OFFICE LEASE AGREEMENT BY AND BETWEEN 6200 STONERIDGE MALL ROAD INVESTORS LLC, a Delaware limited liability company AS LANDLORD and WORKDAY, INC., a Nevada corporation AS TENANT DATED September 18, 2008

EXHIBIT 10.8

BY AND BETWEEN

6200 STONERIDGE MALL ROAD INVESTORS LLC,

a Delaware limited liability company

AS LANDLORD

and

a Nevada corporation

AS TENANT

DATED September 18, 2008

TABLE OF CONTENTS

| Page | ||||||

| Index of Defined Terms | iv | |||||

| Basic Lease Information | vi | |||||

| 1. |

Demise | 1 | ||||

| 2. |

Premises and Common Areas | 1 | ||||

| 3. |

Term | 4 | ||||

| 4. |

Rent | 4 | ||||

| 5. |

Utilities and Services | 16 | ||||

| 6. |

Late Charge | 20 | ||||

| 7. |

Security Deposit (Letter Of Credit) | 20 | ||||

| 8. |

Possession | 22 | ||||

| 9. |

Use of Premises | 23 | ||||

| 10. |

Acceptance of Premises | 26 | ||||

| 11. |

Surrender | 26 | ||||

| 12. |

Alterations and Additions | 27 | ||||

| 13. |

Maintenance and Repairs of Premises | 29 | ||||

| 14. |

Landlord’s Insurance | 30 | ||||

| 15. |

Tenant’s Insurance | 31 | ||||

| 16. |

Indemnification | 32 | ||||

| 17. |

Subrogation | 33 | ||||

| 18. |

Signs | 33 | ||||

| 19. |

Free From Liens | 35 | ||||

| 20. |

Entry By Landlord | 36 | ||||

| 21. |

Destruction and Damage | 36 | ||||

| 22. |

Condemnation | 38 | ||||

| 23. |

Assignment and Subletting | 39 | ||||

| 24. |

Default | 43 | ||||

| 25. |

Landlord’s Remedies | 45 | ||||

| 26. |

Landlord’s Right to Perform Tenant’s Obligations | 47 | ||||

| 27. |

Landlord Default | 48 | ||||

| 28. |

Attorneys’ Fees | 48 | ||||

| 29. |

Taxes | 49 | ||||

i

| 30. |

Effect of Conveyance | 49 | ||||

| 31. |

Estoppel Certificates | 49 | ||||

| 32. |

Subordination | 49 | ||||

| 33. |

Environmental Covenants | 50 | ||||

| 34. |

Notices | 54 | ||||

| 35. |

Waiver | 54 | ||||

| 36. |

Holding Over | 54 | ||||

| 37. |

Successors and Assigns | 55 | ||||

| 38. |

Time | 55 | ||||

| 39. |

Brokers | 55 | ||||

| 40. |

Limitation of Liability | 55 | ||||

| 41. |

Financial Statements | 56 | ||||

| 42. |

Rules And Regulations | 56 | ||||

| 43. |

Mortgagee Protection | 57 | ||||

| 44. |

Parking | 57 | ||||

| 45. |

Entire Agreement | 59 | ||||

| 46. |

Interest | 59 | ||||

| 47. |

Governing Law; Construction | 60 | ||||

| 48. |

Representations and Warranties of Tenant | 60 | ||||

| 49. |

Representations and Warranties of Landlord | 61 | ||||

| 50. |

Name of Building | 62 | ||||

| 51. |

Security | 62 | ||||

| 52. |

Jury Trial Waiver | 62 | ||||

| 53. |

Recordation | 63 | ||||

| 54. |

Right to Lease | 63 | ||||

| 55. |

Force Majeure | 63 | ||||

| 56. |

Acceptance | 63 | ||||

| 57. |

Renewal Option | 63 | ||||

| 58. |

Expansion Option (6210 Stoneridge) | 66 | ||||

| 59. |

Expansion Option (6230 Stoneridge) | 68 | ||||

| 60. |

Right Of First Offer (6210 Stoneridge) | 69 | ||||

| 61. |

Option to Terminate | 70 | ||||

| 62. |

Consents | 72 | ||||

ii

| 63. |

Definition of Prime Rate | 72 | ||||

| 64. |

Business Days | 72 | ||||

| 65. |

Conditions Precedent | 72 | ||||

| 66. |

Interim Resolution | 73 | ||||

| 67. |

Global Termination Right | 74 | ||||

| 68. |

Counterparts | 74 | ||||

INDEX OF EXHIBITS

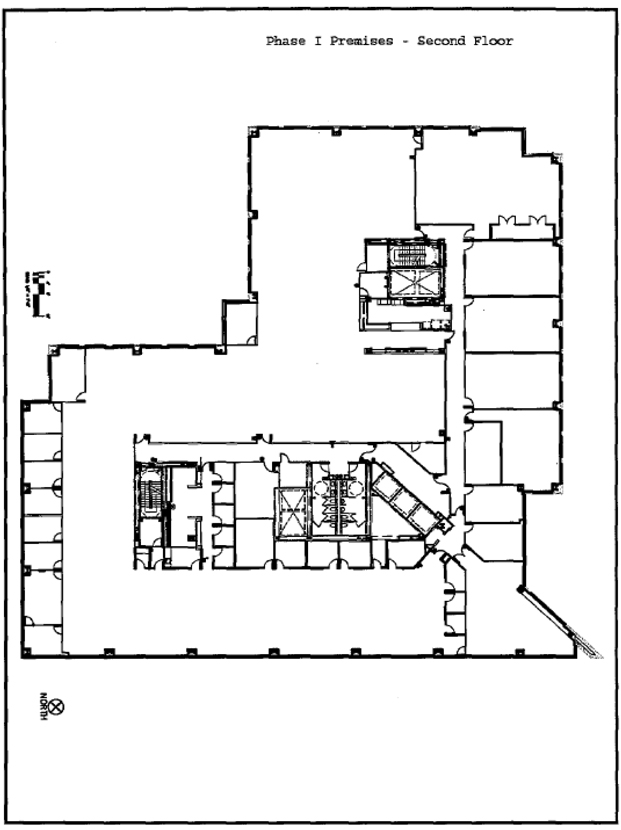

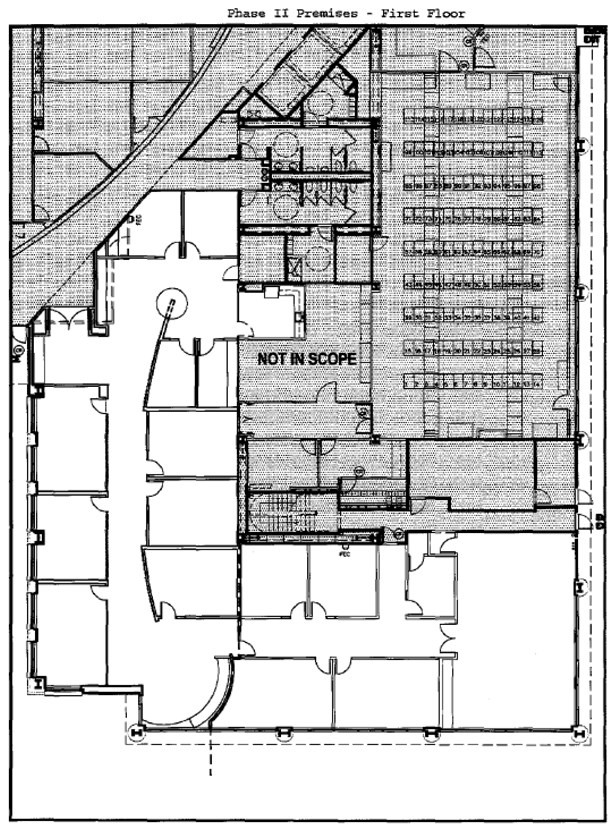

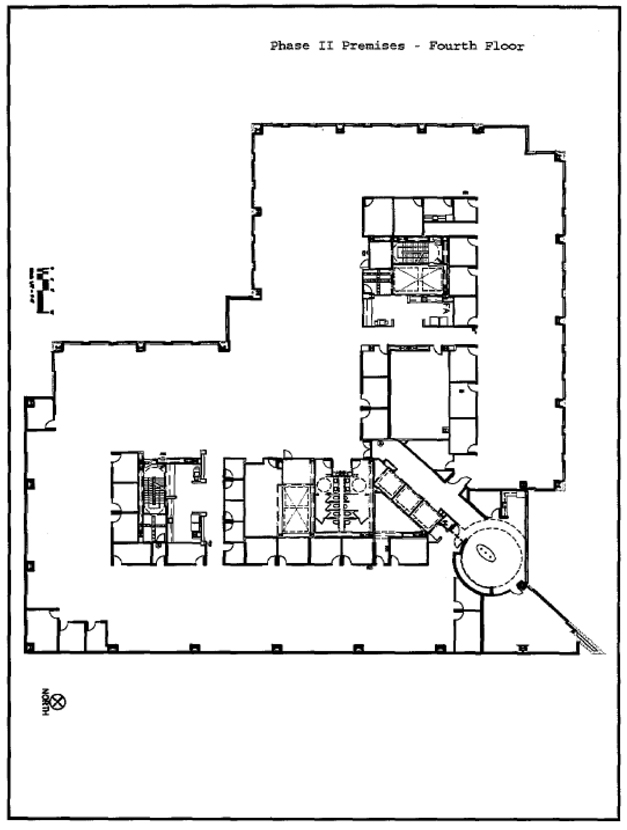

| A |

Diagram of the Phase I Premises and Phase II Premises | |||

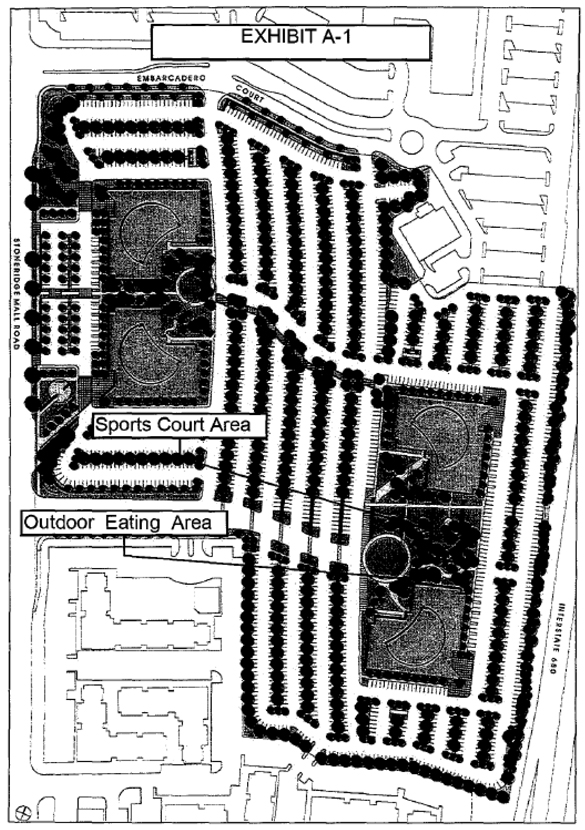

| A-1 |

Potential Sports Court and Outdoor Eating Areas | |||

