SHARE PURCHASE AGREEMENT

THIS AGREEMENT is dated for reference as of the 7th day of April, 2005.

AMONG:

CLYVIA CAPITAL HOLDING GMBH., a company duly formed under the laws of Germany, with its principal office at Xxxxxxxxx. 0x, 00000 Xxxxxxxx, Xxxxxxx (hereinafter called the "Vendor") |

OF THE FIRST PART

AND:

RAPA MINING INC., a corporation duly formed under the laws of Nevada with its principal office at Xxxxx 000, 000 Xxxxxxx Xxxxxx Xxxxxxxxx, Xxxxxxx Xxxxxxxx, Xxxxxx X0X 0X0 (hereinafter called the "Purchaser") |

OF THE SECOND PART

AND:

CLYVIA TECHNOLOGY GMBH, a company with limited liability duly formed under the laws of Germany with its principal office at Xxxxxxxxx-Xxxx-Xxxxx 00, 00000 Xxxxxxx, Xxxxxxx (hereinafter called the "Company") |

OF THE THIRD PART

AND:

XXXXX XXXXXXX of #206 - 0000 Xxxxxxx Xxxxxx, Xxxxxxxxx, Xxxxxxx Xxxxxxxx, Xxxxxx (hereinafter called the "Principal Shareholder") |

OF THE FOURTH PART

WHEREAS:

A. The Purchaser has offered to purchase all of the issued and outstanding shares of the Company;

B. The Vendor has agreed to sell to the Purchaser all of the issued and outstanding shares of the Company held by the Vendor on the terms and conditions set forth herein;

1

C. In order to induce the Vendor to sell the shares of the Company to the Purchaser, the Principal Shareholder has agreed to sell and transfer to the Vendor certain shares of the Purchaser;

D. In order to record the terms and conditions of the agreement among them the parties wish to enter into this Agreement;

NOW THEREFORE THIS AGREEMENT WITNESSES that in consideration of the foregoing and of the sum of $1.00 paid by the Purchaser to the Vendor and to the Company, the receipt of which is hereby acknowledged, the parties hereto agree each with the other as follows:

1. INTERPRETATION

1.1 Where used herein or in any amendments or Schedules hereto, the following terms shall have the following meanings:

| (a) "Business" means the business in which the Company is engaged, namely: |

| (i) | the manufacture of fuels from organic waste through the process known as “catalytic depolymerization”; and | ||

| (ii) | any other enterprise that is directly related to the foregoing. | ||

| (b) | "Closing Date" means the fifth business day following

the day on which the Company delivers the financial statements referred

to in Article 5 to the Purchaser or such other date as may be mutually

agreed upon by the parties hereto but in any event not more than 60 days

from the date of this Agreement. |

|

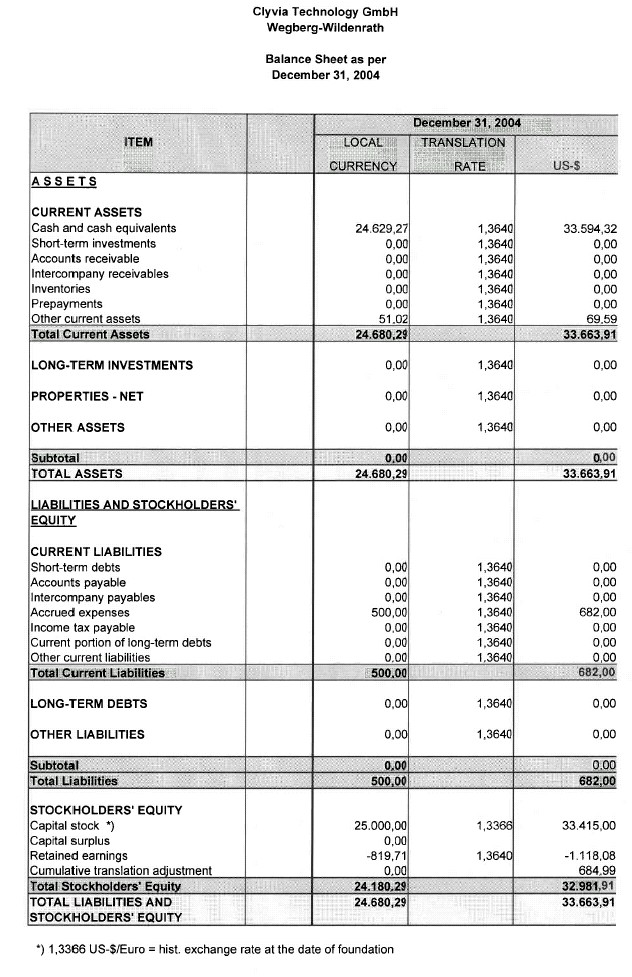

| (c) | "Company Financial Statements" means those unaudited

financial statements of the Company, as at December 31, 2004, which are

attached as Schedule "A" hereto. |

|

| (d) | "Company Shares" means the one share of the capital

stock of the Company held by the Vendor, being all of the issued and outstanding

shares of the Company. |

|

| (e) | “License Agreement” means the license

agreement executed by the Company on December 13, 2004 between the Company

and ECO Impact GmbH relating to the exclusive grant of a worldwide license

with respect to those patents listed in Schedule “I” hereto.

|

|

| (f) | "Principal Shares" means the 14,000,000 presently

issued restricted common shares of the Purchaser to be transferred to

the Vendor as described in paragraph 2.4. |

|

| (g) | "Purchaser Audited Financial Statements" means those

audited financial statements of the Purchaser as at January 31, 2004,

attached as Schedule “B” hereto. |

|

2

| (h) | "Purchaser Financial Statements" means, collectively,

the Purchaser Audited Financial Statements and the Purchaser Unaudited

Financial Statements. |

|

| (i) | "Purchaser Shares" means those fully paid and non-assessable

shares in the common stock of the Purchaser to be issued by the Purchaser

to the Vendor as set out in Article 2. |

|

| (j) | “Purchaser Unaudited Financial Statements”

means those unaudited financial statements of the Purchaser as at October

31, 2004, attached as Schedule “C” hereto. |

|

| (k) | “Securities Act” means the United States

Securities Act of 1933. |

|

1.2 All dollar amounts referred to in this Agreement are in United States funds, unless expressly stated otherwise.

1.3 The following schedules are attached to and form part of this Agreement:

| Schedule A - Company Financial Statements Schedule B – Purchaser Audited Financial Statements Schedule C - Purchaser Unaudited Financial Statements Schedule D - Employment, Service & Pension Agreements of the Company Schedule E - Real Property & Leases of the Company Schedule F - Encumbrances on the Company's Assets Schedule G - Company Litigation Schedule H - Purchaser Litigation Schedule I - Registered Trademarks, Trade Names & Patents of the Company |

2. SHARE EXCHANGE AND PURCHASE OF SHARES

2.1 The Vendor hereby covenants and agrees to sell, assign and transfer to the Purchaser, and the Purchaser covenants and agrees to purchase from the Vendor, the Company Shares held by the Vendor.

2.2 In consideration for the sale of the Company Shares by the Vendor to the Purchaser, the Purchaser shall allot and issue to the Vendor or its nominees the Purchaser Shares.

2.3 The total number of Purchaser Shares to be allotted and issued by the Purchaser to the Vendor or its nominees shall be 55,000,000 shares.

2.4 In consideration for the Vendor entering into this Agreement and completing the sale of the Company Shares to the Purchaser, the Principal Shareholder agrees to transfer the Principal Shares to the Vendor on the Closing Date at and for an aggregate price of $10,000.

