SUBLEASE AGREEMENT

Exhibit 10.17

THIS SUBLEASE AGREEMENT (this “Sublease”) is made and entered into this 10th day of November, 2008, by and between MACFARLANE PARTNERS INVESTMENT MANAGEMENT, LLC, a Delaware limited liability company (“Sublandlord”), and MEDIVATION, INC., a Delaware corporation (“Subtenant”).

W I T N E S S E T H:

A. WHEREAS, pursuant to the terms of that certain Office Lease dated as of November 22, 2005 (the “Original Prime Lease”) between MASSACHUSETTS MUTUAL LIFE INSURANCE COMPANY, a Massachusetts corporation (“Original Prime Landlord”), as Prime Landlord’s (as herein defined) predecessor in interest, and MACFARLANE URBAN REALTY COMPANY, LLC, a California limited liability company (“MURC”), as Sublandlord’s predecessor in interest, as amended by that certain First Amendment to Lease dated January 9, 2006, between Original Prime Landlord and MURC, that certain Second Amendment to Lease dated August 9, 2007 (the “Second Amendment to the Prime Lease”), between CREA SPEAR STREET TERRACE, LLC, a Delaware limited liability company (“Prime Landlord”) and Sublandlord, and that certain Third Amendment to Lease dated November 10, 2008 between Prime Landlord and Sublandlord (the Original Prime Lease, as so amended, is referenced to herein as the “Prime Lease”), Prime Landlord is leasing the Premises (as defined below) to Sublandlord; and

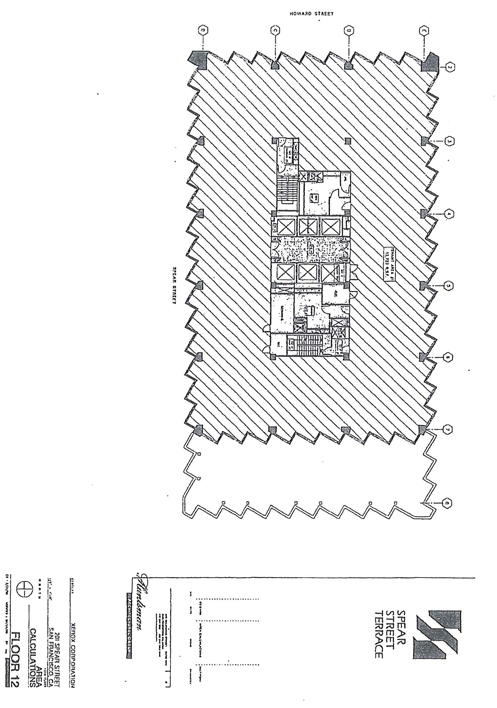

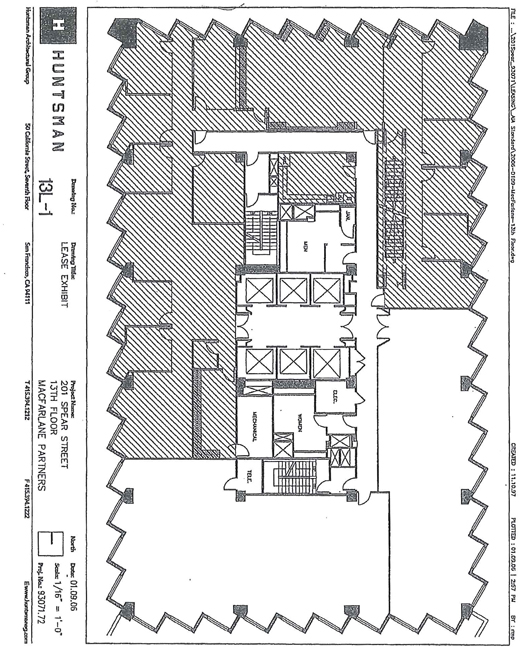

B. WHEREAS, as used herein, the term “Premises” shall mean that certain approximately 13,723 square feet of space consisting of all of the leaseable areas of the twelfth (12th) floor of the building located at ▇▇▇ ▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇ (the “Building”), which Premises is a part of the larger premises that is leased by Sublandlord pursuant to the Prime Lease (as further described in Prime Lease, the “Prime Lease Premises”); and

C. WHEREAS, a copy of the Prime Lease is attached hereto as Exhibit A; and

D. WHEREAS, Sublandlord desires to sublease to Subtenant, and Subtenant desires to sublease from Sublandlord, the Premises subject to the terms and conditions of the Prime Lease and the terms and conditions hereinafter set forth.

NOW, THEREFORE, in consideration of the foregoing, the mutual covenants set forth herein, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Sublandlord and Subtenant hereby agree as follows:

1. Definitions. All capitalized terms used but not defined herein shall have the same meaning as those defined in the Prime Lease.

1

2. Demise. Sublandlord hereby subleases and demises to Subtenant, and Subtenant hereby subleases from Sublandlord, the Premises for the Term (hereinafter defined) and on the terms and conditions hereinafter set forth.

3. Term. Subject to the terms and conditions of this Sublease, the term of this Sublease (the “Term”) shall commence upon the latter of delivery of possession of the Premises by Sublandlord to Subtenant and the delivery of a fully-executed consent by Prime Landlord to this Sublease (the “Commencement Date”), and shall expire on May 31, 2013 (the “Termination Date”), unless earlier terminated in accordance with the terms hereof. Upon the request of either party, Sublandlord and Subtenant shall execute a certificate confirming the actual Commencement Date. Subtenant shall have no option or right to extend the Term of this Sublease.

4. Condition of Premises.

(a) Commencement Date; As-Is. Subject to Section 4(c) and Section 18(a) hereof, Sublandlord shall deliver, and Subtenant shall accept possession of, the Premises “broom clean” and in its “as is” condition as of the Commencement Date. Subtenant acknowledges that except as expressly set forth in Section 4(c) hereof, Sublandlord makes no representation or warranty as to the condition, safety, repair or habitability of the Premises, and shall be under no obligation to make, or pay for, any repair, replacement, renovation or improvement to the Premises prior to or during the Term. Subtenant’s taking possession of the Premises shall be conclusive evidence that Subtenant accepts the Premises as suitable for the purposes for which they are leased and that Subtenant waives any defects in the Premises and the Building, except for claims relating to Sublandlord’s breach of the provisions expressly set forth in Section 4(c) hereof. Sublandlord shall use commercially reasonable efforts to deliver possession of the Premises to Subtenant by November 1, 2008 (the “Anticipated Outside Delivery Date”). In no event shall Sublandlord be liable to Subtenant for any damages of any kind or nature whatsoever due to a failure by Sublandlord to deliver possession of the Premises to Subtenant by said Anticipated Outside Delivery Date. Notwithstanding anything to the contrary contained herein, if Sublandlord has not delivered the Premises to Subtenant on or before the 60th day following the Anticipated Outside Delivery Date, Subtenant shall have the right thereafter to cancel this Sublease, and upon such cancellation, Sublandlord shall return all sums theretofore deposited by Subtenant with Sublandlord, and neither party shall have any further liability to the other.

(b) Alterations; Use of Cable. Subtenant shall not make or permit to be made, any improvements, additions, alterations, painting, carpeting or decorations, structural or otherwise, in or to the Premises or the Building without obtaining the prior written consent of Sublandlord (which consent of Sublandlord shall not be unreasonably withheld and which consent may include such conditions and requirements as Sublandlord may reasonably impose, including the requirement that Subtenant restore the Premises at the end of the Term) and of Prime Landlord (which consent of Prime Landlord, shall be granted or withheld in accordance with the terms of the Prime Lease).

2

Subject to the foregoing, Sublandlord consents to Subtenant’s use and reconfiguration of the existing voice data wiring within the Premises.

(c) Representations and Warranties. Sublandlord represents and warrants to Sublandlord’s knowledge, and except as otherwise disclosed to Subtenant in writing or as otherwise known by Subtenant, that as of the date hereof: (i) the Premises are in compliance with applicable building codes, laws and regulations, and (ii) the building fire protection, HVAC, and electrical and mechanical systems serving and located within the Premises are operational and in good working condition and repair. The term “Sublandlord’s knowledge” or words of similar intent shall mean the knowledge of, and only of, ▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇, with no imputation of knowledge and no duty of investigation or inquiry. The individual described above shall have no personal liability under this Sublease, including, without limitation, by virtue of acting as a representative of the Sublandlord for the purpose of this definition, The representations and warranties made in this Section 4(c) shall expire and be of no further force or effect on the date which is six (6) months following the Commencement Date.

5. Rent.

(a) Amount. Subtenant shall pay minimum annual rent for the Premises in the amounts shown below (the “Base Rent”), in equal monthly installments (“Monthly Base Rent”) with respect to each calendar month during the Term, commencing with the latter of the Commencement Date or November 1, 2008 (the “RCD”), as follows:

| Period |

Annual Base Rent Rate |

Monthly Base Rent Rate |

||||||

| First Lease Year |

$ | 686,150.00 | $ | 57,179.17 | ||||

| Second Lease Year |

$ | 699,873.00 | $ | 58,322.75 | ||||

| Third Lease Year |

$ | 713,596.00 | $ | 59,466.33 | ||||

| Fourth Lease Year |

$ | 727,319.00 | $ | 60,609.92 | ||||

| Fifth Lease Year |

$ | 741,042.00 | $ | 61,753.50 | ||||

Solely for purposes of this Section 5(a), the term “Lease Year” has the following meaning: The first Lease Year shall commence on the RCD and continue until the last day of the calendar month preceding the first anniversary of the RCD. Each subsequent Lease Year shall commence upon the expiration of the preceding Lease Year and be for a period of twelve calendar months, except that the last Lease Year shall expire on May 31, 2013.

