OFFICE LEASE AGREEMENT BETWEEN NORMANDY NICKERSON ROAD, LLC (“LANDLORD”) AND OXFORD IMMUNOTEC, INC. (“TENANT”)

Exhibit 10.27

BETWEEN

NORMANDY XXXXXXXXX ROAD, LLC

(“LANDLORD”)

AND

OXFORD IMMUNOTEC, INC.

(“TENANT”)

TABLE OF CONTENTS

| 1. Basic Lease Information |

1 | |||

| 2. Lease Grant |

4 | |||

| 3. Possession |

4 | |||

| 4. Rent |

4 | |||

| 5. Compliance with Laws; Use |

5 | |||

| 6. Security Deposit |

6 | |||

| 7. Building Services |

7 | |||

| 8. Leasehold Improvements |

9 | |||

| 9. Repairs and Alterations |

10 | |||

| 10. Entry by Landlord |

11 | |||

| 11. Assignment and Subletting |

11 | |||

| 12. Liens |

13 | |||

| 13. Indemnity and Waiver of Claims |

13 | |||

| 14. Insurance |

14 | |||

| 15. Subrogation |

17 | |||

| 16. Casualty Damage |

17 | |||

THIS OFFICE LEASE AGREEMENT (the “Lease”) is made and entered into as of March 1, 2013 (“Execution Date”), by and between NORMANDY XXXXXXXXX ROAD, LLC, a Delaware limited liability company (“Landlord”) and OXFORD IMMUNOTEC, INC., a Delaware corporation (“Tenant”).

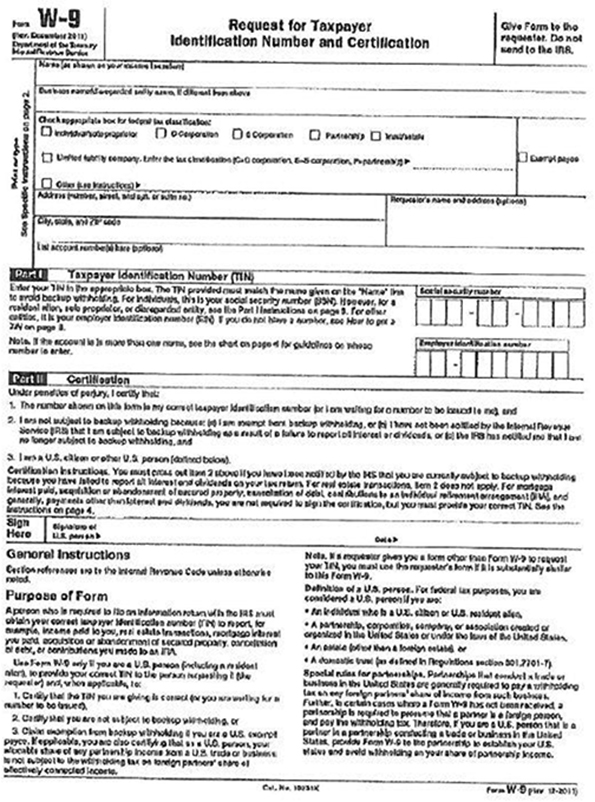

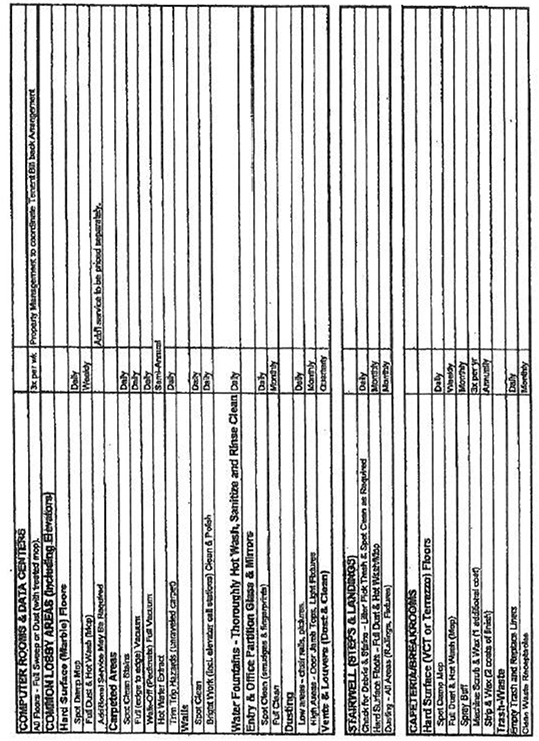

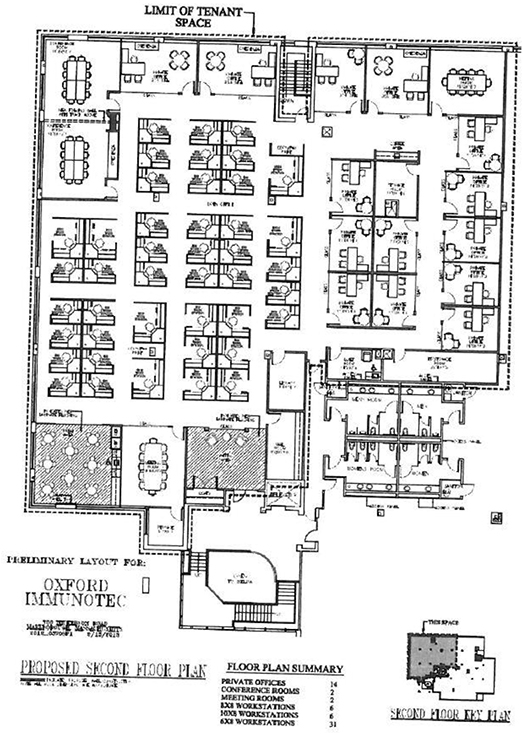

The following exhibits and attachments are incorporated into and made a part of the Lease: Exhibit A (Outline and Location of Premises), Exhibit B (Expenses and Taxes), Exhibit C (Work Letter), Exhibit D (Commencement Letter), Exhibit E (Building Rules and Regulations), Exhibit F (Additional Provisions), Exhibit G (Form of Letter of Credit), Exhibit H (Form of Subordination, Non-disturbance and Attornment Agreement), Exhibit I (W-9 Form), Exhibit J (Cleaning Specifications), Exhibit K (Form of Notice of Lease), Exhibit L (Floorplan), and Guaranty.

1. Basic Lease Information.

1.01. “Building” shall mean the building located at 000 Xxxxxxxxx Xxxx, Xxxxxxxxxxx, Xxxxxxxxxxxxx, and commonly known as Building 700 in Marlborough Technology Park. “Rentable Square Footage of the Building” is deemed to be 77,531 square feet, using BOMA Modified.

1.02. “Premises” shall mean the area shown on Exhibit A to this Lease. The Premises are located on the second (2”) floor of the Building. If the Premises include one or more floors in their entirety, all corridors and restroom facilities located on such full floor(s) shall be considered part of the Premises. The Premises consists of the area bounded by the interior surfaces of the perimeter walls, the floor and the ceiling (but excluding the area above dropped ceilings). The “Rentable Square Footage of the Premises” is deemed to be 14,541 square feet. Landlord and Tenant stipulate and agree that the Rentable Square Footage of the Building and the Rentable Square Footage of the Premises are correct.

1.03. “Base Rent”:

| Period |

Annual Rate Per Square Foot |

Annual Base Rent |

Monthly Base Rent |

|||||||||

| 6/15/13-10/14/13: |

$ | -0- | $ | -0- | $ | -0- | ||||||

| 10/15/13-5/31/14: |

$ | 18.50 | $ | 269,008.50 | * | $ | 22,417.38 | |||||

| 6/1/14-5/31/15: |

$ | 19.00 | $ | 276,279.00 | $ | 23,023.25 | ||||||

| 6/1/15-5/31/16: |

$ | 19.50 | $ | 283,549.50 | $ | 23,629.13 | ||||||

| 6/1/16-5/31/17: |

$ | 20.00 | $ | 290,820.00 | $ | 24,235.00 | ||||||

| 6/1/17-5/31/18: |

$ | 20.50 | $ | 298,090.50 | $ | 24,840.88 | ||||||

| 6/1/18-10/31/18: |

$ | 21.00 | $ | 305,361.00 | * | $ | 25,446.75 | |||||

| * | annualized |

1

Tenant shall have no obligation to pay Base Rent until the “Rent Commencement Date” which shall be the date that is four (4) months after the Commencement Date (“ Abatement Period”). The total amount of Base Rent abated during the Rent Abatement Period is Eighty-Nine Thousand Six Hundred Sixty-Nine and 52/100 Dollars ($89,669.52) (the “Abated Yearly Rent”). During the Rent Abatement Period, only Base Rent shall be abated, and all additional rent and other costs and charges specified in the Lease shall remain as due and payable pursuant to the provisions of the Lease.

Notwithstanding the foregoing, commencing on the earlier of (a) the Commencement Date, or (b) the date following completion of the Initial Alterations Tenant enters the Premises for the purpose of installing Tenant’s trade fixtures, phone, data, and furniture systems pursuant to Section 3 hereof, Tenant shall pay for all electricity consumed in the Premises in accordance with Section 7.02 hereof.