2.5 The Vendor acknowledges that the Purchaser Shares are “restricted securities” within the meaning of the Securities Act and will be issued to the Vendor in accordance with

3

Regulation S of the Securities Act. Any certificates representing the Purchaser Shares will be endorsed with the following legend in accordance with Regulation S of the Securities Act:

“THE SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933 (THE "ACT"), AND HAVE BEEN ISSUED IN RELIANCE UPON AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE ACT PROVIDED BY REGULATION S PROMULGATED UNDER THE ACT. SUCH SECURITIES MAY NOT BE REOFFERED FOR SALE OR RESOLD OR OTHERWISE TRANSFERRED EXCEPT IN ACCORDANCE WITH THE PROVISIONS OF REGULATION S, PURSUANT TO AN EFFECTIVE REGISTRATION UNDER THE ACT, OR PURSUANT TO AN AVAILABLE EXEMPTION FROM REGISTRATION UNDER THE ACT. HEDGING TRANSACTIONS INVOLVING THE SECURITIES MAY NOT BE CONDUCTED UNLESS IN COMPLIANCE WITH THE ACT”.

3. COVENANTS, REPRESENTATIONS AND WARRANTIES OF THE VENDOR AND THE COMPANY

The Vendor and the Company jointly and severally covenant with and represent and warrant to the Purchaser as follows, and acknowledge that the Purchaser is relying upon such covenants, representations and warranties in connection with the purchase by the Purchaser of the Company Shares:

3.1 The Company has been duly incorporated and organized, is a validly existing company with limited liability and is in good standing under the laws of Germany; it has the corporate power to own or lease its property and to carry on the Business; it is duly qualified as a company with limited liability to do business and is in good standing with respect thereto in each jurisdiction in which the nature of the Business or the property owned or leased by it makes such qualification necessary; and it has all necessary licenses, permits, authorizations and consents to operate its Business in accordance with the terms of its business plan.

3.2 The paid in capital of the Company consists of one share with a par value of € 25,000.

3.3 The Company Shares owned by the Vendor are owned by it as the beneficial and recorded owner with good and marketable title thereto, free and clear of all mortgages, liens, charges, security interests, adverse claims, pledges, encumbrances and demands whatsoever.

3.4 No person, firm or corporation has any agreement or option or any right or privilege (whether by law, pre-emptive or contractual) capable of becoming an agreement or option for the purchase from the Vendor of any of the Company Shares held by it.

3.5 No person, firm or corporation has any agreement or option, including convertible securities, warrants or convertible obligations of any nature, or any right or privilege (whether by law, pre-emptive or contractual) capable of becoming an agreement or option for the purchase, subscription, allotment or issuance of any of the unissued shares in the capital of the Company or of any securities of the Company.

4

3.6 The Company does not have any subsidiaries or agreements of any nature to acquire any subsidiary or to acquire or lease any other business operations and will not prior to the Closing Date acquire, or agree to acquire, any subsidiary or business without the prior written consent of the Purchaser.

3.7 The Company will not, without the prior written consent of the Purchaser, issue any additional shares from and after the date hereof to the Closing Date or create any options, warrants or rights for any person to subscribe for or acquire any unissued shares in the capital of the Company.

3.8 The Company is not a party to or bound by any guarantee, warranty, indemnification, assumption or endorsement or any other like commitment of the obligations, liabilities (contingent or otherwise) or indebtedness of any other person, firm or corporation.

3.9 The books and records of the Company fairly and correctly set out and disclose in all material respects, in accordance with generally accepted accounting principles, the financial position of the Company as at the date hereof, and all material financial transactions of the Company relating to the Business have been accurately recorded in such books and records.

3.10 The Company Financial Statements present fairly the assets, liabilities (whether accrued, absolute, contingent or otherwise) and the financial condition of the Company as at the date thereof and there will not be, prior to the Closing Date, any material increase in such liabilities other than increases arising as a result of carrying on the Business in the ordinary and normal course.

3.11 The entering into of this Agreement and the consummation of the transactions contemplated hereby will not result in the violation of any of the terms and provisions of the constating documents or bylaws of the Company or of any indenture, instrument or agreement, written or oral, to which the Company or the Vendor may be a party.

3.12 The entering into of this Agreement and the consummation of the transactions contemplated hereby will not, to the best of the knowledge of the Company and the Vendor, result in the violation of any law or regulation of Germany or of any states in which they are resident or in which the Business is or at the Closing Date will be carried on or of any municipal bylaw or ordinance to which the Company or the Business may be subject.

3.13 This Agreement has been duly authorized, validly executed and delivered by the Company and the Vendor.

3.14 The Business has been carried on in the ordinary and normal course by the Company since the date of the Company Financial Statements and will be carried on by the Company in the ordinary and normal course after the date hereof and up to the Closing Date.

3.15 Except in connection with the real property leases described on Schedule E hereto, no capital expenditures in excess of $5,000 have been made or authorized by the Company since the date of the Company Financial Statements and no capital expenditures in excess of $5,000 will be made or authorized by the Company after the date hereof and up to the Closing Date without the prior written consent of the Purchaser.

5

3.16 Except as disclosed in the Schedules hereto, the Company is not a party to any written or oral employment, service or pension agreement, and, the Company does not have any employees who cannot be dismissed on not more than one months notice without further liability.

3.17 Except as disclosed in the Schedules hereto, the Company does not have outstanding any bonds, debentures, mortgages, notes or other indebtedness, and the Company is not under any agreement to create or issue any bonds, debentures, mortgages, notes other indebtedness, except liabilities incurred in the ordinary course of business.

3.18 Except as disclosed in the Schedules hereto, the Company is not the owner, lessee or under any agreement to own or lease any real property.

3.19 Except as disclosed in the Schedules hereto, the Company owns, possesses and has good and marketable title to its undertaking, property and assets, and without restricting the generality of the foregoing, all those assets described in the balance sheet included in the Company Financial Statements, free and clear of any and all mortgages, liens, pledges, charges, security interests, encumbrances, actions, claims or demands of any nature whatsoever or howsoever arising.

3.20 The Company has its property insured against loss or damage by all insurable hazards or risks on a replacement cost basis and such insurance coverage will be continued full force and effect to and including the Closing Date; to the best of the knowledge of the Company and the Vendor, the Company is not in default with respect to any of the provisions contained in any such insurance policy and has not failed to give any notice or present any claim under any such insurance policy in due and timely fashion.

3.21 Except as disclosed herein the Company does not have any outstanding material agreements, contracts or commitments, whether written or oral, of any nature or kind whatsoever, including, but not limited to, employment agreements, except:

| (a) | the License Agreement; |

| (b) | agreements, contracts and commitments in the ordinary course of business; |

| (c) | service contracts on office equipment; |

| (d) | the employment, services and pension agreements described in the Schedules hereto; and |

| (e) | the lease described in the Schedules hereto. |

3.22 Except as provided in the Schedules hereto, there are no actions, suits or proceedings (whether or not purportedly on behalf of the Company), pending or threatened against or affecting the Company or affecting the Business, at law or in equity, or before or by any federal, state, municipal or other governmental department, commission, board, bureau, agency or instrumentality, domestic or foreign and neither the Company nor the Vendor are aware of any existing ground on which any such action, suit or proceeding might be commenced with any reasonable likelihood of success.

6

3.23 The Company is not in material default or breach of any contracts, agreements, written or oral, indentures or other instruments to which it is a party and there are no facts, which, after notice or lapse of time or both, that would constitute such a default or breach, and all such contracts, agreements, indentures or other instruments are now in good standing and the Company is entitled to all benefits thereunder.

3.24 The Company has the right to use all of the registered trademarks, trade names and patents, both domestic and foreign, in relation to the Business as set out in the Schedules hereto.

3.25 To the best of the knowledge of the Company and the Vendor, the conduct of the Business does not infringe upon the patents, trade marks, trade names or copyrights, domestic or foreign, of any other person, firm or corporation.

