TWENTY-NINTH SUPPLEMENTAL INDENTURE between WESTPAC BANKING CORPORATION and THE BANK OF NEW YORK MELLON as Trustee Dated as of June 3, 2021 TWENTY-NINTH SUPPLEMENTAL INDENTURE

Exhibit 4.1

EXECUTION COPY

TWENTY-NINTH SUPPLEMENTAL INDENTURE

between

WESTPAC BANKING CORPORATION

and

THE BANK OF NEW YORK MELLON

as Trustee

Dated as of June 3, 2021

TWENTY-NINTH SUPPLEMENTAL INDENTURE

TWENTY-NINTH SUPPLEMENTAL INDENTURE, dated as June 3, 2021 (the “Twenty-Ninth Supplemental Indenture”), between WESTPAC BANKING CORPORATION (ABN 33 007 457 141), a company incorporated in the Commonwealth of Australia under the Corporations Xxx 0000 of Australia and registered in New South Wales (the “Company”), and THE BANK OF NEW YORK MELLON, a New York banking corporation, as trustee (the “Trustee”).

RECITALS:

WHEREAS, the Company and The Chase Manhattan Bank are parties to a Senior Indenture, dated as of July 1, 1999 (the “Base Indenture”), relating to the issuance from time to time by the Company of Securities in one or more series as therein provided;

WHEREAS, the Trustee has succeeded The Chase Manhattan Bank as trustee under the Base Indenture;

WHEREAS, the Company and the Trustee entered into the First Supplemental Indenture, dated as of August 27, 2009 (the “First Supplemental Indenture”), the Fifth Supplemental Indenture, dated as of August 14, 2012 (the “Fifth Supplemental Indenture”), the Seventeenth Supplemental Indenture, dated as of November 9, 2016 (the “Seventeenth Supplemental Indenture”), the Twenty-Fifth Supplemental Indenture, dated November 9, 2018 (the “Twenty-Fifth Supplemental Indenture”) and the Twenty-Eighth Supplemental Indenture, dated January 16, 2020 (the “Twenty-Eighth Supplemental Indenture”), among other things, to supplement and amend certain provisions of the Base Indenture (the Base Indenture, as amended and supplemented by the First Supplemental Indenture, the Fifth Supplemental Indenture, the Seventeenth Supplemental Indenture, the Twenty-Fifth Supplemental Indenture and the Twenty-Eighth Supplemental Indenture is referred to herein as the “Amended Base Indenture” and the Amended Base Indenture as further supplemented by this Twenty-Ninth Supplemental Indenture, is referred to herein as the “Indenture”);

WHEREAS, Section 8.1(5) of the Amended Base Indenture provides that the Company may enter into a supplemental indenture to change or eliminate any of the provisions of the Amended Base Indenture, provided that any such change or elimination shall become effective only with respect to any series of Securities which has not been issued as of the execution of such supplemental indenture or when there is no Security Outstanding of any series created prior to the execution of such supplemental indenture which is entitled to the benefit of such provision;

WHEREAS, Section 8.1(7) of the Amended Base Indenture provides that the Company may enter into a supplemental indenture to establish the forms or terms of Securities of any series as permitted by Sections 2.1 and 3.1 therein;

2

WHEREAS, the Company deems it advisable to enter into this Twenty-Ninth Supplemental Indenture for the purposes of amending and supplementing certain provisions of the Amended Base Indenture;

WHEREAS, in connection with the issuance of the 1.150% Notes, the 2.150% Notes and the Floating Rate Notes (each as defined herein), the Company has duly authorized the execution and delivery of this Twenty-Ninth Supplemental Indenture to establish the forms and terms of the 1.150% Notes, the 2.150% Notes and the Floating Rate Notes as hereinafter described; and

WHEREAS, all conditions and requirements of the Amended Base Indenture necessary to make this Twenty-Ninth Supplemental Indenture a valid, binding and legal instrument in accordance with its terms have been performed and fulfilled by the parties hereto.

NOW, THEREFORE, for and in consideration of the premises and other good and valuable consideration, receipt of which is hereby acknowledged by the parties hereto, the parties hereto hereby agree as follows:

Article

I

DEFINITIONS

Section 1.01 General Definitions. For purposes of this Twenty-Ninth Supplemental Indenture:

(a) Capitalized terms used herein without definition shall have the meanings specified in the Amended Base Indenture;

(b) All references to Articles and Sections, unless otherwise specified, refer to the corresponding Articles and Sections of the Amended Base Indenture; and

(c) The terms “herein,” “hereof,” “hereunder” and other words of similar import refer to this Twenty-Seventh Supplemental Indenture as a whole and not to any particular Article, Section or other subdivision.

Article II

THE 1.150% Notes

Section 2.01 Title of Securities. There shall be a series of Securities of the Company designated the “1.150% Notes due June 3, 2026” (the “1.150% Notes”).

3

Section 2.02 Limitation of Aggregate Principal Amount. The aggregate principal amount of the 1.150% Notes shall initially be limited to US$1,450,000,000. The Company may from time to time, without the consent of the Holders of the 1.150% Notes, create and issue additional notes having the same terms and conditions as the 1.150% Notes in all respects or in all respects except for issue date, issue price and, if applicable, the first date on which interest accrues and the first payment of interest thereon (“Additional 1.150% Notes”). Additional 1.150% Notes issued in this manner will be consolidated with, and will form a single series with, the 1.150% Notes, unless such Additional 1.150% Notes will not be treated as fungible with the 1.150% Notes for U.S. federal income tax purposes. The 1.150% Notes and any such Additional 1.150% Notes would rank equally and ratably.

Section 2.03 Principal Payment Date. The principal amount of the 1.150% Notes Outstanding (together with any accrued and unpaid interest) shall be payable in a single installment on June 3, 2026, which date shall be the Stated Maturity of the 1.150% Notes.

Section 2.04 Interest and Interest Rates. The 1.150% Notes will bear interest on the unpaid principal amount thereof at a rate of 1.150% per year from June 3, 2021, or from the most recent Interest Payment Date to which interest has been paid or duly provided for, until the principal amount of the 1.150% Notes shall have been paid or duly provided for, and interest on the 1.150% Notes shall be payable semi-annually in arrears on June 3 and December 3 of each year, beginning on December 3, 2021. Interest on a 1.150% Note will be paid to the Person in whose name that 1.150% Note was registered at the close of business on the May 19 or November 18, as the case may be, whether or not a Business Day, prior to the applicable Interest Payment Date, except that in the case of the Interest Payment Date that is also the Stated Maturity of the 1.150% Notes, the interest due on such date will be paid to the Person to whom principal is payable upon surrender of such Note at a Place of Payment. Interest will be computed on the basis of a 360-day year consisting of twelve 30-day months. The amount of interest payable for any period less than a full interest period shall be computed on the basis of a 360-day year consisting of twelve 30-day months and the actual days elapsed in a partial month in such period. Any payment of principal or interest required to be made on an Interest Payment Date that is not a Business Day shall be made on the next succeeding Business Day, and no interest will accrue on that payment for the period from and after such Interest Payment Date to the date of payment on the next succeeding Business Day. For purposes of the 1.150% Notes, “Business Day” means each Monday, Tuesday, Wednesday, Thursday and Friday that is not a day on which banking institutions in Sydney, Australia, Xxx Xxxx, Xxx Xxxx, xx Xxxxxx, Xxxxxx Xxxxxxx are authorized or obligated by law or executive order to close.

Section 2.05 Place of Payment. The Place of Payment where the 1.150% Notes may be presented or surrendered for payment, where the 1.150% Notes may be surrendered for registration of transfer or exchange and where notices and demands to or upon the Company in respect of the 1.150% Notes and the Indenture may be served initially shall be the Corporate Trust Office of the Trustee maintained for that purpose in the Borough of Manhattan, City of New York.

Section 2.06 Redemption. The Company shall not have the right to redeem the 1.150% Notes other than pursuant to Section 10.8 of the Indenture.

4

Section 2.07 No Sinking Fund. The 1.150% Notes are not entitled to the benefit of any sinking fund.

