LEASE

Exhibit 10.10

by and between

BMR-3030 BUNKER HILL STREET LLC,

a Delaware limited liability company

and

a Delaware corporation

THIS LEASE (this “Lease”) is entered into as of this 21st day of July, 2008 (the “Execution Date”), by and between XXX-0000 XXXXXX XXXX XXXXXX LLC, a Delaware limited liability company (“Landlord”), and TOCAGEN INC., a Delaware corporation (“Tenant”).

RECITALS

A. WHEREAS, Landlord owns certain real property (the “Property”) and the improvements thereon located at 0000 Xxxxxx Xxxx Xxxxxx xx Xxx Xxxxx, Xxxxxxxxxx, including the building located thereon (the “Building”) in which the Premises (as defined below) are located; and

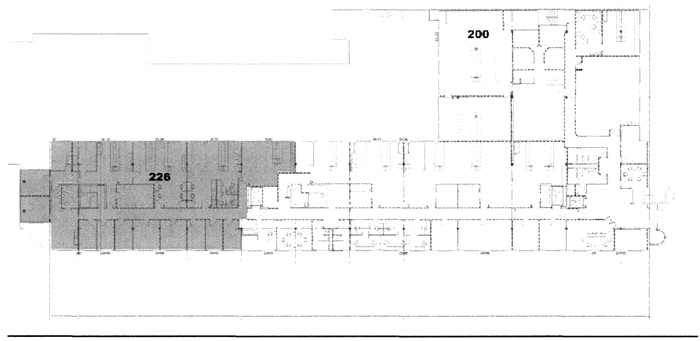

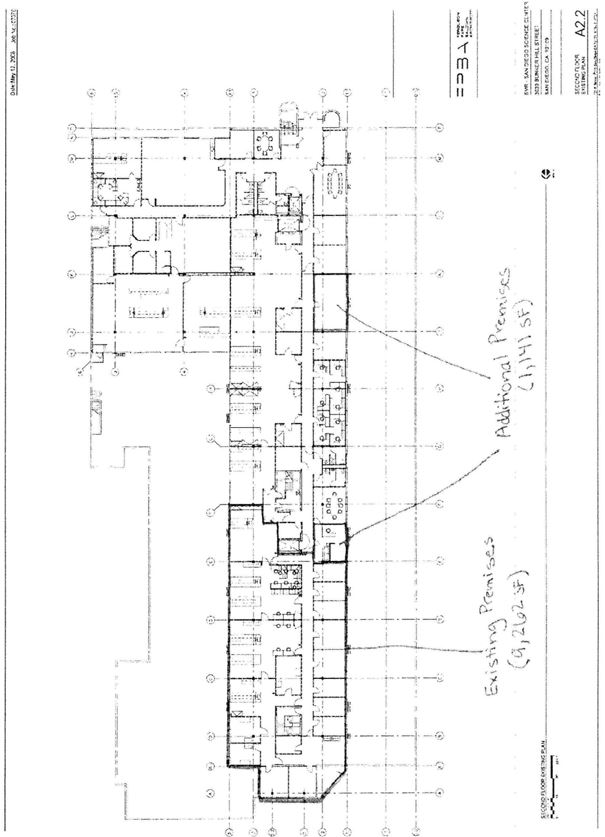

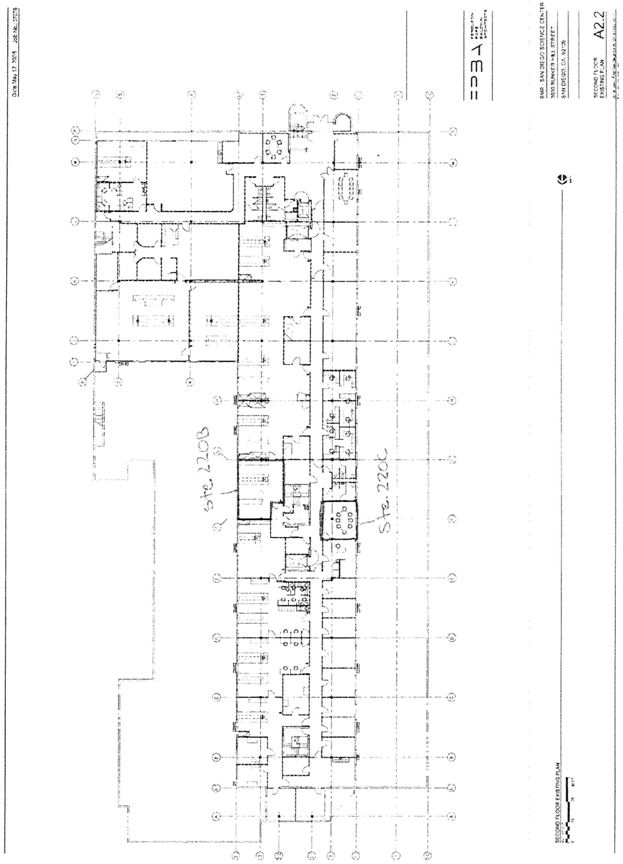

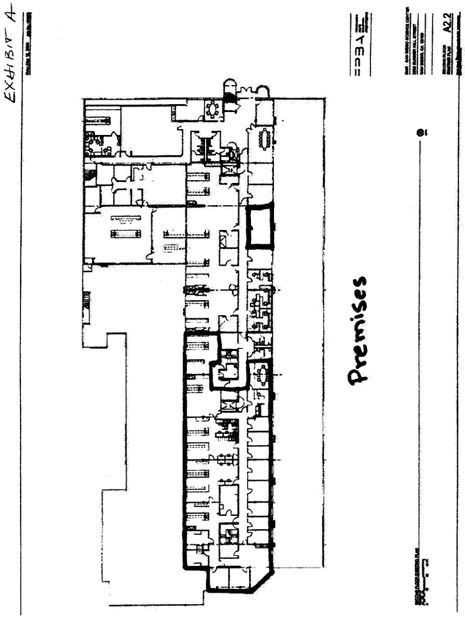

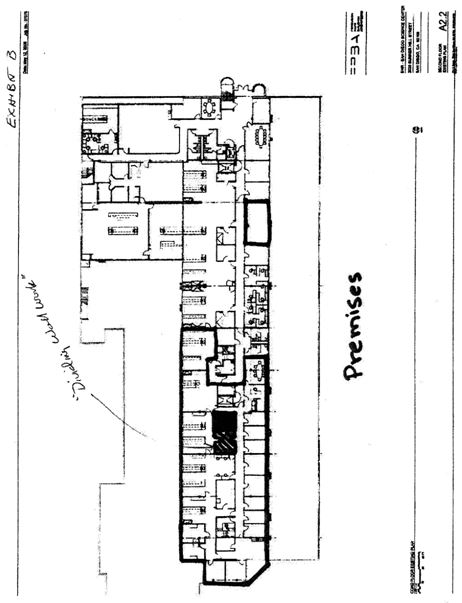

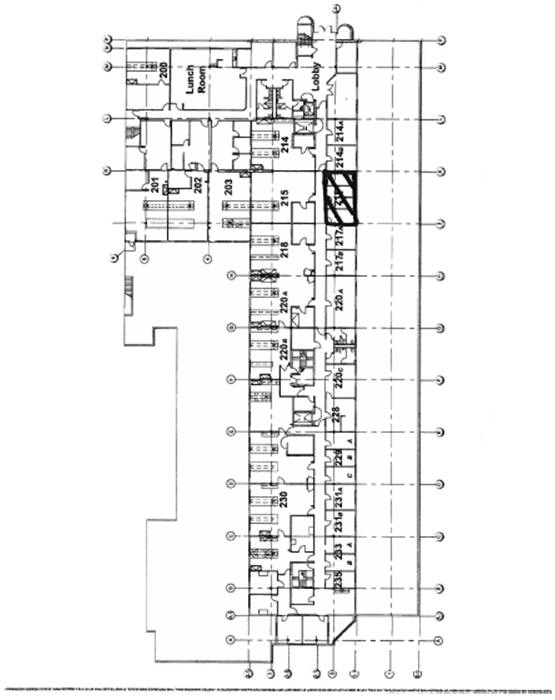

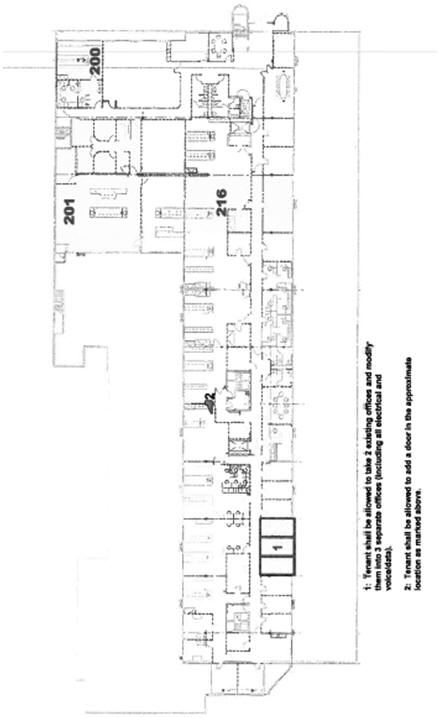

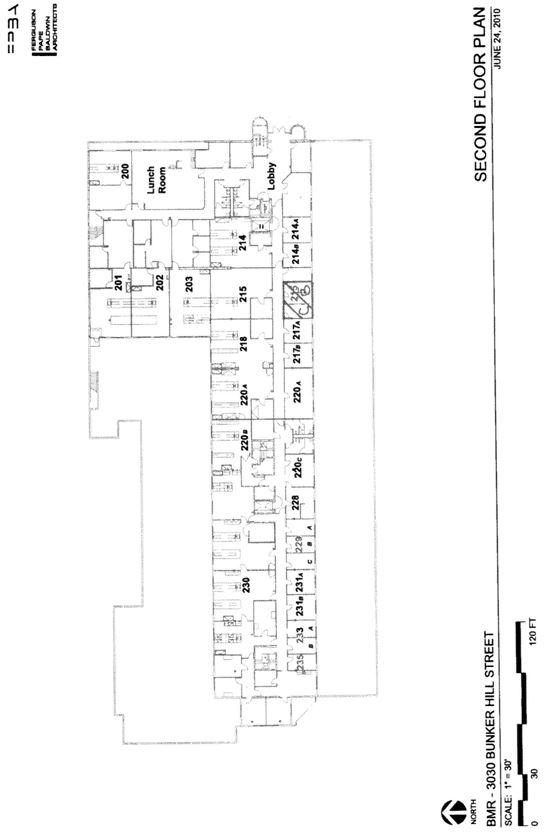

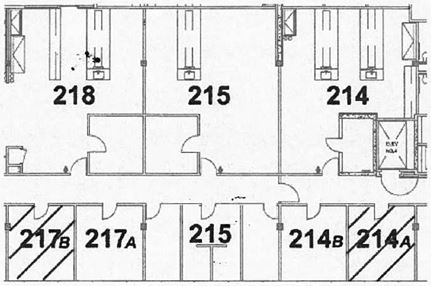

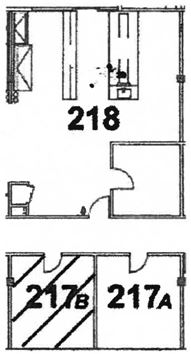

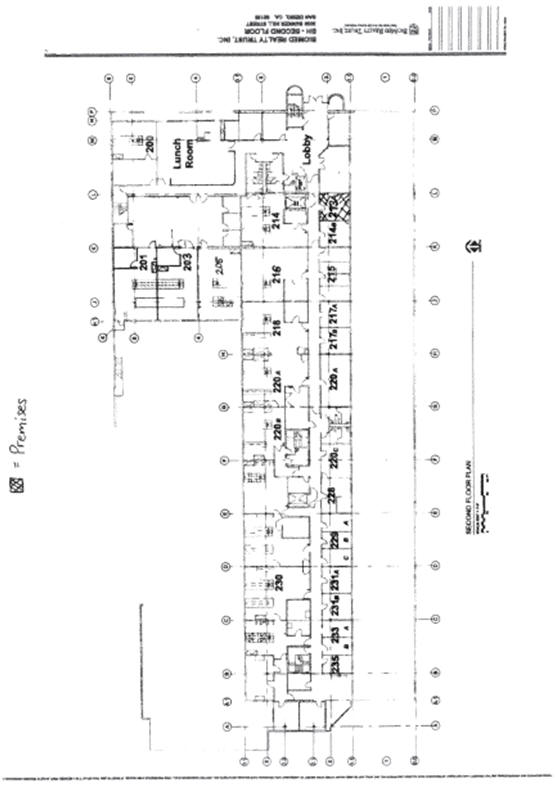

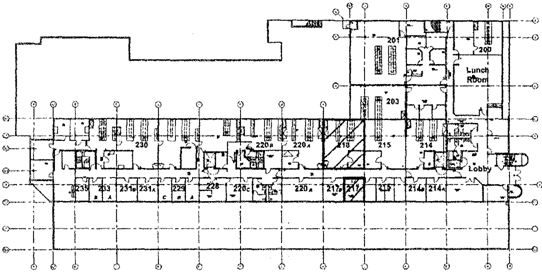

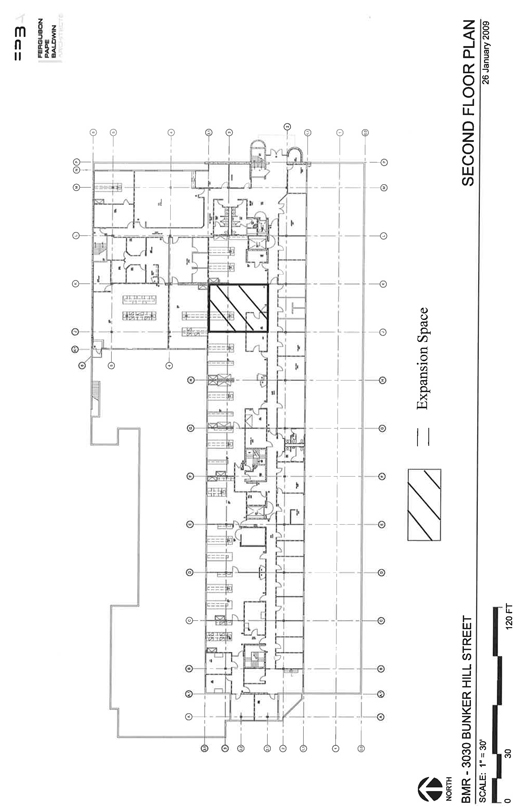

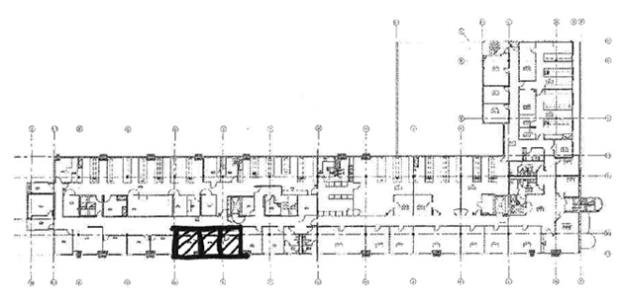

B. WHEREAS, Landlord wishes to lease to Tenant, and Tenant desires to lease from Landlord, Suite 226 (the “Premises”) located in the Building, pursuant to the terms and conditions of this Lease, as detailed below.

AGREEMENT

NOW, THEREFORE, Landlord and Tenant, in consideration of the mutual promises contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound, agree as follows:

