paid to Executive shall be in addition to the Base Salary and to any and all other benefits to which Executive is entitled as provided in this Agreement. Except as in accordance with any deferral election made by Executive pursuant to any deferred...

Exhibit 10.1 EMPLOYMENT AGREEMENT THIS AGREEMENT (the “Agreement”) is made and entered into on [DATE] (the “Effective Date”), by and between JELD-WEN Holding, Inc., a Delaware corporation (the “Company”) and [NAME] (the “Executive”). 1. Term of Employment; Duties. (a) As used herein, the phrase “Term of Employment” shall mean the period commencing on the Effective Date and ending on the date of termination of Executive’s employment in accordance with any one of Sections 5(a) through 5(e) below. (b) The Company hereby agrees to employ Executive as its [TITLE] for the Term of Employment, and Executive agrees to serve in these capacities with the duties and responsibilities customary to such positions in a company of the size and nature of the Company, protecting, encouraging and promoting the interests of the Company, and performing such other duties consistent with the offices held by Executive as may be reasonably assigned to him from time to time by the Chief Executive Officer (“CEO”) or Board of Directors of the Company (the “Board”). During the Term of Employment, Executive shall report solely and directly to the CEO. (c) Executive shall devote all of Executive’s business time and attention to Executive’s duties on the Company’s behalf except for sick leave, vacations and approved leaves of absence; provided, however, that nothing shall preclude Executive from (i) managing Executive’s personal investments and affairs and (ii) participating as a member of the board of directors or similar governing body of no more than one (1) for-profit company which is not a direct competitor of the Company and approved by the Board in writing prior to Executive commencing service therewith and such not-for-profit companies or institutions as do not interfere with the performance of Executive’s duties; provided that in each case, Executive shall not engage in activities inconsistent with the Company’s ethics codes and other conflicts of interest policies in effect from time to time or which materially interfere with or adversely affect the performance of Executive’s duties under this Agreement. 2. Compensation. (a) Base Salary. The Company agrees to pay to Executive as a salary during the Term of Employment the sum of [BASE SALARY AMOUNT] per year, payable in accordance with the normal payroll practices of the Company in the United States as in effect from time to time. The Board shall review, and may adjust in its sole discretion, such base salary no less often than annually. Executive’s annual base salary rate, as in effect from time to time, is hereinafter referred to as the “Base Salary.” (b) Annual Bonuses. During the Term of Employment, Executive shall participate in the Company’s annual Management Incentive Plan or any successor plan (the “MIP”), on terms and conditions that are appropriate to Executive’s positions and responsibilities at the Company and are no less favorable than those applying to other senior executive officers of the Company. Executive’s target annual bonus under the MIP in respect of each Fiscal Year shall be [TARGET PERCENTAGE] of Base Salary and Executive’s maximum annual bonus shall be [MAXIMUM PERCENTAGE] of Base Salary. The Board shall review, and may adjust in its sole discretion, such bonus targets each year when it sets target bonuses for the MIP. Any annual bonus

paid to Executive shall be in addition to the Base Salary and to any and all other benefits to which Executive is entitled as provided in this Agreement. Except as in accordance with any deferral election made by Executive pursuant to any deferred compensation plan maintained by the Company, payment of annual bonuses shall be made at the same time that other senior executive officers of the Company receive their annual bonuses. (c) Long-Term Incentive Programs. Executive shall participate in the Company’s 2017 Omnibus Equity Plan or any successor plan and other long-term incentive compensation plans generally available to other senior executive officers of the Company from time to time on terms and conditions that are appropriate to Executive’s positions and responsibilities at the Company and are no less favorable than those generally applicable to such other senior executive officers. 3. Employee Benefit Programs. During the Term of Employment, Executive shall be entitled to participate in all employee retirement, savings and welfare benefit plans and programs made available to the Company’s executive officers, as such plans may be in effect from time to time and on terms and conditions that are no less favorable than those generally applicable to other senior executive officers to the extent not duplicative of benefits provided by this Agreement. 4. Perquisites, Vacations, and Reimbursement of Expenses. During the Term of Employment: (a) The Company shall furnish Executive with, and Executive shall be allowed full use of, office facilities, secretarial and clerical assistance and other Company property and services commensurate with Executive’s position and of at least comparable quality, nature and extent to those made available to other senior executive officers of the Company from time to time; (b) Executive shall be allowed a minimum of [NUMBER] weeks annual vacation and leaves of absence (“PTO”) with pay on a basis no less favorable than that applicable to other senior executive officers of the Company. PTO shall not be accrued, and any unused PTO shall be forfeited; and (c) The Company shall reimburse Executive for reasonable business expenses incurred by Executive in the performance of Executive’s duties hereunder, such reimbursements to be effected in accordance with normal Company reimbursement procedures in effect from time to time. 5. Termination of Employment. (a) Termination Due to Death. In the event that Executive’s employment is terminated due to Executive’s death, the Company’s payment obligations under this Agreement shall terminate, except that Executive’s estate or Executive’s beneficiaries, as the case may be, shall be entitled to the following: (1) (i) the Base Salary through the date of termination, (ii) any earned but unpaid portion of Executive’s annual bonus provided for in Section 2(b) for the Fiscal Year preceding the year of termination, (iii) reimbursement for any unreimbursed business expenses properly incurred by Executive pursuant to this Agreement or in accordance with Company policy 2

prior to the date of Executive’s termination, and (iv) such employee benefits, if any, to which Executive may be entitled under the employee benefit plans of the Company according to their terms (the amounts described in clauses (i) through (iv) of this Section 5(a)(1), reduced (but not below zero) by any amounts owed by Executive to the Company, being referred to as the “Accrued Rights”); (2) a pro rata annual bonus provided for in Section 2(b) for the Fiscal Year in which Executive’s death occurs, based on the Company’s actual performance for the entire Fiscal Year, prorated for the number of calendar months during the Fiscal Year that Executive was employed prior to such termination (rounded up to the next whole month), payable at the time annual bonuses are paid for such Fiscal Year to executives of the Company generally (a “Pro Rata Bonus”); and (3) except as otherwise provided in Section 2, Executive’s outstanding stock options, restricted stock, performance share units, and restricted stock units (“Stock Awards”) shall be administered in accordance with the terms of the written agreements setting forth the terms of each such Stock Award. A reduction to any amounts required to be provided or paid pursuant to Section 5(a)(1) that are subject to Section 409A shall not be effective until the amounts payable or provided to Executive under this Agreement sought to be reduced would otherwise have been paid to Executive pursuant to the terms of this Agreement. (b) Termination due to Disability. (1) If, as a result of Executive’s incapacity due to physical or mental illness, accident or other incapacity (as determined by the Board in good faith, after consideration of such medical opinion and advice as may be available to the Board from medical doctors selected by Executive or by the Board or both separately or jointly), Executive shall have been absent from Executive’s duties with the Company on a full-time basis for six consecutive months and, within 30 days after written notice of termination thereafter given by the Company, Executive shall not have returned to the full-time performance of Executive’s duties, the Company or Executive may terminate Executive’s employment for “Disability”. (2) In the event that Executive’s employment is terminated due to Disability, Executive shall be entitled to the following benefits: (i) the Accrued Rights; (ii) a Pro Rata Bonus for the Fiscal Year in which Executive’s termination occurs; and (iii) except as otherwise provided in Section 2, Executive’s outstanding Stock Awards shall be administered in accordance with the terms of the written agreements setting forth the terms of each such Stock Award. 3

