SECURITIES PURCHASE AGREEMENT

Exhibit 6.2

THIS SECURITIES PURCHASE AGREEMENT (this “Purchase Agreement”) has been entered into as of January 14, 2020, between Hightimes Holding Corp., a Delaware corporation (“Hightimes”) and Rayray Investments, Inc., an Ontario corporation (the “Purchaser”),

WHEREAS, Hightimes wishes to issue and sell to the Purchaser Three Hundred Sixty Three Thousand Six Hundred and Thirty Six (363,636) “Subject Shares” (as defined below), and

WHEREAS, the Purchaser wishes to subscribe for and purchase such Subject Shares, on the terms and conditions set forth in this Purchase Agreement.

NOW, THEREFORE, IN CONSIDERATION of the issuance of the Subject Shares (as defined below) and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereby agree as follows:

1. Definitions

In this Purchase Agreement, unless something in the subject matter is inconsistent therewith:

“Common Stock” shall mean the shares of Class A Common Stock of Hightimes, $0.0001 par value per share

“Closing Date” has the meaning set forth in Section 4;

“Hightimes” means Hightimes Holding Corp., a corporation governed by the laws of the State of Delaware;

“Laws” means any and all applicable laws including all statutes, codes, ordinances, decrees, rules, regulations, municipal by-laws, judicial or arbitral or administrative or ministerial or departmental or regulatory judgments, orders, decisions, rulings or awards, instruments, policies, guidelines, and general principles of common law and equity, binding on or affecting the Person referred to in the context in which the word is used;

“Person” means an individual, corporation, partnership, limited partnership, limited liability partnership, limited liability company, association, trust, estate, custodian, trustee, executor, administrator, nominee or other entity or organization, including a Governmental Entity or political subdivision or an agency or instrumentality thereof;

“Purchase Price” has the meaning set forth in Section 2(a); and

“Securities Act” means the U.S. Securities Act of 1933, as amended;

“SEC” mean the Securities and Exchange Commission; and

“Securities Laws” mean collectively, the Securities Act, the Securities Exchange Act of 1934, as amended and any applicable state securities laws.

| 2 |

“Subject Shares” means 363,636 shares of Common Stock of Hightimes.

2. Purchase and Sale of Subject Shares. Upon the terms and subject to the conditions set forth in this Agreement, Hightimes hereby agrees to sell and the Purchaser hereby agrees to purchase the Subject Shares, for aggregate consideration of $1,999,998 or $5.50 per Subject Share (the “Purchase Price”).

3. Deliveries

(a) At the Closing (as defined below), the Purchaser shall deliver to Hightimes a wire transfer of $1,999,998 (pursuant to the wire instructions attached hereto as Schedule A) in same day immediately available and transferable United States funds representing the Purchase Price.

(b) At the Closing Hightimes shall issue the Subject Shares to the Purchaser and cause the ownership of the Subject Shares to be registered on the books and records of Hightimes registered as follows:

RBC Dominion Securities Inc.

ITF RAYRAY INVESTMENTS INC. 4280577018

XX Xxx 00, Xxxxx Xxxx Xxxxx

Xxxxxxx, XX

X0X 0X0

and deliver a certificate or certificates representing the Subject Shares to RBC Dominion Securities Inc., 0 Xxxxx Xx. Xxxx, Xxxxx 0000, Xxxxxxx Xxxxxxx Xxxxxx X0X0X0, Attention X. Xx.

4. Closing

The closing for the purchase of Subject Shares contemplated herein (the “Closing”) will be simultaneous with the date of execution and delivery by Seller and Purchaser of this Purchase Agreement, and in no event later than 5:00 pm Pacific time on Tuesday, January 14, 2020 (the “Closing Date”).

5. Representations and Warranties of Hightimes Subject to and in accordance with the terms hereof, Hightimes makes the following representations and warranties to the Purchaser:

