SLIVER BULL RESOURCES, INC. and COPPERBELT AG JOINT VENTURE AGREEMENT September 1, 2020

Exhibit 4.2

SLIVER BULL RESOURCES, INC.

and

COPPERBELT AG

September 1, 2020

| |

Table of Contents

| Page | |

| Article 1 DEFINITIONS AND CROSS-REFERENCES | 1 |

| 1.1 Definitions | 1 |

| 1.2 Cross-References | 1 |

| Article 2 NAME, PURPOSES AND TERM | 1 |

| 2.1 General | 1 |

| 2.2 Name | 1 |

| 2.3 Purposes | 1 |

| Article 3 REPRESENTATIONS AND WARRANTIES; TITLE TO ASSETS; INDEMNITIES | 2 |

| 3.1 Representations and Warranties of Both Participants | 2 |

| 3.2 Disclosures | 2 |

| 3.3 Record Title | 3 |

| 3.4 Loss of Title | 3 |

| Article 4 RELATIONSHIP OF THE PARTICIPANTS | 3 |

| 4.1 No Partnership | 3 |

| 4.2 Tax Operator | 3 |

| 4.3 Other Business Opportunities | 3 |

| 4.4 Waiver of Rights to Partition or Other Division of Assets | 3 |

| 4.5 Transfer or Termination of Rights to Properties | 3 |

| 4.6 Implied Covenants | 3 |

| 4.7 No Third Party Beneficiary Rights | 4 |

| Article 5 CONTRIBUTIONS BY PARTICIPANTS | 4 |

| 5.1 Initial Contributions | 4 |

| Article 6 INTERESTS OF PARTICIPANTS | 4 |

| 6.1 Initial Participating Interests | 4 |

| 6.2 Changes in Participating Interests | 4 |

| 6.3 Documentation of Adjustments to Participating Interests | 5 |

| 6.4 Guarantee of Kazco Loan | 5 |

| Article 7 MANAGER | 5 |

| 7.1 Appointment | 5 |

| 7.2 Powers and Duties of Manager | 5 |

| 7.3 Resignation | 6 |

| 7.4 Payments To Manager | 6 |

| Article 8 WITHDRAWAL AND TERMINATION | 6 |

| 8.1 Termination by Expiration or Agreement | 6 |

| 8.2 Withdrawal | 6 |

| 8.3 Disposition of Assets on Termination | 6 |

| 8.4 Continuing Authority | 6 |

| Article 9 ACQUISITIONS WITHIN AREA OF INTEREST | 7 |

| 9.1 General | 7 |

| 9.2 Notice to Non-Acquiring Participant | 7 |

i

| |

Table of Contents (continued)

| 9.3 Option Exercised | 7 |

| 9.4 Option Not Exercised | 7 |

| Article 10 TRANSFER OF INTEREST; RIGHT OF FIRST REFUSAL | 7 |

| 10.1 General | 7 |

| 10.2 Limitations on Free Transferability | 7 |

| 10.3 Right of First Refusal | 8 |

| 10.4 Sale by SVB. | 8 |

| 10.5 Permitted Transfers by SVB. | 8 |

| Article 11 DISPUTES | 8 |

| 11.1 Governing Law | 8 |

| 11.2 Arbitration. | 9 |

| Article 12 CONFIDENTIALITY | 9 |

| 12.1 Permitted Disclosure of Confidential Business Information | 9 |

| 12.2 Disclosure Required By Law | 9 |

| 12.3 Public Announcements | 10 |

| Article 13 GENERAL PROVISIONS | 10 |

| 13.1 Notices | 10 |

| 13.2 Currency | 11 |

| 13.3 Headings | 11 |

| 13.4 Waiver | 11 |

| 13.5 Modification | 11 |

| 13.6 Force Majeure | 11 |

| 13.7 Rule Against Perpetuities | 12 |

| 13.8 Further Assurances | 12 |

| 13.9 Entire Agreement; Successors and Assigns | 12 |

| 13.10 Counterparts | 12 |

ii

This Agreement is made as of September 1, 2020 (“Effective Date”) between Silver Bull Resources Inc. (“SVB”), and Copperbelt AG (“CB”), a corporation incorporated under the laws of Switzerland. At the request of SVB, CB has taken the necessary measures to incorporate in Kazakhstan Ekidos Minerals LLP (“Kazco”).

RECITALS

| A. | CB has identified two mineral properties (each, a “Property” and together, the “Properties”) located in Kazakhstan available for mineral license application (each, a “License” and together, the “Licenses”), which are more fully described in Exhibit A. |

| B. | The parties now wish to enter into this Agreement and form a joint venture between SVB and CB for the application of the Licenses, and for further exploration and evaluation within the Properties (which Properties, for greater certainty, include the Licenses). |

NOW THEREFORE, in consideration of the covenants and conditions contained herein, SVB and CB agree as follows:

Article

1

DEFINITIONS AND CROSS-REFERENCES

1.1 Definitions. The terms defined in Exhibit B and elsewhere shall have the defined meaning wherever used in this Agreement, including in Exhibits.

1.2 Cross-References. References to “Exhibits,” “Articles,” “Sections” and “Subsections” refer to Exhibits, Articles, Sections and Subsections of this Agreement. References to “Paragraphs” and “Subparagraphs” refer to paragraphs and subparagraphs of the referenced Exhibits.

Article

2

NAME, PURPOSES AND TERM

2.1 General. SVB and CB hereby agree to associate and participate in a joint venture for the purposes hereinafter stated and agree that all of the rights and obligations of the Participants in connection with the Properties, Assets or the Area of Interest and all Operations shall be subject to and governed by this Agreement.

