Contract

Exhibit 10.42

Certain identified information has been excluded from this Exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

| DATED | 20 May 2019 |

CURETIS

GMBH

(as Borrower)

- and -

CURETIS

N.V.

(as Guarantor)

- and -

CURETIS

USA INC.

(as Guarantor)

- and -

ARES

GENETICS GMBH

(as Guarantor)

- and -

EUROPEAN

INVESTMENT BANK

(as Bank)

AMENDMENT

AND RESTATEMENT AGREEMENT IN RELATION TO

THE FINANCE CONTRACT

DATED 12 DECEMBER 2016

Execution Version

| |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

F3/AMT/ODT/6340505

065362.000006

▇▇▇▇▇ Lovells International LLP, ▇▇▇▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇ ▇▇▇

CONTENTS

| CLAUSE | PAGE | |

| 1. DEFINITIONS AND INTERPRETATION | 2 | |

| 2. AMENDMENT AND RESTATEMENT | 3 | |

| 3. REPRESENTATIONS AND WARRANTIES | 3 | |

| 4. CONSTRUCTION | 4 | |

| 5. AFFIRMATION AND FURTHER ASSURANCE | 4 | |

| 6. MISCELLANEOUS | 4 | |

| 7. GOVERNING LAW AND JURISDICTION | 5 | |

| SCHEDULES | ||

| 1. CONDITIONS PRECEDENT | 6 | |

| |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

THIS AGREEMENT is made on 20 May 2019

BETWEEN:

| (1) | Curetis GmbH, a company incorporated in Germany, having its registered office at ▇▇▇-▇▇▇▇-▇▇▇▇▇▇▇ ▇▇, ▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇ (the “Borrower”); |

| (2) | Curetis N.V., a company incorporated in the Netherlands with company number 64302679 and registered office at ▇▇▇-▇▇▇▇-▇▇▇▇▇▇▇ ▇▇, ▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇ (“Curetis NV”); |

| (3) | Ares Genetics GmbH, a company incorporated in Austria with company number FN 468899 H and registered office at ▇▇▇▇-▇▇▇▇▇▇-▇▇▇▇▇ ▇▇, ▇-▇▇▇▇, ▇▇▇▇▇▇, ▇▇▇▇▇▇▇ (“Ares Genetics”); |

| (4) | Curetis USA Inc., a company incorporated under the laws of the State of Delaware with registration number 607544 and having its principal executive office at 10525 Vista Sorrento Parkway, Suite 104, San Diego, CA 92121, United States of America (“Curetis USA”, and together with Curetis NV and Ares Genetics, the “Guarantors”); and |

| (5) | The European Investment Bank, having its seat at ▇▇▇ ▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇, ▇-▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇ (the “Bank”), |

WHEREAS:

| (A) | This Agreement is supplemental to a Finance Contract dated 12 December 2016 and made between the Borrower and the Bank (the “Finance Contract”), and guaranteed by the Guarantors pursuant to the Curetis N.V Guarantee, the Curetis USA Guarantee and the Ares Genetics Guarantee (each as defined below). |

| (B) | Pursuant to the Finance Contract the Bank made available to the Borrower a facility of EUR 25,000,000. |

| (C) | The Bank and the Borrower amended the Finance Contract pursuant to an amendment letter governed by English law, dated 20 April 2018 (the “Amendment Letter”) and made between, the Bank, the Borrower and the Guarantors. Amongst other things, the Amendment Letter required the Borrower to satisfy certain additional conditions precedent before it could request a disbursement of the Second Credit (as defined in the Amended and Restated Finance Contract). |

| (D) | The Borrower has failed to satisfy certain of such conditions precedent. As a result, the Bank agreed to waive certain of the conditions precedent pursuant to an amendment and waiver letter governed by English law and dated 21 March 2019 (the “Amendment and Waiver Letter”) made between, the Bank, the Borrower and the Guarantors. |

| (E) | The Bank and the Borrower now wish to amend the terms of the Finance Contract including (without limitation) by introducing an obligation on the Borrower to pay PPI (as defined in the Amended and Restated Finance Contract) together with any repayment |

| 1 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

or prepayment of the PPI Tranche (as defined in the Amended and Restated Finance Contract).

IT IS AGREED as follows:

| 1. | DEFINITIONS AND INTERPRETATION |

| 1.1 | Incorporation of defined terms: Unless otherwise provided (including in the rest of this Clause 1) or unless the context otherwise requires, all words and expressions defined in the Finance Contract (as defined above) shall have the same respective meanings in this Agreement. |

| 1.2 | Definitions: In this Agreement, the following expressions shall have the following meanings: |

“Ares Genetics Guarantee” means the guarantee and indemnity agreement dated 29 November 2017 entered into between the Bank and Ares Genetics (as Guarantor) (referred to as the Ares Genetics Guarantee Agreement in the Finance Contract).

“Amended and Restated Finance Contract” means the amended and restated Finance Contract in the form set out in the Appendix to this Agreement.

“CP Notification” means the confirmation given by the Bank to the Borrower that the Bank has received (or has waived its requirement to receive) all of the documents and/ or evidence set out in Schedule 1 (Conditions Precedent) in each case in form and substance satisfactory to the Bank.

“Curetis N.V. Guarantee” means the guarantee and indemnity agreement dated 12 December 2016 entered into between the Bank and Curetis NV (as Guarantor) (referred to as the Initial Guarantee Agreement in the Finance Contract).

“Curetis USA Guarantee” means the guarantee and indemnity agreement dated 22 December 2017 entered into between the Bank and Curetis USA (as Guarantor) (referred to as the Curetis USA Guarantee Agreement in the Amended and Restated Finance Contract).

“Effective Date” means the date that the Bank gives the CP Notification.

“Party” means a party to this Agreement.

“New Ares Genetics Guarantee” means the guarantee agreement to be entered into between the Bank and Ares Genetics (as Guarantor) on or around the date of this Agreement substantially in the form of the Ares Genetics Guarantee.

“New Curetis NV Guarantee” means the guarantee agreement to be entered into between the Bank and Curetis NV (as Guarantor) on or around the date of this Agreement substantially in the form of the Curetis NV Guarantee.

| 2 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

“New Curetis USA Guarantee” means the guarantee agreement to be entered into between the Bank and Curetis USA (as Guarantor) on or around the date of this Agreement substantially in the form of the Curetis USA Guarantee.

“Supplemental Documents” means the documents set out in paragraph 4 of Schedule 1 (Conditions Precedent).

| 1.3 | Construction of Schedules: All defined terms used in Schedule 1 (Conditions Precedent), unless otherwise provided or unless the context otherwise requires, shall have the meaning attributed to them in the Amended and Restated Finance Contract (whether or not the Effective Date shall have occurred). |

| 1.4 | Incorporation of terms: The Interpretation and Definitions section of the Finance Contract shall apply to this Agreement as if it were expressly set out in this Agreement with the necessary changes being made and with each reference in the Finance Contract to “this Agreement” (or to like references) being deemed to be a reference to this Agreement. |

| 2. | AMENDMENT AND RESTATEMENT |

| 2.1 | Amendment and restatement: On the Effective Date, the Finance Contract shall be amended and restated on the terms set out in the Amended and Restated Finance Contract. |

| 3. | REPRESENTATIONS AND WARRANTIES |

| (a) | The Borrower represents and warrants that the Repeating Representations in the Amended and Restated Finance Contract are true: |

| (i) | as at the date of this Agreement (whether or not the Effective Date shall have occurred by such date); and |

| (ii) | as at the Effective Date, |

by reference to the facts and circumstances existing at such dates.

| (b) | Curetis NV represents and warrants that the representations set out at articles 6.01 (a) to (e), (g) to (q), and (s) to (z) (in each case, inclusive) in the Curetis NV Guarantee are true: |

| (i) | as at the date of this Agreement (whether or not the Effective Date shall have occurred by such date); and |

| (ii) | as at the Effective Date, |

by reference to the facts and circumstances existing at such dates.

| 3 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

| (c) | Curetis USA represents and warrants that the representations set out at articles 5.01 (a) to (e),(g) to (q), and (s) to (aa) (in each case, inclusive) in the Curetis USA Guarantee are true: |

| (i) | as at the date of this Agreement (whether or not the Effective Date shall have occurred by such date); and |

| (ii) | as at the Effective Date, |

by reference to the facts and circumstances existing at such dates.

