LOAN AGREEMENT

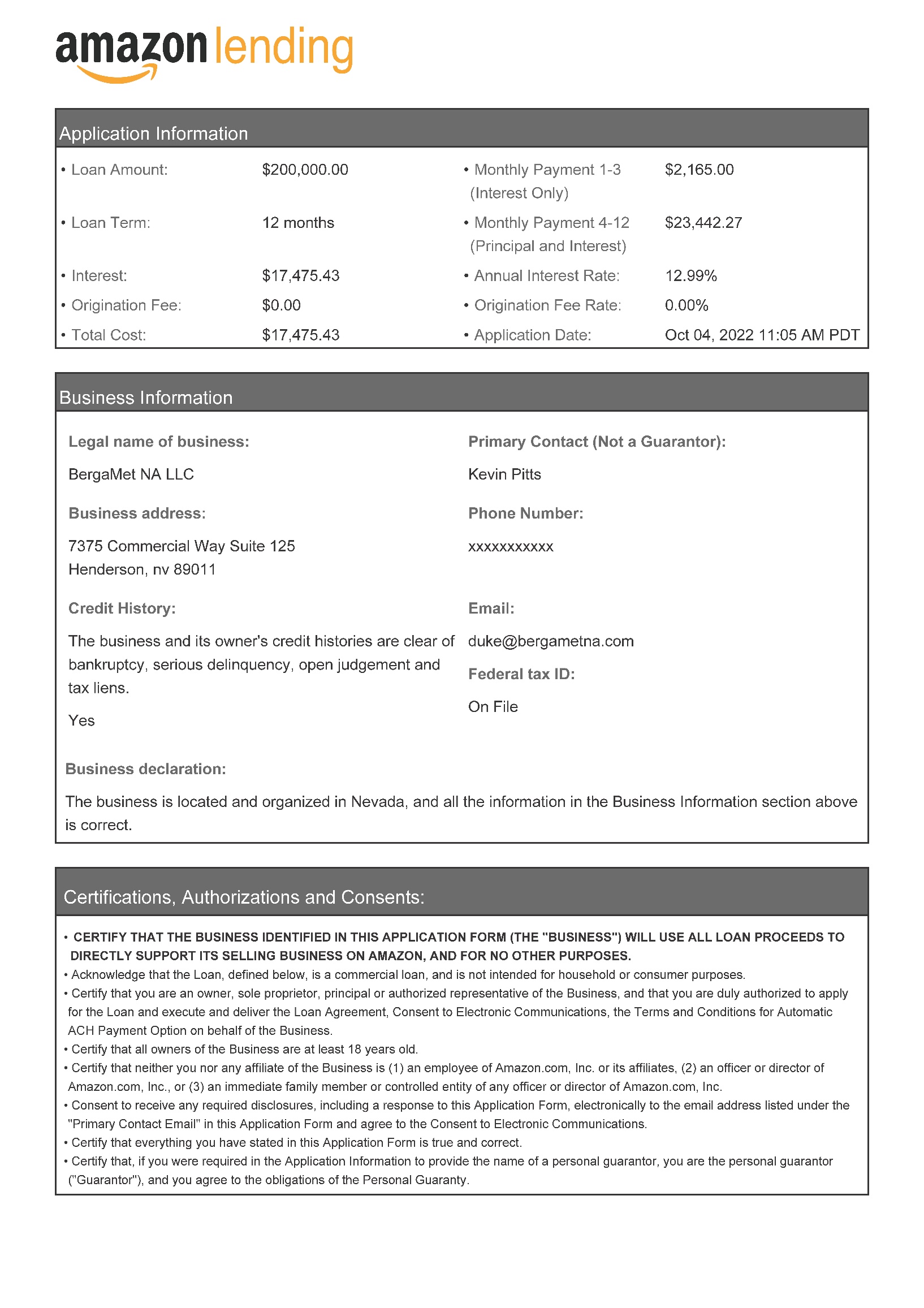

1.Promise to Pay. The Business will pay to Amazon Capital Services, Inc. ("we", "us" or "our") the principal, interest, late interest, and any other charges and expenses due to us under this Loan Agreement, including charges and expenses in exercising any of our remedies, which altogether constitutes the "Loan". The Business must make periodic payments of interest and principal according to the schedule set forth in this Loan Agreement. Any amounts due under this Loan Agreement that remain unpaid on the final scheduled payment due date will be due in full on that date. We may in our sole discretion request a Guarantor, who will be individually responsible for obligations under this Loan Agreement as further defined in the section labeled Personal Guaranty below.