2.2 Name. The Assets shall be managed and operated by under the name of the Ekidos Minerals Joint Venture.

2.3 Purposes. This Agreement is entered into for the following purposes and for no others, and shall serve as the exclusive means by which each of the Participants accomplishes such purposes:

| (a) | to apply for the Licenses; |

| (b) | to conduct exploration within the Properties and Area of Interest, |

| (c) | to evaluate the possible development and mining of the Properties, |

| (d) | to engage in Operations on the Properties, |

| (e) | to complete and satisfy all Environmental Compliance obligations and Continuing Obligations affecting the Properties, and |

| |

| (f) | to perform any other activity necessary, appropriate, or incidental to any of the foregoing. |

2.4 Formation of Kazco. On behalf of CB, Xx. Xxxx Xxxx, a Managing Director of CB Sub, acting as a private person, has caused the incorporation of Kazco with the intention in due course on advice of SVB and CB to submit the applications for the Licenses with the funding previously advanced by SVB for this purpose. CB and Xx. Xxxx have agreed that after issue of the Licenses to Kazco, Xx. Xxxx shall transfer 100% of the equity interests in Kazco to SVB free and clear of all encumbrances and liens whatsoever. CB agrees with SVB that CB will cause all of the issued and outstanding equity interests of Kazco to be transferred to SVB free and clear of all encumbrances and liens whatsoever. Immediately following this transfer SVB shall, and shall be permitted to, transfer all of its right, title and interest in this Agreement to Kazco (for the avoidance of doubt, without complying with the limitations set out in Article 10).

Article

3

REPRESENTATIONS AND WARRANTIES; TITLE TO ASSETS; INDEMNITIES

3.1 Representations and Warranties of Both Participants. As of the Effective Date, each Participant warrants and represents to the other, and CB warrants and represents on behalf of Kazco to SVB that:

| (a) | it is a corporation duly organized and in good standing in its jurisdiction of incorporation and is qualified to do business and is in good standing in those jurisdictions where necessary in order to carry out the purposes of this Agreement; |

| (b) | it has the capacity to enter into and perform this Agreement and all transactions contemplated herein and that all other actions required to authorize it to enter into and perform this Agreement have been properly taken; |

| (c) | no consent or approval of any third party or governmental agency is required for the execution, delivery or performance of this Agreement or the transfer or acquisition of any interest in the Assets or, if such consent or approval is required, such consent or approval has been obtained by the party required to obtain it and evidence thereof delivered to the other party hereto; |

| (d) | it will not breach any other agreement or arrangement by entering into or performing this Agreement; |

| (e) | it is not subject to any governmental order, judgment, decree, sanction or Laws that would preclude the granting of the Licenses, or the permitting or implementation of Operations under this Agreement; |

| (f) | this Agreement has been duly executed and delivered by it and is valid and binding upon it in accordance with its terms; |

| (g) | in the case of CB, the Properties are available for application of the Licenses and are free and clear of all liens, charges, encumbrances, security interests and adverse claims; and |

| (h) | in the case of CB, Kazco was formed on July 1, 2020; all of the equity interests in Kazco are owned by Xx. Xxxx Xxxx; since its formation Kazco has not conducted any business and it has no assets or liabilities other than those related to incorporation of Kazco. |

3.2 Disclosures. Each of the Participants represents and warrants that it is unaware of any material facts or circumstances that have not been disclosed in this Agreement, which should be disclosed to the other Participant in order to prevent the representations and warranties in this Article from being materially misleading.

| 2 |

3.3 Record Title. The Licenses and legal title to the Properties and Assets shall be held by Kazco and shall be beneficially owned by SVB and CB in accordance with their Participating Interests.

3.4 Loss of Title. Any failure or loss of the Licenses or title to the Properties or Assets, and all costs of defending title, shall be charged to Kazco, except that all costs and losses arising out of or resulting from breach of the representations and warranties of CB as to title to its Initial Contribution (including the representation and warranty in Section 3.1(g)) shall be charged to CB. The failure of CB to pay these costs within 30 days of written demand shall cause CB’s 20% beneficial interest in the Licenses to be forfeited to Kazco.

Article

4

RELATIONSHIP OF THE PARTICIPANTS

4.1 No Partnership. Nothing contained in this Agreement shall be deemed to constitute either Participant the partner of the other, or, except as otherwise herein expressly provided, to constitute either Participant the agent or legal representative of the other, or to create any fiduciary relationship between them.

4.2 Tax Operator.

| (a) | Upon the assignment of all of SVB’s right, title and interest in this Agreement to Kazco as contemplated in Section 2.4, Kazco shall be automatically appointed as “operator” of the Property for the purposes of carrying out all exploration and development programs and collecting, remitting and administering all value added tax in respect of the business and operations of the Properties, including, without limitation, applying for any applicable input tax credits, subject to applicable law and until changed by Kazco. |

| (b) | CB hereby authorizes and grant a limited power of attorney to Kazco for the purposes of completing any forms or documents required by the Kazakhstan government agency or ministry responsible for taxes and any modification, replacement or successor thereto in order for Kazco to act as the operator. CB agrees to provide such additional information as is necessary for the completion of the forms or documents required by the applicable Kazakhstan government agency or ministry. |

4.3 Other Business Opportunities. Except as expressly provided in this Agreement, each Participant shall have the right to engage in and receive full benefits from any independent business activities or operations, whether or not competitive with this Business, without consulting with, or obligation to, the other Participant.

4.4 Waiver of Rights to Partition or Other Division of Assets. The Participants hereby waive and release all rights of partition, or of sale in lieu thereof, or other division of Assets, including any such rights provided by Law.

4.5 Transfer or Termination of Rights to Properties. Except as otherwise provided in this Agreement, neither Participant shall Transfer all or any part of its interest in the Licenses, the Properties, the Assets or this Agreement or otherwise permit or cause such interests to terminate.