1.04. “Tenant’s Pro Rata Share”: 18.76%. Tenant’s Pro Rata Share shall be adjusted for changes in the Rentable Square Footage of the Premises and/or the Rentable Square Footage of the Building, including, without limitation, changes which may result from any condemnation or other taking of a portion of the Building.

1.05. “Base Year” for Taxes: Fiscal Year (defined below) 2014 (i.e., July 1, 2013, through June 30, 2014); “Base Year” for Expenses (defined in Exhibit B): Calendar year 2014.

For purposes hereof, “Fiscal Year” shall mean the Base Year for Taxes and each period of July 1 to June 30 thereafter.

1.06. “Term”: A period of five (5) years and four and a half (41/2) months. The Term shall commence on June 15, 2013 (the “Commencement Date”) and, unless terminated early in accordance with this Lease, shall end on October 31, 2018 (the “Termination Date”).

1.07. “Improvement Allowances”: An amount not to exceed $581,640.00, as further described in the attached Exhibit C.

1.08. “Security Deposit”: $112,000.00, as more fully described in Section 6.

1.09. “Guarantor”: Oxford Immunotec, Limited

1.10. “Broker”: Xxxxxxxx Xxxxx Xxxxx & Partners.

1.11. “Permitted Use”: General office use, and, to the extent permitted by law, uses customarily accessory thereto, such as storage related to the use of the Premises, employee lunch rooms, and the like, and for no other purpose whatsoever.

1.12. “Notice Addresses”:

Landlord’s Notice Address:

Normandy Xxxxxxxxx Road, LLC

c/o Normandy Real Estate Management, LLC

00 Xxxxx Xxxxxx

Xxxxxxxxxx, Xxx Xxxxxx 00000

Attention: Corporate Counsel

2

And a copy to:

Normandy Real Estate Partners

00 Xxxxx Xxxxxx

Xxxxxxxxxx, Xxx Xxxxxx 00000

Attention: Xxxxx Xxxxx, Director

And a copy to:

Goulston & Storrs, P.C.

000 Xxxxxxxx Xxxxxx

Xxxxxx, Xxxxxxxxxxxxx 00000

Attention: Normandy Real Estate

Landlord’s Rent Address:

Normandy Xxxxxxxxx Road, LLC

c/o Normandy Real Estate Management, LLC

X.X. Xxx 00000

Xxx Xxxx, Xxx Xxxx 00000-0000

Tenant’s Notice Address:

Before to the Commencement Date:

Xxxxx Xxxxxx

Oxford Immunotec, Inc.

0 Xxxxx Xxxxx Xxxxxx

Xxxxx 000

Xxxxxxxxxxx, Xxxxxxxxxxxxx 00000

With a copy to:

General Counsel

Oxford Immunotec, Inc.

0 Xxxxx Xxxxx Xxxxxx

Xxxxx 000

Xxxxxxxxxxx, Xxxxxxxxxxxxx 00000

After the Commencement Date:

To the same persons designated above at the Premises

3

1.13. “Business Days” are Monday through Friday of each week, exclusive of New Year’s Day, Presidents’ Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day and Christmas Day (the “Holidays”). Landlord may designate additional Holidays that are designated as new Federal holidays. “Building Service Hours” are 8:00 A.M. to 6:00 P.M. on Business Days and 9:00 A.M. to 1:00 P.M. on Saturdays, exclusive of Holidays.

1.14. “Property” means the Building and the parcel(s) of land on which it is located and, at Landlord’s discretion, the parking facilities and other improvements, if any, serving the Building and the parcel(s) of land on which they are located (the maintenance and repair of which such parking facilities shall be included in Expenses).

2. Lease Grant.

The Premises are hereby leased to Tenant from Landlord, together with the right to use any portions of the Property that are from time to time designated by Landlord for the common use of tenants and others, including, without limitation, the conference spaces serving the Building (the “Common Areas”). Nothing contained herein shall affect Landlord’s right to add to, subtract from, or alter the Common Areas, so long as the same does not materially adversely affect Tenant’s access to the Premises.

3. Possession.

Except as expressly otherwise provided in this Lease, the Premises are accepted by Tenant in “as is” condition and configuration without any representations or warranties by Landlord. By taking possession of the Premises, Tenant agrees and Landlord represents that the Premises are in good order and satisfactory condition and that the Building systems serving the Premises (including, without limitation, the HVAC system) are in good order and satisfactory condition as of the Execution Date of this Lease. Tenant shall have the right to take possession of the Premises as of the Execution Date of this Lease and the delivery of the Security Deposit and Guaranty to Landlord. Such possession shall be subject to the terms and conditions of this Lease. Except for the cost of services requested by Tenant (e.g., freight elevator usage and the cost of electric service to the Premises as provided in Section 7.02 below), Tenant shall not be required to pay Rent for any days of possession before the Commencement Date during which Tenant, with the approval of Landlord, is deemed to be in possession of the Premises for the sole purpose of performing improvements or installing furniture, equipment or other personal property. Tenant shall have the right to use the freight elevators serving the Building during the performance of the Initial Alterations (as defined in Exhibit C) and during Tenant’s move into the Premises. Within ten (10) days after the Execution Date of this Lease, Landlord and Tenant shall together conduct an inspection of the Premises and prepare a “punch list” setting forth any items that are not in conformity as required by the terms of this Lease. Landlord shall use good faith efforts to correct all such items within a reasonable time following the completion of the punch list.

4. Rent.

Tenant shall pay Landlord, without any setoff or deduction, unless expressly set forth in this Lease, all Base Rent and Additional Rent due for the Term (collectively referred to as

4

“Rent”). “Additional Rent” means all sums (exclusive of Base Rent) that Tenant is required to pay Landlord under this Lease. Tenant shall pay and be liable for all rental, sales and use taxes (but excluding income taxes), if any, imposed upon or measured by Rent. Base Rent and recurring monthly charges of Additional Rent shall be due and payable in advance on the first day of each calendar month without notice or demand, provided that the installment of Base Rent for the first full calendar month of the Term, and the first monthly installment of Additional Rent for Expenses and Taxes, shall be payable upon the execution of this Lease by Tenant. All other items of Rent shall be due and payable by Tenant on or before thirty (30) days after billing by Landlord. Rent shall be made payable to the entity, and sent to the address, Landlord designates and shall be made by good and sufficient check or by other means acceptable to Landlord. Tenant shall pay Landlord an administration fee equal to three percent (3%) of all payments of Rent that are not paid within five (5) days of the date thereof; provided, however, that the first time, if any, in any calendar year that Tenant fails timely to pay Rent, the foregoing administrative fee shall not accrue or become payable unless such failure continues for five (5) days after notice to Tenant thereof. In addition, past due Rent shall accrue interest at twelve percent (12%) per annum from the due date until actually paid. Landlord’s acceptance of less than the correct amount of Rent shall be considered a payment on account of the earliest Rent due. Rent for any partial month during the Term shall be prorated. No endorsement or statement on a check or letter accompanying payment shall be considered an accord and satisfaction. Tenant’s covenant to pay Rent is independent of every other covenant in this Lease. Tenant’s payment of Rent shall not be construed as a waiver of Tenant’s rights arising under the Lease; Tenant’s preserves all rights and remedies, including all right of offsets or abatement provided under the Lease, notwithstanding payment of Rent.

Tenant shall pay Tenant’s Pro Rata Share of Taxes and Expenses in accordance with Exhibit B of this Lease.

5. Compliance with Laws; Use.

The Premises shall be used for the Permitted Use and for no other use whatsoever. Tenant shall comply with all statutes, codes, ordinances, orders, rules and regulations of any municipal or governmental entity whether in effect now or later, including the Americans with Disabilities Act (the “Law(s)”), regarding the operation of Tenant’s business and the use, condition, configuration, and occupancy of the Premises. In addition, Tenant shall, at its sole cost and expense, promptly comply with any Laws that relate to the “Base Building” (defined below), but only to the extent such obligations are triggered by Tenant’s use of the Premises, other than for general office use, or Alterations or improvements in the Premises performed or requested by Tenant. “Base Building” shall include the structural portions of the Building, the public restrooms, and the Building mechanical, electrical and plumbing systems and equipment located in the internal core of the Building on the floor or floors on which the Premises are located. Tenant shall promptly provide Landlord with copies of any notices it receives regarding an alleged violation of Law. Tenant shall comply with the rules and regulations of the Building attached as Exhibit E and such other reasonable rules and regulations adopted by Landlord from time to time, which (a) are provided to Tenant in advance in writing, (b) do not alter the terms of this Lease, (c) do not substantially interfere with Tenant’s exercise of its rights under the Lease, and (d) are enforced in a non-discriminatory manner, including rules and regulations for the performance of Alterations (defined in Section 9). Notwithstanding anything to the contrary in

5

this Lease contained, Landlord agrees that it will not enforce any rules and regulations against Tenant in a discriminatory or arbitrary manner. In the event of a conflict between the rules and regulations for the Building and the terms of this Lease, the terms of the Lease shall control. Landlord shall use commercially reasonable efforts to enforce such rules and regulations upon the written request of Tenant. As of the date hereof, Landlord has not received notice from any governmental agencies that the Building is in violation of Title III of the Americans with Disabilities Act. Landlord hereby represents to Tenant that, to Landlord’s actual knowledge, the Building and the Property are, as of the Execution Date, in compliance with applicable Laws. Notwithstanding the foregoing, Landlord, at its sole cost and expense, shall be responsible for correcting any violations of Title III of the Americans with Disabilities Act (the “ADA”) with respect to the Premises and the Property promptly after receipt of notice of same, provided that Landlord’s obligation with respect to the Premises shall be limited to violations that exist in the Premises prior to the installation of any furniture, equipment and other personal property of Tenant. Landlord represents that Landlord has no knowledge of any outstanding violations of the ADA with respect to the Premises or the Property as of the Execution Date of this Lease. Landlord represents that, as of the Execution Date, the Premises are zoned for office use.

