SHARE SUBSCRIPTION AND PURCHASE AGREEMENT BETWEEN RELIANCE STRATEGIC BUSINESS VENTURES LIMITED as the “Investor” AND SANMINA CORPORATION as “Sanmina Corp” AND SANMINA SCI INDIA PRIVATE LIMITED as the “Company” AND SANMINA-SCI SYSTEMS SINGAPORE PTE LTD...

EXHIBIT 10.39

The portions of this exhibit marked with “[***]” have been excluded in accordance with Item 601(b)(10)(iv) of Regulation S-K under the Securities Act of 1933 because they are both not material and would like cause competitive harm to the registrant if publicly disclosed.

BETWEEN

RELIANCE STRATEGIC BUSINESS VENTURES LIMITED

as the “Investor”

AND

SANMINA CORPORATION

as “Sanmina Corp”

AND

SANMINA SCI INDIA PRIVATE LIMITED

as the “Company”

AND

SANMINA-SCI SYSTEMS SINGAPORE PTE LTD

as “Sanmina Singapore”

AND

AET HOLDINGS LIMITED

as “Sanmina AET”

EMEA: 1748612-11 | ||

TABLE OF CONTENTS

1. DEFINITIONS AND INTERPRETATION | 2 | ||||

2. TRANSACTION | 20 | ||||

3. CONDITIONS PRECEDENT | 21 | ||||

4. CONDUCT OF BUSINESS PRIOR TO CLOSING | 23 | ||||

5. CLOSING ACTIONS | 31 | ||||

6. POST CLOSING ACTIONS | 34 | ||||

7. WARRANTIES | 38 | ||||

8. INDEMNIFICATION | 39 | ||||

9. CONFIDENTIALITY | 44 | ||||

10. TERM AND TERMINATION | 46 | ||||

11. GOVERNING LAW | 47 | ||||

12. DISPUTE RESOLUTION | 47 | ||||

13. MISCELLANEOUS | 48 | ||||

Schedule 1: SHAREHOLDING PATTERN | 1 | ||||

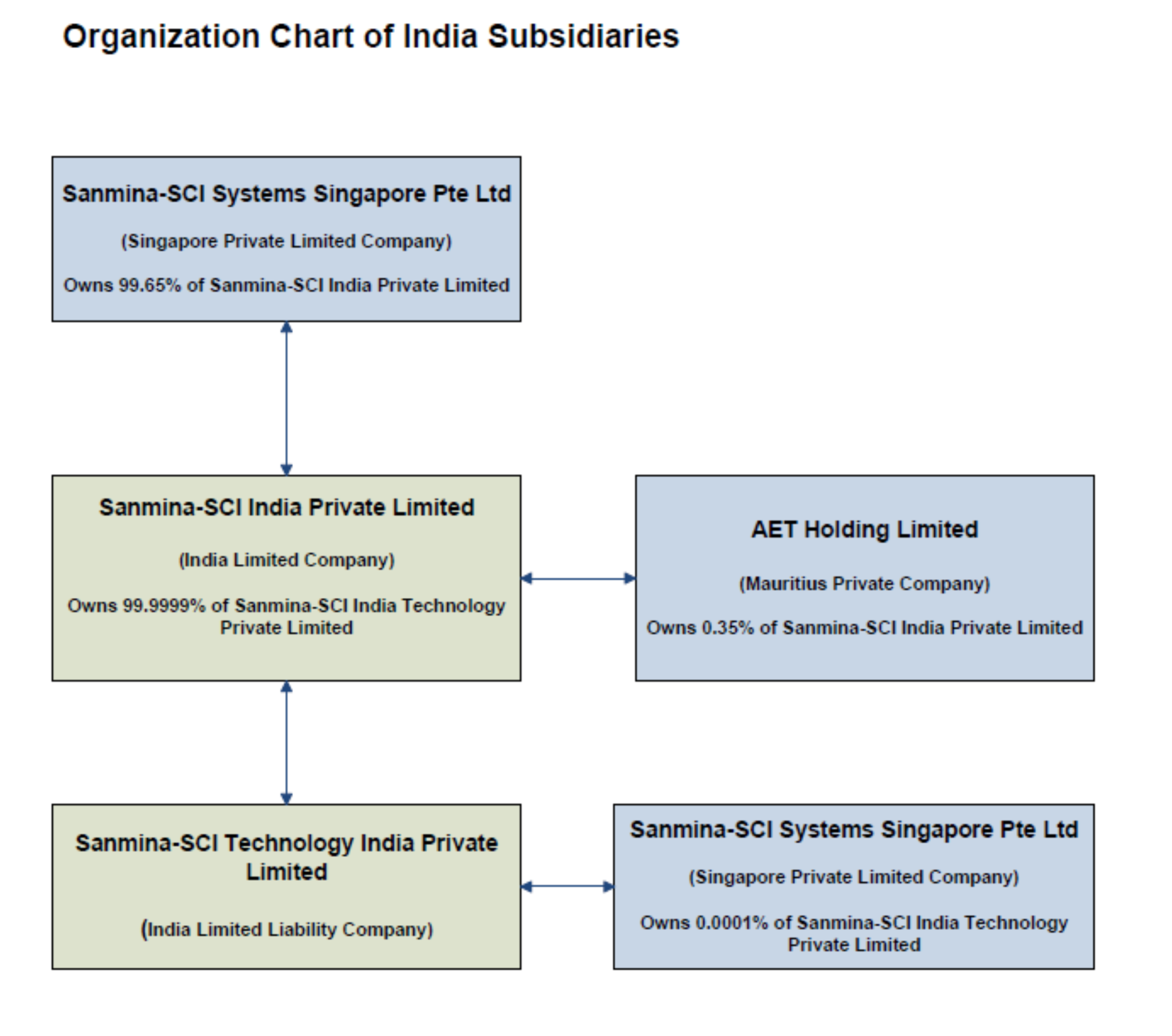

Part A: SHAREHOLDING PATTERN AS ON THE EXECUTION DATE | 1 | ||||

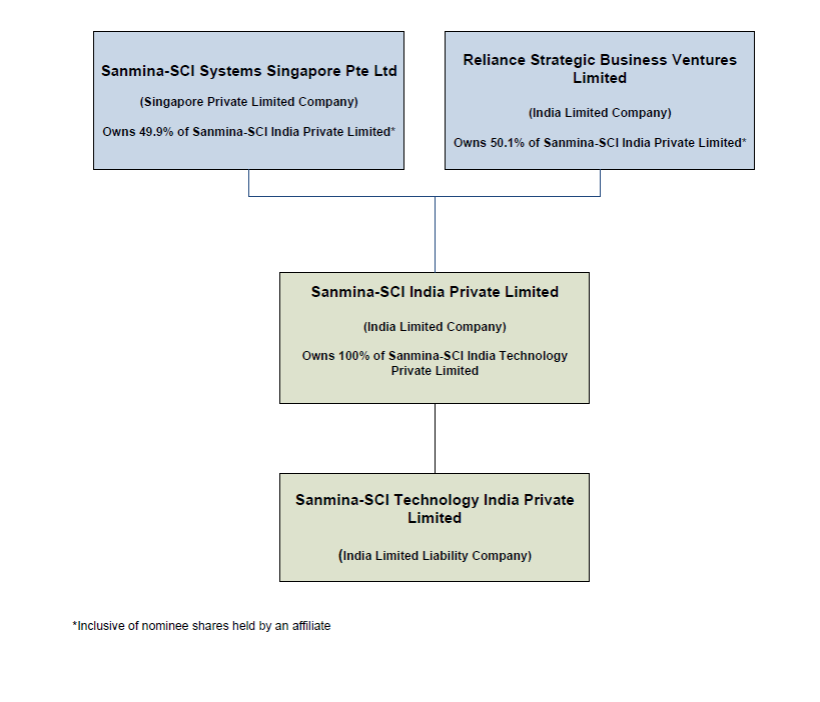

Part B: SHAREHOLDING PATTERN AS ON THE CLOSING DATE | 2 | ||||

Schedule 2: CONDITIONS PRECEDENT | 1 | ||||

Part A: COMPANY CONDITIONS PRECEDENT | 1 | ||||

Part B: INVESTOR CONDITIONS PRECEDENT | 3 | ||||

Schedule 3: COMPANY WARRANTIES | 1 | ||||

Schedule 4: INVESTOR AND SANMINA WARRANTIES | 1 | ||||

Part A – INVESTOR WARRANTIES | 1 | ||||

Part B – SANMINA PARTIES’ WARRANTIES | 1 | ||||

Schedule 5: FORM OF CP COMPLETION NOTICE | 1 | ||||

Schedule 6: FORM OF COMPLIANCE CERTIFICATE | 1 | ||||

Schedule 7: SPECIFIC INDEMNITY ITEMS | 1 | ||||

Schedule 8: FORM OF RESIGNATION LETTER | 1 | ||||

Schedule 9: FORM OF INITIAL BUSINESS PLAN | 1 | ||||

Schedule 10: EXISTING Sanmina Customer Contracts | 1 | ||||

Schedule 11: ILLUSTRATIVE WORKING CAPITAL | 1 | ||||

Reported working capital (Company Group) | 1 | ||||

Reported working capital (SIPL) | 1 | ||||

Schedule 12: BALANCES OF THE CO-DEVELOPER BUSINESS AS OF MARCH 31, 2021 | 1 | ||||

Schedule 13: ITEMS EXCLUDED FROM INDEBTEDNESS | 1 | ||||

Schedule 14: PURCHASE CONSIDERATION MECHANISM * | 1 | ||||

Schedule 15: PROFORMA INCOME STATEMENT | 1 | ||||

Privileged & Confidential

This SHARE SUBSCRIPTION AND PURCHASE AGREEMENT (“Agreement”) is executed as at 08.15 am India Standard Time on this third day of March, 2022 by and between:

(1) RELIANCE STRATEGIC BUSINESS VENTURES LIMITED, a company incorporated under the Companies Xxx, 0000, with Company Identification Number U74999GJ2019PLC108789 and having its registered office at Xxxxxx-000, Xxxxxxx, Xx Xxxxxx Xxxxx, Xxxxxxxxx 5 Rasta, Ambawadi, Xxxxxxxxx - 000000 Xxxxxxx – Xxxxx (hereinafter referred to as the “Investor”, which expression shall, unless repugnant to or inconsistent with the context or meaning thereof, be deemed to include its successors and permitted assigns);

(2) SANMINA CORPORATION, a corporation organized under the laws of the State of Delaware, United States of America, and having its principal place of business located at 0000 X. 0xx Xxxxxx, Xxx Xxxx, Xxxxxxxxxx, Xxxxxx Xxxxxx of America (hereinafter referred to as the “Sanmina Corp”, which expression shall, unless repugnant to or inconsistent with the context or meaning thereof, be deemed to mean and include its successors and permitted assigns);

(3) SANMINA-SCI SYSTEMS SINGAPORE PTE LTD, company incorporated under the laws of Singapore with Company Identification Number 198305350W and having its registered office at 00 Xxxxxxx Xxxxx #00-00 Xxxxx @ Xxxxxxx Xxxxxxxxx 000000 (hereinafter referred to as the “Sanmina Singapore”, which expression shall, unless repugnant to or inconsistent with the context or meaning thereof, be deemed to mean and include its successors and permitted assigns);

(4) AET HOLDINGS LIMITED, a company incorporated in Mauritius with Company Identification Number C09024080 and having its registered office at c/o Trident Trust Company (Mauritius) Limited, 0xx Xxxxx, Xxxxxx Xxxxx, Xx Xxxxxx Xxxxxxxxxx, Xxxx Xxxxx, Xxxxxxxx of Mauritius (hereinafter referred to as the “Sanmina AET”, which expression shall, unless repugnant to or inconsistent with the context or meaning thereof, be deemed to mean and include its successors and permitted assigns); and

(5) SANMINA-SCI INDIA PRIVATE LIMITED, a company incorporated under the Companies Xxx, 0000, with Company Identification Number U30007TN2002PTC048391 and having its registered office at Plot No. OZ-1, SIPCOT Hi-Tech SEZ Oragadam Sriperumbudur Taluk, Kancheepuram District, Orgadam Xxxxxxxxxxxx XX 000000, India (hereinafter referred to as the “Company” which expression shall, unless repugnant to or inconsistent with the context or the meaning thereof, be deemed to mean and include its successors and permitted assigns).

(The Investor, Sanmina Corp, Sanmina Singapore, Sanmina AET and the Company are individually referred to as a “Party” and collectively as the “Parties”).

(A) The Company Group is engaged in the business of (i) manufacturing in the republic of India electronics equipment similar to and including electronics equipment with application in medical, telecommunications, data center and internet domains; and (ii) assembling in the republic of India electronic sub-assemblies similar to and including electronic sub-assemblies for systems used in automotive, aviation, power, audio/visual products and infrastructure equipment such as escalators and elevators which, in the case of (i) or (ii), excludes the business of the STIPL Undertaking (the “Business”).

(B) As on the Execution Date, 100% (One Hundred Percent) of the Share Capital (as defined hereinbelow) of the Company is owned by Sanmina Singapore and Sanmina AET. The shareholding pattern of the Company on a Fully Diluted Basis is set out in Schedule 1 (Shareholding Pattern).

(C) Simultaneously with the execution of this Agreement, the Investor has inter alia entered into a shareholders’ agreement of even date inter alia with the Sanmina Corp, Sanmina Singapore

EMEA: 1748612-11 | ||

and the Company, to set out the rights and obligations of the parties thereto in relation to the management of the Company (“Shareholders’ Agreement”).

(D) In reliance on the Company Warranties and Sanmina Warranties (in each case, as defined hereinbelow) as well as the covenants and undertakings of Sanmina Corp, Sanmina Singapore, Sanmina AET and the Company set out in the Transaction Documents (as defined hereinbelow), the Investor has agreed to (i) invest in the Share Capital (as defined hereinbelow) of the Company by subscribing to the Investor Subscription Shares (as defined hereinbelow) in consideration for the Investor Subscription Amount (as defined hereinbelow); and (ii) acquire the Investor Purchase Shares (as defined hereinbelow) from Sanmina Singapore and Sanmina AET in consideration for the Investor Purchase Amount (as defined hereinbelow), in each case in the manner and subject to the terms and conditions set out in this Agreement (“Proposed Transaction”).

(E) In connection with the Proposed Transaction, the Parties agree that prior to the Closing Date, the Sanmina Parties (as defined hereinbelow) shall procure the transfer of its operations in the STIPL Undertaking to a newly formed subsidiary of Sanmina Singapore or any of its Affiliates for consideration compliant with Applicable Law (“STIPL Business Transfer”).

(F) The Parties are hereby entering into this Agreement to record the terms and conditions for the Company to issue and for the Investor to subscribe to the Investor Subscription Shares and other matters incidental thereto.

NOW THEREFORE, in consideration of the mutual covenants and agreements herein contained, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties hereto agree as follows:

1. DEFINITIONS AND INTERPRETATION

1.1 Definitions: In this Agreement, the following capitalized words and expressions shall have the following meaning:

“Acceptance Notice” has the meaning given to the term in Clause 8.8.2(i);

“Accounts Date” means March 31, 2021;

“Action of Divestiture” has the meaning given to the term in Clause 4.4.4(viii);

“Actual Working Capital” means the Working Capital as of the Closing Date;

“Affiliate(s)” means, with respect to any Person, any other Person who, directly or indirectly through one or more intermediaries, Controls, is Controlled by, or is under common Control with, such Person;

“Affiliate IP Owner” has the meaning given to the term in Paragraph 15.2 of Schedule 3 (Company Warranties);

“Agreed Form” means, in relation to a document, the form of such document that has been approved by or on behalf of Sanmina Corp and the Investor;

“Aggregate Consideration” shall mean the sum of the Investor Purchase Consideration and the Investor Subscription Consideration;

“Anti-Corruption Laws” means any Applicable Law relating to public sector or private sector bribery or corruption, including the FCPA, the India Prevention of Corruption Xxx 0000, the U.K. Bribery Act of 2010, and where applicable, legislation enacted by member states and signatories implementing the OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions;

2

“Anti-Corruption Prohibited Activity” means any payment or transfer prohibited by the Anti-Corruption Laws, including the direct or indirect payment or transfer of money or anything of value to any Government Official or any other Person for the purpose of (i) influencing an act, omission or decision of a Government Official or any Person acting in an official capacity; (ii) inducing any Person or Governmental Official to do or omit to do any act in violation of a lawful duty; (iii) securing an improper advantage; (iv) inducing any Person or Governmental Official to use their influence improperly including with a Governmental Authority to affect or influence any act or decision, including of a Governmental Authority, in each of (i) – (iv) in order to obtain, retain or direct or assist in obtaining, retaining or directing business to any Person; or (v) for any other unlawful purpose;

“Anti-Money Laundering Laws” means any anti-money laundering-related Laws and codes of practice applicable to any Person and its operations from time to time, including the Indian Prevention of Money Xxxxxxxxxx Xxx, 0000, the USA PATRIOT Act, the U.S. Bank Secrecy Act of 1970, and the U.S. Money Laundering Control Act of 1986, each as may be amended from time to time;

“Antitrust Authorities” has the meaning given to the term in Clause 4.4.4(i);

“Antitrust Laws” means the Xxxxxxx Antitrust Act of 1890, the Xxxxxxx Act of 1914, the XXX Xxx, xxx Xxxxxxxxxxx Xxx 0000, and all other United States or non-United States antitrust, competition or other Laws that are designed or intended to prohibit, restrict or regulate actions having the purpose or effect of monopolization or restraint of trade or lessening of competition through merger or acquisition;

“Applicable Law(s)” or “Law(s)” means all statutes, enactments, acts of legislature or the parliament, laws, regulations, ordinances, notifications, rules, judgments, orders, decrees, by-laws, resolutions, directives, guidelines, policies, requirements, or other governmental restrictions or any similar form of decision of, or determination by, or any interpretation or adjudication having the force of law of any of the foregoing, by any concerned Governmental Authority having jurisdiction over the matter in question;

“Approvals” means all allocations, awards, approvals, clearances, licenses, permits, consents, permissions, orders, certificates, authorizations, registrations, or any ruling of any Governmental Authority or the expiration or termination of any applicable waiting period, required under Applicable Laws (including (if applicable) approval from the labour commissioner, approval of master plan and building plans, occupation certificates and other relevant approvals from the relevant municipal corporation, public works department and other department of the applicable Governmental Authority);

