AGREEMENT FOR PURCHASE AND SALE

Exhibit 10.1

AGREEMENT FOR PURCHASE AND SALE

LEGACY AT VALLEY RANCH APARTMENTS

THIS AGREEMENT FOR PURCHASE AND SALE (this "Agreement") is made and entered into as of September 5, 2017, (the "Effective Date") by and between KBS LEGACY PARTNERS DAKOTA HILL LLC, a Delaware limited liability company ("Seller"), and RREF III-P ELITE VENTURE, LLC, a Delaware limited liability company ("Buyer"), with reference to the following:

A. Buyer desires to purchase from Seller, and Seller is prepared to sell to Buyer, the Property (as defined in paragraph B. below) upon the terms and conditions set forth in this Agreement.

B. Subject to the terms and conditions of this Agreement, Seller shall sell, convey and assign to Buyer with no representation or warranty of any kind or nature whatsoever except as otherwise specifically provided herein and/or in the Seller Closing Documents (as defined in Section 2.4.3), and Buyer shall purchase, all of Seller’s rights, title, interest and obligations in, to and under the following described property (all of which is collectively referred to as the "Property"):

1. That certain real property located in the City of Irving, County of Dallas, Texas commonly referred to as Legacy at Valley Ranch Apartments, as more particularly described on Exhibit "A" attached hereto (the "Real Property"), together with all mineral and water rights, covenants, plants, shrubs and trees located thereon, and together with all rights, ways and easements appurtenant thereto (herein collectively referred to as the “Appurtenances”);

2. The personal property owned by Seller which is located on and used in connection with Seller's business operations on the Real Property as of the Closing Date (as defined in Section 2.4.1 hereof), which personal property in existence as of the Effective Date is listed on Exhibit "B" attached hereto and which personal property list shall be subject to modification for normal wear and tear and ordinary usage in the ordinary course of Seller’s business operations on the Property prior to the Closing (as defined in Section 2.4.1 hereof) (collectively, the "Personal Property"), all improvements and fixtures presently located on the Real Property, including, without limitation, 504 apartment units, plus amenities, all other buildings and structures presently located on the Real Property, all apparatus, equipment, goods, inventory, machinery, fittings, furniture, furnishings and appliances used in connection with the Seller's operation or occupancy thereof, such as heating and air conditioning and mechanical systems and facilities used to provide any utility or fire safety services, parking services, refrigeration, ventilation, trash disposal, recreation or other services thereto but expressly excluding fixtures, equipment, appliances and personal property owned by tenants or anyone

1

other than Seller (collectively, the "Improvements");

3. All Assumed Service Contracts (as defined in Subsection 2.5.2 hereof), and to the extent such are assignable at no additional cost or expense to Seller, all utility contracts, permits and approvals (governmental or otherwise), certificates of occupancy, warranties or guaranties, intangible personal property owned and used by Seller in connection with the Property, including all freely assignable telephone numbers, rights to use marketing artwork (including photographs) associated with the Property and trade names (other than the names KBS Legacy Partners Dakota Hill LLC, Legacy at Valley Ranch, Legacy Partners Residential, Inc., Legacy Partners Residential LLC, Legacy Partners, Inc., Legacy Partners, Legacy or derivatives thereof, KBS Legacy Partners Properties LLC, KBS Legacy Partners Limited Partnership, and KBS Legacy Partners Apartment REIT) used in connection with or primarily related to the Real Property, the Appurtenances or the Improvements (collectively, the "Intangible Property"); and

4. All leases for tenants of the Real Property and other leases or agreements (excluding any Assumed Service Contracts) with any persons or entities using or occupying the Real Property or the Improvements or any part thereof, including any amendments, exhibits, addenda and riders thereto, which lease agreements reflect a possessory interest in any portion of the Real Property or the Improvements on or after the Closing Date (collectively, the "Leases"), and the balance as of the Closing Date of any refundable security deposits under the Leases.

NOW, THEREFORE, in consideration of the foregoing recitals and the mutual promises and agreements hereinafter contained and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Seller and Buyer hereby agree as follows:

ARTICLE 1

DEPOSIT

1.1 Buyer’s Xxxxxxx Money Deposit. On or prior to the date which is three (3) business days after the Effective Date, Buyer shall deliver the sum of THREE HUNDRED FORTY-TWO THOUSAND FIVE HUNDRED DOLLARS AND NO CENTS ($342,500.00) in immediately available funds (the "Initial Xxxxxxx Money Deposit") to Fidelity National Title Insurance Company, with an address of 000 Xxxxxxxxxx Xxxxxx, Xxxxx 0000, Xxxxxxx, XX 00000, Attn: Xxx Xxxxxxx ("Escrow Agent" or "Title Insurer"). On or prior to the Approval Date (as defined in Section 2.5.3 hereof), Buyer shall have the right to terminate this Agreement in accordance with Section 2.5.3, in which case the Initial Xxxxxxx Money Deposit (except for the Independent Consideration) shall be returned to Buyer and the parties shall have no further obligations hereunder except as otherwise provided herein. In the event that Buyer does not terminate this Agreement pursuant to the terms of Section 2.5.3, on or prior to the Approval Date Buyer shall deliver the additional sum of SIX HUNDRED EIGHTY-FIVE THOUSAND DOLLARS AND NO CENTS ($685,000.00) in immediately available funds (the "Additional Xxxxxxx Money Deposit") to Escrow Agent and the transaction contemplated by this Agreement shall proceed in accordance with the terms hereof. In the event Buyer elects to exercise its extension option pursuant to Section 2.4.1 hereof, Buyer shall deposit the Extension Deposit (as

2

defined in Section 2.4.1 hereof) in accordance with the provisions of Section 2.4.1 hereof. The Initial Xxxxxxx Money Deposit, the Additional Xxxxxxx Money Deposit, and the Extension Deposit (if delivered), together with all interest accrued thereon, less the Independent Consideration (as defined in Section 1.3 hereof), shall be referenced herein as the "Xxxxxxx Money Deposit". The Xxxxxxx Money Deposit shall be held in accordance with the terms of this Agreement and shall be applied as a credit to the Purchase Price (as defined in Section 2.2 hereof) due to Seller at the Closing. In the event Buyer fails to timely deposit any portion of the Xxxxxxx Money Deposit as provided above, Seller may, as its sole remedy, terminate this Agreement upon written notice to Buyer at any time prior to payment in full of the respective portion of the Xxxxxxx Money Deposit. Escrow Agent shall deposit the Xxxxxxx Money Deposit in an interest-bearing account at a bank or other FDIC insured financial institution reasonably acceptable to Buyer and Seller and all interest earned and/or accrued thereon shall be deemed part of the Xxxxxxx Money Deposit for all purposes. Provided Buyer has not terminated this Agreement pursuant to the terms of Section 2.5.3, after the Approval Date, the Xxxxxxx Money Deposit shall be non-refundable to Buyer except in the event that (i) Seller defaults under this Agreement, (ii) one or more of the conditions to Buyer’s obligations to close the purchase of the Property set forth in Article 4 of this Agreement is not satisfied or waived as provided therein, or (iii) as otherwise expressly provided herein. Upon execution of this Agreement, Buyer shall provide Escrow Agent with Buyer’s Federal tax identification number for reporting of any earnings on the Xxxxxxx Money Deposit.

1.2 Escrow Agent. Escrow Agent, by acceptance of any funds and/or documents deposited and/or delivered by Buyer or Seller hereunder, agrees to hold such funds and/or documents and disburse or deliver same only in accordance with the terms and conditions of this Agreement. If Escrow Agent is in doubt as to its duties or liabilities hereunder, it may continue to hold such funds and/or documents until the parties mutually agree to the disbursement or delivery thereof, or until an order or judgment of a court of competent jurisdiction shall determine the rights of the parties hereto. The Escrow Agent is a depository only and shall not be liable for any loss, damage or cost, including but not limited to attorneys’ fees and costs, which may be suffered by Seller and/or Buyer in connection with Escrow Agent’s action or inaction, except in the event that such loss, damage or cost was caused by Escrow Agent’s gross negligence or willful failure to perform its duties hereunder. In no circumstances shall the Escrow Agent be responsible or liable for the failure of any financial institution into which any funds deposited with Escrow Agent have been deposited, provided that any such fund deposit was not made in violation of the applicable provisions of this Agreement.

1.3 Independent Consideration. A portion of the Initial Xxxxxxx Money Deposit in the amount of $100.00 (the "Independent Consideration"), constitutes the amount the parties have bargained for and agreed to as consideration for Seller's execution and delivery of this Agreement. The Independent Consideration is independent of any other consideration or payment provided in this Agreement, shall be immediately released to Seller by the Escrow Agent upon receipt, is nonrefundable to Buyer, and shall be retained by Seller notwithstanding any other provision of this Agreement.

3

ARTICLE 2

PURCHASE PRICE, PAYMENT, CLOSING, INSPECTION, SURVEY AND TITLE

2.1 Purchase and Sale. Seller agrees to assign and convey the Property to Buyer, and Buyer agrees to assume and purchase the Property from Seller, subject to and in accordance with all of the terms, covenants and conditions hereinafter set forth.

2.2 Purchase Price. The total purchase price for the Property shall be SIXTY-EIGHT MILLION FIVE HUNDRED THOUSAND DOLLARS AND NO CENTS ($68,500,000.00) (the "Purchase Price"), payable as set forth in Section 2.3 hereof.

2.3 Payment of Purchase Price. The balance of the Purchase Price shall be deposited in cash into escrow with Escrow Agent by 3:00 p.m. (Eastern Time) on the Closing Delivery Date (as defined in Section 2.4.1 hereof). Provided that Seller has delivered all other items required to be delivered by Seller pursuant to Section 2.4.3 of this Agreement on or before the Closing Delivery Date and Buyer and Seller have submitted irrevocable instructions to Escrow Agent to close the transaction contemplated herein, Escrow Agent shall disburse the amount necessary to defease Seller’s current financing to Seller’s lender (the “Defeasance Amount”). The Purchase Price less the Defeasance Amount, subject to adjustment for any prorations and cost allocations and credits in accordance with the terms of this Agreement, shall be disbursed to Seller on the Closing Date.

2.4 Closing.

2.4.1 In order to effectuate the defeasance of Seller’s current financing on the Property, the closing of the sale of the Property in accordance with the terms of this Agreement (the "Closing") shall occur over a period of not more than three (3) business days commencing on the date which is thirty (30) days after Seller has notified Buyer that it has obtained the Shareholder Consent (as defined in Section 2.11 hereof) (the "Closing Delivery Date") and concluding no later than the date which is two (2) business days later (the "Closing Date"). Seller shall have the option to extend the Closing Delivery Date for up to thirty (30) days if required to effectuate the defeasance of the Seller’s current financing on the Property, and in order to exercise such extension, Seller shall provide Buyer with written notice of such extension no later than five (5) business days prior to the then scheduled Closing Delivery Date. In addition, Buyer may elect to extend the Closing Delivery Date for thirty (30) days by delivering the following not later than the day which is three (3) business days prior to the then-set Closing Delivery Date: i) written notice of the extension to Seller and ii) additional immediately available funds in the amount of THREE HUNDRED FORTY-TWO THOUSAND FIVE HUNDRED DOLLARS AND NO CENTS ($342,500.00) (the "Extension Deposit") deposited in escrow with the Escrow Agent. The Extension Deposit shall be deemed part of the Xxxxxxx Money Deposit, non-refundable to Buyer, except as provided herein, and applied as a credit against the Purchase Price at Closing.

2.4.2 The Closing shall take place at the office of the Escrow Agent, or such other place as shall be mutually agreed upon by the parties hereto.

4

2.4.3 Seller shall deliver the following documents (collectively, "Seller Closing Documents") on or prior to the Closing Delivery Date (or when indicated otherwise below) to Escrow Agent to be held in escrow and delivered to Buyer upon the completion of the Closing, except for items (g), (h) and (j) which may, at Seller's option, remain at the leasing office of the Property to be released to Buyer upon the completion of the Closing and except for item (e) which shall be delivered by Seller directly to the tenants outside of escrow:

(a) One (1) Special Warranty Deed (the "Deed"), duly executed by Seller and acknowledged (in substantially the same form as that set forth in Exhibit "C" attached hereto), together with if requested by Buyer, a quitclaim deed conveying all of Seller’s right, title and interest in and to the Property in accordance with the legal description prepared from the Buyer purchased updated survey;

(b) One (1) Xxxx of Sale and Assignment (the "Xxxx of Sale"), duly executed by Seller, which conveys to Buyer all of Seller's right, title and interest in and to all of the Personal Property, and to the extent such is assignable by Seller at no additional cost or expense to Seller, the Intangible Property. The Xxxx of Sale shall be in substantially the same form as that set forth on Exhibit "D" attached hereto;

(c) Three (3) of the Assignment and Assumption of Leases (the "Assignment of Leases") duly executed by Seller, which assigns to Buyer all of Seller's right, title and interest in and to all Leases and all obligations related to any refundable security deposits under the Leases, in form substantially the same as set forth on Exhibit "E" attached hereto;

(d) Three (3) of the Assignment and Assumption of Contracts (the "Assignment of Contracts") duly executed by Seller, which assigns to Buyer all Assumed Service Contracts, in form substantially the same as set forth on Exhibit "F" attached hereto;

(e) One (1) Notice to the residential tenants of the Property informing them of the transfer of ownership of the Property and of Buyer's future liability for their security deposits in the form substantially the same as that set forth on Exhibit "G" attached hereto (the "Notice to Tenants");

(f) An affidavit, in the form of Exhibit "H", duly executed by Seller, (i) identifying Seller's United States taxpayer identification number for federal income tax purposes; and (ii) confirming that Seller is not a "foreign person" or a "disregarded entity" within the meaning of Section 1445, et seq., of the Internal Revenue Code of 1986, as amended (the "FIRPTA Affidavit");

(g) Each of the Leases and the Assumed Service Contracts, in original form if available or otherwise a copy thereof;

(h) One (1) copy of the contents of each tenant file for current tenants of the Property;