6. Security Deposit.

The Security Deposit shall be delivered to Landlord upon the execution of this Lease by Tenant and held by Landlord without liability for interest (unless required by Law) as security for the performance of Tenant’s obligations. The Security Deposit is not an advance payment of Rent or a measure of damages. Landlord may use all or a portion of the Security Deposit to cure any Default (defined in Section 18) by Tenant. If Landlord uses any portion of the Security Deposit, Tenant shall, within five (5) days after demand, restore the Security Deposit to its original amount. Landlord shall return any unapplied portion of the Security Deposit to Tenant within forty-five (45) days after the later to occur of: (a) determination of the final Rent due from Tenant; or (b) the later to occur of the Termination Date or the date Tenant surrenders the Premises to Landlord in compliance with Section 25. Landlord may assign the Security Deposit to a successor or transferee and, following the assignment, Landlord shall have no further liability for the return of the Security Deposit. Landlord shall not be required to keep the Security Deposit separate from its other accounts.

The Security Deposit shall be in the form of an irrevocable letter of credit (the “Letter of Credit”), which Letter of Credit shall: (a) be in the initial amount of $112,000.00; (b) be issued on the form attached hereto as Exhibit G; (c) name Landlord as its beneficiary; and (d) be drawn on an FDIC insured financial institution reasonably satisfactory to the Landlord that satisfies both the Minimum Rating Agency Threshold and the Minimum Capital Threshold (as those terms are defined below) (the “Issuing Bank”). Notwithstanding the foregoing, Landlord hereby approves Comerica Bank as the Issuing Bank. The “Minimum Rating Agency Threshold” shall mean that the Issuing Bank has outstanding unsecured, uninsured and unguaranteed senior long-term indebtedness that is then rated (without regard to qualification of such rating by symbols such as “+” or “-” or numerical notation) “Baa” or better by Xxxxx’x Investors Service, Inc. and/or “BBB” or better by Standard & Poor’s Rating Services, or a comparable rating by a comparable national rating agency designated by Landlord in its discretion. The “Minimum Capital Threshold” shall mean that the Issuing Bank has combined capital, surplus and undivided profits of not less than $10,000,000,000. The Letter of Credit (and any renewals or

6

replacements thereof) shall be for a term of not less than one (1) year. If the issuer of the Letter of Credit gives notice of its election not to renew such Letter of Credit for any additional period, Tenant shall be required to deliver a substitute Letter of Credit satisfying the conditions hereof at least thirty (30) days prior to the expiration of the term of such Letter of Credit. If the issuer of the Letter of Credit fails to satisfy either or both of the Minimum Rating Agency Threshold or the Minimum Capital Threshold, Tenant shall be required to deliver a substitute letter of credit from another issuer reasonably satisfactory to the Landlord and that satisfies both the Minimum Rating Agency Threshold and the Minimum Capital Threshold not later than ten (10) Business Days after Landlord notifies Tenant of such failure. Tenant agrees that it shall from time to time, as necessary, whether as a result of a draw on the Letter of Credit by Landlord pursuant to the terms hereof or as a result of the expiration of the Letter of Credit then in effect, renew or replace the original and any subsequent Letter of Credit so that a Letter of Credit, in the amount required hereunder, is in effect until a date which is at least sixty (60) days after the Termination Date of the Lease. If Tenant fails to furnish such renewal or replacement at least sixty (60) days prior to the stated expiration date of the Letter of Credit then held by Landlord, Landlord may draw upon such Letter of Credit and hold the proceeds thereof (and such proceeds need not be segregated) as a Security Deposit pursuant to the terms of this Section 6. Any renewal or replacement of the original or any subsequent Letter of Credit shall meet the requirements for the original Letter of Credit as set forth above, except that such replacement or renewal shall be issued by a national bank reasonably satisfactory to Landlord at the time of the issuance thereof.

If Landlord draws on the Letter of Credit as permitted in this Lease or the Letter of Credit, then, within ten (10) Business Days after notice to Tenant thereof, Tenant shall restore the amount available under the Letter of Credit to its original amount by providing Landlord with an amendment to the Letter of Credit evidencing that the amount available under the Letter of Credit has been restored to its original amount.

Subject to the remaining terms of this Section 6, and provided that no Default exists as of the effective date of the reduction of the Security Deposit (“Reduction Condition”), Tenant shall have the right to reduce the amount of the Security Deposit (i.e., the Letter of Credit) so that the reduced Letter of Credit amount will be $45,000.00 effective as of September 30, 2016. Tenant shall only have the right to reduce the Security Deposit (i.e., the Letter of Credit) if and when the Reduction Condition has been met. Any reduction in the Letter of Credit shall be accomplished by Tenant providing Landlord with a substitute letter of credit in the reduced amount whereupon Landlord shall forthwith return the Letter of Credit previously held by Landlord.

7. Building Services.

7.01. Landlord shall furnish Tenant with the following services consistent with the quality of operations of similar first-class suburban office buildings in the Boston/Metro West market area: (a) water for use in the Base Building lavatories; (b) customary heat and air conditioning in season during Building Service Hours; provided that Tenant shall have the right to receive HVAC service during hours other than Building Service Hours by paying Landlord’s then standard charge for additional HVAC service so long as Tenant requests same by written notice to Landlord not later than 12:00 noon on the Business Day preceding the day of such overtime usage; (c) standard janitorial service on Business Days in accordance with the cleaning

7

specifications attached hereto as Exhibit J; (d) elevator service; (e) electricity in accordance with the terms and conditions in Section 7.02; and (f) such other services as Landlord reasonably determines are necessary or appropriate for the Property. As of the date hereof, Landlord’s charge for after-Building Service Hours heating service is $75.00 per hour, and Landlord’s charge for after-Building Service Hours air conditioning service is $75.00 per hour, in each case for the entire Premises, subject to increase from time to time commensurate with increases to Landlord’s actual out-of-pocket costs for providing such service. Access to the Building for Tenant and its employees shall be available twenty-four (24) hours per day, seven (7) days per week, subject to the terms of this Lease and such security or monitoring systems as Landlord may reasonably impose, including, without limitation, sign-in procedures and/or presentation of identification cards.

7.02. (a) Electricity shall be distributed to the Premises either by the electric utility company selected by Landlord to provide electricity service for the Building or, at Landlord’s option, by Landlord; and Landlord shall permit Landlord’s wires and conduits, to the extent available, suitable and safely capable, to be used for such distribution. If and so long as Landlord is distributing electricity to the Premises, Tenant shall obtain all of its electricity from Landlord and shall pay all of Landlord’s charges therefor. Such charges will be based on Landlord’s actual cost of such electrical service based upon a submeter measuring usage in the Premises, which submeter shall be installed by Tenant, at Tenant’s cost, as part of the Initial Alterations (defined in Exhibit C). If the electric utility company selected by Landlord to provide electricity service for the Building is distributing electricity to the Premises, Landlord may elect to require Tenant, at its cost, to make all necessary arrangements with such electric utility company for metering and paying directly to the utility provider for electric current furnished to the Premises. All electricity used during the performance of janitorial service, or the making of any alterations or repairs in or to the Premises, or the operation of any special air conditioning system serving the Premises, shall be paid by Tenant, as and if evidenced on the reading of the submeter.

Landlord has advised Tenant that presently National Grid (the “Electric Service Provider”) is the electric utility company selected by Landlord to provide electricity service for the Building. Notwithstanding the foregoing, Landlord reserves the right at any time and from time to time before or during the Term to either contract for electric service from a different company or companies providing electricity service (each such company shall hereinafter be referred to as an “Alternative Service Provider”) or continue to contract for electricity service from the Electric Service Provider, provided such service is at commercially reasonable rates. Tenant shall cooperate with Landlord, the Electric Service Provider and any Alternative Service Provider at all times and, as reasonably necessary, shall allow Landlord, the Electric Service Provider and any Alternative Service Provider reasonable access to the Building’s electric lines, feeders, risers, wiring and other machinery within the Premises.

(b) Without the consent of Landlord, Tenant’s use of electrical service shall not exceed, either in voltage, rated capacity, use beyond Building Service Hours or overall load that which Landlord reasonably deems to be standard for the Building. Landlord shall have the right to measure electrical usage by commonly accepted methods.

