FIRST AMENDMENT TO LEASE

Exhibit 10.1

FIRST AMENDMENT TO LEASE

This FIRST AMENDMENT TO LEASE (this “Amendment”) is entered into as of April 4, 2018 (the “Effective Date”), by and between CLPF-CAMBRIDGE SCIENCE CENTER, LLC, a Delaware limited liability company (“Landlord”), and SAGE THERAPEUTICS, INC., a Delaware corporation (“Tenant”).

RECITALS

A.Jamestown Premier 245 First, LLC (the “Original Landlord”), and Tenant entered into that certain Lease dated as of May 24, 2016 (the “Original Lease”) for certain premises consisting of approximately 19,805 rentable square feet on the sixteenth (16th) floor (the “Existing Premises”) of the office building located at 000 Xxxxx Xxxxxx, Xxxxxxxxx, Xxxxxxxxxxxxx (the “Building” or “Office Building”), for a Term scheduled to expire on February 28, 2022 (the “Expiration Date”).

B.Landlord is the successor in interest to the Original Landlord.

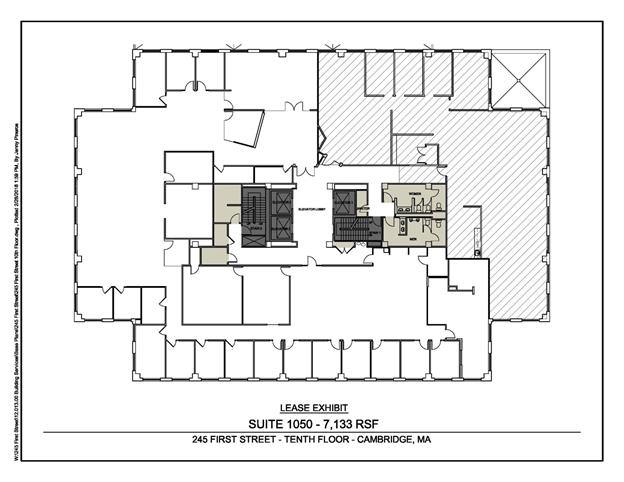

C.Landlord and Tenant wish to enter into this Amendment to (i) expand the Existing Premises to include a total of approximately 20,614 rentable square feet consisting of (a) approximately 13,481 rentable square feet on the ninth (9th) floor of the Building (“Ninth Floor Premises”) and (b) approximately 7,133 rentable square feet on the tenth (10th) floor of the Building (“Tenth Floor Premises”) in the locations shown on Exhibit A attached hereto (collectively, the “Additional Premises”), (ii) extend the Term of the Original Lease and (iii) amend certain other terms and conditions of the Original Lease.

NOW, THEREFORE, in consideration of the mutual covenants contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Landlord and Tenant agree to amend the Original Lease as follows:

1.Recitals; Capitalized Terms. All of the foregoing recitals are true and correct. Unless otherwise defined herein, all capitalized terms used in this Amendment shall have the meaning ascribed to them in the Original Lease, and all references to the Lease or “this Lease” or “herein” or “hereunder” or similar terms or to any sections thereof shall mean the Original Lease, or such section thereof, as amended by this Amendment. From and after the Additional Premises Commencement Date, all references in the Original Lease to the Premises shall be deemed to mean both the Existing Premises and Additional Premises.

2.Remeasurement. The parties hereby agree that the square footage of the Office Building and the Science Building have been recalculated based on a remeasurement of such Buildings, and, therefore, effective as of January 1, 2017, the following measurements shall be applicable for all purposes:

Rentable Square Footage of the Science Building: 135,490 rentable square feet

Rentable Square Footage of the Office Building: 171,514 rentable square feet

1

Rentable Square Footage of the Buildings: 307,004 rentable square feet

Therefore, the parties further agree that, effective as of January 1, 2017, wherever used in the Lease with respect to the Existing Premises, the following terms shall have the following meanings:

Tenant’s Building Pro Rata Share: 11.55%

Tenant’s Common Area Pro Rata Share: 6.45%

3.Demise of Additional Premises. Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, the Additional Premises, for a term commencing on May 1, 2018 (the “Additional Premises Commencement Date”) and, unless sooner terminated in accordance with the terms of the Lease, expiring on August 31, 2024 (the “Extended Expiration Date”). Except as otherwise provided in this Amendment, Tenant’s lease of the Additional Premises shall be on all of the terms and conditions of the Original Lease as amended herein. The Additional Premises shall be delivered to Tenant in vacant, broom-clean condition, with all Building systems serving the Additional Premises, including, without limitation, the base Building HVAC, electrical, and life safety and plumbing systems, in good working order. Except for the foregoing, the Additional Premises are being leased in their condition as of the Additional Premises Commencement Date, AS IS, WHERE IS, WITHOUT REPRESENTATION OR WARRANTY by Landlord. Landlord shall have no obligation to perform any alterations or make any improvements to the Additional Premises to prepare them for Tenant’s occupancy. Tenant acknowledges that Tenant has inspected the Additional Premises and has found the same satisfactory.