“Arm’s Length Basis” means fair and reasonable terms that are consistent with market practice and which have been agreed in comparable transactions between parties which are independent and Related Parties of, or otherwise affiliated with, each other under comparable circumstances;

“Assets” means any assets or properties of any kind, nature, character, and description (whether immovable, movable, tangible, intangible), including cash, cash equivalents, receivables, Securities, accounts and notes receivable, real estate, plant and machinery, equipment, trademarks, brands, other Intellectual Property, raw materials, inventory, finished goods, furniture, fixtures and insurance;

“Audited Accounts” means the audited Financial Statements of the Company as of, and for the twelve (12) month period ended on March 31, 2021 in accordance with Ind AS, together with the auditor’s and directors report in relation to such Financial Statements;

“Big Four Accounting Firm” means any of the Indian Affiliates or associates of:

(i) Deloitte Touche Tohmatsu;

(ii) KPMG;

3

(iii) Price Waterhouse Coopers; and

(iv) EY (formerly, Ernst & Young);

“Board” means the board of directors of a company;

“Business” has the meaning given to the term in Recital A;

“Business Day” means any day other than a (i) Saturday, (ii) Sunday, or (iii) day on which scheduled commercial banks are closed for business in Mumbai and New York;

“Business Warranties” means all Company Warranties other than Fundamental Warranties and Tax Warranties;

“Cash and Cash Equivalent” means the aggregate of the cash (whether in hand or credited to any account with any banking, financial, acceptance credit, lending or other similar institution or organisation) and the cash equivalents of the Company Group relating to the Business, including all interest accrued thereon and the purchase price for the slump sale of the STIPL Undertaking as set forth under the STIPL Business Transfer Agreement, but excluding (i) cash equivalents under lock-in period or cash held in lien, as on a specified date and relating to the Company Group relating to the Business; and (ii) the Investor Subscription Amount; [***];

“Cash Balance” means the net cash balance equal to (i) the amount of Cash and Cash Equivalents of the Company Group as of a given date; minus (ii) the amount equal to the sum of the Indebtedness of the Company Group and Working Capital Adjustment as of such date;

“Cause” means, with respect to an Officer, such Officer’s (i) death, (ii) physical or mental disability that prevents such Officer from performing the essential functions of his or her duties satisfactorily for a period of one hundred and eighty (180) consecutive days or one hundred and eighty (180) days in total within any three hundred and sixty five days (365) consecutive-day period as determined by the Board in its reasonable discretion and in accordance with applicable Law, (iii) act or omission constituting willful misconduct (including a knowing and willful violation of material policies of the Company) or a breach of fiduciary duty, (iv) gross negligence or other conduct that, in the reasonable judgment of the Board, is contrary to the interests of the Company (including a repeated failure to perform duties as directed by the Board of the Company), (v) fraud, money laundering, bribery, misappropriation or embezzlement, (vi) commission of a crime which, if applicable Law provides for a gradation of criminal offences, constitutes a felony or equivalent under applicable Law, (vii) material violation of the Company’s compliance policies and/or conflicts of interest policy, and/or expense reimbursement policies of the Company or engaging in activities that compete with the Business (whether directly or indirectly), (viii) material breach of any employment contract or similar contract with the Company, or any covenant not to compete in favor of the Company, or (ix) drug testing revealing drug usage in violation of Company policy and/or applicable Law and/or reporting to work under the influence of alcohol; (x) obtaining of any personal profit not disclosed in full to and approved by the Board in connection with any transaction entered into by, or on behalf of, the Company; (xi) commission of sexual harassment of any employee or workmen or personnel of the Company; or (xii) being an undischarged insolvent under Law;

“CCI” has the meaning given to the term in Clause 4.4.4(ii);

“CCI Approval” has the meaning given to the term in Clause 4.4.4(ii);

“Charter Documents” means the memorandum of association and articles of association of a company or such analogous organizational and constitutional documents;

“Claim Amount” has the meaning given to the term in Clause 8.8.1;

“Claim Notice” has the meaning given to the term in Clause 8.8.1;

4

“Closing” means the completion by the Parties of their respective obligations set out in Clause 5.1 to Clause 5.5 of this Agreement;

“Closing Board Resolutions” has the meaning given to the term in Clause 5.2.6;

“Closing Calculations” has the meaning given to the term in Clause 6.5.1;

“Closing Calculations Review” has the meaning ascribed to the term in Clause 6.5.3;

“Closing Compliance Certificate” means the certificate to be issued by (a) the Company and the Sanmina Parties; and (b) the Investor, on the Closing Date in the form set out in Schedule 6 (Form of Compliance Certificate);

“Closing Computations” has the meaning given to the term in Clause 6.5.1;

“Closing Date” has the meaning set out in Clause 5.1;

“Closing Shareholders Resolutions” has the meaning set out in Clause 5.2.8;

“Co-Developer Business” means (i) the rights and obligations of STIPL under the STIPL Lease Documents, including the resulting leasehold interests over the land which is the subject matter thereto; (ii) the lease of property to the Company by STIPL pursuant to the terms and subject to the conditions of the STIPL-Company Lease Deeds; and (iii) the operation of and maintenance of the building thereon that is utilized by the Company in the conduct and operation of the Business, and other assets and liabilities relating thereto which are reflected in Schedule 12, as of March 31, 2021;

“Companies Act” means the Companies Act, 2013 (and any amendments or modifications thereto) along with all secretarial standards, rules and regulations issued thereunder;

“Company Account” means the bank account of the Company having account number [***] with [***], with IFSC Code [***];

“Company Conditions Precedent” means the conditions precedents specified in Part A of Schedule 2;

“Company Group” shall mean (i) the Company and (ii) STIPL, excluding for the purposes hereof the STIPL Undertaking;

“Company Intellectual Property” has the meaning given to the term in Paragraph 15.1 of Schedule 3 (Company Warranties);

“Company Permits” means any and all Approvals required under Applicable Law to carry on its Business as currently conducted by the Company Group and for the Company Group to own, lease and operate its Assets and properties as currently owned, leased and operated, whether held by the Company Group in their own name or held by the Sanmina Parties or any other Affiliate of the Company (under which the Company Group operates);

“Company Service Agreement” means the Services Agreement between the Company and Sanmina regarding certain services provided by the Company to Sanmina in the form as annexed to this Agreement in Exhibit D;

“Company Warranties” has the meaning given to the term in Clause 7.1 and the term “Company Warranty” shall be construed accordingly;

“Conditions Precedent” shall mean the Company Conditions Precedent and the Investor Conditions Precedent, taken together;

“Confidential Information” has the meaning given to the term in Clause 9.5;

5

“Control” (including the terms “controlling,” “controlled by,” and “under common control with”) means, with respect to an entity, having the power to direct the affairs of the entity by reason of (a) having the power to elect or appoint, through ownership, membership or otherwise, either directly or indirectly, more than fifty percent (50%) of the board of directors or other governing body of the entity, (b) owning or controlling the right to vote more than fifty percent (50%) of the shares of voting stock or other voting Equity Interests of the entity or (c) having the right to direct the general management of the affairs or policies of the entity by contract or otherwise;

“CP Completion Notice” has the meaning given to the term in Clause 3.2.2;

“CP Satisfaction Notice” has the meaning given to the term in Clause 3.2.4;

“Credit Agreement” means the Fourth Amended and Restated Credit Agreement, dated as of November 30, 2018, among Sanmina Corp, the lenders party thereto and Bank of America, N.A., as administrative agent;

“Current Assets” means, as of any specified date, the total amount of all such assets relating or assigned to the Company Group in relation to the Business (excluding Cash and Cash Equivalents), which are customarily called current assets under Ind AS, and including inventory, loans and advances and accounts receivables of the Company Group pertaining to the Business (valued at book value less provisions for slow, non-moving and obsolescence inventory and less provision for bad and doubtful receivable/ advances) on such date. An illustrative list of the Current Assets (including security deposits placed with electricity boards and other deposits and regular deposits placed to run the business as usual), prepared on the basis of the audited Financial Statements of the Company Group as of March 31, 2021, as referred to in Schedule 11 to this Agreement;

“Current Liabilities” means, as of any specified date, the total amount of all such liabilities relating to the Company Group in relation to the Business, which are customarily called current liabilities under Ind AS, whether due or not, and including the amounts payable to vendors for goods and services, taxes/duties and other statutory dues payable, advances from customers, all types of dues to the Company Group’s employees (as employed in relation to the Business) whether immediately payable or not and liabilities for expenses of the Company Group in relation to the Business (at book value) on such date. An illustrative list of the Current Liabilities, prepared on the basis of the audited Financial Statements of the Company Group as of March 31, 2021, as referred to in Schedule 11 to this Agreement;

“Customer Agreements Status Certificate” has the meaning given to the term in Clause 4.1.6(iv);

“Determination Date” means the date on which all Conditions Precedent are completed, as evidenced by the issue of the CP Satisfaction Notices by the Investor and the Company;

“Director” means a director on the Board of a company;

“Disclosing Party” has the meaning given to the term in Clause 9.2;

“Disclosure Letter” means the disclosure letter provided by the Company and the Sanmina Parties to the Investor as on the Execution Date, providing fair and specific disclosures against identified Business Warranties and Tax Warranties, and shall include the Updated Disclosures;