| B |

Tenant Improvements Work Letter | |||

| C |

Rules and Regulations | |||

| D |

Form of Estoppel Certificate | |||

| E |

Security Deposit and Burn Down | |||

| F |

Janitorial Specifications | |||

| G |

Form of Letter of Credit | |||

| H |

6210 Expansion Premises | |||

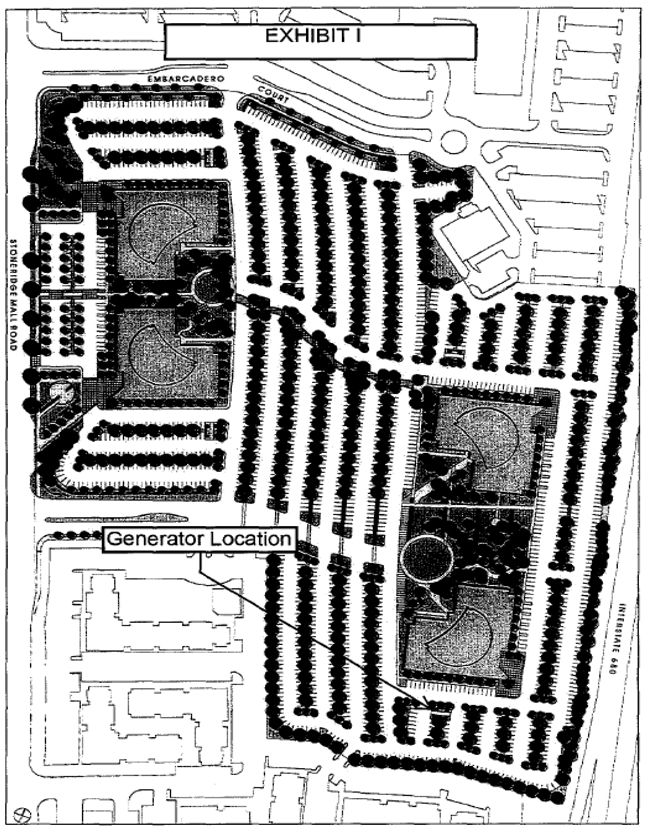

| I |

Generator Location | |||

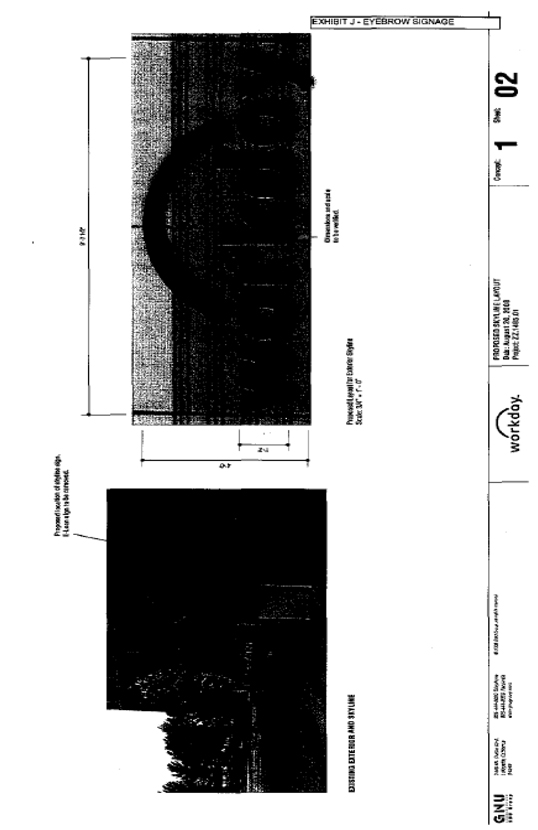

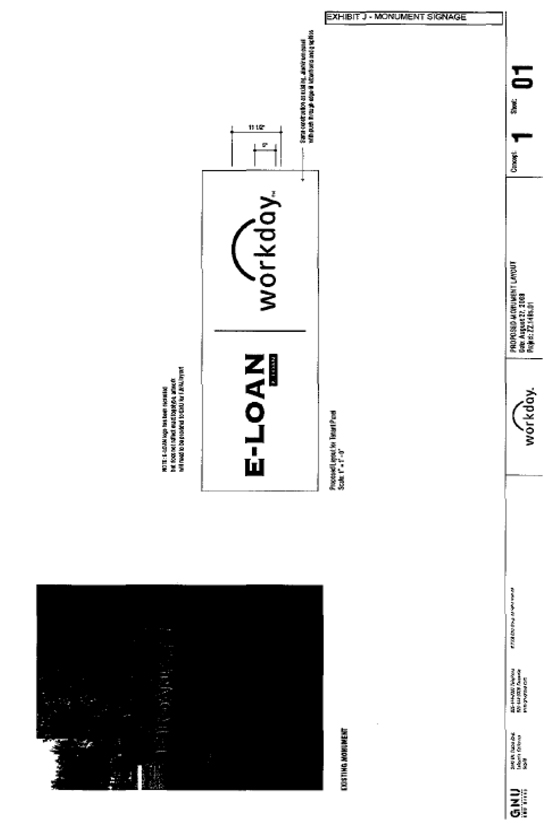

| J |

Approved Signage | |||

iii

INDEX OF DEFINED TERMS

iv

v

LEASE AGREEMENT

BASIC LEASE INFORMATION

|

Lease Date:

|

September 18, 2008

| |||

|

Landlord: |

▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇ ▇▇▇▇ INVESTORS LLC, a Delaware limited liability company

| |||

|

Landlord’s Address: |

c/o UBS Realty Investors LLC ▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇▇ ▇▇▇ ▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇ Attention: Asset Manager,

Pleasanton Corporate Commons

| |||

|

All notices sent to Landlord under this Lease shall be sent to the above address, with copies to:

▇▇▇▇▇ ▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇ ▇▇▇▇, ▇▇▇▇▇ ▇▇▇ ▇▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇ Attention: Property Manager

| ||||

|

Tenant: |

a Nevada corporation

| |||

|

Tenant’s Contact Person:

|

▇▇▇▇▇ ▇▇▇▇

| |||

|

Tenant’s Address and Telephone Number: |

▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇, ▇▇▇▇▇ ▇▇▇ ▇▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇ (925) 951-9000

Notices for Tenant shall be sent to the above address c/o Chief Financial Officer with copies as follows:

▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇, ▇▇▇▇▇ ▇▇▇ ▇▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇ Attention: General Counsel

-and –

▇▇▇▇▇▇ ▇. ▇▇▇▇▇▇, Esquire Bartko, Zankel, Tarrant & ▇▇▇▇▇▇ ▇▇▇ ▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇ ▇▇▇ ▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇

|

vi

|

Premises: |

The entirety of the second floor of the Building (the “Phase I Premises”), and a portion of the first floor and the entirety of the fourth floor of the Building (the “Phase II Premises”)

| |||||

|

Premises Square Footage:

|

Floor

|

Rentable Area

| ||||

|

1st (partial)

|

7,588

| |||||

|

2nd (full)

|

30,772

| |||||

|

4th (full)

|

30,772

| |||||

|

TOTAL:

|

69,132

| |||||

|

Project: |

Pleasanton Corporate Commons, 6200 - ▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇ ▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇, together with the land on which the Project is situated and all Common Areas. The total Rentable Area of the Project is 595,608 square feet.

| |||||

|

Building: |

▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇ ▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇ Corporate Commons, Pleasanton, California. The total Rentable Area of the Building is 148,902 square feet.

| |||||

|

Tenant’s Proportionate Share of Project: |

5.17% as to the Phase I Premises, 11.61% as to the Phase II Premises

| |||||

|

Tenant’s Proportionate Share of Building: |

20.67% as to the Phase I Premises, 46.43% as to the Phase II Premises

| |||||

|

Length of Term: |

Phase I Premises: Eighty (80) months Phase II Premises: Sixty (60) months

| |||||

|

Commencement Date: |

Phase I Premises: November 1, 2008 Phase II Premises: July 1, 2010

| |||||

|

Expiration Date: |

June 30, 2015, for the entire Premises

| |||||

vii

|

Base Rent: |

Months

|

Sq. Ft.

