Page ARTICLE VI Miscellaneous SECTION 6.01 Notices ............................ ............................................................................... .20 SECTION 6.02 Waivers; Amendment ..............................................

Exhibit 10.2 POSTING VERSION SECURITY AGREEMENT dated as of September 6, 2018 among THE GRANTORS IDENTIFIED HEREIN and BANK of AMERICA, N.A., as Administrative Agent Reference is made to the Intercreditor and Collateral Agency Agreement, dated as of November 16, 2012, among APX Group, Inc., a Delaware corporation, the other grantors party thereto, Bank of America, N.A., in its capacity as collateral agent for the Credit Agreement Secured Par- ties (as defined therein) and Wilmington Trust, National Association, in its capacity as collateral agent for the Senior Secured Notes Secured Parties (as defined therein), and each additional col- lateral agent from time to time party thereto as collateral agent for any First Lien Obligations (as defined therein) of any other Class (as defined therein), and as it may be amended from time to time in accordance with the Credit Agreement (as defined below) (the “Closing Date Intercred- itor Agreement”). Each Secured Party (as defined in the Credit Agreement referred to below) (a) consents to the terms of the Closing Date Intercreditor Agreement, including the priority of payment provisions of such Closing Date Intercreditor Agreement, (b) agrees that it will be bound by and will take no actions contrary to the provisions of the Closing Date Intercreditor Agreement and (c) authorizes and instructs the Administrative Agent to enter into the Closing Date Intercreditor Agreement as “Collateral Agent,” and on behalf of such Secured Party.

TABLE OF CONTENTS Page ARTICLE I Definitions SECTION 1.01 Credit Agreement ..............................................................................................1 SECTION 1.02 Other Defined Terms ........................................................................................1 ARTICLE II Pledge of Securities SECTION 2.01 Pledge ...............................................................................................................4 SECTION 2.02 Delivery of the Pledged Equity .........................................................................5 SECTION 2.03 Representations, Warranties and Covenants .....................................................5 SECTION 2.04 Certification of Limited Liability Company and Limited Partnership Interests .....................................................................................7 SECTION 2.05 Registration in Nominee Name; Denominations ..............................................8 SECTION 2.06 Voting Rights; Dividends and Interest .............................................................8 ARTICLE III Security Interests in Personal Property SECTION 3.01 Security Interest ..............................................................................................10 SECTION 3.02 Representations and Warranties .....................................................................12 SECTION 3.03 Covenants .......................................................................................................14 ARTICLE IV Remedies SECTION 4.01 Remedies Upon Default ..................................................................................16 SECTION 4.02 Application of Proceeds ..................................................................................18 SECTION 4.03 Grant of License to Use Intellectual Property ................................................18 ARTICLE V Subordination SECTION 5.01 Subordination ..................................................................................................19 -i-

Page ARTICLE VI Miscellaneous SECTION 6.01 Notices ............................................................................................................20 SECTION 6.02 Waivers; Amendment .....................................................................................20 SECTION 6.03 Administrative Agent’s Fees and Expenses; Indemnification ........................21 SECTION 6.04 Successors and Assigns ..................................................................................21 SECTION 6.05 Survival of Agreement ....................................................................................21 SECTION 6.06 Counterparts; Effectiveness; Several Agreement ...........................................21 SECTION 6.07 Severability .....................................................................................................22 SECTION 6.08 Governing Law; Jurisdiction; Venue; Waiver of Jury Trial; Consent to Service of Process ....................................................................22 SECTION 6.09 Headings .........................................................................................................22 SECTION 6.10 Security Interest Absolute ...............................................................................22 SECTION 6.11 Termination or Release ...................................................................................22 SECTION 6.12 Additional Grantors ........................................................................................23 SECTION 6.13 Administrative Agent Appointed Attorney-in-Fact ........................................23 SECTION 6.14 General Authority of the Administrative Agent .............................................24 SECTION 6.15 Reasonable Care .............................................................................................24 SECTION 6.16 Delegation; Limitation ....................................................................................24 SECTION 6.17 Reinstatement .................................................................................................25 SECTION 6.18 Miscellaneous .................................................................................................25 Schedules Schedule I Subsidiary Parties Schedule II Pledged Equity and Pledged Debt Schedule III Commercial Tort Claims Exhibits Exhibit I Form of Security Agreement Supplement Exhibit II Perfection Certificate Exhibit III Form of Patent Security Agreement Exhibit IV Form of Trademark Security Agreement Exhibit V Form of Copyright Security Agreement -ii-

SECURITY AGREEMENT dated as of September [ ], 2018, among the Gran- tors (as defined below) and Bank of America, N.A., as Administrative Agent for the Secured Parties (in such capacity, the “Administrative Agent”). Reference is made to the Credit Agreement dated as of September [ ], 2018 (as amended, supplemented or otherwise modified from time to time, the “Credit Agreement”), among APX Group Inc., a Delaware corporation, (“Borrower”), APX Group Holdings, Inc., a Delaware corporation, (the “Holdings”), the other Guarantors party thereto from time to time, each lender from time to time party thereto (collectively, the “Lenders” and individually, a “Lender”), and Bank of America, N.A., as Administrative Agent. The Lenders have agreed to extend credit to the Borrower subject to the terms and conditions set forth in the Credit Agree- ment. The obligations of the Lenders to extend such credit are conditioned upon, among other things, the execution and delivery of this Agreement. Holdings and the Subsidiary Parties are affiliates of the Borrower, will derive substantial benefits from the extension of credit to the Bor- rower pursuant to the Credit Agreement, and are willing to execute and deliver this Agreement in order to induce the Lenders to extend such credit. Accordingly, the parties hereto agree as fol- lows: ARTICLE I Definitions SECTION 1.01 Credit Agreement. (a) Capitalized terms used in this Agreement and not otherwise defined herein have the meanings specified in the Credit Agreement. All terms defined in the UCC (as defined herein) and not defined in this Agreement have the meanings specified therein; the term “instru- ment” shall have the meaning specified in Article 9 of the UCC. (b) The rules of construction specified in Article I of the Credit Agreement al- so apply to this Agreement. SECTION 1.02 Other Defined Terms. As used in this Agreement, the follow- ing terms have the meanings specified below: “Account Debtor” means any Person who is or who may become obligated to any Grantor under, with respect to or on account of an Account. “Accounts” has the meaning specified in Article 9 of the UCC. “Administrative Agent” has the meaning assigned to such term in the recitals of the Agreement. “Agreement” means this Security Agreement. “Article 9 Collateral” has the meaning assigned to such term in Section 3.01(a).

“Borrower” has the meaning assigned to such term in the recitals of this Agree- ment. “Collateral” means the Article 9 Collateral and the Pledged Collateral. “Copyright License” means any written agreement, now or hereafter in effect, granting any right to any third party under any Copyright now or hereafter owned by any Grantor or that such Grantor otherwise has the right to license, or granting any right to any Grantor under any Copyright now or hereafter owned by any third party, and all rights of such Grantor under any such agreement. “Copyrights” means all of the following now owned or hereafter acquired by any Grantor: (a) all copyright rights in any work subject to the copyright laws of the United States, whether as author, assignee, transferee or otherwise, and (b) all registrations and applications for registration of any such copyright in the United States, including registrations, recordings, sup- plemental registrations and pending applications for registration in the USCO. “Credit Agreement” has the meaning assigned to such term in the preliminary statement of this Agreement. “General Intangibles” has the meaning specified in Article 9 of the UCC. “Grantor” means the Borrower, each Guarantor that is a party hereto, and each Guarantor that becomes a party to this Agreement after the Closing Date. “Intellectual Property” means all intellectual and similar property of every kind and nature now owned or hereafter acquired by any Grantor, including inventions, designs, Pa- tents, Copyrights, Licenses, Trademarks, trade secrets, the intellectual property rights in software and databases and related documentation and all additions and improvements to the foregoing. “Intellectual Property Security Agreements” means the short-form Patent Se- curity Agreement, short-form Trademark Security Agreement, and short-form Copyright Securi- ty Agreement, each substantially in the form attached hereto as Exhibits III, IV and V, respec- tively. “License” means any Patent License, Trademark License, Copyright License or other Intellectual Property license or sublicense agreement to which any Grantor is a party, to- gether with any and all (i) renewals, extensions, supplements and continuations thereof, (ii) in- come, fees, royalties, damages, claims and payments now and hereafter due and/or payable thereunder or with respect thereto including damages and payments for past, present or future infringements or violations thereof, and (iii) rights to xxx for past, present and future violations thereof. “Patent License” means any written agreement, now or hereafter in effect, grant- ing to any third party any right to make, use or sell any invention on which a Patent, now or hereafter owned by any Grantor or that any Grantor otherwise has the right to license, is in exist- ence, or granting to any Grantor any right to make, use or sell any invention on which a Patent, -2-