4.6 Implied Covenants. There are no implied covenants contained in this Agreement other than those of good faith and fair dealing.

4.7 No Third Party Beneficiary Rights. This Agreement shall be construed to benefit the Participants and their respective successors and assigns only, and shall not be construed to create third party beneficiary rights in any other party or in any governmental organization or agency.

| 3 |

Article

5

CONTRIBUTIONS BY PARTICIPANTS

5.1 Initial Contributions.

As its Initial Contribution:

| (a) | CB hereby contributes to the Joint Venture the identification of the Properties; and |

| (b) | SVB hereby agrees to contribute such funds required for incorporation of Kazco, to apply for the Licenses and fund such other exploration activities on the Properties as it deems appropriate, in its sole discretion. |

Article

6

INTERESTS OF PARTICIPANTS

6.1 Initial Participating Interests. The Participants shall have the following initial Participating Interests:

SVB – 80%

CB – 20%

6.2 Changes in Participating Interests. The Participating Interests shall be eliminated or changed as follows:

| (a) | Upon withdrawal or deemed withdrawal as provided in Article 8; |

| (b) | Upon Transfer by either Participant of part or all of its Participating Interest in accordance with Article 10; |

| (c) | SVB shall be entitled to acquire CB’s entire Participating Interest in respect of a Property (including any corresponding License) by undertaking the below steps. This option may be exercised at any time after a minimum of US$3,000,000 has been spent on a Property by SVB, the results of which are to be provided to both SVB and CB. |

| (i) | SVB providing written notice to CB of SVB’s decision to acquire CB’s Participating Interest in the Property; and |

| (ii) | within 60 days of the date of such notice making a cash payment of $1,500,000, |

and for the avoidance of doubt:

| (iii) | upon acquisition of CB’s Participating Interest in respect of a Property in accordance with subparagraphs (i) and (ii) above, 100% of the legal and beneficial interest in such Property (including any corresponding License) shall be owned by SVB and shall no longer form part of the Properties or Assets subject to this Agreement; and |

| (iv) | the payment referred to in subparagraph (ii) shall only entitle SVB to acquire CB’s Participating Interest in one Property (and any corresponding License), and to the extent SVB wishes to acquire CB’s Participating Interest in any additional Property (including any corresponding License) that forms part of the Assets, SVB may acquire such interest by providing a notice and make such payment to CB in accordance with subparagraphs (i) and (ii) above; and |

| 4 |

| (d) | SVB may not enter into a transaction to dispose of a 100% interest in the Properties for sixty (60) days following exercise of the option set out in Section 6.2(c). |

6.3 Documentation of Adjustments to Participating Interests. Adjustments to the Participating Interests need not be evidenced during the term of this Agreement by the execution and recording of appropriate instruments, but each Participant’s Participating Interest balance shall be shown in the accounting records of the Manager. However, either Participant, at any time upon the request of the other Participant, shall execute and acknowledge instruments necessary to evidence such adjustments in form sufficient for filing and recording in the jurisdiction where the Properties are located.

6.4 Guarantee of Kazco Loan. CB hereby guarantees the obligations of Kazco pursuant to the loan agreement dated August 20, 2020 between Kazco and SVB (the “Loan Agreement”). Wherever the Loan Agreement requires Kazco to take any action or make any payment, CB undertakes to, or cause Kazco to, take such action or make such payment and guarantee the performance or payment thereof.

Article

7

MANAGER

7.1 Appointment. Upon the assignment of SVB’s rights and obligations under this Agreement to Kazco, as contemplated in Section 2.4, Kazco shall automatically be appointed as the Manager with overall management responsibility for Operations. Kazco hereby agrees to serve until it resigns as provided in Section 7.3.

7.2 Powers and Duties of Manager. The Manager shall have the following powers and duties:

| (a) | The Manager shall manage, direct and control Operations, including preparing any Programs and Budgets pertaining to the Properties as it deems advisable from time to time. |

| (b) | The Manager may make any expenditures funded by Kazco and contemplated by a Budget or necessary to carry out Programs as it deems advisable from time to time. |

| (c) | The Manager may amend Budgets and Programs as it deems advisable from time to time. |

| (d) | The Manager may conduct such title examinations of the Properties and cure such title defects pertaining to the Properties as may be advisable in its reasonable judgment. |

| (e) | The Manager may: (i) make or arrange for all payments required by leases, licenses, permits, contracts and other agreements related to the Assets; (ii) pay all taxes, assessments and like charges on Operations and Assets except taxes determined or measured by a Participant’s sales revenue or net income and taxes, including production taxes, attributable to a Participant’s share of Products, and shall otherwise promptly pay and discharge expenses incurred in Operations; and (iii) do all other acts reasonably necessary to maintain the Assets. |

| (f) | The Manager may: (i) apply for all necessary permits, licenses and approvals; (ii) take actions as may be appropriate to comply with all Laws; and (iii) prepare and file all reports or notices required for or as a result of Operations. |

| (g) | The Manager may prosecute, defend and initiate as it considers appropriate, all litigation or administrative proceedings arising out of Operations. |

| (h) | The Manager may obtain and maintain insurance for itself and the other Participants. |

| (i) | The Manager may dispose of Assets, whether by abandonment, surrender, or Transfer in the ordinary course of business. |

| 5 |

| (j) | The Manager shall have the right to carry out its responsibilities hereunder through agents, Affiliates or independent contractors. |

| (k) | The Manager shall keep and maintain all required accounting and financial records in accordance with customary cost accounting practices in the mining industry. |

| (l) | The Manager may undertake all other activities reasonably necessary to fulfill the foregoing. |

7.3 Resignation. The Manager may resign upon not less than two weeks’ prior notice to CB, in which case Kazco may elect another party (including a related party) to become the new Manager by notice to CB within thirty days after the notice of resignation.