3.26 To the best of the knowledge of the Company and the Vendor, the Company is conducting and will conduct the Business in compliance with all applicable laws, rules and regulations of each jurisdiction in which the Business is or will be carried on, the Company is not in material breach of any such laws, rules or regulations and is, or will be on the Closing Date, fully licensed, registered or qualified in each jurisdiction in which the Company owns or leases property or carries on or proposes to carry on the Business to enable the Business to be carried on as now conducted and its property and assets to be owned, leased and operated, and all such licenses, registrations and qualifications are or will be on the Closing Date valid and subsisting and in good standing and that none of the same contains or will contain any provision, condition or limitation which has or may have a materially adverse effect on the operation of the Business.

3.27 All facilities and equipment owned or used by the Company in connection with the Business are in good operating condition and are in a state of good repair and maintenance.

3.28 Except as disclosed in the Company Financial Statements and salaries incurred in the ordinary course of business since the date thereof, the Company has no loans or indebtedness outstanding which have been made to or from directors, former directors, officers, shareholders and employees of the Company or to any person or corporate body not dealing at arm's length with any of the foregoing, and will not, prior to closing, pay any such indebtedness unless in accordance with budgets agreed in writing by the Purchaser.

3.29 The Company has made full disclosure to the Purchaser of all aspects of the Business and has made all of its books and records available to the representatives of the Purchaser in order to assist the Purchaser in the performance of its due diligence searches and no material facts in relation to the Business have been concealed by the Company or the Vendor.

3.30 There are no material liabilities of the Company of any kind whatsoever, whether or not accrued and whether or not determined or determinable, in respect of which the Company or the Purchaser may become liable on or after the consummation of the transaction contemplated by this Agreement, other than liabilities which may be reflected on the Company Financial Statements, liabilities disclosed or referred to in this Agreement or in the Schedules attached hereto, or liabilities incurred in the ordinary course of business and attributable to the period since the date of the Company Financial Statements, none of which has been materially

7

adverse to the nature of the Business, results of operations, assets, financial condition or manner of conducting the Business.

3.31 The Articles, bylaws and other constating documents of the Company in effect with the appropriate corporate authorities as at the date of this Agreement will remain in full force and effect without any changes thereto as at the Closing Date.

3.32 The directors and officers of the Company are as follows:

| Name | Position |

| Xx. Xxxxxxx Xxxxxx | Executive Board Member |

| Xx. Xxxxxx Xxxxxx | Executive Board Member |

3.33 The Vendor represents and warrants to the Purchaser and the Principal Shareholder that the Vendor is not a “U.S. Person” as defined by Regulation S of the United States Securities Act of 1933 and is not acquiring the Purchaser Shares for the account or benefit of a U.S. Person.

3.34 The Vendor represents and warrants to the Purchaser that it is acquiring the Purchaser Shares for investment purposes, only, with no present intention of dividing its interest with others or reselling or otherwise disposing of any or all of the Purchaser Shares.

3.35 The Vendor acknowledges that the Vendor was not in the United States at the time the offer to acquire the Purchaser Shares was received it.

4. COVENANTS, REPRESENTATIONS AND WARRANTIES OF THE PURCHASER AND THE PRINCIPAL SHAREHOLDER

The Purchaser and the Principal Shareholder covenant with and represent and warrant to the Vendor and the Company as follows and acknowledge that the Vendor is relying upon such covenants, representations and warranties in entering into this Agreement:

4.1 The Purchaser has been duly incorporated and organized and is validly subsisting under the laws of the State of Nevada; it is a reporting issuer under the United States Securities Exchange Act of 1934 and is in good standing with respect to all filings required to be made under such statutes with the United States Securities and Exchange Commission; it has the corporate power to own or lease its properties and to carry on its business as now being conducted by it; and it is duly qualified as a corporation to do business and is in good standing with respect thereto in each jurisdiction in which the nature of its business or the property owned or leased by it makes such qualification necessary.

4.2 The authorized capital of the Purchaser consists of 525,000,000 shares of common stock with a par value $0.001 per share, of which 42,805,000 shares are currently issued and outstanding as fully paid and non-assessable.

4.3 No person, firm or corporation has any agreement or option, including convertible securities, warrants or convertible obligations of any nature, or any right or privilege (whether by

8

law, pre-emptive or contractual) capable of becoming an agreement or option for the purchase, subscription, allotment or issuance of any of the unissued shares in the capital of the Purchaser.

4.4 The Purchaser will not, without the prior written consent of the Vendor, issue any additional shares from and after the date hereof to the Closing Date or create any options, warrants or rights for any person to subscribe for any unissued shares in the capital of the Purchaser.

4.5 The directors and officers of the Purchaser are as follows:

| Name | Position |

| Xxxxx Xxxxxxx | Director, President, Secretary and Treasurer |

| Xxxx Xxxxx | Director |

4.6 The Purchaser Audited Financial Statements present fairly the assets, liabilities (whether accrued, absolute, contingent or otherwise) and the financial condition of the Purchaser as at the date thereof.

4.7 The Purchaser Unaudited Financial Statements present fairly the assets, liabilities (whether accrued, absolute, contingent or otherwise) and the financial condition of the Purchaser as of the date thereof and there will not be, prior to the Closing Date, any material increase in such liabilities.

4.8 There have been no material adverse changes in the financial position or condition of the Purchaser or damage, loss or destruction materially affecting the business or property of the Purchaser since the date of the Purchaser Unaudited Financial Statements except as may be disclosed by the Purchaser in Current Reports on Form 8-K filed with the United States Securities and Exchange Commission.

4.9 The Purchaser has made full disclosure to the Company of all material aspects of the Purchaser's business and has made all of its books and records available to the representatives of the Company in order to assist the Company in the performance of its due diligence searches and no material facts in relation to the Purchaser's business have been concealed by the Purchaser.

4.10 The Purchaser is not a party to or bound by any agreement or guarantee, warranty, indemnification, assumption or endorsement or any other like commitment of the obligations, liabilities (contingent or otherwise) or indebtedness or any other person, firm or corporation.

4.11 Except as disclosed in the Schedules attached hereto, there are no actions, suits or proceedings (whether or not purportedly on behalf of the Purchaser), pending or threatened against or affecting the Purchaser or affecting the Purchaser's business, at law or in equity, or before or by any federal, state, municipal or other governmental department, commission, board, bureau, agency or instrumentality, domestic or foreign and the Purchaser is not aware of any existing ground on which any such action, suit or proceeding might be commenced with any reasonable likelihood of success.

9

4.12 The Purchaser's common shares are quoted on the NASD OTC Bulletin Board and the Purchaser is not in breach of any regulation, by-law or policy of, or any of the terms and conditions of its quotation on the NASD OTC Bulletin Board applicable to the Purchaser or its operations.

4.13 The Purchaser does not currently have any employees and is not party to any collective agreements with any labour unions or other association of employees.

4.14 The Purchaser does not have any subsidiaries or agreements of any nature to acquire any subsidiary or to acquire or lease any other business operations and will not prior to the Closing Date acquire, or agree to acquire, any subsidiary or business without the prior written consent of the Company.

4.15 The business of the Purchaser now and until the Closing Date will be carried on in the ordinary and normal course after the date hereof and upon to the Closing Date and no material transactions shall be entered into until the Closing Date without the prior written consent of the Vendor.

4.16 No liability, cost or expense will be incurred or payable by the Purchaser in connection with the disposition of any of its properties.

4.17 No capital expenditures in excess of $5,000 have been made or authorized by the Purchaser since the date of the Purchaser Audited Financial Statements and no capital expenditures in excess of $5,000 will be made or authorized by the Purchaser after the date hereof and up to the Closing Date without the prior written consent of the Vendor.

4.18 The Purchaser is not indebted to any of its directors or officers nor are any of the Purchaser's directors or officers indebted to the Purchaser.

4.19 The Purchaser has good and marketable title to its properties and assets as set out in the Purchaser Audited Financial Statements and such properties and assets are not subject to any mortgages, pledges, liens, charges, security interests, encumbrances, actions, claims or demands of any nature whatsoever or howsoever arising.

