EXECUTION VERSION Constellium: First Omnibus Amendment 745268061 FIRST OMNIBUS AMENDMENT This FIRST OMNIBUS AMENDMENT, dated as of December 21, 2021 (this “Amendment”) is: (1) THE FIRST AMENDMENT to the RECEIVABLES SALE AGREEMENT, between Constellium...

EXECUTION VERSION Constellium: First Omnibus Amendment 745268061 FIRST OMNIBUS AMENDMENT This FIRST OMNIBUS AMENDMENT, dated as of December 21, 2021 (this “Amendment”) is: (1) THE FIRST AMENDMENT to the RECEIVABLES SALE AGREEMENT, between Constellium Muscle Shoals LLC, as seller (the “RSA Seller) and Constellium Muscle Shoals Funding III LLC, as purchaser; and (2) THE FIRST AMENDMENT to the RECEIVABLES PURCHASE AGREEMENT, among Constellium Muscle Shoals Funding III LLC, as seller (the “RPA Seller”), Constellium Muscle Shoals LLC, as servicer (the “Servicer”), Deutsche Bank Trust Company Americas, Deutsche Bank AG New York Branch, and each other subsidiary or affiliate of either such party who may from time to time become a party hereto (collectively, “DB”), in such capacity as a purchaser hereunder (each, a “RPA Purchaser”), and Intesa Sanpaolo S.p.A., New York Branch and each subsidiary or affiliate who may from time to time become a party hereto (collectively, “Intesa”), in its capacity as a purchaser hereunder (each, a “Purchaser” and, together with DB, and each of their permitted successors and assigns, collectively, the “Purchasers”), and in its capacity as purchaser representative hereunder (together with its successors and permitted assigns in such capacity, the “Purchaser Representative”). RECITALS WHEREAS, the RSA Seller and the RPA Seller have heretofore entered into the RECEIVABLES SALE AGREEMENT, dated as of September 30, 2021 (as amended, restated, supplemented, assigned or otherwise modified from time to time, the “Receivables Sale Agreement”); WHEREAS, Constellium International SAS (the “Parent”) has heretofore entered into a PERFORMANCE UNDERTAKING, dated as of September 30, 2021, in favor of the RPA Seller with respect to obligations under the Receivables Sale Agreement (the “First Tier Parent Guarantee”); WHEREAS, the RPA Seller, the Servicer, Intesa (in its capacity as purchaser and purchaser representative) and DB (in its capacity as purchaser) heretofore entered into the RECEIVABLES PURCHASE AGREEMENT, dated as of September 30, 2021 (as amended, restated, supplemented or otherwise modified from time to time, the “Receivables Purchase Agreement”; together with the Receivables Sale Agreement, each an “Agreement” and collectively, the “Agreements”); WHEREAS, the Parent has heretofore entered into an PERFORMANCE UNDERTAKING, dated as of September 30, 2021, in favor of the Purchasers with respect to obligations under the Receivables Purchase Agreement (the “Second Tier Parent Guarantee,” and together with the First Tier Parent Guarantee, the “Guarantees”); WHEREAS, the parties hereto seek to modify each of the Agreements upon the terms hereof.

4 Constellium: First Omnibus Amendment 745268061 SECTION 9. Governing Law. This Amendment shall be governed by the laws of the State of New York, without giving effect to conflict of laws principles that would require the application of the law of any other jurisdiction. SECTION 10. Transaction Document. This Amendment shall be a Transaction Document under each of the Agreements. SECTION 11. Section Headings. The various headings of the Amendment are inserted for convenience only and shall not affect the meaning or interpretation of this Amendment or the Agreements or any provision hereof or thereof. SECTION 12. Severability. If any one or more of the agreements, provisions or terms of this Amendment shall for any reason whatsoever be held invalid or unenforceable, then such agreements, provisions or terms shall be deemed severable from the remaining agreements, provisions and terms of this Amendment and shall in no way affect the validity or enforceability of the provisions of this Amendment. . [Signatures follow]

S-2 Constellium: First Omnibus Amendment 745268061 INTESA SANPAOLO S.P.A., NEW YORK BRANCH, as a Purchaser and as Purchaser Representative By: /s/ Xxxxx Xxxxxxxx Name: Xxxxx Xxxxxxxx Title: Head of Financial Institutions - SEF & TEF By: /s/ Xxxxx Xxxxxxxxx Name: Xxxxx Xxxxxxxxx Title: Business Director Intesa’s Aggregate Commitment: $200,000,000.00 Intesa’s Sublimit Commitment for Crown Cork and Seal USA, Inc.: $70,000,000.00

S-3 Constellium: First Omnibus Amendment 745268061 DEUTSCHE BANK TRUST COMPANY AMERICAS, as a Purchaser By: /s/ Xxxxxxxx Xxxx Name: Xxxxxxxx Xxxx Title: Director By: /s/ Xxxxxx Xxxxxxxxxxx Name: Xxxxxx Xxxxxxxxxxx Title: Director DEUTSCHE BANK AG NEW YORK BRANCH, as a Purchaser By: /s/ Xxxxxxxx Xxxxxx Name: Xxxxxxxx Xxxxxx Title: Director By: /s/ Xxxxxxx Xxxxxxxxxxx Name: Xxxxxxx Xxxxxxxxxxx Title: Assistant Vice President DB’s Aggregate Commitment: $100,000,000.00 DB’s Sublimit Commitment for Crown Cork and Seal USA, Inc.: $40,000,000.00

S-4 Constellium: First Omnibus Amendment 745268061 ACKNOWLEDGED AND AGREED: CONSTELLIUM INTERNATIONAL SAS, as the Parent By: /s/ Xxxxxxx Xxxxxxx Name: Xxxxxxx Xxxxxxx Title: General Manager

A-1 Constellium: First Omnibus Amendment 745268061 EXHIBIT A

EXECUTION VERSION 745268223 RECEIVABLES SALE AGREEMENT This RECEIVABLES SALE AGREEMENT (as it may be amended, modified or supplemented from time to time, this “Agreement”) is made as of September 30, 2021, between Constellium Muscle Shoals LLC, a Delaware limited liability company (“Seller”) and Constellium Muscle Shoals Funding III LLC, a Delaware limited liability company (“Purchaser”). RECITALS WHEREAS, Seller is a supplier of goods or services to each account debtor listed on Schedule 1 hereto (each an “Account Debtor” and, collectively, the “Account Debtors”) and is the legal and beneficial owner of Receivables (as hereinafter defined) payable by each such Account Debtor; WHEREAS, Seller desires to sell certain Receivables to Purchaser, and Purchaser is willing to purchase from Seller such Receivables, in which case the terms set forth herein shall apply to such purchase and sale; WHEREAS, the Purchaser and Wise Alloys Funding II, LLC have previously entered into that certain Receivables Sale Agreement dated as of March 16, 2016 (as amended through and prior to the date hereof, the “Prior Agreement”); WHEREAS, the Prior Agreement is expiring pursuant to its terms on September 30, 2021 and the parties hereto wish to replace the Prior Agreement with this Agreement. THEREFORE, for good and valuable consideration, the sufficiency of which is hereby acknowledged, the parties hereto agree as follows: 1. DEFINITIONS. (a) Certain capitalized terms used in this Agreement shall have the meanings given to those terms in Exhibit A attached hereto and thereby incorporated herein. (b) As used in this Agreement, the terms “include” and “including” shall be read as if followed by “without limitation” whether or not so followed. 2. SALE AND PURCHASE. (a) Sale. Commencing on the date hereof and ending on the Purchase Termination Date, Seller may from time to time make an offer to sell to Purchaser certain Proposed Receivables by submitting to Purchaser a request substantially in the form of Exhibit B hereto by 2:00 p.m., (New York City time), at least three Business Days prior to any purchase hereunder (a “Purchase Request”), and Purchaser agrees, subject to the requirements for purchase and all of the terms and conditions therefor set forth herein (including the conditions precedent set forth in Section 2(c)), to purchase or accept as a capital contribution, as set forth in Section 2(e) from Seller the Proposed Receivables identified in such Purchase Request. Subject to the satisfaction of the conditions precedent set forth in Section 2(c) hereof, Purchaser shall and hereby does purchase or accept as a capital contribution, as set forth in Section 2 (e) from Seller, and Seller shall and hereby