2.Interest and Late Payment Charges. The principal balance of the Loan will accrue interest daily at the annual interest rate shown in the “Application Information” section of this Loan Agreement (“Annual Interest Rate”) from the date we approve the Loan and it appears in Seller Central (the "Origination Date") until the Loan is paid in full. Interest payable on the Loan will be computed by (i) dividing the Annual Interest Rate by twelve to obtain the monthly interest rate (the "Monthly Interest Rate"), (ii) dividing the Monthly Interest Rate by the actual number of days elapsed in the statement period during which interest accrues and (iii) multiplying (ii) above by the principal balance of the Loan outstanding at the beginning of the statement period. Interest on the Loan will accrue on a daily basis and will be payable in arrears (x) on each payment date, (y) upon any prepayment of the Loan and (c) at maturity of the Loan.

If any payment is not made on time, interest will accrue daily on all past due amounts under the Loan at an annual interest rate (the "Late Interest Rate") equal to the lesser of the Annual Interest Rate plus 2.0% or the maximum amount permitted by applicable law until those amounts are paid in full.

3.Making Payments. The Business authorizes us to fund the Loan into the Business's Amazon seller account (the "Seller Account") administered by Amazon Services LLC or any other subsidiary of Xxxxxx.xxx, Inc. ("Affiliate"). The Business directs Amazon Services LLC and its Affiliates to withhold disbursements from the Business's Seller Account sufficient to cover scheduled payments as well as any other amounts due under this Loan Agreement and remit those amounts to us whether or not such action would result in there being insufficient funds to make the next scheduled payment under the Loan Agreement or to meet any other Business obligations. The Business further authorizes Amazon Services LLC and its Affiliates to withhold disbursements from any other Amazon account affiliated with the Business in order to cover scheduled payments and any other amounts due under this Loan Agreement.Unless we specify otherwise, scheduled loan payments will be automatically deducted from the first Seller Account disbursement after the date payment is due. If we approve the Business to make more frequent scheduled payments in amounts less than the Monthly Payment, the Business agrees that this may result in an increase to the total interest due over the life of the Loan, and an increase in the total amount payable to us.

For Loans with interest only payments for the first three payment periods after the Origination Date, payments are due monthly in an amount equal to all the accrued interest on the principal balance. Thereafter, the monthly payments are equal to the "Monthly Payment (Principal and Interest)" shown on the Loan Agreement. For Loans that do not qualify for the interest only payments described in the preceding two sentences, payments are due monthly in an amount equal to the "Monthly Payment" shown in the Application Information section of this Loan Agreement. Payments are due on the same date of each month as the Origination Date (or, if after the 28th of the month, the first day of the next month), beginning the month after the month of the Origination Date.

Xxxx proceeds will first be applied to pay off any negative seller balance the Business may have at the time of disbursement. All payments will be applied in the following order: (i) scheduled payments and other amounts due that have not been paid in full one month after they became due (each a "Past Due Payment"), first to accrued past due interest and then to past due principal, starting with the Past Due Payment that has been outstanding the longest, (ii) currently due interest that has accrued at the Late Interest Rate, (iii) currently due interest that has accrued at the Annual Interest Rate and (iv) currently due principal. If the Business does not have pending disbursements in its Seller Account sufficient to make a scheduled payment or pay any other amounts due, the Business is responsible for paying the remaining amount due by the applicable due date. The Business may make payment by Automated Clearing House (ACH) through Seller Central or by check. Checks must: (x) be made out to Amazon Capital Services, Inc., (y) include the Loan number on the subject line and (z) be mailed to: Amazon Capital Services, Inc., 000 Xxxxx Xxx. Xxxxx, Xxxxxxx, XX 00000-0000. When mailing, a tracking number must be obtained and provided, upon request.

