LEASE by and between WILMINGTON GARDENS GROUP L.L.C., a Utah limited liability company as Landlord and TRAEGER PELLET GRILLS LLC, a Delaware limited liability company as Tenant for SUITE 200 1215 EAST WILMINGTON AVENUE SALT LAKE CITY, UTAH

Exhibit 10.15

LEASE

by and between

WILMINGTON GARDENS GROUP L.L.C.,

a Utah limited liability company

as Landlord

and

XXXXXXX PELLET GRILLS LLC,

a Delaware limited liability company

as Tenant

for

XXXXX 000

0000 XXXX XXXXXXXXXX XXXXXX

XXXX XXXX XXXX, XXXX

WILMINGTON GARDENS – 0000 XXXX XXXXXXXXXX XXXXXX– SALT LAKE CITY, UTAH

TABLE OF CONTENTS

| ARTICLE I. BASIC LEASE PROVISIONS; ENUMERATION OF EXHIBITS |

3 | |||

| SECTION 1.01 BASIC LEASE PROVISIONS |

3 | |||

| SECTION 1.02 SIGNIFICANCE OF A BASIC LEASE PROVISION |

8 | |||

| SECTION 1.03 ENUMERATION OF EXHIBITS |

8 | |||

| ARTICLE II. GRANT AND LEASED PREMISES |

8 | |||

| SECTION 2.01 LEASED PREMISES |

8 | |||

| SECTION 2.02 DEFINITION OF LEASE YEAR |

8 | |||

| SECTION 2.03 NOTICES |

8 | |||

| SECTION 2.04 EXCUSE OF LANDLORD’S PERFORMANCE |

8 | |||

| ARTICLE III. RENT |

8 | |||

| SECTION 3.01 BASE MONTHLY RENT |

8 | |||

| SECTION 3.02 ESCALATION |

9 | |||

| SECTION 3.03 TENANT’S PRO-RATA SHARE OF SPECIFIED PROJECT AREA BASE YEAR OPERATING EXPENSES, SPECIFIED BUILDING AREA BASE YEAR OPERATING EXPENSES AND SPECIFIED OFFICE AREA BASE YEAR OPERATING EXPENSES |

9 | |||

| SECTION 3.04 TAXES |

10 | |||

| SECTION 3.05 PAYMENTS |

11 | |||

| ARTICLE IV. RENTAL TERM, COMMENCEMENT DATE & PRELIMINARY TERM |

11 | |||

| SECTION 4.01 RENTAL TERM |

11 | |||

| SECTION 4.02 RENTAL TERM COMMENCEMENT DATE |

11 | |||

| SECTION 4.03 PRELIMINARY TERM |

11 | |||

| ARTICLE V. LANDLORD’S WORK, FINANCING OF IMPROVEMENTS, TENANT’S POSSESSION DATE AND CANCELLATION |

11 | |||

| SECTION 5.01. CONSTRUCTION OF LEASED PREMISES BY LANDLORD |

11 | |||

| SECTION 5.02. DELIVERY OF POSSESSION FOR TENANT’S WORK |

11 | |||

| SECTION 5.04. ALTERATIONS AND ADDITIONS |

11 | |||

| ARTICLE V. CONSTRUCTION OF LEASED PREMISES |

11 | |||

| ARTICLE VI. TENANT’S WORK & LANDLORD’S CONTRIBUTION |

11 | |||

| SECTION 6.01 CONSTRUCTION OF LEASED PREMISES BY TENANT |

11 | |||

| SECTION 6.02 SETTLEMENT OF DISPUTES |

12 | |||

| ARTICLE VII. USE |

12 | |||

| SECTION 7.01 PERMITTED USE OF LEASED PREMISES |

12 | |||

| SECTION 7.02 HAZARDOUS SUBSTANCES |

12 | |||

| ARTICLE VIII. OPERATION AND MAINTENANCE OF COMMON AREAS |

13 | |||

| SECTION 8.01 CONSTRUCTION AND CONTROL OF COMMON AREAS |

13 | |||

| SECTION 8.02 LICENSE |

13 | |||

| SECTION 8.03 AUDIT |

13 | |||

| ARTICLE IX. ALTERATIONS, SIGNS, LOCKS & KEYS |

14 | |||

| SECTION 9.01 ALTERATIONS |

14 | |||

| SECTION 9.02 SIGNS |

14 | |||

| SECTION 9.03 LOCKS AND KEYS |

14 | |||

| ARTICLE X. MAINTENANCE AND REPAIRS; ALTERATIONS; ACCESS |

14 | |||

| SECTION 10.01 LANDLORD’ S OBLIGATION FOR MAINTENANCE |

14 | |||

| SECTION 10.02 TENANT’S OBLIGATION FOR MAINTENANCE |

14 | |||

| SECTION 10.03 SURRENDER AND RIGHTS UPON TERMINATION |

14 | |||

| ARTICLE XI. INSURANCE AND INDEMNITY |

15 | |||

| SECTION 11.01 LIABILITY INSURANCE AND INDEMNITY |

15 | |||

| SECTION 11.02 FIRE AND CASUALTY INSURANCE |

15 | |||

| SECTION 11.03 WAIVER OF SUBROGATION |

15 | |||

| SECTION 11.04 |

15 | |||

| ARTICLE XII UTILITY CHARGES |

16 | |||

| SECTION 12.01 OBLIGATION OF LANDLORD |

16 | |||

| SECTION 12.02 OBLIGATIONS OF TENANT |

16 | |||

| SECTION 12.03. EXTRA HOURS CHARGES |

17 | |||

| SECTION 12.04. LIMITATIONS ON LANDLORDS LIABILITY |

17 | |||

| ARTICLE XIII. OFF-SET STATEMENT, ATTORNMENT AND SUBORDINATION |

17 | |||

| SECTION 13.01 OFF-SET STATEMENT |

17 | |||

| SECTION 13.02 ATTORNMENT |

17 | |||

| SECTION 13.03 SUBORDINATION |

17 | |||

| SECTION 13.04 MORTGAGEE SUBORDINATION |

17 | |||

| SECTION 13.05 REMEDIES |

17 | |||

| ARTICLE XIV. ASSIGNMENT |

17 | |||

| SECTION 14.01 ASSIGNMENT |

17 | |||

| ARTICLE XV. WASTE OR NUISANCE |

18 | |||

| SECTION 15.01 WASTE OR NUISANCE |

18 | |||

| ARTICLE XVI. NOTICES |

18 | |||

| SECTION 16.01 NOTICES |

18 | |||

| ARTICLE XVII. DESTRUCTION OF THE LEASED PREMISES |

18 | |||

| SECTION 17.01 DESTRUCTION |

18 | |||

| ARTICLE XVIII. CONDEMNATION |

18 | |||

| SECTION 18.01 CONDEMNATION |

18 |

i

WILMINGTON GARDENS – 0000 XXXX XXXXXXXXXX XXXXXX – SALT LAKE CITY, UTAH

TABLE OF CONTENTS

| ARTICLE XIX. DEFAULT OF TENANT |

19 | |||

| SECTION 19.01 DEFAULT - RIGHT TO RE-ENTER |

19 | |||

| SECTION 19.02 DEFAULT - RIGHT TO RE-LET |

19 | |||

| SECTION 19.03 LEGAL EXPENSES |

19 | |||

| ARTICLE XX. BANKRUPTCY, INSOLVENCY OR RECEIVERSHIP |

19 | |||

| SECTION 20.01 ACT OF INSOLVENCY, GUARDIANSHIP, ETC. |

19 | |||

| ARTICLE XXI. LANDLORD ACCESS |

20 | |||

| SECTION 21.01 LANDLORD ACCESS |

20 | |||

| ARTICLE XXII. TENANT’S PROPERTY AND LANDLORD’S LIEN |

20 | |||

| SECTION 22.01. TAXES ON LEASEHOLD |

20 | |||

| SECTION 22.02. LOSS AND DAMAGE |

20 | |||

| SECTION 22.03. NOTICE BY TENANT |

20 | |||

| SECTION 22.04 LANDLORD’S LIEN |

20 | |||

| SECTION 22.05. LANDLORD’S SUBORDINATION |

20 | |||

| ARTICLE XXIII. HOLDING OVER |

20 | |||

| SECTION 23.01 HOLDING OVER |

20 | |||

| SECTION 23.02 SUCCESSORS |

20 | |||

| ARTICLE XXIV. RULES AND REGULATIONS |

20 | |||

| SECTION 24.01 RULES AND REGULATIONS |

20 | |||

| ARTICLE XXV. QUIET ENJOYMENT |

21 | |||

| SECTION 25.01 QUIET ENJOYMENT |

21 | |||

| ARTICLE XXVI. SECURITY DEPOSIT |

21 | |||

| SECTION 26.01 SECURITY DEPOSIT |

21 | |||

| ARTICLE XXVII. MISCELLANEOUS PROVISIONS |

21 | |||

| SECTION 27.01 WAIVER |

21 | |||

| SECTION 27.02 ENTIRE LEASE AGREEMENT |

21 | |||

| SECTION 27.03 FORCE MAJEURE |

21 | |||

| SECTION 27.04 LOSS AND DAMAGE |

21 | |||

| SECTION 27.05 ACCORD AND SATISFACTION |

21 | |||

| SECTION 27.06 NO OPTION |

21 | |||

| SECTION 27.07 ANTI-DISCRIMINATION |

22 | |||

| SECTION 27.08 SEVERABILITY |

22 | |||

| SECTION 27.09 OTHER MISCELLANEOUS PROVISIONS |

22 | |||

| SECTION 27.10 REPRESENTATION REGARDING AUTHORITY |

22 | |||

| SECTION 27.11. TENANT CERTIFICATION |

22 | |||

| ARTICLE XXVIII. ADDITIONAL PROVISIONS |

22 | |||

| SECTION 28.01. OPTION TO RENEW |

22 | |||

| SIGNATURES |

24 | |||

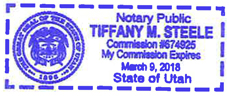

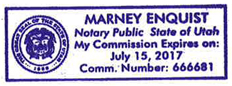

| ACKNOWLEDGMENT OF LANDLORD |

24 | |||

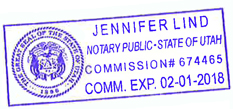

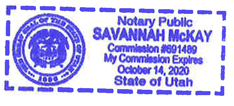

| ACKNOWLEDGMENT OF TENANT |

25 |

ii

(hereinafter “Lease”)

