2725312 CANADA INC. LANDLORD and WESCOM INC. TENANT L E A S E

Exhibit 10.9

MULTI TENANT INDUSTRIAL LEASE – (NET)

2725312 CANADA INC.

LANDLORD

and

WESCOM INC.

TENANT

L E A S E

Project: 0000 Xxxxxxxxxx Xxxx, Xxxxxxxxxxx, Xxxxxxx

Premises: Units 4 & 5

TABLE OF CONTENTS

Section

| 1. |

LEASE SUMMARY | 1 | ||||

| 2. |

DEFINITIONS | 2 | ||||

| 3. |

NET LEASE | 7 | ||||

| 3.1 |

Net Lease | 7 | ||||

| 4. |

LEASE OF PREMISES | 7 | ||||

| 4.1 |

Premises | 7 | ||||

| 4.2 |

Term | 7 | ||||

| 4.3 |

Acceptance of Premises | 9 | ||||

| 4.4 |

Licence to Use Common Facilities | 9 | ||||

| 4.5 |

Quiet Enjoyment | 9 | ||||

| 4.6 |

Fixturing of Premises | 9 | ||||

| 5. |

RENT | 9 | ||||

| 5.1 |

Tenant to Pay | 9 | ||||

| 5.2 |

Rent and Management Fee | 10 | ||||

| 5.3 |

Deemed Rent and Allocation | 10 | ||||

| 5.4 |

Monthly Payments of Operating Costs and Realty Taxes | 10 | ||||

| 5.5 |

Adjustments | 11 | ||||

| 6. |

TAXES | 11 | ||||

| 6.1 |

Payment of Taxes | 11 | ||||

| 6.2 |

Taxes Payable by Tenant | 11 | ||||

| 6.3 |

Determination of Tenant’s Taxes | 11 | ||||

| 6.4 |

Business Taxes and Sales Taxes | 12 | ||||

| 6.5 |

Tax Bills and Assessment Notices | 12 | ||||

| 6.6 |

Contest of Realty Taxes | 12 | ||||

| 7. |

OPERATING COSTS | 12 | ||||

| 7.1 |

Tenant’s Payment of Operating Costs | 12 | ||||

| 7.2 |

Excess Costs | 12 | ||||

| 8. |

USE OF PREMISES | 13 | ||||

| 8.1 |

Permitted Use | 13 | ||||

| 8.2 |

Conduct of Business | 14 | ||||

| 8.3 |

Tenant’s Fixtures | 14 | ||||

| 8.4 |

Signs | 14 | ||||

| 8.5 |

Prohibited Uses | 14 | ||||

| 8.6 |

Waste Removal | 15 | ||||

| 8.7 |

Waste and Nuisance | 15 | ||||

| 8.8 |

Compliance with Laws | 15 | ||||

| 8.9 |

Telecom and Wireless Services | 15 | ||||

| 8.10 |

Deliveries | 15 | ||||

| 8.11 |

Environmental | 15 | ||||

| 9. |

SERVICES AND UTILITIES | 17 | ||||

| 9.1 |

Utilities, Heating and Air Conditioning | 17 | ||||

| 9.2 |

Exclusive Supplier | 18 | ||||

| 10. |

MAINTENANCE, REPAIRS AND ALTERATIONS | 18 | ||||

| 10.1 |

Maintenance and Repairs of Premises | 18 | ||||

| 10.2 |

Approval of Repairs and Alterations | 18 | ||||

| 10.3 |

Notice by Tenant | 19 | ||||

| 10.4 |

Ownership of Leasehold Improvements | 19 | ||||

| 10.5 |

Construction Liens | 20 | ||||

| 10.6 |

Landlord’s Repairs | 20 | ||||

| 11. |

END OF TERM | 20 | ||||

| 11.1 |

Vacating of Possession | 20 | ||||

| 11.2 |

Removal of Trade Fixtures | 20 | ||||

| 11.3 |

Removal of Leasehold Improvements | 20 | ||||

| 11.4 |

Overholding by Tenant | 21 | ||||

| 12. |

DAMAGE AND DESTRUCTION | 21 | ||||

| 12.1 |

Damage to Premises or Project | 21 | ||||

| 12.2 |

Damage to Premises | 21 | ||||

| 12.3 |

Damage to Project | 22 | ||||

| 12.4 |

Restoration of Premises or Project | 22 | ||||

| 12.5 |

Determination of Matters | 23 | ||||

| 13. |

INSURANCE AND INDEMNITY | 23 | ||||

| 13.1 |

Landlord’s Insurance | 23 | ||||

| 13.2 |

Tenant’s Effect On Landlord’s and Other Insurance | 23 | ||||

| 13.3 |

Tenant’s Insurance | 24 | ||||

| 13.4 |

Limitation of Landlord’s Liability | 25 | ||||

| 13.5 |

Indemnity of Landlord | 25 | ||||

| 13.6 |

Landlord’s Parties | 25 | ||||

| 14. |

ASSIGNMENT, SUBLETTING AND CHANGE OF CONTROL | 25 | ||||

| 14.1 |

Consent Required | 25 | ||||

| 14.2 |

Obtaining Consent | 27 | ||||

| 14.3 |

Landlord’s Option | 27 | ||||

| 14.4 |

Terms of Transfer | 28 | ||||

| 14.5 |

Effect of Transfer | 29 | ||||

| 14.6 |

Assignment by Landlord | 29 | ||||

| 15. |

STATUS AND SUBORDINATION OF LEASE | 29 | ||||

| 15.1 |

Status Statement | 29 | ||||

| 15.2 |

Subordination | 30 | ||||

| 15.3 |

Xxxxxxxxxxxx | 00 | ||||

| 00. |

DEFAULT AND REMEDIES | 30 | ||||

| 16.1 |

Default and Remedies | 30 | ||||

| 16.2 |

Interest and Costs | 32 | ||||

| 16.3 |

Bankruptcy and Insolvency | 32 | ||||

| 16.4 |

Landlord’s Right of Distress | 32 | ||||

| 16.5 |

Rent Deposit Agreement | 33 | ||||

| 16.6 |

Remedies to Subsist | 33 | ||||

| 16.7 |

Impossibility of Performance | 33 | ||||

| 17. |

CONTROL OF PROJECT | 33 | ||||

| 17.1 |

Operation of Project by Landlord | 33 | ||||

| 17.2 |

Alterations of the Project | 34 | ||||

| 17.3 |

Landlord Not in Breach | 34 | ||||

| 17.4 |

Use of Common Facilities | 34 | ||||

| 17.5 |

Rules and Regulations | 35 | ||||

| 17.6 |

Access to Premises and Suspension of Utilities | 35 | ||||

| 18. |

EXPROPRIATION | 36 | ||||

| 19. |

MISCELLANEOUS | 36 | ||||

| 19.1 |

Notices | 36 | ||||

| 19.2 |

Planning Act | 36 | ||||

| 19.3 |

Complete Agreement | 36 | ||||

| 19.4 |

Time of the Essence | 36 | ||||

| 19.5 |

Applicable Law | 36 | ||||

| 19.6 |

Severability | 37 | ||||

| 19.7 |

Section Numbers and Headings | 37 | ||||

| 19.8 |

Interpretation | 37 | ||||

| 19.9 |

Successors | 37 | ||||

| 19.10 |

Acting Reasonably | 37 | ||||

| 19.11 |

Joint and Several | 37 | ||||

| 19.12 |

Privacy Policy | 37 | ||||

| 20. |

LIMITATION OF LIABILITY | 37 | ||||

| 21. |

INDEPENDENT LEGAL ADVICE/FREELY NEGOTIATED | 39 | ||||

Schedules:

| Schedule “A” |

Legal Description of Project | |

| Schedule “B” |

Outline Plan of Premises | |

| Schedule “C” |

Special Provisions | |

| Schedule “D” |

Rent Deposit Agreement | |

| Schedule “E” |

Environmental Questionnaire | |

| Schedule “F” |

Rules and Regulations | |

| Schedule “G” |

Tenant’s Work |

- ii -

THIS LEASE is dated April 13, 2009 and is made

B E T W E E N:

| 2725312 CANADA INC. | ||||

| (hereinafter called “Landlord”) | ||||

| OF THE FIRST PART | ||||

| – and – | ||||

| WESCOM INC. | ||||

| (hereinafter called “Tenant”) | ||||

| OF THE SECOND PART | ||||

| 1. | LEASE SUMMARY |

The following is a summary of some of the basic terms of this Lease, which are elaborated upon in the balance of this Lease. This Section 1 is for convenience and if a conflict occurs between the provisions of this Section 1 and any other provisions of this Lease, the other provisions of this Lease shall govern.

