HUNKER OPTION AGREEMENT

EXHIBIT 99.1

HUNKER

OPTION AGREEMENT

THIS AGREEMENT made as of

February 25,

2010

BETWEEN:

XXXXX XXXX, a businessperson

having an address at Xxx 000, Xxxxxx Xxxx, Xxxxx Xxxxxxxxx, X0X 0X0 (Fax:

000-000-0000)

("Xxxx")

AND:

XXXXXXX CAPITAL CORP., a

corporation incorporated under the laws of Nevada and having its head office at

0000 Xxxxxx Xxxxxx Xxxxxxx, Xxxxx 000, Xxx Xxxxx, Xxxxxx 00000, XXX

(the

"Optionee")

WHEREAS:

|

X.

|

Xxxx

is the recorded and beneficial owner of 100% of those mining claims

situated in the Dawson Mining District, Yukon Territory, more particularly

described in Schedule “A” attached hereto, which are generally known and

described as the “Hunker Property” (collectively,

the “Property”);

and

|

|

B.

|

The

Optionee desires to obtain an option from Xxxx, and Xxxx has agreed to

grant to the Optionee an option to acquire an undivided 100% right, title

and interest in and to the

Property.

|

NOW THEREFORE in consideration

of the premises and mutual covenants and agreements herein contained, the

parties agree as follows:

SECTION

1 - INTERPRETATION

1.1 Definitions. In this

Agreement:

| (a) |

“Advance Royalty” has the

meaning set forth in Section 12.

|

|

| (b) |

“Area of Interest” has

the meaning set forth in Section 7;

|

|

| (c) |

“Commercial Production”

means, and is deemed to have been achieved, when the concentrator

processing ores, for other than testing purposes, has operated for a

period of 30 consecutive production days at an average rate of not less

than 60% of design capacity or, if a concentrator is not erected on the

Property, when ores have been produced for a period of 30 consecutive

production days at the rate of not less than 60% of the mining rate

specified in a feasibility study recommending placing the Property in

Commercial Production;

|

|

| (d) |

“Exchange” means the OTC

Bulletin Exchange;

|

|

| (e) |

“Expenditures” means all

costs and expenses actually incurred by a party on or with respect to the

Property, including, without limitation, monies expended in doing

geophysical, geochemical and geological surveys, drilling, drifting and

other surface and underground work, assaying and metallurgical testing and

engineering; in preparing engineering or technical reports; in acquiring

facilities for the Property and equipping the Property for and commencing

Commercial Production, including, without limitation, all taxes,

management, legal and land fees associated to the management of the

Property, net smelter returns royalty and/or net profits interest payments

or pre-payments as the case may be; in paying the fees, wages, salaries,

travelling expenses, and fringe benefits (whether or not required by law)

of all persons engaged in work with respect to and for the benefit of the

Property; in paying for the food, lodging and other reasonable needs of

such persons and including all costs at prevailing charge out rates for

any personnel who from time to time are engaged directly in work on the

Property, such rates to be in accordance with industry

standards;

|

| (f) |

"Lien” means any lien,

security interest, mortgage, charge, encumbrance, or other claim of a

third party, whether registered or unregistered, and whether arising by

agreement, statute or otherwise;

|

||

| (g) |

“Net Smelter Returns"

means actual proceeds received by the Optionee from any mint, smelter,

refinery or other purchaser from the sale of minerals, concentrates,

metals (including bullion) or products from the Property and sold, after

deducting from such proceeds the following charges levied by third parties

to the extent that they are not deducted by a smelter, a milling facility

or other purchaser in computing payment:

|

||

| (i) |

reasonable

cost of transportation and handling of the minerals, concentrates, metals

(including bullion) or products from the Property to such smelter, milling

facility or other purchaser;

|

||

| (ii) |

any

smelting, milling and refining charges, including penalties;

and

|

||

| (iii) |

marketing

and insurance on such minerals, concentrates, metals (including bullion)

or products from the Property;

|

||

| (h) |

“Operator” means the

party responsible for carrying out, or causing to be carried out, all work

in respect of the Property during the currency of the Option;

and

|

||

| (i) |

“Option” means the

option granted to the Optionee by Xxxx in accordance with Section

3.1.