4.20 The Corporate Charter, Articles of Incorporation and Bylaws and any other constating documents of the Purchaser in effect with the appropriate corporate authorities as at the date of this Agreement will not have been materially changed as at the Closing Date.

4.21 There are no material liabilities of the Purchaser of any kind whatsoever, whether or not accrued and whether or not determined or determinable, in respect of which the Purchaser or the Company may become liable on or after the consummation of the transaction contemplated by this Agreement, other than liabilities which may be reflected on the Purchaser Audited Financial Statements, liabilities disclosed or referred to in this Agreement or in the Schedules attached hereto, or liabilities incurred in the ordinary course of business and attributable to the period since the date of the Purchaser Audited Financial Statements, none of which has been materially adverse to the nature of the Purchaser's business, results of operations, assets, financial condition or manner of conducting the Purchaser's business.

4.22 The entering into of this Agreement and the consummation of the transactions contemplated hereby will not result in the violation of any of the terms and provisions of the

10

constating documents or bylaws of the Purchaser or of any indenture, instrument or agreement, written or oral, to which the Purchaser may be a party.

4.23 The entering into of this Agreement and the consummation of the transactions contemplated hereby will not, to the best of the knowledge of the Purchaser, result in the violation of any law or regulation of the United States or the State of Nevada or of any local government bylaw or ordinance to which the Purchaser or the Purchaser's business may be subject.

4.24 This Agreement has been duly authorized, validly executed and delivered by the Purchaser.

4.25 The Purchaser has no contracts with any officers, directors, accountants, lawyers or others which cannot be terminated with not more than one month's notice.

4.26 No agreement has been made with Purchaser in respect of the purchase and sale contemplated by this Agreement that could give rise to any valid claim by any person against the Company or the Vendor for a finder's fee, brokerage commission or similar payment.

5. ACTS IN CONTEMPLATION OF CLOSING

5.1 The Company covenants and agrees with the Purchaser and the Principal Shareholder to, prior to or on the Closing Date, deliver to the Purchaser those audited annual financial statements and unaudited interim financial statements of the Company as are required by Item 310 of Regulation SB of the United States Securities and Exchange Commission in order to permit the Purchaser to make the United States Securities and Exchange Commission filings required in respect of the purchase and sale of the shares of the Company in accordance with this Agreement.

6. CONDITIONS OF CLOSING

6.1 All obligations of the Purchaser under this Agreement are subject to the fulfilment, at or prior to the Closing Date, of the following conditions:

| (a) | The respective representations and warranties of

the Vendor and the Company contained in this Agreement or in any Schedule

hereto or certificate or other document delivered to the Purchaser pursuant

hereto shall be substantially true and correct as of the date hereof and

as of the Closing Date with the same force and effect as though such representations

and warranties had been made on and as of such date, regardless of the

date as of which the information in this Agreement or any such Schedule

or certificate is given, and the Purchaser shall have received on the

Closing Date certificates dated as of the Closing Date, in forms satisfactory

to counsel for the Purchaser and signed under seal by the Vendor and by

two senior officers of the Company to the effect that their respective

representations and warranties referred to above are true and correct

on and as of the Closing Date with the same force and effect as though

made on and as of such date, provided that the acceptance of such certificates

and the |

11

| closing of the transactions herein provided for

shall not be a waiver of the respective representations and warranties

contained in Articles 3 and 4 or in any Schedule hereto or in any certificate

or document given pursuant to this Agreement which covenants, representations

and warranties shall continue in full force and effect for the benefit

of the Purchaser; |

||

| (b) | the Company shall have caused to be delivered to

the Purchaser either a certificate of an officer of the Company or, at

the Purchaser's election, an opinion of legal counsel acceptable to the

Purchaser's legal counsel, in either case, in form and substance satisfactory

to the Purchaser, dated as of the Closing Date, to the effect that: |

|

| (i) | the Company owns, possesses and has good and marketable

title to its undertaking, property and assets, and without restricting

the generality of the foregoing, those assets described in the balance

sheet included in the Company Financial Statements, free and clear of

any and all mortgages, liens, pledges, charges, security interests, encumbrances,

actions, claims or demands of any nature whatsoever and howsoever arising;

|

||

| (ii) | the Company has been duly incorporated, organized

and is validly existing under the laws of Germany, it has the corporate

power to own or lease its properties and to carry on its business that

is now being conducted by it and is in good standing with respect to filings

with the appropriate governmental authorities; |

||

| (iii) | the issued and authorized capital of the Company

is as set out in this Agreement and all of the issued and outstanding

shares have been validly issued as fully paid and non-assessable; |

||

| (iv) | all necessary approvals and all necessary steps

and corporate proceedings have been obtained or taken to permit the Company

Shares to be duly and validly transferred to and registered in the name

of the Purchaser; and |

||

| (v) | the consummation of the purchase and sale contemplated

by this Agreement, including, but not limited to, the transfer of the

Company Shares to the Purchaser, will not be in breach of any laws of

Germany , and, in particular but without limiting the generality of the

foregoing, the execution and delivery of this Agreement by the Vendor

and the Company has not breached and the consummation of the purchase

and sale contemplated hereby will not be in breach of any laws of Germany

or of any other country or state in which a Vendor is resident or the

Company carries on business; |

||

|

and, without limiting the generality of the foregoing, that

all corporate proceedings of the Company, its shareholders and directors

and all other matters which, in the reasonable opinion of counsel for

the Purchaser, are material in connection with the transaction of purchase

and sale contemplated by this Agreement, have been taken or are otherwise

favourable to the completion of such transaction. |

|||

12

| (c) | At the Closing Date there shall have been no materially

adverse change in the affairs, assets, liabilities, or financial condition

of the Company or the Business (financial or otherwise) from that shown

on or reflected in the Company Financial Statements. |

|

| (d) | No substantial damage by fire or other hazard to

the Business shall have occurred prior to the Closing Date. |

|

| (e) | The Company shall have delivered to the Purchaser

those financial statements of the Company specified in paragraph 5.1 hereof.

|

|

6.2 In the event any of the foregoing conditions contained in paragraph 6.1 hereof are not fulfilled or performed at or before the Closing Date to the reasonable satisfaction of the Purchaser, the Purchaser may terminate this Agreement by written notice to the Vendor and in such event the Purchaser shall be released from all further obligations hereunder but any of such conditions may be waived in writing in whole or in part by the Purchaser without prejudice to its rights of termination in the event of the non-fulfilment of any other conditions.

6.3 All obligations of the Vendor under this Agreement are subject to the fulfilment, at or prior to the Closing Date, of the following conditions:

