Certain information in this document has been omitted from this exhibit because it is both (i) not material 28722485.v7 LOAN AGREEMENT Dated as of June 10, 2022 Between COMPLEX THERAPEUTICS LLC, as Borrower and OPG HERMES INVESTMENTS (DE) LLC, as...

[***] Certain information in this document has been omitted from this exhibit because it is both (i) not material 28722485.v7 LOAN AGREEMENT Dated as of June 10, 2022 Between COMPLEX THERAPEUTICS LLC, as Borrower and OPG HERMES INVESTMENTS (DE) LLC, as Lender Property: 18408-18412 Oxnard Street, Los Angeles, California Loan Amount: $55,000,000 and (ii) is the type that the Registrant treats as private or confidential.

-i- 28722485.v7 TABLE OF CONTENTS Page ARTICLE I DEFINITIONS; PRINCIPLES OF CONSTRUCTION ........................................................... 1 SECTION 1.1. Definitions ............................................................................................................... 1 SECTION 1.2. Principles of Construction ..................................................................................... 37 ARTICLE II GENERAL TERMS .............................................................................................................. 37 SECTION 2.1. The Loan ............................................................................................................... 37 SECTION 2.2. Interest Rate .......................................................................................................... 50 SECTION 2.3. Extension Option ................................................................................................... 58 SECTION 2.4. Loan Payment ....................................................................................................... 60 SECTION 2.5. Prepayments .......................................................................................................... 61 SECTION 2.6. Release on Payment in Full ................................................................................... 61 ARTICLE III CASH MANAGEMENT; RESERVE ACCOUNTS ........................................................... 61 SECTION 3.1. Cash Management ................................................................................................. 61 SECTION 3.2. Required Deposits ................................................................................................. 63 SECTION 3.3. Adjustments to Reserve Accounts ........................................................................ 65 SECTION 3.4. Disbursements from the Reserve Accounts .......................................................... 66 SECTION 3.5. Accounts Generally ............................................................................................... 66 SECTION 3.6. Pledge of Accounts ............................................................................................... 67 SECTION 3.7. Mezzanine Loan .................................................................................................... 67 SECTION 3.8. Continuing Security Interest ................................................................................. 67 ARTICLE IV REPRESENTATIONS AND WARRANTIES .................................................................... 68 SECTION 4.1. Borrower Representations ..................................................................................... 68 SECTION 4.2. Survival of Representations .................................................................................. 79 ARTICLE V BORROWER COVENANTS ............................................................................................... 79 SECTION 5.1. Covenants .............................................................................................................. 79 ARTICLE VI INSURANCE; CASUALTY AND CONDEMNATION .................................................. 100 SECTION 6.1. Insurance ............................................................................................................. 100 SECTION 6.2. Casualty ............................................................................................................... 103 SECTION 6.3. Condemnation ..................................................................................................... 104 SECTION 6.4. Application of Net Proceeds ............................................................................... 104 ARTICLE VII EVENTS OF DEFAULT; REMEDIES............................................................................ 107 SECTION 7.1. Events of Default ................................................................................................ 107 SECTION 7.2. Remedies ............................................................................................................. 109 ARTICLE VIII LIMITATION ON RECOURSE ..................................................................................... 112 SECTION 8.1. Exculpation ......................................................................................................... 112 SECTION 8.2. Recourse for Losses ............................................................................................ 113 SECTION 8.3. Full Recourse ...................................................................................................... 115 ARTICLE IX SECONDARY MARKET TRANSACTIONS; SERVICING........................................... 116 SECTION 9.1. Secondary Market Transactions .......................................................................... 116 SECTION 9.2. Borrower Cooperation ......................................................................................... 116

-ii- 28722485.v7 SECTION 9.3. Disclosure Indemnification ................................................................................. 118 SECTION 9.4. Costs and Expenses ............................................................................................. 118 ARTICLE X MISCELLANEOUS............................................................................................................ 118 SECTION 10.1. Survival ............................................................................................................. 118 SECTION 10.2. Lender’s Discretion ........................................................................................... 119 SECTION 10.3. Governing Law ................................................................................................. 119 SECTION 10.4. Modification, Waiver in Writing ....................................................................... 120 SECTION 10.5. Delay Not a Waiver ........................................................................................... 120 SECTION 10.6. Notices .............................................................................................................. 121 SECTION 10.7. Trial by Jury ...................................................................................................... 121 SECTION 10.8. Headings ............................................................................................................ 122 SECTION 10.9. Severability ....................................................................................................... 122 SECTION 10.10. Preferences ...................................................................................................... 122 SECTION 10.11. Waiver of Notice ............................................................................................. 122 SECTION 10.12. Remedies of Borrower .................................................................................... 122 SECTION 10.13. Expenses; Indemnity ....................................................................................... 122 SECTION 10.14. Schedules Incorporated ................................................................................... 124 SECTION 10.15. Offsets, Counterclaims and Defenses ............................................................. 124 SECTION 10.16. No Joint Venture or Partnership; No Third Party Beneficiaries ..................... 124 SECTION 10.17. Publicity .......................................................................................................... 125 SECTION 10.18. Waiver of Marshalling of Assets ..................................................................... 125 SECTION 10.19. Conflict; Construction of Documents; Reliance ............................................. 125 SECTION 10.20. Brokers and Financial Advisors ...................................................................... 125 SECTION 10.21. Prior Agreements ............................................................................................ 126 SECTION 10.22. Time is of the Essence..................................................................................... 126 SECTION 10.23. Certain Additional Rights of Lender (VCOC) ................................................ 126 SECTION 10.24. Duplicate Originals, Counterparts ................................................................... 126 SECTION 10.25. Prepayment Charges........................................................................................ 126 SECTION 10.26. Registrar .......................................................................................................... 127 SECTION 10.27. Acknowledgement and Consent to Bail-In of EEA Financial Institutions...... 127 SECTION 10.28. Servicer ........................................................................................................... 128 SECTION 10.29. Lead Lender and Co-Lender Provisions ......................................................... 128