ARTICLE I. BASIC LEASE PROVISIONS; ENUMERATION OF EXHIBITS

SECTION 1.01 BASIC LEASE PROVISIONS.

| (A) | EFFECTIVE DATE: January 23, 2015 (“Effective Date”) |

| (B) | LANDLORD: Wilmington Gardens Group L.L.C., a Utah limited liability company (“Landlord”). |

| (C) | ADDRESS OF LANDLORD FOR NOTICES (Section 16.01): 0000 Xxxx Xxxxxxx Xxx, Xxxxx 000, Xxxx Xxxx Xxxx, XX 00000. |

| (D) | TENANT: Xxxxxxx Pellet Grills LLC, a Delaware limited liability company (Tax ID: 00-0000000) |

| (E) | ADDRESS OF TENANT FOR NOTICES (Section 16.01): |

From the period commencing on the Effective Date until the date on which Tenant has opened for business from the Leased Premises:

Xxxxxxx Grills

Attention: Xxxxxx Xxxxxx

0000 Xxxxxxxxx Xxxxxx

Xxxx Xxxx Xxxx, Xxxx 00000

With a Copy To:

Xxxxx Xxxxx Xxxxxxxx & XxXxxxxxx, PC

Attention: Xxxxx X. Xxxx

000 X. Xxxx Xxxxxx, Xxxxx 0000

Xxxx Xxxx Xxxx, Xxxx 00000

Following the date on which Tenant has opened for business from the Leased Premises:

Traeger Grills

Attention: Xxxxxx Xxxxxx

0000 Xxxx Xxxxxxxxxx Xxxxxx

Xxxxx 000

Xxxx Xxxx Xxxx, Xxxx 00000

With a Copy To:

Xxxxx Xxxxx Xxxxxxxx & XxXxxxxxx, PC

Attention: Xxxxx X. Xxxx

000 X. Xxxx Xxxxxx, Xxxxx 0000

Xxxx Xxxx Xxxx, Xxxx 00000

| (F) | PERMITTED USE (Section 7.01): General office use including product research and design (“Permitted Use”). Notwithstanding any term or provision of this Lease to the contrary, the Permitted Use shall include the right to operate wood pellet burning stoves, smokers, barbeques and other associated equipment within the outdoor patio during Tenant’s business hours, Monday through Friday, and at any time during weekends and holidays (the “BBQ Use”). |

| (G) | TENANT’S TRADE NAME (Exhibit “E” - Sign Criteria): Xxxxxxx Grills |

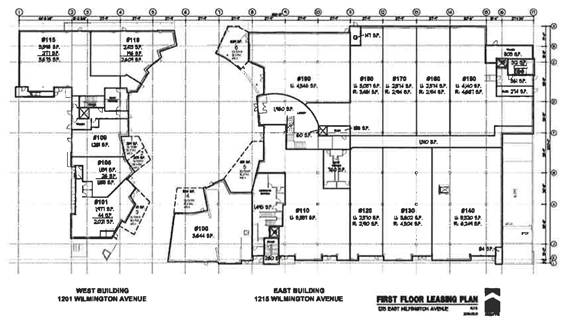

| (H) | BUILDING (Section 2.01): Wilmington Gardens, consisting of one (1) building situated at 0000 Xxxx Xxxxxxxxxx Xxxxxx in Xxxx Xxxx Xxxx, Xxxxxx xx Xxxx Xxxx, Xxxxx of Utah (“Building”). The gross rentable area of the Building (as defined in Section 2.01) is approximately 80,298 square feet. The Building is part of a larger mixed use development which is specifically described in Exhibit “B” and depicted in Exhibit “A” both of which are attached hereto and by this reference incorporated herein (the “Project”). |

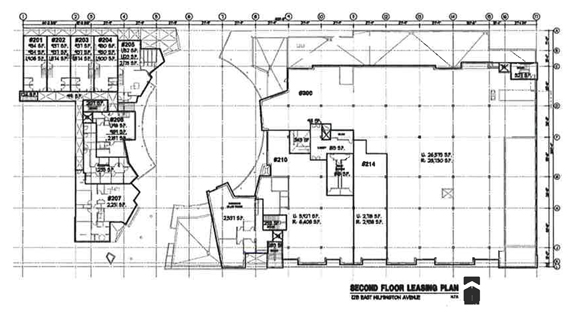

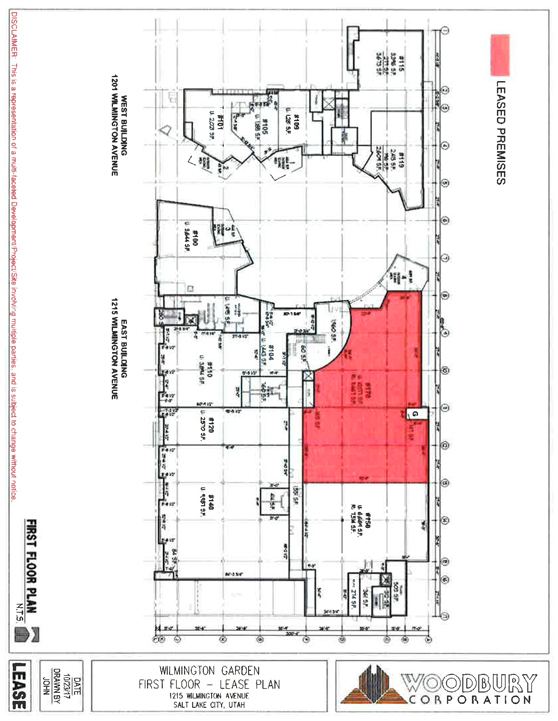

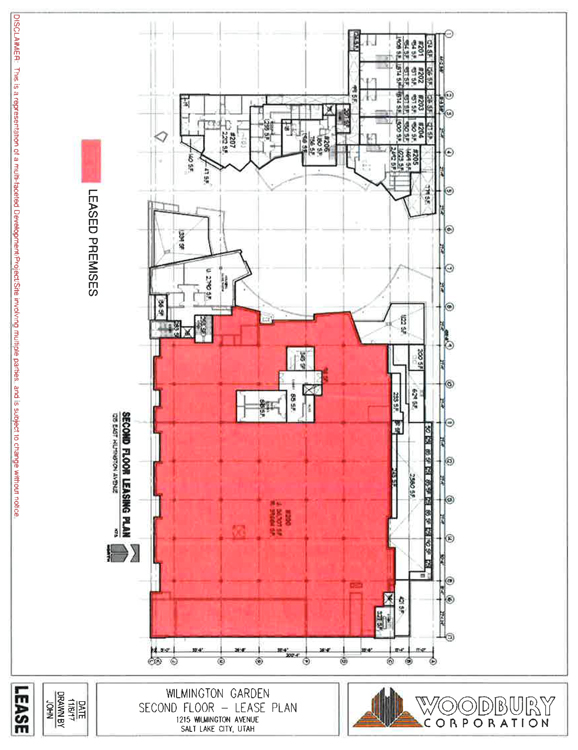

| (I) | LEASED PREMISES (Section 2.01): That portion of the Building (as defined in Section 2.01) at the approximate location outlined on Exhibit “A-l” known as Suite 200, consisting of approximately 28,740 square feet of gross rentable area plus an adjacent outdoor patio depicted on Exhibit “A-l” attached hereto and by this reference incorporated herein and further described in Section 1.01 (AA) below. (“Leased Premises”). Approximately eight and one hundred and forty-eight thousandths percent (8.148%) of such area is Tenant’s proportionate share of Common Area (as defined in Section 8.01) hallways, restrooms, etc. in the Building and Project. Outdoor patio area has been excluded from the calculation of Tenant’s pro-rata share. |

Xxxxxxx Grills Xxxxx.xxxxx. 012315

3

| (J) | DELIVERY OF POSSESSION (Section 5.02): The Leased Premises shall be delivered to Tenant on or within five (5) days of the Effective Date of this Lease (“Delivery of Possession”). Preliminary Term (as defined in Section 4.03) begins on Delivery of Possession. |

| (K) | RENTAL TERM, COMMENCEMENT AND EXPIRATION DATE (Sections 4.01 & 4.02): The term of this Lease shall commence on the earlier to occur of (a) July 1, 2015 or (b) the date Tenant opens for business at the Leased Premises (“Rental Term Commencement Date”), and shall be for a period of ten (10) full Lease Years (as defined in Section 2.02) and at least nine (9) months (“Rental Term”). |

| (L) | BASE MONTHLY RENT (Section 3.01): Sixty-Five Thousand Eight Hundred Sixty-Two and 50/100 Dollars ($65,862.50) (“Base Monthly Rent”). |

| (M) | ESCALATIONS IN BASE MONTHLY RENT (Section 3.02): |

| Escalation Timeline |

Base Monthly Rent | |

| Commencing as of the 1st day of the Rental Term Commencement Date and continuing through the last day of the 9th month Base Monthly Rent shall be $0.00. | ||

| Commencing the 1st day of the 10th month after the Rental Term Commencement Date | ||

| $65,862.50 | ||

| Commencing the 1st day of the 14th month after the Rental Term Commencement Date | ||

| $67,838.38 | ||

| Commencing the 1st day of the 26th month after the Rental Term Commencement Date | ||