4.Prepayment and Refinancing. There is no penalty for repaying the Loan early. Unless the Business repays the Loan in full, any payments in excess of the Monthly Payment and any other charges due will be applied to outstanding principal. If the Business refinances a Loan through Amazon, the proceeds of the refinancing Loan will first be applied to pay off any existing negative seller balance, followed by the outstanding principal balance, accrued interest and any other unpaid fees on all existing loans. The net proceeds of the refinancing Loan will be disbursed to the Business's Seller Account. If the Business terminates the Consent to Electronic Communications, the Business agrees that we may declare this Loan immediately due and payable and exercise all remedies available to us at law or equity or as described in this Loan Agreement, including withdrawing the remaining balance from the Business's Seller Account as funds are available until paid.

5.Default. Subject to applicable law, the Business will be in default under this Loan Agreement if any of the following events occur: (i) we do not receive any payment under this Loan Agreement when due, (ii) the Business ceases offering products on Xxxxxx.xxx, (iii) the Business violates any obligation under the Amazon Services Business Solutions Agreement or any applicable Program Policy, (iv) the Business's ordered product sales on Xxxxxx.xxx as reported in the Business's Seller Account ("OPS") in any 30 day period are less than 50% of the Business's lowest OPS on Xxxxxx.xxx in any of the 12 months prior to the date of this Loan Agreement, (v) the collective value of the Business's units stored in Amazon fulfillment centers in the US, based on the list price of those units on Xxxxxx.xxx, ("FBA Inventory Value") at any time during the term of this Loan Agreement is less than 50% of the Business's lowest average monthly FBA Inventory Value in any of the 12 months prior to the date of this Loan Agreement, other than because of inventory sales in the ordinary course of business, (vi) the number of ASINs listed by the Business as for sale on Xxxxxx.xxx at any time during the term of this Loan Agreement decreases by 50% or more from the number of ASINs listed as at the Origination Date, (vii) the Business breaches any obligation, representation or warranty under or in connection with this Loan Agreement, (viii) the Business or Guarantor becomes insolvent, enters into receivership, makes an assignment for the benefit of creditors, or declares bankruptcy, or similar proceedings are commenced by or against the Business, (ix) any information, signature or certification provided in connection with the application, this Loan Agreement or the Consent to Electronic Communications is false, fraudulent, misleading or inaccurate, (x) an event occurs that has a material adverse effect on the business, operations or financial condition of the Business or on our rights and remedies under the Loan Agreement including, but not limited to, any adverse changes regarding the business reported by any credit bureau, (xi) there is no login to the Business’s Seller Central account in any 30-day period, (xii) the Business undergoes a change of control or another entity or person acquires an aggregate of 10 percent or more of the ownership interests of the Business, (xiii) there occurs a sale of all or substantially all of the property or assets of the Business; or (xiv) any guaranty of the Business’ obligations under the Loan is deemed unenforceable or the Guarantor revokes the Personal Guaranty or challenges the enforceability of the Personal Guaranty. The Business understands and agrees that if its selling privileges on Xxxxxx.xxx are suspended or terminated, the loss of those selling privileges does not give rise to and cannot be used as a basis for any defense to or excuse of the Business’s obligation to perform under this Loan Agreement.