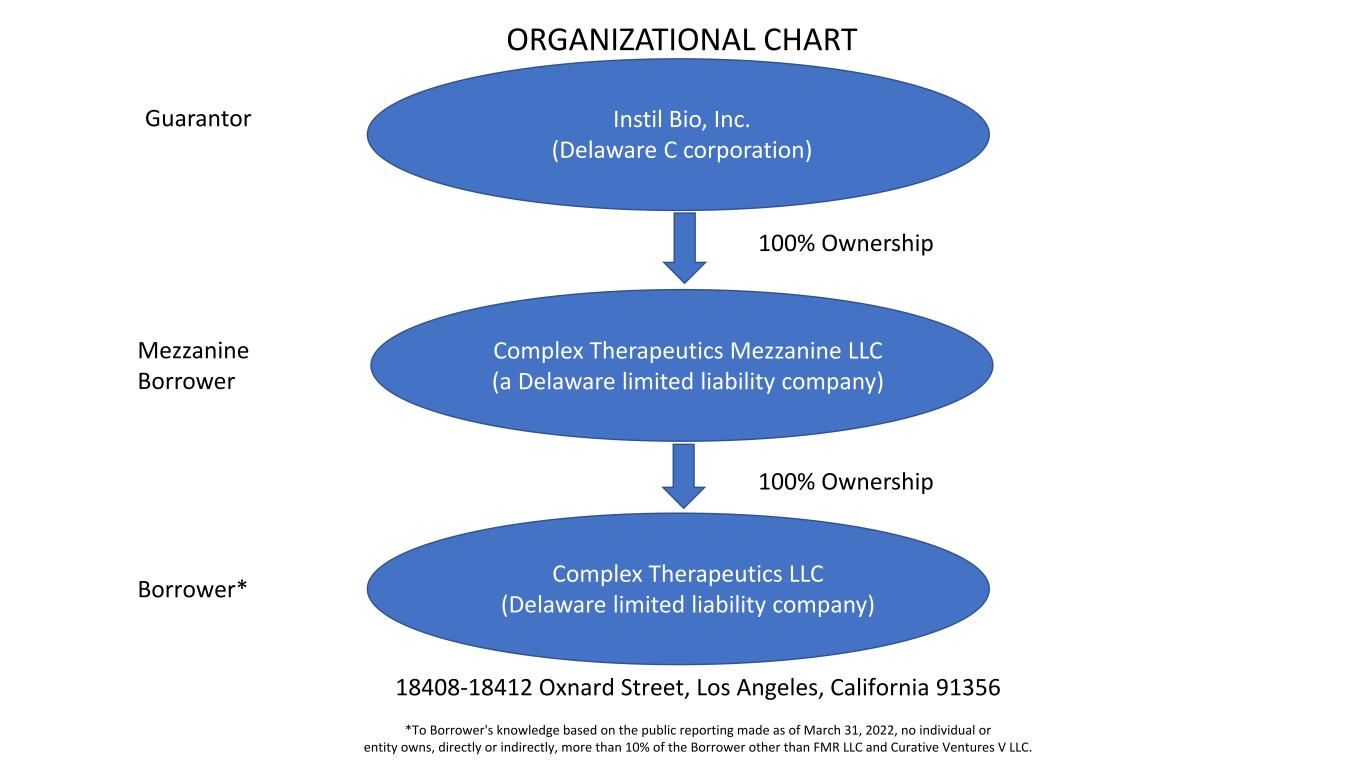

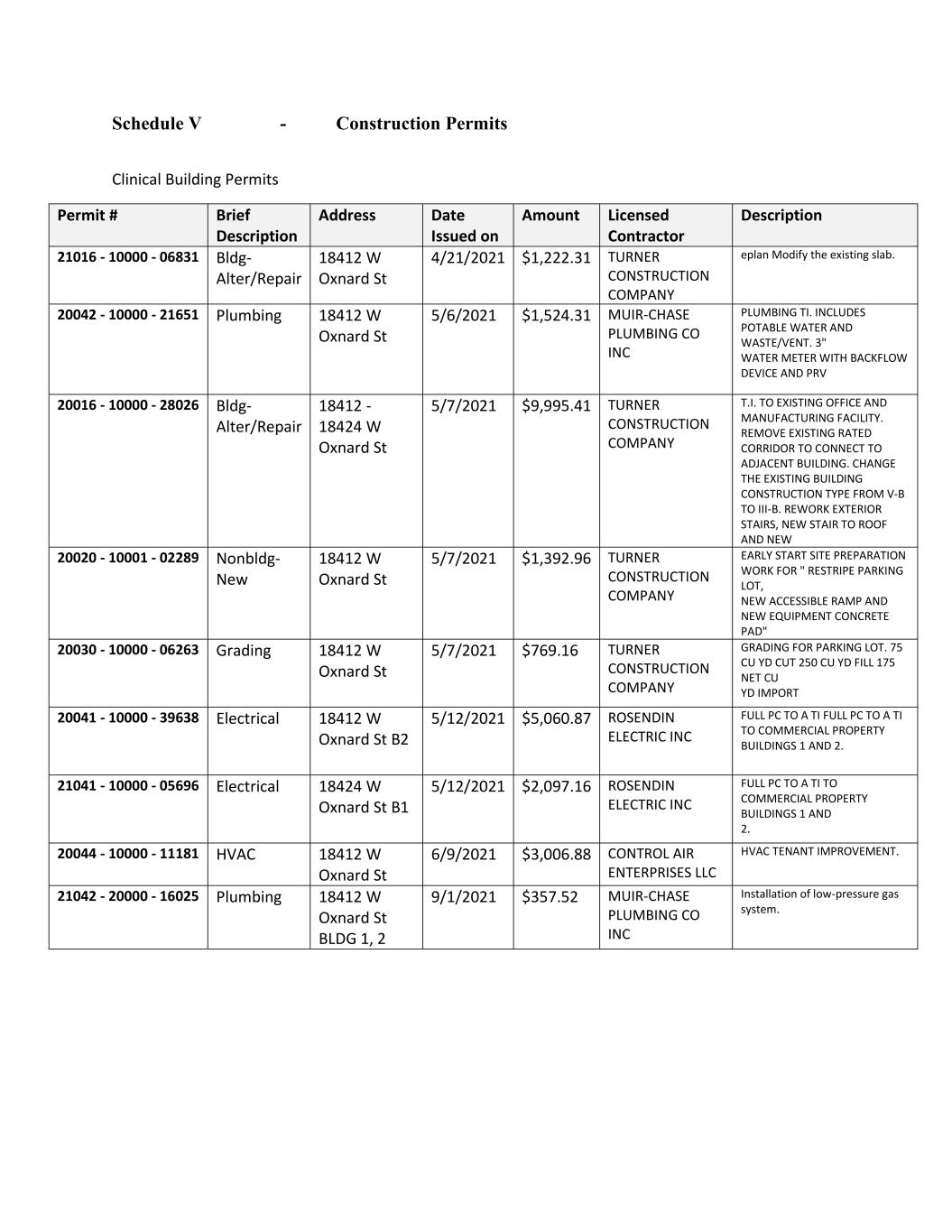

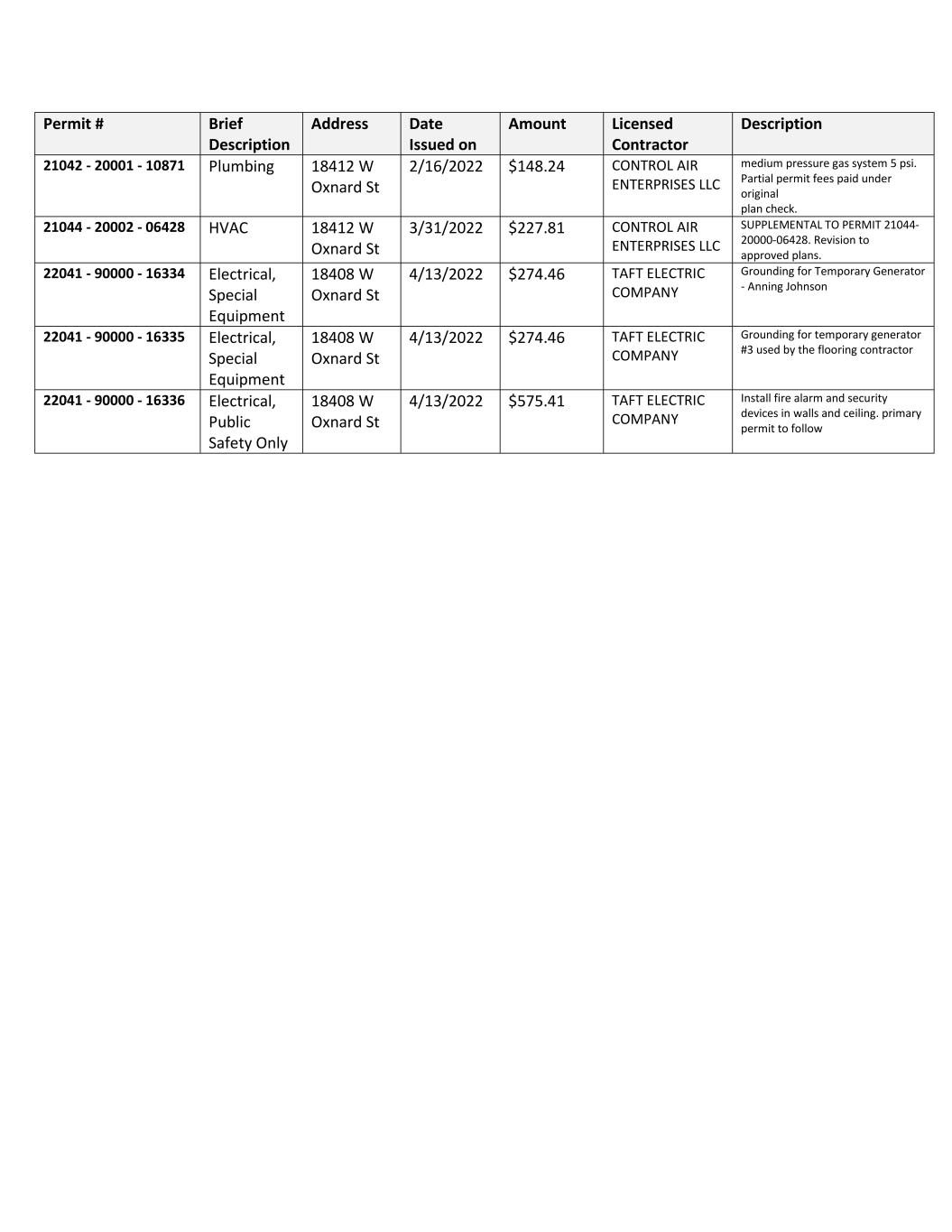

-iii- 28722485.v7 EXHIBITS & SCHEDULES Exhibit A - Legal Description of Property Exhibit B - Form of Major Trade Contractor Consent Exhibit C - Form of Officer’s Certificate Exhibit D - Initial Approved Annual Budget Exhibit E - Form of Requisition Letter Exhibit F - Intentionally Omitted Exhibit G - Intentionally Omitted Exhibit H - Intentionally Omitted Exhibit I - Intentionally Omitted Exhibit J - Intentionally Omitted Exhibits K-1 to K-4 - Forms of U.S. Tax Compliance Certificate Exhibit L - Initial Construction Budget Exhibit M - Initial Construction Schedule Schedule I - Existing Construction Documents Schedule II - Organizational Structure Schedule III - List of Material Agreements Schedule IV - List of Design Professionals Schedule V - Construction Permits Schedule VI - List of REAs Schedule VII - Exception to Physical Condition Representation

28722485.v7 LOAN AGREEMENT THIS LOAN AGREEMENT, dated as of June 10, 2022 (as amended, restated, replaced, supplemented or otherwise modified from time to time, this “Agreement”), is made by and between OPG HERMES INVESTMENTS (DE) LLC, a Delaware limited liability company (together with its successors and assigns, “Lender”), and COMPLEX THERAPEUTICS LLC, a Delaware limited liability company (“Borrower”). RECITALS WHEREAS, Borrower desires to obtain the Loan (as hereinafter defined) from Lender; and WHEREAS, Lender is willing to make the Loan to Borrower, subject to and in accordance with the terms and conditions of this Agreement and the other Loan Documents (as hereinafter defined). NOW THEREFORE, in consideration of the making of the Loan by Lender and the covenants, agreements, representations and warranties set forth in this Agreement, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby covenant, agree, represent and warrant as follows: ARTICLE I DEFINITIONS; PRINCIPLES OF CONSTRUCTION SECTION 1.1. Definitions. For all purposes of this Agreement, except as otherwise expressly required or unless the context clearly indicates a contrary intent: “Acceptable Counterparty” means a counterparty to an Interest Rate Cap Agreement, or the guarantor of such counterparty’s obligations under an Interest Rate Cap Agreement (provided that the form and substance of such guaranty is acceptable to Lender) that has a long-term unsecured debt rating of not less than “A” by S&P and “A2” from Moody’s, which rating shall not include a “t” or otherwise reflect a termination risk. “Acceptable LLC” has the meaning set forth in the definition of Special Purpose Entity. “Account Collateral” has the meaning set forth in Section 3.6 hereof. “Accounts” means, collectively, the Clearing Account, the Cash Management Account, and each of the Reserve Accounts. “Act” has the meaning set forth in the definition of Special Purpose Entity. “Additional Advance” has the meaning set forth in Section 2.1.3 hereof. “Advance Date” means, with respect to each Additional Advance, the date on which such Additional Advance is disbursed to Borrower pursuant to this Agreement. “Advance Item” means, individually and collectively as the context may require, Approved Project Expenditures and Interest and Carry Costs. “Affiliate” means, as to any Person, any other Person that (a) directly or indirectly owns twenty percent (20%) or more of the Equity Interests in such Person, and/or (b) is in Control of, is Controlled by

