PURCHASE AND SALE AGREEMENT CANTERWOOD APARTMENTS BOULDER, COLORADO BETWEEN TRM - MEREDITH PARK CORP. AS SELLER AND RRE OPPORTUNITY OP II, LP AS PURCHASER Dated: December 1, 2015

Exhibit 10.11

CANTERWOOD APARTMENTS

BOULDER, COLORADO

BETWEEN

TRM - XXXXXXXX XXXX CORP.

AS SELLER

AND

RRE OPPORTUNITY OP II, LP

AS PURCHASER

Dated:

December 1, 2015

(the “Effective Date”)

TABLE OF CONTENTS

Page

1. | THE PROPERTY 1 |

1.1 | Description. 1 |

1.2 | “As‑Is” Purchase. 2 |

1.3 | Agreement to Convey. 3 |

2. | PRICE AND PAYMENT. 4 |

2.1 | Purchase Price. 4 |

2.2 | Payment. 4 |

2.3 | Closing. 5 |

3. | INSPECTIONS AND APPROVALS. 5 |

3.1 | Inspections. 5 |

3.2 | Title and Survey; Approval or Disapproval. 8 |

3.3 | Contracts. 9 |

3.4 | Permitted Encumbrances. 9 |

3.5 | Purchaser’s Right to Terminate. 10 |

3.6 | Delivery of Title Policy at Closing. 10 |

i | ||

TABLE OF CONTENTS

(continued)

Page

4. | SELLER’S COVENANTS FOR PERIOD PRIOR TO CLOSING. 10 |

4.1 | Insurance. 10 |

4.2 | Operation. 11 |

4.3 | New Contracts. 11 |

4.4 | New Leases. 11 |

4.5 | Rent-Ready. 11 |

4.6 | Material Events. 11 |

5. | REPRESENTATIONS AND WARRANTIES. 11 |

5.1 | By Seller. 11 |

5.2 | By Purchaser. 13 |

5.3 | Mutual. 14 |

6. | COSTS AND PRORATIONS. 14 |

6.1 | Purchaser’s Costs. 14 |

6.2 | Seller’s Costs. 15 |

6.3 | Prorations. 15 |

ii | ||

TABLE OF CONTENTS

(continued)

Page

6.4 | Taxes. 15 |

6.5 | In General. 16 |

6.6 | Purpose and Intent. 16 |

7. | DAMAGE, DESTRUCTION OR CONDEMNATION. 16 |

7.1 | Material Event. 16 |

7.2 | Immaterial Event. 16 |

7.3 | Termination and Return of Deposit. 17 |

8. | NOTICES. 17 |

9. | CLOSING AND ESCROW. 18 |

9.1 | Escrow Instructions. 18 |

9.2 | Seller’s Deliveries. 18 |

9.3 | Purchaser’s Deliveries. 19 |

9.4 | Possession. 19 |

9.5 | Insurance. 19 |

9.6 | Post‑Closing Collections. 19 |

iii | ||

TABLE OF CONTENTS

(continued)

Page

9.7 | Additional Obligations of Seller and Xxxxxxxxx. 00 |

00. | DEFAULT; FAILURE OF CONDITION. 20 |

10.1 | Purchaser Default. 20 |

10.2 | Seller Default. 20 |

10.3 | Failure of Condition. 21 |

11. | MISCELLANEOUS. 21 |

11.1 | Entire Agreement. 21 |

11.2 | Severability; Construction. 21 |

11.3 | Applicable Law. 21 |

11.4 | Assignability. 22 |

11.5 | Successors Bound. 22 |

11.6 | Breach. 22 |

11.7 | No Public Disclosure. 22 |

11.8 | Captions. 22 |

11.9 | Attorneys’ Fees. 22 |

iv | ||

TABLE OF CONTENTS

(continued)

Page

11.10 | No Partnership. 23 |

11.11 | Time of Essence. 23 |

11.12 | Counterparts; Electronic or Facsimile Copies. 23 |

11.13 | Recordation. 23 |

11.14 | Proper Execution. 23 |

11.15 | Tax Protest. 23 |

11.16 | Survival and Limitation of Representations and Warranties; Seller’s Knowledge. 23 |

