PROPERTY MANAGEMENT AGREEMENT dated as of March 21, 2014 between BR CARROLL LANSBROOK, LLC Owner and CARROLL MANAGEMENT GROUP, LLC Manager

MANAGEMENT GROUP

dated as of March 21, 2014

between

BR XXXXXXX LANSBROOK, LLC

Owner

and

XXXXXXX MANAGEMENT GROUP, LLC

Manager

THIS PROPERTY MANAGEMENT AGREEMENT (this "Agreement") is made as of March 21, 2014, by and between BR XXXXXXX LANSBROOK, LLC, a Delaware limited liability company ("Owner"), and XXXXXXX MANAGEMENT GROUP, LLC, a Georgia limited liability company ("Manager").

RECITALS:

A. Owner is the owner of certain real property more particularly described in Exhibit "A" attached hereto and incorporated herein by this reference, upon which certain improvements consisting of approximately 572 condominium units (subject to increase based on future acquisitions of Additional Units) in the 774-unit multi-family complex located in Palm Harbor, Florida and commonly known as Lansbrook Village, and related amenities, landscaping, parking facilities and other common areas have been constructed (collectively, the "Project"). Owner and Manager acknowledge that the business plan for the Owner includes the expectation that certain additional condominium units (the "Additional Units") within Lansbrook Village will be acquired by the Owner and, upon any such acquisition such units will be automatically added to, and thereafter constitute part of, the Project.

B. Manager has represented to Owner that Manager is experienced in the management, leasing, operation, bookkeeping, reporting, marketing, maintenance and repair of projects similar to the Project;

C. Owner hereby appoints Manager as sole and exclusive agent of Owner to manage the Project on the terms herein and Manager accepts such appointment on the terms herein and agrees to use diligent efforts to conduct and enhance the management of the Project, subject to the terms herein; and

D. The relationship of Manager to Owner shall be that of an independent contractor. Nothing herein shall be construed as creating a partnership, joint venture, or any other relationship between the parties hereto;

NOW, THEREFORE, in consideration of the premises and the sum of TEN AND N0/100 DOLLARS ($10.00) paid by Owner to Manager, and for other valuable consideration, including the mutual covenants hereinafter set forth, the receipt, adequacy, and sufficiency of which are acknowledged by the parties hereto, Owner and Manager covenant and agree as follows:

1. Definitions.

"Additional Units" shall have the meaning set forth in the Recitals.

"Affiliate" means any person that directly or indirectly, through one or more intermediaries, controls or is controlled by or is under common control with a designated Person.

| 1 |

"Annual Business Plan" shall mean, with respect to calendar year 2014, the Annual Business Plan for the management and operation of the Project attached hereto as Exhibit "B" and incorporated herein by this reference, as the same may be modified and amended from time to time to reflect the Additional Units, and for all other years during the term of this Agreement, the Annual Business Plan for such year established pursuant to Section 5(e) below.

"Applicable Law" shall mean all building codes, zoning ordinances, laws, orders, writs, ordinances, rules and regulations of any Federal, state, county, city, borough, or municipality, or of any division, agency, bureau, court, commission or department or of any division, agency, bureau, court, commission or department thereof, or of any public officer or official, having jurisdiction over or with respect to the Project.

"Approved Operating Expenses" shall mean, with respect to calendar year 2014, the expenses set forth in the Annual Business Plan attached hereto as Exhibit "B" and incorporated herein by this reference, as the same may be modified and amended from time to time to reflect the Additional Units, and for all other years during the term of this Agreement, the expenses contained in the Annual Business Plan for such year established pursuant to Section 5(e) below, together with all other operating expenses with respect to the Project which are otherwise approved by Owner or permitted pursuant to the express terms of this Agreement.

"Cause" shall have the meaning set forth in the Operating Agreement. "Claims" shall have the meaning set forth in Section 9(a) below.

“Code” means the Internal Revenue Code of 1986, as amended from time to time, or any corresponding provision or provisions of succeeding law.

“Confidential Information” shall mean the books, records, business practices, methods of operations, computer software, financial models, financial information, policies and procedures, and all other information relating to Owner and the Project (including any such information relating to the Project generated by Manager), which is not available to the public.

“Controllable Expenses” shall mean all expenses, other than Uncontrollable Expenses, with respect to the Project.

“Depository Accounts” shall have the meaning set forth in Section 5(c) below.

“Emergency” shall mean an event requiring action to be taken prior to the time that approval could reasonably be obtained from Owner, (i) in order to comply with Applicable Law, any insurance requirement or this Agreement, or to preserve the Project (or any part thereof), or for the safety of any Tenants, occupants, customers or invitees thereof, or (iii) to avoid the suspension of any services necessary to the Tenants, occupants, licensees or invitees thereof.

“Emergency Expenditures” shall have the meaning set forth in Section 5(j) below.

“Excluded Items” means:

(a) capital contributions by Owner or any interest therein;

| 2 |

(b) the refinancing of any loan or any voluntary conversion, sale, exchange or other disposition of the Project or any portion thereof;

(c) casualty insurance proceeds;

(d) proceeds of condemnation awards;

(e) any deposits including rental, security, damage, or cleaning deposits;

(f) interest on investments or otherwise;

(g) abatement of taxes;

(h) any utility reimbursements received from Tenants for amounts actually paid by Owner or Manager directly to the utility companies (Owner acknowledging and agreeing that any revenues, fees, xxxx-ups and overhead charges received from Tenants in excess of amounts actually paid to the utility companies shall be included in Monthly Gross Receipts);

(i) discounts and dividends on insurance policies; and

G) other income not directly derived from Manager's management of the Project.

"Leases" shall have the meaning set forth in Section 5(f)(ii) below.

"Loan Documents" shall mean any and all documents evidencing or securing any indebtedness obtained by Owner and secured by the Project with respect to which Manager has received written notice from Owner, as same shall be amended, replaced, refinanced or otherwise modified from time to time during the Term of this Agreement. Manager acknowledges receipt of the Loan Documents of even date herewith evidencing and securing that certain Loan in the original maximum principal amount of $48,000,000, more or less, from General Electric Capital Corporation ("Lender") to Owner.

"Management Fee" shall have the meaning set forth in Section 4(a).

"Manager Indemnitees" shall have the meaning set forth in Section 9(b) below.

"Manager's Event of Default" shall have the meaning set forth in Section 10(a) below.

"Master Insurance Program" shall have the meaning set forth in Section 6(b) below.

"Monthly Gross Receipts" shall include the entire amount of all Rental Income and additional revenues derived from the Project other than the Excluded Items, including all receipts, determined on a cash basis, from:

| (a) | Rental Income; |

| (b) | Owner's share of vendor income proceeds from vending machines and concessions; and |

| 3 |

| (c) | All other income and cash receipts attributable to or derived from the Project other than the Excluded Items. |

"Operating Agreement" shall mean that certain Limited Liability Company Agreement for BR Xxxxxxx Lansbrook JV, LLC, dated February 12, 2014.

"Owner Indemnitees" shall have the meaning set forth in Section 9(a) below.

"Owner's Event of Default" shall have the meaning set forth in Section l0(c) below.

"Person" means any individual, partnership, corporation, trust, limited liability company or other entity.

"Per Unit Controllable Expenses" shall have the meaning set forth in Section 5(e) below.

"Per Unit Revenue" shall have the meaning set forth in Section 5(e) below.

"Project" shall have the meaning set forth in the recitals above.

"Reimbursable Expenses" shall have the meaning set forth in Section 4(b) below.

"Rental Income" means all rent and other charges due from Tenants, from users of garage spaces, storage closets, parking charges, and from any other lessees of other non-dwelling facilities, if any, in the Project, from concessionaires in consequence of the authorized operation of facilities in the Project maintained primarily for the benefit of Tenants, and all other rental fees and other charges otherwise due Owner and collected by Manager with respect to the Project.

"Security Account" shall have the meaning set forth in Section 5(d) below.

"Tenants" shall have the meaning set forth in Section 5(d) below.

"Uncontrollable Expenses" shall mean the following expenses with respect to the Owner: taxes and insurance; licenses; HOA assessments; utilities; unanticipated material repairs that are essential to preserve or protect the Project; debt service; and costs due to a change in law.

2. Appointment of Manager. On and subject to the terms and conditions of this Agreement, Owner hereby retains Manager commencing on March 21, 2014 (the "Commencement Date") to manage and lease the Project.

3. Term. This Agreement shall commence on the Commencement Date and shall continue for a term of forty-eight (48) months (the "Initial Term") or until Manager is terminated pursuant to Section 11 of this Agreement.

4. Management Fee; Other Fees; Reimbursement of Expenses. In consideration of the performance by Manager of its duties and obligations hereunder:

| 4 |

(a) Owner agrees to pay to Manager a fee computed and payable monthly in arrears in an amount equal to two and seventy five hundredths percent (2.75%) of Monthly Gross Receipts (the "Management Fee"). The Management Fee shall be deducted each month from the Monthly Gross Receipts to be paid to Owner pursuant to this Agreement.