-2- 28722485.v7 or is under common Control with such Person, and/or (c) is a director, partner, officer or employee of such Person, and/or (d) is the spouse, issue, parent or officer of such Person. “Affiliated Manager” means any Manager that is an Affiliate of Borrower. “Agreement” has the meaning set forth in the introductory paragraph hereto. “Alternate Rate” means, with respect to each Interest Accrual Period, the per annum rate of interest of the Alternate Rate Index determined as of the Determination Date immediately preceding the commencement of such Interest Accrual Period plus the Alternate Rate Spread; provided that in no event will the Alternate Rate be less than the Minimum Rate. “Alternate Rate Index” means a floating rate index determined by Lender in its sole but good faith discretion (a) that is commonly accepted by market participants in commercial real estate loans as an alternative to Term SOFR and (b) that is publicly recognized by the International Swaps and Derivatives Association (ISDA) as an alternative to Term SOFR; provided that in no event will the Alternate Rate Index be less than the Rate Index Floor. “Alternate Rate Loan” means the Loan at such time as interest thereon accrues at a rate of interest based upon the Alternate Rate. “Alternate Rate Spread” means, in connection with any conversion of the Loan from (a) a Term SOFR Loan to an Alternate Rate Loan, the difference (expressed as the number of basis points) of (i) Term SOFR as of the Determination Date for which Term SOFR was last applicable to the Loan plus the Spread minus (ii) the Alternate Rate Index as of such Determination Date, or (b) a Prime Rate Loan to an Alternate Rate Loan, the difference (expressed as the number of basis points) of (i) the Prime Rate Index as of the Determination Date for which the Prime Rate Index was last applicable to the Loan plus the Prime Rate Spread minus (ii) the Alternate Rate Index as of such Determination Date; provided, however, that in either such case, if such difference is a negative number, then the Alternate Rate Spread shall be zero. “Applicable Rate Index” means (i) Term SOFR for so long as the Loan is a Term SOFR Rate Loan, (ii) the Alternate Rate Index for so long as the Loan is an Alternate Rate Loan or (iii) the Prime Rate Index for so long as the Loan is a Prime Rate Loan. “Appraisal” means a written statement setting forth an opinion of the market value of the Property that (i) has been independently and impartially prepared by an appraiser directly engaged by Lender, (ii) complies with all applicable federal and state laws and regulations dealing with appraisals or valuations of real property, including the minimum appraisal standards for national banks promulgated by the Comptroller of the Currency pursuant to Title XI of the Financial Institutions Reform, Recovery, and Enforcement Act of 1989, as amended (FIRREA), (iii) has been prepared on “as-stabilized” basis, (iv) has been prepared not more than sixty (60) days prior to the relevant date and (v) has been reviewed as to form and content and approved by Lender, in its reasonable discretion. “Approved Accounting Method” means generally accepted accounting principles set forth in the opinions and pronouncements of the Accounting Principles Board and the American Institute of Certified Public Accountants and statements and pronouncements of the Financial Accounting Standards Board (or agencies with similar functions of comparable stature and authority within the accounting profession), or in such other statements by such entity as may be in general use by significant segments of the U.S. accounting profession, to the extent such principles are applicable to the facts and circumstances on the date of determination, consistently applied.

-3- 28722485.v7 “Approved Annual Budget” has the meaning set forth in Section 5.1.1(f)(iv) hereof. “Approved Bank” means a bank or other financial institution that has a minimum long term unsecured debt rating of at least “A” by S&P or “A2” by Moody’s. “Approved Extraordinary Expenses” has the meaning set forth in Section 3.1.(b) hereof. “Approved Project Expenditures” means all Costs (other than Interest and Carry Costs) incurred by Borrower with respect to the Project (a) in accordance with the Construction Budget or the applicable Approved Annual Budget, as applicable, or (b) as may otherwise be reasonably approved by Lender from time to time. “Architect” means ▇▇▇▇▇ ▇▇▇▇, Inc., the architect engaged by (or on behalf of) Borrower with respect to the design and construction of the Project, together with any successor or additional architect engaged by (or on behalf of) Borrower in accordance with Section 5.1.3(k). “Architect Agreement” means that certain AIA Document B101-Standard Form of Agreement Between Owner and Architect, dated February 25, 2021 and any other agreements for architectural services which Borrower may enter into with any Architect in accordance with Section 5.1.3(k), as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time in accordance with the terms and conditions of this Agreement. “Architect Consent” means any consents and agreements required pursuant to the terms of this Agreement to be executed and delivered by an Architect to Lender with respect to any Architect Agreements entered into by and between Borrower and any Architect, which, in each case, shall be, in form and substance reasonably acceptable to Lender, as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time in accordance with the terms and conditions of this Agreement. “As-Stabilized Loan-to-Value Ratio” means as of the date of its calculation, the ratio of (a) the sum of (x) the Outstanding Principal Balance as of the date of such calculation, and (y) the Mezzanine Loan Outstanding Principal Balance as of the date of such calculation, to (b) the “as-stabilized” value of the Property, as determined by an Appraisal ordered by Lender. “Assignment of Agreements” means that certain Assignment of Agreements, Plans, Licenses and Permits, dated as of the Closing Date, by Borrower in favor of Lender, as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time. “Assignment of General Contractor Agreement” means that certain Assignment of General Contractor Agreement, Consent of General Contractor and Subordination of Fees, dated as of the Closing Date, executed and delivered by Borrower and General Contractor to Lender, as the same may be amended, replaced, supplemented or otherwise modified from time to time in accordance with the terms thereof. “Assignment of Interest Rate Cap Agreement” has the meaning set forth in Section 2.2.7(a) hereof. “Assignment of Management Agreement” means any Assignment of Management Agreement and Subordination of Management Fees, entered into among Lender, Borrower and Manager in accordance with the terms of this Agreement, as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time.

-4- 28722485.v7 “Bail-In Action” means the exercise of any Write-Down and Conversion Powers by the applicable EEA Resolution Authority in respect of any liability of an EEA Financial Institution. “Bail-In Legislation” means, with respect to any EEA Member Country implementing Article 55 of Directive 2014/59/EU of the European Parliament and of the Council of the European Union, the implementing law for such EEA Member Country from time to time which is described in the EU Bail-In Legislation Schedule. “Bankruptcy Action” means with respect to any Person (a) such Person filing a voluntary petition under the Bankruptcy Code or any other Federal or state bankruptcy or insolvency law; (b) the filing of an involuntary petition against such Person under the Bankruptcy Code or any other Federal or state bankruptcy or insolvency law; (c) such Person filing an answer consenting to or otherwise acquiescing in or joining in any involuntary petition filed against it, by any other Person under the Bankruptcy Code or any other Federal or state bankruptcy or insolvency law; or soliciting or causing to be solicited petitioning creditors for any involuntary petition from any Person; (d) the appointment of a custodian, receiver, trustee, or examiner for such Person or any portion of the Property; (e) such Person making an assignment for the benefit of creditors, or admitting, in writing or in any legal proceeding, its insolvency or inability to pay its debts as they become due, or (f) such Person commencing (or have commenced against it) a proceeding for the dissolution or liquidation of it. “Bankruptcy Code” means 11 U.S.C. § 101 et seq., as the same may be amended from time to time. “Bond” means a payment bond and a performance bond (i) in the form of AIA Document A312, or in such other form as may be reasonably acceptable to Lender, (ii) with dual obligee riders that name Lender as a co-obligee with Borrower, and (iii) issued by a surety reasonably satisfactory to Lender. “Borrower” has the meaning set forth in the introductory paragraph hereto, together with its successors and permitted assigns. “Borrower Party” means, individually and collectively, (i) Borrower, SPE Component Entity (if any), Guarantor, Mezzanine Borrower, Mezzanine Borrower SPE Component Entity (if any), Master Tenant, and any Affiliated Manager, (ii) any Affiliate of any of the foregoing, and (iii) any officers, directors, employees, or agents of any of the foregoing. “Building A” has the meaning set forth in the Master Lease. “Building B” has the meaning set forth in the Master Lease. “Business Day” means any day other than a Saturday, Sunday or any other day on which national banks in New York, New York, are not open for business. “Carry Costs Guaranty” means that certain Carry Costs Guaranty, dated as of the Closing Date, from Guarantor to and for the benefit of Lender, as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time. “Cash Expenses” means, for any period, the operating expenses for the operation of the Property as set forth in the Construction Budget or the then-effective Approved Annual Budget or, to the extent an annual budget has not been approved by Lender in accordance with the terms of this Agreement, to the extent that such expenses are actually incurred by Borrower (excluding (i) any deposits into the Tax Reserve Account and the Insurance Reserve Account that are being applied by Lender for payment of Taxes and

