NEWMONT MINING CORPORATION RESTRICTED STOCK UNIT AGREEMENT

Exhibit 10.1

NEWMONT MINING CORPORATION

2013 STOCK INCENTIVE PLAN

RESTRICTED STOCK UNIT AGREEMENT

This Agreement (“Agreement”), dated February 26, 2014, is made between Newmont Mining Corporation (“Newmont”) and “Executive,” as specified in his or her Grant Summary and Grant Acknowledgment (collectively, the “Grant Acknowledgment”). The Grant Acknowledgment is set forth on the Computershare—Employee Online webpage.

The Grant Acknowledgment is incorporated by reference herein. This Agreement shall be deemed executed by Executive upon his or her electronic execution of the Grant Acknowledgment. All capitalized terms that are not defined herein shall have the meaning as defined in the Newmont Mining Corporation 2013 Stock Incentive Plan (“Plan”).

1. Award of Restricted Stock Units. Newmont hereby grants to Executive the right to receive from Newmont the number of shares of $1.60 par value Common Stock of Newmont (the “Restricted Stock Units” or “RSU’s”) (rounded down to the nearest whole share) specified in the Grant Acknowledgment, pursuant to the terms and subject to the conditions and restrictions set forth in this Agreement and the Plan, including the Vesting Period, as such term is defined in this Agreement, and in connection with such award, Newmont and Executive hereby agree as follows:

2. Vesting Period. The Vesting Period shall commence on the date of this Agreement and shall end on the dates set forth below as to that percentage of the total shares of Common Stock subject to this Agreement set forth opposite each such date:

| Date |

Percentage Vested | |||

| February 26, 2015 |

33 | % | ||

| February 26, 2016 |

33 | % | ||

| February 26, 2017 |

34 | % | ||

3. Termination of Employment for death, disability, and following change of control. Notwithstanding the foregoing, if (i) Executive dies, or (ii) Executive’s employment by Newmont or any Subsidiary terminates by reason of (a) disability (as determined under the terms of the Long-Term Disability Plan of Newmont), or (b) termination of employment entitling Executive to benefits under an Executive Change of Control Plan of Newmont , in any such case prior to the completion of the Vesting Period, the Vesting Period shall terminate, and all RSUs not theretofore forfeited in accordance with this Agreement shall become fully vested and nonforfeitable, as of the date of Executive’s death or other termination of employment, referred to in clause (i) or (ii) above.

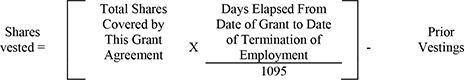

Separation of Employment under a Severance Plan of Newmont or Retirement. Notwithstanding the foregoing, if Executive ceases to be employed by Newmont and/or a Subsidiary prior to completion of the Vesting Period as a result of: a) a termination of employment entitling Executive to benefits under a Severance Plan of Newmont, or; b) retirement under the Pension Plan of Newmont entitling Executive to an immediate pension (not including stable value retirement unless Executive has reached the age of 65 or retirement under the International Retirement Plan of Newmont (“IRP”) entitling Executive to 100% vesting in the IRP supplemental amount), the Vesting Period shall terminate for a pro-rata percentage of the shares granted, based upon the date of grant and separation date, in accordance with the following formula:

If Executive ceases to be employed by Newmont and/or a Subsidiary prior to the completion of the Vesting Period under circumstances other than those set forth above, namely death, disability, termination qualifying for benefits under the Executive Change of Control Plan of Newmont applicable to Executive or separation qualifying for benefits under the Executive Severance Plan of Newmont or retirement as stated above, Executive agrees that any unvested RSUs will be immediately and unconditionally forfeited without any action required by Executive or Newmont, to the extent that the Vesting Period had not ended in accordance with Paragraph 2 as of the date of such cessation of employment.

4. No Ownership Rights Prior to Issuance of Common Stock. Executive shall not have any rights as a shareholder of Newmont with respect to the shares of Common Stock underlying the RSUs, including but not limited to the right to vote with respect to such shares of Common Stock, until and after the shares of Common Stock have been actually issued to Executive and transferred on the books and records of Newmont; provided, however, upon vesting of the RSUs pursuant to the Vesting Period, or Executive’s earlier termination of employment under circumstances entitling Executive to vest in the RSUs pursuant to Paragraph 3, Newmont shall make a cash payment to the Executive equal to any dividends paid with respect to shares of Common Stock underlying such RSUs from the date of this Agreement until the date such RSUs vest, minus any applicable taxes.