(b) Subject to the Annual Business Plan, Owner agrees to reimburse Manager for the aggregate expenses incurred by Manager in connection with or arising from the ownership, operation, management, repair, replacement, maintenance and use or occupancy of the Project (exclusive of any common elements or limited common elements owned, controlled, maintained or operated by the Project condominium association), including, without limitation, those costs expressly set forth in Exhibit "C" attached hereto and incorporated herein by this reference (all items to be reimbursed pursuant to this Section 4(b) are referred to herein as "Reimbursable Expenses"). If any such Reimbursable Expenses are a part of the Approved Operating Expenses and are paid by Manager and not from Monthly Gross Receipts on hand, then Owner agrees to reimburse such amounts to Manager. All other Reimbursable Expenses which are not a part of Approved Operating Expenses and not contained in the list set forth in Exhibit "C" attached hereto must be approved by Owner in advance, such approval not to be unreasonably withheld, conditioned or delayed. Manager shall submit to Owner an invoice detailing the calculation of such Reimbursable Expenses no later than the fifteenth (15th) day of each month for the immediately preceding month. The Reimbursable Expenses then owed shall be deducted each month from the Monthly Gross Receipts to be paid to Owner pursuant to this Agreement.

(c) Intentionally Omitted.

(d) A construction management fee in the amount of five percent (5.0%) of the rehabilitation and renovation expenses for the Project, as set forth in the Annual Business Plan, which fee shall be calculated and paid upon each respective draw and within thirty (30) days of final draw or following completion of the restoration or satisfaction of the claim, whichever is applicable.

(e) A fee will be charged for the initial takeover of the Project in the amount of $2,000.00 to cover costs for training and marketing of the Project.

(f) Intentionally Omitted

(g) Upon the termination or expiration of this Agreement other than for Cause, a close-out fee equal to one hundred percent (100%) of the last month's full management fee (the "Close Out Fee"). The Close Out Fee shall be deducted from the final month's Monthly Gross Receipts to be paid to Owner.

5. Authority and Responsibilities of Manager.

(a) Independent Contractor. In the performance of its duties hereunder, Manager shall be and act as an independent contractor, with the sole duty to supervise, manage, operate, control, direct and determine the methods of performance of the specified duties and obligations hereunder. Nothing contained in this Agreement shall be deemed or construed to create a partnership, joint venture, employment relationship, or otherwise to create any liability for one party with respect to indebtedness, liabilities or obligations of the other party except as otherwise may be expressly set forth herein.

| 5 |

(b) Standard of Care; Acquisition of Additional Units. Manager shall perform its duties and obligations in a professional manner, and shall maintain the Project in accordance with the applicable Annual Business Plan and in accordance with the standards a reasonably prudent multifamily property manager would employ with respect to properties of similar age, size, and as the Project in the market area in which the Project is located. Manager further acknowledges that it shall serve as Owner's primary point of contact with respect to the Owner's acquisition of Additional Units, and shall act in a commercially reasonable manner to assist Owner to acquire such Additional Units as efficiently and as promptly as practicable.

(c) Depository Accounts. All Monthly Gross Receipts from the Project, after deducting Approved Operating Expenses, Reimbursable Expenses and the Management Fee, shall be deposited by Manager into one or more deposit accounts designated by Owner (each a "Depository Account"). All Depository Accounts shall be the sole and exclusive property of Owner, and Manager shall retain no interest therein, except as may be expressly provided in this Agreement. Manager shall not commingle Depository Accounts with any other funds. Checks may be drawn upon such Depository Accounts only by persons authorized by Owner in writing to sign checks, at least one of whom shall be a designee of Manager. No loans shall be made from the Depository Account. Depository Accounts shall be established by and in the name of Manager to be held in trust for Owner.

(d) Security Deposits. Manager shall deposit and maintain all security deposits in a separate account designated by Owner and insured by the Federal Deposit Insurance Corporation (the "Security Account"). Manager shall fully fund all security deposits actually received by Manager from tenants of the Project under written leases (collectively, "Tenants") into the Security Account, notwithstanding whether Applicable Law requires full funding. The Security Account shall be a segregated account that is distinct from the Depository Accounts and any other accounts relating to the Project or Manager. The Security Account shall be the sole and exclusive property of Owner, and Manager shall retain no interest therein, except as may be expressly provided herein. Manager shall not commingle the Security Account with any other funds. Checks may be drawn upon the Security Account only by persons authorized by Owner in writing to sign checks, at least one of whom shall be a designee of Manager. No loans shall be made from the Security Account. Manager shall not use a "standardized clearing account" for the Security Account. The Security Account shall be established in the name of Manager to be held in trust for Owner.

| 6 |

(e) Annual Business Plan. Manager agrees to prepare an Annual Business Plan for the operation of the Project for Owner's review and approval, no later than November 1 in each year during the term of this Agreement. If final approval of a proposed Annual Business Plan by Owner has not been given by the beginning of the year to which such proposed Annual Business Plan relates, Property Manager shall operate the Project on the basis of an Annual Business Plan determined by (i) assuming that the revenue from the Project will increase to 103% of the revenues collected in the prior year, (ii) assuming that the Controllable Expenses will increase to 103% of the amount of the actual Controllable Expenses incurred in the prior year, (iii) increasing all Uncontrollable Expenses by any anticipated or known increases in such Uncontrollable Expenses, and (iv) including any Emergency Expenditure (as defined in Section 5(j) below). In the event that the number of condominium units has increased from the prior year, the Annual Business Plan established pursuant to the preceding sentence would be further adjusted as follows: (1) the amount of revenues determined in accordance with clause (i) above shall be calculated on a per-unit basis based on the type of condominium unit ("Per Unit Revenue"); such Per Unit Revenue shall be applied on a consistent basis to the newly acquired condominium units based on the type of condominium unit; and the amount of revenues in the Annual Business Plan shall be increased by the revenues associated with the newly acquired condominium units as determined pursuant to this sentence; (2) the amount of Controllable Expenses determined in accordance with clause (ii) above shall be calculated on a per-unit basis based on the type of condominium unit ("Per Unit Controllable Expenses"); such Per Unit Controllable Expenses shall be applied on a consistent basis to the newly acquired condominium units based on the type of condominium unit; and the amount of Controllable Expenses in the Annual Business Plan shall be increased by the Controllable Expenses associated with the newly acquired condominium units as determined pursuant to this sentence; (3) items referenced in clauses (iii) and (iv) above shall likewise apply to the newly acquired condominium units. No material deviations (as defined herein) from any item in an Annual Business Plan approved in accordance with the terms herein shall be made by Manager without the prior approval of the "Management Committee" (as defined in the Operating Agreement), to the extent required by the Operating Agreement. The Manager shall provide quarterly updates to the Annual Business Plan, solely for informational purposes. Each Annual Business Plan shall include the information set forth in Exhibit "E". Owner (and its sole member) will consider the proposed Annual Business Plan in accordance with the terms of the Operating Agreement and will consult with Manager prior to the commencement of the forthcoming calendar year in order to agree on an Annual Business Plan for such calendar year. The Annual Business Plan for calendar year 2014 is attached hereto at Exhibit "B". Notwithstanding anything herein to the contrary, the Owner may, at any time and from time to time, in connection with the addition of Additional Units or otherwise, submit to Manager reasonable modifications to all or any portion of the Annual Business Plan during the course of a calendar year, which modifications shall be incorporated in the Annual Business Plan then in effect and such Annual Business Plan as modified shall be deemed to be the Annual Business Plan then in effect, and Owner shall fund into the Disbursement Account any and all amounts as and when necessary to fund any increases in expenditures which may be required as a result of any such change to the Annual Business Plan. Notwithstanding the foregoing sentence to the contrary, in no event shall Owner have the right to modify the Annual Business Plan to reduce the Management Fee or Reimbursable Expenses otherwise due pursuant to Section 4. In no event shall Manager be deemed in default under this Agreement if such changes by Owner to the Annual Business Plan causes Manager to have insufficient funds to perform its obligations hereunder. Manager agrees to use commercially reasonable efforts to ensure that the actual costs of maintaining and operating the Project shall not exceed the amount reasonably necessary and, in any event, will not exceed either the Annual Business Plan (as modified to reflect any Additional Units) either in total amount or in any one accounting category. Notwithstanding anything to the contrary, Manager shall secure Owner's prior written approval for any expenditure that will result in an excess of the annual budgeted amount in any one accounting category by more than $10,000.00 of the Annual Business Plan or $25,000.00 in the aggregate for all categories (a "material deviation"). Manager shall promptly advise and inform the Owner of any transaction, notice, event or proposal directly relating to the management and operation of the Project which does or is likely to significantly affect, either adversely or favorably, the Project, other assets of the Owner or cause a material deviation from the Annual Business Plan. Nothing contained herein shall in any way diminish the obligations or duties of Manager hereunder.

| 7 |

(f) Leasing, Collection of Rents, Etc.