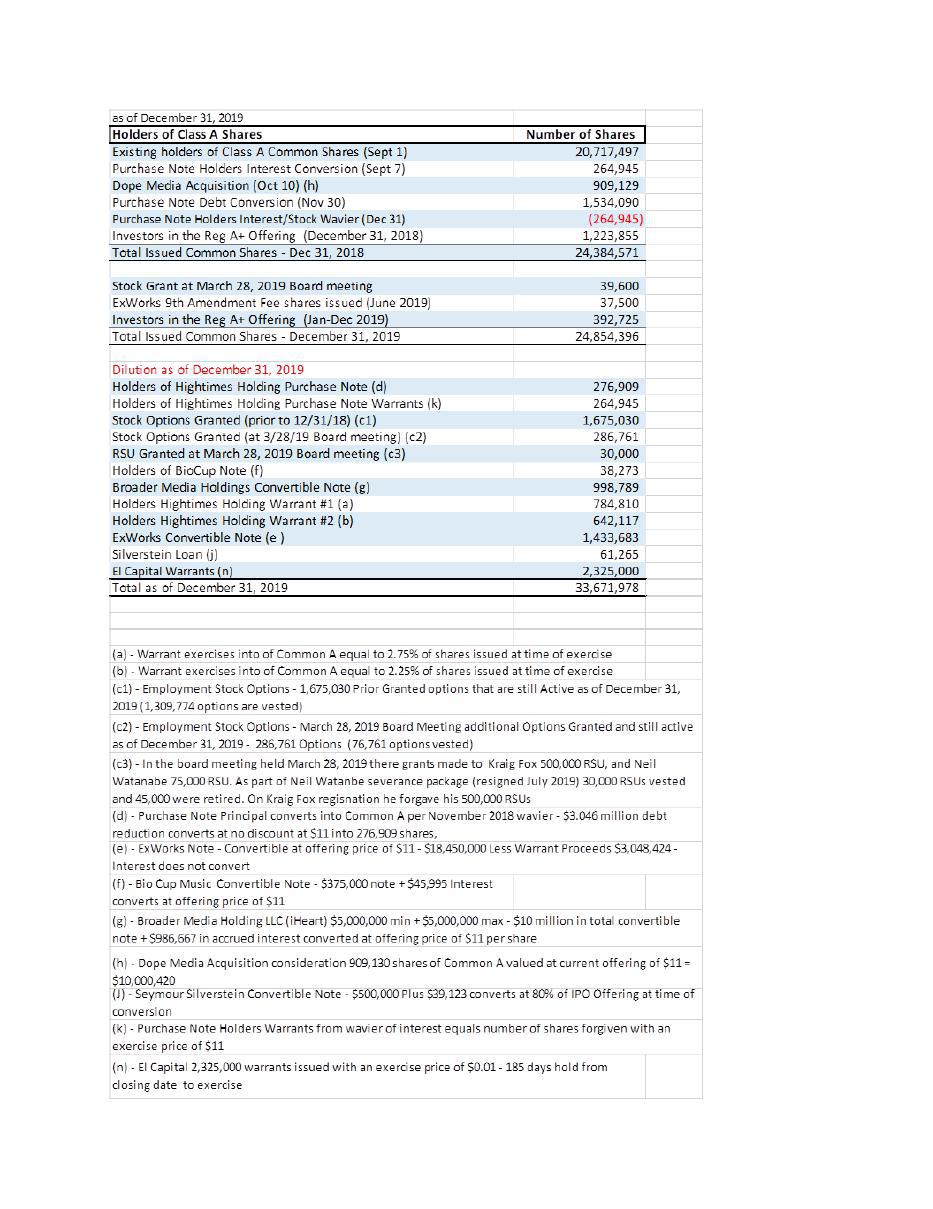

| (a) | Annexed hereto as Exhibit A is a table setting forth the authorized issued and outstanding shares of Hightimes Common Stock and shares of Common Stock issuable under outstanding convertible notes, warrants and stock options. Subsequent to December 31, 2019, less than 10,000 shares of Common Stock have been sold in the pending Regulation A+ public offering. | |

| (b) | The Subject Shares are not subject to any liens, pledges, encumbrances, security interest, stockholder agreements, other agreements with any third party or rights of any third party. | |

| (c) | The Subject Shares have been duly and validly issued by Hightimes and are fully paid and non-assessable. |

| 3 |

| (d) | The Subject Shares have not been registered or qualified by the SEC and are “restricted securities” within the meaning of the Securities Act. | |

| (e) | This Purchase Agreement and the issuance of the Subject Shares has been duly authorized, executed and delivered by all necessary corporate action of Hightimes and constitutes a legal, valid and binding obligation of Hightimes, enforceable against it in accordance with its terms, subject only to (i) any limitation under applicable laws relating to bankruptcy, insolvency, arrangements or other laws of general application affecting the enforcement of creditors’ rights, and (ii) the discretion that a court may exercise in the granting of equitable remedies such as specific performance and injunction. | |