| (a) | Premises: Units 4 & 5 in the building municipally known as 0000 Xxxxxxxxxx Xxxx, Xxxxxxxxxxx, Xxxxxxx; |

| (b) | Term shall mean, collectively: |

| (i) | Unit 4: ten (10) years; and |

| (ii) | Unit 5: ten (10) years and four (4) months. |

| (c) | Commencement Date: |

| (i) | Unit 5: subject to the provisions of subsection 4.2(b) hereof, March 1, 2010 (“Unit 5 Commencement Date”); and |

| (ii) | Unit 4: July 1, 2010 (“Unit 4 Commencement Date”). |

Save and except where expressly set out herein, the Unit 5 Commencement Date and the Unit 4 Commencement Date shall be known collectively as the “Commencement Date”;

| (d) | Delivery Date: |

| (i) | Unit 5: subject to the provisions of subsection 4.2(b) hereof, the later of the date upon which this Lease has been fully executed and delivered and November 1, 2009 (“Unit 5 Delivery Date”); and |

| (ii) | Unit 4: the later of the date upon which this Lease has been fully executed and delivered and March 1, 2010 (“Unit 4 Delivery Date”). |

Save and except where expressly set out herein, the Unit 5 Delivery Date and the Unit 4 Delivery Date shall be known collectively as the “Delivery Date”;

| (e) | Expiry Date: June 30, 2020; |

| (f) | Basic Rent: an amount per square foot of the Rentable Area of the Premises per annum as follows: |

| RENTAL PERIOD FOR UNIT 5 |

RATE PER SQUARE FOOT RENTABLE AREA PER ANNUM | |

| March 1, 2010 to June 30, 2015 |

$14.00 | |

| July 1, 2015 to June 30, 2020 |

$16.00 | |

| RENTAL PERIOD FOR UNIT 4 |

RATE PER SQUARE FOOT RENTABLE AREA PER ANNUM | |

| July 1, 2010 to June 30,2015 |

$14.00 | |

| July 1, 2015 to June 30, 2020 |

$16.00 | |

| (g) | Rentable Area of Premises includes: |

| (i) | approximately twenty-four thousand, eight hundred ninety (24,890) square feet, being the Rentable Area of Unit 4; and |

| (ii) | approximately seventeen thousand, six hundred seventy-five (17,675) square feet, being the Rentable Area of Xxxx 0, |

for an aggregate Rentable Area of approximately forty-two thousand, five hundred sixty-five (42,565) square feet, subject to determination in accordance with this Lease;

| (h) | Rent Deposit: One Hundred and Five Thousand Dollars ($105,000.00), to be held by Landlord as prepaid rent and applied in accordance with the Rent Deposit Agreement attached hereto as Schedule “D”; |

| (i) | Use of Premises: subject to Article 8 below: |

| (i) | as general business offices of an information technology services company; and |

| (ii) | in addition to and as ancillary to the foregoing, subject to the provisions of subsection 8.1(c) hereof, Tenant shall be entitled to use a portion of Unit 5 as a fitness facility for use by Tenant’s employees only (the “Exercise Facility”), |

all to the extent permitted by all Laws and to the extent in keeping with the Building Standard.

| (j) | Address for Service of Notice on Tenant: at the Premises; |

Address for Service of Notice on Landlord: c/o Bentall LP, 00 Xxxxxxx Xxxxx, Xxxxx 000, Xxxxxxxxx, Xxxxxxx X0X 0X0, Attention: VP, Property Management; with a copy to Landlord at: c/o Bentall LP, 00 Xxxxxxxxxx Xxxxxx, Xxxxx 000, Xxxxxxx, Xxxxxxx X0X 0X0, Attention: Director, Asset Management; and c/o Bentall LP, 0000 Xxxxxxxxx Xxxxx, Xxxxx 000, Xxxxxxxxxxx, Xxxxxxx X0X 0X0, Attention: General Manager.

| (k) | Special Provisions: See Schedule “C”. |

| (l) | Option to Extend: See Schedule “C”. |

| 2. | DEFINITIONS |

Where used in this Lease, the following words or phrases shall have the meanings set forth in the balance of this Article.

2.1 “Additional Rent” shall have the meaning given to it in subsection 5.2(b).

2.2 “Alterations” shall have the meaning given to it in Section 10.2.

2.2A “Approved Consultant” shall have the meaning given to it in subsection 8.11(c).

2.3 “Architect” means an independent, duly qualified architect, engineer, surveyor or quantity surveyor or other qualified Person appointed by Landlord, from time to time.

2.4 “Basic Rent” shall have the meaning given to it in subsection 1(f) hereof.

2.5 “Bio-Medical Waste” shall mean and include all surgical, pathological, laboratory and biological waste of any kind and nature, including sharps and other items associated therewith, all as identified as infectious or bio-medical waste under any applicable Laws.

2.6 “Building” means the building in which the Premises are located.

2.7 “Building Standard” means the standard of the Building existing at the date hereof which the parties acknowledge is a first class standard for a building of such quality and age and in the location of the Building.

2.8 “Capital Taxes” means the amount determined by multiplying each of the “Applicable Rates” by the “Project Capital” and totalling the products. “Project Capital” is the amount of capital which Landlord determines, without duplication, is invested from time to time by Landlord, the owners or all of them, in doing all or any of the following: acquiring, developing, expanding, redeveloping and improving the Project. Project Capital will not be increased by any financing or refinancing (except to the extent that the proceeds are invested directly as Project Capital). An “Applicable Rate” is the capital tax rate specified from time to time under any statute of Canada and any statute of the Province which imposes a tax in respect of the capital of corporations. Each Applicable Rate will be considered to be the rate that would apply if none of Landlord or owners employed capital outside of the Province in which the Project is situate.

2.9 “Commencement Date” shall have the meaning given to it in subsection 1(c).

- 2 -

2.10 “Common Facilities” means:

| (1) | the Project (excluding only Leasable Areas), including, without limitation: all areas, facilities, structures, systems, improvements, furniture, fixtures and equipment forming part of or located on the Project; the lands forming part of the Project; the Parking Facilities and other service areas and facilities, if any; Landlord’s management offices and facilities to the extent used for the management of the Project; Storage Areas; and |

| (2) | all lands, areas, facilities, systems, improvements, structures, furniture, fixtures and equipment serving or benefiting the Project. |

Landlord shall have the right to designate, amend and re-designate the Common Facilities from time to time.

2.11 “Delivery Date” shall have the meaning given to it in subsection 1(d).

2.12 “Environmental Laws” means all statutes, laws, ordinances, codes, rules, regulations, orders, notices, guidelines, guidance notes, policies and directives, now or at any time hereafter in effect, made or issued by any local, municipal, provincial or federal government, or by any department, agency, board or office thereof, or by any board of fire insurance underwriters or any other agency or source whatsoever, regulating, relating to or imposing liability or standards of conduct concerning the natural or human environment (including air, land, surface water, groundwater and real and personal, moveable and immoveable property), public or occupational health and safety and the manufacture, importation, handling, use, reuse, recycling, transportation, storage, disposal, elimination and treatment of a substance, hazardous or otherwise (collectively, an “Authority”).

2.13 “Excess Costs” shall have the meaning given to it in Section 7.2.

2.13A “Exercise Facility” shall have the meaning given to it in subsection 1(i)(ii).

2.14 “Expiry Date” shall have the meaning given to it in subsection 1(e).

2.15 “Financial Covenant” shall have the meaning given to it in Section 14.1(c)(i).

2.16 “Hazardous Substance” means any solid, liquid, gas, sound, vibration, ray, heat, radiation, odour, or any other substance or thing or mixture of them which alone, or in combination, or in certain concentrations, is or are flammable, corrosive, reactive or toxic or which might degrade or alter (or form part of the process thereof) the quality of the environment or cause adverse effects or be deemed detrimental to living things or to the environment or which is or are likely to affect the life, health, safety, welfare or comfort of human beings or animals or cause damage to or otherwise impair the quality of soil, vegetation, wildlife or property, including, but not limited to: Bio-Medical Waste; any radioactive materials; explosives; mold, mildew, mycotoxins or microbial growths; urea formaldehyde; asbestos; polychlorinated biphenyl; pesticides or any other substances declared to be hazardous or toxic under any Environmental Laws or any other substance the removal, manufacture, preparation, generation, use, maintenance, storage, transfer, handling or ownership of which is subject to Environmental Laws.

2.17 “Landlord’s Parties” shall mean Landlord’s agents, managers and management companies, servants, agents, employees and those for whom Landlord and Landlord’s managers and management companies, servants, agents, and employees are in law responsible.

2.18 Intentionally Deleted.

2.19 “Lands” means the lands described in Schedule “A”.

2.20 “Last Year’s Rent” means the Rent payable for the period of the last twelve (12) months of the Term.

2.21 “Laws” means all statutes, regulations, by laws, orders, rules, requirements and directions of all federal, provincial, municipal and other governmental authorities and other public authorities having jurisdiction, and includes Environmental Laws.