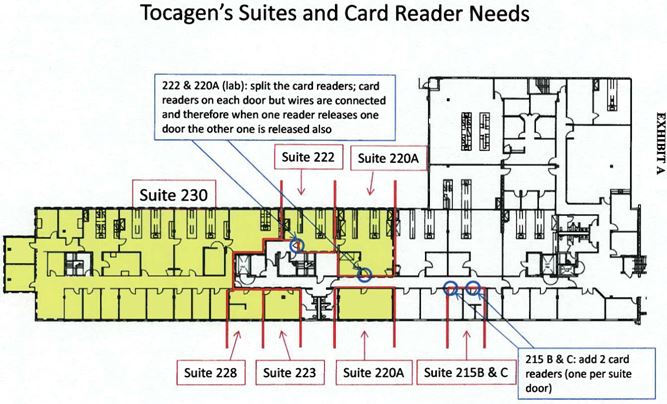

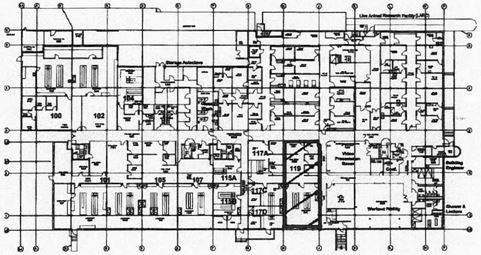

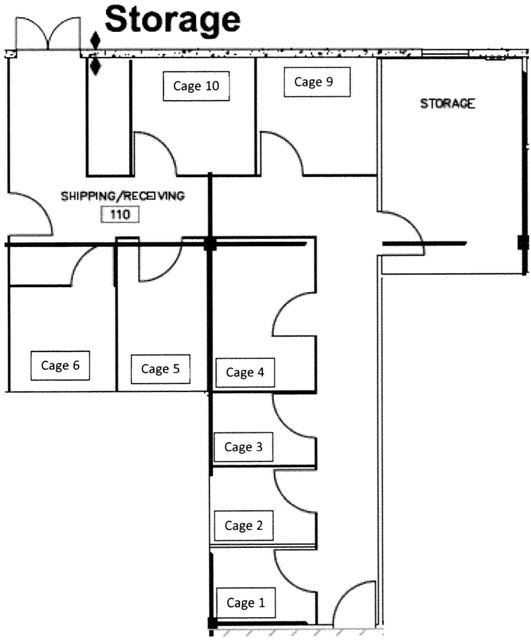

1. Lease of Premises. Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, the Premises, as shown on Exhibit A attached hereto for use by Tenant in accordance with the Permitted Use (as defined below) and no other uses. The Property and all landscaping, parking facilities and other improvements and appurtenances related thereto, including, without limitation, the Building, are hereinafter collectively referred to as the “Project.” All portions of the Project that are for the non-exclusive use of tenants of the Building, including, without limitation, driveways, sidewalks, parking areas, landscaped areas, service corridors, stairways, elevators, public restrooms and public lobbies, are hereinafter referred to as “Common Area.”

2. Basic Lease Provisions. For convenience of the parties, certain basic provisions of this Lease are set forth herein. The provisions set forth herein are subject to the remaining terms and conditions of this Lease and are to be interpreted in light of such remaining terms and conditions.

2.1 This Lease shall take effect upon the date of execution and delivery hereof by all parties hereto and, except as specifically otherwise provided within this Lease, each of the provisions hereof shall be binding upon and inure to the benefit of Landlord and Tenant from the date of execution and delivery hereof by all parties hereto.