| $69,873.53 | ||

| Commencing the 1st day of the 38th month after the Rental Term Commencement Date | ||

| $71,969.73 | ||

| Commencing the 1st day of the 50th month after the Rental Term Commencement Date | ||

| $74,128.82 | ||

| Commencing the 1st day of the 62nd month after the Rental Term Commencement Date | ||

| $75,611.40 | ||

| Commencing the 1st day of the 74th month after the Rental Term Commencement Date | ||

| $77,123.63 | ||

| Commencing the 1st day of the 86th month after the Rental Term Commencement Date | ||

| $78,666.10 | ||

| Commencing the 1st day of the 98th month after the Rental Term Commencement Date | ||

| $80,239.42 | ||

| Commencing the 1st day of the 110th month after the Rental Term Commencement Date | ||

| $81,844.21 | ||

| Commencing the 1st day of the 122nd month after the Rental Term Commencement Date | ||

| $83,481.10 | ||

| (N) | LANDLORD’S SHARE OF BASE YEAR OPERATING EXPENSES (Section 3.03): Landlord shall pay all Operating Expenses (as defined in Section 3.03) for the first twelve (12) months of the Rental Term for: (i) the Specified Project Area Base Year Operating Expenses (hereafter defined); (ii) the Specified Building Area Base Year Operating Expenses (hereafter defined); and (iii) the Specified Office Area Base Year Operating Expenses (hereafter defined) (the Specified Project Area Base Year Operating Expenses, the Specified Building Area Base Year Operating Expenses and the Specified Office Area Base Year Area Expenses are collectively referred to as the “Base Year Operating Expenses”). |

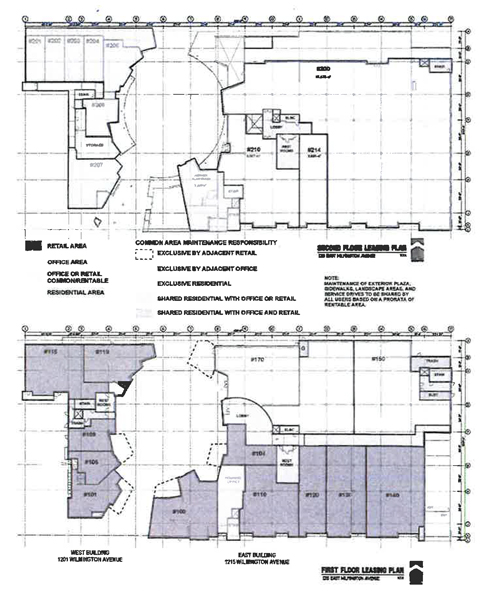

| (i) | The term “Specified Project Area Base Year Operating Expenses” shall mean the Operating Expenses for the first twelve (12) months of the Rental Term associated with the area depicted on Exhibit “G”, labeled as the “Specified Project Area” and containing approximately 216,906 square feet of gross rentable area. |

| (ii) | The term “Specified Project Area Operating Expenses” shall mean the Operating Expenses for any Lease Year following the first twelve (12) months of the Rental Term which are associated with the Specified Project Area. |

| (iii) | The term “Specified Building Area Base Year Operating Expenses” shall mean the Operating Expenses for the first twelve (12) months of the Rental Term associated with the area depicted on Exhibit “G”, labeled as the “Specified Building Area” and containing approximately 80,298 square feet of gross rentable area. |

| (iv) | The term “Specified Building Area Operating Expenses” shall mean the Operating Expenses for any Lease Year following the first twelve (12) months of the Rental Term which are associated with the Specified Building Area. |

| (v) | The term “Specified Office Area Base Year Operating Expenses” shall mean the Operating Expenses for the first twelve (12) months of the Rental Term associated with the area depicted on Exhibit “G”, labeled as the “Specified Office Area” and containing approximately 60,485 square feet of gross rentable area. |

4

| (vi) | The term “Specified Office Area Operating Expenses” shall mean the Operating Expenses for any Lease Year following the first twelve (12) months of the Rental Term which are associated with the Specified Office Area. |

| (O) | TENANT’S PRO-RATA SHARE OF SPECIFIED PROJECT AREA BASE YEAR OPERATING EXPENSES, SPECIFIED BUILDING AREA BASE YEAR OPERATING EXPENSES AND SPECIFIED OFFICE AREA BASE YEAR OPERATING EXPENSES (Section 3.03): |

| (i) | As more particularly set forth in Section 3.03 of this Lease, to the extent the amount of the Specified Project Area Operating Expenses for any Lease Year during the Rental Term exceed the amount of the Specified Project Area Base Year Operating Expenses, Tenant’s pro-rata share of the amount of such excess (if any) shall be thirteen and two hundred fifty thousandths percent (13.250%) (“Tenant’s Share of Project Area Operating Expenses”). |

| (ii) | As more particularly set forth in Section 3.03 of this Lease, to the extent the amount of the Specified Building Area Operating Expenses for any Lease Year during the Rental Term exceed the amount of the Specified Building Area Base Year Operating Expenses, Tenant’s pro-rata share of the amount of such excess (if any) shall be thirty-five and seven hundred ninety-two thousandths percent (35.792%) (“Tenant’s Share of Building Area Operating Expenses”). |

| (iii) | As more particularly set forth in Section 3.03 of this Lease, to the extent the amount of the Specified Office Area Operating Expenses for any Lease Year during the Rental Term exceed the amount of the Specified Office Area Base Year Operating Expenses, Tenant’s pro-rata share of the amount of such excess (if any) shall be forty-seven and five hundred and sixteen thousandths percent (47.516%) (“Tenant’s Share of Office Area Operating Expenses”). |

| (iv) | If it at any time(s) during the Rental Term the gross rentable area of any of the following shall change, the percentages set forth in this Section 1.01(O)(i)-(iii) and any other corresponding sections of this Lease shall be adjusted on a pro-rata basis to reflect such gross rentable area: (a) the Leased Premises, (b) the Specified Project Area, (c) the Specified Building Area, or (d) the Specified Office Area. |

| (P) | RESPONSIBILITY FOR UTILITIES AND SERVICES: Subject to the provisions of Section 3.03, this Lease provides that the utilities and services shall be paid by the party shown below: |

| Heat: |

Landlord | |

| Real Property Taxes: |

Landlord | |

| Water: |

Landlord | |

| Personal Property Taxes: |

Tenant | |

| Telephone: |

Tenant | |

| Janitorial: |

Tenant | |

| Electricity: |

Landlord | |

| Building Casualty Insurance: |

Landlord | |

| Common Area Maintenance: |

Landlord | |

| Personal Property Insurance: |

Tenant | |

| Liability Ins.-Leased Premises: |

Tenant | |

| Liability Ins.-Common Area: |

Landlord | |

| Maintenance and Operations of Outdoor |

||

| Patio Snow Melt System: |

Tenant |

Landlord shall arrange for utility services for the Leased Premises except that telephone services shall be contracted for directly by Tenant. Landlord may separately sub-meter or monitor utilities to the extent Landlord may determine.

| (Q) | EXCESS HOUR UTILITY CHARGES AND HOURS OF OPERATION (Section 12.03): Standard operating hours for the Building shall be 7:00 a.m. to 7:00 p.m. Monday through Friday and 8:00 a.m. to 12:00 p.m. on Saturday, excluding holidays. To the extent Tenant operates up to twenty (20) hours in excess of the standard operating hours (as specified above) during any calendar week, calculated from Monday through Sunday, Tenant shall pay an extra hourly utility charge of Twelve and 50/100 Dollars ($12.50) per hour for mechanical/HVAC system use during which Tenant operates, with a two (2) hour minimum charge. To the extent Tenant operates in excess of twenty (20) hours of the standard operating hours (as specified above) during any calendar week, calculated from Monday through Sunday, Tenant shall pay an extra hourly utility charge of Twenty-Five and 00/100 Dollars ($25.00) per hour for mechanical/HVAC system use during which Tenant operates. For purposes of determining the amount of the charge for excess operating hours, the excess operating hours shall be reset and recalculated each calendar week and any excess operating hours will not carry over to the following week. By way of illustration only, in the event Tenant operates for twenty-five (25) hours in excess of the standard operating hours during a given calendar week, Tenant’s excess operating utility charge would be $375.00 for such calendar week (20 hours charged at $12.50, and 5 hours charged at $25.00). Tenant shall have access to the Building twenty-four (24) hours a day, seven (7) days per week via card access key. |

5

| (R) | Intentionally Omitted. |

| (S) | PARKING (Section 2.01): Upon completion of the parking garage located across Wilmington Avenue, Tenant shall be granted a parking ratio of four (4) parking stalls per 1,000 rentable square feet leased in the parking garage south of the Building. Within that parking allocation, Tenant may lease up to an additional five (5) reserved parking stalls located in the underground parking beneath the Building, at a cost of Forty-Five Dollars ($45.00) per parking stall month. Such charge shall be increased by three percent (3%) per year. Such reserved spaces shall be at locations to be designated by Landlord. |

Prior to the completion of the Project’s parking garage, a majority of Tenant’s parking stalls shall be located in the underground parking beneath the Building with the remainder to be located in the parking garage for Westminster On The Draw (located slightly to the east) and in the surface lot southeast of the Building.