|

Monthly Base Rate

|

Monthly Base Rent

| ||||

|

November 1, 2008 – June 30, 2010

|

30,772 |

x $1.25 |

=$38,465.00 | |||||

|

July 1, 2010 – June 30,2011*

|

69,132 |

x $2.50 |

=$172,830.00 | |||||

|

July 1, 2011 – June 30, 2012

|

69,132 |

x $2.58 |

=$178,014.90 | |||||

|

July 1, 2012 – June 30, 2013

|

69,132 |

x $2.66 |

=$183,355.35 | |||||

|

July 1, 2013 – June 30, 2014

|

69,132 |

x $2.74 |

=$188,856.01 | |||||

|

July 1, 2014 – June 30, 2015

|

69,132 |

x $2.82 |

=$194,521.69 | |||||

|

* subject to the Free Base Rent Period in accordance with Paragraph 4(a) below.

| ||||||||

|

Prepaid Base Rent:

|

Thirty-Eight Thousand Four Hundred Sixty-Five Dollars ($38,465.00)

| |||||||

|

Month(s) to which Prepaid Base Rent will be Applied:

|

November 2008

| |||||||

|

Base Year:

|

Calendar year 2010

| |||||||

|

Security Deposit:

|

Such amount as may be determined, from time to time, in accordance with the provisions of Exhibit E.

| |||||||

|

Permitted Use:

|

General office use consistent with the standards of a First-Class Building, and as further provided in Paragraph 9(a).

| |||||||

|

Unreserved Parking Spaces:

|

An amount equal to three and one-half (3.5) nonexclusive and undesignated parking spaces per 1,000 square feet of leased Rentable Area.

| |||||||

|

Brokers:

|

Colliers International (Landlord’s Broker) ▇▇▇▇▇▇ Resource Group (Tenant’s Broker)

| |||||||

viii

THIS OFFICE LEASE AGREEMENT is made and entered into by and between Landlord and Tenant on the Lease Date. The defined terms used in this Lease which are defined in the Basic Lease Information attached to this Lease Agreement (“Basic Lease Information”) shall have the meaning and definition given them in the Basic Lease Information. The Basic Lease Information, the Exhibits, the Addendum or Addenda attached hereto, if any, and this Office Lease Agreement are and shall be construed as a single instrument and are referred to herein as the “Lease.”

| 1. |

DEMISE |

In consideration for the rents and all other charges and payments payable by Tenant, and for the agreements, terms and conditions to be performed by Tenant in this Lease, LANDLORD DOES HEREBY LEASE TO TENANT, AND TENANT DOES HEREBY HIRE AND TAKE FROM LANDLORD, the Premises described below (the “Premises”), upon the agreements, terms and conditions of this Lease for the Term hereinafter stated.

| 2. |

PREMISES AND COMMON AREAS |

(a) The Premises demised by this Lease are located in that certain building (the “Building”) specified in the Basic Lease Information, which Building is located in that certain real estate development (the “Project”) specified in the Basic Lease Information. The Premises has the address and contains the Rentable Area specified in the Basic Lease Information and, until June 30, 2010, shall consist of the Phase I Premises, and, thereafter, shall consist of both the Phase I Premises and the Phase II Premises; provided, however, that any statement of Rentable Area set forth in this Lease, or that may have been used in calculating any of the economic terms hereof, is an approximation which Landlord and Tenant agree is reasonable and, except as expressly set forth in Paragraph 4(d)(iii) below, no economic terms based thereon shall be subject to revision whether or not the actual square footage is more or less. The location and dimensions of the Phase I Premises and the Phase II Premises are depicted on Exhibit A, which is attached hereto and incorporated herein by this reference. As used in this Lease, (the “Rentable Area”) shall mean an area determined in accordance with the standards of the Building Owners and Managers Association ANSI/BOMA Z65.1 (1996).

(b) Notwithstanding anything herein to the contrary, the Phase II Premises as described in the Basic Lease Information is a portion of the Building that will be occupied by Tenant prior to the Commencement Date for the Phase II Premises pursuant to that certain Sub-Sublease by and between E-Loan, Inc., as sub-sub landlord and Tenant as sub-subtenant (the “E-Loan Sub-Sublease”). The E-Loan Sub-Sublease is expressly subject and subordinate to that certain Amended and Restated Office Building Lease effective March 16, 2000 (the “Master Lease”), between Landlord (as successor-in-interest to California Corporate Properties B, LLC, a Delaware limited liability company) and ▇▇▇▇▇▇▇ ▇▇▇▇▇▇ & Co., Inc., a California corporation. In the event that the portion of the Building subleased by Tenant under the E-Loan Sub-Sublease is expanded to include space in the Building which is in addition to the Phase II Premises as described in the Basic Lease Information, then the Phase II Premises as defined herein shall also be expanded to include such additional space. In such event, the economic terms of this Lease relating to the Phase II Premises shall also be adjusted accordingly to reflect the additional Rentable Area (e.g., square footage, Monthly Base Rent, Tenant’s Proportionate Share, and Tenant Improvement Allowance).

1

(c) Tenant and Tenant’s employees, agents, and invitees shall have the non-exclusive right (in common with any other tenants, Landlord and any other person granted use by Landlord) to use the Common Areas (as hereinafter defined), except that, with respect to the Project’s parking areas (the “Parking Areas”), Tenant shall have only the rights, if any, set forth in Paragraph 44 below. For purposes of this Lease, the term “Common Areas” shall mean all areas and facilities outside the Premises and within the exterior boundary lines of the Project that are, from time to time, reasonably provided and designated by Landlord for the non-exclusive use of Landlord, Tenant and other tenants of the Project and their respective employees, guests and invitees; provided, however, the following portions of the Project are expressly denoted as Common Areas for the non-exclusive use of Tenant and Tenant’s employees, guests and invitees: the entrance and lobby areas on the first (1st) floor of the Building; the risers and runs in the Building (subject to the limitations below in this Paragraph 2(c)); and, in the event effected, the Sports Court specified in Paragraph 2(f) below. Without limiting the generality of the foregoing, Tenant shall have the non-exclusive rights to Tenant’s Proportionate Share of the common risers and runs in the Building in order to install, maintain, replace, remove or use any communications or computer wires and cables serving the Premises (collectively, the “Data Lines”), provided that (i) Tenant shall obtain Landlord’s prior written consent (which shall not be unreasonably withheld, conditioned or delayed), use an experienced and qualified contractor reasonably approved in writing by Landlord, and comply with all of the other provisions of ▇▇▇▇▇▇▇▇▇ ▇▇ ▇▇▇▇▇, (▇▇) an acceptable number of spare lines and space for additional lines shall be maintained for existing and future occupants of the Property, as determined in Landlord’s reasonable opinion, (iii) the Data Lines (including riser cables) shall be appropriately insulated to prevent excessive electromagnetic fields or radiation, shall be surrounded by a protective conduit reasonably acceptable to Landlord, and shall be identified in accordance with the “Identification Requirements,” as that term is set forth below, (iv) any new or existing Data Lines installed by Tenant and servicing the Premises shall comply with all applicable Laws, (v) as a condition to permitting the installation of new Data Lines, Landlord may require that Tenant remove existing redundant Lines located in or serving the Premises and repair any damage in connection with such removal, and (vi) Tenant shall pay all costs in connection therewith. All Data Lines shall be clearly marked with adhesive plastic labels (or plastic tags attached to such Data Lines with wire) to show Tenant’s name, suite number, telephone number and the name of the person to contact in the case of an emergency (A) every four feet (4’) outside the Premises (specifically including, but not limited to, the electrical room risers and other Common Areas), and (B) at the Lines’ termination point(s) (collectively, the “Identification Requirements”). Landlord may, by notice to Tenant given not later than ninety (90) days prior to the Expiration Date (except in the event of a termination of this Lease prior to the scheduled Expiration Date, in which event no advance notice shall be required), require Tenant at Tenant’s expense to remove any or all Data Lines located in or serving the Premises prior to the expiration or earlier termination of this Lease.

(d) Landlord has the right, in its sole discretion, from time to time, to: (i) make changes to the Common Areas, the Building and/or the Project, including, without limitation, changes in the location, size, shape and number of driveways, entrances, parking spaces, Parking Areas, ingress,

2

egress, direction of driveways, entrances, hallways, corridors, lobby areas and walkways; (ii) close temporarily any of the Common Areas for maintenance purposes so long as reasonable access to the Premises remains available; (iii) add additional buildings and improvements to the Common Areas or remove existing buildings or improvements therefrom; (iv) use the Common Areas while engaged in making additional improvements, repairs or alterations to the Project or any portion thereof; and (v) do and perform any other acts, alter or expand, or make any other changes in, to or with respect to the Common Areas, the Building and/or the Project as Landlord may, in its sole discretion, deem to be appropriate. Without limiting the foregoing, Landlord reserves the right from time to time to install, use, maintain, repair, relocate and replace pipes, ducts, conduits, wires, and appurtenant meters and equipment for service to the Premises or to other parts of the Building which are above the ceiling surfaces, below the floor surfaces, within the walls and in the central core areas of the Building which are located within the Premises or located elsewhere in the Building. In connection with any of the foregoing activities of Landlord, Landlord shall use reasonable efforts while conducting such activities to minimize any interference with Tenant’s use of the Premises. Notwithstanding the foregoing, if Landlord makes any alterations to the Common Areas pursuant to its rights under this ▇▇▇▇▇▇▇▇▇ ▇, ▇▇▇▇▇▇▇▇ agrees that such alterations shall not unreasonably interfere with Tenant’s use of, or access to, the Premises.

(e) No rights to any view or to light or air over any property, whether belonging to Landlord or any other person, are granted to Tenant by this Lease. If at any time any windows of the Premises are temporarily darkened or the light or view therefrom is obstructed, the same shall be without liability to Landlord and without any reduction or diminution of Tenant’s obligations under this Lease.