now or hereafter owned by any third party, is in existence, and all rights of any Grantor under any such agreement. “Patents” means all of the following now owned or hereafter acquired by any Grantor: (a) all letters Patent of the United States in or to which any Grantor now or hereafter has any right, title or interest therein, all registrations and recordings thereof, and all applications for letters Patent of the United States, including registrations, recordings and pending applications in the USPTO, and (b) all reissues, continuations, divisions, continuations-in-part, renewals, im- provements or extensions thereof, and the inventions disclosed or claimed therein, including the right to make, use and/or sell the inventions disclosed or claimed therein. “Perfection Certificate” means a certificate substantially in the form of Exhib- it II, completed and supplemented with the schedules and attachments contemplated thereby, and duly executed by a Responsible Officer of each of the Grantors. “Pledged Collateral” has the meaning assigned to such term in Section 2.01. “Pledged Debt” has the meaning assigned to such term in Section 2.01. “Pledged Equity” has the meaning assigned to such term in Section 2.01. “Pledged Securities” means the Pledged Equity and Pledged Debt. “Secured Obligations” means the “Obligations” (as defined in the Credit Agree- ment). “Secured Parties” means, collectively, the Administrative Agent, the Lenders, the Hedge Banks and each co-agent or sub-agent appointed by the Administrative Agent from time to time pursuant to Section 9.05 of the Credit Agreement. “Security Agreement Supplement” means an instrument substantially in the form of Exhibit I hereto. “Subsidiary Parties” means (a) the Restricted Subsidiaries identified on Sched- ule I and (b) each other Restricted Subsidiary that becomes a party to this Agreement as a Sub- sidiary Party after the Closing Date. “Trademark License” means any written agreement, now or hereafter in effect, granting to any third party any right to use any Trademark now or hereafter owned by any Gran- tor or that any Grantor otherwise has the right to license, or granting to any Grantor any right to use any Trademark now or hereafter owned by any third party, and all rights of any Grantor un- der any such agreement. “Trademarks” means all of the following now owned or hereafter acquired by any Grantor: (a) all trademarks, service marks, trade names, corporate names, trade dress, logos, designs, fictitious business names other source or business identifiers, now existing or hereafter adopted or acquired, all registrations and recordings thereof, and all registration and recording applications filed in connection therewith, including registrations and registration applications in -3-