| (T) | PREPAID RENT: Sixty-Five Thousand Eight Hundred Sixty-Two and 50/100 Dollars ($65,862.50), paid upon execution of this Lease to be applied to the first installment of Base Monthly Rent due hereunder. |

| (U) | SECURITY DEPOSIT (Section 26.01): Eighty-Five Thousand and 00/100 Dollars ($85,000.00) (“Security Deposit”). |

| (V) | Intentionally Omitted. |

| (W) | Intentionally Omitted. |

| (X) | OPTION TO RENEW (Section 28.01): Provided Tenant is not, and has not been (more than two (2) times), in default under any of the terms and conditions contained herein, Tenant shall have two (2) additional consecutive five (5) year options to renew and extend the Rental Term as provided herein (“Option”). The Option shall only be exercised by Tenant delivering written notice thereof to Landlord no earlier than the date which is twelve (12) months prior to the expiration of the Rental Term and no later than the date which is nine (9) months prior to the expiration of the Rental Term (the “Option Notice”). The Base Monthly Rent during the first year of each extension periods shall be the lesser of: (i) the then current Fair Market Rate (as defined) for comparable space within the Project, and (ii) the Base Monthly Rent then in effect for the Leased Premises during the last month of the initial Rental Term (increasing each year thereafter by three percent (3%) compounded). “Fair Market Rate” means the market rate for rent chargeable for the Leased Premises based upon the following factors applicable to the Leased Premises or any comparable premises: rent, escalation, term, size, expense stop, tenant allowance, existing tenant finishes, parking availability, and location and proximity to services. |

Within thirty (30) days of Option Notice, Tenant shall notify Landlord of Tenant’s option of Fair Market Rate for the applicable renewal period. If Landlord disagrees with Tenant’s opinion of the Fair Market Rate, Landlord shall notify Tenant of Landlord’s opinion of Fair Market Rate within fifteen (15) days after receipt of Tenant’s opinion of Fair Market Rate (“Landlord’s Value Notice”). If the parties are unable to resolve their differences within thirty (30) days thereafter, Landlord or Tenant, at its sole option, may terminate this Lease, effective as of the last day of the then-current Rental Term. Alternatively, Tenant and Landlord may mutually agree to submit the determination of Fair Market Rate to a “Market Assessment Process,” as provided in Exhibit “F” — Market Assessment Process.

| (Y) | RIGHT TO TERMINATE: (Section 28.02): Provided Tenant is not, and has not been (more than two (2) times), in default beyond any applicable cure period under any of the terms and provisions contained herein, Tenant shall have the right to terminate this Lease on or after the last day of the seventy-eighth (78th) full calendar month of the Rental Term. Tenant shall provide Landlord with three hundred sixty-five (365) days prior written notice of its intent to exercise this right to terminate. At the time Tenant gives it’s notice of its exercise of this right, Tenant shall pay a termination fee equal to the unamortized total of the following: TI Allowance, leasing commissions and Base Monthly Rent abatement, calculated at an eight percent (8%) per annum interest rate. |

| (Z) | RIGHT OF FIRST OFFER TO LEASE CONTIGUOUS SPACE: From the Effective Date of this Lease until the expiration of the Rental Term, and any Rental Term extension thereto, Tenant shall have an one-time right of first offer to lease space adjacent and contiguous to the Leased Premises when such applicable space becomes available for lease as provided herein (hereinafter “First Offer Space”). For purposes hereof, the First Offer Space (or any applicable portion thereof) shall become available for lease by Tenant immediately prior to the first time after the date hereof that Landlord intends to market the First Offer Space (or such applicable portion thereof). Landlord shall give Tenant written notice that the First Offer Space (or portion thereof) shall or has become available for lease by Tenant. Tenant shall have ten (10) business days to exercise its option to lease the First Offer Space by delivering to Landlord written notice of its intent to do so. Failure of Tenant to timely deliver written notice shall be deemed a refusal by Tenant. Thereafter, Landlord shall be entitled to lease the first offer space to other tenants without restriction. |

Any additional office space leased by Tenant within the Building during the first twenty-four (24) months of the initial Rental Term shall be at the same terms and conditions, including Tenant improvement allowance and rent concessions, if any, adjusted to correspond with the Rental Term. Additional terms and conditions shall be addressed in the lease document.

6

In the event Tenant exercises its option to lease the First Officer Space, Landlord and Tenant shall endeavor to execute, within thirty (30) days thereafter, an amendment to this Lease for such First Offer Space upon the terms and conditions as set forth by Landlord in its offer to Tenant to lease such First Offer Space.

| (AA) | OUTDOOR PATIO: Tenant shall be permitted the exclusive use of the outdoor patio depicted in Exhibit “A-l”. Tenant shall be responsible for policing, maintaining and insuring the outdoor patio as part of the Leased Premises. Tenant shall be responsible for the operation and maintenance of the patio heating/snow melting system including the utilities to operate the system (the “Snow Melt System”), which shall be separately metered and passed through to Tenant on a direct basis. The Snow Melt System shall be provided as part of Landlord’s Work, at Landlord’s sole cost and expense. In addition, Tenant shall have the right to build a storage area on the Outdoor Patio at Tenant’s sole cost. This storage space will not be an additional charge to the Tenant. |

| (BB) | Intentionally Omitted. |

| (CC) | TENANT IMPROVEMENT ALLOWANCE (Exhibit “C-1”): Landlord shall provide Tenant an improvement allowance of an amount not to exceed One Million Five Hundred Twenty-Three Thousand Two Hundred Twenty and 00/100 dollars ($1,523,220.00) in accordance with Exhibit “C-l” attached hereto (the “TI Allowance”). The TI Allowance shall be used exclusively towards architectural, engineering, CDs and overall construction of the Leased Premises. In addition to the TI Allowance, Landlord shall install the Snow Melt System, as outlined on Exhibit “C”, on approximately 3,600 SF of the outdoor patio area (total outdoor patio area is approximately 6,160-sf). The west portion of the outdoor patio shall be heated and fifty percent (50%) of the balance of the unheated portion of the outdoor patio shall be green scape. |

| (DD) | TEST FIT ALLOWANCE: Landlord shall provide Tenant with an initial test fit allowance not to exceed $0.10 per rentable square foot (totaling $2,874.00), which shall be part of (and not in addition to) the TI Allowance. |

| (EE) | UNDERGROUND STORAGE PLAN (Exhibit “A-2”): Landlord shall provide to Tenant for storage a four hundred (400) square foot fenced area within the underground parking garage, as depicted on Exhibit “A-2”. Tenant shall lease the storage area at a cost of Two Thousand Four Hundred and No/100 ($2,400.00) annually. Such charge shall be increased by three percent (3%) per Lease Year. Landlord reserves the right to relocate Tenant’s fenced storage area elsewhere within the underground parking garage. Tenant shall have the right to terminate the lease for the storage area at any time following the first year of the Rental Term by delivering written notice of such election to Landlord. In addition, Tenant shall have the right to build a storage area on the Outdoor Patio at Tenant’s cost. This space will not be an additional charge to the Tenant. |

[Remainder of Page Intentionally Left Blank]

7

SECTION 1.02 SIGNIFICANCE OF A BASIC LEASE PROVISION. The foregoing provisions of Section 1.01 summarize for convenience only certain fundamental terms of this Lease delineated more fully in the articles and sections referenced therein. In the event of a conflict between the provisions of Section 1.01 and the balance of this Lease, the latter shall control. Additionally, in the event of a conflict between this Lease and the Exhibits, this Lease shall control.

SECTION 1.03 ENUMERATION OF EXHIBITS. The exhibits enumerated in this Section 1.03 and attached to this Lease are incorporated in this Lease by this reference and are to be construed as a part of this Lease.

| EXHIBIT “A” | - | SITE PLAN | ||

| EXHIBIT “A-1 | - | LEASE PLAN | ||

| EXHIBIT “A-2” | - | UNDERGROUND STORAGE AREA | ||

| EXHIBIT “B” | - | LEGAL DESCRIPTION | ||

| EXHIBIT “C” | - | LANDLORD’S WORK | ||

| EXHIBIT “C-l” | - | LANDLORD’S CONTRIBUTION TO TENANT’S WORK | ||

| EXHIBIT “D” | - | TENANT’S WORK | ||

| EXHIBIT “E” | - | SIGN CRITERIA | ||

| EXHIBIT “E-l” | - | SIGNAGE LOCATION DEPICTION | ||

| EXHIBIT “F” | - | MARKET ASSESSMENT PROCESS | ||

| EXHIBIT “G” | - | COMMON AREA MAINTENANCE PLAN |

ARTICLE II. GRANT AND LEASED PREMISES

SECTION 2.01 LEASED PREMISES. In consideration for the rent to be paid and covenants to be performed by Tenant, Landlord hereby leases to Tenant, and Tenant leases from Landlord for the Rental Term and upon the terms and conditions herein set forth, the Leased Premises described in Section 1.01 (I), located in the office building referred to in Section 1.01(H) (“Building”). The legal description for the property on which the Building is located is attached hereto as Exhibit “B”. Gross rentable area measurements herein specified are from the exterior of the perimeter walls of the Building to the center of the interior walls. In addition, the percentage set forth in Section 1.01(I) is the portion of the gross rentable area attributable to Tenant’s proportionate share of common hallways, restrooms, etc. in the Building.

The exterior walls and roof of the Leased Premises and the areas beneath the Leased Premises are not demised hereunder and the use thereof together with the right to install, maintain, use, repair, and replace pipes, ducts, conduits, and wires leading through the Leased Premises in locations which shall not materially interfere with Tenant’s use thereof and serving other parts of the Building or buildings are hereby reserved to Landlord. Landlord reserves (a) such access rights through the Leased Premises as may be reasonably necessary to enable access by Landlord to the balance of the Building and reserved areas and elements as set forth above; and (b) the right to install or maintain meters on the Leased Premises to monitor use of utilities. In exercising such rights, Landlord shall use reasonable efforts so as to not commit waste upon the Leased Premises and as far as practicable to minimize annoyance, interference or damage to Tenant when making modifications, additions or repairs.

Subject to the provisions of Article VIII, Tenant and its customers, agents and invitees have the right to the non-exclusive use, in common with others of such unreserved automobile parking spaces, driveways, footways, and other facilities designated for common use within the Building and the Project, except that with respect to non-exclusive areas, Tenant shall cause its employees to park their cars only in areas specifically designated from time to time by Landlord for that purpose and shall actively police employees to keep them from parking in “visitor” or other restricted parking areas. Tenant shall have the option to utilize the adjacent parking structure in accordance with the provisions of Section 1.01(S).