-5- 28722485.v7 Insurance Premiums, as applicable, in accordance with the terms of this Agreement, (ii) any expenses which Master Tenant reimburses Borrower for pursuant to the Master Lease, and (iii) any expenses that Master Tenant pays in accordance with the express terms of the Master Lease, provided, that, in the case of the immediately preceding clause (iii), there is no event of default by Master Tenant under the Master Lease. “Cash Management Account” means the deposit account established pursuant to the Cash Management Agreement. “Cash Management Agreement” means that certain Cash Management Agreement, dated as of the Closing Date by and among Cash Management Bank, Borrower and Lender, as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time. “Cash Management Bank” means, initially, Signature Bank, or such other bank or banks selected by Lender to maintain the Cash Management Account (or any Reserve Accounts to the extent they are not subaccounts of the Cash Management Account). “Cash Management Event” means the existence of any of the following: (a) the Closing Date; (b) an Event of Default; (c) any Bankruptcy Action with respect to Borrower, Mezzanine Borrower, Master Tenant, Guarantor, or any Affiliated Manager; or (d) the determination by Lender at any time that the Debt Yield is not at least eight and one-half percent (8.5%) (provided, that in the event of a failure of Borrower to deliver the information and documentation required under Section 5.1.1(f) by the required delivery date hereunder, at Lender’s option the Debt Yield will be presumed to be less than the levels required above unless and until such information and documentation are provided to Lender and demonstrate otherwise). “Cash Management Period” means the period commencing upon the occurrence of a Cash Management Event and terminating upon the occurrence of a Cash Management Termination Event with respect to all then existing Cash Management Events. “Cash Management Termination Event” means the occurrence of any of the following: (a) in the event the related Cash Management Event occurred as a result of an Event of Default, such Event of Default shall no longer exists (without implying that Borrower has a right to cure an Event of Default), no other Default or Event of Default then exists, and Lender shall not have otherwise accelerated the Loan, moved for a receiver, commenced foreclosure proceedings, or otherwise begun exercising remedies; (b) (i) in the event that the related Cash Management Event occurred as a result of a Bankruptcy Action relating to Borrower, Mezzanine Borrower, Master Tenant or Guarantor, as applicable, such Bankruptcy Action no longer exists and there has been no Material Adverse Effect as a result thereof, and (ii) in the event that the related Cash Management Event occurred as a result of a Bankruptcy Action relating to any Affiliated Manager, the replacement of such Affiliated Manager in accordance with the terms and conditions of this Agreement, and (c) with respect to the Cash Management Event described in clause (a) or (d) of the definition thereof, (i) Substantial Completion shall have occurred and (ii) Lender has determined that the Debt Yield is at least eight and one-half percent (8.5%) for two (2) consecutive calendar quarters. “Casualty” has the meaning set forth in Section 6.2 hereof. “Cause” means, with respect to an Independent Director or Independent Manager, (a) acts or omissions by such Person that constitute fraud, bad faith, gross negligence or willful disregard of such Person’s duties under the applicable agreements, (b) that such Person has engaged in or has been charged with, or has been convicted of, fraud or other acts constituting a felony under any law applicable to such Person, (c) that such Independent Director or Independent Manager is unable to perform his or her duties as an Independent Director or Independent Manager due to death, disability, or incapacity, or (d) that such

-6- 28722485.v7 Independent Director or Independent Manager no longer meets the definition of “Independent Director” or “Independent Manager”. “Change in Law” means the occurrence, after the date of this Agreement, of any of the following: (a) the adoption or taking effect of any law, rule, regulation or treaty; (b) any change in any law, rule, regulation or treaty or in the administration, interpretation, implementation or application thereof by any Governmental Authority; or (c) the making or issuance of any request, rule, guideline or directive (whether or not having the force of law) by any Governmental Authority; provided that notwithstanding anything herein to the contrary, (i) all requests, rules, guidelines or directives thereunder or issued in connection with the ▇▇▇▇-▇▇▇▇▇ ▇▇▇▇ Street Reform and Consumer Protection Act or any amendments thereto after the Closing Date, and (ii) all requests, rules, guidelines or directives promulgated by the Bank for International Settlements, the Basel Committee on Banking Supervision (or any successor or similar authority) or the United States or foreign regulatory authorities, in each case pursuant to Basel III, shall in each case be deemed to be a “Change in Law”, regardless of the date enacted, adopted or issued. “Change Order” means any amendment, supplement or other modification from and after the Closing Date in any respect to (i) the Plans and Specifications, (ii) the Construction Schedule, (iii) the Construction Budget or (iv) any Construction Contract. “Clearing Account” means the deposit account established pursuant to the Clearing Account Agreement. “Clearing Account Agreement” means any deposit account control agreement entered into among Clearing Bank, Borrower, Manager (if any) and Lender in accordance with the terms of this Agreement, as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time. “Clearing Bank” means a bank or banks selected by Borrower and approved in writing by Lender in Lender’s sole discretion. “Closing Certificate” means that certain Closing Certificate executed by Borrower as of the Closing Date. “Closing Date” means the date of this Agreement. “Closing Date Minimum Equity Requirement” means the direct and indirect owners in Borrower, in the aggregate, have invested at least $50,059,031 of cash equity in the Property (including the acquisition cost thereof) as determined by Lender. “Closing Date Term SOFR” means 1.19944%. “Code” means the Internal Revenue Code of 1986, as amended, as it may be further amended from time to time, and any successor statutes thereto, and applicable U.S. Department of Treasury regulations issued pursuant thereto in temporary or final form. “Co-Lender Agreement” has the meaning set forth in Section 10.29(b) hereof. “Combined Advance” means, as of any date, (a) the Additional Advance being made or to be made by Lender pursuant to this Agreement, plus (b) the Mezzanine Loan Additional Advance being made or to be made by Mezzanine Lender pursuant to the Mezzanine Loan Agreement.

-7- 28722485.v7 “Commercially Reasonable Efforts” means, with respect to Borrower or Guarantor, as applicable, the continuous and diligent use of all commercially reasonable efforts in good faith taking into account the interests of Lender, including, if commercially reasonable, the commencement and prosecution of litigation or other enforcement of Borrower’s and/or Guarantor’s rights under applicable agreements, at law or in equity. The use of commercially reasonable efforts shall require Borrower and Guarantor to disregard the interests of its Affiliates. Borrower’s or Guarantor’s lack of funds to pay for usual and customary reasonable legal and other costs and expenses related to Borrower’s or Guarantor’s efforts to perform shall not excuse Borrower or Guarantor from fully pursuing such efforts. “Complete” means, with respect to the Approved Project Expenditures, that (i) Substantial Completion has occurred, (ii) all Punchlist Items have been completed, (iii) the Property is free of all mechanics’, materialmen’s, and other similar Liens (or such liens have otherwise been bonded over to Lender’s reasonable satisfaction), (iv) Master Tenant has commenced paying full unabated rent with respect to the entire Property, including without limitation “Building A” and “Building B” (as each such term is defined in the Master Lease), (v) Lender has received evidence acceptable to Lender that all Legal Requirements and all private restrictions and covenants relating to the Property have been complied with or satisfied and that all necessary approvals from Governmental Authorities with respect to the Improvements have been obtained, (vi) Lender has received copies of all warranties from suppliers covering materials, equipment and appliances included within the applicable component of the work, and (vii) the conditions set forth in Section 2.1.19 have been satisfied to the satisfaction of Lender. The terms “Completed” and “Completion” shall have the same meaning when used in the Loan Documents. “Completion Due Date” means December 1, 2023. “Completion Guaranty” means that certain Completion Guaranty Agreement, dated as of the Closing Date, from Guarantor to and for the benefit of Lender, as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time. “Condemnation” means a temporary or permanent taking by any Governmental Authority as the result or in lieu or in anticipation of the exercise of the right of condemnation or eminent domain, of all or any part of the Property, or any interest therein or right accruing thereto, including any right of access thereto or any change of grade affecting the Property or any part thereof. “Conforming Changes” means, with respect to either the use or administration of Term SOFR or the use, administration, adoption or implementation of any Alternate Rate Index or the Prime Rate Index, any technical, administrative or operational changes (including, without limitation, changes to the definitions of “Business Day”, “Determination Date”, “Interest Accrual Period”, “Payment Date” “U.S. Government Securities Business Day”, preceding and succeeding business day conventions, rounding of amounts, timing and frequency of determining rates and making payments of interest, the applicability and length of lookback periods, and other technical, administrative or operational matters) that Lender decides in good faith, from time to time, may be appropriate to reflect the adoption and implementation of any such rate or to permit the use and administration thereof by Lender in a manner substantially consistent with market practice for floating rate loans held on Lender’s balance sheet and secured by U.S. commercial real estate assets (or, if Lender decides that adoption of any portion of such market practice is not administratively feasible or if Lender determines that no market practice for the administration of any such rate exists, in such other manner of administration as Lender decides is reasonably necessary in connection with the administration of this Agreement and the other Loan Documents). “Connection Income Taxes” means Other Connection Taxes that are imposed on or measured by net income (however denominated) or that are franchise Taxes or branch profits Taxes.