4.Extension of Term. The Term of the Lease is hereby extended with respect to the Existing Premises for an additional term (the “Additional Term”), commencing as of March 1, 2022 (the “Additional Term Commencement Date”), and, unless sooner terminated in accordance with the terms of the Lease, ending on the Extended Expiration Date. Said Additional Term shall be upon all of the same terms and conditions of the Lease in effect immediately preceding the Additional Term, except as set forth herein.

2

5.Existing Premises Base Rent during the Additional Term. Tenant shall continue to pay Base Rent, Expenses, Taxes, and Common Area Expenses with respect to the Existing Premises through the Expiration Date in accordance with all of the terms and conditions of the Original Lease. From the Additional Term Commencement Date until the Extended Expiration Date, Tenant shall pay Base Rent to Landlord within respect to the Existing Premises as follows:

|

RENTAL PERIOD |

ANNUAL BASE RENT |

MONTHLY PAYMENT |

|

March 1, 2022 – July 31, 2022 |

$1,673,522.50* |

$139,460.21 |

|

August 1, 2022 – July 31, 2023 |

$1,693,327.50 |

$141,110.63 |

|

August 1, 2023 – July 31, 2024 |

$1,713,132.50 |

$142,761.04 |

|

August 1, 2024 – August 31, 2024 |

$1,732,937.50* |

$144,411.46 |

*annualized

6.Ninth Floor Premises Base Rent. Commencing on August 1, 2018 (the “Ninth Floor Premises Rent Commencement Date”), Tenant shall pay Base Rent to Landlord with respect to Ninth Floor Premises as follows:

|

RENTAL PERIOD |

ANNUAL BASE RENT |

MONTHLY PAYMENT |

|

May 1, 2018 – July 31, 2018 |

$0.00 |

$0.00 |

|

August 1, 2018 – July 31, 2019 |

$1,098,701.50 |

$91,558.46 |

|

August 1, 2019 – July 31, 2020 |

$1,112,182.50 |

$92,681.88 |

|

August 1, 2020 – July 31, 2021 |

$1,125,663.50 |

$93,805.29 |

|

August 1, 2021 – July 31, 2022 |

$1,139,144.50 |

$94,928.71 |

|

August 1, 2022 – July 31, 2023 |

$1,152,625.50 |

$96,052.13 |

|

August 1, 2023 – July 31, 2024 |

$1,166,106.50 |

$97,175.54 |

|

August 1, 2024 – August 31, 2024 |

$1,179,587.50* |

$98,298.96 |

*annualized

3

5.Tenth Floor Premises Base Rent. Commencing on October 1, 2018 (the “Tenth Floor Premises Rent Commencement Date”), Tenant shall pay Base Rent to Landlord with respect to Tenth Floor Premises as follows:

|

RENTAL PERIOD |

ANNUAL BASE RENT |

MONTHLY PAYMENT |

|

May 1, 2018 – September 30, 2018 |

$0.00 |

$0.00 |

|

October 1, 2018 – July 31, 2019 |

$581,339.50* |

$48,444.96 |

|

August 1, 2019 – July 31, 2020 |

$588,472.50 |

$49,039.38 |

|

August 1, 2020 – July 31, 2021 |

$595,605.50 |

$49,633.79 |

|

August 1, 2021 – July 31, 2022 |

$602,738.50 |

$50,228.21 |

|

August 1, 2022 – July 31, 2023 |

$609,871.50 |

$50,822.63 |

|

August 1, 2023 – July 31, 2024 |

$617,004.50 |

$51,417.04 |

|

August 1, 2024 – August 31, 2024 |

$624,137.50* |

$52,011.46 |

*annualized

6.Taxes; Expenses; Common Area Expenses. Commencing on the Additional Premises Commencement Date, Tenant shall pay, with respect to the Additional Premises, Tenant’s Share of the Expense Excess, the Tax Excess, and the Common Area Expense Excess in the manner described in Exhibit 7 of the Original Lease, subject to the following:

a.Tenant’s Share. Solely with respect to the Additional Premises, (i) the term “Tenant’s Building Pro Rata Share,” as it appears in the Lease, shall mean a fraction, the numerator of which is the rentable area of the Additional Premises and the denominator of which is the Rentable Square Footage of the Office Building (i.e., 12.02% as of the Effective Date); and (ii) the term “Tenant’s Common Area Pro Rata Share,” as it appears in the Lease, shall mean a fraction, the numerator of which is the rentable area of the Additional Premises and the denominator of which is the Rentable Square Footage of the Buildings (i.e., 6.71% as of the Effective Date).

b.Base Years. Solely with respect to the Additional Premises, (i) the “Base Year” for Taxes shall be Fiscal Year 2019 (i.e., July 1, 2018 to June 30, 2019); (ii) the “Base Year” for Expenses shall be Calendar Year 2019, and (iii) the “Base Year” for Common Area Expenses shall be Calendar Year 2019.