SECTION 2.02 DEFINITION OF LEASE YEAR. “Lease Year” shall include twelve (12) full calendar months of Rental Term.

SECTION 2.03 NOTICES. This Lease, and the tenancy hereby created, shall terminate at the end of the Rental Term, or any Rental Term extension or renewal thereof, without the necessity of any notice from either Landlord or Tenant to terminate the same, and Tenant hereby waives notice to vacate the Leased Premises and agrees that Landlord shall be entitled to the benefit of all provisions of law respecting the summary recovery of possession of the Leased Premises from a tenant holding over to the same extent as if statutory notice has been given.

SECTION 2.04 EXCUSE OF LANDLORD’S PERFORMANCE. Anything in this Lease to the contrary notwithstanding, providing such cause is not due to the willful act or neglect of Landlord, Landlord shall not be deemed in default with respect to the performance of any of the terms, covenants and conditions of this Lease, if same shall be due to any strike, lockout, civil commotion, war-like operation, invasion, rebellion, hostilities, military or usurped power, sabotage, governmental regulations or controls, inability to obtain any material, service or financing, act of God or other cause beyond the control of Landlord.

ARTICLE III. RENT

SECTION 3.01 BASE MONTHLY RENT. Tenant agrees to pay to Landlord the Base Monthly Rent set forth in Section 1.01 (L) at such place as Landlord may designate, without prior demand therefor, without offset or deduction and in advance on or before the first day of each calendar month during the Rental Term, commencing on the Rental Term Commencement Date. In the event the Rental Term Commencement Date occurs on a day

8

other than the first day of a calendar month, then the Base Monthly Rent to be paid on the Rental Term Commencement Date shall include both the Base Monthly Rent for the first full calendar month occurring after the Rental Term Commencement Date, plus the Base Monthly Rent for the initial fractional calendar month pro-rated on a per-diem basis (based upon a thirty (30) day month).

SECTION 3.02 ESCALATION. As set forth in Section 1.01(M).

SECTION 3.03 TENANT’S PRO-RATA SHARE OF SPECIFIED PROJECT AREA BASE YEAR OPERATING EXPENSES, SPECIFIED BUILDING AREA BASE YEAR OPERATING EXPENSES AND SPECIFIED OFFICE AREA BASE YEAR OPERATING EXPENSES.

(a) If the amount of the Specified Project Area Operating Expenses for any Lease Year during the Rental Term exceed the amount of the Specified Project Area Base Year Operating Expenses, Tenant shall pay to Landlord as “Additional Rent” an amount equal to thirteen and two hundred fifty thousandths percent (13.250%) of the amount of such excess (“Tenant’s Share of Project Area Operating Expenses”). If the amount of the Specified Building Area Operating Expenses for any Lease Year during the Rental Term exceed the amount of the Specified Building Area Base Year Operating Expenses, Tenant shall pay to Landlord as “Additional Rent” an amount equal to thirty-five and seven hundred ninety-two thousandths percent (35.792%) of the amount of such excess (“Tenant’s Share of Building Area Operating Expenses”). If the amount of the Specified Office Area Operating Expenses for any Lease Year during the Rental Term exceed the amount of the Specified Office Area Base Year Operating Expenses, Tenant shall pay to Landlord as “Additional Rent” an amount equal to forty-seven and five hundred and sixteen thousandths percent (47.516%) of the amount of such excess (“Tenant’s Share of Office Area Operating Expenses”). In addition, beginning as of commencement of the Lease, Tenant shall pay the entire amount of the operating expense for the outdoor heated patio. Such operating expense shall include cost of repairs, replacement, maintenance, power and gas required to operate. Gas supply to be separately metered. Power supply to be separately metered or sub-metered at Landlord’s option. Where sub-metered, Tenant’s pro-rata share shall be equal to the ratio of its measured consumption to the total consumption of the master meter. Landlord, at Landlord’s sole cost and expense, shall be solely responsible for any repairs or replacements for the structural portions of the outdoor patio.

(b) Landlord shall xxxx Tenant for Tenant’s Share of Project Area Operating Expenses, Tenant’s Share of Building Area Operating Expenses and/or Tenant’s Share of Office Area Operating Expenses, if any, at the end of the second Lease Year of the Rental Term. Beginning with the third Lease Year and continuing thereafter, Landlord shall reasonably estimate Tenant’s Share of Project Area Operating Expenses, Tenant’s Share of Building Area Operating Expenses and/or Tenant’s Share of Office Area Operating Expenses for the next twelve (12) months and one-twelfth (1/12th) of the estimated Tenant’s Share of Project Area Operating Expenses, Tenant’s Share of Building Area Operating Expenses and/or Tenant’s Share of Office Area Operating Expenses, if any, shall be added to the Base Monthly Rent as determined in Sections 3.01 and 3.02 for the next full twelve (12) calendar months of the Rental Term and shall be paid as set forth in Section 3.05. With respect to the Snow Melt System, Landlord shall xxxx Tenant monthly, and payment shall be due within ten (10) days of Tenant’s receipt of Landlord’s invoice therefor.

(c) To the extent that Tenant’s Share of Project Area Operating Expenses, Tenant’s Share of Building Area Operating Expenses and/or Tenant’s Share of Office Area Operating Expenses is less or greater than the estimated amount paid by Tenant during the Lease Year, Tenant shall be entitled to a reimbursement or shall pay the deficiency as the case may be. Landlord shall determine the actual Tenant’s Share of Project Area Operating Expenses, Tenant’s Share of Building Area Operating Expenses and/or Tenant’s Share of Office Area Operating Expenses within forty-five (45) days after the end of the Lease Year and shall deliver a computation of such Tenant’s Share of Project Area Operating Expenses, Tenant’s Share of Building Area Operating Expenses and/or Tenant’s Share of Office Area Operating Expenses in reasonable detail and reasonable evidence of such costs to Tenant together with an invoice for Tenant’s share or notice of credit for reimbursement thereof. Tenant agrees to pay the amount of such invoice within ten (10) days after Tenant’s receipt of Landlord’s invoice therefor.

(d) “Operating Expense(s)” shall mean, as applicable all reasonable, actual costs and expense incurred by Landlord in connection with the ownership, operation, management and maintenance of the Specified Building Area, the Specified Project Area or the Specified Office Area, and related improvements located thereon (the “Improvements”, including, but not limited to, all commercially reasonable expenses incurred by Landlord as a result of Landlord’s compliance with any and all of its obligations under this Lease (or under similar leases with other tenants). In explanation of the foregoing, and not in limitation thereof, Operating Expenses shall include, as applicable: utilities, repair and maintenance of the Leased Premises, including HVAC, electrical, plumbing, sprinkler and other building system maintenance, (excluding roof and structural repair or replacement), all real and personal property taxes and assessments (whether general or special, known or unknown, foreseen or unforeseen) and any tax or assessment levied or charged in lieu thereof, whether assessed against Landlord and/or Tenant and whether collected from Landlord and/or Tenant; snow removal, trash removal, Common Area (as defined in Section 8.01) utilities, cost of equipment or devices used to conserve or monitor energy consumption, supplies, insurance, license, permit and inspection fees, management fee equal to five percent (5%) of the Base Monthly Rent (the “Management Fee”), cost of services of independent contractors, cost of services of independent contractors, reasonable cost of compensation (including employment taxes and fringe benefits) of all persons who perform regular and recurring duties connected with day-to-day operation, maintenance, repair, and replacement of the Building, its equipment and the adjacent Common Areas

9

(including, but not limited to janitorial, gardening, landscaping, security, parking, elevator, painting, plumbing, electrical, mechanical, carpentry, window washing, performing services not uniformly available to or performed for substantially all the Building tenants; and rental expense or a reasonable allowance for depreciation of personal property used in the maintenance, operation and repair of the Building. In addition to the foregoing to cover Landlord’s supervisory, an administrative fee shall be paid to Landlord equal to fifteen percent (15%) of the Specified Project Area Operating Expenses, the Specified Building Area Operating Expenses and the Specified Office Area Operating Expenses. The Specified Project Area Operating Expenses, the Specified Building Area Operating Expenses and the Specified Office Area Operating Expenses for any calendar year during which actual occupancy of the Project is less than ninety-five percent (95%) of the gross rentable area of the Project shall be appropriately grossed up and adjusted to reflect ninety-five percent (95%) occupancy of the existing Rentable Area of the Project during such period. There shall be no duplication of charges among the Specified Project Area Operating Expenses, the Specified Building Area Operating Expenses or the Specified Office Area Operating Expenses.

Notwithstanding the above, the Specified Project Area Operating Expenses, the Specified Building Area Operating Expenses and the Specified Office Area Operating Expenses shall not include any of the following (all of which shall be at Landlord’s sole cost and expense):

(A) leasing commissions, attorneys’ fees, costs and disbursements and other expenses incurred in connection with leasing, renovating or improving vacant space in the Project for tenants or prospective tenants of the Building or Project;

(B) costs (including permit, license and inspection fees) incurred in renovating or otherwise improving or decorating, painting or redecorating space for tenants or vacant space;

(C) Landlord’s costs of any services sold to tenants for which Landlord is entitled to be reimbursed by such tenants as an additional charge or rental over and above the Base Monthly Rent and Operating Expenses payable under the lease with such tenant or other occupant;

(D) any depreciation or amortization of the Building or Project except as expressly permitted herein;

(E) costs incurred due to a violation of Law by Landlord relating to the Building or Project;

(F) interest on debt or amortization payments on any mortgages or deeds of trust or any other debt for borrowed money;

(G) all items and services for which Tenant or other tenants reimburse Landlord outside of Operating Expenses;

(H) repairs or other work occasioned by fire, windstorm or other work paid for through insurance or condemnation proceeds (excluding any deductible);

(I) repairs resulting from any defect in the original design or construction of the Building or Project;

(J) Costs attributable to original development, such as architectural and engineering;

(K) Costs attributable to seeking and obtaining new tenants or lease extensions, such as advertising, brokerage commissions, or to enforcing leases against tenants in the Building or Project such as attorney’s fees, court costs, adverse judgments and similar expenses;

(L) Reserves for bad debts or future expenditures which would be incurred subsequent to the then current accounting year;

(M) Costs attributable to repairing items that are covered by warranties to the extent that Landlord recovers such costs under the warranties;

(N) Maintenance, repair or replacement of the roof or roof systems, structural items (including but not limited to exterior walls, load bearing columns, foundation and floor slabs) of the Building or Project; or

(O) the Management Fee.