Notwithstanding the foregoing, so long as Subtenant is not then in breach of its obligations under this Sublease, the amount of Monthly Base Rent payable for the month of January 2009 shall be Zero Dollars ($0.00) and for the month of January 2010 shall be Zero Dollars ($0.00).

3

No adjustment shall be made to the Base Rent due to a variance between the actual square footage of the Premises and the square footage of the Premises specified in Recital B, above.

(b) Payment. Monthly Base Rent shall be payable to Sublandlord (or at the direction of the Prime Landlord or Sublandlord, to Prime Landlord for the benefit of Sublandlord), at such place or to such agent as Sublandlord or Prime Landlord may from time to time designate in writing by good check or other good funds, in advance on the first day of each calendar month during the Term, without previous notice or demand therefor, and without deduction, counterclaim or set off. If the Term begins or ends on a date other than on the first day of a month, Monthly Base Rent for the first month of the Term and/or the last month of the Term, as the case may be, shall be prorated on a daily basis based upon a thirty (30) day month.

(c) Additional Rent. Except for the Monthly Base Rent any sums required to be paid by Subtenant under the terms of this Sublease and any charges or expenses incurred by Sublandlord on behalf of Subtenant under this Sublease shall constitute additional rent (“Additional Rent”), and Sublandlord shall have the same rights and remedies for the nonpayment thereof as are available to Sublandlord for the nonpayment of Monthly Base Rent.

(d) Late Charge. In the event any installment of Monthly Base Rent or Additional Rent due hereunder is not paid within five (5) calendar days after it is due, then Subtenant shall also pay to Sublandlord, as Additional Rent, a late payment fee equal to the greater of (i) Fifty Dollars ($50.00), or (ii) five percent (5%) of such delinquent installment of Monthly Base Rent and/or Additional Rent, as the case may be. In addition, such unpaid installment of Monthly Base Rent or Additional Rent, as the case may be, shall bear interest at the rate of ten percent (10%) per annum (or the highest rate allowable under California law, if less) (the “Interest Rate”), from the date Sublandlord sends notice to Subtenant of nonpayment to the date of the payment thereof by Subtenant.

6. Security Deposit.

(a) General. To secure the full and faithful performance by Subtenant of all of the covenants, conditions and agreements set forth in this Sublease to be performed by it, including, without limitation, foregoing such covenants, conditions and agreements in this Sublease which become applicable upon its termination by reentry or otherwise, Subtenant has deposited with Sublandlord concurrently with its execution of this Sublease, in the form of cash or the Letter of Credit (as defined below), the sum of Three Hundred Forty-Three Thousand Seventy-Five and 00/100 Dollars ($343,075.00) as a “Security Deposit” on the following understanding:

(i) That the Security Deposit or any portion thereof may be applied to the curing of any default that may exist beyond any applicable notice and cure period, including but not limited to a breach for failure to pay Base Rent and Additional Rent, without prejudice to any other remedy or remedies which Sublandlord may have on

4

account thereof, and upon such application Subtenant shall pay Sublandlord on demand the amount so applied which shall be added to the Security Deposit so the same will be restored to its original amount (or, as applicable, restore the amount of the Letter of Credit to its original amount);

(ii) That should the Sublandlord’s interest as Tenant under the Prime Lease be assigned by Sublandlord, the Security Deposit or any balance thereof may be turned over to Sublandlord’s assignee, and if the Security Deposit is turned over to such assignee, and if such assignee assumes all Sublandlord’s obligations under this Sublease with respect to the Security Deposit, Subtenant hereby releases Sublandlord from any and all liability with respect to the Security Deposit and its application or return, and Subtenant agrees to look solely to such assignee for such application or return;

(iii) That Sublandlord may commingle the Security Deposit with other funds, shall not be required to keep the Security Deposit in trust, and shall not be obligated to pay Subtenant any interest on the Security Deposit;

(iv) That the Security Deposit shall not be considered an advance payment of Base Rent and Additional Rent or a measure of damages for any default by Subtenant, nor shall it be a bar or defense to any actions by Sublandlord against Subtenant; and

(v) That provided there then exists no default by Subtenant hereunder, the Security Deposit or any then remaining balance thereof, shall be returned to Subtenant, without interest, within thirty (30) days after the expiration of the Term, unless there exists any uncured default by Subtenant at such time, in which case Sublandlord may retain the Security Deposit (and apply the same as provided herein, if Sublandlord so elects) until all defaults are cured and resultant damages are paid. Subtenant hereby waives any and all provisions of law, now or hereafter in effect in the State in which the Premises is located or any local government authority or agency or any political subdivision thereof, that limit the types of defaults for which a Sublandlord may claim sums from a security deposit, it being agreed that Sublandlord, in addition, may claim those sums specified in this Sublease and/or those sums reasonably necessary to compensate Sublandlord for any other loss or damage, foreseeable or unforeseeable, caused by the acts or omissions of Subtenant or any officer, employee, agent, contractor or invitee of Subtenant. Subtenant further covenants that it will not assign or encumber its rights with respect to the money deposited herein as a Security Deposit (other than to an assignee of this Sublease in connection with a permitted assignment) and that neither Sublandlord nor its successors or assigns shall be bound by any such assignment, encumbrance, attempted assignment or attempted encumbrance (other than to an assignee of this Sublease in connection with a permitted assignment).

(b) Letter of Credit. If Subtenant elects to post the Security Deposit in the form of a letter of credit rather than cash, concurrently with the execution of this Sublease, Subtenant shall deliver to Sublandlord an irrevocable standby letter of credit (“Letter of Credit”) in the amount of Three Hundred Forty-Three Thousand Seventy-

5

Five and 00/100 Dollars ($343,075.00) as Subtenant’s Security Deposit under this Sublease, subject to the terms and conditions of this Section 6. The Letter of Credit shall be held by Sublandlord as security for the faithful performance by Subtenant of all of the terms, covenants and conditions of this Sublease to be kept and performed by Subtenant during this Sublease Term. The Letter of Credit shall reflect Sublandlord as beneficiary. The form of the Letter of Credit shall be subject to the review and approval of Sublandlord, in its sole discretion, and the Letter of Credit shall contain language allowing Sublandlord to draw upon the Letter of Credit upon presentation to the issuer of Sublandlord’s written statement that Sublandlord is entitled to the funds represented by such Letter of Credit in accordance with the terms of this Sublease. The Letter of Credit shall be issued by a commercial bank having its principal office within California and shall be capable of being drawn upon at a location in California. In all cases, the identity of the issuer of the Letter of Credit shall be subject to the approval of Sublandlord, in its reasonable discretion. The Letter of Credit shall provide that the issuer of the Letter of Credit shall provide Sublandlord with thirty (30) days written notice prior to revoking or terminating the Letter of Credit. Should Sublandlord receive written notice from the issuer of the Letter of Credit that the issuer intends to revoke or terminate the Letter of Credit, Sublandlord shall have the right, after fifteen (15) days prior written notice to Subtenant, to draw the entire amount of the Letter of Credit. If Sublandlord draws upon the Letter of Credit, Sublandlord shall hold such amount as a cash Security Deposit and shall have the right to use such amount as provided in Section 6(a), above. During such fifteen (15) day period, Subtenant shall have the right to furnish a substitute Letter of Credit, subject to the terms and conditions of this Section 6. Sublandlord may draw upon the Letter of Credit after five (5) days prior written notice to Subtenant upon the occurrence or nonoccurrence of any event entitling Sublandlord under this Sublease to apply any portion of the Security Deposit. The Letter of Credit must permit partial drawings. In the event of an assignment of Sublandlord’s interest as Tenant under the Prime Lease and an assumption by the assignee of Sublandlord’s obligations under this Sublease, Sublandlord may require that Subtenant furnish to Sublandlord’s assignee a substitute or amended Letter of Credit, naming such assignee as the beneficiary and otherwise in compliance with this Section 6, provided such assignee reimburses Subtenant for any administrative fees charged by the issuer of the Letter of Credit for issuing a substitute or amended Letter of Credit in the name of the assignee.

7. Taxes and Operating Expenses. Effective as of January 1, 2010 and continuing throughout the Term, Subtenant shall pay to Sublandlord as Additional Rent, together with Subtenant’s payments of Monthly Base Rent, Subtenant’s Share (hereinafter defined) of the amount of Tenant’s Pro Rata Share for the Current Premises (as such term is defined in the Second Amendment to the Prime Lease) of the Taxes and Operating Expenses (including amounts based on Prime Landlord’s determination of the Estimated Escalation Increase (as defined in Section 4.A. of the Original Prime Lease, as amended by the Second Amendment to the Prime Lease) which Sublandlord is obligated to pay pursuant to the Prime Lease; provided, however, that Subtenant’s Share shall be based on increases over a Tax Base equal to the actual Taxes for Calendar Year 2009 and an Operating Expenses Base equal to the actual Operating Expenses for the Calendar Year 2009, all as determined by the Prime Landlord pursuant to the Prime Lease and without

6

any right of Subtenant to contest the same. Sublandlord shall pay to Subtenant, Subtenant’s Share of any Escalation Reconciliation for the Current Premises within thirty (30) days of Sublandlord’s receipt of the same, if any, from the Prime Landlord. As used herein, the term “Subtenant’s Share” shall be determined based on a fraction, the numerator of which shall be thirteen thousand seven hundred twenty-three (13,723) square feet and the denominator of which shall be the square footage of the Current Premises (as such square footage is determined under the Prime Lease, but which as of the date of this Sublease is 21,753) as such may exist from time to time.