3 745268223 (vi) Purchaser shall have received at least three Business Days prior to any purchase (A) a Purchase Request with respect to the Proposed Receivables, (B) the related Contract (or portion thereof that is permitted to be disclosed to the Purchaser by the parties to such applicable Contract) for such Proposed Receivables, and (C) such additional supporting documentation that Purchaser may have reasonably requested; (vii) Purchaser is not legally prohibited from purchasing the Proposed Receivables listed on the relevant Purchase Request; (viii) The representations and warranties contained in this Agreement and the Purchase Request shall be true and correct (subject to any applicable materiality qualification to the extent expressly set forth in any particular representation or warranty) on and as of such Purchase Date; (ix) Seller and Parent shall be in compliance (subject to any applicable materiality qualification to the extent expressly set forth in any particular covenant or other provision) with each term, covenant and other provision of this Agreement and the Parent Guarantee applicable to Seller or Parent, as applicable; (x) No Event of Repurchase shall then exist hereunder or under (and as defined in) the Prior Agreement, unless Seller has repurchased and paid (or is paying on such proposed Purchase Date and Purchaser is satisfied that Seller will be paying on such proposed Purchased Date in cash), the full amount of the Repurchase Price (or the amount subject to Dispute or Dilution, to the extent provided pursuant to Section 7 hereof) for the affected Purchased Receivables pursuant to the terms of Section 7 hereof; (xi) Following the sale and purchase of the Proposed Receivables set forth in the related Purchase Request, the sum of (x) the Outstanding Aggregate Purchase Amount for all Purchased Receivables hereunder, plus (y) the Prior Agreement Outstanding Aggregate Purchase Amount, which remain outstanding, shall not exceed the Facility Amount hereunder; (xii) (A) No Account Debtor Insolvency Event shall have occurred and be continuing with respect to any Account Debtor obligated on the Proposed Receivables described in such Purchase Request, and no Insolvency Event with respect to Seller or Parent shall have occurred and be continuing; and (B) neither Xxxxx’x nor Standard & Poor’s shall have rated or downgraded Anheuser-Xxxxx InBev SA/NV from its current rating to a rating below Baa3 (in the case or Xxxxx’x) or below BBB- (in the case of Standard & Poor’s); (xiii) [Reserved]; and (xiv) On the initial Purchase Date, Purchaser shall have received each of the following documents, each dated such date and in form and substance satisfactory to Purchaser: (A) Executed counterparts of this Agreement and each of the other Transaction Documents by the parties thereof;

18 745268223 Debtor Insolvency Event, unless Seller is in breach or default of the performance of its obligations hereunder or under the terms of such Receivable. (b) Any fees, expenses, indemnity, Repurchase Price or other amounts payable by Seller to Purchaser in connection with this Agreement shall bear interest each day from the date due until paid in full at the Delinquent Rate, whether before or after judgment. Such interest shall be payable on demand. Fees are deemed payable on the date or dates set forth herein; expenses, indemnity, or other amounts payable by Seller to Purchaser are due ten (10) days after receipt by Seller of written demand thereof. 10. GENERAL PAYMENTS. All amounts payable by Seller to Purchaser under this Agreement shall be paid in full, free and clear of all deductions, set-off or withholdings whatsoever except only as may be required by law, and shall be paid on the date such amount is due by not later than 3:00 pm (New York City time) to the account of Purchaser notified to Seller from time to time. For the avoidance of doubt, Seller shall not be responsible for any deductions, set-off or withholdings made by the Account Debtors or required by law, except to the extent provided for in Section 7 above. If any deduction or withholding is required by law other than as Excluded Taxes, Seller shall pay to Purchaser such additional amount as necessary to ensure that the net amount actually received by Purchaser equals to the full amount Purchaser should have received had no such deduction or withholding been required. All payments to be made hereunder or in respect of a Purchased Receivable shall be in USD. Any amounts that would fall due for payment on a day other than a Business Day shall be payable on the succeeding Business Day. All interest amounts calculated on a per annum basis hereunder are calculated on the basis of a year of three hundred sixty (360) days. 11. LIMITATION OF LIABILITY. IN NO EVENT SHALL PURCHASER SHALL BE LIABLE TO SELLER FOR ANY SPECIAL INCIDENTAL OR CONSEQUENTIAL DAMAGES ARISING OUT OF THIS AGREEMENT (INCLUDING LOST PROFITS OR LOSS OF BUSINESS). 12. NOTICES. Unless otherwise provided herein, any notice, request or other communication which Purchaser or Seller may be required or may desire to give to the other party under any provision of this Agreement shall be in writing and sent by email, hand delivery or first class mail, certified or registered and postage prepaid, and shall be deemed to have been given or made when transmitted with receipt confirmed in the case of email, when received if sent by hand delivery or five (5) days after deposit in the mail if mailed, and in each case addressed to Purchaser or Seller as set forth below. Any party hereto may change the address to which all notices, requests and other communications are to be sent to it by giving written notice of such address change to the other parties in conformity with this paragraph, but such change shall not be effective until notice of such change has been received by the other parties. If to Seller: Constellium Muscle Shoals LLC 0000 Xxxxxx Xxxxxx Xxxxxx Xxxxxx, XX 00000

20 745268223 (a) This Agreement shall be governed by the laws of the State of New York, without giving effect to conflict of laws principles that would require the application of the law of any other jurisdiction. (b) Each of the parties hereto irrevocably and unconditionally submits, for itself and its property, to the nonexclusive jurisdiction of any New York State court or federal court of the United States sitting in the Borough of Manhattan, New York City, and any appellate court from any thereof, in any action or proceeding arising out of or relating to this Agreement, or for recognition or enforcement of any judgment. Each of the parties hereto hereby irrevocably and unconditionally agrees that all claims in respect of any such action or proceeding may be heard and determined in any such New York State court or, to the extent permitted by law, in such federal court. A final judgment in any such action or proceeding shall be conclusive and may be enforced in other jurisdictions by suit on the judgment or in any other manner provided by law. Each of the parties hereto irrevocably and unconditionally waives, to the fullest extent it may legally and effectively do so, any objection that it may now or hereafter have to the laying of venue of any suit, action or proceeding arising out of or relating to this Agreement in any New York State or federal court located in the Borough of Manhattan. Each of the parties hereto hereby irrevocably waives, to the fullest extent permitted by law, the defense of inconvenient forum to the maintenance of such action or proceeding in any such court. (c) EACH PARTY HERETO IRREVOCABLY WAIVES ANY RIGHT THAT SUCH PERSON MAY HAVE TO A JURY TRIAL OF ANY CLAIM OR CAUSE OF ACTION BASED UPON OR ARISING OUT OF ANY OF THE TRANSACTIONS CONTEMPLATED HEREIN, INCLUDING CONTRACT CLAIMS, TORT CLAIMS, BREACH OF DUTY CLAIMS AND ALL OTHER COMMON LAW OR STATUTORY CLAIMS. 15. GENERAL PROVISIONS. (a) This Agreement represents the final agreement of the parties with respect to the subject matter hereof and supersedes all prior and contemporaneous understandings and agreements with respect to such subject matter. No provision of this Agreement may be amended or waived except by a writing signed by the parties hereto. (b) This Agreement shall bind and inure to the benefit of the respective successors and permitted assigns of each of the parties; provided, however, that Seller may not assign any of its rights hereunder without Purchaser’s prior written consent, given or withheld in Purchaser’s sole discretion. Purchaser shall have the right without the consent of or notice to Seller to sell, transfer, negotiate or grant participations in all or any part of, or any interest in, Purchaser’s obligations, rights and benefits hereunder and in any of the Sold Assets hereunder. (c) Each provision of this Agreement shall be severable from every other provision hereof for the purpose of determining the legal enforceability of any specific provision. This Agreement may be executed in any number of counterparts and by different parties on separate counterparts, each of which, when executed and delivered, shall be deemed to be an original, and all of which, when taken together, shall constitute but one and the same agreement.

22 745268223 [remainder of page intentionally blank]

Sch. 1 745268223 Schedule 1 Account Debtors 1. Anheuser-Xxxxx LLC (but only so long as Anheuser-Xxxxx LLC remains a direct or indirect wholly-owned subsidiary of Anheuser-Xxxxx InBev SA/NV) 2. Crown Cork and Seal USA, Inc. (but only so long as Crown Cork and Seal USA, Inc. is a direct or indirect wholly-owned subsidiary of Crown Holdings Inc.)

Sch. 2 745268223 Schedule 2 Seller Information Schedule Actual Name, as reflected in the attached organizational documents (i.e., certified copy of the Certificate of Incorporation, Articles of Formation or Certificate of Limited Partnership): Constellium Muscle Shoals LLC Trade Name(s) (if any): n/a Type and Jurisdiction of Organization (e.g. Delaware corporation, sole proprietorship): Delaware limited liability company Address of Place of Business (if only one) or Chief Executive Office (if more than one place of business): Constellium Muscle Shoals LLC 0000 Xxxxxx Xxxxxx Xxxxxx Xxxxxx, XX 00000 Attn: Xxxx Xxxxxx or Treasury Department Fax: 000.000.0000 Email: xxxx.xxxxxx@xxxxxxxxxxx.xxx Seller Payment Instructions: Account maintained in the name of Constellium Muscle Shoals LLC at Xxxxx Fargo Bank, National Association, with account number 2000013956783 or such other account designated by the Seller from time to time.