6.Remedies. If the Business is in default, subject to any right the Business may have under law, the Business agrees that we may in our sole discretion exercise any remedy available to us at law or equity, including but not limited to any or all of the following actions: (i) declare the unpaid balance of the Loan to be immediately due and payable, (ii) enforce our rights as a secured party by directing Amazon Services LLC or its Affiliates to reserve, hold, and pay to us an amount up to the unpaid balance of the Loan from the Business's Seller Account and any other Amazon account affiliated with the Business until the unpaid balance of the debt under this Loan Agreement is paid in full, (iii) enforce our rights as a secured party, by taking possession of inventory that the Business or parties affiliated with the business have stored in Amazon fulfillment centers and disposing of it, or (iv) offset any amounts that are payable by the Business to us against any payments we or any of our Affiliates may owe to the Business. If this Loan Agreement is referred to an attorney or third party collections agent to collect the amount owed by the Business or otherwise enforce the terms of this Loan Agreement, the Business agrees to pay all of our costs associated with such collection or enforcement action to the fullest extent not prohibited by applicable law, including without limitation our reasonable attorneys' fees, court and arbitration costs and any costs incurred in obtaining and executing upon a judgment. If we choose to take possession of and dispose of any Collateral that consists of inventory held in an Amazon fulfillment center, the Business agrees that we may credit the Business with the value of the Collateral as determined by us in good faith pursuant to a valuation formula that may take into account several factors (depending on the circumstances), such as the recent listed and sale prices of the inventory and the prices listed by the Business's competitors for sale of the same or similar inventory.

0.Xxxxxxxx. Except with respect to any Business licensed in the State of Vermont, in order to induce us to make the Loan to the Business, the Business grants to us, to secure the payment and performance of all of the obligations under this Loan Agreement (including any additional debt arising from the Business's failure to pay or perform under this Loan Agreement, and including all Loans made to the Business in the future), a continuing first lien security interest in all of the following property the Business now owns or may acquire in the future (the "Collateral"): (i) all inventory at any time stored for the Business or Business’s affiliated accounts in Amazon fulfillment centers, wherever found, (ii) any right, title or interest in the Business's Seller Account, as well as any other Amazon accounts affiliated with the Business, (iii) all Accounts, Chattel Paper, Deposit Accounts, Documents, Instruments, Investment Property, or General Intangibles, (iv) all Equipment, Goods, inventory and other tangible personal property located in the United States, (v) any books and records pertaining to the Collateral, and (vi) any insurance, proceeds or products of the foregoing. Until the balance of the debt under this Loan Agreement is paid in full, the Business will not be able to remove sellable inventory stored for the Business in Amazon fulfillment centers. The Business represents and warrants that it has and will maintain good, complete and marketable title to all Collateral, free and clear of any and all security interests, liens, or encumbrances of any kind that may be inconsistent with the Loan Agreement or our interests. Unless otherwise defined in this Loan Agreement, capitalized terms in this Section 7 are used as defined in the Uniform Commercial Code of Washington State.

VERMONT NOTICE: For the avoidance of doubt, Section 7, and the grant of security interest set forth therein, and Section 8, do not apply to any Business licensed in the State of Vermont and the Loan constitutes an unsecured commercial loan for all intents and purposes under 8 V.S.A. § 2201. With respect to any Business licensed in the State of Vermont, the Loan is expressly subordinated to the prior payment of all senior indebtedness of the Business regardless of whether such senior indebtedness exists at the time of the Loan or arises thereafter.

8.Financing Statements; Attorney in Fact. The Business authorizes us to file and, as we may deem necessary or desirable, to sign the name of the Business or its authorized representative on any documents and take any other actions that we deem necessary or desirable to ensure that our security interest is perfected. The Business agrees to cooperate by signing documents or taking any other action we may request. Except in New Jersey, the Business appoints us as the Business’ attorney in fact to sign the name of the Business to documents, applications, filings and certificates of title and transfer documents that are reasonably necessary to evidence or protect our security interest. To the greatest extent not prohibited by law, the Business agrees to pay (and we may charge the Business's Seller Account for) all fees necessary to file any documents in connection with the Business's obligations under this Loan Agreement. Any financing statements may describe the Collateral as "All assets of the Debtor".

9.Notice of Business's Default. If the Business or Guarantor becomes aware of the existence of any condition or event which with the lapse of time or failure to give notice would constitute an event of default under this Loan Agreement, it will immediately give us written notice describing the condition or event and any related action which it is taking or propose to take.

