ASSET PURCHASE AGREEMENT Simlatus Corp. And Proscere Bioscience, Inc.

Exhibit 10.1

Simlatus

Corp.

And

Proscere Bioscience, Inc.

This Asset Purchase Agreement (the “Agreement”) is made as of the 9th day of January 2019 by and between, Proscere Bioscience, Inc. (“Proscere”, or “Seller”), a Florida corporation and Simlatus Corporation, a Nevada Corporation (“Buyer”).

PRELIMINARY STATEMENT

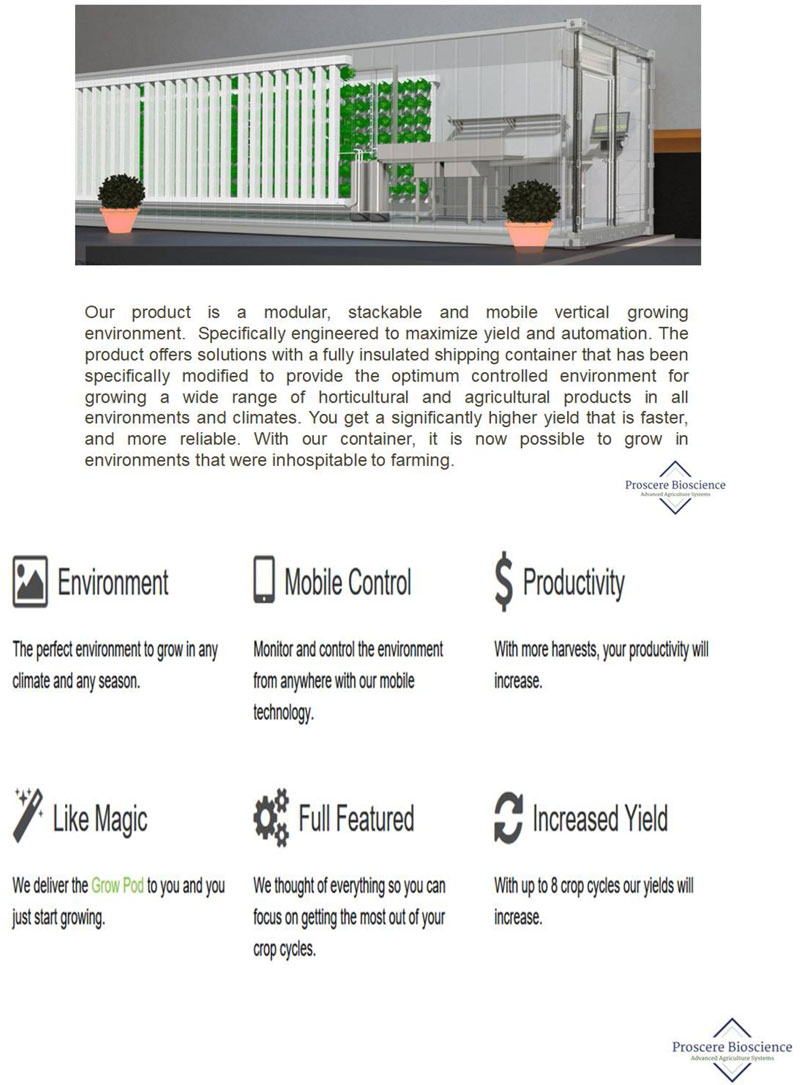

Buyer desires to acquire, and the Seller desires to sell its business and assets pursuant with Exhibit-A attached hereto referred to as “ASSET”, owned by the Seller, and the Seller desires to provide ‘Know-How’ regarding that ASSET under the terms and conditions stated below.

The Buyer and the Seller acknowledge that upon consummation of the transaction contemplated hereunder, Seller will assign the Business and ASSET, and provide “Know-How”, valued at Three Million Dollars ($3,000,000). As consideration for the ASSET and the “Know -How”, the Buyer shall issue, or cause to be issued One Million Six Hundred Seventy Five Thousand Nine Hundred Seventy Eight (1,675,978) shares of Series A Preferred Stock (“Shares”) of Simlatus Corporation, a Nevada corporation (“Company”, “SIML”), the stock shall be issued in the name of Optempus Investments, LLC a California LLC.