2.22 “Leasable Areas” means all areas and spaces of the Project to the extent designated or intended from time to time by Landlord to be leased to tenants, whether leased or not, but excluding the following, to the extent the same may exist from time to time, and whether or not the same are leased from time to time or all the time: Storage Areas, the Parking Facilities and service areas and facilities which may be leased or licensed from time to time.

2.23 “Lease” means this Lease, including all schedules attached hereto.

2.24 “Leasehold Improvements”, where used in this Lease, includes without limitation, all fixtures, improvements, installations, alterations and additions from time to time made, erected or installed in or about the Premises, including any of the same which pre-exist this Lease, and including all telecommunications and computer and other technology wiring, conduits and the like (located in and/or serving the Premises), and includes all cabling, conduits, connections and attachments associated therewith (located in and/or serving the Premises) as well as the following, whether or not any of the same are in fact Tenant’s fixtures or trade fixtures and whether or not they are easily disconnected and moveable: doors, partitions and hardware; mechanical, electrical and utility installations; carpeting, drapes, other floor and window coverings and drapery hardware; decorations; all supplemental heating, ventilating air conditioning and humidity control (“HVAC”) equipment; lighting fixtures; built in furniture and furnishings; counters in any way connected to the Premises or to any utility services located therein. The only

- 3 -

exclusions from “Leasehold Improvements” are free standing furniture, trade fixtures, equipment not in any way connected to the Premises or to any utility systems located therein and, notwithstanding the immediately foregoing, furniture systems. Except to the extent otherwise provided for herein, Leasehold Improvements include Non-Standard Leasehold Improvements, as hereinafter defined.

2.25 Intentionally Deleted.

2.26 “Liabilities” shall have the meaning given to it in Section 13.5 hereof.

2.27 “Management Fee” shall mean an amount equal to up to five percent (5%) of Tenant’s Proportionate Share of all gross amounts received or receivable by Landlord in respect of the Project for all items, including all such items as are included in this Lease as Rent (except, to avoid duplication, for the amount payable under subsection 5.2(b)), assuming full occupancy and disregarding any reduction, limitation, deferral or abatement of any amounts in the nature of Rent but excluding any amounts recovered by Landlord from Tenant as Excess Costs and which would be recoverable from other tenants for amounts which would hereunder be Excess Costs if their leases contained provisions similar to those contained herein).

2.27A “Non-Standard Leasehold Improvements” mean the following items which are deemed by Landlord to either be atypical for a normal general business office or unusable by Landlord in re-leasing the Premises to a successor tenant including all cabling, wiring, conduit, connections and other attachments associated therewith: the creation within the Premises of a large number of small offices and corridors which change direction or discontinue; computer rooms and/or any other raised-floor environments; modifications to the base Building Standard systems (including, without limitation, the installation of supplemental HVAC systems and modifications to the electrical, lighting and security systems installed and/or implemented for the specific use of the Premises); telecommunication equipment; vaults; all electrical, mechanical and exhaust systems installed for the stove/grill in the kitchen facilities; any shower facilities; the Exercise Facility (including the Tread Pool (as hereinafter defined) and, whether located within the Premises or elsewhere in the Project, any Signs, back-up and/or emergency power supplies, antennae, satellite dishes or other communication facilities.

2.28

| (a) | “Operating Costs” means the aggregate of all expenses and costs of every kind determined, for each fiscal period designated by Landlord, on an accrual basis and without duplication, incurred by or on behalf of Landlord with respect to and for the operation, maintenance, repair, replacement and management of the Project and all insurance relating to the Project. Provided that if the Project is less than one hundred percent (100%) completed or occupied for any time period, Operating Costs shall be adjusted to mean the amount obtained by adding to the actual Operating Costs during such time additional costs and amounts as would have been incurred or otherwise included in Operating Costs if the Project had been one hundred percent (100%) completed, leased and occupied as determined by Landlord, acting reasonably. Landlord shall be entitled to adjust upward only those amounts which may vary depending on occupancy and in no event shall this provision entitle Landlord to recover more than Landlord actually incurs in respect of any adjusted item or require Tenant to pay in respect of such adjusted item more than Tenant would have had to pay had the Project been one hundred percent (100%) completed, leased and occupied. |

Without in any way limiting the generality of the foregoing, Operating Costs shall include all costs in respect of the following:

| (i) | all remuneration including wages and benefits of employees to the extent employed or engaged in the operation, maintenance, repair, replacement, and management of the Project including contributions and premiums towards unemployment and Workers Compensation insurance, pension plan contributions and similar premiums and contributions; |

| (ii) | HVAC and fire sprinkler maintenance and monitoring, if any, of the Project; |

| (iii) | cleaning, janitorial services, window cleaning, waste removal and pest control (excluding janitorial and waste removal services provided to the Premises); |

| (iv) | the provision of all utilities supplied to the Project and the cost of consumption of all utilities consumed on the Project including, without limitation, hot and cold water, gas, electricity, steam, sewer charges and any other utilities or forms of energy; |

| (v) | landscaping and maintenance of all outside areas, including snow and ice removal; |

| (vi) | amortization of the costs of all items which Landlord, in its sole discretion, chooses not to charge in the year incurred, over such period as determined by Landlord in its sole discretion, on a straight line basis to zero and interest to be calculated and paid annually on the unamortized cost of such items in respect of which amortization is included herein at two percent (2%) per annum in excess of the Prime Rate; |

| (vii) | all insurance which Landlord is obliged to obtain and/or which Landlord otherwise obtains and the cost of any deductible amounts payable by Landlord in respect of any |

- 4 -

| insured risk or claim, including, but not limited to, premiums, brokerage fees, self-insured retentions, adjusters’ fees and insurance department costs; |

| (viii) | policing, supervision, security and traffic control; |

| (ix) | all maintenance, repairs and replacements in respect of the Project and all machinery, furniture, furnishings, equipment, facilities, systems, property and fixtures located therein; |

| (x) | engineering, accounting, legal and other consulting and professional services related to the Project, including the cost of preparing and verifying statements respecting Operating Costs and Realty Taxes; |

| (xi) | signs including, without limitation, the cost of all repairs, maintenance and rental charges in respect thereof; |

| (xii) | business taxes, if any, on Common Facilities, Realty Taxes charged against or in respect of or reasonably allocated by Landlord to Common Facilities and the amount, if any, of Realty Taxes charged against the Project in excess of the amount of Realty Taxes in the aggregate, charged against or allocated by Landlord to Leasable Areas; |

| (xiii) | contribution, as determined by Landlord, acting reasonably and bona fide, on account of all costs in the nature of those included in Operating Costs and/or Realty Taxes in respect of all shared facilities and services including, without limitation, amenities (whether on or outside the Project) made available for occupants of the Project, roads, loading areas and docks, parking ramps, driveways and exterior areas, which will be shared by users of the Project and the users of any other properties and all costs in the nature of Operating Costs incurred by Landlord in consequence of its interest in the Project such as landscaping of municipal areas, maintaining, cleaning, and clearing of ice and snow from municipal sidewalks, adjacent properties and the like and all charges and amounts payable under a reciprocal cost sharing agreements with the owners of any other buildings or structures; |

| (xiv) | Capital Taxes, if applicable, to the extent payable by, or assessed against, Landlord, any Person acting on behalf of Landlord and/or any other Person who owns a legal or beneficial interest in the Project or any part thereof, it being acknowledged that, as at the date hereof, Landlord does not pay Capital Taxes; |

| (xv) | Sales Taxes payable by Landlord on the purchase of goods and services included in Operating Costs (excluding any such Sales Taxes which are available to and claimed by Landlord as a credit or refund in determining Landlord’s net tax liability on account of Sales Taxes, but only to the extent that such Sales Taxes are included in Operating Costs); |

| (xvi) | the fair rental value (having regard to rentals prevailing from time to time for similar space) of amenities for the Project and of space occupied by Landlord or others for management, supervisory, administrative or operational purposes relating to the Project and all office expenses incurred therein; |

| (xvii) | costs and expenses of environmental site reviews and investigations and, to the extent not recovered from third parties or from insurance proceeds, if any, actually received by Landlord, the costs of removal, remediation and/or clean up of Hazardous Substances, provided such remediation and/or clean up is not required as a result of the act or omission of Landlord or Landlord Parties (in which case Landlord shall be responsible for one hundred percent (100%) of such costs) or as a result of the act or omission of Tenant or Tenant’s Parties (in which case Tenant shall be responsible for one hundred percent (100%) of the such costs); |

| (xviii) | all costs incurred by Landlord for the purpose or intent of investigating or reducing any Operating Costs, Realty Taxes or other taxes, whether or not Operating Costs, Realty Taxes or other taxes are in fact reduced, and costs incurred for the purpose of allocating Realty Taxes and/or utilities among Tenant and other occupants of the Project; |

| (xix) | interest on deposits paid by Landlord to the supplier of a utility at a rate which shall be two percent (2%) per annum in excess of the Prime Rate; and |

| (xx) | the amount of any deposits paid to a utility supplier lost by Landlord as a result of any bankruptcy of any utility supplier amortized over a period of three (3) years from the date of such bankruptcy and interest thereon at a rate of two percent (2%) in excess of the Prime Rate. |

| (b) | Operating Costs, however, shall be reduced by the following to the extent actually received by Landlord: |

