Contract

EXECUTION VERSION AMENDMENT NO. 5 TO CREDIT AGREEMENT This AMENDMENT NO. 5 TO CREDIT AGREEMENT, dated as of September 19, 2023 (this “Amendment”), is entered into among INTERNATIONAL FLAVORS & FRAGRANCES INC. (as successor to Nutrition & Biosciences, Inc.) (the “Company”), the Lenders signatory hereto and XXXXXX XXXXXXX SENIOR FUNDING, INC., as administrative agent (in such capacity, the “Agent”). WHEREAS, the Company, the Lenders from time to time party thereto and the Agent are parties to that certain Term Loan Credit Agreement, dated as of January 17, 2020 (as amended by that certain Amendment No. 1 to Credit Agreement, dated as of August 25, 2020, as further supplemented by that certain Icon Debt Assumption Supplement, dated as of March 4, 2021, as further amended by that certain Amendment No. 2 to Credit Agreement, dated as of August 4, 2022, as further amended by that certain Amendment No. 3 to Credit Agreement, dated as of March 23, 2023, as further amended by that certain Amendment No. 4 to Credit Agreement, dated as of March 23, 2023, and as further amended, amended and restated, supplemented or otherwise modified prior to the date hereof, the “Credit Agreement”). WHEREAS, pursuant to Section 9.01 of the Credit Agreement, the Company, the Lenders party hereto (constituting the Required Lenders) and the Agent have agreed to amend the Credit Agreement as provided for herein. NOW, THEREFORE, in consideration of the mutual execution hereof and other good and valuable consideration, the parties hereto hereby agree as follows: 1. Defined Terms. Capitalized terms used herein and not otherwise defined herein have the meanings given in the Credit Agreement. 2. Amendment. Upon satisfaction of the conditions set forth in Section 3 hereof, the Credit Agreement is hereby amended as follows: (a) Section 1.01 of the Credit Agreement is hereby amended by adding the following definitions thereto, in the appropriate alphabetical order: “Amendment No. 5” means that certain Amendment No. 5 to Credit Agreement, dated as of September 19, 2023, among the Company, the Lenders signatory thereto and the Agent. “Amendment No. 5 Effective Date” means the Amendment Effective Date, as defined in Amendment No. 5. “Net Cash Proceeds” means the cash proceeds (including any cash proceeds received by way of deferred payment of principal pursuant to a note or installment receivable or purchase price adjustment or otherwise, but only as and when received) actually received in respect of any sale or other disposition of assets (including as a result of casualty or condemnation), net of (i) all attorneys’ fees, accountants’ fees, brokerage, consultant and other customary fees and commissions, title and recording tax expenses and other reasonable fees and expenses incurred in connection therewith, (ii) all taxes paid or reasonably estimated to be payable as a result thereof (including taxes resulting from the Exhibit 10.1 2 repatriation of such cash proceeds from a Subsidiary organized outside of the United States), (iii) all payments made, and all installment payments required to be made, with respect to any obligation (A) that is secured by any assets subject to such sale or disposition in accordance with the terms of any lien upon such assets or (B) that must by its terms, or in order to obtain a necessary consent to such sale or disposition, or by applicable laws, be repaid out of the proceeds from such sale or disposition, (iv) all distributions and other payments required to be made to minority interest holders in Subsidiaries or joint ventures as a result of such sale or disposition, or to any other Person (other than to the Company or any of its Subsidiaries) owning a beneficial interest in the assets disposed of in such sale or disposition, (v) the amount of any reserves established by the Company or any of