| (a) | The representations and warranties of the Purchaser

contained in this Agreement or in any Schedule hereto or certificate or

other document delivered to the Company and the Vendor pursuant hereto

shall be substantially true and correct as of the date hereof and as of

the Closing Date with the same force and effect as though such representations

and warranties had been made on and as of such date, regardless of the

date as of which the information in this Agreement or any such Schedule

or certificate is given, and the Vendor shall have received on the Closing

Date a certificate dated as of the Closing Date, in a form satisfactory

to the Vendor and signed under seal by two senior officers of the Purchaser,

to the effect that such representations and warranties referred to above

are true and correct on and as of the Closing Date with the same force

and effect as though made on and as of such date, provided that the acceptance

of such certificate and the closing of the transaction herein provided

for shall not be a waiver of the representations and warranties contained

in Article 4 or in any Schedule hereto or in any certificate or document

given pursuant to this Agreement which covenants, representations and

warranties shall continue in full force and effect for the benefit of

the Vendor. |

|

| (b) | The Purchaser shall have caused to be delivered

to the Vendor either a certificate of an officer of the Purchaser or,

at the Vendor's election, an opinion of legal counsel acceptable to counsel

to the Vendor, in either case, in form and substance satisfactory to the

Vendor, dated as of the Closing Date, to the effect that: |

|

| (i) | the Purchaser has been duly incorporated and organized

and is validly subsisting under the laws of the State of Nevada, it has

the corporate |

13

| power to own or lease its properties and to carry

on its business that is now being conducted by it and is in good standing

with respect to all filings with the appropriate corporate authorities

in Nevada and with respect to all annual and quarterly filings with the

United States Securities and Exchange Commission; |

|||

| (ii) | the issued and authorized capital of the Purchaser

is as set out in this Agreement and all issued shares have been validly

issued as fully paid and non-assessable; |

||

| (iii) | all necessary approvals and all necessary steps

and corporate proceedings have been obtained or taken to permit the Purchaser

Warrants to be duly and validly issued to the Vendor and the Purchaser

Shares to be duly and validly allotted and issued to and registered in

the name of the Vendor; |

||

| (iv) | the consummation of the purchase and sale contemplated

by this Agreement, including, but not limited to, the issuance and delivery

of the Purchaser Shares to the Vendor, in consideration of the purchase

of the Company Shares from the Vendor, will not be in breach of any laws

of Nevada and, in particular, but without limiting the generality of the

foregoing, the execution and delivery of this Agreement by the Purchaser

has not breached, and the consummation of the purchase and sale contemplated

hereby will not be in breach of, any securities laws of the United States

of America; |

||

| and, without limiting the generality of the foregoing,

that all corporate proceedings of the Purchaser, its shareholders and

directors and all other matters which, in the reasonable opinion of counsel

for the Company, are material in connection with the transaction of purchase

and sale contemplated by this Agreement, have been taken or are otherwise

favourable to the completion of such transaction. |

||

| (c) | At the Closing Date there shall have been no materially

adverse change in the affairs, assets, liabilities, financial condition

or business (financial or otherwise) of the Purchaser from that shown

on or reflected in the Purchaser Audited Financial Statements. |

|

6.4 In the event that any of the conditions contained in paragraph 6.3 hereof shall not be fulfilled or performed by the Purchaser at or before the Closing Date to the reasonable satisfaction of the Vendor then the Vendor shall have all the rights and privileges granted to the Purchaser under paragraph 6.2, mutatis mutandis.

7. CLOSING ARRANGEMENTS

7.1 The closing shall take place on the Closing Date at the offices of X’Xxxxx Law Corporation at Suite 1880, 0000 Xxxx Xxxxxxx Xxxxxx, Xxxxxxxxx, Xxxxxxx Xxxxxxxx, Xxxxxx X0X 0X0, or at such other time and place as the parties may mutually agree.

14

7.2 On the Closing Date, upon fulfilment of all the conditions set out in Article 6 which have not been waived in writing by the Purchaser or by the Vendor, as the case may be, then:

| (a) | the Vendor shall deliver to the Purchaser: |

| (i) | certificates representing all the Company Shares

duly endorsed in blank for transfer or with a stock power of attorney

(in either case with the signature guaranteed by the appropriate official)

with all applicable security transfer taxes paid; |

||

| (ii) | the certificates and officer's certificate or opinion

referred to in paragraph 6.1; and |

||

| (iii) | evidence satisfactory to the Purchaser and its legal

counsel of the completion by the Company and the Vendor of those acts

referred to in paragraph 5.1. |

||

| (b) | the Vendor and the Company shall cause the Company

Shares to be transferred into the name of the Purchaser, or its nominee,

to be duly and regularly recorded in the books and records of the Company;

|

|

| (c) | the Purchaser shall issue and deliver to the Vendor:

|

|

| (i) | certificates representing the Purchaser Shares and

the Purchaser Warrants duly endorsed with legends, acceptable to the Purchaser's

counsel, respecting restrictions on transfer as required by or necessary

under the applicable securities legislation of the United States or any

state, including, but not limited to, the non-transferability of such

shares for a period of one year from the Closing Date; |

|||

| (ii) | the certificates and officer's certificate or opinion referred to in paragraph 6.3; and | |||

| (iii) | sequential resignations and directors resolutions

such that all of the directors and officers of the Purchaser will have

resigned and the following will have been appointed directors and/or officers

of the Purchaser immediately following closing: |

|||

| Name | Position | |

| Xxxxxx X.X. Xxxxxx | Director, President, Secretary and Treasurer |

| (d) | The Principal Shareholder shall deliver to the Vendor

the certificates representing all the Principal Shares duly endorsed in

blank for transfer or with a stock power of attorney (in either case with

the signature guaranteed by the appropriate official) with all applicable

security transfer taxes paid. |

15

8. GENERAL PROVISIONS

8.1 Time shall be of the essence of this Agreement.

8.2 This Agreement contains the whole agreement between the parties hereto in respect of the purchase and sale of the Company Shares and there are no warranties, representations, terms, conditions or collateral agreements expressed, implied or statutory, other than as expressly set forth in this Agreement.

8.3 This Agreement shall enure to the benefit of and be binding upon the parties hereto and their respective successors and permitted assigns. The Purchaser may not assign this Agreement without the consent of the Company which consent may be withheld for any reason whatsoever.

8.4 Any notice to be given under this Agreement shall be duly and properly given if made in writing and delivered or telecopied to the addressee at the address as set out on page one of this Agreement. Any notice given as aforesaid shall be deemed to have been given or made on, if delivered, the date on which it was delivered or, if telecopied, on the next business day after it was telecopied. Any party hereto may change its address for notice from time to time by providing notice of such change to the other parties hereto in accordance with the foregoing.

8.5 This Agreement may be executed in one or more counter-parts, each of which so executed shall constitute an original and all of which together shall constitute one and the same agreement.

8.6 This Agreement shall be construed and enforced in accordance with, and the rights of the parties shall be governed by, the laws of the State of Nevada, and each of the parties hereto irrevocably attorns to the jurisdiction of the courts of the State of Nevada.

8.7 No claim shall be made by the Company or the Vendor against the Purchaser, or by the Purchaser against the Company or the Vendor, as a result of any misrepresentation or as a result of the breach of any covenant or warranty herein contained unless the aggregate loss or damage to such party exceeds $5,000.

-- INTENTIONALLY LEFT BLANK --

16

IN WITNESS WHEREOF the parties hereto have executed this Agreement as of the day and year first above written.

CLYVIA TECHNOLOGY GMBH

/s/Xxxxxx Xxxxxx

/s/Xxxxxxx Xxxxxx

_______________________________

By Its Authorized Signatory

/s/Xxxxx Xxxxxxx

_______________________________

By Its Authorized Signatory

CLYVIA CAPITAL HOLDING GMBH

/s/Xxxxxx Xxxxxx

/s/Xxxxxxx Xxxxxx

_______________________________

By Its Authorized Signatory

SIGNED, SEALED AND DELIVERED BY XXXXX XXXXXXX in the presence of:

| /s/ Xxxxxxxxx X. Cu | /s/Xxxxx Xxxxxxx |

| Signature of Witness | XXXXX XXXXXXX |

Xxxxxxxxx X. Cu

Name

Suite 1880, Royal Centre

0000 Xxxx Xxxxxxx Xxxxxx, Xxx 00000

Xxxxxxxxx, X.X. X0X 0X0

Address

17

SCHEDULE "A"

to that Share Purchase Agreement dated for reference as of the 7th day of April, 2005

COMPANY FINANCIAL STATEMENTS

SCHEDULE "B"

to that Share Purchase Agreement dated for reference as of the 7th day of April, 2005

PURCHASER AUDITED FINANCIAL STATEMENTS

Rapa Mining Inc.