5

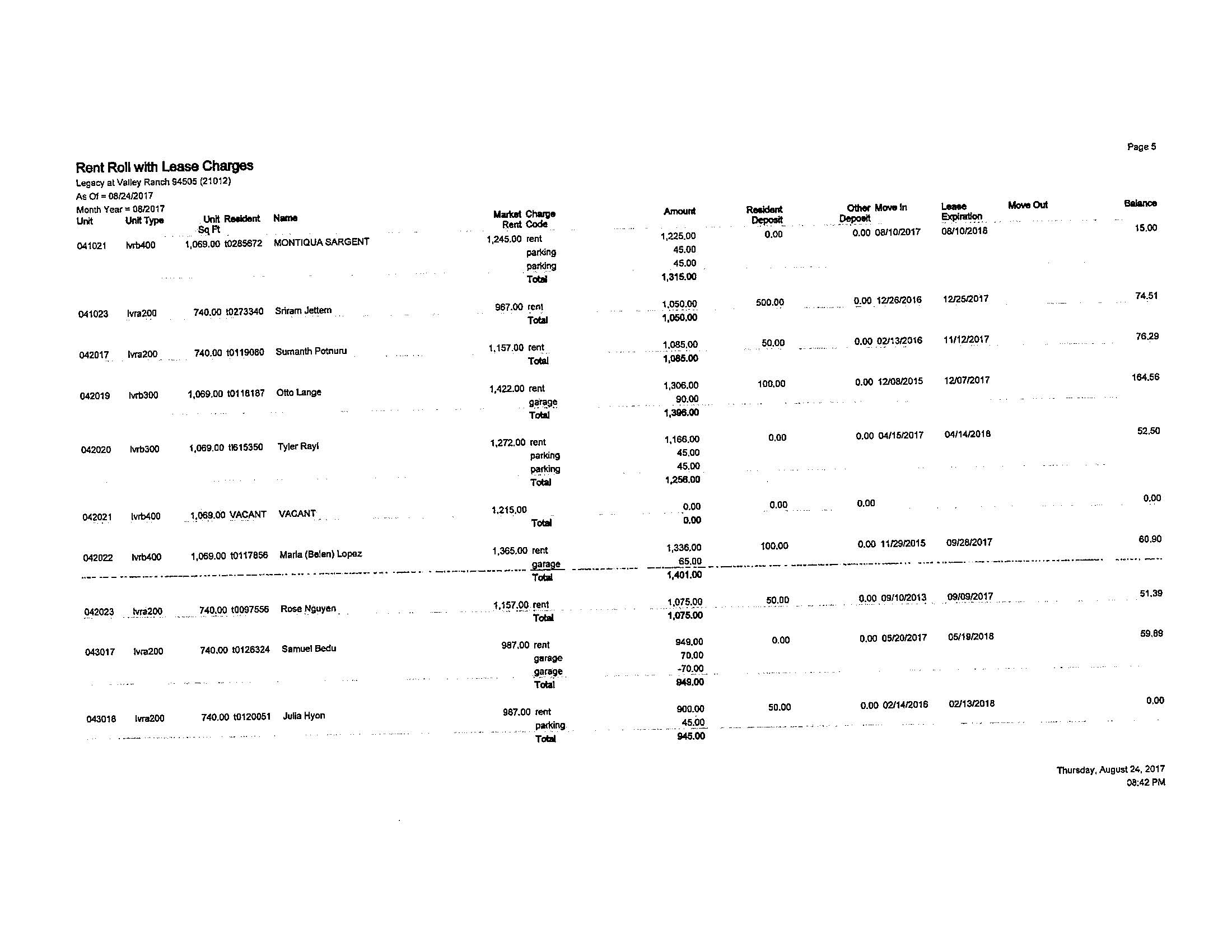

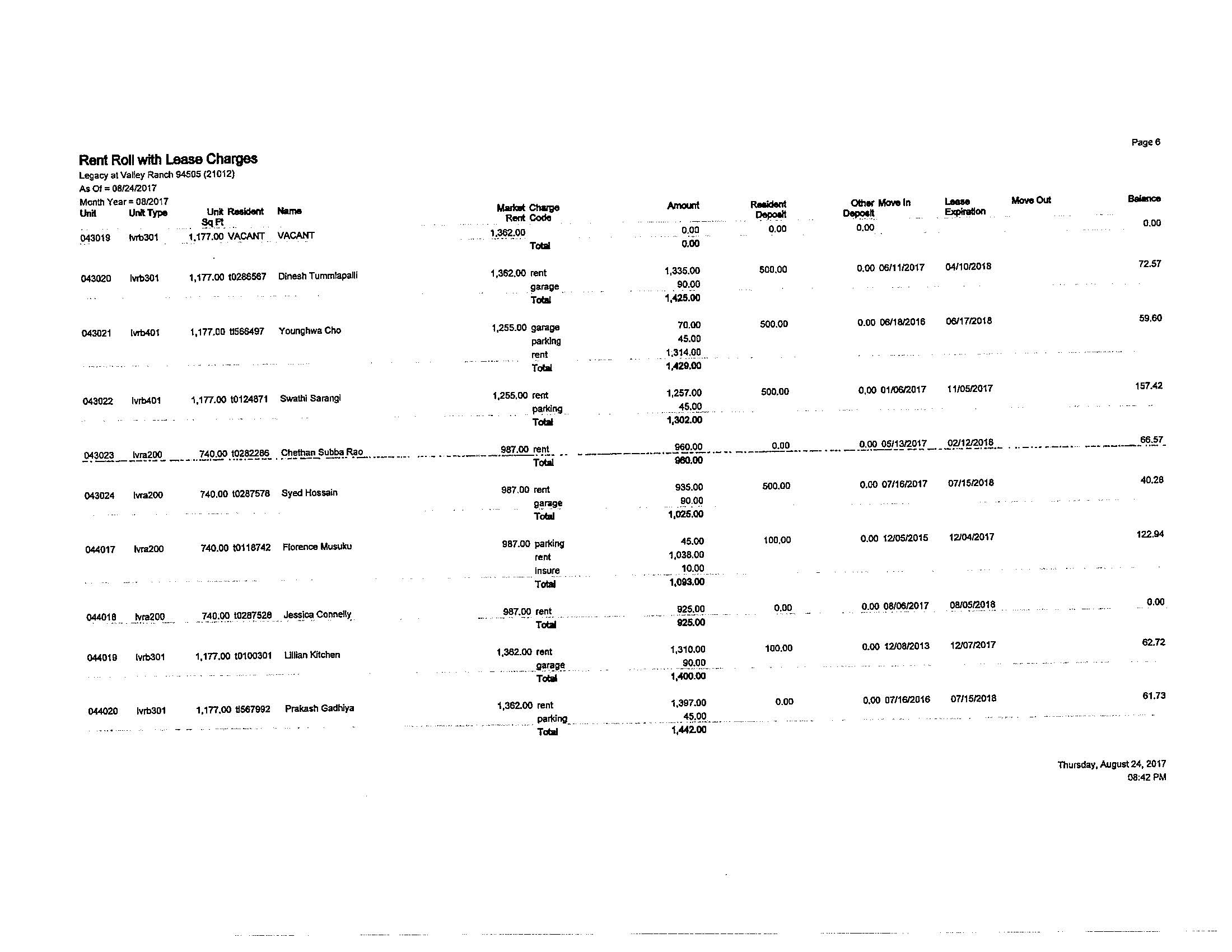

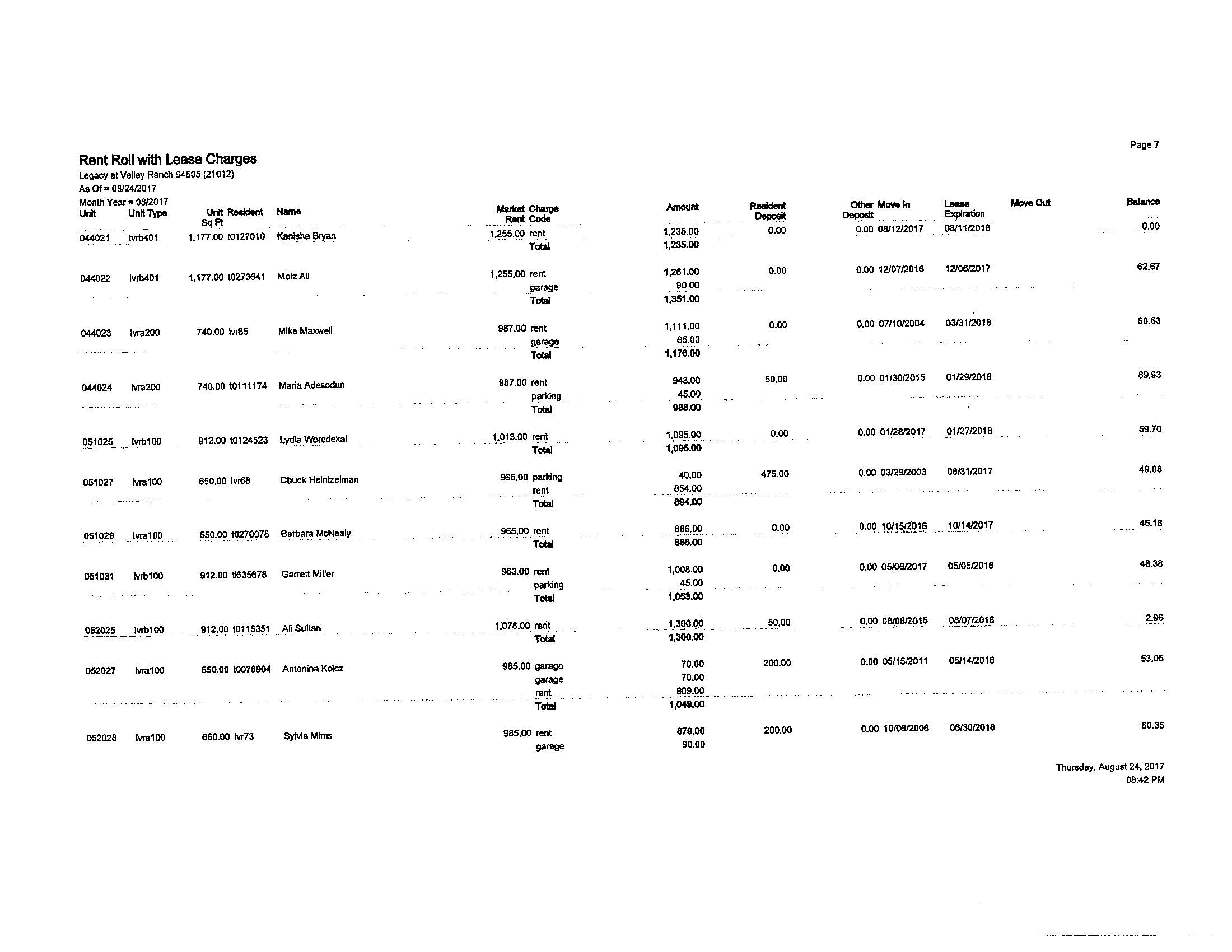

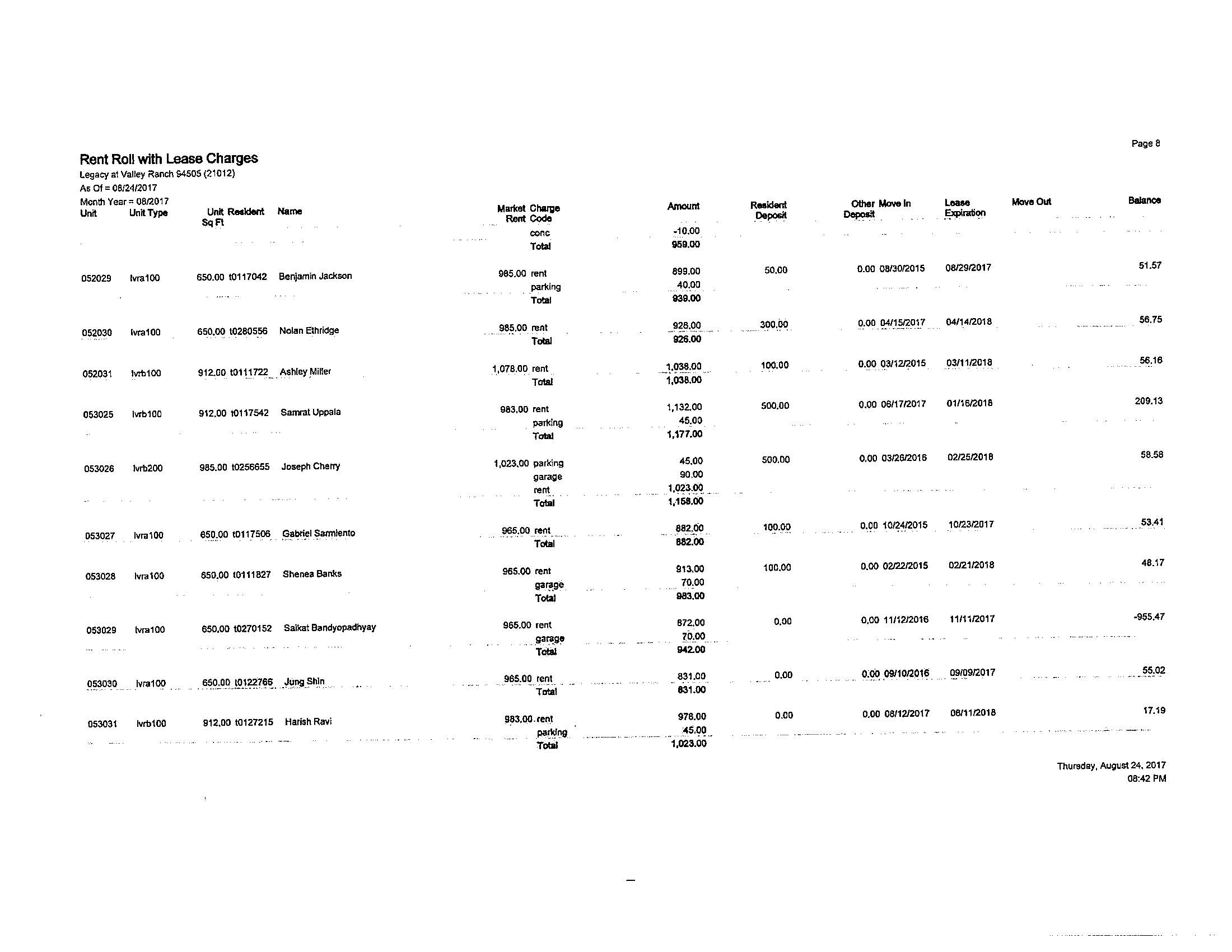

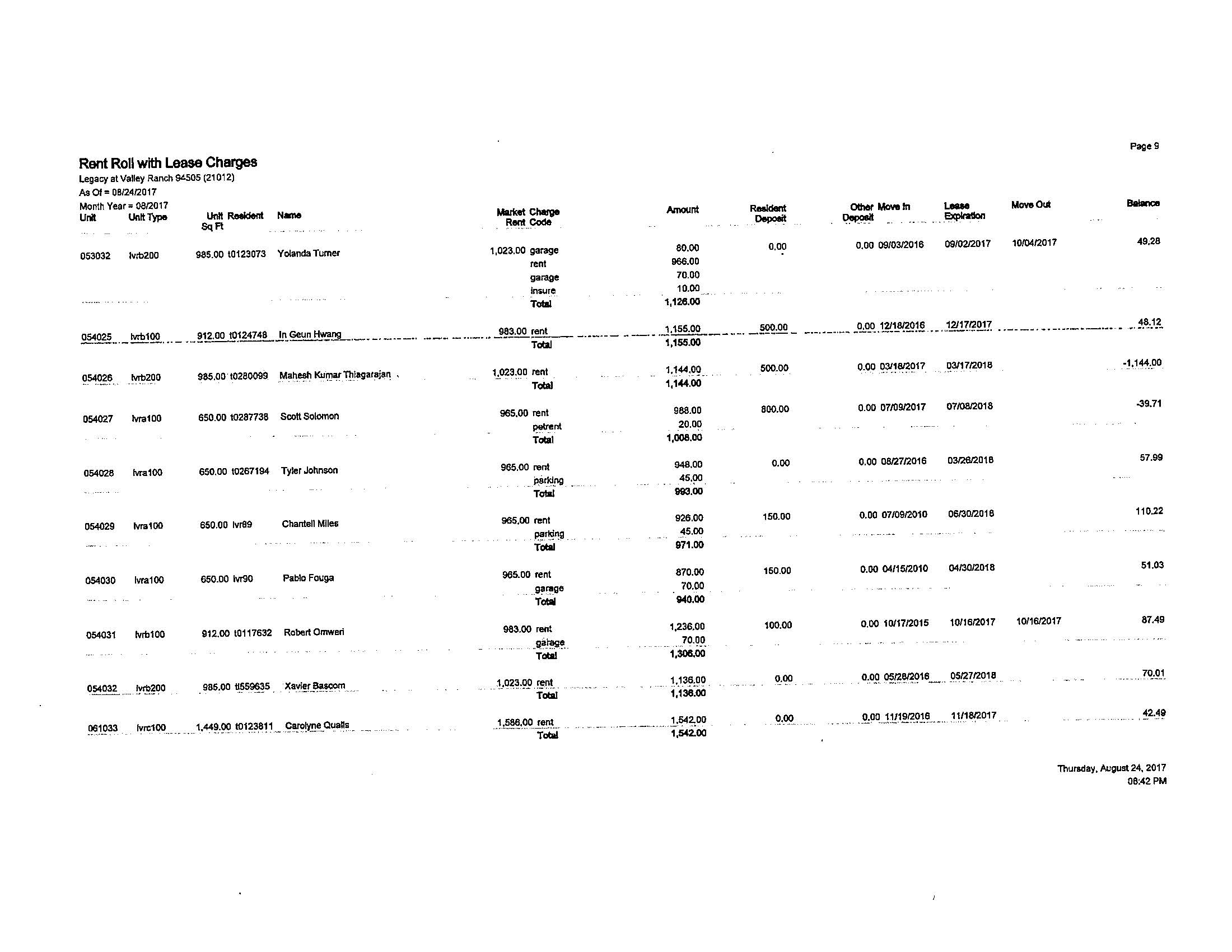

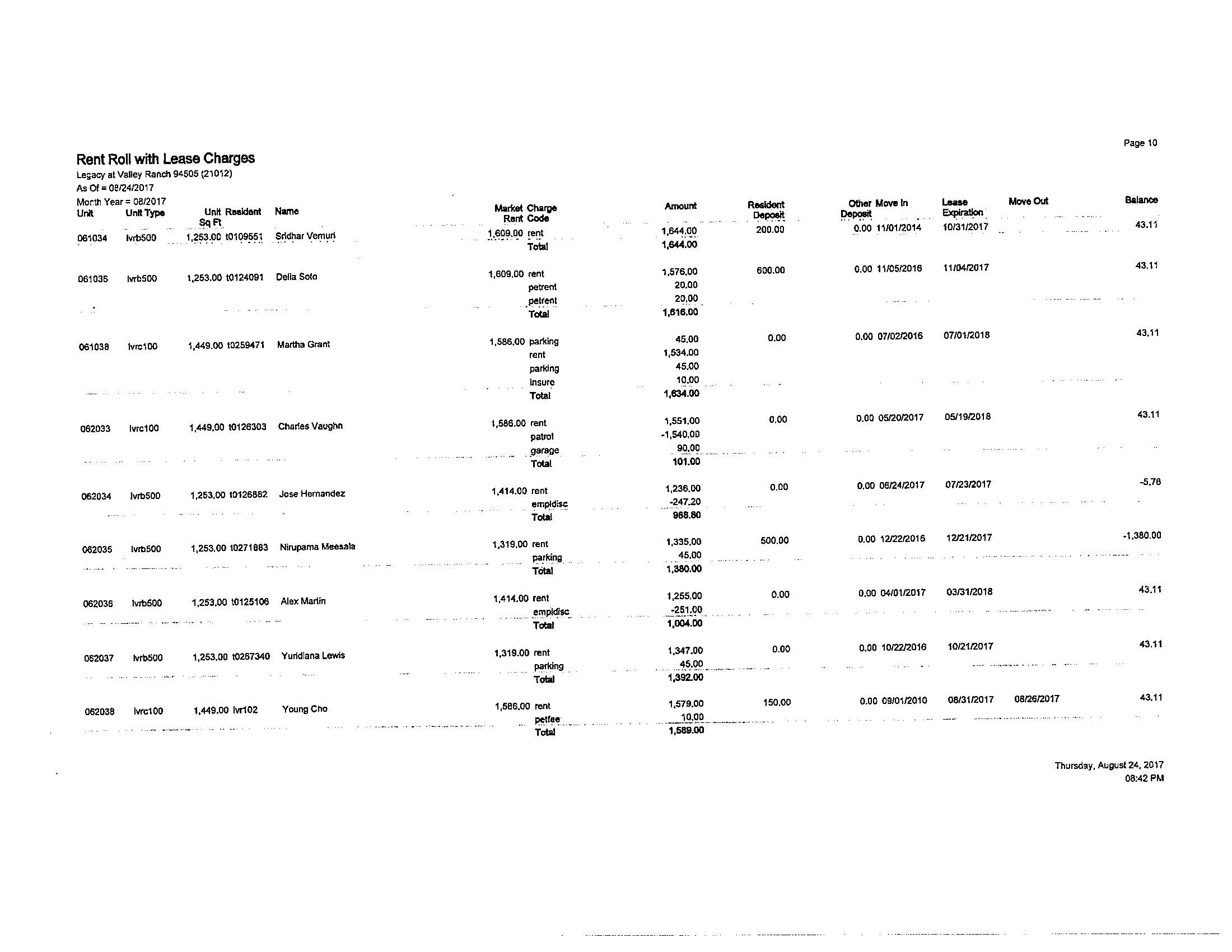

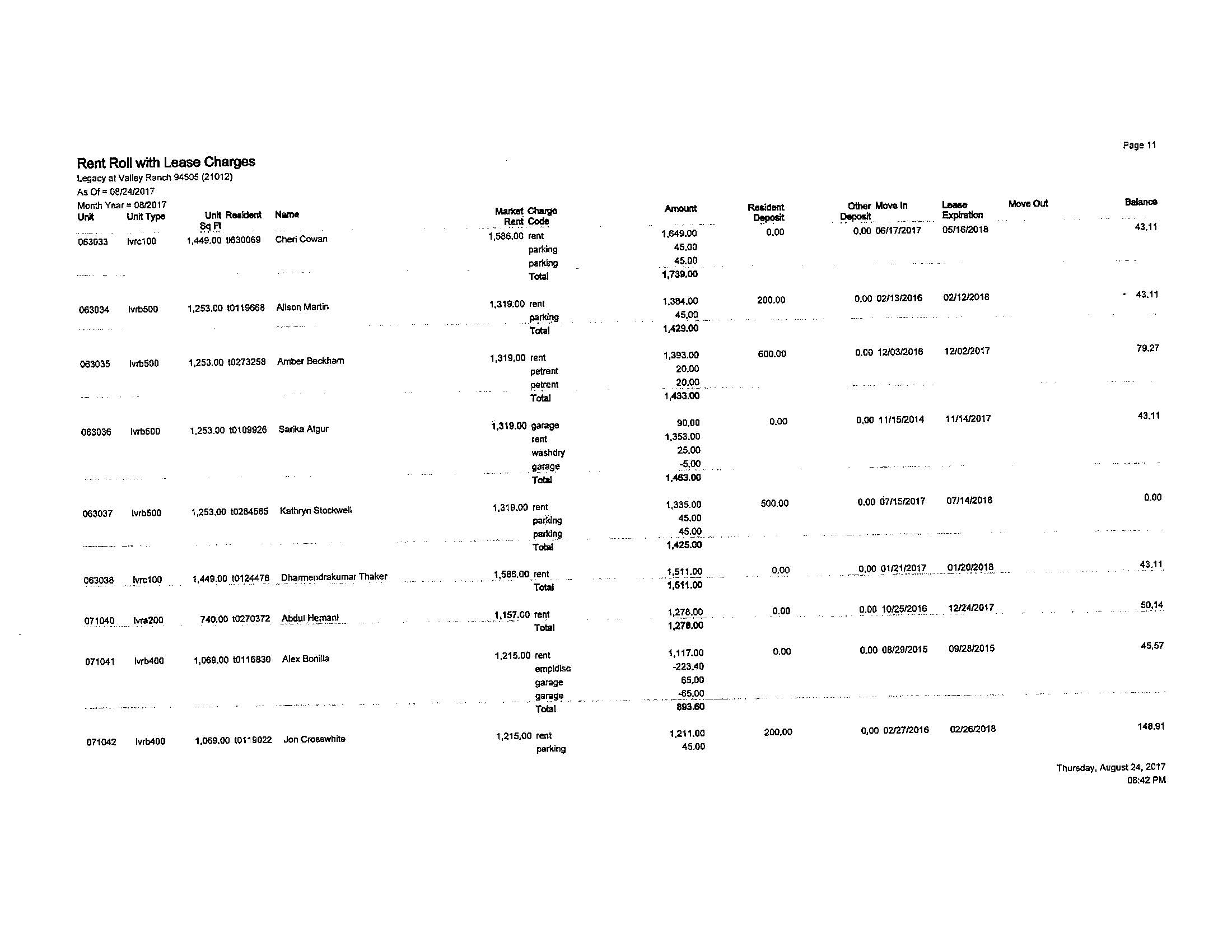

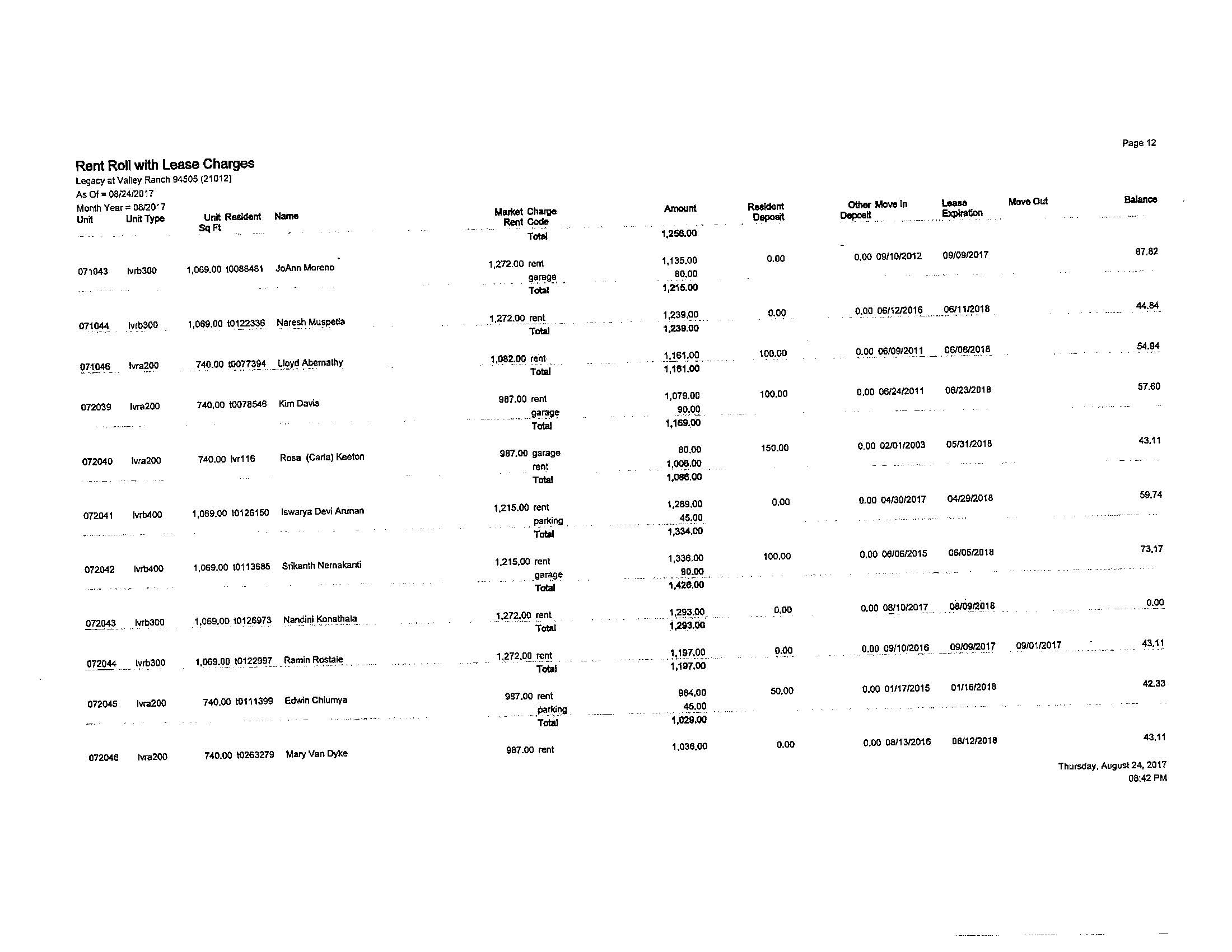

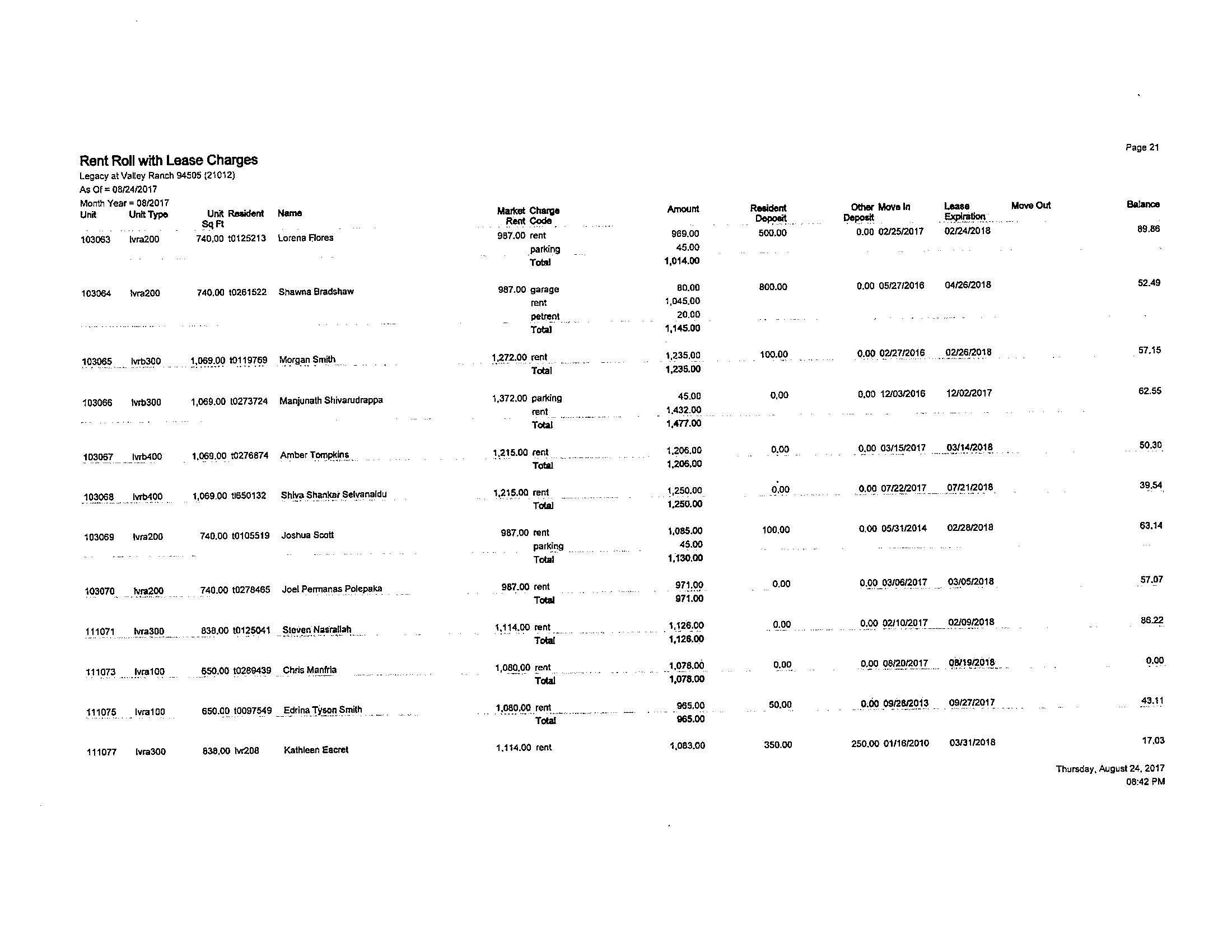

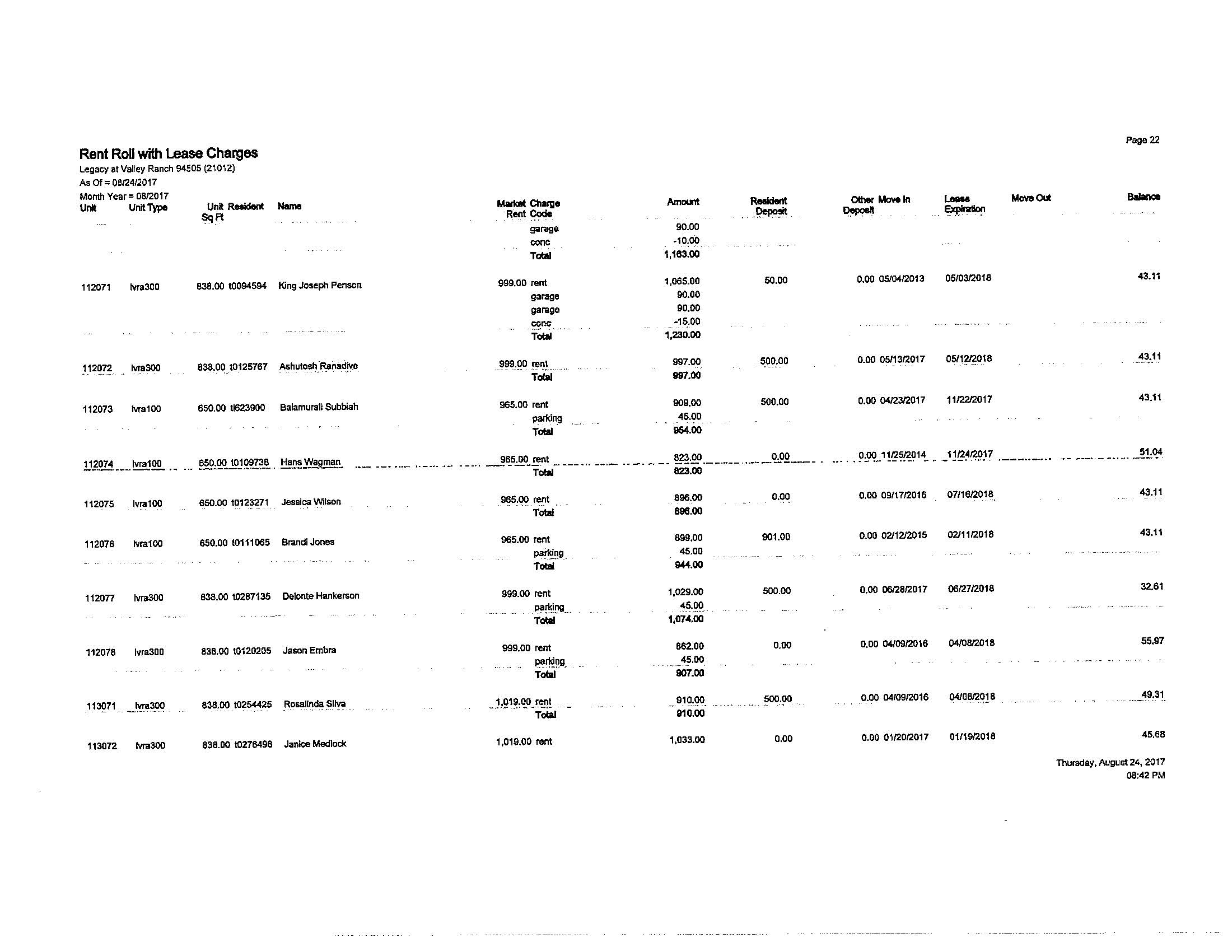

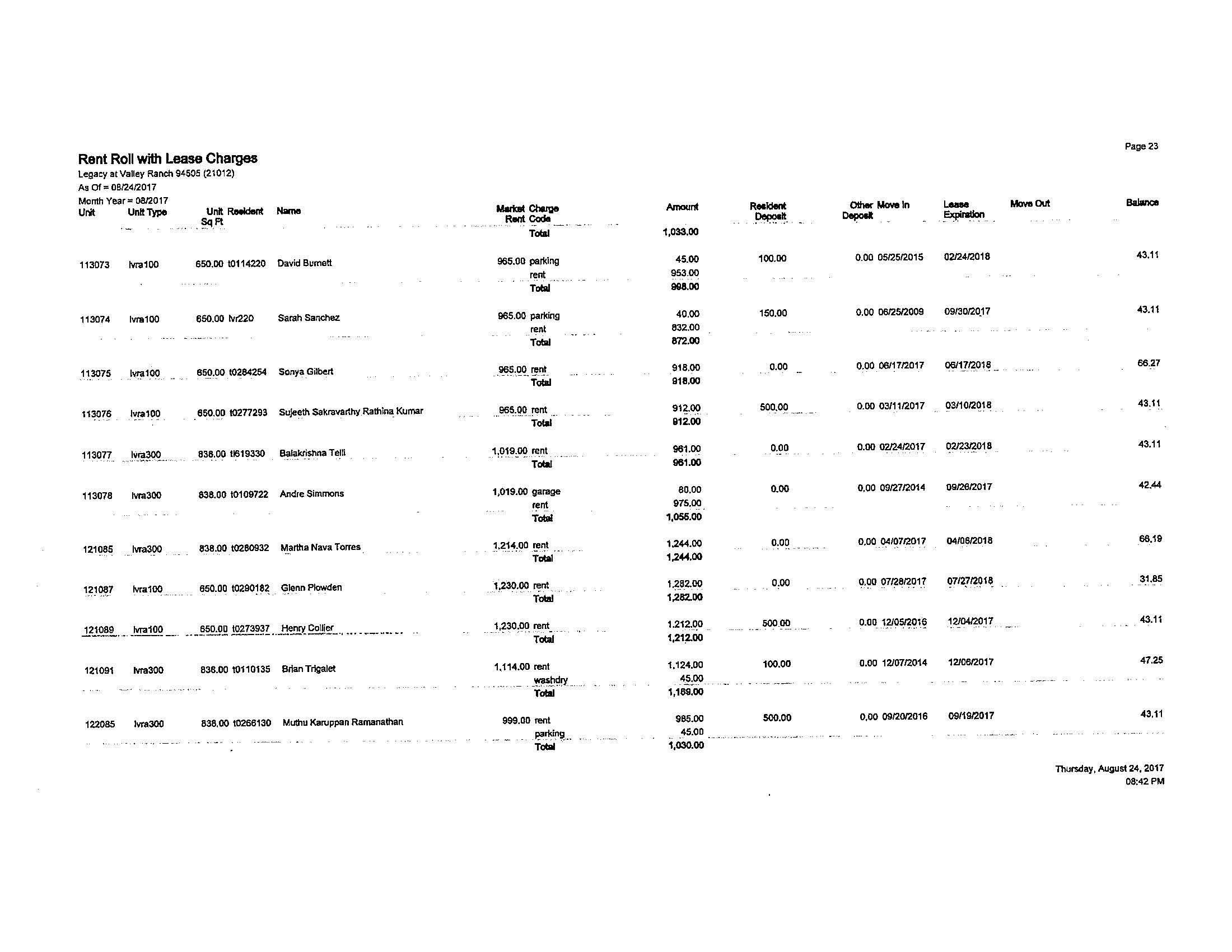

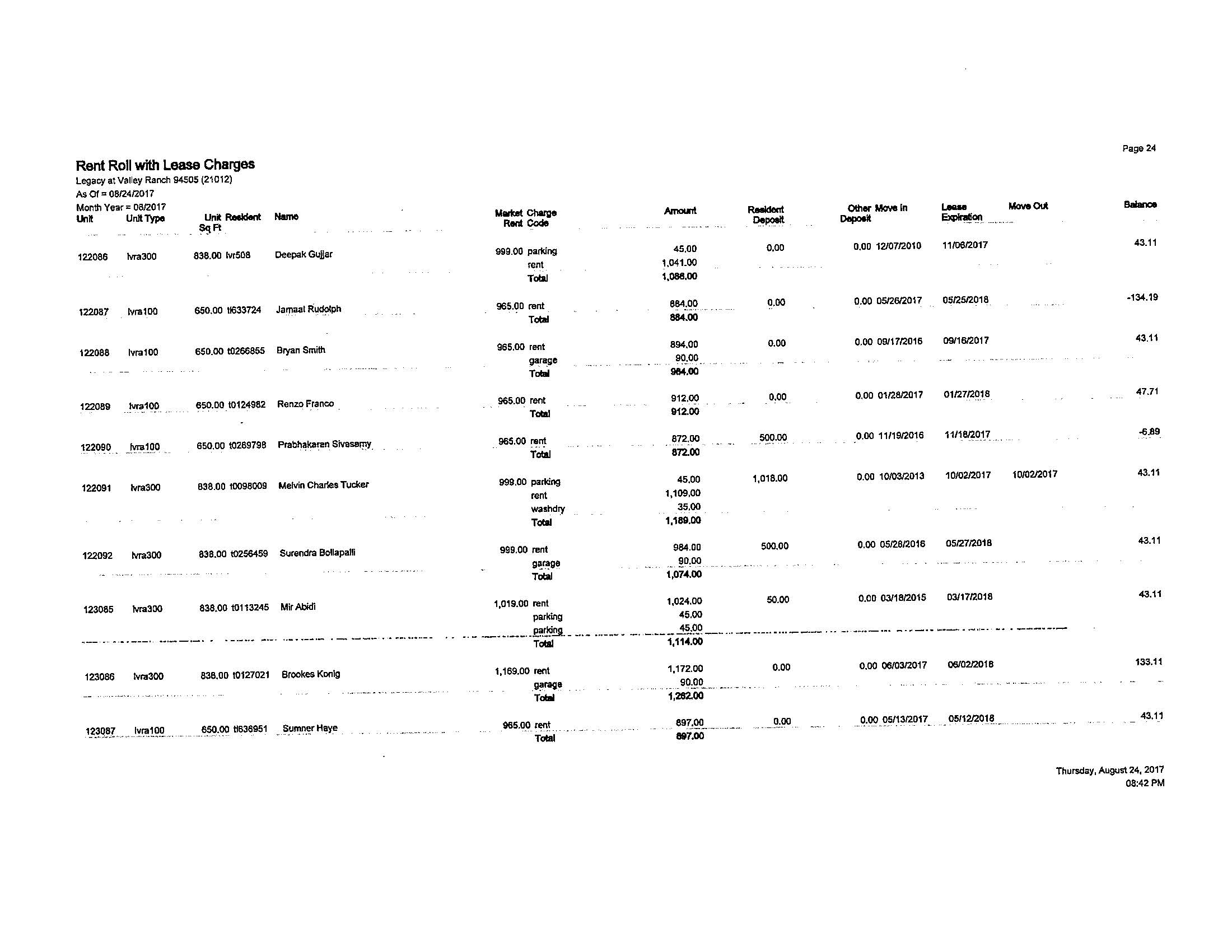

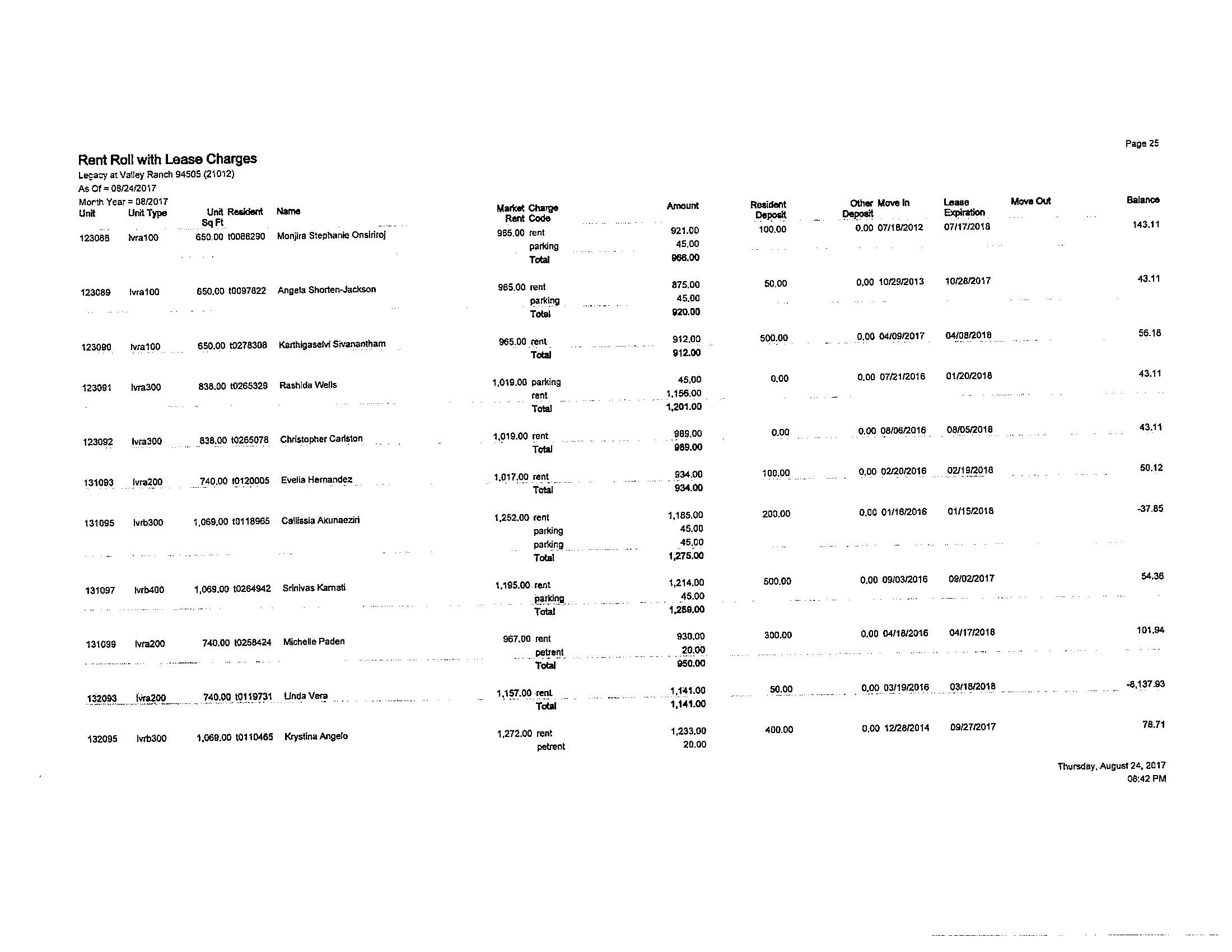

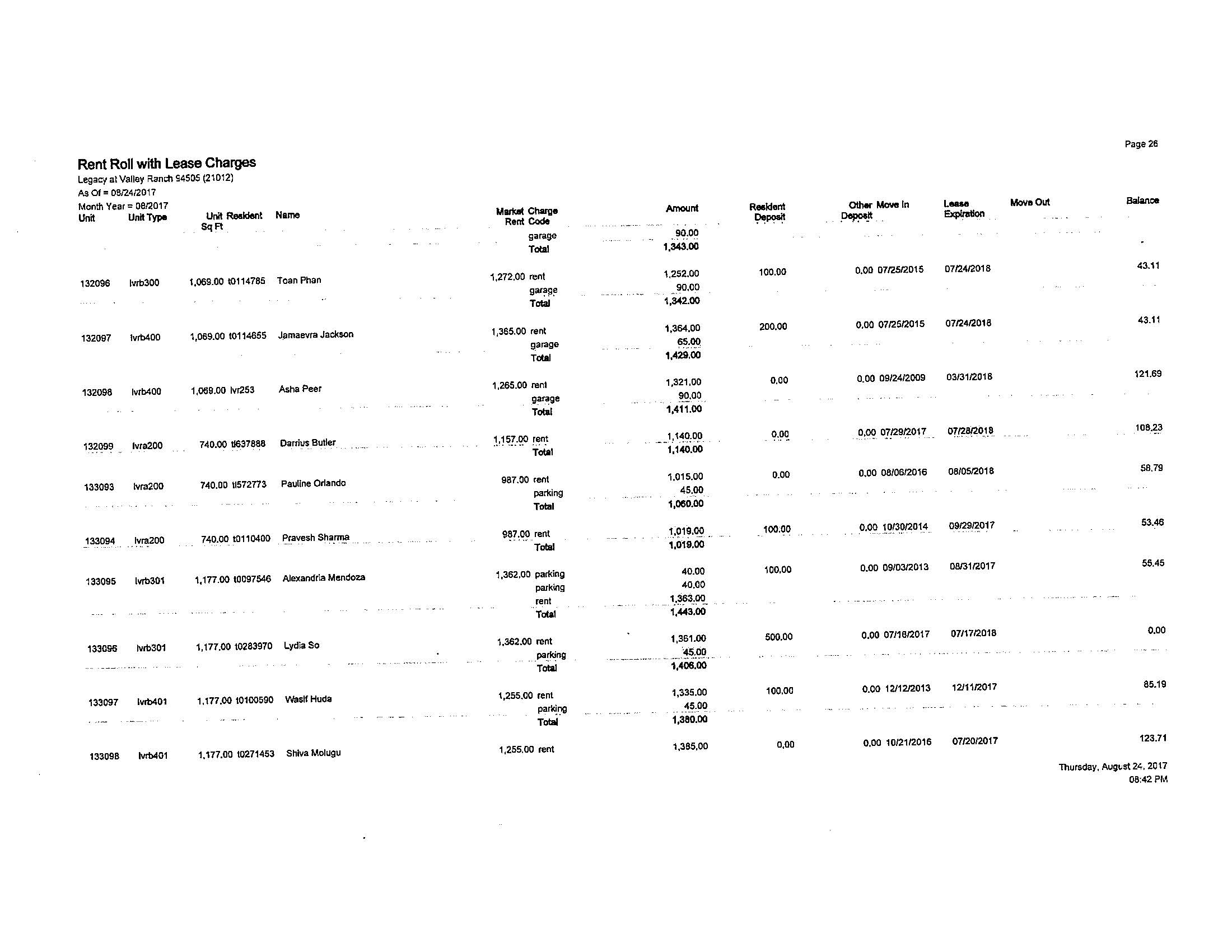

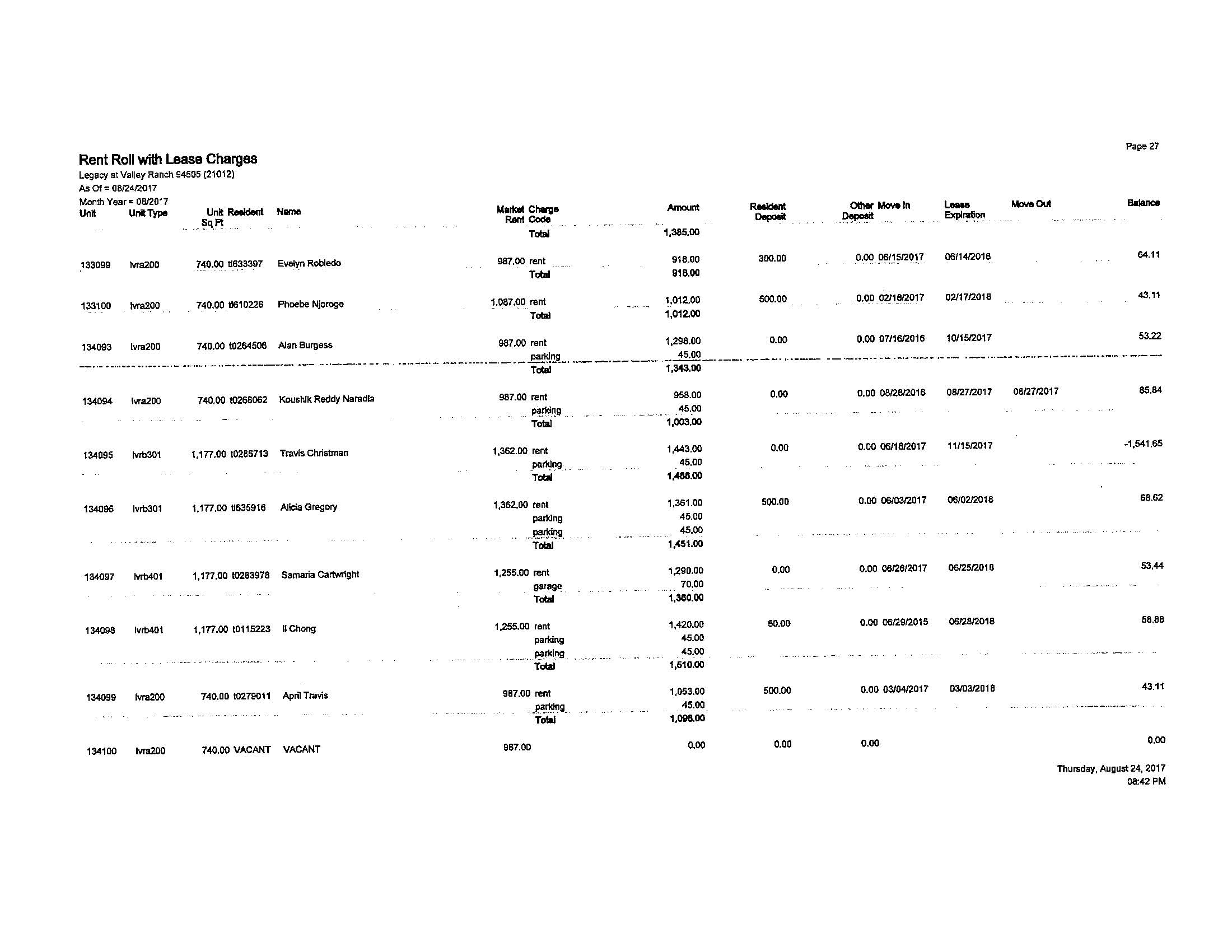

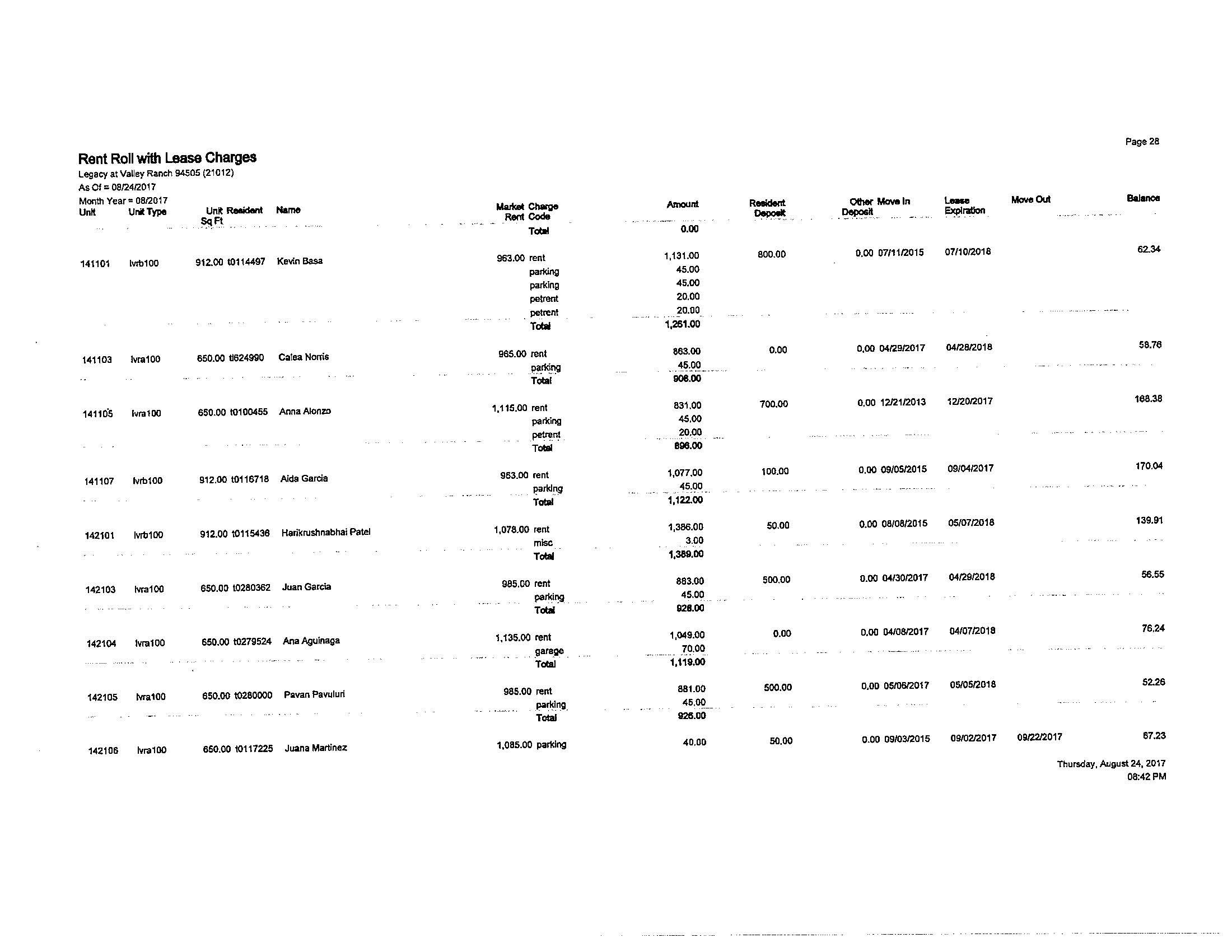

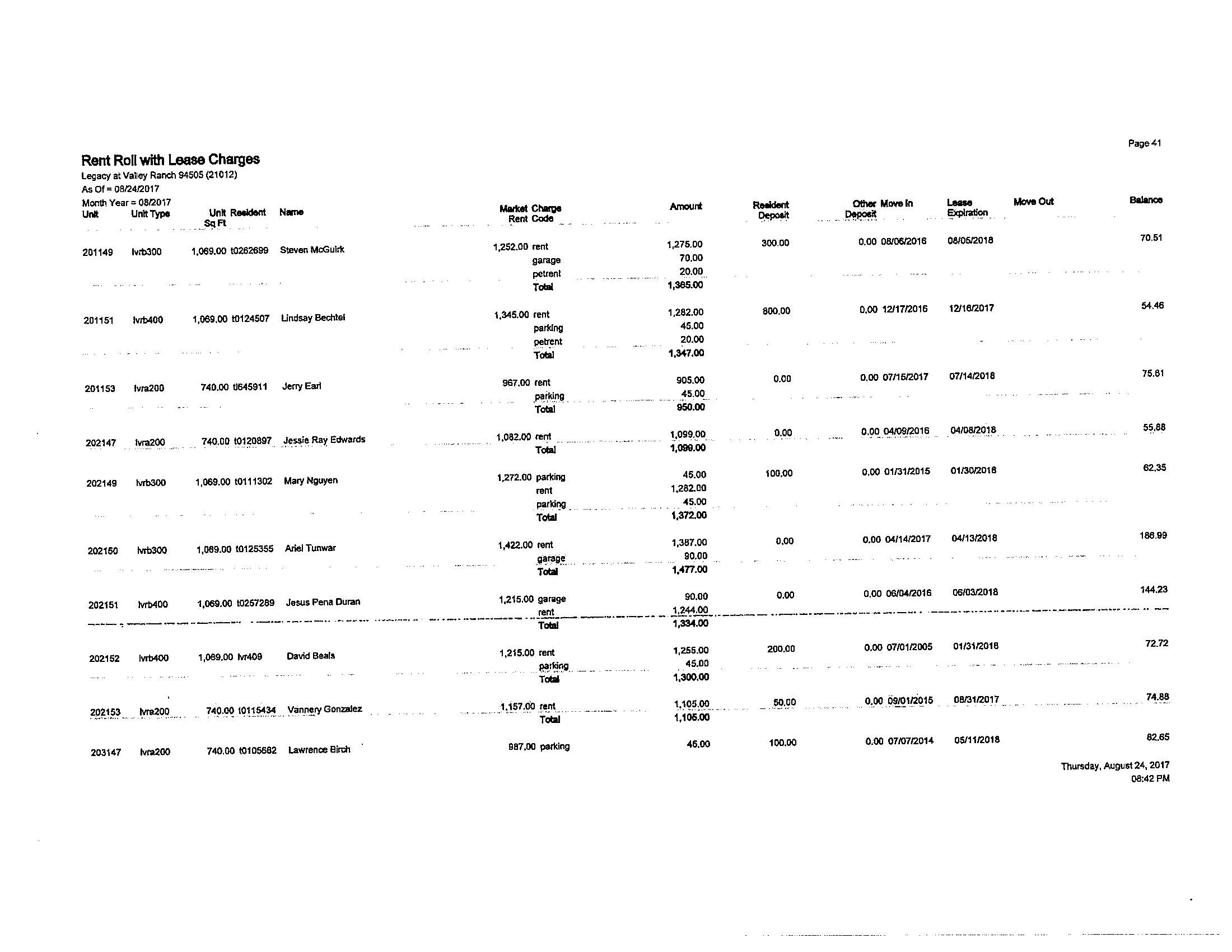

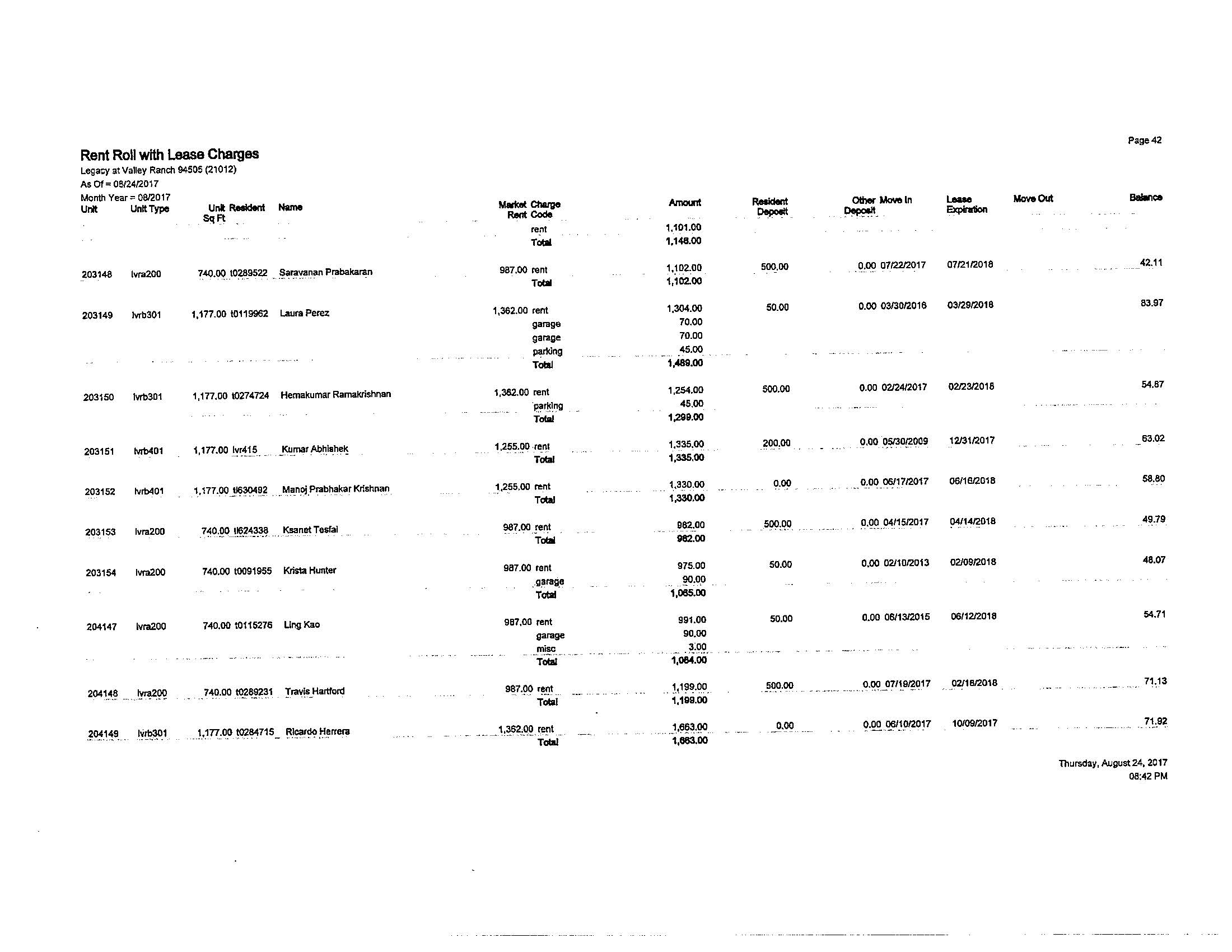

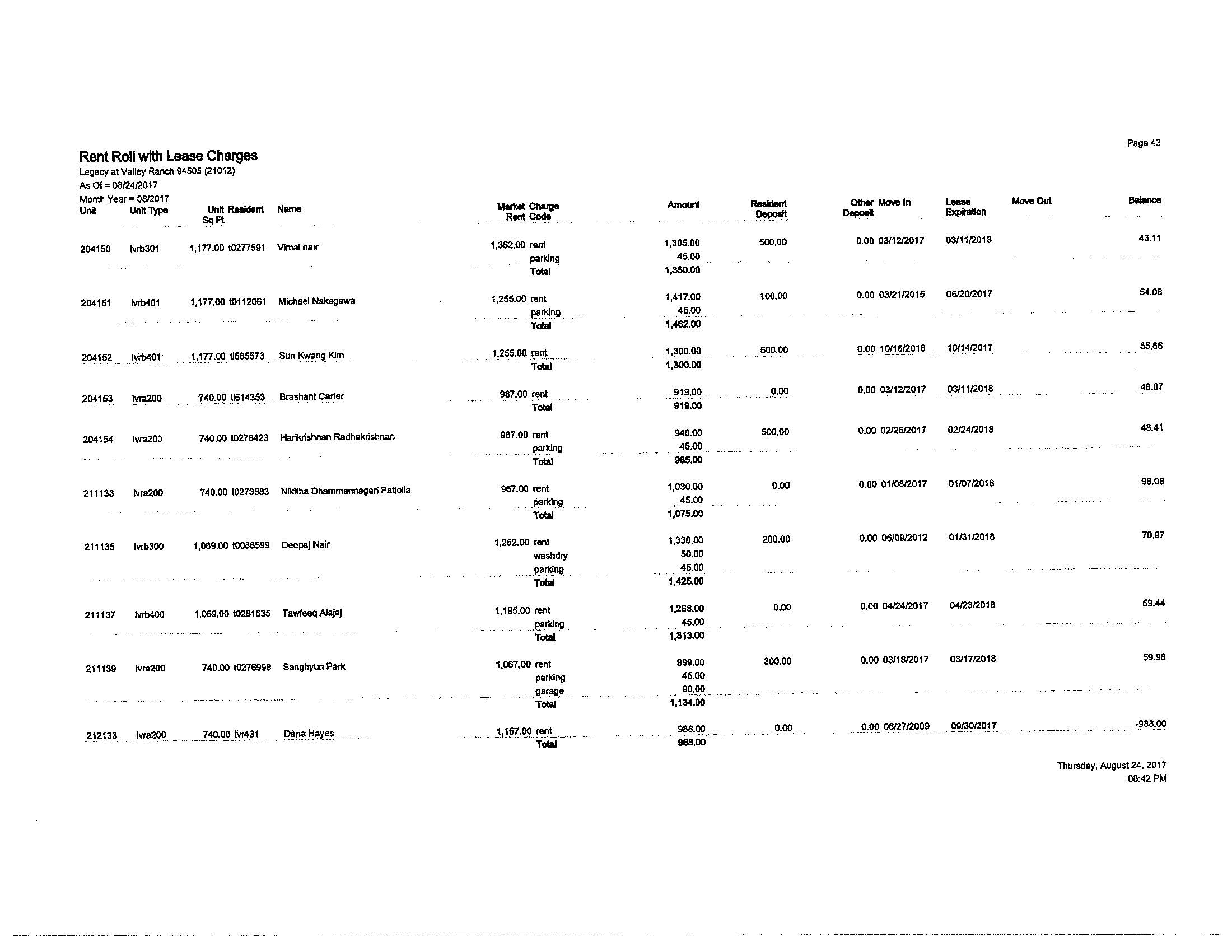

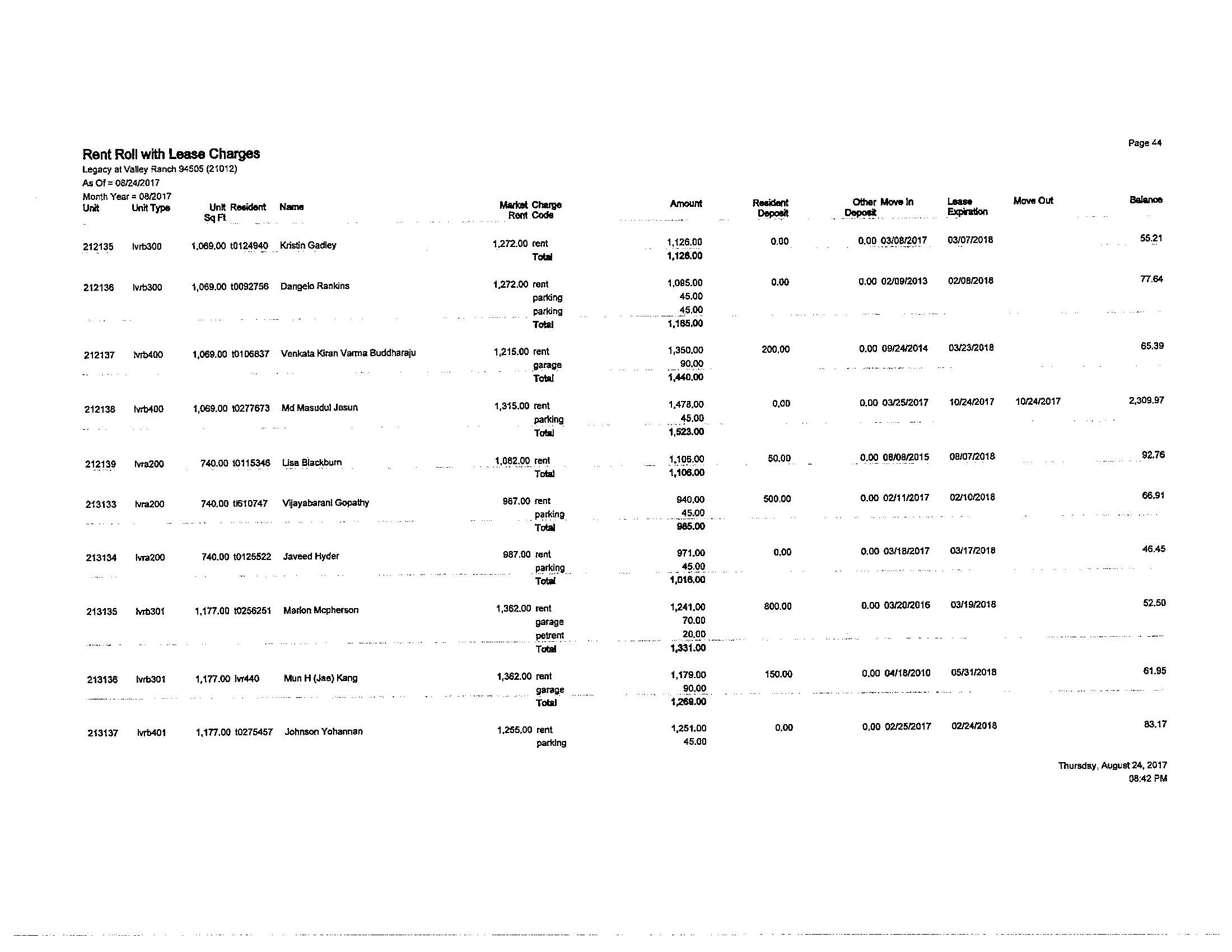

(i) One (1) updated Rent Roll prepared within two (2) business days prior to the anticipated Closing Delivery Date (the "Updated Rent Roll"). The Updated Rent Roll may be delivered to the Escrow Agent and Buyer via facsimile or other electronic means;

(j) All keys for the Property to the extent they are in the possession or control of Seller;

(k) One (1) Water District Notice (“Water District Notice”), duly executed by Seller and acknowledged, in form substantially the same as set forth on Exhibit "I" attached hereto;

(l) One (1) Assignment, Assumption and Ratification of Declaration of Covenants and Restrictions (“Assignment of Covenants and Restrictions”), in the form substantially the same as set forth on Exhibit “J”, duly executed by Seller and acknowledged;

(m) One (1) duly executed counterpart of a closing statement prepared by the Escrow Agent and approved by the parties on or prior to the Closing Date (the "Closing Statement"); and

(n) All such other documents duly executed by Seller as may be reasonably necessary to consummate the transaction contemplated herein, each in form reasonably acceptable to Seller (provided such documents do not increase in any material respect the costs to, or liability or obligations of, Seller in a manner not otherwise provided for herein).

