Firstmark' SERVICES PRIVATE STUDENT LOAN SERVICING AGREEMENT This Private Student Loan Servicing Agreement (the "Agreement") is entered into and effective as of the 9th day of October, 2014, by and between Nelnet Servicing, LLC, d/b/a Firstmark...

Firstmark' SERVICES PRIVATE STUDENT LOAN SERVICING AGREEMENT This Private Student Loan Servicing Agreement (the "Agreement") is entered into and effective as of the 9th day of October, 2014, by and between Nelnet Servicing, LLC, d/b/a Firstmark Services, a Nebraska limited liability company, ("Firstmark") and Union Bank and Trust Company, a Nebraska state banking corporation, ("Lender"). WHEREAS, Firstmark provides processing services related to the servicing of Education Loans for lenders; and, WHEREAS, Lender in the ordinary course of its business makes or acquires Education Loans; and, WHEREAS, Firstmark agrees to process and service Education Loans for Lender pursuant to the Servicing Guidelines, and Lender therefore desires to retain Firstmark for such services. NOW THEREFORE, in consideration of the premises and the mutual covenants hereinafter set forth, the parties agree as follows: Article I - Definitions 1_1. "Affiliate" means any individual, corporation, partnership, association 01' business that directly or indirectly through one or more intermediaries) controls, or is controlled by, or is under common control with a party or its successors. The term "control" including the terms "controlling," "controlled by," and "under common control with" means the possession, direct 01' indirect, of the power to direct or cause the direction of the management and policies of a corporation, partnership, association or business, whether through the ownership of voting shares, by contract or otherwise, Affiliates shall include such entities whether now existing or later established by investment, merger or otherwise, including the successors and assigns of such entities. 1w2, "Agreement" means this Agreement. 1~3, "Applicable Law" means federal, state or local statute, rule, regulation or similar legal requirement applicable to processing the origination and servicing of Education Loans, 1-4. "Almlicable Requirements" means each of the following, as applicable: (i) all contractual obligations under this Agreement and under the Loan Documents; (ii) Applicable Law, and (iii) the Servicing Guidelines. 1-5. "Borrower" means a maker ofa promissory note with respect to an Education Loan, CONPIDENTIAL FlRSTMARK SERV1CES Pnge J