Section 2.08 Form. The 1.150% Notes shall be issued initially as Registered Securities (as defined in the Indenture) in the form of one or more permanent notes in global form, without coupons, substantially in the form attached hereto as Exhibit A, deposited with The Bank of New York Mellon, as custodian for the Depositary, duly executed by the Company and authenticated by the Trustee as provided in the Indenture.

Section 2.09 Denomination. The 1.150% Notes shall be issuable only in denominations of US$2,000 and integral multiples of US$1,000 in excess thereof. The 1.150% Notes shall be numbered, lettered, or otherwise distinguished in such manner or in accordance with such plans as the Officers of the Company executing the same may determine with the approval of the Trustee.

Section 2.10 Depositary. The Depository Trust Company shall be the initial Depositary for the 1.150% Notes, until a successor shall have been appointed and become such pursuant to the applicable provisions of the Indenture, and thereafter, “Depositary” shall mean or include such successor.

Section

2.11 Defeasance; Discharge. The provisions of Sections 4.3, 4.4, 4.5 and 4.6 of

the Indenture will apply to the 1.150% Notes.

Article

III

The 2.150% NOTES

Section 3.01 Title of Securities. There shall be a series of Securities of the Company designated the “2.150% Notes due June 3, 2031” (the “2.150% Notes”).

Section 3.02 Limitation of Aggregate Principal Amount. The aggregate principal amount of the 2.150% Notes shall initially be limited to US$1,000,000,000. The Company may from time to time, without the consent of the Holders of the 2.150% Notes, create and issue additional notes having the same terms and conditions as the 2.150% Notes in all respects or in all respects except for issue date, issue price and, if applicable, the first date on which interest accrues and the first payment of interest thereon (“Additional 2.150% Notes”). Additional 2.150% Notes issued in this manner will be consolidated with, and will form a single series with, the 2.150% Notes, unless such Additional 2.150% Notes will not be treated as fungible with the 2.150% Notes for U.S. federal income tax purposes. The 2.150% Notes and any such Additional 2.150% Notes would rank equally and ratably.

5

Section 3.03 Principal Payment Date. The principal amount of the 2.150% Notes Outstanding (together with any accrued and unpaid interest) shall be payable in a single installment on June 3, 2031, which date shall be the Stated Maturity of the 2.150% Notes.

Section 3.04 Interest and Interest Rates. The 2.150% Notes will bear interest on the unpaid principal amount thereof at a rate of 2.150% per year from June 3, 2021, or from the most recent Interest Payment Date to which interest has been paid or duly provided for, until the principal amount of the 2.150% Notes shall have been paid or duly provided for, and interest on the 2.150% Notes shall be payable semi-annually in arrears on June 3 and December 3 of each year, beginning on December 3, 2021. Interest on a 2.150% Note will be paid to the Person in whose name that 2.150% Note was registered at the close of business on the May 19 or November 18, as the case may be, whether or not a Business Day, prior to the applicable Interest Payment Date, except that in the case of the Interest Payment Date that is also the Stated Maturity of the 2.150% Notes, the interest due on such date will be paid to the Person to whom principal is payable upon surrender of such Note at a Place of Payment. Interest will be computed on the basis of a 360-day year consisting of twelve 30-day months. The amount of interest payable for any period less than a full interest period shall be computed on the basis of a 360-day year consisting of twelve 30-day months and the actual days elapsed in a partial month in such period. Any payment of principal or interest required to be made on an Interest Payment Date that is not a Business Day shall be made on the next succeeding Business Day, and no interest will accrue on that payment for the period from and after such Interest Payment Date to the date of payment on the next succeeding Business Day. For purposes of the 2.150% Notes, “Business Day” means each Monday, Tuesday, Wednesday, Thursday and Friday that is not a day on which banking institutions in Sydney, Australia, Xxx Xxxx, Xxx Xxxx, xx Xxxxxx, Xxxxxx Xxxxxxx are authorized or obligated by law or executive order to close.

Section 3.05 Place of Payment. The Place of Payment where the 2.150% Notes may be presented or surrendered for payment, where the 2.150% Notes may be surrendered for registration of transfer or exchange and where notices and demands to or upon the Company in respect of the 2.150% Notes and the Indenture may be served initially shall be the Corporate Trust Office of the Trustee maintained for that purpose in the Borough of Manhattan, City of New York.

Section 3.06 Redemption. The Company shall not have the right to redeem the 2.150% Notes other than pursuant to Section 10.8 of the Indenture.

Section 3.07 No Sinking Fund. The 2.150% Notes are not entitled to the benefit of any sinking fund.

Section 3.08 Form. The 2.150% Notes shall be issued initially as Registered Securities (as defined in the Indenture) in the form of one or more permanent notes in global form, without coupons, substantially in the form attached hereto as Exhibit B, deposited with The Bank of New York Mellon, as custodian for the Depositary, duly executed by the Company and authenticated by the Trustee as provided in the Indenture.

6

Section 3.09 Denomination. The 2.150% Notes shall be issuable only in denominations of US$2,000 and integral multiples of US$1,000 in excess thereof. The 2.150% Notes shall be numbered, lettered, or otherwise distinguished in such manner or in accordance with such plans as the Officers of the Company executing the same may determine with the approval of the Trustee.

Section 3.10 Depositary. The Depository Trust Company shall be the initial Depositary for the 2.150% Notes, until a successor shall have been appointed and become such pursuant to the applicable provisions of the Indenture, and thereafter, “Depositary” shall mean or include such successor.

Defeasance; Discharge. The provisions of Sections 4.3, 4.4, 4.5 and 4.6 of the Indenture will apply to the 2.150% Notes.

Article

IV

THE FLOATING RATE NOTES

Section 4.01 Title of Securities. There shall be a series of Securities of the Company designated the “Floating Rate Notes due June 3, 2026” (the “Floating Rate Notes”).

Section 4.02 Limitation of Aggregate Principal Amount. The aggregate principal amount of the Floating Rate Notes shall initially be limited to US$300,000,000. The Company may from time to time, without the consent of the Holders of the Floating Rate Notes, create and issue additional notes having the same terms and conditions as the Floating Rate Notes in all respects or in all respects except for issue date, issue price and, if applicable, the first date on which interest accrues and the first payment of interest thereon (“Additional Floating Rate Notes”). Additional Floating Rate Notes issued in this manner will be consolidated with, and will form a single series with, the Floating Rate Notes, unless such Additional Floating Rate Notes will not be treated as fungible with the Floating Rate Notes for U.S. federal income tax purposes. The Floating Rate Notes and any such Additional Floating Rate Notes would rank equally and ratably.

Section 4.03 Principal Payment Date. The principal amount of the Floating Rate Notes Outstanding (together with any accrued and unpaid interest) shall be payable in a single installment on June 3, 2026 which date shall be the Stated Maturity of the Floating Rate Notes.

7

Section 4.04 Interest and Interest Rates.

(a) The Floating Rate Notes will bear interest on the unpaid principal amount thereof from June 3, 2021, or from the most recent Floating Rate Interest Payment Date (as defined below) to which interest has been paid or duly provided for, until the principal amount of the Floating Rate Notes shall have been paid or duly provided for. The interest rate per annum for the Floating Rate Notes will be reset quarterly on the first day of each Floating Rate Interest Period (as defined below) and will be equal to Compounded SOFR (as defined below) plus a margin of 52 basis points, as determined by a calculation agent (the “Calculation Agent”). The Bank of New York Mellon will initially act as Calculation Agent. The amount of interest accrued and payable on the Floating Rate Notes for each Floating Rate Interest Period will be equal to the product of (i) the Outstanding principal amount of the Floating Rate Notes multiplied by (ii) the product of (a) the interest rate for the relevant Floating Rate Interest Period (as defined below) multiplied by (b) the quotient of the actual number of calendar days in such Observation Period (as defined below) divided by 360.