|

||

SECTION

2 - REPRESENTATIONS AND WARRANTIES

| 2.1 | Xxxx hereby represents and warrants to the Optionee that: | ||

|

(i)

|

he

is of the age of majority and has full power, authority and capacity to

enter into this Agreement and to carry out his obligations under this

Agreement and is qualified to carry on business in the Yukon

Territory;

|

||

|

(ii)

|

the

claims comprising the Property were properly recorded and filed with

appropriate governmental agencies; (ii) all assessment work required to

hold the claims comprising the Property has been performed and all

governmental fees have been paid and all filings required to maintain the

claims comprising the Property in good standing have been properly and

timely recorded or filed with appropriate governmental agencies; (iii) he

has no knowledge of conflicting mining

claims;

|

||

2

|

(iii)

|

the

Property is properly and accurately described in Schedule "A"

hereto;

|

||

|

(iv)

|

Xxxx

is the owner of a 100% registered and beneficial interest in the Property

and the Property is free and clear of all Liens and third party

interests;

|

||

|

(v)

|

there

has been no known spill, discharge, deposit, leak, emission or other

release of any contaminant, pollutant, dangerous or toxic substance, or

hazardous waste on, into, under or affecting the Property and no such

contaminant, pollutant, dangerous or toxic substance, or hazardous waste

is stored in any type of container on, in or under the Property, except as

necessary to carry on exploration on the Property; and

|

||

|

(vi)

|

there

are no pending or threatened actions, suits, claims or proceedings

regarding the Property.

|

||

| 2.2 | The Optionee hereby represents and warrants that: | ||

|

(a)

|

it

is a corporation duly incorporated and organised and validly existing

under the Business Corporations Act

(Nevada);

|

||

|

(b)

|

it

has full corporate power, authority and capacity to enter into this

Agreement and to carry out its obligations under this Agreement and is

qualified to carry on business in its jurisdiction of

incorporation;

|

||

|

(c)

|

it

has been duly authorized to enter into, and to carry out its obligations

under, this Agreement and no obligation of it in this Agreement conflicts

with or will result in the breach of any term in:

|

||

| (i) |

its

notice of articles or articles; or

|

||

| (ii) |

any

other agreement to which it is a party.

|

||

2.3 Each party's

representations and warranties set out above will be relied on by the other

party in entering into the Agreement and shall survive the execution and

delivery of the Agreement. Each Party shall indemnify and hold harmless the

other party for any loss, cost, expense, claim or damage, including legal fees

and disbursements, suffered or incurred by the other party at any time as a

result of any misrepresentation or breach of warranty arising under the

Agreement.

SECTION

3 - OPTION

3.1 Xxxx hereby

grants to the Optionee the sole and exclusive right Option to acquire an

undivided 100% right, title and interest in and to the Property on the terms set

out herein.

3.2 In order

to maintain the Option in good standing, the Optionee must:

|

(a)

|

pay

to Xxxx a total of $400,000:

|

||

|

(i)

|

$25,000

no later than April 1st,

2010;

|

||

|

(ii)

|

$75,000

on or before Feb.15th,

2011;

|

||

|

(iii)

|

$100,000

on or before Feb.15th,

2012;

|

||

|

(iv)

|

$100,000

on or before Feb.15th,

2013; and

|

||

|

(v)

|

$100,000

on or before Feb.15th,

2014;

|

||

|

(b)

|

incur

a total of $1,730,000 in Expenditures:

|

||

|

(i)

|

in

the amount of $30,000 on or before April 1st,

2010;

|

||

|

(ii)

|

in

the additional amount of $150,000 on or before Feb.15th,

2011;

|

||

|

(iii)

|

in

additional amount of $300,000 on or before Feb.15th,

2012;

|

||

3

|

(iv)

|

in

the additional amount of $500,000 on or before Feb.15th,

2013; and

|

||

|

(v)

|

in

the additional amount of $750,000 on or before Feb.15th,

2014;

|

||

| (c) | issue and deliver to Xxxx: | ||

|

(i)

|

500,000

common shares of the Optionee on or before April 1st,

2010;

|

||

|

(ii)

|

an

additional 500,000 common shares of the Optionee on or before April

15th,

2010;

|

||

|

(iii)

|

a

bonus of 500,000 common shares if exploration costs exceed $3,000,000

Canadian dollars. The shares must be issued within 30 days of this

expenditure total being reached.

|

||

3.3 All of the

payment, Expenditure or share obligations herein may be accelerated at the

Optionee's option. This Agreement, and in particular, the payment,

Expenditure and share obligations herein are subject to acceptance by the

Exchange.