10.Disputed Payments. The Business will not to send us partial payments marked "paid in full", "without recourse", or with similar language, but if the Business sends such a payment, we may accept it without losing any of our rights under this Loan Agreement. All written communications concerning disputed amounts, including but not limited to any check or other payment instrument indicating that the payment constitutes "payment in full" of the amount owed, must be marked for special handling and mailed or delivered to us at 000 Xxxxx Xxx. Xxxxx, Xxxxxxx, XX 00000, Attn: Amazon Capital Services, Inc. and will be effective only if so delivered.

11.Notices; Change of Address. The Business and the Guarantor agree that any notice we send to the Business will be received when the notice is delivered personally, when we mail it, postage paid, to the last address that we have for the Business in our records, or when the notice is delivered via email to the Primary Contact Email address provided in the Application Information. The Business and the Guarantor agree to notify us by email at amazon- xxxxxxx@xxxxxx.xxx(i) promptly and in any event within 30 days of any change in the Primary Contact Email address, postal address and telephone number, or change in the Business's principal place of business or state of residence, state of incorporation or legal name and (ii) promptly and in any event within 30 days of any additional secured credit that the Business obtains at any time during the term of this Loan Agreement.

12.Interpretation; Severability. Paragraph headings are for convenience only and may not be used in the interpretation of this Loan Agreement. If applicable law is finally interpreted so that charges collected or to be collected in connection with this Loan Agreement exceed the permitted limits, then (i) any such charges will be reduced to the permitted amounts and (ii) any amounts already collected that exceed the permitted amounts will be credited to the Business by, at our option, applying the credit to any amounts due hereunder or making a direct payment to the Business. If any provision in this Loan Agreement is invalid under applicable law, the remainder of the provisions in this Loan Agreement will remain in effect. The Business agrees that for purposes of compliance with law under this Loan Agreement, the Business's principal place of business or state of residence is the business address provided in the Application Information.

13.Assignment. We may sell, assign or transfer any or all of our rights or obligations under this Loan Agreement (including without limitation, any or all of the Collateral) and any or all of our rights and remedies under this Loan Agreement without prior notice to the Business. The Business may not sell, assign or transfer this Loan Agreement or its obligations under this Loan Agreement in whole or in part, by operation of law or otherwise.

14.Telephone Monitoring and Recording. From time to time, we may monitor and/or record telephone calls regarding the Loan, and the Business and Guarantor agree to any such monitoring and/or recording.

15.Communicating with the Business and the Guarantor; Consent to Contact by Electronic and Other Means. We or our agents may contact the Business and the Guarantor for any lawful purpose related to the Loan, including for the collection of amounts owed to us and for the offering of products or services at any of the addresses, phone numbers or email addresses provided to us. No such contact will be deemed unsolicited. To the greatest extent not prohibited by applicable law, we or our agents may (i) contact the Business and the Guarantor at any address or telephone number (including wireless cellular telephone or ported landline telephone number) that may be provided to us from time to time; (ii) use any means of communication, including, but not limited to, postal mail, electronic mail, telephone or other technology, to reach the Business and the Guarantor; (iii) use automatic dialing and announcing devices which may play recorded messages; and (iv) send text messages to the Business's and Guarantor's telephone. The Business and the Guarantor may contact us at any time to ask that we not contact the Business or the Guarantor using any one or more methods or technologies.

16.Reservation of Rights. We will not be deemed to have waived any of our rights by delaying the enforcement of any of our rights. If we waive any of our rights on one occasion, that waiver will not constitute a waiver by us of our rights on any future occasion. We will be under no duty to enforce payment of the amount owed us under this Loan Agreement by exercising any of our rights under this Loan Agreement.