(b) Interest on the Floating Rate Notes shall be payable quarterly in arrears on each March 3, June 3, September 3 and December 3 (each such date, a “Floating Rate Interest Payment Date”), beginning on September 3, 2021. If any Floating Rate Interest Payment Date would fall on a day that is not a Business Day, other than the Floating Rate Interest Payment Date that is also the Stated Maturity of the Floating Rate Notes, that Floating Rate Interest Payment Date will be postponed to the following day that is a Business Day, except that if such next Business Day is in a different month, then that Floating Rate Interest Payment Date will be the immediately preceding day that is a Business Day. If the Stated Maturity of the Floating Rate Notes is not a Business Day, payment of principal and interest on the Floating Rate Notes will be made on the following day that is a Business Day and no interest will accrue for the period from and after such Stated Maturity of the Floating Rate Notes. Interest on a Floating Rate Note will be paid to the Person in whose name that Floating Rate Note was registered at the close of business on the February 16, May 19, August 19 or November 18, as the case may be, whether or not a Business Day, prior to the applicable Floating Rate Interest Payment Date, except that in the case of the Floating Rate Interest Payment Date that is also the Stated Maturity of the Floating Rate Notes, the interest due on such date will be paid to the Person to whom principal is payable upon surrender of such Floating Rate Note at a Place of Payment.

(c) On each Floating Rate Interest Payment Date, the Company will pay interest for the Floating Rate Interest Period ended on the day immediately preceding such Floating Rate Interest Payment Date. “Floating Rate Interest Period” shall mean the period commencing on and including June 3, 2021 to but excluding the first Floating Rate Interest Payment Date and each successive period from and including a Floating Rate Interest Payment Date to but excluding the next Floating Rate Interest Payment Date.

8

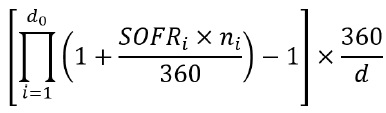

(d) The interest rate on the Floating Rate Notes for each Floating Rate Interest Period will be equal to Compounded SOFR (as defined herein) plus a margin of 52 basis points. “Compounded SOFR” will be determined by the Calculation Agent in accordance with the following formula:

where:

“d0,” for any Observation Period, is the number of U.S. Government Securities Business Days in the relevant Observation Period;

“i” is a series of whole numbers from one to d0, each representing the relevant U.S. Government Securities Business Day in chronological order from, and including, the first U.S. Government Securities Business Day in the relevant Observation Period;

“SOFRi,” for any U.S. Government Securities Business Day “i” in the relevant Observation Period, is equal to SOFR in respect of that day “i”;

“ni,” for any U.S. Government Securities Business Day “i” in the relevant Observation Period, is the number of calendar days from, and including, such U.S. Government Securities Business Day “i” to, but excluding, the following U.S. Government Securities Business Day (“i+1”); and

“d” is the number of calendar days in the relevant Observation Period.

For these calculations, the daily SOFR in effect on any U.S. Government Securities Business Day will be the applicable SOFR as reset on that date.

(e) For purposes of determining Compounded SOFR, “SOFR” means, with respect to any U.S. Government Securities Business Day:

| (i) | the Secured Overnight Financing Rate published for such U.S. Government Securities Business Day as such rate appears on the Federal Reserve Bank of New York’s Website at 3:00 p.m. (New York time) on the immediately following U.S. Government Securities Business Day (the “SOFR Determination Time”); or |

9

| (ii) | if the rate specified in (i) above does not so appear, unless both a Benchmark Transition Event and its related Benchmark Replacement Date have occurred, the Secured Overnight Financing Rate as published in respect of the first preceding U.S. Government Securities Business Day for which the Secured Overnight Financing Rate was published on the Federal Reserve Bank of New York’s Website. |

(f) Notwithstanding anything to the contrary herein, if the Company or its designee (which may be an independent financial advisor or other designee of the Company (any of such entities, a ‘‘Designee’’)), determines on or prior to the relevant Reference Time that a Benchmark Transition Event and its related Benchmark Replacement Date (each as defined below) have occurred with respect to determining Compounded SOFR, then the benchmark replacement provisions set forth herein will thereafter apply to all determinations of the rate of interest payable on the Floating Rate Notes.

(g) For the avoidance of doubt, in accordance with the benchmark replacement provisions, after a Benchmark Transition Event and its related Benchmark Replacement Date have occurred, the interest payable for each Floating Rate Interest Period on the Floating Rate Notes will be an annual rate equal to the sum of the Benchmark Replacement (as defined below) and the applicable margin.

(h) Effect of Benchmark Transition Event

| (i) | Benchmark Replacement. If the Company or its Designee determines that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred prior to the Reference Time in respect of any determination of the Benchmark on any date, the Benchmark Replacement will replace the then-current Benchmark for all purposes relating to the Floating Rate Notes in respect of such determination on such date and all determinations on all subsequent dates. |

| (ii) | Benchmark Replacement Conforming Changes. In connection with the implementation of a Benchmark Replacement, the Company or its Designee will have the right to make Benchmark Replacement Conforming Changes from time to time. |

10

| (iii) | Decisions and Determinations. Any determination, decision or election that may be made by the Company or its Designee pursuant to the benchmark replacement provisions herein, including any determination with respect to tenor, rate or adjustment or of the occurrence or non-occurrence of an event, circumstance or date and any decision to take or refrain from taking any action or any selection: |

(A) will be conclusive and binding absent manifest error;

(B) if made by the Company, will be made in its sole discretion;

(C) if made by the Company’s Designee, will be made after consultation with the Company, and the Designee will not make any such determination, decision or election to which the Company objects; and

(D) shall become effective without consent from any other party.

| (iv) | Any determination, decision or election pursuant to the benchmark replacement provisions not made by the Company’s Designee will be made by the Company on the basis set forth above. The Designee shall have no liability for not making any such determination, decision or election. In addition, the Company may designate an entity (which may be the Company’s affiliate) to make any determination, decision or election that the Company has the right to make in connection with the benchmark replacement provisions set forth herein. |

(i) Certain Defined Terms. As used herein:

| (i) | “Benchmark” means, initially, Compounded SOFR, as such term is defined above; provided that if a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to Compounded SOFR (or the published daily SOFR used in the calculation thereof) or the then-current Benchmark, then “Benchmark” means the applicable Benchmark Replacement. |

11

| (ii) | “Benchmark Replacement” means the first alternative set forth in the order below that can be determined by the Company or its Designee as of the Benchmark Replacement Date: |

(A) the sum of: (I) an alternate rate of interest that has been selected or recommended by the Relevant Governmental Body as the replacement for the then-current Benchmark for the applicable Corresponding Tenor and (II) the Benchmark Replacement Adjustment;

(B) the sum of: (I) the ISDA Fallback Rate and (II) the Benchmark Replacement Adjustment; and

(C) the sum of: (I) the alternate rate of interest that has been selected by the Company or its Designee as the replacement for the then-current Benchmark for the applicable Corresponding Tenor giving due consideration to any industry-accepted rate of interest as a replacement for the then-current Benchmark for U.S. dollar denominated Floating Rate Notes at such time and (II) the Benchmark Replacement Adjustment.

| (iii) | “Benchmark Replacement Adjustment” means the first alternative set forth in the order below that can be determined by the Company or its Designee as of the Benchmark Replacement Date: |

(A) the spread adjustment, or method for calculating or determining such spread adjustment (which may be a positive or negative value or zero) that has been selected or recommended by the Relevant Governmental Body for the applicable Unadjusted Benchmark Replacement;

(B) if the applicable Unadjusted Benchmark Replacement is equivalent to the ISDA Fallback Rate, then the ISDA Fallback Adjustment; and

(C) the spread adjustment (which may be a positive or negative value or zero) that has been selected by the Company or its Designee giving due consideration to any industry-accepted spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of the then-current Benchmark with the applicable Unadjusted Benchmark Replacement for U.S. dollar denominated Floating Rate Notes at such time.

