlord shall be given the opportunity to participate in any applicable discussions with the City of Linden.

(d) Tenant shall ensure that all alterations shall be made in accordance with all applicable Laws, in a good and workmanlike manner and of quality at least equal to the original construction of the Leased Premises. No person shall be entitled to any lien derived through or under Tenant for any labor or material furnished to the Leased Premises, and nothing in this Lease shall be construed to constitute Landlord’s consent to the creation of any lien. If any lien is filed against the Leased Premises for work claimed to have been done for or material claimed to have been furnished to Tenant, Tenant shall cause such lien to be discharged of record or bonded over within thirty (30) days after Tenant receives written notice thereof. Tenant shall indemnify Landlord from all costs, losses, expenses and attorneys’ fees in connection with any construction or alteration by Tenant to the Leased Premises and any related lien. Notwithstanding any contrary provisions contained in this Lease, in no event shall Landlord’s consent to any alterations or approval of any plans, specifications, work orders or any other documents in connection with any alterations constitute written authorization by Landlord of any contract entered into by Tenant for or in connection with any such alterations pursuant to N.J.S.A. 2A:44-A-3.

ARTICLE 8 - INDEMNITY AND INSURANCE

Section 8.01. Release. All of Tenant’s trade fixtures, merchandise, inventory, special fire protection equipment, telecommunication and computer equipment, supplemental air conditioning equipment, kitchen equipment and other personal property located in or about the Leased Premises, which is deemed to include the trade fixtures, merchandise, inventory and personal property of others located in or about the Leased Premises at the invitation, direction or acquiescence (express or implied) of Tenant (all of which property shall be referred to herein, collectively, as “Tenant’s Property”), shall be and remain at Tenant’s sole risk. Landlord shall not be liable to Tenant or to any other person for, and subject to Section 8.03 below, Tenant hereby releases Landlord (and its affiliates, property managers and mortgagees) from (a) any and all liability for theft of or damage to Tenant’s Property, and (b) any and all liability for any injury to Tenant or its employees, agents, representatives, contractors, customers, guests and invitees in or about the Leased Premises, except to the extent caused by the negligence (or more

culpable act) or willful misconduct of Landlord, its agents, employees or contractors. Nothing contained in this Section 8.01 shall limit (or be deemed to limit) the waivers contained in Section 8.06 below. In the event of any conflict between the provisions of Section 8.06 below and this Section 8.01, the provisions of Section 8.06 shall prevail. This Section 8.01 shall survive the expiration or earlier termination of this Lease.

Section 8.02. Indemnification by Tenant. Tenant shall protect, defend, indemnify and hold harmless Landlord, its agents, employees and contractors from and against any and all claims, damages, demands, penalties, costs, liabilities, losses, and expenses (including reasonable attorneys’ fees and expenses at the trial and appellate levels) to the extent (a) arising out of or relating to any act, omission, negligence (or more culpable act), or willful misconduct of Tenant or Tenant’s agents, representatives, employees, or contractors in or about the Leased Premises, (b) arising out of or relating to any of Tenant’s Property, or (c) arising out of any other act or occurrence within the Building, in all such cases except to the extent proximately caused by the negligence (or more culpable act) or willful misconduct of Landlord, its agents, employees or contractors. Nothing contained in this Section 8.02 shall limit (or be deemed to limit) the waivers contained in Section 8.06 below. In the event of any conflict between the provisions of Section 8.06 below and this Section 8.02, the provisions of Section 8.06 shall prevail. This Section 8.02 shall survive the expiration or earlier termination of this Lease.

Section 8.03. Indemnification by Landlord. Landlord shall protect, defend, indemnify and hold harmless Tenant, its agents, employees and contractors of all tiers from and against any and all claims, damages, demands, penalties, costs, liabilities, losses and expenses (including reasonable attorneys’ fees and expenses at the trial and appellate levels) to the extent arising out of or relating to any act, omission, negligence (or more culpable act) or willful misconduct of Landlord or Landlord’s agents, representatives, guests, employees or contractors. Nothing contained in this Section 8.03 shall limit (or be deemed to limit) the waivers contained in Section 8.06 below. In the event of any conflict between the provisions of Section 8.06 below and this Section 8.03, the provisions of Section 8.06 shall prevail. This Section 8.03 shall survive the expiration or earlier termination of this Lease.

Section 8.04. Tenant’s Insurance.

(a) During the Lease Term (and any period of early entry or occupancy or holding over by Tenant, if applicable), Tenant shall maintain the following types of insurance, in the amounts specified below:

(i) Liability Insurance. Commercial General Liability Insurance, ISO Form CG 00 01, or its equivalent, covering Tenant’s use of or occupancy at the Leased Premises against claims for bodily injury or death or property damage, which insurance shall be primary and non-contributory and shall provide coverage on an occurrence basis with a per occurrence limit of not less than $10,000,000 for each policy year, which limit may be satisfied by any combination of primary and excess or umbrella per occurrence policies.