(c) Termination by the Company for Cause. (1) The Company shall have the right to terminate Executive’s employment at any time for Cause in accordance with this Section 5(c). (2) For purposes of this Agreement, “Cause” shall mean: (i) the conviction or entry of a plea of guilty or nolo contendere to (A) any felony or (B) any crime (whether or not a felony) involving moral turpitude, fraud, theft, breach of trust or other similar acts, whether under the laws of the United States or any state thereof or any similar foreign law to which the person may be subject; (ii) being engaged or having engaged in conduct constituting breach of fiduciary duty, dishonesty, willful misconduct or material neglect relating to the Company or any of its subsidiaries or the performance of a person’s duties; (iii) appropriation (or an overt act attempting appropriation) of a material business opportunity of the Company or any of its subsidiaries; (iv) misappropriation (or an overt act attempting misappropriation) of any funds of the Company or any of its subsidiaries; (v) the willful failure to (A) follow a reasonable and lawful directive of the Company or any of its subsidiaries at which a person is employed or provides services, or the Board of Directors or (B) comply with any written rules, regulations, policies or procedures of the Company or a subsidiary at which a person is employed or to which he or she provides services which, if not complied with, would reasonably be expected to have more than a de minimis adverse effect on the business or financial condition of the Company; (vi) willful and knowing material violation of any (I) material rules or regulations of any governmental or regulatory body that are material to the business of the Company or (II) U.S. securities laws; provided that for the avoidance of doubt, a violation shall not be considered as willful or knowing where Executive has acted in a manner consistent with specific advice of outside counsel to the Company; (vii) failure to cooperate, if requested by the Board, with any investigation or inquiry by the Company, the Securities Exchange Commission or another governmental body into Executive’s or the Company’s business practices, whether internal or external, including, but not limited to, Executive’s refusal to be deposed or to provide testimony at any trial or inquiry; (viii) violation of a person’s employment, consulting, separation or similar agreement with the Company or any non-disclosure, non-solicitation or non-competition covenant in any other agreement to which the person is subject; (ix) deliberate and continued failure to perform material duties to the Company or any of its subsidiaries; or (x) violation of the Company’s Code of Business Conduct and Ethics, as it may be amended from time to time. (3) No termination of Executive’s employment by the Company for Cause pursuant to this Section 5(c) shall be effective unless the provisions of this Section 5(c)(3) shall have been complied with and unless a majority of the members of the Board have duly voted to approve such termination. Executive shall be given written notice by the Board of its intention to terminate him for Cause, which notice (A) shall state in detail the particular circumstances that constitute the grounds on which the proposed termination for Cause is based and (B) shall be given no later than ninety (90) days (or sixty (60) days on or after a Change in Control) after the first meeting of the Board at which the Board became aware of the occurrence of the event giving rise to such grounds. For purposes of this agreement, “Change in Control” shall have the meaning ascribed to it in the 2017 Omnibus Equity Plan. Executive shall have 30 days after receiving such notice in which to cure such grounds, to the extent curable, as determined by the Board in good faith. If Executive fails to cure such grounds within such 30-day period, Executive’s employment with the Company shall thereupon be terminated for Cause. If the Board determines in good faith 4

that the grounds are not curable, Executive’s employment with the Company shall be terminated for Cause upon Executive’s receipt of written notice from the Board. (4) In the event the Company terminates Executive’s employment for Cause pursuant to this Section 5(c), Executive shall be entitled to the Accrued Rights. Executive’s outstanding Stock Awards shall be administered in accordance with the terms of the written agreements setting forth the terms of each such Stock Award. (d) Termination Without Cause or for Good Reason. (1) In the event of a Termination without Cause or Resignation for Good Reason (a “Qualifying Termination”), Executive shall be entitled to 30 days’ notice, following which Executive shall receive the Accrued Rights and, subject to (X) Executive’s continued compliance with the provisions of Sections 10, 11, 12 and 13 hereof, and (Y) in the case of a Qualifying Termination which occurs prior to a Change in Control (a “Non-CIC Qualifying Termination”), Executive’s execution and non-revocation of a release of claims substantially in the form attached hereto as Annex A, with such changes as may be required by changes in applicable law (a “Release”) pursuant to Section 5(d)(4), the following: (i) (A) in the event of a Non-CIC Qualifying Termination, a Pro Rata Bonus for the Fiscal Year in which such termination occurs, at the time annual bonuses are paid for such Fiscal Year to executives of the Company generally; or (B) in the event of a Qualifying Termination which occurs on or after a Change in Control (a “CIC Qualifying Termination”), a pro rata annual bonus for the Fiscal Year in which such termination occurs, based on Executive’s target annual bonus for such Fiscal Year, prorated for the number of calendar months during the Fiscal Year that Executive was employed prior to such termination (rounded up to the next whole month), payable (I) in the event of a CIC Qualifying Termination which occurs two (2) years or less following a Change in Control, as soon as practicable following Executive’s termination of employment, and (II) in the event of a CIC Qualifying Termination which occurs more than two (2) years following a Change in Control, at the time annual bonuses are paid for such Fiscal Year to executives of the Company generally; (ii) a severance payment in an amount equal to the sum of (A) and (B) (or, in the event of a CIC Qualifying Termination, an amount equal to two times the sum of (A) and (B)), where (A) is the Base Salary, as in effect immediately prior to the delivery of notice of termination or, for a termination for Good Reason, as in effect immediately prior to the event giving rise to Good Reason, and (B)(1) in the event of a Non-CIC Qualifying Termination, is Executive’s target annual bonus provided for in Section 2(b) of this Agreement for the Fiscal Year in which such termination occurs or, for a termination for Good Reason, Executive’s target annual bonus as in effect immediately prior to the event giving rise to Good Reason, or (2) in the event of a CIC Qualifying Termination, is the average annual short-term incentive compensation bonus (including any bonus or portion thereof that has been earned but deferred, annualized for any fiscal year during which the Participant was employed for less than twelve (12) full months), the Participant received from the Company or any of its affiliates during (i) the three (3) full fiscal years of the Company immediately preceding the Change in Control (or such fewer number of fiscal years during which Executive was employed), or (ii) the three (3) full fiscal years of the Company immediately preceding the Date of Termination (or such fewer number of fiscal years 5