12

| (iv) | “Benchmark Replacement Conforming Changes” means, with respect to any Benchmark Replacement, any technical, administrative or operational changes (including changes to the definitions or interpretations of Floating Rate Interest Period, the timing and frequency of determining rates and making payments of interest, the rounding of amounts or tenors, and other administrative matters) that the Company or its Designee decides may be appropriate to reflect the adoption of such Benchmark Replacement in a manner substantially consistent with market practice (or, if the Company or its Designee decides that adoption of any portion of such market practice is not administratively feasible or if the Company or its Designee determines that no market practice for use of the Benchmark Replacement exists, in such other manner as the Company or its Designee determines is reasonably practicable). |

| (v) | “Benchmark Replacement Date” means the earliest to occur of the following events with respect to the then-current Benchmark: |

(A) in the case of clause (A) or (B) of the definition of “Benchmark Transition Event,” the later of (I) the date of the public statement or publication of information referenced therein and (II) the date on which the administrator of the Benchmark permanently or indefinitely ceases to provide the Benchmark; or

(B) in the case of clause (C) of the definition of “Benchmark Transition Event,” the date of the public statement or publication of information referenced therein.

For the avoidance of doubt, if the event giving rise to the Benchmark Replacement Date occurs on the same day as, but earlier than, the Reference Time in respect of any determination, the Benchmark Replacement Date will be deemed to have occurred prior to the Reference Time for such determination.

| (vi) | “Benchmark Transition Event” means the occurrence of one or more of the following events with respect to the then-current Benchmark: |

(A) a public statement or publication of information by or on behalf of the administrator of the Benchmark announcing that such administrator has ceased or will cease to provide the Benchmark, permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark;

13

(B) a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark, the central bank for the currency of the Benchmark, an insolvency official with jurisdiction over the administrator for the Benchmark, a resolution authority with jurisdiction over the administrator for the Benchmark or a court or an entity with similar insolvency or resolution authority over the administrator for the Benchmark, which states that the administrator of the Benchmark has ceased or will cease to provide the Benchmark permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark; or

(C) a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark announcing that the Benchmark is no longer representative.

| (vii) | “Corresponding Tenor” with respect to a Benchmark Replacement means a tenor (including overnight) having approximately the same length (disregarding business day adjustment) as the applicable tenor for the then-current Benchmark. |

| (viii) | “Federal Reserve Bank of New York’s Website” means the website of the Federal Reserve Bank of New York, currently at xxxx://xxx.xxxxxxxxxx.xxx, or any successor source. |

| (ix) | ‘‘Floating Rate Interest Payment Determination Date’’ means the date two U.S. Government Securities Business Days before each Floating Rate Interest Payment Date. |

| (x) | “ISDA Definitions” means the 2006 ISDA Definitions published by the International Swaps and Derivatives Association, Inc. or any successor thereto, as amended or supplemented from time to time, or any successor definitional booklet for interest rate derivatives published from time to time. |

| (xi) | “ISDA Fallback Adjustment” means the spread adjustment, (which may be a positive or negative value or zero) that would apply for derivatives transactions referencing the ISDA Definitions to be determined upon the occurrence of an index cessation event with respect to the Benchmark for the applicable tenor. |

| (xii) | “ISDA Fallback Rate” means the rate that would apply for derivatives transactions referencing the ISDA Definitions to be effective upon the occurrence of an index cessation date with respect to the Benchmark for the applicable tenor excluding the applicable ISDA Fallback Adjustment. |

14

| (xiii) | “Observation Period” means, in respect of each Floating Rate Interest Period, the period from, and including, the date two U.S. Government Securities Business Days preceding the first date in such Floating Rate Interest Period to, but excluding, the date two U.S. Government Securities Business Days preceding the Floating Rate Interest Payment Date for such Floating Rate Interest Period. |

| (xiv) | “Reference Time” with respect to any determination of the Benchmark means (1) if the Benchmark is Compounded SOFR, the SOFR Determination Time, and (2) if the Benchmark is not Compounded SOFR, the time determined by the Company or its Designee in accordance with the Benchmark Replacement Conforming Changes. |

| (xv) | “Relevant Governmental Body” means the Federal Reserve Board and/or the Federal Reserve Bank of New York, or a committee officially endorsed or convened by the Federal Reserve Board and/or the Federal Reserve Bank of New York or any successor thereto. |

| (xvi) | “SOFR” with respect to any day means the secured overnight financing rate published for such day by the Federal Reserve Bank of New York, as the administrator of the benchmark, (or a successor administrator) on the Federal Reserve Bank of New York’s Website. |

| (xvii) | “Unadjusted Benchmark Replacement” means the Benchmark Replacement excluding the Benchmark Replacement Adjustment. |

| (xviii) | “U.S. Government Securities Business Day” means any day except for a Saturday, a Sunday or a day on which the Securities Industry and Financial Markets Association recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities. |

(j) The interest rate and amount of interest to be paid on the Floating Rate Notes for each Floating Rate Interest Period will be determined by the Calculation Agent. All determinations made by the Calculation Agent shall, in the absence of manifest error, be conclusive for all purposes and binding on the Company and the Holders. So long as Compounded SOFR is required to be determined with respect to the Floating Rate Notes, there will at all times be a Calculation Agent. In the event that any then acting Calculation Agent shall be unable or unwilling to act, or that such Calculation Agent shall fail duly to establish Compounded SOFR for any Floating Rate Interest Period, or the Company proposes to remove such Calculation Agent, the Company shall appoint another Calculation Agent.

15

(k) In no event shall the Calculation Agent be the Company’s Designee. The Calculation Agent shall have no liability for any determination made by or on behalf of the Company or its Designee in connection with a Benchmark Transition Event or a Benchmark Replacement or any adjustments or conforming changes thereto. In no event shall the Calculation Agent be responsible for determining any substitute for SOFR or any Benchmark Replacement, or for determining whether any Benchmark Transition Event has occurred or for making any Benchmark Replacement Adjustments or Benchmark Replacement Conforming Changes. In connection with the foregoing, the Calculation Agent will be entitled to conclusively rely on any determinations made by the Company or its Designee.

(l) In no event shall the interest rate on the Floating Rate Notes be higher than the maximum rate permitted by New York law, as the same may be modified by United States law of general application. Additionally, the interest rate on the Floating Rate Notes will in no event be lower than zero.

(m) All percentages resulting from any of the calculations in this Article IV will be rounded, if necessary, to the nearest one hundred thousandth of a percentage point, with five one-millionths of a percentage point rounded upwards (e.g., 9.876545% (or .09876545) being rounded to 9.87655% (or .0987655)) and all dollar amounts used in or resulting from such calculations will be rounded to the nearest cent (with one-half cent being rounded upwards).

Section 4.05 Place of Payment. The Place of Payment where the Floating Rate Notes may be presented or surrendered for payment, where the Floating Rate Notes may be surrendered for registration of transfer or exchange and where notices and demands to or upon the Company in respect of the Floating Rate Notes and the Indenture may be served initially shall be the Corporate Trust Office of the Trustee maintained for that purpose in the Borough of Manhattan, City of New York.

Section 4.06 Redemption. The Company shall not have the right to redeem the Floating Rate Notes other than pursuant to Section 10.8 of the Indenture.

Section 4.07 No Sinking Fund. The Floating Rate Notes are not entitled to the benefit of any sinking fund.

Section 4.08 Form. The Floating Rate Notes shall be issued initially as Registered Securities (as defined in the Indenture) in the form of one or more permanent notes in global form, without coupons, substantially in the form attached hereto as Exhibit C, deposited with The Bank of New York Mellon, as custodian for the Depositary, duly executed by the Company and authenticated by the Trustee as provided in the Indenture.

16

Section 4.09 Denomination. The Floating Rate Notes shall be issuable only in denominations of US$2,000 and integral multiples of US$1,000 in excess thereof. The Floating Rate Notes shall be numbered, lettered, or otherwise distinguished in such manner or in accordance with such plans as the Officers of the Company executing the same may determine with the approval of the Trustee.

Section 4.10 Depositary. The Depository Trust Company shall be the initial Depositary for the Floating Rate Notes, until a successor shall have been appointed and become such pursuant to the applicable provisions of the Indenture, and thereafter, “Depositary” shall mean or include such successor.

Section 4.11 Defeasance; Discharge. The provisions of Sections 4.3, 4.4, 4.5 and 4.6 of the Indenture will apply to the Floating Rate Notes.

Section 4.12 Defined Terms. Terms specifically defined in this Article V shall only relate to the Floating Rate Notes and shall have no bearing on any other series of notes referenced in this Twenty-Ninth Supplemental Indenture.