(i) Manager shall use commercially reasonable efforts consistent with the standard of care set forth herein to lease apartment units in accordance with all Applicable Laws, to retain residents and to maximize Rental Income. Manager shall not enter into any Lease which has a term greater than twelve (12) months, except as may be expressly permitted by any Loan Documents. Manager shall comply in all material respects with all of the terms and conditions applicable to the leasing of the Project set forth in any Loan Documents.

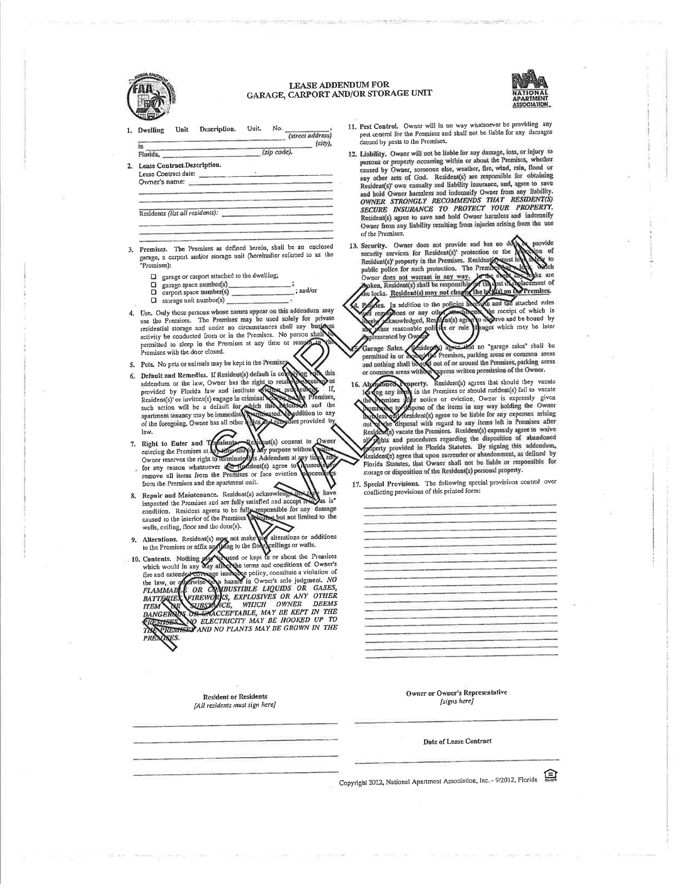

(ii) Manager shall sign apartment leases ("Leases") on behalf of Owner in its capacity as property manager hereunder. Manager shall only sign Leases in the form of lease attached hereto as Exhibit "D".

(iii) Manager shall collect rents, security deposits and other charges payable by Tenants in accordance with the Leases, and shall collect Monthly Gross Receipts due Owner with respect to the Project from all other sources, and shall deposit all such monies received promptly upon receipt in the appropriate accounts as provided herein. If Manager receives Excluded Items, Manager shall promptly deposit same in an account designated by Owner.

(iv) Manager shall pay all debt service, monthly bills and insurance premiums on the Project from the Depository Account.

(v) Manager shall, at Owner's expense, market the Project for rental, terminate Leases, evict Tenants, institute and settle suits for delinquent payments as Manager, in its reasonable discretion, deems advisable, subject to other provisions of this Agreement. In connection therewith, Manager may, at Owner's expense, as limited by the provisions of Section 5(k) of this Agreement, consult and retain legal counsel.

(vi) Manager shall, at Owner's written request, on the twenty-first (21st) day of each month, pay Owner an amount equal to Monthly Gross Receipts for such month, less amounts paid for Approved Operating Expenses of the Project in accordance with this Agreement, including, without limitation, the fees owed to Manager pursuant to Section 4 of this Agreement.

| 8 |

(vii) The responsibilities and services included in this Section 5 as part of Manager's duties shall not entitle Manager to any additional compensation over and above the fees set forth in Section 4 of this Agreement. Except as expressly provided in Section 4, Manager shall not be entitled to any compensation based upon any Project financing or sale of the Project, unless Manager is engaged pursuant to a separate agreement with Owner to provide brokerage services in connection therewith, in which case Manager's right to compensation for Project financing or sale shall be based upon such separate agreement.

(g) Repair, Maintenance and Service.

(i) Manager shall maintain the Project in good repair and condition, consistent with the standard of care set forth herein and in accordance with the Annual Business Plan.

(ii) Subject to the other terms and conditions of this Agreement, Manager in its capacity hereunder shall, in Owner's name and at Owner's expense, execute contracts for water, sanitary sewer, electricity, gas, internet service, telephone, trash removal, television, vermin or pest extermination and any other services which are necessary to properly maintain the Project, except for utility services to individual apartment units, which shall be each Tenants' respective responsibility to the extent provided in the applicable Leases. Any such contracts shall not, unless the Owner otherwise approves the terms thereof, materially deviate from the terms of the then existing approved Annual Business Plan of the Project. Manager shall, in Owner's name and at Owner's expense, out of available cash flow, hire and discharge independent contractors for the repair and maintenance of the Project. Other than Leases, which Manager is authorized to execute hereunder, Manager shall not, without the prior written consent of the Owner, enter into any contract in the name of Owner which may not be terminated without payment of penalty or premium with not more than thirty (30) days' notice. Except as set forth above, Manager shall be permitted to and shall enter into all other contracts (in the name of and/or as agent for Owner) in accordance with the standard of care established by this Agreement and as Manager reasonably believes are necessary to perform Manager's obligations hereunder. Manager shall act at arms' length with all contractors and shall employ no Affiliates of Manager without the prior written consent of Owner.

| 9 |

(h) Manager's Employees. Manager shall have in its employ at all times a sufficient number of employees to enable it to professionally manage the Project in accordance with the terms of this Agreement, as determined by Manager in its professional discretion and subject to the Annual Business Plan. Manager shall prepare, execute and file all forms, reports and returns, as applicable, but only to the extent expressly required by Applicable Laws, and Manager shall be permitted to rely on the advice of counsel and other experts in making the determination of what is required. Manager is authorized to screen, test, investigate, hire, supervise, discharge, and pay all personnel necessary in Manager's reasonable discretion to maintain and operate the Project. Owner shall reimburse Manager for all employee related expenses, liabilities, and administrative burden (including, without limitation, costs for all full-time and part- time employees such as gross salaries and wages, payroll taxes, health insurance, workers compensation, and other benefits of Manager's employees including the costs for training, software, and other administrative and processing costs, including without limitation, Project accounting, payroll processing, risk management, benefits administration, travel, marketing expenses, bank charges, telephone and answering service [which may be equitably allocated on a prorata basis (based on the gross revenues of each such property) among the Project and other properties managed by Manager, if applicable]) and all costs related to pre-employment testing and screening, provided, however, that all of the foregoing costs shall be subject to the then effective Annual Business Plan or otherwise permitted or approved by Owner pursuant to this Agreement. Owner expressly acknowledges and agrees that Manager may use employees normally assigned to other work centers and/or part-time employees to properly staff the Project, in which case wages and related expenses shall be reimbursed on a pro rata basis for the time actually spent for the Project (rather than being allocated based on the gross revenues of each property); provided, however, Owner shall not pay or reimburse Manager for all or any part of Manager's general overhead expenses, including salaries and payroll expenses of personnel of Manager, except as otherwise set forth herein.

(i) Maintenance of Records. Manager agrees to keep and maintain at all times all necessary books and records relating to the leasing, management and operation of the Project, and to prepare and render to Owner monthly itemized accounts of receipts and disbursements incurred in connection with its leasing operation and management by the thirteenth (13th) day of the following month. In particular, Manager shall furnish Owner with the statements and reports listed on Exhibit "F" attached hereto. An annual audit report shall be prepared at Owner's expense, showing a balance sheet and an income and expense statement, all in reasonable detail and certified by an independent certified public accountant approved by Owner in its sole discretion. All books, correspondence and data pertaining to the leasing, management and operation of the Project shall, at all times, be safely preserved. Such books, correspondence and data shall be available to Owner at all reasonable times, upon not less than forty-eight (48) hours' advance notice, for Owner's inspection thereof, and shall, upon the termination of this Agreement be delivered to Owner in their entirety and upon request of Owner be delivered to Owner within thirty (30) days of such request. Manager shall maintain files of all original documents relating to Leases, vendors and all other business of the Project in an orderly fashion at the Project, which files shall be the property of Owner and shall at all times be open to Owner's inspection and available for copying at Owner's request, cost and expense. On or about the end of each calendar quarter of each year, Manager shall cause to be furnished to BR Lansbrook JV Member, LLC ("Bluerock") such information as reasonably requested in writing by Bluerock as is necessary for any reporting requirements of the any direct or indirect members of Bluerock or for any reporting requirements of any REIT Member (as defined in the Operating Agreement) (whether a direct or indirect owner) to determine its qualification as a real estate investment trust and its compliance with REIT Requirements (as defined in the Operating Agreement) as shall be reasonably requested by Bluerock. Further, the Manager shall cooperate in a reasonable manner at the request of Owner and any direct or indirect member of Owner to work in good faith with any designated accountants or auditors of such party or its Affiliates so that such party or its Affiliate is able to comply with its public reporting, attestation, certification and other requirements under the Securities Exchange Act of 1934, as amended, applicable to such entity, and to work in good faith with the designated accountants or auditors of the such party or any of its Affiliates in connection therewith, including for purposes of testing internal controls and procedures of such party or its Affiliates.