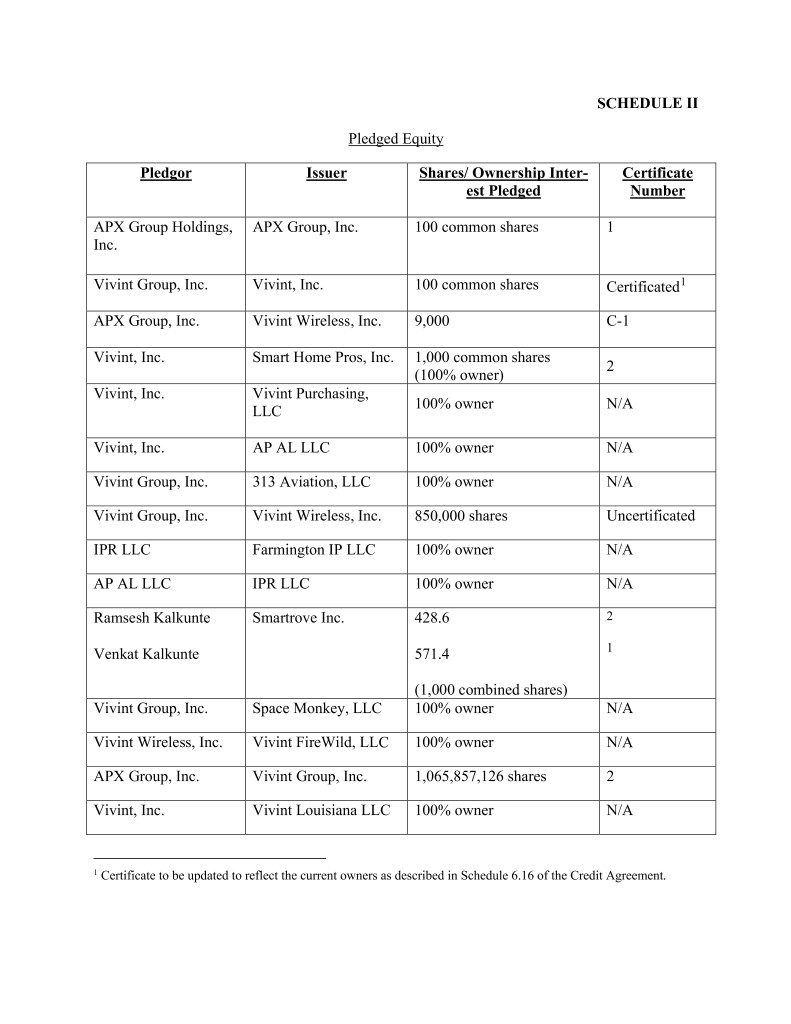

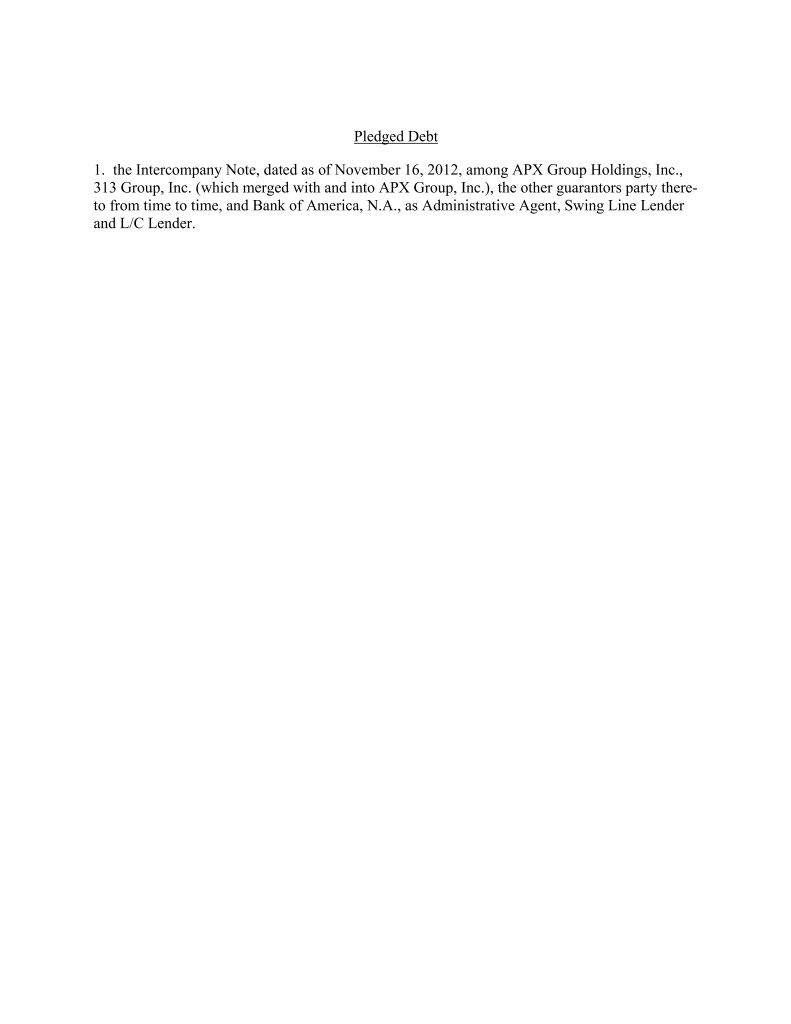

the USPTO or any similar offices in any State of the United States or any political subdivision thereof, and all extensions or renewals thereof, as well as any unregistered trademarks and ser- vice marks used by a Grantor and (b) all goodwill connected with the use of and symbolized thereby. “UCC” means the Uniform Commercial Code as from time to time in effect in the State of New York; provided that, if perfection or the effect of perfection or non-perfection or the priority of the security interest in any Collateral is governed by the Uniform Commercial Code as in effect in a jurisdiction other than the State of New York, “UCC” means the Uniform Commercial Code as in effect from time to time in such other jurisdiction for purposes of the provisions hereof relating to such perfection, effect of perfection or non-perfection or priority. “USCO” means the United States Copyright Office. “USPTO” means the United States Patent and Trademark Office. ARTICLE II Pledge of Securities SECTION 2.01 Pledge. As security for the payment or performance, as the case may be, in full of the Secured Obligations, including the Guarantees, each of the Grantors hereby assigns and pledges to the Administrative Agent, its successors and assigns, for the bene- fit of the Secured Parties, and hereby grants to the Administrative Agent, its successors and as- signs, for the benefit of the Secured Parties, a security interest in all of such Grantors’ right, title and interest in, to and under: (i) all Equity Interests held by it that are listed on Schedule II and any other Equity Interests obtained in the future by such Grantor and the certificates representing all such Equity Interests (the “Pledged Equity”); provided that the Pledged Equity shall not include (A) Excluded Assets or (B) for the avoidance of doubt, Equity Interests in ex- cess of 65% of the issued and outstanding Equity Interests of (1) any Restricted Subsidi- ary that is a wholly owned Material Domestic Subsidiary that is directly owned by the Borrower or by any Subsidiary Guarantor and that (x) is treated as a disregarded entity for federal income tax purposes and (y) substantially all of the assets of which consist of the Equity Interests and/or Indebtedness of one or more CFCs and any other assets inci- dental thereto and (2) any Restricted Subsidiary that is a wholly owned Material Foreign Subsidiary that is directly owned by the Borrower or by any Subsidiary Guarantor; (ii) (A) the debt securities owned by it and listed opposite the name of such Grantor on Schedule II, (B) any debt securities obtained in the future by such Grantor and (C) the promissory notes and any other instruments evidencing such debt securities (the “Pledged Debt”); provided that the Pledged Debt shall not include any Excluded Assets; (iii) all other property that may be delivered to and held by the Administrative Agent pursuant to the terms of this Section 2.01; -4-

(iv) subject to Section 2.06, all payments of principal or interest, dividends, cash, instruments and other property from time to time received, receivable or otherwise distributed in respect of, in exchange for or upon the conversion of, and all other Pro- ceeds received in respect of, the securities referred to in clauses (i) and (ii) above; (v) subject to Section 2.06, all rights and privileges of such Grantor with re- spect to the securities and other property referred to in clauses (i), (ii), (iii) and (iv) above; and (vi) all Proceeds of any of the foregoing (the items referred to in clauses (i) through (vi) above being collectively referred to as the “Pledged Collateral”). TO HAVE AND TO HOLD the Pledged Collateral, together with all right, title, interest, powers, privileges and preferences pertaining or incidental thereto, unto the Administrative Agent, its successors and assigns, for the benefit of the Secured Parties, forever, subject, however, to the terms, covenants and conditions hereinafter set forth. SECTION 2.02 Delivery of the Pledged Equity. (a) Each Grantor agrees promptly (but in any event within 30 days after re- ceipt by such Grantor or such longer period as the Administrative Agent may agree in its reason- able discretion) to deliver or cause to be delivered to the Administrative Agent, for the benefit of the Secured Parties, any and all (i) Pledged Equity to the extent certificated and (ii) to the extent required to be delivered pursuant to paragraph (b) of this Section 2.02, Pledged Debt. (b) Each Grantor will cause any Indebtedness for borrowed money having an aggregate principal amount in excess of $5,000,000 owed to such Grantor by any Person that is evidenced by a duly executed promissory note to be pledged and delivered to the Administrative Agent, for the benefit of the Secured Parties, pursuant to the terms hereof. (c) Upon delivery to the Administrative Agent, any Pledged Securities shall be accompanied by stock or security powers duly executed in blank or other instruments of trans- fer reasonably satisfactory to the Administrative Agent and by such other instruments and docu- ments as the Administrative Agent may reasonably request (other than instruments or documents governed by or requiring actions in any non-U.S. jurisdiction related to Equity Interests of For- eign Subsidiaries). Each delivery of Pledged Securities shall be accompanied by a schedule de- scribing the securities, which schedule shall be deemed to supplement Schedule II and made a part hereof; provided that failure to supplement Schedule II shall not affect the validity of such pledge of such Pledged Equity. Each schedule so delivered shall supplement any prior schedules so delivered. SECTION 2.03 Representations, Warranties and Covenants. Each Grantor rep- resents, warrants and covenants to and with the Administrative Agent, for the benefit of the Se- cured Parties, that: -5-

(a) As of the date hereof, Schedule II includes all Equity Interests, debt secu- rities and promissory notes required to be pledged by such Grantor hereunder in order to satisfy the Collateral and Guarantee Requirement; (b) the Pledged Equity issued by the Borrower, each other Borrower, or a wholly-owned Restricted Subsidiary have been duly and validly authorized and issued by the issuers thereof and are fully paid and nonassessable; (c) except for the security interests granted hereunder, such Grantor (i) is, subject to any transfers made in compliance with the Credit Agreement, the direct owner, beneficially and of record, of the Pledged Equity indicated on Schedule II, (ii) holds the same free and clear of all Liens, other than (A) Liens created by the Collateral Docu- ments and any Liens expressly permitted by Section 7.01 of the Credit Agreement that are governed by any Intercreditor Agreement and (B) nonconsensual Liens expressly permitted pursuant to Section 7.01 of the Credit Agreement, and (iii) if requested by the Administrative Agent, will defend its title or interest thereto or therein against any and all Liens (other than the Liens permitted pursuant to this Section 2.03(c)), however arising, of all Persons whomsoever; (d) except for restrictions and limitations (i) that are imposed or permitted by the Loan Documents or securities laws generally, (ii) in the case of Pledged Equity of Persons that are not Subsidiaries, that are transfer restrictions that exist at the time of ac- quisition of Equity Interests in such Persons, and (iii) that are described in the Perfection Certificate, the Pledged Collateral is freely transferable and assignable, and none of the Pledged Collateral is subject to any option, right of first refusal, shareholders agreement, charter or by-law provisions or contractual restriction of any nature that might prohibit, impair, delay or otherwise affect in any manner material and adverse to the Secured Par- ties the pledge of such Pledged Collateral hereunder, the sale or disposition thereof pur- suant hereto or the exercise by the Administrative Agent of rights and remedies hereun- der; (e) the execution and performance by the Grantors of this Agreement are within each Grantor’s corporate or limited liability company powers and have been duly authorized by all necessary corporate or limited liability company action or other organi- zational action; (f) no consent or approval of any Governmental Authority, any securities ex- change or any other Person was or is necessary to the validity of the pledge effected hereby, except for (i) filings and registrations necessary to perfect the Liens on the Col- lateral granted by the Loan Parties in favor of the Administrative Agent (for the benefit of the Secured Parties) and (ii) approvals, consents, exemptions, authorizations, actions, no- tices and filings which have been duly obtained, taken, given or made and are in full force and effect (except to the extent not required to be obtained, taken, given, or made or to be in full force and effect pursuant to the Collateral and Guarantee Requirement); (g) by virtue of the execution and delivery by each Grantor of this Agreement, and delivery of the Pledged Securities to and continued possession by the Administrative -6-