8. Additional Utilities and Other Services. Subtenant shall pay to Sublandlord upon ten (10) business days notice for any after-hours HVAC costs, excess utility costs, janitorial services, or any other services provided with respect to the Premises charged by Prime Landlord to Sublandlord.

9. Assignment and Sub-subletting.

(a) Consent Required. Except for Permitted Transfers (defined below) Subtenant shall not, without the prior written consent of Sublandlord, which consent (subject to the remaining provisions hereof) shall not be unreasonably withheld, conditioned or delayed, and the consent of Prime Landlord (which consent of Prime Landlord, shall be granted or withheld in accordance with the terms of the Prime Lease); (i) assign this Sublease or any of its rights hereunder; (ii) further sublet the Premises or any part thereof to any other person or entity; (iii) permit the use of the Premises by any person or entity other than Subtenant, or its employees and agents approved in advance by Sublandlord at Sublandlord’s reasonable discretion; or (iv) permit the assignment or other transfer, including, without limitation, any change in ownership or voting control of Subtenant, or any mortgage, encumbrance, pledge or other hypothecation of all or any part of this Sublease or any of Subtenant’s rights hereunder by operation of law ((i)-(iv), each a “Transfer”). Sublandlord shall have the right to recapture and terminate this Sublease with respect to any such portion of the Premises that Sublandlord proposes to Transfer. Unless Sublandlord elects to recapture the portion of the Premises which Subtenant proposes to assign or sub-sublease, Sublandlord shall not unreasonably withhold its consent to an assignment or sub-sublease so long as the proposed sub-subtenant or assignee (i) has a reputation which in Sublandlord’s reasonable judgment, makes it appropriate for Sublandlord to consent to the proposed assignment or sub-sublease, and (ii) has, in Sublandlord’s reasonable opinion, the financial ability to perform its obligations under the assignment or sub-sublease. Neither the consent by Sublandlord to any Transfer, nor the acceptance or collection of rent from any assignee, transferee or sub-subtenant, shall be construed as a release of Subtenant from liability for each and every term or obligation of this Sublease, and Subtenant shall continue to remain primarily liable for all of the terms, covenants, conditions and liabilities of the “Subtenant” contained herein. No consent by Sublandlord to any Transfer in any one instance shall constitute a waiver of the necessity for such consent in any subsequent instance. Any Transfer or attempted Transfer of the Premises by Subtenant in violation of the terms and provisions of this Section 9 shall be void and of no force and effect.

7

(b) Excess Rent. In the event that Subtenant assigns this Sublease or sublets all or any portion of the Premises, Subtenant shall pay to Sublandlord as Additional Rent an amount equal to fifty percent (50%) of the difference between (i) all sums paid to Subtenant or its agent by or on behalf of such assignee or subtenant under the assignment or sub-sublease (less all reasonable out of pocket costs and expenses paid by Subtenant in connection with consummating any such assignment or sub-sublet), and (ii) the Base Rent and Additional Rent paid by Subtenant under this Sublease and attributable to the portion of the Premises assigned or sub-subleased.

(c) Fees. Subtenant shall reimburse Sublandlord for its reasonable attorneys’ fees (not to exceed Two Thousand and 00/100ths Dollars ($2000.00)) and other reasonable third party expenses (including without limitation fees and expenses which are reimbursable by Sublandlord to Prime Landlord under the Prime Lease) incurred in reviewing any requested consent whether or not such consent is granted.

(d) Permitted Transfers. So long as the Prime Landlord’s consent is obtained and, as applicable, (i) the assignee assumes all obligations of Subtenant under and in connection with this Sublease pursuant to an assignment and assumption agreement reasonably acceptable to Sublandlord or (ii) the sublessee enters into a sub-sublease agreement reasonably acceptable to Sublandlord, Subtenant may assign this Lease or sublet the Premises, or any portion thereof, without Sublandlord’s consent, to any entity which controls, is controlled by, or is under common control with Medivation, Inc. (the “Original Subtenant”); to any entity which results from a merger of, reincorporation of, reorganization of, or consolidation with the Original Subtenant; or to any entity which acquires substantially all of the stock or assets of the Original Subtenant, as a going concern (hereinafter each a “Permitted Transfer”). In addition, a sale or transfer of the stock of the Original Subtenant shall be deemed a Permitted Transfer if (1) such sale or transfer occurs in connection with any bona fide financing or capitalization for the benefit of the Original Subtenant, or (2) the Original Subtenant is, or in connection with the proposed transfer becomes, a publicly traded entity. Sublandlord shall have no right to terminate the Lease in connection with, and shall have no right to any sums or other economic consideration resulting from, any Permitted Transfer. Following a Permitted Transfer, the transferor shall remain primarily liable for all of the terms, covenants, conditions and liabilities of the “Subtenant” contained herein.

10. Prime Lease.

(a) Incorporation of Prime Lease. Sublandlord’s rights in and to the Premises are governed by the Prime Lease. This Sublease shall be subject and subordinate in all respects to the Prime Lease. For the purpose of describing obligations between Sublandlord and Subtenant, the following terms, covenants and conditions of the Prime Lease (to the extent they are not inconsistent with the terms and conditions of this Sublease) are incorporated by reference into this Sublease as if completely set forth herein: Articles 6, 21, 22, 25 and 27 (but not the second sentence of Article 27D, it being understood that Section 14 of this Sublease addresses the indemnification obligations of Subtenant); provided that each reference therein to “Tenant” shall be deemed to refer to

8

“Subtenant”, each reference to “Landlord” therein shall be deemed to refer to “Sublandlord”, and each reference to “Premises” in the incorporated provisions of the Prime Lease shall be deemed to refer to the Premises subleased by Subtenant pursuant to the terms of this Sublease. Except as otherwise expressly provided herein, Subtenant shall perform all affirmative covenants and shall refrain from performing any act which is prohibited by the negative covenants of the Prime Lease, where the obligation to perform or refrain from performing is by its nature imposed upon the party in possession of the Premises. If practicable, Subtenant shall perform affirmative covenants which are also covenants of Sublandlord under the Prime Lease at least five (5) days prior to the date when Sublandlord’s performance is required under the Prime Lease. If Subtenant breaches any term, covenant or condition of this Sublease, Sublandlord, in addition to the rights and remedies available to Sublandlord under this Sublease, shall have all the rights and remedies against Subtenant as would be available to Prime Landlord under the Prime Lease. Notwithstanding anything to the contrary, including without limitation this Section 10(a), Sublandlord shall have no obligation to perform any of Prime Landlord’s obligations under the Prime Lease and in no event shall Sublandlord be liable to Subtenant due to Prime Landlord’s failure to undertake its obligations under the Prime Lease. Upon the written request of Subtenant, Sublandlord (at Subtenant’s sole cost and expense) shall cooperate with Subtenant’s efforts to obtain all services and utilities required to be provided by Prime Landlord under the Prime Lease, Subtenant represents and warrants that it has reviewed the Prime Lease and is thoroughly familiar with and understands the contents thereof.

(b) Termination of Prime Lease. Subtenant shall not cause or permit any act which would give Prime Landlord the right to terminate the Prime Lease prior to the stated expiration of the term thereof. Subtenant shall indemnify and hold harmless Sublandlord from and against any loss, liability, claim, cost or expense (including reasonable attorneys’ fees) incurred by Sublandlord as a result of any termination or attempted termination of the Prime Lease resulting from any such act or omission by Subtenant. Notwithstanding anything to the contrary contained in this Sublease, Subtenant acknowledges that the expiration or any earlier termination of the underlying Prime Lease shall automatically extinguish and terminate this Sublease.

(c) Rights to the Premises. Notwithstanding any provision contained herein to the contrary, during the Term, Subtenant shall have no greater rights in and to the Premises than Sublandlord shall have, from time to time, in and to the Premises under the Prime Lease. Subtenant shall not have the right to exercise any options to renew, extend, negotiate or terminate the Prime Lease to the extent such options are exercisable by Sublandlord and shall have no interest or rights with respect to any other portion of the Prime Lease Premises or any option to expand the Prime Lease Premises.

(d) Prime Landlord Approval. This Sublease shall not be effective unless and until approved in writing by Prime Landlord. Subtenant agrees to promptly provide to Sublandlord any and all reasonable information regarding Subtenant, including without limitation financial statements, that Prime Landlord may request and Subtenant shall

9

otherwise cooperate to satisfy any reasonable requirement Prime Landlord may impose as a condition to its consent to this Sublease.