(An Exploration Stage Company)

Balance Sheet

| January 31, 2004 | |||

| ASSETS | |||

| Current Assets | |||

| Cash and cash equivalents | $ | 18,883 | |

| Deferred tax asset less valuation allowance of $9,141 | - | ||

| Total Assets | $ | 18,883 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||

| Current Liabilities | |||

| Accounts payable and accrued liabilities | $ | 5,000 | |

| Total Current Liabilities | 5,000 | ||

| Stockholders’ Equity | |||

| Common stock, $0.001 par value; 75,000,000 shares authorized, | |||

| 5,800,000 issued and outstanding | 5,800 | ||

| Additional paid-in capital | 34,200 | ||

| Deficit accumulated during the exploration stage | (26,117 | ) | |

| Total Stockholders’ Equity | 13,883 | ||

| Total Liabilities and Stockholders’ Equity | $ | 18,883 |

The accompanying notes are an integral part of these financial statements.

Rapa Mining Inc.

(An Exploration Stage Company)

Statement of Operations

For the period from inception (December 11, 2003) to January 31, 2004

| EXPENSES | |||

| Bank charges | $ | 84 | |

| Filing fees | 1,004 | ||

| Mineral property expenditures | 19,748 | ||

| Office expenses | 34 | ||

| Professional fees | 5,247 | ||

| Loss before income taxes | 26,117 | ||

| Provision for income taxes | - | ||

| Net loss | $ | (26,117 | ) |

| Basic and diluted net loss per share | $ | (0.01 | ) |

| Weighted average number of shares | |||

| of common stock outstanding | 2,847,059 |

The accompanying notes are an integral part of these financial statements.

Rapa Mining Inc.

(An Exploration Stage Company)

Statement of Stockholders’ Equity

| Common Stock | ||||||||||||||

| Deficit | ||||||||||||||

| Accumulated | Total | |||||||||||||

| Additional | During | Stockholders’ | ||||||||||||

| Shares | Amount | Paid-in Capital | Exploration Stage | Equity | ||||||||||

| Balance, December 11, 2003 (date of inception) | – | $ | – | $ | – | $ | – | $ | – | |||||

| Common stock issued for cash at $0.001 per | ||||||||||||||

| share, December 2003 | 2,000,000 | 2,000 | – | – | 2,000 | |||||||||

| Common stock issued for mineral property at | ||||||||||||||

| $0.01 per share, January 2004 | 200,000 | 200 | 1,800 | – | 2,000 | |||||||||

| Common stock issued for cash at $0.01 per | ||||||||||||||

| share, January 2004 | 3,600,000 | 3,600 | 32,400 | – | 36,000 | |||||||||

| Net loss | – | – | – | (26,117 | ) | (26,117 | ) | |||||||

| Balance, January 31, 2004 | 5,800,000 | $ | 5,800 | $ | 34,200 | $ | (26,117 | ) | $ | 13,883 | ||||

The accompanying notes are an integral part of these financial statements.

Rapa Mining Inc.

(An Exploration Stage Company)

Statement of Cash Flows

For the period from inception (December 11, 2003) to January 31, 2004

| Cash flows from operating activities | |||

| Net loss | $ | (26,117 | ) |

| Adjustments to reconcile net loss to cash used by operating activities | |||

| Stock issued for mineral property acquisition | 2,000 | ||

| Change in liabilities: | |||

| Increase in accounts payable and accrued liabilities | 5,000 | ||

| Net cash used in operating activities | (19,117 | ) | |

| Cash flows from financing activities | |||

| Proceeds from issuing common stock | 38,000 | ||

| Net cash provided by financing activities | 38,000 | ||

| Change in cash and cash equivalents for the period | 18,883 | ||

| Cash and cash equivalents, beginning of period | – | ||

| Cash and cash equivalents, end of period | $ | 18,883 | |

| Cash paid during the period for interest | $ | – | |

| Cash paid during the period for income taxes | $ | – |

The accompanying notes are an integral part of these financial statements.

Rapa Mining Inc.

(An Exploration Stage Company)

Notes to Financial Statements

January 31, 2004

1. HISTORY AND ORGANIZATION OF THE COMPANY

The Company was incorporated on December 11, 2003, under the Laws of the State of Nevada and is in the business of exploring mineral properties. The Company has not yet determined whether its properties contain mineral resources that may be economically recoverable. The Company therefore has not reached the development stage and is considered to be an exploration stage company.

The recoverability of mineral property costs is dependent upon the existence of economically recoverable reserves, confirmation of the Company's interest in the underlying mineral claims, the ability of the Company to obtain necessary financing to complete the exploration and upon future profitable production.

The Company’s fiscal year end is January 31st.

2. GOING CONCERN

These financial statements have been prepared in conformity with generally accepted accounting principles in the United States of America with the on-going assumption that the Company will be able to realize its assets and discharge its liabilities in the normal course of business. However, certain conditions noted below currently exist which raise substantial doubt about the Company’s ability to continue as a going concern. These financial statements do not include any adjustments to the amounts and classifications of assets and liabilities that might be necessary should the Company be unable to continue as a going concern.

The operations of the Company have primarily been funded by the issuance of common stock. Continued operations of the Company are dependent on the Company’s ability to complete equity financings or generate profitable operations in the future. Management’s plan in this regard is to secure additional funds through future equity financings. Such financings may not be available or may not be available on reasonable terms.

| Deficit accumulated during the exploration stage | $ (26,117 | ) |

| Working capital | 13,883 | |

3. SIGNIFICANT ACCOUNTING POLICIES

The financial statements of the Company have been prepared in accordance with generally accepted accounting principles in the United States of America and are stated in US dollars. The significant accounting policies adopted by the Company are as follows:

Rapa Mining Inc.

(An Exploration Stage Company)

Notes to Financial Statements

January 31, 2004

3. SIGNIFICANT ACCOUNTING POLICIES (continued)

Use of estimates

The preparation of financial statements in conformity with generally accepted accounting principles in the United States of America requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Actual results could differ from these estimates.

Foreign currency translation

Transaction amounts denominated in foreign currencies are translated into United States currency at exchanges rates prevailing at transactions dates. Carrying values of monetary assets and liabilities are adjusted at each balance sheet date to reflect the exchange rate at that date. Gains and losses from restatement of foreign currency monetary assets and liabilities are included in income.

Cash and cash equivalents

The Company considers cash held at banks and all highly liquid investments with original maturities of three months or less to be cash and cash equivalents.

Mineral properties

Costs of acquisition, exploration, carrying, and retaining unproven properties are expensed as incurred.

Environmental requirements

At the report date, environmental requirements related to mineral claims acquired are unknown and therefore an estimate of any future cost cannot be made.

Income taxes

A deferred tax asset or liability is recorded for all temporary differences between financial and tax reporting and net operating loss carryforwards. Deferred tax expenses (benefit) result from the net change during the period of deferred tax assets and liabilities.

Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment.

Rapa Mining Inc.

(An Exploration Stage Company)

Notes to Financial Statements

January 31, 2004

3. SIGNIFICANT ACCOUNTING POLICIES (continued)

Net loss per share

Basic net loss per share is computed by dividing loss attributable to common stockholders by the weighted average number of shares of common stock outstanding during the period. Diluted earnings per share takes into consideration shares of common stock outstanding (computed under basic earnings per share) and potentially dilutive shares of common stock.

Recent Accounting Pronouncements

In April 2003, FASB issued Statements of Financial Accounting Standards No. 149 “Amendment of Statement 133 on Derivative Instruments and Hedging Activities” (“SFAS 149”). SFAS 149 amends and clarifies financial accounting and reporting for derivative instruments, including certain derivative instruments embedded in other contracts and for hedging activities under FASB Statement No. 133 “Accounting for Derivative Instruments and Hedging Activities”. SFAS 149 is generally effective for contracts entered into or modified after June 30, 2003.