5. Withholding Taxes. Upon vesting pursuant to the Vesting Period, or Executive’s earlier termination of employment under circumstances entitling Executive to vest in the RSUs pursuant to Paragraph 3, Executive shall be entitled to receive the shares of Common Stock, less an amount of shares of Common Stock with a Fair Market Value on the date of vesting equal to the minimum required withholding obligation taking into account Executive’s effective tax rate and all applicable federal, state, local and foreign taxes, and Executive shall be entitled to receive the net number of shares of Common Stock after withholding of shares for taxes unless such tax obligations are satisfied in accordance with Paragraph 6. Notwithstanding the foregoing, to the extent any such taxes are required by law to be withheld with respect to the Restricted Stock Units prior to the end of the Vesting Period, Executive agrees that Newmont may withhold such amount for taxes through payroll services from other cash compensation payable to Executive from Newmont.

- 2 -

6. Delivery of Shares of Common Stock. As soon as reasonably practicable following the date of vesting pursuant to the Vesting Period, or Executive’s earlier termination of employment or other event entitling Executive to vest in the RSUs pursuant to Paragraph 3, subject to Section 9(i), Newmont shall cause to be delivered to Executive a stock certificate or electronically deliver shares through a direct registration system for the number of shares of Common Stock (net of tax withholding as provided in Paragraph 5) deliverable to Executive in accordance with the provisions of this Agreement; provided, however, that Newmont may allow Executive to elect to have shares of Common Stock, which are deliverable in accordance with the provisions of this Agreement upon vesting (or a portion of such shares at least sufficient to satisfy Executive’s tax withholding obligations with respect to such Common Stock), sold on behalf of Executive, with the cash proceeds thereof, net of tax withholding, remitted to Executive, in lieu of Executive receiving a stock certificate or electronic delivery of shares in a direct registration system.

7. Nontransferability. Executive’s interest in the RSUs and any shares of Common Stock relating thereto may not be sold, transferred, pledged, assigned, encumbered or otherwise alienated or hypothecated otherwise than by will or by the laws of descent and distribution, prior to such time as the shares of Common Stock have actually been issued and delivered to Executive.

8. Acknowledgements. Executive acknowledges receipt of and understands and agrees to the terms of the RSUs award and the Plan. In addition to the above terms, Executive understands and agrees to the following:

(a) Executive hereby acknowledges receipt of a copy of the Plan and agrees to be bound by all of the terms and provisions thereof, including the terms and provisions adopted after the date of this Agreement but prior to the completion of the Vesting Period. If and to the extent that any provision contained in this Agreement is inconsistent with the Plan, the Plan shall govern.

(b) Executive acknowledges that as of the date of this Agreement, the Agreement, the Grant Acknowledgement and the Plan set forth the entire understanding between Executive and Newmont regarding the acquisition of shares of Common Stock underlying the RSUs in Newmont and supersedes all prior oral and written agreements pertaining to the RSUs.

(c) Executive understands that his or her employer, Newmont and its Subsidiaries hold certain personal information about Executive, including but not limited to his or her name, home address, telephone number, date of birth, social security number, salary, nationality, job title and details of all RSUs or other entitlement to shares of Common Stock awarded, canceled, exercised, vested, unvested or outstanding (“personal data”). Certain personal data may also constitute “sensitive personal data” within the meaning of applicable law. Such data include but are not limited to the information provided above and any changes thereto and other appropriate personal and financial data about Executive. Executive hereby gives explicit consent to Newmont and any of its Subsidiaries to process any such personal data and/or sensitive personal data. Executive also hereby gives explicit consent to Newmont to transfer any such personal data and/or sensitive personal data outside the country in which Executive is employed, including, but not limited to the United States. The legal persons for whom such personal data are intended include, but are not limited to Newmont and its agent, Computershare Investor Services. Executive has been informed of his or her right of access and correction to his or her personal data by applying to Director of Compensation, Newmont Corporate.

- 3 -

(d) Executive understands that Newmont has reserved the right to amend or terminate the Plan at any time, and that the award of RSUs under the Plan at one time does not in any way obligate Newmont or its Subsidiaries to grant additional RSUs in any future year or in any given amount. Executive acknowledges and understands that the RSUs are awarded in connection with Executive’s status as an employee of his or her employer and can in no event be interpreted or understood to mean that Newmont is Executive’s employer or that there is an employment relationship between Executive and Newmont. Executive further acknowledges and understands that Executive’s participation in the Plan is voluntary and that the RSUs and any future RSUs under the Plan are wholly discretionary in nature, the value of which do not form part of any normal or expected compensation for any purposes, including, but not limited to, calculating any termination, severance, resignation, redundancy, end of service payments, bonuses, long-service awards, pension or retirement benefits or similar payments, other than to the extent required by local law.

(e) Executive acknowledges and understands that the future value of the shares of Common Stock acquired by Executive under the Plan is unknown and cannot be predicted with certainty and that no claim or entitlement to compensation or damages arises from the forfeiture of the RSUs or termination of the Plan or the diminution in value of any shares of Common Stock acquired under the Plan and Executive irrevocably releases Newmont and its Subsidiaries from any such claim that may arise.