(f) Tenant has notified Landlord that Tenant desires to construct a sports court, including exterior volleyball/basketball (sand and hard surface) courts in a portion of the Common Areas shown on Exhibit A-1 with specifications and in a location to be mutually agreed upon by Landlord and Tenant(the “Sports Court”). Landlord has generally approved the Sports Court and Tenant shall have the right to construct the Sports Court, provided that (i) Landlord and Tenant mutually agree on the precise design and location of the Sports Court, and (ii) Tenant fully complies with the terms and conditions of Paragraphs 12(a) through 12(g) below, including, without limitation, the review and approval by Landlord of detailed plans and specifications, and the approval by Landlord of Tenant’s contractor(s). Tenant shall be solely responsible for the costs to construct the Sports Court; provided, however, that Landlord shall reimburse Tenant for up to Fifty Thousand Dollars ($50,000.00) of all actual and documented out-of-pocket costs and expenses directly incurred by Tenant in connection with Tenant’s construction of the Sport’s Court. In the event Seller’s actual costs to construct the Sports Court exceed Fifty Thousand Dollars ($50,000.00), then any such excess shall be the sole responsibility of Tenant; provided, however, that Tenant may apply any such costs against the Tenant Improvement Allowance for the Phase I Premises and the Phase II Premises. Landlord’s obligation to reimburse Tenant as set forth herein shall be subject to (i) Tenant providing Landlord with reasonable documentary evidence that Tenant has paid for the ▇▇▇▇(s) or invoice(s) related to the design and construction of the Sports Court, and (ii) Tenant requesting such reimbursement within twelve (12) months following the Lease Date. Upon completion of the Sports Court, such area shall remain as part of the Common Areas and shall be available to all tenants of the Project. Notwithstanding anything to the contrary contained in Paragraph 11, upon the expiration of the Term of this Lease, or earlier termination, Tenant shall not be required to restore the Sports Court to its original Common Area condition prior to construction of the Sports Court.

3

(g) If and when Tenant leases and occupies the portion of the first (1st) floor of the Building located contiguous to the Outdoor Eating Area described in Exhibit A-1 attached hereto, then Tenant, at Tenant’s sole cost and expense, may convert a portion of the Common Areas as generally shown in Exhibit A-1 as the Outdoor Eating Area into an outdoor seating/eating area for the exclusive use of Tenant, provided that (i) Landlord and Tenant mutually agree on the precise size, design and location (provided that any design elements that are visible from areas outside the Building shall be subject to Landlord’s sole but good faith discretion), and (ii) Tenant fully complies with the terms and conditions of Paragraphs 12(a) through 12(g) below, including, without limitation, the review and approval by Landlord of detailed plans and specifications, and the approval by Landlord of Tenant’s contractor(s). Tenant may, at Tenant’s option, utilize any then unused portion of the Tenant Improvement Allowance for the Phase I Premises and the Phase II Premises toward the cost of construction of any such Outdoor Eating Area.

| 3. |

TERM |

(a) The term of this Lease (the “Term”) with respect to each of the Phase I Premises and the Phase II Premises shall commence on each respective Term Commencement Date specified in the Basic Lease Information and shall terminate on the Term Expiration Date specified in the Basic Lease Information.

(b) Notwithstanding the provisions of Paragraph 3(a) above, in the event the Master Lease is terminated with an effective date of such termination which is prior to June 30, 2010, then subject to the terms of Paragraph 21 and Paragraph 22 herein, the Term with respect to the Phase II Premises (including any additional space leased by Tenant under the E-Loan Sub-Sublease as contemplated by Paragraph 2(b) above) shall commence concurrently with such termination of the Master Lease at a monthly Base Rate equal to $1.25 for each square foot of Rentable Area during the period prior to July 1, 2010, but otherwise on the terms and conditions set forth herein.

| 4. |

RENT |

(a) Base Rent. Tenant shall pay to Landlord, in advance, on the first day of each month, without further notice or demand, and except as expressly otherwise provided herein, without abatement, offset, rebate, credit or deduction for any reason whatsoever, the monthly installments of rent specified in the Basic Lease Information (the “Base Rent”); provided, however, that if Tenant is not then in Default hereunder (and that no event is occurring which, with the giving of notice or the passage of time, or both, would constitute a Default hereunder), Tenant shall have no obligation to pay Base Rent during the period from July 1, 2010, through September 30, 2010 (the “Free Base Rent Period”).

Upon full execution of this Lease and delivery of an original copy to Tenant, Tenant shall pay to Landlord the Prepaid Base Rent to be applied toward Base Rent for the month of the Term specified in the Basic Lease Information. Within five (5) Business Days of the full execution and delivery of this Lease to Tenant, Tenant shall pay to Landlord as a Security Deposit for the

4

Phase I Premises the amount specified in Exhibit E (either in cash or as a Letter of Credit, or as subsequent substitutions for cash or a Letter of Credit) as more fully described in Paragraph 7 below. The Security Deposit for the Phase II Premises shall be paid by Tenant to Landlord as hereinafter provided in this Lease.

(b) Additional Rent. As used in this Lease, the term “Additional Rent” shall mean all sums of money, other than Base Rent, that shall become due from and payable by Tenant pursuant to this Lease.

(i) Commencing July 1, 2011, but not prior to July 1, 2011, in addition to the Base Rent, Tenant shall pay to Landlord as Additional Rent, in accordance with this Paragraph 4, the aggregate net increases of the following applicable to each Computation Year over the Base Year (A) Tenant’s Proportionate Share(s) of the total dollar increase, if any, in Operating Expenses (as defined below) attributable to each Computation Year (as defined below) over Base Operating Expenses (as defined below), (B) Tenant’s Proportionate Share(s) of the total dollar increase, if any, in Insurance Expenses (as defined below) attributable to each Computation Year over Base Insurance Expenses (as defined below), (C) Tenant’s Proportionate Share(s) of the total dollar increase, if any, in Utility Expenses (as defined below) attributable to each Computation Year over Base Utility Expenses (as defined below), and (D) Tenant’s Proportionate Share(s) of the total dollar increase, if any, in Taxes (as defined below) attributable to each Computation Year over Base Taxes (as defined below).

(ii) As used in this Lease, the following terms shall have the meanings specified:

(A) “Operating Expenses” means those costs and expenses paid or incurred by Landlord in connection with the ownership, operation, maintenance, management and repair of the Premises, the Building and/or the Project or any part thereof, including, without limitation, all the following items (but subject to the Expense Exclusions as specified in Paragraph 4(c) below).

(1) Common Area Operating Expenses. All costs to operate, maintain, repair, replace, supervise, insure and administer the Common Areas, including, without limitation, any Parking Areas owned by Landlord for the use of tenants, and further including, without limitation, supplies, materials, labor and equipment used in or related to the operation and maintenance of the Common Areas, including Parking Areas (including, without limitation, all costs of resurfacing and restriping Parking Areas), signs and directories on the Building and/or the Project, landscaping (including, without limitation, maintenance contracts and fees payable to landscaping consultants), amenities, sprinkler systems, sidewalks, walkways, driveways, curbs, lighting systems and security services, if any, provided by Landlord for the Common Areas, and any charges, assessments, costs or fees levied by any common association.

(2) Parking Charges; Public Transportation Expenses. Any parking charges or other costs levied, assessed or imposed by, or at the direction of, or resulting from statutes or regulations, or interpretations thereof, promulgated by any governmental authority or insurer in connection with the use or occupancy of the Building or the Project, and the cost of maintaining any public transit system, vanpool, or other public or semi-public transportation imposed upon Landlord’s ownership and operation of the Building and/or the Project.

5

(3) Maintenance and Repair Costs. All costs to maintain, repair, and replace the Premises, the Building and/or the Project or any part thereof and the personal property used in conjunction therewith, including insurance deductibles but subject to the Deductible Cap specified in Paragraph 4(b)(ii)(B) below and, without limitation, (a) all costs paid under maintenance, management and service agreements such as contracts for janitorial, security and refuse removal, (b) all costs to maintain, repair and replace the roof coverings of the Building or the Project or any part thereof, (c) all costs to maintain, repair and replace the heating, ventilating, air conditioning, plumbing, sewer, drainage, electrical, fire protection, escalator, elevator, life safety and security systems and other mechanical, electrical and communications systems and equipment serving the Premises, the Building and/or the Project or any part thereof (collectively, the “Systems”), (d) the cost of all cleaning and janitorial services and supplies, the cost of window glass replacement and repair, and (e) the cost of maintenance, depreciation and replacement of machinery, tools and equipment (if owned by Landlord) and for rental paid for such machinery, tools and equipment (if rented) used in connection with the operation or maintenance of the Building, and (f) costs for improvements made to the Project which, although capital in nature, Landlord determines, in its sole discretion, are necessary to enhance the security systems and improve the security measures at the Project.

(4) Life Safety and Security Costs. All costs to install, maintain, repair and replace all life safety systems, including, without limitation, (a) all fire alarm systems, serving the Premises, the Building and/or the Project or any part thereof (including all maintenance contracts and fees payable to life safety consultants) whether such systems are or shall be required by Landlord’s insurance carriers, Laws (as hereinafter defined) or otherwise, and (b) all costs of security and security systems at the Project, including, without limitation; (i) wages and salaries (including third-party management fees) of all employees engaged in the security of the Project; (ii) all supplies, materials, equipment, and devices used in the security of the Project, and any upgrades thereto; and (iii) all service or maintenance contracts with independent contractors for Project security, including, without limitation, alarm service personnel, security guards, watchmen, and any other security personnel.