11.17 | No Processing. 24 |

11.18 | Calculation of Time Periods. 24 |

11.19 | Section 1031 Exchange. 24 |

11.20 | Limitation of Liability. 24 |

11.21 | Jury Waiver. 24 |

11.22 | Prohibited Persons and Transactions. 25 |

v | ||

LIST OF EXHIBITS

Exhibit 1.1.1 | Legal Description |

Exhibit 1.1.3 | Inventory of Personal Property |

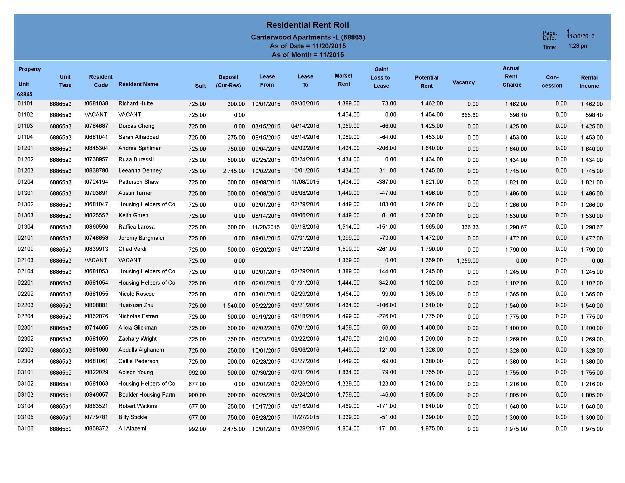

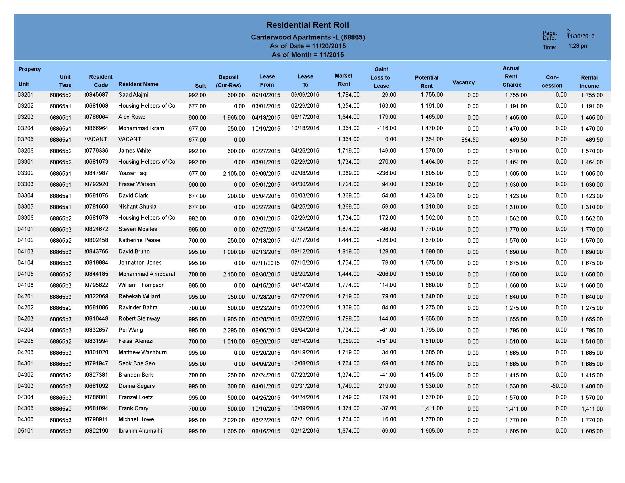

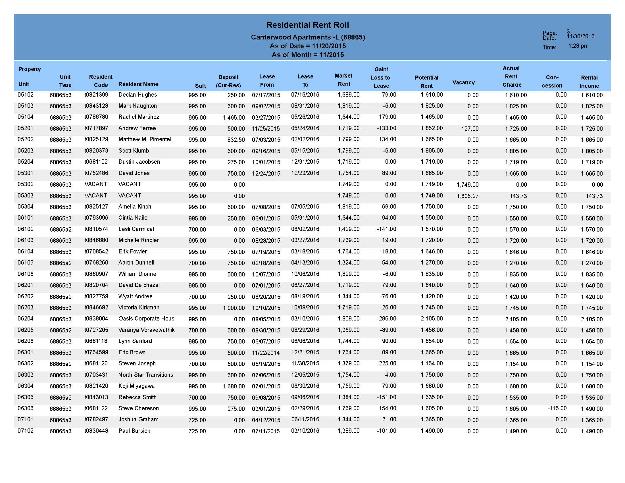

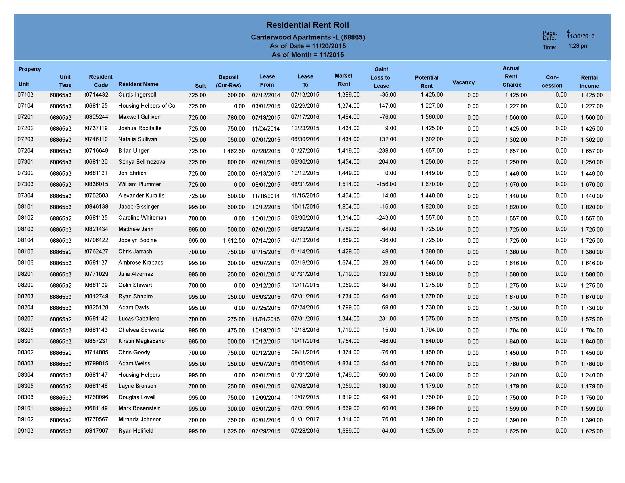

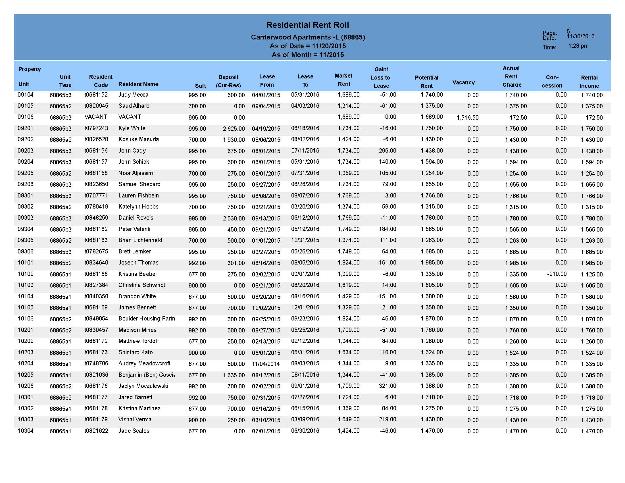

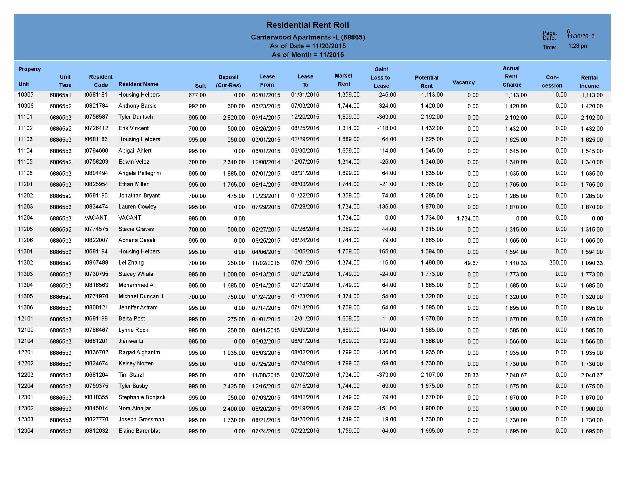

Exhibit 1.1.6 | Schedule of Tenants (Rent Roll) |

Exhibit 3.1 | Property Documents (Due Diligence) |

Exhibit 3.3 | Schedule of Service Contracts |

Exhibit 9.2.1 | Form of Special Warranty Deed |

Exhibit 9.2.2 | Form of Xxxx of Sale and Assignment and Assumption Agreement |

Exhibit 9.2.6 | Form of FIRPTA Affidavit |

Exhibit 9.2.7 | Form of Tenant Notice Letter |

List of Exhibits

Page 1

LIST OF CERTAIN DEFINED TERMS

PURCHASER: | RRE Opportunity OP II, LP, a Delaware limited partnership |

SELLER: | TRM – Xxxxxxxx Xxxx Corp., an Illinois corporation |

PURCHASE PRICE: | $65,200,000 |

DEPOSIT: | $2,500,000 |

APPROVAL DATE: | December 4, 2015 |

TITLE NOTICE DATE: | December 9, 2015 |

RESPONSE DATE: | As defined in Section 3.2, two (2) business days of Seller’s receipt of the Title Notice from Purchaser |

CURE DATE: | As defined in Section 3.2, two (2) business days of the Response Date, but in no event later than the Approval Date |

CLOSING DATE: | December 18, 2015 |

TITLE COMPANY: | Xxxxxxx Title Guaranty Company |

BROKER: | XXX Xxxxxxx |

PROPERTY MANAGER: | Lincoln Apartment Management Limited Partnership |

Defined Terms

Page 1

THIS PURCHASE AND SALE AGREEMENT (this “Agreement”), dated as of the Effective Date, is made by and between Seller and Purchaser.

A G R E E M E N T S:

NOW, THEREFORE, in consideration of the covenants, promises and undertakings set forth herein, and for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Seller and Purchaser agree as follows:

1.THE PROPERTY

1.1 Description. Subject to the terms and conditions of this Agreement, and for the consideration herein set forth, Seller agrees to sell and transfer, and Purchaser agrees to purchase and acquire, that certain 216-unit multi-family residential project commonly known as Canterwood Apartments, located in Boulder, Colorado, consisting of all of the following (collectively, the “Property”):

1.1.1 That certain land (the “Land”) more specifically described in Exhibit 1.1.1 attached hereto;

1.1.2 The buildings, parking areas, improvements, installations, structures and fixtures now situated on the Land (the “Improvements”) (the Land and the Improvements are sometimes collectively referred to herein as the “Real Property”);

1.1.3 All furniture, personal property, machinery, apparatus, supplies and equipment owned by Seller and currently used in the operation, repair and maintenance of the Land and Improvements and situated thereon (collectively, the “Personal Property”), and generally described on Exhibit 1.1.3 attached hereto. The Personal Property to be conveyed is subject to depletions, replacements and additions in the ordinary course of Seller’s business;

1.1.4 Seller’s assignable and transferrable right, title and interest in and to all rights, privileges, easements, hereditaments, and appurtenances belonging to or inuring to the benefit of Seller and pertaining to the Land or used by Seller in connection with the operation of the Real Property, if any;

1.1.5 All right, title and interest of Seller in and to any streets, alleys or rights-of-way (whether open, closed or proposed), within or adjacent to the Land;

1.1.6 All of Seller’s right, title and interest as landlord or lessor in, to and under all leases or occupancy agreements, including those in effect on the Effective Date and described on Exhibit 1.1.6 attached hereto (the “Rent Roll”), and any new leases entered into pursuant to Section 4.4, which as of the Closing (as hereinafter defined) affect all or any portion of the Land or Improvements (collectively, the “Leases”), and any security deposits actually held by Seller or Property Manager with respect to any such Leases;

1.1.7 All right, title and interest of Seller in, to and under the Designated Service Contracts (as hereinafter defined);

1.1.8 All right, title and interest of Seller in and to the common name of the Property and all signs, logos, trade names, trademarks, symbols or styles relating to the Real Property owned by Seller (specifically including the name “Canterwood” but excluding the name “Capri”) and all other intangible property now owned or hereafter acquired by Seller in connection with the Real Property or the Personal Property, including without limitation all brochures, manuals, lists of prospective tenants, advertising and marketing materials (including, all social media accounts and logo, photo, video and e-brochure files), assignable telephone and facsimile numbers, plans, specifications, drawings, reports, studies and any and all web addresses, domain names and URLs relating to the Real Property (collectively, the “Intangible Personal Property”);

1.1.9 All right, title and interest of Seller in and to all unexpired assignable warranties, guaranties and sureties relating to the Real Property or the Personal Property (the “Warranties”); and

1.1.10 All right, title and interest of Seller in and to all assignable governmental permits, licenses, certificates and authorizations relating to the use, occupancy or operation of the Real Property or the Personal Property (the “Permits”).

1.2 “As‑Is” Purchase. Except as expressly set forth in this Agreement, the Property is being sold in an “AS IS, WHERE IS” condition and “WITH ALL FAULTS” as of the Effective Date and of Closing. Except as expressly set forth in this Agreement or the Deed and Xxxx of Sale as referenced in Section 9.2, no representations or warranties have been made or are made and no responsibility has been or is assumed by Seller or by any partner, officer, person, firm, agent, attorney or representative acting or purporting to act on behalf of Seller as to (i) the condition or state of repair of the Property; (ii) the compliance or non-compliance of the Property with any applicable laws, regulations or ordinances (including, without limitation, any applicable zoning, building or development codes); (iii) the value, expense of operation, or income potential of the Property; (iv) any other fact or condition which has or might affect the Property or the condition, state of repair, compliance, value, expense of operation or income potential of the Property or any portion thereof; (v) whether the Property contains asbestos or harmful or toxic substances or

2

pertaining to the extent, location or nature of same; or (vi) any other matter related in any way to the Property. The parties agree that all understandings and agreements heretofore made between them or their respective agents or representatives are merged in this Agreement and the Exhibits hereto annexed, which alone fully and completely express their agreement, and that this Agreement has been entered into with the parties satisfied with the opportunity afforded for full investigation, neither party relying upon any statement or representation by the other unless such statement or representation is specifically embodied in this Agreement or the Exhibits annexed hereto.

With the exception of any Claims (as defined below) resulting from the material inaccuracy or material breach of any representations or warranties expressly made by Seller in this Agreement, Purchaser waives its right to recover from, and forever releases and discharges Seller, Seller’s affiliates, Seller’s investment advisor and manager, the partners, trustees, shareholders, directors, officers, attorneys, employees and agents of each of them, and their respective heirs, successors, personal representatives and assigns (collectively, the “Releasees”) from any and all demands, claims (including, without limitation, causes of action in tort), legal or administrative proceedings, losses, liabilities, damages, penalties, fines, liens, judgments, costs or expenses whatsoever (including, without limitation, attorneys’ fees and costs), whether direct or indirect, known or unknown, foreseen or unforeseen (collectively, “Claims”), that may arise on account of or in any way be connected with the Property, the physical condition thereof, or any law or regulation applicable thereto (including, without limitation, claims under the Clean Air Act (42 U.S.C. 7401, et seq.), as amended, the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended (42 U.S.C. Section 9601, et seq.), the Resource Conservation and Recovery Act of 1976 (42 U.S.C. Section 6901, et seq.), as amended, the Clean Water Act (33 U.S.C. Section 1251, et seq.), as amended, the Safe Drinking Water Act (49 U.S.C. Section 1801, et seq.), as amended, the Hazardous Materials Transportation Act (49 U.S.C. Section 1801, et seq.), as amended, and the Toxic Substances Control Act (15 U.S.C. Section 2601, et seq.). Without limiting the foregoing, with the exception of any Claims resulting from the material inaccuracy or material breach of any representations or warranties expressly made by Seller in this Agreement or the Deed and Xxxx of Sale, Purchaser, upon Closing, shall be deemed to have waived, relinquished and released Seller and all other Releasees from any and all Claims, matters arising out of latent or patent defects or physical conditions, violations of applicable laws (including, without limitation, any environmental laws) and any and all other acts, omissions, events, circumstances or matters affecting the Property. As part of the provisions of this Section 1.2, but not as a limitation thereon, Purchaser hereby agrees, represents and warrants that the matters released herein are not limited to matters which are known or disclosed, and Purchaser hereby waives any and all rights and benefits which it now has, or in the future may have conferred upon it, by virtue of the provisions of federal, state or local law, rules and regulations. Without limiting Seller’s post-Closing obligations under Section 11.16, Purchaser agrees that should any cleanup, remediation or removal of hazardous substances

3

or other environmental conditions on or about the Property be required after the date of Closing, such clean-up, removal or remediation shall not be the responsibility of Seller.