In May 2003, FASB issued Statements of Financial Accounting Standards No. 150 “Accounting for Certain Financial Instruments with Characteristics of both Liabilities and Equity” (“SFAS 150”). SFAS 150 establishes standards for how an issuer classifies and measures certain financial instruments with characteristics of both liabilities and equity. SFAS 150 is effective for financial instruments entered into or modified after May 31, 2003.

The adoption of these new pronouncements is not expected to have a material effect on the Company's financial position or results of operations.

4. MINERAL PROPERTY

Pursuant to an option agreement dated January 5, 2004, the Company has the right to acquire a 100% interest in certain mining claims located in the Kamloops Mining Division of British Columbia, Canada for $10,000 (paid), the issuance of 200,000 shares of the Company’s common stock (issued) and incurring exploration and expenditures of $100,000 in various stages by October 2005. As the claims do not contain any known reserves, the acquisition costs were expensed during the period ended January 31, 2004. The mineral property claims expire February 19, 2005.

Rapa Mining Inc.

(An Exploration Stage Company)

Notes to Financial Statements

January 31, 2004

5. COMMON STOCK

On December 18, 2003, the Company issued 2,000,000 shares of common stock at a price of $0.001 per share under Regulation S of the Securities Act of 1933 for total proceeds of $2,000.

On January 5, 2004, the Company issued 200,000 shares of common stock at a price of $0.01 per share under Regulation S of the Securities Act of 1933 in conjunction with the signing of an option agreement for certain mining claims.

On January 16, 2004, the Company issued 3,600,000 shares of common stock at a price of $0.01 per share under Regulation S of the Securities Act of 1933 for total proceeds of $36,000.

6. RELATED PARTY TRANSACTIONS

During the period from inception (December 11, 2003) to January 31, 2004, the Company issued 2,000,000 shares of its common stock for proceeds of $2,000 to an officer and director of the Company.

7. INCOME TAXES

A reconciliation of income taxes at statutory rates with the reported taxes is as follows:

| January 31, 2004 | ||||

| Net loss | $ | (26,117 | ) | |

| Expected income tax recovery | $ | 9,141 | ||

| Unrecognized current benefit of operating losses | (9,141 | ) | ||

| Total income taxes | $ | - | ||

| The Company’s total future income tax asset is as follows: | ||||

| January 31, 2004 | ||||

| Tax benefit of net operating loss carryforward | $ | 9,141 | ||

| Valuation allowance | (9,141 | ) | ||

| $ | - |

The Company has net operating loss carryforwards of approximately $26,000 available for deduction against future years taxable income. The valuation allowance increased to $9,141 during the period ended January 31, 2004, since the realization of the net operating loss carryforwards are doubtful. It is reasonably possible that the Company's estimate of the valuation allowance will change. The operating loss carryforwards will expire in 2024.

Rapa Mining Inc.

(An Exploration Stage Company)

Notes to Financial Statements

January 31, 2004

8. FINANCIAL INSTRUMENTS

The Company's financial instruments consist of cash and cash equivalents and accounts payable and accrued liabilities. Unless otherwise noted, it is management's opinion that the Company is not exposed to significant interest, currency or credit risks arising from these financial instruments. The fair value of these financial instruments approximate their carrying values, unless otherwise noted.

9. SEGMENT INFORMATION

The Company operates in one reportable segment, being the exploration of mineral properties, in Canada.

SCHEDULE "C"

to that Share Purchase Agreement dated for reference as of the 7th day of April, 2005

PURCHASER UNAUDITED FINANCIAL STATEMENTS

Rapa Mining Inc.

(An Exploration Stage Company)

Balance Sheet

(Unaudited)

| October 31, | |||

| 2004 | |||

| ASSETS | |||

| Current Assets | |||

| Cash and cash equivalents | $ | 57,386 | |

| Deferred tax asset, less valuation allowance of $24,028 | - | ||

| Total Assets | $ | 57,386 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||

| Current Liabilities | |||

| Accounts payable and accrued liabilities | $ | 23,038 | |

| Total Current Liabilities | 23,038 | ||

| Contingency (Notes 2 and 4) | |||

| Stockholders’ Equity | |||

| Common stock, $0.001 par value; 75,000,000 shares authorized, | |||

| 6,115,000 shares issued and outstanding | 6,115 | ||

| Additional paid-in capital | 96,885 | ||

| Deficit accumulated during the exploration stage | (68,652 | ) | |

| Total Stockholders’ Equity | 34,348 | ||

| Total Liabilities and Stockholders’ Equity | $ | 57,386 |

The accompanying notes are an integral part of these interim financial statements.

Rapa Mining Inc.

(An Exploration Stage Company)

Statements of Operations

(Unaudited)

| Cumulative | |||||||||

| amounts from | |||||||||

| inception | |||||||||

| (December 11, | Three-month | Nine-month | |||||||

| 2003) to | period ended | period ended | |||||||

| October 31, 2004 | October 31, 2004 | October 31, 2004 | |||||||

| EXPENSES | |||||||||

| Bank charges | $ | 484 | $ | 124 | $ | 400 | |||

| Filing fees | 5,400 | 1,668 | 4,396 | ||||||

| Mineral property expenditures | 27,513 | 7,765 | 7,765 | ||||||

| Office expenses | 655 | 213 | 621 | ||||||

| Professional fees | 33,600 | 14,653 | 28,353 | ||||||

| Transfer agent | 1,000 | 500 | 1,000 | ||||||

| Loss before income taxes | 68,652 | 24,923 | 42,535 | ||||||

| Provision for income taxes | - | - | - | ||||||

| Net loss | $ | (68,652 | ) | $ | (24,923 | ) | $ | (42,535 | ) |

| Basic and diluted net loss per share | $ | - | $ | (0.01 | ) | ||||

| Weighted average number of shares of | |||||||||

| common stock outstanding | 5,916,413 | 5,839,088 |

The accompanying notes are an integral part of these interim financial statements.

Rapa Mining Inc.

(An Exploration Stage Company)

Statements of Cash Flows

(Unaudited)

| Cumulative | ||||||

| amounts from | ||||||

| inception | ||||||

| (December 11, | Nine-month | |||||

| 2003) to | period ended | |||||

| October 31, 2004 | October 31, 2004 | |||||

| Cash flows from operating activities | ||||||

| Net loss | $ | (68,652 | ) | $ | (42,535 | ) |

| Adjustments to reconcile net loss to cash used by operating activities | ||||||

| Stock issued for mineral property acquisition | 2,000 | - | ||||

| Change in liabilities: | ||||||

| Increase in accounts payable and accrued liabilities | 23,038 | 18,038 | ||||

| Net cash used in operating activities | (43,614 | ) | (24,497 | ) | ||

| Cash flows from financing activities | ||||||

| Proceeds from sale and issuing common stock | 101,000 | 63,000 | ||||

| Net cash provided by financing activities | 101,000 | 63,000 | ||||

| Change in cash and cash equivalents for the period | 57,386 | 38,503 | ||||

| Cash and cash equivalents, beginning of period | – | 18,883 | ||||

| Cash and cash equivalents, end of period | $ | 57,386 | $ | 57,386 | ||

| Cash paid during the period for interest | $ | – | $ | – | ||

| Cash paid during the period for income taxes | $ | – | $ | – |

The accompanying notes are an integral part of these interim financial statements.

Rapa Mining Inc.

(An Exploration Stage Company)

Notes to Interim Financial Statements

October 31, 2004

(Unaudited)

1. HISTORY AND ORGANIZATION OF THE COMPANY

The Company was incorporated on December 11, 2003, under the Laws of the State of Nevada and is in the business of exploring mineral properties. The Company has not yet determined whether its properties contain mineral resources that may be economically recoverable. The Company therefore has not reached the development stage and is considered to be an exploration stage company.

The recoverability of mineral property costs is dependent upon the existence of economically recoverable reserves, confirmation of the Company’s interest in the underlying mineral claims, the ability of the Company to obtain necessary financing to complete the exploration and upon future profitable production.