| 10 |

(j) Approved Operating Expenses; Emergency Expenditures. The Approved Operating Expenses which Manager is authorized to incur and pay on behalf of Owner under this Agreement shall in all respects be limited to those expenses set forth in the Annual Business Plan for the period during which such expenses are paid; provided, however, that Manager shall be authorized to incur and pay for all other expenses permitted pursuant to Section 5(e) above, or which are otherwise expressly permitted by this Agreement regardless of whether or not such expenses are within the limitations set by the Annual Business Plan. Any expenses permitted pursuant to Section 5(e) or otherwise approved in writing by Owner which were not included in the Annual Business Plan shall be deemed sums permitted to be expended by Manager in addition to (and not in limitation of) the amounts permitted under the Annual Business Plan. The foregoing notwithstanding, if an Emergency occurs necessitating repairs the cost of which would have the effect of exceeding the Annual Business Plan by more than those limitations as provided above (such expenses referred to herein as "Emergency Expenditures"), and Manager is unable to communicate promptly with Owner, then Manager may order, contract for and pay for such Emergency Expenditures not to exceed $20,000.00, with the cost thereof being included as a Reimbursable Expense for the purposes of the Agreement, and Manager shall promptly thereafter notify Owner of any such expenses and the nature of the Emergency.

(k) Legal Proceedings and Compliance with Applicable Laws.

(i) Manager shall promptly notify Owner (and each insurance carrier of which Manager is aware and whose policy may cover a related claim) in writing of the receipt of, or attempted service on Owner or Manager of (A) any demand, notice or legal process, or (B) the occurrence of any casualty, loss, injury or damage on, at or concerning the Project.

(ii) Manager acknowledges that it is not authorized to accept service of process or any other notice on behalf of Owner. Manager shall not make representations or provide information to any Person that is inconsistent with the foregoing.

(iii) Manager shall promptly provide copies to Owner of all notices and other written communications from Owner's insurance carriers with respect to accepting coverage, appointing counsel or any other matter related to a claim against Owner.

(iv) Manager shall promptly provide notice to Owner of any oral or written communication relating to the Project that Manager receives from a governmental or regulatory agency. Manager shall promptly provide Owner with a complete copy of any such written materials.

| 11 |

(v) Manager shall fully comply and cause its employees to fully comply, with all Applicable Laws in connection with this Agreement and the performance of its obligations hereunder.

(vi) Manager agrees that it shall not, and shall not permit its employees to, cause any hazardous materials or toxic substances, to be stored, released or disposed of on or in the Project except as may be incidental to the operation of the Project (e.g., cleaning supplies, fertilizers, paint, pool supplies and chemicals) and then only in complete compliance with all Applicable Laws, in conformity with the standard of care established hereby and in accordance with any limitations set forth in in any loan documents evidencing or securing any financing secured by the Project. If (A) there is a violation of Applicable Laws or a violation of the terms of any applicable loan documents regarding the storage, release and disposal of such hazardous materials, or toxic substances, or (B) Manager reasonably believes that the storage, release or disposal of any hazardous material, petroleum product, or toxic substances, could cause liability to the Owner, including any releases caused by Tenants, third parties or employees, on or affecting the Project, Manager shall notify Owner promptly.

(vii) Manager agrees that the Project shall be offered to all prospective tenants on a nondiscriminatory basis without regard to race, color, religion, sex, family status, handicap or national origin in accordance with Applicable Law.

(l) Computers. All computers, hardware, software, computer upgrades and maintenance in connection therewith shall be at Owner's expense.

(m) Insufficient Cash Flow. In the event Manager, at its sole option, elects to advance funds for Owner's account or Owner is indebted to Manager for services or otherwise arising out of, and incurred in accordance with the terms of, this Agreement, all monies advanced by Manager or otherwise past-due shall thereafter be due and payable by Owner upon demand and shall bear interest at the prime rate as set forth in the Wall Street Journal, plus one percent, per annum, computed on monthly debit balances on Owner's account. At the election of Manager, and upon prior written notice to Owner, Manager may satisfy any permitted advances made by Manager, together with the interest due thereon, from the Monthly Gross Receipts of the Project. In the event that the Depository Accounts for the Project do not have sufficient funds to cover the monetary obligations of Manager or the Project pursuant to this Agreement, Manager shall give Owner prompt written notice with respect to such shortfall and if Owner has not promptly provided funds, then Manager will have no duty to perform any such obligations until Owner provides sufficient funding, unless Manager so elects in its sole discretion pursuant to this Section 5(m), and Manager shall not be in default under this Agreement for failure to perform any obligation hereunder as a result of such lack of funds. If Manager suspects that the cash flow from the Project will not, at any time, be sufficient to cover any Project related expenses, Manager shall promptly notify Owner, and Manager and Owner shall mutually determine the order in which the obligations of the Project will be satisfied; provided, however, that Manager and Owner agree that available cash flow will in any event first be applied to Uncontrollable Expenses that are then due and payable.

| 12 |

6. Insurance Requirements.

(a) Manager's Insurance. With respect to its operations of the Project, Manager shall carry, (i) worker's compensation insurance for compensation to any person engaged in the performance of any work undertaken under this Agreement, including employer's liability coverage with limits of not less than as may be required by Applicable Law, (ii) commercial general liability insurance and excess/umbrella liability insurance policies with combined limits of not less than $3,000,000.00 per occurrence and in the aggregate; such policies shall be written on an occurrence basis, and include contractual liability and other provisions as Owner shall reasonably require, (iii) a crime insurance policy including insuring agreement for employee dishonesty, forgery and alteration, theft, disappearance and destruction, and robbery and safe burglary, with limits of liability for each insuring agreement not less than $100,000.00, with a maximum deductible of $5,000.00 per claim, and (iv) if the Manager provides services similar to those set forth in this Agreement to third-party clients with which the Manager has no other affiliation, a professional liability insurance policy covering all the activities of Manager; such policy shall be written on a "claims made" basis, with limits of at least $1,000,000.00 in the aggregate and with a maximum deductible of $25,000.00. Any loss for less than the amount of the deductibles shall be borne by Manager. All policies of insurance shall be maintained in effect during the period of this Agreement. Each policy shall be from an insurance company rated "A" or higher by the A.M. Best Insurance Guide, with a financial size category rating of 12 or higher. The Commercial General Liability insurance policy shall be endorsed to include Owner as an additional insured. Manager shall furnish Owner with copies Xxxxx certificates evidencing such policies and the renewals thereof.

(b) Owner's Insurance. As an operating expense of the Project, Owner or Owner's representative shall provide and maintain insurance as consistent and required by the loan documents relating to the Project, or if there are none applicable, in an amount equal to 100% of the full replacement value of the Project and the improvements thereon. Alternatively, Manager has arranged, through its insurance agent, a master insurance program in which owners of property managed by Manager may participate (the "Master Insurance Program"). If Owner elects to participate in the Master Insurance Program, the Owner shall pay the amount thereof set forth on the insurance invoice delivered to Owner under the Master Insurance Program, which invoice may include administrative charges in excess of the actual insurance premiums charged by the underling insurance carriers. All insurance coverage provided under the Master Insurance Program shall be terminated when this Agreement expires or is sooner terminated without the need for prior notice of termination of the insurance coverage. Owner acknowledges that Manager is not an expert or consultant regarding insurance coverages and requirements; accordingly, Owner assumes all risk with respect to the adequacy of insurance coverages, whether such insurance is provided through the Master Insurance Program or otherwise, and Manager shall have no liability therefor in any respect. Manager shall be named an additional insured under any policies of insurance carried by Owner with respect to the Project.

| 13 |

(c) Annual Business Plan. Upon Manager's submission of each Annual Business Plan, Manager shall affirmatively and in writing confirm and set forth the scope of all existing insurance coverage, including confirming coverage for the forthcoming year.

7. Representations and Duties of Manager. Manager represents, warrants, covenants and agrees that:

(a) Manager has the authority to enter into and to perform this Agreement, to execute and deliver all documents relating to this Agreement, and to incur the obligations provided for in this Agreement.

(b) When executed, this Agreement shall constitute the valid and legally binding obligations of Manager in accordance with its terms.

(c) Manager has all necessary licenses, consents and permissions to enter into this Agreement, manage the Project, and otherwise comply with and perform Manager's obligations and duties hereunder. Manager shall comply with any conditions or requirements set out in any such licenses, consents and permissions, and shall at all times operate and manage the Project in accordance with such conditions and requirements.