| (f) | Hightimes will take all action as may be necessary and appropriate so that the transactions contemplated in this Purchase Agreement will be effected in accordance with applicable Securities Laws. Hightimes has complied with all Laws to which it and its business is subject and has not received any notice that it is in violation of any such laws. | |

| (g) | All of the statements made by Hightimes in its public filings with the SEC were and are true and accurate in all material respects, are not materially misleading and do not omit any statement required to be made therein, when made, not materially misleading. | |

| (h) | Assuming that the Purchaser is not an executive officer, director or holder of 5% or more of the voting securities of Hightimes, the Subject Shares may be sold by the Purchaser after six months pursuant to Rule 144 promulgated under the Securities Act. In such connection, and subject only to its continued compliance with the reporting requirements under the Securities Exchange Act of 1934, as amended, Hightimes will cooperate with the Purchaser in effective sales of such Subject Shares after the expiration of the applicable six month holding period. | |

| (i) | Hightimes owns the registered trademarks “High Times®” and “Planet Hemp®” and the design for the medical Cannabis Cup. In addition, Hightimes also uses common law marks that have not been, or due to their nature are unable to be, registered, including those common law marks listed under the heading Intellectual Property in its Form 1-A Offering Circular and supplements and amendments thereto. Hightimes currently owns trademark protection for its name and logos in the United States, pursuant to certain trademark and copyright applications and other registrations worldwide. |

6. Representations and Warranties of Purchaser. Subject to and in accordance with the terms hereof, the Purchaser makes the following representations and warranties to Hightimes:

| (a) | The Purchaser acknowledges that the Subject Shares have not been registered under the Securities act and are “restricted securities” as that term is defined in the Rules and Regulations of the SEC; |

| 4 |

| (b) | Purchaser is aware that Hightimes is currently offering its shares of common stock to the public pursuant to a Regulation A+ Offering under the JOBS Act and, although its Form 1-A and related Offering Circular have been approved by the SEC, as at the date hereof, such common stock has not, as yet, commenced trading on the OTCQX Market or any other securities exchange; | |

| (c) | Purchaser has had an opportunity to review all of Hightimes public filings with the SEC under the Securities Act; | |

| (d) | As set forth in Section 5(h) above, the Subject Shares may be subject to resale restrictions under applicable Securities Laws and the Purchaser covenants to comply with all relevant Securities Laws concerning any resale of the Subject Shares; | |

| (e) | The Subject Shares will bear a legend respecting restrictions on transfer as required under applicable Securities Laws. | |

| (f) | There is no current trading market for the Subject Shares and no assurance that a market will develop, and Purchaser realizes that achievement of the objectives of Hightimes is subject to significant uncertainty and economic and business risks. The Purchaser understands that investment in the Subject Shares involves a high degree of risk and is suitable only for persons of substantial financial resources who have no need for liquidity in their investment. The Purchaser is an “accredited investor” (as defined in Rule 144 promulgated under the Securities Act) and is able to bear a total loss of his investment; | |

| (g) | The Purchaser is responsible for obtaining such legal and tax advice as he considers appropriate in connection with the execution, delivery and performance of this Purchase Agreement and the transactions contemplated under this Purchase Agreement. The Purchaser acknowledges that he is not relying on legal or tax advice provided by Hightimes; | |

| (h) | The Purchaser acknowledges that Hightimes’ counsel is acting as counsel to Hightimes and not as counsel to the Purchaser; and | |

| (i) | The Purchaser is purchasing the Subject Shares for investment purposes only and not with a view to any resale or distribution of all or any of the Securities in violation of applicable Securities Laws, and not in a transaction or series of transactions involving a purchase and sale or a repurchase and resale in the course of or incidental to a distribution; | |

| (j) | This Purchase Agreement has been duly authorized, executed and delivered by the Purchaser and constitutes a legal, valid and binding obligation of the Purchaser, enforceable against him in accordance with its terms, subject only to (i) any limitation under applicable laws relating to bankruptcy, insolvency, arrangements or other laws of general application affecting the enforcement of creditors’ rights, and (ii) the discretion that a court may exercise in the granting of equitable remedies such as specific performance and injunction; |

| 5 |

7. Governing Law

This Purchase Agreement will be governed by, interpreted and enforced in accordance with the laws of the State of Delaware. Each party hereby unconditionally and irrevocably submits to the exclusive jurisdiction of the courts of the State of Delaware in respect of all matters arising out of this Purchase Agreement.