Exhibit A-1 745268223 Exhibit A Definitions “ABL Agent”: means Xxxxx Fargo Bank, National Association, as successor in interest to General Electric Capital Corporation, in its capacity as agent under the ABL Credit Agreement, together with its successors and assigns. “ABL Credit Agreement”: means the credit agreement, dated as of December 11, 2013 (as amended, restated, supplemented or otherwise modified from time to time), by and among Constellium Muscle Shoals LLC (f/k/a Wise Alloys LLC), as the borrower, the other credit parties signatory thereto, the ABL Agent, and the lenders signatory thereto. “Account Debtor”: The meaning set forth in the recitals hereto. “Account Debtor Insolvency Event”: With respect to any Account Debtor, such Account Debtor shall generally not pay its debts as such debts become due, or shall admit in writing its inability to pay its debts generally (including its obligations under the Receivables), or shall make a general assignment for the benefit of creditors; or any proceeding shall be instituted by or against such Account Debtor seeking to adjudicate it a bankrupt or insolvent, or seeking liquidation, winding up, reorganization, arrangement, adjustment, protection, relief, or composition of it or its debts under any law relating to bankruptcy, insolvency or reorganization or relief of debtors, or seeking the entry of an order for relief or the appointment of a receiver, trustee, custodian or other similar official for it or for any substantial part of its property, or any of the actions sought in such proceeding (including, without limitation, the entry of an order for relief against, or the appointment of a receiver, trustee, custodian or other similar official for, it or for any substantial part of its property) shall occur; or such Account Debtor shall take any action to authorize any of the actions set forth above in this definition. “Adverse Claim”: means any ownership interest or claim, mortgage, deed of trust, pledge, lien, security interest, hypothecation, charge or other encumbrance or security arrangement of any nature whatsoever, whether voluntarily or involuntarily given, including, but not limited to, any conditional sale or title retention arrangement, and any assignment, deposit arrangement or lease intended as, or having the effect of, security and any filed financing statement or other notice of any of the foregoing (whether or not a lien or other encumbrance is created or exists at the time of the filing); it being understood that any such interest, lien or claim in favor of, or assigned to the Purchaser hereunder or Constellium Muscle Shoals Funding II, LLC under the Prior Agreement, shall not constitute an Adverse Claim. “Affiliate”: With respect to any Person, each officer, director, general partner or joint- venturer of such Person and any other Person that directly or indirectly controls, is controlled by, or is under common control with, such Person. For purpose of this definition, “control” means the possession of either (a) the power to vote, or the beneficial ownership of, 25% or more of the equity interests having ordinary voting power for the election of directors of such Person or (b) the power to direct or cause the direction of the management and policies of such Person, whether by contract or otherwise.

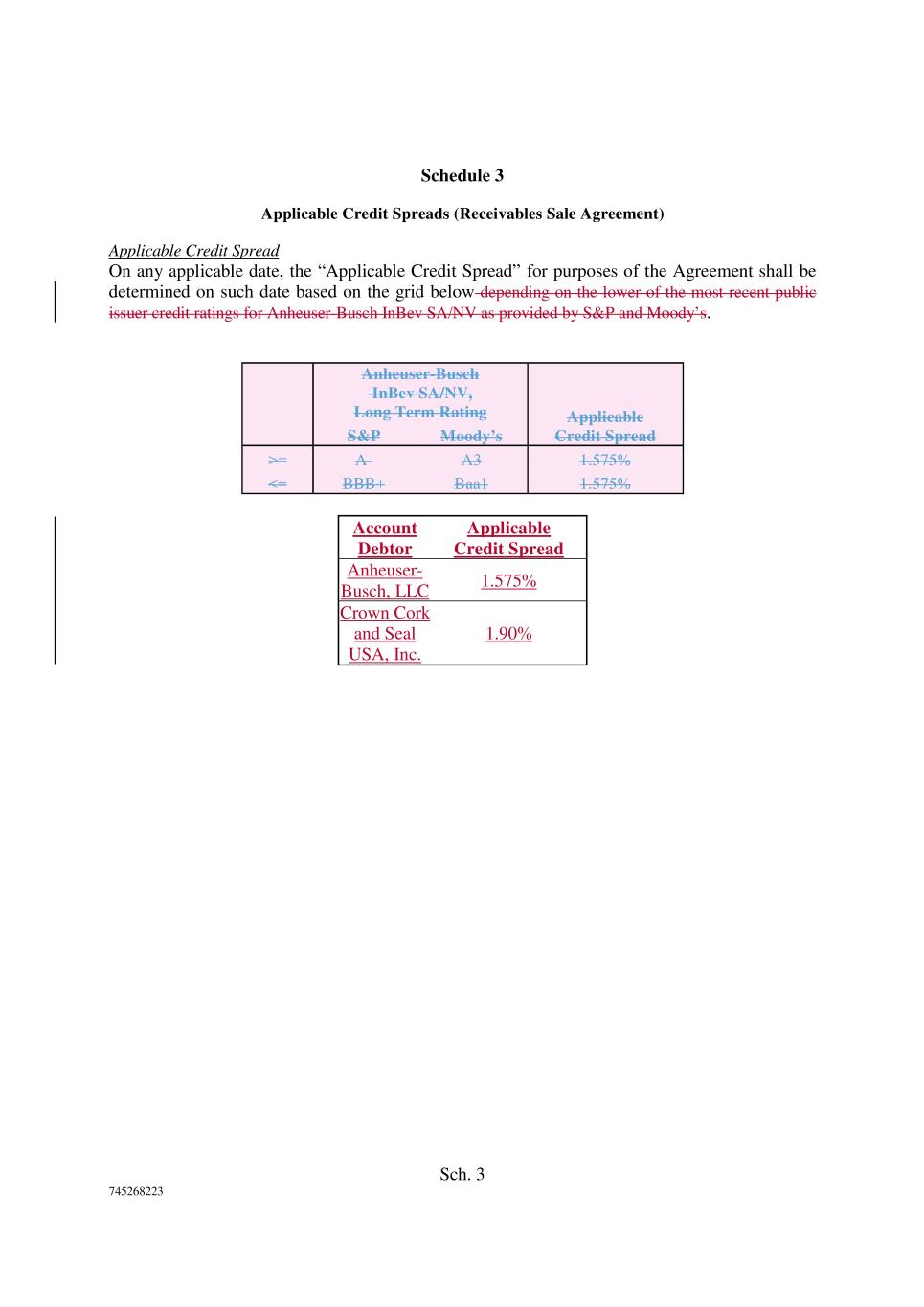

Exhibit A-2 745268223 “Agreement”: The meaning set forth in the first paragraph of the agreement to which this Exhibit is attached. “Applicable Credit Spread”: On any applicable date of determination, means the credit spreads determined at such time in accordance with the credit spread chart set forth on Schedule 3 attached hereto. “Applicable Law”: means any law (including common law), constitution, statute, treaty, regulation, rule, ordinance, order, injunction, writ, decree, judgment, award or similar item of or by a governmental authority or any interpretation, implementation or application thereof. “Benchmark Discontinuation Event”: The meaning set forth in Section 17 hereof. “Buffer Period”: means five (5) days. “Business Day”: means any day that is not a Saturday, Sunday or other day on which banks in New York City are required or permitted to close. “Capital Stock”: means, with respect to any Person, any and all common shares, preferred shares, interests, participations, rights in or other equivalents (however designated) of such Person’s capital stock, partnership interests, limited liability company interests, membership interests or other equivalent interests and any rights (other than debt securities convertible into or exchangeable for capital stock), warrants or options exchangeable for or convertible into such capital stock or other equity interests. “Change of Control”: means, if at any time, (i) Constellium SE ceases to own, directly or indirectly, 100% of the Capital Stock of Parent, (ii) Parent ceases to own directly or indirectly, 100% of the Capital Stock of the Originator or (iii) Seller ceases to own, directly or indirectly, free and clear of any Adverse Claim, except with respect to the ABL Credit Agreement, or any other similar incurrence of debt, 100% of the Capital Stock of the Purchaser. “Code”: means the Internal Revenue Code of 1986 and shall include all amendments, modifications and supplements thereto from time to time. “Collections”: means all collections and other proceeds received and payment of any amounts owed in respect of the Purchased Receivables, including, without limitation, all cash collections, wire transfers or electronic funds transfers. “Collection Account”: means the account maintained in the name of Constellium Muscle Shoals Funding III, LLC at Xxxxx Fargo Bank, National Association, with Account No. 4943965525 and ABA No. 000000000. “Compliance Action”: means any action taken by Purchaser (or any action that Purchaser instructs other members of the Purchaser, its Affiliates or subsidiaries to take) to the extent it is legally permitted to do so under the laws of its jurisdiction, which it, in its sole discretion, considers appropriate to act in accordance with Sanctions Laws or domestic and foreign laws and regulations, including without limitation, the interception and investigation of any payment, communication or instruction; the making of further enquiries as to whether a person or entity is subject to any

Exhibit A-3 745268223 Sanctions Laws; and the refusal to process any transaction or instruction that does not conform with Sanctions Laws. “Contracts”: means the contracts and other agreements related to the Purchased Receivables. “Credit and Collection Policy” means, as the context may require, those receivables credit and collection policies and practices of each Originator, or the Seller in effect on the date of this Agreement and delivered to Purchaser on or prior to the date hereof, as may be modified in compliance with this Agreement and the Transaction Documents. “Defaulted Receivable”: means a Receivable: (a) as to which any payment, or part thereof, remains unpaid for more than 10 days from the original due date for such payment, or (b) without duplication (i) as to which an Account Debtor Insolvency Event shall have occurred, or (ii) that has been (or consistent with its standard Credit and Collection Policies, should have been) written off on Seller’s or Purchaser’s books as uncollectible. “Default Ratio”: means the ratio (expressed as a percentage and rounded to the nearest 1/100 of 1%, with 5/1000th of 1% rounded upward) computed as of the last day of each calendar month by dividing: (a) the aggregate outstanding balance of all Purchased Receivables that became or remained Defaulted Receivables during such month, by (b) the aggregate outstanding balance of all Purchased Receivables during the month that is three calendar months before such month. “Delinquency Ratio”: means the ratio (expressed as a percentage and rounded to the nearest 1/100 of 1%, with 5/1000th of 1% rounded upward) computed as of the last day of each calendar month by dividing: (a) the aggregate outstanding balance of all Purchased Receivables that were Delinquent Receivables on such day by (b) the aggregate outstanding balance of all Purchased Receivables on such day. “Delinquent Receivable”: means a Receivable as to which any payment, or part thereof, remains unpaid for more than 5 days from the original due date for such payment. “Delinquent Rate”: A rate of interest equal to 2.00% per annum plus the Discount Rate. “Dilution”: All actual offsets to the face value of the Net Invoice Amount for the relating to one or more Purchased Receivables, including, without limitation, customer payment and/or volume discounts, write-offs, deductions, offsets, credit memoranda, returns and allowances, billing errors, rebates and other similar items but no event shall include failure or inability of the Account Debtor to timely pay due to credit-related reasons. “Discount Rate”: On any date of determination, a rate equal to LIBOR plus a per annum rate equal to the Applicable Credit Spread at such time. “Dispute”: Any dispute, Dilution, claim, defense or counterclaim relating to one or more Purchased Receivables (other than an adjustment granted with Purchaser’s prior written consent)