its Subsidiaries in accordance with generally accepted accounting principles to fund purchase price or similar adjustments, indemnities or liabilities, contingent or otherwise, reasonably estimated to be payable in connection with such sale or disposition (provided, that to the extent and at the time any such amounts are released from such reserve, such amounts shall constitute Net Cash Proceeds), (vi) any funded escrow established pursuant to the documents evidencing any such sale or disposition to secure any indemnification obligations or adjustments to the purchase price associated with any such sale or disposition (provided, that to the extent that any amounts are released from such escrow to the Company or a Subsidiary, such amounts net of any related expenses shall constitute Net Cash Proceeds), (vii) the cash proceeds of any such sale or disposition to the extent such proceeds are required to be used in another manner pursuant to contractual or other obligations entered into in connection with financing the acquisition, construction or development of such property and (viii) any cash proceeds arising from a sale or disposition by a Subsidiary organized outside of the United States to the extent that (x) the repatriation thereof would be unlawful, as reasonably determined by the Company, (y) material adverse tax consequences would result from the repatriation thereof, as reasonably determined by the Company or (z) the repatriation thereof would require, or result in, a cost, burden, difficulty or consequence (including administrative burden), on the Company that is disproportionate in comparison to the amount of such cash proceeds, as reasonably determined by the Company and the Agent in writing (including by email). (b) Section 1.01 of the Credit Agreement is hereby amended by amending and restating the definition of “Covenant Relief Period Termination Date” to read as follows: “Covenant Relief Period Termination Date” means the earlier of (a) March 31, 2026 and (b) the date on which the Agent receives a Covenant Relief Period Termination Notice from the Company. (c) Section 1.01 of the Credit Agreement is hereby amended by amending and restating the definition of “Applicable Rate” to read as follows: “Applicable Margin” means: (a) during the period commencing on the Amendment No. 5 Effective Date until (but excluding) the Covenant Relief Period Termination Date, with respect to any Base Rate Advance or Term Benchmark Rate Advance, as the case may be, a percentage per annum 3 determined by reference to the Public Debt Rating in effect on such date as set forth below under the applicable caption: 3-Year Tranche 5-Year Tranche Public Debt Rating S&P/Moody’s Applicable Margin for Base Rate Advances Applicable Margin for Term Benchmark Rate Advances Applicable Margin for Base Rate Advances Applicable Margin for Term Benchmark Rate Advances Level 1 A+ / A1 or above..... 0.000% 0.875% 0.250% 1.250% Level 2 A / A2 ...................... 0.000% 1.000% 0.375% 1.375% Level 3 A- / A3 .................... 0.125% 1.125% 0.500% 1.500% Level 4 BBB+ / Baa1 ........... 0.250% 1.250% 0.625% 1.625% Level 5 BBB / Baa2 ............. 0.375% 1.375% 0.750% 1.750% Level 6 BBB- / Baa3 ........... 0.625% 1.625% 1.000% 2.000% Level 7 Lower than Level 6 1.125% 2.125% 1.500% 2.500% (b) otherwise, with respect to any Base Rate Advance or Term Benchmark Rate Advance, as the case may be, a percentage per annum determined by reference to the Public Debt Rating in effect on such date as set forth below under the applicable caption: 3-Year Tranche 5-Year Tranche Public Debt Rating S&P/Moody’s Applicable Margin for Base Rate Advances Applicable Margin for Term Benchmark Rate Advances Applicable Margin for Base Rate Advances Applicable Margin for Term Benchmark Rate Advances Level 1 A+ / A1 or above..... 