Agent or its bailee pursuant to the Closing Date Intercreditor Agreement, the Administra- tive Agent for the benefit of the Secured Parties has a legal, valid and perfected lien upon and security interest in such Pledged Security as security for the payment and perfor- xxxxx of the Secured Obligations to the extent such perfection is governed by the UCC, subject only to nonconsensual Liens permitted by Section 7.01 of the Credit Agreement and any Lien expressly permitted by Section 7.01 of the Credit Agreement that are gov- erned by any Intercreditor Agreement; and (h) the pledge effected hereby is effective to vest in the Administrative Agent, for the benefit of the Secured Parties, the rights of the Administrative Agent in the Pledged Collateral to the extent intended hereby. Subject to the terms of this Agreement, each Grantor hereby agrees that upon the occurrence and during the continuance of an Event of Default, it will comply with instructions of the Administrative Agent with respect to the Equity Interests in such Grantor that constitute Pledged Equity hereunder that are not certificated without further consent by the applicable own- er or holder of such Equity Interests. Notwithstanding anything to the contrary in this Agreement, to the extent any provision of this Agreement or the Credit Agreement excludes any assets from the scope of the Pledged Collateral, or from any requirement to take any action to perfect any security interest in favor of the Administrative Agent for the benefit of the Secured Parties in the Pledged Collateral, the representations, warranties and covenants made by any relevant Grantor in this Agreement with respect to the creation, perfection or priority (as applicable) of the security interest granted in favor of the Administrative Agent for the benefit of the Secured Parties (including, without limitation, this Section 2.03) shall be deemed not to apply to such excluded assets. SECTION 2.04 Certification of Limited Liability Company and Limited Part- nership Interests. No interest in any limited liability company or limited partnership controlled by any Grantor that constitutes Pledged Equity shall be represented by a certificate unless (i) the limited liability company agreement or partnership agreement expressly provides that such inter- ests shall be a “security” within the meaning of Article 8 of the UCC of the applicable jurisdic- tion, and (ii) such certificate shall be delivered to the Administrative Agent in accordance with Section 2.02. Any limited liability company and any limited partnership controlled by any Gran- tor shall either (a) not include in its operative documents any provision that any Equity Interests in such limited liability company or such limited partnership be a “security” as defined under Article 8 of the Uniform Commercial Code or (b) certificate any Equity Interests in any such limited liability company or such limited partnership. To the extent an interest in any limited liability company or limited partnership controlled by any Grantor and pledged under Section 2.01 is certificated or becomes certificated, (i) each such certificate shall be delivered to the Ad- ministrative Agent, pursuant to Section 2.02(a) and (ii) such Grantor shall fulfill all other re- quirements under Section 2.02 applicable in respect thereof. Such Grantor hereby agrees that if any of the Pledged Collateral are at any time not evidenced by certificates of ownership, then each applicable Grantor shall, to the extent permitted by applicable law, if necessary or, upon the request of the Administrative Agent, desirable to perfect a security interest in such Pledged Col- lateral, cause such pledge to be recorded on the equity holder register or the books of the issuer, execute any customary pledge forms or other documents necessary or appropriate to complete -7-

the pledge and give the Administrative Agent the right to transfer such Pledged Collateral under the terms hereof. SECTION 2.05 Registration in Nominee Name; Denominations. If an Event of Default shall have occurred and be continuing and the Administrative Agent shall have given the Borrower prior written notice of its intent to exercise such rights, (a) the Administrative Agent, on behalf of the Secured Parties, shall have the right to hold the Pledged Securities in its own name as pledgee, the name of its nominee (as pledgee or as sub-agent) or the name of the appli- cable Grantor, endorsed or assigned in blank or in favor of the Administrative Agent and each Grantor will promptly give to the Administrative Agent copies of any written notices or other written communications received by it with respect to Pledged Equity registered in the name of such Grantor and (b) the Administrative Agent shall have the right to exchange the certificates representing Pledged Equity for certificates of smaller or larger denominations for any purpose consistent with this Agreement, to the extent permitted by the documentation governing such Pledged Securities. SECTION 2.06 Voting Rights; Dividends and Interest. (a) Unless and until an Event of Default shall have occurred and be continu- ing and the Administrative Agent shall have provided prior notice to the Borrower that the rights of the Grantor under this Section 2.06 are being suspended: (i) Each Grantor shall be entitled to exercise any and all voting and/or other consensual rights and powers inuring to an owner of Pledged Securities or any part there- of and each Grantor agrees that it shall exercise such rights for purposes consistent with the terms of this Agreement, the Credit Agreement and the other Loan Documents. (ii) The Administrative Agent shall promptly (after reasonable advance no- xxxx) execute and deliver to each Grantor, or cause to be executed and delivered to such Grantor, all such proxies, powers of attorney and other instruments as such Grantor may reasonably request for the purpose of enabling such Grantor to exercise the voting and/or consensual rights and powers it is entitled to exercise pursuant to subparagraph (i) above. (iii) Each Grantor shall be entitled to receive and retain any and all dividends, interest, principal and other distributions paid on or distributed in respect of the Pledged Securities to the extent and only to the extent that such dividends, interest, principal and other distributions are permitted by, and otherwise paid or distributed in accordance with, the terms and conditions of the Credit Agreement, the other Loan Documents and appli- cable Laws; provided that any noncash dividends, interest, principal or other distributions that would constitute Pledged Equity or Pledged Debt, whether resulting from a subdivi- sion, combination or reclassification of the outstanding Equity Interests of the issuer of any Pledged Securities or received in exchange for Pledged Securities or any part thereof, or in redemption thereof, or as a result of any merger, consolidation, acquisition or other exchange of assets to which such issuer may be a party or otherwise, shall be and become part of the Pledged Collateral, and, if received by any Grantor, shall not be commingled by such Grantor with any of its other funds or property but shall be held separate and apart therefrom, shall be held in trust for the benefit of the Administrative Agent and the -8-