“Dispute” has the meaning given to the term in Clause 12.1;

“DOJ” has the meaning given to the term in Clause 4.4.4(iii);

“Draft Secondary Report” means a draft valuation report prepared by a category -– I merchant banker reasonably acceptable to the Investor (and in a form reasonably acceptable to the Investor), setting out the fair value of the Shares of the Company pursuant to Section 56(2)(x) of the IT Act;

6

“Draft Updates” has the meaning given to the term in Clause 7.7.2;

“Draft Updates Date” has the meaning given to the term in Clause 7.7.2;

“Encumbrance” means (i) any mortgage, charge (whether fixed or floating), pledge, lien, hypothecation, assignment, deed of trust, security interest or other encumbrance of any kind, securing or conferring any priority of payment in respect of any obligation of any Person, including any right granted by a transaction which, in legal terms, is not the granting of security but which has an economic or financial effect similar to the granting of security under Applicable Law; (ii) any voting agreement, interest, option, right of first offer, right of first refusal, call right, put right, tag along right, drag along right, or other transfer restriction in favour of any Person or any restrictions on use, exercise of any attribute of ownership, or any right of set-off; and (iii) any adverse claim as to title, possession or use or any title retention agreement and “Encumber” shall be construed accordingly; provided, that, liens arising as a result of Taxes not yet due shall not be deemed as Encumbrances;

“Equity Interest” means, irrespective of any voting rights, a share of stock with respect to a corporation, a partnership interest with respect to a partnership, a limited liability company interest with respect to a limited liability company, a share with respect to a company limited by shares or any comparable interest with respect to any other entity;

“Estimated Working Capital” means the Working Capital as of the Determination Date;

“Excluded Products” means the products identified or described as “Excluded Products” in Annex A to the Shareholders’ Agreement;

“Excluded Third Party Claim” has the meaning given to the term in Clause 8.9.2;

“Execution Date” means the date of execution of this Agreement written hereinabove;

“Existing Shares” shall mean 1,160,444,830 Shares of the Company, beneficially held by Sanmina Singapore (including through Sanmina AET) as on Execution Date;

“FEMA Report” means a valuation certificate prepared by a merchant banker registered with the Securities and Exchange Board of India or a chartered accountant (in either case, reasonably acceptable to the Investor), certifying the price of the Shares as per the pricing guidelines set out under the Foreign Exchange Regulations (in a form reasonably acceptable to the Investor);

“Final Investor Objection Notice” has the meaning ascribed to the term in Clause 6.5.5;

“Financial Statements” means audited and unaudited balance sheet, cash flow statement, profit and loss statement and all the schedules, opinions, annexures and notes thereto prepared in accordance with US GAAP and/or Ind AS;

“Financial Year” means the 52 or 53 week fiscal year ending on the Saturday closest to September 30 each year;

“Foreign Exchange Regulations” means Foreign Exchange Management Act, 1999 and rules and regulations made thereunder, as amended from time to time;

“FTC” has the meaning given to the term in Clause 4.4.4(iii);

“Fully Diluted Basis” means the assumption that the exercise, and as may be applicable, the conversion of any options (including employee stock options), warrants, contracts and instruments exercisable or exchangeable for or convertible into Shares (whether or not compulsorily convertible), outstanding on the date of calculation, have been exercised or

7

exchanged for or converted into Shares and all Shares issuable pursuant to contractual or other obligations have been issued;

“Fundamental Warranties” means: the Sanmina Warranties (other than Paragraphs (j) to (bb)), Paragraphs 1 (Authority and Capacity), 2.1 (Particulars of the Company), 2.2 (Capital Structure and Shareholding), 2.3 (Title to Shares), 2.7 (Memorandum and Articles), 7 (Insolvency) of Schedule 3 (Company Warranties);

“GAAP” shall mean U.S. Generally Accepted Accounting Practices;

“Government” or “Governmental Authority” means: (i) any supranational, national, state, city, municipal, county or local government, governmental authority or political subdivision thereof; (ii) any agency or instrumentality of any of the authorities referred to in (i) above; (iii) any regulatory or administrative authority, body or other similar organisation, to the extent that the rules, regulations, standards, requirements, procedures or orders of such authority, body or other organisation have the force of Law; (iv) any court or tribunal having jurisdiction; or (v) the governing body of any stock exchange(s);

“Government Official” means any officer, employee or other person acting in an official capacity on behalf of (i) any Governmental Authority or any department or agency of a Government, including elected officials, judicial officials, civil servants and military personnel, children, spouses, siblings or parents of a Government Official; (ii) any public international organisation, such as the World Bank; (iii) any company or business that is owned or Controlled by a Governmental Authority; and (iv) any political party, as well as candidates for political office;

“Guarantee” means, in relation to a Person (“Guarantor”), any obligation, contingent or otherwise, of the Guarantor, guaranteeing or having the economic effect of guaranteeing any Indebtedness, indemnity or other liability or obligation of any other Person (“Primary Obligor”) in any manner, whether directly or indirectly, and including any obligation of the Guarantor, direct or indirect, (i) to purchase or pay (or advance or supply funds for the purchase or payment of) such Indebtedness or other obligation or to purchase (or to advance or supply funds for the purchase of) any security for the payment thereof; (ii) to purchase or lease property, Securities or services for the purpose of assuring the owner of such Indebtedness or other obligation of the payment thereof; (iii) to maintain working capital, equity capital or any other Financial Statement condition or liquidity of the Primary Obligor so as to enable the Primary Obligor to pay such Indebtedness or other obligation; or (iv) as an account party in respect of any letter of credit or letter of guarantee issued to support such Indebtedness or obligation of the Primary Obligor;

“HSR Act” shall mean the Xxxx-Xxxxx-Xxxxxx Antitrust Improvements Act of 1976, as amended and the rules and regulations promulgated thereunder;

“IBC” shall mean the Insolvency and Bankruptcy Code, 2016 (as amended from time to time);

“Ind AS” shall mean the Indian Accounting Standards as prescribed under the Companies (Indian Accounting Standards) Rules, 2015;

“Indebtedness” of any Person means, without duplication: (i) all obligations of such Person for borrowed money (including all obligations for principal, interest, premiums, penalties, fees, expenses, breakage costs and bank overdrafts thereunder) or with respect to deposits or advances of any kind, (ii) all obligations of such Person evidenced by bonds, debentures, notes or similar instruments, (iii) all obligations of such Person under conditional sale or other title retention agreements relating to Assets acquired by such Person, (iv) all obligations of such Person in respect of the deferred purchase price of property or services (excluding accounts payable, intercompany charges of expenses and other accrued obligations, in each case incurred in the Ordinary Course of Business), (v) liabilities under any sale and leaseback transaction, any synthetic lease or tax ownership operating lease transaction or any other

8

transaction which is the functional equivalent of or takes the place of borrowing but which does not constitute a liability on the balance sheet, (vi) all Indebtedness of others secured by (or for which the holder of such Indebtedness has an existing right, contingent or otherwise, to be secured by) any Encumbrance on Assets owned or acquired by such Person, whether or not the Indebtedness secured thereby has been assumed, (vii) net liabilities under interest rate cap agreements, interest rate swap agreements, foreign currency exchange agreements and other hedging or similar agreements, (viii) to the extent not otherwise included in the foregoing, any financing of accounts receivable or inventory, and (ix) all Guarantees granted by such Person of Indebtedness of another Person; and provided, further, that (A) the term “Indebted” shall be construed accordingly and (B) the terms “obligations” or “liabilities” shall include obligations and liabilities, whether absolute, accrued, contingent, fixed or otherwise, or whether due to or to become due or asserted or unasserted; provided, however, the items set forth on Schedule 13 shall not be deemed Indebtedness;

“Indemnification Claim” has the meaning given to the term in Clause 8.8.1;

“Indemnification Event” has the meaning given to the term in Clause 8.1;

“Indemnified Parties” means the Investor, any Affiliates of the Investor holding Securities in the Company and their respective Directors and officers;

“Indemnifying Party” means Sanmina Corp and Sanmina Singapore, jointly and severally;

“Identified Group Policies” shall mean the policies to be adopted by the Company on and from the Closing Date, as may be mutually agreed between the Investor and the Sanmina Parties;

“Indian Financial Year” means the period of twelve (12) months commencing from the 1st of April of a calendar year and ending on the 31st of March of the following calendar year;

“Initial Business Plan” means the business plan of the Company and STIPL as set out in Schedule 9 (Form of Initial Business Plan) adopted by the Company on the Execution Date;

“Initial Investor Objection Notice” has the meaning ascribed to the term in Clause 6.5.2;

“INR” or “Rupees” or “Indian Rupees” or “Rs.” means Indian rupees, being the lawful currency of India;

“Insolvency Event” in relation to any Person, means, any corporate action, legal Proceedings or other procedure or step is taken in relation to:

(i) the suspension of payments, a moratorium of any Indebtedness, winding-up, dissolution, administration, provisional supervision or reorganisation (by way of voluntary arrangement, scheme of arrangement or otherwise) of such Person and such action has been admitted by a court of competent jurisdiction;

(ii) a composition, compromise, assignment or arrangement with any creditor of such Person in relation to unpaid dues;