2.2 In the definitions below, each current Rentable Area (as defined below) is expressed in rentable square footage. Rentable Area and Tenant’s Pro Rata Share (as defined below) are all subject to adjustment as provided in this Lease.

| Definition or Provision |

Means the Following (As of the Term Commencement Date) | |

| Rentable Area of Premises |

9,262 square feet | |

| Rentable Area of Building |

105,364 square feet | |

| Tenant’s Pro Rata Share of Building |

8.79% |

2.3 Monthly and annual installments of Base Rent for the Premises, (“Base Rent”) as of the Term Commencement Date:

| Months |

Rentable S.F. |

Per Rentable S.F. |

Total Monthly |

Total Annual | ||||

| 1 |

9,262 | $2.35 monthly | $21,765.70 | $261,188.40 | ||||

| 2-4 |

9,262 | $0.00 monthly | $0.00 | $0.00 | ||||

| 5-12 |

9,262 | $2.35 monthly | $21,765.70 | $261,188.40 | ||||

| 13-15 |

9,262 | $2.43 monthly | $22,506.67 | $270,080.04 | ||||

| 16-24 |

9,262 | $2.43 monthly | $22,506.67 | $270,080.04 | ||||

| 25-27 |

9,262 | $2.50 monthly | $23,155.00 | $277,860.00 |

2.4 Term Commencement Date: Execution Date

2.5 Term Expiration Date: Fifteen (15) months after the Term Commencement Date

2.6 Option Term: Twelve (12) additional months after the initial Term Expiration Date

2.7 Security Deposit: $21,765.70, subject to increase in accordance with the terms hereof

2.8 Permitted Use: General office and laboratory use and related administrative and ancillary uses as permitted by Applicable Laws (as defined below).

| 2.9 Address for Rent Payment: |

XXX-0000 Xxxxxx Xxxx Xxxxxx LLC | |||||

| Unit K | ||||||

| X.X. Xxx 00000 | ||||||

| Xxx Xxxxxxx, Xxxxxxxxxx 00000-0000 | ||||||

| 2.10 Address for Notices to Landlord: |

XXX-0000 Xxxxxx Xxxx Xxxxxx LLC | |||||

| 00000 Xxxxxxxx Xxxxxx Xxxxx | ||||||

| Xxx Xxxxx, Xxxxxxxxxx 00000 | ||||||

| Attn: General Counsel/Real Estate | ||||||

| 2.11 Address for Notices to Tenant: |

0000 Xxxxxx Xxxx Xxxxxx, Xxxxx 000 | |||||

| Xxx Xxxxx, Xxxxxxxxxx 00000 | ||||||

| Attn: Chief Financial Officer | ||||||

| 2.12 The following Exhibits are attached hereto and incorporated herein by reference: | ||||||

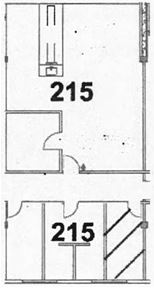

| Exhibit A |

Premises | |||||

| Exhibit B |

Services to Be Provided by Landlord | |||||

| Exhibit C |

[Intentionally omitted] | |||||

| Exhibit D |

[Intentionally omitted] | |||||

| Exhibit E |

Form of Letter of Credit | |||||

| Exhibit F |

Rules and Regulations | |||||

| Exhibit G |

[Intentionally omitted] | |||||

| Exhibit H |

Tenant’s Personal Property | |||||

| Exhibit I |

Form of Estoppel Certificate | |||||

3. Term; Extension Option.

3.1 The initial term Lease shall be fifteen (15) months (the initial “Term”), starting on the Term Commencement Date and ending on the Term Expiration Date, subject to earlier termination of this Lease as provided herein.

3.2 Landlord hereby grants Tenant one (1) option to extend the initial fifteen (15) month Term of this Lease (the “Extension Option”) for one (1) additional period of twelve (12)

2

months (the “Extension Period”), all upon the same terms and conditions herein contained, except for: (a) Base Rent payable during the Extension Period shall be payable as described in Section 2.3, and (b) the Extension Option described herein shall not apply to any period following the Extension Period and Tenant shall have no further options to extend. The foregoing notwithstanding, Tenant shall not have the right to exercise the Extension Option if: (x) Tenant is in default of any term, condition or covenant contained in this Lease beyond the applicable notice and cure period, if any, either as of the date Tenant elects to exercise the Extension Option as provided below or at any time thereafter preceding the Extension Period, (y) Tenant has sublet, with Landlord’s consent, more than twenty-five percent (25%) of the Premises or assigned its interests under the Lease, except pursuant to an Exempt Transfer (as defined in Section 30.1), or (z) Tenant fails to timely exercise the Extension Option by delivering a written notice to Landlord not less than four (4) months prior to the expiration of the initial Term of this Lease. Tenant understands, acknowledges and agrees that time is of the essence with respect to Tenant’s exercise of its Extension Option rights, and that if Landlord has not actually received Tenant’s written notice of exercise of the Extension Option within the time periods set forth above, which time periods are to be strictly enforced, then Tenant’s Extension Option rights shall immediately expire and be of no further force or effect.

| 4. | Possession and Commencement Date. |

4.1 Landlord shall tender possession of the Premises to Tenant on the Term Commencement Date.

4.2 Failure by Tenant to obtain validation by any medical review board or validation of the Premises for Tenant’s intended use by State or Federal FDA shall not serve to extend the Term Commencement Date.

4.3 [Intentionally omitted].

4.4 Possession of areas of the Premises necessary for utilities, services, safety and operation of the Building is reserved to Landlord.

5. Condition of Premises. Tenant acknowledges that neither Landlord nor any agent of Landlord has made any representation or warranty with respect to the condition of the Premises, the Building or the Project, or with respect to the suitability of the Premises, the Building or the Project for the conduct of Tenant’s business. Tenant acknowledges that (a) it is fully familiar with the condition of the Premises and agrees to take the same in its condition “as is” as of the Term Commencement Date and (b) Landlord shall have no obligation to alter, repair or otherwise prepare the Premises for Tenant’s occupancy or to pay for or construct any improvements to the Premises. Notwithstanding the foregoing, if Tenant determines within the first thirty (30) days following the Commencement Date that any of the Building systems serving the Premises are not in working order (consistent with the applicable manufacturer’s specifications), Landlord shall promptly rectify any such condition or detect at its sole cost and expense after receipt of written notice from Tenant within such time setting forth the nature and extent of any such condition or defect. If after expiration of such initial thirty (30) day period, Tenant is required to make repairs to any component of the Premises for which Landlord may have obtained a warranty, Landlord shall, upon request by Tenant, use its good faith efforts to pursue its rights under any such warranties for the benefit of Tenant. Tenant’s taking of possession of the Premises shall, except as otherwise agreed to in writing by Landlord and Tenant, conclusively establish that the Premises, the Building and the Project were at such time in good, sanitary and satisfactory condition and repair. Landlord and Tenant agree and acknowledge that the Exit Audit Report for Gemini Science dated August 20, 2006, performed by URS, the radioactive materials license release survey referenced therein, and the fume hood decontamination report dated July 18, 2008, shall constitute the baseline environmental condition of the Premises (the “Baseline Phase I”) and, notwithstanding anything to the contrary in Article 27, Tenant shall have no obligation to perform any remediation recommendations that are inconsistent with the Baseline Phase I environmental condition of the Premises.

| 6. | [Intentionally omitted] |

| 7. | Rentable Area. |

3

7.1 The term “Rentable Area” shall reflect such areas as reasonably calculated by Landlord’s architect (in accordance with Landlord’s modified BOMA standards consistently applied throughout the Term), as the same may be reasonably adjusted from time to time by Landlord in consultation with Landlord’s architect to reflect physical changes to the Premises or Building, as applicable.

7.2 The Rentable Area of the Building is generally determined by making separate calculations of Rentable Area applicable to each floor within the Building and totaling the Rentable Area of all floors within the Building. The Rentable Area of a floor is computed by measuring to the outside finished surface of the permanent outer Building walls. The full area calculated as previously set forth is included as Rentable Area, without deduction for columns and projections or vertical penetrations, including stairs, elevator shafts, flues, pipe shafts, vertical ducts and the like, as well as such items’ enclosing walls.

7.3 The term “Rentable Area” when applied to the Premises, is that area equal to the usable area of the Premises, plus an equitable allocation of Rentable Area within the Building that is not then utilized or expected to be utilized as usable area, including, but not limited to, that portion of the Building devoted to corridors, equipment rooms, restrooms, elevator lobby, atrium and mailroom.

8. Rent.

8.1 Tenant shall pay to Landlord as Base Rent for the Premises, commencing on the Term Commencement Date, the sums set forth in Section 2.3. Base Rent shall be paid in equal monthly installments as set forth in Section 2.3, each in advance on the first day of each and every calendar month during the Term.

8.2 In addition to Base Rent, Tenant shall pay to Landlord as additional rent (“Additional Rent”) at times hereinafter specified in this Lease (a) Tenant’s pro rata share, as set forth in Section 2.2 (“Tenant’s Pro Rata Share”), of Operating Expenses (as defined below) and (b) any other amounts that Tenant assumes or agrees to pay under the provisions of this Lease that are owed to Landlord, including, without limitation, any and all other sums that may become due by reason of any default of Tenant or failure on Tenant’s part to comply with the agreements, terms, covenants and conditions of this Lease to be performed by Tenant, after notice and the lapse of any applicable cure periods.

8.3 Base Rent and Additional Rent shall together be denominated “Rent.” Rent shall be paid to Landlord, without abatement, deduction or offset, in lawful money of the United States of America at the office of Landlord as set forth in Section 2.8 or to such other person or at such other place as Landlord may from time designate in writing. In the event the Term commences or ends on a day other than the first day of a calendar month, then the Rent for such fraction of a month shall be prorated for such period on the basis of a thirty (30) day month and shall be paid at the then-current rate for such fractional month.