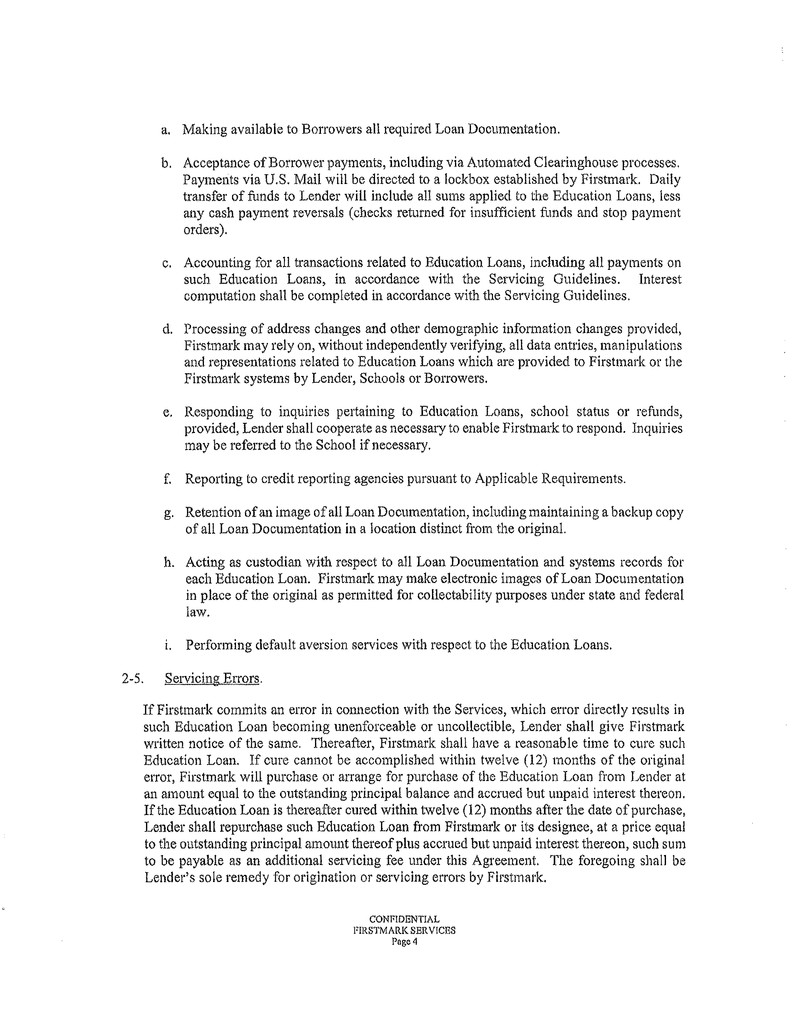

1-6. "Business Day" means any day other than a Saturday, Sunday, 01' a day on which the banking institutions in the city in which a payment is received or a disbursement hereunder must be initiated are authorized or required by law 01' executive order to close. 1-7. "Claims" means claims, liabilities, losses, damages, costs, expenses and reasonable attorney's fees asserted against or incurred by a party in connection with a dispute by or the assertions of a third party which arise out of the relationship created by the Agreement. 1-8. "Confidential Information" has the meaning given such term in Section 1lI-II.a. hereof. 1-9. "Education Loan" means a consumer loan made or to be made to a Borrower for the funding of expenses in connection with such Borrower's education, and which is not insured or guaranteed by, or made pursuant to a program sponsored by, a state or federal government 01' governmental agency. 1-10. "Effective Date" means the date set forth in the preamble to this Agreement. I -11. "Fees" means the amounts to be paid by Lender to Firstmark fOI'the Services, as further defined in Section 2-7(a) and Schedule A. 1-12. "Force Majyure" means, without limitation, the following: acts of God, strikes, lockouts, or other industrial disturbances; acts of public enemies; order 01' restraint of any kind of the government of the United States of America or of any state or locality in which a party is doing business or any of their departments, agencies or officials, or any civil or military authority; insurrections; riots; landslides; earthquakes;. fires; storms; droughts; floods; explosions; breakage or accident to machinery, equipment, transmission pipes or canals; or any other cause or event not reasonably within the control of the party. 1-13. "Intellectual Prop-erty" means user manuals, training materials, computer programs, routines, structures, layout, report formats, trademarks, servicemarks, copyrights, patent rights and all oral or written information relating to a party's business which is not generally known to the public and which gives such party an advantage over its competitors who do not know or use such information. 1-14. "Lender" has the meaning given to such term in the preamble to this Agreement. 1~15. "Loan Documents" means loan applications, promissory notes, credit agreements, disclosures and notices with respect to Education Loans. Lender acknowledges that it holds the "Customer Relationship" (as defined in the Xxxxx-Xxxxx-Xxxxxx Act) with Borrowers and thereby has the responsibility to provide privacy policies and notices to such Borrowers as required therein. Firstmark will deliver or make available Lender's privacy notices in connection with the Services, as directed by Lender) at the fee set forth in Schedule A. 1-16. "NPl" means "Nonpublic Personal Information" as such term is defined in the regulations implementing Subtitle A of Title V of the Xxxxxx-Xxxxx-Xxxxxx Act, Pub. L. 106-102, CONFIDENTtAL FJRSTMARK SERVICES Page 2

Schedule A Fee Schedule Activi.!l:_ Fee Unit Measure ,",_'.""'- - Monthly Servicing Fees Base Servicing $4.15 Per Borrower Per Month Miscellaneous Fees Delinquency surcharge I $1.80 Per Participant Per Month 1098-E Tax Form 15t Class Postage + Per Form $.10 Privacy Statements 1st Class Postage + Pel' One Page Statement, $.10 $.04 per additional P_~.g~ Special Proiect Fee2 $150.00 Per Hour Removal/Deconversion Fee $40.00, not to exceed Per Loan $1 million in aggregate -- Manual Loan Add Fee $10.00 Per Loan Sale/Internal Transfer Fee $3.00 Per Loan Claim/Charge-Off! Bankrup.!Si Filing Fee $15.00 Per Defaulted Loan .._---- • Increases in Postage expense due to United States Postal Service postage increase will be a pass through cost 1 Surcharge Is assessed for each participant upon whom delinquency activity is performed In the month consistent with the standard collection schedule Included in the program guidelines 2 The "Special Project" fee would be charged for system and report changes or enhancements that would be needed to meet lenders requfrements. Fee only to be charged If disclosed and approved by lender In advance. Schedule A - Page 1