(iii) the appointment of a liquidator, receiver, administrator, administrative receiver, compulsory manager or other similar officer in respect of such Person or any of its Assets by a Governmental Authority;

(iv) attachment, enforcement or distress of any security interest over any material Assets of such Person;

(v) initiation or commission of an act of insolvency (including a petition or application for insolvency being admitted) in relation to such Person, and such initiation or commission is admitted by a court of competent jurisdiction;

9

(vi) any analogous procedure is taken in any jurisdiction, or any other event occurs which would, under any Applicable Law, have a substantially similar effect to any of the events listed in sub-paragraphs (i) to (iv) above;

(vii) the value of the Assets of such Person is less than its liabilities (taking into account contingent liabilities but excluding shareholders’ funds);

(viii) the admission of any application by the National Company Law Tribunal to initiate corporate insolvency resolution process against such Person; or

(ix) the passage of a resolution by the members of the Person to initiate a voluntary liquidation process in relation to the Person under the IBC;

“Intellectual Property” means all intellectual property rights of any kind or nature, now known or hereafter recognised, in any jurisdiction anywhere in the world, whether registered or unregistered, including intellectual property rights in and to (i) patents, and patent applications, and reissues, divisions, continuations, renewals, re-examinations, interferences, extensions, continuations and continuations in part thereof; (ii) utility models; (iii) designs; (iv) copyrights; (v) trade secrets; (vi) trademarks (vii) any registrations or applications to register any of the foregoing;

“Intercompany Manufacturing Agreement” means the intercompany manufacturing agreement entered into on April 1, 2012 by and between Sanmina Corp and the Company pursuant to which the Company manufactures certain products to support Sanmina in the performance of its obligations under the Sanmina Customer Contracts (as amended and restated from time to time);

“Investor Conditions Precedent” means the conditions precedents identified in Part B of Schedule 2;

“Investor Director” means any Director nominated to the Board of the Company and STIPL by the Investor in accordance with the provisions of the Shareholders’ Agreement, as may be notified by the Investor to the Company and STIPL, at least ten (10) Business Days prior to the Closing Date;

“Investor Purchase Amount” has the meaning ascribed to the term in Clause 2.3;

“Investor Purchase Shares” means a number of Shares of the Company equal to the quotient obtained by dividing (i) an amount equal to the Cash Balance by (ii) the quotient obtained by dividing (A) the Pre-Money Enterprise Valuation by (B) the number of Shares of the Company immediately prior to Closing;

“Investor Review Period” has the meaning ascribed to the term in Clause 6.5.3;

“Investor Subscription Amount” has the meaning ascribed to the term in Clause 2.3;

“Investor Subscription Shares” means the number of Shares of the Company to be issued by the Company to the Investor on the Closing Date in accordance with the terms of this Agreement, which number will be equal to:

(i) if the Secondary Transaction Trigger has not occurred, 50.1/49.9 x the Existing Shares; or

(ii) if the Secondary Transaction Trigger has occurred, (50.1/49.9 x Existing Shares) – (100/49.9 x Investor Purchase Shares);

“Investor Review Firm” has the meaning ascribed to the term in Clause 6.5.3;

“Investor Review Firm Report” has the meaning ascribed to the term in Clause 6.5.5;

10

“Investor Warranty” means the warranties of the Investor as specified in Part A of Schedule 4 (Investor Waranties);

“Investor’s Objections” has the meaning given to the term in Clause 7.7.2;

“IT Act” means the Income Tax Act, 1961 and rules and regulations issued thereunder;

“Key Personnel” means the key managerial personnel of the relevant entity, including the Managing Director or Chief Executive Officer (as applicable), Chief Financial Officer, Chief Operating Officer, Head of Legal and Compliance/Company Secretary and all the direct reportees to the Managing Director or Chief Executive Officer;

“Know-How” means any and all know-how, technology, inventions, discoveries, ideas, processes, methods, designs, plans, instructions, specifications, formulas, testing and other protocols, settings, and procedures, computer software, programming codes, databases and related schemas and other confidential or proprietary technical, scientific, engineering, business, or financial information the Sanmina Parties, their Affiliates or any member of the Company Group owns or controls that may be useful in or required for the manufacture of equipment by Company in the conduct of the Business;

“LCIA Rules” has the meaning given to the term in Clause 12.1;

“Lease Assignment Agreement” means the agreement for the assignment of the MEPZ Lease Deed proposed to be entered into by and between STIPL and a newly formed subsidiary of Sanmina Singapore or any of its Affiliates on or around the Closing Date, in the form annexed to the STIPL Business Transfer Agreement;

“License Agreement” means a license agreement between Sanmina Corp and the Company with respect to the grant of Intellectual Property to the Company in the form as annexed to this Agreement in Exhibit E;

“Long Stop Date” means [***] ([***]) days following the Execution Date, or such later date as may be mutually agreed to by the Investor and the Sanmina Parties in writing;

“Loss” or “Losses” means all direct and actual liabilities, obligations, losses, damages, penalties, claims, counterclaims, demands, actions, suits, judgments or settlements of any kind, whether arising in common law or equity, whether created by Law, and whether or not resulting from third-party claims, including interest and penalties and reasonable out-of-pocket expenses, and reasonable fees and expenses for attorneys, accountants, consultants, and experts incurred in connection with any of the foregoing;

“Management Services Agreement” means the Management Services Agreement by and among the Company, Sanmina Singapore and Sanmina Corp and the Investor to be executed on the Closing Date in the form as annexed to this Agreement in Exhibit A;

“March 31, 2022 Audited Accounts” has the meaning given to the term in Clause 4.1.6(i);

“March 31, 2022 Unaudited Accounts” has the meaning given to the term in Clause 4.1.6(ii);

“Material Adverse Effect” means any event, condition, development, fact or effect that, individually or in the aggregate, has had or would reasonably be expected to have or result in: (i) a material adverse effect on the Business, results of operations, assets and financial condition of the Company Group; (ii) the effect of rendering any of the Transaction Documents unenforceable or an adverse impact on the validity of any of the Transaction Documents, or an adverse impact on the ability of the Company, the Sanmina Parties, and/or the Investor to consummate the transactions contemplated under the Transaction Documents to which it is a party or perform their respective obligations under such Transaction Documents; provided that any change, directly or indirectly, arising out of or attributable to: (i) general economic or political conditions; (ii) changes in laws, regulations (including retrospective changes) or accounting practices post-Execution Date; (iii) anything consented to in writing by the Investor

11

or any of its authorized representatives; (iv) any acts or omissions of the Company expressly and specifically required to be undertaken pursuant to this Agreement; (v) any changes in financial or securities markets in general; or (vi) the announcement of the transaction contemplated hereunder, shall not constitute a “Material Adverse Effect” as defined under sub-clause (i) above, provided that such event, condition, development, fact or effect does not have a disproportionately material adverse effect on the Company Group as compared to other Persons engaged in a similar industry;

“Material Contracts” means: (i) any contract executed by the Company Group relating to Indebtedness in an amount in excess of INR equivalent of USD [***]; (ii) any contract executed by the Company Group in relation to the acquisition or disposition of any business, undertaking and/or Shares of and/or stake in any Person or in relation to any joint venture or strategic cooperation arrangement, in each, under which the Company Group has ongoing obligations or rights; (iii) any contract including letter of allotments and leases executed by the Company Group with any Governmental Authorities or otherwise in relation to any immovable properties; (iv) any contract or series of related contracts under which the Company Group is entitled to receive at least INR equivalent of USD [***]; (v) any contract or series of related contracts under which the Company is liable to pay at least INR equivalent of USD [***]; (vi) any contract that contains covenants limiting in any way the freedom of the Company Group (or any of their respective Affiliates, including for purposes of this definition only, the Investor and its Affiliates) to sell or otherwise dispose of its Assets, operate at any location, engage in any market or line of business or compete with, deal with or solicit customers of any Person; (vii) any contract which grants management, operational or voting rights in the Company Group to any Person; (viii) any contract to which the Company Group is party that is outside the Ordinary Course of Business of the Company Group and not on Arm’s Length Basis; (ix) any contract pursuant to which the Company Group grants any loan or provides any credit to any Person (including by way of any Guarantee) other than trade credit in the Ordinary Course of Business; (x) any contract pursuant to which the Company Group grants exclusivity, ‘most favoured nations’ or similar preferred terms, to any Person; (xi) any contract involving revenue/cost/profit/loss sharing between the Company and/or any other Person; (xii) any contract entered into by the Company Group with Related Parties; (xiii) any contracts involving any payments required to be made pursuant to a change in Control of the Company; and/or (xiv) any Sanmina Customer Contract;

“MEPZ Authority” means MEPZ Unit Approval Committee formed for the SEZs in Tamil Nadu, Puducherry and Andaman and Nicobar Islands in terms of the Instruction No. 109 issued by Ministry of Commerce and Industry, Department of Commerce (SEZ Section);

“MEPZ Lease Deed” means the lease deed between STIPL and the Development Commissioner and Chairperson, MEPZ Special Economic Zone Authority, Government of India, Ministry of Commerce and Industry (Department of Commerce) dated August 21, 2017, for the property situated at X-0, Xxxxx XX, XXXX Xxxxxxx Xxxxxxxx Xxxx Xxxxxxxx;

“New STIPL” has the meaning given to the term in Clause 4.4.2(i);