- 5 -

| (i) | proceeds of insurance and damages paid by third parties in respect of and to the extent of costs included in Operating Costs as set forth above; |

| (ii) | contributions from parties, other than tenants of the Project, if any, in respect of their sharing the use of Common Facilities, such as shared driveways, but not including in such contributions rent or fees charged directly for the use of any Common Facilities such as parking fees, if any, and rent for Storage Areas; and |

| (iii) | amounts, if any, received by Landlord on account of Excess Costs. |

| (c) | Operating Costs, however, shall exclude the following: |

| (i) | Realty Taxes except to the extent included as set forth above (the intent being not to duplicate Tenant’s obligations in respect thereof pursuant to other provisions of this Lease); |

| (ii) | expenses incurred by Landlord in respect of other tenants’ leasehold improvements; |

| (iii) | costs of repairs or replacements to the extent that such costs are recovered by Landlord pursuant to construction warranties; |

| (iv) | costs of utilities consumed in respect of Leasable Areas, if separately charged to tenants of the Building, to be determined by separate meters where practicable or by Landlord acting reasonably (the intent being not to duplicate the amounts included in Operating Costs with amounts charged pursuant to Article 9 of this Lease and comparable provisions in other leases of premises in the Project); |

| (v) | ground rent and the purchase price of the acquisition of the Project and financing payments in respect thereof; |

| (vi) | commitment, stand-by, finance, mortgage and interest charges on the debt of Landlord; |

| (vii) | amounts expended by Landlord for advertising and promotion (including the costs of commissions, advertising and legal expenses) and the costs of inducements (including Landlord’s work) all incurred in connection with the leasing of premises in the Building, or any part of the Project; and |

| (viii) | bad debts and any collection and legal costs associated with the same. |

| (d) | Landlord, acting reasonably, shall have the right to allocate Operating Costs or any portion or portions thereof to such portion or portions of the Building or the Project as Landlord shall determine. |

2.29 “Parking Facilities” means any parking areas and facilities and any other similar service areas and facilities located on the Lands and serving the Project.

2.30 “Permitted Transfer” has the meaning given to it in subsection 14.1(c) and “Permitted Transferee” has a corresponding meaning.

2.31 “Person” means any Person, firm, partnership or corporation, or any group or combination of Persons, firms, partnerships or corporations.

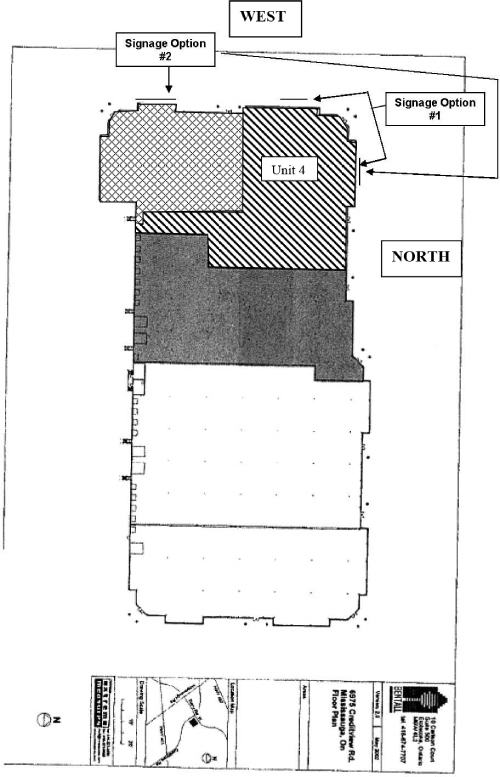

2.32 “Premises” shall have the meaning given to it in subsection 1(a), approximately as shown hatched for Unit 4 and cross-hatched for Unit 5 on the floor plan attached hereto as Schedule “B”. The purpose of Schedule “B” is to show the approximate location of the Premises and the contents thereof are not intended as a representation of any kind as to the precise size or dimensions of the Premises or any other aspects of the Project. The Rentable Area of the Premises is as estimated in subsection 1(g). The Premises shall include, without limitation, all Leasehold Improvements and the interior faces of permanent walls (including entrance and exit doors) and windows and all services, equipment and systems located in the Premises, including all services which exclusively serve the Premises and which are located within the Premises but excluding base building services which serve Leasable Areas in the Building other than the Premises, but which run through the Premises (“Base Building Services”). The Premises shall extend from the structural sub-floor to the structural ceiling, subject to the exclusion for Base Building Services, and excluding, for clarification, the exterior faces of the perimeter walls and windows.

2.33 “Prime Rate” means the rate of interest known as the prime rate of interest charged by Landlord’s bank in Toronto which serves as the basis on which other interest rates are calculated for Canadian dollar loans in Ontario from time to time.

2.34 “Project” means the Lands, the Building and all other buildings, structures, improvements, equipment and facilities of any kind erected or located thereon from time to time.

2.35 “Proportionate Share” means a fraction which has as its numerator the Rentable Area of the Premises and which has as its denominator the aggregate Rentable Area of Leasable Areas within the Project or Building or such portion or portions thereof to which Landlord, acting reasonably and equitably, shall allocate such items of which

- 6 -

Tenant is required to pay the Proportionate Share, all as determined by Landlord, acting reasonably and equitably, subject to adjustment pursuant to Section 7.2(b). For the purpose of determining the denominator as aforesaid, the Rentable Area of all Leasable Areas within the Project or Building shall be determined in the same manner as the Rentable Area of the Premises as set forth in Section 2.38 below.

2.36 “Realty Taxes” means all taxes, rates, duties, levies, fees, charges, local improvement rates, imposts, charges and assessments whatever, including school taxes, water and sewer taxes, extraordinary and special assessments and all rates, charges, excises or levies, whether or not of the foregoing nature (collectively “Taxes”), and whether municipal, provincial, federal, regional, school, parking or otherwise, which may be levied, confirmed, imposed, assessed, charged or rated against the Project or any part thereof or any furniture, fixtures, equipment or improvements therein, or against Landlord in respect of any of the same or in respect of any rental or other compensation receivable by Landlord and/or the owners of the Project in respect of the same, including all of such Taxes which may be incurred by or imposed upon Landlord and/or the owners of the Project or the Project in lieu of or in addition to the foregoing including, without limitation, any Taxes on real property rents or receipts as such (as opposed to a tax on such rents as part of the income of Landlord), any Taxes based, in whole or in part, upon the value of the Project, any commercial concentration or similar levy in respect of the Project. For clarification, Realty Taxes shall not include any taxes personal to Landlord such as income tax, inheritance tax, gift tax or estate tax nor shall Realty Taxes include any penalties or fines incurred as a result of Landlord’s late payment of same, provided Tenant has in fact remitted such Realty Taxes as and when required hereby and provided same are not being bona fide contested and/or withheld by Landlord.

| 2.37 | “Rent” shall have the meaning given to it in Section 5.1. |

2.38 “Rentable Area” of the Premises shall be calculated in accordance with the current Society of Industrial and Office Realtor’s method for measuring industrial space, Method “B”. Every other Rentable Area shall be as determined by the Architect from time to time and each such determination shall be binding upon the parties hereto and the cost of which determination shall be included in Operating Costs.

| 2.39 | “Rent Deposit Agreement” shall mean the Rent Deposit Agreement provided pursuant to this Lease. |

2.40 “Sales Taxes” means all goods and services, business transfer, multi-stage sales, sales, use, consumption, value-added or other similar taxes imposed by any federal, provincial or municipal government upon Landlord or Tenant in respect of this Lease, or the payments made by Tenant hereunder or the goods and services provided by Landlord hereunder including, without limitation, the rental of the Premises and the provision of administrative services to Tenant hereunder.

2.41 “Storage Areas” means all areas, if any, as designated by Landlord from time to time to be used for storage purposes.

| 2.42 | Intentionally Deleted. |

2.43 “Tenant’s Parties” shall mean any Transferee or any of Tenant’s or Transferee’s servants, agents, employees, invitees, licensees, sub tenants, concessionaires, contractors or Persons for whom Tenant or the Transferee or any of them are in law responsible.

| 2.44 | “Tenant’s Work” has the meaning given to it in Schedule “G” attached hereto. |

| 2.45 | “Term” shall have the meaning given to it in subsection 1(b) hereof. |

| 2.46 | “Tread Pool” shall have the meaning given to it in subsection 8.1(c)(ii). |

| 3. | NET LEASE |

3.1 Net Lease

It is the intent of the parties hereto that, except as expressly herein set out, this Lease be a lease that is absolutely net to Landlord, and that Landlord shall not be responsible for any expenses or obligations of any kind whatsoever in respect of or attributable to the Premises or the Project.

| 4. | LEASE OF PREMISES |

4.1 Premises

Landlord hereby leases to Tenant and Tenant hereby leases from Landlord the Premises.