(e) Sublandlord’s Rights. Sublandlord shall have the right from time to time, in its sole and absolute discretion, and without the consent of Subtenant, to exercise any and all of its rights as the “Tenant” under the Prime Lease, or otherwise extend, modify and/or amend the terms and provisions of the Prime Lease in accordance with the terms therein; provided that Sublandlord shall not modify or amend the terms of the Prime Lease in any way that would materially impair Subtenant’s use of the Premises in accordance with the terms of this Sublease, but this prohibition shall not operate to impair Sublandlord’s rights of termination as such may arise in connection with damage, destruction, condemnation or breach by Prime Landlord.

11. Repairs and Compliance. Subtenant shall be responsible for, and shall pay at its own expense for all maintenance, repairs and replacements to the Premises and the Building and its equipment, to the extent Sublandlord is obligated to perform or pay for the same under the Prime Lease. To the extent Sublandlord is obligated to do so under the Prime Lease with respect to the Premises, Subtenant shall, at Subtenant’s own expense, comply with all laws and ordinances, and all orders, rules and regulations of all governmental authorities and of all insurance bodies and their life prevention engineers at any time in force, applicable to the Premises or to Subtenant’s particular use or manner of use thereof.

12. Restrictions on Use. Subtenant may use the Premises only for the uses set forth in Article 6 of the Prime Lease and for no other purpose. Subtenant shall not (i) commit waste on or to the Premises or the Building; (ii) use the Premises for any unlawful purpose or in violation of any municipal laws or regulations, insurance requirements or any certificate(s) of occupancy; and (iii) permit any dangerous article to be brought on the Premises unless safeguarded as required by law. The Premises shall not be used by Subtenant for any unlawful, immoral or improper purpose.

13. Sublandlord Right to Cure. If Subtenant shall breach any term, covenant or condition of this Sublease with regard to the making of any payment or the doing of any act, which results or may result in the occurrence of a default under the Prime Lease, then in addition to any rights and remedies available to Sublandlord hereunder or under the Prime Lease, Sublandlord, upon not less than five (5) business days prior written notice to Subtenant (or such shorter period of time as may be necessary to avoid a default under the Prime Lease), shall have the right to make such payment or to do such act, provided that the making of such payment or the doing of such act by Sublandlord shall not operate to cure such breach under the terms of this Sublease. Any payments made, and any costs or expenses (including reasonable attorneys’ fees) incurred, by Sublandlord in connection with its exercise of its rights under this Section 13, shall constitute Additional Rent and shall bear interest at the Interest Rate from the date incurred until payment in full by Subtenant. Subtenant shall reimburse Sublandlord for the cost incurred by Sublandlord in making such payments or doing such acts upon demand.

10

14. Indemnification. In addition to the provisions of the Prime Lease incorporated herein, Subtenant shall indemnify, defend and save Sublandlord, its directors, officers, agents and employees harmless from and against all liability, claims, suits, judgments, damages, penalties, costs and expenses (including reasonable attorneys’ fees) to which any of them may be subject or suffer (collectively “Indemnified Claims”), arising from or in connection with (i) the use or occupancy of the Premises, (ii) any act or omission of Subtenant, (iii) any default or claimed default on the part of Sublandlord under the Prime Lease caused by the failure of Subtenant to perform any obligation of the “Tenant” under those provisions of the Prime Lease which are by their nature imposed upon the party in possession of the Premises; (iv) any default by Subtenant in performing any of its covenants under this Sublease; (v) any violation of the provisions of Article 27 of the Prime Lease by Subtenant, Subtenant’s occupants, employees, contractors or agents; or (vi) any termination or attempted termination of the Prime Lease resulting from any act or omission of Subtenant, its employees or agents. In no way limiting the generality of the foregoing, if Sublandlord is obligated to indemnify Prime Landlord under the Prime Lease from and against any Indemnified Claims arising from or in connection any of the items enumerated in the immediately preceding subclauses (i) through (v), then Subtenant shall additionally indemnify, defend and save Prime Landlord, its directors, officers, agents and employees harmless from and against all liability, claims, suits, judgments, damages, costs and expenses (including reasonable attorneys’ fees) to which any of them may be subject or suffer, arising from or in connection with the same.

15. Insurance. Subtenant, at its sole expense, shall obtain and keep in force the insurance types and coverages specified in the Prime Lease required to be carried by the “Tenant” under the Prime Lease, in amounts not less than those specified in the Prime Lease, naming Sublandlord, as well as Prime Landlord and such other parties as Prime Landlord and Sublandlord may require be named, in the manner required therein. Subtenant shall furnish to Sublandlord and Prime Landlord a certificate of Subtenant’s insurance required hereunder prior to Subtenant’s taking possession of the Premises. Each party hereby waives claims against the other for property damage actually covered by the waving party’s property insurance, provided such waiver shall not invalidate the waiving party’s property insurance; each party shall attempt to obtain from its insurance carrier a waiver of its right of subrogation. Subtenant hereby waives claims against Prime Landlord and Sublandlord for property damage to the Premises or its contents if and to the extent that Sublandlord waives such claims against Prime Landlord under the Prime Lease. Subtenant agrees to obtain, for the benefit of Prime Landlord and Sublandlord, such waivers of subrogation rights from its insurer as are required of Sublandlord under the Prime Lease.

16. Default of Subtenant.

(a) Event of Default. The occurrence of any one or more of the following events shall constitute an event of default (an “Event of Default”) of Subtenant under this Sublease: (i) if Subtenant shall fail to pay any installment of Monthly Base Rent or Additional Rent provided herein and such failure shall continue for a period of five (5) days after written notice thereof to Subtenant by Sublandlord; (ii) if Subtenant shall fail

11

to secure insurance or in providing evidence of insurance as set forth in Section 15 of this Sublease and such failure shall continue for a period of five (5) days after written notice thereof to Subtenant by Sublandlord; (iii) if Subtenant shall be adjudged an involuntary bankrupt, or a decree or order approving, as properly filed, a petition or answer filed against Subtenant asking reorganization of Subtenant under the Federal bankruptcy laws as now or hereafter amended, or under the laws of any state, shall be entered, and any such decree or judgment or order shall not have been vacated or stayed or set aside within sixty (60) days from the date of the entry or granting thereof; (iv) if Subtenant shall file, or admit the jurisdiction of the court and the material allegations contained in, any petition in bankruptcy, or any petition pursuant or purporting to be pursuant to the Federal bankruptcy laws now or hereafter amended, or Subtenant shall institute any proceedings for relief of Subtenant under any bankruptcy or insolvency laws or any laws relating to the relief of debtors, readjustment of indebtedness, reorganization, arrangements, composition or extension; (v) if Subtenant shall admit in writing its inability to pay its debts as they become due; (vi) if Subtenant shall make any assignment for the benefit of creditors or shall apply for or consent to the appointment of a receiver for Subtenant or any of the property of Subtenant; (vii) if Subtenant shall, by its act or omission to act, cause a default under the Prime Lease and such default shall not be cured within the time, if any, permitted for such cure under the Prime Lease; (viii) if any termination of the Prime Lease occurs as a result of any act or omission of Subtenant, its employees or agents; (ix) if Subtenant shall violate or fail to perform any of the other conditions, covenants or agreements herein made by Subtenant and such violation or failure shall continue for a period of thirty (30) days after written notice thereof to Subtenant by Sublandlord; (x) if Subtenant shall abandon the Premises before the Termination Date of this Sublease; or (xi) if Subtenant assigns this Sublease or subsubleases all or a part of the Premises, except in accordance with Section 9 hereof.

(b) Remedies. Upon the occurrence of any one or more Events of Default, Sublandlord may exercise any remedy against Subtenant which Prime Landlord may exercise for default by Sublandlord under the Prime Lease.

17. Fire or Casualty or Eminent Domain. In the event of a fire or other casualty affecting the Building, the Prime Lease Premises or the Premises, or of a taking of all or a part of the Building, the Prime Lease Premises or Premises under the power of eminent domain, Sublandlord shall have the right, in its sole and absolute discretion, to exercise any right which Sublandlord may have under the Prime Lease, including, without limitation, any right that will have the effect of terminating the Prime Lease, and Subtenant hereby consents to, and Subtenant shall cooperate with Sublandlord in, the exercise of any such right. In the event Sublandlord is entitled, under the Prime Lease, to a rent abatement as a result of a fire or other casualty or as a result of a taking under the power of eminent domain, then Subtenant shall be entitled to its equitable share of such rent abatement unless the effect on the Premises of such fire or other casualty or such taking shall be substantially disproportionate to the amount of the abatement, in which event the parties shall equitably adjust the abatement as between themselves, based on the relative impact of the fire or other casualty, or the taking, as the case may be. If the Prime Lease imposes on Sublandlord the obligation to repair or restore leasehold

12

improvements or alterations, Subtenant shall be responsible for repair or restoration of leasehold improvements or alterations to the Premises, unless Sublandlord caused the damage. Subtenant shall make any insurance proceeds resulting from the loss which Sublandlord is obligated to repair or restore available to Sublandlord and shall permit Sublandlord to enter the Premises to perform the same. In the event Sublandlord is entitled, under the Prime Lease, to terminate the Prime Lease as a result of a fire, other casualty or taking, then Subtenant shall be entitled to terminate this Sublease, even if Sublandlord declines to exercise its right to terminate the Prime Lease.