8

7.03. Landlord’s failure to furnish, or any interruption, diminishment or termination of services due to the application of Laws, the failure of any equipment, the performance of repairs, improvements or alterations, utility interruptions or interference with Tenant’s access to the Premises by Landlord, its agents, contractors or employees that continues after notice to Landlord thereof, or the occurrence of an event of Force Majeure (defined in Section 26.03) (collectively a “Service Failure”) shall not render Landlord liable to Tenant, constitute a constructive eviction of Tenant, give rise to an abatement of Rent, nor relieve Tenant from the obligation to fulfill any covenant or agreement. However, if, as a result of a Service Failure that is reasonably within the control of Landlord to correct, the Premises are made untenantable or not capable of Tenant’s reasonable access for a period in excess of three (3) consecutive Business Days after Tenant notifies Landlord of the Service Failure (the “Service Failure Notice”), then Tenant, as its sole remedy, shall be entitled to receive an abatement of Rent payable hereunder during the period beginning on the fourth (4th) consecutive Business Day after delivery to Landlord of the Service Failure Notice and ending on the day the service has been restored. If the entire Premises have not been rendered untenantable by the Service Failure or if the entire Premises are not reasonably accessible by Tenant, the amount of abatement shall be equitably prorated. Notwithstanding the foregoing, if a Service Failure is reasonably within the control of Landlord and (a) continues for sixty (60) days after the Service Failure and (b) is not being diligently remedied by Landlord, then Tenant, as its sole remedy, shall have the right to elect to terminate this Lease within ten (10) days after the expiration of said sixty (60) day period without penalty, by delivering written notice to Landlord of its election thereof; provided, however, if Landlord is diligently pursuing the repair or restoration of the Service Failure, Tenant shall not be entitled to terminate the Lease but rather Tenant’s sole remedy shall be to xxxxx Rent as provided above. The foregoing termination right shall not apply if the Service Failure is due to fire or other casualty or condemnation. Instead, in such an event, the terms and provisions of Section 16 or Section 17, as the case may be, shall apply.

8. Leasehold Improvements.

All improvements in and to the Premises, including any Alterations (collectively, “Leasehold Improvements”) shall remain upon the Premises at the end of the Term without compensation to Tenant. Landlord, however, by written notice to Tenant at least thirty (30) days prior to the Termination Date, may require Tenant, at its expense, to remove (a) any Cable (defined in Section 9.01) installed by or for the benefit of Tenant for the purposes of the installation of telecommunications equipment, and (b) any Alterations that, in Landlord’s reasonable judgment, are of a nature that would require removal and repair costs that are materially in excess of the removal and repair costs associated with standard office improvements (collectively referred to as “Required Removables”). Required Removables shall include, without limitation, internal stairways, raised floors, personal restrooms and showers, vaults, rolling file systems and structural alterations and modifications. Landlord agrees that Initial Alterations shall not be Required Removables so long as such Initial Alterations are consistent with the schematic drawing/floorplan attached as Exhibit L (provided that the IT Room shown thereon will not contain a raised floor and that the library shown thereon will not contain any rolling file). The designated Required Removables shall be removed by Tenant before the Termination Date. Tenant shall repair damage caused by the installation or removal of Required Removables. If Tenant fails to perform its obligations in a timely manner, Landlord may perform such work at Tenant’s expense. Tenant, at the time it requests approval

9

for a proposed Alteration, may request in writing that Landlord advise Tenant whether the Alteration or any portion of the Alteration is a Required Removable. Within ten (10) days after receipt of Tenant’s request, Landlord shall advise Tenant in writing as to which portions of the Alteration are Required Removables. However, it is agreed that Required Removables shall not include any usual office improvements such as gypsum board, partitions, ceiling grids and tiles, fluorescent lighting panels, building standard doors and non-glued down carpeting.

9. Repairs and Alterations.

9.01. Following the Lease Commencement Date, Tenant shall periodically inspect the Premises to identify any conditions that are dangerous or in need of maintenance or repair. Tenant shall promptly provide Landlord with notice of any such conditions. Tenant shall, at its sole cost and expense, perform all maintenance and repairs to the Premises that are not Landlord’s express responsibility under this Lease, and keep the Premises in good condition and repair, reasonable wear and tear and damage by fire or other casualty or by reason of any taking by eminent domain (subject to the terms of Section 16) excepted, provided that, subject to the provisions of Section 15, Tenant shall not be responsible for repairs and maintenance to the Premises to the extent that any damage is caused by the negligence or willful acts of Landlord or Landlord’s employees, agents or contractors or other third parties over whom Tenant has neither control nor a right of control. Tenant’s repair and maintenance obligations with respect to the Premises include, without limitation, repairs and maintenance to the following: (a) floor covering; (b) interior partitions; (c) doors; (d) the interior side of demising walls; (e) electronic, phone and data cabling and related equipment that is installed by or for the exclusive benefit of Tenant (collectively, “Cable”); (f) supplemental air conditioning units, kitchens, including hot water heaters, plumbing, and similar facilities exclusively serving Tenant; and (g) Alterations. To the extent Landlord is not reimbursed by insurance proceeds under any policy that Landlord actually carries or is required to carry under this Lease, Tenant shall reimburse Landlord for the cost of repairing damage to the Building caused by the negligent or willful acts of Tenant, Tenant Related Parties and their respective contractors and vendors. If Tenant fails to make any repairs to the Premises for more than fifteen (15) days after notice from Landlord (although notice shall not be required in an emergency), Landlord may make the repairs, and Tenant shall pay the reasonable cost of the repairs, together with an administrative charge in an amount equal to five percent (5%) of the cost of the repairs.

9.02. Landlord shall keep and maintain in good repair and working order and perform maintenance upon the: (a) structural elements of the Building; (b) mechanical (including HVAC), electrical, plumbing and fire/life safety systems serving the Building in general; (c) Common Areas; (d) roof of the Building, as well as downspouts and drains; (e) exterior walls and windows of the Building; and (f) elevators serving the Building. Landlord shall promptly perform maintenance and repairs for which Landlord is responsible.

9.03. From and after the Commencement Date, and continuing throughout the Term of the Lease, Tenant shall not make alterations, repairs, additions or improvements or install any Cable (collectively referred to as “Alterations”) without first obtaining the written consent of Landlord in each instance, which consent shall not be unreasonably withheld or delayed. Landlord’s consent is solely for the benefit of Landlord, and neither Tenant nor any third party shall have the right to rely on Landlord’s consent, or its approval of Tenant’s plans, for any

10

purpose whatsoever. However, Landlord’s consent shall not be required for any Alteration that satisfies all of the following criteria (a “Cosmetic Alteration”): (a) is of a cosmetic nature such as painting, wallpapering, hanging pictures and installing carpeting; (b) is not visible from the exterior of the Premises or Building; (c) will not affect the Base Building; (d) does not require work to be performed inside the walls, below the floor, or above the ceiling of the Premises and (e) the cost of such work does not exceed Fifty Thousand and 00/100 Dollars ($50,000.00). Cosmetic Alterations shall be subject to all the other provisions of this Section 9.03. Prior to commencing Alterations (except for Alterations of a purely cosmetic nature such as painting, wallpapering, hanging pictures, and installing carpeting), Tenant shall furnish Landlord with plans and specifications; names of contractors reasonably acceptable to Landlord (provided that Landlord may designate specific contractors with respect to Base Building); required permits and approvals; evidence of contractor’s and subcontractor’s insurance in amounts reasonably required by Landlord and naming Landlord as an additional insured; and any security for performance in amounts reasonably required by Landlord. Changes to the plans and specifications must also be submitted to Landlord for its approval. Alterations shall be constructed in a good and workmanlike manner using materials of a quality reasonably approved by Landlord. Tenant shall reimburse Landlord for any reasonable sums paid by Landlord for third party examination of Tenant’s plans for non-Cosmetic Alterations. In addition, Tenant shall pay Landlord a fee for Landlord’s oversight and coordination of any Alterations other than Cosmetic Alterations equal to five percent (5%) of the cost of the Alterations. Upon completion, Tenant shall furnish “as-built” plans for all Alterations other than Cosmetic Alterations, completion affidavits and full and final waivers of lien. Landlord’s approval of an Alteration shall not be deemed a representation by Landlord that the Alteration complies with Law.

10. Entry by Landlord.

Landlord may enter the Premises to inspect, show or clean the Premises or to perform or facilitate the performance of repairs, alterations or additions to the Premises or any portion of the Building. Except in emergencies or to provide Building services, Landlord shall provide Tenant with at least forty-eight (48) hours advance notice of entry (which may be oral) and shall use reasonable efforts to minimize any interference with Tenant’s use of the Premises. Tenant shall be entitled to have an employee of Tenant accompany the person(s) entering the Premises, provided Tenant makes such employee available at the time Landlord or such other party desires to enter the Premises. If reasonably necessary, Landlord may temporarily close all or a portion of the Premises to perform repairs, alterations and additions. However, except in emergencies, Landlord will not close the Premises if the work can reasonably be completed on weekends and after Building Service Hours. Subject to the provisions of Section 7.03, 16 and 17 hereof, entry by Landlord in accordance with this Section 10 shall not constitute a constructive eviction or entitle Tenant to an abatement or reduction of Rent. Landlord may not enter the Premises to show the Premises to prospective tenants earlier than the date that is six (6) months before the expiration or prior termination of the Term of this Lease.