during which Executive was employed), if greater, payable (I) in the event of a Non-CIC Qualifying Termination or in the event of a CIC Qualifying Termination which occurs more than two (2) years following a Change in Control, in Twelve (12) equal monthly installments following Executive’s termination or (II) in the event of a CIC Qualifying Termination which occurs on or within two (2) years following a Change in Control, in a single lump sum not later than ten (10) days following Executive’s termination of employment; (iii) in the event of a CIC Qualifying Termination, all Stock Options, RSUs or similar equity incentives shall fully and immediately vest upon termination and all PSUs or similar equity incentives shall vest at target levels prorated for the number of years of service in the applicable performance period prior to termination (rounded up to the next full year) upon termination. In the event of a Non-CIC Qualifying Termination, all equity awards shall be treated in accordance with the applicable agreements; (iv) if Executive elects to continue coverage under the Company’s medical, dental, and/or vision insurance plans pursuant to COBRA following termination of employment, the Company shall pay Executive’s COBRA premiums or otherwise provide continuing coverage for a period of twelve (12) months following termination in the event of a Non-CIC Qualifying Termination and twenty-four (24) months following termination in the event of a CIC Qualifying Termination and timely report the COBRA premiums as taxable income to Executive in a manner necessary for Executive to not incur penalty taxes on such benefits pursuant to Section 409A; and (v) Company will provide Executive with outplacement services not to exceed $10,000 in total value. (2) For purposes of this Agreement, “Change in Control” shall mean the occurrence of any of the following: (i) An acquisition (other than directly from the Company) of any voting securities of the Company (the “Voting Securities”) by any Person, immediately after which such Person first acquires “Beneficial Ownership” (within the meaning of Rule 13d-3 promulgated under the Exchange Act) of fifty percent (50%) or more of the combined voting power of the Company’s then-outstanding Voting Securities; provided, however, that in determining whether a Change in Control has occurred pursuant to this section, the acquisition of Voting Securities in a Non-Control Acquisition (as hereinafter defined) shall not constitute a Change in Control. A “Non-Control Acquisition” shall mean an acquisition by (i) an employee benefit plan (or a trust forming a part thereof) maintained by (A) the Company or (B) any corporation or other Person the majority of the voting power, voting equity securities or equity interest of which is owned, directly or indirectly, by the Company (for purposes of this definition, a “Related Entity”), (ii) the Company or any Related Entity or (iii) any Person in connection with a Non-Control Transaction (as hereinafter defined); (ii) The individuals who, as of the Effective Date of this Plan, are members of the Board (the “Incumbent Board”) cease for any reason to constitute at least a majority of the members of the Board; provided, however, that if the election, or nomination for election by the Company’s common stockholders, of any new director was approved by a vote of 6

at least two-thirds of the Incumbent Board, such new director shall, for purposes of this Plan, be considered as a member of the Incumbent Board; provided further, however, that no individual shall be considered a member of the Incumbent Board if such individual initially assumed office as a result of either an actual or threatened solicitation of proxies or consents by or on behalf of a Person other than the Board (a “Proxy Contest”) including by reason of any agreement intended to avoid or settle any Proxy Contest; (iii) The consummation of: (a) A merger, consolidation or reorganization (x) with or into the Company or (y) in which securities of the Company are issued (a “Merger”), unless such Merger is a Non-Control Transaction. A “Non- Control Transaction” shall mean a Merger in which: (i) the stockholders of the Company immediately before such Merger own directly or indirectly immediately following such Merger at least a majority of the combined voting power of the outstanding voting securities of (1) the corporation resulting from such Merger (the “Surviving Corporation”), if fifty percent (50%) or more of the combined voting power of the then outstanding voting securities of the Surviving Corporation is not Beneficially Owned, directly or indirectly, by another Person (a “Parent Corporation”), or (2) if there is one or more than one Parent Corporation, the ultimate Parent Corporation; (ii) the individuals who were members of the Board immediately prior to the execution of the agreement providing for such Merger constitute at least a majority of the members of the board of directors of (1) the Surviving Corporation, if there is no Parent Corporation, or (2) if there is one or more than one Parent Corporation, the ultimate Parent Corporation; and (iii) no Person other than (1) the Company or another corporation that is a party to the agreement of Merger, (2) any Related Entity, (3) any employee benefit plan (or any trust forming a part thereof) that, immediately prior to the Merger, was maintained by the Company or any Related Entity or (4) any Person who, immediately prior to the Merger, had Beneficial Ownership of Voting Securities representing more than fifty percent (50%) of the combined voting power of the Company’s then-outstanding Voting Securities, has Beneficial Ownership, directly or indirectly, of fifty percent (50%) or more of the combined voting power of the outstanding voting securities of (x) the Surviving Corporation, if there is no Parent Corporation, or (y) if there is one or more than one Parent Corporation, the ultimate Parent Corporation; 7

(iv) The sale or other disposition of all or substantially all of the assets of the Company and its Subsidiaries taken as a whole to any Person (other than (x) a transfer to a Related Entity or (y) the distribution to the Company’s stockholders of the stock of a Related Entity or any other assets). Notwithstanding the foregoing, a Change in Control shall not be deemed to occur solely because any Person (the “Subject Person”) acquired Beneficial Ownership of more than the permitted amount of the then outstanding Voting Securities as a result of the acquisition of Voting Securities by the Company which, by reducing the number of Voting Securities then outstanding, increases the proportional number of shares Beneficially Owned by the Subject Person; provided that if a Change in Control would occur (but for the operation of this sentence) as a result of the acquisition of Voting Securities by the Company and, after such acquisition by the Company, the Subject Person becomes the Beneficial Owner of any additional Voting Securities and such Beneficial Ownership increases the percentage of the then outstanding Voting Securities Beneficially Owned by the Subject Person, then a Change in Control shall occur. (3) For purpose of this Agreement, “Good Reason” shall mean the occurrence of any of the following subsequent to the Effective Date of this Agreement without Executive’s consent: (i) Prior to a Change in Control, (A) the removal of Executive from the position of [TITLE]; (B) the assignment to Executive of duties that are materially inconsistent with, or that materially impair Executive’s ability to perform, the duties customarily assigned to an [TITLE] of a corporation of the size and nature of the Company; or a change in the reporting structure so that Executive reports to someone other than the CEO or is subject to the direct or indirect authority or control of a person or entity other than the CEO or the Board; (C) any material breach by the Company of this Agreement; (D) conduct by the Company that would cause Executive to commit fraudulent acts or would expose Executive to criminal liability; (E) the Company failing to obtain the assumption in writing of its obligation to perform this Agreement by any successor to all or substantially all of the Company’s business or assets; (F) a relocation of Executive’s principal place of employment to any place which is more than 50 miles from the Company’s corporate headquarters as of the Effective Date; (G) a decrease in Executive’s Base Salary below the Base Salary in effect on the Effective Date, other than an across the board reduction in base salary applicable in like proportions to all senior executive officers; or (H) a decrease in Executive’s target annual bonus percentage or maximum annual bonus percentage under the MIP below those in effect on the Effective Date, other than an across the board reduction of percentages or elimination of the MIP in like proportions to all senior executive officers. (ii) On or after a Change in Control, in addition to anything described in Section 5(d)(3)(i), (A) a substantial change in the nature, or diminution in the status of Executive’s duties or position from those in effect immediately prior to the Change in Control (which will be presumed to have occurred if, immediately following such Change in Control, the Company or its successor is not publicly traded and, if the ultimate parent of the Company is publicly traded, Executive is not [TITLE] of such ultimate parent); (B) a material reduction by the Company of Executive’s Base Salary as in effect on the date of a Change in Control or as in effect thereafter if such Base Salary has been increased and such increase was approved prior to the Change in Control; (C) a reduction by the Company in the overall value of benefits provided to 8