(ii) Property Insurance. Special Form Insurance in the amount of the full replacement cost of Tenant’s Property (including, without limitation, alterations or additions performed by Tenant following the Commencement Date pursuant hereto, but excluding those improvements, if any, made pursuant to Section 2.02 above), which insurance shall waive coinsurance limitations.

(iii) Worker’s Compensation Insurance. Worker’s Compensation insurance in amounts required by applicable Laws; provided, if there is no statutory requirement for Tenant, Tenant shall still obtain Worker’s Compensation insurance coverage.

(iv) Business Interruption Insurance. Business Interruption Insurance with limits not less than an amount equal to $1,000,000.

(v) Automobile Insurance. Commercial Automobile Liability Insurance insuring bodily injury and property damage arising from all owned, non-owned and hired vehicles, if any, with minimum limits of liability of $1,000,000 combined single limit, per accident.

(b) All insurance required to be carried by Tenant hereunder shall be issued by one or more insurance companies reasonably acceptable to Landlord, licensed to do business in the State in which the Leased Premises is located and having an AM Best’s rating of A IX or better. Tenant shall promptly provide notice to Landlord if Tenant is notified that coverage is materially changed, canceled or permitted to lapse. In addition, Tenant shall name Landlord, Landlord’s managing agent, and any mortgagee requested by Landlord, as additional insureds under Tenant’s Commercial General Liability Insurance, excess and umbrella policies (but only to the extent of the limits required hereunder). On or before the Commencement Date (or the date of any earlier entry or occupancy by Tenant), and thereafter, prior to the expiration of each such policy, Tenant shall furnish Landlord with certificates of insurance in the form of XXXXX 25 (or other evidence of insurance reasonably acceptable to Landlord), evidencing all required coverages, and that with the exception of Workers’ Compensation insurance, such insurance is primary and non-contributory. Upon Tenant’s receipt of a request from Landlord, Tenant shall provide Landlord with copies of all insurance policies, including all endorsements, evidencing the coverages required hereunder. If Tenant fails to carry such insurance and furnish Landlord with such certificates of insurance or copies of insurance policies (if applicable), Landlord may, upon ten (10) business days’ notice to Tenant, obtain such insurance on Tenant’s behalf and Tenant shall reimburse Landlord upon demand for the cost thereof as Additional Rent. Landlord reserves the right from time to time (but not more than once every five (5) years) to require Tenant to obtain higher minimum amounts or different types of insurance if it becomes customary for other landlords of similar buildings in the area to require similar sized tenants in similar industries to carry insurance of such higher minimum amounts or of such different types.

Section 8.05. Landlord’s Insurance. During the Lease Term, Landlord shall maintain the following types of insurance, in the amounts specified below (the cost of which shall be included in Operating Expenses):

(a) Liability Insurance. Commercial General Liability Insurance, ISO Form CG 00 01, or its equivalent, against claims for bodily injury or death and property damage, which insurance shall provide coverage on an occurrence basis with a per occurrence limit of not less than $10,000,000 for each policy year, which limit may be satisfied by any combination of primary and excess or umbrella per occurrence policies.

(b) Property Insurance. Special Form Insurance in the amount of the full replacement cost of the Building, including, without limitation, any improvements, if any, made pursuant to Section 2.02 above, but excluding Tenant’s Property and any other items required to be insured by Tenant pursuant to Section 8.04 above.

Section 8.06. Waiver of Subrogation. Notwithstanding anything contained in this Lease to the contrary, each of Landlord (and its affiliates, property managers and mortgagees) and Tenant (and its affiliates) hereby waives any and all rights of recovery, claims, actions or causes of action against the other party, or such other party’s employees, agents or contractors, for any loss or damage to the Leased Premises and to any personal property of such party, arising from any risk which is required to be insured against by Sections 8.04(a)(ii), 8.04(a)(iii) and 8.05(b) above. The effect of such waiver is not limited by the amount of such insurance actually carried or required to be carried, or to the actual proceeds received after a loss or to any deductible applicable thereto, and either party’s failure to carry insurance required under this Lease shall not invalidate such waiver. The foregoing waiver shall apply regardless of the cause or origin of any such claim, including, without limitation, the fault or negligence of either party or such party’s employees, agents or contractors. The Special Form Insurance policies and Workers’ Compensation Insurance policies maintained by Landlord and Tenant as provided in this Lease shall include an express waiver of any rights of subrogation by the insurance company against Landlord or Tenant, as applicable.