11. Assignment and Subletting.

11.01. Except in connection with a Permitted Transfer (defined in Section 11.04), Tenant shall not assign, sublease, transfer or encumber any interest in this Lease or allow any third party to use any portion of the Premises (collectively or individually, a “Transfer”) without the prior

11

written consent of Landlord, which consent shall not be unreasonably withheld, conditioned or delayed for more than ten (10) Business Days if Landlord does not exercise its recapture rights under Section 11.02. If Landlord refuses to consent to such Transfer, Landlord shall give written notice to Tenant setting forth in reasonable detail the reason(s) therefor. If the entity which controls the voting shares/rights of Tenant changes at any time, such change of ownership or control shall constitute a Transfer unless Tenant is an entity whose outstanding stock is listed on a recognized securities exchange or if at least eighty percent (80%) of its voting stock is owned by another entity, the voting stock of which is so listed. Any attempted Transfer in violation of this Section is voidable by Landlord. In no event shall any Transfer, including a Permitted Transfer, release or relieve Tenant from any obligation under this Lease.

11.02. Tenant shall provide Landlord with financial statements for the proposed transferee, a fully executed copy of the proposed assignment, sublease or other Transfer documentation and such other information as Landlord may reasonably request. Within fifteen (15) Business Days after receipt of the required information and documentation, Landlord shall either: (a) consent to the Transfer by execution of a consent agreement in a form reasonably designated by Landlord; (b) reasonably refuse to consent to the Transfer in writing; or (c) in the event of an assignment of this Lease or subletting of more than twenty percent (20%) of the Rentable Area of the Premises for substantially all of the remaining Term (excluding unexercised options), recapture the portion of the Premises that Tenant is proposing to Transfer. If Landlord exercises its right to recapture, this Lease shall automatically be amended (or terminated if the entire Premises is being assigned or sublet) to delete the applicable portion of the Premises effective on the proposed effective date of the Transfer. Tenant shall pay Landlord Landlord’s out-of-pocket fees in connection with any review of a Permitted Transfer or requested Transfer, not to exceed $2,500.00, provided that the Permitted Transfer or Transfer, as the case may be, does not require amendment to the terms of the Lease.

11.03. Except in connection with a Permitted Transfer (hereinafter defined), Tenant shall pay Landlord fifty percent (50%) of all rent and other consideration which Tenant receives as a result of a Transfer that is in excess of the Rent payable to Landlord for the portion of the Premises and Term covered by the Transfer. Tenant shall pay Landlord for Landlord’s share of the excess within thirty (30) days after Tenant’s receipt of the excess. Tenant may deduct from the excess, on a straight-line basis, all reasonable and customary expenses, including, without limitation, brokerage fees, legal fees, free rent and any tenant improvement allowance directly incurred by Tenant attributable to the Transfer. If Tenant is in Default, Landlord may require that all sublease payments be made directly to Landlord, in which case Tenant shall receive a credit against Rent in the amount of Tenant’s share of payments received by Landlord.

11.04. Tenant may assign this Lease to a successor to Tenant by purchase, merger, consolidation or reorganization (an “Ownership Change”) or assign this Lease or sublet all or a portion of the Premises to an Affiliate without the consent of Landlord and without giving Landlord a recapture right pursuant to Section 11.02 above, provided that all of the following conditions are satisfied (a “Permitted Transfer”): (a) Tenant is not in Default beyond applicable notice and cure periods; (b) in the event of an Ownership Change, Tenant’s successor shall own substantially all of the assets of Tenant and have a net worth which is at least equal to Tenant’s net worth as of the day prior to the proposed Ownership Change; (c) the Permitted Use does not allow the Premises to be used for retail purposes; and (d) Tenant shall give Landlord written

12

notice at least fifteen (15) Business Days prior to the effective date of the Permitted Transfer to the extent the same is not prohibited by applicable law or any confidentiality agreement to which Tenant is a party (in which event Tenant shall notify Landlord immediately after the effective date of any such transfer). Tenant’s notice to Landlord shall include information and documentation evidencing the Permitted Transfer and showing that each of the above conditions has been satisfied. If requested by Landlord, Tenant’s successor shall sign a commercially reasonable form of assumption agreement. “Affiliate” shall mean an entity controlled by, controlling or under common control with Tenant (for such period of time as such entity continues to be controlled by, controlling or under common control with Tenant, it being agreed that the subsequent sale or transfer of stock resulting in a change in voting control, or any other transaction(s) having the overall effect that such entity ceases to be controlled by, controlling or under common control with Tenant, shall be treated as if such sale or transfer or transaction(s) were, for all purposes, an assignment of this Lease governed by the provisions of this Section 11).

12. Liens.

Tenant shall not permit mechanics’ or other liens to be placed upon the Property, Premises or Tenant’s leasehold interest in connection with any work or service done or purportedly done by or for the benefit of Tenant or its transferees. Tenant shall give Landlord notice at least fifteen (15) days prior to the commencement of any Alterations in the Premises to afford Landlord the opportunity, where applicable, to post and record notices of non-responsibility. Tenant, within ten (10) days of notice from Landlord, shall fully discharge any lien by settlement, by bonding or by insuring over the lien in the manner prescribed by the applicable lien Law. If Tenant fails to do so, Landlord may bond, insure over or otherwise discharge the lien. Tenant shall reimburse Landlord for any amount paid by Landlord, including, without limitation, reasonable attorneys’ fees. Landlord shall have the right to require Tenant to post a performance or payment bond in connection with any Alterations other than Initial Alterations (provided that the same are performed by either X. Xxxxxx & Associates or Landlord’s construction manager) done or purportedly done by or for the benefit of Tenant if the cost of such work exceeds $200,000.00. Tenant acknowledges and agrees that all such work or service is being performed for the sole benefit of Tenant and not for the benefit of Landlord.

13. Indemnity and Waiver of Claims.

Tenant hereby waives all claims against and releases Landlord and its trustees, members, principals, beneficiaries, partners, officers, directors, employees, Mortgagees (defined in Section 23) and agents (the “Landlord Related Parties”) from all claims for damage to property or business loss in any manner related to (a) Force Majeure, (b) acts of third parties claiming by or through Tenant other than any agent or contractor of Landlord, (c) the bursting or leaking of any tank, water closet, drain or other pipe, unless due to or arising out of the gross negligence or willful misconduct of the Landlord or any of Landlord’s contractors, employees, or agents, (d) the inadequacy or failure of any security services, personnel or equipment, unless due to or arising out of the gross negligence or willful misconduct of the Landlord or any of Landlord’s contractors, employees, or agents, or (e) any matter not within the reasonable control of Landlord or Landlord’s employees or agents. Notwithstanding the foregoing, except as provided in Section 15 to the contrary, Tenant shall not be required to waive any claims against Landlord for

13

damage to property or business loss where such loss or damage is due to the gross negligence or willful misconduct of Landlord, Landlord Related Parties or Landlord’s contractors or agents. Except to the extent caused by the negligence or willful misconduct of Landlord or any of Landlord’s contractors, employees, or agents, Tenant shall indemnify, defend and hold Landlord and Landlord Related Parties harmless against and from all liabilities, obligations, damages, penalties, claims, actions, and reasonable costs, charges and expenses, including, without limitation, reasonable attorneys’ fees and other reasonable professional fees (if and to the extent permitted by Law) (collectively referred to as “Losses”), which may be imposed upon, incurred by or asserted against Landlord or any of the Landlord Related Parties by any third party and arising out of or in connection with any damage or injury occurring in the Premises or any acts or omissions (including violations of Law) of Tenant, the Tenant Related Parties or any of Tenant’s transferees, contractors, licensees, employees or agents. Except to the extent caused by the negligence or willful misconduct of Tenant or any Tenant Related Parties or any of Tenant’s transferees, contractors, licensees, employees or agents, Landlord shall indemnify, defend and hold Tenant, its trustees, members, principals, beneficiaries, partners, officers, directors, and employees (“Tenant Related Parties”) harmless against and from all Losses which may be imposed upon, incurred by or asserted against Tenant or any of the Tenant Related Parties by any third party and arising out of or in connection with the acts or omissions (including violations of Law) of Landlord, the Landlord Related Parties or any of Landlord’s contractors, employees or agents. Nothing herein shall be construed as to diminish the repair and maintenance obligations of Landlord contained elsewhere in this Lease or Tenant’s rights under Section 7.03. Any obligations under this Section 13 shall survive the expiration or sooner termination of the Term of this Lease. The provisions of this Section 13 shall be subject to the provisions of Section 15 below.

14. Insurance.

(a) Tenant’s Insurance. Tenant shall obtain, and shall keep in full force and effect, the following insurance, with insurers that are authorized to do business in the Commonwealth of Massachusetts and are rated at least A (Class X) in Best’s Key Rating Guide:

(i) Commercial General Liability Insurance, which shall include premises liability, contractual liability covering Tenant’s indemnity obligations under this Lease (to the extent covered as an Insured Contract in a standard ISO GCL Policy), fire legal liability, personal & advertising injury and products/completed operations coverage. Policy shall insure against claims for bodily injury, personal injury, death or property damage occurring on, in or about the Premises with limits of not less than $1,000,000.00 per occurrence and $2,000,000.00 in the aggregate. If the policy covers other locations owned or leased by Tenant, then such policy must include an aggregate limit per location endorsement.