2.4.4 Buyer shall deliver the following on or prior to the Closing Delivery Date (or when indicated otherwise below) to Escrow Agent to be held in escrow and disbursed or delivered to Seller at Closing:

(a) The Purchase Price which will be delivered to Escrow Agent not later than the Closing Delivery Date and disbursed to Seller on the Closing Date as set forth in Section 2.3 above;

(b) Three (3) of the Assignment of Leases, duly executed by Buyer;

(c) Three (3) of the Assignment of Contracts, duly executed by Buyer;

(d) One (1) Water District Notice, duly executed by Buyer and acknowledged;

(e) One (1) Assignment of Covenants and Restrictions, duly executed by Buyer and acknowledged;

(f) One (1) duly executed counterpart of the Closing Statement on or prior to the Closing Date; and

6

(g) All such other documents duly executed by Buyer as may be reasonably necessary or desirable to consummate the transaction contemplated herein, each in form reasonably acceptable to Buyer (provided such documents do not increase in any material respect the costs to, or liability or obligations of, Buyer in a manner not otherwise provided herein).

2.5 Inspection and Due Diligence.

2.5.1 If Seller has not previously delivered or made available to Buyer the following, then not later than the date which is three (3) days after the Effective Date, Seller will deliver or make available to Buyer the following documents and records regarding the Property to the extent such are in Seller’s possession or control and which are not privileged as reasonably determined by Seller (collectively, the "Property Materials"). The Property Materials are being delivered or made available to Buyer to facilitate Buyer’s Physical Inspections and Other Investigations (as such terms are defined in Section 2.5.3 hereof), of the Property, and except as otherwise specifically provided in this Agreement, Seller makes no representations or warranties of any kind or nature whatsoever regarding the accuracy, completeness or thoroughness of such Property Materials:

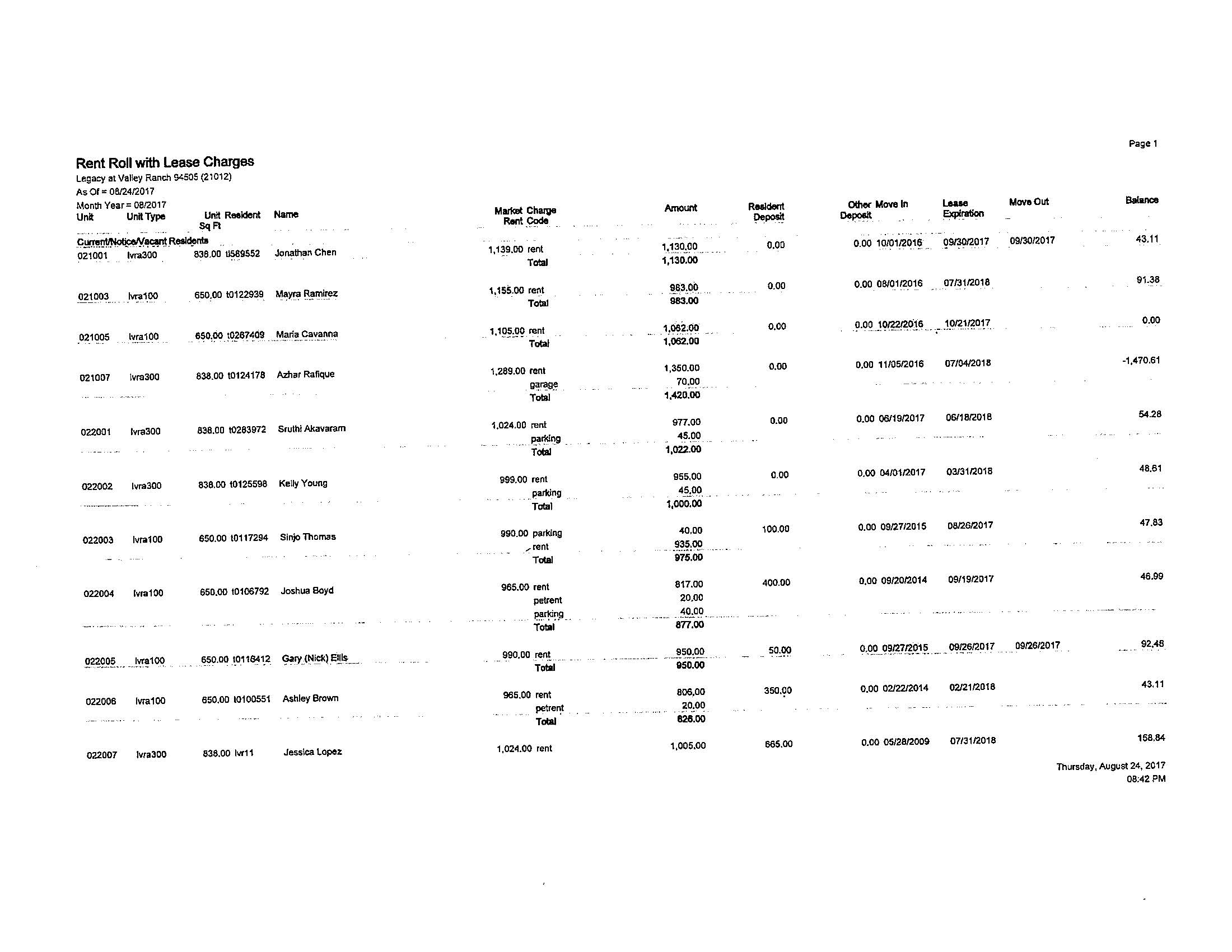

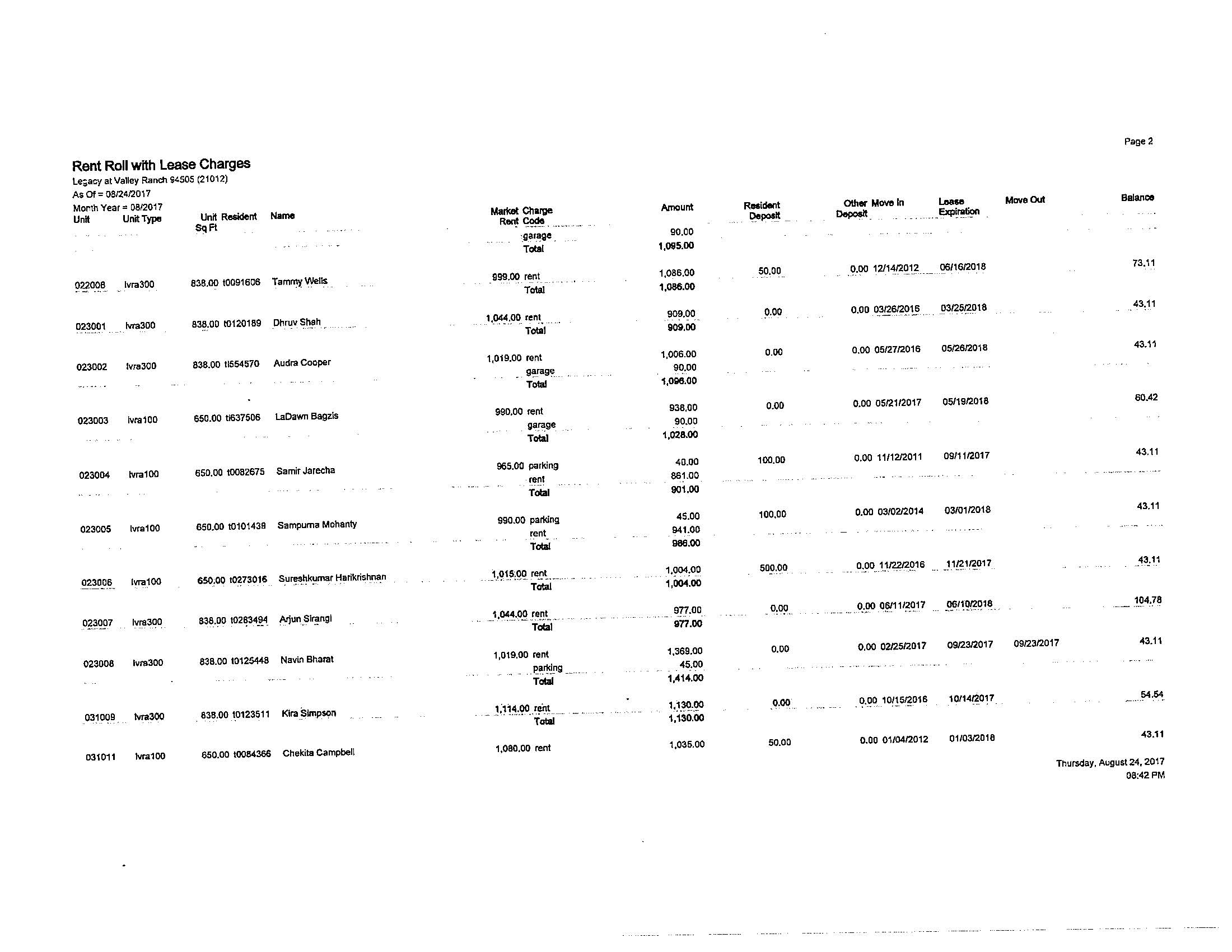

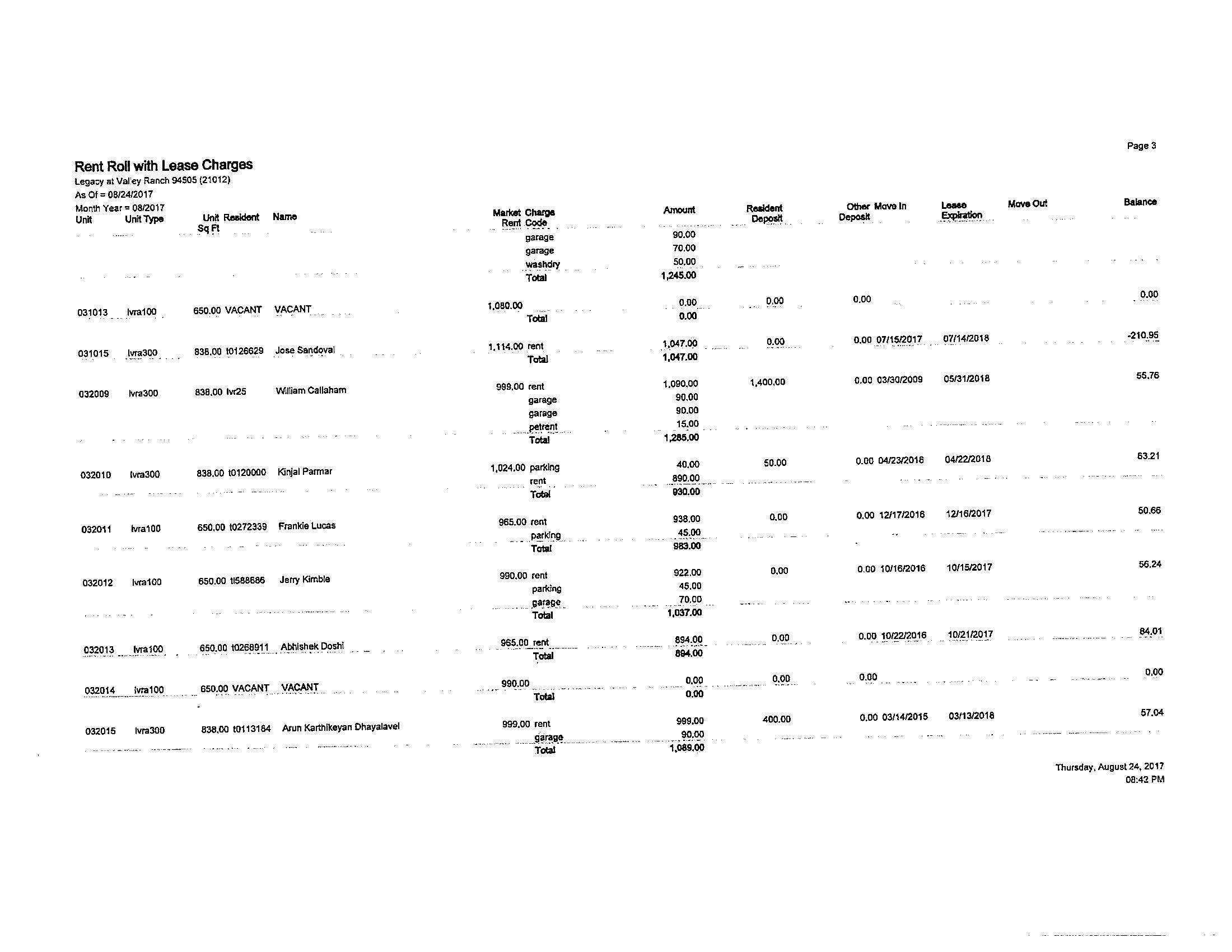

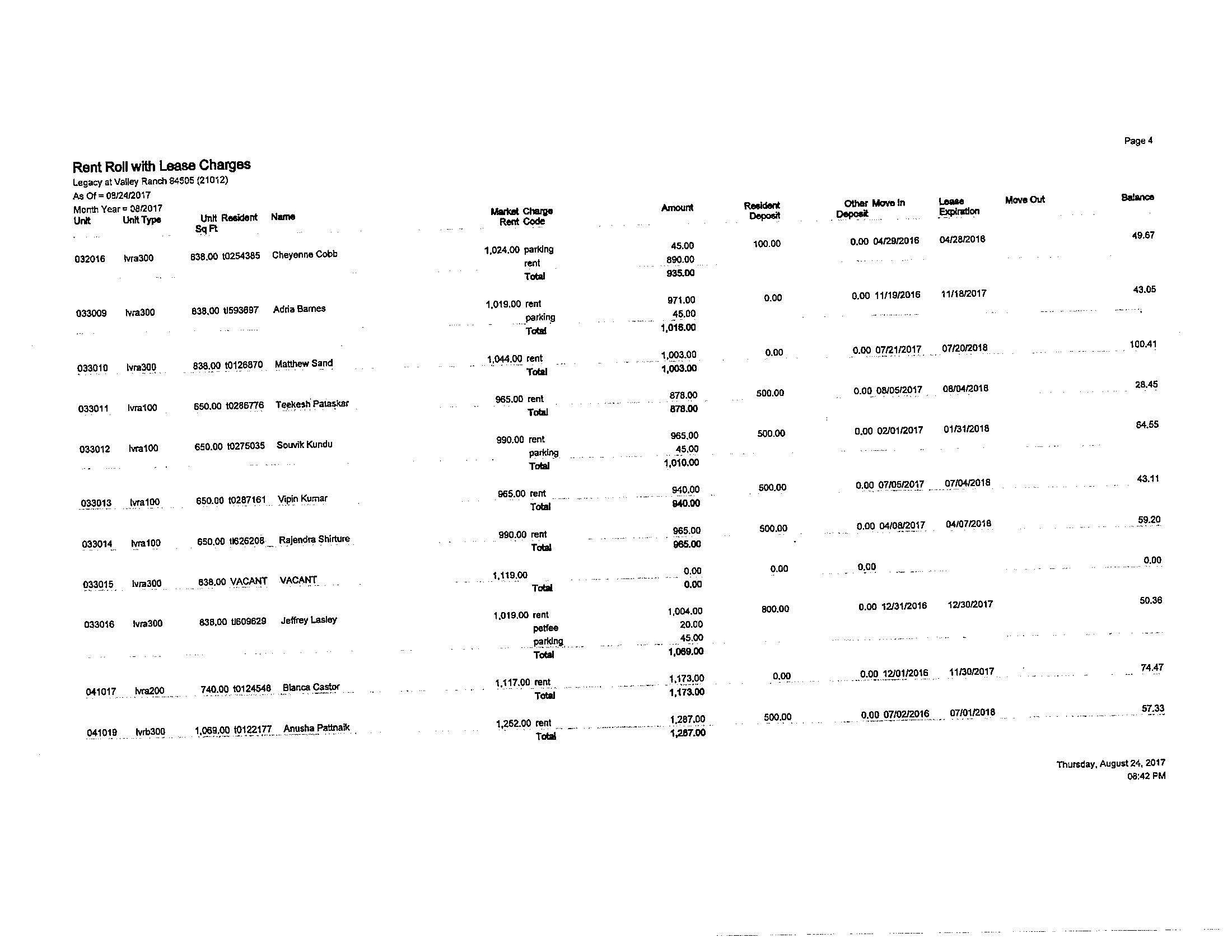

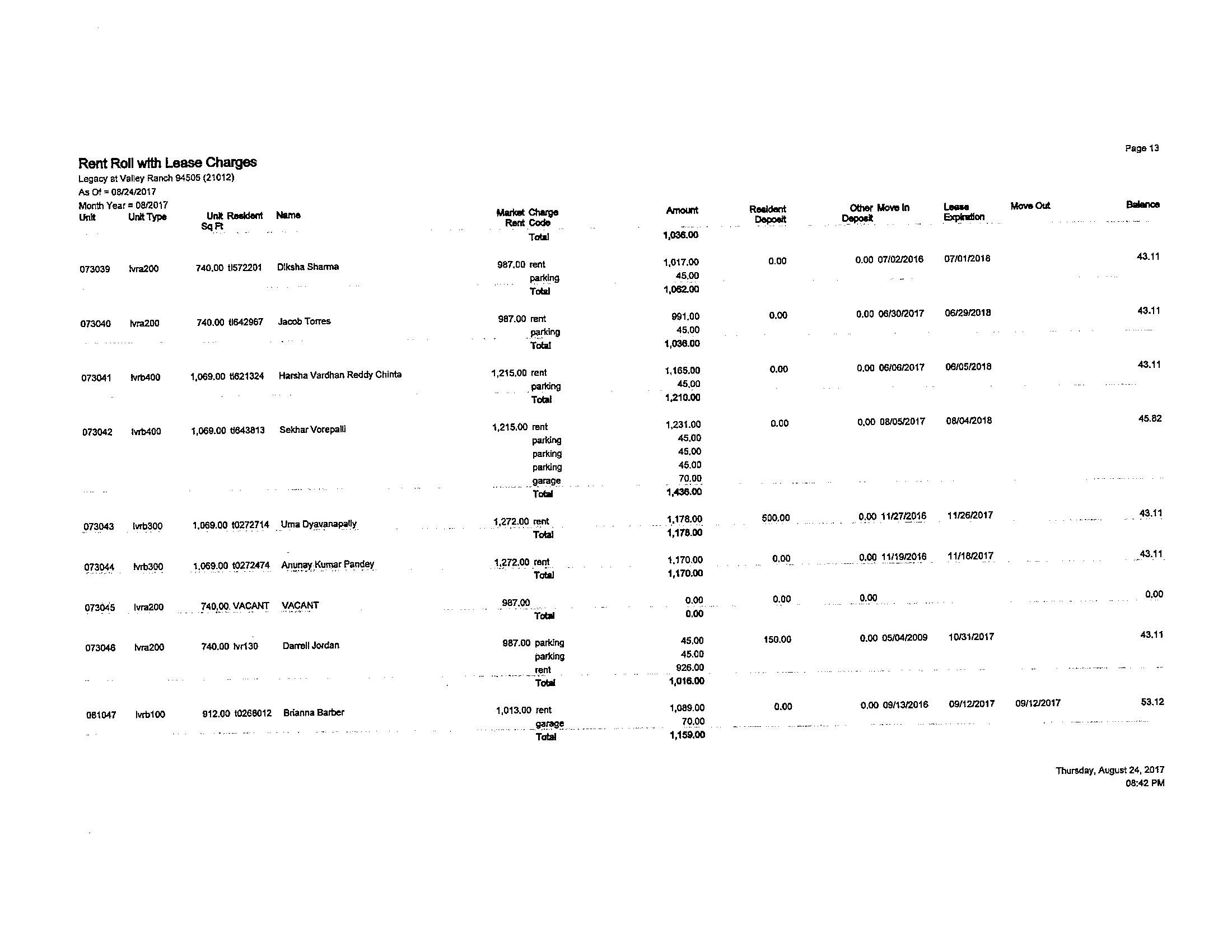

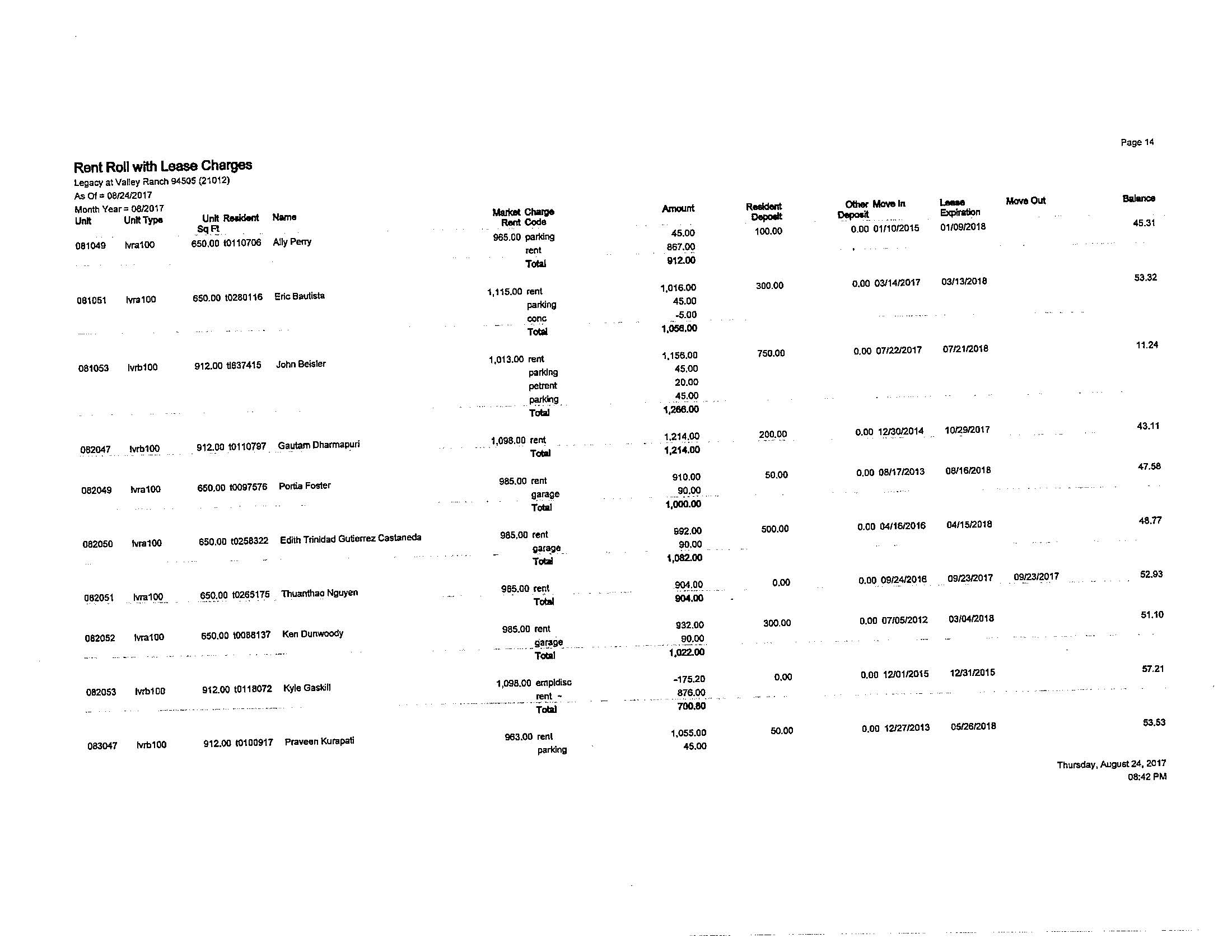

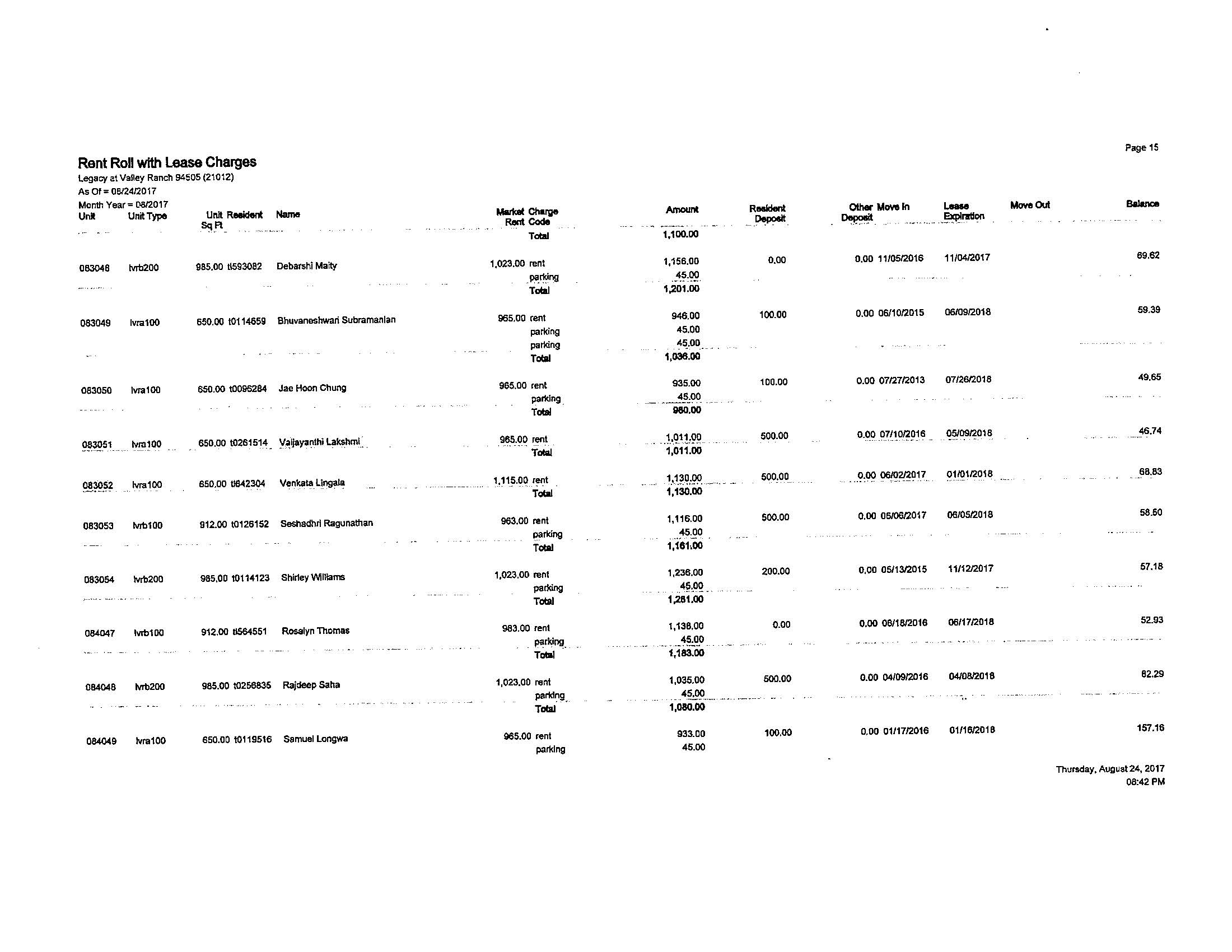

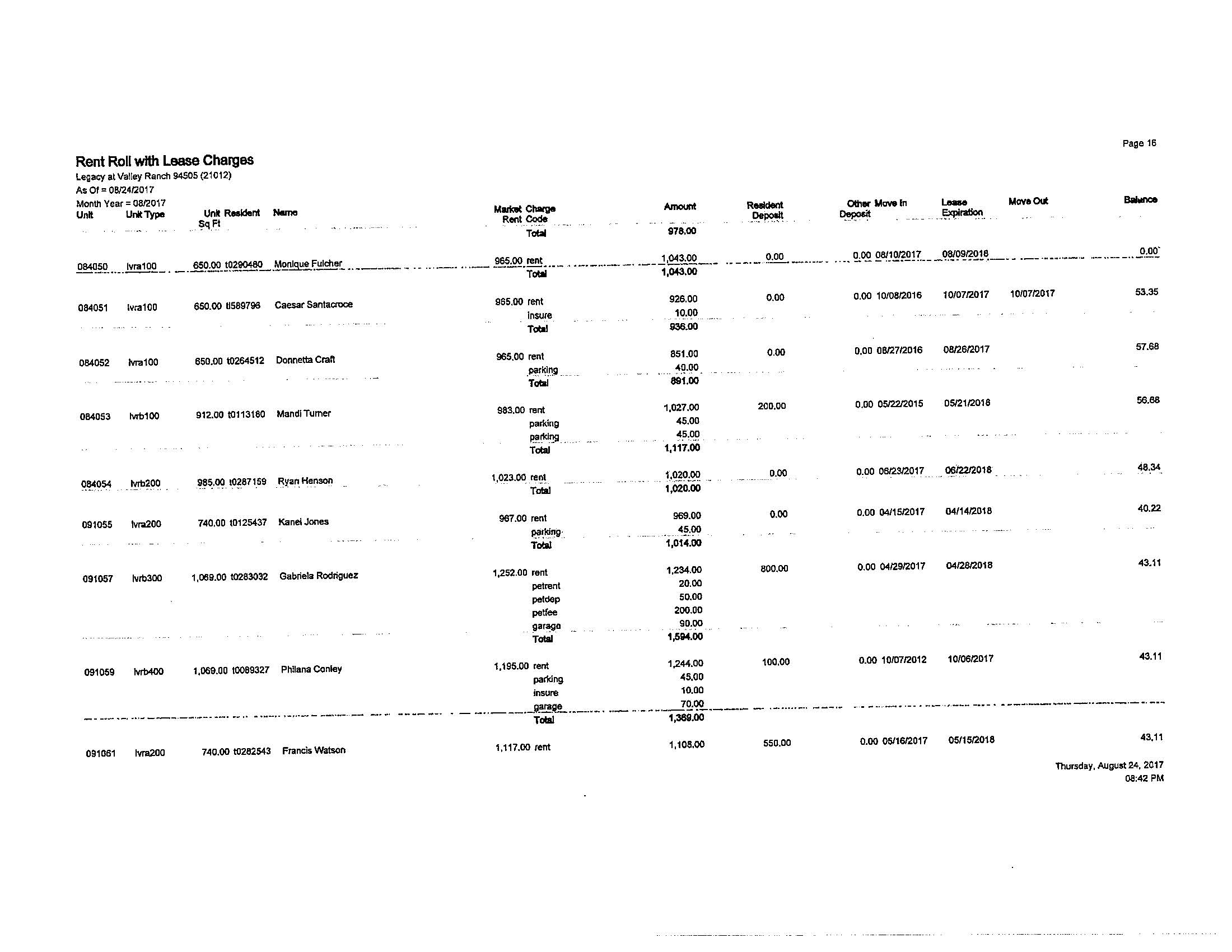

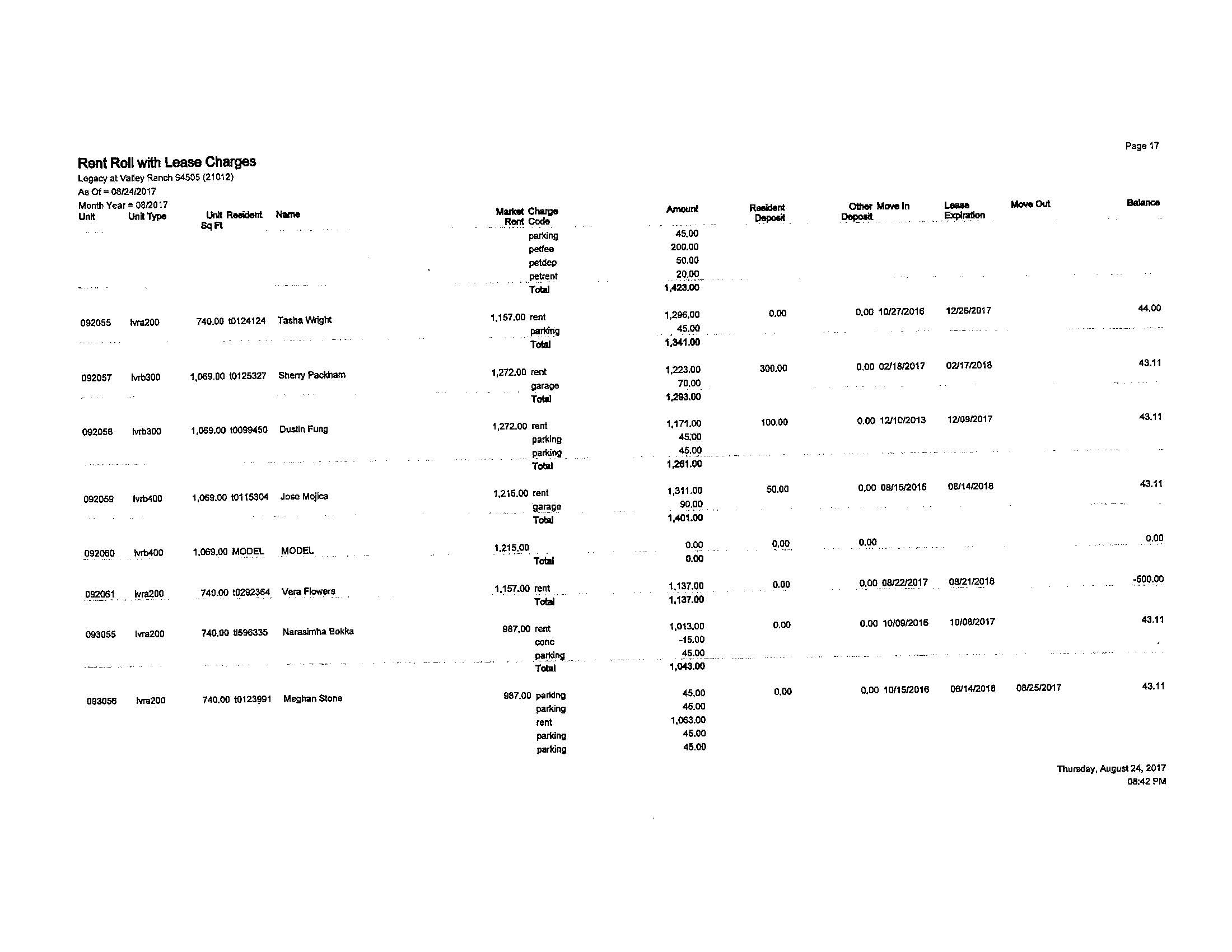

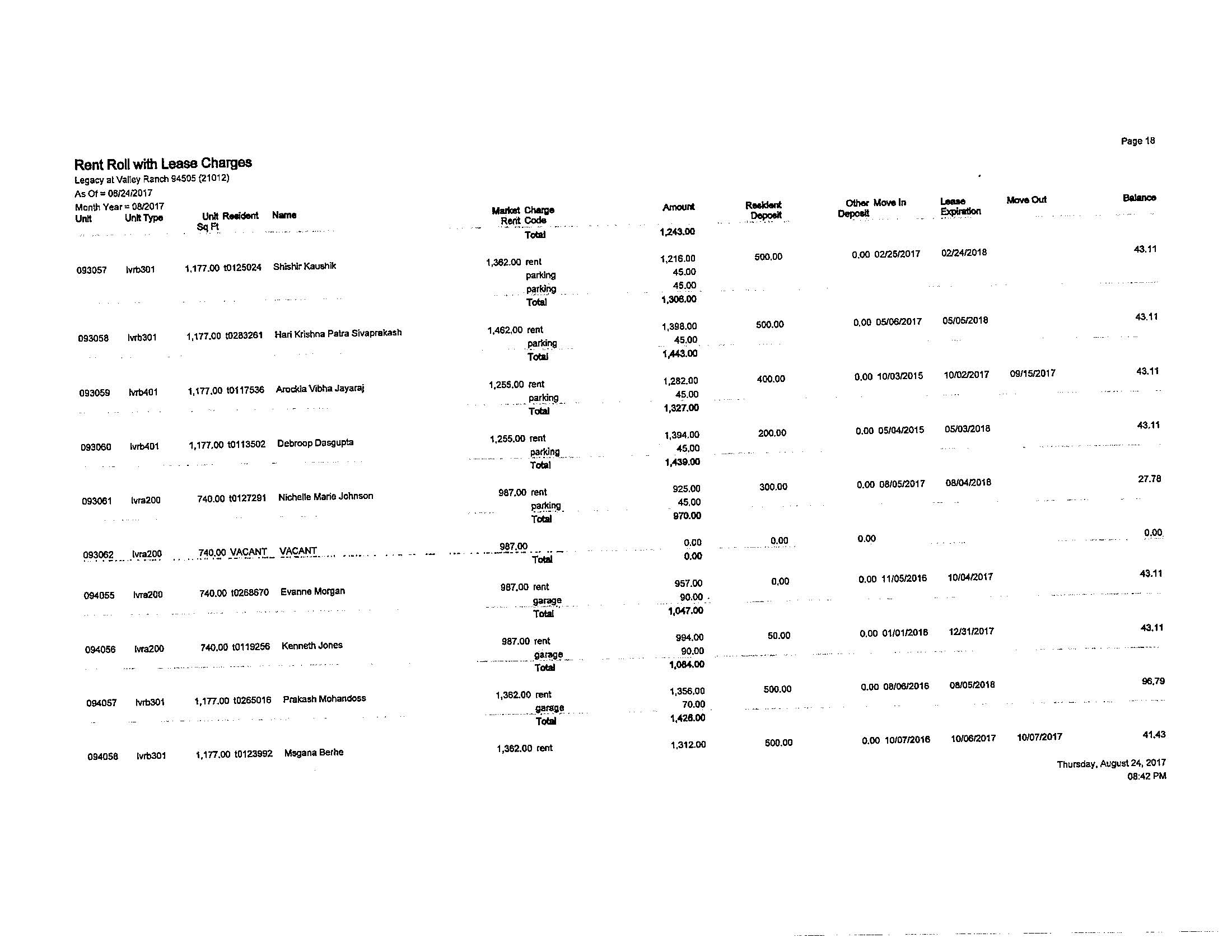

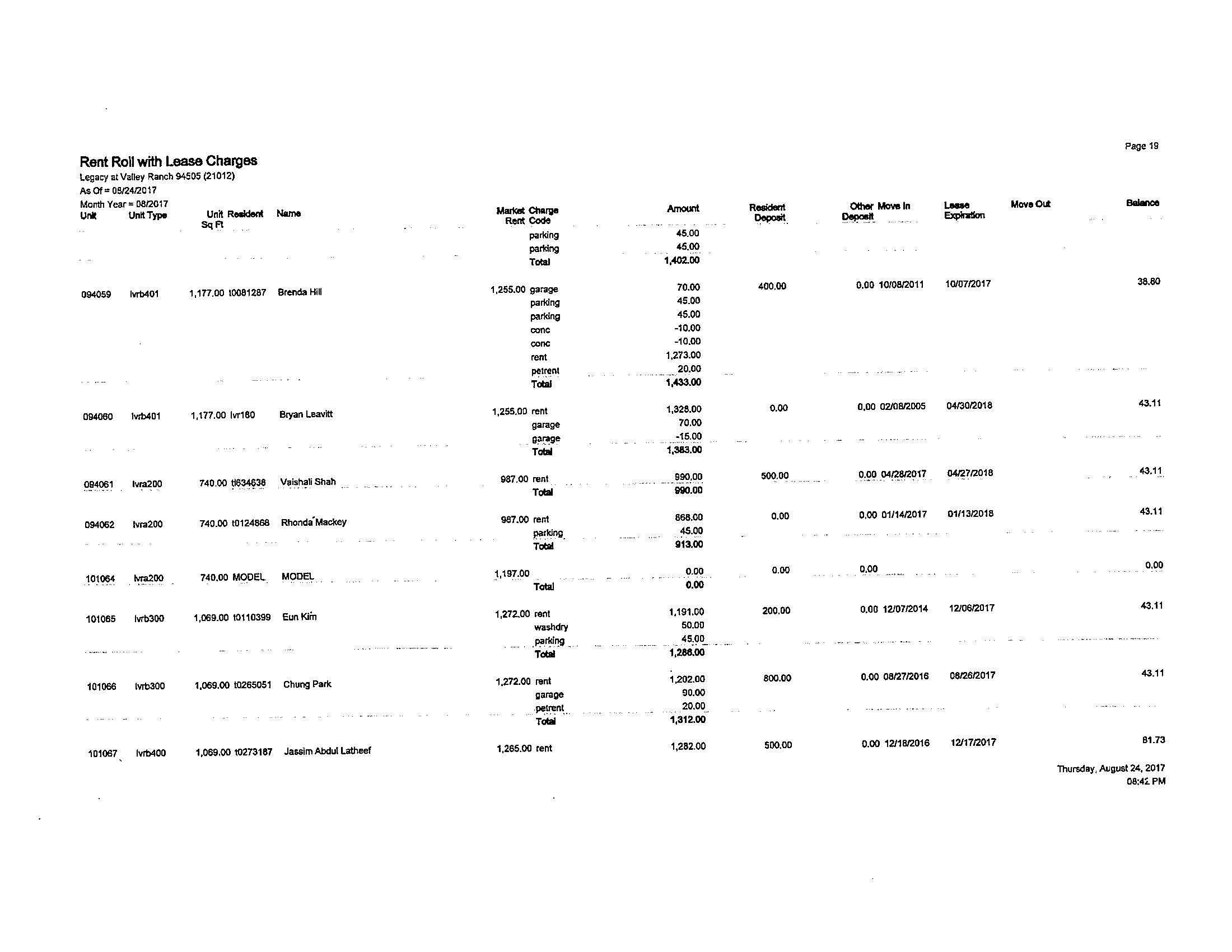

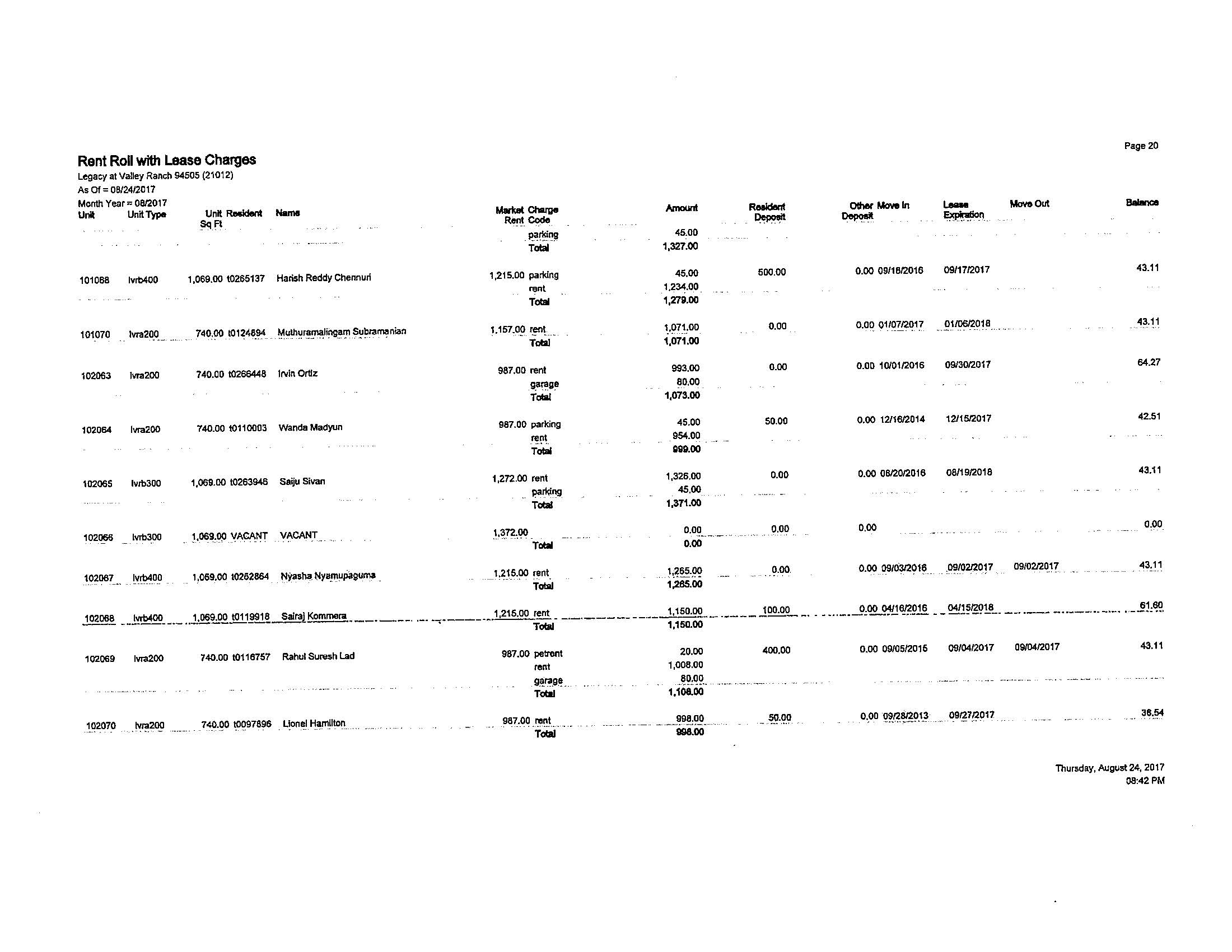

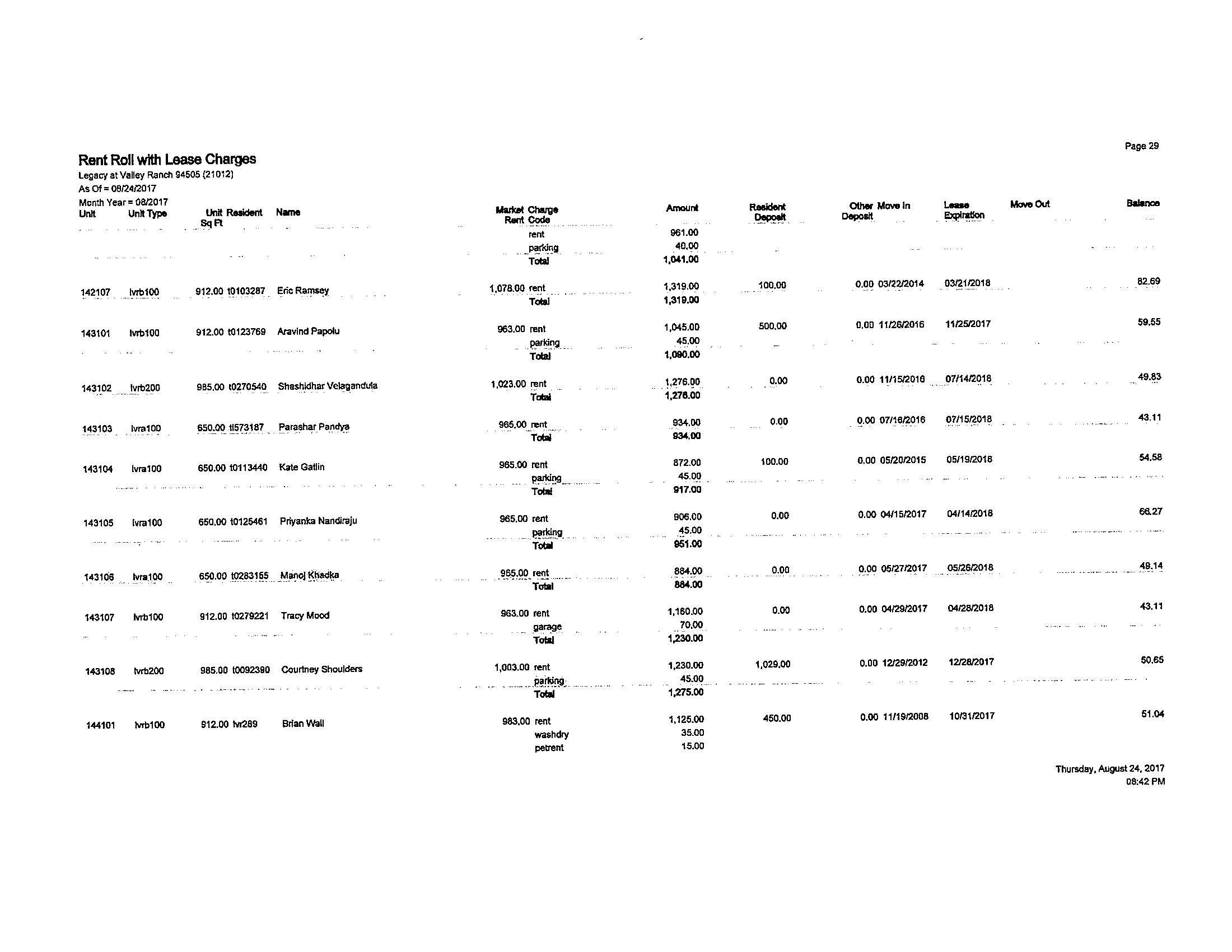

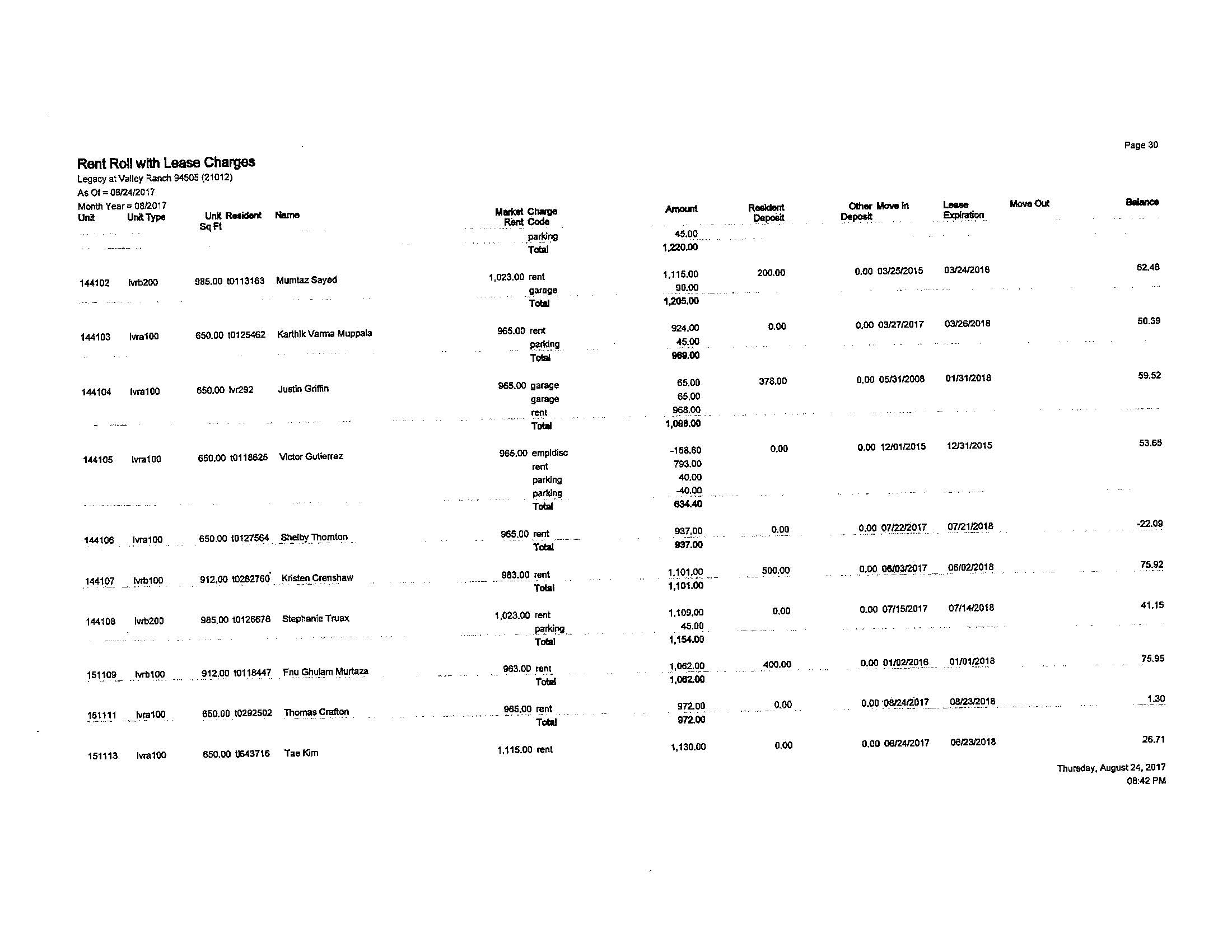

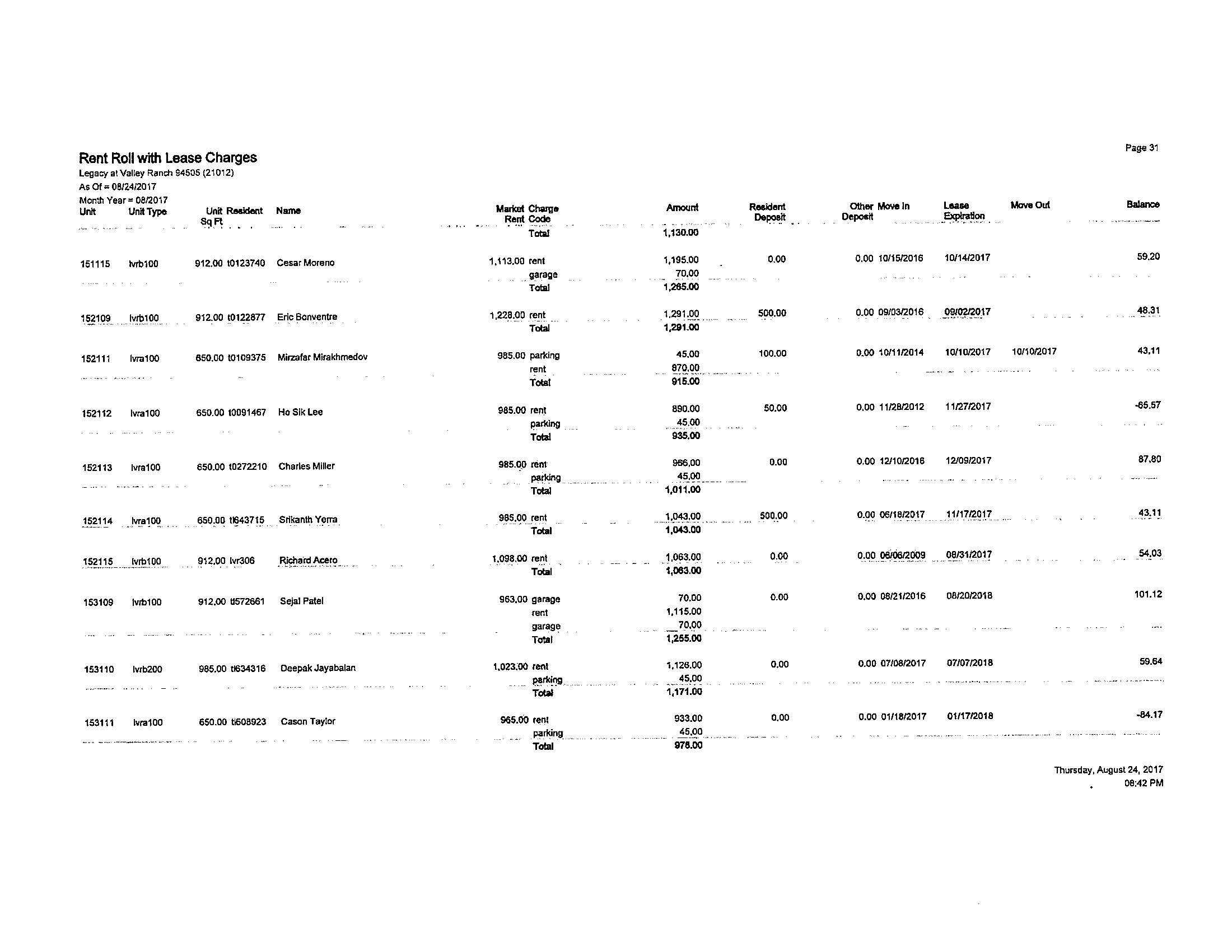

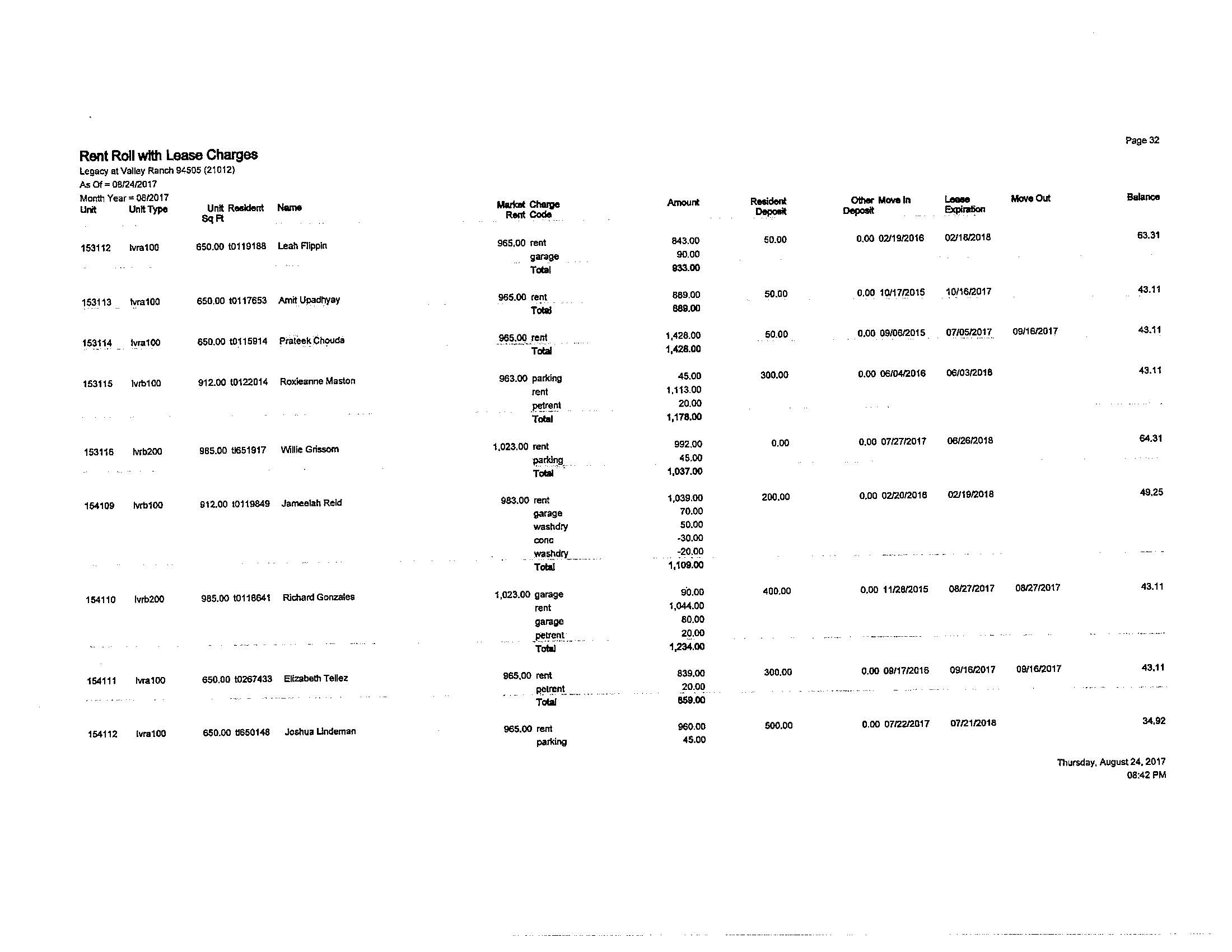

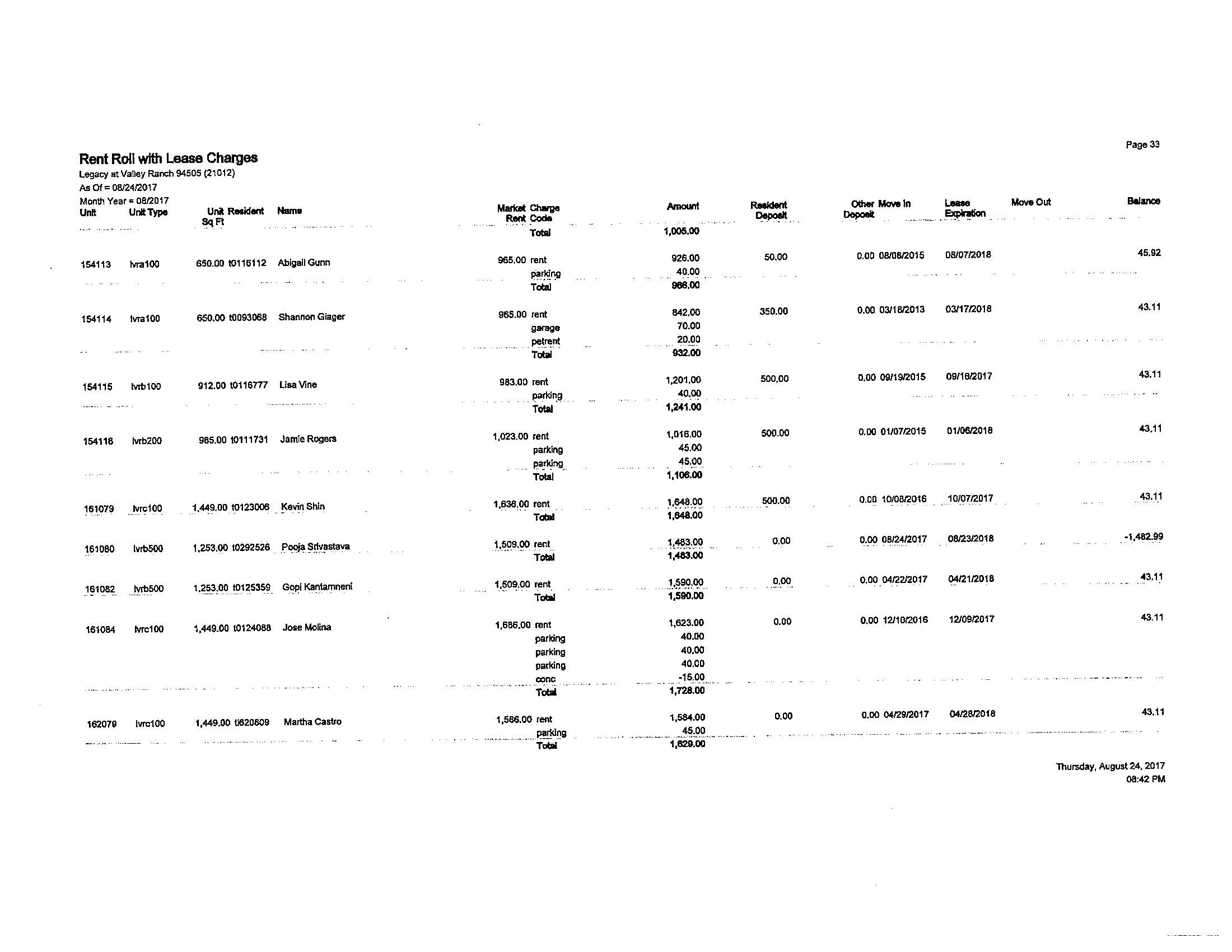

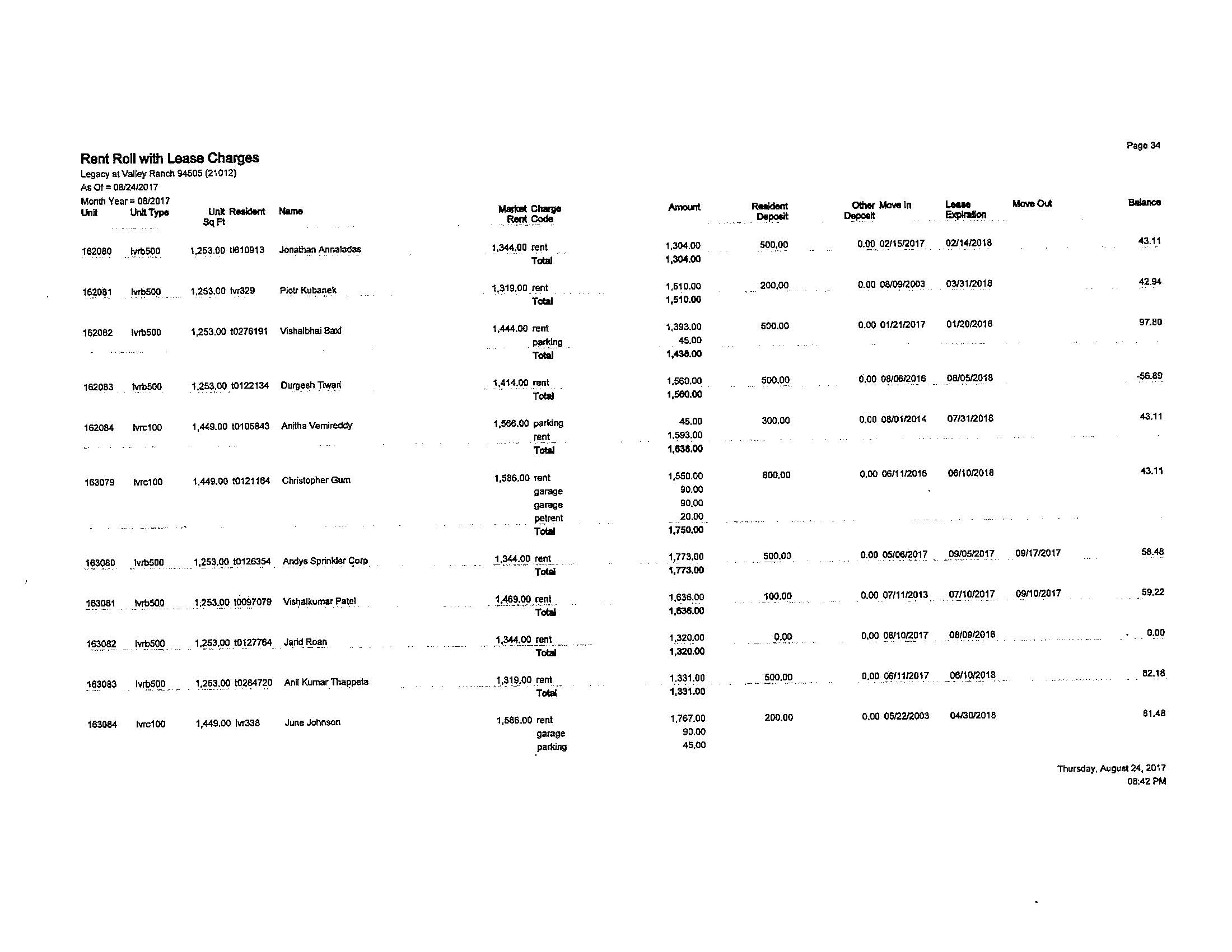

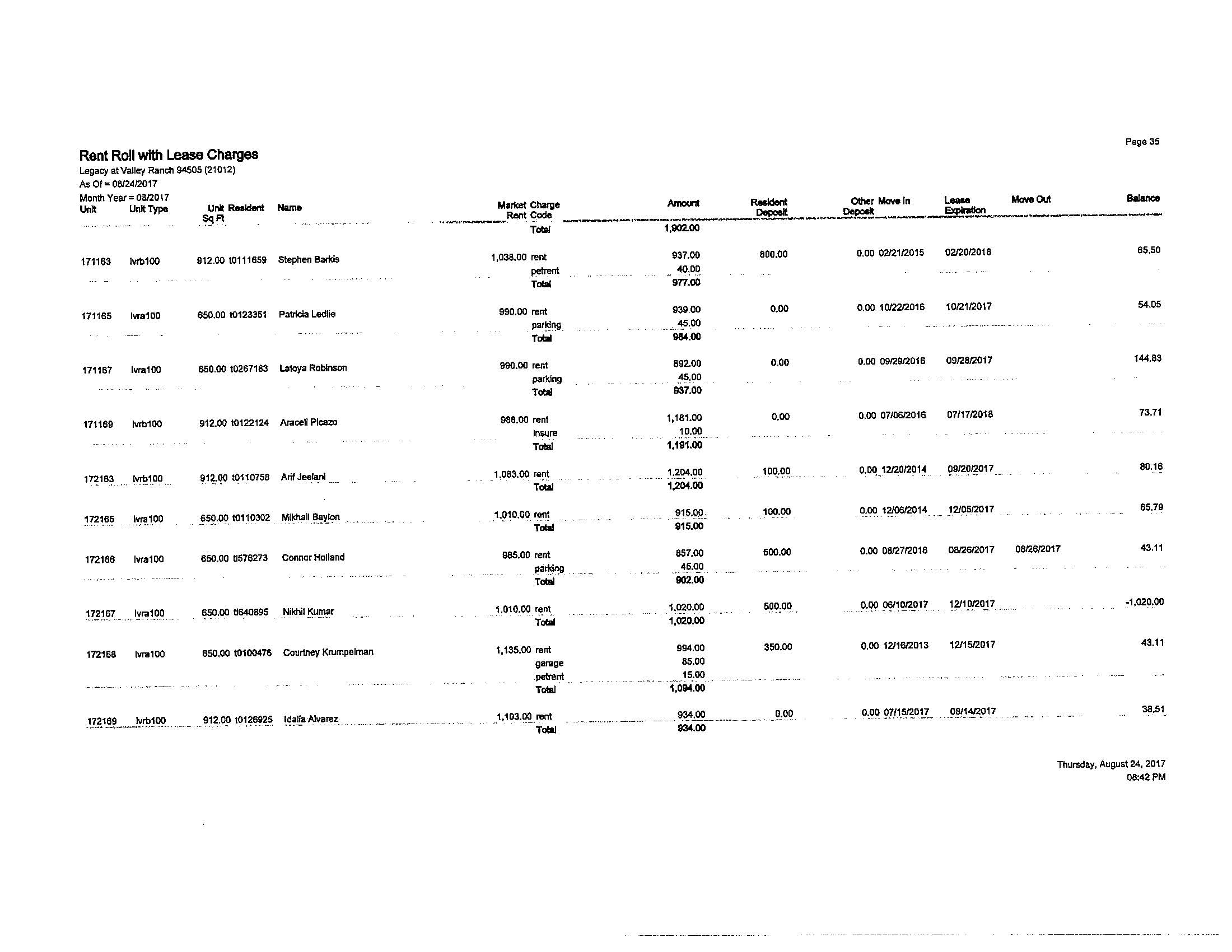

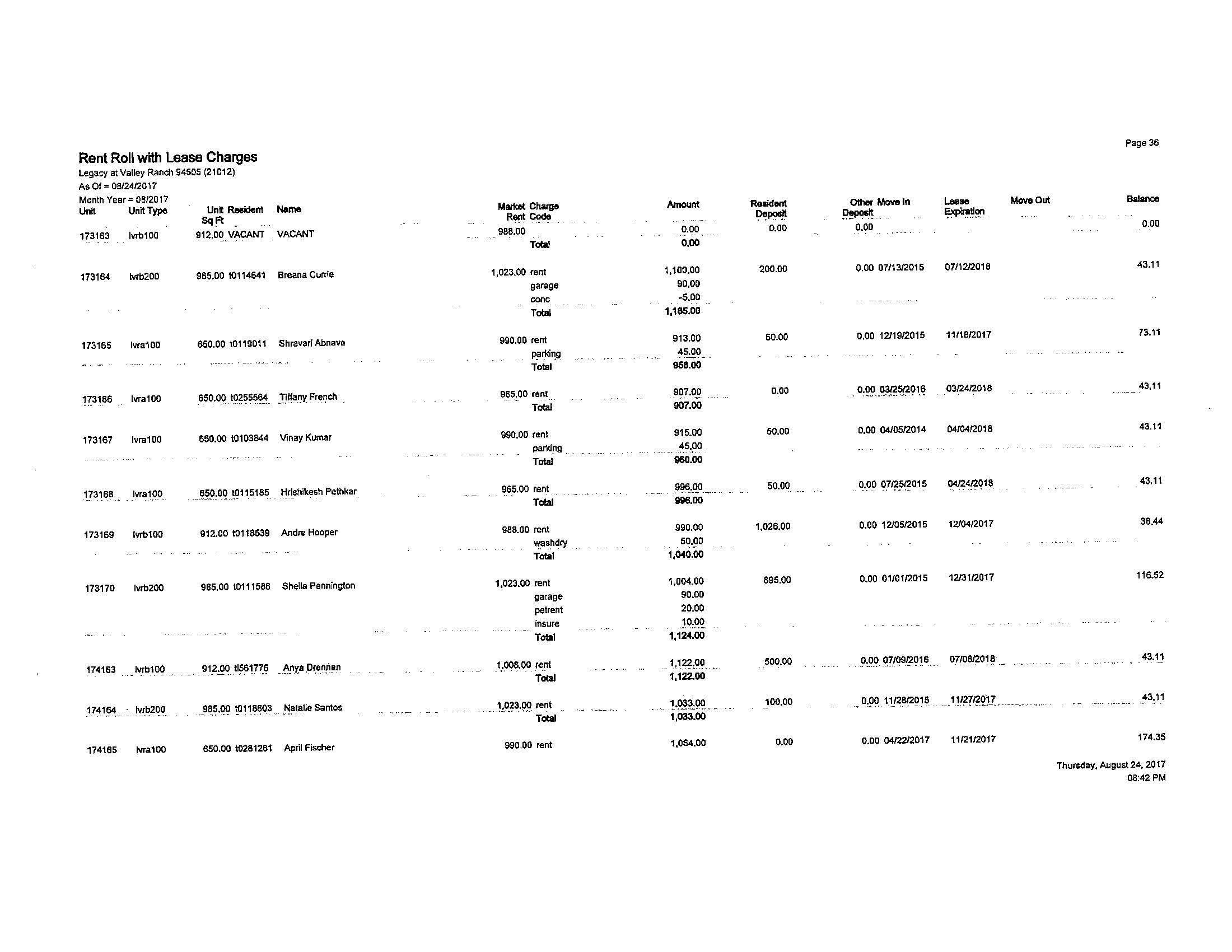

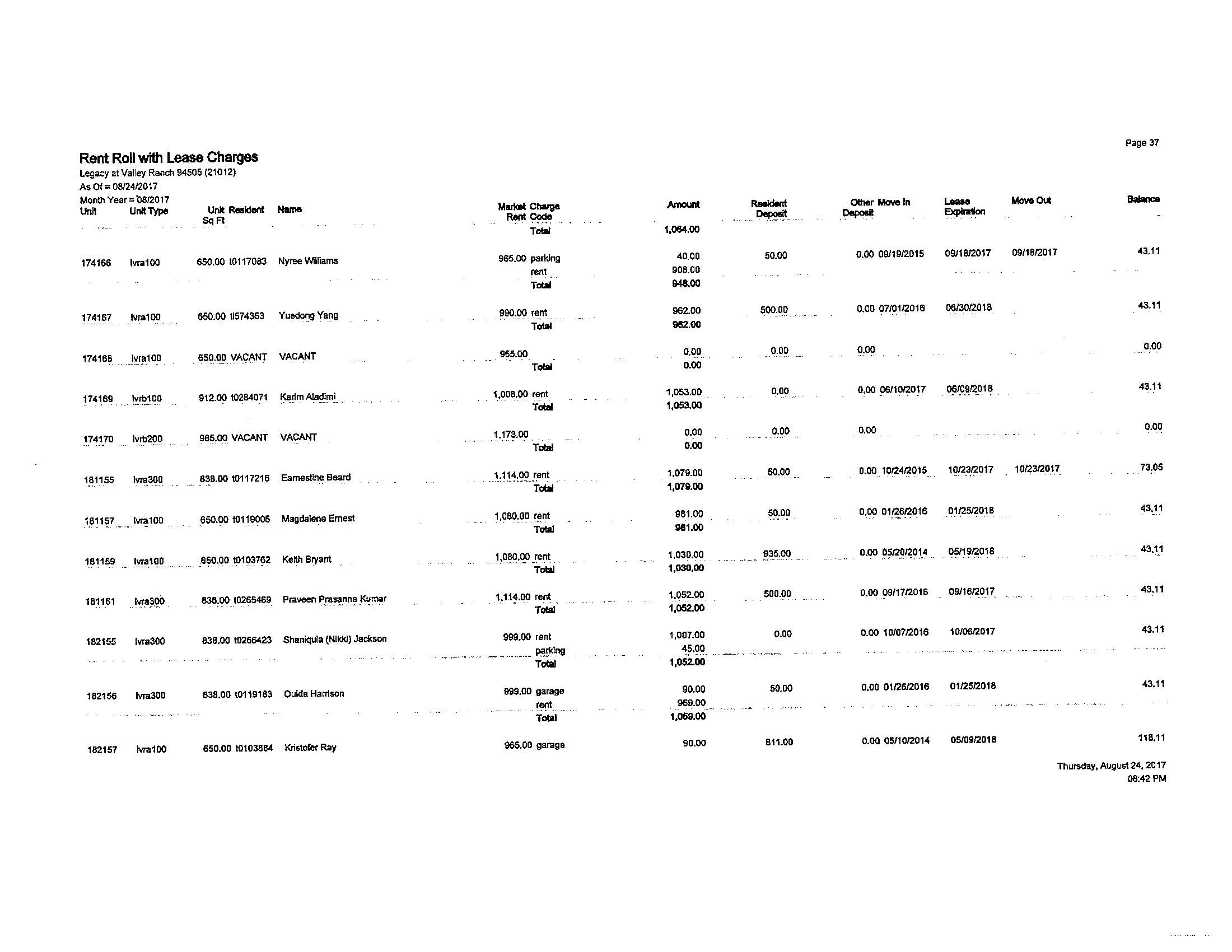

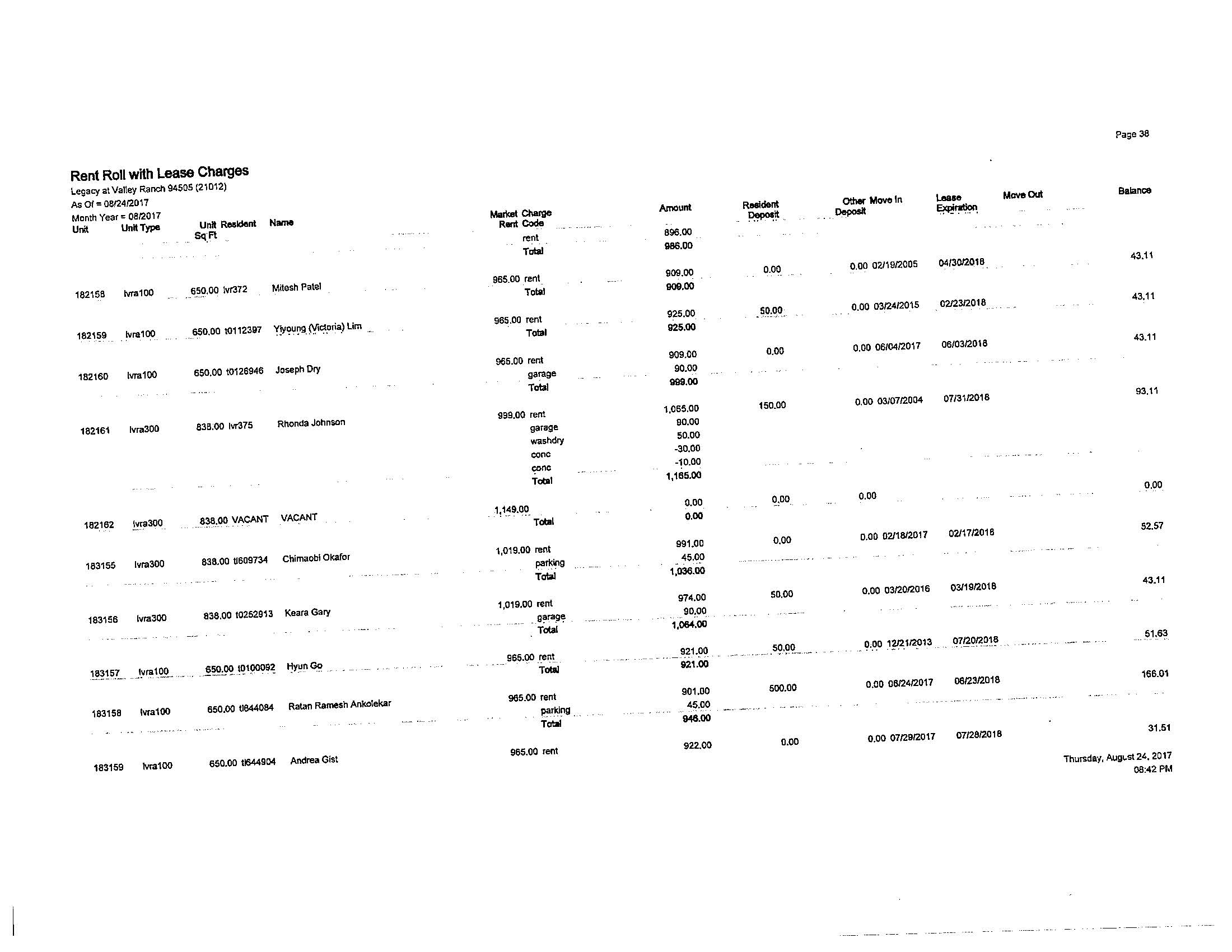

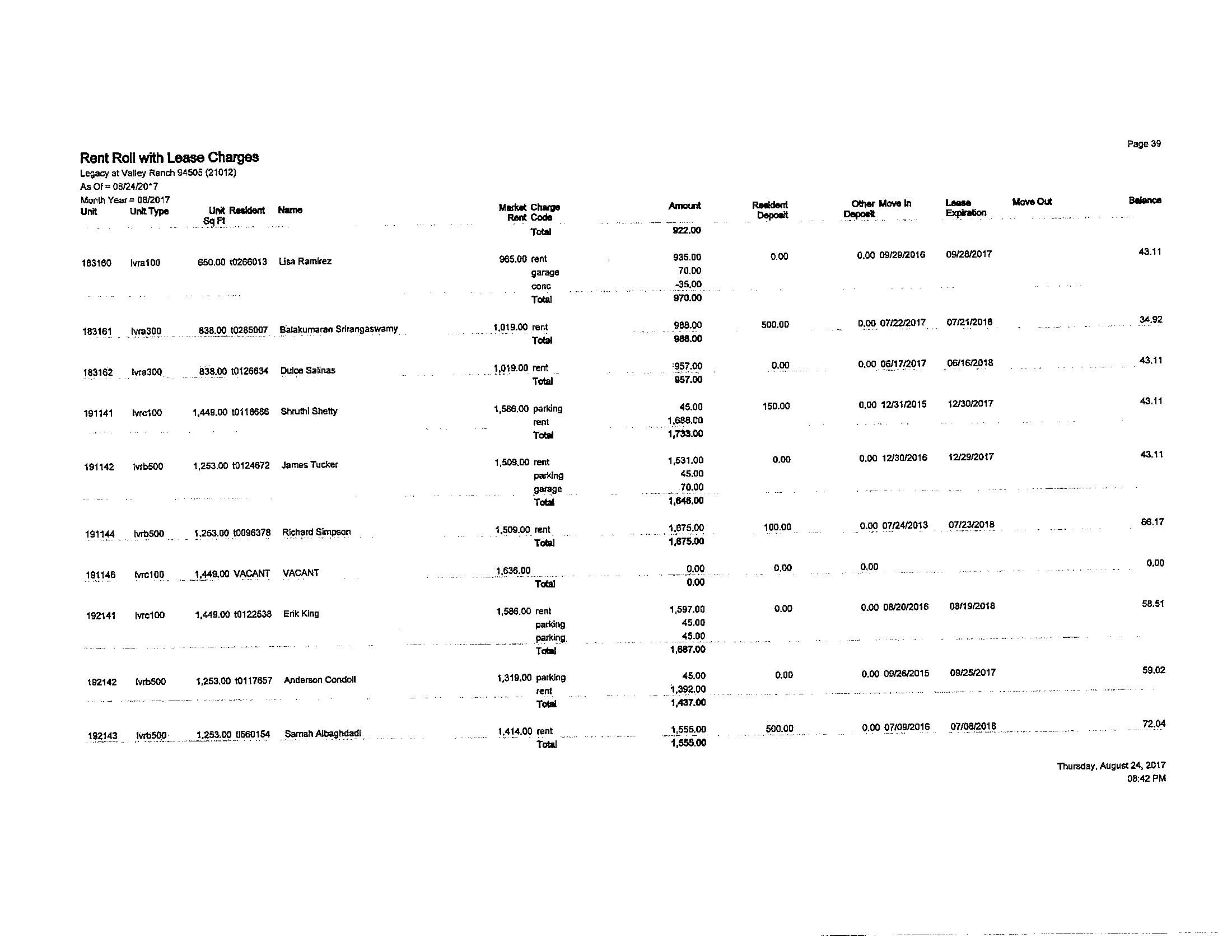

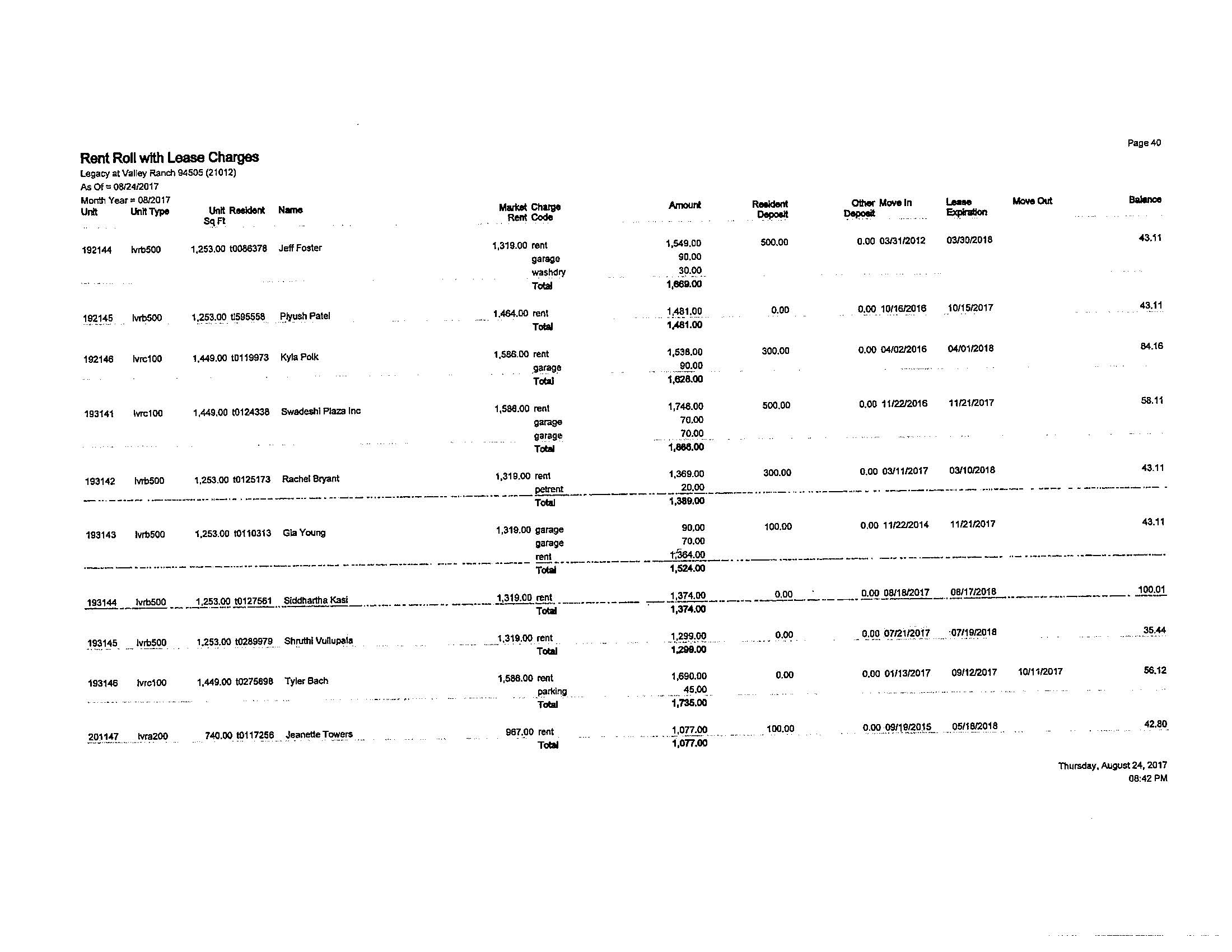

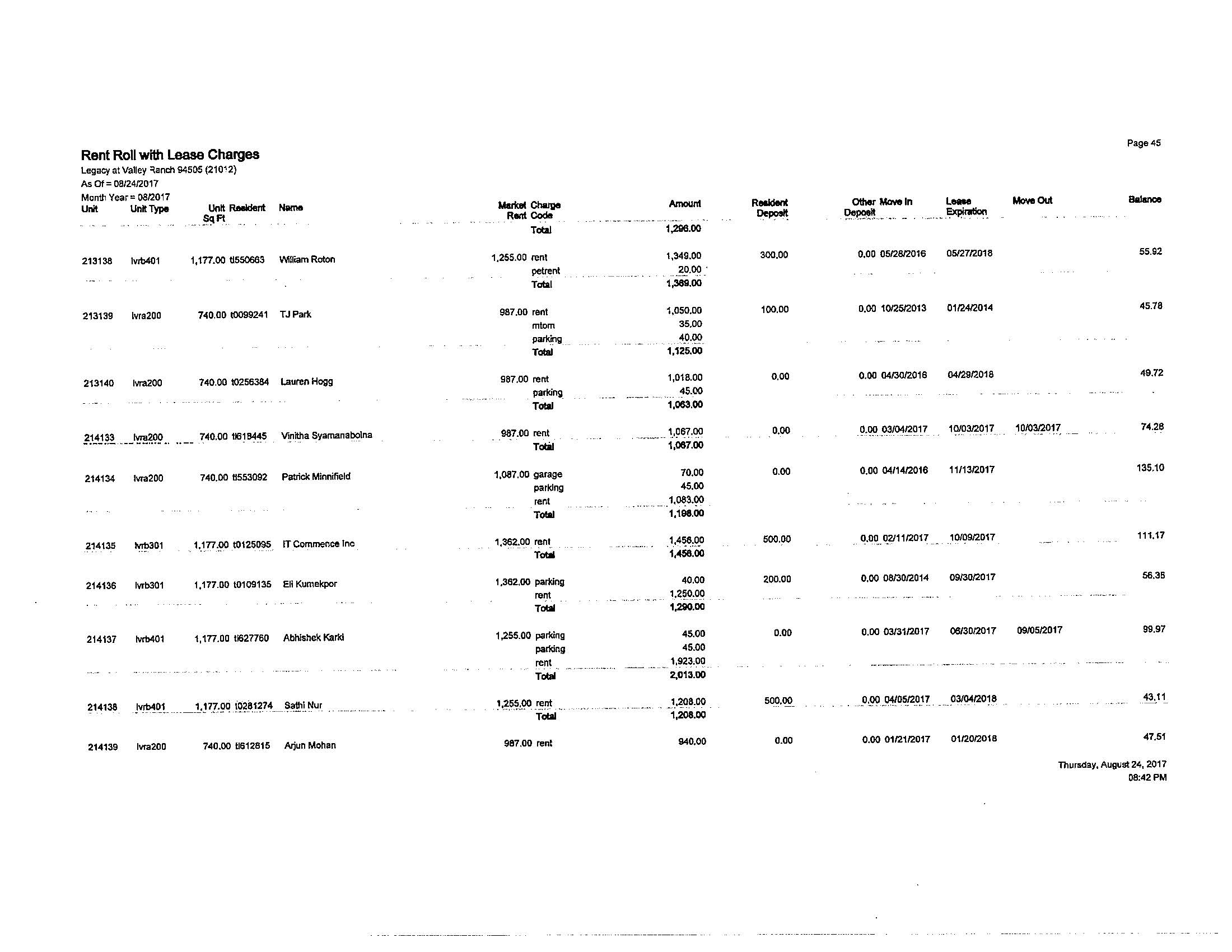

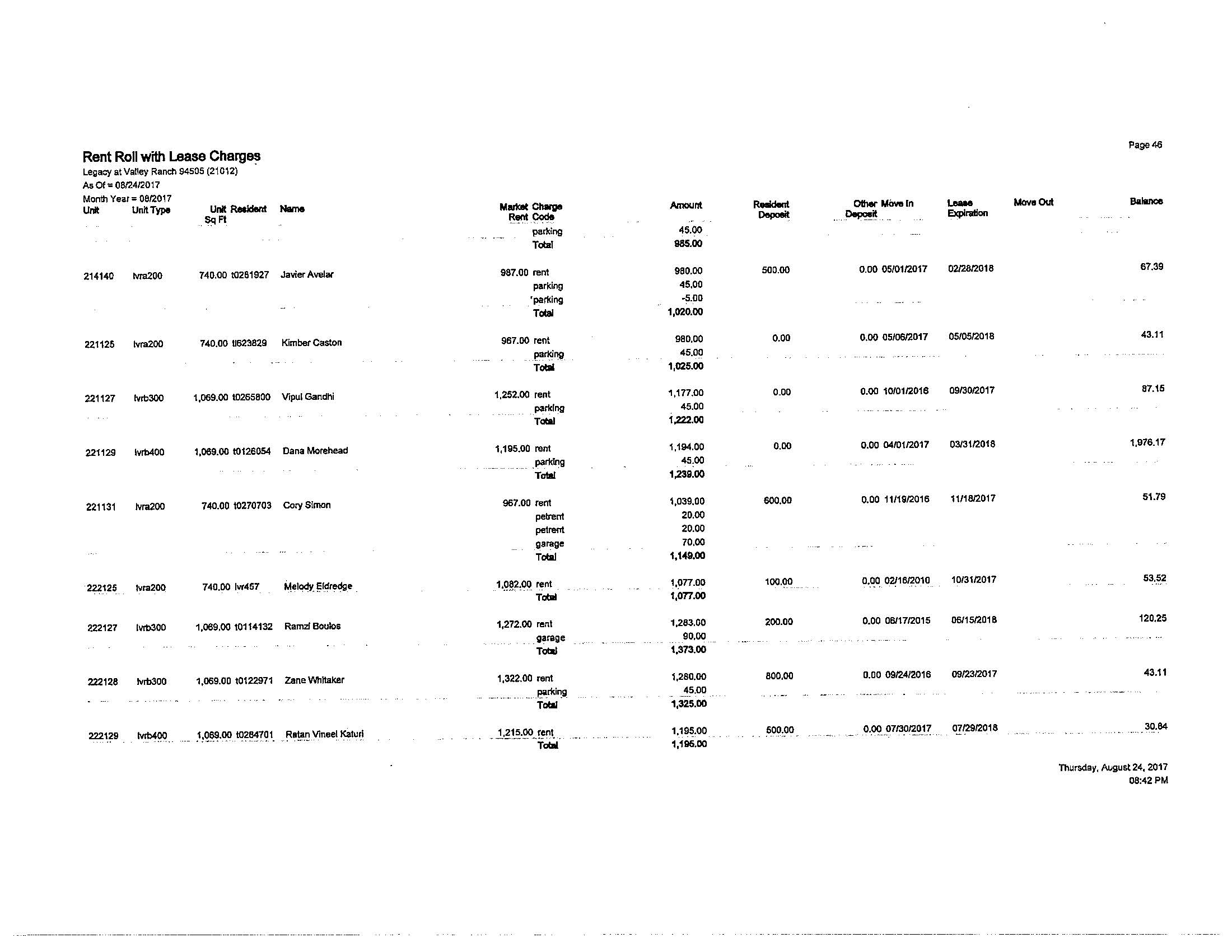

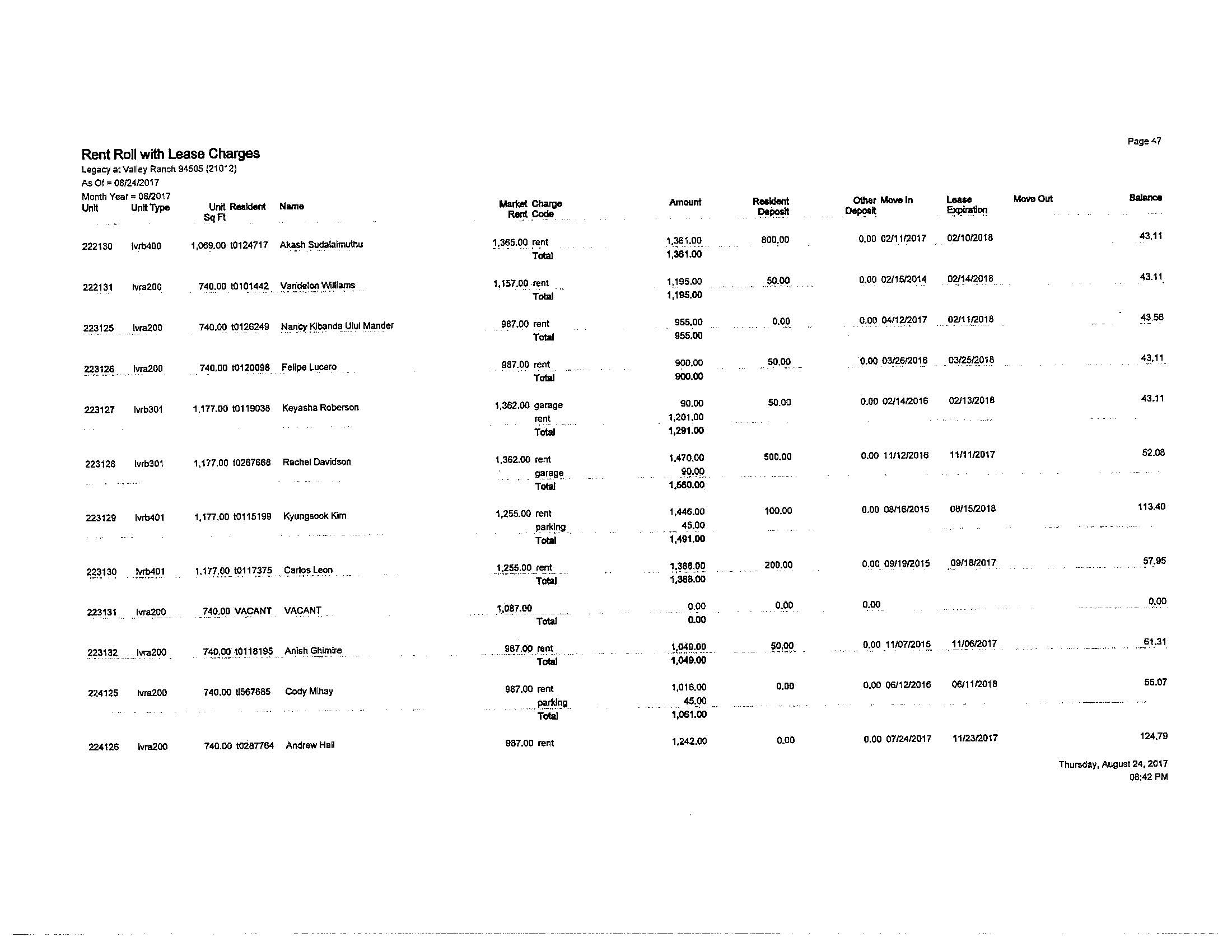

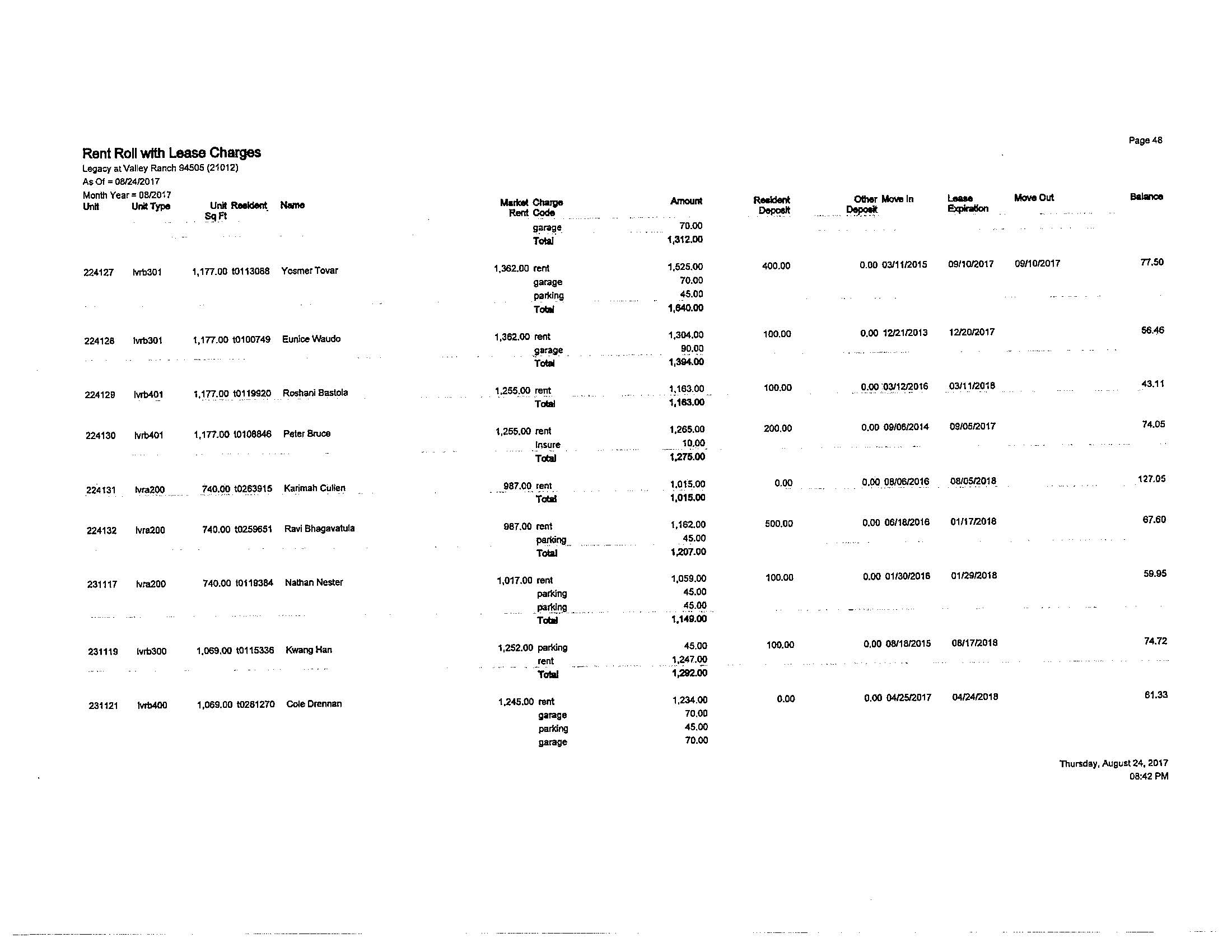

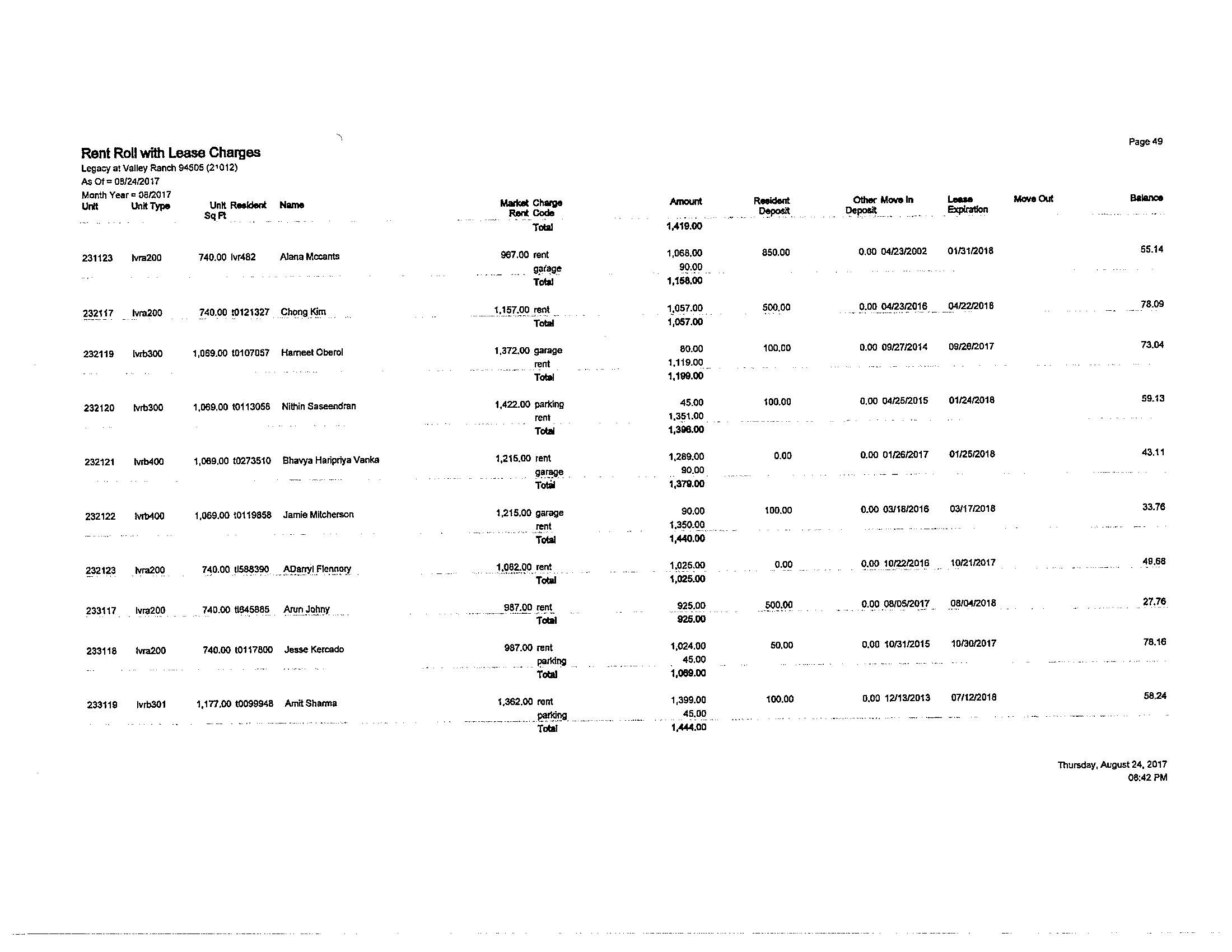

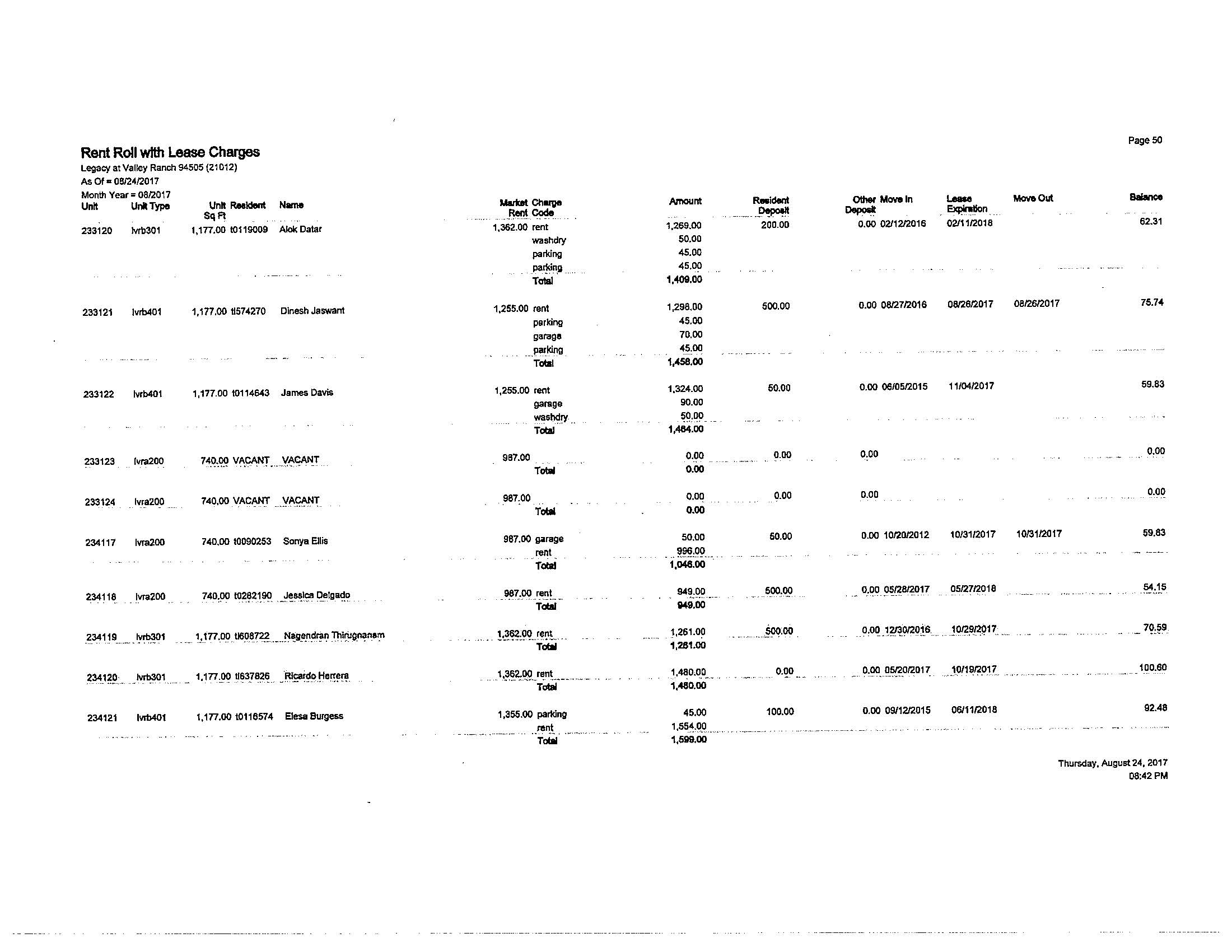

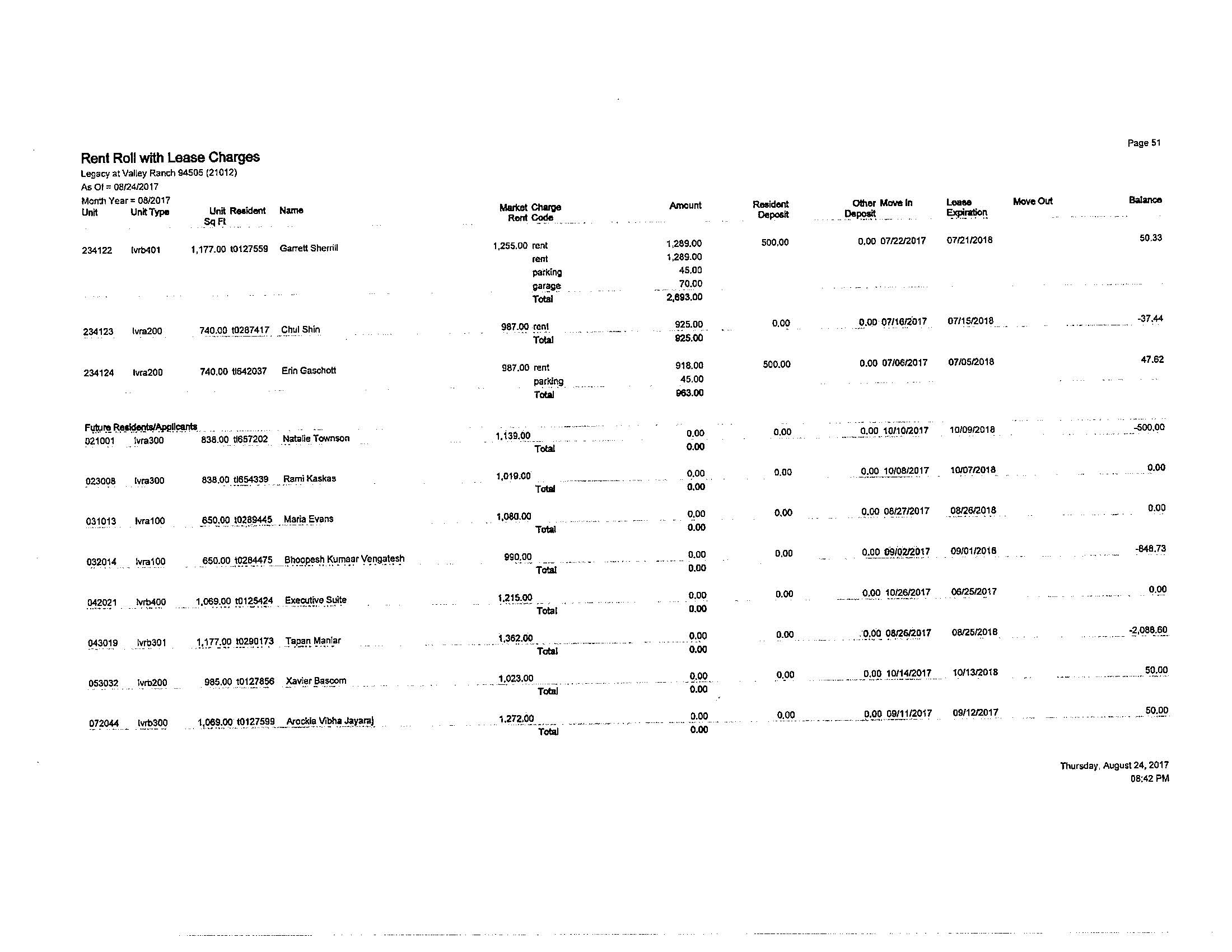

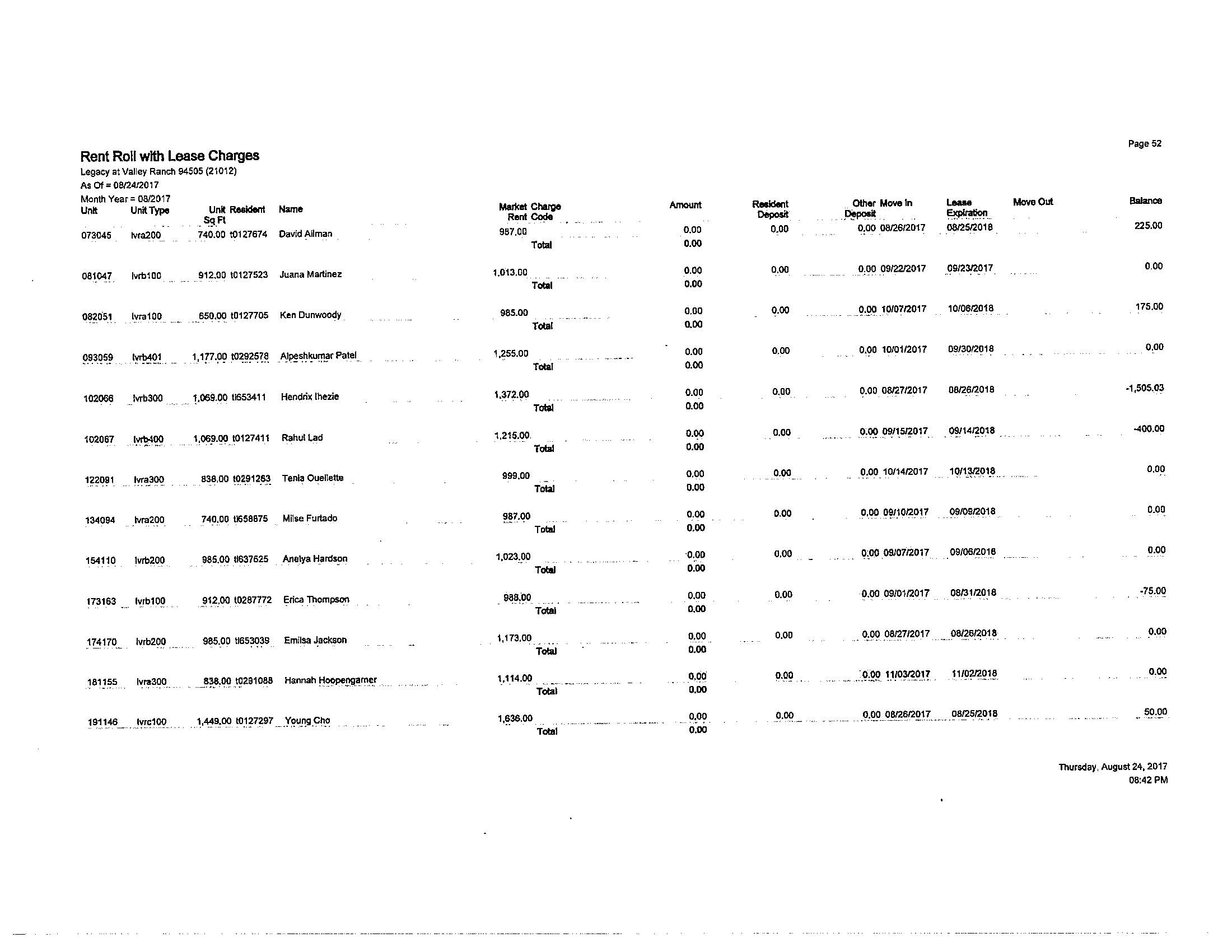

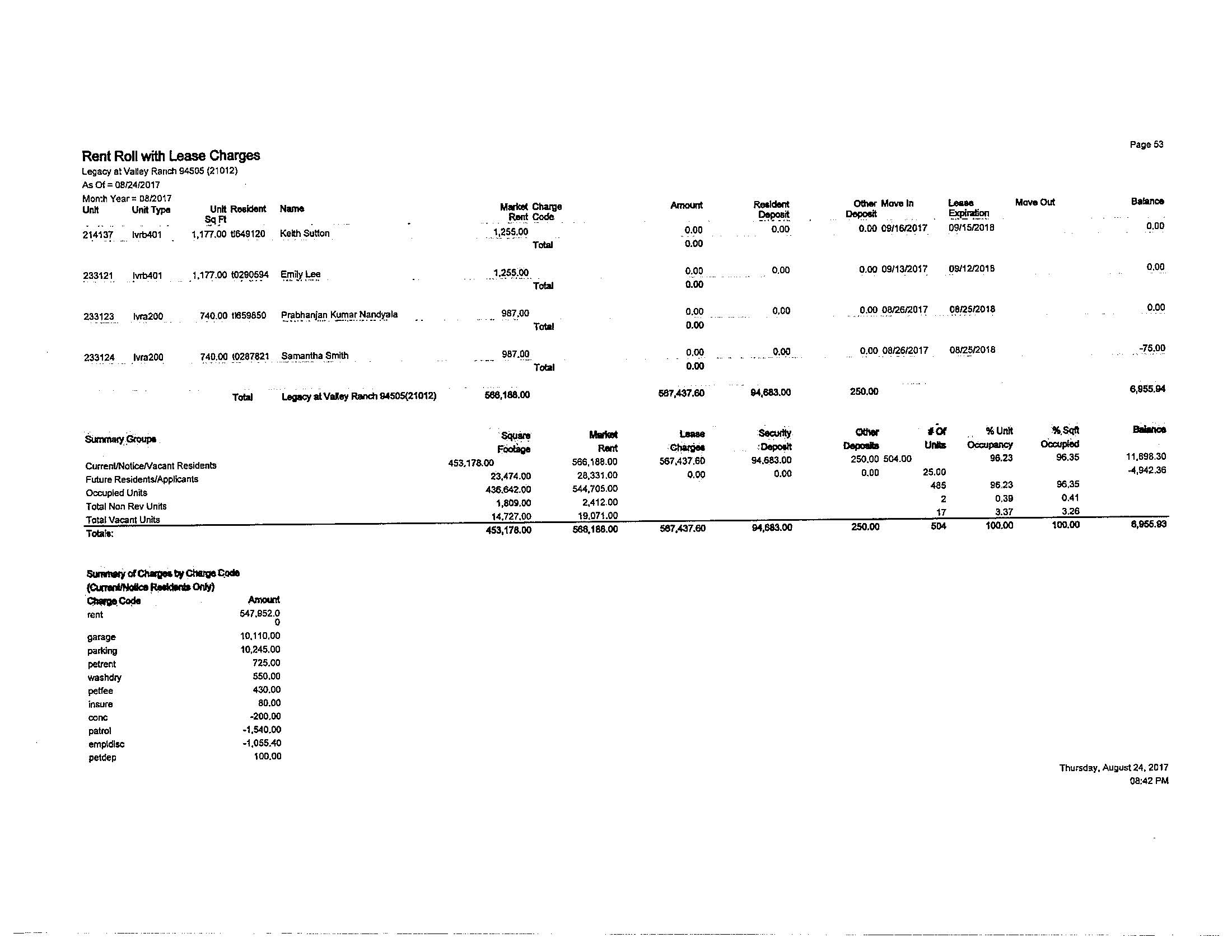

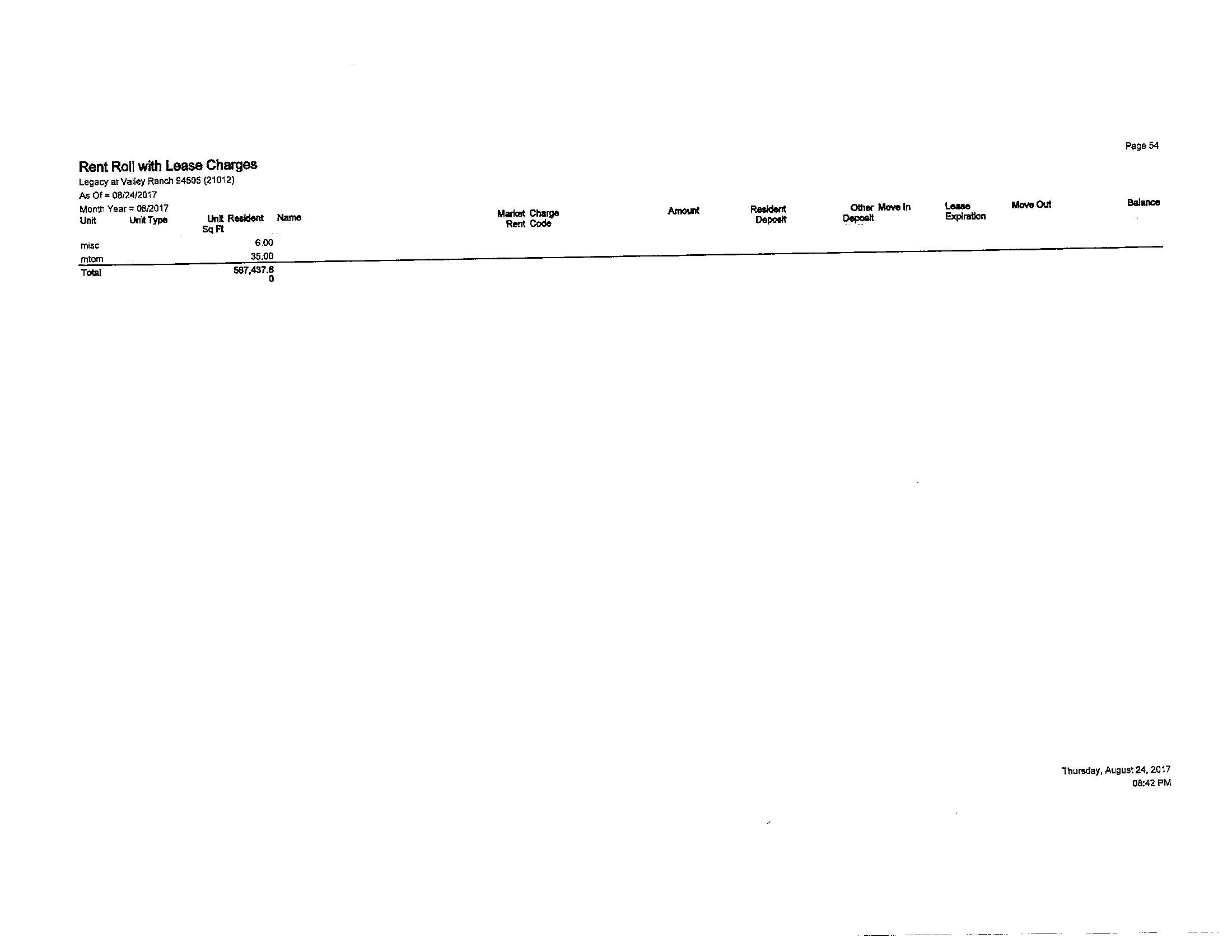

(a) The current Rent Roll of the Property, identifying the leased premises for each Lease, the term of each such Lease, recurring concessions, and the amount of any security deposit held by Seller pursuant to each such Lease;

(b) A copy of the current Accounts Receivable Report for the Property indicating prepaid rent and delinquencies;

(c) Copies of the Leases and contents of the tenant files for each current tenant;

(d) Copies of the Property’s operating statements for the year 2013, 2014, 2015 and 2016 through the end of the month prior to the Effective Date, including, without limitation, the general ledger for the 12 full calendar months preceding the Effective Date (redacted to remove Seller's confidential information);

(e) Copies of Loss Run Reports under Seller’s insurance for the two (2) years prior to the Effective Date;

(f) Copies of bills for the two (2) year period prior to the Effective Date for water, electricity, natural gas, and any other utility charges

(g) A copy of the most recent Texas survey of the Real Property and Improvements in Seller’s possession;

(h) A copy of all maintenance work orders for the two (2) year period prior to the Effective Date;

(i) A copy of the Owner’s Policy of Title Insurance (T-1) for the Real Property;

7

(j) Copies of the real property tax bills for the current and past four (4) tax years;

(k) Copies of all environmental, asbestos and lead paint reports regarding the Real Property (including, without limitation, a copy of the most recent Phase I report);

(l) Copies of or a schedule describing all permits, licenses, and certificates of occupancy with respect to the Property or any part thereof; and

(m) Service and operating leases and contracts regarding operation of the Property, together with any amendments or letter agreements relating thereto (collectively, the "Service Contracts"), which Service Contracts are identified on Exhibit "K" attached hereto.

2.5.2 Subject to the terms hereof, Buyer shall notify Seller in writing on or prior to the Approval Date of the Service Contracts which it elects to assume in connection with its purchase of the Property (the "Assumed Service Contracts"); provided, however, that Buyer shall be deemed to have elected to assume i) any Service Contract which has a termination date after the Closing Date and which cannot be terminated by Seller on thirty (30) days prior notice without the payment of a penalty or fee and ii) any Service Contracts for which Buyer failed to deliver notice of its election not to assume on or prior to the Approval Date.

2.5.3 Buyer shall from the Effective Date until 5:00 pm Pacific Time on the date which is forty-five (45) days after the Effective Date (the "Approval Date") to inspect the Property and to make any other investigations set forth herein below. Subject to the rights of tenants in possession, prior to the Approval Date, Buyer and its agents, managers, members, employees and contractors shall be afforded reasonable access to the Property during normal business hours, following at least twenty-four (24) hours prior notice to Seller for inspections not including apartment units and following at least two (2) business days advance prior notice for in-unit inspections, for the purpose of making such inspections and investigations which Buyer elects with respect to the physical condition of the Property, including, without limitation, soils and compaction studies, engineering and geotechnical studies, Americans with Disabilities Act ("ADA") compliance studies, OSHA compliance studies, inspections to confirm compliance with any state or local laws or ordinances related to public health and safety issues (including any applicable water conservation, seismic or smoke detector and sprinkler requirements), seismic tests, environmental studies (including, without limitation, surface and subsurface tests, borings, samplings and measurements) and a survey of the Property (collectively, the "Physical Inspections"). Notwithstanding the foregoing, any destructive or invasive testing or investigation related to the Physical Inspections shall require the prior written consent of Seller, which consent may be withheld in Seller's sole and absolute discretion. In any event, Buyer shall be solely responsible for any corrective or repair work necessitated by Buyer’s Physical Inspections and any such corrective or repair work shall be promptly undertaken by or on behalf of Buyer. Seller will have the right to have a representative of Seller accompany Buyer and Buyer’s representatives, agents, managers, members or assignees while they are on the Property. Prior to any entry upon the Property, Buyer or Buyer’s third party consultants shall be required