(d) During the term of this Agreement, Manager will be a valid limited liability company, duly organized under the laws of the State of its formation, be qualified in the State in which the Project is located and shall have full power and authority to manage the Project, and otherwise comply with and perform Manager's obligations and duties under this Agreement.

(e) Manager shall comply with any requirements under applicable environmental laws, regulations and orders which affect the Project.

(f) Manager shall cause the Project to be operated in a manner so that all requirements shall be met which are necessary to obtain or achieve issuance of all necessary permanent unconditional certificates of occupancy, including all governmental approvals required to permit occupancy of all of the apartment units in the Project.

8. Representations of Owner. Owner represents and warrants, that:

(a) Owner has the authority to enter into and to perform this Agreement, to execute and deliver all documents relating to this Agreement, and to incur the obligations provided for in this Agreement;

(b) The Person executing this Agreement on behalf of Owner has the requisite power and authority to execute this Agreement on behalf of Owner; and

| 14 |

(c) When executed, this Agreement, together with all documents executed pursuant hereto, shall constitute the valid and legally binding obligations of Owner in accordance with its terms.

9. Indemnification.

(a) Indemnification of Owner. Manager shall indemnify, protect, defend (with legal counsel approved by Owner) and hold harmless Owner and Owner's members, managers, partners and Affiliates, together with their respective officers, directors, agents, employees and affiliates (collectively, "Owner Indemnitees"), from and against any and all claims, demands, actions, liabilities, losses, costs, expenses, damages, penalties, interest, fines, injuries and obligations, including reasonable attorneys' fees, court costs and litigation expenses ("Claims") actually incurred by any Owner Indemnitee as a result of (i) any act by Manager (or any officer, agent, employee or contractor of Manager) outside the scope of Manager's authority hereunder, (ii) any act or failure to act by Manager (or any officer, agent, employee or contractor of Manager) constituting gross negligence, willful misconduct, fraud or material breach of this Agreement, other than as covered by Owner's insurance (for negligence or misconduct only) and to the extent Owner's insurance is available, (iii) Claims made by current or former employees or applicants for employment arising from hiring, supervising or firing same, or (iv) any act or omission by Manager, its employees, officers, agents or contractors knowingly in violation of any Applicable Laws.

(b) Indemnification of Manager by Owner. Owner shall indemnify, protect, defend and hold harmless Manager and its Affiliates, together with their respective officers, directors, agents, employees and affiliates (collectively, "Manager lndemnitees") from and against any and all Claims actually incurred by any Manager Indemnitee resulting from performance of its obligations under this Agreement, except that this indemnification shall not apply with respect to any Claims (i) resulting from any act by Manager, its employees, officers, agents or contractors outside the scope of Manager's authority hereunder, (ii) resulting from any act or failure to act by Manager, its employees, officers, agents or contractors constituting gross negligence, willful misconduct, fraud or material breach of this Agreement, (iii) resulting from Claims made by current, former employees or applicants for employment arising from hiring, supervising or firing same, or (iv) any act by Manager, its employees, agents or contractors knowingly in violation of any Applicable Law.

(c) Survival. The provisions of this Section 9 shall survive the termination of this Agreement.

10. Defaults.

(a) Manager's Event of Default. Manager shall be deemed to be in default hereunder upon the happening of any of the following ("Manager's Event of Default"):

(i) The failure by Manager to keep, observe or perform any covenant, agreement, term or provision of this Agreement and the continuation of such failure, in full or in part, for a period of thirty (30) days after written notice thereof by Owner to Manager, or if such default cannot be cured within such thirty (30) day period, then such additional period as shall be reasonable (but in no event to exceed an additional sixty (60) days thereafter), provided Manager commences to cure such default within such thirty (30) day period and proceeds diligently to prosecute such cure to completion;

| 15 |

(ii) The making of a general assignment by Manager for benefit of its creditors, the filing by Manager with any bankruptcy court of competent jurisdiction of a voluntary petition under Title 11 of U.S. Code, as amended from time to time, the filing by Manager of any petition or answer seeking any reorganization, arrangement, composition, readjustment, liquidation, dissolution, or similar relief under any present or future federal or state act or law relating to bankruptcy, insolvency, or other relief for debtors, Manager being the subject of any order for relief issued under such Title 11 of the U.S. Code, as amended from time to time, or the dissolution or liquidation of Manager;

(iii) The intentional misapplication, misappropriation or commingling of funds held by Manager for the benefit of Owner, including the payment of fees to Affiliates of the Manager or the loaning of funds to Affiliates; or

(iv) The occurrence of any other for Cause event with respect to Manager's Affiliate, Xxxxxxx Lansbrook JV Member, LLC.

(b) Remedies of Owner. Upon a Manager's Event of Default, after expiration of all applicable notice and cure periods, Owner shall be entitled to (i) terminate in writing this Agreement effective as of the date designated by Owner (which may be the date upon which notice is given) and/or (ii) pursue an action for the actual compensatory damages incurred by Owner provided the Manager's Event of Default has not then been cured or such cure has not commenced and is not being diligently pursued. Owner expressly agrees that termination of this Agreement and compensatory monetary damages are its sole rights and remedies with respect to a Manager's Event of Default and Owner expressly waives and releases all other rights and remedies, including, without limitation, the right to seek equitable relief, including specific performance or injunctive relief, and to xxx for any consequential or punitive damages.

(c) Owner's Event of Default. Owner shall be deemed to be in default hereunder upon the happening of any of the following (an "Owner's Event of Default"):

(i) The failure by Owner to keep, observe or perform any covenant, agreement, term or provision of this Agreement to be kept, observed or performed by Owner, and such default shall continue for a period of thirty (30) days after written notice thereof by Manager to Owner, or if such default cannot be cured within such thirty (30) day period, then such additional period as shall be reasonable, provided Owner commences to cure such default within such thirty (30) day period and proceeds diligently to prosecute such cure to completion; or

| 16 |

(ii) The making of a general assignment by Owner for benefit of its creditors, the filing by Owner with any bankruptcy court of competent jurisdiction of a voluntary petition under Title 11 of U.S. Code, as amended from time to time, the filing by Owner of any petition or answer seeking any reorganization, arrangement, composition, readjustment, liquidation, dissolution, or similar relief under any present or future federal or state act or law relating to bankruptcy, insolvency, or other relief for debtors, Owner being the subject of any order for relief issued under such Title 11 of the U.S. Code, as amended from time to time, or the dissolution or liquidation of Owner.

(d) Remedies of Manager. Upon an Owner's Event of Default, Manager shall be entitled to (i) terminate in writing this Agreement effective as of the date designated by Manager which is at least ten (10) days after receipt of such notice of termination by Owner provided the Owner's Event of Default has not then been cured or such cure commenced, and/or (ii) pursue an action for the actual compensatory damages incurred by Manager. Manager expressly agrees that termination and compensatory monetary damages are its sole rights and remedies with respect to an Owner's Event of Default and Manager expressly waives and releases the right to seek equitable relief, including specific performance or injunctive relief, and to xxx for any consequential or punitive damages.

11. Termination Rights. In addition to the termination right set forth in Section 3 above, Manager and Owner shall have the following rights to terminate this Agreement:

(a) Termination By Owner Upon Manager's Event of Default. Upon a Manager's Event of Default, Owner may terminate this Agreement as specified in Section 10(b) of this Agreement.

(b) Termination By Manager Upon Owner's Event of Default. Upon an Owner's Event of Default, Manager may terminate this Agreement as specified in Section l0(d) of this Agreement.

(c) Termination Without Cause. Either Owner or Manager may terminate this Agreement on ninety (90) days' prior written notice after the expiration of the Initial Term, without cause. In addition, upon any sale of the Project, this Agreement shall automatically terminate as of the closing date of such sale.

(d) Effect of Termination Upon Payment of Fees. Upon the termination of this Agreement for any reason, Manager shall be entitled to its earned, but unpaid, fees as set forth in Section 4 of this Agreement, for the period prior to the termination.

(e) Final Accounting; Delivery of Project Upon Termination.

(i) Within thirty (30) days after termination of this Agreement for any reason, Manager shall:

(1) deliver to Owner all funds (less final payroll and applicable fees), checks, keys, Lease files, books and records and other Confidential Information; and

| 17 |

(2) Promptly leave the Project and cause Manager's employees to leave the Project without causing any damage thereto.

(ii) Within ninety (90) days' after termination of this Agreement, Manager shall deliver to Owner a final accounting for the Project, reflecting the balance of income and expenses thereon as of the date of termination.

(iii) Termination of this Agreement under any of the prov1s1ons of this Agreement shall not release either party as against the other from liability for failure to perform any of its duties or obligations as expressed herein and required to be performed prior to such termination. Owner agrees to cooperate with Manager in the performance of the obligations set forth in this Section 1l(e).