(ii) Special Form (“All Risk”) Property, insuring all equipment, trade fixtures, inventory, fixtures and personal property (“Tenant’s Property”) and any Alterations or other Leasehold Improvements which are the responsibility of Tenant, located on or in the Premises with an agreed amount endorsement and equal to the full replacement cost value of such property.

14

(iii) Workers’ Compensation Insurance as required by applicable laws of the State in which the Premises is located, including Employers’ Liability Insurance with limits of not less than: (x) $100,000 per accident; (y) $500,000 disease, policy limit; and (z) $100,000 disease, each employee.

(iv) Business Interruption Insurance with limits of not less than the amount necessary to cover continuing expenses including rents and extra expenses for at least one (1) year; provided that Tenant may elect not to carry business interruption insurance, but in any event Tenant releases Landlord from any and all liability arising during the Lease Term which would have been covered by business interruption insurance had Tenant carried such insurance.

(v) Excess or Umbrella Liability Insurance with limits of not less than Two Million Dollars ($2,000,000.00) per occurrence and in the aggregate providing coverage excess and follow-form of the primary general and employer’s liability insurances required hereinto.

(vi) Such other insurance as Landlord reasonably deems necessary and prudent, provided that such other insurance is then customarily required to be carried by tenants of buildings similar to the Building in the Boston/Metro West market area, or as may be required in writing by any Mortgagee (defined below), but only to the extent such Mortgagee has the contractual right to require same under its mortgage or related loan documents.

(vii) In addition to the above aforementioned insurances, and during any such time as any alterations or work is being performed at the Premises (except that work being performed by the Landlord or on behalf of Landlord) Tenant, at its sole cost and expense, shall carry, or shall cause to be carried and shall deliver to Landlord at least ten (10) days prior to commencement of any such alteration or work, evidence of insurance with respects to (a) workers compensation insurance covering all persons employed in connection with the proposed alteration or work in statutory limits, (b) general/excess liability insurance, in an amount commensurate with the work to be performed but not less than Two Million Dollars ($2,000,000) per occurrence and in the aggregate, for ongoing and completed operations insuring against bodily injury and property damage and naming all additional insured parties as outlined below and required of Tenant and shall include a waiver of subrogation in favor of such parties, (c) builders risk insurance, to the extent such alterations or work may require, on a completed value form including permission to occupy, covering all physical loss or damages, in an amount and kind reasonable

15

satisfactory to Landlord, and (d) such other insurance, in such amounts, as Landlord deems reasonably necessary to protect Landlord’s interest in the Premises from any act or omission of Tenant’s contactors or subcontractors, provided that such other insurance is then customarily required to be carried by tenants of buildings similar to the Building in the Boston/Metro West market area.

(b) Policy Requirements. The policies of insurance required to be maintained by Tenant pursuant to this Section 14 must be reasonably satisfactory to Landlord and must be written as primary policy coverage and not contributing with, or in excess of, any coverage carried by Landlord. All policies must name Tenant as the named insured party (it is understood and agreed that Tenant’s parent company may be first named insured on various policies, but that coverage extends to the interest of Tenant) and (except for worker’s compensation and property insurance) all policies shall name as additional insureds for on-going and completed operations, Landlord, Normandy Real Estate Partners, LLC, Normandy Real Estate Management Co., LLC, the Mortgagees under any Mortgage defined below, and all of their respective affiliates, members, officers, employees, agents and representatives, managing agents, and other designees of Landlord and its successors as the interest of such designees shall appear. In addition Tenant agrees and shall provide thirty (30) days’ prior written notice of suspension, cancellation, termination, or non-renewal of coverage to Landlord. Tenant shall not self-insure for any insurance coverage required to be carried by Tenant under this Lease. The deductible for any insurance policy required hereunder must not exceed $10,000.00. Tenant shall have the right to provide the insurance coverage required under this Lease through a blanket policy, provided such blanket policy expressly affords coverage to the Premises and to Landlord as required by this Lease.

(c) Certificates of Insurance. Prior to the Commencement Date, Tenant shall deliver to Landlord certificates of insurance evidencing all insurance Tenant is obligated to carry under this Lease, together with a copy of the endorsement(s), specifically but not limited to Waiver of Rights to Recover From Others, Additional Insureds (on-going and completed operations) and Contractual Liability endorsements. Prior to the expiration of any such insurance, Tenant shall deliver to Landlord certificates of insurance evidencing the renewal of such insurance. Tenant’s certificates of insurance must be on: (i) Xxxxx Form 27 with respect to property insurance; and (ii) Xxxxx Form 25-S with respect to liability insurance or, in each case, on successor forms approved by Landlord, and in any event state as the certificate holder: Compliance Services Corporation, on behalf of Normandy Real Estate Partners, LLC, X.X. Xxx 0000, Xxxxxxxxxx Xxxxxxx, XX 00000.

(d) No Separate Insurance. Tenant shall not obtain or carry separate insurance concurrent in form or contributing in the event of loss with that required by Section 14(a) unless Landlord is named as an additional insured therein.

(e) Tenant’s Failure to Maintain Insurance. If Tenant fails to maintain the insurance required by this Lease, Landlord may, but shall not be obligated to, obtain, and pay the premiums for, such insurance. Upon demand, Tenant shall pay to Landlord all amounts paid by Landlord pursuant to this Section 14(e).

16

(f) Landlord’s Insurance. Landlord, shall at all times during the Term of this Lease procure and keep in force (i) commercial general liability insurance covering the Common Areas and Landlord’s indemnity obligations through contractual liability coverage set forth within at limits no less than those required by Landlord’s mortgagee and, (ii) Special Form “All Risk” property insurance covering the full replacement cost of the Building with no coinsurance limitation and including all coverages and perils as required by Landlord’s mortgagee. Landlord agrees promptly to notify tenant of any cancellation or non-renewal of any such required policy except to the extent that simultaneously therewith Landlord obtains replacement coverage satisfying the foregoing requirements.

15. Subrogation.

Landlord and Tenant agree to have all property insurance policies which are required to be carried by either of them hereunder endorsed to provide that the insurer waives all rights of subrogation which such insurer might have against the other party and Landlord’s mortgagee, if any. By this clause, the parties intend and hereby agree that the risk of loss or damage to property shall be borne by the parties’ insurance carriers. It is hereby agreed that Landlord and Tenant shall look solely to, and seek recovery from, only their respective insurance carriers in the event a loss is sustained for which Property Insurance is carried or is required to be carried under this Lease. Without limiting any release or waiver of liability or recovery contained in any other Section of this Lease but rather in confirmation and furtherance thereof, Landlord waives all claims for recovery from Tenant, and Tenant waives all claims for recovery from Landlord, and their respective agents, partners and employees, for any loss or damage to any of its property insured under the insurance policies required hereunder including but not limited to any business interruption, loss of income or special, indirect or consequential damages. The provisions of this Section 15 will survive the expiration or earlier termination of this Lease.

16. Casualty Damage.

If all or any portion of the Premises becomes untenantable by fire or other casualty to the Premises (collectively a “Casualty”), Landlord within forty-five (45) days after the occurrence of the Casualty shall cause a general contractor selected by Landlord to provide Landlord and Tenant with a good faith written estimate of the amount of time required using standard working methods to Substantially Complete the repair and restoration of the Premises and any Common Areas necessary to provide access to the Premises (“Completion Estimate”). If the Completion Estimate indicates that the Premises or any Common Areas necessary to provide access to the Premises cannot be made tenantable within two hundred ten (210) days from the date of the Casualty, then either party shall have the right to terminate this Lease upon written notice to the other within ten (10) days after receipt of the Completion Estimate. Tenant, however, shall not have the right to terminate this Lease if the Casualty was caused by the negligence or intentional misconduct of Tenant or any Tenant Related Parties. In addition, Landlord, by notice to Tenant within ninety (90) days after the date of the Casualty, shall have the right to terminate this Lease if: (1) the Premises have been materially damaged and there is less than two (2) years of the Term remaining on the date of the Casualty; (2) any Mortgagee requires that the insurance proceeds be applied to the payment of the mortgage debt; or (3) a material uninsured loss to the Building occurs.

17

16.01 If this Lease is not terminated, Landlord shall promptly and diligently, subject to reasonable delays for insurance adjustment or other matters beyond Landlord’s reasonable control, restore the Premises and Common Areas. Such restoration shall be to substantially the same condition that existed prior to the Casualty, except for modifications required by Law or any other modifications to the Common Areas deemed desirable by Landlord. Landlord shall not be liable for any inconvenience to Tenant, or injury to Tenant’s business resulting in any way from the Casualty or the repair thereof. The Rent shall xxxxx for the portion of the Premises that is untenantable and not used by Tenant for such period of time as the Premises or such portion shall be untenantable. In addition to Landlord’s right to terminate as provided herein, Tenant shall have the right to terminate this Lease if: (a) a substantial portion of the Premises has been damaged by fire or other Casualty and such damage cannot reasonably be repaired within sixty (60) days after receipt of the Completion Estimate; (b) there is less than one (1) year of the Term remaining on the date of such Casualty; (c) the Casualty was not caused by the negligence or willful misconduct of Tenant or its agents, employees or contractors; and (d) Tenant provides Landlord with written notice of its intent to terminate within thirty (30) days after Tenant’s receipt of the Completion Estimate. Notwithstanding the foregoing, if Tenant was entitled to but elected not to exercise its right to terminate the Lease and Landlord does not substantially complete the repair and restoration of the Premises within thirty (30) days after the expiration of the estimated period of time set forth in the Completion Estimate, which period shall be extended (but not by more than thirty (30) days in the aggregate) to the extent of any Reconstruction Delays (hereinafter defined), then Tenant may terminate this Lease by written notice to Landlord within 15 days after the expiration of such period, as the same may be extended. For purposes of this Lease, the term “Reconstruction Delays” shall mean: (i) any delays caused by the insurance adjustment process; (ii) any delays caused by Tenant (that Tenant does not cure within one (1) day after written notice to Tenant identifying the delay); and (iii) any delays caused by events of Force Majeure. If Tenant so elects, then this Lease shall terminate on the date that is thirty (30) days after Tenant delivers such termination notice to Landlord, with the same force and effect as if such day were the last day of the Term of the Lease, unless Landlord substantially completes such restoration on or before the expiration of such thirty (30) day period, in which event Tenant’s election to terminate shall become void.