8

to provide to Seller current certificates of insurance evidencing that Buyer or the applicable third parties have in place commercial general liability insurance, including public liability and property damage insurance, in the amount of at least Two Million Dollars ($2,000,000), combined single limit for personal injuries or death of persons or property damage occurring in or about the Property. Such insurance shall: (i) name the Seller as an additional insured; (ii) specifically cover the liability assumed by Buyer under this Agreement; (iii) be issued by an insurance company reasonably approved by Seller; (iv) be primary and noncontributory with any insurance which may be carried by Seller; and (v) provide that said insurance shall not be cancelled or coverage changed unless fifteen (15) days' prior written notice shall have been given to Seller. Buyer shall deliver said certificates of insurance to Seller on or before entering the Property. In the event Buyer shall fail to procure and provide satisfactory evidence of such insurance, Seller may prohibit Buyer and its agents, managers, members, employees and contractors from entering the Property. In addition to the Physical Inspections, Buyer may conduct any feasibility studies and other investigations of the Property which it desires or which would be deemed reasonable and prudent in connection with the acquisition of the Property (the "Other Investigations"), which Other Investigations may include, without limitation, the Property’s compliance with all applicable laws, codes, ordinances and regulations which relate to the use, operation and occupancy of the Property, any permit, zoning, land use and related matters, any proposed impositions, assessments or governmental regulations which may affect or do affect the Property, and any financial and economic assessments related to the Property (including operational matters) and the market area. Notwithstanding the foregoing, Buyer shall not contact any governmental authority having jurisdiction over the Property without Seller’s express written consent (which shall not be unreasonably withheld, conditioned or delayed) other than ordinary contacts normally associated with routine due diligence examinations that do not involve any discussions with governmental officials (except to the extent necessary to request records). Buyer shall not unreasonably and materially interfere with any tenant’s right to use or possession of the Property pursuant to a Lease while conducting such Physical Inspections and Other Investigations of the Property and Buyer shall utilize its commercially reasonable efforts to schedule all of its inspections of the interior of each apartment, retail or office unit at the same time. Seller shall reasonably cooperate with Buyer at no cost or liability to Seller in connection with such Physical Inspections and Other Investigations of the Property.

Buyer shall notify Seller in writing, at its sole discretion, of its approval or disapproval of its Physical Inspections and Other Investigations of the Property on or prior to the Approval Date (the "Inspection Notice").

If Buyer’s Inspection Notice is timely delivered and unconditionally indicates Buyer’s approval of its Physical Inspections and Other Investigations of the Property, then the transaction contemplated by this Agreement shall proceed in accordance with the terms hereof. If Buyer fails to timely deliver the Inspection Notice, or if Buyer’s Inspection Notice does not unconditionally indicate Buyer’s approval of its Physical Inspections and Other Investigations of the Property, this Agreement shall immediately terminate, the Initial Xxxxxxx Money Deposit less the Independent Consideration shall be returned to Buyer, and the rights and obligations of the parties hereunder, other than as otherwise expressly set forth in this Agreement shall terminate.

9

2.5.4 Buyer agrees to indemnify, defend and hold Seller harmless from and against any and all damages, injury to property or people, claims, demands, losses, liabilities, liens, judgments, costs and expenses including, without limitation, reasonable attorneys fees and disbursements, arising out of the Physical Inspections or Other Investigations or out of the conduct of Buyer, its employees, agents, managers, members, contractors and consultants in conducting its Physical Inspections and Other Investigations of the Property. Notwithstanding anything to the contrary, however, Buyer shall not be liable for the mere discovery of an existing condition to the extent such condition was not exacerbated by Buyer. Such indemnification shall survive the Closing or termination of this Agreement for a period of two (2) years.