Article

V

MISCELLANEOUS

Section 5.01 Electronic Communications. The Trustee shall have the right to accept and act upon instructions, including funds transfer instructions (“Instructions”) given pursuant to the Indenture and delivered using Electronic Means (as defined below); provided, however, that, unless previously provided, the Company shall provide to the Trustee an incumbency certificate listing officers with the authority to provide such Instructions (“Authorized Officers”) and containing specimen signatures of such Authorized Officers, which incumbency certificate shall be amended by the Company whenever a person is to be added or deleted from the listing. If the Company elects to give the Trustee Instructions using Electronic Means and the Trustee in its discretion elects to act upon such Instructions, the Trustee’s understanding of such Instructions shall be deemed controlling. The Company understands and agrees that the Trustee cannot determine the identity of the actual sender of such Instructions and that the Trustee shall conclusively presume that directions that purport to have been sent by an Authorized Officer listed on the incumbency certificate provided to the Trustee have been sent by such Authorized Officer. The Company shall be responsible for ensuring that only Authorized Officers transmit such Instructions to the Trustee and that the Company and all Authorized Officers are solely responsible to safeguard the use and confidentiality of applicable user and authorization codes, passwords and/or authentication keys upon receipt by the Company. The Trustee shall not be liable for any losses, costs or expenses arising directly or indirectly from the Trustee’s reliance upon and compliance with such Instructions notwithstanding such directions conflict or are inconsistent with a subsequent written instruction, except as may result from its own gross negligence, bad faith or willful misconduct. The Company agrees: (i) to assume all risks arising out of the use of Electronic Means to submit Instructions to the Trustee, including without limitation the risk of the Trustee acting on unauthorized Instructions (unless the Trustee has acted on such unauthorized Instructions with gross negligence, in bad faith or with willful misconduct), and the risk of interception and misuse by third parties; (ii) that it is fully informed of the protections and risks associated with the various methods of transmitting Instructions to the Trustee and that there may be more secure methods of transmitting Instructions than the method(s) selected by the Company; (iii) that the security procedures (if any) to be followed in connection with its transmission of Instructions provide to it a commercially reasonable degree of protection in light of its particular needs and circumstances; and (iv) to notify the Trustee immediately upon learning of any compromise or unauthorized use of the security procedures.

17

"Electronic Means" shall mean the following communications methods: e-mail, facsimile transmission, secure electronic transmission containing applicable authorization codes, passwords and/or authentication keys issued by the Trustee, or another method or system specified by the Trustee as available for use in connection with its services hereunder.

Section 5.02 OFAC. None of the Company, any of its subsidiaries or, to the knowledge of the Company, any director, officer, agent, employee or affiliate of the Company or any of its subsidiaries is currently subject to any U.S. sanctions administered by the Office of Foreign Assets Control of the U.S. Department of the Treasury (“OFAC”); and the Company will not use the proceeds of the offering of the 1.150% Notes, the 2.150% Notes and the Floating Rate Notes in a manner that would result in a violation by the Bank of the U.S. sanctions administered by OFAC.

Section 5.03 Integral Part; Effect of Supplement on Indenture. This Twenty-Ninth Supplemental Indenture constitutes an integral part of the Indenture. Except for the amendments and supplements made by this Twenty-Ninth Supplemental Indenture, the Amended Base Indenture shall remain in full force and effect as executed.

Section 5.04 Adoption, Ratification and Confirmation. The Indenture, as amended and supplemented by this Twenty-Ninth Supplemental Indenture, is in all respects hereby adopted, ratified and confirmed.

Section 5.05 Trustee Not Responsible for Recitals. The recitals in this Twenty-Ninth Supplemental Indenture shall be taken as statements of the Company, and the Trustee assumes no responsibility for their correctness. The Trustee makes no representations as to the validity or adequacy of this Twenty-Ninth Supplemental Indenture.

Section 5.06 Counterparts. This Twenty-Ninth Supplemental Indenture may be executed in any number of counterparts, each of which shall be an original but such counterparts shall together constitute but one instrument.

18

Section 5.07 Separability. In case any provision of this Twenty-Ninth Supplemental Indenture shall be invalid, illegal or unenforceable, the validity, legality and enforceability of the remaining provisions shall not in any way be affected or impaired thereby.

Section 5.08 Governing Law. This Twenty-Ninth Supplemental Indenture shall be governed by and construed in accordance with the laws of the State of New York, including all matters of construction, validity and performance.

[signature page follows]

19

IN WITNESS WHEREOF, the Company and the Trustee have executed this Twenty-Ninth Supplemental Indenture as of the date first above written.

| WESTPAC BANKING CORPORATION | |||

| By: | /s/ Xxxxxx Xxxxxxxx | ||

| Name: | Xxxxxx Xxxxxxxx | ||

| Title: | Tier 1 Attorney | ||

| THE BANK OF NEW YORK MELLON, as Trustee | |||

| By: | /s/ Xxxxxxx Xxxxxxxx | ||

| Name: | Xxxxxxx Xxxxxxxx | ||

| Title: | Agent | ||

20

Exhibit A

(FORM OF FACE OF NOTE)

[THIS SECURITY IS IN GLOBAL FORM WITHIN THE MEANING OF THE INDENTURE HEREINAFTER REFERRED TO AND IS REGISTERED IN THE NAME OF A DEPOSITARY OR A NOMINEE OF A DEPOSITARY. UNLESS AND UNTIL IT IS EXCHANGED IN WHOLE OR IN PART FOR SECURITIES IN CERTIFICATED FORM, THIS SECURITY MAY NOT BE TRANSFERRED EXCEPT AS A WHOLE BY THE DEPOSITARY TO A NOMINEE OF THE DEPOSITARY OR BY A NOMINEE OF THE DEPOSITARY TO THE DEPOSITARY OR ANOTHER NOMINEE OF THE DEPOSITARY OR BY THE DEPOSITARY OR ANY SUCH NOMINEE TO A SUCCESSOR DEPOSITARY OR A NOMINEE OF SUCH SUCCESSOR DEPOSITARY. EVERY SECURITY AUTHENTICATED AND DELIVERED UPON REGISTRATION OF, OR IN EXCHANGE FOR, OR IN LIEU OF, THIS SECURITY WILL BE IN GLOBAL FORM, SUBJECT TO THE FOREGOING.

UNLESS THIS CERTIFICATE IS PRESENTED BY AN AUTHORIZED REPRESENTATIVE OF THE DEPOSITORY TRUST COMPANY, A NEW YORK CORPORATION (“DTC”), NEW YORK, NEW YORK, TO THE COMPANY OR ITS AGENT FOR REGISTRATION OF TRANSFER, EXCHANGE OR PAYMENT, AND ANY CERTIFICATE ISSUED IS REGISTERED IN THE NAME OF CEDE & CO. OR SUCH OTHER NAME AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC (AND ANY PAYMENT IS MADE TO CEDE & CO., OR TO SUCH OTHER ENTITY AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC), ANY TRANSFER, PLEDGE OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL INASMUCH AS THE REGISTERED OWNER HEREOF, CEDE & CO., HAS AN INTEREST HEREIN.]1

1 Insert in Global Notes only

X-0

| Xx. | XXXXX Xx. 000000XX0 | |

| ISIN No. US961214ER00 |

WESTPAC BANKING CORPORATION

1.150% NOTE DUE JUNE 3, 2026

WESTPAC BANKING CORPORATION, a company incorporated in the Commonwealth of Australia under the Corporations Xxx 0000 of the Commonwealth of Australia and registered in New South Wales (the “Company”, which term includes any successor corporation under the Indenture hereinafter referred to), for value received, hereby promises to pay to or registered assigns, the principal sum of (US$ ) on June 3, 2026 (the “Stated Maturity”). This Note will bear interest on the unpaid principal amount hereof at a rate of 1.150% per year from June 3, 2021, or from the most recent Interest Payment Date to which interest has been paid or duly provided for, until the principal amount hereof shall have been paid or duly provided for, and interest on the Notes shall be payable semi-annually in arrears on June 3 and December 3 of each year (each such date, an “Interest Payment Date”), beginning on December 3, 2021. Interest will be computed on the basis of a 360-day year consisting of twelve 30-day months. The amount of interest payable for any period less than a full interest period shall be computed on the basis of a 360-day year consisting of twelve 30-day months and the actual days elapsed in a partial month in such period. Any payment of principal or interest required to be made on an Interest Payment Date that is not a Business Day shall be made on the next succeeding Business Day, and no interest will accrue on that payment for the period from and after such Interest Payment Date to the date of payment on the next succeeding Business Day. For purposes hereof, “Business Day” means each Monday, Tuesday, Wednesday, Thursday and Friday that is not a day on which banking institutions in Sydney, Australia, Xxx Xxxx, Xxx Xxxx, xx Xxxxxx, Xxxxxx Xxxxxxx are authorized or obligated by law or executive order to close.