0.000% 0.750% 0.125% 1.125% Level 2 A / A2 ...................... 0.000% 0.875% 0.250% 1.250% Level 3 A- / A3 .................... 0.000% 1.000% 0.375% 1.375% Level 4 BBB+ / Baa1 ........... 0.125% 1.125% 0.500% 1.500% Level 5 BBB / Baa2 ............. 0.250% 1.250% 0.625% 1.625% Level 6 BBB- / Baa3 ........... 0.500% 1.500% 0.875% 1.875% 4 3-Year Tranche 5-Year Tranche Level 7 Lower than Level 6 1.000% 2.000% 1.375% 2.375% (d) Section 1.01 of the Credit Agreement is hereby amended by amending and restating the definition of “Loan Documents” to read as follows: “Loan Documents” shall mean this Agreement, the Amendment No. 1, the Amendment No. 2, the Amendment No. 3, the Amendment No. 4, the Amendment No. 5, the Icon Debt Assumption Supplement and any Note. (e) Section 2.10 of the Credit Agreement is hereby amended and restated in its entirety to read as follow: Section 2.10. Prepayments of Advances. (a) Optional. The Company may, upon notice not later than 11:00 A.M. (New York City time) three U.S. Government Securities Business Days prior to the date of such prepayment, to the Agent stating the proposed date and aggregate principal amount of the prepayment, and if such notice is given the Company shall, prepay the outstanding principal amount of the Advances of any Class comprising part of the same Borrowing in whole or ratably in part, together with accrued interest to the date of such prepayment on the principal amount prepaid; provided, however, that (x) each partial prepayment of Advances shall be in an aggregate principal amount of not less than $10,000,000 or a multiple of $1,000,000 in excess thereof, and (y) in the event of any such prepayment of a Term Benchmark Rate Advance, the Company shall be obligated to reimburse the Lenders in respect of any such Borrowing pursuant to Section 9.04(c) for any such prepayment other than on the last day of the Interest Period for such Advance. Optional prepayments shall be applied to Advances (and, in the case of 5-Year Xxxxxxx Advances, to amortization payments thereof) as directed by the Company, and absent any direction, shall be applied (x) to 3-Year Tranche Advances and 5-Year Tranche Advances pro rata and (y) in the case of 5-Year Tranche Advances, to the amortization payments required by Section 2.06 in direct order of maturity. Any notice of prepayment by the Company may be conditioned on the occurrence of any event, in which case such notice may be revoked by the Company (by notice delivered to the Agent on or prior to the date of the proposed prepayment) if such condition is not satisfied. The Company shall indemnify each Lender against any loss, cost or expense incurred by such Lender as a result of any failure to fulfill on or before the date specified in such notice of prepayment the applicable conditions set forth therein, including, without limitation, any loss (excluding any loss of profits), cost or expense incurred by reason of the liquidation or reemployment of deposits or other funds acquired by such Lender in anticipation of such prepayment, as a result of such failure, is not made on such date. (b) Mandatory. (i) The Company shall, as soon as practicable (and in any event within five Business Days after receipt thereof), prepay Advances owing by the Company in an amount equal to 100% of the Net Cash Proceeds actually received by the Company or any of its Subsidiaries during the period commencing on the Amendment No. 5 Effective Date until (but excluding) the Covenant Relief Period Termination Date from any sale or other

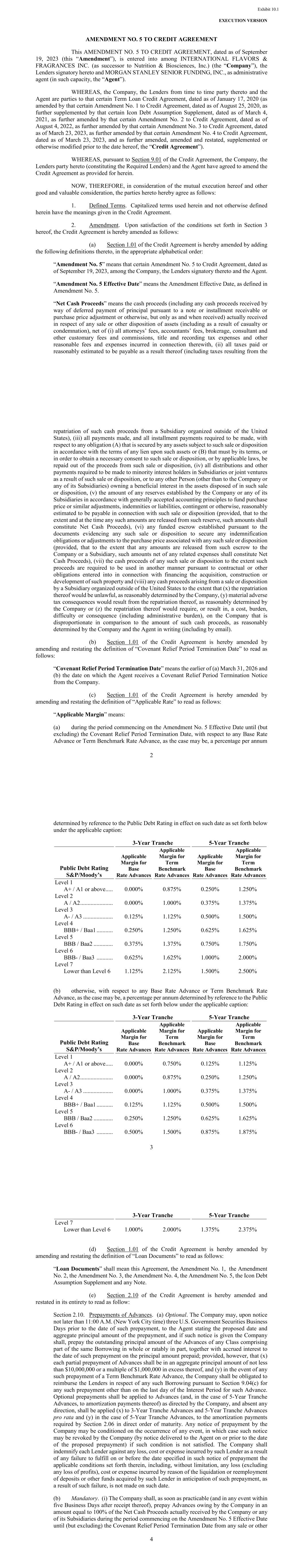