1.3 Agreement to Convey. Seller agrees to convey, and Purchaser agrees to accept, title to the Land and Improvements by Deed (as hereinafter defined) in the condition described in Section 3.4, and title to the Personal Property, the Leases, the Intangible Personal Property, the Warranties and the Permits by the Xxxx of Sale (as hereinafter defined).

1.4 Condominium Conversion. Purchaser hereby acknowledges and agrees that, except as expressly set forth in this Agreement, Seller has made no representations or warranties whatsoever concerning the Property or the ability to convert the Property to condominiums, and that Purchaser has solely relied on its own due diligence and investigation in deciding to purchase the Property pursuant to the terms and conditions of this Agreement. Accordingly, Purchaser, for itself and its successors and assigns under this Agreement, hereby agrees to advance, indemnify, defend, and hold Seller and its respective parents, subsidiaries, affiliates, divisions, companies and partnerships, and their respective partners, members, shareholders, managers, officers, directors, insurers, contractors, subcontractors, sub-subcontractors, attorneys, agents, trustees, investors, employees, representatives and their respective transferees, assigns, heirs, executors and administrators (collectively, the “Indemnified Parties”) free and harmless from any losses, liabilities, lawsuits, obligations, responsibilities, duties, actions, rights of action, causes of action, cross-claims, injuries, damages, judgments, awards, settlements, claims, liens, construction costs, demands, remedies, costs and/or expenses, including attorneys’ fees and costs, of whatever kind, nature or description, in law or equity or otherwise, in contract, tort or otherwise, whether known or unknown, foreseeable or unforeseeable, suspected or unsuspected, fixed or contingent, liquidated or unliquidated, arising out of, relating to or in connection with, directly or indirectly, at any time, any action that may be taken by Purchaser to effect the conversion of the Property from the existing rental apartment complex into a condominium project (“Condominium Conversion”), including, without limitation, (i) the condition of the Property, and (ii) any construction, maintenance or other work done or performed on or about the Property during periods prior to and after the Closing insofar as such matters could give rise to claims incident to a Condominium Conversion (collectively, the “Indemnification Claims”).

2. PRICE AND PAYMENT.

2.1 Purchase Price. Purchaser agrees to pay the Purchase Price for the acquisition of the Property, subject to the terms of this Agreement.

2.2 Payment. Payment of the Purchase Price is to be made in cash as follows:

2.2.1 Within one (1) business day after the Effective Date, Purchaser shall deliver the Deposit, as an xxxxxxx money deposit, to the Title Company. If Purchaser timely delivers

4

the Termination Notice pursuant to Section 3.5 of this Agreement on or prior to the Approval Date, or timely elects to terminate this Agreement pursuant to Section 3.2.2, this Agreement shall automatically terminate, in which event the Deposit together with all interest accrued thereon shall be returned to Purchaser and, except for the Surviving Obligations (as hereinafter defined), Seller and Purchaser shall have no further obligations or liabilities to each other hereunder.

2.2.2 The Deposit will be placed with and held in escrow by the Title Company, in immediately available funds in an interest-bearing account at a mutually acceptable, federally-insured banking institution (the “Escrow Account”). Any interest earned by the Deposit shall accrue, except as otherwise provided in this Agreement, for the benefit of Purchaser and be considered as part of the Deposit. Except as otherwise provided in this Agreement, the Deposit will be applied to the Purchase Price at Closing.

2.2.3 Prior to or contemporaneous with the execution hereof by Purchaser and Seller, Purchaser has paid to Seller $100.00 (the “Independent Contract Consideration”), which amount Seller and Purchaser bargained for and agreed to as consideration for Seller’s execution and delivery of this Agreement. The Independent Contract Consideration is non-refundable and in addition to any other payment or deposit required by this Agreement, and Seller shall retain the Independent Contract Consideration notwithstanding any other provision of this Agreement to the contrary.

2.2.4 At Closing, Purchaser shall deliver the balance of Purchase Price, subject to adjustment for the prorations as provided herein, to the Title Company for disbursement to Seller via wire transfer in immediately available funds.

2.3 Closing. Payment of the Purchase Price and the closing hereunder (the “Closing”) will take place pursuant to an escrow closing on or before the Closing Date, provided that this Agreement does not terminate prior to such date. Closing shall occur through an escrow with the Title Company. Funds shall be deposited into and held by the Title Company in the Escrow Account by 11:00 a.m. local Colorado time. Upon satisfaction or completion of all Closing conditions and deliveries, the parties shall direct the Title Company to immediately record and deliver the closing documents to the appropriate parties and make disbursements from the Escrow Account according to the closing statements executed by Seller and Purchaser. Closing shall be performed on a “gap” basis (i.e., disbursement of the funds deposited by Purchaser shall occur immediately following receipt of all required escrow deposits by Title Company and authorization by the parties to close, rather than following recordation of the Deed).

3. INSPECTIONS AND APPROVALS.

3.1 Inspections.

5

3.1.5 Commencing on the Effective Date and continuing thereafter so long as this Agreement remains in full force and effect, Seller agrees to allow Purchaser and Purchaser’s engineers, architects, employees, agents and representatives (collectively, “Purchaser’s Agents”) reasonable access, during normal business hours, to the Property and to the records, if any, maintained for Seller by the Property Manager during normal business hours. Such access shall be for the sole purpose of undertaking inspections and investigations of the Property as Purchaser deems desirable to evaluate the Property, including, without limitation, (i) reviewing Leases and contracts and any records relating thereto; (ii) reviewing records relating to operating expenses; and (iii) inspecting the physical condition of the Property and conducting non-intrusive physical or environmental inspections of the Property. Purchaser shall not conduct or allow any invasive testing at the Property or any physically intrusive testing of, on or under the Property without first obtaining Seller’s written consent as to the timing and scope of work to be performed and entering into an access agreement in form and substance satisfactory to Seller. To the extent Seller has not previously done so, it shall deliver or cause to be delivered to Purchaser all Leases and the items listed in Exhibit 3.1 attached hereto (collectively, the “Property Documents”) within three (3) business days after the Effective Date; provided, however, that Seller may make the Leases and the Lease files available to Purchaser at the Property for scanning in lieu of delivering the Leases to Purchaser.

3.1.6 Purchaser agrees that, in making any physical or environmental inspections of the Property, Purchaser and all of Purchaser’s Agents entering onto the Property shall carry not less than $2,000,000 commercial general liability insurance insuring all activity and conduct of Purchaser and such representatives while exercising such right of access and naming Seller, Capri Capital Partners, LLC, and the Property Manager as additional insureds. Purchaser represents and warrants that it carries not less than $2,000,000 commercial general liability insurance with contractual liability endorsement which insures Purchaser’s indemnity obligations hereunder. Seller confirms receipt and approval of Purchaser’s written evidence of insurance.

3.1.7 Purchaser agrees that in exercising its right of access hereunder, Purchaser will use and will cause Purchaser’s Agents to use their best efforts not to interfere with the activity of tenants or any persons occupying or providing service at the Property. Purchaser shall, at least twenty-four (24) hours prior to inspection, give Seller written (which may include e-mailed) notice of its intention to conduct any inspections, so that Seller shall have an opportunity to have a representative present during any such inspection, and Seller expressly reserves the right to have such a representative present, including, but not limited to, any discussion with any tenants. Purchaser agrees to cooperate with any reasonable request by Seller in connection with the timing of any such inspection. If Purchaser elects not to proceed with its purchase of the Property, at Seller’s option, Purchaser shall supply Seller with copies of any third party tests, studies or inspections of the Property performed under this Section 3 (the “Third Party Reports”) solely in the event Seller reimburses Purchaser fifty percent (50%) of its costs related to the Third Party Reports and the applicable vendors agree to release such Third Party Reports. The parties

6

acknowledge and agree that Purchaser’s delivery of the Third Party Reports shall not constitute a representation or warranty as to any of the information contained therein. The foregoing agreement to deliver the Third Party Reports shall survive Closing or termination of this Agreement.