Executive (including profit sharing, retirement, health, medical, dental, disability, insurance, and similar benefits, to the extent provided by the Company prior to any such reduction), as in effect on the date of Change in Control or as in effect thereafter if such benefits have been increased and such increase was approved prior to the Change in Control; (D) a failure to continue in effect any MIP, stock option or other equity-based or non-equity based incentive compensation plan in effect immediately prior to the Change in Control, or a reduction in Executive’s participation in any such plan, unless Executive is afforded the opportunity to participate in an alternative incentive compensation plan of reasonably equivalent value; (E) a failure to provide Executive the same number of PTO days per year available to him prior to the Change in Control; (F) relocation of Executive’s principal place of employment to any place more than fifty (50) miles from Executive’s previous principal place of employment; (G) any material breach by the Company of any provision of this Agreement or any equity award agreement; (H) conduct by the Company, against Executive’s volition, that would cause Executive to commit fraudulent acts or would expose Executive to criminal liability or (I) any failure by the Company to obtain the assumption of this Agreement by any successor or assign of the Company; provided, that for purposes of clauses (B) through (E) above, “Good Reason” shall not exist (1) if the aggregate value of all salary, benefits, incentive compensation arrangements, perquisites and other compensation is reasonably equivalent to the aggregate value of salary, benefits, incentive compensation arrangements, perquisites and other compensation as in effect immediately prior to the Change in Control, or as in effect thereafter if the aggregate value of such items has been increased and such increase was approved prior to the Change in Control, or (2) if the reduction in aggregate value is due to the application of Company or Executive performance against the applicable performance targets, in each case applying standards reasonably equivalent to those utilized by the Company prior to the Change in Control. (4) No termination of Executive’s employment by Executive for Good Reason pursuant to Section (5)(d)(3)(i) shall be effective unless the provisions of this Section 5(d)(4) shall have been complied with. Executive shall give written notice to the Company of Executive’s intention to terminate Executive’s employment for Good Reason, which notice shall (i) state in detail the particular circumstances that constitute the grounds on which the proposed termination for Good Reason is based and (ii) be given no later than ninety (90) days after the first occurrence of such circumstances. The Company shall have thirty (30) days after receiving such notice in which to cure such grounds. If the Company fails to cure such grounds within such thirty (30)-day period, Executive’s employment with the Company shall thereupon terminate for Good Reason. (5) This Section 5(d)(5) shall apply only in the event of a Non-CIC Qualifying Termination. The Company shall furnish to Executive within five (5) business days following such termination a Release and Executive must return the Release and it must have become irrevocable before the sixtieth (60th) day after Executive’s termination before any payments or benefits may be provided. If the Release is timely provided and is irrevocable on or before the sixtieth (60th) day following Executive’s termination of employment, the benefits and amounts described in Section 5(d)(1) shall commence to be provided (and provided retroactively to the extent that the payment or benefit would otherwise have been provided but for the requirement of the Release) two (2) business days after the Release is irrevocable but in any event not later than the sixtieth (60th) day after termination of Executive’s employment; provided that if the sixty (60) day period following the termination of Executive’s employment expires in the 9

calendar year following the calendar year of Executive’s termination of employment, payments and benefits shall not commence earlier than the calendar year following termination of Executive’s employment. If the Company fails to furnish the form of Release timely to Executive, no Release shall be required and Executive shall be treated as if Executive had timely executed and submitted the Release and such Release had become irrevocable on the tenth (10th) day after termination of Executive’s employment. If Executive fails to submit the Release timely enough so that it is irrevocable on or before the sixtieth (60th) day following termination of employment and the Company has complied with its obligation to furnish the form of Release to Executive within five (5) business days following Executive’s termination of employment, then Executive shall not be entitled to receive any benefits under Section 5(d)(1) other than the Accrued Rights. (e) Voluntary Termination. Executive shall have the right to terminate Executive’s employment with the Company in a voluntary termination at any time upon thirty days’ notice. A voluntary termination shall mean a termination of employment by Executive on Executive’s own initiative, other than a termination due to Disability or for Good Reason. Executive’s voluntary termination shall have the same consequences as provided in Section 5(c) for a termination for Cause. (f) Reduction of Certain Payments. (1) Anything in this Agreement to the contrary notwithstanding, in the event that the receipt of all payments or distributions by the Company in the nature of compensation to or for Executive’s benefit, whether paid or payable pursuant to this Agreement or otherwise (a “Payment”), would subject Executive to the excise tax under Section 4999 of the Code, the accounting firm which audited the Company prior to the corporate transaction which results in the application of such excise tax (the “Accounting Firm”) shall determine whether to reduce any of the Payments paid or payable pursuant to this Agreement (the “Agreement Payments”) to the Reduced Amount (as defined below). The Agreement Payments shall be reduced to the Reduced Amount only if the Accounting Firm determines that Executive would have a greater Net After-Tax Receipt (as defined below) of aggregate Payments if Executive’s Agreement Payments were reduced to the Reduced Amount. If such a determination is not made by the Accounting Firm, Executive shall receive all Agreement Payments to which Executive is entitled under this Agreement. (2) If the Accounting Firm determines that aggregate Agreement Payments should be reduced to the Reduced Amount, the Company shall promptly give Executive notice to that effect and a copy of the detailed calculation thereof. All determinations made by the Accounting Firm under this Section 5(f) shall be made as soon as reasonably practicable and in no event later than sixty (60) days following the date of termination or such earlier date as requested by the Company and the Executive. For purposes of reducing the Agreement Payments to the Reduced Amount, only amounts payable under this Agreement (and no other Payments) shall be reduced. All fees and expenses of the Accounting Firm shall be borne solely by the Company. (3) As a result of the uncertainty in the application of Section 4999 of the Code at the time of the initial determination by the Accounting Firm hereunder, it is possible that amounts will have been paid or distributed by the Company to or for the benefit of Executive pursuant to this Agreement which should not have been so paid or distributed (the “Overpayment”) 10