NOW, THEREFORE, in consideration of the mutual promises hereinafter set forth, and other good and valuable consideration, the ASSET of which is hereby acknowledged, the parties hereby agree as follows:

| 1. | ACQUISITION OF THE ASSETS AND OTHER ACTIONS |

| 1.01 | ACQUISITION OF THE SELLER’S ASSETS. |

Subject to and upon the terms and conditions of this Agreement, at the closing of the transactions contemplated by this Agreement (the “Closing”), the Seller shall sell, assign and transfer all of its right, title and interest to its ASSET to the Buyer (collectively, the “Seller’s Assets”).

| 1.02 | OFFICERS AND DIRECTORS |

| a) | Xxxxxxx Xxxxx is the sole director of Simlatus Corporation. |

| b) | Xxxxx Xxxxxxxx & Xxxxxxxx Xxxxxxxx are Co-Founders, Chairman-CEO, and Chief Operations Officer of Proscere Bioscience, Inc. |

Upon the signing and closing of this transaction both Xxxxx Xxxxxxxx & Xxxxxxxx Xxxxxxxx will join the board of directors of Simlatus Corporation, receive an Employment Agreement, and remain as President and Vice President of Proscere Bioscience Inc., respectively.

| 1.03 | CONSIDERATION FOR THE SELLER’S ASSETS. |

In consideration for the sale and transfer of the Seller’s Assets, and subject to the terms and conditions of this Agreement, Buyer shall on the Closing Date:

| (a) | Upon execution of this Agreement, Buyer shall issue, or cause to be issued, One Million Six Hundred Seventy Five Thousand Nine Hundred Seventy Eight (1,675,978) shares of Series A Preferred Stock (“Shares”) of Simlatus Corporation, a Nevada corporation (“Company”, “SIML”), the stock shall be issued in the name of Optempus Investments, LLC a California LLC. |

| (b) | Proscere Bioscience, Inc. will be a wholly owned subsidiary of Simlatus Corporation. |

Page 1 of 12

| 1.04 | CLOSING. |

The Closing shall take place at the offices of Simlatus Corporation, at 17:00 hours on January 9, 2019, or at such other place, time or date as may be mutually agreed upon in writing by the parties, once the Conditions Precedent have been met (the “Closing Date”).

| 1.05 | CONSENT TO ASSIGNMENT. |

This Agreement may not be assigned, hypothecated, transferred or contracted to another party without the express written consent of both parties.

| 2. | REPRESENTATIONS OF THE SELLER REGARDING THE SELLER’S ASSETS. |

The Seller represents and warrants to the Buyer as follows:

(a) The Seller has good and marketable title to the Seller’s Assets, free and clear of any and all covenants, conditions, restrictions, voting trust arrangements, liens, charges, encumbrances, options and adverse claims or rights whatsoever.

(b) The Seller is not a party to, subject to or bound by any agreement or any judgment, order, writ, prohibition, injunction or decree of any court or other governmental body which would prevent the execution or delivery of this Agreement by the Seller, or the transfer, conveyance and sale of the Seller’s Assets to the Buyer pursuant to the terms hereof.

(c) No broker or finder has acted for the Seller in connection with this agreement or the transactions contemplated hereby, and no broker or finder is entitled to any brokerage or finder’s fee or other commissions in respect of such transactions based upon agreements, arrangements or understandings made by or on behalf of the Seller.

(d) Seller is not in default under any of the Seller Contracts, and, to the Seller’s knowledge, no third party is in default under any of the Seller’s Assets. The Seller’s Assets, together with the assets held by the Company, constitutes all of the assets necessary to operate the business of the Seller and the Company as currently conducted.

| 3. | REPRESENTATIONS OF THE SELLER REGARDING THE SELLER. |

The Seller represents and warrants to the Buyer as follows:

| 3.01 | ORGANIZATION. |

The Seller is a Limited Liability Corporation duly organized, validly existing and in good standing under the laws of the State of California, and has all requisite power and authority (corporate and other) to own its properties, to carry on its business as now being conducted, to execute and deliver this Agreement and the agreements contemplated herein, and to consummate the transactions contemplated hereby and thereby.