4.2 Term

| (a) | The Term of this Lease shall commence on the Commencement Date and expire on the Expiry Date. |

| (b) | Provided this Lease has been fully executed and delivered, if Landlord is unable to obtain vacant possession of Xxxx 0 by November 1, 2009 for any reason whatsoever, this Lease shall not be void or voidable and Landlord shall not be liable for any losses, costs or damages whatsoever resulting therefrom and the Unit 5 Commencement Date shall be delayed by the |

- 7 -

| number of days, if any, which fall between November 1, 2009 and the date upon which Landlord delivers vacant possession of Unit 5 to Tenant but, for greater certainty, there shall be no delay to the Expiry Date. |

| (c) | Tenant shall be entitled to occupy each of Xxxx 0 xxx Xxxx 0 from the Unit 5 Delivery Date and the Unit 4 Delivery Date, respectively, and continuing thereafter for a maximum of four (4) months, up to and including the day immediately preceding the Unit 5 Commencement Date and the Unit 4 Commencement Date, respectively, for the purpose of completing the Tenant’s Work in Xxxx 0 and Unit 4, as the case may be and, thereafter, in order to commence carrying on business therefrom (collectively, “Fixturing Period”). During the Fixturing Period, Tenant shall not be obliged to pay Basic Rent, Operating Costs, Management Fee or Realty Taxes with respect to such portion of the Premises being occupied but shall be liable for its separately metered utilities and the costs of any additional services in accordance with this Lease for which Tenant will continue to be obligated to pay, and Tenant shall be subject to all the other terms and conditions of this Lease insofar as they are applicable including, without limitation, the obligation to maintain insurance, and the provisions relating to the liability of Tenant for its acts and omissions, and the acts and omissions of its servants, employees, agents, contractors, invitees, concessionaires and licensees and the indemnification of Landlord and others under this Lease. |

| (d) | On or before the Xxxx 0 Delivery Date and the Unit 4 Delivery Date, as the case may be, Tenant shall deliver to Landlord: certificate(s) evidencing requisite insurance coverage under this Lease for such portion of the Premises to be occupied; post-dated Rent cheques (or account information, as the case may be) as required pursuant to this Lease; and evidence, satisfactory to Landlord, that the utilities for such portion of the Premises to be occupied have been changed into the name of Tenant. |

| (e) | It is hereby acknowledged by the parties hereto that Tenant, through its wholly-owned subsidiary, Wescom Solutions Inc. (“WSI”), is currently the occupant of Unit 4 pursuant to the provisions of a sub-sublease agreement (“Sub-sublease”) with Accredited Processing Services Inc. (“Subtenant”) for a term which expires on February 26, 2010, two (2) days prior to the Unit 4 Commencement Date (such two (2) day period being hereinafter referred to as the “Reversionary Period”), to which Landlord granted its consent pursuant to a consent agreement between Landlord, Tenant, Subtenant, Accredited Home Lenders Holding Co., Inc. (“Indemnifier”) and Yellow Pages Inc., successor to Verizon Information Services (Canada) Inc. (“Head Tenant”) and dated April 25, 2008 (“Sub-sublease Consent”). |

| (f) | It is hereby acknowledged by the parties hereto that Subtenant is currently the sub-tenant of Unit 4 pursuant to the provisions of a sublease agreement (“Sublease”) with Head Tenant for a term which expires on February 27, 2010, to which Landlord granted its consent pursuant to a consent agreement between Landlord, Subtenant, Indemnifier and Head Tenant and dated November 23, 2005 (“Sublease Consent”). |

| (g) | During the Reversionary Period, when the Sub-sublease has expired but Head Tenant continues to be the head tenant of Unit 4 pursuant to the provisions of its lease for Unit 4 with Landlord dated September 9, 2002 (“Head Lease”), Tenant will be required to obtain the written consent of Subtenant and Head Tenant to allow Tenant to continue to remain in occupancy and possession of Unit 4. Landlord hereby consents to such continued occupancy and possession of Unit 4 by Tenant during the Reversionary Period. For greater certainty, during the Reversionary Period, all of the terms of the Head Lease shall continue to govern with respect to Unit 4. |

| (h) | In the event that Landlord terminates either the Sublease or Head Lease as a result of the default by Subtenant or Head Tenant, as the case may be, or in the event that the Sublease or Head Lease is otherwise disclaimed or repudiated as a result of the bankruptcy or insolvency of Subtenant or Head Tenant, as the case may be, notwithstanding anything contained in the Sublease, Head Lease, Sublease Consent or the Sub-sublease Consent to the contrary, Tenant shall be entitled to remain in possession of Xxxx 0 and the Unit 4 Commencement Date shall be advanced to be the date of termination, disclaimer or repudiation of the Sublease or Head Lease, as the case may be, without affecting the Expiry Date. |

| (i) | In the event that Landlord terminates the Sub-sublease Consent as a result of the default by Tenant, as Sub-subtenant thereunder (in its capacity as sub-subtenant) or in the event that the Sub-sublease is otherwise disclaimed or repudiated as a result of the bankruptcy or insolvency of Tenant (in its capacity as sub-subtenant), notwithstanding anything contained herein to the contrary, at Landlord’s option and in addition to any other rights accorded to Landlord hereunder or at Law, Landlord shall be entitled to terminate this Lease with respect to the whole of the Premises or with respect to Xxxx 0 only, at Landlord’s option, to be executed effective as at the date of such termination, disclaimer or repudiation of the Sub-sublease, as the case may be, and all amounts otherwise due and payable hereunder, shall immediately become due and payable to Landlord. |

- 8 -

| (j) | Tenant acknowledges and confirms that: |

| (i) | it has good right, full power and authority to enter into this Lease for Unit 4 in the manner as aforesaid; |

| (ii) | neither Tenant nor WSI have executed, nor will either of Tenant or WSI execute, any agreement with Head Tenant or the Subtenant to extend the term of the Head Lease or Sub-sublease (which is the subject of the Sub-sublease Consent), as the case may be, or otherwise enter into any agreement with Head Tenant or Subtenant to otherwise remain in possession of Unit 4 beyond the expiry of the Head Lease; |

| (iii) | it has obtained reasonable assurances from each of Subtenant and Head Tenant confirming they have not entered into any agreement to otherwise allow Subtenant to remain in possession of Unit 4 beyond the expiry of the Head Lease; |

| (iv) | Tenant shall indemnify and hold harmless Landlord from and against any and all liabilities, claims, damages, losses and expenses, due to or arising from or to the extent contributed to by any breach by Tenant of any provisions contained herein. |

4.3 Acceptance of Premises

| (a) | Unit 4 |

Landlord shall have no obligation to construct any Leasehold Improvements in Unit 4 in connection with Tenant’s continued occupancy thereof and Tenant’s continued occupancy of Unit 4 shall be conclusive evidence against Tenant that Unit 4 is in good order and satisfactory condition. Any leasehold improvement work which Tenant intends to complete within Unit 4 prior to the Unit 4 Commencement Date shall be governed by the applicable provisions of the Head Lease and shall be subject to Tenant’s receipt of prior written approval from each of the Subtenant and Head Tenant. Any leasehold improvement work which Tenant intends to complete within Unit 4 during the Unit 4 Term shall be governed by the applicable provisions of this Lease.

| (b) | Unit 5 |

Tenant shall accept possession of Unit 5 in the condition in which it is received by Landlord, “as is”, without any obligation on the part of Landlord to perform any work in Unit 5 in connection with Tenant’s intended use thereof, save and except that Landlord shall ensure the existing HVAC, electrical, mechanical, plumbing and life safety systems serving Xxxx 0, based on the configuration of Unit 5 as of April 2, 2009, are in good working order as of the Unit 5 Delivery Date and occupancy of Unit 5 by Tenant shall be conclusive evidence against Tenant that, at the time Tenant assumed occupancy, Unit 5 was in good order and satisfactory condition and that Tenant has accepted Unit 5.

4.4 Licence to Use Common Facilities

Subject to all other relevant provisions of this Lease, Landlord grants to Tenant the non-exclusive licence during the Term to use for their intended purposes, in common with others entitled thereto, such portions of the Common Facilities as are reasonably required for the use and occupancy of the Premises for their intended purpose during such hours as the Common Facilities are open for use, as determined by Landlord from time to time.