17. Condemnation.

Either party may terminate this Lease if any material part of the Premises is taken or condemned for any public or quasi public use under Law, by eminent domain or private purchase in lieu thereof (a “Taking”), Landlord shall also have the right to terminate this Lease if there is a Taking of any portion of the Building or Property which would have a material adverse effect on Landlord’s ability to profitably operate the remainder of the Building. The terminating party shall provide written notice of termination to the other party within forty-five (45) days after it first receives notice of the Taking. The termination shall be effective on the date the physical taking occurs. If this Lease is not terminated, Base Rent and Tenant’s Pro Rata Share shall be appropriately adjusted to account for any reduction in the square footage of the Building or Premises. All compensation awarded for a Taking shall be the property of Landlord. The right to receive compensation or proceeds are expressly waived by Tenant, however, Tenant may file a separate claim for Tenant’s Property, the unamortized cost (amortized over the initial Term of this Lease) of the Initial Alterations, net of the Allowance and Tenant’s reasonable relocation expenses, provided the filing of the claim does not diminish the amount of Landlord’s award. If only a part of the Premises is subject to a Taking and this Lease is not terminated, Landlord, with reasonable diligence, will restore the remaining portion of the Premises and the Property as nearly as practicable to the condition immediately prior to the Taking.

18

18. Events of Default.

Each of the following occurrences shall be a “Default”: (a) Tenant’s failure to pay any portion of Rent when due, if the failure continues for ten (10) days after written notice to Tenant (“Monetary Default”); (b) Tenant’s failure (other than a Monetary Default) to comply with any term, provision, condition or covenant of this Lease, if the failure is not cured within thirty (30) days after written notice to Tenant provided, however, if Tenant’s failure to comply cannot reasonably be cured within thirty (30) days, Tenant shall be allowed additional time (not to exceed ninety (90) days) as is reasonably necessary to cure the failure so long as Tenant begins the cure within ten (10) days after such notice to Tenant and diligently pursues the cure to completion; (c) Tenant or any Guarantor becomes insolvent, makes a transfer in fraud of creditors, makes an assignment for the benefit of creditors, admits in writing its inability to pay its debts when due or forfeits or loses its right to conduct business; (d) the leasehold estate is taken by process or operation of Law; or (e) in the case of any ground floor or retail Tenant, Tenant does not take possession of or abandons or vacates all or any portion of the Premises. All notices sent under this Section shall be in satisfaction of, and not in addition to, notice required by Law.

19. Remedies.

19.01 Upon Default, Landlord shall have the right to pursue any one or more of the following remedies:

(a) Terminate this Lease, in which case Tenant shall immediately surrender the Premises to Landlord. If Tenant fails to surrender the Premises, Landlord, in compliance with Law, may enter upon and take possession of the Premises and remove Tenant, Tenant’s Property and any party occupying the Premises. Tenant shall pay Landlord, on demand, all past due Rent and other losses and damages Landlord suffers as a result of Tenant’s Default, including, without limitation, all Costs of Reletting (defined below) and any deficiency that may arise from reletting or the failure to relet the Premises. “Costs of Reletting” shall include all reasonable costs and expenses incurred by Landlord in reletting or attempting to relet the Premises, including, without limitation, reasonable legal fees, brokerage commissions, the cost of alterations and the value of other commercially reasonable concessions or allowances granted to a new tenant.

(b) Terminate Tenant’s right to possession of the Premises and, in compliance with Law, remove Tenant, Tenant’s Property and any parties occupying the Premises. Landlord may (but, except as expressly provided below, shall not be obligated to) relet all or any part of the Premises, without notice to Tenant, for such period of time and on such terms and conditions (which may include concessions, free rent and work allowances) as Landlord in its absolute discretion shall determine. Landlord may collect and receive all rents and other income from the reletting. Tenant shall pay Landlord on demand all past due Rent, all Costs of Reletting and any deficiency arising from the reletting or failure to relet the Premises. The re-entry or taking of

19

possession of the Premises shall not be construed as an election by Landlord to terminate this Lease. Landlord shall use reasonable efforts to relet the Premises on such terms as Landlord in its sole discretion may determine (including a term different from the Term, rental concessions, and alterations to, and improvement of, the Premises). Landlord shall not be liable for, nor shall Tenant’s obligations hereunder be diminished because of, Landlord’s failure to relet the Premises or to collect rent due for such reletting. Marketing of Tenant’s Premises in a manner similar to the manner in which Landlord markets other premises within Landlord’s control in the Building shall be deemed to have satisfied Landlord’s obligation to use “reasonable efforts.” In no event shall Landlord be required to (i) solicit or entertain negotiations with any other prospective tenants for the Premises until Landlord obtains full and complete possession of the Premises including, without limitation, the final and unappealable legal right to re-let the Premises free of any claim of Tenant, (ii) relet the Premises before leasing other vacant space in the Building, (iv) lease the Premises for a rental less than the current fair market rental then prevailing for similar office space in the Building, or (iv) enter into a lease with any proposed tenant that does not have, in Landlord’s reasonable opinion, sufficient financial resources or operating experience to operate the Premises in a first-class manner.

19.02 In lieu of calculating damages under Section 19.01, Landlord may elect to calculate damages as the sum of (a) all Rent accrued through the date of termination of this Lease or Tenant’s right to possession, and (b) an amount equal to the total Rent that Tenant would have been required to pay for the remainder of the Term discounted to present value, minus the then present fair rental value of the Premises for the remainder of the Term, similarly discounted, after deducting all anticipated Costs of Reletting. If Tenant is in Default of any of its non-monetary obligations under the Lease, Landlord shall have the right to perform such obligations. Tenant shall reimburse Landlord for the cost of such performance upon demand together with an administrative charge equal to ten percent (10%) of the cost of the work performed by Landlord. The repossession or re-entering of all or any part of the Premises shall not relieve Tenant of its liabilities and obligations under this Lease. No right or remedy of Landlord shall be exclusive of any other right or remedy. Each right and remedy shall be cumulative and in addition to any other right and remedy now or subsequently available to Landlord at Law or in equity.

20. Limitation of Liability.

NOTWITHSTANDING ANYTHING TO THE CONTRARY CONTAINED IN THIS LEASE, THE LIABILITY OF LANDLORD (AND OF ANY SUCCESSOR LANDLORD) SHALL BE LIMITED TO LANDLORD’S INTEREST IN THE PROPERTY FOR THE RECOVERY OF ANY JUDGMENT OR AWARD AGAINST LANDLORD OR ANY LANDLORD RELATED PARTY. NEITHER LANDLORD NOR ANY LANDLORD RELATED PARTY SHALL BE PERSONALLY LIABLE FOR ANY JUDGMENT OR DEFICIENCY, AND IN NO EVENT SHALL LANDLORD OR ANY LANDLORD RELATED PARTY BE LIABLE TO TENANT FOR ANY LOST PROFIT, DAMAGE TO OR LOSS OF BUSINESS OR ANY FORM OF SPECIAL, INDIRECT OR CONSEQUENTIAL DAMAGE. BEFORE FILING SUIT FOR AN ALLEGED DEFAULT BY LANDLORD, TENANT SHALL GIVE LANDLORD AND THE MORTGAGEE(S) WHOM TENANT HAS BEEN NOTIFIED HOLD MORTGAGES (DEFINED IN SECTION 23 BELOW), NOTICE AND REASONABLE TIME TO CURE THE ALLEGED DEFAULT(WHICH SHALL NOT EXCEED 60 DAYS).

20

WITHOUT LIMITING THE FOREGOING, IN NO EVENT SHALL LANDLORD OR ANY MORTGAGEES OR LANDLORD RELATED PARTIES EVER BE LIABLE FOR ANY CONSEQUENTIAL OR INCIDENTAL DAMAGES OR ANY LOST PROFITS OF TENANT. ADDITIONALLY, IN NO EVENT SHALL TENANT OR ANY TENANT RELATED PARTIES EVER BE LIABLE FOR ANY SPECIAL, INDIRECT, CONSEQUENTIAL OR INCIDENTAL DAMAGES OR ANY LOST PROFITS OF LANDLORD OR ANY LANDLORD RELATED PARTY. THE FOREGOING SHALL NOT LIMIT LANDLORD’S RIGHT TO RECOVER DAMAGES IN ACCORDANCE WITH SECTION 22 HEREOF AS A RESULT OF THE HOLDOVER BY TENANT IN THE PREMISES BEYOND THE TERM OF THE LEASE.