(5) Management and Administration. All costs for management and administration of the Premises, the Building and/or the Project or any part thereof, including, without limitation, a property management fee, accounting, auditing, billing, postage, salaries and benefits for all employees and contractors engaged in the management, operation, maintenance, repair and protection of the Building and the Project, whether located on the Project or off-site, payroll taxes and legal and accounting costs, fees for licenses and permits related to the ownership and operation of the Project, and office rent for the Building and/or the Project management office or the rental value of such office if it is located within the Building and/or the Project, such office to be approximately one thousand eight hundred (1,800) square feet of Rentable Area; provided, however, to the extent such property management office serves projects other than the Project, such costs shall be equitably allocated among the Project and such other projects, and only the Project’s allocable share of such costs shall be an Operating Expense.

6

(6) Capital Improvements. Amounts paid for capital improvements or other costs incurred in connection with the Project (a) which are intended by Landlord, in good faith, to effect economies in the operation or maintenance of the Project, or any portion thereof, (b) that are required to comply with present or anticipated conservation programs, (c) which are replacements or modifications of nonstructural items located in the Common Areas, (d) that are required under any governmental law or regulation, and (e) which Landlord determines, in Landlord’s reasonable discretion, are necessary to enhance Building security and improve security measures at the Project. To the extent any such capital costs are typically capitalized under commonly utilized commercial real estate accounting principles, then Tenant shall be required to pay only the pro rata share of the cost of the item falling due within the Term (including any Renewal Term, if applicable) based upon the amortization of the same over the useful life of such item(s), as determined by such generally accepted commercial real estate accounting principles.

Notwithstanding anything in this Paragraph 4(b) to the contrary, Insurance Expenses, Utility Expenses and Taxes shall not be deemed to constitute “Operating Expenses” for purposes of this Paragraph 4(b)(ii)(A).

(B) “Insurance Expenses” means the total costs and expenses paid or incurred by Landlord in connection with the obtaining of insurance on the Premises, the Building and/or the Project or any part thereof or interest therein, including, without limitation, premiums for “all risk” fire and extended coverage insurance, commercial general liability insurance, rent loss or abatement insurance (not to exceed twelve (12) months), earthquake insurance, flood or surface water coverage, and other insurance which is commercially reasonable and consistent with insurance maintained generally by other first-class, class A office projects in the Pleasanton, California area of similar size, age and use (hereinafter, “First-Class Buildings”), or required by Landlord’s lender, together with any deductibles paid under policies of any such insurance; provided, however, that with respect to any particular casualty event affecting the Project, in no event shall Tenant’s Proportionate Share any individual insurance deductible under Landlord’s Casualty Insurance or other casualty policy exceed an amount equal to One Dollar ($1.00) for each square foot of leased Rentable Area. The foregoing shall not be deemed an agreement by Landlord to carry any particular insurance relating to the Premises, the Building, or the Project.

(C) “Utility Expenses” means the cost of all electricity, water, gas, sewers, oil and other utilities (collectively, “Utilities”), including any surcharges imposed, serving the Premises, the Building and the Project or any part thereof that are not separately metered to Tenant or any other tenant, and any amounts, taxes, charges, surcharges, assessments or impositions levied, assessed or imposed upon the Premises, the Building or the Project or any part thereof, or upon Tenant’s use and occupancy thereof, as a result of any rationing of Utility services or restriction on Utility use affecting the Premises, the Building and/or the Project, as contemplated in Paragraph 5 below.

7

(D) “Taxes” means all real estate taxes and assessments, which shall include any form of tax, assessment (including any special or general assessments and any assessments or charges for Utilities or similar purposes included within any tax ▇▇▇▇ for the Building or the Project or any part thereof, including, without limitation, entitlement fees, allocation unit fees and/or any similar fees or charges), fee, license fee, business license fee, levy, penalty (if a result of Ten ant’s delinquency in payment), sales tax on rents or rental receipts, rent tax, occupancy tax or other tax (other than net income, estate, succession, inheritance, transfer or franchise taxes), imposed by any authority having the direct or indirect power to tax, or by any city, county, state or federal government or any improvement or other district or division thereof, whether such tax is determined by the area of the Premises, the Building and/or the Project or any part thereof, or the Rent and other sums payable hereunder by Tenant or by other tenants, including, but not limited to, (i) any gross income or excise tax levied by any of the foregoing authorities, with respect to receipt of Rent and/or other sums due under this Lease; (ii) upon any legal or equitable interest of Landlord in the Premises, the Building and/or the Project or any part thereof, (iii) upon this transaction or any document to which Tenant is a party creating or transferring any interest in the Premises, the Building and/or the Project; (iv) levied or assessed in lieu of, in substitution for, or in addition to, existing or additional taxes against the Premises, the Building and/or the Project, whether or not now customary or within the contemplation of the parties; or surcharged against the Parking Areas. Tenant and Landlord acknowledge that Proposition 13 was adopted by the voters of the State of California in the June, 1978 election and that assessments, taxes, fees, levies and charges may be imposed by governmental agencies for such purposes as fire protection, street, sidewalk, road, utility construction and maintenance, refuse removal and for other governmental services which may formerly have been provided without charge to property owners or occupants. It is the intention of the parties that all new and increased assessments, taxes, fees, levies and charges due to any cause whatsoever are to be included within the definition of real property taxes for purposes of this Lease. “Taxes” shall also include reasonable legal and consultants’ fees, costs and disbursements incurred in connection with proceedings to contest, determine or reduce taxes, Landlord specifically reserving the right, but not the obligation, to contest by appropriate legal proceedings the amount or validity of any taxes.

(E) “Base Year” shall mean the calendar year specified in the Basic Lease Information.

(F) “Base Operating Expenses” shall mean the amount of Operating Expenses for the Base Year.

(G) “Base Insurance Expenses” shall mean the amount of Insurance Expenses for the Base Year.

(H) “Base Taxes” shall mean the amount of Taxes for the Base Year.

(I) “Base Utility Expenses” shall mean the greater of the following amounts: (1) Utility Expenses for 2009; (2) Utility Expenses for the Base Year; or (3), with respect to the Building, Utility Expenses for 2010 for a comparable building in the Project (other than the Building).

(J) “Computation Year” shall mean each twelve (12) consecutive month period commencing January 1 of each year during the Term following the Base Year.

8

(K) “Expenses” shall mean collectively, Operating Expenses, Insurance Expenses, Utility Expenses and Taxes.

(c) Exclusions from Expenses. Notwithstanding anything to the contrary contained in Paragraph 4(b) above, “Expenses” shall not include the following (the “Expense Exclusions”):

(i) non-cash items, such as deductions for depreciation, amortization or obsolescence of the Project and the Premises and the equipment used in or on the Project, or interest on capital invested;

(ii) payments of principal and interest or other finance charges, penalties or fees, made on any debt, and rental payments made under any ground lease or other underlying leases, except to the extent that a portion of such rental payments is for the payment or reimbursement of ad valorem/real estate taxes or insurance premiums on the Project;

(iii) costs incurred in connection with the leasing, sale, financing, refinancing, mortgaging, entering into a superior lease or change of ownership of the Project, including, without limitation, real estate brokerage and leasing commissions, marketing costs, finder fees, attorneys’ and accountants’ fees, closing costs, title insurance premiums, appraisal fees, survey costs, engineering and inspection reports, transfer taxes and interest charges;

(iv) Landlord’s general overhead costs, including salaries, equipment, supplies, accounting and legal fees, rent and other occupancy costs, and other costs relating to the operation and internal organization and function of Landlord as a business entity (as opposed to the maintenance and/or operation of the Project), including, but not limited to, costs of entity accounting and the cost of Landlord’s preparation of income tax returns and information returns, legal matters, costs of defending any lawsuits with any mortgagee, costs of selling, syndicating, financing, mortgaging or hypothecating of any of the Landlord’s interest in the Premises or the Project and costs of any disputes between Landlord and its employees, tenants, third party contractors, and third parties;

(v) job placement, advertising and promotional costs for the Project or associated with the leasing of the Project (other than bulletins or newsletters distributed to tenants of the Project) and the costs of signs in or on the Building identifying the owner of the Building or other tenant’s signs;

(vi) all amounts that would otherwise be included in Expenses which are paid to any Affiliate of Landlord to the extent the costs of such services exceed the competitive rates in comparable buildings for such services rendered by persons or entities of similar skill, competence and experience (but excluding any such amounts specifically provided for or permitted in this Lease for which the provisions of this Lease shall control);

(vii) costs incurred due to (A) violation by Landlord or any managing agent or any tenant (including Tenant) of the terms and conditions of any lease, (B) violation by Landlord of any governmental rule or authority, or (C) penalties and interest for late payment of any obligation of Landlord, including any penalties or interest incurred as a result of Landlord’s failure to file any tax or information returns when due, unless such late payment is caused by Tenant;

9

(viii) inheritance, gift or estate taxes imposed upon or assessed against the Project, or any part thereof or interest therein; taxes computed upon the basis of the gross or net income derived from the Project by Landlord or the owner of any interest therein, unless any such taxes are imposed as a substitute for, in lieu of, or in addition to, any of the taxes described in Paragraph 4(b)(ii)(D); non-delinquent assessments existing as of January 1, 2000, related to the North Pleasanton Improvement District; income, franchise, corporation, capital levy, gross receipts, excess profits, revenue (except any business or license tax payable by Landlord but specifically excluding any business or license tax payable by Landlord’s property manager calculated on revenue), rent, payroll taxes and benefits (except as related to the personnel described in Paragraph 4(b)(ii) above) or stamp or transfer taxes or any tax upon the sale, transfer or assignment of Landlord’s title or estate which at any time may be assessed against or become a lien upon all or any part of the Project or this leasehold, unless any such taxes are imposed as a substitute for, in lieu of, or in addition to, any of the taxes described in Paragraph 4(b)(ii) above; and any liens or taxes, penalties or interest that are levied or assessed against the Premises or the Project for any time prior to the Term;