Exhibit A-4 745268223 asserted or claimed by the Account Debtor in writing or other reasonable and customary form of business communication and which is not remedied within 10 days regardless of whether the same (i) is in an amount greater than, equal to or less than the applicable Purchased Receivable, or (ii) arises by reason of an act of God, civil strife, war, currency restrictions, foreign political restrictions or regulations, or any other circumstance beyond the control of Seller or the applicable Account Debtor, but shall in no event include the failure of the Account Debtor to timely pay any of its obligations under the Receivable in the absence of a Dispute, Dilution or any other event for which any amount is payable pursuant to Section 6. For the avoidance of doubt, and notwithstanding the foregoing, the failure to make payment of a Purchased Receivable as a result of an Account Debtor Insolvency Event of the applicable Account Debtor shall not be deemed a “Dispute” hereunder. “Eligible Receivable”: A Receivable that satisfies each of the following conditions to the satisfaction of Purchaser: (i) is generated by Seller in the ordinary course of its business from sale of goods or the provision of services to an Account Debtor under a duly authorized Contract that is in full force and effect and that is a legal, valid and binding obligation of Seller and the related Account Debtor, enforceable against such Person in accordance with its terms, except as may be limited by bankruptcy, insolvency, reorganization, fraudulent conveyance, arrangement, moratorium, receivership, conservatorship or other laws relating to or affecting the enforcement of creditors’ rights generally; (ii) such sale of goods or provision of services to the applicable Account Debtor have been fully delivered or performed by Seller, (iii) if the Account Debtor with respect to such Receivable is Anheuser-Xxxxx LLC, its parent, Anheuser-Xxxxx InBev SA/NV is rated investment grade by all nationally recognized statistical rating organizations then rating such Account DebtorAnheuser-Xxxxx InBev SA/NV; (iv) that by its terms has an Invoice Due Date that is no more than 180 days from the original invoice date and such Invoice Due Date has not occurred, (v) that is owned by Seller, free and clear of all liens, encumbrances and security interests of any Person. (vi) that is freely assignable without the consent of any Person, including the applicable Account Debtor, (vii) for which no default or event of default (howsoever defined) exists under the applicable Contract between Seller and the applicable Account Debtor, (viii) which is not subject to any Dispute or Dilution, (ix) the related Account Debtor has been instructed in writing to make payments on such Receivable only to the Collection Account,

Exhibit A-5 745268223 (x) the related Account Debtor (i) is a resident of the United States of America and has provided Seller with a billing address in the United States of America, (ii) is not an Affiliate of Seller or Parent and (iii) is not a natural person, (xi) such Receivable (i) is denominated and payable only in USD in the United States and (ii) is not payable in installments, (xii) such Receivable is not a Receivable which arose as a result of the sale of consigned goods or finished goods that have incorporated any consigned goods into such finished goods or a sale in which Seller acted as a bailee, consignee or agent of any other Person or otherwise not as principal or otherwise in respect of deferred or unearned revenues, (xiii) such Receivable does not constitute a re-billed amount arising from a deduction taken by the related Account Debtor with respect to a previously arising Receivable, (xiv) as of the related Purchase Date, no Account Debtor Insolvency Event has occurred with respect to the related Account Debtor, such Account Debtor is not delinquent or in default either on more than 5% of its then unpaid and outstanding Receivables, or more than 5% its then unpaid and outstanding Purchased Receivables, (xv) such Receivable (i) does not arise from a sale of accounts made as part of a sale of a business or constitute an assignment for the purpose of collection only, (ii) is not a transfer of a single account made in whole or partial satisfaction of a preexisting indebtedness or an assignment of a right to payment under a contract to an assignee that is also obligated to perform under the contract and (iii) is not a transfer of an interest in or an assignment of a claim under a policy of insurance, (xvi) such Receivable constitutes an account or a payment intangible as defined in the UCC and is not evidenced by instruments or chattel paper, and (xvii) the related Account Debtor is Anheuser-Xxxxx LLC (but only so long as Anheuser-Xxxxx LLC remains a direct or indirect wholly-owned subsidiary of Anheuser-Xxxxx InBev SA/NV), or the related Account Debtor is Crown Cork and Seal USA, Inc. (“CCSU”) (but only so long as CCSU remains a direct or indirect wholly-owned subsidiary of Crown Holdings, Inc.) and/or such other Account Debtors as Purchaser may agree to from time to time in its sole discretion and in a writing signed by the Purchaser. “Event of Repurchase”: The meaning set forth in Section 7(a) hereof. “Excluded Taxes”: Any of the following taxes imposed on or with respect to Purchaser or required to be withheld or deducted from a payment to Purchaser, taxes imposed on or measured by net income (however denominated) or capital, franchise taxes, and branch profits taxes, in each case, (i) imposed as a result of Purchaser being organized under the laws of, or having its principal office or applicable lending office located in, the jurisdiction imposing such tax (or any political subdivision thereof), (ii) imposed under or as a result of FATCA, or (iii) that are taxes imposed as a result of a present or former connection between Purchaser and the jurisdiction imposing such tax (other than connections arising from Purchaser having executed, delivered, become a party to, performed its obligations under, received payments under, received or perfected a security interest

Exhibit A-6 745268223 under, Purchased Receivables under or engaged in any other transaction pursuant to this Agreement). “Facility Amount”: Up to USD 300,000,000, as such amount may be reduced from time to time by the Seller in accordance with the terms of Section 2(g) hereof. “FATCA”: means Sections 1471 through 1474 of the Code, as of the date of this Agreement (or as amended or a successor version that is substantively comparable and not materially more onerous to comply with), any current or future regulations or official interpretations thereof, any agreements entered into pursuant to Section 1471(b)(1) of the Code (or any amended or successor version as described above), any intergovernmental agreement entered into in connection with such sections of the Code and any legislation, law, regulation or practice enacted or promulgated pursuant to such intergovernmental agreement. “First Tier Parent Guarantee”: A guarantee agreement in form and substance satisfactory to Seller and Purchaser duly executed and delivered by Parent to Seller, as the purchaser under the Sale Agreement and assigned to Deutsche Bank Trust Company Americas and Intesa Sanpaolo S.p.A. “GAAP”: means generally accepted accounting principles in the United States of America or the International Financial Reporting Standards issued by the International Accounting Standards Board (IASB) and related interpretations (in each case as in effect from time to time). “Identification Ratio”: means the ratio (expressed as a percentage and rounded to the nearest 1/100 of 1%, with 5/1000th of 1% rounded upward) computed as of the last day of each calendar month by dividing: (a) the aggregate of all Collections during such month on all outstanding receivables originated by the Originator (whether or not Purchased Receivables hereunder (and whether or not then owned, pledged or otherwise assigned by the Originator), which were not, within five (5) Business Days of receipt of such Collections, properly identified as being related or applicable to a particular receivable (whether or not a Purchased Receivable), by (b) the aggregate of all Collections during such month on all outstanding Purchased Receivables, which were, within five (5) Business Days of receipt of such Collections, properly identified as being related or applicable to a particular Purchased Receivable. “Indemnified Amounts”: The meaning set forth in Section 7(b) hereof. “Indemnified Party”: The meaning set forth in Section 7(b) hereof. “Insolvency Event”: With respect to any Person, such Person shall generally not pay its debts as such debts become due, or shall admit in writing its inability to pay its debts generally, or shall make a general assignment for the benefit of creditors; or any proceeding shall be instituted by or against such Person seeking to adjudicate it as bankrupt or insolvent, or seeking liquidation, winding up, reorganization, arrangement, adjustment, protection, relief, or composition of it or its debts under any law relating to bankruptcy, insolvency or reorganization or relief of debtors, or seeking the entry of an order for relief or the appointment of a receiver, trustee, custodian or other similar official for it or for any substantial part of its property and, in the case of any such proceeding instituted against it (but not instituted by it), either such proceeding shall remain undismissed or unstayed for a period of 30 days, or any of the actions sought in such proceeding