“Non-Liable Persons” has the meaning given to the term in Clause 13.14;

“Offer Letter” has the meaning given to the term in Clause 4.4.7;

“Order” means any order, decision, judgment, writ, injunction, decree, award or other determination of any Governmental Authority;

“Ordinary Course of Business” means an action which is taken in the ordinary course of the normal day-to-day operations of the Person taking such action including all significant activities associated therewith, in each case consistent with the customary commercial practices of such Person and adhering to generally accepted industry practices, which industry, for the purposes of the Company, means the provision of manufacturing and global supply chain solutions on an integrated basis to Original Equipment Manufacturers (OEMs). For the avoidance of doubt, the Company's normal day-to-day operations and/or significant activities of the Company include the following, all of which shall be deemed to be in the

12

Company’s ordinary course of business: sourcing of raw materials and production inputs, negotiation of customer and supplier agreements, allocation of resources, plant operating practices and procedures, pricing of goods and services, onboarding new customers and customer programs, customer and supplier relationships, customer disengagements, acquisition and disposition of capital equipment, and compensation of Officers and other employees in each case consistent with standards and operating procedures generally implemented by other leading integrated manufacturing services companies that provide manufacturing and global supply chain solutions to Original Equipment Manufacturers (OEMs);

“Other Sanmina Activities” means specific business resources of the Sanmina Parties across various Affiliates other than the Company, including, by way of illustration and not of limitation, India operations, facilities leases, customers and supplier arrangements and Approvals. For avoidance of doubt, the operations of the STIPL Undertaking, which shall primarily relate to Sanmina Corp’s worldwide Human Resources Information Services, ERP and IT services and design services shall be considered “Other Sanmina Activities” for the purpose of this Agreement;

“Outside Firm” has the meaning given to the term in Clause 6.5.8;

“Owned IP” has the meaning given to the term in Paragraph 15.2 of Schedule 3 (Company Warranties);

“Person” means any individual, joint venture, company, corporation, partnership (whether limited or unlimited), proprietorship, trust or other enterprise (whether incorporated or not), Hindu undivided family, union, association, Government or any agency, political subdivision, department, authority or subdivision thereof or any other entity that may be treated as a person under Applicable Law, and shall include their respective successors and in case of an individual shall include his/her legal representatives, administrators, executors and heirs and in case of a trust shall include the trustee or the trustees for the time being;

“Post Closing Review Firm” has the meaning given to the term in Clause 6.5.1;

“Post Closing Review Report” has the meaning given to the term in Clause 6.5.1;

“Pre-Closing Interim Period Income Statement and Balance Sheets” has the meaning given to the term in Clause 4.1.6(i);

“Pre-Closing Interim Period Additional Income Statement and Balance Sheets” has the meaning given to the term in Clause 4.1.6(ii);

“Pre-Closing Purchase Statement” has the meaning given to the term in Clause 2.3.3;

“Pre-Money Enterprise Valuation” means the enterprise value (i.e. assessed on a cash-free and debt-free basis) of the Company Group, which the Parties have agreed is equal to the INR equivalent of USD 220,000,000;

“Proceeding(s)” includes all suits, civil and criminal actions, arbitration proceedings, and all legal proceedings, legal notices, inquiries, investigations or claims of any kind, pending, whether before any court, judicial or quasi-judicial or regulatory authority, tribunal, Governmental Authority or any arbitrator or arbitrators;

“Proforma Income Statement” means the proforma GAAP adjusted income statements of the Company Group as of, and for the twelve (12) month period ended on October 02, 2021, as set out in Schedule 15 hereto;

“Proposed Transaction” has the meaning given to the term in Recital D;

“Rejection Notice” has the meaning given to the term in Clause 8.8.2(ii);

13

“Related Party” has the meaning set out in the Companies Act and accounting standards applicable to the Person;

“Related Party Transactions” has the meaning given to the term in Schedule 3 (Company Warranties);

“Relevant Claim” has the meaning given to the term in Clause 8.11;

“Relevant Person” means a Person’s Directors, officers, employees, and any other Persons acting on behalf of any of them;

“Relevant Proportion” shall mean the proportion in which the Investor Purchase Shares are proposed to be transferred by Sanmina Singapore and Sanmina AET respectively, to the Investor in accordance with the terms of this Agreement, as may be notified by Sanmina Corp to the Investor at least ten (10) Business Days prior to Closing;

“Resigning Directors” means the existing Directors on the Board of the Company and/or STIPL (as the case may be), immediately prior to Closing;

“Resolution Period” has the meaning given to the term in Clause 6.5.7;

“Restated Charter Documents” means the amended and restated articles of the Company Group incorporating the provisions of the Shareholders’ Agreement in Agreed Form between the Parties;

“Restricted Cash” means any Cash and Cash Equivalents of the Company Group, wherever and however held, (i) usage of which is not readily available pursuant to Applicable Law or contract; or (ii) not domiciled in India;

“Review Firm” means statutory auditor of the Company;

“Revised Buy-Sell Arrangement” means the hypothetical situation in which (i) the Intercompany Manufacturing Agreement is terminated; (ii) the Sanmina Customer Contracts have been assigned to, or novated for the benefit of, the Company as contemplated by Clause 4.4.5 hereof; and (iii) the Company has entered into other third party supply and service arrangements on substantially similar terms on those made available to Sanmina Corp in order to enable the Company to perform its obligations under such Sanmina Customer Contracts so assigned or novated;

“RSU” means restricted stock units / shares (both those vested and yet to be vested) of Sanmina Corporation which are offered to the select employees of Company Group for employee retention purposes;

“Sanctioned Person” means (i) any Person that at such time is designated on the list of “Specially Designated Nationals and Blocked Persons” administered by the U.S. Treasury Department’s Office of Foreign Assets Control, or on any list of any economic or financial sanctions administered by the U.S. State Department, the United Nations, the European Union or any member state thereof, the United Kingdom, or any similar list maintained by, or public announcement of Sanctions designation made by, any applicable national economic sanctions authority; (ii) any Government, national, or resident of, or legal entity located in or organized under, a country or territory which is the subject of country-wide or territory-wide Sanctions, including Cuba, North Korea, Syria, Iran or the Crimea region of Ukraine; (iii) any Person who is owned 50% (fifty percent) or more or Controlled by any of the foregoing; or (iv) any Person with whom business transactions, including exports and re-exports, would violate Sanctions;

“Sanctions” means all economic or financial sanctions Laws, measures or embargoes administered or enforced by the United States (including the United States Department of

14

Treasury or the United States Department of State), the European Union, the United Nations Security Council, or the United Kingdom, and any other relevant trade or economic sanctions imposed by any Governmental Authority to which the Company is subject;

“Sanmina AET Account” means the bank account of Sanmina AET having account number [***] with [***], with IBAN of [***] and SWIFT Code of [***];

“Sanmina Customer Contracts” means such agreements by and between Sanmina Corp and/or its Affiliates on the one hand and a customer on the other, inter alia for the supply of products manufactured by the Company to such customer whether in place as on the Execution Date or the Closing Date, including those out in Schedule 10 to this Agreement (Existing Sanmina Customer Contracts);

“Sanmina Directors” means any Director nominated to the Board of the Company or STIPL (as the case may be) by Sanmina in accordance with the provisions of the Shareholders Agreement, as may be notified by Sanmina to the Company and STIPL, at least ten (10) Business Days prior to the Closing Date;

“Sanmina Objection Notice” has the meaning given to the term in Clause 6.5.7;

“Sanmina Parties” means Sanmina Corp, Sanmina Singapore and Sanmina AET;

“Sanmina Services Agreement” means the agreement proposed to be entered into by the Company with Sanmina Corp, with respect to the provision of certain services to the Company (including the Support Services) in the form annexed to this Agreement as Exhibit C;

“Sanmina Singapore Account” means the bank account of Sanmina Singapore having account number [***] with [***], with IFSC Code [***] and beneficiary of [***];

“Sanmina Warranty” means the warranties of the Sanmina Parties as specified in PART B of Schedule 4 (Sanmina Warranties);

“Secondary Transaction” has the meaning given to the term in Clause 2.1.2;

“Secondary Transaction Trigger” has the meaning given to the term in Clause 2.1.2;

“Securities” means Shares or other securities of any class or nature, including convertible debt, which are mandatorily or optionally exercisable for or exchangeable or convertible into Shares and each of them shall be referred to as a “Security”;

“Share Capital” means the total issued and paid-up equity share capital of a company, determined on a Fully Diluted Basis;

“Shareholder” has the meaning given to the term in Clause 14.2;

“Shareholders’ Agreement” has the meaning given to the term in Recital C;

“Shares” means the equity shares of a company;

“SIPCOT” means State Industries Promotion Corporation of Tamil Nadu Limited;

“SIPL Nominee Shares” means the 408,206 Shares held by Sanmina AET in the Company representing 0.35% of the Share Capital of the Company;

“Specific Indemnity Item” means any and/or all the matters mentioned in Schedule 7 (Specific Indemnity Items);

“STIPL” shall mean Sanmina-SCI Technology India Private Limited;

15

“STIPL Board Resolutions” has the meaning given to the term in Clause 5.2.10;

“STIPL Business Transfer” has the meaning given to the term in Recital E;