2.6 Title and Survey Inspection. Seller shall cause to be delivered to Buyer, with a copy to Seller, a preliminary title report or commitment for title insurance for the Property, together with copies of all documents affecting title referenced therein (the "Title Report"), which Title Report shall be issued by Title Insurer. Buyer may cause to be prepared at Buyer's expense, with a copy to be delivered to Seller, a new or updated Texas survey of the Property (the "Survey").

2.6.1 On or prior to the date which is ten (10) days prior to the Approval Date (the "Title Review Deadline"), Buyer shall notify Seller in writing of Buyer's approval or disapproval of the state of title to the Property as reflected in the Title Report and the Survey (collectively, the "State of Title"). Any disapproval of any portion of the State of Title shall identify the objectionable matters set forth in the Title Report and/or the Survey. Failure to timely provide a notice of approval or disapproval of the State of Title as provided above shall be deemed approval thereof and a waiver by Buyer of any objection thereto (other than the Mandatory Cure Items, defined in Section 2.6.3). The term "Permitted Exceptions" shall be defined herein as all matters which have been approved or deemed approved by Buyer in accordance with this Section 2.6.1 and Section 2.6.2 hereof, and those Objectionable Title Matters (as defined in Section 2.6.3) waived or deemed waived by Buyer pursuant to Section 2.6.3 hereof. The general exceptions contained in the Title Report, the lien of any current real property taxes and assessments not yet due and payable and the rights of parties in possession pursuant to the Leases shall be deemed approved by Buyer and shall therefore constitute Permitted Exceptions. In addition, if Buyer does not obtain the Survey prior to the Title Review Deadline, then Buyer shall be deemed to have approved any exceptions, encroachments, encumbrances or other matters that are disclosed by Seller’s existing survey delivered to Buyer pursuant to Section 2.5.1(f) hereof as of the Title Review Deadline and such matters shall therefore constitute Permitted Exceptions.

2.6.2 In the event any additional title exceptions (each an "Additional Exception") are reported or discovered by the Title Insurer or Buyer after the date of the Title Report, Buyer shall give Seller written notice of Buyer's objection, if any, to such Additional Exception on or prior to the later of the Title Review Deadline or five (5) business days after receipt of written notice of any such Additional Exception, but in no event later than the then scheduled Closing Date. Buyer shall only be entitled to object to those Additional Exceptions that (a) materially and adversely affect the value of the Property, or title thereto, or Buyer's intended use of the Property, (b) were not caused, created or consented to in writing by Buyer, (c) were not previously reflected in the Title Report, and (d) were not reflected on the Survey (or,

10

if Buyer did not obtain the Survey prior to the Title Review Deadline, not disclosed by Seller’s existing survey delivered to Buyer pursuant to Section 2.5.1(f) hereof). The failure of Buyer to give timely notice of objection to any Additional Exception, which Buyer is entitled to object to within the aforesaid time period shall be deemed approval by Buyer of such Additional Exception and a waiver by Buyer of any objection thereto. Any Additional Exceptions, which Buyer is not entitled to object to, shall be deemed approved by Buyer.

2.6.3 In the event that Buyer delivers to Seller an appropriate written notice of objection pursuant to and in accordance with Section 2.6.1 and/or Section 2.6.2 above (each such expressly disapproved matter identified in any such notice being referenced herein as an "Objectionable Title Matter"), Seller, in its sole discretion, within three (3) days after receipt of Buyer's notice of an Objectionable Title Matter (the "Cure Notice Period"), may advise Buyer in writing whether Seller will attempt to cure such Objectionable Title Matter. In the event that Seller elects to attempt to cure such Objectionable Title Matter, Seller shall have until the then scheduled Closing Date to effectuate such cure; provided, however, if Seller elects to attempt to cure an Additional Exception, the Closing Date shall be automatically extended until Seller completes the cure but in no event shall such extension exceed thirty (30) days after the then scheduled Closing Date. If Seller determines in its sole discretion that it will be unable or unwilling to cure any Objectionable Title Matters which it elected to attempt to cure as provided above, Seller shall deliver written notice thereof to Buyer as soon as such determination is made but in no event later than the then scheduled Closing Date (each a "Notice of Inability to Cure"). Notwithstanding anything to the contrary, Seller shall cure or remove all of the following as of the Closing to the extent such are in effect prior to Closing, by bonding or otherwise (including, without limitation, procuring title insurance over, at Seller's expense) (collectively, the "Mandatory Cure Items"): (i) liens resulting from Seller’s existing financing, (ii) tax liens for delinquent ad valorem real estate taxes; (iii) mechanics' liens for services or materials supplied to Seller; (iv) any delinquent utility account for service to the Property (as opposed to tenant utility accounts); and (vi) any code enforcement lien.