| (d) | Ares Genetics represents and warrant that the representations set out at articles 6.01 (a) to (e), and (g) to (n) (in each case, inclusive) in the Ares Genetics Guarantee are true: |

| (i) | as at the date of this Agreement (whether or not the Effective Date shall have occurred by such date); and |

| (ii) | as at the Effective Date, |

by reference to the facts and circumstances existing at such dates.

| 4. | CONSTRUCTION |

| 4.1 | Confirmation: Subject to Clause 2 (Amendment and Restatement) and except where inconsistent with the provisions of this Agreement, the terms of the Finance Contract are confirmed and shall remain in full force and effect. |

| 4.2 | Construction: As of and after the Effective Date, the Finance Contract and this Agreement shall be read and construed as one document and references in the Finance Contract and in each of the Finance Documents to the Finance Contract shall be read and construed as references to the Finance Contract as amended and restated by this Agreement. |

| 4.3 | Designation: This Agreement is hereby designated as a Finance Document. |

| 5. | AFFIRMATION AND FURTHER ASSURANCE |

| 5.1 | Affirmation: |

| (a) | The Borrower and each Guarantor confirms: |

| (i) | its knowledge and acceptance of the Amended and Restated Finance Contract coming into effect on and from the Effective Date; |

| (b) | In addition, each Guarantor confirms that from the Effective Date: |

| 4 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

| (i) | the guarantee given by it in Curetis NV Guarantee, the Ares Genetics Guarantee and the Curetis USA Guarantee (as applicable) will continue in full force and effect; and |

| (ii) | such guarantee will extend to all obligations of the Borrower under the Amended and Restated Finance Contract and the other Finance Documents. |

| 5.2 | Binding nature: The Bank and the Borrower hereby agree that, with effect from the Effective Date, they shall be bound by the terms of the Amended and Restated Finance Contract. |

| 5.3 | Further assurance: The Borrower shall, at the request of the Bank and at its own expense, do all such acts and things necessary or desirable to give effect to the amendments effected or to be effected pursuant to this Agreement. |

| 6. | MISCELLANEOUS |

| 6.1 | Incorporation of terms: The provisions of Article 10.04 (Non-Waiver), Article 11.10 (Counterparts), Article 11.04 (Place of performance), Article 11.08 (Invalidity), Article 11.09 (Amendments) of the Finance Contract shall apply to this Agreement as if they were expressly set out in this Agreement with the necessary changes being made and with each reference in the Finance Contract to “this Agreement” or like references being deemed to be a reference to this Agreement. |

| 6.2 | Third party rights: A person who is not a Party has no right under the Contracts (Rights of Third Parties) ▇▇▇ ▇▇▇▇ (the “Third Parties Act”) to enforce or to enjoy the benefit of any term of this Agreement. |

| 7. | GOVERNING LAW AND JURISDICTION |

| 7.1 | Governing law: This Agreement and any non-contractual obligations arising out of or in connection with it are governed by and shall be construed and take effect in accordance with English law. |

| 7.2 | Jurisdiction: The provisions of Article 11.02 (Jurisdiction) of the Finance Contract shall be deemed to be incorporated herein as if set out in full in this Agreement with the necessary changes being made and with each reference in the Finance Contract to “this Agreement” (or like references) being construed as references to this Agreement. |

| 7.3 | Agent of Service: Without prejudice to any other mode of service allowed under any relevant law, the Borrower hereby irrevocably appoints Vistra (UK) Ltd., ▇▇▇ ▇▇▇▇▇, ▇▇-▇▇ ▇▇ ▇▇▇▇▇’s Square, ▇▇▇▇▇▇ ▇▇▇▇ ▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇▇▇▇ as its agent of service for the purposes of accepting service on its behalf of any writ, notice, order, judgement or other legal process. The Borrower agrees that failure by a process agent to notify it of the process will not invalidate the proceedings concerned. |

This Agreement has been entered into on the date stated at the beginning of this Agreement

| 5 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

SCHEDULE 1

CONDITIONS PRECEDENT

| 1. | BORROWER |

| (a) | A copy of the constitutional documents of the Borrower. |

| (b) | A copy of a resolution passed at a general meeting of the shareholders of the Borrower: |

| (i) | approving the terms of the Supplemental Documents and resolving that it execute, deliver and perform the Supplemental Documents to which it is a party; |

| (ii) | authorising a specified person or persons to execute this Agreement on its behalf; |

| (iii) | authorising a specified person or persons, on its behalf, to sign and/or despatch all documents and notices to be signed and/or despatched by it under or in connection with the Supplemental Documents to which it is a party; and |

| (c) | A certificate of the Borrower (signed by an authorised signatory): |

| (i) | confirming that borrowing or guaranteeing or securing, as appropriate, the Credit would not cause any borrowing, guarantee, security or similar limit binding on the Borrower to be exceeded; and |

| (ii) | certifying that each copy document relating to it specified in this Schedule 1 is correct, complete and in full force and effect and has not been amended or superseded as at a date no earlier than the date of this Agreement. |

| 2. | CURETIS NV |

| (a) | A copy of the constitutional documents of Curetis NV. |

| (b) | A copy of a resolution of the management board (raad van bestuur) of Curetis NV: |

| (i) | approving the terms of the Supplemental Documents and resolving that it execute, deliver and perform the Supplemental Documents to which it is a party; |

| (ii) | authorising a specified person or persons to execute the Supplemental Documents to which it is a party on its behalf; |

| (iii) | authorising a specified person or persons, on its behalf, to sign and/or despatch all documents and notices to be signed and/or despatched by it |

| 6 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

under or in connection with the Supplemental Documents to which it is a party; and

| (c) | A copy of a resolution of the supervisory board (raad van commissarissen): |

| (i) | approving the terms of the resolution referred to in paragraph (b); |

| (ii) | resolving that the Company execute, deliver and perform the Supplemental Documents to which it is a party; and |

| (d) | A certificate of Curetis NV (signed by an authorised signatory): |

| (i) | confirming that borrowing or guaranteeing or securing, as appropriate, the Credit would not cause any borrowing, guarantee, security or similar limit binding on that Guarantor to be exceeded; and |

| (ii) | certifying that each copy document relating to it specified in this Schedule 1 is correct, complete and in full force and effect and has not been amended or superseded as at a date no earlier than the date of this Agreement. |

| 3. | CURETIS USA |

| (a) | A copy of the constitutional documents of Curetis USA. |

| (b) | A copy of a resolution of the board of directors of Curetis USA: |

| (i) | approving the terms of the Supplemental Documents and resolving that it execute, deliver and perform the Supplemental Documents to which it is a party; |

| (ii) | authorising a specified person or persons to execute the Supplemental Documents to which it is a party on its behalf; |

| (iii) | authorising a specified person or persons, on its behalf, to sign and/or despatch all documents and notices to be signed and/or despatched by it under or in connection with the Supplemental Documents to which it is a party; |

| (c) | A copy of a resolution of the sole shareholder of Curetis USA: |

| (i) | approving the terms of the Supplemental Documents and resolving that it execute, deliver and perform the Supplemental Documents to which it is a party; |

| (ii) | authorising a specified person or persons to execute the Supplemental Documents to which it is a party on its behalf; and |

| 7 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

| (iii) | authorising a specified person or persons, on its behalf, to sign and/or despatch all documents and notices to be signed and/or despatched by it under or in connection with the Supplemental Documents to which it is a party; |

| (d) | A copy of the Action by Unanimous Written Consent of the Board dated 22 March 2019 confirming the incumbency of Curetis USA’s officers; |

| (e) | A copy of the Action by Written Consent of the Stockholder dated 22 March 2019 confirming the incumbency of Curetis USA’s directors; |

| (f) | To the extent required by the Bank, a specimen of the signature of each person authorised by the resolution referred to in paragraph (b) above; |

| (g) | A certificate of Curetis USA (signed by an authorised signatory): |

| (i) | confirming that borrowing or guaranteeing or securing, as appropriate, the Credit would not cause any borrowing, guarantee, security or similar limit binding on that Guarantor to be exceeded; and |