17.Limitation of Liability. To the maximum extent permitted by applicable law, we and our Affiliates will not be liable to the Business or any Guarantor for any indirect, incidental, special, consequential, or exemplary damages (including damages for loss of profits, goodwill, use, or data), even if we or our Affiliates have been advised of the possibility of such damages or losses. We and our Affiliates will not be liable for any delay or failure to perform any obligation under these terms based on reasons, events, or other matters beyond our reasonable control. In any event, our maximum aggregate liability under this Loan Agreement is $100.

18.Disputes. Any dispute or claim relating in any way to this Loan Agreement will be resolved by binding arbitration, rather than in court, and administered by the American Arbitration Association (AAA). The Federal Arbitration Act and federal arbitration law apply to this agreement.The Business, Guarantor and we agree that any dispute resolution proceedings will be conducted only on an individual basis and not in a class, consolidated, or representative action. There is no judge or jury in arbitration, and court review of an arbitration award is limited. An arbitrator can, however, award on an individual basis the same damages and relief as a court (including injunctive and declaratory relief or statutory damages), and must follow the terms of this Loan Agreement as a court would.All proceedings must be conducted in accordance with the AAA Commercial Arbitration Rules, and the AAA Expedited Procedures; the Procedures for Large, Complex Commercial Disputes do not apply. The hearing will be in Seattle, Washington. The arbitrator may award to the prevailing party, if any, as determined by the arbitrator, all pre-award expenses of the arbitration, including the arbitrators' fees, administrative fees, travel expenses, court or AAA costs, witness fees, and reasonable attorneys' fees. If for any reason a claim proceeds in court rather than in arbitration, the Business, Guarantor, and we each waive any right to a jury trial.

To begin an arbitration proceeding, the Business or Guarantor must send a letter requesting arbitration and describing its claim to our registered agent Corporation Service Company, 000 Xxxxxxxxx Xxx XX, Xxxxx 000, Xxxxxxxx, XX 00000. Instructions for filing an arbitration demand with the AAA are available at xxx.xxx.xxx.

19.Governing Law. The Federal Arbitration Act, applicable federal law and the laws of the state of Washington, without regard to the conflict of laws principles, will govern this Loan Agreement and any dispute of any sort that might arise between the Business, any Guarantor and us. This Loan Agreement is entered into between the Business, any Guarantor and us in the state of Washington.

20.Privacy Notice. As a subsidiary of Xxxxxx.xxx, Inc., Amazon Capital Services, Inc. follows the same information practices as Xxxxxx.xxx, Inc., and information we collect from the Business and the Guarantor, is subject to the Xxxxxx.xxx Privacy Notice (the "Privacy Notice"), current version of which is located at:xxxx://xxx.xxxxxx.xxx/xxxxxxx

00.Xxxxxx Bureau Notice. We may report information about the Business's Loan to credit bureaus. Late payments, missed payments, or other defaults on the Business's Loan may be reflected in the Business's credit report. In underwriting and approving the Loan, we reserve all rights to conduct credit checks and financial and legal diligence necessary or desirable to evaluate the creditworthiness of the Business and the Guarantor.

22.Entire Agreement. The Business and the Guarantor agree that this Loan Agreement is the entire agreement with respect to the matters set forth herein and no oral changes can be made.

23.Oral Agreements. PLEASE BE ADVISED THAT ORAL AGREEMENTS OR ORAL COMMITMENTS TO LOAN MONEY, EXTEND CREDIT, OR TO FORBEAR FROM ENFORCING REPAYMENT OF A DEBT ARE NOT ENFORCEABLE UNDER WASHINGTON LAW.

CONSENT TO ELECTRONIC COMMUNICATIONS

1.Categories of Communications.The Business and the Guarantor understand and agree that Amazon Capital Services, Inc., our Affiliates, assignees, agents or other holders of the Loan may provide all communications, notices, and transactions related to the Loan by electronic means, including but not limited to the Loan Agreement and any policies, disclosures, notices, transaction information, statements, responses to communications and customer services claims, notices of default, notices regarding delinquencies, notices for collections and any other notices that we may be required to provide to you by law (collectively, “Communications”).