3.02 THE COMPANY.

Schedule 3.02 attached hereto sets forth: (i) the name of the Company; (ii) the jurisdiction of incorporation of the Company; (iii) the names of the officers and directors of each Company; and (iv) the jurisdictions in which the Company is qualified or holds licenses to do business. The Company is a CORPORATION duly organized and validly existing and in good standing under the laws of California and has all requisite power and authority to own its properties and carry on its business as now being conducted.

| 3.03 | AUTHORIZATION. |

The execution and delivery by the Seller of this Agreement and the agreements provided for herein, and the consummation by the Seller of all transactions contemplated hereunder and thereunder by the Seller, have been duly authorized by all requisite corporate action. This Agreement has been duly executed by the Seller. This Agreement and all other agreements and obligations entered into and undertaken in connection with the transactions contemplated hereby to which the Seller is a party constitute the valid and legally binding obligations of the Seller, enforceable against it in accordance with their respective terms. The execution, delivery and performance by the Seller of this Agreement and the agreements provided for herein, and the consummation by the Seller of the transactions contemplated hereby and thereby, will not, with or without the giving of notice or the passage of time or both, (a) violate the provisions of any law, rule or regulation applicable to the Seller; (b) violate the provisions of the Certificate of Incorporation or Bylaws of the Seller; (c) violate any judgment, decree, order or award of any court, governmental body or arbitrator; or (d) conflict with or result in the breach or termination of any term or provision of, or constitute a default under, or cause any acceleration under, or cause the creation of any lien, charge or encumbrance upon the properties or assets of the Company pursuant to, any indenture, mortgage, deed of trust, security agreement or other instrument or agreement to which any of the Companies is a party or by which any of the Companies or any of its properties is or may be bound.

Page 2 of 12

| 3.04 | ABSENCE OF UNDISCLOSED LIABILITIES. |

Except as and to the extent (a) reflected and reserved against in the Current Balance Sheets, or (b) incurred in the ordinary course of business after the date of the Current Balance Sheets and not material in amount, either individually or in the aggregate, none of the Company has any liability or obligation, secured or unsecured, whether accrued, absolute, contingent, un-asserted or otherwise, which, either individually or in the aggregate, is material to the condition (financial or otherwise) of the assets, properties, business or prospects of such Company.

| 3.05 | LITIGATION. |

There is no action, other than the one described in Attachment No. 1, attached to this Agreement, suit or proceeding to which the Seller is a party (either as a plaintiff or defendant) pending or threatened before any court or governmental agency, authority, body or arbitrator and, to the best knowledge of the Seller, there is no basis for any such action, suit or proceeding; (b) the Seller, to the best of its knowledge, no officer, director or employee of the Seller, has been permanently or temporarily enjoined by any order, judgment or decree of any court or any governmental agency, authority or body from engaging in or continuing any conduct or practice in connection with the business, assets, or properties of the Seller; and (c) there is not in existence on the date hereof any order, judgment or decree of any court, tribunal or agency enjoining or requiring the Seller to take any action of any kind with respect to its business, assets or properties.

| 3.06 | COMPLIANCE WITH AGREEMENTS AND LAWS. |

The Seller has all requisite licenses, permits and certificates from all local authorities necessary to conduct its respective business and to own and operate its assets (collectively, the “Permits”). The Seller is not in violation in any material respect of any law, regulation or ordinance relating to its properties. The Seller has not violated, and on the date hereof will not violate any local or foreign laws, regulations or orders (including, but not limited to, any of the foregoing relating to employment discrimination, immigration, occupational safety, or corrupt practices), the enforcement of which would have a Material Adverse Effect.