9. [Intentionally omitted]

10. Operating Expenses.

10.1 As used herein, the term “Operating Expenses” shall include:

(a) Government impositions including, without limitation, property tax costs consisting of real and personal property taxes and assessments, including amounts due under any improvement bond upon the Building or the Project, including the parcel or parcels of real property upon which the Building and areas serving the Building are located or assessments in lieu thereof imposed by any federal, state, regional, local or municipal governmental authority, agency or subdivision (each, a “Governmental Authority”) are levied; taxes on or measured by gross rentals received from the rental of space in the Project; taxes based on the square footage of the Premises, the Building or the Project, as well as any parking charges, utilities surcharges or any other costs levied, assessed or imposed by, or at the direction of, or resulting from Applicable Laws (as defined below) or interpretations thereof, promulgated by any Governmental Authority in connection with the use or occupancy of the Project or the parking facilities serving

4

the Project; taxes on this transaction or any document to which Tenant is a party creating or transferring an interest in the Premises, and fee for a business license to operate an office building; and any expenses, including the reasonable cost of attorneys or experts, reasonably incurred by Landlord in seeking reduction by the taxing authority of the applicable taxes, less tax refunds obtained as a result of an application for review thereof Operating Expenses shall not include any net income, franchise, capital stock, estate or inheritance taxes, or taxes that are the personal obligation of Tenant or of another tenant of the Project; and

(b) All other costs of any kind paid or incurred by Landlord in connection with the operation or maintenance of the Building and the Project including, by way of example and not of limitation, costs of repairs and replacements to improvements within the Project as appropriate to maintain the Project as required hereunder, including costs of funding such reasonable reserves as Landlord, consistent with good business practice, may establish to provide for future repairs and replacements; costs of utilities furnished to the Common Areas; sewer fees; cable television; trash collection; cleaning, including windows; heating; ventilation; air-conditioning; maintenance of landscaping and grounds; maintenance of drives and parking areas; maintenance of the roof; security services and devices; building supplies; maintenance or replacement of equipment utilized for operation and maintenance of the Project; license, permit and inspection fees; sales, use and excise taxes on goods and services purchased by Landlord in connection with the operation, maintenance or repair of the Project or Building systems and equipment; telephone, postage, stationery supplies and other expenses incurred in connection with the operation, maintenance or repair of the Project; accounting, legal and other professional fees and expenses incurred in connection with the Project; costs of furniture, draperies, carpeting, landscaping and other customary and ordinary items of personal property provided by Landlord for use in Common Areas; annual amortization of capital expenditures in the Project, made for repairs, replacements or compliance with Applicable Laws (with the cost of such capital expenditures amortized on a straight-line basis over their useful lives in accordance with generally accepted accounting principles (but in no event longer than seven (7) years)); costs of remedying non-compliance existing as of the Execution Date with all federal, state, municipal and local laws, codes, ordinances, rules and regulations of Governmental Authorities, committees, associations, or other regulatory committees, agencies or governing bodies having jurisdiction over the Property, the Project, the Building, the Premises, Landlord or Tenant, including both statutory and common law and hazard waste rules and regulations (“Applicable Laws”); insurance premiums, including premiums for public liability, property casualty, earthquake, terrorism and environmental coverages; portions of insured losses paid by Landlord as part of the deductible portion of a loss pursuant to the terms of insurance policies; service contracts; costs of services of independent contractors retained to do work of a nature referenced above; and costs of compensation (including employment taxes and fringe benefits) of all persons who perform regular and recurring duties connected with the day-to-day operation and maintenance of the Project, its equipment, the adjacent walks, landscaped areas, drives and parking areas, including, without limitation, janitors, floor waxers, window washers, watchmen, gardeners, sweepers and handymen.

Notwithstanding the foregoing, Operating Expenses shall not include any leasing commissions; expenses that relate to preparation of rental space for a tenant; expenses of initial development and construction, including, but not limited to, grading, paving, landscaping and decorating (as distinguished from maintenance, repair and replacement of the foregoing); legal expenses relating, to other tenants; costs of repairs to the extent reimbursed by payment of insurance proceeds received by Landlord; interest, principal, points or fees upon loans to Landlord or secured by a mortgage or deed of trust covering the Project or a portion thereof (provided that interest upon a government assessment or improvement bond payable in installments shall constitute an Operating Expense under Subsection 10.1(a)); salaries, benefits and other compensation of executive officers of Landlord; depreciation claimed by Landlord for tax purposes (provided that this exclusion of depreciation is not intended to delete from Operating Expenses actual costs of repairs and replacements and reasonable reserves in regard thereto that are provided for in Subsection 10.1(b)); taxes that are excluded from Operating Expenses by the last sentence of Subsection 10.1(a); costs incurred for the repair, maintenance or replacement of the structural components of the footings, foundation, ground floor slab, and load bearing walls of the Building (but excluding painting and ordinary maintenance and repair of exterior surfaces); costs recovered under any construction or materials warranty procured by

5

Landlord; costs of any kind, including attorneys’ fees, incurred to correct any defects in design, materials or construction of the Project existing as or the Execution Date; costs, expenses and penalties (including, without limitation, attorneys’ fees) incurred as a result of the use, storage, removal or remediation of any toxic or hazardous substances or other environmental contamination caused by Landlord or its employees, contractors, agents or representatives; costs incurred in connection with the financing, sale or acquisition of the Project or any portion thereof, any costs incurred as a result of Landlord’s violation of any statute, ordinance or other Applicable Law, Landlord’s breach of this Lease, or Landlord’s or its employees’, agents’ or representatives’ tort liability to any other party, including, without limitation, any third party; the cost of any work or service performed for or facilities furnished to another occupant of the Project at such occupant’s cost; any interest or penalties imposed upon Landlord by any taxing authority for late payment; any other expense otherwise chargeable as Operating Expenses but that is not of general benefit to the Project but is for the benefit of one or more specific tenants and not for Tenant; and the amount of any payments to subsidiaries and affiliates of Landlord for services to the Project or for supplies or other materials to the extent that the cost of such services, supplies or materials materially exceeds the cost that would have been paid had the services, supplies or materials been provided by unaffiliated parties on a competitive basis. To the extent that Tenant uses more than Tenant’s Pro Rata Share of any item of Operating Expenses, Tenant shall pay Landlord for such excess in addition to Tenant’s obligation to pay Tenant’s Pro Rata Share of Operating Expenses.

10.2 Tenant shall pay to Landlord on the first day of each calendar month of the Term, as Additional Rent, (a) the Property Management Fee (as defined below) and (b) Landlord’s estimate of Tenant’s Pro Rata Share of Operating Expenses with respect to the Building and the Project, as applicable, for such month.

(x) The “Property Management Fee” shall equal three percent (3%) of the Base Rent due from Tenant.

(y) Within ninety (90) days after the conclusion of each calendar year (or such longer period as may be reasonably required by Landlord). Landlord shall furnish to Tenant a statement showing in reasonable detail the actual Operating Expenses and Tenant’s Pro Rata Share of Operating Expenses for the previous calendar year. Any additional sum due from Tenant to Landlord shall be immediately due and payable. If the amounts paid by Tenant pursuant to this Section 10.2 exceed Tenant’s Pro Rata Share of Operating Expenses for the previous calendar year, then Landlord shall credit the difference against the Rent next due and owing from Tenant; provided that, if the Lease term has expired, Landlord shall accompany said statement with payment for the amount of such difference.

(z) Any amount due under this Section 10.2 for any period that is less than a full month shall be prorated (based on a thirty (30)-day month) for such fractional month.

10.3 Landlord’s annual statement shall be final and binding upon Tenant unless Tenant, within sixty (60) days after Tenant’s receipt thereof shall contest any item therein by giving written notice to Landlord, specifying each item contested and the reasons therefor. If, during such sixty (60)-day period, Tenant reasonably and in good faith questions or contests the correctness of Landlord’s statement of Tenant’s Pro Rata Share of Operating Expenses, Landlord shall provide Tenant with reasonable access to Landlord’s books and records to the extent relevant to determination of Operating Expenses, and such information as Landlord reasonably determines to be responsive to Tenant’s written inquiries. In the event that, after Tenant’s review of such information, Landlord and Tenant cannot agree upon the amount of Tenant’s Pro Rata Share of Operating Expenses, then Tenant shall have the right to have an independent public accounting firm hired by Tenant on an hourly basis and not on a contingent-fix basis (at Tenant’s sole cost and expense) and approved by Landlord (which approval Landlord shall not unreasonably withhold or delay) audit and review such of Landlord’s books and records for the year in question as directly relate to the determination of Operating Expenses for such year (the “Independent Review”). Landlord shall make such books and records available at the location where Landlord maintains them in the ordinary course of its business. Landlord need not provide copies of any books or records. Tenant shall commence the Independent Review within thirty (30) days after the date Landlord has given Tenant access to Landlord’s books and records for the Independent Review. Tenant shall complete the Independent Review and notify Landlord in

6

writing of Tenant’s specific objections to Landlord’s calculation of Operating Expenses (including Tenant’s accounting firm’s written statement of the basis, nature and amount of each proposed adjustment) no later than sixty (60) days after Landlord has first given Tenant access to Landlord’s books and records for the Independent Review. Landlord shall review the results of any such Independent Review. The parties shall endeavor to agree promptly and reasonably upon Operating Expenses taking into account the results of such Independent Review. If as of sixty (60) days after Tenant has submitted the Independent Review to Landlord, the parties have not agreed on the appropriate adjustments to Operating Expenses, then the parties shall engage a mutually agreeable independent third party accountant with at least ten (10) years’ experience in commercial real estate accounting in the San Diego area (the “Accountant”). If the parties cannot agree on the Accountant, each shall within ten (10) days after such impasse appoint an Accountant (different from the accountant and accounting firm that conducted the Independent Review) and, within ten (10) days after the appointment of both such Accountants, those two Accountants shall select a third (which cannot be the accountant and accounting firm that conducted the Independent Review). If either party fails to timely appoint an Accountant, then the Accountant the other party appoints shall be the sole Accountant. Within ten (10) days after appointment of the Accountant(s), Landlord and Tenant shall each simultaneously give the Accountants (with a copy to the other party) its determination of Operating Expenses, with such supporting data or information as each submitting party determines appropriate. Within ten (10) days after such submissions, the Accountants shall by majority vote select either Landlord’s or Tenant’s determination of Operating Expenses. The Accountants may not select or designate any other determination of Operating Expenses. The determination of the Accountant(s) shall bind the parties. If the parties agree or the Accountant(s) determine that Tenant’s Pro Rata Share of Operating Expenses actually paid for the calendar year in question exceeded Tenant’s obligations for such calendar year, then Landlord shall, at Tenant’s option, either (a) credit the excess to the next succeeding installments of estimated Additional Rent or (b) pay the excess to Tenant within thirty (30) days after delivery of such results. If the parties agree or the Accountant(s) determine that Tenant’s payments of Tenant’s Pro Rata Share of Operating Expenses for such calendar year were less than Tenant’s obligation for the calendar year, then Tenant shall pay the deficiency to Landlord within thirty (30) days after delivery of such results. If the parties agree or the Accountant(s) determines that Tenant has overpaid with respect to Tenant’s Pro Rata Share of Operating Expenses by more than five percent (5%), then Landlord shall pay Tenant for the reasonable costs of the Independent Review and the Accountant(s),

10.4 Tenant shall not be responsible for Operating Expenses attributable to the time period prior to the Term Commencement Date nor any prepayment of Operating Expenses for any period after the expiration or earlier termination of this Lease (except as provided in Section 10.5 below). Tenant’s responsibility for Tenant’s Pro Rata Share of Operating Expenses shall continue to the latest of (a) the date of termination of the Lease, (b) the date Tenant has fully vacated the Premises or (c) if termination of the Lease is due to a default by Tenant, the date of rental commencement of a replacement tenant.