| (ii) | certifying that each copy document relating to it specified in this Schedule 1 is correct, complete and in full force and effect and has not been amended or superseded as at a date no earlier than the date of this Agreement. |

| 4. | ARES GENETICS |

| (a) | A copy of the constitutional documents of Ares Genetics. |

| (b) | A copy of a resolution passed by the shareholder of Ares Genetics: |

| (i) | approving the terms of the Supplemental Documents and resolving that it execute, deliver and perform the Supplemental Documents to which it is a party; |

| (ii) | authorising a specified person or persons to execute the Supplemental Documents to which it is a party on its behalf; |

| (iii) | authorising a specified person or persons, on its behalf, to sign and/or despatch all documents and notices to be signed and/or despatched by it under or in connection with the Supplemental Documents to which it is a party; |

| (c) | A certificate of Ares Genetics (signed by an authorised signatory): |

| (i) | confirming that borrowing or guaranteeing or securing, as appropriate, the Credit would not cause any borrowing, guarantee, security or similar limit binding on that Guarantor to be exceeded; and |

| 8 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

| (ii) | certifying that each copy document relating to it specified in this Schedule 1 is correct, complete and in full force and effect and has not been amended or superseded as at a date no earlier than the date of this Agreement. |

| 5. | LEGAL OPINIONS |

| (a) | A legal opinion of ▇▇▇▇▇ Lovells International LLP, legal advisors to the Bank as to English law, substantially in the form distributed to the Bank prior to signing this Agreement. |

| (b) | A legal opinion of CMS ▇▇▇▇▇▇ ▇▇▇▇▇, Partnerschaft von Rechtsanwälten und Steuerberatern mbB, legal advisers to the Borrower as to German law, on the valid existence of the Borrower, the authority and capacity of the Borrower to enter into this Agreement, substantially in the form distributed to the Bank prior to signing this Agreement. |

| (c) | A legal opinion of California Counsel Group Inc., legal advisers to the Borrower as to Delaware law, on the valid existence of Curetis USA, the authority and capacity of Curetis USA to enter into the New Curetis USA Guarantee and on the due execution and choice of law of the New Curetis USA Guarantee, substantially in the form distributed to the Bank prior to signing this Agreement. |

| (d) | A legal opinion of CMS ▇▇▇▇▇ Star Busmann NV, legal advisers to the Borrower as to Dutch law, on the valid existence of Curetis NV, the authority and capacity of Curetis NV to enter into the New Curetis NV Guarantee and on the due execution and choice of law of the New Curetis NV Guarantee, substantially in the form distributed to the Bank prior to signing this Agreement. |

| (e) | A legal opinion of CMS ▇▇▇▇▇-Rohrwig ▇▇▇▇▇ Rechtsanwälte GmbH, legal advisers to the Borrower as to Austrian law, on the valid existence of Ares Genetics, the authority and capacity of Ares Genetics to enter into the New Ares Genetics Guarantee and on the due execution and choice of law of the New Ares Genetics Guarantee, substantially in the form distributed to the Bank prior to signing this Agreement. |

| 6. | SUPPLEMENTAL DOCUMENTS |

| (a) | This Agreement, executed by the Parties. |

| (b) | The New Curetis NV Guarantee, executed by the Parties thereto. |

| (c) | The New Curetis USA Guarantee, executed by the Parties thereto. |

| (d) | The New Ares Genetics Guarantee, executed by the Parties thereto. |

| 7. | OTHER DOCUMENTS AND EVIDENCE |

| 9 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

| (a) | Evidence that the process agent referred to in clause 7.3 (Agent of Service) has accepted its appointment; and evidence that the process agent referred to in the New Curetis NV Guarantee, the New Curetis USA Guarantee and/or the New Ares Genetics Guarantee has accepted its appointment. |

| (b) | A group structure chart of the Group as at the date of this Agreement. |

| (c) | Evidence that any fees, costs and expenses then due from the Borrower have been paid or will be paid by the Effective Date. |

| (d) | A copy of any other Authorisation or other document, opinion or assurance which the Bank considers to be reasonably necessary or desirable (if it has notified the Borrower accordingly) in connection with the entry into and performance of the transactions contemplated by this Agreement or for the validity and enforceability of any Finance Document. |

| 10 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

EXECUTION PAGES

THE BORROWER

Curetis GmbH

By: /s/ ▇▇▇▇▇▇ ▇▇▇▇▇▇▇

Name: ▇▇▇▇▇▇ ▇▇▇▇▇▇▇, Ph.D

Title: Managing Director

By: /s/ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇

Name: ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇

Title: Managing Director

THE GUARANTORS

Curetis N.V.

By: /s/ Achim Plum

Name: ▇▇ ▇▇▇▇▇ ▇▇▇▇

Title: CBO

By: /s/ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇

Name: ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇

Title: COO

| 11 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

Curetis USA Inc.

By: /s/ ▇▇▇▇▇ ▇▇▇▇▇

Name: ▇▇▇▇▇ ▇▇▇▇▇

Title: President and CEO

By: /s/ ▇▇▇▇▇▇ ▇▇▇▇▇▇▇

Name: ▇▇▇▇▇▇ ▇▇▇▇▇▇▇, Ph.D

Title: CFO and Chairman of the Board

Ares Genetics GmbH

By: /s/ ▇▇▇▇▇▇▇ ▇▇▇▇▇

Name: ▇▇. ▇▇▇▇▇▇▇ ▇▇▇▇▇

Title: Managing Director and CEO

By: /s/ Achim Plum

Name: ▇▇ ▇▇▇▇▇ ▇▇▇▇

Title: Managing Director

| 12 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

THE BANK

EUROPEAN INVESTMENT BANK

acting by its duly authorised signatory

By: /s/ ▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇▇ Name: ▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇▇ Title: Head of Division |

By: /s/ Oksana Seasenko Name: Oksana Seasenko Title: Transaction Monitoring Officer |

| 13 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

APPENDIX

The Amended and Restated Finance Contract

{*inserted overleaf*}

| 2 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

Fl

N° 86508 / 87226

Serapis N° 2016-0480

Curetis (EGFF)

Finance Contract

as amended and restate pursuant to the Amendment and Restatement Agreement dated 20 May 2019