Interest on this Note which is payable, and is punctually paid or duly provided for, on any Interest Payment Date shall be paid to the Person in whose name this Note (or one or more Predecessor Securities) is registered at the close of business on the Regular Record Date for such interest, which shall be the close of business on the May 19 or November 18 (whether or not a Business Day), as the case may be, next preceding such Interest Payment Date, at the office or agency maintained for such purpose pursuant to the Indenture; provided, however, that at the option of the Company, interest on this Note may be paid (i) by check mailed to the address of the Person entitled thereto as it shall appear on the Register or (ii) to a Holder of US$1,000,000 or more in aggregate principal amount of the Notes by wire transfer to an account maintained by the Person entitled thereto as specified in the Register. Any interest on this Note which is payable, but is not punctually paid or duly provided for, on any Interest Payment Date (herein called “Defaulted Interest”) shall forthwith cease to be payable to the Holder on the relevant Regular Record Date by virtue of having been such Holder, and such Defaulted Interest shall instead be payable to the Person in whose name this Note is registered on the Special Record Date or other specified date in accordance with the Indenture. Notwithstanding the foregoing, interest payable on an Interest Payment Date that is also the Stated Maturity of this Note will be paid at such office or agency to the Person to whom the principal hereof is payable, upon surrender of this Note at such office or agency.

A-2

This Note shall not be entitled to any benefit under the Indenture hereinafter referred to or be valid or become obligatory for any purpose until the Certificate of Authentication hereon shall have been signed by or on behalf of the Trustee.

The provisions of this Note are continued on the reverse side hereof and such continued provisions shall for all purposes have the same effect as though fully set forth at this place.

A-3

IN WITNESS WHEREOF, the Company has caused this instrument to be executed on this 3rd day of June, 2021.

| WESTPAC BANKING CORPORATION | ||

| By: | ||

| Name: | ||

| Title: | ||

CERTIFICATE OF AUTHENTICATION

This is one of the Securities of the series designated herein and issued under the within-mentioned Indenture.

| The Bank of New York Mellon, as Trustee | ||||

| Dated: | By: | |||

| Authorized Signatory | ||||

A-4

(FORM OF REVERSE OF NOTE)

This Note is one of a duly authorized series of securities of the Company, issued and to be issued in one or more series under and pursuant to a Senior Indenture, dated as of July 1, 1999 (the “Base Indenture”), duly executed and delivered between the Company and The Bank of New York Mellon, as successor to The Chase Manhattan Bank, as trustee (the “Trustee”, which term includes any successor trustee under the Indenture), as amended and supplemented by the First Supplemental Indenture, dated as of August 27, 2009, between the Company and the Trustee (the “First Supplemental Indenture”), the Fifth Supplemental Indenture, dated as of August 14, 2012, between the Company and the Trustee (the “Fifth Supplemental Indenture”), the Seventeenth Supplemental Indenture, dated as of November 9, 2016, between the Company and the Trustee (the “Seventeenth Supplemental Indenture”) and the Twenty-Fifth Supplemental Indenture, dated as of November 9, 2018, between the Company and the Trustee (the “Twenty-Fifth Supplemental Indenture”; the Base Indenture as amended and supplemented by the First Supplemental Indenture, the Fifth Supplemental Indenture, the Seventeenth Supplemental Indenture and the Twenty-Fifth Supplemental Indenture is referred to herein as the “Amended Base Indenture”), and as further amended and supplemented by the Twenty-Ninth Supplemental Indenture, dated as of June 3, 2021, between the Company and the Trustee (the “Twenty-Ninth Supplemental Indenture”; the Amended Base Indenture, as further amended and supplemented by the Twenty-Ninth Supplemental Indenture, is referred to herein as the “Indenture”), to which Indenture and all Indentures supplemental thereto reference is hereby made for a description of the rights, limitations of rights, obligations, duties and immunities thereunder of the Trustee, the Company and the Holders of the Notes. This Note is one of a series of securities designated on the face hereof (the “Notes”). The Notes are issued pursuant to the Indenture and are limited in aggregate principal amount to US$1,450,000,000; provided, however, that the Company may from time to time, without the consent of the Holders of the Notes, create and issue additional notes having the same terms and conditions as the Notes in all respects or in all respects except for issue date, issue price and, if applicable, the first date on which interest accrues and the first payment of interest thereon. Additional notes issued in this manner will be consolidated with, and will form a single series with, the Notes, unless such additional notes will not be treated as fungible with the Notes for U.S. federal income tax purposes. The Notes and any such additional notes would rank equally and ratably.

A-5

In accordance with Section 10.8 of the Indenture, pursuant to the procedure set forth in Article X of the Indenture, the Company may, at its option, redeem all, but not less than all, of the Notes if (a) there is a change in or any amendment to the laws or regulations (i) of the Commonwealth of Australia, or any political subdivision or taxing authority thereof or therein, or (ii) in the event of the assumption pursuant to Section 7.1 of the Indenture of the obligations of the Company under the Indenture and this Note by an entity organized under the laws of a country other than the Commonwealth of Australia or a political subdivision of a country other than the Commonwealth of Australia, of the Commonwealth of Australia or the country in which such entity is organized or resident or deemed resident for tax purposes or any political subdivision or taxing authority thereof or therein, or (b) there is a change in any application or interpretation of any such laws or regulations, which change or amendment becomes effective, (i) with respect to taxes imposed by the Commonwealth of Australia or any political subdivision or taxing authority thereof or therein, on or after the date the Company originally issued this Note, or (ii) in the event of the assumption pursuant to Section 7.1 of the Indenture of the obligations of the Company under the Indenture and this Note by an entity organized under the laws of a country other than the Commonwealth of Australia or a political subdivision of a country other than the Commonwealth of Australia, with respect to taxes imposed by a non-Australian jurisdiction, on or after the date of the transaction resulting in such assumption, and, in each case, as a result of such change or amendment (1) the Company is or will become obligated to pay any additional amounts on this Note pursuant to Section 9.8 of the Indenture or (2) the Company would not be entitled to claim a deduction in computing its taxation liabilities in respect of (A) any payments of interest or additional amounts or (B) any original issue discount on this Note.

Before the Company may redeem this Note, it must give the Holder of this Note at least 30 days’ written notice and not more than 60 days’ written notice of its intention to redeem this Note, provided that if the earliest date on which (i) the Company will be obligated to pay any additional amounts, or (ii) the Company would not be entitled to claim a deduction in respect of any payments of interest or additional amounts on or any original issue discount in respect of this Note in computing its taxation liabilities, would occur less than 45 days after the relevant change or amendment to the applicable laws, regulations, determinations or guidelines, the Company may give less than 30 days’ written notice but in no case less than 15 days’ written notice, provided it gives such notice as soon as practicable in all the circumstances.

The Redemption Price for this Note shall equal 100% of the principal amount of this Note plus accrued but unpaid interest to but excluding the date of redemption.

The Indenture contains provisions for defeasance and covenant defeasance at any time of the indebtedness evidenced by this Note upon compliance by the Company with certain conditions set forth therein.

If an Event of Default shall have occurred and be continuing, the principal hereof may be declared, and upon such declaration become, due and payable immediately, in the manner, with the effect and subject to the conditions provided in the Indenture. The Indenture contains provisions permitting the Holders of not less than a majority in aggregate principal amount of the Outstanding Notes, on behalf of all of the Holders of the Notes, to waive any Event of Default under the Indenture and its consequences, subject to Section 5.7 of the Indenture.