3.4 The Optionee

will have the right to terminate this Agreement at any time up to the date of

exercise of the Option by giving notice in writing of such termination to Xxxx,

and in the event of such termination, this Agreement will, except for the

provisions of Sections 2.3, 5.2 and 6, be of no further force and effect save

and except for any obligations of the Optionee incurred prior to the effective

date of termination.

3.5 Once the

Optionee has made the payments, incurred the Expenditures and issued and

delivered the shares under Section 3.2 on the terms set out herein, the Optionee

will be deemed to have exercised the Option and to have acquired an undivided

100% right, title and interest in and to the Property pursuant to this

Agreement.

3.6 Xxxx hereby

acknowledges that the Optionee’s ability to issue securities is subject to the

rules and policies of the stock exchange on which the common shares of the

Optionee are listed and the securities issuable to Xxxx hereunder will be

subject to resale restrictions imposed by applicable securities laws and the

rules of any stock exchange on which the common shares of the Optionee are

listed, which rules require that a restrictive legend be placed on all

certificates delivered to Xxxx under this Agreement and Xxxx covenants and

agrees with the Optionee to abide by all such resale restrictions.

4

3.7 Expenditures

incurred by any date in excess of the amount of Expenditures required to be

incurred by such date shall be carried forward to the succeeding period and

qualify as Expenditures for the succeeding period.

3.8 Upon the

Optionee completing all payments, incurring all Expenditures, and delivering all

shares as required under section 3.2, Xxxx will register or cause to be

registered transfers of the Property in favour of the Optionee, as may be

appropriate or desirable to effect the legal transfer of the Property to the

Optionee.

SECTION

4 - COVENANTS OF XXXX

4.1 During the

currency of this Agreement, Xxxx will:

|

(a)

|

not

do any other act or thing which would or might in any way adversely affect

the rights of the Optionee hereunder;

|

||

|

(b)

|

make

available to the Optionee and its representatives all available relevant

technical data, geotechnical reports, maps, digital files and other data

with respect to the Property in Ryan’s possession or control, including

soil samples, and all records and files relating to the Property and

permit the Optionee and its representatives at their own expense to take

abstracts therefrom and make copies thereof;

|

||

|

(c)

|

promptly

provide the Optionee with any and all notices and correspondence received

by Xxxx from government agencies in respect of the

Property;

|

||

|

(d)

|

cooperate

fully with the Optionee in obtaining any surface and other rights on or

related to the Property as the Optionee deems

desirable;

|

||

|

(e)

|

grant

to the Optionee, its employees, agents and independent contractors, the

sole and exclusive right and option to:

|

||

| (i) | enter upon the Property; | ||

| (ii) | have exclusive and quiet possession thereof; | ||

| (iii) |

do

such prospecting, exploration, development or other mining work thereon

and thereunder as the Optionee in its sole discretion may consider

advisable;

|

||

| (iv) |

bring

and erect upon the Property such equipment and facilities as the Optionee

may consider advisable; and

|

||

| (v) |

remove

from the Property and dispose of material for the purpose of

testing.

|

||

5

SECTION

5 - COVENANTS OF THE OPTIONEE

5.1 During the

currency of the Option, the Optionee shall:

| (a) |

keep

the Property free and clear of all Liens arising from its operations

hereunder (except liens for taxes not yet due, other inchoate liens or

liens contested in good faith by the Optionee) and proceed with all

diligence to contest or discharge any Lien that is

filed;

|

||

| (b) |

pay

or cause to be paid all workers and wage earners employed by it or its

contractors on the Property, and pay for all materials, services and

supplies purchased or delivered in connection with its activities on or

with respect to the Property;