3.1.8 Unless Seller specifically and expressly otherwise agrees in writing, Purchaser agrees that (a) the results of all inspections, analyses, studies and similar reports relating to the Property prepared by or for Purchaser utilizing any information acquired in whole or in part through the exercise of Purchaser’s inspection rights; and (b) all information (the “Proprietary Information”) regarding the Property of whatsoever nature made available to Purchaser by Seller or Seller’s agents or representatives is confidential and shall not be disclosed to any other person except those assisting Purchaser with the transaction (including, without limitation, Purchaser’s prospective investors and lenders, Purchaser’s Agents and Purchaser’s accountants, consultants, attorneys and other advisors), and then only upon Purchaser making such persons aware of the confidentiality restriction (in which event Purchaser shall be responsible for such person’s breach of such confidentiality restrictions, as if such breach were committed by Purchaser). Purchaser agrees not to use or allow to be used any such information for any purpose other than to determine whether to proceed with the contemplated purchase, or if Closing is consummated, in connection with the operation of the Property post-Closing. Further, if the purchase and sale contemplated hereby fails to close for any reason whatsoever, Purchaser agrees to return to Seller, or cause to be returned to Seller, or, if hard copies were not provided to Purchaser, to destroy all Proprietary Information provided to Purchaser by Seller or Seller’s Agents. Notwithstanding any other term of this Agreement, (i) Purchaser shall not be prohibited from making any disclosures to any governmental authority which Purchaser is required to make by law or order of a court or such governmental authority, and (ii) the provisions of this Section 3.1.4 shall survive Closing or the termination of this Agreement.

3.1.9 Except as otherwise provided in Section 3.1.7 below, Purchaser shall, at its sole cost and expense, promptly restore to substantially the same condition prior to such inspections any physical damage or alteration of the physical condition of the Property which results from any inspections conducted by or on behalf of Purchaser, reasonable wear and tear excepted. All inspections shall be conducted at Purchaser’s sole cost and expense and in strict accordance with all requirements of applicable law.

3.1.10 Except as specifically set forth herein, Seller makes no representations or warranties as to the truth, accuracy, completeness, methodology of preparation or otherwise concerning any engineering or environmental reports or any other materials, data or other information supplied to Purchaser in connection with Purchaser’s inspection of the Property (e.g., that such materials are complete, accurate or the final version thereof). It is the parties’ express understanding and agreement that any materials which Purchaser is allowed to review are provided only for Purchaser’s convenience in making its own examination and determination prior to the

7

Approval Date as to whether it wishes to purchase the Property, and in doing so, Purchaser shall rely exclusively on its own independent investigation and evaluation of every aspect of the Property and not on any materials supplied by Seller. Purchaser expressly disclaims any intent to rely on any such materials provided to it by Seller in connection with its inspection and agrees that it shall rely solely on its own independently developed or verified information.

3.1.11 PURCHASER AGREES (WHICH AGREEMENT SHALL SURVIVE CLOSING OR TERMINATION OF THIS AGREEMENT) TO INDEMNIFY, DEFEND, AND HOLD SELLER, CAPRI CAPITAL PARTNERS, LLC, AND THE PROPERTY MANAGER FREE AND HARMLESS FROM ANY LOSS, INJURY, DAMAGE, CLAIM, LIEN, COST OR EXPENSE, INCLUDING REASONABLE ATTORNEYS’ FEES AND COSTS, ARISING OUT OF A BREACH OF THIS SECTION 3 BY PURCHASER IN CONNECTION WITH THE INSPECTION OF THE PROPERTY, OR OTHERWISE FROM THE EXERCISE BY PURCHASER OR PURCHASER’S AGENTS OF THE RIGHT OF ACCESS ON THE PROPERTY (COLLECTIVELY, “PURCHASER’S INDEMNITY OBLIGATIONS”). PURCHASER HEREBY ACKNOWLEDGES AND AGREES THAT IN THE EVENT THAT PRIOR TO THE EFFECTIVE DATE PURSUANT TO THE TERMS OF THAT CERTAIN ACCESS AND DUE DILIGENCE AGREEMENT BETWEEN PURCHASER AND SELLER DATED AS OF NOVEMBER 10, 2015, PURCHASER, OR ANY OF ITS EMPLOYEES, AGENTS, CONTRACTORS, CONSULTANTS, OR OTHER REPRESENTATIVES, HAVE ENTERED ONTO THE PROPERTY TO INSPECT, TEST, SURVEY OR OTHERWISE EXAMINE THE PROPERTY, AND THE RECORDS RELATING THERETO, THE INDEMNITY SET FORTH IN THIS SECTION 3.1.7 OF THIS AGREEMENT SHALL APPLY RETROACTIVELY TO THE DATE OF SUCH INSPECTIONS, TESTING, SURVEYING, AND EXAMINATION. NOTWITHSTANDING ANYTHING IN THIS SECTION 3.1.7 OR IN SECTION 3.1.5 TO THE CONTRARY, PURCHASER SHALL HAVE NO LIABILITY FOR (A) EXCEPT FOR THE EXACERBATION OF SUCH CONDITION, ANY RELEASE OF PRE-EXISTING HAZARDOUS SUBSTANCES ARISING FROM THE CONDUCT OF ANY INVESTIGATION OR TESTING OF THE PROPERTY, (B) ANY GROSS NEGLIGENCE OR WILLFUL MISCONDUCT OF SELLER OR ANY AGENT, CONTRACTOR OR EMPLOYEE OF SELLER, OR (C) EXCEPT FOR THE EXACERBATION OF SUCH CONDITION, ANY PRE-EXISTING CONDITIONS ON OR ABOUT THE PROPERTY. THIS SECTION 3.1.7 SHALL SURVIVE CLOSING OR THE TERMINATION OF THIS AGREEMENT.

3.1.12 Purchaser shall keep the Property free from any liens arising out of any work performed, materials furnished or obligations incurred by or on behalf of Purchaser or Purchaser’s Agents with respect to any inspection or testing of the Property. If any such lien at any time shall be filed, Purchaser shall cause the same to be discharged of record within fifteen (15) days thereafter by satisfying the same or, if Purchaser, in its discretion and in good faith determines

8

that such lien should be contested, by recording a bond. Failure by Purchaser to discharge such lien shall be a material breach of this Agreement.

3.1.13 Purchaser understands that any financial statements and data, including, without limitation, gross rental income, operating expenses and cash flow statements, which may be made available by Seller to Purchaser, will be unaudited financial statements and data not prepared or reviewed by independent public accountants, and that except as expressly set forth in this Agreement, Seller makes no representation as to the accuracy or completeness thereof.

3.2 Title and Survey; Approval or Disapproval.

3.2.1 Prior to or contemporaneously with execution of this Agreement Seller has caused to be delivered to Purchaser a commitment for title insurance on the Real Property, together with copies of all items shown as exceptions to title therein, issued by the Title Company (the “Title Commitment”), and Seller has provided to Purchaser prior to the Effective Date a copy of Seller’s existing survey of the Land. Purchaser has ordered, at its expense, an update to such survey. The updated survey obtained by Purchaser, shall constitute the “Survey” hereunder. Purchaser shall have until the Title Notice Date to provide written notice to Seller of any matters shown by the Title Commitment or the Survey which are not satisfactory to Purchaser, which notice (the “Title Notice”) must specify the reason such matter(s) are not satisfactory (collectively, the “Title Objections”). In the event Seller is unable or unwilling to eliminate or modify all of the Title Objections, Seller shall so notify Purchaser in writing within two (2) business days of receipt of the Title Notice (the “Response Date”), and Purchaser may (as its sole and exclusive remedy) terminate this Agreement by delivering written notice thereof to Seller not later than two (2) business days after the Response Date (the “Cure Date”). Except for Voluntary Liens, Seller shall have no obligation whatsoever to expend or agree to expend any funds, to undertake or agree to undertake any obligations or otherwise to cure or agree to cure any Title Objections, and Seller shall not be deemed to have any obligation to cure unless Seller expressly undertakes such an obligation by a written notice to or written agreement with Purchaser given or entered into on or prior to the Closing Date and which recites that it is in response to the Title Notice. Purchaser’s sole right with respect to any Title Objection shall be to elect on or before the Cure Date to terminate this Agreement (other than continuing obligations under Section 3.1.4 and 3.1.7 that expressly survive the Closing or termination of this Agreement, which are herein called the “Surviving Obligations”) and to receive a refund of the Deposit. All matters shown on the Title Commitment and/or Survey with respect to which Purchaser fails to give a Title Notice on or before the last date for so doing, or with respect to which a timely Title Notice is given but Seller fails to undertake an express obligation to cure as provided above, shall be deemed to be approved by Purchaser and shall be deemed a “Permitted Encumbrance” as provided in Section 3.4 hereof, subject, however, to Purchaser’s termination right provided above. Notwithstanding anything to the contrary contained in this Agreement, Seller shall, on or prior to the Closing Date discharge or remove of record or cause to be paid, discharged

9

or removed of record at Seller’s sole cost and expense, all of the Voluntary Liens (as hereinafter defined) (including judgments and federal, state and municipal tax liens). The term “Voluntary Liens” as used herein shall mean (i) delinquent taxes or assessments, (ii) any deed of trust, mortgage or other lien securing financing with respect to the Property or any part thereof, (iii) any lien, encumbrance or other matter affecting title to the Property or any monetary liens on or against the Property that was created, consented to or caused by Seller after the effective date of the initial Title Commitment without Purchaser’s written consent.