SECTION 3.04 TAXES.

(a) Landlord shall pay all real property taxes and assessments, which are levied against or which apply with respect to the Leased Premises.

(b) Tenant shall pay prior to delinquency all taxes, assessments, charges, and fees which during the Rental Term may be imposed, assessed, or levied by any governmental or public authority against or upon Tenant’s use of the Leased Premises or any inventory, personal property, fixtures or equipment kept or installed, or permitted to be located therein by Tenant.

10

SECTION 3.05 PAYMENTS. All payments of Base Monthly Rent, Additional Rent and other payments to be made to Landlord shall be made on a timely basis and shall be payable to Landlord or as Landlord may otherwise designate. All such payments shall be mailed or delivered to Landlord’s principal office set forth in Section 1.01(C), or at such other place as Landlord may designate from time to time in writing. If mailed, all payments shall be mailed in sufficient time and with adequate postage thereon to be received in Landlord’s account by no later than the due date for such payment. If Tenant shall fail to pay any Base Monthly Rent or any Additional Rent or any other amounts or charges within five (5) days of the date when due, Tenant shall pay interest from the due date of such past due amounts to the date of payment, both before and after judgment at a rate equal to the greater of twelve percent (12%) per annum; provided however, that in any case the maximum amount or rate of interest to be charged shall not exceed the maximum non-usurious rate in accordance with applicable law.

ARTICLE IV. RENTAL TERM, COMMENCEMENT DATE & PRELIMINARY TERM

SECTION 4.01 RENTAL TERM. The initial term of this Lease shall be for the period defined as the Rental Term in Section 1.01(K), plus the partial calendar month, if any, occurring after Delivery of Possession if the Rental Term Commencement Date occurs other than on the first day of a calendar month.

SECTION 4.02 RENTAL TERM COMMENCEMENT DATE. The Rental Term of this Lease and Tenant’s obligation to pay rent hereunder shall commence on the Rental Term Commencement Date as set forth in Section 1.01(K). Within five (5) days after Landlord’s request to do so, Landlord and Tenant shall execute a written affidavit, in recordable form, expressing the Rental Term Commencement Date and the termination date, which affidavit shall be deemed to be part of this Lease.

SECTION 4.03 PRELIMINARY TERM. The period between the date Tenant enters upon the Leased Premises and the Rental Term Commencement Date shall be designated as the “Preliminary Term” during which no Base Monthly Rent shall accrue; however, other covenants and obligations of Tenant shall be in full force and effect. Delivery of Possession of the Leased Premises to Tenant as provided in Section 5.02 shall be considered “entry” by Tenant and commencement of the Preliminary Term.

ARTICLE V. LANDLORD’S WORK, FINANCING OF IMPROVEMENTS,

TENANT’S POSSESSION DATE AND CANCELLATION

SECTION 5.01. CONSTRUCTION OF LEASED PREMISES BY LANDLORD. Landlord shall construct the Building in which the Leased Premises is located substantially in accordance with outline specifications as set forth in Exhibit “C” (“Landlord’s Work”). It is understood and agreed by Tenant that no minor changes from any plans or from such outline specifications made necessary during construction of the building or the Leased Premises shall affect or change this Lease or invalidate same.

SECTION 5.02. DELIVERY OF POSSESSION FOR TENANT’S WORK. Except as hereinafter provided, Landlord covenants that actual possession of the Leased Premises shall be delivered to Tenant, ready for Tenant’s Work, with the exception of the Snow Melt System, (see Article VI), on the date set forth in Section 1.01 (J). It is agreed that by taking possession of the Leased Premises as a tenant, Tenant formally accepts the same and acknowledges that the Leased Premises are in the condition called for hereunder, except for items specifically excepted in writing at the date of occupancy as “incomplete”.

SECTION 5.03. Intentionally Omitted.

SECTION 5.04. ALTERATIONS AND ADDITIONS. Provided such alteration or additions do not materially or adversely interfere with Tenant’s access to or use of the Leased Premises, and provided Landlord takes commercially reasonable efforts to avoid or minimize, to the greatest extent possible, interference with Tenant’s access to or use of the Leased Premises, the parties agree as follows: Notwithstanding anything else in this Lease contained, Landlord hereby reserves the right at any time, and from time to time, to make alterations or additions to the Building in which the Leased Premises are contained. Landlord also reserves the right to construct improvements in the Building area from time to time and to make alterations therein or additions thereto, to expand the Building area. The purpose of the site plan attached hereto as Exhibit “A” is to show the approximate location of the Leased Premises within the Building and Landlord reserves the right at any time to reconfigure the Common Areas shown on such site plan. Tenant shall have no right to object to such alteration by Landlord, nor to claim any damages or reduction in rent as a result of such work or the exercise of Landlord’s rights under Section 8.01, nor damages for any related nuisance, inconvenience, temporary interruption of utility systems, Common Facilities (as defined in Section 8.03(b)), nor except as hereinafter mentioned for interruption of Tenant’s use of the gross rentable area of the Leased Premises.

ARTICLE VI. TENANT’S WORK & LANDLORD’S CONTRIBUTION

SECTION 6.01 CONSTRUCTION OF LEASED PREMISES BY TENANT. Subject to Landlord’s obligation to pay to Tenant the TI Allowance, pursuant to the terms and conditions set forth in this Lease, Tenant agrees, at Tenant’s sole cost and expense, to provide all work of whatsoever nature in accordance with its obligations set forth in Exhibit “D” (“Tenant’s Work”). Tenant agrees to furnish Landlord, prior to commencement of construction, with a complete and detailed set of plans and specifications drawn by a registered architect (or by some other qualified person acceptable to Landlord) setting forth and describing Tenant’s Work in such detail as Landlord may reasonably require and in compliance with Exhibit “D”, unless this requirement be

11

waived in writing by Landlord. If such plans and specifications are not so furnished by Tenant prior to commencement of construction then Landlord may, at its option, in addition to other remedies, enjoin Tenant from continuing construction while such plans and specifications have not been so furnished. No material deviation from the final set of plans and specifications once submitted to and approved by Landlord, shall be made by Tenant without Landlord’s prior written consent. Landlord shall have the right to approve or disapprove Tenant’s architect and contractor to be used in performing Tenant’s Work, and the right to require and approve insurance or bonds to be provided by Tenant or such contractors. In due course, after completion of Tenant’s Work, Tenant shall certify to Landlord the itemized cost of Tenant improvements and fixtures located upon the Leased Premises. To the extent that Landlord elects to perform certain Tenant’s Work as provided in Exhibit “D”, Tenant shall pay Landlord for such work within ten (10) business days of invoice by Landlord. The following architect is approved by Landlord: Method Studios. The following contractors are hereby approved by Landlord: Xxxxxx Construction, Xxxxxx, and United Contractors.

SECTION 6.02 SETTLEMENT OF DISPUTES. It is understood and agreed that any disagreement or dispute which may arise between Landlord and Tenant with reference to the work to be performed pursuant to Exhibits “C” and “D” shall be resolved by Landlord’s architect, whose good faith decision shall be final and binding on both Landlord and Tenant.

ARTICLE VII. PERMITTED USE

SECTION 7.01 PERMITTED USE OF LEASED PREMISES. Tenant shall use and occupy the Leased Premises solely for the purpose of conducting the business as indicated in Section 1.01(F). Tenant shall promptly comply with all present or future laws, ordinances, lawful orders and regulations affecting the Leased Premises and the cleanliness, safety, occupancy and use of same. Tenant shall not make any use of the Leased Premises which shall cause cancellation or an increase in the cost of any insurance policy covering the same (this restriction shall not apply to the BBQ Use). Tenant shall not keep or use on the Leased Premises any article, item, or thing which is prohibited by the standard form of fire insurance policy (this restriction shall not apply to the BBQ Use). Tenant shall not commit any waste upon the Leased Premises and shall not conduct or allow any business, activity, or thing on the Leased Premises which is an annoyance or causes damage to Landlord, to other subtenants, occupants, or users of the improvements, or to occupants of the vicinity (this restriction shall not apply to the BBQ Use).

SECTION 7.02 HAZARDOUS SUBSTANCES.