between the

European Investment Bank

and

Curetis GmbH

Luxembourg

on 2016

Execution Version

| |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

| ARTICLE 1 | 19 |

| 1.01 Amount of Credit | 19 |

| 1.02 Disbursement procedure | 19 |

| 1.03 Currency of disbursement | 21 |

| 1.04 Conditions of disbursement | 21 |

| 1.05 Second Credit | 23 |

| 1.06 Deferment of disbursement | 24 |

| 1.07 Cancellation and suspension | 24 |

| 1.08 Cancellation after expiry of the Credit | 25 |

| 1.09 Sums due under Article 1 | 25 |

| ARTICLE 2 | 26 |

| 2.01 Amount of Loan | 26 |

| 2.02 Currency of repayment, interest and other charges | 26 |

| 2.03 Confirmation by the Bank | 26 |

| ARTICLE 3 | 26 |

| 3.01 Rate of interest – Cash Pay Margin | 26 |

| 3.02 Rate of interest – Deferred Interest | 26 |

| 3.03 Interest on overdue sums | 27 |

| 3.04 Market Disruption Event | 27 |

| 3.05 PPI | 28 |

| ARTICLE 4 | 28 |

| 4.01 Normal repayment | 28 |

| 4.02 Voluntary prepayment | 28 |

| 4.03 Compulsory prepayment | 29 |

| 4.04 General | 32 |

| ARTICLE 5 | 32 |

| 5.01 Day count convention | 32 |

| 5.02 Time and place of payment | 32 |

| 5.03 No set-off by the Borrower | 33 |

| 5.04 Disruption to Payment Systems | 33 |

| 5.05 Application of sums received | 33 |

| ARTICLE 6 | 34 |

| 6.01 Use of Loan and availability of other funds | 34 |

| 6.02 Completion of Project | 34 |

| |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

| 6.03 Increased cost of Project | 34 |

| 6.04 Procurement procedure | 34 |

| 6.05 Continuing Project undertakings | 34 |

| 6.06 Disposal of assets | 36 |

| 6.07 Compliance with laws; Hedging | 36 |

| 6.08 Change in business | 36 |

| 6.09 Merger | 36 |

| 6.11 Books and records | 38 |

| 6.12 Acquisitions | 38 |

| 6.13 Indebtedness | 38 |

| 6.14 Guarantees | 38 |

| 6.15 Permitted Payments | 38 |

| 6.16 Intellectual Property Rights | 38 |

| 6.17 Maintenance of Status | 38 |

| 6.18 Eligibility Prerequisites | 39 |

| 6.19 Illicit origin | 39 |

| 6.20 Visibility | 39 |

| 6.21 Loans | 39 |

| 6.22 General Representations and Warranties | 39 |

| ARTICLE 7 | 42 |

| 7.01 Guarantee | 42 |

| 7.02 Negative pledge | 42 |

| 7.03 Pari passu ranking | 44 |

| 7.04 Clauses by inclusion | 44 |

| ARTICLE 8 | 44 |

| 8.01 Information concerning the Project The Borrower shall: | 44 |

| 8.02 Information concerning the Borrower The Borrower shall: | 45 |

| 8.03 Visits by the Bank | 47 |

| 8.04 Disclosure and publication | 47 |

| 8.05 Information required by an Accountant | 48 |

| ARTICLE 9 | 48 |

| 9.01 Taxes, duties and fees | 48 |

| 9.02 Other charges | 48 |

| 9.03 Increased costs, indemnity and set-off | 49 |

| 3 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

| 9.04 Accountant fees | 49 |

| ARTICLE 10 | 49 |

| 10.01 Right to demand repayment | 49 |

| 10.02 Other rights at law | 51 |

| 10.03 Indemnity | 51 |

| 10.04 Non-Waiver | 51 |

| ARTICLE 11 | 51 |

| 11.01 Governing Law | 51 |

| 11.02 Jurisdiction | 52 |

| 11.03 Agent of Service | 52 |

| 11.04 Place of performance | 52 |

| 11.05 Evidence of sums due | 53 |

| 11.06 Third party rights | 53 |

| 11.07 Entire Agreement | 53 |

| 11.08 Invalidity | 53 |

| 11.09 Amendments | 53 |

| 11.10 Counterparts | 53 |

| ARTICLE 12 | 53 |

| 12.01 Notices to either party | 53 |

| 12.02 Form of notice | 54 |

| 12.03 Recitals and Schedules | 54 |

| Schedule A | 56 |

| Schedule B | 60 |

| Schedule C | 62 |

| Schedule D | 64 |

| Schedule E | 66 |

| Schedule F | 67 |

| 4 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

THIS CONTRACT IS MADE ON 12 DECEMBER 2016 (AND REFERENCES TO “THE DATE OF THIS CONTRACT” SHALL BE CONSTRUED ACCORDINGLY) AND IS SET OUT BELOW AS AMENDED AND RESTATED PURSUANT TO THE AMENDMENT AND RESTATEMENT AGREEMENT (AS DEFINED BELOW) BETWEEN:

| The European Investment Bank having its seat at ▇▇▇ ▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇, ▇-▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇, represented by Vice-President Ambroise Fayolle | (the “Bank”) |

of the first part, and

| Curetis GmbH, a company incorporated in Germany, having its registered office at ▇▇▇-▇▇▇▇-▇▇▇▇▇▇▇ ▇▇, ▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇, represented by its Managing Directors ▇▇▇▇▇▇ ▇▇▇▇▇▇▇ and ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇ | (the “Borrower”) |

of the second part.

| 5 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

WHEREAS:

| (1) | The Borrower has stated that it is undertaking a project as more particularly described in the technical description (the “Technical Description”) set out in Schedule A (the “Project”). |

| (2) | The total cost of the Project, as estimated by the Bank, is EUR 50,000,000 (fifty million euros) and the Borrower has stated that it intends to finance the Project as follows: |

| Source | Amount (EUR m) |

| Own funds | 25,000,000 |

| Credit from the Bank | 25,000,000 |

| TOTAL | 50,000,000 |

| (3) | In order to fulfil the financing plan set out in Recital (2), the Borrower has requested from the Bank a credit of EUR 25,000,000 (twenty five million euros). |

| (4) | The Bank considering that the financing of the Project falls within the scope of its functions, and having regard to the statements and facts cited in these Recitals, has decided to give effect to the Borrower’s request providing to it a credit in an amount of EUR 25,000,000 (twenty five million euros) under this Finance Contract (the “Contract”); provided that the amount of the Bank loan shall not, in any case, exceed 50% (fifty per cent) of the total cost of the Project set out in Recital (2). |

| (5) | The Managing Directors of the Borrower have authorised the borrowing of the sum of EUR 25,000,000 (twenty five million euros) represented by this credit on the terms and conditions set out in this Contract and it has been duly certified that such borrowing is within the corporate powers of the Borrower. |

| (6) | The financial obligations of the Borrower under this Contract are guaranteed by Curetis NV, Curetis USA and Ares Genetics (each as defined below) under: |

(a) a guarantee and indemnity agreement entered into between the Bank and Curetis NV, governed by English law and dated 12 December 2016 (the “Initial Guarantee Agreement”);

(b) the guarantee and indemnity agreement entered into between the Bank and Ares Genetics, governed by English law and dated 29 November 2017 (the “Ares Genetics Guarantee Agreement”); and

(c) the guarantee and indemnity agreement entered into between the Bank and Curetis USA, governed by English law and dated 22 December 2017 (the “Curetis USA Guarantee Agreement”).

| (7) | This operation benefits from a guarantee from the European Union under the European Fund for Strategic Investments (“EFSI”). |

| (8) | The statute of the Bank provides that the Bank shall ensure that its funds are used as rationally as possible in the interests of the European Union; and, accordingly, the terms and conditions of the Bank’s loan operations must be consistent with relevant policies of the European Union. |

| 6 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

| (9) | The Bank considers that access to information plays an essential role in the reduction of environmental and social risks, including human rights violations, linked to the projects it finances and has therefore established its transparency policy, the purpose of which is to enhance the accountability of the EIB Group towards its stakeholders and the citizens of the European Union in general. |

| (10) | The processing of personal data shall be carried out by the Bank in accordance with applicable European Union legislation on the protection of individuals with regard to the processing of personal data by the European Union institutions and bodies and on the free movement of such data. |

NOW THEREFORE it is hereby agreed as follows:

INTERPRETATION AND DEFINITIONS

(a) Interpretation

In this Contract:

| (i) | References to Articles, Recitals, Schedules and Annexes are, save if explicitly stipulated otherwise, references respectively to articles of, and recitals, schedules and annexes to this Contract. |

| (ii) | References to a provision of law are references to that provision as amended or reenacted. |

| (iii) | References to any other agreement or instrument are references to that other agreement or instrument as amended, novated, supplemented, extended or restated. |

| (iv) | References to “accrued interest” includes any Deferred Interest. |

(b) Definitions

In this Contract:

“Acceptance Deadline” for a notice means:

| (a) | 16h00 Luxembourg time on the day of delivery, if the notice is delivered by 14h00 Luxembourg time on a Business Day; or |

| (b) | 11h00 Luxembourg time on the next following day which is a Business Day, if the notice is delivered after 14h00 Luxembourg time on any such day or is delivered on a day which is not a Business Day. |

“Accountant” means any firm of accountants approved in advance by the Bank (such approval not to be unreasonably withheld or delayed).

“Accounting Reference Date” means 31 December.

“Affiliates” means, in relation to any person, a Subsidiary of that person or a Holding Company of that person or any other Subsidiary of that Holding Company.

“Amendment and Restatement Agreement” means the amendment and restatement agreement in relation to this Contract made between the Bank, the Borrower, Curetis NV, Ares Genetics and Curetis USA and dated 20 May 2019.

| 7 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

“Ares Genetics” means Ares Genetics GmbH (a company incorporated in Austria with company number FN 468899 H and registered office at ▇▇▇▇-▇▇▇▇▇▇-▇▇▇▇▇ ▇▇, ▇-▇▇▇▇, ▇▇▇▇▇▇, ▇▇▇▇▇▇▇).

“Authorisation” means an authorisation, permit, consent, approval, resolution, licence, exemption, filing, notarisation or registration.

“BPE” means, the British Private Equity & Venture Capital Association.