7.4 Payments To Manager. The Manager may charge reasonable management fees for its services.

Article

8

WITHDRAWAL AND TERMINATION

8.1 Termination by Expiration or Agreement. This Agreement shall terminate:

(a) Automatically upon there being one Participant in the Joint Venture, including as a result in the change in the Participating Interests contemplated by Section 6.2 or withdrawal as contemplated by Section 8.2; or

| (b) | by written agreement of the Participants, |

provided that CB’s obligations pursuant to Section 6.4 shall only terminate on repayment of the loan in accordance with the Loan Agreement.

8.2 Withdrawal. A Participant may elect to withdraw from the Business by giving notice to the other Participant of the effective date of withdrawal, which shall be (30) days after the date of the notice. Upon such withdrawal or election, the Business shall terminate, and the withdrawing Participant shall be deemed to have transferred to the remaining Participant all of its Participating Interest, including all of its interest in the Assets, without cost and free and clear of all Encumbrances arising by, through or under such withdrawing Participant. The withdrawing Participant shall execute and deliver all instruments as may be necessary in the reasonable judgment of the other Participant to effect the transfer of its interests in the Assets to the other Participant.

8.3 Disposition of Assets on Termination. Promptly after termination under Section 8.1, the Manager shall take all action necessary to wind up the activities of the Business. All costs and expenses incurred in connection with the termination of the Business in excess of funds raised from Asset dispositions shall be expenses chargeable to Kazco.

8.4 Continuing Authority. On termination of the Business under Sections 8.1 or 8.2, the Participant which was the Manager prior to such termination or withdrawal (or the other Participant in the event of a withdrawal by the Manager) shall have the power and authority to do all things on behalf of both Participants which are reasonably necessary or convenient to: (a) wind up Operations and (b) complete any transaction and satisfy any obligation, unfinished or unsatisfied, at the time of such termination or withdrawal, if the transaction or obligation arises out of Operations prior to such termination or withdrawal. The Manager shall have the power and authority to grant or receive extensions of time or change the method of payment of an already existing liability or obligation, prosecute and defend actions on behalf of both Participants and the Business, encumber Assets, and take any other reasonable action in any matter with respect to which the former Participants continue to have, or appear or are alleged to have, a common interest or a common liability.

| 6 |

Article

9

ACQUISITIONS WITHIN AREA OF INTEREST

9.1 General. Any interest or right to acquire any interest in real property or water rights related thereto within the Area of Interest either acquired or proposed to be acquired during the term of this Agreement by or on behalf of either Participant (“Acquiring Participant”) or any Affiliate of such Participant shall be subject to the terms and provisions of this Agreement. Kazco and CB and their respective Affiliates for their separate account shall be free to acquire lands and interests in lands outside the Area of Interest and to locate mining claims outside the Area of Interest. Failure of any Affiliate of either Participant to comply with this Article 9 shall be a breach by such Participant of this Agreement.

9.2 Notice to Non-Acquiring Participant. Within thirty (30) days after the acquisition or proposed acquisition, as the case may be, of any interest or the right to acquire any interest in real property or water rights wholly or partially within the Area of Interest (except real property acquired by the Manager pursuant to a Program) (the “New Interest”), the Acquiring Participant shall notify the other Participant of such acquisition by it or its Affiliate; provided further that if the acquisition of any interest or right to acquire any interest pertains to real property or water rights partially within the Area of Interest, then all such real property (i.e., the part within the Area of Interest and the part outside the Area of Interest) shall be subject to this Article 9. If SVB or an Affiliate of SVB acquires or proposes to acquire a New Interest, upon notification to CB in accordance with this Section 9.2 and acquisition of the New Interest by SVB, the New Interest shall become part of the Properties. If CB or an Affiliate of CB acquires or proposes to acquire a New Interest, CB shall notify SVB in accordance with this Section 9.2, and SVB may elect, in its sole discretion, to purchase the New Interest such that the New Interest shall become part of the Properties.

9.3 Option Exercised. Within thirty (30) days after receiving the Acquiring Participant’s notice, the other Participant may notify the Acquiring Participant of its election to accept a proportionate interest in the acquired interest equal to its Participating Interest. Promptly upon such notice, the Acquiring Participant shall convey or cause its Affiliate to convey to the Participants, in proportion to their respective Participating Interests, by special warranty deed with title held as described in Section 3.3, all of the Acquiring Participant’s (or its Affiliate’s) interest in such acquired interest, free and clear of all Encumbrances arising by, through or under the Acquiring Participant (or its Affiliate) other than those to which both Participants have agreed. The acquired interests shall become a part of the Properties for all purposes of this Agreement immediately upon such notice. The other Participant shall promptly pay to the Acquiring Participant its proportionate share of the latter’s actual out-of-pocket acquisition costs.

9.4 Option Not Exercised. If the other Participant does not give such notice within the thirty (30) day period set forth in Section 9.3, it shall have no interest in the acquired interests, and the acquired interests shall not be a part of the Assets or continue to be subject to this Agreement.

Article

10

TRANSFER OF INTEREST; RIGHT OF FIRST REFUSAL

10.1 General. A Participant shall have the right to Transfer to a third party its Participating Interest, including an interest in this Agreement or the Assets, solely as provided in Section 2.4 and this Article 10.