10.5 Operating Expenses for the calendar year in which Tenant’s obligation to share therein commences and for the calendar year in which such obligation ceases shall be prorated on a basis reasonably and equitably determined by Landlord. Expenses such as taxes, assessments and insurance premiums that are incurred for an extended time period shall be prorated based upon the time periods to which they apply so that the amounts attributed to the Premises relate in a reasonable manner to the time period wherein Tenant has an obligation to share in Operating Expenses.

10.6 Within three (3) business days after the end of each calendar month, Tenant shall submit to Landlord an invoice, or, in the event an invoice is not available, an itemized list, of all costs and expenses that (a) Tenant has incurred (either internally or by employing third parties) during the prior month and (b) tor which Tenant reasonably believes it is entitled to reimbursements from Landlord pursuant to the terms of this Lease.

11. Taxes on Tenant’s Property.

11.1 Tenant shall pay prior to delinquency any and all taxes levied against any personal property or trade fixtures placed by Tenant in or about the Premises.

7

11.2 If any such taxes on Tenant’s personal property or trade fixtures are levied against Landlord or Landlord’s property or, if the assessed valuation of the Building or the Property is increased by inclusion therein of a value attributable to Tenant’s personal property or trade fixtures, and if Landlord, after written notice to Tenant, pays the taxes based upon any such increase in the assessed valued of the Building or the Project, then Tenant shall, upon demand, repay to Landlord the taxes so paid by Landlord; provided that Tenant shall not be liable for such assessments associated with the value of any other tenant’s personal property or trade fixtures as part of Operating Expenses.

11.3 If any improvements in or alterations to the Premises, whether owned by Landlord or Tenant and whether or not affixed to the real property so as to become a part thereof, are assessed for real property tax purposes at a valuation higher than the valuation at which improvements conforming to Landlord’s building standards the “Building Standard”) in other spaces in the Building are assessed, then the real property taxes and assessments levied against Landlord or the Building by reason of such excess assessed valuation shall be deemed to be taxes levied against personal property of Tenant and shall be governed by the provisions of Section 11.2. Any such excess assessed valuation due to improvements in or alterations to space in the Building leased by other tenants of Landlord shall not be included in the Operating Expenses defined in Article 10, but shall be treated, as to such other tenants, as provided in this Section 11.3. If the records of the County Assessor are available and sufficiently detailed to serve as a basis for determining whether said Tenant improvements or alterations are assessed at a higher valuation than the Building Standard, then such records shall be binding on both Landlord and Tenant.

12. Security Deposit.

12.1 Tenant has deposited with Landlord the sum set forth in Section 2.6 the (“Security Deposit”), which sum shall be held by Landlord as security for the faithful performance by Tenant of all of the terms, covenants and conditions of this Lease to be kept and performed by Tenant during the period commencing on the Execution Date and ending upon the expiration or termination of this Lease. If Tenant defaults with respect to any provision of this Lease, including, but not limited to, any provision relating to the payment of Rent, then Landlord may (but shall not be required to) use, apply or retain all or any part of the Security Deposit for the payment of any Rent or any other sum in default, or to compensate Landlord for any other loss or damage that Landlord may suffer by reason of Tenant’s default. If any portion of the Security Deposit is so used or applied, then Tenant shall, within ten (10) business days following demand therefor, deposit cash with Landlord in an amount sufficient to restore the Security Deposit to its original amount, and Tenant’s failure to do so shall be a material breach of this Lease. The provisions of this Article 12 shall survive the expiration or earlier termination of this Lease. TENANT HEREBY WAIVES THE REQUIREMENTS OF SECTION 1950.7 OF THE CALIFORNIA CIVIL CODE, AS THE SAME MAY BE AMENDED FROM TIME TO TIME.

12.2 In the event of bankruptcy or other debtor-creditor proceedings against Tenant, the Security Deposit shall be deemed to be applied first to the payment of Rent and other charges due Landlord for all periods prior to the tiling of such proceedings.

12.3 Landlord may deliver to any purchaser of Landlord’s interest in the Premises the funds deposited hereunder by Tenant, and thereupon Landlord shall be discharged from any further liability with respect to such deposit. This provision shall also apply to any subsequent transfers.

12.4 If Tenant shall fully and faithfully perform every provision of this Lease to be performed by it, then the Security Deposit, or any balance thereof, shall be returned to Tenant (or, at Landlord’s option, to the last assignee of Tenant’s interest hereunder) within thirty (30) days after the expiration or earlier termination of this Lease.

12.5 [Intentionally omitted]

12.6 If the Security Deposit shall be in cash. Landlord shall hold the Security Deposit in an account at a banking organization selected by Landlord; provided, however, that Landlord shall not be required to maintain a separate account for the Security Deposit, but may intermingle

8

it with other funds of Landlord. Landlord shall be entitled to all interest and/or dividends, if any, accruing on the Security Deposit. Landlord shall not be required to credit Tenant with any interest for any period during which Landlord does not receive interest on the Security Deposit.

12.7 The Security Deposit may be in the form of cash, a letter of credit or any other security instrument acceptable to Landlord in its sole discretion. Tenant may at any time, except during Default (as defined below), deliver a letter of credit (the “L/C Security”) as the entire Security Deposit, as follows.

12.7.1 If Tenant elects to deliver L/C Security, then Tenant shall provide Landlord and maintain in full force and effect throughout the Term, a letter of credit in the form of Exhibit E issued by an issuer reasonably satisfactory to Landlord, in the amount of the Security Deposit, with an initial term of at least one year. If, at the Term Expiration Date, any Rent remains uncalculated or unpaid, then: (i) Landlord shall with reasonable diligence complete any necessary calculations; (ii) Tenant shall extend the expiry date of such L/C Security from time to time as Landlord reasonably requires; and (iii) in such extended period, Landlord shall not unreasonably refuse to consent to an appropriate reduction of the L/C Security. Tenant shall reimburse Landlord’s legal costs (as estimated by Landlord’s counsel) in handling Landlord’s acceptance of L/C Security or its replacement or extension.

12.7.2 If Tenant delivers to Landlord satisfactory L/C Security in place of the entire Security Deposit, Landlord shall remit to Tenant any cash Security Deposit Landlord previously held.

12.7.3 Landlord may draw upon the L/C Security, and hold and apply the proceeds in the same manner and for the same purposes as the Security Deposit, if: (i) an uncured Default (as defined below) exists; (ii) as of the date forty-five (45) days before any L/C Security expires (even if such scheduled expiry date is after the Term Expiration Date) Tenant has not delivered to Landlord an amendment or replacement for such L/C Security, reasonably satisfactory to Landlord, extending the expiry date to the earlier of (1) six (6) months after the then-current Term Expiration Date or (2) the date one year after the then-current expiry date of the L/C Security; (iii) the L/C Security provides for automatic renewals, Landlord asks the issuer to confirm the current L/C Security expiry date, and the issuer fails to do so within ten (10) business days; (iv) Tenant fails to pay (when and as Landlord reasonably requires) any bank charges for Landlord’s transfer of the L/C Security; or (v) the issuer of the L/C Security ceases, or announces that it will cease, to maintain an office in the city where Landlord may present drafts under the L/C Security. This paragraph does not limit any other provisions of this Lease allowing Landlord to draw the L/C Security under specified circumstances.

12.7.4 Tenant shall not seek to enjoin, prevent, or otherwise interfere with Landlord’s draw under L/C Security, even if it violates this Lease. Tenant acknowledges that the only effect of a wrongful draw would be to substitute a cash Security Deposit for L/C Security, causing Tenant no legally recognizable damage. Landlord shall hold the proceeds of any draw in the same manner and for the same purposes as a cash Security Deposit. In the event of a wrongful draw, the parties shall cooperate to allow Tenant to post replacement L/C Security simultaneously with the return to Tenant of the wrongfully drawn sums, and Landlord shall upon request confirm in writing to the issuer of the L/C Security that Landlord’s draw was erroneous.

12.7.5 If Landlord transfers its interest in the Premises, then Tenant shall at Tenant’s expense, within five (5) Business Days after receiving a request from Landlord, deliver (and, if the issuer requires. Landlord shall consent to) an amendment to the L/C Security naming Landlord’s grantee as substitute beneficiary. If the required Security changes while L/C Security is in force, then reliant shall deliver (and, if the issuer requires, Landlord shall consent to) a corresponding amendment to the L/C Security.

13. Use.

13.1 Tenant shall use the Premises for the purpose set forth in Section 2.7, and shall not use the Premises, or permit or suffer the Premises to be used, for any other purpose without Landlord’s prior written consent, which consent Landlord may withhold in its sole and absolute discretion.

9

13.2 Tenant shall not use or occupy the Premises in violation of Applicable Laws; zoning ordinances; or the certificate of occupancy issued for the Building, and shall, upon five (5) days’ written notice from Landlord, discontinue any use of the Premises that is declared or claimed by any Governmental Authority having jurisdiction to be a violation of any of the above, or that in Landlord’s reasonable opinion violates any of the above. Tenant shall comply with any direction of any Governmental Authority having jurisdiction that shall, by reason of the nature of Tenant’s use or occupancy of the Premises, impose any duty upon Tenant or Landlord with respect to the Premises or with respect to the use or occupation thereof. Tenant shall not be deemed to be in default of the foregoing obligation if it has the right to appeal such directive and Tenant prosecutes such appeal in a timely fashion and in a manlier that does not impose or threaten to impose any lien, charge or other obligation on Landlord or any portion of the Project.

13.3 Tenant shall not do or permit to be done anything that will invalidate or increase the cost of any fire, environmental, extended coverage or any other insurance policy covering the Building and the Project and underwritten for building uses consistent with the Permitted Use, and shall comply with all rules, orders, regulations and requirements of the insurers of the Building and the Project consistent with market insurance requirements, and Tenant shall promptly, upon demand, reimburse Landlord for any additional premium charged for such policy by reason of Tenant’s failure to comply with the provisions of this Article 13.