“Business Day” means a day (other than a Saturday or Sunday) on which the Bank and commercial banks are open for general business in Luxembourg.

“Cash Pay Margin” has the meaning given in Article 3.01.

“Change-of-Control Event” has the meaning given to it in Article 4.03A(3).

“Change in the Beneficial Ownership” means a change in the ultimate ownership or control of the Borrower according to the definition of “beneficial owner” set out in article 3(6) of Directive 2015/849 of the European Parliament and of the Council of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing.

“Change-of-Law Event” has the meaning given to it in Article 4.03A(4).

“Compliance Certificate” means a certificate substantially in the form set out in Schedule D.2.

“Contract” has the meaning given to it in Recital (4).

“Credit” means the First Credit and the Second Credit.

“Curetis NV” means Curetis NV (a company incorporated in the Netherlands with company number 64302679 and registered office at ▇▇▇-▇▇▇▇-▇▇▇▇▇▇▇ ▇▇, ▇▇▇▇▇ ▇▇▇▇▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇).

“Curetis NV Exchange” means each of the Euronext Amsterdam and the Euronext Brussels exchanges (or, in each case, any replacement exchange).

“Curetis UK” means Curetis UK Limited (a company incorporated in England and Wales with company number 10164457 and registered office at c/o Buzzacott, ▇▇▇ ▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇ ▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇▇▇▇).

“Curetis USA” means Curetis USA Inc, (a company incorporated under the laws of the State of Delaware with registration number 607544 and having its principal executive office at 10525 Vista Sorrento Parkway, Suite 104, San Diego, CA 92121, United States of America).

“Deferment Indemnity” means an indemnity calculated on the amount of disbursement deferred or suspended at the percentage rate (if higher than zero) by which:

| - | the interest rate that would have been applicable to such amount had it been disbursed to the Borrower on the Scheduled Disbursement Date |

exceeds

| - | EURIBOR (one month rate) less 0.125% (12.5 basis points), unless this value is less than zero, in which case it will be set at zero. |

Such indemnity shall accrue from the Scheduled Disbursement Date to the Disbursement Date or, as the case may be, until the date of cancellation of the Notified Tranche in accordance with this Contract.

“Deferred Interest” means the component of the interest defined in Article 3.02.

| 8 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

“Deferred Interest Rate” means the rate of interest quantified in Article 3.02.

“Disbursement Date” means the date on which actual disbursement of a Tranche is made by the Bank.

“Disbursement Notice” means a notice from the Bank to the Borrower pursuant to and in accordance with Article 1.02C.

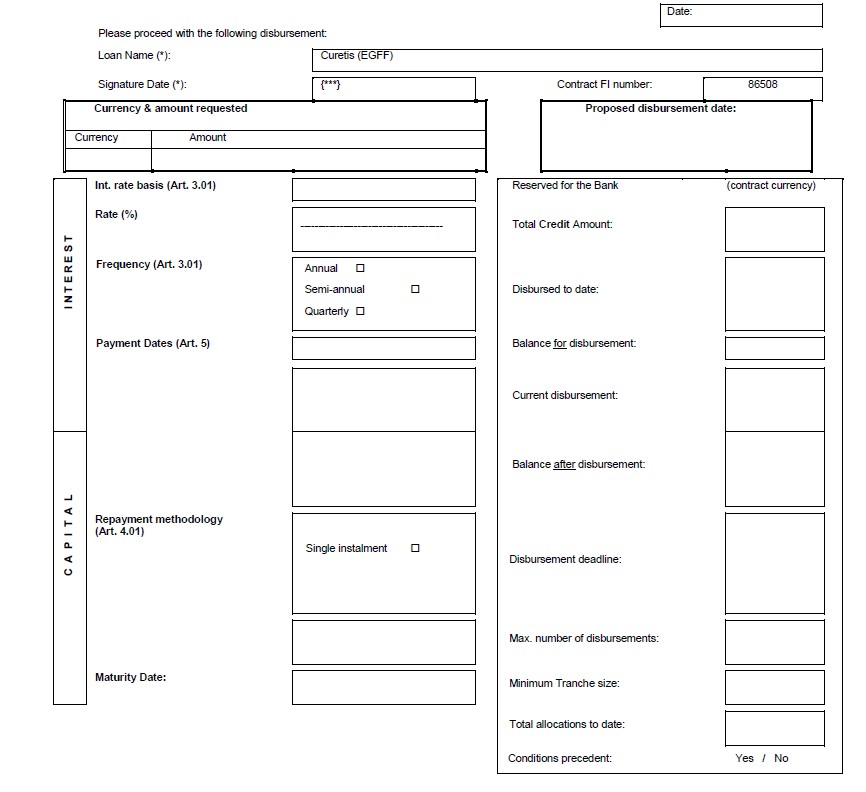

“Disbursement Request” means a notice substantially in the form set out in Schedule C.1.

“Disruption Event” means either or both of:

| (a) | a material disruption to those payment or communications systems or to those financial markets which are, in each case, required to operate in order for payments to be made in connection with this Contract; or |

| (b) | the occurrence of any other event which results in a disruption (of a technical or systems-related nature) to the treasury or payments operations of either the Bank or the Borrower, preventing that party: |

| (i) | from performing its payment obligations under this Contract; or |

| (ii) | from communicating with other parties in accordance with the terms of this Contract, |

and which disruption (in either such case as per (a) or (b) above) is not caused by, and is beyond the control of, the party whose operations are disrupted.

“EBITDA” means, in respect of any Relevant Period, the consolidated operating profit of the Group before taxation (excluding the results from discontinued operations):

| (a) | before deducting any interest, commission, fees, discounts, prepayment fees, premiums or charges and other finance payments whether paid, payable or capitalised by any member of the Group (calculated on a consolidated basis) in respect of that Relevant Period; |

| (b) | not including any accrued interest owing to any member of the Group; |

| (c) | after adding back any amount attributable to the amortisation or depreciation of assets of members of the Group; |

| (d) | before taking into account any Exceptional Items; |

| (e) | after deducting the amount of any profit (or adding back the amount of any loss) of any member of the Group which is attributable to minority interests; |

| (f) | plus or minus the Group’s share of the profits or losses (after finance costs and tax) of Non-Group Entities; |

| (g) | before taking into account any unrealised gains or losses on any financial instrument (other than any derivative instrument which is accounted for on a hedge accounting basis); and |

| (h) | before taking into account any gain arising from an upward revaluation of any other asset, |

in each case, to the extent added, deducted or taken into account, as the case may be, for the purposes of determining operating profits of the Group before taxation.

| 9 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

“Effective Date” has the meaning given to that term in the Amendment and Restatement Agreement.

“EFSI” has the meaning given in Recital (7).

“EFSI Regulation” means the Regulation 2015/1017 of the European Parliament and of the Council of 25 June 2015 on the European Fund for Strategic Investments.

“Environment” means the following, in so far as they affect human health and social well-being:

| (a) | fauna and flora; |

| (b) | soil, water, air, climate and the landscape; and |

| (c) | cultural heritage and the built environment, |

and includes, without limitation, occupational and community health and safety.

“Environmental Approval” means any Authorisation required by Environmental Law.

“Environmental Claim” means any claim, proceeding, formal notice or investigation by any person in respect of any Environmental Law.

“Environmental Law” means:

| (a) | European Union law, including principles and standards; |

| (b) | national laws and regulations; and |

| (c) | applicable international treaties, |

of which a principal objective is the preservation, protection or improvement of the Environment.

“EURIBOR” has the meaning given to it in Schedule B.

“EUR” or “euro” means the lawful currency of the Member States of the European Union which adopt or have adopted it as their currency in accordance with the relevant provisions of the Treaty on European Union and the Treaty on the Functioning of the European Union or their succeeding treaties.

“Event of Default” means any of the circumstances, events or occurrences specified in Article 10.01.

“Exceptional Items” means any material items of an unusual or non-recurring nature which represent gains or losses including those arising on:

| (a) | the restructuring of the activities of an entity and reversals of any provisions for the cost of restructuring; |

| (b) | disposals, revaluations, write downs or impairment of non-current assets or any reversal of any write down or impairment; |

| (c) | disposals of assets associated with discontinued operations; and |

| (d) | any other examples of “exceptional items” (as such term has the meaning attributed to it in IFRS). |

“FDA” means the US Food and Drugs Administration.