(ix) any cost or expense related to removal, cleaning, abatement or remediation of “Hazardous Materials” or environmental conditions in or on the Project which were not deposited, released or caused by Tenant or any of Tenant’s Agents;

(x) costs of maintenance, repair or replacement covered by a warranty;

(xi) costs for which Landlord is reimbursed by its insurance carrier or by any tenant’s insurance carrier (or would have been so reimbursed if Landlord had maintained all of the insurance required to be carried by Landlord pursuant to this Lease) or by any other entity (other than through Expense pass throughs);

(xii) any damages and costs (including interest) resulting from the gross negligence, willful misconduct or other intentional tortious acts of Landlord, Landlord’s contractors, subcontractors and employees, including payment of damages, attorneys’ fees and any other amounts to any person seeking recovery for bodily injury, death or property damage, and any fines, assessments, or penalties resulting from the negligence, gross negligence, willful misconduct or other tortious acts of Landlord (and Landlord’s contractors, subcontractors and employees) or the breach of this Lease;

(xiii) costs required to be capitalized under commonly and consistently utilized commercial real estate industry accounting principles, except to the extent expressly set forth in Paragraph 4(b)(ii)(A)(6) above;

(xiv) the cost of the design, construction, renovation, decorating, redecorating, improving, fixturing, furnishing or other preparation of tenant improvements for Tenant and for other tenants and for prospective tenants of the Project (including design fees for space planning and all third party fees and charges, permit, license, and inspection fees), and moving expenses to move in or out, or relocate, Tenant or other tenants to, from or within the Project, and allowances, including the Tenant Improvement Allowance herein (whether by contribution or credit against rent or otherwise) or concessions (including any rent abatement) for any of the foregoing;

10

(xv) costs or expenses of utilities directly metered to tenants of the Project and payable separately by such tenants;

(xvi) salaries, wages, benefits and other expenses of Building personnel above the level of the on-site third party building manager of the Building;

(xvii) costs incurred for the acquisition of permanent and temporary works of art and decorations, including, without limitation, seasonal decorations (but not the maintenance of, or security for, such items);

(xviii) the costs, expenses and fees of any asset manager or investment advisor representing Landlord or any partner or any other constituent member of Landlord (except that nothing in this clause is intended to preclude such manager, advisor, partner or member from sharing a portion of the property management fees received by the property manager);

(xix) property management fees to the extent the same exceed three percent (3%) of gross receipts;

(xx) cost of installing, operating and maintaining any specialty service or other benefits, such as an observatory, broadcasting facilities, child or daycare, luncheon club, cafeteria or other dining facility, newsstand, flower service, shoeshine service, or athletic or recreation club and helicopter pad, unless such service is requested by Tenant and usable by Tenant on a non-discriminatory basis;

(xxi) any costs or expenses expressly excluded from Additional Rent under any other provisions of this Lease;

(xxii) costs arising from Landlord’s entertainment, dining, charitable or political contributions;

(xxiii) real estate trade group and civic association dues and related expenses, to the extent such costs exceed Two Thousand Dollars ($2,000.00) per calendar year in the aggregate;

(xxiv) rentals, excluding temporary rentals, for items which, if purchased rather than rented, would constitute a capital improvement which is specifically excluded in Paragraph 4(b)(ii)(A)(6) above;

(xxv) the rental value of offices for the property manager and related management, engineering and operations personnel, except as permitted under Paragraph 4(b)(ii)(A)(5) above;

(xxvi) cost of the initial stock of tools and equipment for operation, repair and maintenance of the Project, to the extent not directly used in the Project;

(xxvii) costs related to governmental compliance in connection with those parts of the Project that Landlord is responsible for maintaining and repairing except as provided in Paragraph 4(b)(ii)(A)(6) above;

(xxviii) reserves for bad debts or repair or maintenance;

11

(xxix) cost of any work or services performed for any facility other than the Project;

(xxx) Fines, penalties, assessments, fees or interest resulting from (A) Landlord’s failure to pay charges, expenses, or Taxes on a current basis, (B) Landlord’s failure to comply with governmental requirements, or (C) Landlord’s breach of this Lease or any other agreement binding on Landlord;

(xxxi) the cost of services provided to tenants of the Building to the extent in excess of services generally provided to Tenant, whether or not Landlord is entitled to reimbursement therefore;

(xxxii) any compensation paid to clerks, attendants or other persons in commercial concessions operated by Landlord, to the extent of gross receipts payable to Landlord from such activities;

(xxxiii) costs (including in connection therewith all attorneys’ fees and costs of settlement judgments and payments, and payments in lieu thereof) arising from claims, disputes or potential disputes in connection with potential or actual claims, litigation or arbitration pertaining to Landlord’s legal title in and to the Building;

(xxxiv) costs of any “tap fees” or any sewer or water connection fees for the exclusive benefit of any particular tenant in the Building;

(xxxv) any “validated” parking charges exclusively for any tenant or tenants (or other users) other than Tenant;

(xxxvi) the cost of replacement of the structural elements of the Project, including the structural elements of the roof of any Building; and

(xxxvii) costs incurred by Landlord for the repair of damage to the Building or the Project to the extent that Landlord is reimbursed from any source (including, without limitation, insurance proceeds, condemnation or warranty).

(d) Payment of Additional Rent.

(i) Within ninety (90) days after the end of the Base Year and each Computation Year or as soon thereafter as practicable, Landlord shall give to Tenant notice of Landlord’s estimate of the total amounts that will be payable by Tenant under Paragraph 4(b) for the following Computation Year, and Tenant shall pay such estimated Additional Rent on a monthly basis, in advance, on the first (1st) day of each month. Tenant shall continue to make said monthly payments of estimated Additional Rent until Landlord provides at least thirty (30) days’ prior notice and reasonably justifies any increase in such monthly payments. If at any time or times Landlord reasonably determines that the amounts payable under Paragraph 4(b) for the current Computation Year will vary from Landlord’s estimate given to Tenant, Landlord, by at least thirty (30) days’ notice to Tenant, may revise the estimate for such Computation Year, and subsequent payments by Tenant for such Computation Year shall be based upon such revised estimate. Each calendar year following the initial Computation Year, Landlord shall use commercially reasonable efforts to provide to Tenant by April 1, a statement showing the actual

12

Additional Rent due to Landlord for the prior Computation Year. If the total of the monthly payments of Additional Rent that Tenant has made for the prior Computation Year is less than the actual Additional Rent chargeable to Tenant for such prior Computation Year, then Tenant shall pay the difference in a lump sum within twenty (20) days after receipt of such statement from Landlord. Any overpayment by Tenant of Additional Rent for the prior Computation Year shall, at Landlord’s option, be either credited towards the Rent next due or returned to Tenant in a lump sum payment within ten (10) days after delivery of such statement; provided, however, that upon the expiration of the Term, or earlier termination, Landlord shall, within sixty (60) days thereafter, provide Tenant a reconciliation of estimated payments of Additional Rent and estimated actual Additional Rent and ▇▇▇▇ Tenant for any Additional Rent due or reimburse any overpayment at the time of such reconciliation.

(ii) Landlord’s then-current annual operating and capital budgets for the Building and the Project or the pertinent part thereof shall be used for purposes of calculating Tenant’s monthly payment of estimated Additional Rent for the current year, subject to adjustment as provided above. Landlord shall make the final determination of Additional Rent for the year in which this Lease terminates as soon as possible after termination of such year. Even though the Term has expired and Tenant has vacated the Premises, with respect to the year in which this Lease expires or terminates, Tenant shall remain liable for payment of any amount due to Landlord in excess of the estimated Additional Rent previously paid by Tenant for a period of twenty-four (24) months following the date that the Lease expires, and, conversely, Landlord shall promptly return within twenty (20) days of determination to Tenant any overpayment made by Tenant during such period. The failure of Landlord to submit statements within twenty-four (24) months of the respective statement due date as called for herein shall be deemed a waiver of Tenant’s obligation to pay Additional Rent as herein provided.

(iii) With respect to Operating Expenses, Insurance Expenses, Utility Expenses or Taxes which Landlord allocates to the Building, Tenant’s “Proportionate Share” shall be the percentage set forth in the Basic Lease Information as Tenant’s Proportionate Share of the Building, as adjusted by Landlord from time to time for changes in the physical size of the Premises or the Building, whether such changes in size are due to an addition to or a sale or conveyance of a portion of the Building or otherwise. With respect to Operating Expenses, Insurance Expenses, Utility Expenses or Taxes which Landlord reasonably allocates to the Project as a whole or to only a portion of the Project, Tenant’s “Proportionate Share” shall be, with respect to Operating Expenses, Insurance Expenses, Utility Expenses or Taxes which Landlord allocates to the Project as a whole, the percentage set forth in the Basic Lease Information as Tenant’s Proportionate Share of the Project and, with respect to Operating Expenses, Insurance Expenses, Utility Expenses or Taxes which Landlord allocates to only a portion of the Project, a percentage calculated by Landlord from time to time in its reasonable discretion and furnished to Tenant in writing, in either case as adjusted by Landlord from time to time for a remeasurement of or changes in the physical size of the Premises or the Project, whether such changes in size are due to an addition to or a sale or conveyance of a portion of the Project or otherwise. Notwithstanding the foregoing provisions of this Paragraph 4(d)(iii), Landlord may, in its reasonable discretion, equitably adjust Tenant’s Proportionate Share(s) for all or part of any item of expense or cost reimbursable by Tenant that relates to a repair, replacement, or service that benefits only the Premises or only a portion of the Building and/or the Project or that varies with the occupancy of the Building and/or the Project. Without limiting

13

the generality of the foregoing, Tenant understands and agrees that Landlord shall have the right to adjust Tenant’s Proportionate Share(s) of any Utility Expenses based upon Tenant’s use of the Utilities or similar services as reasonably estimated and determined by Landlord based upon factors such as size of the Premises and intensity of use of such Utilities by Tenant such that Tenant shall pay the portion of such charges reasonably consistent with Tenant’s excessive use or underuse of such Utilities and similar services. If Tenant disputes any such estimate or determination of Utility Expenses, then Tenant shall either pay the estimated adjusted amount (and, if disputed, resolve the dispute pursuant to the Interim Resolution procedure specified in Paragraph 66 below) or, with the prior written approval of Landlord, which approval may be given or withheld in Landlord’s sole and absolute discretion, cause the Premises to be separately metered, at Tenant’s sole expense.