LANDLORD AND TENANT EXPRESSLY DISCLAIM ANY IMPLIED WARRANTY THAT THE PREMISES ARE SUITABLE FOR TENANT’S INTENDED COMMERCIAL PURPOSE, AND, EXCEPT AS EXPRESSLY PROVIDED IN THIS LEASE, TENANT’S OBLIGATION TO PAY RENT HEREUNDER IS NOT DEPENDENT UPON THE CONDITION OF THE PREMISES OR THE PERFORMANCE BY LANDLORD OF ITS OBLIGATIONS HEREUNDER, AND, EXCEPT AS OTHERWISE EXPRESSLY PROVIDED HEREIN, TENANT SHALL CONTINUE TO PAY THE RENT, WITHOUT ABATEMENT, SETOFF OR DEDUCTION, NOTWITHSTANDING ANY BREACH BY LANDLORD. OF ITS DUTIES OR OBLIGATIONS HEREUNDER, WHETHER EXPRESS OR IMPLIED FOR PURPOSES HEREOF, “INTEREST OF LANDLORD IN THE PROPERTY” SHALL INCLUDE RENTS DUE FROM TENANTS, INSURANCE PROCEEDS, AND PROCEEDS FROM CONDEMNATION OR EMINENT DOMAIN PROCEEDINGS (PRIOR TO THE DISTRIBUTION OF SAME TO ANY PARTNER OR SHAREHOLDER OF LANDLORD OR ANY OTHER THIRD PARTY).

NO TENANT RELATED PARTY (OTHER THAN TENANT ITSELF) SHALL BE PERSONALLY LIABLE FOR ANY OBLIGATIONS OF TENANT UNDER THIS LEASE.

21. Intentionally Omitted.

22. Holding Over.

If Tenant fails to surrender all or any part of the Premises at the termination of this Lease, occupancy of the Premises after termination shall be that of a tenancy at sufferance. Tenant’s occupancy shall be subject to all the terms and provisions of this Lease, and Tenant shall pay an amount (on a per month basis without reduction for partial months during the holdover) equal to one hundred fifty percent (150%) of the Base Rent plus 100% of Additional Rent due for the period immediately preceding the holdover. No holdover by Tenant or payment by Tenant after the termination of this Lease shall be construed to extend the Term or prevent Landlord from immediate recovery of possession of the Premises by summary proceedings or otherwise. If Landlord is unable to deliver possession of the Premises to a new tenant or to perform improvements for a new tenant as a result of Tenant’s holdover for more than sixty (60) days, Tenant shall be liable for all damages that Landlord suffers from the holdover.

21

23. Subordination to Mortgages; Estoppel Certificate.

Tenant accepts this Lease subordinate to any mortgage(s), deed(s) of trust, ground lease(s) or other lien(s) now or subsequently arising upon the Premises, the Building or the Property, and to renewals, modifications, refinancings and extensions thereof (collectively referred to as a “Mortgage”). The party having the benefit of a Mortgage shall be referred to as a “Mortgagee”. This clause shall be self-operative, but upon request from a Mortgagee, Tenant shall execute a commercially reasonable subordination agreement in favor of the Mortgagee. As an alternative, a Mortgagee shall have the right at any time to subordinate its Mortgage to this Lease. Upon request, Tenant, without charge, shall attorn to any successor to Landlord’s interest in this Lease, provided, however, that the subordination of this Lease to any mortgage or ground lease entered into after the date of this Lease shall be upon the express condition that so long as Tenant is not in Default of the Lease beyond applicable notice and cure periods, Tenant’s possession and enjoyment of the Premises and Tenant’s rights under this Lease shall not be disturbed or interfered with in the event of a foreclosure of such mortgage or lease or the exercise of any rights thereunder. Landlord and Tenant shall each, within ten (10) days after receipt of a written request from the other, execute and deliver a commercially reasonable estoppel certificate to those parties as are reasonably requested by the other (including a Mortgagee or prospective purchaser). Without limitation, such estoppel certificate may include a certification as to the status of this Lease, the existence of any Defaults and the amount of Rent that is due and payable.

Notwithstanding the foregoing, Landlord shall use commercially reasonable efforts to obtain a non-disturbance, subordination and attornment agreement (“SNDA”) from Landlord’s current Mortgagee on such Mortgagee’s current standard form of agreement, a copy of which is attached hereto as Exhibit H. Upon request of Landlord, Tenant will execute the Mortgagee’s form of SNDA and return the same to Landlord for execution by the Mortgagee. Landlord’s failure to obtain an SNDA for Tenant shall have no effect on the rights, obligations and liabilities of Landlord and Tenant or be considered to be a Default by Landlord or Tenant hereunder.

24. Notice.

All demands, approvals, consents or notices (collectively referred to as a “notice”) shall be in writing and delivered by hand or sent by registered or certified mail with return receipt requested or sent by overnight or same day courier service at the party’s respective Notice Addresses set forth in Section 1. Each notice shall be deemed to have been received on the earlier to occur of actual delivery or the date on which delivery is refused, or, if Tenant has vacated the Premises or any other Notice Address of Tenant without providing a new Notice Address, three (3) days after notice is deposited in the U.S. mail or with a courier service in the manner described above. Either party may, at any time, change its Notice Address (other than to a post office box address) by giving the other party written notice of the new address.

25. Surrender of Premises.

At the termination of this Lease or Tenant’s right of possession, Tenant shall remove Tenant’s Property from the Premises, and quit and surrender the Premises to Landlord, broom clean, and in good order, condition and repair, ordinary wear and tear and damage which Landlord is obligated to repair hereunder excepted. If Tenant fails to remove any of Tenant’s Property within two (2) days after termination of this Lease or Tenant’s right to possession,

22

Landlord, at Tenant’s sole cost and expense, shall be entitled (but not obligated) to remove and store Tenant’s Property. Landlord shall not be responsible for the value, preservation or safekeeping of Tenant’s Property. Tenant shall pay Landlord, upon demand, the expenses and storage charges incurred. If Tenant fails to remove Tenant’s Property from the Premises or storage, within thirty (30) days after notice, Landlord may deem all or any part of Tenant’s Property to be abandoned and title to Tenant’s Property shall vest in Landlord.

26. Miscellaneous.

26.01 This Lease shall be interpreted and enforced in accordance with the Laws of the state or commonwealth in which the Building is located and Landlord and Tenant hereby irrevocably consent to the jurisdiction and proper venue of such state or commonwealth. If any term or provision of this Lease shall to any extent be void or unenforceable, the remainder of this Lease shall not be affected. If there is more than one Tenant or if Tenant is comprised of more than one party or entity, the obligations imposed upon Tenant shall be joint and several obligations of all the parties and entities, and requests or demands from any one person or entity comprising Tenant shall be deemed to have been made by all such persons or entities. Notices to any one person or entity shall be deemed to have been given to all persons and entities. Tenant represents and warrants to Landlord that each individual executing this Lease on behalf of Tenant is authorized to do so on behalf of Tenant and that Tenant is not, and the entities or individuals constituting Tenant or which may own or control Tenant or which may be owned or controlled by Tenant are not, among the individuals or entities identified on any list compiled pursuant to Executive Order 13224 for the purpose of identifying suspected terrorists.

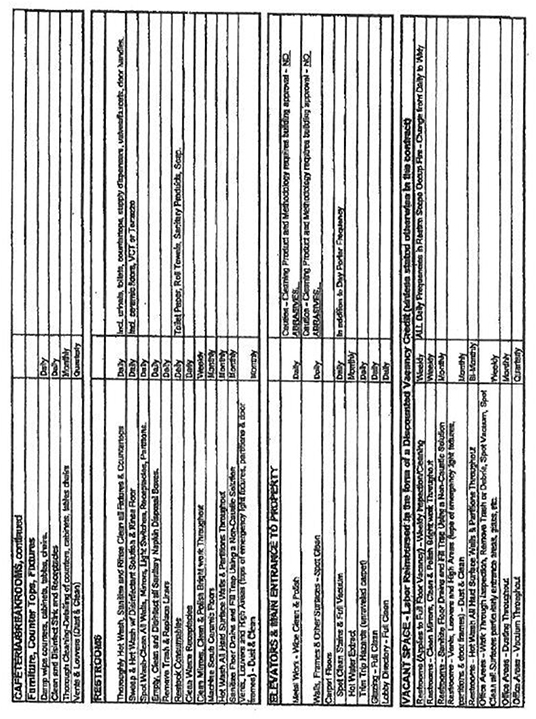

26.02 If either party institutes a suit against the other for violation of or to enforce any covenant, term or condition of this Lease, the prevailing party shall be entitled to all of its costs and expenses, including, without limitation, reasonable attorneys’ fees. Landlord and Tenant hereby waive any right to trial by jury in any proceeding based upon a breach of this Lease. Either party’s failure to declare a Default immediately upon its occurrence, or delay in taking action for a Default, shall not constitute a waiver of the Default, nor shall it constitute an estoppel.