| 3.07 | FULL DISCLOSURE. |

There are no materially misleading misstatements in any of the representations and warranties made by Seller in this Agreement, the Exhibits or Schedules to this Agreement, or any certificates delivered by Seller pursuant to this Agreement and Seller has not omitted to state any fact necessary to make statements made herein or therein not materially misleading.

| 4. | REPRESENTATIONS OF THE BUYER REGARDING THE BUYER |

The Buyer represents and warrants to the Seller that:

| 4.01 | ORGANIZATION AND AUTHORITY. |

The Buyer is a corporation duly organized, validly existing and in good standing under the laws of the State of Nevada, doing business in California, and has all requisite power and authority (corporate and other) to own its properties and to carry on its business as now being conducted. The Buyer has full power to execute and deliver this Agreement and the agreements contemplated herein, and to consummate the transactions contemplated hereby and thereby.

Page 3 of 12

| 4.02 | CAPITALIZATION OF THE BUYER |

Upon execution of this Agreement, Buyer shall issue said Preferred Series A shares to the Seller as payment in full in accordance with Section 1.03 (a) in this Agreement.

| 4.03 | AUTHORIZATION. |

The execution and delivery of this Agreement by the Buyer, and the agreements provided for herein, as well as the transactions contemplated herein, have been duly authorized by all requisite corporate action. This Agreement and all such other agreements and written obligations entered into and undertaken in connection with the transactions contemplated hereby constitute the valid and legally binding obligations of the Buyer, enforceable against the Buyer in accordance with their respective terms. The execution, delivery and performance of this Agreement and the agreements provided for herein, and the consummation by the Buyer of the transactions contemplated hereby and thereby, will not, with or without the giving of notice or the passage of time or both, (a) violate the provisions of any law, rule or regulation applicable to the Buyer; (b) violate the provisions of the Buyer’s Certificate of Incorporation or Bylaws; (c) violate any judgment, decree, order or award of any court, governmental body or arbitrator; or (d) conflict with or result in the breach or termination of any term or provision of, or constitute a default under, or cause any acceleration under, or cause the creation of any lien, charge or encumbrance upon the properties or assets of the Buyer pursuant to, any indenture, mortgage, deed of trust or other agreement or instrument to which the Buyer is a party or by which the Buyer is or may be bound.

| 4.05 | BROKER’S FEE. |

No broker or finder has acted for the Buyer in connection with this Agreement or the transactions contemplated hereby, and no broker or finder is entitled to any brokerage or finder’s fee or other commissions in respect of such transactions based upon agreements, arrangements or understandings made by or on behalf of the Buyer.

| 5. | CONFIDENTIALITY. |

The Seller recognizes and acknowledges that by reason of the terms contemplated in this Agreement, has had access to confidential information relating to the Buyer’s business, including, without limitation, information and knowledge pertaining to products and services offered, innovations, ideas, plans, trade secrets, proprietary information, advertising, sales methods and systems, sales and profit figures, customer and client lists, and relationship with dealers, customers, clients, suppliers and others who have business dealings with the Business (“Confidential Information”). The Seller acknowledges that such Confidential Information is a valuable and unique asset and covenants that it will not disclose any such Confidential Information after Closing to any person for any reason whatsoever, unless such information is (a) within the public domain through no wrongful act of the Seller, (b) has been rightfully received from a third party without restriction and without breach of this Agreement, (c) is required by law to be disclosed or is disclosed for purposes of defending claims related to the Seller in a manner designed to protect the confidentiality of the Confidential Information; or (d) represents historical information reasonably required by a prospective purchaser of the Seller.

| 6. | NOTICES. |

Any notices or other communications required or permitted hereunder shall be sufficiently given if delivered personally or federal express, registered or certified mail, postage prepaid, addressed as follows or to such other address of which the parties may have given notice:

| To the Buyer: | Simlatus Corporation |

| 000 Xxxxxxxxx Xxxxx | |

| Xxxxx Xxxxxx, XX 00000 | |

| To the Seller: | Proscere Bioscience, Inc. |

| 0000 Xxxxx Xxxxx | |

| Xxxxxxxx, XX 00000 | |

Unless otherwise specified herein, such notices or other communications shall be deemed received (a) on the date delivered, if delivered personally, or (b) three business days after being sent, if sent by registered or certified mail.