3.2.2 Notwithstanding anything to the contrary herein, on or before the Cure Date, Purchaser shall advise Seller in writing that it has elected to either approve or disapprove all title and survey matters with respect to the Property. In the event that Purchaser has timely elected in writing to disapprove such title and survey, the Agreement shall terminate and Seller shall direct the Title Company to promptly return the Deposit to Purchaser and neither party shall have any further liability hereunder except for the Surviving Obligations. However, if Purchaser has (i) timely elected in writing to approve the title and survey matters with respect to the Property or (ii) has failed to timely give any written notice to Seller as to Purchaser’s approval or disapproval of such title and survey matters, Purchaser shall be deemed to have elected to approve such title and survey matters, and in either such event Purchaser shall have waived its right to terminate this Agreement with respect to title and survey matters relating to the Property (except as otherwise specifically provided in Section 3.2.1) and the entire Deposit shall be deemed non-refundable except as otherwise specifically provided in this Agreement.

3.3 Contracts. On or before the Approval Date, Purchaser shall notify Seller in writing if Purchaser elects not to assume at Closing any of the service, maintenance, supply or other contracts relating to the operation of the Property which are identified on Exhibit 3.3 attached hereto (collectively, the “Service Contracts”), provided, however, in the event that Purchaser has not received copies of all of the Service Contracts as of the Approval Date, Purchaser shall have one (1) business day following receipt of any of the missing Service Contracts to elect by written notice to Seller to not assume at Closing any such Service Contracts. Following the Approval Date, Seller shall use commercially reasonable efforts to negotiate the termination of any disapproved Service Contracts with the other parties to such Service Contracts such that all disapproved Service Contracts will terminate on the Closing Date; provided, if by the terms of the disapproved Service Contract Seller has no right to terminate same on or prior to Closing, or if any fee or other compensation is due thereunder as a result of such termination, Purchaser shall be required at Closing to assume all obligations thereunder from the Closing Date until the effective date of the termination and to assume the obligation to pay or to reimburse Seller for the payment of the termination charge. Purchaser shall have no obligation to assume any Service Contracts that are not assignable without the applicable other party’s consent where such consent has not been obtained prior to the Closing Date. Purchaser shall be responsible to pay the costs/fees under the Service Contracts which are terminated at Purchaser’s election pursuant to this Section 3.3 for the stub period from and after

10

Closing to the termination date of any such Senior Contracts, during which period Purchaser shall be solely responsible to pay all such costs until termination of such Service Contracts. All Service Contracts which Purchaser elects to assume, or which Purchaser is required to assume pursuant to this Section 3.3, are collectively referred to herein as the “Designated Service Contracts.” Notwithstanding anything contained in this Section 3.3 to the contrary, Seller shall be obligated, at no cost or expense to Purchaser, to terminate the property management agreement with Property Manager and any asset management or other agreement with Capri Capital Partners, LLC or its affiliates effective as of the Closing Date.

3.4 Permitted Encumbrances. Unless Purchaser terminates this Agreement pursuant to Sections 3.2 or 3.5 hereof following its opportunity fully to inspect the Property, the state of title thereto and all other matters relating to the Property, including its feasibility for Purchaser’s intended use and its suitability as an investment, Purchaser shall be deemed to have approved and to have agreed to purchase the Property subject to the following:

3.4.1 All exceptions to title shown in the Title Commitment or matters shown on the Survey which Purchaser has approved or is deemed to have approved pursuant to Section 3.2 hereof;

3.4.2 The lien of non‑delinquent real and personal property taxes and assessments;

3.4.3 Rights of possession of the tenants, as residential tenants only, under the Leases; and

3.4.4 Matters created by or resulting from Purchaser’s actions.

All of the foregoing are referred to herein collectively as “Permitted Encumbrances.” Notwithstanding the foregoing, the Permitted Encumbrances shall not include any mortgage or deed of trust that was granted by Seller and that encumbers the Land.

3.5 Purchaser’s Right to Terminate. Purchaser may terminate this Agreement at any time during the period ending at 5:00 p.m. (Colorado Time) on the Approval Date (the “Feasibility Period”) for any or no reason. If Purchaser determines, in its sole discretion, not to proceed with the purchase of the Property, Purchaser shall have the right by giving Seller written notice (the “Termination Notice”) on or before the Approval Date to terminate its obligation to purchase the Property. If the Termination Notice is timely given, Seller shall direct the Title Company to promptly return the Deposit to Purchaser and neither party shall have any further liability hereunder except for the Surviving Obligations; provided, however, if Purchaser terminates this Agreement after the Cure Period as a result of a title or survey matter, the Deposit shall be paid to Seller. If the Termination Notice is not timely given, Purchaser shall have no further right to terminate

11

this Agreement except as otherwise provided under Section 3.2, Section 7 and Section 10.2 hereof in this Agreement.

3.6 Delivery of Title Policy at Closing. As a condition to Purchaser’s obligation to close, the Title Company shall deliver to Purchaser at Closing an ALTA Owner’s Policy of Title Insurance (the “Title Policy”) issued by the Title Company as of the date and time of the recording of the Deed, in the amount of the Purchase Price, insuring Purchaser as owner of fee simple title to the Property, and subject only to the Permitted Encumbrances. Seller shall execute and deliver to the Title Company at Closing such affidavits and agreements (in form reasonably acceptable to Seller) to facilitate the issuance of the Title Policy (but not additional matters required for any endorsements required by Purchaser, except in connection with any title or survey objection which Seller elects or is required to cure pursuant to the terms hereof). The Title Policy may be delivered after the Closing if at the Closing the Title Company issues a currently effective, duly-executed “marked-up” Title Commitment and irrevocably commits in writing to issue the Title Policy in the form of the “marked-up” Title Commitment promptly after the Closing Date. Purchaser may elect to obtain additional coverage or endorsements to the Title Policy at Purchaser’s sole cost and expense but obtaining such additional coverage or endorsements shall not be a condition precedent to Purchaser’s Closing obligations under this Agreement.

4. SELLER’S COVENANTS FOR PERIOD PRIOR TO CLOSING. Until Closing, Seller or Seller’s agent shall:

4.1 Insurance. Keep the Property insured under its current or comparable policies against fire and other hazards covered by extended coverage endorsement and commercial general liability insurance against claims for bodily injury, death and property damage occurring in, on or about the Property.

4.2 Operation. Operate, repair, manage and maintain the Property in good order and repair substantially in accordance with Seller’s current practices with respect to the Property, normal wear and tear excepted, and perform when due all of its obligations with respect to the Property, including, without limitation, its obligations under the Leases, the Service Contracts, the Permitted Encumbrances, any mortgages or deeds of trust affecting the Property and applicable laws.

4.3 New Contracts. Following the Approval Date, not execute any amendments to existing Service Contracts and enter into only those third-party service contracts which are necessary to carry out its obligations under Section 4.2 and which shall be cancelable on thirty (30) days written notice without penalty. If Seller enters into any such contract, it shall promptly provide written notice thereof to Purchaser and unless Purchaser, within three (3) business days thereafter,

12

notifies Seller in writing of its intention to assume such contract, it shall be treated as a Designated Service Contract under Section 3.3 hereof.

4.4 New Leases. Seller shall use commercially reasonable efforts to enter into new residential Leases and grant renewals and extensions of existing residential Leases, provided that the same are done in the ordinary course of business at market rents and for a term of one (1) year or less. In addition, following the Approval Date, Seller may continue to execute new leases or amend, terminate or accept the surrender of any existing tenancies or approve any subleases without the prior consent of Purchaser in accordance with Seller’s past practices.

4.5 Rent-Ready. At Closing all rental units vacant for more than seven (7) days prior to Closing shall be delivered to Purchaser in “rent-ready” condition in accordance with Seller’s normal standard operating procedure. Notwithstanding the foregoing, in lieu of delivering any such vacant unit in rent-ready condition, Seller may provide Purchaser with a $500.00 credit per such vacant unit.

4.6 Material Events. Seller shall promptly inform Purchaser in writing of any breach or default under the Leases or Service Contracts or any event that materially or adversely affects the ownership, use, occupancy, operation or maintenance of the Property, including any Violations (as hereinafter defined) or any Litigation (as hereinafter defined).

5. REPRESENTATIONS AND WARRANTIES.

5.1 By Seller. Seller represents and warrants to Purchaser as follows as of the Effective Date and at Closing as of the Closing Date:

5.1.1 Seller is duly organized and validly existing under the laws of the State in which it was organized and is authorized to do business in the State in which the Land is located. Seller owns the Property and has duly authorized the execution and performance of this Agreement and the transactions contemplated hereunder, and such execution and performance will not violate any term of its articles of incorporation, bylaws or other organizational documents. No third party approval or consent is required for Seller to enter into this Agreement or to consummate the transactions contemplated hereby. This Agreement and all documents required hereby to be executed by Seller are and shall be valid, legally binding obligations of and enforceable against Seller in accordance with their terms.

5.1.2 Performance of this Agreement will not result in any breach of, or constitute any default under, or result in the imposition of any lien or encumbrance upon the Property under, any agreement to which Seller is a party.

13

5.1.3 There is no existing or pending litigation with respect to the Property nor, to the best of Seller’s knowledge, have any such actions, suits, proceedings or claims been threatened or asserted, which could have an adverse effect on the Property or Seller’s ability to consummate the transactions contemplated hereby (collectively, “Litigation”). No petition in bankruptcy (voluntary or otherwise), assignment for the benefit of creditors, or petition seeking reorganization or arrangement or other action under federal or state bankruptcy laws is pending against or contemplated by Seller.