Secured Parties and shall be promptly (and in any event within 10 Business Days or such longer period as the Administrative Agent may agree in its reasonable discretion) deliv- ered to the Administrative Agent in the same form as so received (with any necessary en- dorsement reasonably requested by the Administrative Agent). So long as no Default or Event of Default has occurred and is continuing, the Administrative Agent shall promptly deliver to each Grantor any Pledged Securities in its possession if requested to be deliv- ered to the issuer thereof in connection with any exchange or redemption of such Pledged Securities permitted by the Credit Agreement in accordance with this Section 2.06(a)(iii). (b) Upon the occurrence and during the continuance of an Event of Default, after the Administrative Agent shall have notified the Borrower of the suspension of the Gran- tors’ rights under paragraph (a)(iii) of this Section 2.06, then all rights of any Grantor to divi- dends, interest, principal or other distributions that such Grantor is authorized to receive pursuant to paragraph (a)(iii) of this Section 2.06 shall cease, and all such rights shall thereupon become vested in the Administrative Agent, which shall have the sole and exclusive right and authority to receive and retain such dividends, interest, principal or other distributions subject to the terms of the Closing Date Intercreditor Agreement. All dividends, interest, principal or other distributions received by any Grantor contrary to the provisions of this Section 2.06 shall be held in trust for the benefit of the Administrative Agent, shall be segregated from other property or funds of such Grantor and shall be promptly (and in any event within 10 days or such longer period as the Ad- ministrative Agent may agree in its reasonable discretion) delivered to the Administrative Agent upon demand in the same form as so received (with any necessary endorsement reasonably re- quested by the Administrative Agent). Any and all money and other property paid over to or re- ceived by the Administrative Agent pursuant to the provisions of this paragraph (b) shall be re- tained by the Administrative Agent in an account to be established by the Administrative Agent upon receipt of such money or other property and shall be applied in accordance with the provi- sions of Section 4.02. After all Events of Default have been cured or waived, the Administrative Agent shall promptly repay to each Grantor (without interest) all dividends, interest, principal or other distributions that such Grantor would otherwise be permitted to retain pursuant to the terms of paragraph (a)(iii) of this Section 2.06 and that remain in such account. (c) Upon the occurrence and during the continuance of an Event of Default, after the Administrative Agent shall have provided the Borrower with notice of the suspension of its rights under paragraph (a)(i) of this Section 2.06, then all rights of any Grantor to exercise the voting and consensual rights and powers it is entitled to exercise pursuant to paragraph (a)(i) of this Section 2.06, and the obligations of the Administrative Agent under paragraph (a)(ii) of this Section 2.06, shall cease, and all such rights shall thereupon become vested in the Administrative Agent, which shall have the sole and exclusive right and authority to exercise such voting and consensual rights and powers; provided that, unless otherwise directed by the Required Lenders, the Administrative Agent shall have the right from time to time following and during the contin- uance of an Event of Default to permit the Grantors to exercise such rights. After all Events of Default have been cured or waived, each Grantor shall have the exclusive right to exercise the voting and/or consensual rights and powers that the Borrower would otherwise be entitled to ex- ercise pursuant to the terms of paragraph (a)(i) above, and the obligations of the Administrative Agent under paragraph (a)(ii) of this Section 2.06 shall be reinstated. -9-

(d) Any notice given by the Administrative Agent to the Borrower under Sec- tion 2.05 or Section 2.06 (i) shall be given in writing, (ii) may be given with respect to one or more Grantors at the same or different times and (iii) may suspend the rights of the Grantors un- der paragraph (a)(i) or paragraph (a)(iii) of this Section 2.06 in part without suspending all such rights (as specified by the Administrative Agent in its sole and absolute discretion) and without waiving or otherwise affecting the Administrative Agent’s rights to give additional notices from time to time suspending other rights so long as an Event of Default has occurred and is continu- ing. ARTICLE III Security Interests in Personal Property SECTION 3.01 Security Interest. (a) As security for the payment or performance, as the case may be, in full of the Secured Obligations, including the Guarantees, each Grantor hereby assigns and pledges to the Administrative Agent, its successors and assigns, for the benefit of the Secured Parties, and hereby grants to the Administrative Agent, its successors and assigns, for the benefit of the Se- cured Parties, a security interest (the “Security Interest”) in, all right, title or interest in or to any and all of the following assets and properties now owned or at any time hereafter acquired by such Grantor or in which such Grantor now has or at any time in the future may acquire any right, title or interest (collectively, the “Article 9 Collateral”): (i) all Accounts; (ii) all Chattel Paper; (iii) all Documents; (iv) all Equipment; (v) all General Intangibles; (vi) all Goods; (vii) all Instruments; (viii) all Inventory; (ix) all Investment Property; (x) all books and records pertaining to the Article 9 Collateral; (xi) all Fixtures; -10-

(xii) all Letter-of-Credit Rights, but only to the extent constituting a supporting obligation for other Article 9 Collateral as to which perfection of security interests in such Article 9 Collateral is accomplished by the filing of a UCC financing statement; (xiii) all Intellectual Property; (xiv) all Commercial Tort Claims listed on Schedule III and on any supplement thereto received by the Administrative Agent pursuant to Section 3.03(g); and (xv) to the extent not otherwise included, all Proceeds and products of any and all of the foregoing and all Supporting Obligations, collateral security and guarantees given by any Person with respect to any of the foregoing; provided that, notwithstanding anything to the contrary in this Agreement, this Agreement shall not constitute a grant of a security interest in any Excluded Assets and the term “Article 9 Col- lateral” shall not include any Excluded Assets. (b) Subject to Section 3.01(e), each Grantor hereby irrevocably authorizes the Administrative Agent for the benefit of the Secured Parties at any time and from time to time to file in any relevant jurisdiction any initial financing statements with respect to the Article 9 Col- lateral or any part thereof and amendments thereto that (i) indicate the Article 9 Collateral as “all assets” or “all personal property” of such Grantor or words of similar effect as being of an equal or lesser scope or with greater detail and (ii) contain the information required by Article 9 of the Uniform Commercial Code or the analogous legislation of each applicable jurisdiction for the filing of any financing statement or amendment, including whether such Grantor is an organiza- tion, the type of organization and, if required, any organizational identification number issued to such Grantor. Each Grantor agrees to provide such information to the Administrative Agent promptly upon any reasonable request. (c) The Security Interest is granted as security only and shall not subject the Administrative Agent or any other Secured Party to, or in any way alter or modify, any obliga- tion or liability of any Grantor with respect to or arising out of the Article 9 Collateral. (d) Each Grantor hereby further authorizes the Administrative Agent to file with the USPTO or the USCO (or any successor office) one or more Intellectual Property Securi- ty Agreements substantially in the form of Exhibits III, IV or V, as applicable, and such other documents as may be necessary or advisable for the purpose of perfecting, confirming, continu- ing, enforcing or protecting the Security Interest in United States Intellectual Property of each Grantor in which a security interest has been granted by each Grantor, without the signature of any Grantor, and naming any Grantor or the Grantor as debtors and the Administrative Agent as secured party. No Grantor shall be required to complete any filings governed by non-United States laws or take any other action with respect to the perfection of the Security Interests created hereby in any Intellectual Property subsisting in any non-United States jurisdiction. (e) Notwithstanding anything to the contrary in the Loan Documents, none of the Grantors shall be required, nor is the Administrative Agent authorized, (i) to perfect the Se- curity Interests granted by this Security Agreement (including Security Interests in Investment Property and Fixtures) by any means other than by (A) filings pursuant to the Uniform Commer- -11-