4.5 Quiet Enjoyment

Subject to all of the terms of this Lease and subject to Tenant’s paying all Rent and performing all obligations whatsoever as and when the same are due to be paid and performed by Tenant, Tenant may peaceably possess and enjoy the Premises for the Term without interruption by Landlord or any Person claiming by, from or under Landlord.

4.6 Fixturing of Premises

By the Unit 5 Commencement Date, Tenant shall fixture Unit 5 and commence business thereon.

| 5. | RENT |

5.1 Tenant to Pay

Tenant shall pay in lawful money of Canada at par at such address as shall be designated from time to time by Landlord Basic Rent and Additional Rent (all of which is herein sometimes referred to collectively as “Rent”) as herein provided without any deduction, set-off or abatement whatsoever, Tenant hereby agreeing to waive any rights it may have pursuant to the provisions of Section 35 of the Commercial Tenancies Act (Ontario) or any other statutory provision to the same or similar effect and any other rights it may have at law to set-off. On the Commencement Date and the first day of each year thereafter and at any time when required by Landlord, Tenant shall deliver to Landlord as requested by Landlord either post dated cheques or a requisition for a pre authorized debit from Tenant’s bank account in such form as reasonably required by Landlord, for all payments of Basic Rent

- 9 -

and estimates by Landlord of Additional Rent or any portions thereof payable during the balance of such fiscal period.

5.2 Rent and Management Fee

| (a) | Tenant shall pay to Landlord Basic Rent in equal monthly instalments in advance on the first day of each month during the Term. |

| (b) | In addition to Basic Rent, Tenant shall pay to Landlord as Additional Rent: (i) all other amounts as and when the same shall be due and payable pursuant to the provisions of this Lease (all of which shall be deemed to accrue on a per diem basis); (ii) all other amounts payable pursuant to any other agreement or obligation between Landlord and Tenant (whether or not related to the Premises) as and when the same shall be due and payable; and (iii) the Management Fee. Tenant shall promptly deliver to Landlord upon request evidence of due payment of all payments of Additional Rent required to be paid by Tenant hereunder, to the extent same are payable to other than Landlord. |

| (c) | Landlord has estimated that Tenant’s obligations hereunder in respect of Operating Costs, Management Fee and Realty Taxes for the year 2009 would be approximately Four Dollars Fifty-Nine Cents ($4.59) per square foot of the Rentable Area of the Premises; it is understood that this estimate by Landlord is a bona fide estimate made as of January 1, 2009, but that it is not intended by Landlord to be relied upon by Tenant and is not binding and does not impose liabilities on Landlord or affect Tenant’s obligations hereunder. |

| (d) | For clarity, it is acknowledged and agreed by the parties hereto that the foregoing estimate of Operating Costs does not include the cost for provision of janitorial services within the Premises, nor does it include the cost of providing gas and hydro to the Premises. |

5.3 Deemed Rent and Allocation

| (a) | If Tenant defaults in payment of any Rent (whether to Landlord or otherwise) or any Sales Taxes as and when the same are due and payable hereunder, Landlord shall have the same rights and remedies against Tenant (including rights of distress and the right to accelerate Rent in accordance with Section 16.1) upon such default as if such sum or sums were Rent in arrears under this Lease. All Rent and Sales Taxes shall, as between the parties hereto, be deemed to be Rent due or Sales Taxes due on the dates upon which such sum or sums were originally payable pursuant to Section 5.1 of this Lease. |

| (b) | No payment by Tenant or acceptance of payment by Landlord of any amount less than the full amount payable to Landlord, and no endorsement, direction or note on any cheque or other written instruction or statement respecting any payment by Tenant shall be deemed to constitute payment in full or an accord and satisfaction of any obligation of Tenant and Landlord may receive any such lesser amount and any such endorsement, direction, note, instruction or statement without prejudice to any of Landlord’s other rights under this Lease or at law, whether or not Landlord notifies Tenant of any disagreement with or non acceptance of any amount paid or any endorsement, direction, note, instruction or statement received. |

| (c) | Tenant agrees that Landlord may, at its option to be exercised by written notice to Tenant at any time, and without regard to and notwithstanding any instructions given by or allocations in respect of such amounts made by Tenant, apply all sums received by Landlord from Tenant or any other Persons in respect of any Rent to any amounts whatsoever payable by Tenant and it is further agreed that any allocation made by Landlord, on its books and records or by written notice to Tenant or otherwise, may subsequently be re-allocated by Landlord as it may determine in its sole discretion, and any such allocation and re-allocation from time to time shall be final and binding on Tenant unless and to the extent subsequently re-allocated by Landlord. |

5.4 Monthly Payments of Operating Costs and Realty Taxes

Landlord may from time to time estimate any amount(s) payable by Tenant pursuant to any provisions of this Lease for the then current or the next following fiscal period, provided that Landlord may, in respect of any particular item, shorten such fiscal period to correspond to a shorter period within any fiscal period, where such item, for example Realty Taxes, is payable in full by Landlord over such shorter period, and may notify Tenant in writing of the estimated amounts thus payable by Tenant, which notification need not include particulars. The amounts so estimated shall be payable by Tenant in advance in equal monthly instalments over the fiscal period, such monthly instalments being payable on the same day as the monthly payments of Basic Rent. Landlord may, from time to time, designate or alter the fiscal period selected in each case. Notwithstanding the foregoing, no change in the fiscal period shall result in Tenant paying a greater amount than that amount which would have been payable but for such change. As soon as practicable, not to exceed one hundred and eighty (180) days (it being hereby acknowledged that neither party shall be relieved of its obligations hereunder as a result of Landlord’s failure to deliver such statement within such one hundred and eighty (180) day period) after the expiration of each fiscal period, Landlord shall make a final determination of the amounts payable by Tenant pursuant hereto for such fiscal period and shall furnish to Tenant, showing in reasonable detail the method by which the same has been calculated, a statement of the actual Operating Costs, Management Fee and Realty Taxes for such fiscal period (“Final Statement”). If the amount determined to be payable by Tenant as aforesaid shall be greater or less than the

- 10 -

payments on account thereof made by Tenant prior to the date of such determination, then the appropriate adjustments will be made and Tenant shall pay any deficiency to Landlord within thirty (30) days after delivery of the Final Statement and the amount of any overpayment shall, at Landlord’s option, be paid to or credited to the account of Tenant within thirty (30) days after the delivery of the Final Statement. Tenant agrees that it shall not be entitled to make any claim, including the commencing of an action against Landlord, with respect to any Additional Rent charges payable hereunder for any fiscal period unless such claim is made within three (3) months after the date on which Landlord has delivered to Tenant a Final Statement for such fiscal period; subject to any claim being made within the time as aforesaid, each Final Statement shall be final and binding on Tenant.

5.5 Adjustments

| (a) | All amounts of Rent payable for less than a full month or year or payable for any period not falling entirely within the Term shall be adjusted between Landlord and Tenant on a per diem basis. |

| (b) | All amounts of Rent determined or estimated as an amount per square foot shall be adjusted between Landlord and Tenant based on the determination or re-determination from time to time, of Rentable Area of the Premises or other areas within the Project. The effective date of adjustment shall be: (i) in the case of the initial leasing of the Premises, the Commencement Date; (ii) in the case of a reconfiguration of areas within the Project, the effective date of such reconfiguration; and (iii) in the case of error, the date upon which such error became known to the parties. |

6. TAXES

6.1 Payment of Taxes

Landlord shall have the right to require Tenant to pay Realty Taxes and any other taxes which are Tenant’s responsibility as set out herein to the relevant taxing authority or Landlord shall have the right to pay any such Realty Taxes or other taxes directly to such taxing authority without thereby affecting Tenant’s obligation to pay or contribute to such Realty Taxes or other taxes. To the extent Realty Taxes are actually received by Landlord from Tenant, and subject to Landlord’s rights herein to be able to contest or withhold same, Landlord shall pay same to the relevant taxing authority.

6.2 Taxes Payable by Tenant

Tenant shall pay to Landlord or the relevant taxing authority, as required by Landlord, all Realty Taxes levied, confirmed, imposed, assessed or charged (herein collectively or individually referred to as “charged”) against or in respect of the Premises and all furnishings, fixtures, equipment, improvements and alterations in or forming part of the Premises, and including, without limiting the generality of the foregoing, any such Realty Taxes charged against the Premises in respect of Common Facilities.