-8- 28722485.v7 “Construction Budget” means the construction and development budget prepared by, or on behalf of, Borrower for the construction and development of the Project, as the same may be adjusted due to changes or reallocations made in accordance with Section 2.1.7 and Section 5.1.3(c) hereof, and which, (A) shall contain Line Items with respect to the Approved Project Expenditures and setting forth (i) the Line Items for all direct and indirect Costs estimated to be incurred in connection with the Completion of the Approved Project Expenditures (including the Contingency with respect to the Approved Project Expenditures), and (ii) whether each such Line Item constitutes a Hard Cost or a Soft Cost, (B) shall contain a Line Item with respect to the estimated Interest and Carry Costs and setting forth the Line Items for all direct and indirect Costs estimated to be incurred in connection with the payment in full of the Interest and Carry Costs and (C) in any event (i) sets forth Borrower’s estimates for budgeted construction categories of all items of direct and indirect Costs to be incurred or payable with respect to the foregoing (including monthly interest on the Loan) and (ii) specifies each direct and indirect Cost that is to be funded from proceeds of each of the Loan, as the same may be amended, restated, replaced, supplemented or otherwise modified in accordance with the terms of this Agreement. The initial Construction Budget is attached hereto as Exhibit L. “Construction Consultant” means CBRE, Inc., or such other Person as may be designated and engaged by Lender in its sole discretion from to time as construction consultant to advise, consult and render reports to Lender concerning the status of the development and construction of the Project. “Construction Contract” means the Architect Agreement, the General Contractor Agreement, each Major Trade Contract, any other Trade Contract to which Borrower, General Contractor or an Affiliate of Borrower is a party, and each agreement to which a Design Professional is party, in each case, as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time to time in accordance with the terms and conditions of this Agreement. “Construction Documents” means, collectively, all Construction Contracts, the Plans and Specifications, the Construction Budget, the Construction Permits and all Change Orders, as the same may be amended, replaced, supplemented or otherwise modified from time to time in accordance with the terms and conditions of this Agreement. “Construction Drawings” means the drawings, calculations and final specifications acceptable for permitting, bidding and construction of the Required Improvements. “Construction Permits” means, collectively, all authorizations, consents and approvals, licenses and permits given or issued by Governmental Authorities which are required, from time to time, for the development and construction of the Project substantially in accordance with all Legal Requirements and the Plans and Specifications, as the same may be amended, replaced, supplemented, assigned or otherwise modified from time to time in accordance with the terms of this Agreement and applicable Legal Requirements. “Construction Schedule” means a schedule for the projected progress of the development and construction of the Project, setting forth a construction progress schedule reflecting, among other things, the anticipated dates of completion, which shall include a trade-by-trade breakdown of the estimated periods of commencement and completion of the specific work to be completed in connection with the completion of the Project substantially in accordance with the Plans and Specifications and Legal Requirements, as the same may be amended, restated, replaced, supplemented, updated or otherwise modified from time to time in accordance with the terms of this Agreement. The initial Construction Schedule is attached hereto as Exhibit M.

-9- 28722485.v7 “Contingency” means the contingency line item set forth in the Construction Budget, initially in the amount of $3,106,237 and available for Costs, pursuant to this Agreement, subject to compliance at all times with the Lien Law. “Contractor” means any contractor, subcontractor, sub-subcontractor, supplier or provider of labor, materials, equipment and/or services in connection with the construction of the Project or any Design Professional. “Control” means the possession, directly or indirectly, of the power to direct or cause the direction of management, policies or activities of a Person, whether through ownership of voting securities, by contract or otherwise. “Controlled” and “Controlling” shall have correlative meanings. “Cost Saving” has the meaning set forth in Section 2.1.11(d) hereof. “Costs” means, collectively, all costs and expenses of constructing the Project (or, with respect to Reimbursable Costs, all costs and expenses of construction of the Project prior to the Closing Date, not to exceed $33,432,725) and operating the Property (including, without limitation, all Approved Project Expenditures and Interest and Carry Costs) through the Maturity Date whether or not set forth in the Construction Budget or the Approved Annual Budget. “Debt” means the Outstanding Principal Balance, together with all interest accrued and unpaid thereon, and all other sums (including the Prepayment Premium) due from Borrower under the Loan Documents to which it is a party. “Debt Service” means, with respect to any particular period of time, scheduled principal and/or interest payments due under this Agreement. “Debt Yield” means, as of any date of determination, the amount (expressed as a percentage) determined by dividing the UNOI by the sum of (a) the Outstanding Principal Balance and (b) the Mezzanine Loan Outstanding Principal Balance. “Default” means the occurrence of any event hereunder or under any other Loan Document which, but for the giving of notice or passage of time, or both, would be an Event of Default. “Default Rate” means a rate per annum equal to the lesser of (a) the Maximum Legal Rate and (b) five percent (5%) above the Interest Rate. “Deficiency” means, as of any date of determination, the amount by which the sum of (i) such portion of the Loan and the Mezzanine Loan (so long as Mezzanine Lender is not in default of its obligations to fund Mezzanine Loan Additional Advances thereunder), in each case, as remains to be advanced as of such date in respect of Approved Project Expenditures (but only to the extent such unadvanced amounts are permitted (or would be permitted, upon satisfaction of applicable conditions precedent) pursuant to the Loan Documents to be applied to the applicable Costs and excluding undisbursed amounts in the Construction Budget for Interest and Carry Costs and other sums to be advanced to pay non-construction costs such as marketing costs), plus (ii) amounts that are guaranteed pursuant to the Equity Funding Guaranty (provided that no claim is then being pursued by Lender in respect of any of the Guarantees and Guarantor is not then in default or in breach of any of its obligations in respect of any of the Guarantees) with respect to Approved Project Expenditures, plus (iii) any unused Deficiency Collateral as of such date, is less than the actual sum, as estimated by Lender or Construction Consultant in its good faith judgment, which will be required to Complete the Project substantially in accordance with the Plans and Specifications (taking into account all Landlord Requested Changes and all Tenant Requested Changes (each such term

-10- 28722485.v7 as defined in the Master Lease), in each case, approved in accordance with the Master Lease and the Loan Documents, and as the Plans and Specifications may otherwise be amended as provided herein), in substantial accordance with the then current Construction Schedule (as the same may be amended as provided herein), and all Legal Requirements and this Agreement, and to pay all unpaid Costs in connection therewith, in each case, exclusive of any Interest and Carry Costs and other sums to be advanced to pay non-construction costs such as marketing expenses. Such estimate shall be binding and conclusive, provided that it is made in good faith and absent manifest error. “Deficiency Account” has the meaning set forth in Section 2.1.12(b) hereof “Deficiency Collateral” has the meaning set forth in Section 2.1.12(b) hereof. “Design Drawings” means the drawings and outline specifications that illustrate and describe the refinement of the design of the Required Improvements, establishing the scope, relationships, forms, size, materials, systems and appearance of the Required Improvements by means of plans, sections and elevations, typical construction details and equipment layouts. “Design Professionals” means, collectively, all architects, engineers, consultants, and similar professionals retained by or on behalf of Borrower or its Affiliates in connection with the design of the Project (including the Architect), all of which shall be licensed professionals in the State (if so required by the Legal Requirements) and shall be subject to approval by Lender prior to such engagement in connection with the Project, not to be unreasonably withheld, conditioned or delayed. Lender has approved the Design Professions listed on Schedule IV. “Determination Date” means, with respect to any determination of the Applicable Rate Index applicable to an Interest Accrual Period, the date that is two (2) U.S. Government Securities Business Days preceding the first day of the applicable Interest Accrual Period. “Downgraded Counterparty” means a counterparty to an Interest Rate Cap Agreement, or the guarantor of such counterparty’s obligations under an Interest Rate Cap Agreement that has a long-term unsecured debt rating of “A-“ or lower by S&P and “A3” or lower from Moody’s. “Draw Request” has the meaning set forth in Section 2.1.5(a) hereof. “EEA Financial Institution” means (a) any credit institution or investment firm established in any EEA Member Country which is subject to the supervision of an EEA Resolution Authority; (b) any entity established in an EEA Member Country which is a parent of an institution described in clause (a) of this definition, or (c) any financial institution established in an EEA Member Country which is a subsidiary of an institution described in clauses (a) or (b) of this definition and is subject to consolidated supervision with its parent. “EEA Member Country” means any of the member states of the European Union, Iceland, Liechtenstein, and Norway. “EEA Resolution Authority” means any public administrative authority or any person entrusted with public administrative authority of any EEA Member Country (including any delegee) having responsibility for the resolution of any EEA Financial Institution. “Eligible Account” means a separate and identifiable account from all other funds held by the holding institution that is either (a) an account or accounts maintained with a federal or state-chartered depository institution or trust company which complies with the definition of Eligible Institution or (b) a