A-6

In accordance with Section 9.8 of the Indenture, the Company will pay all amounts that it is required to pay in respect of this Note without withholding or deduction for, or on account of, any present or future taxes, duties, assessments or other governmental charges imposed or levied by or on behalf of the Commonwealth of Australia or any political subdivision or taxing authority thereof or therein, unless such withholding or deduction is required by law. In that event, the Company will pay such additional amounts as may be necessary so that the net amount received by the Holder of this Note, after such withholding or deduction, will equal the amount that the Holder of this Note would have received in respect of this Note without such withholding or deduction; provided that the Company will pay no additional amounts in respect of this Note for or on account of:

| (1) | any tax, duty, assessment or other governmental charge that would not have been imposed but for the fact that the Holder, or the beneficial owner, of this Note was a resident, domiciliary or national of, or engaged in business or maintained a permanent establishment or was physically present in, the Commonwealth of Australia or any political subdivision or taxing authority thereof or therein or otherwise had some connection with the Commonwealth of Australia or any political subdivision or taxing authority thereof or therein other than merely holding this Note or receiving payments under this Note; |

| (2) | any tax, duty, assessment or other governmental charge that would not have been imposed but for the fact that the Holder of this Note presented this Note for payment in the Commonwealth of Australia, unless the Holder was required to present this Note for payment and it could not have been presented for payment anywhere else; |

| (3) | any tax, duty, assessment or other governmental charge that would not have been imposed but for the fact that the Holder of this Note presented this Note for payment more than 30 days after the date such payment became due and was provided for, whichever is later, except to the extent that the Holder would have been entitled to the additional amounts on presenting this Note for payment on any day during that 30 day period; |

| (4) | any estate, inheritance, gift, sale, transfer, personal property or similar tax, duty, assessment or other governmental charge; |

| (5) | any tax, duty, assessment or other governmental charge which is payable otherwise than by withholding or deduction; |

| (6) | any tax, duty, assessment or other governmental charge that would not have been imposed if the Holder, or the beneficial owner, of this Note complied with the Company’s request to provide information concerning his, her or its nationality, residence or identity or to make a declaration, claim or filing or satisfy any requirement for information or reporting that is required to establish the eligibility of the Holder, or the beneficial owner, of this Note to receive the relevant payment without (or at a reduced rate of) withholding or deduction for or on account of any such tax, duty, assessment or other governmental charge; |

A-7

| (7) | any tax, duty, assessment or other governmental charge that would not have been imposed but for the Holder, or the beneficial owner, of this Note being an associate of the Company’s for purposes of Section 128F of the Income Tax Assessment Xxx 0000 of the Commonwealth of Australia, as amended, or any successor act (the “Australian Tax Act”) (other than in the capacity of a clearing house, paying agent, custodian, funds manager or responsible entity of a registered scheme under the Corporations Xxx 0000 of the Commonwealth of Australia, as amended, or any successor act); |

| (8) | any tax, duty, assessment or other governmental charge that is imposed or withheld as a consequence of a determination having been made under Part IVA of the Australian Tax Act (or any modification thereof or provision substituted therefor) by the Australian Commissioner of Taxation that such tax, duty, assessment or other governmental charge is payable in circumstances where the Holder, or the beneficial owner, of this Note is a party to or participated in a scheme to avoid such tax which the Company was not a party to; |

| (9) | any tax, duty, assessment or other governmental charge arising under or in connection with Section 1471 to 1474 of the U.S. Internal Revenue Code of 1986, as amended, including any regulations or official interpretations issued, agreements (including, without limitation, intergovernmental agreements) entered into or non-U.S. laws enacted with respect thereto (“FATCA”); or |

| (10) | any combination of the foregoing. |

Subject to the foregoing, additional amounts will also not be payable by the Company with respect to any payment on this Note to any Holder who is a fiduciary or partnership or other than the sole beneficial owner of such payment to the extent that payment would, under the laws of the Commonwealth of Australia or any political subdivision or taxing authority thereof or therein, be treated as being derived or received for tax purposes by a beneficiary or settler of that fiduciary or member of that partnership or a beneficial owner, in each case, who would not have been entitled to those additional amounts had it been the actual Holder of this Note.

If, as a result of the Company’s consolidation or merger with or into an entity organized under the laws of a country other than the Commonwealth of Australia or a political subdivision of a country other than the Commonwealth of Australia or the sale, conveyance or transfer by the Company of all or substantially all its assets to such an entity, such an entity assumes the obligations of the Company, such entity will pay additional amounts on the same basis, except that references to “the Commonwealth of Australia” (other than in clause (7) above) will be treated as references to both the Commonwealth of Australia and the country in which such entity is organized or resident (or deemed resident for tax purposes).

A-8

The Company, and any other Person to or through which any payment with respect to this Note may be made, shall be entitled to withhold or deduct from any payment with respect to this Note amounts required to be withheld or deducted under or in connection with FATCA, and Holders and beneficial owners of this Note shall not be entitled to receive any gross up or other additional amounts on account of any such withholding or deduction.

All references in this Note to the payment of the principal of or interest on this Note shall be deemed to include the payment of additional amounts to the extent that, in that context, additional amounts are, were or would be payable as provided above.

The Indenture contains provisions permitting the Company and the Trustee, with the written consent of the Holders of not less than a majority in aggregate principal amount (calculated as provided in the Indenture) of the Outstanding Securities of each series adversely affected thereby to add any provisions to or to change or eliminate any provisions of the Indenture or any supplemental indenture or to modify the rights of the Holders of the Securities of such series, provided that, without the consent of the Holder of each such Security so affected, no such modification shall (a) change the Stated Maturity of the principal of, or any installment of principal of or interest on, any Security, or reduce the principal amount of any Security or the rate of interest thereon, or change the coin or currency in which any Security or the interest thereon is payable, or impair the right to institute suit for the enforcement of any such payment on or after the Stated Maturity of any Security (or, in the case of redemption, on or after the Redemption Date), or (b) reduce the percentage in principal amount of the Outstanding Securities of any series, the consent of whose Holders is required for any such amendment or modification, or the consent of whose Holders is required for any waiver (of compliance with certain provisions of the Indenture or certain defaults thereunder and their consequences) provided for in the Indenture, or (c) change any obligation of the Company to maintain an office or agency in the places and for the purposes specified in Section 9.2 of the Indenture, or (d) except to the extent provided in Section 8.1(9) of the Indenture, make any change in Section 5.2, 5.7, 5.10 or 8.2 of the Indenture except to increase any percentage or to provide that certain other provisions of the Indenture cannot be modified or waived except with the consent of the Holders of each Outstanding Security affected thereby. Any such consent given by the Holder of this Note shall be conclusive and binding upon such Holder and all future Holders of this Note and of any Notes issued on registration hereof, the transfer hereof or in exchange herefor or in lieu hereof, whether or not notation of such consent is made upon this Note.

A-9

No reference herein to the Indenture and no provision of this Note or of the Indenture shall alter or impair the obligation of the Company, which is absolute and unconditional, to pay the principal of and interest on this Note at the place, at the respective time, at the rate and in the coin or currency herein prescribed.

Upon surrender for registration of transfer of this Note, the Company shall execute and the Trustee shall authenticate and deliver, in the name of the designated transferee or transferees, a new Note or Notes of like tenor and authorized denominations for an equal aggregate principal amount in exchange herefor, subject to the limitations provided in the Indenture. Every Note presented or surrendered for registration of transfer or for exchange shall (if so required by the Company, the Registrar or the Trustee) be duly endorsed, or be accompanied by a written instrument of transfer in form satisfactory to the Company, the Registrar and the Trustee duly executed by the Holder thereof or his attorney duly authorized in writing. No service charge shall be made for any registration of transfer or exchange, but the Company may require payment of a sum sufficient to cover any tax or other governmental charge payable in connection therewith.

Prior to due presentment of this Note for registration of transfer, the Company, the Trustee and any agent of the Company or the Trustee may treat the person in whose name this Note is registered as the owner hereof for all purposes (subject to the provisions hereof with respect to determination of the Person to whom interest is payable).