6.3 Determination of Tenant’s Taxes

Whether or not there is a separate xxxx for Realty Taxes charged against the Premises or a separate assessment, the Realty Taxes charged against the Premises shall be determined by Landlord and the cost of making such determination shall be included in Operating Costs. In making such determination Landlord shall have the right, but not the obligation, to allocate Realty Taxes to the Premises and all other portions of the Project by using such criteria as Landlord, in its sole discretion, shall determine to be relevant including, without limitation:

| (a) | the then current established principles of assessment used by the relevant assessing authorities; |

| (b) | assessments of the Premises and any other portions of the Project in previous periods of time; |

| (c) | the Proportionate Share; |

| (d) | any act, religion or election of Tenant or any other occupant of the Project which results in an increase or decrease in the amount of Realty Taxes which would otherwise have been charged against the Project or any portion thereof; |

| (e) | the quality of construction, use, location within the Project or income generated by the Premises and/or the assessor’s valuation of the Premises or Project; and |

| (f) | tax classifications of tenants in the Project, as determined by Landlord. |

Notwithstanding any other contrary provisions of this Lease, if, at any time during a fiscal period, any part of the Project is not one hundred percent (100%) occupied, the Realty Taxes shall be allocated by Landlord to the Building(s), the Common Facilities and the other components of the Project without regard to any credits which may be received or receivable by Landlord in respect of any vacant premises within the Project and without regard to any reduced tax rate for such vacant premises. Landlord may use an expert to assist it in making such determination and allocation and all cost incurred in so doing shall be included in Operating Costs.

- 11 -

6.4 Business Taxes and Sales Taxes

| (a) | Tenant shall pay as and when the same are due and payable all taxes, if any, reasonably allocated by Landlord which are attributable to the personal property, trade fixtures, income, occupancy, sales or business of Tenant or any other occupant of the Premises and to the use of the Premises by Tenant or any other occupant, whether or not charged against Landlord or the Premises. |

| (b) | Tenant shall pay to Landlord when due all Sales Taxes imposed on Landlord or Tenant, in respect of this Lease. |

6.5 Tax Bills and Assessment Notices

| Tenant | shall promptly deliver to Landlord forthwith upon Tenant’s receiving the same: |

| (a) | copies of all assessment notices, tax bills and any other documents received by Tenant related to Realty Taxes chargeable against or in respect of the Premises or the Project; and |

| (b) | receipts for payment of Realty Taxes and business taxes, if any, payable by Tenant directly to the taxing authority pursuant hereto. |

On or before the expiry of each fiscal period, Tenant shall provide to Landlord evidence satisfactory to Landlord that all Realty Taxes and business taxes, if any, payable by Tenant directly to the taxing authority pursuant to the terms hereof up to the expiry of such fiscal period, including all penalties and interest resulting from late payment of Realty Taxes and business taxes, have been duly paid.

6.6 Contest of Realty Taxes

| (a) | Realty Taxes, or the assessments in respect of Realty Taxes, which are the subject of any contest by Landlord shall nonetheless be payable by Tenant in accordance with the foregoing provisions hereof provided, however, in the event Tenant shall have paid any amount in respect of Realty Taxes in excess of the amount ultimately found payable as a result of the disposition of any such contest, and Landlord receives a refund in respect thereof, the appropriate amount (net of all costs incurred in obtaining such refund) of such refund shall be credited to the account of Tenant or paid to Tenant, net of any amounts then owing by Tenant to Landlord, where the Term has expired without renewal. |

Landlord may contest any Realty Taxes with respect to the Premises or any part or all of the Project and appeal any assessments related thereto and may withdraw any such contest or appeal or may agree with the relevant authorities on any settlement, compromise or conclusion in respect thereof and Tenant consents to Landlord’s so doing. Tenant will co-operate with Landlord in respect of any such contest and appeal and shall make available to Landlord such information in respect thereof as Landlord requests. Tenant will execute forthwith on request all consents, authorizations or other documents as Landlord requests to give full effect to the foregoing.

Tenant will not contest any Realty Taxes or appeal any assessments related to the Premises or the Project.

| (b) | At Landlord’s sole option, in lieu of including the same in Operating Costs, Tenant shall pay, as Additional Rent, its share of the costs of investigating and contesting Realty Taxes and/or assessments on the following basis: (i) Proportionate Share; (ii) as allocated based on Realty Taxes payable by Tenant pursuant hereto; or (iii) based on any tax savings realized as a result of such investigation and contesting of Realty Taxes and/or assessments in respect thereof. |

| 7. | OPERATING COSTS |

7.1 Tenant’s Payment of Operating Costs

Tenant shall pay to Landlord the Proportionate Share of Operating Costs.

7.2 Excess Costs

| (a) | If, by reason of: |

| (i) | the particular use or occupancy of the Premises or any of the Common Facilities; or |

| (ii) | the requirement for any services beyond building standard services, such as, without limitation, waste removal; |

additional costs in the nature of Operating Costs such as, without limitation, costs of: insurance (including insurance increases incurred by tenants of the Project); security; and/or waste disposal, are incurred in excess of the costs which would otherwise have been incurred for such items, then Landlord shall have the right, but not the obligation, to determine such excess costs on a reasonable basis (“Excess Costs”) and require Tenant to pay such Excess Costs, plus fifteen percent (15%) of the amount thereof.

- 12 -

| (b) | If Tenant or any other tenant of the Project, pursuant to its lease or otherwise by arrangement with Landlord, provides at its cost any goods or services the cost of which would otherwise be included in Operating Costs, or if any goods or services the cost of which is included in Operating Costs benefit any portion of the Project to a materially greater or lesser extent than any other portion of the Project, then either the denominator for determining a Proportionate Share, or alternatively the amount of Operating Costs, may be adjusted as determined by Landlord, at its option, to provide for the equitable allocation of the cost of such goods and services among the tenants of the Project. |

| 8. | USE OF PREMISES |

8.1 Permitted Use

| (a) | Tenant covenants that it shall not use and shall not cause, suffer or permit the Premises to be used for any purpose other than as described in subsection 1(i) hereof. Tenant acknowledges that Landlord is making no representation or warranty as to Tenant’s ability to use the Premises for its intended use and Tenant shall, prior to executing this Lease, perform such searches and satisfy itself that its use is permitted under all applicable Laws and that Tenant will be able to obtain an occupancy permit. If required, Tenant shall be responsible to apply to the City in which the Building is located for an occupancy permit for Unit 5 on or before the Unit 5 Delivery Date and a renewal occupancy permit for Unit 4 on or before the Unit 4 Term Commencement Date. |

| (b) | Tenant acknowledges that Landlord has granted exclusive covenants and may grant other exclusive covenants to tenants of the Project and accordingly, Tenant covenants that it shall carry on only the business permitted to be carried on in the Premises as and to the extent set out in subsection 1(i) of this Lease and in no other manner whatsoever. |

| (c) | Tenant shall be entitled to use the Exercise Facility on the following terms and conditions: |

| (i) | the Exercise Facility shall be: (A) located within Unit 5; (B) comprise a Rentable Area not to exceed approximately three thousand (3,000) square feet; (C) installed, operated, maintained, repaired and replaced (as required) by Tenant, at its sole cost and expense, in accordance with applicable Laws and the applicable provisions of this Lease; |

| (ii) | Tenant shall be permitted to install a tread pool (“Tread Pool”) within the Exercise Facility, which shall not exceed approximately two hundred (200) square feet in size. The Tread Pool shall be an above ground, pre-fabricated unit, to be installed, operated, maintained, repaired and/or replaced (as required) at Tenant’s sole expense by a reputable contractor who has received the prior written approval of Landlord, and Tenant shall thereafter be responsible for quarterly inspections of the Exercise Facility by an Approved Consultant (as hereinafter defined) to ensure there is no development of mold or other Hazardous Substances within the Premises as a result of the presence of the Tread Pool or the Exercise Facility. Tenant shall deliver to Landlord copies of its annual maintenance and quarterly inspection contracts for the Exercise Facility and any service reports generated in connection therewith, including confirmation, satisfactory to Landlord, that all maintenance, repairs and/or replacements required or recommended by such service reports have been completed; |

| (iii) | the Exercise Facility shall at all times be used and operated in a first class manner; |

| (iv) | Tenant shall take every reasonable precaution to ensure that the use and operation of the Exercise Facility does not disturb any other tenants or any other Persons permitted to be on the Project and, for greater certainty, shall ensure no undue noises or vibrations emanate from the Premises; |

| (iv) | Tenant shall cause each user of the Exercise Facility to execute a liability waiver confirming that such user assumes all risk and liability for its use of the Exercise Facility; |

| (v) | Landlord shall not be liable for any Liabilities which arise from or are associated with the Exercise Facility. Tenant hereby indemnifies Landlord from Liabilities resulting from the use thereof by Tenant or any of Tenant’s Parties; |

| (vi) | no portion of the Exercise Facility shall be visible from the exterior of the Premises; |

| (viii) | Tenant shall ensure that any additional insurance coverage which may be required to be carried by Tenant as a prudent operator of the Exercise Facility (including the Tread Pool) is obtained by Tenant at its sole expense and Tenant shall provide evidence of such coverage to Landlord upon request; and |

- 13 -

| (v) | Tenant shall provide copies to Landlord of any licenses or other permits required in connection with the Exercise Facility, all of which must be obtained by Tenant, at its sole cost and expense, prior to commencing operations of the Exercise Facility. |

8.2 Conduct of Business

Tenant shall conduct its business in the Premises in an up to date first class and reputable manner, in keeping with the Building Standard.