12. Confidentiality.

(a) Preservation of Confidentiality. In connection with the performance of its obligations hereunder, Manager acknowledges that it will have access to Confidential Information. Manager shall treat such Confidential Information as proprietary to Owner and private, and shall preserve the confidentiality thereof and not disclose, or cause or permit its employees, agents or contractors to disclose, such Confidential Information. Notwithstanding the foregoing, Manager shall have the right to disclose Confidential Information if and only to the extent it has become public knowledge, but not due to the actions of Manager, or Manager is required by court order to disclose any Confidential Information. IfManager or anyone to whom Manager transmits Confidential Information pursuant to this Agreement becomes legally compelled to disclose any of the Confidential Information, Manager shall provide Owner with prompt notice thereof so that Owner may seek a protective order or other appropriate remedy or waive compliance with the provisions of this Agreement. In the event that such protective order or other remedy is not obtained by Owner or Owner waives compliance with the provisions of this Agreement, Manager shall furnish or cause to be furnished only that portion of the Confidential Information which Manager is required by Applicable Law to furnish, and will exercise commercially reasonable efforts to obtain reliable assurances that confidential treatment is accorded the Confidential Information so furnished.

(b) Property Right in Confidential Information. All Confidential Information shall remain the property of Owner and Manager shall have no ownership interest therein.

13. Survival of Agreement. All indemnity obligations set forth herein, all obligations to pay earned and accrued fees and expenses, all confidentiality obligations, and all obligations to perform accrued prior to the date of termination shall survive the termination of this Agreement.

14. Enforcement of Agreement. This Agreement, its interpretation, performance and enforcement, and the rights and remedies of the parties hereto, shall be governed and construed by and in accordance with the law of the State in which the Project is located. In any dispute pertaining to, or litigation or arbitration arising from the enforcement or interpretation of the provisions of this Agreement, the prevailing party shall be entitled to recover its reasonable attorney's fees and costs actually incurred, including those incurred in connection with all appellate levels, bankruptcy, mediation or otherwise to maintain such action, from the losing party.

| 18 |

15. Assignment. Manager shall not sell, directly or indirectly, assign or otherwise transfer by operation of law or otherwise all or any part of its rights or obligations under this Agreement, except, with Owner's consent, to an Affiliate of Manager or to any lender of Manager as collateral security for any and all borrowings of Manager and/or any of its Affiliates, and any such unauthorized assignment shall be void ab initio and of no effect. A change in the ownership of Manager shall not constitute an assignment, provided that the Key Individuals (as defined in the Operating Agreement), or any of them, remain in control of the day to day operations of Manager with respect to the Project.

16. Use of Trademark. If at any time the Project shall be promoted and branded using the name "ARIUM" (the "Trademark"), as elected by Owner in its sole discretion, Owner shall grant (or cause to be granted} to Manager a non-exclusive, royalty-free license to use (but not the right to sublicense) the Trademark for such purpose, until the earlier of (i) the dissolution and termination of the Agreement or (ii) the date on which Owner elects, in its sole discretion, to brand the Project using a different name. Owner and certain of its Affiliates retain ownership of and the right to use (and to license) the Trademark in connection with any and all matters. At no time during the term of the Agreement shall any value be placed upon the Trademark by Manager or the right to its use, or the goodwill, if any, attached thereto. Upon the dissolution of the Agreement, neither the Trademark nor the right to its use, nor the goodwill, if any, attached thereto shall be considered as an asset of the Manager, unless otherwise licensed or sublicensed to Manager by Affiliates of Owner having a right to so license or sublicense the Trademark.

17. Notices. All notices, demands, requests or other communications to be sent by one party to the other hereunder or required by Applicable Law shall be in writing and shall be deemed to have been validly given or served by delivery of same in person to the addressee, by depositing same with a nationally recognized overnight delivery service such as Federal Express for next business day delivery ("Overnight Delivery") or by sending by facsimile transmission, addressed as follows:

| If to Owner: | c/o Bluerock Real Estate, L.L.C. | |

| 000 Xxxxx Xxxxxx, 0xx Xxxxx Xxx Xxxx, Xxx Xxxx 00000 Attention: Jordan X. Xxxxx Facsimile No. (000) 000-0000 |

||

| with copies to: | c/o Bluerock Real Estate, L.L.C. | |

| 000 Xxxxx Xxxxxx, 0xx Xxxxx Xxx Xxxx, Xxx Xxxx 00000 Attention: Xxxxxxx Xxxxx, Esq. Facsimile No. (000) 000-0000 |

| 19 |

| And: | c/x Xxxxxxx Organization, LLC 0000 | |

| Xxxxxxxxx Xxxx, Xxxxx 0000 | ||

| Xxxxxxx, Xxxxxxx 00000 Attention: M. Xxxxxxx Xxxxxxx Facsimile No. (000) 000-0000 |

||

| If to Manager: | Carroll Management Group, LLC. | |

| c/x Xxxxxxx Organization, LLC 0000 Xxxxxxxxx Xx, XX Xxxxx 0000 |

||

| Xxxxxxx, XX 00000 Attn: Xxxxx Xxxxxxxxx |

||

| Facsimile No. 000-000-0000 |

All notices shall· be effective upon such personal delivery, upon being deposited in Overnight Delivery or upon facsimile transmission as required above. However, with respect to notices so deposited in Overnight Delivery, the time period in which a response to any such notice, demand or request must be given shall commence to run from the next business day following any such deposit in Overnight Delivery. Notices delivered via facsimile will be effective upon sender's receipt of confirmation of transmission. A party may change its address for notice purposes by giving to the other party hereto at least fifteen (15) days' prior written notice in accordance with the provisions hereof.

18. Miscellaneous.

(a) Captions. The captions of this Agreement are inserted only for the purposes of convenient reference and do not define, limit or prescribe the scope or intent of this Agreement or any part hereof.

(b) Amendments. This Agreement cannot be amended or modified except by another agreement in writing, signed by both Owner and Manager.

(c) Entire Agreement. This Agreement embodies the entire understanding of the parties, and there are no further agreements or understandings, written or oral, in effect between the parties relating to the subject matter hereof.

(d) Time is of Essence. Time is the essence hereof.

(e) Construction of Document. This Agreement has been negotiated at arms' length and has been reviewed by counsel for the parties. No provision of this Agreement shall be construed against any party based upon the identity of the drafter.

(f) Severability. If any provision of this Agreement or the application thereof is held to be invalid or unenforceable, such defect shall not affect other provisions or applications of this Agreement that can be given effect without the invalid or unenforceable provisions or applications, and to this end, the provisions and applications of this Agreement shall be severable.

| 20 |

(g) Waiver of Jury Trial. To the fullest extent permitted by Applicable Law, each party to this agreement severally, knowingly, irrevocably and unconditionally waives any and all rights to trial by jury in any action, suit or counterclaim brought by any party to this Agreement arising in connection with, out of or otherwise relating to this Agreement.

(h) No Continuing Waiver. No waiver by a party hereto of any breach of this Agreement shall be effective unless in a writing executed by such party. No waiver shall operate or be construed to be a waiver of any subsequent breach.

(i) Terrorism and Money Laundering: Owner and Manager mutually represent and warrant to each other as follows:

(i) They are not now nor will they be at any time following the execution of this Agreement a Person with whom a U.S. Person is prohibited from transacting business of the type contemplated by this Agreement, whether such prohibition arises under U.S. law, regulation, executive orders and lists published by the Office of Foreign Asset Control ("OFAC") (including those executive orders and lists published by OFAC with respect to Specially Designated Nationals and Blocked Persons) or otherwise (such persons being referred to in this Agreement as "Prohibited Persons"); and

(ii) They have made reasonable inquiry and taken such other steps, consistent with best industry practices (including conducting background searches and checking published lists of Prohibited Persons) and in any event as required by Applicable Law, to ensure that no Person who is an employee of their respective organization or who owns an interest in their respective organization is now, or will be at any time following the execution of the Agreement, a Prohibited Person.

(j) Governing Law. It is the express intention of Manager and Owner that the laws of the State of Florida shall govern the validity, interpretation, construction and performance of this Agreement, excluding any conflict-of-law rules which would direct the application of the law of another jurisdiction. Each of the parties hereto irrevocably submits to the jurisdiction of the New York State courts and the Federal courts sitting in the State of New York and agrees that all matters involving this Agreement shall be heard and determined in such courts. Each of the parties hereto waives irrevocably the defense of inconvenient forum to the maintenance of such action or proceeding. Each of the parties hereto designates CT Corporation System, 0000 Xxxxxxxx, Xxx Xxxx, Xxx Xxxx 00000, as its agent for service of process in the State of New York, which designation may only be changed on not less than ten (10) days' prior notice to all of the other parties.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

| 21 |

IN WITNESS WHEREOF, the parties have executed this Agreement under seal as of the date first set forth above.