or that additional amounts which will have not been paid or distributed by the Company to or for the benefit of Executive pursuant to this Agreement could have been so paid or distributed (the “Underpayment”), in each case, consistent with the calculation of the Reduced Amount hereunder. In the event that the Accounting Firm, based upon the assertion of a deficiency by the Internal Revenue Service against either the Company or Executive which the Accounting Firm believes has a high probability of success, determines that an Overpayment has been made, Executive shall pay any such Overpayment to the Company together with interest at the applicable federal rate provided for in Section 7872(f)(2) of the Code; provided, however, that no amount shall be payable by Executive to the Company if and to the extent such payment would not either reduce the amount on which Executive is subject to tax under Section 1 and Section 4999 of the Code or generate a refund of such taxes. In the event that the Accounting Firm, based upon controlling precedent or substantial authority, determines that an Underpayment has occurred, any such Underpayment shall be paid promptly (and in no event later than sixty (60) days following the date on which the Underpayment is determined) by the Company to or for the benefit of Executive together with interest at the applicable federal rate provided for in Section 7872(f)(2) of the Code. (4) For purposes hereof, the following terms have the meanings set forth below: (i) “Reduced Amount” shall mean the greatest amount of Payments that can be paid that would not result in the imposition of the excise tax under Section 4999 of the Code if the Accounting Firm determines to reduce Payments pursuant to this Section 5(g) and (ii) “Net After- Tax Receipt” shall mean the present value (as determined in accordance with Sections 280G(b)(2)(A)(ii) and 280G(d)(4) of the Code) of a Payment net of all taxes imposed on Executive with respect thereto under Sections 1 and 4999 of the Code and under applicable state and local laws, determined by applying the highest marginal rate under Section 1 of the Code and under state and local laws which applied to Executive’s taxable income for the immediately preceding taxable year, or such other rate(s) as Executive certifies, in Executive’s sole discretion, as likely to apply to him in the relevant tax year(s). 6. Indemnification and Insurance. (a) The Company and Executive acknowledge that they shall, as soon as reasonably practicable after the Effective Date, enter into an Indemnification Agreement, substantially in the form attached hereto as Annex B, which agreement shall not be affected by this Agreement. (b) The Company agrees that Executive shall be covered as a named insured under the Company’s Directors’ and Officers’ liability insurance as applicable from time to time to the Company’s senior executive officers on terms and conditions that are no less favorable than those applying to such other senior executive officers. 7. No Mitigation; No Offset. In the event of a termination of Executive’s employment for any reason, Executive shall not be required to seek other employment or to mitigate any of the Company’s obligations under this Agreement, and except as otherwise provided in this Agreement, no amount payable under Section 5 shall be reduced by (a) any claim the Company may assert against Executive or (b) any compensation or benefits earned by Executive as a result of employment by another employer, self-employment or from any other source after such termination of employment with the Company. 11

8. Designated Beneficiary. In the event of the death of Executive while in the employ of the Company, or at any time thereafter during which amounts remain payable to Executive under Section 5 above, such payments shall thereafter be made to such person or persons as Executive may specifically designate (successively or contingently) to receive payments under this Agreement following Executive’s death by filing a written beneficiary designation with the Company during Executive’s lifetime. Any change in the beneficiary designation shall be in such form as may be reasonably prescribed by the Company and may be amended from time to time or may be revoked by Executive pursuant to written instruments filed with the Company during Executive’s lifetime. Beneficiaries designated by Executive may be any natural or legal person or persons, including a fiduciary, such as a trustee of a trust, or the legal representative of an estate. Unless otherwise provided by the beneficiary designation filed by Executive, if all of the persons so designated die before Executive on the occurrence of a contingency not contemplated in such beneficiary designation, or if Executive shall have failed to provide such beneficiary designation, then the amount payable under this Agreement shall be paid to Executive’s estate. 9. Ethics. During the Term of Employment, Executive shall be subject to the Company’s Code of Business Conduct and Ethics and related policies (the “Policies”), as the Policies may be updated from time to time, which Policies are set forth on the Corporate Governance page of the Company’s website. If for any reason an arbitrator, subject to judicial review as provided by law, or a court should determine that any provision of the Policies is unreasonable in scope or otherwise unenforceable, such provision shall be deemed modified and fully enforceable as so modified to the extent the arbitrator and any reviewing court determines what would be reasonable and enforceable under the circumstances. 10. Confidential Information, Return of Property, Developments. (a) Executive covenants and agrees that, except to the extent the use or disclosure of any Confidential Information is required to carry out Executive’s assigned duties with the Company, during the Term and thereafter: (i) Executive shall keep strictly confidential and not disclose to any person not employed by the Company any Confidential Information; and (ii) Executive shall not use or refer to any Confidential Information. However, this provision shall not preclude Executive from: (x) the use or disclosure of information known generally to the public (other than information known generally to the public as a result of Executive’s violation of this Section), (y) any disclosure required by law or court order so long as Executive provides the Company prompt written notice of any such potential disclosure and reasonably cooperates with the Company to prevent or limit such disclosure to the extent lawful, or (z) communicating with a government office, official or agency. “Confidential Information” means confidential, proprietary or business information related to the Company’s business that is or was furnished to, obtained by, or created by Executive during Executive’s employment with the Company. Confidential Information includes by way of illustration, but is not limited to, such information relating to the Company’s: (A) customers and suppliers, including customer lists, supplier lists, contact information, contractual terms, prices, and billing histories; (B) finances, financial statements, balance sheets, forecasts, profit margins and cost analyses; (C) plans and projections for new and developing business opportunities and for maintaining existing business; and (D) operating methods, business processes and techniques, services, products, prices, costs, service performance, and operating results. For the avoidance of doubt, this provision in no way limits Executive’s obligations or the Company’s rights under applicable trade secrets statutes. 12

(b) All property, documents, data, and Confidential Information prepared or collected by Executive as part of Executive’s employment with the Company, in whatever form, are and shall remain the property of the Company. Executive agrees that Executive shall return upon the Company’s request at any time (and, in any event, before Executive’s employment with the Company ends) all documents, data, Confidential Information, and other property belonging to the Company in Executive’s possession or control, regardless of how stored or maintained and including all originals, copies and compilations. (c) Executive hereby assigns and agrees in the future to assign to the Company Executive’s full right, title and interest in all Developments (as defined below). In addition, all copyrightable works that Executive has created or creates in the course of or related to Executive’s employment with the Company shall be considered “work made for hire” and shall be owned exclusively by the Company. “Developments” means any invention, formula, process, development, design, innovation or improvement made, conceived or first reduced to practice by Executive, solely or jointly with others, during Executive’s employment with the Company and that was developed using the equipment, supplies, facilities or trade secret information of the Company or that relates at the time of conception or reduction to practice to: (i) the business of the Company, or (ii) any work performed by Executive for the Company. 11. Noncompete. (a) During the Restricted Period (as defined below), Executive shall not: (i) engage in Competitive Activity (as defined below) within or with respect to the Prohibited Territory (as defined below); or (ii) assist any entity or person to engage in Competitive Activity within or with respect to the Prohibited Territory, whether as an owner, financing source, consultant, employee or otherwise. In interpreting the foregoing, Executive agrees, for example, that Executive communicating about a project located within the Prohibited Territory (whether such communication is by telephone, e-mail, or otherwise) would constitute Executive engaging in activity “within or with respect to the Prohibited Territory” regardless of where Executive may be physically located at the time of that communication. (b) The “Restricted Period” means: (i) the Term; and (ii) the 24-month period following the last day of the Term (the “Separation Date”). (c) “Competitive Activity” means competing against the Company by: (i) engaging in work for a competitor of the Company that is the same as or substantially similar to the work Executive performed on behalf of the Company; and/or (ii) engaging in an aspect of the Restricted Business (as defined below) that Executive was involved with on behalf of the Company. Notwithstanding the preceding, passively owning less than 3% of a public company shall not constitute by itself Competitive Activity or assisting others to engage in Competitive Activity. (d) The “Restricted Business” means: (i) the business engaged in by the Company as of the Separation Date; and (ii) the business of the manufacture, sale and/or distribution of doors and/or windows. (e) “Prohibited Territory” means: (i) Executive’s geographic areas of responsibility for the Company at any point during the 6 months prior to the Separation Date; (ii) the area within 100 miles from Executive’s primary office location(s) for the Company at any point 13