Page 4 of 12

| 7. | SUCCESSORS AND ASSIGNS. |

This Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns, except that the Buyer, on the one hand, and the Seller, on the other hand, may not assign their respective obligations hereunder without the prior written consent of the other party; provided, however, that the Buyer may assign this Agreement, and its rights and obligations hereunder, to a subsidiary or Affiliate of the Buyer. Any assignment in contravention of this provision shall be void. No assignment shall release the Buyer or the Seller from any obligation or liability under this Agreement.

| 8. | ENTIRE AGREEMENT; AMENDMENTS; ATTACHMENTS |

(a) This Agreement, all Schedules and Exhibits hereto, and all agreements and instruments to be delivered by the parties pursuant hereto represent the entire understanding and agreement between the parties with respect to the subject matter hereof and supersede all prior oral and written and all contemporaneous oral negotiations, commitments and understandings between such parties. The Buyer, by the consent of its Directors or officers, and the Seller may amend or modify this Agreement, in such manner as may be agreed upon, by a written instrument executed by the Buyer and the Seller.

(b) If the provisions of any Schedule or Exhibit to this Agreement are inconsistent with the provisions of this Agreement, the provisions of the Agreement shall prevail. The Exhibits and Schedules attached hereto or to be attached hereafter are hereby incorporated as integral parts of this Agreement.

| 9. | SEVERABILITY. |

Any provision of this Agreement which is invalid, illegal or unenforceable in any jurisdiction shall, as to that jurisdiction, be ineffective to the extent of such invalidity, illegality or unenforceability, without affecting in any way the remaining provisions hereof in such jurisdiction or rendering that or any other provision of this Agreement invalid, illegal or unenforceable in any other jurisdiction.

| 10. | INVESTIGATION OF THE PARTIES. |

All representations and warranties contained herein which are made to the best knowledge of a party shall require that such party make reasonable investigation and inquiry with respect thereto to ascertain the correctness and validity thereof.

| 11. | EXPENSES. |

Except as otherwise expressly provided herein, the Buyer, on the one hand, and the Seller, on the other hand, will pay all fees and expenses (including, without limitation, legal and accounting fees and expenses) incurred by them in connection with the transactions contemplated herein. All fees or expenses incurred in connection with this transaction by the Seller shall be allocated to and borne by the Seller.

| 12. | GOVERNING LAW. |

This Agreement shall be governed by and construed in accordance with the laws of the State of California.

| 13. | SECTION HEADINGS. |

The section headings are for the convenience of the parties and in no way alter, modify, amend, limit, or restrict the contractual obligations of the parties.

Page 5 of 12

| 14. | MODIFICATIONS. |

This Agreement can be modified only by a written agreement duly signed by each party.

| 15. | COUNTERPARTS. |

This Agreement may be executed in one or more counterparts, each of which shall be deemed to be an original, but all of which shall be one and the same document.

| 16. | DEFAULT |

In the event that either Party(s) defaults on this Agreement, defaulting Party shall have 15 days to cure the default. In the event that the default is not cured in 15 days, or if it is found to be incurable, the transaction contemplated under this Agreement shall “unwind” in accordance with the Unwind Agreement entered into and executed by all Parties.

IN WITNESS WHEREOF, this Agreement has been duly executed by the parties hereto as of and on the date first above written.

| BUYER: | Proscere Bioscience, Inc. | |

| By: |  | |

| Xxxxx Xxxxxxxx, President | ||

| SELLER: | Simlatus Corp. | |

| By: |  | |

| Xxxxxxx Xxxxx, CEO and Chairman | ||

Page 6 of 12

EXHIBIT-A

Page 7 of 12

Page 8 of 12

Page 9 of 12

Page 10 of 12

Page 11 of 12

Page 12 of 12