|

||

| (c) |

permit

Xxxx, or its representatives duly authorized by it in writing, at its own

risk and expense, access to the Property at all reasonable times and to

all records and reports, if any, prepared by the Optionee in connection

with work done on or with respect to the Property, and xxxxxxx Xxxx within

60 days of the completion of a program on the Property with a report with

respect to the work carried out by the Optionee on or with respect to said

program and material results obtained;

|

||

| (d) |

conduct

all work on or with respect to the Property in a careful and minerlike

manner and in compliance with all applicable federal, provincial and local

laws, rules, orders and regulations, and indemnify and save Xxxx harmless

from any and all claims, suits, demands, losses and expenses including,

without limitation, with respect to environmental matters, made or brought

against it as a result of work done or any act or thing done or omitted to

be done by the Optionee on or with respect to the

Property;

|

||

| (e) |

file

all assessment work within the calendar year the work was completed;

and

|

||

| (f) |

provide

to Xxxx within 60 days of the end of each calendar quarter during which

any Expenditures have been incurred comprehensive written reports showing

the operations carried out and the results obtained and detailing the

Expenditures incurred together with evidence of payment

thereof.

|

||

5.2 In the event

of termination of the Option for any reason other than through the exercise

thereof, the Optionee will:

| (a) |

leave

the Property:

|

||

| (i) |

in

good standing and free and clear of all Liens arising from its operations

hereunder,

|

||

| (ii) |

in

a safe and orderly condition, and

|

||

| (iii) |

in

a condition which is in compliance with all rules and orders of

governmental authorities with respect to reclamation and rehabilitation of

all disturbances resulting from the Optionee's use and occupancy of the

Property;

|

||

| (b) |

deliver

to Xxxx, within 90 days of a written request therefor, a report on all

work carried out by the Optionee on the Property (limited to factual

matters only) together with copies of all sample location maps, drillhole

assay logs, assay results and other technical data compiled by the

Optionee or its representatives with respect to the Property;

and

|

||

6

| (c) |

have

the right (and, if requested by Xxxx within 90 days of the effective date

of termination, the obligation) to remove from the Property within one

year of termination of this Agreement all facilities erected, installed or

brought upon the Property by or at the instance of Optionee, failing

which, the facilities shall become the property of

Xxxx.

|

SECTION

6 - CONFIDENTIALITY

6.1 All matters

concerning the execution and contents of this Agreement and the Property shall

be treated as and kept confidential by the parties and there shall be no public

release of any information concerning the Property, except as required by

applicable securities laws, the rules of any stock exchange on which a party’s

shares are listed or other applicable laws or regulations, without the prior

written consent of the other party, such consent not to be unreasonably

withheld. Notwithstanding the foregoing, the parties are entitled to

disclose confidential information to prospective investors or lenders, who shall

be required to keep all such confidential information confidential.

SECTION

7 - AREA OF INTEREST

7.1 The Property

boundaries are defined by the claims in Schedule "A" and as more fully set out

in Schedule "B". In the event either party acquires, directly or

indirectly, any interest in any new property which is immediately adjacent to

and tied on to the Property, the acquiring party must disclose this acquisition

promptly to the other party and the acquiring party's entire property shall form

part of the Property and become subject to the terms of this

Agreement.

SECTION

8 - TERMINATION

8.1 In addition

to any other termination provisions contained in this Agreement, this Agreement

and the Option shall terminate if the Optionee should be in default in

performing any requirement herein set forth and has failed to take reasonable

steps to cure such default within 30 days after the giving of a notice of

default by Xxxx.

SECTION

9 - ARBITRATION

9.1 If

any dispute, controversy or claim arises under or in connection with this

Agreement and cannot be settled by negotiation, the dispute shall be finally

settled by arbitration in accordance with the provisions of the Arbitration Act (Yukon),

subject to the following modifications or additions:

| (i) |

the

arbitration shall be conducted by one arbitrator. Within seven (7) days of

written notice to the other party of a dispute, the parties shall attempt

to agree upon the person who is to act as the arbitrator. If the parties

fail to agree on the arbitrator within this time period, such arbitrator

shall be appointed by a Justice of the Yukon Supreme

Court;

|

||

| (ii) |

the

arbitrator shall have such technical and other qualifications as may be

reasonably necessary to enable the arbitrator to properly adjudicate upon

the dispute;