In the event that Seller (a) advises Buyer in writing prior to the expiration of an applicable Cure Notice Period of its election not to cure an Objectionable Title Matter, (b) delivers a Notice of Inability to Cure to Buyer, (c) fails to advise Buyer in writing prior to the expiration of an applicable Cure Notice Period that Seller will attempt to cure an Objectionable Title Matter, or (d) advises Buyer that Seller will attempt to cure an Objectionable Title Matter but fails to do so on or prior to Closing (as such date may be extended in accordance with this Agreement), Buyer shall have the right, in Buyer's sole and absolute discretion, to provide written notice to Seller (the applicable notice deadline below being referred to as the "Waiver Notice Period"), within three (3) days after Buyer's receipt of Seller's written notice for (a) or (b) above, or within three (3) days after the expiration of the applicable Cure Notice Period for (c) above, or on the Closing Date for (d) above, that Buyer elects to either (i) waive the uncured Objectionable Title Matters (other than the Mandatory Cure Items) without any adjustment to the Purchase Price (in each instance, a "Title Waiver Notice") and proceed with the Closing on the later to occur of the then scheduled Closing Date or seven (7) business days after the expiration of Buyer's Waiver Notice Period, or (ii) terminate this Agreement in which event the Xxxxxxx Money Deposit less the Independent Consideration will be returned to Buyer and the rights and obligations of the parties hereunder shall terminate, except as otherwise expressly set forth in this

11

2.7 Damage, Destruction or Condemnation. If, before legal title or possession of the Property has been transferred to Buyer, any portion of the Property, which portion will cost more than $500,000 to restore is damaged or destroyed without fault of Buyer, then Buyer shall have the option to either (i) terminate this Agreement, in which event the rights and obligations of the parties hereunder shall terminate except as otherwise expressly set forth in this Agreement, and Buyer shall be entitled to a return of the Xxxxxxx Money Deposit less the Independent Consideration, or (ii) proceed with the purchase of the Property without any adjustment to the Purchase Price, in which latter case Seller shall assign to Buyer any amounts due from or pay to Buyer any amounts received from Seller's casualty insurance company as a result of the damage or destruction, excepting therefrom any amounts payable for lost rental or other income and shall credit the Purchase Price by the amount of Seller’s deductible with respect to such casualty insurance. In the event such damage will cost equal to or less than $500,000 to restore, then the transaction shall proceed in accordance with (ii) above.

If, before legal title or possession of the Property has been transferred to Buyer, any portion of the Property with a value in excess of $500,000 is taken by eminent domain by any governmental entity, then Buyer shall have the option to either (a) terminate this Agreement, in which event the rights and obligations of the parties hereunder shall terminate except as otherwise expressly set forth in this Agreement, and Buyer shall be entitled to a return of the Xxxxxxx Money Deposit less the Independent Consideration, or (b) proceed with the purchase of the Property without any adjustment to the Purchase Price, in which latter case Seller shall assign to Buyer any amounts due from or pay to Buyer any amounts received from any governmental entity as a result of the taking. In the event the portion of the Property which is taken has a value of equal to or less than $500,000, then the transaction shall proceed in accordance with (b) above.

2.8 Closing Costs.

2.8.1 Buyer’s Costs. Buyer will pay the following costs and expenses in connection with the transactions contemplated in this Agreement:

(i) The premium for the Title Policy (as defined in Section 4.1.2 hereof), including any endorsements thereto, required by Buyer and/or its lender, in excess of the cost of a standard coverage owner’s policy of title insurance with coverage in an amount equal to the Purchase Price;

(ii) All costs of Buyer’s financing;

(iii) All recording fees associated with recording the Deed;

(iv) One-half of all escrow fees and other customary charges of the

12

Escrow Agent;

(v) Buyer’s share of the prorations;

(vi) Real estate commissions owed to anyone other than Broker (as defined in Section 6.1 hereof) as a result of Buyer’s actions;

(vii) Any and all costs, fees and expenses of Buyer’s attorneys, advisors and consultants incurred in connection with the preparation, review and negotiation of this Agreement and the transactions and the Closing contemplated herein (including any and all costs associated with Buyer’s financing of the Property), and the costs, fees and expenses of Buyer’s Physical Inspections and Other Investigations of the Property and any other due diligence related activities.