-11- 28722485.v7 segregated trust account or accounts maintained with a federal or state chartered depository institution or trust company acting in its fiduciary capacity which, in the case of a state chartered depository institution or trust company, is subject to regulations substantially similar to 12 C.F.R. § 9.10(b), having in either case a combined capital and surplus of at least $50,000,000.00 and is subject to supervision or examination by federal and state authority. An Eligible Account will not be evidenced by a certificate of deposit, passbook or other instrument. “Eligible Institution” means a depository institution or trust company insured by the Federal Deposit Insurance Corporation the short term unsecured debt obligations or commercial paper of which are rated at least “A-1” by S&P, “P-1” by Moody’s, and “F-1+” by Fitch in the case of accounts in which funds are held for thirty (30) days or less or, in the case of letters of credit or accounts in which funds are held for more than thirty (30) days, the long term unsecured debt obligations of which are rated at least “A” by Fitch and S&P and “A2” by Moody’s. “Embargoed Person” means any Person (a) that is subject to trade restrictions under United States law, including the International Emergency Economic Powers Act, 50 U.S.C. §§ 1701 et seq., The Trading with the Enemy Act, 50 U.S.C. App. 1 et seq., and any Executive Orders or regulations promulgated under any such United States laws, with the result that transacting business with such Person (whether directly or indirectly) is or would be prohibited by law; (b) that is listed in the annex to, or who is otherwise subject to the provisions of, Executive Order No. 13224 on Terrorist Financing, effective September 24, 2001, and relating to Blocking Property and Prohibiting Transactions With Persons Who Commit, Threaten to Commit, or Support Terrorism (as amended or supplemented, the “Executive Order”) or any other Prescribed Laws; (c) that is owned or Controlled by, or acting for or on behalf of, any person or entity that is listed in the annex to, or is otherwise subject to the provisions of, the Executive Order or any other Prescribed Laws; (d) with whom a Person is prohibited from dealing or otherwise engaging in any transaction by any terrorism or money laundering law, including the Executive Order and any other Prescribed Laws; (e) who commits, threatens or conspires to commit or supports “terrorism” as defined in the Executive Order or any other Prescribed Laws; (f) that is named as a “specially designated national and blocked person” on the most current list published by the U.S. Treasury Department Office of Foreign Assets Control at its official website or at any replacement website or other replacement official publication of such list; (g) that is named on any other list of terrorists, terrorist organizations or narcotics traffickers maintained pursuant to any of the Rules and Regulations of OFAC, or on any similar lists maintained by the United States Department of State, the United States Department of Commerce or any other Governmental Authority or pursuant to any Executive Order of the President of the United States of America; (h) that has been previously indicted for or convicted of any felony involving a crime or crimes of moral turpitude or for any violation of Prescribed Laws, or is currently under investigation by any Governmental Authority for alleged criminal activity; or (i) who is an Affiliate of a Person listed in clauses (a) through (h) above. “Engineer” means each engineer with respect to the Project on the date hereof, together with any successor or additional engineers engaged by (or on behalf of) Borrower or its Affiliate to perform any structural, mechanical, electrical and/or soil engineering services with respect to all or any portion of the Project. “Engineer Agreement” means each agreement for engineering services which Borrower has entered into or may enter into with any Engineer in accordance with Section 5.1.3(k), as the same may be amended, replaced, supplemented or otherwise modified from time to time in accordance with the terms hereof. “Engineer Consent” means any consents and agreements required pursuant to the terms of this Agreement to be executed and delivered by an Engineer to Lender with respect to any Engineer Agreements

-12- 28722485.v7 entered into by and between Borrower and any Engineer, which, in each case, shall be, in form and substance reasonably acceptable to Lender, as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time in accordance with the terms and conditions of this Agreement. “Environmental Indemnity” means that certain Environmental Indemnity Agreement, dated as of the Closing Date, executed by Borrower and Guarantor in connection with the Loan for the benefit of Lender, as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time. “Environmental Report” means that certain Phase I Environmental Site Assessment Report, dated as of May 6, 2022, prepared by Partner Engineering and Science, Inc., as Project No. 22-366205.1. “Equity Funding Guaranty” means that certain Guaranty of Equity Obligations, dated as of the Closing Date, from Guarantor to and for the benefit of Lender, as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time. “Equity Interests” means (a) partnership interests (general or limited) in a partnership; (b) membership interests in a limited liability company; (c) shares or stock interests in a corporation, and (d) the beneficial ownership interests in a trust. “ERISA” means the Employee Retirement Income Security Act of 1974, as amended. “Estimated Interest and Carry Available Amount” has the meaning set forth in Section 2.1.9(d) hereof. “Estimated Interest and Carry Costs” has the meaning set forth in Section 2.1.9(d) hereof. “EU Bail-In Legislation Schedule” means the EU Bail-In Legislation Schedule published by the Loan Market Association (or any successor person), as in effect from time to time. “Event of Default” has the meaning set forth in Section 7.1 hereof. “Excess Cash Flow” has the meaning set forth in Section 3.1(b) hereof. “Excess Cash Flow Reserve Account” has the meaning set forth in Section 3.1(b) hereof. “Exchange Act” means the Securities and Exchange Act of 1934, as amended. “Excluded Taxes” means any of the following Taxes imposed on or with respect to a Lender or required to be withheld or deducted from a payment to a Lender: (a) Taxes imposed on or measured by net income (however denominated), franchise Taxes, and branch profits Taxes, in each case, (i) imposed as a result of such Lender being organized under the laws of, or having its principal office or, in the case of any Lender, its applicable lending office located in, the jurisdiction imposing such Tax (or any political subdivision thereof), or (ii) that are Other Connection Taxes; (b) in the case of a Lender, U.S. federal withholding Taxes imposed on amounts payable to or for the account of such Lender with respect to an applicable interest in a Loan or commitment pursuant to a law in effect on the date on which (i) such Lender acquires such interest in the Loan or commitment, or (ii) such Lender changes its lending office, except in each case to the extent that, pursuant to Section 2.2.3(a), amounts with respect to such Taxes were payable either to such Lender’s assignor immediately before such Lender became a party hereto or to such Lender immediately before it changed its lending office; (c) Taxes attributable to such Lender’s failure to comply with Section 2.2.3(b); and (d) any withholding Taxes imposed under FATCA.

-13- 28722485.v7 “Excusable Delay” means any delay or number of delays due to conditions beyond the reasonable control of Borrower and/or its Affiliates (in each case, so long as Borrower continuously and diligently uses all Commercially Reasonable Efforts to mitigate the effect thereof), including, without limitation, strikes, stays, judgments, orders, decrees, labor disputes, governmental restrictions, acts of God, the elements, enemy action, civil commotion, fire, casualty, accidents, shortages of, or inability to obtain, labor, utilities or material, actual or threatened health emergency (including, without limitation, epidemic, pandemic (including, for the avoidance of doubt, the ongoing COVID-19 pandemic), famine, disease, plague, quarantine, and other health risk); provided, however, that (i) any lack of funds in and of itself shall not be deemed to be a condition beyond the reasonable control of Borrower and (ii) any failure by any contractor or sub-contractor to perform its obligations under any contractor or sub-contractor agreement in and of itself shall not be deemed to be a condition beyond the reasonable control of Borrower (unless due to the bankruptcy or insolvency of such contractor or sub-contractor); provided that in no event shall Excusable Delay exceed sixty (60) consecutive calendar days or ninety (90) days in the aggregate. “Executive Order” has the meaning set forth in the definition of “Embargoed Person”. “Existing Construction Documents” means, collectively, the Construction Documents in effect as of the Closing Date, as more particularly described on Schedule I hereto. “Extension Option” has the meaning set forth in Section 2.3.1 hereof. “Extension Shortfall” has the meaning set forth in Section 2.3.1(k) hereof. “Extension Term” has the meaning set forth in Section 2.3.1 hereof. “Extraordinary Expenses” has the meaning set forth in Section 5.1.1(f)(iv). “FATCA” means Sections 1471 through 1474 of the Code, as of the date of this Agreement (or any amended or successor version that is substantively comparable and not materially more onerous to comply with), any current or future regulations or official interpretations thereof, any agreements entered into pursuant to Section 1471(b)(1) of the Code and any fiscal or regulatory legislation, rules or practices adopted pursuant to any intergovernmental agreement, treaty or convention among Governmental Authorities and implementing such Sections of the Code. “Financial Covenant Requirements” means, collectively, the Guarantor Net Worth and Liquid Assets (each such term as defined in the Recourse Guaranty) requirements set forth in the Recourse Guaranty. “Fitch” means Fitch, Inc. “Foreign Lender” means (a) if Borrower is a U.S. Person, a Lender that is not a U.S. Person, and (b) if Borrower is not a U.S. Person, a Lender that is resident or organized under the laws of a jurisdiction other than that in which Borrower is resident for tax purposes. “General Contractor” means (i) ▇▇▇▇▇▇ Construction Company or (ii) any other bondable general contractor or construction manager, as the case may be, licensed in the State, engaged by Borrower or its Affiliate with respect to the construction of the Project and approved by Lender, such approval not to be unreasonably withheld, conditioned or delayed, and for which Lender has received a general contractor in the form of the Assignment of General Contractor Agreement.