10.2 Limitations on Free Transferability. Subject to Sections 10.3, 10.4 and 10.5, any Transfer by either Participant under Section 10.1 shall be subject to the following limitations:

| (a) | Neither Participant shall Transfer any interest in this Agreement or the Assets (including, but not limited to, any royalty, profits, or other interest in the Products) except in conjunction with the Transfer of all of its Participating Interest; |

| 7 |

| (b) | No transferee of all or any part of a Participant’s Participating Interest shall have the rights of a Participant unless and until the transferring Participant has provided to the other Participant notice of the Transfer, and, except as provided in this Section 10.2, the transferee, as of the effective date of the Transfer, has committed in writing to assume and be bound by this Agreement to the same extent as the transferring Participant; |

| (c) | Neither Participant, without the consent of the other Participant, shall make a Transfer that shall violate any Law, or result in the cancellation of any permits, licenses, or other similar authorization (including the Licenses); and |

| (d) | No Transfer permitted by this Article 10 shall relieve the transferring Participant of its share of any liability, whether accruing before or after such Transfer, which arises out of Operations conducted prior to such Transfer or exists on the Effective Date, provided that if such transferee is deemed by the remaining Participant as creditworthy and assumes in writing all such liabilities of the transferring Participant, the transferring Participant shall no longer be responsible for such liabilities. |

10.3 Right of First Refusal. Any Transfer by CB under Section 10.1 and any Transfer by an Affiliate of CB shall be subject to a right of first refusal of SVB to the extent provided in Exhibit C. Failure of CB’s Affiliate to comply with this Article 10 and Exhibit C shall be a breach by CB of this Agreement.

10.4 Sale by SVB. Notwithstanding any other provision of this Agreement, SVB is permitted to sell 100% of the legal and beneficial interest in the Properties to a third party on arms’ length terms (which shall include CB’s Participating Interest), provided that:

| (i) | SVB provides notice of such sale, or proposed sale, prior to execution of the sale agreement in respect of the Properties, which shall describe the consideration and its monetary equivalent (based upon the fair market value of the nonmonetary consideration and stated in terms of cash or currency); and |

| (ii) | CB receives a portion of the proceeds of any such sale equal to its Participating Interest. |

10.5 Permitted Transfers by SVB. Notwithstanding any other provision of this Agreement, SVB is permitted to Transfer all or any part of its Participating Interest:

| (a) | to an Affiliate; |

| (b) | by way of corporate merger or amalgamation involving SVB by which the surviving entity or amalgamated company shall possess all of the stock or all of the property rights and interests, and be subject to substantially all of the liabilities and obligations of SVB; or |

| (c) | by way of the transfer of Control of SVB by an Affiliate of SVB to another Affiliate of SVB. |

Article

11

DISPUTES

11.1 Governing Law. This Agreement shall be governed by and interpreted in accordance with the laws of the Province of British Columbia and the federal laws of Canada applicable therein, without regard for any conflict of laws or choice of laws principles that would permit or require the application of the laws of any other jurisdiction.

| 8 |

11.2 Arbitration.

| (a) | All disputes, disagreements, controversies, questions or claims arising out of or relating to this Agreement, or in respect of any legal relationship associated with or arising from this Agreement, including with respect to this Agreement’s formation, execution, validity, application, interpretation, performance, breach, termination or enforcement, shall be determined by arbitration. |

| (b) | The number of arbitrators shall be one. |

| (c) | The arbitration shall be in Vancouver, British Columbia in the English language. |

| (d) | The Participant commencing the arbitration shall include in its written notice the names of three individuals who are acceptable to it to serve as a sole arbitrator. Within 10 days of the receipt of the notice, the other Participant shall give written notice that it accepts the appointment of one of the three individuals or shall name three other individuals who are acceptable to it to serve as sole arbitrator. If the Participants are unable to agree upon a sole arbitrator within a further 10 days, the appointment of a sole arbitrator shall be made by the ADR Institute of Canada, Inc. in accordance with that institution’s rules and procedures. |

| (e) | Any award or determination of the sole arbitrator shall be final and binding on the Participants and there shall be no appeal on any ground, including for greater certainty, any appeal on a question of law, a question of fact, or a question of mixed fact and law. |

Article

12

CONFIDENTIALITY

12.1 Permitted Disclosure of Confidential Business Information. Either Participant may disclose Business Information that is Confidential Information: (a) to a Participant’s officers, directors, partners, members, employees, Affiliates, shareholders, agents, attorneys, accountants, consultants, contractors, subcontractors or advisors, for the sole purpose of such Participant’s performance of its obligations under this Agreement; (b) to any party to whom the disclosing Participant contemplates a Transfer of all or any part of its Participating Interest, for the sole purpose of evaluating the proposed Transfer; (c) to any actual or potential lender, underwriter or investor for the sole purpose of evaluating whether to make a loan to or investment in the disclosing Participant; or (d) to a third party with whom the disclosing Participant contemplates any independent business activity or operation.

The Participant disclosing Confidential Information pursuant to this Section 12.1, shall disclose such Confidential Information to only those parties who have a bona fide need to have access to such Confidential Information for the purpose for which disclosure to such parties is permitted under this Section 12.1 and who have agreed in writing supplied to, and enforceable by, the other Participant to protect the Confidential Information from further disclosure, to use such Confidential Information solely for such purpose and to otherwise be bound by the provisions of this Article 12. Such writing shall not preclude parties described in Section 12.1 from discussing and completing a Transfer with the other Participant. The Participant disclosing Confidential Information shall be responsible and liable for any use or disclosure of the Confidential Information by such parties in violation of this Agreement and such other writing.