5 disposition (including as a result of casualty or condemnation) of any assets outside the ordinary course of business (other than any such sales or dispositions solely among the Company and its Subsidiaries) by the Company or any of its Subsidiaries; provided that, subject to the immediately following proviso, Net Cash Proceeds up to an amount that, in the good faith determination of the Company, will be required to repurchase, redeem or repay all of the Company’s 1.750% Notes due 2024 shall not be required to be applied to prepay Advances pursuant to this Section 2.10(b)(i); provided, further, that to the extent any Net Cash Proceeds were retained pursuant to the immediately preceding proviso in order to repurchase the Company’s 1.750% Notes due 2024 and were not actually so applied, then as soon as practicable following the repurchase, redemption or repayment of all of the Company’s 1.750% Notes due 2024 (and in any event within five Business Days), the Company shall prepay Advances owing by the Company in an amount equal to 100% of such retained amounts not so applied. (ii) Each prepayment made pursuant to this Section 2.10(b) shall be applied to the Advances (and, in the case of 5-Year Tranche Advances, to amortization payments thereof) as directed by the Company, and absent any direction, shall be applied (x) to 3-Year Tranche Advances and 5-Year Tranche Advances pro rata and (y) in the case of 5-Year Tranche Advances, to the amortization payments required by Section 2.06 in direct order of maturity. Each prepayment made pursuant to this Section 2.10(b) shall be made together with any interest accrued to the date of such prepayment on the principal amounts prepaid and, in the case of any prepayment of a Term Benchmark Rate Advance on a date other than the last day of an Interest Period or at its maturity, any additional amounts which the Company shall be obligated to reimburse to the Lenders in respect thereof pursuant to Section 9.04(c). (iii) The Company will notify the Administrative Agent of the receipt of the Company or any Subsidiary of any Net Cash Proceeds required to be prepaid pursuant to Section 2.10(b)(i) and the Administrative Agent will promptly notify each Lender of its receipt of such notice. (f) Section 5.02(a)(iv) of the Credit Agreement is hereby amended and restated in its entirety to read as follows: (iv) other Liens securing Debt or other obligations in an aggregate principal amount at any time outstanding not to exceed (1) during the Covenant Relief Period, the greater of (x) $300,000,000 (or its equivalent in another currency or currencies) and (y) 3.65% of Consolidated Net Tangible Assets and (2) and any other time, the greater of (x) $500,000,000 (or its equivalent in another currency or currencies) and (y) 15% of Consolidated Net Tangible Assets; (g) Section 5.02 of the Credit Agreement is hereby amended by adding the following new clause (g) at the end thereof: (g) Dividends. During the Covenant Relief Period, the Company will not declare or pay any dividend or make any other distribution in cash with respect to any class or series of its capital stock or other equity interests; provided that, the Company may declare and 6 pay a dividend in cash in respect of its common stock in an amount per share not to exceed $0.81 per fiscal quarter, for an aggregate amount of $3.24 per fiscal year. (h) Section 5.03 of the Credit Agreement is hereby amended and restated in its entirety to read as follows: SECTION 5.03 Financial Covenant. So long as any Advance shall remain unpaid, the Company shall maintain a Leverage Ratio as of the end of any Relevant Period of not more than 3.50 to 1.00; provided, however, that notwithstanding the foregoing, during the Covenant Relief Period, the Company shall maintain a Leverage Ratio as of the end of each Relevant Period (solely to the extent such Relevant Period ended prior to the Covenant Relief Period Termination Date) of not more than: (i) 5.25 to 1.00 until and including the end of the fiscal quarter ending on March 31, 2024, (ii) 4.75 to 1.00 until and including the end of the fiscal quarter ending on June 30, 2024, (iii) 