(a) Tenant shall not use, produce, store, release, dispose or handle in or about the Leased Premises or transfer to or from the Leased Premises (or permit any other party to do such acts) any Hazardous Substance (as defined herein) except in compliance with all applicable Environmental Laws (as defined herein). Tenant shall not construct or use any improvements, fixtures or equipment or engage in any act on or about the Leased Premises that would require the procurement of any license or permit pursuant to any Environmental Law. Tenant shall immediately notify Landlord of (i) the existence of any Hazardous Substance on or about the Leased Premises that may be in violation of any Environmental Law (regardless of whether Tenant is responsible for the existence of such Hazardous Substance), (ii) any proceeding or investigation by any governmental authority regarding the presence of any Hazardous Substance on the Leased Premises or the migration thereof to or from any other property, (iii) all claims made or threatened by any third party against Tenant relating to any loss or injury resulting from any Hazardous Substance, or (iv) Tenant’s notification of the National Response Center of any release of a reportable quantity of a Hazardous Substance in or about the Leased Premises. “Environmental Law(s)” shall mean any federal, state or local statute, ordinance, rule, regulation or guideline pertaining to health, industrial hygiene, or the environment, including without limitation, the federal Comprehensive Environmental Response, Compensation, and Liability Act; “Hazardous Substance” shall mean all substances, materials and wastes that are or become regulated, or classified as hazardous or toxic, under any Environmental Law. If it is determined that any Hazardous Substance exists on the Leased Premises resulting from any act of Tenant or its employees, agents, contractors, licensees, subtenants or customers, then Tenant shall immediately take necessary action to cause the removal of such substance and shall remove such within ten (10) days after discovery. Notwithstanding the above, if the Hazardous Substance is of a nature that cannot be reasonably removed within ten (10) days, then Tenant shall not be in default if Tenant has commenced to cause such removal and proceeds diligently thereafter to complete removal, except that in all cases, any Hazardous Substance must be removed within sixty (60) days after discovery thereof. Furthermore, notwithstanding the above, if in the good faith judgment of Landlord, the existence of such Hazardous Substance creates an emergency or is of a nature which may result in immediate physical danger to persons at the Building, Landlord may enter upon the Leased Premises and remove such Hazardous Substances and charge the cost thereof to Tenant as Additional Rent.

(b) The party herein responsible for removal of Hazardous Substances shall upon learning of such condition proceed within five (5) days thereafter to commence removal of such Hazardous Substance and shall diligently continue to effect such removal until completion. Removal shall be accomplished in accordance with any applicable safety standards.

(c) To the best knowledge of Landlord, the Building and Project are free of asbestos and any other Hazardous Materials and comply with all applicable Environmental Laws.

(d) Landlord shall indemnify, defend, and hold Tenant harmless from and against any and all losses, claims, demands, actions, suits, damages, expenses (including, without limitation, remediation,

12

removal, repair, corrective action, or cleanup expenses, or restoration of the Leased Premises or any part or component thereof following remediation), and costs (including, without limitation, reasonable attorneys’ fees, consultant fees or expert fees) which are brought or recoverable against, or suffered or incurred by Tenant as a result of any release or presence of Hazardous Materials in, on, at, under or to the Leased Premises not caused or permitted by Lessee, its agents, employees, contractors, sublessees or invitees.

ARTICLE VIII. OPERATION AND MAINTENANCE OF COMMON AREAS.

SECTION 8.01 CONSTRUCTION AND CONTROL OF COMMON AREAS. All automobile parking areas, driveways, entrances and exits thereto, and other facilities furnished by Landlord in or near the Building and/or Project, including if any, employee parking areas, parking garage, truck ways, loading docks, trash rooms, elevators, mail rooms or mail pickup areas, pedestrian sidewalks and hallways, landscaped areas, retaining walls, stairways, restrooms and other areas and improvements provided by Landlord (“Common Area(s)”) for the general use in common with all tenants, their officers, agents, employees and customers, shall at all times be subject to the exclusive control and management of Landlord which shall have the right from time to time to establish, modify and enforce reasonable rules and regulations with respect to all facilities and areas mentioned in this Section 8.01. Landlord shall have the right to construct, maintain and operate lighting and drainage facilities on or in all such areas and improvements; to the same, from time to time, to change the area, level, location and arrangement of parking areas and other facilities hereinabove referred to; to restrict parking by tenants, their officers, agents and employees to employee parking areas; to close temporarily all or any portion of such areas or facilities to such extent as may, in the opinion of counsel, be legally sufficient to prevent a dedication thereof or the accrual of any rights to any person or the public therein; to assign reserved parking spaces for exclusive use of certain tenants or for customer parking, to discourage non-employee and non-customer parking; and to do and perform such other acts in and to such areas and improvements as, in the exercise of good business judgment, Landlord shall determine to be advisable with a view toward maintaining of appropriate convenience uses, amenities, and for permitted use by tenants, their officers, agents, employees and customers. Landlord shall at all times operate and maintain the Common Facilities (as defined herein) referred to above in a manner commensurate with Class A office buildings located in Salt Lake City, Utah. Without limiting the scope of such discretion, Landlord shall have the full right and authority to employ all personnel and to make all rules and regulations pertaining to and necessary for the proper operation, security and maintenance of the Common Areas and Common Facilities. Building project signs, traffic control signs and other signs determined by Landlord to be in best interest of the Building shall be considered part of Common Area and Common Facilities.

“Common Facilities” means all areas, space, equipment and special services available for the common or joint use and/or benefit of any of the occupants of the Building their employees, agents, servants, customers and other invitees, including without limitation, parking areas, access roads, driveways, retaining walls, landscaped areas, truck serviceways or tunnels, loading docks, pedestrian lanes, courts, stairs, ramps and sidewalks, comfort and first-aid stations, washrooms, restrooms, janitorial rooms, transformer vaults, electrical rooms, sprinkler riser rooms, common equipment storage rooms, information booths, canopies, utility systems, energy management systems, roof drains, sumps and gutters, walls and fences, if any.

SECTION 8.02 LICENSE. All Common Areas and Common Facilities not within the Leased Premises, which Tenant may be permitted to use and occupy, are to be used and occupied under a revocable license, and if the amount of such areas be diminished, Landlord shall not be subject to any liabilities nor shall Tenant be entitled to any compensation or diminution or abatement of rent, nor shall such diminution of such areas be deemed constructive or actual eviction, so long as such revocations or diminutions are deemed by Landlord to serve the best interests of the Building. The term of such revocable license shall be coterminous with this Lease and shall not be revoked or terminated during the Rental Term of this Lease.

SECTION 8.03 AUDIT. Tenant shall have the right, not more frequently than once every two (2) calendar years, to audit Landlord’s or Landlord’s balance sheet pertaining to Operating Cost Expenses for the prior two (2) Lease Years (the “CAM Audit”). Tenant shall not be permitted to utilize a so-called “contingent fee” Operating Cost Expenses auditor. Accordingly, any representative of Tenant conducting, assisting, or having any involvement with the CAM Audit shall not be permitted to have a financial stake in the outcome of the CAM Audit and Landlord shall be entitled to receive credible evidence of the same and Landlord may refuse to allow such CAM Audit in the absence of such evidence. Additionally, any representative of Tenant conducting a CAM Audit shall first sign a confidentiality agreement that provides that it shall not disclose the CAM Audit, its conclusions or any information obtained in the course of conducting the CAM Audit to anyone other than Tenant and Landlord.

Landlord shall retain its records regarding Operating Expenses for a period of at least two (2) years following the final billing for each calendar year during the Rental Term. At any time during such two (2) year period, upon thirty (30) days’ advance written notice to Landlord, Tenant may conduct a CAM Audit. The CAM Audit shall commence on a date of which Tenant has notified Landlord not less than thirty (30) days in advance. Tenant shall in all cases share with Landlord the conclusions of the CAM Audit and any CAM Audit report. If the CAM Audit discloses an overbilling, Landlord may, by written notice to Tenant within forty-five (45) days of Landlord’s receipt of a copy of the CAM Audit, object to the conclusions or process of the CAM Audit, stating its conclusions as to whether or not there was any overbilling (and if so, the amount thereof). If Tenant disputes Landlord’s conclusions, Tenant shall notify Landlord and the parties shall use good faith efforts to resolve the dispute. If Landlord agrees with the CAM Audit, Landlord shall pay to Tenant the amount of the overbilling within forty-five (45) days of Landlord’s receipt of a copy of the CAM Audit. If the CAM Audit discloses an underbilling, Tenant shall pay to Landlord the amount of the underbilling within forty-five (45) days of Tenant’s receipt of a copy of the CAM Audit or its conclusions.

13

ARTICLE IX. ALTERATIONS, SIGNS, LOCKS & KEYS

SECTION 9.01 ALTERATIONS. Tenant shall not make or suffer to be made any alterations or additions to the Leased Premises or any part thereof without the prior written consent of Landlord; provided however, such consent of Landlord shall not be unreasonably withheld for any non-structural alterations or additions to the Leased Premises proposed by Tenant. Any additions to, or alterations of the Leased Premises except movable furniture, equipment and trade fixtures shall become a part of the realty and belong to Landlord upon the termination of this Lease or Rental Term renewal or other termination or surrender of the Leased Premises to Landlord.

SECTION 9.02 SIGNS. Tenant shall not place or suffer to be placed or maintained on any exterior door, wall or window of the Leased Premises, or elsewhere in the Building, any sign, awning, marquee, decoration, lettering, attachment, canopy, advertising matter or other thing of any kind, and shall not place or maintain any decoration, lettering or advertising matter on the glass of any window or door of the Leased Premises without first obtaining Landlord’s written approval, which shall not be unreasonably withheld or delayed. Tenant shall maintain any such sign, decoration, lettering, advertising matter or other things as may be approved in good condition and repair at all times. Landlord may, at Tenant’s cost, and without liability to Tenant, enter the Leased Premises and remove any item erected in violation of this Section 9.02. Landlord has established rules and regulations governing the size, type and design of all signs, decorations, etc., which is specifically set forth in Exhibit “E” and Exhibit “E-1”. Tenant’s signage on the Building and/or the Project is subject to Landlord and Salt Lake City approval.

SECTION 9.03 LOCKS AND KEYS. Landlord shall install a card key system for access to the Building and covered parking area and shall issue appropriate card keys to Tenant and Tenant’s authorized employees. Landlord shall initially provide keys for entry doors to the Leased Premises. From time to time, Tenant may change locks or install other locks on such doors, but if Tenant does, Tenant must provide Landlord with duplicate keys within twenty-four (24) hours after such change or installation. Tenant, upon termination of this Lease, shall deliver to Landlord all the keys to the Building and the Leased Premises including any interior offices, toilet rooms, combinations to built-in safes, etc. which shall have been furnished to or by Tenant or are in the possession of Tenant.