8. Severability

If any provision of this Purchase Agreement is determined to be invalid or unenforceable in whole or in part, such invalidity or unenforceability will attach only to such provision or part thereof and the remaining part of such provision and all other provisions hereof will continue in full force and effect. The parties hereto agree to negotiate in good faith a substitute provision which will be as close as possible to the intention of any invalid or unenforceable provision as may be valid or enforceable. The invalidity or unenforceability of any provision in any particular jurisdiction will not affect its validity or enforceability in any other jurisdiction where it is valid or enforceable.

9. Survival

This Purchase Agreement, including, without limitation, the representations, warranties and covenants contained herein, shall survive and continue in full force and effect and be binding upon Hightimes and the Purchaser notwithstanding the completion of the purchase of the Subject Shares by the Purchaser pursuant hereto and any subsequent disposition by the Purchaser of the Securities.

10. Further Assurances

Each of the parties hereto upon the request of the other party hereto, whether before or after the Closing Date, shall do, execute, acknowledge and deliver or cause to be done, executed, acknowledged and delivered all such further acts, deeds, documents, assignments, transfers, conveyances, powers of attorney and assurances as may reasonably be necessary or desirable to complete the transactions contemplated herein.

11. Assignment

Neither the Purchaser nor Hightimes may assign or transfer this Purchase Agreement or any interest herein without the prior written consent of the other party. Notwithstanding the foregoing, following the Closing Date, the Purchaser may assign some or all of the Subject Shares to one or more third parties who are accredited investors; provided, that such third parties execute a joinder to this Purchase Agreement or a separate agreement reasonably satisfactory to Hightimes and its counsel that is consistent with the Purchaser’s representations above

12. Binding Effect

This Purchase Agreement will be binding upon and inure to the benefit of the parties hereto and their respective successors and permitted assigns.

| 6 |

13. Waiver

Failure by any party hereto to insist in any one or more instances upon the strict performance of any one of the covenants or rights contained herein will not be construed as a waiver or relinquishment of such covenant. No waiver by either party hereto of any such covenant or right will be deemed to have been made unless expressed in writing and signed by the waiving party.

14. Amendments

No term or provision hereof may be amended, discharged or terminated except by an instrument in writing signed by the party against which the enforcement of the amendment, discharge or termination is sought.

15. Entire Agreement

This Purchase Agreement and any other agreements and other documents referred to herein and delivered in connection herewith, constitute the entire agreement between the parties hereto pertaining to the subject matter hereof and supersede all prior agreements, understandings, negotiations and discussions, whether oral or written, between the parties with respect to the subject matter hereof.

16. Time of the Essence

Time shall be of the essence of this Purchase Agreement and every part hereof.

17. Third Party Beneficiaries

The provisions of this Purchase Agreement are solely for the benefit of the parties hereto and the persons to whom their respective rights may be assigned in accordance with this Purchase Agreement.

18. Counterparts

This Purchase Agreement may be signed in one or more counterparts, each of which once signed will be deemed to be an original. All such counterparts together will constitute one and the same instrument. Notwithstanding the date of execution of any counterpart, each counterpart will be deemed to bear the effective date first written above. This Purchase Agreement, any and all agreements and instruments executed and delivered in accordance herewith, along with any amendments hereto or thereto, to the extent signed and delivered by means of a facsimile machine or other means of electronic transmission, will be treated in all manner and respects and for all purposes as an original signature, agreement or instrument and will be considered to have the same binding legal effect as if it were the original signed version thereof delivered in person

19. Language

The parties hereby confirm their express wish that this document and all documents and agreements directly or indirectly related thereto be drawn up in English.

| 7 |

IN WITNESS WHEREOF, the Parties have executed and delivered this Purchase Agreement, this 14th day of January 2020.

| SELLER: | HIGHTIMES HOLDING CORP. | |

| By: | /s/ Xxxx X. Xxxxx | |

| Xxxx X. Xxxxx, Executive Chairman | ||

| PURCHASER: | RAYRAY INVESTMENTS, INC. | |

| By: | /s/ Xxxxxxx Xxxxx | |

| Xxxxxxx Xxxxx, President | ||

EXHIBIT A

Fully-Diluted Common Stock as at December 31, 2019

attached

| 2 |

Schedule A

Wire Transfer Details

Bank Name:

Bank Routing:

Account Name: Hightimes Holding Corp

Account Number:

Swift Code :