4.50 to 1.00 until and including the end of the fiscal quarter ending on September 30, 2024, (iv) 4.25 to 1.00 until and including the end of the fiscal quarter ending on March 31, 2025, (v) 4.00 to 1.00 until and including the end of the fiscal quarter ending on September 30, 2025, and (vi) 3.75 to 1.00 until and including the end of the fiscal quarter ending on December 31, 2025; provided further that, commencing after the earlier of the (x) the Covenant Relief Period Termination Date and (y) the end of the fiscal quarter ending on December 31, 2025, if the Company or any of its Subsidiaries consummates an acquisition of all or substantially all of the assets of a Person, or of any business or division of a Person, for which it paid at least $500,000,000 in consideration (a “Qualifying Acquisition”), the maximum Leverage Ratio shall step up to no greater than 3.75 to 1.00 until and including the end of the third full fiscal quarter following the date of consummation of such Qualifying Acquisition and then shall be reduced to 3.50 to 1.00 thereafter. 3. Effectiveness. This Amendment will become effective upon the date on which the following conditions precedent are first satisfied (the “Amendment Effective Date”): (a) The Agent shall have received from the Company and from Consenting Lenders (as defined below) constituting Required Lenders an executed counterpart of this Amendment (or photocopies thereof sent by fax, .pdf or other electronic means, each of which shall be enforceable with the same effect as a signed original). (b) The Agent shall have received a certificate, dated the Amendment Effective Date and signed by a duly authorized officer of the Company, confirming (i) the representations and warranties set forth in this Amendment shall be true and correct in all material respects on and as of the Amendment Effective Date and (ii) no event shall have occurred and be continuing, or would result from this Amendment or the transactions contemplated hereby, that would, as of the Amendment Effective Date, constitute a Default. (c) The Agent shall have received, for the account of each Lender that has executed and delivered a signature page to this Amendment at or prior to 5:00 P.M. (New York time) on September 18, 2023 (each such Lender, a “Consenting Lender”), a consent fee, in an amount equal to 0.10% of the amount of the aggregate principal amount of Advances under the 7 Credit Agreement held by such Consenting Lender on the date hereof, which consent fee shall be earned, due and payable on the Amendment Effective Date. (d) The Agent shall have received all expenses due and payable on or prior to the Amendment Effective Date, including, to the extent invoiced two (2) Business Days prior to the Amendment Effective Date, reimbursement or payment of all out-of‑pocket expenses required to be reimbursed or paid by the Company under the Credit Agreement. 4. Representations and Warranties. The Company represents and warrants, as of the date hereof, that, after giving effect to the provisions of this Amendment, (a) each of the representations and warranties made by the Company in Section 4.01 of the Credit Agreement is true in all material respects on and as of the date hereof as if made on and as of the date hereof, except (i) to the extent that such representations and warranties refer to an earlier date, in which case they were true in all material respects as of such earlier date or (ii) to the extent that such representations and warranties are qualified as to materiality or Material Adverse Effect, in which case such representations and warranties shall be true in all respects, and (b) no event shall have occurred and be continuing, or would result from this Amendment or the transactions contemplated hereby, that would, as of the Amendment Effective Date, constitute a Default. 