5.1.4 Seller has not received any written notice from any governmental authority of a violation of any governmental laws, regulations, codes or other requirements (including, without limitation, environmental, zoning, building, fire, health and anti-discrimination laws, regulations and codes) on the Property (collectively, “Violations”), which has not been remedied.

5.1.5 Seller has no actual knowledge of, nor has Seller received notice from any governmental authority regarding, any change to the zoning classification, any condemnation proceedings or proceedings to widen or realign any street or highway adjacent to the Property.

5.1.6 The list of Service Contracts attached hereto as Exhibit 3.3 is true, correct and complete in all material respects as of the Effective Date, which shall be updated by Seller prior to Closing, if necessary, to include new Service Contracts and delete terminated Service Contracts. To Seller’s knowledge, true, correct and complete copies of all Service Contracts were provided to Purchaser in accordance with this Agreement and all Service Contracts are in full force and effect and free from material default. To Seller's knowledge, there are no service or maintenance contracts, warranties, guarantees, listing agreements, parking agreements or bonds (whether oral or written) which will be obligations of Purchaser or the Property, other than the Service Contracts.

5.1.7 Seller is not a “foreign person” within the meaning of Sections 1445 and 7701 the Internal Revenue Code of 1986, as amended (hereinafter, the “Code”).

5.1.8 Except for those tenants in possession of the Improvements under written residential leases for space in the Improvements, as shown in the Rent Roll attached hereto as Exhibit 1.1.6, there are no other tenants in possession of, or claiming any possession to, any portion of the Improvements. To the best of Seller’s knowledge, the Rent Roll contains a complete and correct list of all Leases as of the Effective Date, which shall be updated by Seller prior to Closing. To Seller’s knowledge, true, correct and complete copies of all Leases listed on the Rent Roll have been provided or made available to Purchaser and all such Leases are in full force and effect and free from material default.

5.1.9 Seller has no employees at the Property.

14

5.1.10 Seller has not granted, and to Seller’s actual knowledge there exist no, recorded or unrecorded options to purchase or rights of first refusal or first offer on the Property or any portion thereof.

5.1.11 Seller is (a) not an “employee benefit plan” (within the meaning of Section 3(3) of the Employment Retirement Income Security Act of 1974, as amended (“ERISA”)), which is subject to ERISA, (b) is a “government plan” under Section 3(32) of ERISA, and state pension statutes governing Seller do not prohibit or otherwise restrict the sale of the Property, (c) is not a “plan” (within the meaning of Section 4975(e)(1) of the Code, as amended), which is subject to Section 4975 of the Code, as amended and the sale of the Property is not a non-exempt prohibited transaction under such section and (d) is not an entity whose underlying assets include “plan assets” by reason of a plan’s investment in such entity.

5.1.12 To the best of Seller’s knowledge, the operating statements delivered to Purchaser pursuant to Section 3.1 present fairly the financial condition of the Property at such date and the result of its operations for the periods described therein.

5.1.13 To the best of Seller’s knowledge, Exhibit 1.1.3 constitutes a list of all Personal Property as of the Effective Date. The Personal Property is not subject to any liens or encumbrances (except for any liens or encumbrances which will be satisfied at Closing), and Seller owns and has good title to all Personal Property.

5.2 By Purchaser. Purchaser represents and warrants to Seller as follows:

5.2.5 Purchaser is duly organized, validly existing and in good standing under the laws of the State in which it was organized, is or will be prior to Closing authorized to do business in the State in which the Land is located, has duly authorized the execution and performance of this Agreement, and such execution and performance will not violate any term of its organizational documents.

5.2.6 No petition in bankruptcy (voluntary or otherwise), assignment for the benefit of creditors, or petition seeking reorganization or arrangement or other action under federal or state bankruptcy laws is pending against or contemplated by Purchaser.

5.2.7 Purchaser acknowledges that, by the Closing Date, Purchaser will have had sufficient opportunity to inspect the Property fully and completely at its expense in order to ascertain to its satisfaction the extent to which the Property complies with applicable zoning, building, environmental, health and safety and all other laws, codes and regulations.

5.2.8 Purchaser acknowledges that, by the Closing Date, Purchaser will have had sufficient opportunity to review the Leases, Service Contracts, expenses and other matters

15

relating to the Property in order to determine, based upon its own investigations, inspections, tests and studies and Seller’s representations and warranties set forth in this Agreement, whether to purchase the Property and to assume Seller’s obligations under the Leases, contracts and otherwise with respect to the Property.

5.2.9 Purchaser will not use the assets of an employee benefit plan as defined in Section 3(3) of ERISA and covered under Title I, Part 4 of ERISA or Section 4975 of the Code, as amended, in the performance or discharge of its obligations hereunder, including the acquisition of the Property. Purchaser will not assign its interest hereunder to any person or entity which does not expressly make this covenant and warranty for the benefit of Seller.

5.3 Mutual. Each of Seller and Purchaser represents to the other that it has had no dealings, negotiations, or consultations with any broker, representative, employee, agent or other intermediary in connection with the Agreement or the sale of the Property, except for Broker, who will be paid by Seller upon the Closing of the transaction contemplated hereby and not otherwise, pursuant to a separate written agreement between Seller and Broker. Said commission shall in no event be earned, due or payable unless and until the transaction contemplated hereby is closed and fully consummated strictly in accordance with the terms and conditions of this Agreement and Seller has actually received the Purchase Price in immediately available funds. Seller and Purchaser agree that each will indemnify, defend and hold the other free and harmless from the claims of any other broker(s), representative(s), employee(s), agent(s) or other intermediary(ies) claiming to have represented Seller or Purchaser, respectively, or otherwise to be entitled to compensation in connection with this Agreement or in connection with the sale of the Property. The terms and provisions of this paragraph shall survive Closing hereunder.

6. COSTS AND PRORATIONS.

6.1 Purchaser’s Costs. Purchaser shall pay the following costs of closing this transaction:

6.1.10 The fees and disbursements of its counsel, inspecting architect and engineer and any other consultants engaged by Purchaser, if any;

6.1.11 Except as otherwise provided by Section 6.2.3 below, the cost of any extended coverage or special endorsements to the Title Policy, including, any additional premium charge(s) for endorsements and/or deletion(s) of exception items and any cancellation charge(s) imposed by the Title Company in the event the Title Policy is not issued, unless caused by default of Seller hereunder;

6.1.12 Any and all recording fees for the Deed and any loan related document related to financing obtained by Purchaser;

16

6.1.13 One half (1/2) of any and all closing escrow fees;

6.1.14 Any and all real estate transfer, stamp or documentary taxes;

6.1.15 Any and all sales or use taxes relating to the transfer of personal property to Purchaser;

6.1.16 Any other expense(s) incurred by Purchaser or its representative(s) in inspecting or evaluating the Property or closing this transaction; and

6.1.17 All costs relating to any update, recertification or changes to the Survey.

6.2 Seller’s Costs. Seller shall pay the following costs of closing this transaction:

6.2.1 The fees and disbursements of Seller’s counsel;

6.2.2 One half (1/2) of any and all closing escrow fees;

6.2.3 the basic premium for the Title Policy for coverage in the amount of the Purchase Price and the premium for any endorsements or modifications to the Title Policy that Seller has agreed to pay in order to cure any title defects,

6.2.4 the costs of curing all title objections for which Seller is responsible under this Agreement; and

6.2.5 the costs of recording all mortgage and deed of trust cancellations.

6.3 Prorations. The following shall be prorated as of the Closing Date and be adjusted against the Purchase Price due at Closing: (a) Rents and any other amounts actually collected from tenants and other persons using or occupying the Property as of the Closing Date; (b) personal property taxes, installment payments of special assessment liens, sewer charges, utility charges (utility charges shall be prorated based on the last reading of meters prior to Closing performed at Seller’s request, if possible) and normally prorated operating expenses actually billed or paid as of the Closing Date; (c) amounts owed by Seller or paid under the Designated Service Contracts as of the Closing Date, including, without limitation, any amounts paid by any service provider under the Designated Service Contracts prior to Closing; provided, however, that Purchaser hereby assumes all payments coming due under the Designated Service Contracts from and after the Closing Date (provided that Purchaser shall receive a credit for the portion of any such payment that relates to the period prior to the Closing Date), including, but not limited to, the stub period until the term of the Designated Service Contracts expire; and (d) leasing commissions, finder’s fees and locator fees shall be paid in full by Seller for each lease executed by Seller prior to the Closing Date;

17

provided, however, that Purchaser hereby assumes all such fees and commissions for each lease executed from and after the Closing Date. Within ninety (90) days after the Closing (the “Reproration Period”), Purchaser and Seller will make a further adjustment for such rents, taxes or charges which may have accrued or been incurred prior to the Closing Date, but not billed or paid at that date; such obligations shall survive the Closing.

6.4 Taxes. General real estate taxes and special assessments relating to the Property payable during the year in which Closing occurs shall be prorated as of the Closing Date. If Closing shall occur before the actual taxes and special assessments payable during such year are known, the apportionment of taxes shall be upon the basis of the taxes for the Property payable during the immediately preceding year, provided that, if the taxes and special assessments payable during the year in which Closing occurs are thereafter determined to be more or less than the taxes payable during the preceding year (after any appeal of the assessed valuation thereof is concluded), Seller and Purchaser promptly (but no later than March 31, 2016, except in the case of an ongoing tax protest) shall adjust the proration of such taxes and special assessments, and Seller or Purchaser, as the case may be, shall pay to the other any amount required as a result of such adjustment and this covenant shall not merge with the Deed delivered hereunder but shall survive the Closing.