cial Code in the office of the secretary of state (or similar central filing office) of the relevant State(s), and filings in the applicable real estate records with respect to any fixtures relating to Mortgaged Properties, (B) filings in United States government offices with respect to Intellectual Property of Grantor as expressly required elsewhere herein, (C) delivery to the Administrative Agent to be held in its possession of all Collateral consisting of Instruments and certificated Pledged Equity as expressly required elsewhere herein or (D) other methods expressly provided herein, (ii) to enter into any deposit account control agreement, securities account control agree- ment or any other control agreement with respect to any deposit account, securities account or any other Collateral that requires perfection by “control” except as otherwise set forth in this Section 3.01(e), (iii) to take any action (other than the actions listed in clauses (i)(A) and (C) above) with respect to any assets located outside of the United States, (iv) to perfect in any assets subject to a certificate of title statute or (v) to deliver any Equity Interests except as expressly provided in Section 2.01. SECTION 3.02 Representations and Warranties. Each Grantor jointly and sev- erally represents and warrants, as to itself and the other Grantors, to the Administrative Agent and the Secured Parties that: (a) Subject to Liens permitted by Section 7.01 of the Credit Agreement, each Grantor has good and valid rights in and title (except as otherwise permitted by the Loan Documents) to the Article 9 Collateral with respect to which it has purported to grant a Security Interest hereunder and has full power and authority to grant to the Administra- tive Agent the Security Interest in such Article 9 Collateral pursuant hereto and to exe- cute, deliver and perform its obligations in accordance with the terms of this Agreement, without the consent or approval of any other Person other than any consent or approval that has been obtained. (b) The Perfection Certificate has been duly prepared, completed and execut- ed and the information set forth therein is correct and complete in all material respects (except the information therein with respect to the exact legal name of each Grantor shall be correct and complete in all respects) as of the Closing Date. Subject to Section 3.01(e), the Uniform Commercial Code financing statements or other appropriate filings, recordings or registrations prepared by the Administrative Agent based upon the infor- mation provided to the Administrative Agent in the Perfection Certificate for filing in the applicable filing office (or specified by notice from the Borrower to the Administrative Agent after the Closing Date in the case of filings, recordings or registrations (other than filings required to be made in the USPTO and the USCO in order to perfect the Security Interest in Article 0 Xxxxxxxxxx xxxxxxxxxx xx Xxxxxx Xxxxxx Patents, Trademarks and Copy- rights), in each case, as required by Section 6.11 of the Credit Agreement), are all the fil- ings, recordings and registrations that are necessary to establish a legal, valid and perfect- ed security interest in favor of the Administrative Agent (for the benefit of the Secured Parties) in respect of all Article 9 Collateral in which the Security Interest may be per- fected by filing, recording or registration in the United States (or any political subdivision thereof) and its territories and possessions pursuant to the Uniform Commercial Code, and no further or subsequent filing, re-filing, recording, rerecording, registration or re-registration is necessary in any such jurisdiction, except as provided under applicable Law with respect to the filing of continuation statements. -12-

(c) Each Grantor represents and warrants that short-form Intellectual Property Security Agreements containing a description of all Article 9 Collateral consisting of ma- terial United States registered Patents (and Patents for which United States registration applications are pending), United States registered Trademarks (and Trademarks for which United States registration applications are pending) and United States registered Copyrights, respectively (other than, in each case, any Excluded Assets), have been de- livered to the Administrative Agent for recording by the USPTO and the USCO pursuant to 35 U.S.C. § 261, 15 U.S.C. § 1060 or 17 U.S.C. § 205 and the regulations thereunder, as applicable, (for the benefit of the Secured Parties) in respect of all Article 9 Collateral consisting of registrations and applications for Patents, Trademarks and Copyrights. To the extent a security interest may be perfected by filing, recording or registration in USPTO or USCO under the Federal intellectual property laws, then no further or subse- quent filing, re-filing, recording, rerecording, registration or re-registration is necessary (other than (i) such filings and actions as are necessary to perfect the Security Interest with respect to any Article 9 Collateral consisting of Patents, Trademarks and Copyrights (or registration or application for registration thereof) acquired or developed by any Grantor after the date hereof and (ii) the UCC financing and continuation statements con- templated in Section 3.02(b)). (d) The Security Interest constitutes (i) a legal and valid security interest in all the Article 9 Collateral securing the payment and performance of the Secured Obligations and (ii) subject to the filings described in Section 3.02(b), a perfected security interest in all Article 9 Collateral in which a security interest may be perfected by filing, recording or registering a financing statement or analogous document in the United States (or any political subdivision thereof) and its territories and possessions pursuant to the Uniform Commercial Code. Subject to Section 3.01(e) of this Agreement, the Security Interest is and shall be prior to any other Lien on any of the Article 9 Collateral, other than any Liens expressly permitted pursuant to Section 7.01 of the Credit Agreement. (e) The Article 9 Collateral is owned by the Grantors free and clear of any Lien, except for Liens expressly permitted pursuant to Section 7.01 of the Credit Agree- ment. None of the Grantors has filed or consented to the filing of (i) any financing state- ment or analogous document under the Uniform Commercial Code or any other applica- ble Laws covering any Article 9 Collateral, (ii) any assignment in which any Grantor as- signs any Article 9 Collateral or any security agreement or similar instrument covering any Article 9 Collateral with the USPTO or the USCO or (iii) any assignment in which any Grantor assigns any Article 9 Collateral or any security agreement or similar instru- ment covering any Article 9 Collateral with any foreign governmental, municipal or other office, which financing statement or analogous document, assignment, security agree- ment or similar instrument is still in effect, except, in each case, for Liens expressly per- mitted pursuant to Section 7.01 of the Credit Agreement and assignments permitted by the Credit Agreement. (f) As of the date hereof, no Grantor has any Commercial Tort Claim in ex- cess of $8,000,000 other than the Commercial Tort Claims listed on Schedule III. -13-

SECTION 3.03 Covenants. (a) The Borrower agrees to notify the Administrative Agent in writing promptly, but in any event within 60 days (or such longer period as the Administrative Agent may agree in its reasonable discretion), after any change in (i) the legal name of any Grantor, (ii) the identity or type of organization or corporate structure of any Grantor, (iii) the jurisdiction of organization of any Grantor or (iv) the organizational identification number of such Grantor, if any. (b) Subject to Section 3.01(e), each Grantor shall, at its own expense, upon the reasonable request of the Administrative Agent, take any and all commercially reasonable actions necessary to defend title to the Article 9 Collateral against all Persons and to defend the Security Interest of the Administrative Agent in the Article 9 Collateral and the priority thereof against any Lien not expressly permitted pursuant to Section 7.01 of the Credit Agreement; pro- vided that, nothing in this Agreement shall prevent any Grantor from discontinuing the operation or maintenance of any of its assets or properties if such discontinuance is (x) determined by such Grantor to be desirable in the conduct of its business and (y) permitted by the Credit Agreement. (c) Subject to Section 3.01(e), each Grantor agrees, at its own expense, to ex- ecute, acknowledge, deliver and cause to be duly filed all such further instruments and docu- ments and take all such actions as the Administrative Agent may from time to time reasonably request to better assure, preserve, protect and perfect the Security Interest and the rights and remedies created hereby, including the payment of any fees and taxes required in connection with the execution and delivery of this Agreement, the granting of the Security Interest and the filing of any financing statements (including amendments or continuations thereof) or other doc- uments in connection herewith or therewith. If any amount payable under or in connection with any of the Article 9 Collateral that is in excess of $5,000,000 shall be or become evidenced by any promissory note, other instrument or debt security, such note, instrument or debt security shall be promptly (and in any event within 30 days of its acquisition or such longer period as the Administrative Agent may agree in its reasonable discretion) pledged and delivered to the Ad- ministrative Agent, for the benefit of the Secured Parties, duly endorsed in a manner reasonably satisfactory to the Administrative Agent. (d) At its option, the Administrative Agent may discharge past due taxes, as- sessments, charges, fees, Liens, security interests or other encumbrances at any time levied or placed on the Article 9 Collateral and not permitted pursuant to Section 7.01 of the Credit Agreement, and may pay for the maintenance and preservation of the Article 9 Collateral to the extent any Grantor fails to do so as required by the Credit Agreement or any other Loan Docu- ment and within a reasonable period of time after the Administrative Agent has requested that it do so, and each Grantor jointly and severally agrees to reimburse the Administrative Agent with- in 10 Business Days after demand for any payment made or any reasonable expense incurred by the Administrative Agent pursuant to the foregoing authorization; provided, however, the Gran- tors shall not be obligated to reimburse the Administrative Agent with respect to any Intellectual Property that any Grantor has failed to maintain or pursue, or otherwise allowed to lapse, termi- nate, expire or be put into the public domain in accordance with Section 3.03(f)(iv). Nothing in this paragraph shall be interpreted as excusing any Grantor from the performance of, or imposing any obligation on the Administrative Agent or any Secured Party to cure or perform, any cove- -14-