OWNER:

| BR XXXXXXX LANSBROOK, LLC, a Delaware limited liability company | ||

| By: | /s/ Jordan X. Xxxxx | |

| Name: | Jordan X. Xxxxx | |

| Title: | Chief Executive Officer | |

MANAGER:

| XXXXXXX MANAGEMENT GROUP, LLC, a Georgia limited liability company | ||

| By: | /s/ M. Xxxxxxx Xxxxxxx | |

| Name: | M. Xxxxxxx Xxxxxxx | |

| Title: | President and CEO | |

Exhibits:

Exhibit A - Property Description

Exhibit B -2014 Annual Business Plan

Exhibit C - Reimbursable Expenses

Exhibit D - Form of Lease

Exhibit E - Additional Business Plan Information

Exhibit F- Statements and Reports

| 22 |

EXHIBIT "A"

Project Legal Description

[See Attached]

| A-1 |

EXHIBIT A

PARCEL I:

UNITS as shown on Exhibit ''A" LEGAL DESCRIPTION being in the following:

LANSBROOK VILLAGE CONDOMINIUM, a Condominium according to the Declaration of Condominium thereof, as recorded in O.R. Book 14696, Pages 673 through 874, inclusive and according to the Plat thereof recorded in Condominium Book 139, Pages 42 through 62, inclusive and all amendments thereof, of the Public Records of Pinellas County, Florida, together with an undivided interest in the common elements for each unit described in Exhibit "A" LEGAL DESCRIPTION.

PARCEL 2:

Easements in and to the common areas, as more particularly defined and described in the Declaration of Covenants, Conditions, Restrictions and Easements for The Villages at Lansbrook (The "Villages at Lansbrook Declaration, recorded December 17, 1999, in O.R. Book 10758, Page 763, as further supplemented by the document recorded in

O.R. Book 10758, Page 855, as further supplements by the document recorded in O.R Book 11378, Page 120 and as Amended and Restated by Amended and Restate Declaration of Covenants, Conditions, Restrictions and Easements for Village of Lansbrook, recorded in O.R. Book 12489, Page 234 l, Second Amended and Restate Declaration of Covenants, Conditions, Restrictions and Easements for Villages of Lansbrook recorded October 4, 2004, in 0.R

Book 13864, Page 2510, all of the Public Records of Pinellas County, Florida. LESS and EXCEPT those easement

areas created under the aforementioned documentation that are located within Parcel l described above.

PARCEL 3:

Drainage and retention easements over the drainage area more particularly described and defined in the Declaration of Drainage Easements and Maintenance Agreement (the "Drainage Declaration") recorded October 15, 1993, in O.R Book 8437, Page 1145, as modified by O.R..Book 9109, Page 1086 and as supplemented by document recorded in O.R. Book 11378, Page 111, all of the Public Records of Pinellas County, Florida.

| A-2 |

EXHIBIT "A" LEGAL DESCRIPTION

PARCEL 1:

Cambridge Village "C" Xxxxx

X0-000 X0-000 X0-000 X0-000 X0-000 C1-202 C1-205 C1-206

C2-101 C2-103 C2-104 C2-201 C2-202 C3-101 C3-102 C3-104 C3-105 C3-106 C3-201 C3-202 C3-203 C3-204 C3-205 C4-101 C4-102 C4-103 C4-104 C4-201 C4-203 C4-204 C5-104 C5-105 C5-106 C5-202 C5-203 C5-205 C5-206 C6-101 C6-102 C6-103 C6-104 C6-201 C6-203 C6-204 C7-104 C7-105 C7-106 C7-201 C7-202 C7-204 C7-206 CB-101 XX-000 XX-000 XX-000 XX-000 C9-101 C9-102 C9-103 C9-104 C9-201 C9-202

C9-203 C9-204 C10-102 C10-103 C10-104 C10-105 C10-106 C10-201 C10-202 C10-203 C10-205 C10-206 C11-101 C11-102 C11-103 C11-201 C11-202 C11-203 C12-101 C12-104 C12-201 C12-203 C13-101 C13-102 C13-104 C13-201 C13-203 C13-204 C14-102 C14-104 C14-201 C14-202 C14-204 C15-101 C15-102 C15-104 C15-201 C15-202 C15-204 C16-101 C16-102 C16-104 C16-201 C16-202 C16-203 C16-204 C17-103 C17-104 C17-201 C17-202 C17-203 C17-204 C18-101 C18-102 C18-103 C18-104 C18-201 C18-202 C18-203 C18-204 C19-104 C19-201 C19-203 C19-204 C20-101 C20-104 C20-201 C20-204 C21-101 C21-102 C21-103 C21-104 C21-201 C21-202 C21-203 C22-103 C22-104 C22-105 C22-106 C22-204 C22-205 C22-206 C23-101 C23-102 C23-103 C23-104 C23-105 C23-106 C23-201 C23-202 C23-203 C23-204 C23-205 C23-206 C24-101 C24-102 C24-103 C24-201 C24-203 C24-204 C25-101 C25-102 C25-104 C25-105 C25-201 C25-203 C25-204 C25-205 C25-206 C26-101 C26-102 C26-104 C26-201 C26-203 C26-204

Hampton Village "H" Units

H1-102 H1-103 H1-104 H1-106 H1-107 H1-108 H2-101 H2-103 H2-104 H2-105 H2-106 H2-108 H3-103 H3-104 H3-105 H3-106 H3-107 H4-101 H4-106 H5-103 H5-104 H6-101 H6-102 H6-107 H6-108 H6-201 H6-202 H6.:203 H6-204 H6-207 H6-208 H6-301 H6-302 H6-303 H6-304 H6-305 H6-306 H6-307 H6-308 H7-102 H7-103 XX-000 XX-000 H9-102 H9-103

H9-104 H9-105 H9-106 H9-107 H9-108 H10-101 H10-102 H10-103 H10-106

H10-107 H10-108 H10-203 H10-204 H10-205 H10-206 H10-207 H10-301 H10-302 H10-304 H10-306 H10-307 H10-308 H11-103 H11-105 H11-106 H11-107 H11-108 H11-109 H12-101 H12-102 H12-103 H12-104 H12-105 H12-106 H12-107 H12-108 H12-201 H12-202 H12-203 H12-205 H12-206 H12-207 H12-208 H12-301 H12-302 H12-304 H12-305 H12-306 H13-103 H13-104 H13-105 H14-101 H14-102 H14-104 H14-105 H15-101 H15-106 H15-108 H16-104 H16-105 H16-106 H16-107 H16-108 H16-201 H16-202 H16-203 H16-204 H16-205 H16-206 H16-207 H16-208 H16-301 H16-302 H16-304 H16-306 H16-307 H16-308 H17-102 H17-104 H17-105 H17-106 H17-107 H18-101 H18-102 H18-103 H18-104 H18-105 H18-106 H18-108 H19-102 H19-103 H19-104 H19-105 H19-106 H20-101 H20-102 H20-103 H20-104 H20-105 H21-103 H21-105 H21-107 H21-108 H21-109 H21-110 H22-103 H22-104 H22-106 H22-107 H22-108 H22-109 H22-110 H23-101 H23-102 H23-103 H23-104 H23-105 H23-106 H24-101 H24-102 H24-103 H24-105 H24-108 H23-109

| A-3 |

Windsor Village 'W" Units

W1-101 W1-204 W2-104 W2-201 W2-203 W3-101 W3-201 W3-202 W3-203 W3-204 W4-102 W4-104 W4-204 W5-101 W5-104 W6-101 W6-102 W6-104 W6-203 W6-204 W7-101 W7-103 W7-104 W7-201 W7-202 W7-203 W7-204 XX-000 XX-000 XX-000 XX-000 XX-000 XX-000 W9-104 W9-105 W10-101

W10-103 W10-105 W11-104 W11-106 W12-101 W12-103 W12-104 W12-105 W12-106

W13-102 W13-105 W13-106 W14-102 W14-103 W14-104 W15-101 W15-102 W15-103 W15-104 W15-105 W15-106 W16-102 W16-103 W16-104 W16-105 W17-101 W17-103 W18-101 W18-102 W18-103 W18-104 W18-201 W18-202 W18-203 W18-204 W19-101 W19-201 W19-204 W20-102 W20-103 W20-104 W20-203 W21-101 W21-102 W21-103 W21-201 W21-202 W21-204 W22-101 W22-102 W22-103 W22-104 W22-202 W22-203 W22-204 W23-101 W23-102 W23-104 W23-202 W23-203 W24-101 W24-102 W24-103 W24-104 W24-202 W24-203 W24-204 W25-101 W25-102 W25-103 W25-104 W25-203 W26-101 W26-102 W26-103 W26-104 W26-201 W26-202 W27-202 W28-102 W28-103 W28-202 W28-203 W29-102 W29-103 W30-101 W30-102 W30-201 W31-101 W31-103 W31-104 W32-101 W32-103 W33-101 W33-104 W34-101 W34-105 W35-101 W35-102 W35-104 W35-105 W35-106 W36-103 W36-106 W37-101 W37-102 W34-103 W37-104 W37-105 W38-101 W38-104 W38-106 W39-101 W39-105 W40-101 W41-101 W41-102 W41-103 W41-104