6.5 In General. Any other costs or charges of closing this transaction not specifically mentioned in this Agreement shall be paid and adjusted in accordance with local custom in the County in which the Land is located. All prorations shall be made on a 365-day calendar year basis, based on the actual number of days in the applicable month.

6.6 Purpose and Intent. Except as expressly provided herein, the purpose and intent as to the provisions of prorations and apportionments set forth in this Section 6 and elsewhere in this Agreement is that Seller shall bear all expenses of ownership and operation of the Property and shall receive all income therefrom accruing through midnight at the end of the day preceding the Closing Date and Purchaser shall bear all such expenses and receive all such income accruing thereafter.

6.7 Settlement Statements. Seller shall deliver to Purchaser no later than two (2) business days prior to the Closing Date invoices or bills for all prorated expenses and other reasonable backup information. Seller and Purchaser shall use commercially reasonable efforts to cause the Title Company to prepare a draft settlement statements containing the prorations described above and deliver the same to the parties no later than 12:00 p.m. (Denver time) one (1) business day prior to the Closing Date. Prior to Closing, Seller and Purchaser shall sign off on the prorations and other information set forth in the settlement statements.

7. DAMAGE, DESTRUCTION OR CONDEMNATION.

18

7.1 Material Event. If, prior to Closing, the number of parking spaces on the Property are reduced by fifteen percent (15%) or more, the Improvements are damaged and the cost of repair exceeds $500,000.00 (as determined by Seller and its contractors in consultation with Purchaser) or all access to the Property is rendered completely unusable, or is destroyed or taken under power of eminent domain and the cost or repair exceeds $500,000.00 (as determined by Seller and its contractors in consultation with Purchaser) (a “Material Event”), Purchaser may elect to terminate this Agreement by giving written notice of its election to Seller within seven (7) days after receiving written notice of such destruction or taking from Seller of such Material Event, in which case, that Purchaser timely terminates this Agreement, the Title Company shall promptly return the Deposit to Purchaser and the parties shall have no further liability hereunder except for any Surviving Obligations. If Purchaser does not give such written termination notice within such seven (7) day period, this transaction shall be consummated on the Closing Date and at the Purchase Price provided for in Section 2, and Seller will assign to Purchaser the physical damage proceeds of any insurance policy(ies) payable to Seller, or Seller’s portion of any condemnation award, in both cases, up to the amount of the Purchase Price, and, if an insured casualty, pay to Purchaser as a credit to the Purchase Price at Closing the amount of any deductible but not to exceed the amount of the loss.

7.2 Immaterial Event. If, prior to Closing, the Property is subject to a casualty or a condemnation event that is not a Material Event, Purchaser shall close this transaction on the date and at the Purchase Price agreed upon in Section 2, and Seller will assign to Purchaser the physical damage proceeds of any insurance policies payable to Seller, or Seller’s rights to any portion of any condemnation award (or reduce the Purchase Price by the amount of such proceeds or award), in both cases, up to the amount of the Purchase Price and, if an insured casualty, pay to Purchaser as a credit to the Purchase Price at Closing the amount of any deductible but not to exceed the amount of the loss.

7.3 Termination and Return of Deposit. If Purchaser elects to terminate this Agreement pursuant to this Section 7, Seller shall promptly direct the Title Company to return the Deposit to Purchaser, and neither party shall have any further liability hereunder except for the Surviving Obligations.

8. NOTICES. Any notice required or permitted to be given hereunder shall be deemed to be given by either party or their respective counsel when hand delivered or one (1) business day after pickup by UPS, Airborne, Federal Express, or similar overnight express service, or by facsimile or email (only as provided below) in either case addressed to the parties at their respective addresses referenced below:

19

If to Seller: | TRM – Xxxxxxxx Xxxx Corp. c/o Capri Capital Partners, LLC 875 X. Xxxxxxxx Xxxxxx, Xxxxx 0000 Xxxxxxx, Xxxxxxxx 60611 Attention: Xxxxx Lewis Telephone: (312) 676-4152 EMAIL: xxxxxx@xxxxxxxxxxxx.xxx |

With a copy to: | Holland & Knight LLP 131 South Dearborn Street, 30th Floor Chicago, Illinois 60603 Attention: Xxxxx X. Xxxxxx Xxxxx X. Mayer Telephone: (000) 000-0000 (312) 715-5841 Email: xxxxx.xxxxxx@xxxxx.xxx xxxxx.xxxxx@xxxxx.xxx |

If to Purchaser: | RRE Opportunity OP II, LP c/o Resource Real Estate, Inc. 1845 Walnut Street, 18th Floor Philadelphia, Pennsylvania 19103 Attention: Xxxxxx Arms Telephone: (000) 000-0000 (215) 761-0491 Email: xxxxx@xxxxxxxxxxx.xxx |

With a copy to: | Resource Real Estate, Inc. 1845 Walnut Street, 18th Floor Philadelphia, Pennsylvania 19103 Attention: Xxxxx Xxxxxxxx Xxxxxxx, Esq. Telephone: (000) 000-0000 (215) 553-8426 Email: xxxxxxxx@xxxxxxxxxxx.xxx |

20

If to Title Company: | Xxxxxxx Title Guaranty Company Stewart Commercial Services 10 X. Xxxxxxxxx Xxxxx, Xxxxx 0000 Xxxxxxx, Xxxxxxxx 60606 Attention: Xxxxxxxxxxx X. Xxxxxxxx Senior Business Development Officer Direct: (000) 000-0000 Cell: (847) 899-1655 Fax: (312) 849-4410 E-mail XXxxxxxx@Xxxxxxx.xxx |

or in each case to such other address as either party may from time to time designate by giving notice in writing to the other party. Except for facsimile or email notices between 9:00 a.m. and 5:00 p.m. Central time on a business day that are followed up by an overnight courier delivery, telephone and facsimile numbers and email addresses are for informational purposes only. Effective notice will be deemed given only as provided above.

9. CLOSING AND ESCROW.

9.1 Escrow Instructions; Closing Date. Upon execution of this Agreement, the parties shall deliver an executed counterpart of this Agreement to the Title Company to serve as the instructions to the Title Company as the escrow holder for consummation of the transaction contemplated herein. Seller and Purchaser agree to execute such additional and supplementary escrow instructions as may be appropriate to enable the Title Company to comply with the terms of this Agreement; provided, however that in the event of any conflict between the provisions of this Agreement and any supplementary escrow instructions, the terms of the Agreement shall prevail.

9.2 Seller’s Deliveries. Seller shall deliver to the Title Company one (1) day prior to Closing or by making available at the Property, as appropriate for the items in Sections 9.2.3, 9.2.4 and 9.2.5 below, the following original documents, each executed and, if required, acknowledged:

9.2.1 A Special Warranty Deed to the Property, in the form attached hereto as Exhibit 9.2.1, conveying to Purchaser all of Seller’s right, title and interest in and to the Real Property, subject only to the Permitted Encumbrances and any other matters subsequently approved in writing by Purchaser or Purchaser’s counsel (the “Deed”).

9.2.2 A Xxxx of Sale and Assignment and Assumption Agreement in the form attached hereto as Exhibit 9.2.2 (the “Xxxx of Sale”).

9.2.3 (i) The Leases described in Section 1.1.6 which are still in effect as of Closing, and any new leases entered into pursuant to Section 4.4; and (ii) a current listing of any

21

tenant security deposits and prepaid rents held by Seller with respect to the Property as set forth in a current Rent Roll which shall be certified by Seller, to the best of Seller’s knowledge, to be true and correct in all material respects.

9.2.4 Copies of all Designated Service Contracts.

9.2.5 All books and records at the Property held by or for the account of Seller, including, without limitation, plans and specifications, as available.

9.2.6 An affidavit pursuant to the Foreign Investment and Real Property Tax Act in the form attached hereto as Exhibit 9.2.6.

9.2.7 A letter notifying tenants of the conveyance of the Property in the form attached hereto as Exhibit 9.2.7.

9.2.8 The Title Company’s standard owner’s affidavit, subject to the terms of this Agreement.

9.3 Purchaser’s Deliveries. At the Closing, Purchaser shall pay Seller the Purchase Price. One (1) day prior to the Closing Purchaser shall deliver executed originals of the agreements referred to in Sections 9.2.2 and 9.2.7 to the Title Company.

9.4 Possession. Purchaser shall be entitled to possession of the Property upon conclusion of the Closing, subject to the Permitted Encumbrances.

9.5 Insurance. Seller shall terminate its policies of insurance as of noon Central Time on the Closing Date, and Purchaser shall be responsible for obtaining its own insurance thereafter.

9.6 Post‑Closing Collections. Purchaser shall use its best efforts during the four (4) month period immediately following Closing to collect and promptly remit to Seller rents or other amounts due Seller for the period prior to Closing. Purchaser shall apply such rents or other amounts received after the Closing Date, first for the account of Purchaser for amounts currently due to Purchaser; second, to Seller for any and all amounts due to Seller for periods prior to Closing; and the balance to be retained by Purchaser. If Purchaser uses its best efforts to collect past-due amounts owed to Seller for the first four (4) months after Closing but is unsuccessful, Seller shall have the right to collect delinquent rents thereafter, but in no event shall Seller have the right to evict any tenant or terminate any tenant’s lease. This Section shall survive the Closing.