during the 6 months prior to the Separation Date; and (iii) the continental United States. As a senior executive with the Company, Executive agrees that Executive’s duties and responsibilities for the Company extend to the entire area of the Company’s operations and that the Company does business throughout the United States. 12. Non-Interference Agreement. (a) During the Restricted Period, Executive shall not: (i) solicit, encourage, or cause any Restricted Client (as defined below) not to do business with or to reduce any part of its business with the Company; (ii) market, sell or provide to any Restricted Client any services or products that are competitive with or a substitute for the Company’s services or products; (iii) solicit, encourage, or cause any supplier of capital, goods or services to the Company not to do business with or to reduce any part of its business with the Company; (iv) make any disparaging comments about the Company or its business, services, officers, managers, directors or employees, whether in writing, verbally, or on any online forum; (v) assist or encourage anyone else to engage in any of the conduct prohibited by this Section; or (vi) allow any of Executive’s family members or any entity controlled by Executive to engage in any of the conduct prohibited by this Section. (b) “Restricted Client” means: (i) any Company customer or client with whom Executive had business contact or communications at any time during the 12 months prior to the Separation Date; (ii) any Company customer or client for whom Executive supervised or assisted with the Company’s dealings at any time during the 12 months prior to the Separation Date; (iii) any Company customer or client about whom Executive received Confidential Information at any time during the 12 months prior to the Separation Date; and (iv) any prospective Company customer or client with whom Executive had business contact or communications at any time during the 6 months prior to the Separation Date. As a senior executive with the Company, Executive agrees that Executive will receive confidential and trade secret information from the Company that would allow Executive to unfairly compete for business from any Company client such that the restrictions in this Section are necessary and reasonable. 13. Non-Raiding. During the Restricted Period, Executive shall not, directly or indirectly: (a) hire or engage or attempt to hire or engage for employment or as an independent contractor any Restricted Employee; or (b) solicit or encourage any Restricted Employee to leave the Company. “Restricted Employee” means: (i) each Company employee; and (ii) any person who was employed by the Company at any time during the then previous 12 months. 14. Reasonableness. Executive has carefully read and considered the provisions of this Agreement and, having done so, agrees that the restrictions set forth herein are fair, reasonable, and necessary to protect the Company’s legitimate business interests, its goodwill with its clients, suppliers and employees, and its confidential and trade secret information. In addition, Executive acknowledges and agrees that the foregoing restrictions do not unreasonably restrict Executive with respect to earning a living should Executive’s employment with the Company end. As such, Executive agrees not to contest the general validity or enforceability of this Agreement in any forum. The post-Term covenants in this Agreement shall survive the last day of the Term and shall be in addition to any restrictions imposed upon Executive by statute, at common law, or other written agreements. Executive agrees that the Company may share the terms of this Agreement with any business with which Executive becomes associated while any of the post-Term restrictions in this Agreement remain in effect. 14

15. Remedies. Executive acknowledges and agrees that Executive’s breach of this Agreement would result in irreparable damage and continuing injury to the Company. Therefore, in the event of any breach or threatened breach of this Agreement, the Company shall be entitled to an injunction enjoining Executive from committing any violation or threatened violation of this Agreement, without limiting the Company’s other remedies. The Company shall not be required to post a bond to obtain such an injunction. If the Company is successful in any litigation to enforce this Agreement, then Executive agrees that the Company shall be entitled to the reasonable attorneys’ fees it incurred in connection with such enforcement. In addition, if Executive breaches this Agreement, then (a) Executive will stop earning severance pay under this Agreement and such payments will stop; and (b) Employee agrees to repay any severance pay already paid under this Agreement beyond $2,000. Any such forfeiture and/or repayment of Severance Pay shall in no way impair Employee’s obligations to comply with this Agreement, the effectiveness of the Release, or the Company’s right to injunctive relief and damages for the breach. 16. Certain Affiliates. The “Company” as used in Section 11 (Non-Compete), Section 12 (Non-Interference) and Section 13 (Non-Raiding) shall mean: (a) the Company as defined above and (b) any Company affiliate with or for whom Executive performed services or had responsibilities any time during the last 12 months of the Term. The “Company” as used in Section 10 (Confidential Information, Return of Property, Developments) shall mean the Company and its affiliates. 17. Notices. For purposes of this Agreement, notices and all other communications provided for in the Agreement shall be in writing and shall be deemed to have been duly given when delivered or mailed by United States registered mail, return receipt requested, postage prepaid, or delivered by private courier, as follows: if to the Company — JELD-WEN Holding, Inc., 000 X. Xxxxxx Xxxxxx, Xxxxx 000, Xxxxxxxxx, XX 00000 (or such other address indicated from time to time as the worldwide corporate headquarters of JELD-WEN Holding, Inc. on its website or in its annual proxy statement) Attention: General Counsel; and if to Executive to the address of Executive as it appears in the records of the Company. Notice may also be given at such other address as either party may have furnished to the other in writing in accordance herewith, except that notices of change of address shall be effective only upon receipt. 18. Miscellaneous. This Agreement shall also be subject to the following miscellaneous provisions: (a) The Company represents and warrants to Executive that it has the authorization, power and right to deliver, execute and fully perform its obligations under this Agreement in accordance with its terms. (b) This Agreement contains a complete statement of all the agreements between the parties with respect to Executive’s employment by the Company, supersedes all prior and existing negotiations and agreements between them concerning the subject matter thereof and can only be changed or modified pursuant to a written instrument duly executed by each of the parties hereto and stating an intention to change or modify this Agreement. For the avoidance of doubt, the payments due under this Agreement upon termination apply in lieu of, and not in addition to, any severance policy or practice of the Company. No waiver by either party of any breach by the other party of any condition or provision contained in this Agreement to be 15