8.3 Tenant’s Fixtures

Tenant shall install and maintain in the Premises at all times during the Term trade fixtures, furnishings and equipment at least equal to Building Standard. Tenant shall not remove any trade fixtures or other contents from the Premises during the Term except that Tenant may, provided it is not in default, remove trade fixtures or contents in the ordinary course of business or for the purpose of replacing them with others at least equal in value and function to those being removed.

8.4 Signs

| (a) | Tenant shall not erect, install or display any sign or display on or visible from the exterior of the Premises except for two (2) signs (including all cabling, wiring, conduits, attachments, fittings and connections associated therewith) to be erected on the Building to identify Tenant’s business in the Premises, collectively, the “Signs”. |

| (b) | The Signs shall be located as follows: |

| (i) | Option 1: one (1) sign on the north side of Unit 4 and one (1) sign on the west side of Unit 4; or |

| (ii) | Option #2: in the event the location of the Signs in Option #1 is prohibited due to municipal by-laws, then Tenant shall be permitted one (1) sign in the approximate location of the “Ratiopharm” sign as it existed on April 2, 2009, |

all in the approximate locations identified on Schedule “B” attached hereto.

| (c) | The size, style, design, colour, precise location and method of affixation of the Signs shall be subject to the prior written approval of Landlord and shall otherwise be subject to compliance with all Laws governing such Signs. |

| (d) | Such Signs shall remain the property of Tenant and shall be maintained by Tenant in Building Standard condition at all times during the Term. Tenant shall be solely responsible for all costs associated with the supply, installation, operation, maintenance, repair and replacement of the Signs, including any costs of utilities, insurance and taxes related thereto and any damages caused thereby and, upon the expiry or earlier termination of the Lease, Tenant shall remove the Signs from the Building and shall restore the Building to the condition in which it existed prior to the installation and removal of such Sign, and shall repair any damage caused thereby. |

8.5 Prohibited Uses

Tenant shall not cause, suffer or permit the Premises or any part thereof to be used at any time during the Term for any of the following sales, businesses or activities:

| (a) | any retail or wholesale sales activities, except to the extent otherwise expressly permitted pursuant to the provisions of subsection 1(i) of this Lease; |

| (b) | any auction; |

| (c) | any sale of tickets for theatre or other entertainment events or lottery tickets; |

| (d) | any use which would result in people waiting in Common Facilities to enter the Premises or any other type of business or business practice which would, in the sole opinion of Landlord, tend to lower the character or image of the Project or any portion thereof; |

| (e) | a call centre; |

| (f) | a school or training centre of any kind; or |

| (g) | any use which might: |

| (i) | result in an actual or threatened cancellation of or adverse change in any policy of insurance of Landlord or others on or related to the Project or any part or contents thereof; or |

- 14 -

| (ii) | be prohibited by any policy of insurance of Landlord or any others in force from time to time in respect of the Project or any part or contents thereof. |

The inclusion of the foregoing provisions of this Section 8.5 shall not be deemed to be a covenant, representation or warranty of Landlord that any of the foregoing activities will not be authorized by Landlord to be conducted on any part of the Project.

8.6 Waste Removal

Tenant shall not allow any refuse, garbage or any loose, objectionable material to accumulate in or about the Premises or the Project. Tenant at its expense shall at all times comply with Landlord’s rules and regulations regarding the separation, removal, storage and disposal of waste for the Premises. Landlord shall have the option to take over the function of separating, removing and/or disposing of the waste and the cost to Landlord of same shall be included in Operating Costs. Tenant shall be responsible for all costs of removal of waste from the Premises other than costs of routine waste removal, if any, included in Operating Costs.

8.7 Waste and Nuisance

| (a) | Tenant shall not cause, suffer or permit any waste or damage to the Premises or Leasehold Improvements, fixtures or equipment therein nor permit any overloading of the floors thereof and shall not use or permit to be used any part of the Premises for any dangerous, noxious or offensive activity or any activity which involves dangerous, noxious or offensive goods and shall not do or bring anything or permit anything to be done or brought on or about the Premises or the Project which results in undue noise, odour or vibration or which Landlord may reasonably deem to be a nuisance or annoyance (including, for greater certainty, labour disturbances) to any other tenants or any other Persons permitted to be on the Project (collectively “Nuisance”). If Landlord determines that any Nuisance exists on or emanates from the Premises, Tenant shall forthwith on notice remedy the same. Tenant shall take every reasonable precaution to protect the Premises and the Project from risk of damage by fire, water or the elements or any other cause. |

| (b) | Tenant shall not, and shall not permit anyone else to, place anything on the roof of the Building or go on to the roof of the Building for any purpose whatsoever, without Landlord’s prior written approval, which may be arbitrarily withheld in Landlord’s sole discretion. |

| (c) | Tenant shall not use any advertising, transmitting or other media or devices which can be heard, seen, or received outside the Premises, except for usual business communications such as facsimile transmission, e-mail and internet use provided the same do not interfere with any communications or other systems outside the Premises. |

8.8 Compliance with Laws

| (a) | Tenant shall use the Premises, and shall perform all maintenance, repairs and replacements thereto, in such manner as shall be required by or in compliance with all applicable Laws. |

| (b) | Tenant shall provide Landlord with evidence satisfactory to Landlord acting reasonably that Tenant has obtained and is complying with the terms of all applicable licences, approvals and permits from time to time. |

8.9 Telecom and Wireless Services

Tenant shall not utilize any telephone, data or other network and telecommunications services (collectively, “Telecom Services”) which require the installation of any wiring or other connections or transmission services between the Premises and any other part of the Project, without Landlord’s prior written consent, which may be withheld in Landlord’s sole discretion. At Landlord’s option, any third party telecommunications service provider which is not already providing services to other tenants of the Project shall, as a condition to being permitted to provide such service to the Premises, enter into a licence agreement with Landlord on Landlord’s standard form, entitling such party to connect to or transmit to or from the Premises. Landlord, at its option, may require such third party telecommunications service provider to pay a licence fee to Landlord in an amount determined by Landlord in its sole discretion. Any costs incurred by Landlord in documenting such agreement shall be paid for by Tenant, as Additional Rent on demand. If any Telecom Services installed or used by any Person in the Premises, or installed or used by Tenant or any Tenant’s Parties in the Project are determined by Landlord to be interfering with any other Telecom Services in the Project, Tenant shall forthwith on notice take such steps as may be necessary to cease such interference, including, if necessary, discontinuing such Telecom Services of Tenant.

8.10 Deliveries

All deliveries to and from the Premises, and loading and unloading of goods, merchandise, refuse, materials and any other items, shall be made only by way of such driveways, access routes, doorways, corridors and loading docks as Landlord may from time to time designate and shall be subject to all applicable rules and regulations made by Landlord from time to time pursuant to this Lease.

8.11 Environmental

| (a) | Tenant covenants with Landlord that Tenant: |

- 15 -

| (i) | shall be responsible for Hazardous Substances (including the Remediation (as hereinafter defined) thereof) introduced on the Lands by Tenant and/or Tenant’s Parties during the Term of this Lease and during any period of time prior to the Commencement Date during which Tenant or any Tenant’s Parties occupied or had use of all or any portion of the Project for any purpose and during any period of time following the Expiry Date that Tenant and/or Tenant’s Parties use or occupy the Project, or any portion thereof, for any purpose; |

| (ii) | shall not use or permit or suffer the use of the Premises or any part of the Project to generate, manufacture, refine, treat, transport, store, handle, dispose of, transfer, produce or process any Hazardous Substance or permit the release of any Hazardous Substances from the Premises except in strict compliance with all Environmental Laws including, without limitation, the Environmental Protection Act, R.S.O. 1990, c. E-19 and all other Environmental Laws in respect of environmental, land use, occupation, or health and safety matters. In the event Tenant fails to comply with any such Environmental Laws, Landlord may, but shall not be obligated to, do such things as necessary to effect such compliance, and all costs and expenses incurred by Landlord in so doing, together with an administration charge equal to fifteen percent (15%) of such costs and expenses, shall be payable forthwith by Tenant to Landlord as Additional Rent; |

| (iii) | shall not permit any Tenant’s Parties to engage in any activity on or about the Project, or permit any Person to engage in any activity on or about the Premises, which may reasonably be anticipated to lead to a violation of any Environmental Laws; |

| (iv) | shall deliver prompt written notice to Landlord, and any Authority, of the actual, alleged or suspected release of any Hazardous Substances from the Premises; |