Exhibit A-7 745268223 (including, without limitation, the entry of an order for relief against, or the appointment of a receiver, trustee, custodian or other similar official for, it or for any substantial part of its property) shall occur; or such Person shall take any action to authorize any of the actions set forth above in this definition; provided, that in the case of the inability of a Person to pay its debts as such debts become due arising by reason of currency restrictions or foreign political restrictions or regulations beyond the control of Seller or such Person, such event shall not be deemed an “Insolvency Event” hereunder. “Intercreditor Agreement”: That certain Intercreditor Agreement, dated as of the date hereof, by and among the ABL Agent, the Purchaser, the Seller and Constellium Muscle Shoals LLC as servicer under the Purchase Agreement, as amended, restated, supplemented or otherwise modified from time to time. “Invoice Due Date”: With respect to a Purchased Receivable, the last date identified for timely payment in the applicable original invoice. “LIBOR”: With respect to any purchase of Receivables on any Purchase Date, the offered rate for deposits in U.S. dollars in the London interbank market for a period determined by the Purchaser, by reference to ICE Benchmark Administration Limited (“ICE”) (or the generally accepted industry successor thereto) appearing at Reuters Reference LIBOR01 page (or on any successor thereto or substitute therefor), as of 11:00 a.m. (London time) day that the Purchase Price is paid pursuant hereto; provided, however, that if such a rate (x) ceases to be available on such Reuters Reference LIBOR01 page (or on any generally accepted industry successor thereto or substitute therefor) or (y) is otherwise replaced, withdrawn or ceases to be available in the financial markets generally, then, in either such case, “LIBOR”, on any such date of determination, shall be a rate per annum, for the relevant period, as may be reasonably determined (based on commercially reasonable standards for such determinations at such time) by the Purchaser, and reasonably agreed to, on any such date, by the Seller; provided, further, however, if any such determined rate at any such time is less than 0.0%, then “LIBOR” for purposes hereof in connection with such determination, at such time, shall be deemed to be 0.0%. “Material Adverse Change”: With respect to any Person, an event that results or could likely result in (a) a material adverse change in (i) the business condition (financial or otherwise), operations, performance or properties of such Person, or (ii) the ability of such Person to fulfill its obligations hereunder, or (b) the impairment of the validity or enforceability of, or the rights, remedies or benefits available to, Purchaser under this Agreement. “Moody’s”: Xxxxx’x Investors Service, Inc. “Net Invoice Amount”: The amount shown on the original invoice for the applicable Purchased Receivable as the total amount payable by the applicable Account Debtor, which amount shall be net of any discounts, credits or other allowances identified with specificity on such original invoice. “OFAC”: The meaning set forth in the definition of “Sanctioned Country”. “Offset Condition”: On any date of determination shall be satisfied, so long as (i) the aggregate outstanding Purchase Prices of all Purchased Receivables at such time related to any

Exhibit A-8 745268223 Account Debtor and its Affiliates (on a combined basis) does not exceed (ii) 90% of (x) the aggregate outstanding principal balance of all receivables payable at such time by such Account Debtor (whether or not such receivables are Purchased Receivables hereunder), minus (y) the aggregate amounts of principal and interest, if any, at such time in respect of any amounts which are subject to payment by (whether or not then due and payable) the Seller or any of its Affiliates (on an aggregate basis), to or for the account of such Account Debtor (and any of its Affiliates (on a combined basis). “Organization Documents”: Means (a) with respect to any corporation, the certificate or articles of incorporation and the bylaws (or equivalent or comparable constitutive documents with respect to any non-U.S. jurisdiction); (b) with respect to any limited liability company, the certificate or articles of formation or organization and the operating agreement, or the equivalent thereof; and (c) with respect to any partnership, joint venture, trust or other form of business entity, the partnership, joint venture or other applicable agreement of formation or organization and any agreement, instrument, filing or notice with respect thereto filed in connection with its formation or organization with the applicable governmental authority in the jurisdiction of its formation or organization and, if applicable, any certificate or articles of formation or organization of such entity, or any equivalent thereof. “Originator”: means the Seller. “Outstanding Account Debtor Purchase Amount”: As of the date of determination, an amount equal to (i) the aggregate amount paid by Purchaser to Seller in respect of Purchased Receivables of a particular Account Debtor, minus (ii) the aggregate amount of all Collections with respect to such Purchased Receivables actually deposited into the Collection Account. “Outstanding Aggregate Purchase Amount”: As of the date of determination, an amount equal the Outstanding Account Debtor Purchase Amount for all Account Debtors. “Parent”: Constellium International SAS, a French joint stock company. “Parent Guarantee”: A guarantee agreement in form and substance satisfactory to Purchaser duly executed and delivered by Parent to Deutsche Bank Trust Company Americas and Intesa Sanpaolo S.p.A. as the purchasers under the Purchase Agreement. “Person”: An individual, partnership, corporation (including a business trust), limited liability company, limited partnership, joint stock company, trust, unincorporated association, joint venture or other entity, or a government or any political subdivision or agency thereof. “Prior Agreement”: The meaning set forth in the recitals hereto. “Prior Agreement Outstanding Aggregate Purchase Amount”: With respect to Purchaser’s commitment under the Prior Agreement, shall have the meaning assigned to the term “Outstanding Aggregate Purchase Amount” in the Prior Agreement. “Proposed Receivables”: With respect to any Purchase Date, the Eligible Receivables proposed by Seller to Purchaser for purchase hereunder and described in a Purchase Request to be purchased on such Purchase Date.

Exhibit A-9 745268223 “Purchase Date”: Each date on which Purchaser purchases Eligible Receivables. “Purchase Price”: The meaning set forth in Section 2(d) hereof. “Purchase Request”: The meaning set forth in Section 2(a) hereof. “Purchase Termination Date”: The date which is the earlier of (i) on which this Agreement terminates pursuant to Section 2(b) hereof, (ii) the date declared by Purchaser in its sole discretion following the occurrence of a Termination Event, (iii) the date declared by the Seller in accordance with the terms of Section 2(b) hereof, and (iv) September 30, 2023, as such date may be extended in accordance with the terms of Section 2(b) hereof. “Purchased Receivables”: The meaning set forth in Section 2(a) hereof. “Purchaser”: The meaning set forth in the preamble hereto. “Receivables”: Any indebtedness or other payment obligation owing to Seller by any Account Debtor (whether constituting an account or payment intangible), including any right to payment of interest or finance charges and other obligations of such Account Debtor with respect thereto, arising out of Seller’s sale and delivery of goods or Seller’s sale and provision of services. “Regulatory Change”: means, relative to any Person: (a) any change in (or the adoption, implementation, administration, change in phase-in or interpretation or commencement of effectiveness of) any: (i) Applicable Law applicable to such Person; (ii) regulation, interpretation, directive, requirement or request (whether or not having the force of law) applicable to such Person of (A) any governmental authority charged with the interpretation or administration of any Applicable Law referred to in clause (a)(i) or of (B) any fiscal, monetary or other authority having jurisdiction over such Person; (iii) GAAP, IFRS or regulatory accounting principles applicable to such Person and affecting the application to such Person of any Applicable Law, regulation, interpretation, directive, requirement or request referred to in clause (a)(i) or (a)(ii) above; or (iv) notwithstanding the forgoing, (A) the Xxxx-Xxxxx Xxxx Street Reform and Consumer Protection Act and all requests, rules, guidelines or directives thereunder, issued in connection therewith or in implementation thereof, and (B) all requests, rules, guidelines and directives promulgated by the Bank for International Settlements, the Basel Committee on Banking Supervision (or any successor or similar authority) or the United States or foreign governmental or regulatory authorities, shall in each case be deemed to be a “Regulatory Change” occurring and implemented after the date hereof, regardless of the date enacted, adopted, issued or implemented; or

Exhibit A-10 745268223 (b) any change in the application to such Person of any existing Applicable Law, regulation, interpretation, directive, requirement, request or accounting principles referred to in clause (a)(i), (a)(ii), (a)(iii) or (a)(iv) above. “Related Rights”: means, with respect to any Receivable: (a) all of the Seller’s interest in any documents of title evidencing the shipment or storage of any goods that give rise to such Receivable, and all goods (including returned goods) relating to such Receivable, (b) all instruments, chattel paper or other documents or contracts, to the extent evidencing such Receivable, (c) all other security interests or liens and property subject thereto from time to time, to the extent purporting to secure payment of such Receivable, whether pursuant to the Contract related to such Receivable or otherwise, together with all UCC financing statements or similar filings relating thereto, (d) all of the Seller’s rights, interests and claims under the Contracts and all guaranties, indemnities, insurance and other agreements (including the related Contract) or arrangements of whatever character from time to time, to the extent supporting or securing payment of such Receivable or otherwise relating to such Receivable, whether pursuant to the Contract related to such Receivable or otherwise, (e) the Seller’s rights and remedies as against the Originator or Parent under the Sale Agreement and/or any other Transaction Document; and (f) all Collections and proceeds of any of the foregoing. “Repurchase Date”: The meaning set forth in Section 7 hereof. “Repurchase Price”: The meaning set forth in Section 7 hereof. “Repurchase Rate”: For any Purchased Receivable repurchased by the Seller, a rate per annum equal to the Discount Rate. “Repurchase Ratio”: means, the ratio (expressed as a percentage) with respect to any month, equal to (i) the aggregate outstanding balance of all Purchased Receivables which has become the subject of a Repurchase Event, divided by (ii) the aggregate outstanding balance of all Receivables generated by the Seller one month prior to such month. “Retained Obligations”: The meaning set forth in Section 8 hereof. “Sanctioned Country”: A country that is the subject of country-wide or territory wide economic or trade sanctions administered by the US Treasury Department’s Office of Foreign Assets Control (“OFAC”). “Sanctioned Person”: Any of the following currently or in the future: (i) an entity, vessel, or individual named on the list of Specially Designated Nationals or Blocked Persons maintained