|

||

| (iii) |

the

arbitrator shall have the power to obtain the assistance, advice or

opinion of any expert as the arbitrator may think fit and shall have the

discretion to act upon any assistance, advice or opinion so

obtained;

|

7

| (iv) |

the

arbitrator shall be instructed that time is of the essence in proceeding

with his or her determination of the dispute;

|

||

| (v) |

unless

otherwise decided by the arbitrator, each party shall be responsible for

any costs associated with its legal and other advisors. The costs

associated with the arbitrator, including any expert retained by the

arbitrator, and any facility in which the arbitration takes place, shall

be shared equally by the parties;

|

||

| (vi) |

the

arbitration shall take place in Whitehorse, Yukon; and

|

||

| (vii) |

the

arbitration decision shall be given in writing and shall be final and

binding on the Parties, and shall deal with questions of the costs of the

arbitration and all matters related

thereto.

|

SECTION

10 - OPERATOR

10.1 During the

term of this Agreement, the Optionee shall be the operator for purposes of

developing and executing exploration programs to complete the

Expenditures

SECTION

11 - ROYALTY

11.1 Upon the

commencement of Commercial Production with respect to the Property, the Optionee

(the "Payor") shall pay to Xxxx (the "Payee") a Net Smelter Returns royalty (the

"Royalty"), being equal to 2.0% of Net Smelter Returns. The Payor

shall be entitled at any time and from time to time to purchase 1/2 of the

Royalty (i.e., a Royalty equal to 1.0% of Net Smelter Returns) from the Payee

for $2,000,000.

11.2 Instalments

of the Royalty payable shall be paid by the Payor to the Payee immediately upon

the receipt by the Payor of the payment from the smelter, refinery or other

place of treatment of the proceeds of sale of the minerals, ore, concentrates or

other product from the Property.

11.3 Within 120

days after the end of each fiscal year, commencing with the year in which

commencement of Commercial Production occurs, the accounts of the Payor relating

to operations on the Property and the statement of operations, which shall

include the statement of calculation of the Royalty for the year last completed,

shall be audited by the independent auditors of the Payor at its

expense. The Payee shall have 60 days after receipt of such

statements to question the accuracy thereof in writing and, failing such

objection, the statements shall be deemed to be correct and unimpeachable

thereafter.

11.4 If such

audited financial statements disclose any overpayment by the Payor of the

Royalty during the fiscal year, the amount of the overpayment shall be deducted

from future instalments of Royalty payable.

11.5 If such

audited financial statements disclose any underpayment by the Payor of the

Royalty during the year, the amount thereof shall be paid to the Payee forthwith

after determination thereof.

11.6 The Payor

agrees to maintain for each mining operation on the Property, up-to-date and

complete records relating to the production and sale of minerals, ore, bullion

and other product from the Property, including accounts, records, statements and

returns relating to treatment and smelting arrangements of such

product. The Payee shall have the right to have such accounts audited

by independent auditors at its own expense once each fiscal year.

8

SECTION

12 - ROYALTY - ADVANCE PAYMENT

12.1 The Optionee

will make annual cash advance payments of $30,000 for the Property (the

“Advance Royalty”) to Xxxx commencing February 15th, 2015 and continuing each

year thereafter until commencement of Commercial Production, deductible against

the Royalty.

12.2 The Optionee

may elect to pay the Advance Royalty in cash or an equivalent amount of common

stock of the company, based on the average closing price for its shares in the

10 trading days prior to the due date for the Advance Royalty.

SECTION

13 - GENERAL

13.1 Assignment. Any

assignment of this Agreement or any rights hereunder in the Property shall be

effected by delivering notice to that effect to the other party provided the

assignee agrees in writing to be bound by the terms of this

Agreement. Neither party shall be entitled to assign this Agreement

or any rights hereunder in the Property without the prior written consent of the

other party, such consent not to be unreasonably withheld. For

greater certainty, nothing herein shall prevent any party from entering into any

corporate reorganization, merger, amalgamation, takeover bid, plan of

arrangement, or any other such corporate transaction which has the effect of,

directly or indirectly, selling, assigning, transferring, or otherwise disposing

of all or a part of the rights under this Agreement to a purchaser.