13.4 Tenant shall keep all doors opening onto public corridors closed, except when in use for ingress and egress.

13.5 No additional locks or bolts of any kind shall be placed upon any of the doors or windows by Tenant, nor shall any changes be made to existing locks or the mechanisms thereof without Landlord’s prior written consent. Tenant shall, upon termination of this Lease, return to Landlord all keys to offices and restrooms either furnished to or otherwise procured by Tenant. In the event any key so furnished to Tenant is lost, Tenant shall pay to Landlord the cost of replacing the same or of changing the lock or locks opened by such lost key if Landlord shall deem it necessary to make such change.

13.6 No awnings or other projections shall be attached to any outside wall of the Building. No curtains, blinds, shades or screens shall be attached to or hung in, or used in connection with, any window or door of the Premises other than Landlord’s standard window coverings. Neither the interior nor exterior of any windows shall be coated or otherwise sunscreened without Landlord’s prior written consent, nor shall any bottles, parcels or other articles be placed on the windowsills. No equipment, furniture or other items of personal property shall be placed on any exterior balcony without Landlord’s prior written consent.

13.7 No sign, advertisement or notice (“Signage”) shall be exhibited, painted or affixed by Tenant on any part of the Building without Landlord’s prior written consent. Interior signs on doors and the directory tablet shall be inscribed, painted or affixed for Tenant by Landlord at Tenant’s sole cost and expense, and shall be of a size, color and type and be located in a place acceptable to Landlord. The directory tablet shall be provided exclusively for the display of the name and location of tenants only. Tenant shall not place anything on the exterior of the corridor walls or corridor doors other than Landlord’s standard lettering. Tenant shall have Signage rights for the Premises substantially consistent with the Signage permitted for other comparable Tenants in the Project, as Landlord reasonably determines. At Landlord’s option, Landlord may install any such Signage, and Tenant shall pay all costs associated with such installation within five (5) days after demand therefor.

13.8 Tenant shall only place equipment within the Premises with floor loading consistent with the structural design of the Building without Landlord’s prior written approval, and such equipment shall be placed in a location designed to carry the weight of such equipment.

13.9 Tenant shall cause any office equipment or machinery to be installed in the Premises so as to reasonably prevent sounds or vibrations therefrom from extending into the Common Areas or other offices in the Building.

13.10 Tenant shall not (a) do or permit anything to be done in or about the Premises that shall in any way obstruct or interfere with the rights of other tenants or occupants of the Building

10

or the Project, or injure or annoy them, (b) use or allow the Premises to be used for immoral, unlawful or objectionable purposes, (c) cause, maintain or permit any nuisance or waste in, on or about the Premises, the Building or the Project or (d) take any other action that would in Landlord’s reasonable determination in any manner adversely affect other tenants’ quiet use and enjoyment of their space or adversely impact their ability to conduct business in a professional and suitable work environment.

13.11 Landlord shall remedy at its sole cost and expense any non-compliance of the Premises as of the Execution Date with the Americans with Disabilities Act, 42 U.S.C. § 12101, et seq. (together with regulations promulgated pursuant thereto, the “ADA”). Landlord shall indemnify, defend and hold harmless Tenant from and against any Claims (as defined below) arising out of Landlord’s failure to comply with the preceding sentence.

13.12 Subject to the foregoing Landlord obligations. Tenant shall be responsible for all liabilities, costs and expenses arising out of or in connection with the compliance of the Premises with the ADA, and Tenant shall indemnify, defend and hold harmless Landlord from and against any Claims (as defined below) arising out of any such failure of the Premises to comply with the ADA.

14. Rules and Regulations, Parking Facilities and Common Areas.

14.1 Tenant shall have the non-exclusive right, in common with others, to use the Common Areas, subject to the rules and regulations adopted by Landlord and attached hereto as Exhibit F, together with such other reasonable and nondiscriminatory rules and regulations as are hereafter promulgated by Landlord in its sole and absolute discretion (the “Rules and Regulations”). Tenant shall faithfully observe and comply with the Rules and Regulations to the extent consistent with the express terms of this Lease. Landlord shall not be responsible to Tenant for the violation or non-performance by any other tenant or any agent, employee or invitee thereof of any of the Rules and Regulations.

14.2 [Intentionally omitted]

14.3 Tenant shall have a non-exclusive, revocable license to use Tenant’s Pro Rata Share of parking facilities serving the Building in common on an unreserved basis with other tenants of the Building and the Project; provided that (a) Tenant shall be entitled to not less than three (3) spaces per one thousand (1,000) rentable square feet of the Premises, (b) such license shall be irrevocable as long as Tenant is not in Default under this Lease and (c) if Landlord grants any other tenant of the Building exclusive parking rights in the parking area of the Project, Tenant shall have the right Tenant’s Pro Rata Share of exclusive parking in the Project parking areas.

14.4 Tenant agrees not to unreasonably overburden the parking facilities and agrees to cooperate with Landlord and other tenants in the use of the parking facilities. Landlord reserves the right to determine that parking facilities are becoming overcrowded and to limit Tenant’s use thereof, but not less than Tenant’s Pro Rata Share thereof. Upon such determination, Landlord may reasonably allocate parking spaces among Tenant and other tenants of the Building or the Project. Nothing in this Section, however, is intended to create an affirmative duty on Landlord’s part to monitor parking.

14.5 Landlord reserves the right to modify the Common Areas, including the right to add or remove exterior and interior landscaping and to subdivide real property. Tenant acknowledges that Landlord specifically reserves the right to allow the exclusive use of corridors and restroom facilities located on specific floors to one or more tenants occupying such floors; provided, however, that Tenant shall not be deprived of the use of the corridors reasonably required to serve the Premises or of restroom facilities serving the floor upon which the Premises are located.

14.6 Tenant shall have the non-exclusive right to reasonable use of the shipping dock and shipping and receiving areas of the Building, including shipping and receiving support services by Landlord’s agent, during the hours of 8:30 a.m. and 4:00 p.m. daily (other than on non-business days).

11

15. Project Control by Landlord.

15.1 Landlord reserves full control over the Building and the Project to the extent not inconsistent with Tenant’s enjoyment of the Premises as provided by this Lease. This reservation includes, without limitation, Landlord’s right to subdivide the Project, convert the Building to condominium units, grant casements and licenses to third parties, and maintain or establish ownership of the Building separate from fee title to the Property.

15.2 Possession of areas of the Premises necessary for utilities, services, safety and operation of the Building is reserved to Landlord.

15.3 Tenant shall, at Landlord’s request, promptly execute such further documents as may be reasonably appropriate to assist Landlord in the performance of its obligations hereunder; provided that Tenant need not execute any document that creates additional liability for Tenant or that deprives Tenant of the quiet enjoyment and use of the Premises as provided for in this Lease.

15.4 Landlord may, at any and all reasonable times during non-business hours (or during business hours if Tenant so requests), and upon twenty-four (24) hours’ prior notice and subject to personal escort by a Tenant employee in which Tenant shall make available to Landlord; provided that no time restrictions or escort requirement shall apply or advance notice be required if an emergency threatening immediate damage to Landlord’s property or injury to persons in the Building necessitates immediate entry), enter the Premises to (a) inspect the same and to determine whether Tenant is in compliance with its obligations hereunder, (b) supply any service Landlord is required to provide hereunder, (c) show the Premises to prospective purchasers or tenants during the final six (6) months of the Term, (d) post notices of nonresponsibility, (e) access the telephone equipment, electrical substation and fire risers and (f) alter, improve or repair any portion of the Building other than the Premises for which access to the Premises is reasonably necessary. In connection with any such alteration, improvement or repair as described in Subsection 15.4( f), Landlord may erect in the Premises or elsewhere in the Project scaffolding and other structures reasonably required for the alteration, improvement or repair work to be performed; provided that such activities shall not unreasonably interfere with Tenant’s Permitted Use of the Premises. In no event shall Tenant’s Rent xxxxx as a result of Landlord’s activities pursuant to this Section 15.4; provided, however, that all such activities shall be conducted in such a manner so as to cause as little interference to Tenant as is reasonably possible. Landlord shall at all times retain a key with which to unlock all of the doors in the Premises. If an emergency necessitates immediate access to the Premises, Landlord may use whatever force is necessary to enter the Premises, and any such entry to the Premises shall not constitute a forcible or unlawful entry to the Premises, a detainer of the Premises, or an eviction of Tenant from the Premises or any portion thereof.

16. Quiet Enjoyment. So long as Tenant is not in Default under this Lease, Landlord or anyone acting through or under Landlord shall not disturb Tenant’s occupancy of the Premises, except as permitted by this Lease.

17. Utilities and Services.

17.1 As part of the Operating Expenses, Landlord shall provide those utilities and services set forth on Exhibit B to this Lease. Tenant shall pay for such utilities and services, and all other water (including the cost to service, repair and replace any reverse osmosis, de-ionized and other treated water systems), gas, heat, light, power, telephone, internet service, cable television, other telecommunications and other utilities supplied to the Premises, together with any fees, surcharges and taxes thereon as a reasonable proportion (to be equitably determined by Landlord) of all charges of such utility jointly metered with other premises as part of Tenant’s Pro Rata Share of Operating Expenses. Tenant’s employees operating at the Project shall have the non-exclusive right to reasonable use of the Building’s workout room (subject to each employee’s and Tenant’s execution of Landlord’s standard form of liability waiver and release), and Tenant shall have the right to use the Common Area conference rooms and video conference facility on a “first come, first served” basis.

17.2 Landlord shall not be liable for, nor shall any eviction of Tenant result from, the failure to furnish any utility or service, whether or not such failure is caused by Force Majeure;

12

provided, however, that Landlord hereby represents and warrants that as of the date of this Lease, the emergency generator and UPS system serving the Building are operable and have sufficient capacity to carry Landlord’s reasonable estimate of the electrical load requirements of the tenants of the Building in the event of a power interruption. In the event of such failure, as long as such failure is not attributable to the gross negligence or intentional misconduct of Landlord or any of its agents or employees. Tenant shall not be entitled to termination of this Lease or any abatement or reduction of Rent, nor shall Tenant be relieved from the operation of any covenant or agreement of this Lease.