Exhibit A-11 745268223 by U.S. Department of Treasury’s Office of Foreign Assets Control (“OFAC”) available at xxxx://xxx.xxxxxxxx.xxx/xxxxxxxx-xxxxxx/xxxxxxxxx/XXX-Xxxx/Xxxxx/xxxxxxx.xxxx or on the consolidated list of persons, groups, and entities subject to the European Union financial sanctions currently available at xxxx://xxxx.xxxxxx.xx/xxxx/xxxxxxxxx/xxxxxx-xxxx_xx.xxx; (ii) any entity or individual located in or organized under the laws of any Sanctioned Country to the extent that the entity or individual is subject to sanctions under Sanctions Laws; (iii) any entity or individual otherwise a subject of sanctions under Sanctions Laws; and (iv) any entity or individual engaged in sanctionable activities under the Sanctions Laws. “Sanctions Laws”: The sanctions laws, regulations, and rules promulgated or administered by OFAC and the U.S. Department of State, including any enabling legislation or Executive Order related thereto, as amended from time to time; the sanctions and other restrictive measures applied by the European Union in pursuit of the Common Foreign and Security Policy objectives set out in the Treaty on European Union; the United Kingdom, and any similar sanctions laws as may be enacted from time to time in the future by the U.S., the European Union (and any of its member states), or the Security Council or any other legislative body of the United Nations; and any corresponding laws of jurisdictions in which Seller operates or in which the proceeds of the Purchase Price will be used or from which repayments of such obligations be derived. “Scheduled Payment Date”: For any invoice, the date arrived at by adding the Buffer Period to the Invoice Due Date. “Seller”: The meaning set forth in the preamble. “Sold Assets”: The meaning set forth in Section 2(f) hereof. “Standard & Poor’s”: Standard & Poor’s, a division of The XxXxxx-Xxxx Companies, Inc. “Successor Benchmark Rate”: The meaning set forth in Section 17 hereof. “Termination Event”: Each of the following shall be a “Termination Event”: (a)(i) Seller or Parent shall fail to perform or observe any term, covenant or agreement under this Agreement or any Transaction Document and, except as otherwise provided herein, such failure shall continue for five (5) Business days after such Person’s knowledge or notice thereof or (ii) Seller shall fail to make when due any payment or deposit to be made by it under this Agreement including without limitation, any payment or deposit of Collections Due on each Settlement Date or under Section 7(b) of this Agreement and such failure shall continue unremedied for one Business Day; (b) any representation or warranty made by Seller or Parent (or any of their respective officers) under or in connection with this Agreement or any Transaction Document, or any information or report delivered by Seller or Parent pursuant to the Agreement, shall prove to have been incorrect or untrue in any material respect when made or deemed made or delivered and shall continue unremedied for five (5) Business days after such Person’s knowledge or notice thereof;

Exhibit A-12 745268223 (c) Seller shall fail to deliver any report required to be delivered by this Agreement when due; (d) this Agreement or any purchase pursuant to the Agreement shall for any reason: cease to create with respect to the Purchased Receivables, or the interest of Purchaser with respect to such Purchased Receivables shall cease to be, a valid and enforceable first priority perfected ownership interest, free and clear of any Adverse Claim; or there shall exist any Adverse Claim on the Purchased Receivables other than the Adverse Claims created under this Agreement; (e) Seller or Parent shall generally not pay its debts as such debts become due, or shall admit in writing its inability to pay its debts generally, or shall make a general assignment for the benefit of creditors; or any proceeding shall be instituted by or against Seller seeking to adjudicate it a bankrupt or insolvent, or seeking liquidation, winding up, reorganization, arrangement, adjustment, protection, relief or composition of it or its debts under any law relating to bankruptcy, insolvency or reorganization or relief of debtors, or seeking the entry of an order for relief or the appointment of a receiver, trustee, custodian or other similar official for it or for any substantial part of its property and, in the case of any such proceeding instituted against it (but not instituted by it), either such proceeding shall remain undismissed or unstayed for a period of 60 days, or any of the actions sought in such proceeding (including the entry of an order for relief against, or the appointment of a receiver, trustee, custodian or other similar official for, it or for any substantial part of its property) shall occur; or Seller or Parent shall take any corporate action to authorize any of the actions set forth above in this paragraph; (f) (i) on any date of determination the (A) Default Ratio shall exceed 1.00%, (B) the Delinquency Ratio shall exceed 1.00%; (C) the Repurchase Ratio shall exceed 3.00%, or (D) the Identification Ratio shall exceed 5.00%, (ii) the average for three consecutive calendar months of: (A) the Default Ratio shall exceed 1.00%, (B) the Delinquency Ratio shall exceed 1.00%, (C) the Repurchase Ratio shall exceed 3.00%, or (D) the Identification Ratio shall exceed 5.00% or (iii) the Offset Condition shall fail to be satisfied; (g) a Change in Control shall occur; (h) (i) Parent or Seller or any of their subsidiaries shall fail to pay any principal of or premium or interest on any of its debt that is outstanding in a principal amount of at least $75,000,000 in the aggregate when the same becomes due and payable (whether by scheduled maturity, required prepayment, acceleration, demand or otherwise), and such failure shall continue after the applicable grace period, if any, specified in the agreement, mortgage, indenture or instrument relating to such debt (and shall have not been waived); or (ii) any other “default”, “event of default” or similar event shall occur or condition shall exist under any agreement, mortgage, indenture or instrument relating to any such debt and shall continue after the applicable grace period, if any, specified in such agreement, mortgage, indenture or instrument; (i) to the extent Ultimate Parent has a credit rating from Standard & Poor’s or Moody’s (including, if applicable, a shadow rating from either such rating agency): (i) such rating shall be downgraded below B- by Standard & Poor’s and below B3 by Moody’s or (ii) such rating of Ultimate Parent is withdrawn by Standard & Poor’s or Moody’s, as the case may be (for the avoidance of doubt, if either Standard & Poor’s or Moody’s takes any of the actions described in

Exhibit A-13 745268223 clauses (i) or (ii) above, whether or not such action is taken by the other or both, such action by either such agency shall constitute a Termination Event hereunder); (j) one or more final judgments for the payment of money in an amount in excess of $50,000,000, individually or in the aggregate, shall be entered against Parent or Seller on claims not covered by insurance or as to which the insurance carrier has denied its responsibility; (k) This Agreement, the Parent Guarantee, at any time, ceases to be the legal, valid and binding obligation of the Seller or the Parent, or the Seller or the Parent, at any time, challenges its obligations thereunder; or (l) so long as any purchased receivables remain outstanding thereunder, any “Termination Event” (as defined in the Prior Agreement) shall have occurred and be continuing under the Prior Agreement. “Transaction Documents”: means this Agreement, the Parent Guarantee, the First Tier Parent Guarantee and all other certificates, instruments, UCC financing statements, reports, notices, agreements and documents executed or delivered under or in connection with this Agreement, in each case as the same may be amended, supplemented or otherwise modified from time to time in accordance with this Agreement. “UCC”: The Uniform Commercial Code in effect in the State of New York from time to time. “Ultimate Parent” means Constellium SE, a French company. “Unmatured Termination Event”: means an event that, with the giving of notice or lapse of time, or both, would constitute a Termination Event. “USD”: United States Dollars, the lawful currency of the United States of America.

Exhibit B-1 745268223 Exhibit B Form of Purchase Request [date] Constellium Muscle Shoals LLC 0000 Xxxxxx Xxxxxx Xxxxxx Xxxxxx, XX 00000 Attn: Xxxx Xxxxxx or Treasury Department Fax: 000.000.0000 Email: xxxx.xxxxxx@xxxxxxxxxxx.xxx Reference is hereby made to that certain Receivable Sale Agreement, dated as of September 30, 2021, between Constellium Muscle Shoals LLC (“Seller”) and Constellium Muscle Shoals Funding III, LLC (“Purchaser”) (as it may be amended, modified or supplemented from time to time, the “Agreement”; capitalized terms not otherwise defined herein shall have the meanings set forth in the Agreement). Pursuant to the terms of the Agreement, Seller hereby requests that Purchaser purchase from Seller the Proposed Receivables listed herein with an aggregate Net Invoice Amount of USD[_____]. Seller represents and warrants that as of the date hereof and on the Purchase Date: 1. Following the purchase of the Proposed Receivables set forth in this Purchase Request, (A) the Outstanding Aggregate Purchase Amount does not exceed USD [ ] and (B) the Outstanding Account Debtor Purchase Amount with respect to the Purchased Receivables (assuming the Proposed Receivables constitute Purchased Receivables) payable by any Account Debtor does not exceed the sublimit established by Purchaser for such Account Debtor; 2. Seller’s representations, warranties and covenants set forth in the Agreement are true and correct; 3. The conditions precedent for purchase set forth in Section 2(d) of the Agreement have been satisfied; 4. No Event of Repurchase exists on such Purchase Date except for repurchases being effectuated on the date hereof by setoff by Purchaser against the Purchase Price for the Proposed Receivables; and 5. There has not been any Material Adverse Change in Seller. 6. With respect to the related Proposed Receivables offered for sale by Seller to Purchaser based on the approved Account Debtor(s), set forth below is the following: applicable Account Debtor’s legal name, address, the invoice number(s), the stated amount of the invoice(s), the date and term of the invoice(s), the stated due date of such invoice (s), the Scheduled Payment Date of such invoice and the calculation of the Offset Condition:

Exhibit B-2 745268223 [__________________________________________________] [__________________________________________________] [__________________________________________________] Upon acceptance by Purchaser of this Purchase Request and payment of the Purchase Price, Purchaser hereby purchases, and Seller hereby sells, all of Seller’s right, title and interest with respect to the Proposed Receivables on the attached Exhibit as of the date hereof, and the Proposed Receivables shall become Purchased Receivables in the manner set forth in the Agreement. Constellium Muscle Shoals LLC, as Seller By: _______________________________________ Name: Title: PURCHASE REQUEST ACCEPTED: Constellium Muscle Shoals Funding III, LLC By: Name: Title: Date:

Exhibit C-1 745268223 Exhibit C [Reserved]

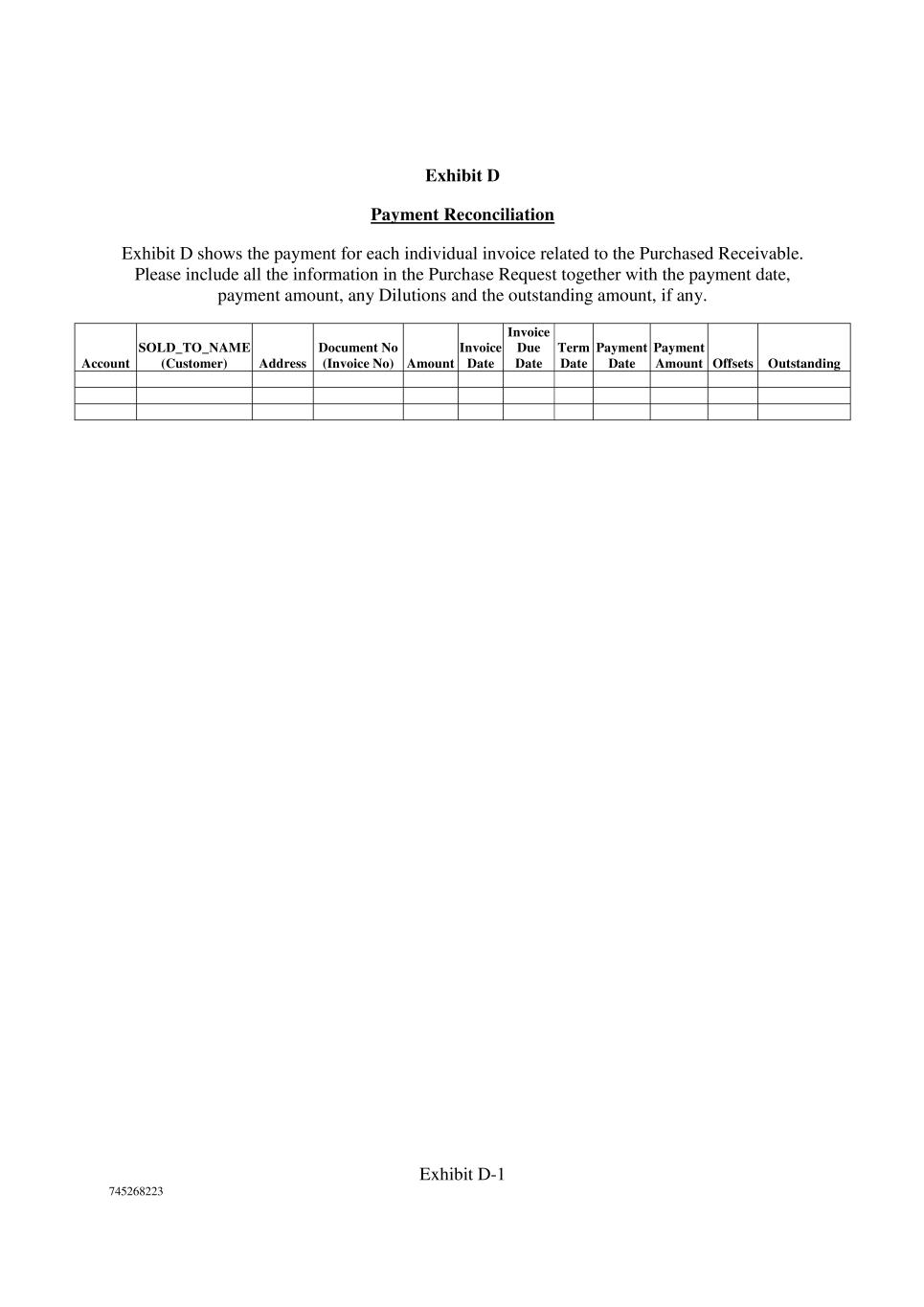

Exhibit D-1 745268223 Exhibit D Payment Reconciliation Exhibit D shows the payment for each individual invoice related to the Purchased Receivable. Please include all the information in the Purchase Request together with the payment date, payment amount, any Dilutions and the outstanding amount, if any. Account SOLD_TO_NAME (Customer) Address Document No (Invoice No) Amount Invoice Date Invoice Due Date Term Date Payment Date Payment Amount Offsets Outstanding

Exhibit E-1 745268223 Exhibit E Form of Account Debtor Notice

B-1 Constellium: First Omnibus Amendment 745268061 EXHIBIT B

2 745260365 16500839 York City time), at least three Business Days prior to any purchase hereunder (a “Purchase Request”), and each Purchaser agrees, subject to the requirements for purchase and all of the terms and conditions therefor set forth herein (including the conditions precedent set forth in Section 2(c)), to purchase from Seller the related Proposed Receivables identified in such Purchase Request. The Seller shall have the right to select which Purchaser to offer certain specific Proposed Receivables on any applicable Purchase Date; provided, however, that (i) that the applicable Purchase Request which has been delivered to all Purchasers shall identify which specific Proposed Receivables are being offered to each Purchaser, respectively, on such date, (ii) when determining which Proposed Receivables to offer to a Purchaser, the Seller shall not use selection procedures which could be reasonably expected to materially and adversely affect any Purchaser when compared to the Proposed Receivables offered to any other Purchaser and (iii) the Seller shall offer individual Proposed Receivables to each Purchaser on a substantially ratable basis (based on the Commitments of each such Purchaser, respectively). Notwithstanding anything herein to the contrary, and for the avoidance of doubt, any Proposed Receivable offered to a Purchaser shall be 100% of such Proposed Receivable and the Purchasers will not be sharing ratable portions of any individual Purchased Receivables. Subject to the satisfaction of the conditions precedent set forth in Section 2(c) hereof, with respect to any Proposed Receivable on any Purchase Date, the applicable Purchaser to whom such Proposed Receivable is being offered on such date shall and hereby does purchase from Seller, and Seller shall and hereby does sell to such Purchaser, without representation, warranty, covenant or recourse except as expressly provided herein, all of Seller’s right, title and interest in such Proposed Receivable and all Related Rights with respect thereto as of the applicable Purchase Date (all such Proposed Receivables together with such Related Rights, once sold to and purchased by a Purchaser hereunder, being referred to, collectively, as the “Purchased Receivables”). The Seller shall not request and no Purchaser shall be required to fund more than two (2) purchases per week, to take place on the Monday and Thursday of each week (or, if any such day is not a Business Day, on the immediately following Business Day). No single request for purchase hereunder shall be for an amount less than $250,000. Each Purchaser’s obligation hereunder shall be several, such that the failure of any Purchaser to make a payment in connection with any Proposed Receivables offered to it on any Purchase Date hereunder shall not relieve any other Purchaser of its obligation hereunder to make payment in connection with any other Proposed Receivables offer to such other Purchaser on such date; it being understood that no Purchaser shall be responsible for the obligations of any other Purchaser. If a Purchaser fails its obligation to purchase any Proposed Receivable offered to it hereunder on any Purchase Date, the Seller may offer such Proposed Receivables to the other Purchaser, and if so offered, such other Purchaser shall be obligated to fund such Proposed Receivables, subject to all conditions to funding in paragraph (c) below and otherwise herein being satisfied at such time; it being understood that no Purchaser shall be obligated or committed to fund any purchases hereunder if, after giving effect thereto, the sum of (x) the Outstanding Aggregate Purchase Amount funded by such Purchaser hereunder, plus (y) the Prior Agreement Outstanding Aggregate Purchase Amount funded by such Purchaser under the Prior Agreement and which remain outstanding shall exceed its Commitment hereunder at such time. (b) Term. This Agreement shall continue in effect until the Purchase Termination Date provided that either Purchaser shall have the right to terminate this Agreement solely with respect to such Purchaser at any time (i) upon ten (10) days’ prior written notice to Seller and the Purchaser Representative in the event that such Purchaser is legally prohibited under applicable law or any rule or regulation applicable to such Purchaser from being a party to this Agreement or consummating the