18. Sublandlord’s Furniture and Equipment.

(a) Use. The Premises currently contain certain furniture, equipment and other personal property of Sublandlord more particularly described in Exhibit B attached hereto and incorporated herein (the “Existing Personal Property”),. In connection with the subleasing of the Premises by Subtenant, effective as of the Commencement Date Sublandlord hereby grants to Subtenant the right to use the Existing Personal Property throughout the Term of this Sublease. Sublandlord makes no representations or warranties with respect to the condition of the Existing Personal Property, Subtenant accepts the Existing Personal Property in its “as is, where is” condition and Subtenant shall indemnify and save Sublandlord, its directors, officers, agents and employees harmless from and against all liability, claims, suits, judgments, damages, costs and expenses (including reasonable attorneys’ fees) to which any of them may be subject or suffer, arising from or in connection with Subtenant’s use of the Existing Personal Property. Subtenant shall keep and maintain the Existing Personal Property in as good a condition and repair as when received, reasonable wear and tear excepted, and shall insure the Existing Personal Property under the insurance policies maintained by Subtenant pursuant to Section 15 hereof. Sublandlord shall have the right, prior to the Commencement Date, but shall not be obligated to, remove from the Premises any other furniture, fixtures, equipment or other personal property of Sublandlord located within the Premises.

(b) Purchase. Subtenant may elect to purchase all, but not less than all, of the Existing Personal Property from Sublandlord upon the expiration of the Term of this Sublease. Subtenant shall provide Sublandlord with written notice of its interest in purchasing the Existing Personal Property at least six (6) months prior to the expiration of the Term of this Sublease. Within thirty (30) days of Sublandlord’s receipt of such notice, Sublandlord shall notify Subtenant in writing of Sublandlord’s determination of the purchase price which shall be the then fair market value for the Existing Personal Property. Within thirty (30) days following Subtenant’s receipt of Sublandlord’s determination of the fair market value for the Existing Personal Property, Subtenant shall give written notice to Sublandlord of its election to purchase the Existing Personal Property, and Subtenant’s failure to give such written notice shall be deemed to be Subtenant’s election not to purchase such Existing Personal Property. Any purchase of the Existing Personal Property shall be pursuant to a separate written agreement (including a ▇▇▇▇ of sale) reasonably acceptable to both parties, which shall provide, without limitation, that the Existing Personal Property shall be conveyed in its then “as is,

13

where is” condition at the time conveyed without any representation or warranty of any kind except title to such property.

19. Surrender. Upon the expiration of this Sublease, or upon the termination of this Sublease or of the Subtenant’s right to possession of the Premises, Subtenant will at once surrender and deliver up the Premises, together with all improvements thereon, to Sublandlord in good condition and repair, reasonable wear and tear and casualty excepted; provided, however, that conditions existing because of Subtenant’s failure to perform maintenance, repairs or replacements as required of Subtenant under this Sublease shall not be deemed “reasonable wear and tear.” Subtenant shall surrender to Sublandlord all keys to the Premises. All alterations in or upon the Premises made by Subtenant shall become a part of and shall remain upon the Premises upon such termination without compensation, allowance or credit to Subtenant; provided, however, that Subtenant shall remove any alterations made by Subtenant, or portion thereof, which Prime Landlord may require Sublandlord to remove, pursuant to the terms of the Prime Lease. In any such event, Subtenant shall restore the Premises to their condition prior to the making of such alteration, repairing any damage occasioned by such removal or restoration. If Prime Landlord requires removal of any alteration made by Subtenant, or a portion thereof, and Subtenant does not make such removal in accordance with this Section, Sublandlord may remove the same (and repair any damage occasioned thereby), and dispose thereof, or at its election, deliver the same to any other place of business of Subtenant, or warehouse the same. Subtenant shall pay the costs of such removal, repair, delivery and/or warehousing on demand. Subtenant shall not be required to remove any alterations performed by Sublandlord prior to the Commencement Date or to restore the Premises to their condition prior to the making of such alterations.

20. Removal of Subtenant’s Property. Upon the expiration or earlier termination of this Sublease, Subtenant shall remove Subtenant’s articles of personal property incident to Subtenant’s business, including without limitation the Existing Personal Property if purchased by Subtenant (collectively, “Subtenant’s Personal Property”); provided, however, that Subtenant shall repair any injury or damage to the Premises which may result from such removal, and shall restore the Premises to the same condition as prior to the installation thereof. If Subtenant does not remove Subtenant’s Personal Property from the Premises prior to the expiration or earlier termination of the Term, Sublandlord may, at its option, remove the same (and repair any damage occasioned thereby and restore the Premises as aforesaid) and dispose thereof or deliver the same to any other place of business of Subtenant, or warehouse the same, and Subtenant shall pay the cost (together with interest thereon at the Interest Rate) of such removal, repair, restoration, delivery or warehousing to Sublandlord on demand, or Sublandlord may treat Subtenant’s Personal Property as having been conveyed to Sublandlord with this Sublease as a ▇▇▇▇ of sale, without further payment or credit by Sublandlord to Subtenant.

21. Holding Over. Subtenant shall have no right to occupy the Premises or any portion thereof after the expiration of this Sublease or after termination of this Sublease or of Subtenant’s right to possession in consequence of an Event of Default hereunder. In the event Subtenant or any party claiming by, through or under Subtenant holds over,

14

Sublandlord may exercise any and all remedies available to it at law or in equity to recover possession of the Premises, and to recover damages, including without limitation, damages payable by Sublandlord to Prime Landlord by reason of such holdover. For each and every month or partial month that Subtenant or any party claiming by, through or under Subtenant remains in occupancy of all or any portion of the Premises after the expiration of this Sublease or after termination of this Sublease or Subtenants right to possession, Subtenant shall pay, as minimum damages and not as a penalty, monthly rental at a rate equal to one hundred fifty percent (150%) of the greater of (i) the holdover rent payable by Sublandlord to Prime Landlord under the Prime Lease or (ii) the scheduled rate of Monthly Base Rent and Additional Rent payable under this Sublease at the end of the Term. The acceptance by Sublandlord of any lesser sum shall be construed as payment on account and not in satisfaction of damages for such holding over.

22. Entry by Sublandlord. Subtenant shall permit Sublandlord or Prime Landlord or their authorized agent or representative entry into the Premises with reasonable notice and at reasonable times, in accordance with the provisions of the Prime Lease, for the purpose of entering to inspect, make necessary repairs and for other purposes specified in the Prime Lease.

23. Encumbering Title. Subtenant shall not do any act which shall in any way encumber the title of Prime Landlord in and to the Building or the Project, nor shall the interest or estate of Prime Landlord or Sublandlord be in any way subject to any claim by way of lien or encumbrance, whether by operation of law by virtue of any express or implied contract by Subtenant, or by reason of any other act or omission of Subtenant. Any claim to, or lien upon, the Premises, or the Building arising from any act or omission of Subtenant shall accrue only against the subleasehold estate of Subtenant and shall be subject and subordinate to the paramount title and rights of Prime Landlord in and to the Building and the interest of Sublandlord in the Prime Lease Premises. Without limiting the generality of the foregoing, Subtenant shall not permit the Premises or the Building to become subject to any mechanics’, laborers’ or materialmen’s lien on account of labor or material furnished to Subtenant or claimed to have been furnished to Subtenant in connection with work of any character performed or claimed to have been performed on the Premises by, or at the direction or sufferance of, Subtenant.

24. Rules. Subtenant agrees to comply with all rules and regulations that Prime Landlord has made, or may hereafter from time to time make, for the Building. Sublandlord shall not be liable in any way for damage caused by the non-observance by any of the other tenants of such similar covenants in their leases or of such rules and regulations.

25. Execution. Each party represents and warrants the following: (i) with respect to the person executing this Sublease on its behalf, he or she is duly authorized to execute this Sublease on behalf of such party; and (ii) such party has full power and authority to execute this Sublease and perform its obligations hereunder without the consent of any other person or entity.

15

26. Parking. During the Term of this Sublease, without representation or warranty of any kind, Sublandlord hereby subleases to Subtenant Sublandlord’s rights under the Prime Lease in and to three (3) parking spaces located within the Building, the choice of which shall be determined by Sublandlord in its sole discretion, if such designation is permitted under the Prime Lease (the “Subleased Parking Spaces”). In addition to its obligation to pay any Base Rent, Subtenant shall pay to Sublandlord, as a part of Additional Rent any costs or expenses associated with any of the Subleased Parking Spaces elected to be used by Subtenant that are charged to or paid for by Sublandlord, Such payments shall be made at such time and in such manner as Subtenant pays the Base Rent, or as otherwise requested by Sublandlord. Except as set forth in this Section 26, Sublandlord shall have no obligation to provide any parking spaces to Subtenant.

27. Signage. Sublandlord agrees that it shall deliver any requests by Subtenant for Building directory and suite entry signage to Prime Landlord. Subtenant shall not be permitted to use any of Sublandlord’s allocated directory and signage space other than such as is located on the floor in which the Premises is located. Subtenant (i) acknowledges that Sublandlord shall have no further obligations to Subtenant with respect to signage and (ii) agrees that Subtenant shall bear all costs with respect any such approved signage.