13.2 Binding. This Agreement inures

to the benefit of and binds the parties and their respective successors and

permitted assigns.

13.3 Further Assurances. Each

party shall from time to time promptly execute and deliver all further documents

and take all further action reasonably necessary or desirable to give effect to

the terms and intent of this Agreement.

13.4 Amendment. No amendment,

supplement or restatement of any term of this Agreement is binding unless it is

in writing and signed by both parties.

13.5 Notice. Any notice or

other communication required or permitted to be given under this Agreement must

be in writing and shall be effectively given if delivered personally or by

overnight courier or if sent by fax, addressed in the case of notice to Xxxx or

the Optionee, as the case may be, to its address set out on the first page of

this Agreement. Any notice or other communication so given is deemed

conclusively to have been given and received on the day of delivery when so

personally delivered, on the day following the sending thereof by overnight

courier, and on the same date when faxed (unless the notice is sent after 4:00

p.m. (Vancouver time) or on a day which is not a business day, in which case the

fax will be deemed to have been given and received on the next business day

after transmission). Either party may change any particulars of its name,

address, contact individual or fax number for notice by notice to the other

party in the manner set out in this Section 12.6. Neither party shall

prevent, hinder or delay or attempt to prevent, hinder or delay the service on

that party of a notice or other communication relating to this

Agreement.

13.6 Counterparts. This

Agreement may be executed by facsimile and in any number of counterparts, each

of which shall constitute one and the same agreement.

13.7 Severability. If any term

of this Agreement is or becomes illegal, invalid or unenforceable, that term

shall not affect the legality, validity or enforceability of the remaining terms

of this Agreement.

9

13.8 Schedules. The schedules

referenced herein and attached to this Agreement, are incorporated into and form

part of this Agreement.

13.9 Time. Time is of the

essence of this Agreement.

13.10 Governing Law. This Agreement

shall be governed by and shall be construed and interpreted in accordance with

the laws of the Yukon Territory and the laws of Canada applicable in the Yukon

Territory.

13.11 Entire Agreement. This

Agreement constitutes the entire agreement between the parties with respect to

the subject matter herein and supersedes all prior arrangements, negotiations,

discussions, undertakings, representations, warranties and understandings,

whether written or verbal.

The

parties hereto intending to be legally bound have executed this Agreement as of

the date and year first written above.

|

Witness:

|

|

|

/s/ XXXXX

XXXX

XXXXX

XXXX

|

_______________________________

(Signature)

|

|

_______________________________

(Print

Name)

|

|

|

_______________________________

(Address)

_______________________________

|

XXXXXXX

CAPITAL CORP. – Xxxxx Xxxxxx

By:

/s/ Xxxxx

Xxxxxx

Authorized

Signatory

10

SCHEDULE

A - DESCRIPTION OF THE PROPERTY

|

Grantnumber

|

Label

|

Claim

type

|

|

XX00000

|

XXXXX

XXXXX 0

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 2

|

Quartz

|

|

XX00000

|

XXXXX

XXXXX 0

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 4

|

Quartz

|

|

XX00000

|

XXXXX

XXXXX 0

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 6

|

Quartz

|

|

XX00000

|

XXXXX

XXXXX 0

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 8

|

Quartz

|

|

YC23524

|

CROWN

JEWEL 9

|

Quartz

|

|

XX00000

|

XXXXX

XXXXX 00

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 11

|

Quartz

|

|

XX00000

|

XXXXX

XXXXX 00

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 13

|

Quartz

|

|

XX00000

|

XXXXX

XXXXX 00

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 15

|

Quartz

|

|

XX00000

|

XXXXX

XXXXX 00

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 17

|

Quartz

|

|

XX00000

|

XXXXX

XXXXX 00

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 19

|

Quartz

|

|

XX00000

|

XXXXX

XXXXX 00

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 21

|

Quartz

|

|

XX00000

|

XXXXX

XXXXX 00

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 23

|

Quartz

|

|

XX00000

|

XXXXX

XXXXX 00

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 25

|

Quartz

|

|

XX00000

|

XXXXX

XXXXX 00

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 27

|

Quartz

|

|

YC34436

|

CROWN

JEWEL 28

|

Quartz

|

|

XX00000

|

XXXXX

XXXXX 00

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 30

|

Quartz

|

|

XX00000

|

XXXXX

XXXXX 00

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 32

|

Quartz

|

|

XX00000

|

XXXXX

XXXXX 00

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 34

|

Quartz

|

|

XX00000

|

XXXXX

XXXXX 00

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 36

|

Quartz

|

|

XX00000

|

XXXXX

XXXXX 00

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 38

|

Quartz

|

|

XX00000

|

XXXXX

XXXXX 00

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 40

|

Quartz

|

|

XX00000

|

XXXXX

XXXXX 00

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 42

|

Quartz

|

|

XX00000

|

XXXXX

XXXXX 00

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 44

|

Quartz

|

|

XX00000

|

XXXXX

XXXXX 00

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 46

|

Quartz

|

|

XX00000

|

XXXXX

XXXXX 00

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 48

|

Quartz

|

|

XX00000

|

XXXXX

XXXXX 00

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 50

|

Quartz

|

|

XX00000

|

XXXXX

XXXXX 00

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 52

|

Quartz

|

|

YC35010

|

CROWN

JEWEL 53

|

Quartz

|

|

XX00000

|

XXXXX

XXXXX 00

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 55

|

Quartz

|

|

XX00000

|

XXXXX

XXXXX 00

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 104

|

Quartz

|

11

|

Grantnumber

|

Label

|

Claim

type

|

|

YC35678

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 000

|

Xxxxxx

|

|

XX00000

|

CROWN

JEWEL 150

|

Quartz

|

12

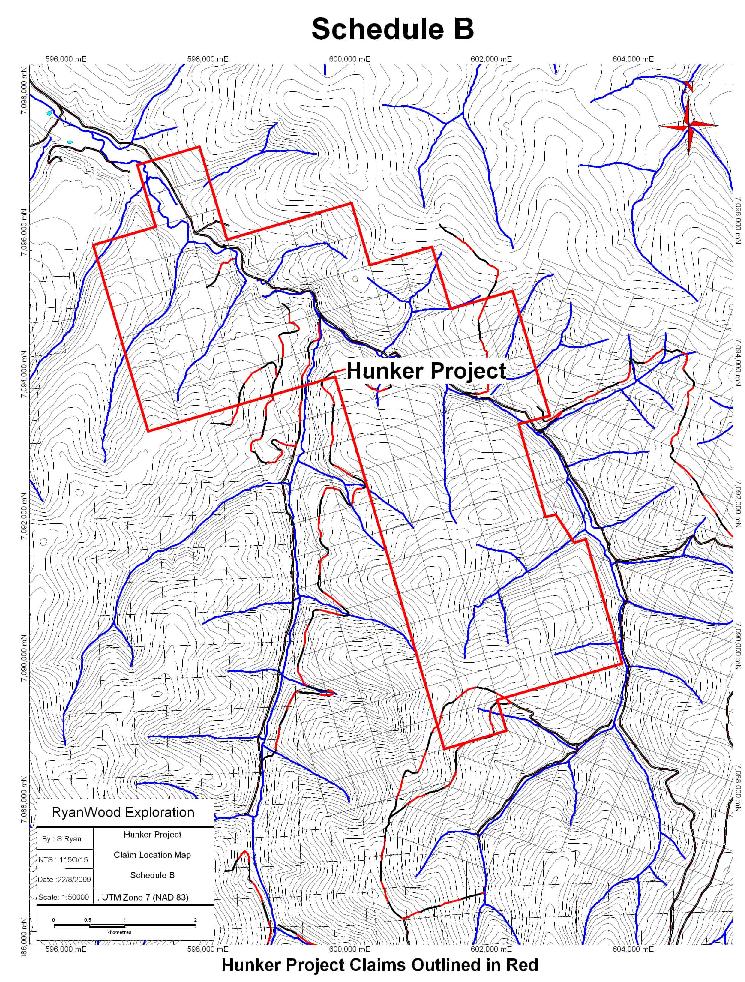

SCHEDULE

B - MAP AND AREA OF INTEREST

13