Reference is made to the Indenture for a statement of the respective rights, limitations of rights, duties and immunities thereunder of the Company, the Trustee and the Holders of the Notes and of the terms upon which the Notes are to be authenticated and delivered.

No past, present or future director, officer, employee, agent, member, manager, trustee or stockholder, as such, of the Company or any successor Person shall have any liability for any obligations of the Company or any successor Person, either directly or through the Company or any successor Person, under the Notes or the Indenture or for any claim based on, in respect of or by reason of such obligations or their creation, whether by virtue of any rule of law, statute or constitutional provision or by the enforcement of any assessment or by any legal or equitable proceeding or otherwise. By accepting a Note, each Holder agrees to the provisions of Section 1.13 of the Indenture and waives and releases all such liability. Such waiver and release shall be part of the consideration for the issue of the Notes.

A-10

The Notes of this series shall be issuable only in denominations of US$2,000 and integral multiples of US$1,000 in excess thereof. [This Global Note is exchangeable for Notes in definitive form only under certain limited circumstances set forth in the Indenture.]2 At the option of the Holder, the Notes (except a Note in global form) may be exchanged for other Notes, of any authorized denominations and of a like aggregate principal amount containing identical terms and provisions, upon surrender of the Notes to be exchanged at such office or agency.

All terms used in this Note that are defined in the Indenture shall have the meanings assigned to them in the Indenture.

THE INDENTURE AND THIS NOTE SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK WITHOUT REGARD TO CONFLICTS OF LAWS.

2 Insert in Global Notes only

A-11

TRANSFER NOTICE

FOR VALUE RECEIVED the undersigned registered Holder hereby sell(s), assign(s) and transfer(s) unto

Insert Taxpayer Identification No.

Please print or typewrite name and address including zip code of assignee

the within Note and all rights thereunder, hereby irrevocably constituting and appointing attorney to transfer such Note on the books of the Company with full power of substitution in the premises.

Your Signature:

| By: |

| Date: |

Signature Guarantee:

| By: | |||

(Participant in a Recognized Signature Guaranty Medallion Program) |

| Date: |

A-12

EXHIBIT B

(FORM OF FACE OF NOTE)

[THIS SECURITY IS IN GLOBAL FORM WITHIN THE MEANING OF THE INDENTURE HEREINAFTER REFERRED TO AND IS REGISTERED IN THE NAME OF A DEPOSITARY OR A NOMINEE OF A DEPOSITARY. UNLESS AND UNTIL IT IS EXCHANGED IN WHOLE OR IN PART FOR SECURITIES IN CERTIFICATED FORM, THIS SECURITY MAY NOT BE TRANSFERRED EXCEPT AS A WHOLE BY THE DEPOSITARY TO A NOMINEE OF THE DEPOSITARY OR BY A NOMINEE OF THE DEPOSITARY TO THE DEPOSITARY OR ANOTHER NOMINEE OF THE DEPOSITARY OR BY THE DEPOSITARY OR ANY SUCH NOMINEE TO A SUCCESSOR DEPOSITARY OR A NOMINEE OF SUCH SUCCESSOR DEPOSITARY. EVERY SECURITY AUTHENTICATED AND DELIVERED UPON REGISTRATION OF, OR IN EXCHANGE FOR, OR IN LIEU OF, THIS SECURITY WILL BE IN GLOBAL FORM, SUBJECT TO THE FOREGOING.

UNLESS THIS CERTIFICATE IS PRESENTED BY AN AUTHORIZED REPRESENTATIVE OF THE DEPOSITORY TRUST COMPANY, A NEW YORK CORPORATION (“DTC”), NEW YORK, NEW YORK, TO THE COMPANY OR ITS AGENT FOR REGISTRATION OF TRANSFER, EXCHANGE OR PAYMENT, AND ANY CERTIFICATE ISSUED IS REGISTERED IN THE NAME OF CEDE & CO. OR SUCH OTHER NAME AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC (AND ANY PAYMENT IS MADE TO CEDE & CO., OR TO SUCH OTHER ENTITY AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC), ANY TRANSFER, PLEDGE OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL INASMUCH AS THE REGISTERED OWNER HEREOF, CEDE & CO., HAS AN INTEREST HEREIN.]1

| No. | CUSIP No. 000000XX0 |

| ISIN No. US961214ET65 |

WESTPAC BANKING CORPORATION

2.150% NOTE DUE JUNE 3, 2031

WESTPAC BANKING CORPORATION, a company incorporated in the Commonwealth of Australia under the Corporations Xxx 0000 of the Commonwealth of Australia and registered in New South Wales (the “Company”, which term includes any successor corporation under the Indenture hereinafter referred to), for value received, hereby promises to pay to or registered assigns, the principal sum of (US$ ) on June 3, 2031 (the “Stated Maturity”). This Note will bear interest on the unpaid principal amount hereof at a rate of 2.150% per year from June 3, 2021, or from the most recent Interest Payment Date to which interest has been paid or duly provided for, until the principal amount hereof shall have been paid or duly provided for, and interest on the Notes shall be payable semi-annually in arrears on June 3and December 3 of each year (each such date, an “Interest Payment Date”), beginning on December 3, 2021. Interest will be computed on the basis of a 360-day year consisting of twelve 30-day months. The amount of interest payable for any period less than a full interest period shall be computed on the basis of a 360-day year consisting of twelve 30-day months and the actual days elapsed in a partial month in such period. Any payment of principal or interest required to be made on an Interest Payment Date that is not a Business Day shall be made on the next succeeding Business Day, and no interest will accrue on that payment for the period from and after such Interest Payment Date to the date of payment on the next succeeding Business Day. For purposes hereof, “Business Day” means each Monday, Tuesday, Wednesday, Thursday and Friday that is not a day on which banking institutions in Sydney, Australia, Xxx Xxxx, Xxx Xxxx, xx Xxxxxx, Xxxxxx Xxxxxxx are authorized or obligated by law or executive order to close.

1 Insert in Global Notes only

B-1

Interest on this Note which is payable, and is punctually paid or duly provided for, on any Interest Payment Date shall be paid to the Person in whose name this Note (or one or more Predecessor Securities) is registered at the close of business on the Regular Record Date for such interest, which shall be the close of business on the May 19 or November 18 (whether or not a Business Day), as the case may be, next preceding such Interest Payment Date, at the office or agency maintained for such purpose pursuant to the Indenture; provided, however, that at the option of the Company, interest on this Note may be paid (i) by check mailed to the address of the Person entitled thereto as it shall appear on the Register or (ii) to a Holder of US$1,000,000 or more in aggregate principal amount of the Notes by wire transfer to an account maintained by the Person entitled thereto as specified in the Register. Any interest on this Note which is payable, but is not punctually paid or duly provided for, on any Interest Payment Date (herein called “Defaulted Interest”) shall forthwith cease to be payable to the Holder on the relevant Regular Record Date by virtue of having been such Holder, and such Defaulted Interest shall instead be payable to the Person in whose name this Note is registered on the Special Record Date or other specified date in accordance with the Indenture. Notwithstanding the foregoing, interest payable on an Interest Payment Date that is also the Stated Maturity of this Note will be paid at such office or agency to the Person to whom the principal hereof is payable, upon surrender of this Note at such office or agency.

B-2

This Note shall not be entitled to any benefit under the Indenture hereinafter referred to or be valid or become obligatory for any purpose until the Certificate of Authentication hereon shall have been signed by or on behalf of the Trustee.

The provisions of this Note are continued on the reverse side hereof and such continued provisions shall for all purposes have the same effect as though fully set forth at this place.

B-3

IN WITNESS WHEREOF, the Company has caused this instrument to be executed on this 3rd day of June, 2021.

| WESTPAC BANKING CORPORATION | |||

| By: | |||

| Name: | |||

| Title: | |||

CERTIFICATE OF AUTHENTICATION

This is one of the Securities of the series designated herein and issued under the within-mentioned Indenture.

| The Bank of New York Mellon, as Trustee | ||||

| Dated: | By: | |||

| Authorized Signatory | ||||

B-4

(FORM OF REVERSE OF NOTE)