Notwithstanding anything in this Amendment to the contrary, the Base Years with respect to the Existing Premises shall continue to be Fiscal Year 2017 for Taxes, and Calendar Year 2017 for Expenses and Common Area Expenses.

5.Tenant’s Additional Premises Work. Tenant shall have the right to perform certain alterations and improvements in the Additional Premises (the “Additional Premises Initial Alterations”). The Additional Premises Initial Alterations shall be performed in accordance with the terms and conditions of Exhibit 3 of the Original Lease, except that for

4

purposes of the Additional Premises Initial Alterations (i) the term “Allowance shall mean the sum of (a) $313,135.00 (i.e., $10.00 per rentable square foot of the Ninth Floor Premises, and $25.00 per rentable square foot of the Tenth Floor Premises) and (b) the Remaining Allowance (as defined below); (ii) the term “Test-Fit Allowance” shall mean an amount not to exceed $2,061.40 (i.e., $0.10 per rentable square foot of the Additional Premises); (iii) Tenant shall not be responsible for paying one percent (1%) of the sum of the hard costs and costs of engineering and design associated with the Additional Premises Initial Alterations, and therefore Section 7 of Exhibit 3 and Section 11.6 of the Original Lease shall be inapplicable to the Additional Premises Initial Alterations; and (iv) the term “Outside Draw Date” shall mean May 1, 2019. Notwithstanding anything in the Original Lease to the contrary, including without limitation Section 6 of Exhibit 3, Landlord and Tenant acknowledge that a balance of $32,384.00 remains from the Allowance provided under the Original Lease (the “Remaining Allowance”), which Remaining Allowance shall be available for Tenant to apply towards the cost of Tenant’s Additional Premises Initial Alterations. Tenant shall be permitted to allocate up to twenty percent (20%) of the Allowance toward architectural and engineering fees, and shall be permitted to allocate up to fifteen percent (15%) of the Allowance toward telephone and/or data cabling.

6.Electricity. Landlord and Tenant acknowledge that the Ninth Floor Premises is separately metered for electricity, and Tenant agrees to pay for the electricity consumed in the Ninth Floor Premises in the manner set forth in Section 9.1 of the Original Lease. Further, Landlord and Tenant acknowledge that electricity consumed on the 10th floor of the Building is measured by a check meter, which Landlord shall read and invoice Tenant for such usage pro-rated on a per square foot basis between Tenant and other tenants of the tenth floor, and Tenant agrees to pay to Landlord, as Additional Rent, such amount within thirty (30) days of receipt of Landlord’s invoice. Should at any point during the Term the intended use of the balance of the tenth (10th) floor of the Building change from Office/General Administrative to a different use that is known to consume a higher level of electricity, Landlord, at its expense, shall separately meter the Tenth Floor Premises.

7.Extension Option. Tenant shall continue have the option to extend the Term of the Lease for one (1) additional period of five (5) years pursuant to the terms and conditions of Section 1.2 of the Original Lease; provided, however, such Extension Term shall run from September 1, 2024 through August 31, 2029, and shall be with respect to the entire Premises, including both the Exiting Premises and Additional Premises.

8.Parking. Notwithstanding anything to the contrary set forth in the Lease, effective as of the Additional Premises Commencement Date, Tenant shall have the right to use nineteen (19) additional parking spaces (at the ratio of 0.9 parking spaces per 1,000 rentable square feet of the Additional Premises). Tenant’s use of the additional parking spaces shall be on a first come, first served basis at the then prevailing monthly parking rate, as adjusted from time to time in accordance with the published rates applicable to the Building. As of the Execution Date of this Amendment, the current monthly rate is $300.00 per unreserved parking space per month.

9.Security Deposit. Reference is made to the fact that Landlord is presently holding a Security Deposit in the amount of $524,832.52 (the “Existing Security Deposit”) in the form of a letter of credit. At the time that Tenant executes and delivers this Amendment to Landlord, Tenant shall deliver to Landlord additional security in the amount of $420,010.25 (the “First

5

Amendment Security Deposit”), thereby increasing the Security Deposit to $944,842.77 (the “Total Security Deposit”). Such adjustment to the Security Deposit shall be effected by Tenant’s delivery of a new letter of credit, or an amendment to the existing letter of credit held by Landlord, in a form reasonably acceptable to Landlord. The Total Security Deposit shall continue to secure Tenant’s obligations under the Lease, and shall be held by Landlord in accordance with Section 7 of the Original Lease, as amended hereby.