ARTICLE 9 - CASUALTY

Section 9.01. Casualty Restoration. In the event of total or partial destruction of the Leased Premises by fire or other casualty, Landlord agrees promptly to restore and repair same; provided, however, Landlord’s obligation hereunder with respect to the Leased Premises shall be limited to the reconstruction of such of the improvements as were originally required to be made by Landlord pursuant to the Workletter. Rent shall proportionately xxxxx during the time that the Building or part thereof is unusable or inaccessible because of any such damage. Within sixty (60) days after such casualty, Landlord shall deliver to Tenant written notice (the “Casualty Notice”) setting forth Landlord’s reasonable estimate for substantial completion of the required restoration and repair work. If the Casualty Notice provides that the Leased Premises is destroyed to the extent that it cannot be repaired or rebuilt within one hundred eighty (180) days from the casualty date, then either Landlord or Tenant may, upon thirty (30) days’ written notice to the other party, terminate this Lease with respect to matters thereafter accruing. In the event Landlord elects to terminate this Lease, Tenant shall have the right to reject Landlord’s termination in which case the Lease shall remain in full force and effect; provided, however, if the remaining Lease Term following Landlord’s estimated completion date is less than five (5) years, the Lease Term shall be automatically extended as follows: Tenant may elect to either (x) exercise a remaining option to extend the Lease Term pursuant to Section 17.01 below, in which case any right to retract its exercise of an option to extend set forth in Section 17.01 shall be null and void and the applicable Extension Term shall commence upon the expiration of the preceding term, or (y) keep any remaining options to extend (if any) unaffected by the casualty, in which case the Lease Term shall be extended to the last day of the fifth (5th) year following Landlord’s substantial completion of the restoration and repair work in connection with such casualty, and the Minimum Annual Rent per square foot for any resulting extension term shall be an amount equal to one hundred two percent (102%) of the Minimum Annual Rent per square foot for the period immediately preceding such extension term for the first twelve (12) months of such extension term, with an increase of two percent (2%) for each successive twelve (12) month period of such extension term.

Section 9.02. Landlord Termination. Notwithstanding Section 9.01 above, if the Building is destroyed by a casualty that is not covered by the insurance required to be carried by Landlord hereunder or, if covered, such insurance proceeds are insufficient to rebuild the Building, then, provided that Landlord complied with the insurance requirements under this Lease, Landlord may, by delivering written notice to Tenant within sixty (60) days after such casualty, terminate this Lease with respect to matters thereafter accruing.

Section 9.03. Notwithstanding anything to the contrary contained herein, if a casualty occurs during the last year of the Lease Term and the Casualty Notice provides that the repair is estimated to take more than ninety (90) days from the date of the casualty to complete, Landlord or Tenant may terminate the Lease effective as of the date of such casualty by written notice given to the other delivered within ten (10) days after Landlord’s delivery of the Casualty Notice, whereupon the Lease shall terminate and all Rent and other charges under the Lease will be apportioned as of the date of such casualty. Notwithstanding the foregoing, if (i) Landlord elects to terminate this Lease pursuant to this Section 9.03, (ii) more than two hundred eighty (280) days remain in the Lease Term at the time of Landlord’s termination, (iii) Tenant has at least one (1) remaining right to extend the Lease Term pursuant to Section 17.01, and (iv) Tenant satisfies all of the conditions set forth in said Section 17.01, then Tenant may, within ten (10) days following Tenant’s receipt of Landlord’s termination notice, reject Landlord’s notice of termination by exercising its right to extend the Lease Term pursuant to Section 17.01, in which case any right to retract its option to extend set forth in Section 17.01 shall be null and void, Landlord’s termination notice shall be rendered null and void, and this Lease shall remain in full force and effect. Tenant hereby waives any rights under applicable Laws inconsistent with the terms of this Article 9.

ARTICLE 10 - EMINENT DOMAIN

If all or any substantial part of the Leased Premises shall be acquired by the exercise of eminent domain, Landlord may terminate this Lease by giving written notice to Tenant on or before the date possession thereof is so taken. If all or any material part of the Leased Premises shall be acquired by the exercise of eminent domain, Tenant may terminate this Lease by giving written notice to Landlord as of the date possession thereof is so taken. In the event of the exercise of eminent domain that does not result in termination of this Lease, Rent shall be equitably reduced based on the amount of the Leased Premises taken. All damages awarded shall belong to Landlord; provided, however, that Tenant may claim an award for Tenant’s personal property (including removable fixtures) and for relocation expenses but only if such amount is not subtracted from Landlord’s award and does not otherwise diminish or adversely affect any award to Landlord.

ARTICLE 11 - ASSIGNMENT AND SUBLEASE

Section 11.01. Assignment and Sublease.