17.3 Tenant shall pay for, prior to delinquency of payment therefor, any utilities and services that may be furnished to the Premises during or, if Tenant occupies the Premises after the expiration or earlier termination of the Term, after the Term.

17.4 Tenant shall not, without Landlord’s prior written consent, use any device in the Premises (including, without limitation, data processing machines) that will in any way (a) increase the amount of ventilation, air exchange, gas, steam, electricity or water beyond the existing capacity of the Building as proportionately allocated to the Premises based upon Tenant’s Pro Rata Share as usually furnished or supplied for the use set forth in Section 2.7 or (b) exceed Tenant’s Pro Rata Share of the Building’s capacity to provide such utilities or services.

17.5 If Tenant shall require utilities or services in excess of those usually furnished or supplied for tenants in similar spaces in the Building by reason of Tenant’s equipment or extended hours of business operations, then Tenant shall first procure Landlord’s consent for the use thereof, which consent Landlord may condition upon the availability of such excess utilities or services, and Tenant shall pay as Additional Rent an amount equal to the cost of providing such excess utilities and services. Notwithstanding the foregoing, as part of Operating Expenses Tenant shall have the right to have Landlord’s agent perform autoclave and glass washing services for Tenant’s laboratory glassware in the Common Area glass washing facility between the hours of 7:30 a.m. and 4:00 p.m. daily (excluding non-business days); provided that Tenant shall xxxx and inventory any items provided to Landlord’s agent for washing; and further provided that Landlord shall cause its agent to provide such autoclave and glass washing services in a manner consistent with customary levels of quality and timeliness for such services in the San Diego market.

17.6 Utilities and services provided by Landlord to the Premises that are separately metered shall be paid by Tenant directly to the supplier of such utility or service.

17.7 Landlord shall provide water in Common Areas for lavatory purposes only.

17.8 Subject to Landlord’s obligation to repair and maintain in operation in accordance with this Lease the emergency generator and other UPS equipment serving the Building, Landlord reserves the right to stop service of the elevator, plumbing, ventilation, air conditioning and electric systems, when Landlord deems necessary or desirable, due to accident, emergency or the need to make repairs, alterations or improvements, until such repairs, alterations or improvements shall have been completed, and Landlord shall further have no responsibility or liability for failure to supply elevator facilities, plumbing, ventilation, air conditioning or electric service when prevented from doing so by Force Majeure or a failure by a third party to deliver gas, oil or another suitable fuel supply not attributable to Landlord’s gross negligence or willful misconduct, or Landlord’s inability by exercise of reasonable diligence to obtain gas, oil or another suitable fuel. Without limiting the foregoing, it is expressly understood and agreed that any covenants on Landlord’s part to furnish any service pursuant to any of the terms, covenants, conditions, provisions or agreements of this Lease, or to perform any act or thing for the benefit of Tenant, shall not be deemed breached if Landlord is unable to furnish or perform the same by virtue of Force Majeure. Notwithstanding the foregoing, if all or a portion of the Premises is rendered untenantable due to the failure of any Building systems during the Term due to Landlord’s gross negligence or willful misconduct (including, without limitation, Landlord’s failure to timely pay utility bills), Tenant shall not be responsible for payment of Base Rent for any period after the first (1st) five (5) business days of such untenantability until such systems return to functionality; provided, however, that tenant shall promptly provide Landlord with written notice of the failure of any such Building systems.

13

17.9 For the Premises, Landlord shall (a) maintain and operate the heating, ventilating and air conditioning systems used for the Permitted Use only (“HVAC”) and (b) subject to clause (a) above, furnish HVAC as reasonably required (except as this Lease otherwise provides or as to any special requirements that arise from Tenant’s particular use of the Premises) for reasonably comfortable occupancy of the Premises twenty-four (24) hours a day, 365 or 366 days a year, and in compliance with the requirements set forth in Article 23 of this Lease.

18. Alterations.

18.1 Tenant shall make no alterations, additions or improvements in or to the Premises or engage in any construction, demolition, reconstruction, renovation, or other work (whether major or minor) of any kind in, at, or serving the Premises (“Alterations”) without Landlord’s prior written approval, which approval Landlord shall not unreasonably withhold; provided, however, that in the event any proposed Alteration affects (a) any structural portions of the Building, including exterior walls, roof, foundation or core of the Building, (b) the exterior of the Building or (c) any Building systems including elevator, plumbing, air conditioning, heating, electrical, security, life safety and power, then Landlord may withhold its approval with respect thereto in its sole and absolute discretion. Tenant shall, in making any such Alterations, use only those architects, contractors, suppliers and mechanics of which Landlord has given prior written approval, which approval shall be in Landlord’s sole and absolute discretion. In seeking Landlord’s approval, Tenant shall provide Landlord, at least fourteen (14) days in advance of any proposed construction, with plans, specifications, bid proposals, work contracts, requests for laydown areas and such other information concerning the nature and cost of the Alterations as Landlord may reasonably request and Landlord shall have five (5) business days thereafter to grant or withhold its consent. If Landlord does not notify Tenant of its decision within five (5) business days, Landlord shall be deemed to have given its approval. Notwithstanding any other provision contained herein, Tenant shall not be required to obtain Landlord’s prior consent for minor, non-structural cosmetic Alterations, such as painting or carpeting, that (v) do not affect any of the Building Systems, (w) are not visible from the exterior of the Premises, (x) do not affect the watertight character of the Building or its roof, (y) do not require a building permit and (z) cost less than Twenty Thousand Dollars ($20,000) per item of work and Seventy-Five Thousand Dollars ($75,000) in the aggregate during the Term (collectively, “Minor Changes”) so long as Tenant gives Landlord notice of the proposed Minor Change at least ten (10) days prior to commencing any Minor Change and complies with all other provisions of this Article 18 (except that Tenant shall not be required to obtain Landlord’s approval of any plans or specifications therefor).

18.2 Tenant shall not construct or permit to be constructed partitions or other obstructions that might interfere with free access to mechanical installation or service facilities of the Building, or interfere with the moving of Landlord’s equipment to or from the enclosures containing such installations or facilities.

18.3 Tenant shall accomplish any work performed on the Premises or the Building in such a manner as to permit any fire sprinkler system and fire water supply lines to remain fully operable at all times.

18.4 Any work performed on the Premises or the Building by Tenant or Tenant’s contractors shall be done at such times and in such manner as Landlord may from time to time designate. Tenant covenants and agrees that all work done by Tenant or Tenant’s contractors shall be performed in full compliance with Applicable Laws. Within thirty (30) days after completion of any Alterations (other than Minor Alterations). Tenant shall provide Landlord with complete “as-built” drawing print sets and electronic CADD files on disc (or files in such other current format in common use as Landlord reasonably approves or requires) showing any changes in the Premises.

18.5 Before commencing any work, Tenant shall give Landlord at least ten (10) days’ prior written notice of the proposed commencement of such work and shall, if required by Landlord, secure, at Tenant’s own cost and expense, a completion and lien indemnity bond satisfactory to Landlord for said work.

14

18.6 All Alterations, attached equipment, decorations, fixtures, trade fixtures, additions and improvements, subject to Section 18.8, attached to or built into the Premises, made by either of the Parties, including, without limitation, all floor and wall coverings, built-in cabinet work and paneling, sinks and related plumbing fixtures, laboratory benches, exterior venting fume hoods and walk-in freezers and refrigerators, ductwork, conduits, electrical panels and circuits, shall (unless, prior to such construction or installation, Landlord elects otherwise) become the property of Landlord upon the expiration or earlier termination of the Term, and shall remain upon and be surrendered with the Premises as a part thereof. The Premises shall at all times remain the property of Landlord and shall be surrendered to Landlord upon the expiration or earlier termination of this Lease. All trade fixtures, equipment, Alterations and Signage installed by or under Tenant that become an integral part of the Building structure or Building systems (i.e., cannot be removed without material damage to the Building structure or damage to the Building systems), shall be the property of Landlord; and all other trade fixtures, equipment and Alterations as listed on Exhibit H (as modified from time to time in accordance with Section 18.8 below) shall be the property of Tenant.

18.7 Tenant shall repair any damage to the Premises caused by Tenant’s removal of any property from the Premises. During any such restoration period, Tenant shall pay Rent to Landlord as provided herein as if said space were otherwise occupied by Tenant. The provisions of this Section shall survive the expiration or earlier termination of this Lease.

18.8 Except as provided in Section 18.6 and with respect to those items listed on Exhibit H attached hereto (as such exhibit may be updated from time to time by Tenant, with those additional trade fixtures satisfying the requirements for removal under Section 18.6, as approved by Landlord at the time installation of such trade fixtures is made), all business and trade fixtures, machinery and equipment, built-in furniture and cabinets, together with all additions and accessories thereto, installed in and upon the Premises shall be and remain the property of Landlord and shall not be moved by Tenant at any time during the Term. If Tenant shall fail to remove any of its effects from the Premises prior to termination of this Lease, then Landlord may, at its option, remove the same in any manner that Landlord shall choose and store said effects without liability to Tenant for loss thereof or damage thereto, and Tenant shall pay Landlord, upon demand, any costs and expenses incurred due to such removal and storage or Landlord may, at its sole option and without notice to Tenant, sell such property or any portion thereof at private sale and without legal process for such price as Landlord may obtain and apply the proceeds of such sale against any (a) amounts due by Tenant to Landlord under this Lease and (b) any expenses incident to the removal, storage and sale of said personal property.

18.9 Notwithstanding any other provision of this Article 18 to the contrary, in no event shall Tenant remove any improvement from the Premises as to which Landlord contributed payment without Landlord’s prior written consent, which consent Landlord may withhold in its sole and absolute discretion.

18.10 Tenant shall pay to Landlord an amount equal to two percent (2%) of the cost to Tenant of all changes installed by Tenant or its contractors or agents to cover Landlord’s overhead and expenses for plan review, coordination, scheduling and supervision thereof. For purposes of payment of such sum. Tenant shall submit to Landlord copies of all bills, invoices and statements covering the costs of such charges, accompanied by payment to Landlord of the fee set forth in this Section. Tenant shall reimburse Landlord for any extra expenses incurred by Landlord by reason of faulty work done by Tenant or its contractors, or by reason of delays caused by such work, or by reason of inadequate clean-up.