(iv) In the event the average occupancy level of the Building or the Project for the Base Year and/or any subsequent Computation Year is not ninety-five percent (95%) or more of full occupancy and fully used, then the Operating Expenses for such Base Year and/or subsequent Computation Year shall be apportioned among the tenants by the Landlord to reflect those costs which would have occurred had the Building or the Project, as applicable, been ninety-five percent (95%) occupied during such Base Year and/or subsequent Computation Year.

(v) Landlord reserves the right from time to time to remeasure the Premises, the Building and/or the Project in accordance with the current or revised standards promulgated from time to time by the Building Owners and Managers Association (BOMA) or the American National Standards Institute or other generally accepted measurement standards utilized by Landlord, but in no event shall the Base Rent or Proportionate Share(s) of Tenant be adjusted solely by reason of such remeasurement.

(vi) In the event that the Commencement Date shall be a day other than the first day of a Computation Year or the Expiration Date or other termination of this Lease shall be a day other than the last day of a Computation Year, the amounts payable by Tenant pursuant to Paragraph 4(b) above with respect to the year in which such Commencement Date or Expiration Date (or other termination of this Lease) occurs will be prorated on the basis on which the number of days of the Term included in such year bears to three hundred sixty (360).

(vii) With respect to any Expenses that are “incurred” but not paid by Landlord in any Computation Year, such Expenses shall only be included to the extent such inclusion is generally consistent with commonly and consistently utilized commercial real estate accounting principles. Expenses shall be reduced by the amount of all reimbursements, recoupments, payments, credits, allowances or the like actually received by Landlord in respect of amounts previously billed to Tenant as Expenses; provided, however, that Landlord may include in Expenses, the reasonable and actual costs and expenses, if any, incurred by Landlord in obtaining such reimbursements, recoupments, payments, credits, allowances or the like. Landlord shall not collect as Additional Rent an amount that would reimburse Landlord for a sum in excess of one hundred percent (100%) of Expenses in any calendar year and Landlord shall not recover any item of Expenses more than once. Landlord shall at all times use its best efforts to operate the Project in an economically reasonable manner consistent with other First-Class Buildings.

14

(viii) Landlord shall have no right to ▇▇▇▇ Tenant for any Expenses (other than Taxes) attributable to a Computation Year after the date which is twenty-four (24) months after the end of such Computation Year. Landlord shall have no obligation to return, rebate or credit to Tenant any refund, rebate, or return of Expenses (other than Taxes) received by Landlord after the date which is twenty-four (24) months after the Expiration Date of this Lease.

(e) General Payment Terms. The Base Rent, Additional Rent and all other sums payable by Tenant to Landlord hereunder, including, without limitation, any late charges assessed pursuant to Paragraph 6 below and any interest assessed pursuant to Paragraph 46 below, are referred to as the “Rent.” All Rent shall be paid in lawful money of the United States of America and through a domestic branch of a United States financial institution. Checks are to be made payable to “6200 Stoneridge Mall Road Investors LLC” and shall be mailed to: Department 33149, ▇.▇. ▇▇▇ ▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇-▇▇▇▇ or to such other person or place as Landlord may, from time to time, designate to Tenant in writing. The Rent for any fractional part of a calendar month at the commencement or termination of the Term shall be a prorated amount of the Rent for a full calendar month based upon a thirty (30) day month.

(f) Statements Binding. Every statement given by Landlord pursuant to Paragraph 4(a) above shall be conclusive and binding upon Tenant unless (i) within ninety (90) days after the receipt of such statement Tenant shall notify Landlord that desires to review the correctness thereof, and (ii) if Landlord and Tenant are unable to settle by agreement any dispute which may arise in connection with such review by Tenant, then, unless, subject to the provisions of Paragraph 4(g) below, Tenant shall submit such dispute to the CPA Arbitration within one hundred twenty (120) days after receipt of the statement. Pending the determination of such dispute by agreement or the “CPA Arbitration” (as hereinafter defined), Tenant shall, within twenty (20) days after receipt of such statement, pay Additional Rent in accordance with Landlord’s statement and such payment shall be without prejudice to Tenant’s position. If the dispute shall be determined in Tenant’s favor, Landlord shall forthwith pay Tenant the amount of Tenant’s overpayment of Additional Rent resulting from compliance with Landlord’s statement.

(g) Audit Rights. Provided Tenant notifies Landlord in accordance with the terms of Paragraph 4(f) above that Tenant disputes a statement received from Landlord, Tenant or its CPA (as defined below) shall have the right, at Tenant’s sole cost and expense, provided Tenant utilizes a Certified Public Accountant (the “CPA”) compensated solely on an hourly basis, upon at least twenty (20) days’ prior notice to Landlord at any time during regular business hours, to audit, review and photocopy Landlord’s records pertaining to Operating Expenses for the immediately previous two (2) calendar years and the Base Year only. Tenant shall complete the audit and present any disputed charges to Landlord, in writing, within six months of receipt of Landlord’s statement pursuant to Paragraph 4(d) above. If, following Landlord’s receipt of the audit and any disputed charges (the “Report Date”), Landlord disputes the findings contained therein, and Landlord and Tenant are not able to resolve their differences within thirty (30) days following the Report Date, the dispute shall be resolved by the “CPA Arbitration” as follows: Landlord and Tenant shall each designate an independent certified public accountant, which shall in turn jointly select a third independent Certified Public Accountant (the “Third CPA”). The Third CPA, within thirty (30) days of selection, shall, at Tenant’s sole expense, audit the relevant records and certify the proper amount within. That certification shall be final and conclusive. If the Third CPA determines that the amount of Operating Expenses billed to Tenant was incorrect,

15

the appropriate party shall pay to the other party the deficiency or overpayment, as applicable, within thirty (30) days following delivery of the Third Party CPA’s decision, without interest. Tenant agrees to keep all information thereby obtained by Tenant confidential and to obtain the agreement of its CPA and Third CPA to keep all such information confidential. Tenant shall provide a copy of such CPA agreements to Landlord promptly upon request. Notwithstanding anything herein to the contrary, if the Third CPA determines that Landlord overstated the amount of Operating Expenses by five percent (5%) or more, then Landlord shall reimburse Tenant for its reasonable out-of-pocket audit expenses, including the cost of the Third CPA.

5. UTILITIES AND SERVICES

(a) Landlord shall furnish Tenant during Tenant’s occupancy of the Premises the following services (collectively, (“Basic Services” at no additional cost to Tenant (other than Tenant’s payment of Tenant’s Proportionate Share thereof as Additional Rent specified in Paragraph 4(b) above:

(i) Hot and cold running water and sewer services twenty-four (24) hours per day, seven (7) days per week at existing points of supply in the Premises, and central heat and air conditioning from 7:00 a.m. to 6:00 p.m. on weekdays (“Normal Business Hours” (excluding legal holidays)) for the comfortable occupation of the Premises.

(ii) Janitorial services for the Premises on weekdays (excluding legal holidays) consistent with general office use and otherwise in accordance with the specifications set forth herein as Exhibit F.

(iii) Electricity for lighting and operation sufficient to service the number of Tenant users/employees depicted in Tenant’s improvement plans for the Initial Alterations (i.e., approximately one hundred fifty (150) persons for each square foot of leased Rentable Area) inclusive of standard office equipment for the same “Base Service Load.”

(iv) Replacement of lamps, bulbs and ballasts ‘used in the Premises (excluding Tenant’s specialty fixtures), and all portions of the Project necessary to maintain the Project as a First-Class Building.

(v) Public elevator service serving the Building twenty-four (24) hours per day, seven (7) days per week.

(vi) Access to the Premises twenty-four (24) hours a day, seven (7) days a week, but subject to the terms of this Lease and all applicable Laws.

(b) Tenant shall separately arrange with, and pay directly to, the applicable local public authorities or utilities, as the case may be, for the furnishing, installation and maintenance of all telephone services and equipment as may be required by Tenant in the use of the Premises. If Tenant desires to use any telecommunications vendors that are not already servicing the Building, Landlord will not unreasonably withhold or condition its consent to the same; provided, however, that Landlord may condition its consent to such vendor’s execution of a commercially reasonable license agreement acceptable to Landlord. Landlord shall not be liable for any damages resulting from the interruption of, or Tenant’s inability to receive such

16

telecommunications service, and any such inability shall not relieve Tenant of any of its obligations under this Lease. If at any time during the Term Landlord shall determine that installation of a separate electrical meter for the Premises is necessary or desirable as a result of Tenant’s electrical usage, Tenant shall pay the cost of installing and maintaining such meter and the cost of Tenant’s electrical usage as measured by such meter, with an appropriate credit for the cost incurred by Landlord in providing the electricity included in the Base Utility Expenses.