“Final Availability Date” means the date falling 36 months after the date of this Contract.

| 10 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

“Finance Document” means this Contract, any Guarantee Agreement, the Amendment and Restatement Agreement and any other document designated from time to time as such between the Bank and the Borrower.

“Finance Lease” means any lease or hire purchase contract which would, in accordance with IFRS, be treated as a finance or capital lease.

“Financial Quarter” means the period commencing on the day after one Quarter Date and ending on the next Quarter Date.

“Financial Year” means the annual accounting period of the Group ending on the Accounting Reference Date.

“Fixed Rate” means an annual interest rate determined by the Bank in accordance with the applicable principles from time to time laid down by the governing bodies of the Bank for loans made at a fixed rate of interest, denominated in the currency of the Tranche and bearing equivalent terms for the repayment of capital and the payment of interest.

“Floating Rate” means a fixed-spread floating interest rate, that is to say an annual interest rate determined by the Bank for each successive Floating Rate Reference Period equal to EURIBOR plus the Cash Pay Margin.

“Floating Rate Reference Period” means each period from one Payment Date to the next relevant Payment Date; the first Floating Rate Reference Period shall commence on the date of disbursement of the Tranche.

“GAAP” means generally accepted accounting principles in Germany and the Netherlands including IFRS.

“Group” means Curetis NV and its Affiliates from time to time, and the Borrower and its Affiliates (other than Curetis UK).

“Guarantee” means any guarantee and indemnity that is the subject of a Guarantee Agreement.

“Guarantee Agreement” means the Initial Guarantee Agreement and/or any Subsequent Guarantee Agreement.

“Guarantor” means any person which enters into a Guarantee Agreement in the capacity as a guarantor.

“Hedging Policy” means any derivative transaction by a member of the Group to hedge actual or projected exposure arising in the ordinary course of trading or any derivative instrument of a member of the Group which is accounted for on a hedge accounting basis and does not include any derivative transaction and/or instrument for speculative purposes.

“Holding Company” means, in relation to a person, any other person in respect of which it is a Subsidiary.

“IFRS” means international accounting standards within the meaning of IAS Regulation 1606/2002 to the extent applicable to the relevant financial statements.

“Illegal Activities” means any of the following illegal activities or activities carried out for illegal purposes: tax evasion, tax fraud, fraud, corruption, coercion, collusion, obstruction, money laundering, financing of terrorism, organised crime or any illegal activity that may affect the financial interests of the EU, according to applicable laws.

| 11 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

“Indebtedness” means any:

| (a) | obligations for borrowed money; |

| (b) | indebtedness under any acceptance credit; |

| (c) | indebtedness under any bond, debenture, note or similar instrument; |

| (d) | instrument under any ▇▇▇▇ of exchange; |

| (e) | indebtedness in respect of any interest rate or currency swap or forward currency sale or purchase or other form of interest or currency hedging transaction (including without limit caps, collars and floors); |

| (f) | indebtedness under any Finance Lease; |

| (g) | indebtedness (actual or contingent) under any guarantee, bond security, indemnity or other agreement; |

| (h) | indebtedness (actual or contingent) under any instrument entered into for the purpose of raising finance; |

| (i) | indebtedness in respect of a liability to reimburse a purchaser of any receivables sold or discounted in the event that any amount of those receivables is not paid; |

| (j) | indebtedness arising under a securitisation; or |

| (k) | other transaction which has the commercial effect of borrowing. |

“Indemnifiable Prepayment Event” means a Prepayment Event other than those specified in Articles 4.03A(2) or 4.03A(5).

“Initial Guarantee Agreement” has the meaning given to it in Recital (6).

“Intellectual Property Rights” means, including without limitation, intellectual property of every designation (including patents, utility patents, copyrights, design rights, trademarks, service marks and know how) whether capable of registration or not.

“IPEV Valuation Standards” means, the International Private Equity and Venture Capital Valuation Guidelines published by, amongst others, BPE in December 2018 as may be amended, updated or replaced from time-to-time.

“Joint Venture” means any joint venture entity, whether a company, unincorporated firm, undertaking, association, joint venture or partnership or any other entity.

“Lead Organisation” means reputable international, standard-setting institutions and organisations including the European Union, the United Nations, the International Monetary Fund, the Financial Stability Board, the Financial Action Task Force and the Organisation for Economic Co-operation and Development Global Forum on Transparency and Exchange of Information for Tax Purposes.

“Loan” means the aggregate amount of Tranches disbursed from time to time by the Bank under this Contract.

“Market Capitalisation” means:

| (a) | at any time that: |

| 12 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

| (i) | Curetis NV holds all the voting shares in the Borrower, and |

| (ii) | Curetis NV is listed on the Curetis NV Exchange or another regulated market exchange, |

the market value (as determined by the Bank) of the Borrower on a PPI Demand Date calculated as the sum of:

| (i) | the non-weighted average closing price per share over the 90 Trading Days prior to that PPI Demand Date, multiplied by the total number of issued shares as at that PPI Demand Date; and |

| (ii) | the aggregate of all dividends and other distributions or similar payments made to any shareholder of Curetis NV in the period from the Disbursement Date of the PPI Tranche until the relevant PPI Payment Date; and |

| (b) | at any other time, the sum of (as determined by the Bank): |

| (i) | the market value of the Borrower on a PPI Demand Date as determined by an Accountant (at the cost of the Borrower) in accordance with IPEV Valuation Standards; |

| (ii) | the aggregate of all dividends and other distributions or similar payments made to any shareholder of Curetis NV in the period from the Disbursement Date of the PPI Tranche until the relevant PPI Payment Date. |

“Market Disruption Event” means any of the following circumstances:

| (a) | there are, in the reasonable opinion of the Bank, events or circumstances adversely affecting the Bank’s access to its sources of funding; |

| (b) | in the opinion of the Bank, funds are not available from its ordinary sources of funding in order to adequately fund a Tranche in the relevant currency and/or for the relevant maturity and/or in relation to the reimbursement profile of such Tranche; |

| (c) | in relation to a Tranche in respect of which interest is or would be payable at Floating Rate: |

| (A) | the cost to the Bank of obtaining funds from its sources of funding, as determined by the Bank, for a period equal to the Floating Rate Reference Period of such Tranche (i.e. in the money market) would be in excess of EURIBOR; |

| or |

| (B) | the Bank determines that adequate and fair means do not exist for ascertaining EURIBOR for the relevant currency of such Tranche or it is not possible to determine EURIBOR in accordance with the definition contained in Schedule B. |

“Material Adverse Change” means, any event or change of condition, which, in the reasonable opinion of the Bank has a material adverse effect on:

| (a) | the ability of any Obligor to perform its obligations under any Finance Document to which it is party; |

| (b) | the business, operations, property or financial conditions or prospects of any Obligor or the Group as a whole; or |

| 13 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

| (c) | the validity or enforceability of, or the effectiveness or ranking of, or the value of any security granted to the Bank, or the rights or remedies of the Bank under any Finance Document. |

“Material Subsidiary” means any Subsidiary of Curetis NV from time to time, whose gross revenues, total assets or EBITDA represents not less than 10% (ten per cent) of (i) the consolidated gross revenues of the Group taken as a whole and attributable to the shareholders of the Borrower or, (ii) the consolidated total assets of the Group taken as a whole or, (iii) as the case may be, the consolidated EBITDA of the Group taken as a whole, as each of the foregoing is calculated based on the then latest consolidated audited accounts of the Group.

“Maturity Date” means, in relation to each Tranche, the date falling on the 5th anniversary of the Scheduled Disbursement Date of that Tranche.

“Non-Group Entity” means any investment or entity (which is not itself a member of the Group (including associates and Joint Ventures)) in which any member of the Group has an ownership interest.

“Notified Tranche” means a Tranche in respect of which the Bank has issued a Disbursement Notice.

“Obligor” means the Borrower and any Guarantor.