3 745260365 16500839 transactions contemplated hereunder, (ii) as provided in Section 5 below, and (iii) as provided in paragraphs (b), (c) and (d) of Section 7 below; provided further, that Seller shall have the right to terminate this Agreement (A) as provided in the last sentence of Section 7(d) below and (B) upon thirty (30) days’ prior written notice to Purchasers. Termination shall not affect the rights and obligations of the parties with respect to Purchased Receivables sold hereunder prior to the Purchase Termination Date or are expressed to survive termination hereof. Notwithstanding the foregoing, so long as no Termination Event or Unmatured Termination Event has occurred and is continuing, Seller may provide a written request to each Purchaser and the Purchaser Representative no less than 90 days prior to the then existing Purchase Termination Date of its desire to extend the then current Purchase Termination Date and each Purchaser shall notify Seller within 30 days of the then existing Purchase Termination Date whether such Purchaser has elected and agreed (in its sole discretion) to extend such Purchase Termination Date, solely with respect to itself, for a period not longer than an additional term of 728 days from the date of such election by such Purchaser. (c) Conditions Precedent. Each purchase of Proposed Receivables described in a Purchase Request is subject to the satisfaction of the following conditions prior to (and, if applicable, after giving effect to) the proposed Purchase Date, all to the reasonable satisfaction of the applicable Purchaser to whom such Proposed Receivables have been offered: (i) No event has occurred and is continuing, or would result from such purchase that constitutes a Termination Event or an Unmatured Termination Event; (ii) No Material Adverse Change has occurred since the last purchase of Receivables under this Agreement with respect to Seller, Parent, Originator or Servicer; (iii) The Servicer has delivered the most recent Servicer Report required to be delivered by it hereunder; (iv) (A) There are no amounts then due and owing by the Seller or the Originator to the Account Debtor in respect of any Purchased Receivable (including, without limitation, in relation to any adjustments or settlements related to any preliminary invoices, based on any agreements with respect thereto between the Seller or the Originator and the Account Debtor); and (B) the Offset Condition shall be satisfied before and after giving effect to the purchase of such Proposed Receivables; (v) The Sale Agreement remains in full force and effect and no Termination Event or Unmatured Termination Event has occurred and is continuing thereunder; (vi) The applicable Purchaser and the Purchaser Representative shall have received at least three Business Days prior to any purchase (A) a Purchase Request with respect to the Proposed Receivables, (B) the related Contract (or portion thereof that is permitted to be disclosed to the Purchasers by the parties to such applicable Contract) and any material amendments thereto to the extent affecting the Receivables, in each case, to the extent not previously delivered to such Purchaser, and (C) such additional

4 745260365 16500839 supporting documentation that the applicable Purchaser may have reasonably requested; (vii) The applicable Purchaser is not legally prohibited from purchasing the Proposed Receivables listed on the relevant Purchase Request; (viii) The representations and warranties contained in this Agreement and the Purchase Request shall be true and correct (subject to any applicable materiality qualification to the extent expressly set forth in any particular representation or warranty) on and as of such Purchase Date; (ix) Seller, Servicer and Parent shall be in compliance (subject to any applicable materiality qualification to the extent expressly set forth in any particular covenant or other provision) with each term, covenant and other provision of this Agreement and the Parent Guarantee applicable to Seller, Servicer or Parent, as applicable; (x) No Event of Repurchase shall then exist hereunder or under (and as defined in) the Prior Agreement, unless Seller has repurchased and paid (or is paying on such proposed Purchase Date and the applicable Purchaser who purchased the related Purchased Receivable is satisfied that Seller will be paying on such proposed Purchased Date in cash), the full amount of the Repurchase Price (or the amount subject to Dispute or Dilution, to the extent provided pursuant to Section 7 hereof) for the affected Purchased Receivables pursuant to the terms of Section 7 hereof; (xi) Following the sale and purchase of the Proposed Receivables set forth in the related Purchase Request, (A) the sum of (x) the Outstanding Aggregate Purchase Amount, plus (y) the Prior Agreement Outstanding Aggregate Purchase Amount which remain outstanding under the Prior Agreement, with respect to the applicable Purchaser, shall not exceed such Purchaser’s Commitment hereunder, and (B) the sum of (x) the Outstanding Aggregate Purchase Amount for all Purchased Receivables for all Purchasers hereunder and under the Prior Agreement, collectively, plus (y) the Prior Agreement Aggregate Outstanding Purchase Amounts for all Purchasers under the Prior Agreement shall not exceed the Facility Amount hereunder; (xii) (A) No Account Debtor Insolvency Event shall have occurred and be continuing with respect to any Account Debtor obligated on the Proposed Receivables described in such Purchase Request, and no Insolvency Event with respect to Seller, Servicer or Parent shall have occurred and be continuing; and (B) neither Xxxxx’x nor Standard & Poor’s shall have rated or downgraded Anheuser-Xxxxx InBev SA/NV from its current rating to a rating below Baa3 (in the case or Xxxxx’x) or below BBB- (in the case of Standard & Poor’s); (xiii) Each Purchaser shall have received payment of all Commitment Fees due and payable to such Purchaser under Section 2(e) and

5 745260365 16500839 all other amounts due to such Purchaser under this Agreement and the Prior Agreement by any party at such time have been paid; (xiv) The Collection Account shall be open under the Collection Account Agreement and not subject to a notice of termination by the account bank under the Collection Account Agreement, or a replacement collection account under a replacement collection account agreement reasonably acceptable to each Purchaser shall be in effect (or scheduled to be in effect upon the termination of the Collection Account); and (xv) On the initial Purchase Date, the Purchasers shall have received each of the following documents, each dated such date and in form and substance satisfactory to each such Purchaser: (A) Executed counterparts of this Agreement and each of the other Transaction Documents by the parties thereof; (B) Each Purchaser shall have received evidence satisfactory to it that Seller shall have established the Collection Account and the Purchaser Representative shall have control over such account for the benefit of the Purchasers as herein provided and pursuant to the Collection Account Agreement; (C) A certificate of each of the Secretary or Assistant Secretary of Seller, Servicer and the Parent certifying the names and true signatures of the incumbent officers authorized on behalf of such Person to execute and deliver this Agreement, each Purchase Request, the other Transaction Documents and any other documents to be executed or delivered by it hereunder, together with its Organizational Documents and board resolutions, evidencing necessary organizational action and governmental approvals, if any, necessary for Seller, Servicer and Parent to execute, deliver and perform its obligations under this Agreement and the other Transaction Documents. (D) UCC and tax judgment lien searches or equivalent reports or searches, listing all effective financing statements, lien notices or comparable documents that name Seller or Originator as debtor and that are filed in those state and county jurisdictions in which Seller or Originator is organized or maintains its principal place of business or chief executive office and such other searches that the Purchasers deem reasonably necessary or appropriate. (E) Acknowledgment copies of proper termination statements (Form UCC-3) and any other relevant filings necessary to evidence the release of all security interests, ownership and other rights of any Person previously granted by Seller in the Proposed Receivables. (F) Copies of proper Uniform Commercial Code financing statements (or appropriate amendments thereto) identifying Seller as “seller” and each Purchaser as “buyer”, together with evidence that they have been duly filed on or before the initial Purchase Date hereunder in the correct filing office under the Uniform Commercial Code of the jurisdiction in which seller is located for purposes of the UCC. For the avoidance of doubt, each Purchaser will be listed as a “buyer” in separate Uniform Commercial Code financing statements. (G) A good standing certificate for each of Seller, Servicer and Parent from its respective jurisdiction of organization.

6 745260365 16500839 (H) A fully completed Seller Information Schedule in the form attached as Schedule 2, containing certain factual information regarding Seller to the extent that such information was not previously delivered to the Purchasers. (I) A duly executed Parent Guarantee, together with a secretary’s certificate of Parent and such other documentation relating to Parent as the Purchasers may request. (J) A favorable legal opinion of counsel to each of Seller, Servicer and Parent covering enforceability, general corporate matters, no conflicts and UCC matters, in form and substance satisfactory to the Purchasers and addressed to the Purchasers; (K) A favorable “true sale” opinion of counsel to Seller in form and substance satisfactory to the Purchasers and addressed to the Purchasers; (L) A schedule of Receivables purchased by the Purchasers from the Seller on each Purchase Date, as such schedule may be amended, modified, updated or supplemented from time to time as Receivables are purchased by any Purchaser hereunder; (M) Originator and Seller shall have executed and delivered to each Purchaser two (2) original Notifications of Assignment in the form of Exhibit E hereto to be used in accordance with Section 6(d); and (N) All documents and other evidence that each Purchaser requires for its know-your-customer and other compliance checks on Seller, Servicer, Parent and each Account Debtor. (d) Purchase Price. The purchase price for any Purchased Receivable purchased on any Purchase Date (the “Purchase Price”) shall be determined on and as of the applicable Purchase Date (without any subsequent adjustment whether for late payment, credit rating deterioration or otherwise), shall be paid to Seller on the Purchase Date and shall be equal to: Purchase Price = A - (A x (B x ((C)/360)), where: A = Net Invoice Amount B = Discount Rate C = number of days between the Purchase Date and the Scheduled Payment Date (including the Purchase Date, but not including the Scheduled Payment Date On each Purchase Date, the Purchase Price for Purchased Receivables purchased by any Purchaser shall be paid by such Purchaser to such account designated by the Seller (or the Servicer on its behalf) in immediately available funds. (e) Commitment Fee and Purchaser Account Information. The Seller shall pay to each Purchaser, a commitment fee (the “Commitment Fee”) on the last business day of each calendar quarter (commencing with the calendar quarter ending on December 31, 2021) and on the Purchase Termination Date, to each Purchaser, respectively, in an amount equal to: (i) solely with respect to the first quarterly payment to be paid on December 31, 2021, an amount calculated in arrears on a daily basis at a rate of 0.56% per annum (calculated on a 360-day basis), on the difference between such Purchaser’s Commitment and such Purchaser’s Outstanding Aggregate Purchase Amount on each such day during such period, and (ii) with respect to all quarterly payments and respective quarterly periods thereafter, an amount calculated