performed by such other party shall be deemed a waiver of a similar or dissimilar condition or provision at the same or any prior or subsequent time. Any waiver must be in writing and signed by Executive or an authorized officer of the Company, as the case may be. (c) The provisions of this Agreement are severable and in the event that a court of competent jurisdiction determines that any provision of this Agreement is in violation of any law or public policy, in whole or in part, only the portions of this Agreement that violate such law or public policy shall be stricken. All portions of this Agreement that do not violate any statute or public policy shall not be affected thereby and shall continue in full force and effect. Moreover, if any of the provisions contained in this Agreement are determined by a court of competent jurisdiction to be excessively broad as to duration, activity, geographic application or subject, it shall be construed, by limiting or reducing it to the extent legally permitted, so as to be enforceable to the extent compatible with then applicable law. (d) This Agreement shall be governed by and construed in accordance with North Carolina law, without regard to the choice of law principles of any jurisdiction. Each party further agrees that any litigation under this Agreement shall occur exclusively in a state or federal court in Mecklenburg County, North Carolina and in no other venue. As such, each party irrevocably consents to the jurisdiction of and venue in the courts in Mecklenburg County, North Carolina for all disputes with respect to this Agreement. Executive agrees to service of process in any such dispute via FedEx to Executive’s home address, without limiting other service methods allowed by applicable law. The parties agree that the terms in this Section are material to this Agreement, and that they will not challenge the enforceability of this Section in any forum. (e) All compensation payable hereunder shall be subject to such withholding taxes as may be required by law. (f) This Agreement shall be binding upon and inure to the benefit of the successors and assigns of the Company. No rights or obligations of the Company under this Agreement may be assigned or transferred by the Company except that such rights or obligations may be assigned or transferred pursuant to a merger or consolidation in which the Company is not the continuing entity, or the sale or liquidation of all or substantially all of the assets of the Company, provided that the assignee or transferee is the successor to all or substantially all of the assets of the Company and such assignee or transferee assumes the liabilities, obligations and duties of the Company, as contained in this Agreement, either contractually or as a matter of law. The Company further agrees that, in the event of a sale of assets or liquidation as described in the preceding sentence, it shall take commercially reasonable action in order to cause such assignee or transferee to expressly assume the liabilities, obligations and duties of the Company hereunder. Except as expressly provided herein, Executive may not sell, transfer, assign, or pledge any of Executive’s rights or obligations pursuant to this Agreement. (g) The rights of Executive hereunder shall be in addition to any rights Executive may otherwise have under any Company sponsored stock incentive plans or any grants or award agreements issued thereunder. The provisions of this Agreement shall not in any way abrogate Executive’s rights under such stock incentive plans and underlying grants or award agreements. 16

(h) The respective rights and obligations of the parties hereunder shall survive any termination of Executive’s employment to the extent necessary to the intended preservation of such rights and obligations. (i) The headings of the sections contained in this Agreement are for convenience only and shall not be deemed to control or affect the meaning or construction of any provision of this Agreement. (j) Each of the parties agrees to execute, acknowledge, deliver and perform, and cause to be executed, acknowledged, delivered and performed, at any time and from time to time, as the case may be, all such further acts, deeds, assignments, transfers, conveyances, powers of attorney and assurances as may be reasonably necessary to carry out the provisions or intent of this Agreement. (k) This Agreement may be executed in two or more counterparts each of which shall be legally binding and enforceable. (l) Without limiting any rights which the Company otherwise has or obligations to which Executive is otherwise subject pursuant to any compensation clawback policy adopted by the Company from time to time, Executive hereby acknowledges and agrees that, notwithstanding any provision of this Agreement to the contrary, Executive will be subject to any legally mandatory policy relating to the recovery of compensation, to the extent that the Company is required to adopt and/or implement such policy pursuant to applicable law, whether pursuant to the Xxxxxxxx-Xxxxx Act of 2002, the Xxxx-Xxxxx Xxxx Street Reform and Consumer Protection Act of 2010 or otherwise. 19. Section 409A. (a) Each payment under this Agreement is intended to be a separate payment which is compliant with or excepted from Section 409A, including, but not limited to, by compliance with the short-term deferral exception as specified in Treasury Regulation § 1.409A- 1(b)(4) and the involuntary separation pay exception within the meaning of Treasury Regulation § 1.409A-1(b)(9)(iii), and the provisions of this Agreement will be administered, interpreted and construed accordingly (or disregarded to the extent such provision cannot be so administered, interpreted or construed). (b) In the event that Executive is a “specified employee” (within the meaning of Section 409A and with such classification to be determined in accordance with the methodology established by the Company), amounts and benefits payable or to be provided under this Agreement that are deferred compensation (within the meaning of Section 409A) that would otherwise be paid or provided on account of Executive’s “separation from service” (as defined in Section 409A) during the six-month period immediately following such separation from service (the “Delayed Severance”) shall instead be paid, with interest (other than in respect of any payments for the vesting of Stock Awards) accrued at a per annum rate equal to the prime rate for large banks, as published in the Wall Street Journal on Executive’s separation from service for the period beginning on (but excluding) the date such payment would have been made but for Section 409A of the Code through (and including) the date of payment, on the earlier of (i) Executive’s death or (ii) the first business day after the date that is six months following such separation from service; provided, however, in the event of a CIC Qualifying Termination, the Delayed Severance 17

shall, on or as soon as practicable following Executive’s separation from service, be contributed into a rabbi trust established by the Company or the successor thereto. (c) All reimbursements or provisions of in-kind benefits pursuant to this Agreement shall be made in accordance with Treasury Regulation § 1.409A-3(i)(1)(iv) such that the reimbursement or provision will be deemed payable at a specified time or on a fixed schedule relative to a permissible payment event. Specifically, (i) the amount reimbursed or in-kind benefits provided under this Agreement during Executive’s taxable year may not affect the amounts reimbursed or provided in any other taxable year (except that total reimbursements may be limited by a lifetime maximum under a group health plan), (ii) the reimbursement of an eligible expense shall be made on or before the last day of Executive’s taxable year following the taxable year in which the expense was incurred, (iii) in the event that the provision of in-kind benefits requires the Company to impute income to Executive, the Company shall timely impute such income to Executive under applicable tax rules for the appropriate taxable year, and (iv) the right to reimbursements or provisions of in-kind benefits is not subject to liquidation or exchange for other benefit. IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of [DATE]. EXECUTIVE JELD-WEN HOLDING, INC. [NAME] [OFFICER NAME AND TITLE] 18

ANNEX A RELEASE OF CLAIMS Executive hereby irrevocably, fully and finally releases JELD-WEN Holding, Inc., a Delaware corporation (the “Company”), its parent, subsidiaries, affiliates, directors, officers, agents and employees (“Releasees”) from all causes of action, claims, suits, demands or other obligations or liabilities, whether known or unknown, suspected or unsuspected, that Executive ever had or now has as of the time that Executive signs this release which relate to Executive’s hiring, Executive’s employment with the Company, the termination of Executive’s employment with the Company and claims asserted in shareholder derivative actions or shareholder class actions against the Company and its officers and Board, to the extent those derivative or class actions relate to the period during which Executive was employed by the Company. The claims released include, but are not limited to, any claims arising from or related to Executive’s employment with the Company, such as claims arising under (as amended) Title VII of the Civil Rights Act of 1964, the Civil Rights Act of 1991, the Age Discrimination in Employment Act of 1974, the Americans with Disabilities Act, the Equal Pay Act, the Fair Labor Standards Act, the California Fair Employment and Housing Act, the California Labor Code, the Employee Retirement Income and Security Act of 1974 (“ERISA”) (except for any vested right Executive has to benefits under an ERISA plan), the state and federal Worker Adjustment and Retraining Notification Act, and the California Business and Professions Code; any other local, state, federal, or foreign law governing employment; and the common law of contract and tort. In no event, however, shall any claims, causes of action, suits, demands or other obligations or liabilities be released pursuant to the foregoing if and to the extent they relate to: (i) claims for workers’ compensation benefits under any of the Company’s workers’ compensation insurance policies or funds; (ii) claims related to Executive’s COBRA rights; (iii) claims for indemnification from the Company to which Executive is or may become entitled, including but not limited to claims submitted to an insurance company providing the Company with directors and officers liability insurance; and (iv) any claims for benefits under any employee benefit plans of the Company that become due or owing at any time following Executive’s termination of employment, including, but not limited to, any ERISA plans, deferred compensation plans or equity plans. Executive represents and warrants that Executive has not filed any claim, charge or complaint against any of the Releasees. Executive intends that this release of claims cover all claims, whether or not known to Executive. Executive further recognizes the risk that, subsequent to the execution of this release, Executive may incur loss, damage or injury which Executive attributes to the claims encompassed by this release. Executive expressly assumes this risk by signing this release and voluntarily and Annex A-1