“Payment Date” means quarterly, semi-annual or annual dates specified in the Disbursement Notice of a Tranche until, and including the Maturity Date for such Tranche, save that, in case any such date is not a Relevant Business Day, it means for a Tranche, the next day, if any, of that calendar month that is a Relevant Business Day or, failing that, the nearest preceding day that is a Relevant Business Day, in all cases with corresponding adjustment to the interest due under Article 3.01.

“Permitted Acquisition” means an acquisition:

| (a) | by the Borrower or any other member of the Group of shares or other ownership interests by way of acquisition of a wholly owned shelf company, provided that such company is incorporated in a country that is a member of either or both of the European Union or the Organisation of Economic Co-Operation and Development; |

| (b) | for which the prior written consent of the Bank has been received; |

| (c) | of the Gyronimo platform and all related intellectual property, know-how and assets from Carpegen and Systec (the “Gyronimo Acquisition”) for (i) an initial up front-payment of no more than EUR 5,000,000, (ii) potential future milestone payments of EUR 2,500,000 in total, and (iii) royalties of [***]% of net sales on Gyronimo application cartridges and Gyronimo analyzers (capped at EUR 9,000,000); provided that the Gyronimo Acquisition will be signed by 31 January 2017; or |

| (d) | of shares or other ownership interests in a Target Entity, which do not exceed an aggregate amount of EUR 1,000,000 (one million euros) during the term of the Credit, |

but, in relation to paragraphs (a), and (d) above, only if:

| (i) | no Event of Default is continuing on the date the relevant acquisition agreement is entered into or would occur as a result of the acquisition; |

| 14 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

| (ii) | the acquired Target Entity, business or undertaking is engaged in a business similar or complementary to the business carried on by the Group as at the date of this Contract; |

| (iii) | the acquired Target Entity, business or undertaking is not incorporated or located in a jurisdiction that is blacklisted by any Lead Organisation in connection with activities such as money laundering, financing of terrorism, tax fraud and tax evasion or harmful tax practices as such blacklist may be amended from time to time; |

| (iv) | a business plan (in the form of the most recent budget supplemented to account for the effects of the acquisition) in respect of the 3 (three) next following financial years and any due diligence reports received in connection with the acquisition (if any) are provided to the Bank; and |

| (v) | the Borrower demonstrates that the acquisition has been approved by the Borrower’s Managing Directors. |

“Permitted Disposal” means any act effecting a sale, transfer, lease or other disposal of assets which is for fair market value and on arms’ length terms:

| (a) | related to the sale of finished products and/or services made on arm’s length terms in the ordinary course of business of the Borrower or other member of the Group; |

| (b) | by an Obligor to another member of the Group which is also an Obligor; |

| (c) | by any member of the Group which is not an Obligor to a member of the Group which is an Obligor; |

| (d) | for cash in an amount reflecting or exceeding the fair market value of such assets, which is reinvested in assets of comparable or superior type, value and quality; |

| (e) | made in exchange for other assets comparable or superior as to type, value and quality; |

| (f) | constituted by a licence of Intellectual Property Rights; |

| (g) | made in relation to non-material assets which have depreciated to less than 25% (twenty five per cent) of their initial value or which are obsolete; |

| (h) | excluding any disposal permitted under (a) to (g) above, disposals where the higher of the market value or consideration receivable for such disposals does not exceed EUR 5,000,000 (five million euros) during the term of the Credit; |

| (i) | arising as a result of Permitted Security; or |

| (j) | made with the prior written consent of the Bank. |

“Permitted Guarantees” means guarantees issued in the ordinary course of business by any member of the Group:

| (a) | under a Guarantee Agreement; |

| (b) | under any negotiable instruments; |

| (c) | in connection with any performance bond; |

| (d) | in connection with any Permitted Indebtedness; |

| 15 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

| (e) | by an Obligor to another member of the Group which is also an Obligor; |

| (f) | by any member of the Group which is not an Obligor to a member of the Group which is an Obligor; or |

| (g) | with the prior written consent of the Bank, |

provided that the maximum aggregate liability in respect of any guarantees described above (excluding all Guarantee Agreements) shall not any time exceed an aggregate amount equal 10% of the Total Assets at any time.

“Permitted Indebtedness” means Indebtedness of the Borrower and/or members of the Group incurred under:

| (a) | this Contract; |

| (b) | a Permitted Loan; |

| (c) | any Finance Lease if the aggregate liability in respect of the equipment leased does not at any time exceed EUR 1,500,000 (one and a half million euros) (or its equivalent in another currency or currencies) for finance leases and EUR 100,000 (one hundred thousand euros) (or its equivalent in another currency or currencies) for capital leases (as defined by IFRS); |

| (d) | the leasing of the laser welding machine concluded in August 2012 which will be terminated on or before 31 May 2017; |

| (e) | any hedging or derivative transactions entered into in accordance with the Hedging Policy; |

| (f) | a working capital facility of an amount no more than EUR 3,000,000 (or its equivalent in another currency or currencies); |

| (g) | a Permitted Guarantee; or |

| (h) | any other Indebtedness incurred with the prior written consent of the Bank. |

“Permitted Loan” means:

| (a) | any trade credit extended by any member of the Group to its customers on normal commercial terms and in the ordinary course of its trading activities; |

| (b) | any loan made by the Borrower to a Guarantor or by a Guarantor to the Borrower; |

| (c) | any loan made by one member of the Group (other than the Borrower or a Guarantor) to another member of the Group (other than the Borrower or a Guarantor); or |

| (d) | any other Indebtedness or loan advanced to or made available by any member of the Group with the prior written consent of the Bank. |

“Permitted Merger” means any amalgamation, demerger, merger or corporate reconstruction which does not result in a Material Adverse Change and which is on a solvent basis, and where:

| (a) | only members of the Group are involved; and |

| (b) | the resulting entity will not be incorporated or located in a country which is in a jurisdiction that is blacklisted by any Lead Organisation in connection with activities such as money laundering, financing of terrorism, tax fraud and tax evasion or harmful tax practices as such blacklist may be amended from time to time; and |

| 16 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

| (c) | if an Obligor is involved, (i) the rights and obligations of that Obligor under the Finance Documents to which it is a party will remain with that Obligor, (ii) the surviving entity will be that Obligor and the statutory seat of that Obligor would not as a result of such merger be transferred to a different jurisdiction, (iii) the merger will not have an effect on the validity, legality or enforceability of any Obligor’s obligations under the Finance Documents to which it is a party; and (iv) all of the business and assets of each Obligor are retained by it; or |

| (d) | any other amalgamation, demerger, merger or corporate reconstruction with prior written consent of the Bank. |

“Permitted Payments” means

| (a) | shares purchased from former employees, managers or directors, provided that such shares were awarded under a share programme of the Borrower or any Guarantor; |

| (b) | dividends of any member of the Group distributed to the Borrower in accordance with Article 6.15; |

| (c) | any payment made under a Permitted Loan; or |

| (d) | any payment made with prior written consent of the Bank, in each case without double counting. |

“Permitted Security” means the security listed in Schedule E (Existing Security) and as described in Article 7.02(b).

“PPI” means, in relation to a PPI Tranche Due Payment and its PPI Demand Date, an amount in euros equal to:

(amount

of PPI Tranche Due Payment)

amount of the PPI Tranche x PPI Amount

“PPI Amount” means in relation to a PPI Demand Date, an amount in Euros equal to the PPI Rate multiplied by the relevant PPI Demand Date Market Capitalisation.

“PPI Demand Date” means the date of any written demand by the Bank for a payment of PPI delivered by the Bank to the Borrower in accordance with Article 3.05(B).

“PPI Payment Date” means any date on which PPI becomes payable pursuant to Article 3.05(B).

“PPI Demand Date Market Capitalisation” means the Market Capitalisation of the Borrower’s entire issued share capital on a PPI Demand Date.

“PPI Rate” means 2.1%.

“PPI Tranche” means the EUR 5,000,000 Tranche of the Second Credit which the Borrower may drawdown pursuant to Article 1.5(b).

“PPI Tranche Due Payment” has the meaning given to that term in Article 3.05B.

“Prepayment Amount” means the amount of a Tranche to be prepaid by the Borrower in accordance with Article 4.02A.

| 17 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

“Prepayment Date” means the date, which shall be a Payment Date, on which the Borrower proposes to effect prepayment of a Prepayment Amount.

“Prepayment Event” means any of the events described in Article 4.03A.