“STIPL Business Transfer Agreement” means the agreement by and between STIPL and an Affiliate of Sanmina Singapore for the slump-sale of the STIPL Undertaking, in the form set out in Exhibit B hereto subject to such amendments as the Parties may agree in writing prior to the Closing Date; provided that such agreement shall not be unreasonably withheld or delayed;

“STIPL-Company Lease Deeds” mean, together, that certain: (i) Lease Deed between STIPL and the Company dated June 19, 2019 relating to Xxxx Xx. 0, XXXXXX Xxxxxxxxxx Xxxxxx Xxxxxx, Xxxxxxxx, Xxxxxxxxxxxx, Xxxxx Xxxx, 000000; and (ii) Lease Deed between STIPL and the Company dated June 19, 2019 relating to Plot No. OZ-1, SIPCOT High Tech SEZ, Oragadam, Xxxxxxxxxxxxx Xxxxx, Xxxxxxxxxxxx Xxxxxxxx, Xxxxx Xxxx, 000000;

“STIPL Lease Documents” shall mean the Lease Deed dated August 22, 2008 between State Industries Promotion Corporation of Tamil Nadu Limited and STIPL and/or the Letter of Allotment dated September 27, 2007 issued by State Industries Promotion Corporation of Tamil Nadu Limited to STIPL;

“STIPL Nominee Shares” means the 100 (one hundred) Shares held by Sanmina Singapore in STIPL representing 0.0001% of the Share Capital of the Company;

“STIPL Shareholders Resolutions” has the meaning given to the term in Clause 5.2.10;

“STIPL Undertaking” shall mean the conduct and operation of the business of STIPL prior to the Closing Date excluding the Co-Developer Business;

“Support Services” means such services arising from or relating to or comprising of the Other Sanmina Activities, that are relevant to the operation, maintenance, and continuation of the Business;

“Tax”, “Taxes” or “Taxation” means all forms of taxation, duties, levies, imposts and social security (or similar) charges of any kind whatsoever in any jurisdiction, including corporate income tax, minimum alternate tax, property tax, wealth tax, any other form of withholding tax, provident fund, employee state insurance, gratuity contributions, statutory pension or any other employment benefit plan contributions, service tax, value added tax, customs and excise duties, goods and services tax, buy-back tax, capital gains tax and other legal transaction taxes, stamp duty, dividend distribution tax, securities transaction tax, real estate taxes, gross receipts taxes, windfall profit taxes, employment taxes, severance taxes, franchise taxes, transfer taxes, profit taxes, registration taxes, unclaimed property or escheatment taxes, alternative or add-on minimum taxes, estimated taxes, other municipal, provincial, state or local taxes and duties, environmental taxes and duties and any other type of taxes or duties in any relevant jurisdiction, whether disputed or not, together with any interest, penalties, surcharges, cess, fines, fees or any other additional amounts relating thereto, due, payable, levied, imposed upon or claimed to be owed in any relevant jurisdiction, and including any obligations to indemnify or otherwise assume or succeed to the tax liability of any other Person;

“Tax Authority” means the relevant Governmental Authority competent to impose or assess or collect any Tax;

“Tax Return” means any report, return, election, statement, claim for refund, declaration or other information with respect to any Tax required to be filed, permitted to be filed or actually filed with a tax authority in accordance with Applicable Laws, including any schedule or attachment thereto, and including any amendment thereof;

16

“Tax Warranties” means the Company Warranties set out in Paragraph 14 of Schedule 3 (Company Warranties) and the Sanmina Warranties set out in Paragraph (j) to (t) of PART B of Schedule 4 (Sanmina Warranties);

“Third Party Claim” has the meaning given to the term in Clause 8.9;

“Third Party Intellectual Property” has the meaning given to the term in Paragraph 15.5 of Schedule 3 (Company Warranties);

“Threshold Amount” has the meaning given to the term in Clause 8.11;

“Trademark License Agreement” shall mean the trademark license agreement proposed to be entered into by and between Sanmina Corp and the Company, as set out in Exhibit F hereto;

“Transaction Documents” means the following:

(i) this Agreement;

(ii) the Shareholders’ Agreement;

(iii) the Restated Charter Documents;

(iv) the Sanmina Services Agreement;

(v) the License Agreement;

(vi) the Management Services Agreement;

(vii) the STIPL Business Transfer Agreement;

(viii) the Trademark License Agreement;

(ix) the Company Service Agreement;

(x) the Lease Assignment Agreement; and

(xi) any other documents and certificates to be executed pursuant to, in connection with and/or simultaneously with this Agreement and shall include the schedules or annexures or appendices to any of the aforesaid, including the certificates and confirmation letters issued pursuant to this Agreement;

“Transaction Expenses” means the reasonable costs and expenses incurred in connection with: (i) the registration, filing and stamping of the Transaction Documents; and (ii) completion of (A) all Conditions Precedent and (B) all actions of each of the Parties reasonably undertaken pursuant to the terms of the Transaction Documents which are required pursuant thereto, including (1) the capital gains taxes and transaction taxes on STIPL in relation to the STIPL Business Transfer, (2) expenses incurred in connection with obtaining third party consents under Clauses 4.4.2 and 4.4.3, (3) costs of the Review Firm to prepare the Pre-Closing Purchase Statement, (4) costs of Investor Review Firm to issue the Post Closing Review Report, (5) all costs and expenses of the Outside Firm, but shall exclude legal, diligence and other advisory fees in connection with the negotiation of the Transaction Documents and (6) stamp duty in relation to the Secondary Transaction; for the avoidance of doubt, costs and expenses incurred in connection with obtaining the necessary consent, waiver or amendment to the Credit Agreement as set forth in Clause 4.2 shall be excluded from Transaction Expenses;

“Transfer” (including with correlative meaning, the terms “Transferred”, “Transferred by” and “Transferability”) means to, directly or indirectly, sell, gift, give, assign, transfer, transfer of any interest in trust, mortgage, alienate, hypothecate, pledge, Encumber, grant a security interest in, suffer to exist (whether by operation of Law otherwise) any Encumbrance on, or otherwise dispose of in any manner whatsoever voluntarily or involuntarily, any Securities or any right, title or interest therein;

“Trusted Source” means such Persons who are designated as ‘Trusted Sources’ by the National Cyber Security Coordinator pursuant to the National Security Directive on Telecommunications Sector approved by the Cabinet Committee on Security, Government of India December 16, 2020;

17

“Undertaking” means the entire undertaking through which the business of a Person is carried out as on a given date, and includes (but is not limited to) the following:

(i) assets;

(ii) liabilities;

(iii) employees;

(iv) Intellectual Property; and

(v) all other rights, benefits and privileges (including goodwill) accruing to such Person and relates to the relevant business;

“Unilateral Disclosures” has the meaning given to the term in Clause 7.7.4;

“Updated Disclosures” has the meaning given to the term in Clause 7.7.1;

“USD” shall mean United States Dollars;

“Verified Purchase Amount” has the meaning given to the term in Clause 6.5.10;

“Verified Subscription Amount” has the meaning given to the term in Clause 6.5.9;

“Working Capital” means, as of a specified date the working capital of the Company Group in relation to the Business, computed as the difference between the Current Assets and the Current Liabilities, as of such date. Illustratively, the Working Capital as of March 31, 2021 is set out in Schedule 11 (Illustrative Working Capital) to this Agreement; provided that any Transaction Expenses shall not be included in the calculation of Working Capital; and

“Working Capital Adjustment” means (i) in the event the Estimated Working Capital or the Actual Working Capital, as the case may be, is between INR [***] (inclusive) and INR [***] (inclusive), the Working Capital Adjustment shall be [***]; (ii) in the event the Estimated Working Capital or the Actual Working Capital, as the case may be, is less than INR [***], the Working Capital Adjustment shall be INR [***] minus the (A) Estimated Working Capital if the date of determination is the Determination Date and (B) Actual Working Capital if the date of determination is the Closing Date, as the case may be; or (iii) in the event the Estimated Working Capital or the Actual Working Capital, as the case may be, is more than INR [***], the Working Capital Adjustment shall be INR [***]minus the (A) Estimated Working Capital if the date of determination is the Determination Date and (B) Actual Working Capital if the date of determination is the Closing Date, as the case may be.

1.2 Interpretation: Unless the context of this Agreement otherwise requires:

1.2.1 Clause headings and Schedule headings are for convenience only and do not affect the construction or interpretation of any provision of this Agreement.

1.2.2 In addition to the terms defined in Clause 1.1 (Definitions) above, certain terms may be defined elsewhere in this Agreement and wherever such terms are used in this Agreement, they shall have the meaning so assigned to them.

1.2.3 All references in this Agreement to statutory provisions shall be statutory provisions for the time being in force and shall be construed as including references to any statutory modifications, consolidation or re-enactment (whether before or after the date of this Agreement) for the time being in force and all statutory rules, regulations and orders made pursuant to a statutory provision, as may be modified or amended from time to time.

1.2.4 All references in this Agreement to any agreement or document shall be deemed to include any amendments or modifications to such agreement or document, from time to time.

18

1.2.5 The terms referred to but not defined in this Agreement shall, unless defined otherwise or unless inconsistent with the context or meaning thereof, shall have the same meaning as defined under the Shareholders’ Agreement.

1.2.6 Words denoting singular shall include the plural and vice versa and words denoting any gender shall include all genders unless the context otherwise requires.