18.11 Within sixty (60) days after final completion of the Tenant Improvements (or any other Alterations performed by Tenant with respect to the Premises), Tenant shall submit to Landlord documentation showing the amounts expended by Tenant with respect to such Tenant Improvements or any other Alterations performed by Tenant with respect to the Premises), together with supporting documentation reasonably acceptable to Landlord.

18.12 Tenant shall require its contractors and subcontractors performing work on the Premises to name Landlord and its affiliates and lenders as additional insureds on their respective insurance policies.

15

18.13 If Tenant requests in writing that Landlord determine, at the time Landlord consents to any Alterations, which Alterations, if any, Landlord shall require be removed at the expiration of the Term, Landlord shall indicate along with its consent to such Alterations those items that Tenant must remove at the end of the Term.

19. Repairs and Maintenance.

19.1 Landlord shall repair and maintain the structural and exterior portions and Common Areas of the Building and the Project, including, without limitation, roofing and covering materials, foundations, exterior walls, plumbing, fire sprinkler systems (if any), heating, ventilating, air conditioning, elevators, and electrical systems (including, but not limited to, the emergency generator and any other UPS systems serving the Building) installed or furnished by Landlord. Any costs related to the repair or maintenance activities specified in this Section 19.1 shall be included as a part of Operating Expenses (subject to the exclusions set forth in Article 10), unless such repairs or maintenance is required in whole or in part because of any act, neglect, fault or omissions of Tenant, its agents, servants, employees or invitees, in which case Tenant shall pay to Landlord the cost of such repairs and maintenance.

19.2 Except for services of Landlord, if any, required by Section 19.1, and subject to the terms and conditions of Articles 25 and 26 below, Tenant shall at Tenant’s sole cost and expense maintain and keep the Premises and every part thereof in good condition and repair, damage thereto from ordinary wear and tear excepted. Tenant shall, upon the expiration or sooner termination of the Term, surrender the Premises to Landlord in as good of a condition as when received, ordinary wear and tear and damage due to casualty covered by Landlord’s insurance excepted. Landlord shall have no obligation to alter, remodel, improve, repair, decorate or paint the Premises or any part thereof except as provided in Section 19.1 of this Lease.

19.3 Landlord shall not be liable for any failure to make any repairs or to perform any maintenance that is an obligation of Landlord unless such failure shall persist for an unreasonable time (but not to exceed 30 days) after Tenant provides Landlord with written notice of the need of such repairs or maintenance. Tenant waives its rights under Applicable Laws now or hereafter in effect to make repairs at Landlord’s expense.

19.4 Repairs under this Article 19 that are obligations of Landlord are subject to allocation among Tenant and other tenants as Operating Expenses, except as otherwise provided in this Article 19 and in Article 10.

19.5 This Article 19 relates to repairs and maintenance arising in the ordinary course of operation of the Building and the Project and any related facilities. In the event of fire, earthquake, flood, vandalism, war, terrorism, natural disaster or similar cause of damage or destruction, Article 25 shall apply in lieu of this Article 19.

19.6 If any excavation shall be made upon land adjacent to or under the Building, or shall be authorized to be made, Tenant shall afford to the person causing or authorized to cause such excavation, license to enter the Premises for the purpose of performing such work as said person shall deem necessary or desirable to preserve and protect the Building from injury or damage and to support the same as long as such actions do not interfere with Tenant’s Permitted Use and occupancy of the Premises.

20. Liens.

20.1 Subject to the immediately succeeding sentence, Tenant shall keep the Premises, the Building and the Project free from any liens arising out of work performed, materials furnished or obligations incurred by Tenant. Tenant further covenants and agrees that any mechanic’s lien filed against the Premises, the Building or the Project for work claimed to have been done for, or materials claimed to have been furnished to, shall be discharged or bonded by Tenant within fifteen (15) days after the filing thereof, at Tenant’s sole cost and expense.

20.2 Should Tenant fail to discharge or bond against any lien of the nature described in Section 20.1, Landlord may, at Landlord’s election, pay such claim or post a bond or otherwise

16

provide security to eliminate the lien as a claim against title, and Tenant shall immediately reimburse Landlord for the costs thereof as Additional Rent.

20.3 In the event that Tenant leases or finances the acquisition of office equipment, furnishings or other personal property of a removable nature utilized by Tenant in the operation of Tenant’s business, Tenant warrants that any Uniform Commercial Code financing statement shall, upon its face or by exhibit thereto, indicate that such financing statement is applicable only to removable personal property of Tenant located within the Premises. In no event shall the address of the Building be furnished on a financing statement without qualifying language as to applicability of the lien only to removable personal property located in an identified suite leased by Tenant. Should any holder of a financing statement record or place of record a financing statement that appears to constitute a lien against any interest of Landlord or against equipment that may be located other than within an identified suite leased by Tenant, Tenant shall, within ten (10) days after tiling such financing statement, cause (a) a copy of the lender security agreement or other documents to which the financing statement pertains to be furnished to Landlord to facilitate Landlord’s ability to demonstrate that the lien of such financing statement is not applicable to Landlord’s interest and (b) Tenant’s lender to amend such financing statement and any other documents of record to clarify that any liens imposed thereby are not applicable to any interest of Landlord in the Premises, the Building or the Project.

20.4 Notwithstanding the terms and conditions of Section 20.3 above, Tenant shall have the right, from time to time, to grant and assign a mortgage or other security interest in Tenant’s removable trade fixtures (as determined in accordance with Sections 18.6 and 18.8 above) and other personal property located in or at the Premises, and Landlord agrees to execute, at Tenant’s sole cost and expense, waiver forms reasonably acceptable to Landlord releasing Landlord’s interest therein in favor of any purchase money seller, lessor or lender who has financed or may finance in the immediate future such property of Tenant. Without limiting the effectiveness of the foregoing, provided that no default shall have occurred and be continuing. Landlord shall, upon the request of Tenant, and at Tenant’s sole cost and expense, execute and deliver any reasonable instruments reasonably necessary or appropriate to confirm any such grant, release, dedication, transfer, annexation or amendment to any person or entity permitted under this paragraph, including reasonable Landlord waivers with respect to any of the foregoing, and such acknowledgment shall include, if requested by the person holding such security interest, the right to enter upon the Premises following a Default for a period not to exceed thirty (30) days, for the limited purpose of removing any personal property so secured, provided that the secured party agrees to repair any damages resulting from the exercise of such right and pay all Rent due and payable (including, without limitation, Base Rent and Tenant’s Pro Rata Share of Operating Expenses) for such time. Tenant shall indemnify and hold Landlord harmless from and against any and all Claims (as defined below) in any manner directly or indirectly related to the mortgage or security interests in Tenant’s trade fixtures and other personal property.

21. Estoppel Certificate. Tenant shall, within ten (10) business days of receipt of written notice from Landlord, execute, acknowledge and deliver a statement in writing substantially in the form attached to this Lease as Exhibit I or on any other form reasonably requested by a proposed lender, mortgagee or beneficiary (each, a “Lender”) or purchaser, (a) certifying that this Lease is unmodified and in full force and effect (or, if modified, stating the nature of such modification and certifying that this Lease as so modified is in full force and effect) and the dates to which rental and other charges are paid in advance, if any, (b) acknowledging that there are not, to Tenant’s knowledge, any uncured defaults on the part of Landlord hereunder, or specifying such defaults if any are claimed, and (c) setting forth such further information with respect to this Lease or the Premises as may be requested thereon. Any such statement may be relied upon by any prospective purchaser or encumbrancer of all or any portion of the real property of which the Premises are a part. Tenant’s failure to deliver such statement within such the prescribed time shall, at Landlord’s option, constitute a Default (as defined below) under this Lease, and, in any event, shall be binding upon Tenant that the Lease is in full force and effect and without modification except as may be represented by Landlord in any certificate prepared by Landlord and delivered to Tenant for execution.

22. Hazardous Materials.

17

22.1 Tenant shall not cause or permit any Hazardous Materials (as defined below) to be brought upon, kept or used in or about the Premises, the Building or the Project in violation of Applicable Laws by Tenant, its agents, employees, contractors or invitees. If Tenant breaches such obligation, or if the presence of Hazardous Materials as a result of such a breach results in contamination of the Premises, the Building, the Project or any adjacent property, or if contamination of the Premises, the Building, the Project or any adjacent property by Hazardous Materials otherwise occurs during the Term or any extension or renewal hereof or holding over hereunder, then Tenant shall indemnify, save, defend and hold Landlord, its agents and contractors harmless from and against any and all claims, judgments, damages, penalties, fines, costs, liabilities and losses (including, without limitation, diminution in value of the Premises, the Building, the Project or any portion thereof; damages for the loss or restriction on use of rentable or usable space or of any amenity of the Premises or Project; damages arising from any adverse impact on marketing of space in the Premises, the Building or the Project; and sums paid in settlement of claims, attorneys’ fees, consultants’ fees and experts’ fees) that arise during or after the Term as a result of such breach or contamination. This indemnification of Landlord by Tenant includes, without limitation, costs incurred in connection with any investigation of site conditions or any cleanup, remedial, removal or restoration work required by any Governmental Authority because of Hazardous Materials present in the air, soil or groundwater above, on or under the Premises. Without limiting the foregoing, if the presence of any Hazardous Materials in, on, under or about the Premises, the Building, the Project or any adjacent property caused or permitted by Tenant results in any contamination of the Premises, the Building, the Project or any adjacent property, then Tenant shall promptly take all actions at its sole cost and expense as are necessary to comply with Applicable Laws and, to the extent possible, to return the Premises, the Building, the Project and any adjacent property to their respective condition existing prior to the time of such contamination; provided that Landlord’s written approval of such action shall first be obtained, which approval Landlord shall not unreasonably withhold; and provided, further, that it shall be reasonable for Landlord to withhold its consent if such actions could have a material adverse long-term or short-term effect on the Premises, the Building or the Project. Landlord shall indemnify, save, defend and hold Tenant harmless from and against any and all Claims (as defined below) related to the presence of Hazardous Materials at the Premises prior to the Execution Date.