10.Brokerage. Each party represents to the other that it has not dealt with any broker in connection with this Amendment other than Transwestern Consulting Group. Tenant shall indemnify and hold Landlord harmless from and against any claim or claims for brokerage or other commissions relating to this Amendment asserted by any broker, agent or finder engaged by Tenant or with whom Tenant has dealt other than Transwestern Consulting Group. Landlord shall indemnify and hold Tenant harmless from and against any claim or claims for brokerage or other commissions relating to this Amendment asserted by any broker, agent or finder engaged by Landlord or with whom Landlord has dealt other than Transwestern Consulting Group. Any commission due in connection with this Amendment shall be paid by Landlord pursuant to a separate agreement between Landlord and Transwestern Consulting Group.

11.Ratification. Except as expressly modified by this Amendment, the Original Lease shall remain in full force and effect, and as further modified by this Amendment, is expressly ratified and confirmed by the parties hereto. This Amendment shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns, subject to the provisions of the Original Lease regarding assignment and subletting.

12.Governing Law; Interpretation and Partial Invalidity. This Amendment shall be governed and construed in accordance with the laws of the Commonwealth of Massachusetts. If any term of this Amendment, or the application thereof to any person or circumstances, shall to any extent be invalid or unenforceable, the remainder of this Amendment, or the application of such term to persons or circumstances other than those as to which it is invalid or unenforceable, shall not be affected thereby, and each term of this Amendment shall be valid and enforceable to the fullest extent permitted by law. The titles for the paragraphs are for convenience only and are not to be considered in construing this Amendment. This Amendment contains all of the agreements of the parties with respect to the subject matter hereof, and supersedes all prior dealings between them with respect to such subject matter. No delay or omission on the part of either party to this Amendment in requiring performance by the other party or exercising any right hereunder shall operate as a waiver of any provision hereof or any rights hereunder, and no waiver, omission or delay in requiring performance or exercising any right hereunder on any one occasion shall be construed as a bar to or waiver of such performance or right on any future occasion.

13.Successors. This Amendment shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns.

6

14.Counterparts and Authority. This Amendment may be executed in multiple counterparts, each of which shall be deemed an original and all of which together shall constitute one and the same document. Landlord and Tenant each warrant to the other that the person or persons executing this Amendment on its behalf has or have authority to do so and that such execution has fully obligated and bound such party to all terms and provisions of this Amendment

[Signature Pages Follow]

7

IN WITNESS WHEREOF, Landlord and Tenant have executed this Amendment as of the day and year first above written.

LANDLORD:

CLPF-CAMBRIDGE SCIENCE CENTER, LLC,

a Delaware limited liability company

|

By: |

Clarion Lion Properties Fund Holdings, L.P., |

||||||

|

|

a Delaware limited partnership, |

||||||

|

|

its Sole Member |

||||||

|

|

|

||||||

|

|

By: |

CLPF-Holdings, LLC, |

|||||

|

|

|

a Delaware limited liability company, |

|||||

|

|

|

its General Partner |

|||||

|

|

|

|

|||||

|

|

|

By: |

Clarion Lion Properties Fund Holdings REIT, LLC, |

||||

|

|

|

|

a Delaware limited liability company, |

||||

|

|

|

|

its Sole Member |

||||

|

|

|

|

|

||||

|

|

|

|

By: |

Clarion Lion Properties Fund, LP, |

|||

|

|

|

|

|

a Delaware limited partnership, |

|||

|

|

|

|

|

its Managing Member |

|||

|

|

|

|

|

|

|||

|

|

|

|

|

By: |

Clarion Partners LPF GP, LLC, |

||

|

|

|

|

|

|

a Delaware limited liability company, |

||

|

|

|

|

|

|

its General Partner |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

Clarion Partners, LLC, |

|

|

|

|

|

|

|

|

a New York limited liability company, |

|

|

|

|

|

|

|

|

its Sole Member |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Xxxxx Xxxxxxx |

|

|

|

|

|

|

|

Name: |

|

|

|

|

|

|

|

|

Title: |

|

8

TENANT:

a Delaware corporation

|

By: |

/s/ Xxxx Xxxxxx |

|

|

Name: |

|

|

|

Title: |

|

|

9

EXHIBIT A

ADDITIONAL PREMISES

1

2