28. Notices. All payments, notices or other communications hereunder shall be in writing and shall be deemed duly given if delivered by hand, or by a nationally recognized delivery service providing receipt evidencing such delivery, or by facsimile transmission the receipt of which is confirmed, or by certified or registered mail return receipt requested, first class, postage prepaid, to the address set forth below unless notice of a change of address is given in writing pursuant to this Section 28. Notice shall be deemed to have been given upon receipt or at the time delivery is refused.

| If to Sublandlord: | Macfarlane Partners Investment Management | |

| ▇▇▇ ▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇ ▇▇▇▇▇ | ||

| ▇▇▇ ▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇ | ||

| Attn: ▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇, | ||

| Chief Operating Officer | ||

| with a required copy to: | ▇▇▇▇, August and ▇▇▇▇▇ | |

| ▇▇▇▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇ | ||

| ▇▇▇ ▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇ | ||

| Attn: ▇▇▇▇▇▇▇ ▇. Rips | ||

| If to Subtenant: | Medivation, Inc. | |

| ▇▇▇ ▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇ | ||

| ▇▇▇ ▇▇▇▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇ Attn: ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇ | ||

16

| with a required copy to: | ▇▇▇▇▇▇ Godward Kronish LLP | |

| ▇▇▇ ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇ ▇▇▇ ▇▇▇▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇ Attn: ▇▇▇▇ ▇. ▇▇▇▇ |

All payments and notices shall be deemed given on the date the recipient actually receives the same or would have received the same if delivery is refused. Either party may, by written notice to the other, designate a new address and/or addresses for such payments and notices.

29. Brokerage. Sublandlord represents and warrants to Subtenant that no real estate agent, broker or finder, other than Dunhill Partners West on behalf of Sublandlord (the “Sublandlord’s Broker”) has acted for it with respect to this Sublease or the transaction contemplated hereby. Subtenant represents and warrants to Sublandlord that no real estate agent, broker or finder other than ▇▇▇▇▇ Lang LaSalle (the “Subtenant’s Broker”) has acted for it with respect to this Sublease or the transaction contemplated hereby. Sublandlord shall pay the Sublandlord’s Broker any commission due and owing as a result of this Sublease pursuant to the terms of a separate agreement. Provided that Sublandlord pays Sublandlord’s Broker in accordance with the commission agreement between Sublandlord and Sublandlord’s Broker, Sublandlord shall have not have any obligation to pay Subtenant’s Broker any commission or other fee in connection with this Sublease; it being understood that Subtenant’s Broker is to be paid by Sublandlord’s Broker pursuant to a customary cooperating broker agreement between them. Other than Sublandlord’s Broker and Subtenant’s Broker, Sublandlord and Subtenant each does hereby indemnify and hold the other harmless from the claim of any persons claiming by or through it by reason of this Sublease or the transaction contemplated hereby.

30. Construction. This Sublease (i) embodies the entire integrated agreement of Sublandlord and Subtenant with respect to Subtenant’s lease and occupancy of the Premises, and supersedes all prior agreements and understandings, whether written or oral; (ii) may be executed in multiple counterparts, each of which shall constitute an original and all of which shall constitute but one and the same agreement; and (iii) shall be governed by and construed in accordance with the laws of the State of California. If any provision of this Sublease conflicts with a provision of the Prime Lease, the provisions of the Prime Lease shall govern as between the Prime Landlord and the Subtenant. Subtenant specifically waives all claims against Sublandlord arising out of any such conflicts. If any provision of the Prime Lease as incorporated into this Sublease conflicts with any other provision of this Sublease, the provisions set forth in this Sublease shall govern as between the Subtenant and the Sublandlord.

31. Binding Effect. This Sublease shall be binding upon and inure to the benefit of Sublandlord and Subtenant and their respective successors and permitted assigns. Sublandlord shall have the right to assign any or all of its rights and powers under this Sublease to Prime Landlord.

17

32. Termination of Sublease. If Prime Landlord has failed to consent to this Sublease within sixty (60) days after the date that this Sublease is fully executed (which period may be extended by the mutual written agreement of Sublandlord and Subtenant), then this Sublease shall immediately terminate and be of no further force or effect.

33. Attorneys’ Fees. In the event that either Sublandlord or Subtenant, as the case may be, shall bring a lawsuit against the other party for breach of such party’s obligations under this Sublease, the losing party shall pay the prevailing party’s costs and expenses incurred in connection with such litigation, including without limitation reasonable attorneys’ fees. The “prevailing party” shall be determined by the court hearing such matter.

34. Waiver of Jury Trial. Sublandlord and Subtenant shall and each does hereby waive trial by jury in any action, proceeding or counterclaim brought by either of the parties hereto against the other on any matters whatsoever arising out of or in any way connected with this Sublease or its termination, the relationship of Sublandlord and Subtenant, Subtenant’s use or occupancy of the Premises or any claim of injury or damage and any emergency statutory or any other statutory remedy. In the event Sublandlord commences any summary proceeding for nonpayment of Monthly Base Rent or Additional Rent, or commences any other action or proceeding against Subtenant in connection with this Sublease, Subtenant will interpose no counterclaim of whatever nature or description in any such proceeding, other than any mandatory counterclaim as required by law.

35. Transfer by Sublandlord. In the event of any transfer or other conveyance of the Premises by Sublandlord or an assignment by Sublandlord of this Sublease, Sublandlord shall be and is hereby entirely freed and relieved of all liability under all of its covenants and obligations contained in or derived from this Sublease arising out of any act, occurrence or omission relating to the Subleased Premises or this Sublease occurring after the consummation of such sale, conveyance or assignment.

36. Exculpation. No present or future officer, director, employee, trustee, member, investment manager, shareholder, or agent of Sublandlord shall have any personal liability, directly or indirectly, and recourse shall not be had against any such officer, director, employee, trustee, member, investment manager, shareholder, or agent under or in connection with this Sublease. Subtenant hereby waives and releases any and all such personal liability and recourse. The limitations of liability provided in this Section 36 are in addition to and not in limitation of, any limitation on liability applicable to Sublandlord provided by law or in any other contract, agreement or instrument.

37. Financial Information. Within thirty (30) days after the end of each calendar year, or within thirty (30) days of Sublandlord’s written request therefor, Subtenant shall furnish Sublandlord with financial statements, or other financial information reasonably acceptable to Sublandlord, reflecting Subtenant’s current financial condition certified by Subtenant or its financial officer. If Subtenant is a publicly-traded corporation, delivery

18

of Subtenant’s last published financial information shall be satisfactory for purposes of this Section 37.

38. Estoppel Certificate. Subtenant shall from time to time, upon written request by Sublandlord or Prime Landlord, execute, acknowledge and deliver to Sublandlord or Prime Landlord, within ten (10) business days after receipt of such request, a statement in writing certifying, without limitation: (i) that this Sublease is unmodified and in full force and effect (or if there have been modifications, identifying such modifications and certifying that the Sublease, as modified, is in full force and effect); (ii) the dates to which Base Rent, Additional Rent and any other charges have been paid; (iii) that, to Subtenant’s knowledge, Sublandlord is not in default under any provision of this Sublease (or if Sublandlord is in default, specifying each such default) and that no events or conditions exist which, with the passage of time or notice or both, would constitute a default on the part of Sublandlord hereunder; (iv) the address to which notices to Subtenant shall be sent; (v) the amount of Subtenant’s security deposit; and (vi) such other statements as reasonably requested by Sublandlord or Prime Landlord; it being understood that any such statement so delivered may be relied upon in connection with any lease, mortgage or transfer. Subtenant’s failure to deliver such statement within such time shall be conclusive upon Subtenant that: (i) this Sublease is in full force and effect and has not been modified except as Sublandlord may represent; (ii) no Base Rent, Additional Rent, or any other charges have been paid in advance; (iii) there are no defaults by Sublandlord; (iv) notices to Subtenant shall be sent to Subtenant’s address as set forth in this Sublease; (v) the amount of Subtenant’s security deposit; and (vi) that all other statements contained in such estoppel are true and correct. Notwithstanding the presumptions of this Section 38, Subtenant shall not be relieved of its obligation to deliver said statement. Sublandlord shall from time to time, upon written request by Subtenant, execute, acknowledge and deliver to Subtenant, within thirty (30) days after receipt of such request, a similar written certification concerning this Sublease.

39. Non Merger. Nothing herein shall be construed to merge the interests of Sublandlord and Subtenant, whether by operation of law or otherwise.

40. Time of Essence. Time is of the essence with respect to all of the parties’ obligations under this Sublease.

[SIGNATURES ON THE FOLLOWING PAGE]

19

IN WITNESS WHEREOF, the parties hereto have executed this Sublease Agreement under seal as of the date first above written.

| SUBLANDLORD: | ||||

| MACFARLANE PARTNERS INVESTMENT MANAGEMENT, LLC, a Delaware limited liability company | ||||

| By: | /s/ ▇▇▇▇▇▇▇ ▇. ▇▇▇▇▇▇ | |||

| Name: | ▇▇▇▇▇▇▇ ▇. ▇▇▇▇▇▇ | |||

| Title: | President | |||

| SUBTENANT: | ||||

| MEDIVATION, INC., a Delaware corporation | ||||

| By: | /s/ C. ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇ | |||

| Name: | C. ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇ | |||

| Title: | CFO | |||

20

EXHIBIT A

PRIME LEASE

[attached]

M Equity No.