C19-102 CB-202 C20-103 C25-103 XX-000 XX-000 C10-101 C12-102 C12-202 C19-103

H6-206 H10-201 H10-303 H11-110 H15-102 H15-104 H15-110 H16-305 H22-105 H1-105 HS-101 H6-104 H16-103 H6-106 H17-103 H22-101

W3-102 X0-000 XX-000 XX-000 W?-102 W10-104 W12-102 W16-101 W19-102

W19-104 W21-104 W27-203 W28-101 W28-104 W28-204 W29-204 W30-103 W11-101 W10-102 W36-105 W26-204 W27-201 W36-102 WB-203 W20-101 W33-106 W25-204 W27-102

C1-102 H10-105 W1-102 W2-102 W10-106 W25-201

H3-101 H23-107 W1-103 W4-203 W21-203 W29-104 W33-103 W34-102 W36-101

W2-204

| A-4 |

EXHIBIT "B"

Calendar Year 2014

Annual Business Plan

[See Attached]

| B-1 |

| Lansbrook Village | RESIDENTIAL OPERATING BUDGET | PRINTED 3/21/2014 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| # of Units 571 | XXXXXXX MANAGEMENT GROUP | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Leasable SF 662225 | Mar-2014 | Apr-2014 | May'2014 | Jun-2014 | Jul-2014 | Aug-2014 | Sep-2014 | Oct-2014 | Nov-2014 | Dec-2014 | Jan-2015 | Feb-2015 | TOTAL | $/SQFT | $/UNIT | %OF GROSS | ||||||||||||||||||||||||||||||||||||||||||||||||||

| OCCUPANCY PERCENTAGE | 93.17 | % | 92.99 | % | 93.17 | % | 92.64 | % | 92.64 | % | 92.82 | % | 92.99 | % | 93.17 | % | 93.17 | % | 92.99 | % | 92.64 | % | 92.82 | % | 92.94 | % | ||||||||||||||||||||||||||||||||||||||||

| REVENUE: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4310-0000 | MARKET RENT PER SCHEDULE | 619,266 | 624,976 | 628,973 | 638,680 | 638,680 | 638,680 | 648,387 | 648,387 | 648,387 | 648,387 | 648,387 | 648,387 | 7,679,577 | 11.60 | 13,449 | 102.35 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| 4320-0000 | LEASES OVER/UNDER SCHEDULE | (3,940 | ) | (8,393 | ) | (10,897 | ) | (18,878 | ) | (16,650 | ) | (14,530 | ) | (22,365 | ) | (20,093 | ) | (17,948 | ) | (15,987 | ) | (14,124 | ) | (12,353 | ) | (176,159 | ) | -2.35 | % | |||||||||||||||||||||||||||||||||||||

| GROSS POTENTIAL RENT | 615,326 | 616,583 | 618,076 | 619,802 | 622,030 | 624,150 | 626,022 | 628,294 | 630,439 | 632,400 | 634,263 | 636,034 | 7,503,418 | 11.33 | 13,141 | 100.00 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| 5220-0000 | VACANCY LOSS | 42,028 | 43,193 | 42,215 | 45,590 | 45,753 | 44,816 | 43,854 | 42,913 | 43,060 | 44,301 | 46,653 | 45,670 | 530,047 | 7.06 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 6312-0000 | ADMINISTRATIVE UNITS | 3,975 | 3,975 | 3,975 | 3,975 | 3,975 | 3,975 | 3,975 | 3,975 | 3,975 | 3,975 | 3,975 | 3,975 | 47,700 | 0.64 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 6370-0000 | BAD DEBT | 2,054 | 2,054 | 2,054 | 2,054 | 2,054 | 2,054 | 2,054 | 2,054 | 2,054 | 2,054 | 2,054 | 2,054 | 24,648 | 0.33 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 6370-0001 | BAD DEBT RECOVERY | (650 | ) | (650 | ) | (650 | ) | (650 | ) | (650 | ) | (650 | ) | (650 | ) | (650 | ) | (650 | ) | (650 | ) | (650 | ) | (650 | ) | (7,800 | ) | |||||||||||||||||||||||||||||||||||||||

| 5250-0000 | LOST RENT- CONCESSIONS | 1,200 | 1,200 | 1,200 | 1,200 | 1,200 | 1,200 | 1,200 | 1,200 | 1,200 | 1,200 | 1,200 | 1,200 | 14,400 | 0.19 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL RENTAL LOSSES | 48,607 | 49,772 | 48,794 | 52,169 | 52,332 | 51,395 | 50,433 | 49,492 | 49,639 | 50,880 | 53,232 | 52,249 | 608,995 | 0.92 | 1,067 | 8.12 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| NET RENTAL INCOME | 566,720 | 566,811 | 569,282 | 567,633 | 569,697 | 572,754 | 575,589 | 578,801 | 580,800 | 581,520 | 581,030 | 583,785 | 6,894,423 | 10.41 | 12,074 | 91.88 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| OTHER INCOME: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5990-0040 | GARAGE INCOME | $ | <=PER UNIT PER MONTH | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5990-0045 | STORAGE UNIT INCOME | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5910-0010 | MONTH TO MONTH FEES | - | - | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5910-0000 | LAUNDRY INCOME | - | $ | <=PER UNIT PER MONTH | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5910-0002 | VENDING INCOME | - | - | - | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5910-0004 | ADMINISTRATIVE FEES | 2,600 | 2,700 | 2,900 | 3,000 | 3,300 | 3,500 | 3,100 | 3,000 | 2,900 | 2,600 | 2,500 | 2,800 | 34,900 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5920-0000 | LATE CHARGES | 2,177 | 2,177 | 2,177 | 2,177 | 2,177 | 2,177 | 2,177 | 2,177 | 2,177 | 2,177 | 2,177 | 2,177 | 26,124 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5920-0002 | NSF CHARGES | 150 | 150 | 150 | 150 | 150 | 150 | 150 | 150 | 150 | 150 | 150 | 150 | 1,800 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5920-0003 | CLEANING & DAMAGE FEES | 250 | 250 | 250 | 250 | 250 | 250 | 250 | 250 | 250 | 250 | 250 | 250 | 3,000 | $ | 8.50 | <=PER UNIT TURNED | |||||||||||||||||||||||||||||||||||||||||||||||||

| FORFEITED DEPOSIT | 1,100 | 1,100 | 1,100 | 1,100 | 1,100 | 1,100 | 1,100 | 1,100 | 1,100 | 1,100 | 1,100 | 1,100 | 13,200 | $ | 1.93 | <=PER UNIT PER MONTH | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 5990-0001 | CORPORATE UNITS | - | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5990-0002 | LEGAL FEES | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 12,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5990-0003 | PET FEES | 6,155 | 6,155 | 6,155 | 6,155 | 6,155 | 6,155 | 6,155 | 6,155 | 6,155 | 6,155 | 6,155 | 6,155 | 73,860 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5990-0004 | TERMINATION FEES | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 60,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| GARAGE I CARPORT INCOME | 4,200 | 4,200 | 4,200 | 4,200 | 4,200 | 4,200 | 4,200 | 4,200 | 4,200 | 4,200 | 4,200 | 4,200 | 50,400 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| STORAGE UNIT INCOME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5990-0005 | APPLICATION FEES | 1,430 | 1,485 | 1,595 | 1,650 | 1,815 | 1,925 | 1,705 | 1,650 | 1,595 | 1,430 | 1,375 | 1,540 | 19,195 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5990-0006 | WASHER/DRYER COLLECTIONS | - | - | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5990-0008 | UTILITY COLLECTIONS | 5,340 | 5,320 | 5,310 | 5,320 | 5,290 | 5,290 | 5,300 | 5,310 | 5,320 | 5,320 | 5,310 | 5,290 | 63,720 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5990-0009 | CABLE TV COLLECTIONS | 11,883 | - | 12,127 | 11,669 | 11,771 | 47,450 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5990-0099 | MISCELLANEOUS INCOME | 500 | 500 | 500 | 500 | 500 | 500 | 500 | 500 | 500 | 500 | 500 | 500 | 6,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL OTHER INCOME | 29,902 | 30,037 | 42,220 | 30,502 | 30,937 | 43,374 | 30,637 | 30,492 | 42,016 | 29,882 | 29,717 | 41,933 | 411,649 | 0.62 | 721 | 5.49 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL REVENUE | 596,622 | 596,848 | 611,502 | 598,135 | 600,634 | 616,128 | 606,226 | 609,293 | 622,816 | 611,402 | 610,747 | 625,718 | 7,306,072 | 11 | 12,795 | 97.37 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| B-2 |

| Lansbrook Village | RESIDENTIAL OPERATING BUDGET | PRINTED 3/21/2014 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| # of Units | 571 | XXXXXXX MANAGEMENT GROUP | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||