5. Effect of the Amendment. Except as expressly set forth herein, this Amendment shall not by implication or otherwise limit, impair, constitute a waiver of, or otherwise affect the rights and remedies of the Lenders or the Agent under the Credit Agreement or any other Loan Document, and shall not alter, modify, amend or in any way affect any of the terms, conditions, obligations, covenants or agreements contained in the Credit Agreement or any other Loan Document, all of which, as amended, amended and restated, supplemented or otherwise modified hereby, are ratified and affirmed in all respects and shall continue in full force and effect. Upon the effectiveness of this Amendment, each reference in the Credit Agreement and in any exhibits attached thereto to “this Agreement”, “hereunder”, “hereof”, “herein” or words of similar import shall mean and be a reference to the Credit Agreement after giving effect to this Amendment. 6. Authorization. Each of the Lenders party hereto (which collectively constitute the Required Lenders) hereby (i) authorizes and directs the Agent to execute and deliver this Amendment, and to take, or forbear from taking, any and all actions as set forth herein, and (ii) acknowledges and agrees that (x) the foregoing directed action constitutes a direction from the Required Lenders under Article 8 of the Credit Agreement, (y) Sections 8.03 (Exculpatory Provisions), 8.04 (Reliance by Agent), 8.07 (Non-Reliance on Agent and Other Lenders) and 9.04 (Costs and Expenses) and all other rights, protections, privileges, immunities, exculpations and indemnities afforded to the Agent under the Loan Documents shall apply to any and all actions taken or not taken by the Agent in accordance with such direction, and (z) the Agent may conclusively rely upon (and shall be fully protected in relying upon) the Register in determining such Xxxxxx’s ownership of the Advances on and as of the date hereof. This paragraph 6 is solely for the benefit of the Agent and the Lenders and the Company shall have no rights as third party beneficiary of the provisions in this paragraph 6. 7. Miscellaneous. The provisions of Sections 9.02 (Notices, Etc.); 9.03 (No Waiver; Remedies); 9.04 (Costs and Expenses) (except clauses (c) and (d) thereof); 9.08 8 (Confidentiality); 9.10 (Governing Law; Jurisdiction; Etc.); 9.11 (Execution in Counterparts); 9.14 (Acknowledgement and Consent to Bail-In of Affected Financial Institutions); and 9.19 (Waiver of Jury Trial) of the Credit Agreement shall apply with like effect to this Amendment. This Amendment shall be a “Loan Document” for all purposes under the Credit Agreement. [REMAINDER OF XXXX LEFT INTENTIONALLY BLANK]

[Signature Page to TL Amendment No. 5] BNP Paribas as a Lender By: Name: Xxxxxxx Xxxxxx Title: Managing Director By: Name: Xxxxx Xxxxxx Title: Director [Signature Page to TL Amendment No. 5] MIZUHO BANK, LTD. as a Lender By: Name: Xxxxx XxXxxxxxxxx Title: Executive Director

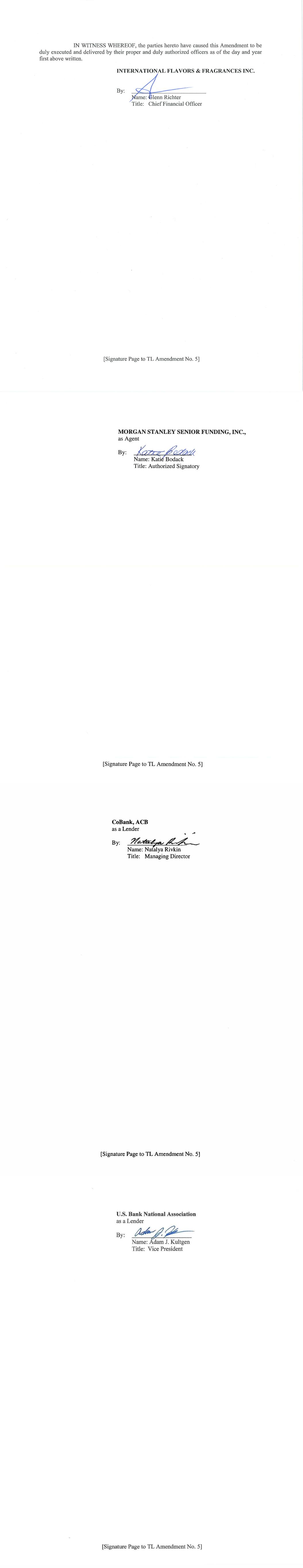

[Signature Page to TL Amendment No. 5] Industrial and Commercial Bank of China Limited, New York Branch as a Lender By: Name: Xxxxxx Xxxx Title: Executive Director By: Name: Xxxxx Xxxxxxx Title: Director [Signature Page to TL Amendment No. 5] ING Bank N.V., Dublin Branch as a Lender By: Name: Xxxx Xxxxxxx Title: Director By: Name: Xxxxxx Xxxxxxxx Title: Director [Signature Page to TL Amendment No. 5] Farm Credit Bank of Texas, as a Lender By: Name: Xxxx X. X. Xxxxxxx Title: Director Capital Markets

[Signature Page to TL Amendment No. 5] AgFirst Farm Credit Bank as a Lender By: Name: Xxxxxxxx XxXxxxxx Title: Senior Vice President [Signature Page to TL Amendment No. 5] Sumitomo Mitsui Banking Corporation as a Lender By: Name: Xxx Xxxxxx Title: Director American as a Lender By: AITEN Director - Structuring and Syndications fSignature Page to TL Amendment No. 5]