-14- 28722485.v7 “General Contractor Agreement” means (i) that certain AIA Document A133-Standard Form Agreement Between Owner and Construction Manager as Constructor, dated as of October 26, 2020, between Borrower and General Contractor, as amended by those two (2) certain Guaranteed Maximum Price Amendments, dated as of December 17, 2020, as further amended by that certain Guaranteed Maximum Price Amendment, dated as of December 31, 2020, as further amended by that certain Guaranteed Maximum Price Amendment, dated as of January 27, 2021, by those two (2) certain Guaranteed Maximum Price Amendment, dated March 5, 2021, as further amended by that certain Guaranteed Maximum Price Amendment, dated as of March 30, 2021, as further amended by that certain Guaranteed Maximum Price Amendment, dated as of April 20, 2021, as further amended by that certain Guaranteed Maximum Price Amendment, dated as of April 26, 2021, as further amended by that certain Guaranteed Maximum Price Amendment, dated as of May 13, 2021, as further amended by that certain Guaranteed Maximum Price Amendment, dated as of May 21, 2021, as further amended by that certain Guaranteed Maximum Price Amendment, dated as of May 27, 2021, as further amended by that certain Guaranteed Maximum Price Amendment, dated as of June 20, 2021, as further amended by that certain Guaranteed Maximum Price Amendment, dated as of July 23, 2021, as further amended by that certain Guaranteed Maximum Price Amendment, dated as of August 25, 2021, and as further amended by that certain Guaranteed Maximum Price Amendment, dated as of September 15, 2021, (b) any other documentation executed by and between Borrower and General Contractor evidencing or relating to the guaranteed maximum price thereunder and (c) any guaranty of General Contractor’s obligations under the General Contractor Agreement provided by any Person, and (ii) any general contractor or other agreement which may be entered into by (or on behalf of) Borrower or its Affiliate with any successor or additional or other General Contractor subject to the requirements of Section 5.1.3(k), as each of the foregoing in (i) and (ii) may be amended, restated, replaced, supplemented or otherwise modified from time to time in accordance with the terms and conditions of this Agreement. “Governmental Authority” means any court, board, agency, bureau, department, commission, office or other authority of any nature whatsoever for any governmental ▇▇▇▇ (▇▇▇▇▇▇▇, ▇▇▇▇▇, ▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇, ▇▇▇▇ or otherwise), whether now or hereafter in existence. “Guarantor” means Instil Sponsor, together with its successors and permitted assigns. “Guarantees” means, collectively, the Recourse Guaranty, the Carry Cost Guaranty, the Completion Guaranty and the Equity Funding Guaranty, each dated as of the Closing Date, from Guarantor to and for the benefit of Lender, as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time. “Hard Costs” means, collectively, all costs and expenses constituting Costs of the Project set forth in the Construction Budget which are denominated in the Construction Budget as “Hard Costs”. “HVCRE” means any loan classified as a Highly Volatile Commercial Real Estate Loan by the Basel Committee on Banking Regulations and Supervisory Practices (or any successor or similar authority) including the rules, guidelines and directives promulgated pursuant to Basel III. “Improvements” has the meaning set forth in the granting clause of the Security Instrument. “In Balance” has the meaning set forth in Section 2.1.11(a) hereof. “Increased Costs” has the meaning set forth in Section 2.2.5(a) hereof. “Indebtedness” means for any Person, on a particular date, the sum (without duplication) at such date of (a) all indebtedness or liability of such Person (including amounts for borrowed money and

-15- 28722485.v7 indebtedness in the form of mezzanine debt and preferred equity); (b) obligations of such Person that are evidenced by bonds, debentures, notes, or other similar instruments; (c) obligations of such Person for the deferred purchase price of property or services (including trade obligations for which such Person is liable); (d) obligations of such Person under letters of credit; (e) obligations of such Person under acceptance facilities; (f) all guaranties, endorsements (other than for collection or deposit in the ordinary course of business) and other contingent obligations to purchase, to provide funds for payment, to supply funds, to invest in any Person or entity, or otherwise to assure a creditor against loss; (g) obligations secured by any liens granted by such Person, whether or not the obligations have been assumed or are those of any other Person, and (h) without duplication of the foregoing, any contingent obligations of such Person (determined in accordance with the Approved Accounting Method). “Indemnified Party” has the meaning set forth in Section 10.13(b) hereof. “Indemnified Taxes” means (a) Taxes, other than Excluded Taxes, imposed on or with respect to any payment made by or on account of any obligation of Borrower under any Loan Document, and (b) to the extent not otherwise described in clause (a), Other Taxes. “Independent” means, when used with respect to any Person, a Person that: (a) does not have any direct financial interest or any material indirect financial interest in Borrower or in any Affiliate of Borrower; (b) is not connected with Borrower or any Affiliate of Borrower as an officer, employee, promoter, underwriter, trustee, partner, member, manager, creditor, director, supplier, customer, or person performing similar functions; and (c) is not a member of the immediate family of a Person defined in clause (a) or (b) above. “Independent Accountant” means a “Big Four” accounting firm or another accounting firm of nationally recognized, certified public accountants which is Independent and which is selected by Borrower and reasonably acceptable to Lender. “Independent Director” or “Independent Manager” means, of any Special Purpose Entity, or if such Special Purpose Entity is a limited partnership, the general partner of such Special Purpose Entity, an individual who has prior experience as an independent director, independent manager or independent member with at least three years of employment experience and who is provided by CT Corporation, Corporation Service Company, National Registered Agents, Inc. (or its affiliate NRAI Entity Services, LLC), Wilmington Trust Company, ▇▇▇▇▇▇▇ Management Company, Lord Securities Corporation or, if none of those companies is then providing professional Independent Directors or Independent Managers, another nationally-recognized company reasonably approved by Lender, in each case that is not an Affiliate of the Borrower Parties and that provides professional Independent Directors and Independent Managers and other corporate services in the ordinary course of its business, and which individual is duly appointed as an Independent Manager or Independent Director, or as a member of the board of directors or board of managers of such corporation or limited liability company, as applicable, and for the five-year period prior to his or her appointment as an Independent Director has not been and during the continuation of his or her serving as an Independent Director will not be, any of the following: (a) a member (other than a Special Member), manager, director, trustee, officer, employee, attorney, or counsel of any of the Borrower Parties or their Affiliates (provided that such person may be an Independent Director or Independent Manager of Borrower as long as they are not a member, manager, director, trustee, officer, employee, attorney, or counsel of any other Borrower Party or Affiliate of a Borrower Party, except that a Person who otherwise satisfies the definition of Independent Director or Independent Manager other than this subparagraph (a) by reason of being the independent director or independent manager of a “special purpose entity” that is an Affiliate of Borrower shall not be disqualified from serving as an Independent Director or Independent Manager of Borrower if such Person is either (i)

-16- 28722485.v7 a professional Independent Director or Independent Manager or (ii) the fees that such individual earns from serving as independent director or independent manager of Affiliates of Borrower in any given year constitute in the aggregate less than five percent (5%) of such individual’s annual income for that year); (b) a creditor, customer, supplier, service provider (including provider of professional services) or other Person who derives any of its purchases or revenues from its activities with any Borrower Party or any Affiliate of a Borrower Party (other than an Independent Manager or Independent Director provided by a nationally-recognized company that routinely provides professional Independent Directors or Independent Managers and other corporate services to any Borrower Party or any Affiliate of a Borrower Party in the ordinary course of business); (c) a direct or indirect legal or beneficial owner in any Borrower Party or any Affiliate of a Borrower Party; (d) a member of the immediate family of any member, manager, employee, attorney, customer, supplier or other Person referred to above; and (e) a Person Controlling or under the common Control of anyone listed in subparagraphs (a) through (d) above. “Initial Advance” has the meaning set forth in Section 2.1.2 hereof. “Initial Maturity Date” means the Payment Date in July 9, 2025. “Initial Payment Date” means the Payment Date occurring in July, 2022. “Instil Sponsor” means Instil Bio, Inc., a Delaware corporation. “Insurance Reserve Account” has the meaning set forth in Section 3.2.2(a) hereof. “Insurance Premiums” has the meaning set forth in Section 6.1(b) hereof. “Interest Accrual Period” means, (i) with respect to the Initial Payment Date, the period commencing on the Closing Date up to but not including the Initial Payment Date, and (ii) with respect to any other Payment Date, the period commencing on and including the ninth (9th) day of the preceding calendar month and ending on and including the eighth (8th) day of the calendar month in which such Payment Date occurs. “Interest and Carry Costs” means all amounts required to be deposited or paid (as applicable) pursuant to Section 3.1(b)(i) through (ix) hereof (including, without limitation, all fees, costs and expenses payable to Lender under the Loan Documents or Mezzanine Lender under the Mezzanine Loan Documents). “Interest and Carry Costs Advance Amount” means an amount equal to $399,422. “Interest and Carry Cost Line Item” means the Line Item or Line Items set forth in the Construction Budget in an amount equal to $1,210,369 and available for Interest and Carry Costs pursuant to this Agreement. “Interest and Carry Cost Shortfall” has the meaning set forth in Section 2.1.9(d) hereof.