9.7 Additional Obligations of Seller and Purchaser. In addition to the other obligations of Purchaser and Seller described in this Section 9, at Closing, the following shall occur

22

(either directly or through Title Company, as is customary for transactions of this type in the State of Colorado):

9.7.1 Seller and Purchaser shall execute and deliver any applicable ownership information or other disclosure forms or reports required under the laws of the State of Colorado or the United States.

9.7.2 To the extent the same are in Seller’s possession, Seller shall deliver to Purchaser the original certificates of occupancy for the Property and the originals of the other certificates, licenses and permits necessary for the ownership and operation of the Property, except to the extent the same are required to be and are affixed at the Property.

9.7.3 Seller and Purchaser shall execute and deliver settlement statements approved by the parties to reflect the credits, prorations and adjustments specifically provided for in this Agreement.

9.7.4 Seller and Purchaser agree to execute, acknowledge and deliver, or cause to be executed, acknowledged and delivered, any and all other instruments and documents as may be reasonably necessary in order to complete the transaction herein provided and to carry out the intent and purposes of this Agreement, including taking any actions or executing any documents post-Closing required by third parties to transfer the web addresses, domain names and URLs to Purchaser and required under the Designated Service Contracts.

10. DEFAULT; FAILURE OF CONDITION.

10.1 Purchaser Default. If Purchaser shall become in breach of or default under this Agreement and the breach or default continues beyond the expiration of the notice and cure period, if any, provided in Section 11.6 hereof, the Deposit shall be retained by Seller as liquidated damages, and both parties shall be relieved of and released from any further liability hereunder except for the Surviving Obligations. Seller and Purchaser agree that the Deposit is a fair and reasonable amount to be retained by Seller as agreed and liquidated damages in light of Seller’s removal of the Property from the market and the costs incurred by Seller and shall not constitute a penalty or a forfeiture.

10.2 Seller Default. If Seller shall become in breach of or default under this Agreement and the breach or default continues beyond the expiration of the notice and cure period, if any, provided in Section 11.6 hereof, Purchaser shall elect as its sole and exclusive remedy hereunder either to (i) terminate the Agreement and recover the Deposit or; (ii) enforce Seller’s obligations to convey the Property by delivering written notice to Seller within ten (10) days after the scheduled Closing which describes such default and states Purchaser’s election to enforce specific performance and actually filing suit within such 10-day period, provided if such limitation

23

on the time period to file suit is prohibited or limited by law, the time period shall be extended to the minimum limitation period allowed by law, and provided that no such action in specific performance shall seek to require Seller to do any of the following: (1) change the condition of the Property or restore the same after any fire or other casualty; (2) subject to Section 10.3, below, expend money or post a bond to remove a title encumbrance or defect or correct any matter shown on a survey of the Property; or (3) secure any permit, approval, or consent with respect to the Property or Seller’s conveyance of the Property. Purchaser waives any right to receive damages as a result of Seller’s default. In the event Purchaser terminates this Agreement in accordance with this Section 10.2, then Seller shall reimburse Purchaser for Purchaser’s actual unrelated third party out-of-pocket costs, not to exceed a maximum aggregate reimbursement of Fifty Thousand Dollars ($50,000.00) (the “Reimbursement”) and Seller’s obligation to make the Reimbursement shall survive the termination of this Agreement.

10.3 Failure of Condition. If, prior to Closing, Seller discloses to Purchaser or Purchaser discovers that (i) title to the Property is subject to defects, limitations or encumbrances other than Permitted Encumbrances; or (ii) any representation or warranty of Seller contained in this Agreement is or, as of the Closing Date, will be materially inaccurate or untrue, then Purchaser shall promptly give Seller written notice of its objection thereto. Notwithstanding the foregoing, Purchaser may not object to the state of title of the Property on the basis of matters set out in Section 3.4 above after the Cure Period. Seller shall have five (5) days after notice from Purchaser to provide written notice to Purchaser about whether Seller will attempt to cure any such objection; provided, however, the parties acknowledge and agree that Seller shall have no obligation to cure any objection within (i) or (ii) above. In the event that Seller elects to attempt to cure any such objection, Seller may elect to postpone the Closing for thirty (30) days and attempt to cure such objection. If Purchaser fails to waive any such objection within five (5) days after notice from Seller that Seller will not cure the objection, this Agreement will terminate automatically and Seller shall promptly direct the Title Company to return the Deposit to Purchaser, and neither party shall have any liability to the other except for the Surviving Obligations. For the purposes of this Agreement, any title defect, limitation or encumbrance other than a Permitted Encumbrance shall be deemed cured if Title Company will agree to issue the Title Policy, which policy takes no exception for such defect, limitation or encumbrance and is issued for no additional premium or for an additional premium if Seller agrees to pay such additional premium upon Closing. Notwithstanding the foregoing or any other provision of this Agreement, it shall not be a failure of a condition precedent, a breach of any representation or warranty, or a default by Seller if a tenant is in default of his or her Lease.

11. MISCELLANEOUS.

11.1 Entire Agreement. This Agreement, together with the Exhibits attached hereto, all of which are incorporated by reference, is the entire agreement between the parties with

24

respect to the subject matter hereof, and no alteration, modification or interpretation hereof shall be binding unless in writing and signed by both parties.

11.2 Severability; Construction. If any provision of this Agreement or application to any party or circumstances shall be determined by any court of competent jurisdiction to be invalid and unenforceable to any extent, the remainder of this Agreement or the application of such provision to such person or circumstances, other than those as to which it is so determined invalid or unenforceable, shall not be affected thereby, and each provision hereof shall be valid and shall be enforced to the fullest extent permitted by law. All dollar amounts stated in this Agreement are U.S. dollar amounts. The normal rule of construction that any ambiguities be resolved against the drafting party shall not apply to the interpretation of this Agreement or any exhibits or amendments hereto.

11.3 Applicable Law. THIS AGREEMENT SHALL BE CONSTRUED AND ENFORCED IN ACCORDANCE WITH THE LAWS OF THE STATE IN WHICH THE LAND IS LOCATED.

11.4 Assignability. Except for an assignment to a wholly owned subsidiary of Purchaser with five (5) days’ prior written notice to Seller, Purchaser may not assign this Agreement without first obtaining Seller’s written consent. Any assignment in contravention of this provision shall be void. No assignment shall release the Purchaser herein named from any obligation or liability under this Agreement. Any assignee shall be deemed to have made any and all representations and warranties made by Purchaser hereunder, as if the assignee were the original signatory hereto. If Purchaser requests Seller’s written consent to any assignment, Purchaser shall (1) notify Seller in writing of the proposed assignment; (2) provide Seller with the name and address of the proposed assignee; (3) provide Seller with financial information including financial statements of the proposed assignee; and (4) provide Seller with a copy of the proposed assignment.

11.5 Successors Bound. This Agreement shall be binding upon and inure to the benefit of Purchaser and Seller and their respective successors and permitted assigns.

11.6 Breach. Should either party be in breach of or default under or otherwise fail to comply with any of the terms of this Agreement, except as otherwise provided in this Agreement, the complying party shall have the option to cancel this Agreement upon ten (10) days written notice to the other party of the alleged breach, default or failure by such other party to cure such breach within such ten (10) day period. The non‑defaulting party shall promptly notify the defaulting party in writing of any such alleged breach, default or failure upon obtaining knowledge thereof. The Closing Date shall be extended to the extent necessary to afford the defaulting party the full ten‑day period within which to cure such breach, default or failure; provided, however, that the failure or refusal by a party to perform on the scheduled Closing Date (except in respect of a

25

Pending Default by the other party) shall be deemed to be an immediate default without the necessity of notice; and provided further, that if the Closing Date shall have been once extended as a result of default by a party, such party shall be not be entitled to any further notice or cure rights with respect to that or any other default. For purposes of this Section 11.6, a “Pending Default” shall be a default for which (i) written notice was given by the non‑defaulting party, and (ii) the cure period extends beyond the scheduled Closing Date.

11.7 No Public Disclosure. Neither Purchaser nor Seller shall make any public disclosure of the terms of this transaction before Closing, without the prior written consent of the other party, except that Purchaser may, without Seller’s consent, discuss the transaction in confidence with Purchaser’s Agents, proposed joint venturers or prospective mortgagees; make disclosure required by applicable law, including disclosures required to be made to the Securities and Exchange Commission; and issue a press release provided such press release does not disclose the name of the Seller, Teachers’ Retirement System of the State of Illinois, Capri Capital Partners, LLC, or the Purchase Price. The provisions of this Section 11.7 shall survive Closing and any termination of this Agreement.

11.8 Captions. The captions in this Agreement are inserted only as a matter of convenience and for reference and in no way define, limit or describe the scope of this Agreement or the scope or content of any of it provisions.

11.9 Attorneys’ Fees. In the event of any litigation arising out of this Agreement, the prevailing party shall be entitled to reasonable attorneys’ fees and costs.

11.10 No Partnership. Nothing contained in this Agreement shall be construed to create a partnership or joint venture between the parties or their successors in interest.

11.11 Time of Essence. Time is of the essence in this Agreement.