OFFICE LEASE

THIS LEASE, made as of November 22, 2005 by and between MASSACHUSETTS MUTUAL LIFE INSURANCE COMPANY, a Massachusetts corporation (“Landlord”), through its agent CORNERSTONE REAL ESTATE ADVISERS, INC., having an address at ▇▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇., ▇▇▇▇▇ ▇▇▇, ▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇ and MACFARLANE URBAN REALTY COMPANY, LLC, a California limited liability company (“Tenant”), having its principal office at ▇▇▇ ▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇.

INDEX

| ARTICLE |

TITLE | |

| 1. | BASIC PROVISIONS | |

| 2. | PREMISES, TERM AND COMMENCEMENT DATE | |

| 3. | RENT | |

| 4. | TAXES AND OPERATING EXPENSES | |

| 5. | TENANT IMPROVEMENTS, ALTERATIONS AND ADDITIONS | |

| 6. | USE | |

| 7. | SERVICES | |

| 8. | INSURANCE | |

| 9. | INDEMNIFICATION | |

| 10. | CASUALTY DAMAGE | |

| 11. | CONDEMNATION | |

| 12. | REPAIR AND MAINTENANCE | |

| 13. | INSPECTION OF PREMISES | |

| 14. | SURRENDER OF PREMISES | |

| 15. | HOLDING OVER | |

| 16. | SUBLETTING AND ASSIGNMENT | |

| 17. | SUBORDINATION, ATTORNMENT AND MORTGAGEE PROTECTION | |

| 18. | ESTOPPEL CERTIFICATE | |

| 19. | DEFAULTS | |

| 20. | REMEDIES OF LANDLORD | |

| 21. | QUIET ENJOYMENT | |

| 22. | ACCORD AND SATISFACTION | |

| 23. | SECURITY DEPOSIT | |

| 24. | BROKERAGE COMMISSION | |

| 25. | FORCE MAJEURE | |

| 26. | PARKING | |

| 27. | HAZARDOUS MATERIALS | |

| 28. | ADDITIONAL RIGHTS RESERVED BY LANDLORD | |

| 29. | DEFINED TERMS | |

| 30. | MISCELLANEOUS PROVISIONS | |

| 31. | TENANT SIGNS | |

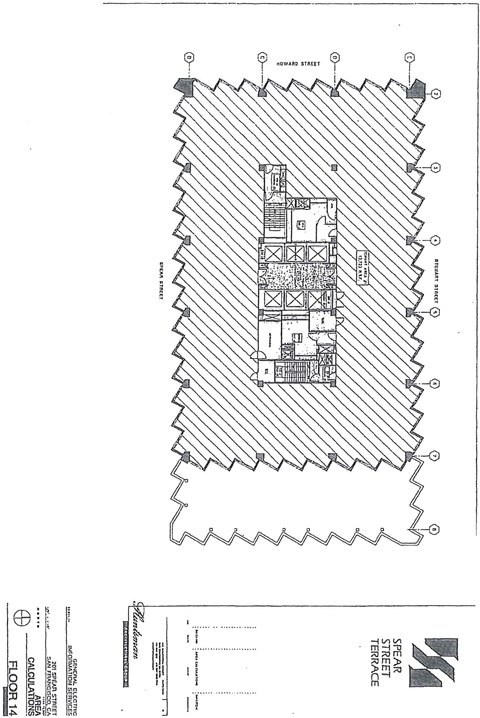

| 32. | OPTION TO LEASE SPACE ON 14th FLOOR | |

| 33. | TENANT EARLY TERMINATION RIGHT | |

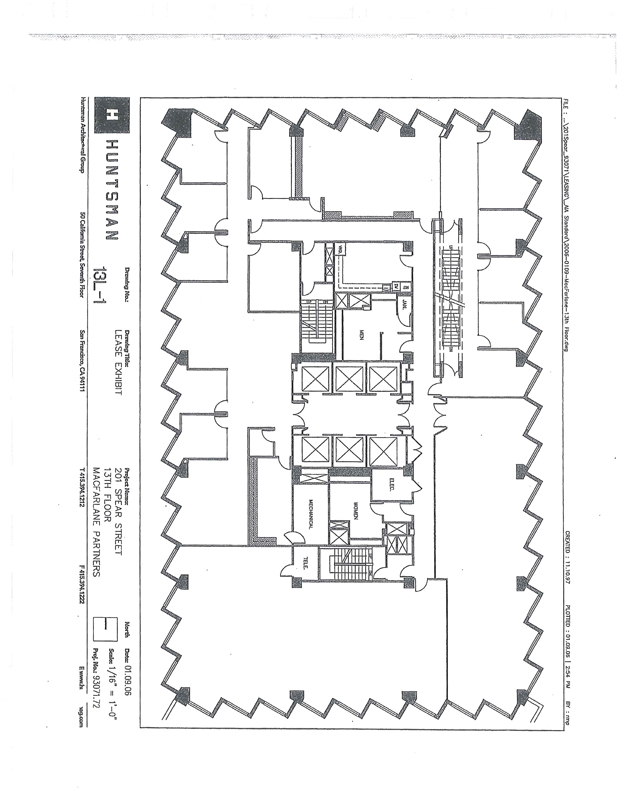

| 34. | RIGHT OF FIRST OFFER ON 13th FLOOR |

i

EXHIBITS

| Exhibit A | Plan Showing Property and Premises | |

| Exhibit A-1 | Plan Showing Option Space on 14th Floor | |

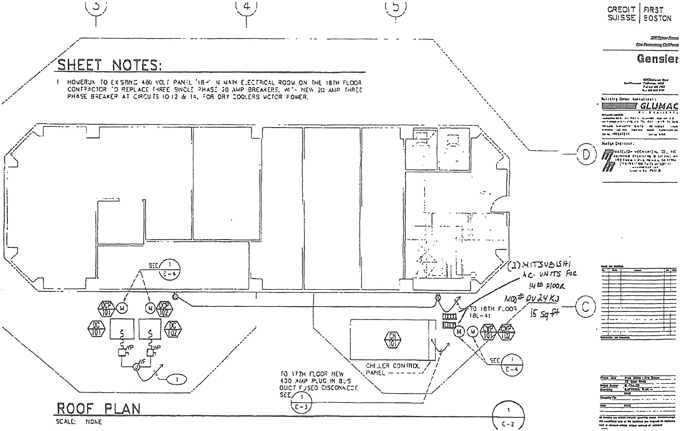

| Exhibit A-2 | Plan Showing 14th Floor Supplemental HVAC Units | |

| Exhibit B | Tenant Work Letter | |

| Exhibit C | Intentionally Deleted | |

| Exhibit D | Building Rules and Regulations | |

| Exhibit E | Commencement Date Confirmation |

ii

ARTICLE 1

BASIC PROVISIONS

| A. | Tenant’s Tradename: | MacFarlane Urban Realty Company, LLC | ||

| B. | Tenant’s Address: | 20▇ ▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇ ▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇ | ||

| C. | Office Building Name: | 20▇ ▇▇▇▇▇ ▇▇., ▇▇▇ ▇▇▇▇▇▇▇▇▇, ▇▇ | ||

| D. | Premises: | Suite/Unit No.: 12th Floor (with option for 14th Floor upon the terms and conditions set forth in Article 32) Square Feet (Rentable): 13,723 | ||

| E. | Landlord: | Massachusetts Mutual Life Insurance Company | ||

| F. | Landlord’s Address: | c/o Cornerstone Real Estate Advisers, Inc. 10▇ ▇▇▇▇▇▇▇▇ ▇▇., ▇▇▇▇▇ ▇▇▇ ▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇ | ||

| G. | Building Manager/ Address: | 20▇ ▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇▇ ▇▇▇ ▇▇▇▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇ ▇roperty Manager: ▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇ | ||

| H. | Commencement Date: | The earlier of the date on which (i) Tenant has substantially completed the Tenant Improvements (as defined and discussed in the Tenant Work Letter attached hereto as Exhibit B (“Tenant Work Letter”)) and has received any required approvals from the City of San Francisco for the occupancy of substantially all of Premises (such as permanent or temporary certificates of occupancy), or (ii) Tenant substantially occupies the Premises for purposes of doing business thereat, whichever is earlier. For the purposes hereof, Tenant substantially occupies the Premises if its personnel are using at least 50% of the usable square footage of the Premises and conducting its business therein, whether or not the Tenant Improvements have been substantially completed. Tenant is responsible for the construction of the Tenant Improvements. Notwithstanding the foregoing, the Commencement Date shall be no later than April 1, 2006 (the “Outside Commencement Date”). Except as provided above, substantial completion of the Tenant Improvements and the substantial occupation of the Premises are not conditions to the establishment of the Commencement Date or the Outside Commencement Date. | ||

| I. | Expiration Date: | The date which is 7 years and 2 months following the first day of the first calendar month following the Commencement Date. | ||