12.2 Disclosure Required By Law. Notwithstanding anything contained in this Article 12, a Participant may disclose any Confidential Information if, in the opinion of the disclosing Participant’s legal counsel: (a) such disclosure is legally required to be made in a judicial, administrative or governmental proceeding pursuant to a valid subpoena or other applicable order; or (b) such disclosure is legally required to be made pursuant to the rules or regulations of a stock exchange or similar trading market applicable to the disclosing Participant.

| 9 |

Prior to any disclosure of Confidential Information under this Section 12.2, the disclosing Participant shall give the other Participant at least ten (10) days prior written notice (unless less time is permitted by such rules, regulations or proceeding) and, in making such disclosure, the disclosing Participant shall disclose only that portion of Confidential Information required to be disclosed and shall take all reasonable steps to preserve the confidentiality thereof, including, without limitation, obtaining protective orders and supporting the other Participant in intervention in any such proceeding.

12.3 Public Announcements. Prior to making or issuing any press release or other public announcement or disclosure of Business Information that is not Confidential Information, a Participant shall first consult with the other Participant as to the content and timing of such announcement or disclosure, unless in the good faith judgment of such Participant, there is not sufficient time to consult with the other Participant before such announcement or disclosure must be made under applicable Laws; but in such event, the disclosing Participant shall notify the other Participant, as soon as possible, of the pendency of such announcement or disclosure, and it shall notify the other Participant before such announcement or disclosure is made if at all reasonably possible. Any press release or other public announcement or disclosure to be issued by either Participant relating to this Business shall also identify the other Participant.

Article

13

GENERAL PROVISIONS

13.1 Notices. All notices, payments and other required or permitted communications (“Notices”) to either Participant shall be in writing, and shall be addressed respectively as follows:

If to SVB:

|

||||

c/o Silver Bull Resources, Inc. 000 Xxxxxxxx Xxxxxx, Xxxxx 0000 Xxxxxxxxx, Xxxxxxx Xxxxxxxx X0X 0X0 | ||||

| Attention: | Xxx Xxxxx | |||

| Email: | xxxxxx@xxxxxxxxxxxxxxxxxxx.xxx | |||

| Attention: | Xxxx Xxxxxx | |||

| Email: | xxxxxxx@xxxxxxxxxxxxxxxxxxx.xxx | |||

with a copy (which does not constitute notice) to:

Blake, Xxxxxxx & Xxxxxxx LLP 000 Xxxxxxx Xxxxxx Xxxxx 0000, Xxxxx Xxxxxxx Xxxxxx Xxxxxxxxx, Xxxxxxx Xxxxxxxx X0X 0X0 | ||||

| Attention: | Xxxxx Xxxxxxx | |||

| Email: | xxxxx.xxxxxxx@xxxxxx.xxx | |||

| 10 |

If to CB:

|

||||

Xxxxxxxxxx XX 0000 Xxx Xxxxxxxxxxx | ||||

| Attention: | Xx. Xxxxxxxx Xxxxxxx | |||

| Email: | xxx0000@xxxxx.xxx | |||

With a Copy to:

| ||||

NEOVIUS AG Xxxxxxxxxxxxxxx 00 0000 Xxxxx Xxxxxxxxxxx | ||||

| Attention: | Xxxxx Xxxxxxx | |||

| Email: | xxxxx.xxxxxxx@xxxxxxx.xx | |||

All Notices shall be given (a) by personal delivery to the Participant, (b) by electronic communication, capable of producing a printed transmission, (c) by registered or certified mail return receipt requested; or (d) by overnight or other express courier service. All Notices shall be effective and shall be deemed given on the date of receipt at the principal address if received during normal business hours, and, if not received during normal business hours, on the next business day following receipt, or if by electronic communication, on the date of such communication. Either Participant may change its address by Notice to the other Participant.

13.2 Currency. All references to “dollars” or “$” herein shall mean lawful currency of the United States.

13.3 Headings. The subject headings of the Sections and Subsections of this Agreement and the Paragraphs and Subparagraphs of the Exhibits to this Agreement are included for purposes of convenience only, and shall not affect the construction or interpretation of any of its provisions.

13.4 Waiver. The failure of either Participant to insist on the strict performance of any provision of this Agreement or to exercise any right, power or remedy upon a breach hereof shall not constitute a waiver of any provision of this Agreement or limit such Participant’s right thereafter to enforce any provision or exercise any right.

13.5 Modification. No modification of this Agreement shall be valid unless made in writing and duly executed by both Participants.

13.6 Force Majeure. Except for the obligation to make payments when due hereunder, the obligations of a Participant shall be suspended to the extent and for the period that performance is prevented by any cause, whether foreseeable or unforeseeable, beyond its reasonable control, including, without limitation, labour disputes (however arising and whether or not employee demands are reasonable or within the power of the Participant to grant); acts of God; Laws, instructions or requests of any government or governmental entity; judgments or orders of any court; inability to obtain on reasonably acceptable terms any public or private license, permit or other authorization; curtailment or suspension of activities to remedy or avoid an actual or alleged, present or prospective violation of federal, provincial or local environmental standards; action or inaction by any federal, provincial or local agency that delays or prevents the issuance or granting of any approval or authorization required to conduct Operations beyond the reasonable expectations of the Participant seeking the approval or authorization; acts of war or conditions arising out of or attributable to war, whether declared or undeclared; riot, civil strife, insurrection or rebellion; fire, explosion, earthquake,

| 11 |

storm, flood, sink holes, drought or other adverse weather condition; delay or failure by suppliers or transporters of materials, parts, supplies, services or equipment or by contractors’ or subcontractors’ shortage of, or inability to obtain, labour, transportation, materials, machinery, equipment, supplies, utilities or services; accidents; breakdown of equipment, machinery or facilities; actions by First Nations rights groups, environmental groups, or other similar special interest groups; pandemics, epidemics or other public health emergencies (including those resulting from diseases, influenzas and other viruses) and governmental actions relating thereto (including quarantines, business closures and travel restrictions relating to public health emergencies); or any other cause whether similar or dissimilar to the foregoing. The affected Participant shall promptly give notice to the other Participant of the suspension of performance, stating therein the nature of the suspension, the reasons therefor, and the expected duration thereof. The affected Participant shall resume performance as soon as reasonably possible.