(f) Executive acknowledges that the vesting of the RSUs ceases upon the earlier of termination of employment or receipt of notice of termination of employment for any reason, except as may otherwise be explicitly provided herein, and the Executive irrevocably waives any right to the contrary under applicable law.

(g) Executive acknowledges that the Executive’s acceptance of the RSUs, including the terms and conditions herein, is voluntary.

9. Miscellaneous

(a) No Right to Continued Employment. Neither the RSUs nor any terms contained in this Agreement shall confer upon Executive any expressed or implied right to be retained in the service of any Subsidiary for any period at all, nor restrict in any way the right of any such Subsidiary, which right is hereby expressly reserved, to terminate his or her employment at any time with or without cause. Executive acknowledges and agrees that any right to receive delivery of shares of Common Stock is earned only by continuing as an employee of a Subsidiary at the will of such Subsidiary, or satisfaction of any other applicable terms and conditions contained in this Agreement and the Plan, and not through the act of being hired, being granted the RSUs or acquiring shares of Common Stock hereunder.

(b) Compliance with Laws and Regulations. The award of the RSUs to Executive and the obligation of Newmont to deliver shares of Common Stock hereunder shall be subject to (a) all applicable federal, state, local and foreign laws, rules and regulations, and (b) any registration, qualification, approvals or other requirements imposed by any government or regulatory agency or body which the Newmont Committee shall, in its sole discretion, determine to be necessary or applicable. Moreover, shares of Common Stock shall not be delivered hereunder if such delivery would be contrary to applicable law or the rules of any stock exchange.

- 4 -

(c) Investment Representation. If at the time of delivery of shares of Common Stock, the Common Stock is not registered under the Securities Act of 1933, as amended (the “Securities Act”), and/or there is no current prospectus in effect under the Securities Act with respect to the Common Stock, Executive shall execute, prior to the delivery of any shares of Common Stock to Executive by Newmont, an agreement (in such form as the Newmont Committee may specify) in which Executive represents and warrants that Executive is purchasing or acquiring the shares acquired under this Agreement for Executive’s own account, for investment only and not with a view to the resale or distribution thereof, and represents and agrees that any subsequent offer for sale or distribution of any kind of such shares shall be made only pursuant to either (i) a registration statement on an appropriate form under the Securities Act, which registration statement has become effective and is current with regard to the shares being offered or sold, or (ii) a specific exemption from the registration requirements of the Securities Act, but in claiming such exemption Executive shall, prior to any offer for sale of such shares, obtain a prior favorable written opinion, in form and substance satisfactory to the Newmont Committee, from counsel for or approved by the Newmont Committee, as to the applicability of such exemption thereto.

(d) Definitions. All capitalized terms that are used in this Agreement that are not defined herein have the meanings defined in the Plan. In the event of a conflict between the terms of the Plan and the terms of this Agreement, the terms of the Plan shall prevail.

(e) Notices. Any notice or other communication required or permitted hereunder shall, if to Newmont, be in accordance with the Plan, and, if to Executive, be in writing and delivered in person or by registered or certified mail or overnight courier, postage prepaid, addressed to Executive at his or her last known address as set forth in Newmont’s records.

(f) Severability. If any of the provisions of this Agreement should be deemed unenforceable, the remaining provisions shall remain in full force and effect.

(g) Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Delaware.

(h) Transferability of Agreement. This Agreement may not be transferred, assigned, pledged or hypothecated by either party hereto, other than by operation of law. This Agreement shall be binding upon and shall inure to the benefit of the parties hereto and their respective successors and permitted assigns, including, in the case of Executive, his or her estate, heirs, executors, legatees, administrators, designated beneficiary and personal representatives. Nothing contained in this Agreement shall be deemed to prevent transfer of the RSUs in the event of Executive’s death in accordance with Section 14(b) of the Plan.

(i) Specified Employee Delay. If Newmont determines that settlement of RSUs hereunder (i) constitutes a deferral of compensation for purposes of Section 409A of the Internal Revenue Code (the “Code”), (ii) is made to Executive by reason of his or her “separation from service” (within the meaning of Code Section 409A), and (iii) Executive is a “specified employee” (within the meaning of Code Section 409A) at the time settlement would otherwise occur, transfers of Common Stock will be delayed until the first day of the seventh month following the date of such separation from service or, if earlier, on Executive’s death.

- 5 -

(j) Modification. Except as otherwise permitted by the Plan, this Agreement may not be modified or amended, nor may any provision hereof be waived, in any way except in writing signed by the parties hereto. Notwithstanding any other provision of this Agreement to the contrary, the Committee may amend this Agreement to the extent it determines necessary or appropriate to comply with the requirements of Code Section 409A and the guidance thereunder and any such amendment shall be binding on Executive.

IN WITNESS WHEREOF, pursuant to Executive’s Grant Acknowledgement (including without limitation, the Terms and Conditions section hereof), incorporated herein by reference, and electronically executed by Executive, Executive agrees to the terms and conditions of this Award Agreement.

- 6 -