The accompanying unaudited financial statements have been prepared by the Company in conformity with generally accepted accounting principles in the United States of America for interim financial statements. In the opinion of management, the accompanying unaudited financial statements contain all adjustments necessary (consisting of normal recurring accruals) to present fairly the financial information contained therein. The accompanying unaudited financial statements do not include all disclosures required by generally accepted accounting principles in the United States of America and should be read in conjunction with the audited financial statements of the Company for the period ended January 31, 2004. The results of operations for the nine-month period ended October 31, 2004, are not necessarily indicative of the results to be expected for the year ending January 31, 2005.

2. GOING CONCERN

These financial statements have been prepared with the on-going assumption that the Company will be able to realize its assets and discharge its liabilities in the normal course of business. However, certain conditions noted below currently exist which raise substantial doubt about the Company’s ability to continue as a going concern. These financial statements do not include any adjustments to the amounts and classifications of assets and liabilities that might be necessary should the Company be unable to continue as a going concern.

The operations of the Company have primarily been funded by the sale of common stock. Continued operations of the Company are dependent on the Company’s ability to complete additional equity financings or generate profitable operations in the future. Management’s plan in this regard is to secure additional funds through future equity financings. Such financings may not be available or may not be available on reasonable terms.

| October 31, | ||||

| 2004 | ||||

| Deficit accumulated during the exploration stage | $ | (68,652 | ) | |

| Working capital | 34,348 | |||

Rapa Mining Inc.

(An Exploration Stage Company)

Notes to Interim Financial Statements

October 31, 2004

(Unaudited)

3. SIGNIFICANT ACCOUNTING POLICIES

Use of estimates

The preparation of financial statements requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Actual results could differ from these estimates.

Foreign currency translation

Transaction amounts denominated in foreign currencies are translated into United States currency at exchanges rates prevailing at transactions dates. Carrying values of monetary assets and liabilities are adjusted at each balance sheet date to reflect the exchange rate at that date. Gains and losses from restatement of foreign currency monetary assets and liabilities are included in income.

Cash and cash equivalents

The Company considers cash held at banks and all highly liquid investments with original maturities of three months or less to be cash and cash equivalents.

Mineral properties

Costs of acquisition, exploration, carrying, and retaining unproven properties are expensed as incurred.

Environmental requirements

At the report date, environmental requirements related to mineral claims acquired are unknown and therefore an estimate of any future cost cannot be made.

Income taxes

A deferred tax asset or liability is recorded for all temporary differences between financial and tax reporting and net operating loss carryforwards. Deferred tax expenses (benefit) result from the net change during the period of deferred tax assets and liabilities.

Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment.

Net loss per share

Basic net loss per share is computed by dividing the net loss by the weighted average number of shares of common stock outstanding during the period. Diluted earnings per share takes into consideration shares of common stock outstanding (computed under basic earnings per share) and potentially dilutive shares of common stock. As of October 31, 2004 there were no potentially dilutive securities outstanding.

Rapa Mining Inc.

(An Exploration Stage Company)

Notes to Interim Financial Statements

October 31, 2004

(Unaudited)

3. SIGNIFICANT ACCOUNTING POLICIES (continued)

Recent Accounting Pronouncements

In January 2003, FASB issued Financial Interpretation No. 46 “Consolidation of Variable Interest Entities” (“FIN 46”) (revised on December 17, 2003). The objective of FIN 46 is to improve financial reporting by companies involved with variable interest entities. A variable interest entity is a corporation, partnership, trust, or any other legal structure used for business purposes that either (a) does not have equity investors with voting rights or (b) has equity investors that do not provide sufficient financial resources for the entity to support its activities. FIN 46 requires a variable interest entity to be consolidated by a company if that company is subject to a majority of the risk of loss from the variable interest entity’s activities or entitled to receive a majority of the entity’s residual returns or both. FIN 46 also requires disclosures about variable interest entities that the company is not required to consolidate but in which it has significant variable interest. The consolidation requirements of FIN 46 are required in financial statements of public entities that have interests in variable interest entities for periods ending after December 15, 2003. The consolidation requirements for all other types of entities are required in financial statements for periods ending March 15, 2004.

The adoption of the new pronouncement did not have a material effect on the Company’s financial position or results of operations.

4. MINERAL PROPERTY

Pursuant to an option agreement dated January 5, 2004, the Company has the right to acquire a 100% interest in certain mining claims located in the Kamloops Mining Division of British Columbia, Canada for $10,000 (paid), the issuance of 200,000 shares of the Company’s common stock (issued) and incurring exploration and expenditures of $100,000 in various stages by October 2005. As the claims do not contain any known reserves, the acquisition costs were expensed during the period ended January 31, 2004. The mineral property claims expire February 19, 2005.

5. COMMON STOCK

On December 18, 2003, the Company issued 2,000,000 shares of common stock at a price of $0.001 per share under Regulation S of the Securities Act of 1933 for total proceeds of $2,000.

On January 5, 2004, the Company issued 200,000 shares of common stock at a price of $0.01 per share under Regulation S of the Securities Act of 1933 in conjunction with the signing of an option agreement for certain mining claims.

On January 16, 2004, the Company issued 3,600,000 shares of common stock at a price of $0.01 per share under Regulation S of the Securities Act of 1933 for total proceeds of $36,000.

On September 27, 2004, the Company issued 315,000 shares of common stock at a price of $0.20 per share for total proceeds of $63,000.

6. RELATED PARTY TRANSACTIONS

During the period from inception (December 11, 2003) to July 31, 2004, the Company issued 2,000,000 shares of its common stock, for proceeds of $2,000, to an officer and director of the Company.

At October 31, 2004, included in accounts payable is $40 owed to an officer and director of the Company.

Rapa Mining Inc.

(An Exploration Stage Company)

Notes to Interim Financial Statements

October 31, 2004

(Unaudited)

7. FINANCIAL INSTRUMENTS

The Company’s financial instruments consist of cash and cash equivalents and accounts payable and accrued liabilities. Unless otherwise noted, it is management's opinion that the Company is not exposed to significant interest, currency or credit risks arising from these financial instruments. The fair value of these financial instruments approximate their carrying values, unless otherwise noted.

8. SEGMENT INFORMATION

The Company operates in one reportable segment, being the exploration of mineral properties, in Canada.

SCHEDULE "D”

to that Share Purchase Agreement dated for reference as of the 7th day of April, 2005

EMPLOYMENT, SERVICE & PENSION AGREEMENTS OF THE COMPANY

None.

SCHEDULE "E"

to that Share Purchase Agreement dated for reference as of the 7th day of April, 2005

REAL PROPERTY & LEASES OF THE COMPANY

None.

SCHEDULE "F"

to that Share Purchase Agreement dated for reference as of the 7th day of April, 2005

ENCUMBRANCES ON THE COMPANY'S ASSETS

None.

SCHEDULE "G"

to that Share Purchase Agreement dated for reference as of the 7th day of April, 2005

COMPANY LITIGATION

None.

SCHEDULE "H"

to that Share Purchase Agreement dated for reference as of the 7th day of April, 2005

PURCHASER LITIGATION

None.

SCHEDULE "I"

to that Share Purchase Agreement dated for reference as of the 7th day of April, 2005

REGISTERED TRADEMARKS, TRADE NAMES & PATENTS OF THE COMPANY

| Identification No. | Description |

| DE 19837277 | Plant for distilling and cracking bitumens, asphalt, tars and tar sludges comprises double screw conveyor in heating chamber connected to distillation column recovering valuable hydrocarbons. |

| DE 19837276 | Apparatus for distilling and cracking used oil comprises distillation and cracking xxxxxxxx either built-in horizontally or in a slanting plane. |

| DE 19708384 | Distillation plant for waste oil and oil mixed with other waste or scrap materials. |