13.7 Rule Against Perpetuities. The Participants do not intend that there shall be any violation of the Rule Against Perpetuities or any similar rule. Accordingly, if any right or option to acquire any interest in the Properties, in a Participating Interest, in the Assets, or in any real property exists under this Agreement, such right or option must be exercised, if at all, so as to vest such interest within time periods permitted by applicable rules. If, however, any such violation should inadvertently occur, the Participants hereby agree that a court shall reform that provision in such a way as to approximate most closely the intent of the Participants within the limits permissible under such rules.

13.8 Further Assurances. Each of the Participants shall take, from time to time and without additional consideration, such further actions and execute such additional instruments as may be reasonably necessary or convenient to implement and carry out the intent and purpose of this Agreement or as may be reasonably required by lenders in connection with project financing obtained for the purpose of placing a mineral deposit situated on the Properties into commercial production.

13.9 Entire Agreement; Successors and Assigns. This Agreement contains the entire understanding of the Participants and supersedes all prior agreements and understandings between the Participants relating to the subject matter hereof. This Agreement shall be binding upon and inure to the benefit of the respective successors and permitted assigns of the Participants.

13.10 Counterparts. This Agreement may be executed in any number of counterparts, and it shall not be necessary that the signatures of both Participants be contained on any counterpart. Each counterpart shall be deemed an original, but all counterparts together shall constitute one and the same instrument.

[Signature page follows.]

| 12 |

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the Effective Date.

SILVER BULL RESOURCES, INC.

| ||

| By | /s/ Xxxxxxx Xxxxx Name: Xxxxxxx Xxxxx Title: President & CEO | |

COPPERBELT AG

| ||

| By | /s/ Xxxxxxxx Xxxxxxx Name: Xxxxxxxx Xxxxxxx Title: President & CEO | |

COPPERBELT AG

| ||

| By | /s/ Xxxxx Xxxxxxx Name: Xxxxx Xxxxxxx Title: Director | |

| |

EXHIBIT A

ASSETS AND AREA OF INTEREST

1.1 DESCRIPTION OF PROPERTIES AND AREA OF INTEREST

Once granted, the Licenses will form part of the Properties set out below:

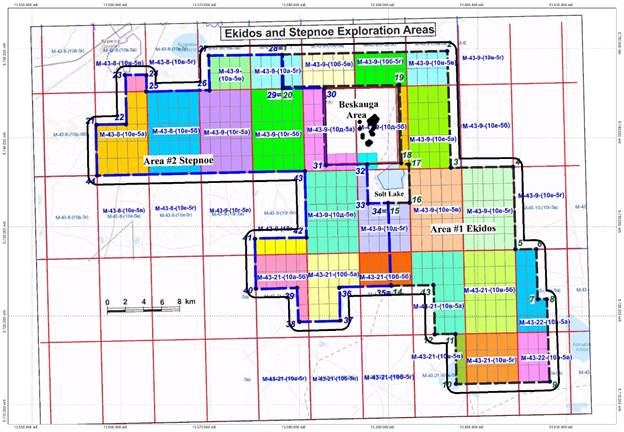

The one kilometer line surrounding the Properties above defines the Area of Interest. In addition the grid above is in the GK Zone 13 Pulkovo 1942.

1.2 PERMITTED ENCUMBRANCES

No encumbrances.

| |

EXHIBIT B

DEFINITIONS

“Affiliate” means any person, partnership, limited liability company, joint venture, corporation, or other form of enterprise which Controls, is Controlled by, or is under common Control with a Participant.

“Agreement” means this Joint Venture Agreement, including all amendments and modifications, and all schedules and exhibits, all of which are incorporated by this reference.

“Area of Interest” means the area described in Paragraph 1.1 of Exhibit A.

“Assets” means the Properties, Products, Business Information, and all other real and personal property, tangible and intangible, including existing or after-acquired properties and all contract rights held for the benefit of the Participants hereunder.

“Budget” means a detailed estimate of all costs to be incurred with respect to a Program.

“Business” means the contractual relationship of the Participants under this Agreement.

“Business Information” means the terms of this Agreement, and any other agreement relating to the Business, the Existing Data, and all information, data, knowledge and know-how, in whatever form and however communicated (including, without limitation, Confidential Information), developed, conceived, originated or obtained by either Participant in performing its obligations under this Agreement. The term “Business Information” shall not include any improvements, enhancements, refinements or incremental additions to Participant Information that are developed, conceived, originated or obtained by either Participant in performing its obligations under this Agreement.

“Confidential Information” means all information, data, knowledge and know-how (including, but not limited to, formulas, patterns, compilations, programs, devices, methods, techniques and processes) that derives independent economic value, actual or potential, as a result of not being generally known to, or readily ascertainable by, third parties and which is the subject of efforts that are reasonable under the circumstances to maintain its secrecy, including without limitation all analyses, interpretations, compilations, studies and evaluations of such information, data, knowledge and know-how generated or prepared by or on behalf of either Participant.

“Continuing Obligations” mean obligations or responsibilities that are reasonably expected to continue or arise after Operations on a particular area of the Properties have ceased or are suspended, such as future monitoring, stabilization, or Environmental Compliance.