(c) If requested by Tenant, Landlord shall furnish heat and air conditioning at times other than Normal Business Hours (“After Hours HVAC”) and the cost of such services as established by Landlord shall be paid by Tenant as Additional Rent, payable concurrently with the next installment of Base Rent. As of the Lease Date, Landlord’s charges for After Hours HVAC are Twenty-Five Dollars ($25.00) per one-half (1/2) floor, per hour, and any increases in such charges during the Term shall be based on increases in Landlord’s cost of providing the same. Landlord’s charge for After Hours HVAC shall be based on Landlord’s actual direct utility costs, plus Landlord’s other direct costs, including a reasonable depreciation factor or replacement reserve for the system on account of said additional hours of operation. Landlord and Tenant agree that such hourly rate has been established at an amount so as to reimburse Landlord for the actual cost to Landlord to supply the service plus a reasonable reserve for depreciation or replacement of the HVAC equipment, but without a profit to Landlord.

(d) Tenant acknowledges that Landlord has contracted with Pacific Gas & Electric Company to provide electricity for the Building, and that Landlord reserves the right to change the provider of such service at any time and from time to time in Landlord’s sole discretion (any such provider being referred to herein as the “Electric Service Provider”). Tenant shall obtain and accept electrical service for the Premises only from and through Landlord, in the manner and to the extent expressly provided in this Lease, at all times during the Term, and, except as provided in Paragraph 5(g) below, Tenant shall have no right (and hereby waives any right Tenant may otherwise have) (i) to contract with or otherwise obtain any electrical service for or with respect to the Premises or Tenant’s operations therein from any provider of electrical service other than the Electric Service Provider, or (ii) to enter into any separate or direct contract or other similar arrangement with the Electric Service Provider for the provision of electrical service to Tenant at the Premises. Tenant shall cooperate with Landlord and the Electric Service Provider at all times to facilitate the delivery of electrical service to Tenant at the Premises and to the Building, including, without limitation, allowing Landlord and the Electric Service Provider, and their respective agents and contractors, (A) to install, repair, replace, improve and remove and any and all electric lines, feeders, risers, junction boxes, wiring, and other electrical equipment, machinery and facilities now or hereafter located within the Building or the Premises for the purpose of providing electrical service to or within the Premises or the Building, and (B) reasonable access for the purpose of maintaining, repairing, replacing or upgrading such electrical service from time to time. Tenant shall provide such information and specifications regarding Tenant’s use or projected use of electricity at the Premises as shall be required from time to time by Landlord or the Electric Service Provider to efficiently provide electrical service to the Premises or the Building.

(e) In the event that either (i) the electric service generally provided by Landlord’s then existing Electric Service Provider is consistently unreliable with a resulting materially adverse impact or potential impact on Tenant’s business within the Premises, or (ii) Tenant leases one

17

hundred percent (100%) of the Building and Tenant demonstrates to Landlord’s reasonable satisfaction that an alternative electrical service provider can provide electric service at a reduced rate, then Landlord agrees to consider, in good faith, any reasonable request by Tenant that such an alternative or additional electrical service provider be permitted to provide electrical services to the Premises and/or the Building, provided the same would not adversely affect existing Systems and would not result in any exterior changes to the Building or Project; provided, however in no event shall Landlord have any liability or be in breach hereunder for any failure to engage, or permit the use of, any such alternative or additional electrical service provider for any good faith reason.

(f) Except as expressly set forth in Paragraph 5(j) below, in no event shall Landlord be liable or responsible for any loss, damage, expense or liability, including, without limitation, loss of business or any consequential damages, arising from any failure or inadequacy of the electrical service being provided to the Premises or the Building, whether resulting from any change, failure, interference, disruption, or defect in the supply or character of the electrical service furnished to the Premises or the Building, or arising from the partial or total unavailability of electrical service to the Premises or the Building, from any cause whatsoever, or otherwise, nor shall any such failure, inadequacy, change, interference, disruption, defect or unavailability constitute an actual or constructive eviction of Tenant, or entitle Tenant to any abatement or diminution of Rent or otherwise relieve Tenant from any of its obligations under this Lease.

(g) Tenant acknowledges that the Premises, the Building and/or the Project may become subject to the rationing of Utility services or restrictions on Utility use as required by a public utility company, governmental agency or other similar entity having jurisdiction thereof. Tenant acknowledges and agrees that its tenancy and occupancy hereunder shall be subject to such rationing or restrictions as may be imposed upon Landlord, Tenant, the Premises, the Building and/or the Project, and Tenant shall in no event be excused or relieved from any covenant or obligation to be kept or performed by Tenant by reason of any such rationing or restrictions. Tenant agrees to comply with reasonable and non-discriminatory energy conservation programs implemented by Landlord by reason of rationing, restrictions or Laws.

(h) Landlord shall not be liable for any loss, injury or damage to property caused by or resulting from any variation, interruption, or failure of Utilities due to any cause whatsoever, or from failure to make any repairs or perform any maintenance. No temporary interruption or failure of services incident to the making of repairs, alterations, improvements, or due to accident, strike, or conditions or other events shall be deemed an eviction of Tenant or, except as provided in Paragraph 5(j) below, relieve Tenant from any of its obligations hereunder. In no event shall Landlord be liable to Tenant for any damage to the Premises or for any loss, damage or injury to any property therein or thereon occasioned by bursting, rupture, leakage or overflow of any plumbing or other pipes (including, without limitation, water, steam, and/or refrigerant lines), sprinklers, tanks, drains, drinking fountains or washstands, or other similar cause in, above, upon or about the Premises, the Building, or the Project.

(i) Landlord makes no representation with respect to the adequacy or fitness of the air conditioning or ventilation equipment in the Building to maintain temperatures which may be required for, or because of, any equipment of Tenant, other than normal fractional horsepower

18

office equipment, or occupancy of the Premises in excess of the Base Service Load. Tenant shall not, without Landlord’s prior written consent, use heat-generating machines, machines other than normal fractional horsepower office machines, equipment or lighting other than Building standard lights in the Premises, which may affect the temperature otherwise maintained by the air conditioning system or increase the water normally furnished for the Premises by Landlord pursuant to the terms of this Paragraph 5. If such consent is given, Landlord shall have the right to install supplementary air conditioning units or other facilities in the Premises, including supplementary or additional metering devices, and the cost thereof, including the cost of installation, operation and maintenance, increased wear and tear on existing equipment and other similar charges, shall be paid by Tenant to Landlord upon billing by Landlord. Tenant’s consumption of electricity shall not exceed the Building’s capacity considering all other tenants of the Building.

(j) Notwithstanding anything herein to the contrary, if the Premises, or a material portion of the Premises, is made untenantable, inaccessible or unsuitable for the ordinary conduct of Tenant’s business, as a result of an interruption in any of the Basic Services provided by Landlord pursuant to Paragraph 5(a) above, then (i) Landlord shall use commercially reasonable good faith efforts to restore the same as soon as is reasonably possible, (ii) if, despite such commercially reasonable good faith efforts by Landlord, such interruption persists for a period in excess of three (3) consecutive Business Days, then Tenant, as its sole remedy, shall be entitled to receive an abatement of Base Rent and Additional Rent payable hereunder during the period beginning on the fourth (4th) consecutive business day of such interruption and ending on the day the utility or service has been restored; provided, however, that in the event such interruption is not due to Landlord’s negligence or willful misconduct, then such abatement shall only apply to the extent Landlord collects proceeds under the policy of rental-loss insurance the cost of which has been included in Operating Expenses and the proceeds from which are allocable to the Premises.

19

6. LATE CHARGE

Notwithstanding any other provision of this Lease to the contrary, Tenant hereby acknowledges that the late payment to Landlord of Rent, or other amounts due hereunder will cause Landlord to incur costs not contemplated by this Lease, the exact amount of which will be extremely difficult to ascertain. If any Rent or other sums due from Tenant are not received by Landlord or by Landlord’s designated agent within five (5) days after their due date, then Tenant shall pay to Landlord a late charge equal to Two Hundred Fifty Dollars ($250.00) plus five percent (5%) of such overdue amount, plus any costs and attorneys’ fees incurred by Landlord by reason of Tenant’s failure to pay Rent and/or other charges when due hereunder; provided, however, that in any twelve (12) consecutive month period, such late charge shall be waived (a) with respect to the first (1st) occurrence of a late payment of Base Rent, and (b) with respect to the first two (2) occurrences of a late payment of Additional Rent. Landlord and Tenant hereby agree that such late charges represent a fair and reasonable estimate of the cost that Landlord will incur by reason of Tenant’s late payment and shall not be construed as a penalty. Landlord’s acceptance of such late charges shall not constitute a waiver of Tenant’s default with respect to such overdue amount or estop Landlord from exercising any of the other rights and remedies granted under this Lease.

INITIALS: Landlord Tenant

7. SECURITY DEPOSIT (LETTER OF CREDIT)

(a) As collateral for the full and faithful performance by Tenant of all of its obligations under this Lease and for all losses and damages Landlord may suffer for which Tenant is liable hereunder, Tenant shall deposit with Landlord, from time to time, the aggregate amount of all security deposits as determined, from time to time, in accordance with the provisions of Exhibit E (as so determined, the “Security Deposit”). The Security Deposit shall be provided to Landlord either in the form of cash or in the form of one or more irrevocable and unconditional negotiable letter(s) of credit in a form reasonably approved by Landlord (each a “Letter of Credit”). For purposes of the initial Letter of Credit to be delivered by Tenant, Landlord approves of the form attached hereto as Exhibit G. At Tenant’s option, from time to time during the Term (but, following the end of the 24th month of the Term, not more frequently than one (1) time every twelve (12) months), Tenant may replace or substitute cash for a Letter of Credit, or vice versa, as all or portions of the Security Deposit. The Security Deposit for the Phase I Premises shall be paid to Landlord within five (5) Business Days of the full execution and delivery of this Lease. The Security Deposit for the Phase II Premises shall be paid to Landlord no later than the Commencement Date respecting the Phase II Premises.