(a) Tenant shall not assign this Lease or sublet the Leased Premises in whole or in part without Landlord’s prior written consent. In the event of any permitted assignment or subletting, Tenant shall remain primarily liable hereunder, and, except for a sublet or assignment to a Permitted Transferee (as hereinafter defined), any extension, expansion, rights of first offer, rights of first refusal or other options granted to Tenant under this Lease shall be rendered void and of no further force or effect. The acceptance of rent by Landlord from any other person or entity shall not be deemed to be a waiver of any of the provisions of this Lease or to be a consent to the assignment of this Lease or the subletting of the Leased Premises. Any assignment or sublease consented to by Landlord shall not relieve Tenant (or its assignee) from obtaining Landlord’s consent to any subsequent assignment or sublease hereunder.

(b) By way of example and not limitation, Landlord shall be deemed to have reasonably withheld consent to a proposed assignment or sublease if in Landlord’s opinion (i) the Leased Premises are or may be materially adversely affected; (ii) the business reputation of the proposed assignee or subtenant is unacceptable; (iii) the financial worth of the proposed assignee or subtenant is insufficient to

meet the obligations of Tenant hereunder, or (iv) the prospective assignee or subtenant is a current tenant of Landlord or its affiliate in 301 or 801 (each as defined in Section 17.02 below) or is a bona-fide third-party prospective tenant of Landlord or its affiliate in 301 or 801 and Landlord then has substantially similar space available for lease. Landlord further expressly reserves the right to refuse to give its consent to any subletting if the proposed rent is publicly advertised to be less than the rent publicly advertised for similar premises in the Building. Landlord agrees that Landlord shall not have the right to withhold consent to a proposed assignment or sublease if such proposed assignee or subtenant meets the requirements of clauses (i), (ii) and (iv) above and has a tangible net worth of at least $200,000,000.00.

(c) Tenant agrees to pay Landlord $500.00 upon demand by Landlord for reasonable accounting and attorneys’ fees incurred in conjunction with the processing and documentation of any requested assignment, subletting or any other hypothecation of this Lease or Tenant’s interest in and to the Leased Premises as consideration for Landlord’s consent. The provisions of this Section 11.01(c) shall not apply to a Permitted Transferee.

Section 11.02. Permitted Transfer. Notwithstanding anything to the contrary contained in Section 11.01 above, Tenant shall have the right, without Landlord’s consent, but upon ten (10) days’ prior notice to Landlord, to (a) sublet all or part of the Leased Premises to any related corporation or other entity which controls Tenant, is controlled by Tenant or is under common control with Tenant; (b) provided that the tangible net worth of the successor entity after any such transaction is not less than the tangible net worth of Tenant as of the date hereof and provided further that such successor entity assumes all of the obligations and liabilities of Tenant, assign this Lease to any related corporation or other entity which controls Tenant, is controlled by Tenant, or is under common control with Tenant, or to a successor entity into which or with which Tenant is merged, reorganized or consolidated or which acquires all or substantially all of Tenant’s stock, assets or property; or (c) effectuate any public offering of Tenant’s or any of its affiliates’ stock on the New York Stock Exchange, the NASDAQ over the counter market or any other nationally recognized securities exchange (any such entity hereinafter referred to as a “Permitted Transferee”). For the purpose of this Article 11 and Section 17.01(a), (i) “control” shall mean ownership of not less than fifty percent (50%) of all voting stock or legal and equitable interest in such corporation or entity, and (ii) “tangible net worth” shall mean the excess of the value of tangible assets (i.e. assets excluding those which are intangible such as goodwill, patents and trademarks) over liabilities. Any such transfer shall not relieve Tenant of its obligations under this Lease. Nothing in this Section 11.02 is intended to nor shall permit Tenant to transfer its interest under this Lease as part of a fraud or subterfuge to intentionally avoid its obligations under this Lease (for example, transferring its interest to a shell corporation that subsequently files a bankruptcy), and any such transfer shall constitute a Default hereunder. Any change in control of Tenant resulting from a merger, consolidation, or a transfer of partnership or membership interests, a stock transfer, or any sale of substantially all of the assets of Tenant that do not meet the requirements of this Section 11.02 shall be deemed an assignment or transfer that requires Landlord’s prior written consent pursuant to Section 11.01 above.

ARTICLE 12 - TRANSFERS BY LANDLORD

Section 12.01. Sale of the Leased Premises. Landlord shall have the right to sell the Leased Premises or any portion thereof at any time during the Lease Term, subject to the rights of Tenant hereunder; and such sale shall operate to release Landlord from liability accruing hereunder after the date of such conveyance, but such covenants and obligations shall be binding upon and shall be deemed to have been assumed by each new owner of the Leased Premises as of the date of such conveyance without the need of a further agreement.

Section 12.02. Estoppel Certificate.