1

| J. | Security Deposit: | $380,813.22 by way of a Letter of Credit (as provided in, and subject to, Article 23) | ||

| K. | Monthly Rent: | The Monthly Rent for the Premises shall be payable on a full service basis during the Lease Term in installments as set forth below: | ||

| Calendar Months Following Commencement Date |

Annual Rate per rentable square foot (“RSF”) |

Monthly Rent |

||||||

| 1-12: |

$ | 34.00 | $ | 38,881.83 | ||||

| 13-24: |

$ | 35.00 | $ | 40,025.42 | ||||

| 25-36: |

$ | 36.00 | $ | 41,169.00 | ||||

| 37-48: |

$ | 37.00 | $ | 42,312.58 | ||||

| 49-60: |

$ | 38.00 | $ | 43,456.17 | ||||

| 61-72: |

$ | 39.00 | $ | 44,599.75 | ||||

| 73-86 |

$ | 40.00 | $ | 45,743.33 | ||||

| L. | Operating Expenses Base: | Actual Operating Expenses for Calendar Year 2006, subject to adjustment as provided in Section 4.A. | ||

| M. | Tax Base: | Actual Taxes for Calendar Year 2006, subject to adjustment as provided in Section 4.A. | ||

| N. | Tenant’s Pro Rata Share: | 5.55%. Tenant’s Pro Rata Share shall be determined by and adjusted by Landlord from time to time by dividing the Tenant’s Rentable Square Feet of the Premises by the Rentable Square Feet of the Building and multiplying the resulting quotient, to the second decimal place, by one hundred. | ||

| O. | Normal Business Hours of the Building: | Monday through Friday: 7:00 a.m. to 6:00 p.m. (Excepting local and national holidays) | ||

| P. | Brokers: | The CAC Group; Dunhill Partners West; ▇▇▇▇▇▇▇ ▇▇▇▇ Company | ||

| Q. | Parking: | Parking for 4 vehicles | ||

The foregoing provisions shall be interpreted and applied in accordance with the other provisions of this Lease set forth below. The capitalized terms, and the terms defined in Article 29, shall have the meanings set forth herein or therein (unless otherwise modified in the Lease) when used as capitalized terms in other provisions of the Lease.

Landlord and Tenant hereby stipulate that the Premises contains the number of square feet specified in Article I.D., above.

2

ARTICLE 2

PREMISES, TERM AND COMMENCEMENT DATE

A. Commencement Date. Subject to the terms and conditions set forth herein, Landlord hereby leases and demises to Tenant and Tenant hereby takes and leases from Landlord that certain space identified in Article 1 and shown on a plan attached hereto as Exhibit A (“Premises”) for a term (“Term”) commencing on the Commencement Date and ending on the Expiration Date set forth in Article 1, unless sooner terminated as provided herein. The Commencement Date set forth in Article 1 shall be advanced to such earlier date as Tenant commences substantial occupancy of the Premises (as defined in Article 1) for the conduct of its business (it being understood that interim, phased occupancy of less than a substantial portion of the Premises during the construction of the Tenant Improvements shall not trigger the Commencement Date). Upon the earlier of (i) substantial completion of the Tenant Improvements, the date of which shall be established by Landlord’s construction supervisor, or (ii) the date by which Tenant has substantially occupied the Premises as provided in Article 1.H set forth above, Landlord shall execute and deliver to Tenant the Commencement Date Confirmation in the form as set forth in Exhibit E, which Tenant shall execute and return to Landlord within 5 days after receipt thereof. Tenant’s failure to timely execute and deliver the Commencement Date Confirmation shall constitute an acknowledgment by Tenant that the statements included in such notice are true and correct, without exception. If Tenant disagrees with any matters set forth in the Commencement Date Confirmation, it shall set forth in a written notice to Landlord within such five-day period the matters which it disagrees with, the reasons for such disagreement, and the Commencement Date which Tenant contends should be established. Landlord shall have five days thereafter to accept or reject Tenant’s proposed Commencement Date. If Landlord rejects such date, then the date set forth in the initial Commence Date Confirmation executed and delivered by Landlord shall be used for the purposes hereof until the matter is resolved by legal proceedings or further agreement of the Parties. To the extent the Premises includes an entire floor of the Building, Tenant shall have exclusive use of the Common Areas located within such floor.

B. Delivery of Possession. Landlord shall deliver exclusive possession of the Premises to Tenant (the “Actual Delivery Date”) no later than 2 business days after full execution of this Lease (the “Estimated Delivery Date”).

C. Installation of Supplemental HVAC. In addition to the Premises (and not as part thereof), Tenant shall have the right to the reasonable use of the roof and core of the Building for the purpose of installing, operating and maintaining such supplemental HVAC systems serving the Premises as Tenant may reasonably require, all of which shall be considered to be Alterations hereunder and subject to the prior approval of Landlord as provided in Section 5.B of this Lease. Without limitation of the foregoing, Landlord shall be entitled in its sole discretion to specify a precise location for the supplemental HVAC unit, to prohibit the installation of a proposed HVAC unit if Landlord determines that there are structural, mechanical or safety concerns over the installation of such HVAC unit and shall be entitled to require Tenant to pay to Landlord a monthly amount established by Landlord that is comparable to the charges imposed for such purposes to other tenants in the Building as Additional Rent for the use of space for such HVAC unit on the roof or in the core of the Building. Upon the Option Space (defined in Article 32) on

3

the 14th floor of the Building becoming a part of the Premises and provided that Tenant first obtains from Credit Suisse First Boston LLC (“CSFB”) or any assignee of CSFB, if applicable, any consent required for the use of the 14th Floor Supplemental HVAC and provides to Landlord reasonable evidence thereof: (a) Tenant shall be entitled to use the 2 Mitsubishi A/C units (model PV24K3) identified on the attached Exhibit A-2 currently serving the Option Space (“14th Floor Supplemental HVAC”) throughout the remainder of the Term; (b) Tenant may replace the 14th Floor Supplemental HVAC (within the same approximate 15 square foot footprint on the roof); and (c) Tenant shall pay to Landlord $300 per month plus monthly utility costs for the use and operation of the 14th Floor Supplemental HVAC for the remainder of the Term. Landlord shall have the option of requiring Tenant, at the termination of the Lease and at Tenant’s sole cost and expense, to remove the 14th Floor Supplemental HVAC and to restore the affected portions of the Building to the condition that existed before the installation of the 14th Floor Supplemental HVAC. Upon the Option Space becoming a part of the Premises, Landlord shall at Tenant’s timely written request given before the end of the term of Landlord’s lease with CSFB and provided that the CSFB lease gives Landlord the right to do so, notify CSFB to leave the 14th Floor Supplemental HVAC in place at the end of the term of its lease.

ARTICLE 3

RENT

A. Monthly Rent. Tenant shall pay Monthly Rent in advance on or before the first day of each month of the Term without demand, setoff or deduction. If the Commencement Date does not fall on the first day of a calendar month, then on the Commencement Date, Tenant shall pay a prorated Monthly Rent for any partial month between the Commencement Date and the first full calendar month of the Term, based on the rental charge established for the first calendar month of the Term for which Monthly Rent is due. If the Term shall end on a day other than the first day of a month, the Monthly Rent for the last partial month shall be prorated on a per diem basis. Upon the execution of this Lease, Tenant shall pay one installment of Monthly Rent for the first calendar month of the Term and shall deliver the Letter of Credit (defined in Article 23) to Landlord.

B. Additional Rent. Tenant’s share of Taxes and Operating Expenses is referred to herein as “Additional Rent.”

C. Rent. Monthly Rent, Additional Rent, and any other amounts of every nature which Tenant is or becomes obligated to pay Landlord under this Lease are herein referred to collectively as “Rent,” and all remedies applicable to the nonpayment of Rent shall be applicable thereto. Landlord may apply payments received from Tenant to any obligations of Tenant then accrued, without regard to such obligations as may be designated by Tenant.

D. Place of Payment. Late Charge. Default Interest. Rent and other charges required to be paid under this Lease, no matter how described, shall be paid by Tenant to Landlord at the Building Manager’s address listed in Article 1, or to such other person and/or address as Landlord may designate in writing, without any prior notice or demand therefor and without deduction or set-off or counterclaim and without relief from any valuation or appraisement laws. In the event Tenant fails to pay Minimum Rent or Tenant’s Pro Rata Share of Taxes or Operating

4

Expenses due under this Lease within 10 days of the due date of said Rent, Tenant shall pay to Landlord a late charge of 10% on the amount overdue as and for liquidated damages which are agreed to be reasonable under the circumstances of this Lease. Any Rent not paid when due shall also bear interest at the Default Rate.

ARTICLE 4

TAXES AND OPERATING EXPENSES

A. Payment of Taxes and Operating Expenses. During each Lease Year, beginning with the first month of the second Lease Year, and each month thereafter during the original Lease Term or any extension thereof, Tenant shall pay to Landlord, as Additional Rent due concurrently with Monthly Rent, an amount equal to 1/12 of Landlord’s estimate (as determined by Landlord in its sole discretion) of Tenant’s Pro Rata Share of any projected increase in the Taxes or Operating Expenses for the particular Lease Year in excess of the Tax Base or Operating Expenses Base, as the case may be (the “Estimated Escalation Increase”). A final adjustment (“Escalation Reconciliation”) shall be made by Landlord and Tenant as soon as practical following the end of each Lease Year, but in no event later than 90 days after the end of each Lease Year. In computing the Estimated Escalation Increase for any particular Lease Year, Landlord shall take into account any prior increases in Tenant’s Pro Rata Share of Taxes and Operating Expenses. If any Estimated Escalation Increase is less than the Estimated Escalation Increase for the immediately preceding Lease Year, the Additional Rent payments to be paid by Tenant for the new Lease Year attributable to said Estimated Escalation Increase shall be decreased accordingly; provided, however, in no event will the Rent paid by Tenant hereunder ever be less than the Monthly Rent plus all other amounts of Additional Rent.