1.2.7 References to Recitals, Clauses, Annexures, Appendices or Schedules are, unless the context otherwise requires, references to recitals, Clauses, annexures, appendices or schedules of/to this Agreement.

1.2.8 Any reference to “writing” includes printing, typing, lithography and other means of reproducing words in permanent visible form.

1.2.9 The terms “include” and “including” shall mean, “include without limitation”.

1.2.10 The terms “hereof”, “herein”, “hereby”, “hereto” and derivative or similar words refer to this entire Agreement or specified Clauses of this Agreement, as the case may be.

1.2.11 Where in any provision of this Agreement, the Knowledge of the Company or the Sanmina Parties is specified, it shall mean the actual knowledge of [***], [***], [***], [***], [***] and [***], upon due and careful enquiry by such persons.

1.2.12 Where the performance of any obligation by a Party under this Agreement (“Subject Obligation”) requires any consents, approvals, no objection certificates or authorizations in order for the Subject Obligation to be performed, then the Subject Obligation shall be deemed to include the obligation to apply for, obtain, maintain and comply with the terms of, all such consents, approvals and authorizations.

1.2.13 Reference to days, months and years are to calendar days, calendar months and calendar years, respectively (unless otherwise specified in this Agreement).

1.2.14 Time taken to complete any action required to be completed under this Agreement shall exclude the time taken to procure any Approvals that may be required in order to complete or perform such action and all time periods under this Agreement, shall be construed accordingly, unless otherwise stated in this Agreement.

1.2.15 All references to this Agreement or any other Transaction Document shall be deemed to include any amendments or modifications to this Agreement or the relevant Transaction Document, as the case may be, from time to time.

1.2.16 Unless otherwise specified, time periods within or following which any payment is to be made or act is to be done shall be calculated by excluding the day on which the period commences and including the day on which the period ends and by extending the period to the next Business Day if the last day of such period is not a Business Day; and whenever any payment is to be made or action to be taken under this Agreement is required to be made or taken on a day other than a Business Day, such payment shall be made or action taken on the next Business Day.

1.2.17 The words “directly or indirectly” and “directly and/or indirectly” mean directly or indirectly through one or more intermediary Persons or through contractual or other legal arrangements, and “direct or indirect” and “direct and/or indirect” shall have the correlative meanings, respectively.

1.2.18 Any numerical reference to equity share thresholds and swap ratios shall be duly adjusted to reflect valid stock splits, consolidation, rights and bonus issues.

1.2.19 Where any obligation is imposed on the Company under the Transaction Documents, it shall be deemed that, prior to and as of the Closing, the Sanmina Parties have a corresponding obligation to cause the Company to comply with its obligations and the Sanmina Parties shall exercise all its powers (including voting power) and take all

19

necessary steps (including vote in a manner which ensures that the Company is compliant with its obligations) and do or cause to be done all acts, deeds and things as required to ensure compliance of all obligations of the Company.

1.2.20 If any provision in this Clause 1.2 (Interpretation) is a substantive provision conferring rights or imposing obligations on any Party, effect shall be given to it as if it were a substantive provision in the body of this Agreement.

1.2.21 No provisions of this Agreement shall be interpreted in favour of, or against, any party to this Agreement by reason of the extent to which such party or its counsel participated in the drafting hereof or by reason of the extent to which any such provision is inconsistent with any prior draft hereof.

1.2.22 The INR equivalent of all amounts expressed in USD or any other foreign currency shall be determined on the basis of the relevant foreign exchange rate as published by Financial Benchmarks India Private Limited, as of the date immediately preceding the date on which such amounts are proposed to be remitted or such transactions proposed to be undertaken, or such other date as may be mutually agreed between Parties.

2. TRANSACTION

2.1 Subject to the terms and conditions of this Agreement, including satisfaction (or waiver by the Investor or the Company, as the case may be) of the Conditions Precedent set out in Schedule 2 (Conditions Precedent) in accordance with Clause 3.2 (Fulfilment of Conditions Precedent) of this Agreement, on the Closing Date:

2.1.1 the Company shall issue and allot to the Investor the Investor Subscription Shares, and the Investor shall subscribe to the Investor Subscription Shares, free from and clear of any and all Encumbrances, together with all rights, title, interests and advantages attached to the Investor Subscription Shares as on the Closing Date or subsequently becoming attached to them, in consideration for the payment of the Investor Subscription Amount; and

2.1.2 if the aggregate amount of Cash and Cash Equivalent as of the Determination Date is higher than the aggregate amount of (a) Indebtedness as of the Determination Date and (b) Working Capital Adjustment as of the Determination Date (“Secondary Transaction Trigger”), then, Sanmina Singapore and Sanmina AET shall transfer (in the Relevant Proportion) to the Investor, the Investor Purchase Shares, and the Investor shall acquire the Investor Purchase Shares, free from and clear of any and all Encumbrances, together with all rights, title, interests and advantages attached to the Investor Purchase Shares as on the Closing Date or subsequently becoming attached to them, in consideration for the payment of the Investor Purchase Amount, subject to any withholdings or deductions under Applicable Law (“Secondary Transaction”).

2.2 The (i) subscription to, the issue, and allotment of the Investor Subscription Shares; and (ii) transfer and acquisition of the Investor Purchase Shares (if proposed to be undertaken in accordance with the terms and conditions of this Agreement), shall be completed in accordance with Clause 5 (Closing Actions).

2.3 Pre-Closing Adjustment. The total consideration payable by the Investor on Closing Date in order to (i) subscribe to the Investor Subscription Shares (“Investor Subscription Amount”); and (ii) if applicable, acquire the Investor Purchase Shares (“Investor Purchase Amount”) shall be computed subject to applicable Laws in the following manner:

2.3.1 If the Secondary Transaction Trigger is met, then:

(i) the Investor Subscription Amount shall equal (A x B) – C, where:

20

A = the Pre-Money Enterprise Valuation;

B = 50.1%/49.9%; and

C = the Investor Purchase Amount.

(ii) The Investor Purchase Amount shall equal the Cash Balance, if positive, as on the Determination Date.

2.3.2 If the Secondary Transaction Trigger is not met, then:

(i) the Investor Subscription Amount shall equal: (A – (B + C - D)) x E ,where:

A = the Pre-Money Enterprise Valuation;

B = Indebtedness;

C = Working Capital Adjustment;

D= Cash and Cash Equivalent; and

E = 50.1%/49.9%.

(ii) The Investor Subscription Shares shall constitute such number of Shares as is equal to 50.1% (Fifty decimal One Percent) of the post-issue Share Capital of the Company and notwithstanding anything contained elsewhere in this Agreement, the Secondary Transaction shall not be consummated.

2.3.3 At least ten (10) Business Days prior to the Closing Date, the Company shall (and the Sanmina Parties shall procure that the Company shall) provide to the Investor a written statement certified by the Review Firm, setting out (in each case of the Company Group, in relation to the Business) the (i) the total amount of Cash and Cash Equivalents computed as of the Determination Date; (ii) the Indebtedness computed as of the Determination Date; (iii) the Estimated Working Capital; (iv) the Investor Purchase Amount (if any); (v) the Investor Purchase Shares; (vi) the Investor Subscription Amount; (vii) the Investor Subscription Shares; and (viii) all supporting documents, evidencing items (i) to (iii) above (“Pre-Closing Purchase Statement”). For purposes of illustration, a form of the Pre-Closing Purchase Statement is attached hereto as Schedule 11 calculated as if March 31, 2021 were the Determination Date.

2.3.4 It is clarified that the Review Firm shall be appointed by the Company, subject to execution of a suitable non-disclosure agreement, for the sole purpose of verifying (and not arbitrating) the amounts set out in the Pre-Closing Purchase Statement and confirming the Investor Subscription Amount and the Investor Purchase Amount (if any), in accordance with the computation mechanism set out in Schedule 14 to this Agreement, the Parties shall proceed to Closing on the basis of the Pre-Closing Purchase Statement absent manifest error, in accordance with Clause 5 of this Agreement (Closing Actions).

2.3.5 The Company shall (and the Sanmina Parties shall procure that the Company shall) provide access to all books and accounts of the Company in order for the Review Firm to certify the Pre-Closing Purchase Statement. The Investor shall have the right, on its reasonable request, to consult and discuss with the Review Firm on all matters in relation to the Pre-Closing Purchase Statement (and for the avoidance of doubt the Investor may make such requests both prior to the commencement of the Review Firm’s engagement with Company and after the Pre-Closing Purchase Statement has been prepared and furnished.

2.3.6 On and from the Determination Date and without prejudice to the provisions of Clause 4 (Conduct of Business Prior to Closing), the Company Group shall not and the Sanmina Parties shall procure that the Company Group shall not, other than in the Ordinary Course of Business, take any action that is reasonably likely to cause any change in the information set out in the Pre-Closing Purchase Statement.

3. CONDITIONS PRECEDENT

21

3.1 Conditions Precedent to Closing:

3.1.1 the obligation of the Investor to subscribe to the Investor Subscription Shares and (if applicable) acquire the Investor Purchase Shares, on the Closing Date, shall be subject to fulfilment (or waiver by the Investor) of the Company Conditions Precedent, to the reasonable satisfaction of the Investor on or prior to the Long Stop Date; and