“Prepayment Fee” means the fee payable in accordance with Article 4.02B.

“Prepayment Notice” means a written notice from the Bank to the Borrower in accordance with Article 4.02C.

“Prepayment Request” means a written request from the Borrower to the Bank to prepay all or part of the Loan, in accordance with Article 4.02A.

“Project” has the meaning given to it in Recital (1).

“Quarter Date” means each of 31 March, 30 June, 30 September and 31 December from the date of this Contract until the final Maturity Date.

“Redeployment Rate” means the Fixed Rate in effect on the day of the indemnity calculation for fixed-rate loans denominated in the same currency and which shall have the same terms for the payment of interest and the same repayment profile to the Maturity Dates as the Tranche in respect of which a prepayment is proposed or requested to be made. For those cases where the period is shorter than 36 months the most closely corresponding money market rate equivalent will be used, that is EURIBOR minus 0.125% (12.5 basis points) for periods of up to 12 (twelve) months. For periods falling between 12 and 36 months, the bid point on the swap rates as published by Reuters for the related currency and observed by the Bank at the time of calculation will apply.

“Relevant Business Day” means a day on which the Trans-European Automated Real-time Gross Settlement Express Transfer payment system which utilises a single shared platform and which was launched on 19 November 2007 (TARGET2) is open for the settlement of payments in EUR.

“Relevant Period” means each period of twelve months ending on or about the last day of the Financial Year and each period of twelve months ending on or about the last day of the second Financial Quarter of a Financial Year.

“Repeating Representations” means each of the representations and warranties set out in paragraphs (a) to (f), (h) to (m), (o) to (t), and (v) to (gg) (in each case inclusive) of clause 6.22 (General Representations and Warranties).

“Revised Group Structure Chart” means the group structure chart delivered by the Borrower to the Bank pursuant to paragraph 5(b) of Schedule 1 (Conditions Precedent) of the Amendment and Restatement Agreement.

“Scheduled Disbursement Date” means the date on which a Tranche is scheduled to be disbursed in accordance with Article 1.02C.

“Security” means any mortgage, pledge, lien, charge, assignment, hypothecation, or other security interest securing any obligation of any person or any other agreement or arrangement having a similar effect.

“Subsidiary” means an entity of which Curetis NV has direct or indirect control or owns directly or indirectly more than 50% of the voting capital or similar right of ownership and “control” for this purpose means the power to direct the management and the policies of the entity, whether through the ownership of voting capital, by contract or otherwise.

| 18 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

“Subsequent Guarantee Agreement” means: (a) the Curetis USA Guarantee Agreement; (b) the Ares Genetics Guarantee Agreement; and (c) any other guarantee and indemnity in materially the same form as the Initial Guarantee Agreement executed by a member of the Group in favour of the Bank, as contemplated in Article 6.10A(e) (Ownership).

“Target Entity” means any limited liability company, corporation, limited liability partnership or any equivalent.

“Tax” means any tax, levy, impost, duty or other charge or withholding of a similar nature (including any penalty or interest payable in connection with any failure to pay or any delay in paying any of the same).

“Technical Description” has the meaning given to it in Recital (1).

“Total Assets” means the total consolidated assets of the Group, as shown in the Borrower’s latest consolidated financial statements.

“Trading Day” means a day (other than a Saturday or Sunday) on which the Curetis NV Exchange or any other relevant regulated market exchange (as applicable) is open for trading.

“Tranche” means each disbursement made or to be made under this Contract. In case no Disbursement Notice has been delivered, Tranche shall mean a Tranche as requested under Article 1.02B.

“USD” means the lawful currency of the United States of America.

“Yorkville Facility” means the up to EUR 20,000,000 convertible note issuance to Ya II PN, LTD dated 2 October 2018.

ARTICLE 1

Credit and Disbursements

| 1.01 | Amount of Credit |

| 1.01A | First Credit |

By this Contract the Bank establishes in favour of the Borrower, and the Borrower accepts, a credit in an amount of EUR 10,000,000 (ten million euros) for the financing of the Project (the “First Credit”).

| 1.01B | Second Credit |

By this Contract the Bank establishes in favour of the Borrower, and the Borrower accepts, a credit in an amount of EUR 15,000,000 (fifteen million euros) for the financing of the Project (the “Second Credit”).

| 1.02 | Disbursement procedure |

| 1.02A | Tranches |

The Bank shall disburse the Credit in Euros in up to five (5) Tranches. The amount of each Tranche, if not being the undrawn balance of the Credit, shall be in a minimum amount of EUR 3,000,000 (three million euros).

| 19 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

| 1.02B | Disbursement Request |

| (a) | The Borrower may present to the Bank a Disbursement Request for the disbursement of a Tranche, such Disbursement Request to be received at the latest 15 (fifteen) days before the Final Availability Date. The Disbursement Request shall be in the form set out in Schedule C.1 and shall specify: |

| (i) | the amount and currency (to be EUR) of the Tranche; |

| (ii) | the preferred disbursement date for the Tranche; such preferred disbursement date must be a Relevant Business Day falling at least 15 (fifteen) days after the date of the Disbursement Request and, in any event, on or before the Final Availability Date, it being understood that notwithstanding the Final Availability Date the Bank may disburse the Tranche up to 4 (four) calendar months from the date of the Disbursement Request; |

| (iii) | the interest rate basis of the Tranche, pursuant to the relevant provisions of Article 3.01; |

| (iv) | the interest payment periodicity for the Tranche, determined in accordance with Article 3.01; |

| (v) | the terms for repayment of principal for the Tranche, chosen in accordance with Article 4.01; |

| (vi) | the date for repayment of principal for the Tranche; and |

| (vii) | the IBAN code (or appropriate format in line with local banking practice) and SWIFT BIC of the bank account to which disbursement of the Tranche should be made in accordance with Article 1.02D. |

| (b) | Each Disbursement Request shall be accompanied by evidence of the authority of the person or persons authorised to sign it and the specimen signature of such person or persons or a declaration by the Borrower that no change has occurred in relation to the authority of the person or persons authorised to sign Disbursement Requests under this Contract. |

| (c) | Subject to Article 1.02C(b), each Disbursement Request is irrevocable. 1.02C |

| 1.02C | Disbursement Notice |

| (a) | Not less than 10 (ten) days before the proposed Scheduled Disbursement Date of a Tranche the Bank shall, if the Disbursement Request conforms to this Article 1.02, deliver to the Borrower a Disbursement Notice which shall specify: |

| (i) | the currency, and amount of the Tranche; |

| (ii) | the Scheduled Disbursement Date; |

| (iii) | the interest rate basis for the Tranche, pursuant to the relevant provisions of Article 3.01; |

| (iv) | the first interest Payment Date and the periodicity for the payment of interest for the Tranche; |

| 20 |

Certain identified information has been excluded from this exhibit because it is both (i) not material and (ii) would likely cause competitive harm if publicly disclosed. [***] indicates that information has been redacted.

|

| (v) | the terms for repayment of principal for the Tranche; |

| (vi) | the date for repayment of principal for the Tranche; |

| (vii) | the applicable Payment Dates for the Tranche; and |

| (viii) | the Floating Rate and the Deferred Interest Rate applicable to the Tranche until the Maturity Date of the Tranche. |

| (b) | If one or more of the elements specified in the Disbursement Notice does not reflect the corresponding element, if any, in the Disbursement Request, the Borrower may following receipt of the Disbursement Notice revoke the Disbursement Request by written notice to the Bank to be received no later than 12h00 Luxembourg time on the next Business Day and thereupon the Disbursement Request and the Disbursement Notice shall be of no effect. If the Borrower has not revoked in writing the Disbursement Request within such period, the Borrower will be deemed to have accepted all elements specified in the Disbursement Notice. |

| 1.02D | Disbursement Account |

Disbursement shall be made to such account of the Borrower as the Borrower shall notify in writing to the Bank not later than 15 (fifteen) days before the Scheduled Disbursement Date (with IBAN code or with the appropriate format in line with local banking practice).

Only one account may be specified for each Tranche.

| 1.03 | Currency of disbursement |

The Bank shall disburse each Tranche in EUR.

| 1.04 | Conditions of disbursement |

| 1.04A | First Tranche |