ARTICLE X. MAINTENANCE AND REPAIRS; ALTERATIONS; ACCESS

SECTION 10.01 LANDLORD’S OBLIGATION FOR MAINTENANCE. Landlord shall at all times maintain and repair, in a manner commensurate with Class A office buildings located in Salt Lake City, Utah: (1) the areas outside the Leased Premises including hallways, public restrooms, if any, general landscaping, parking areas, driveways and walkways within the project; (2) the roof or roof systems, structural items (including but not limited to exterior walls, load bearing columns, foundation and floor slabs) of the Building or Project; and (3) all plumbing, electrical, heating, and air conditioning systems. However, if the need for such repairs or maintenance results from any careless, wrongful or negligent act or omission of Tenant, Tenant shall pay the entire cost of any such repair or maintenance including a reasonable charge to cover Landlord’s supervisory overhead. Landlord shall not be obligated to repair any damage or defect until receipt of written notice from Tenant of the need of such repair and Landlord shall have a reasonable time after receipt of such notice in which to make such repairs. Tenant shall give immediate notice to Landlord in case of fire or accidents in the Leased Premises or in the Building of which the Leased Premises are a part or of defects therein or in any fixtures or equipment provided by Landlord. Costs of Landlord provided maintenance for Item 2 herein shall be included as Operating Expenses as defined in Section 3.03(d) and (e) herein.

SECTION 10.02 TENANT’S OBLIGATION FOR MAINTENANCE.

(a) Tenant shall provide its own janitorial service and keep and maintain the Leased Premises including the interior wall surfaces and windows, floors, floor coverings and ceilings in a clean, sanitary and safe condition in accordance with the laws of the State and in accordance with all directions, rules and regulations of the health officer, fire marshal, building inspector, or other proper officials of the governmental agencies having jurisdiction, at the sole cost and expense of Tenant, and Tenant shall comply with all requirements of law, ordinance and otherwise, affecting the Leased Premises.

(b) Tenant shall pay, when due, all claims for labor or material furnished, for work under Sections 9.01, 9.02 and 10.02 hereof, to or for Tenant at or for use in the Leased Premises, and shall bond such work if reasonably required by Landlord to prevent assertion of claims against Landlord.

(c) Tenant agrees to be responsible for all furnishings, fixtures and equipment located upon the Leased Premises from time to time and shall replace carpeting within the Leased Premises if same shall be damaged by tearing, burning, or stains resulting from spilling anything on such carpet, reasonable wear and tear accepted. Tenant further agrees to use chair mats or floor protectors wherever it uses chairs with wheels or casters on carpeted areas.

SECTION 10.03 SURRENDER AND RIGHTS UPON TERMINATION.

(a) This Lease and the tenancy hereby created shall cease and terminate at the end of the Rental Term, or any Rental Term extension or renewal, without the necessity of any notice form either Landlord or Tenant to terminate the same, and Tenant hereby waives notice to vacate the Leased Premises and agrees that Landlord shall be entitled to the benefit of all provisions of law respecting summary

14

recovery of possession of the Leased Premises from a Tenant holding over to the same extent as if statutory notice has been given.

(b) Upon termination of this Lease at any time and for any reason whatsoever, Tenant shall surrender and deliver up the Leased Premises, including the items constituting Tenant’s Work, to Landlord in the same condition as when the Leased Premises were delivered to Tenant or as altered as provided in Section 9.01, ordinary wear and tear accepted. Upon request of Landlord, Tenant shall promptly remove all personal property from the Leased Premises and repair any damage caused by such removal. Obligations under this Lease relating to events occurring or circumstances existing prior to the date of termination shall survive the expiration or other termination of the Rental Term of this Lease. Liabilities accruing after date of termination are defined in Sections 19.01 and 19.02.

ARTICLE XI. INSURANCE AND INDEMNITY

SECTION 11.01 LIABILITY INSURANCE AND INDEMNITY. Tenant shall, during all terms hereof, keep in full force and effect a policy of commercial general liability insurance with respect to the Leased Premises, with a combined single limit of not less than Two Million Dollars ($2,000,000.00) per occurrence. The policy shall name Landlord, property manager (i.e., Woodbury Corporation) and any other persons, firms or corporations designated by Landlord and Tenant as additional insureds, and shall contain a clause that the insurer shall not cancel or change the insurance without first giving Landlord ten (10) days prior written notice. Such insurance shall include an endorsement permitting Landlord and property manager to recover damage suffered due to act or omission of Tenant, notwithstanding being named as an additional “insured party” in such policies. Such insurance may be furnished by Tenant under any blanket policy carried by it or under a separate policy therefor. The insurance shall be with an insurance company approved by Landlord and a copy of the paid-up policy evidencing such insurance or a certificate of insurer certifying to the issuance of such policy shall be delivered to Landlord. If Tenant fails to provide such insurance, Landlord may do so and charge same to Tenant.

SECTION 11.02 FIRE AND CASUALTY INSURANCE.

(a) Subject to the provisions of this Section 11.02, Landlord shall secure, pay for, and at all times during the Rental Term hereof maintain fire and casualty, insurance providing coverage upon the building improvements in an amount equal to the full insurable replacement value thereof (as determined by Landlord). Such insurance shall include twelve (12) months rental income coverage as well as such additional endorsements as may be required by Landlord’s lender or Landlord. All insurance required hereunder shall be written by reputable, responsible companies licensed in the State of Utah. Tenant shall have the right, at its request at any reasonable time, to be furnished with copies of the insurance policies then in force pursuant to this Section 11.02, together with evidence that the premiums therefor have been paid.

(b) Tenant agrees to maintain at its own expense such fire and casualty insurance coverage as Tenant may desire or require in respect to Tenant’s personal property, equipment, furniture, fixtures or inventory and Landlord shall have no obligation in respect to such insurance or losses. All property kept or stored on the Leased Premises by Tenant or with Tenant’s permission shall be so done at Tenant’s sole risk and Tenant shall indemnify Landlord against and hold it harmless from any claims arising out of loss or damage to same.

(c) Tenant shall not permit the Leased Premises to be used for any purpose which would render the insurance thereon void or cause cancellation thereof or increase the insurance risk or increase the insurance premiums in effect just prior to the Rental Term Commencement Date of this Lease (this restriction shall not apply to the BBQ Use). Tenant agrees to pay as Additional Rent the total amount of any increase in the insurance premium of Landlord over that in effect prior to the Rental Term Commencement Date of this Lease to the extent solely resulting from Tenant’s unique and particular use of the Leased Premises. If Tenant installs any electrical or other equipment which overloads the lines in the Leased Premises, Tenant shall, at its own expense, make whatever changes are necessary to comply with the requirements of Landlord’s insurance.

(d) Tenant shall be responsible for all glass breakage from any cause whatsoever and agrees to immediately replace all glass broken or damaged during the Rental Term with glass of the same quality as that broken or damaged. Landlord may replace, at Tenant’s expense, any broken or damaged glass if not replaced by Tenant within five (5) days after such damage.

SECTION 11.03 WAIVER OF SUBROGATION. Each party hereto does hereby release and discharge the other party hereto and any officer, agent, employee or representative of such party, of and from any liability whatsoever hereafter arising from loss, damage or injury caused by fire or other casualty for which insurance (permitting waiver of liability and containing a waiver of subrogation) is carried by the injured party at the time of such loss, damage or injury to the extent of any recovery by the injured party under such insurance.

SECTION 11.04 INDEMNIFICATION.

15

(a) Subject to the terms and conditions set forth in Section 11.03, Tenant shall indemnify Landlord and save it harmless from and against any and all claims, actions, damages, liability and expense in connection with loss of life, personal injury and/or damage to property arising from or out of any occurrence in, upon or at the Leased Premises or from the occupancy or use by Tenant of the Leased Premises or any part thereof, or occasioned wholly or in part by any act or omission of Tenant, its agents, contractors, employees, servants, sublessees, concessionaires or business invitees to extent not covered by insurance required by Article XI. For the purpose hereof, the Leased Premises shall include the outdoor patio and green space allocated to the use of Tenant. In case Landlord is, without fault on its part, made a party to any litigation commenced by or against Tenant, then Tenant shall protect and hold Landlord harmless and shall pay all costs, expenses and reasonable attorneys’ fees incurred or paid by Landlord in defending itself or enforcing the covenants and agreements of this Lease.

(b) Subject to the terms and conditions set forth in Section 11.03, To the extent not covered by the insurance required to be maintained by Tenant, or that would not have been covered by insurance had Tenant maintained such insurance, Landlord agrees to indemnify and save harmless Tenant in regard to third parties for damages occurring on the Common Area proximately caused by the wrongful acts or negligence of Landlord, its contractors, agents or employees in scope of their employment, including costs of defense and reasonable attorneys’ fees incurred in such defense. In case Tenant is, without fault on its part, made a party to litigation against Landlord as a result of such acts or negligence which Tenant’s insurer is not required to defend, then Landlord shall indemnify Tenant against costs of such defense including reasonable attorneys’ fees.

ARTICLE XII UTILITY CHARGES

SECTION 12.01 OBLIGATION OF LANDLORD. Unless otherwise agreed in writing by the parties, during the Rental Term of this Lease Landlord shall cause to be furnished to the Leased Premises during “standard operating hours” which shall be 7:00 a.m. to 7:00 p.m. Monday through Friday and 8:00 a.m. to 12:00 p.m. on Saturday, excluding holidays, the following utilities and services, the cost and expense of which shall be included in Operating Expenses:

(a) Electricity, water, gas and sewer service.

(b) Telephone connection, but not including telephone stations and equipment (it being expressly understood and agreed that Tenant shall be responsible for the ordering and installation of telephone lines and equipment which pertain to the Leased Premises).