specifically waives any rights conferred by California Civil Code section 1542 which provides as follows: A general release does not extend to claims which the creditor does not know or suspect to exist in Executive’s or her favor which if known by him or her must have materially affected his or her settlement with the debtor. Executive also hereby waives any rights under the laws of the Commonwealth of Virginia, the State of New York, or any other jurisdiction which Executive may otherwise possess that are comparable to those set forth under California Civil Code section 1542. Executive represents and warrants that there has been no assignment or other transfer of any interest in any claim by Executive that is covered by this release. Executive acknowledges that Executive has been given at least 21 days in which to review and consider this release, although Executive is free to execute this release at any time within that 21-day period. Executive acknowledges that Executive has been advised to consult with an attorney about this release. Executive also acknowledges Executive’s understanding that if Executive signs this release, Executive will have an additional 7 days from the date that Executive signs this release to revoke that acceptance, which Executive may effect by means of a written notice sent to the General Counsel of the Company at the Company’s corporate headquarters. If this 7-day period expires without a timely revocation, Executive acknowledges and agrees that this release will become final and effective on the eighth day following the date of Executive’s signature, which eighth day will be the effective date of this release. Executive acknowledges and agrees that Executive’s execution of this release is supported by independent and adequate consideration in the form of payments and/or benefits from the Company to which Executive would not have become entitled if Executive had not signed this release. IN WITNESS WHEREOF, Executive has duly executed this release as of the day and year set forth below. EXECUTIVE [NAME] Date: Annex A-2

ANNEX B FORM INDEMNIFICATION AGREEMENT INDEMNIFICATION AGREEMENT [Standard Form] Annex B-1

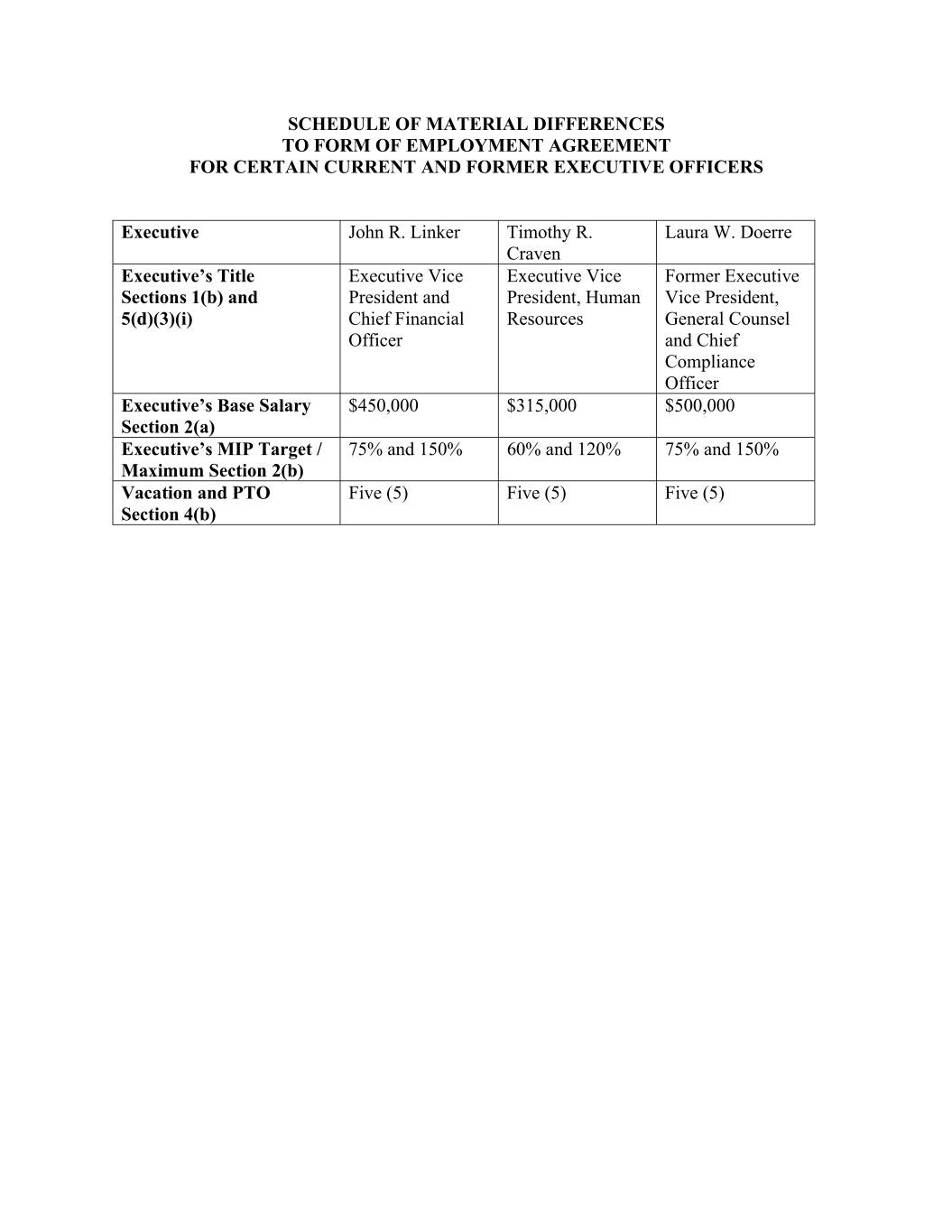

SCHEDULE OF MATERIAL DIFFERENCES TO FORM OF EMPLOYMENT AGREEMENT FOR CERTAIN CURRENT AND FORMER EXECUTIVE OFFICERS Executive Xxxx X. Xxxxxx Xxxxxxx X. Xxxxx X. Xxxxxx Xxxxxx Executive’s Title Executive Vice Executive Vice Former Executive Sections 1(b) and President and President, Human Vice President, 5(d)(3)(i) Chief Financial Resources General Counsel Officer and Chief Compliance Officer Executive’s Base Salary $450,000 $315,000 $500,000 Section 2(a) Executive’s MIP Target / 75% and 150% 60% and 120% 75% and 150% Maximum Section 2(b) Vacation and PTO Five (5) Five (5) Five (5) Section 4(b)