2.Manner of Electronic Communications. Communications may be sent to the Primary Contact Email provided in the Application Information or may be provided in Seller Central. All such Communications shall be considered to be “in writing.” The Business and the Guarantor acknowledge that by accessing Seller Central, the Business and the Guarantor demonstrate that each can access information that we may provide to the Business and the Guarantor by electronic Communications.

3.Copies of Communications and Withdrawal of Consent. The Business and the Guarantor are responsible for printing, storing, and maintaining their own records of such Communications. The Business or the Guarantor may withdraw consent to electronic disclosures by contacting us at xxxxxx-xxxxxxx@xxxxxx.xxx, however, withdrawal of consent to electronic disclosures may result in termination of our relationship with the Business and we may consider this Loan immediately due and payable.

4.Electronic Signatures. The Business and the Guarantor acknowledge that by clicking on the "I Agree", the "Submit" or similar button on the application page or elsewhere on the lending landing page of the Seller Central website, the Business and the Guarantor are indicating their intent to sign the relevant document or record and that this will constitute the signature of the Guarantor and an authorized individual of the Business.

TERMS AND CONDITIONS FOR AUTOMATIC ACH PAYMENT OPTION

These terms and conditions (the "Terms and Conditions") govern the Business's use of the automatic ACH payment option as described herein and apply if the Business elects to enable automatic debit payments.

1.ACH Payment Option. The Business authorizes us to debit the Business's designated financial institution account ("Payment Account") to make one or more payments, as necessary, against any outstanding balance due on the Loan (the "ACH Payment Option"). The Business further authorizes us to debit or credit its Payment Account to correct any erroneous debit, make necessary adjustments to its payments, or to issue a refund back to its Payment Account. The Payment Account must be an account established for commercial or business purposes and must not be used primarily for personal, family, or household purposes, and it must be able to accept debits denominated in US currency.

2.Acceptance of Terms and Conditions. By using the ACH Payment Option, the Business agrees to these Terms and Conditions, and authorizes us (or our agent) to make any inquiries we consider necessary to validate the bank account or any dispute involving payment, including performing credit checks or verifying information with third parties. We may update these Terms and Conditions at any time, and by continuing to use the designated bank account as a payment method, the Business accepts these updated Terms and Conditions.

3.Returned Payments. If any payment using your Payment Account is returned unpaid (for example, if you have insufficient funds available), we may retry the payment. Your bank may charge you an overdraft or other fee for each payment failure. You are responsible for any such fees.

PERSONAL GUARANTY

This Section, and all references to Guarantor in this Agreement, is applicable only if we request a Guarantor for the Loan. The Loan Agreement documentation will indicate whether there is a Guarantor.

As used in this Section, "you" means the person applying for the Loan, and you certify that you are an owner, sole proprietor, principal or authorized representative of the Business and are duly authorized by the Business to apply for this Loan and execute and deliver the Loan Agreement.

You certify that you are at least 18 years old and are the Guarantor of all indebtedness, liabilities and obligations of the Business to Amazon under the Loan Agreement, whether presently existing or hereafter arising (the "Guaranteed Obligations"), that you authorize the Personal Guaranty, and that you agree to the Consent to Electronic Communications as the Guarantor.

The Guarantor unconditionally and irrevocably guarantees the Guaranteed Obligations, together with all expenses we incur relating to collection of the Guaranteed Obligations, including reasonable attorneys' fees.

The Guarantor understands that we may proceed directly against the Guarantor in their individual or personal capacity without first exhausting our remedies against the Business or any other person or any security held by us or any guarantor, and that this Personal Guaranty will not be affected by failure by us to enforce any rights or remedies we may have against the Business.