nants or other promises of any Grantor with respect to taxes, assessments, charges, fees, Liens, security interests or other encumbrances and maintenance as set forth herein or in the other Loan Documents. (e) Each Grantor (rather than the Administrative Agent or any Secured Party) shall remain liable (as between itself and any relevant counterparty) to observe and perform all the conditions and obligations to be observed and performed by it under each contract, agree- ment or instrument relating to the Article 9 Collateral, all in accordance with the terms and con- ditions thereof. (f) If at any time any Grantor shall take a security interest in any property of an Account Debtor or any other Person the value of which is in excess of $5,000,000 to secure payment and performance of an Account, such Grantor shall promptly assign such security inter- est to the Administrative Agent for the benefit of the Secured Parties provided that, notwith- standing anything to the contrary in this Agreement, this Agreement shall not constitute a grant of a security interest in any Excluded Assets. Such assignment need not be filed of public record unless necessary to continue the perfected status of the security interest against creditors of and transferees from the Account Debtor or other Person granting the security interest. (g) Intellectual Property Covenants. (i) Other than to the extent not prohibited herein or in the Credit Agreement or with respect to registrations and applications no longer used or useful, except to the extent failure to act would not, as deemed by the applicable Grantor in its reasonable business judg- ment, reasonably be expected to have a Material Adverse Effect, with respect to registration or pending application of each item of its Intellectual Property for which such Grantor has standing to do so, each Grantor agrees to take, at its expense, all reasonable steps, including, without limi- tation, in the USPTO, the USCO and any other governmental authority located in the United States, to pursue the registration and maintenance of each Patent, Trademark, or Copyright regis- tration or application now or hereafter included in the Intellectual Property of such Grantor that are not Excluded Assets. (ii) Other than to the extent not prohibited herein or in the Credit Agreement, or with respect to registrations and applications no longer used or useful, or except as would not, as deemed by the applicable Grantor in its reasonable business judgment, reasonably be expected to have a Material Adverse Effect, no Grantor shall do or permit any act or knowingly omit to do any act whereby any of its Intellectual Property, excluding Excluded Assets, may lapse, be ter- minated, or become invalid or unenforceable or placed in the public domain (or in the case of a trade secret, become publicly known). (iii) Other than as excluded or as not prohibited herein or in the Credit Agree- ment, or with respect to Patents, Copyrights or Trademarks which are no longer used or useful in the applicable Grantor’s business operations or except where failure to do so would not, as deemed by the applicable Grantor in its reasonable business judgment, reasonably be expected to have a Material Adverse Effect, each Grantor shall take all reasonable steps to preserve and pro- tect each item of its Intellectual Property, including, without limitation, maintaining the quality of any and all products or services used or provided in connection with any of the Trademarks, -15-

consistent with the quality of the products and services as of the date hereof, and taking reasona- ble steps necessary to ensure that all licensed users of any of the Trademarks abide by the appli- cable license’s terms with respect to standards of quality. (iv) Notwithstanding any other provision of this Agreement, nothing in this Agreement or any other Loan Document prevents or shall be deemed to prevent any Grantor from disposing of, discontinuing the use or maintenance of, failing to pursue, or otherwise allow- ing to lapse, terminate or be put into the public domain, any of its Intellectual Property to the ex- tent permitted by the Credit Agreement if such Grantor determines in its reasonable business judgment that such discontinuance is desirable in the conduct of its business. (v) Within the same delivery period as required for the delivery of the annual Compliance Certificate required to be delivered under Section 6.02(a) of the Credit Agreement the Borrower shall provide a list of any additional registrations of Intellectual Property of all Grantors not previously disclosed to the Administrative Agent including such information as is necessary for such Grantor to make appropriate filings in the USPTO and USCO. (h) Commercial Tort Claims. If the Grantors shall at any time hold or acquire a Commercial Tort Claim in an amount reasonably estimated by such Grantor to exceed $5,000,000 for which this clause has not been satisfied and for which a complaint in a court of competent jurisdiction has been filed, such Grantor shall within 45 days (or such longer period as the Administrative Agent may agree in its reasonable discretion) after the end of the fiscal quar- ter in which such complaint was filed notify the Administrative Agent thereof in a writing signed by such Grantor including a summary description of such claim and grant to the Administrative Agent, for the benefit of the Secured Parties, in such writing a security interest therein and in the proceeds thereof, all upon the terms of this Agreement. ARTICLE IV Remedies SECTION 4.01 Remedies Upon Default. Upon the occurrence and during the continuance of an Event of Default, it is agreed that the Administrative Agent shall have the right to exercise any and all rights afforded to a secured party with respect to the Secured Obligations, including the Guarantees, under the Uniform Commercial Code or other applicable Law and also may (i) require each Grantor to, and each Grantor agrees that it will at its expense and upon re- quest of the Administrative Agent, promptly assemble all or part of the Collateral as directed by the Administrative Agent and make it available to the Administrative Agent at a place and time to be designated by the Administrative Agent that is reasonably convenient to both parties; (ii) occupy any premises owned or, to the extent lawful and permitted, leased by any of the Grantors where the Collateral or any part thereof is assembled or located for a reasonable period in order to effectuate its rights and remedies hereunder or under Law, without obligation to such Grantor in respect of such occupation; provided that the Administrative Agent shall provide the applica- ble Grantor with notice thereof prior to such occupancy; (iii) exercise any and all rights and rem- edies of any of the Grantors under or in connection with the Collateral, or otherwise in respect of the Collateral; provided that the Administrative Agent shall provide the applicable Grantor with notice thereof prior to such exercise; and (iv) subject to the mandatory requirements of applica- -16-