-17- 28722485.v7 “Interest Rate” means, for any Interest Accrual Period, (i) the Term SOFR Rate for so long as the Loan is a Term SOFR Rate Loan, (ii) the Alternate Rate for so long as the Loan is an Alternate Rate Loan or (iii) the Prime Rate for so long as the Loan is a Prime Rate Loan. “Interest Rate Cap Agreement” has the meaning set forth in Section 2.2.7(a); provided, that, after delivery of a Replacement Interest Rate Cap Agreement or a Substitute Interest Rate Cap Agreement to Lender, the term “Interest Rate Cap Agreement” shall be deemed to include such Replacement Interest Rate Cap Agreement or Substitute Interest Rate Cap Agreement and such Replacement Interest Rate Cap Agreement or Substitute Interest Rate Cap Agreement shall be subject to all requirements applicable to the Interest Rate Cap Agreement. “Late Payment Charge” has the meaning set forth in Section 2.4.2 hereof. “Lead Lender” has the meaning set forth in Section 10.29(a) hereof. “Lease” means the Master Lease any other lease, sublease or sub-sublease, letting, license, concession or other agreement (whether written or oral and whether now or hereafter in effect) pursuant to which any Person is granted a possessory interest in, or right to use or occupy all or any portion of any space in the Property, and (a) every modification, amendment or other agreement relating to such lease, sublease, sub-sublease, or other agreement entered into in connection with such lease, sublease, sub- sublease, or other agreement and (b) every guarantee of the performance and observance of the covenants, conditions and agreements to be performed and observed by the other party thereto. “Legal Requirements” means all federal, state, county, municipal and other governmental statutes, laws, rules, orders, regulations, ordinances, building codes, land laws, judgments, decrees and injunctions of Governmental Authorities affecting the Loan, any Secondary Market Transaction with respect to the Loan, Borrower, Master Tenant, Guarantor and/or the Property or any part thereof, or the construction, use, alteration or operation thereof, or any part thereof, whether now or hereafter enacted and in force, including the Securities Act, the Exchange Act, Regulation AB, and regulations promulgated pursuant to the ▇▇▇▇- ▇▇▇▇▇ ▇▇▇▇ Street Reform and Consumer Protection Act (or any statute replacing or amending the same), the Americans with Disabilities Act of 1990, as amended, and all permits, licenses and authorizations and regulations relating thereto, and all covenants, agreements, restrictions and encumbrances contained in any instruments, either of record or known to Borrower, at any time in force affecting Borrower, Master Tenant, Guarantor, the Property or any part thereof, including any which may (a) require repairs, modifications or alterations in or to the Property or any part thereof, or (b) in any way limit the use and enjoyment thereof. “Lender” has the meaning set forth in the introductory paragraph hereto, together with its successors and assigns (including the holder of each Note). “Letter of Credit” means an irrevocable, unconditional, freely transferable (without cost to Lender), clean sight draft letter of credit, as the same may be replaced, split, substituted, modified, amended, supplemented, assigned or otherwise restated from time to time, which (a) names a Person other than Borrower as the account party, (b) either does not expire sooner than, or can be renewed for successive one (1) year periods ending not sooner than, thirty (30) days after the Maturity Date (or such earlier date as is thirty (30) days after such Letter of Credit is no longer required pursuant to the terms of this Agreement), (c) entitles Lender to draw thereon in New York City based solely on a statement purportedly executed by an officer of Lender stating that it has the right to draw thereon, (d) is issued by a domestic Approved Bank or the U.S. agency or branch of a foreign Approved Bank, or if there are no domestic Approved Banks or U.S. agencies or branches of a foreign Approved Bank then issuing letters of credit, then such letter of credit may be issued by a domestic bank, the long term unsecured debt rating of which is the highest such rating then given by the Rating Agency or Rating Agencies, as applicable, to a domestic commercial bank,

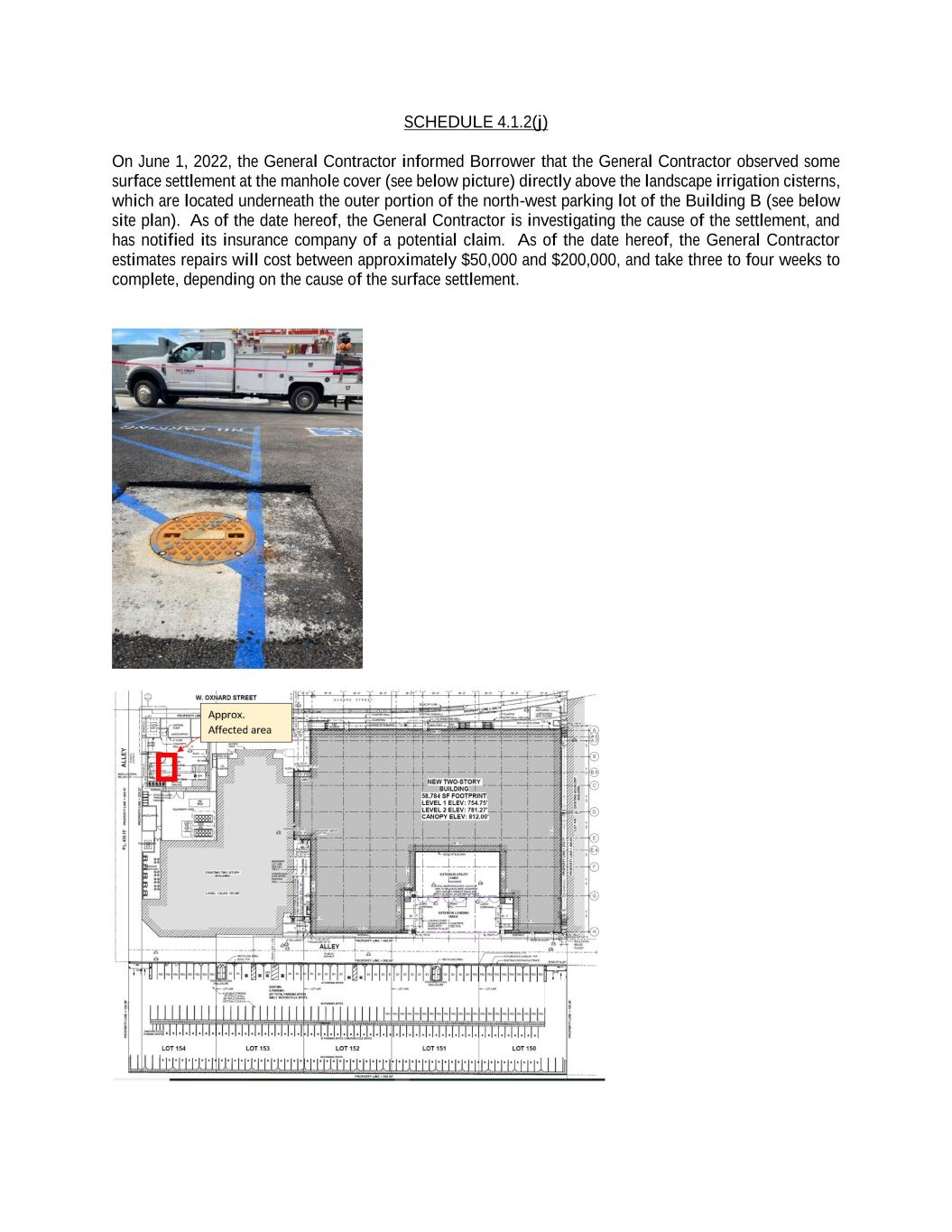

-18- ▇▇▇▇▇▇▇▇.v7 in any event having an office in New York City where presentation may be made by Lender, and (e) is otherwise in form and substance acceptable to Lender. If at any time the bank issuing any such Letter of Credit shall cease to be an Approved Bank, or if Borrower fails to cause such Letter of Credit to be renewed or replaced no later than thirty (30) days prior to any annual expiration thereof, Lender shall have the right immediately to draw down the same in full (or in part) and hold the proceeds of such draw as collateral for the Loan in a Reserve Account. “Lien” means any mortgage, deed of trust, lien (statutory or otherwise), pledge, hypothecation, easement, restrictive covenant, preference, assignment, security interest, or any other encumbrance, charge or transfer of, or any agreement to enter into or create any of the foregoing, on or affecting Borrower, the Property, or any portion thereof or any interest therein, or any direct or indirect interest in Borrower or SPE Component Entity, including any conditional sale or other title retention agreement, any financing lease having substantially the same economic effect as any of the foregoing, the filing of any financing statement, and mechanic’s, materialman’s and other similar liens and encumbrances. “Lien Law” means the lien law of the State as in effect from time to time, with respect to mechanic’s liens and lien priority. “Line Item” means a line item of cost or expense set forth in the Construction Budget, as the same may be adjusted in compliance with Section 2.1.11 or Section 5.1.3(c). “Loan” means the loan in the maximum principal amount of the Loan Amount made by Lender to Borrower pursuant to this Agreement. “Loan Amount” means the sum of $55,000,000. “Loan Documents” means, collectively, this Agreement, the Note, the Security Instrument, the Guarantees, the Environmental Indemnity, the Assignment of Management Agreement, the Assignment of Agreements, the Assignment of General Contractor Agreement, each Architect Consent, each Engineer Consent, each Major Trade Contractor Consent, the Cash Management Agreement, the Clearing Account Agreement, any Assignment of Interest Rate Cap Agreement, the Closing Certificate, the Master Lease SNDA and all other certificates, documents, agreements or instruments now or hereafter executed and/or delivered in connection with the Loan (as each may be amended, modified, extended, consolidated or supplemented from time to time). “Loss” or “Losses” means, with respect to any Person, all liabilities, obligations, losses, damages, fines, penalties, actions, proceedings, judgments, suits, claims, debts, costs, expenses, charges, fees, awards, amounts paid in settlement, demands, and disbursements of any kind or nature whatsoever (including reasonable attorneys’ fees) of or suffered or incurred by such Person in connection with or relating to the Loan, the Property, or any other collateral for the Loan (but not including (a) special, speculative, exemplary, or punitive damages, or (b) consequential damages in the nature of alleged “lost profits” or “lost opportunities”, in each case with respect to the foregoing clauses (a) and (b) except to the extent that a party seeking indemnification of such amount has paid or is required to pay such measure of damages other than as a result of (and to the extent of) its own gross negligence, willful misconduct or fraud). “Major Milestones” means the fulfillment of the following milestones for the Project as determined by Lender in its sole but good faith discretion: (i) Substantial Completion shall have occurred no later than the Substantial Completion Due Date; and (ii) Completion shall have occurred no later than the Completion Due Date.