The Guarantor waives (i) all defenses of the Business pertaining to the duties and obligations of the Business (including discharge in bankruptcy), any evidence thereof, and any security therefor, except the defense of discharge by payment; (ii) all defenses of a surety to which the Guarantor may be entitled by statute or otherwise; (iii) notice of acceptance of this Personal Guaranty and of the creation and existence of the duties and obligations of the Guarantor hereunder; (iv) presentment, demand for payment, notice of dishonor, notice of non-payment, and protest of any instrument evidencing the duties and obligations of the Business; (v) all other demands and notices to the Guarantor or any other person and all other actions to establish the liability of the Guarantor; and (vi) the right to trial by jury in any action in connection with this Personal Guaranty. Guarantor agrees to the Dispute provisions in Section 18 of the Loan Agreement with the same force and effect on any dispute or claim relating in any way to this Personal Guaranty and Guarantor.

Any indebtedness the Business may owe to the Guarantor is hereby subordinated to the payment of the Guaranteed Obligations. The Guarantor agrees that after any default by the Business under the Loan Agreement, it will hold any funds received from the Business in trust for us to satisfy the obligations of the Business to us under the Loan Agreement, and will promptly pay those funds to us. Until the Guaranteed Obligations are fully satisfied, Guarantor waives all rights of subrogation, contribution, indemnification, exoneration, or reimbursement the Guarantor may have against the Business arising from the existence of this Personal Guaranty.

Nothing, except full payment and discharge of all of the Guarantor's duties and obligations to us, which but for this provision could act as a release or impairment of the liability of the Guarantor, will in any way release, impair, or affect the liability of the Guarantor. The Guarantor hereby consents that we may without further consent or disclosure and without affecting or releasing the obligations of Guarantor hereunder: (a) surrender, exchange, release, assign, or sell any collateral or waive, release, assign, sell, or subordinate any security interest; (b) waive or delay the exercise of any of our rights or remedies against the Business; (c) waive or delay the exercise of any of our rights or remedies in respect of any collateral or security interest now or hereafter held; (d) renew, extend, waive or modify the terms of any obligation, or any instrument or agreement evidencing the same; (e) renew, extend, waive or modify the terms of any security document; (f) apply payments received from the Business or any surety or guarantor or from any collateral, to any indebtedness, liability, or obligations of the Business or such sureties or guarantors whether or not a Guaranteed Obligation hereunder; and (g) realize on any security interest, judicially or nonjudicially, with or without preservation of a deficiency judgment.

This Personal Guaranty will not be discharged or affected by the death of the Guarantor, will bind all heirs, administrators, representatives, and assigns, and may be enforced by or for the benefit of any successors in interest to us. The Guarantor may not assign or otherwise transfer all or any part of its rights or obligations hereunder.

Guarantor represents and warrants as follows:

(a)The execution, delivery and performance by Guarantor of this Personal Guaranty do not and will not (i) conflict with or contravene any law, rule, regulation, judgment, order, or decree of any government, governmental instrumentality or court having jurisdiction over Guarantor or Guarantor's activities or properties, (ii) conflict with, or result in any default under, any agreement or instrument of any kind to which Guarantor is a party or by which Guarantor or any of Guarantor's properties may be bound or affected or (iii) require the consent, approval, order, or authorization of, or registration with or the giving of notice to any United States or other governmental authority or any person or entity not a party to the Loan Documents;

(b)This Guaranty constitutes a legal, valid and binding obligation of Guarantor, enforceable against Guarantor in accordance with its terms;

(c)There is no action, litigation or other proceeding pending or to Guarantor's knowledge threatened against Guarantor before any court, arbitrator or administrative agency that may have a material adverse effect on the assets or the business or financial condition of Guarantor or that would prevent, hinder or jeopardize the performance by Guarantor of Guarantor's obligations under this Guaranty;

(d)Guarantor is not party to any contract, agreement, indenture or instrument, or subject to any restriction individually or in the aggregate that would have a material adverse effect on Guarantor's financial condition or business or that would in any way jeopardize the ability of Guarantor to perform under this Guaranty.

Guarantor acknowledges that we are making credit accommodations to the Business with reliance on the truth and accuracy of Guarantor's representations set forth above, and Guarantor's enforceable Guaranty is an inducement for us to make such credit accommodations.