“Control” used as a verb means, when used with respect to an entity, the ability, directly or indirectly through one or more intermediaries, to direct or cause the direction of the management and policies of such entity through (i) the legal or beneficial ownership of voting securities or membership interests; (ii) the right to appoint managers, directors or corporate management; (iii) contract; (iv) operating agreement; (v) voting trust; or otherwise; and, when used with respect to a person, means the actual or legal ability to control the actions of another, through family relationship, agency, contract or otherwise; and “Control” used as a noun means an interest which gives the holder the ability to exercise any of the foregoing powers.

“Effective Date” means the date set forth in the preamble to this Agreement.

| |

“Encumbrance” or “Encumbrances” means mortgages, deeds of trust, security interests, pledges, liens, net profits interests, royalties or overriding royalty interests, other payments out of production, or other burdens of any nature.

“Environmental Compliance” means actions performed during or after Operations to comply with the requirements of all Environmental Laws or contractual commitments related to reclamation of the Properties or other compliance with Environmental Laws.

“Environmental Laws” means Laws aimed at reclamation or restoration of the Properties; abatement of pollution; protection of the environment; protection of wildlife, including endangered species; ensuring public safety from environmental hazards; protection of cultural or historic resources; management, storage or control of hazardous materials and substances; releases or threatened releases of pollutants, contaminants, chemicals or industrial, toxic or hazardous substances as wastes into the environment, including without limitation, ambient air, surface water and groundwater; and all other Laws relating to the manufacturing, processing, distribution, use, treatment, storage, disposal, handling or transport of pollutants, contaminants, chemicals or industrial, toxic or hazardous substances or wastes.

“Existing Data” means maps, drill logs and other drilling data, core tests, pulps, reports, surveys, assays, analyses, production reports, operations, technical, accounting and financial records, and other material information developed in operations on the Properties prior to the Effective Date.

“Initial Contribution” means that contribution each Participant has made or agrees to make pursuant to Section 5.1 of the Agreement.

“Law” or “Laws” means all applicable federal, provincial and local laws, rules, ordinances, regulations, grants, concessions, franchises, licenses, orders, directives, judgments, decrees, and other governmental restrictions, including permits and other similar requirements, whether legislative, municipal, administrative or judicial in nature.

“Manager” means the Participant appointed under Article 7 of the Agreement to manage Operations, or any successor Manager.

“Operations” means the activities carried out under this Agreement.

“Participant” means initially SVB or CB, or any permitted successor or assign of SVB or CB under the Agreement.

“Participant Information” means all information, data, knowledge and know-how, in whatever form and however communicated (including, without limitation, Confidential Information but excluding the Existing Data), which, as shown by written records, was developed, conceived, originated or obtained by a Participant: (a) prior to entering into this Agreement, or (b) independent of its performance under the terms of this Agreement.

“Participating Interest” means the percentage interest representing the beneficial ownership interest of a Participant in the Assets, and all other rights and obligations arising under this Agreement, as such interest may from time to time be adjusted hereunder. The initial Participating Interests of the Participants are set forth in Section 6.1 of the Agreement.

“Products” means all ores, minerals and mineral resources produced from the Properties.

“Program” means a description in reasonable detail of Operations to be conducted and objectives to be accomplished by the Manager for a period.

| |

“Properties” means each of the interests in real property described in Paragraph 1.1 of Exhibit A and all other interests in real property within the Area of Interest that are acquired and held subject to the Agreement.

“Transfer” means, when used as a verb, to sell, transfer, grant, assign, create an Encumbrance, pledge or otherwise convey, or dispose of or commit to do any of the foregoing, or to arrange for substitute performance by an Affiliate or third party (except as permitted under Subsection 7.2(j) of the Agreement), either directly or indirectly; and, when used as a noun, means such a sale, grant, assignment, Encumbrance, pledge or other conveyance or disposition, or such an arrangement.

EXHIBIT C

RIGHT OF FIRST REFUSAL

1.1 Right of First Refusal.

| (a) | If CB intends to Transfer all or any part of its Participating Interest, or an Affiliate of CB intends to Transfer Control of CB (“Transferring Entity”), CB shall promptly notify Kazco of such intentions. The notice shall state the price and all other pertinent terms and conditions of the intended Transfer, and shall be accompanied by a copy of the offer or the contract for sale. If the consideration for the intended transfer is, in whole or in part, other than monetary, the notice shall describe such consideration and its monetary equivalent (based upon the fair market value of the nonmonetary consideration and stated in terms of cash or currency). Kazco shall have thirty (30) days from the date such notice is delivered to notify the Transferring Entity (and the Participant if its Affiliate is the Transferring Entity) whether it elects to acquire the offered interest at the same price (or its monetary equivalent in cash or currency) and on the same terms and conditions as set forth in the notice. If it does so elect, the acquisition by the other Participant shall be consummated promptly after notice of such election is delivered; |

| (b) | If Kazco fails to so elect within the period provided for above, the Transferring Entity shall have sixty (60) days following the expiration of such period to consummate the Transfer to a third party at a price and on terms no less favorable to the Transferring Entity than those offered by the Transferring Entity to Kazco in the aforementioned notice; |

| (c) | If the Transferring Entity fails to consummate the Transfer to a third party within the period set forth above, the right of first refusal of the other Participant in such offered interest shall be deemed to be revived. Any subsequent proposal to Transfer such interest shall be conducted in accordance with all of the procedures set forth in this Paragraph. |

1.2 Exceptions to Right of First Refusal. Paragraph 1.1 above shall not apply to the following:

| (a) | Transfer by CB of all or any part of its Participating Interest to an Affiliate; |

| (b) | Corporate merger or amalgamation involving CB by which the surviving entity or amalgamated company shall possess all of the stock or all of the property rights and interests, and be subject to substantially all of the liabilities and obligations of CB; or |

| (c) | the transfer of Control of CB by an Affiliate of CB to another Affiliate of CB; |