2.8.2 Seller’s Costs. Seller will pay the following costs and expenses in connection with the transactions contemplated in this Agreement:

(i) The premium for a standard coverage owner’s policy of title insurance with coverage in an amount equal to the Purchase Price issued in favor of Buyer insuring Buyer’s title to the Property;

(ii) One-half of all escrow fees and other customary charges of the Escrow Agent;

(iii) Seller’s share of the prorations;

(iv) Real estate commissions owed to Broker;

(v) All costs of recording any curative documents related to Mandatory Cure Items or Objectionable Title Matters that Seller agreed to cure, or any other customary documents reasonably required by the title company; and

(vi) Any and all costs and fees of Seller’s attorneys and/or advisors incurred in connection with the preparation, review and the negotiation of this Agreement and the transactions and the Closing contemplated herein, including any defeasance costs.

2.9 Prorations. All prorations and adjustments shall be made as of the Closing Date based on the actual number of days in the month of Closing and Seller shall be deemed the owner of the Property on the Closing Date for proration purposes. Except as otherwise provided below, any proration which must be estimated at Closing, and any erroneous prorations or omitted prorations, shall be reprorated and finally adjusted as soon as practicable but in no event later than ninety (90) days after the Closing Date (other than real estate taxes and assessments that were prorated at Closing based on an estimate, which real estate taxes and assessments shall be reprorated and adjusted between the parties within thirty (30) days after receipt of the actual tax bills, or if the real estate taxes in issue are the subject of a proceeding challenging the

13

assessed value of the Real Property, within thirty (30) days after the proceeding is dismissed or a final unappealable order is entered by the court or agency having jurisdiction and the final xxxx is issued by the taxing authority implementing the terms of such order), with any refunds payable to Seller or Buyer to be made as soon as practicable; otherwise, all prorations shall be final. The provisions of this Section 2.9 shall survive Closing.

2.9.1 Rents due or paid under the Leases shall be prorated to the Closing Date based upon rents actually collected for the month of Closing as reflected on the Updated Rent Roll or any revision thereof. After the Closing, Seller may continue to pursue collection of any delinquent rents applicable to the period on or prior to the Closing Date if the collection activities related thereto were commenced prior to the Closing or the tenant no longer resides at or occupies any portion of the Property, but not otherwise. Rents allocable to the period on or prior to the Closing Date will be the property of Seller and rents allocable to the period after the Closing Date will be the property of Buyer. With respect to any delinquent rent as of Closing, in the first sixty (60) days after the Closing Date, Buyer shall include such rent in its regular billing and pay to Seller any rent actually collected within such 60-day period which is applicable to the period preceding the Closing Date; provided, however, it is understood and agreed that all rent collected by Buyer shall be applied (a) first to any rent then owed by the applicable tenant which accrued after the Closing Date, and (b) then to unpaid rent of such tenant which accrued prior to the Closing Date with offset for the reasonable allocation of any collection costs related thereto. In the event any rent is paid by tenants under the Leases directly to Seller after Closing, Seller shall pay Buyer any such rent which is applicable to the period after the Closing Date. Buyer shall have no obligation to pay Seller any rent collected by Buyer after the date which is sixty (60) days after the Closing Date, and Buyer shall be under no obligation to collect or pursue unpaid rent. The provisions of this Section 2.9.1 shall survive Closing.

2.9.2 Seller’s insurance policies will not be assigned to Buyer. Accordingly, Buyer shall secure its own casualty insurance effective as of the Closing Date, and Seller shall be entitled to any unearned premium of any existing policy held by Seller as of the Closing Date.

2.9.3 Water, electric, telephone and all other utility and fuel charges to the extent not billed directly to tenants of the Property shall be prorated ratably on the basis of the last ascertainable bills (and reprorated in accordance herewith upon receipt of the actual bills and invoices) unless final meter readings and final billing can be obtained as of the Closing Date. Seller shall also be entitled to pursue and retain any applicable refunds of security deposits paid by or on behalf of Seller to any utility companies. Buyer shall be solely responsible for making any deposits and arrangements required for utilities and other services to continue to serve the Property after the Closing.

2.9.4 Any assessments affecting the Property which are not delinquent shall be prorated as of the Closing Date based upon the latest data available (and re-prorated as provided above based on final bills).

2.9.5 Real Property and Personal Property taxes assessed for the year of Closing shall be prorated as of the Closing Date based upon the latest data available (and re-prorated as provided above based on final bills). Seller shall be entitled to any refunds of property taxes

14

applicable to any period prior to the Closing Date.

2.9.6 All costs and expenses of maintaining and operating the Property which have been incurred, whether or not yet billed, prior to the Closing Date shall be paid by Seller and all costs and expenses of maintaining and operating the Property on and after the Closing Date shall be paid by Buyer. All prepaid costs and expenses of operating the Property which have accrued as of the Closing Date, but which are allocable to the operation of the Property after the Closing Date, shall be adjusted as a credit for the Seller as of the Closing Date, unless pursuant to a Service Contract not being assumed by Buyer at Closing.

2.9.7 Portions of advance rentals, if any, paid by any tenant under any of the Leases which are applicable to periods after the Closing Date shall be transferred to Buyer at the Closing.

2.9.8 An amount equal to the remaining balance as of the Closing Date of all refundable security deposits paid by tenants of the Property (including pet deposits and similar fees) pursuant to the Leases, including any interest owed thereon (if applicable), the responsibility for which will be assumed by Buyer at the Closing, shall be credited to Buyer at the Closing.

2.9.9 Fees and charges under the Assumed Service Contracts shall be prorated at the Closing.

2.9.10 At Closing Buyer shall receive a credit against the Purchase Price in the amount of $750 for each apartment unit which has been vacant as of the Closing Date for more than three (3) business days and which is not in “rent ready” condition in accordance with Seller’s customary practices.

2.10 Covenants of Seller Prior to Closing. During the period from the Effective Date until the earlier of (a) the Closing, or (b) the termination of this Agreement, Seller shall, in addition to the covenants set forth elsewhere in this Agreement:

(a) Maintain any existing insurance coverage for the Property;

(b) Not permit or suffer to exist any new encumbrance, charge or lien (excluding the Permitted Exceptions) against the Property unless such encumbrance, charge or lien is a residential tenant Lease entered into in the ordinary course of Seller's business, or has been approved in writing by Buyer, or unless such encumbrance, charge or lien will be removed by Seller prior to the Closing or is otherwise permitted hereunder;

(c) Other than residential tenant Leases entered into in the ordinary course of Seller's business, not, without Buyer’s prior written consent (not to be unreasonably withheld, conditioned or delayed), enter into any new contracts affecting the Property, or amend any existing contracts affecting the Property, which cannot be canceled upon thirty (30) days prior notice or terminated at the Closing without penalty;

15

(d) Continue to operate and maintain the Property in substantially the same manner in which the Property is currently operated and maintained, including the leasing of vacant apartments and the renewal of existing Leases based on Seller’s current practices and subject to market conditions and maintenance of substantially the same advertising and other marketing programs for the Property;

(e) Furnish Buyer with copies of all written notices of (i) any violation of any law, statute, ordinance, regulation or order received by Seller from any governmental or public authority relating to the Property, (ii) any pending or threatened (and unresolved) litigation which affects or relates to the Property or any part thereof and would subject Buyer to liability or which would materially and adversely affect the transaction contemplated hereby, (iii) any pending or threatened (and unresolved) condemnation or eminent domain proceeding affecting the Property or any part thereof, and (iv) any default or alleged default by any party under a Lease or Assumed Service Contract;

(f) Not intentionally (i) take any action, or (ii) omit to take any action which Seller is expressly obligated to take under this Agreement or under any other agreement pertaining to the Property which would have the effect of causing any of the representations or warranties set forth in Section 3.1 hereof to be untrue or materially misleading or incomplete on and as of the Closing Date; and

(g) In the event prior to the Closing Date Seller receives a written notice from a governmental or public authority citing a material violation at the Property of any law, statute, ordinance, rule, regulation or order pertaining to life/safety matters, Seller shall promptly remedy such violation provided that the cost to remedy all such cited violations does not exceed $5,000 in the aggregate.

Notwithstanding the foregoing, Seller shall be entitled to enter into all agreements effective as of the Closing Delivery Date necessary to effect the defeasance of Seller’s current financing provided that such will have no effect on Buyer or the Property after the Closing.

2.11 Shareholder Consent. It shall be a condition of Seller’s obligation to close hereunder that Seller shall have received the consent of its shareholders (the “Shareholder Consent”) to consummate the sale transaction described herein and in the Other Purchase Agreements (as defined in Section 8.3 hereof) not later than 5:00 pm on the date which is ninety (90) days after the Approval Date (the “Consent Deadline”), provided that, in the event the United States Securities and Exchange Commission (“SEC”) notifies Seller that the SEC intends to review Seller’s proposed Proxy Statement related to the Shareholder Consent, Seller may elect to extend the Consent Deadline for up to sixty (60) days by delivering written notice of such extension to Buyer not later than the day which is five (5) days prior to the Approval Date. Notwithstanding anything contained in this Agreement, in the event Seller does not receive the Shareholder Consent and so notifies Buyer in writing prior to the Consent Deadline, the Xxxxxxx Money Deposit less the Independent Consideration shall be returned to Buyer, Seller shall reimburse Buyer for its documented out-of-pocket third-party costs and expenses incurred in connection with this Agreement and the Other Purchase Agreements and its variable, direct travel costs and expenses incurred in connection with this Agreement and the Other Purchase Agreements (the “Travel Expenses”), up to a maximum aggregate amount of Two Hundred

16

Fifty Thousand Dollars ($250,000), this Agreement shall terminate and be null and void and neither party shall have any further rights or obligations under this Agreement except those which expressly survive termination. The Travel Expenses reimbursed pursuant to this Agreement shall not in any event exceed the aggregate amount of Twenty-Five Thousand Dollars ($25,000).

ARTICLE 3

REPRESENTATIONS AND WARRANTIES

3.1 Seller’s Representations and Warranties. As of the Effective Date and effective through and as of the Closing Date, Seller hereby represents, warrants and covenants to and for the benefit of Buyer the following (which warranties, representations and covenants shall survive the Closing subject to Section 3.3 below):

3.1.1 Seller is validly formed and duly authorized as a limited liability company and in good standing under the laws of the State of Delaware and is duly qualified to transact business in and is in good standing under the laws of the State of Texas, and has full power and authority, to enter into and perform this Agreement in accordance with its terms; all proceedings required to be taken by or on behalf of Seller to authorize it to make, deliver and carry out the terms of this Agreement have been duly and properly taken, and the individual executing this Agreement on behalf of Seller has the legal power, right and actual authority to bind Seller to the terms and conditions of this Agreement;

3.1.2 This Agreement is a valid and binding obligation of Seller, enforceable against Seller in accordance with its terms, subject to the effect of applicable bankruptcy, insolvency, reorganization, or other similar laws affecting the rights of creditors generally;

3.1.3 To Seller’s actual knowledge, there are no actions, suits, litigation or proceedings pending or threatened, which would adversely affect Buyer or the Property or affect the right, power or authority of Seller to enter into and perform this Agreement in accordance with its terms, or which question the validity or enforceability of this Agreement or of any action taken by Seller under this Agreement, in any court or before any governmental authority, domestic or foreign (including, but not limited to, any pending claims by the tenants or any guests or invitees);

3.1.4 The execution of and entry into this Agreement, and the execution and delivery of the documents and instruments to be executed and delivered by Seller on the Closing Date, and the performance by Seller of Seller’s duties and obligations under this Agreement and of all other acts necessary and appropriate for the consummation of the transactions contemplated by and provided for in this Agreement are not in violation of any contract, agreement or other instrument to which Seller is a party or to Seller's actual knowledge, to which the Property is subject, any judicial order or judgment of any nature by which Seller is bound or to Seller's actual knowledge, to which the Property is subject, or Seller’s organizational documents;

3.1.5 Seller has not received written notice from any governmental authority of

17

any violation of any existing applicable law, statute or code, including, without limitation, zoning, land use, building, fire, health or safety laws, ordinances, rules and regulations and environmental laws with respect to the Property which remains uncured;

3.1.6 Seller has no actual knowledge, and has received no formal written notice from any governmental authorities, that eminent domain proceedings for the condemnation of the Property or any portion thereof are pending or threatened;

3.1.7 Seller has not engaged in any dealings or transactions, directly or indirectly, (i) in contravention of any U.S., international or other money laundering regulations or conventions, including, without limitation, the United States Bank Secrecy Act, the United States Money Laundering Control Act of 1986, the United States International Money Laundering Abatement and Anti-Terrorist Financing Act of 2001, Trading with the Enemy Act (50 U.S.C. §1 et seq., as amended), or any foreign asset control regulations of the United States Treasury Department (31 CFR, Subtitle B, Chapter V, as amended) or any enabling legislation or executive order relating thereto, or (ii) in contravention of Executive Order No. 13224 dated September 24, 2001 issued by the President of the United States (Executive Order Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit, or Support Terrorism), as may be amended or supplemented from time to time (the "Anti-Terrorism Order") or on behalf of terrorists or terrorist organizations, including those persons or entities that are included on any relevant lists maintained by the United Nations, North Atlantic Treaty Organization, Organization of Economic Cooperation and Development, Financial Action Task Force, U.S. Office of Foreign Assets Control, U.S. Securities & Exchange Commission, U.S. Federal Bureau of Investigation, U.S. Central Intelligence Agency, U.S. Internal Revenue Service, or any country or organization, all as may be amended from time to time. Seller (i) is not and will not be conducting any business or engaging in any transaction with any person appearing on the U.S. Treasury Department’s Office of Foreign Assets Control list of restrictions and prohibited persons, or (ii) is not a person described in section 1 of the Anti-Terrorism Order, and Seller has not engaged in any dealings or transactions, or otherwise been associated with any such person;

3.1.8. The Leases described on the Rent Roll attached hereto as Exhibit “L” (the “Rent Roll”) are the only leases which are in effect for the residential units at the Property as of the date of such Rent Roll. The Rent Roll, and any update thereof delivered to Buyer by Seller, is the rent roll that Seller relies upon in the ordinary course of its business;

3.1.9 To Seller’s actual knowledge, the Assumed Service Contracts are all of the service contracts, equipment, labor or material contracts, and other agreements which are presently in force and which affect the Project or the operation, repair or maintenance thereof, other than a property management agreement with Seller’s property manager, which will be terminated by Seller effective at Closing and any service contracts that Buyer has elected not to assume pursuant to Section 2.5.2 hereof. To Seller's actual knowledge, there are no material defaults under the Assumed Service Contracts;

3.1.10. Any Property Materials prepared by Seller that provide financial information and income and expense data with respect to the Project are the financial materials

18

that Seller relies upon in the ordinary course of its business;

3.1.11 Seller is not a "foreign corporation," "foreign partnership" or "foreign estate" as those terms are defined in the Internal Revenue Code of 1986; and

3.1.13. Seller has not filed for and or is not subject to any bankruptcy, reorganization or receivership proceeding or similar law affecting the rights of creditors generally which has not been discharged within ninety (90) days of such filing.

All references in this Section 3.1 to "Seller’s actual knowledge" or words of similar import shall refer only to the best actual knowledge of Xxx X. Xxxx and Xxxx Xxxxxxxx (the "Designated Representatives"), without any duty to review or investigate the matters to which such knowledge or the absence thereof pertains, including without limitation the information contained in the Property Materials or in the Property’s or the Designated Representatives’ respective files, and with no imputed knowledge whatsoever, whether from any other partner, officer, member, shareholder, agent or employee of Seller, or Seller’s members (or the members thereof) or any affiliate thereof or any consultant or agent of Seller or any other party whatsoever. There shall be no personal liability on the part of the Designated Representatives arising out of any representations or warranties made herein. In the event that, on or prior to the Closing, Buyer discovers a breach of any warranty, representation or covenant made in this Agreement by Seller, then within five (5) days after learning of such breach (but not later than the Closing Date), Buyer shall notify Seller in writing of such breach. Within five (5) days after receipt of written notice from Buyer of any such breach (but not later than the Closing Date), Seller shall notify Buyer in writing of Seller's election: (i) not to cure such breach; or (ii) to attempt to cure such breach within thirty (30) days of receipt of Buyer's notice, and, if necessary, the Closing will be extended accordingly. If Seller elects not to cure such breach, or if Seller fails to so cure all breaches by the Closing Date (as the Closing Date may have been extended in accordance herewith), then Buyer shall have the option to either: (a) terminate this Agreement by written notice to Seller in which event Seller shall be deemed not to be in breach hereunder, the Xxxxxxx Money Deposit less the Independent Consideration shall be returned to Buyer, and the rights and obligations of the parties hereunder shall terminate except as otherwise expressly set forth in this Agreement; or (b) elect to waive such breach and proceed to close subject to such breach without any adjustment to the Purchase Price and subject to the terms of Section 3.3 below; provided that, if Buyer fails to notify Seller of its election under the preceding clause (a) or (b) on or prior to the Closing Date (as the Closing Date may have been extended in accordance herewith), Buyer shall be deemed to have made the election under clause (b). If, after Closing, Buyer discovers a breach of a warranty, representation or covenant made by Seller of which Buyer did not have knowledge prior to the Closing, Buyer shall notify Seller in writing of the specifics of such breach and Buyer shall have the right to pursue all remedies available at law or equity, subject to Section 3.3 below.

3.2 Buyer’s Representations and Warranties. As of the Effective Date and effective through the Closing Date, Buyer hereby represents, warrants, covenants and agrees (which warranties, representations, covenants and agreements shall survive the Closing subject to Section 3.3 below) to and for the benefit of Seller as follows:

3.2.1 Buyer is a validly formed and duly authorized legal entity in good

19

standing in its state of formation and qualified to business in the State of Texas;

3.2.2 Buyer has the full power and authority to enter into and perform this Agreement in accordance with its terms, to consummate the transactions contemplated hereby and to execute and deliver all documents and instruments to be delivered by Buyer hereunder;

3.2.3 All requisite action (corporate, trust, partnership or otherwise) has been taken or obtained by Buyer in connection with the entering into of this Agreement and the consummation of the transactions contemplated hereby, or shall have been taken prior to the Closing Date;

3.2.4 The documents and instruments to be delivered by Buyer hereunder shall constitute the valid and legally binding obligations of Buyer, enforceable in accordance with their terms subject to the effect of applicable bankruptcy, insolvency, reorganization, or other similar laws affecting the rights of creditors generally, and Buyer (a) has not filed for and/or is not subject to any bankruptcy, reorganization or receivership proceeding or similar law affecting the rights of creditors generally which has not been discharged within ninety (90) days of such filing, and (b) is not currently insolvent or at the imminent risk of becoming insolvent;

3.2.5 The individual(s) executing this Agreement and the documents contemplated hereunder on behalf of Buyer has/have the legal power, right and actual authority to bind Buyer to the terms and conditions of this Agreement and such documents without any additional signatories required hereto or thereto; and

3.2.6 Buyer has not engaged in any dealings or transactions, directly or indirectly, (i) in contravention of any U.S., international or other money laundering regulations or conventions, including, without limitation, the United States Bank Secrecy Act, the United States Money Laundering Control Act of 1986, the United States International Money Laundering Abatement and Anti-Terrorist Financing Act of 2001, Trading with the Enemy Act (50 U.S.C. §1 et seq., as amended), or any foreign asset control regulations of the United States Treasury Department (31 CFR, Subtitle B, Chapter V, as amended) or any enabling legislation or executive order relating thereto, or (ii) in contravention of the Anti-Terrorism Order or on behalf of terrorists or terrorist organizations, including those persons or entities that are included on any relevant lists maintained by the United Nations, North Atlantic Treaty Organization, Organization of Economic Cooperation and Development, Financial Action Task Force, U.S. Office of Foreign Assets Control, U.S. Securities & Exchange Commission, U.S. Federal Bureau of Investigation, U.S. Central Intelligence Agency, U.S. Internal Revenue Service, or any country or organization, all as may be amended from time to time. Neither Buyer nor any of its affiliates or constituents nor, to the best of Buyer’s knowledge, any brokers or other agents of same, (i) are or will be conducting any business or engaging in any transaction with any person appearing on the U.S. Treasury Department’s Office of Foreign Assets Control list of restrictions and prohibited persons, or (ii) are a person described in section 1 of the Anti-Terrorism Order, and to the best of Buyer’s knowledge neither Buyer nor any of its affiliates have engaged in any dealings or transactions, or otherwise been associated with any such person.

3.3 Survival of Representations and Warranties. Notwithstanding anything to the contrary, all agreements, representations and warranties made in this Agreement herein shall not

20

be impaired by any investigation or other act of Buyer or Seller and shall not be merged into the documents executed and delivered at Closing, but rather, except for Article 6, Sections 2.5.4, 3.4, 7.4 and 7.16 which shall survive for the periods indicated in such applicable Article or Section, shall survive the Closing until the earlier of: i) nine (9) months following the Closing Date or ii) November 30, 2018 (the “Survival Period”). Any claim by one party hereto against the other for the breach of any agreement, representation or warranty contained herein not made within the foregoing Survival Period will be forever barred, except to the extent such claim related to or alleges any fraudulent act or omission of either party.

3.3.1 Notwithstanding anything in this Agreement to the contrary, if the Closing occurs, Buyer hereby expressly waives, relinquishes and releases any right or remedy available to it at law, in equity or under this Agreement as the result of any of Seller’s representations or warranties being untrue, inaccurate or incorrect if (a) Buyer knew that such representation or warranty was untrue, inaccurate or incorrect at the time of the Closing, or (b) Buyer’s actual damages are reasonably estimated to aggregate less than Twenty-Five Thousand Dollars ($25,000). Notwithstanding anything in this Agreement to the contrary, if the Closing occurs, Seller hereby expressly waives, relinquishes and releases any right or remedy available to it at law, in equity or under this Agreement as the result of any of Buyer's representations or warranties being untrue, inaccurate or incorrect if (a) Seller knew that such representation or warranty was untrue, inaccurate or incorrect at the time of the Closing, or (b) Seller's actual damages are reasonably estimated to aggregate less than Twenty-Five Thousand Dollars ($25,000).

3.3.2 Notwithstanding any provision to the contrary contained in this Agreement or any documents executed by either party pursuant hereto or in connection herewith, the maximum aggregate liability of either party, and the maximum aggregate amount which may be awarded to and collected by the claimant party, in connection with the breach of any representations, warranties or covenants contained herein for which a claim is timely made (as determined under this Agreement) by the other party shall not exceed One Million Dollars ($1,000,000).

3.4 AS-IS. The terms of this Section 3.4 shall survive Closing indefinitely.

3.4.1 Buyer represents that it is a sophisticated real estate investor and owner of real property and will conduct its own due diligence and investigations regarding the Property and Buyer’s intended uses thereof as provided for in this Agreement. Buyer further represents and acknowledges that this Agreement provides Buyer with sufficient time and opportunity to complete the Physical Inspections and Other Investigations of the Property, to review the Property Materials and to conduct any related due diligence of the Property which Buyer or its consultants or agents deem necessary and appropriate for Buyer to fully and completely evaluate the physical, environmental and economic condition of the Property and the Property's suitability for Buyer’s intended use. Buyer is purchasing the Property solely in reliance upon Buyer’s own due diligence and investigation of the Property, including the Physical Inspections and Other Investigations of the Property, and fully and completely represents, acknowledges, understands and agrees that, except for Seller representations and warranties expressly set forth in Section 3.1 of this Agreement and the Seller Closing Documents, Buyer is not relying upon any

21

representations, warranties or statements of any kind or nature whatsoever, whether oral or written, express or implied, that Seller, any direct or indirect constituent partner, member or shareholder of Seller, or any officer, director, shareholder, employee, agent, representative, broker, servant, successor, assign, affiliate or subsidiary of any of them, or any other person or entity acting on behalf of Seller or any such other party for whom Seller or such other party may be held legally responsible (collectively, the "Released Parties"), may have made with respect to the following (collectively, the "Condition and Suitability of the Property"): 1) the contents, accuracy and completeness of the Property Materials, 2) any matters which were disclosed by or should have been disclosed by the Physical Inspections and Other Investigations of the Property, 3) the financial performance or the economic prospects of the Property, 4) the applicability or amount of any taxes upon or assessments against the Property, 5) the merchantability or habitability of the Property, the fitness of the Property or any portion thereof for any particular purpose or the suitability of the Property for Buyer’s intended use, 6) the environmental condition of the Property (including, without limitation, any contamination in, on, under or adjacent to the Property by any solid, hazardous or toxic substance, material or waste, including lead paint, asbestos and toxic or other mold and mildew), 7) the physical condition or quality of the Property, including without limitation the plumbing, sewer, HVAC, electrical, mechanical and similar operating systems, or the functionality, location and accessibility thereof, the adequacy of the roofs, foundations, structural integrity or earthquake preparedness of the Property, the quality of construction and sufficiency of undershoring, or any soils, subsurface, subsidence, drainage, seismic, geologic and hydrologic matters, 8) the size or dimensions of the Property or the accuracy of any floor plans, square footage estimates, drawings, renderings or lease abstracts, 9) whether the appliances, plumbing or electrical systems are in working order, 10) the Property’s or Seller’s compliance with applicable statutes, laws, codes, ordinances, regulations or requirements relating to the use, operation, leasing, zoning, subdivision, planning, building, fire, safety, health or environmental matters (including but not limited to the ADA, OSHA, the Subdivision Map Act, the Toxic Substances Control Act, the Comprehensive Environmental Response, Compensation and Liability Act, the Clean Water Act, the Resource Conservation and Recovery Act and any other similar federal, state or local laws), 11) compliance with any applicable covenants, conditions or restrictions (whether or not of record), 12) access to the Property and the right to use adjoining property or rights of way, 13) the possibility of conversion of the Property to condominiums or Buyer's ability to obtain any required governmental approvals in connection therewith, and 14) any other matter affecting or relating to the Property, including but not limited to those matters relating to the use, operation, condition, title, occupation or management of the Property and Buyer’s ability to obtain any required governmental approvals in connection therewith. Buyer further represents and acknowledges and agrees that the period from the Effective Date until the Title Review Deadline provides Buyer with sufficient time and opportunity to complete its review of the State of Title to the Property, and that, except for Seller representations and warranties expressly set forth in Section 3.1 hereof, Seller makes no representation or warranty of any kind or nature whatsoever, either express or implied, regarding the accuracy or completeness of the Property Materials, the Title Report or the Survey. Buyer further acknowledges and agrees that the Property shall be conveyed by Seller and accepted by Buyer on and as of the Closing Date "AS IS, WHERE IS, WITH ALL FAULTS", without any representation or warranty of any kind or nature whatsoever, either express or implied, except as expressly set forth in Section 3.1 hereof, and with no right of setoff or reduction in the Purchase Price. Buyer hereby assumes the risk that

22

adverse physical and environmental conditions may not have been revealed by the Property Materials, Buyer’s Physical Inspections and Other Investigations of the Property and any other due diligence investigations of Buyer.

3.4.2 BUYER, FOR ITSELF, AND ITS SUCCESSORS AND ASSIGNS AND ANY OTHER PARTY CLAIMING BY, THROUGH OR UNDER BUYER, HEREBY WAIVES, RELEASES, REMISES, ACQUITS AND FOREVER DISCHARGES THE RELEASED PARTIES, OF AND FROM ANY CLAIMS, ACTIONS, CAUSES OF ACTION, DEMANDS, RIGHTS, DAMAGES, COSTS, EXPENSES, PENALTIES, FINES OR COMPENSATION WHATSOEVER, WHETHER DIRECT OR INDIRECT (COLLECTIVELY, THE "Claims"), WHICH ANY OF THEM NOW HAS OR MAY HAVE IN THE FUTURE ON ACCOUNT OF OR IN ANY WAY ARISING OUT OF OR IN CONNECTION WITH THE PROPERTY OR THE CONDITION AND SUITABILITY THEREOF, WHETHER CAUSED BY THE RELEASED PARTIES OR ANY OTHER PARTY AND WHETHER OR NOT KNOWN TO BUYER AT OR BEFORE THE CLOSING (COLLECTIVELY, THE "Released Matters"). NOTWITHSTANDING ANYTHING TO THE CONTRARY, RELEASED MATTERS SHALL NOT INCLUDE: (I) SELLER'S BREACHES OF THOSE REPRESENTATIONS, WARRANTIES AND COVENANTS PROVIDED IN THIS AGREEMENT OR IN THE SELLER CLOSING DOCUMENTS, (II) SELLER’S FRAUD, OR (III) SELLER'S INDEMNITIES IN FAVOR OF BUYER SET FORTH IN THIS AGREEMENT OR IN THE SELLER CLOSING DOCUMENTS. WITHOUT LIMITATION ON THE FOREGOING, BUYER HEREBY ASSUMES FULL RESPONSIBILITY FOR ANY INJURIES, DAMAGES, LOSSES OR LIABILITIES THAT MAY ARISE OR HAVE ARISEN OUT OF THE RELEASED MATTERS, WHETHER KNOWN OR UNKNOWN. BUYER ACKNOWLEDGES AND HEREBY EXPRESSLY AGREES THIS AGREEMENT SHALL EXTEND TO ALL UNKNOWN, UNSUSPECTED AND UNANTICIPATED CLAIMS OR DAMAGES, AS WELL AS THOSE WHICH ARE NOW DISCLOSED, WITH RESPECT TO THE RELEASED MATTERS. THE PARTIES HEREBY ACKNOWLEDGE THAT EACH OF THE RELEASED PARTIES OTHER THAN SELLER IS INTENDED TO BE A THIRD-PARTY BENEFICIARY OF THIS SECTION 3.4.2. NOTHING IN THIS SECTION 3.4.2 SHALL SERVE TO RELEASE SELLER FROM LIABILITY SELLER MAY HAVE TO THIRD PARTIES FOR TORT CLAIMS FOR PERSONAL INJURY OR PROPERTY DAMAGE ACCRUING PRIOR TO THE CLOSING DATE.

ARTICLE 4

CONDITIONS OF BUYER’S OBLIGATIONS

4.1 Conditions. Buyer’s obligation to consummate the transaction contemplated by this Agreement shall be subject to the satisfaction or performance of the following terms and conditions, any one or more of which may be waived by Buyer in writing, in its sole discretion, in whole or in part, on or as of the Closing Date as such may be extended in accordance herewith:

4.1.1 Seller shall have kept, observed, performed, satisfied and complied with

23

all terms, covenants, conditions, agreements, requirements, restrictions and provisions required by this Agreement to be kept, observed, performed, satisfied or complied with by Seller before, on or as of the Closing Date, in all material respects;

4.1.2 The irrevocable commitment of the Title Insurer to issue a Texas Form T-1 Owner’s Policy of Title Insurance issued by Title Insurer, subject only to the Permitted Exceptions with liability in the amount of the Purchase Price (the "Title Policy");

4.1.3 Seller shall have obtained the Shareholder Consent on or before the Consent Deadline; and

4.1.4 All of the representations and warranties of Seller set forth in this Agreement shall be true and correct at and as of the Closing Date in all material respects, without giving effect to any qualifications thereof based upon Seller’s knowledge, as though such representations and warranties were made at and as of the Closing Date.

4.2 Failure of Conditions. Upon the failure of the conditions precedent set forth in Section 4.1.1 Seller shall be in default of this Agreement and Buyer shall be entitled to the remedies set forth in Section 8.2 of this Agreement. In the event of a failure of the condition precedent set forth in Section 4.1.2 then this Agreement shall terminate, and the Xxxxxxx Money Deposit shall be returned to Buyer and the rights and obligations of Buyer and Seller shall terminate except as expressly set forth in this Agreement. In the event of a failure of the condition precedent set forth in Section 4.1.3, the provisions of Section 2.11 shall control. In the event of a failure of the conditions precedent set forth in Section 4.1.4, the provisions of Article 3 shall control.

ARTICLE 5

CONDITIONS OF SELLER’S OBLIGATIONS

5.1 Conditions. Seller’s obligation to consummate the transaction contemplated by this Agreement shall be subject to the satisfaction or performance of the following terms and conditions, any one or more of which may be waived by Seller in its sole discretion, in whole in part, on or as of the Closing Date as such may be extended in accordance herewith:

5.1.1 Buyer shall have kept, observed, performed, satisfied and complied with all terms, covenants, conditions, agreements, requirements, restrictions and provisions required by this Agreement to be kept, observed, performed, satisfied or complied with by Buyer before, on or as of the Closing Date, in all material respects;

5.1.2 All of the representations and warranties of Buyer set forth in this Agreement shall be true and correct at and as of the Closing Date in all material respects as though such representations and warranties were made at and as of the Closing Date; and

5.1.3 Seller shall have obtained the Shareholder Consent on or before the Consent Deadline.

24