ble Law and the notice requirements described below, sell or otherwise dispose of all or any part of the Collateral securing the Secured Obligations at a public or private sale or at any broker’s board or on any securities exchange, for cash, upon credit or for future delivery as the Adminis- trative Agent shall deem appropriate. The Administrative Agent shall be authorized at any such sale of securities (if it deems it advisable to do so) to restrict the prospective bidders or purchas- ers to Persons who will represent and agree that they are purchasing the Collateral for their own account for investment and not with a view to the distribution or sale thereof, and upon consum- mation of any such sale the Administrative Agent shall have the right to assign, transfer and de- liver to the purchaser or purchasers thereof the Collateral so sold. Each such purchaser at any sale of Collateral shall hold the property sold absolutely, free from any claim or right on the part of any Grantor, and each Grantor hereby waives (to the extent permitted by Law) all rights of redemption, stay and appraisal which such Grantor now has or may at any time in the future have under any Law now existing or hereafter enacted. The Administrative Agent shall give the applicable Grantors 10 days’ written no- xxxx (which each Grantor agrees is reasonable notice within the meaning of Section 9-611 of the UCC or its equivalent in other jurisdictions) of the Administrative Agent’s intention to make any sale of Collateral. Such notice, in the case of a public sale, shall state the time and place for such sale and, in the case of a sale at a broker’s board or on a securities exchange, shall state the board or exchange at which such sale is to be made and the day on which the Collateral, or portion thereof, will first be offered for sale at such board or exchange. Any such public sale shall be held at such time or times within ordinary business hours and at such place or places as the Ad- ministrative Agent may fix and state in the notice (if any) of such sale. At any such sale, the Collateral, or portion thereof, to be sold may be sold in one lot as an entirety or in separate par- cels, as the Administrative Agent may (in its sole and absolute discretion) determine. The Ad- ministrative Agent shall not be obligated to make any sale of any Collateral if it shall determine not to do so, regardless of the fact that notice of sale of such Collateral shall have been given. The Administrative Agent may, without notice or publication, adjourn any public or private sale or cause the same to be adjourned from time to time by announcement at the time and place fixed for sale, and such sale may, without further notice, be made at the time and place to which the same was so adjourned. In case any sale of all or any part of the Collateral is made on credit or for future delivery, the Collateral so sold may be retained by the Administrative Agent until the sale price is paid by the purchaser or purchasers thereof, but the Administrative Agent shall not incur any liability in case any such purchaser or purchasers shall fail to take up and pay for the Collateral so sold and, in case of any such failure, such Collateral may be sold again upon like notice. At any public (or, to the extent permitted by Law, private) sale made pursuant to this Agreement, any Secured Party may bid for or purchase, free (to the extent permitted by Law) from any right of redemption, stay, valuation or appraisal on the part of any Grantor (all said rights being also hereby waived and released to the extent permitted by Law), the Collateral or any part thereof offered for sale and may make payment on account thereof by using any claim then due and payable to such Secured Party from any Grantor as a credit against the purchase price, and such Secured Party may, upon compliance with the terms of sale, hold, retain and dis- pose of such property without further accountability to any Grantor therefor. For purposes here- of, a written agreement to purchase the Collateral or any portion thereof shall be treated as a sale thereof; the Administrative Agent shall be free to carry out such sale pursuant to such agreement and no Grantor shall be entitled to the return of the Collateral or any portion thereof subject thereto, notwithstanding the fact that after the Administrative Agent shall have entered into such -17-

an agreement all Events of Default shall have been remedied and the Secured Obligations paid in full. As an alternative to exercising the power of sale herein conferred upon it, the Administra- tive Agent may proceed by a suit or suits at Law or in equity to foreclose this Agreement and to sell the Collateral or any portion thereof pursuant to a judgment or decree of a court or courts having competent jurisdiction or pursuant to a proceeding by a court-appointed receiver. Any sale pursuant to the provisions of this Section 4.01 shall be deemed to conform to the commer- cially reasonable standards as provided in Section 9-610(b) of the UCC or its equivalent in other jurisdictions. Each Grantor irrevocably makes, constitutes and appoints the Administrative Agent (and all officers, employees or agents designated by the Administrative Agent) as such Grantor’s true and lawful agent (and attorney-in-fact) during the continuance of an Event of De- fault (provided that the Administrative Agent shall provide the applicable Grantor with notice thereof prior to, to the extent reasonably practicable, or otherwise promptly after, exercising such rights), for the purpose of (i) making, settling and adjusting claims in respect of Article 9 Collat- eral under policies of insurance, endorsing the name of such Grantor on any check, draft, instru- ment or other item of payment for the proceeds of such policies if insurance, (ii) making all de- terminations and decisions with respect thereto and (iii) obtaining or maintaining the policies of insurance required by Section 6.07 of the Credit Agreement or to pay any premium in whole or in part relating thereto. All sums disbursed by the Administrative Agent in connection with this paragraph, including reasonable attorneys’ fees, court costs, expenses and other charges relating thereto, shall be payable, within 10 days of demand, by the Grantors to the Administrative Agent and shall be additional Secured Obligations secured hereby. SECTION 4.02 Application of Proceeds. The Administrative Agent shall ap- ply the proceeds of any collection or sale of Collateral, including any Collateral consisting of cash in accordance with Section 8.03 of the Credit Agreement. The Administrative Agent shall have absolute discretion as to the time of applica- tion of any such proceeds, moneys or balances in accordance with this Agreement. Upon any sale of Collateral by the Administrative Agent (including pursuant to a power of sale granted by statute or under a judicial proceeding), the receipt of the Administrative Agent or of the officer making the sale shall be a sufficient discharge to the purchaser or purchasers of the Collateral so sold and such purchaser or purchasers shall not be obligated to see to the application of any part of the purchase money paid over to the Administrative Agent or such officer or be answerable in any way for the misapplication thereof. The Administrative Agent shall have no liability to any of the Secured Parties for actions taken in reliance on information supplied to it as to the amounts of unpaid principal and interest and other amounts outstanding with respect to the Secured Obligations, provided that nothing in this sentence shall prevent any Grantor from contesting any amounts claimed by any Secured Party in any information so supplied. All distributions made by the Administrative Agent pursuant to this Section 4.02 shall be (subject to any decree of any court of competent ju- risdiction) final (absent manifest error). SECTION 4.03 Grant of License to Use Intellectual Property. For the exclu- sive purpose of enabling the Administrative Agent to exercise rights and remedies under this -18-

Agreement at such time as the Administrative Agent shall be lawfully entitled to exercise such rights and remedies at any time after and during the continuance of an Event of Default, each Grantor hereby grants to the Administrative Agent a non-exclusive, royalty-free, limited license (until the termination or cure of the Event of Default) for cash, upon credit or for future delivery as the Administrative Agent shall deem appropriate to use, license or sublicense any of the Intel- lectual Property now owned or hereafter acquired by such Grantor, and wherever the same may be located, and including in such license reasonable access to all media in which any of the li- censed items may be recorded or stored and to all computer software and programs used for the compilation or printout thereof; provided, however, that all of the foregoing rights of the Admin- istrative Agent to use such licenses, sublicenses and other rights, and (to the extent permitted by the terms of such licenses and sublicenses) all licenses and sublicenses granted thereunder, shall expire immediately upon the termination or cure of all Events of Default and shall be exercised by the Administrative Agent solely during the continuance of an Event of Default and upon 10 Business Days’ prior written notice to the applicable Grantor, and nothing in this Section 4.03 shall require Grantors to grant any license that is prohibited by any rule of law, statute or regula- tion, or is prohibited by, or constitutes a breach or default under or results in the termination of any contract, license, agreement, instrument or other document evidencing, giving rise to or theretofore granted, to the extent permitted by the Credit Agreement, with respect to such proper- ty or otherwise unreasonably prejudices the value thereof to the relevant Grantor; provided, fur- ther, that any such license and any such license granted by the Administrative Agent to a third party shall include reasonable and customary terms and conditions necessary to preserve the ex- istence, validity and value of the affected Intellectual Property, including without limitation, pro- visions requiring the continuing confidential handling of trade secrets, requiring the use of ap- propriate notices and prohibiting the use of false notices, quality control and inurement provi- sions with regard to Trademarks, patent designation provisions with regard to Patents, copyright notices and restrictions on decompilation and reverse engineering of copyrighted software (it be- ing understood and agreed that, without limiting any other rights and remedies of the Adminis- trative Agent under this Agreement, any other Loan Document or applicable Law, nothing in the foregoing license grant shall be construed as granting the Administrative Agent rights in and to such Intellectual Property above and beyond (x) the rights to such Intellectual Property that each Grantor has reserved for itself and (y) in the case of Intellectual Property that is licensed to any such Grantor by a third party, the extent to which such Grantor has the right to grant a sublicense to such Intellectual Property hereunder). For the avoidance of doubt, the use of such license by the Administrative Agent may be exercised, at the option of the Administrative Agent, only dur- ing the continuation of an Event of Default. Upon the occurrence and during the continuance of an Event of Default, the Administrative Agent may also exercise the rights afforded under Sec- tion 4.01 of this Agreement with respect to Intellectual Property contained in the Article 9 Col- lateral. ARTICLE V Subordination SECTION 5.01 Subordination. (a) Notwithstanding any provision of this Agreement to the contrary, all rights of the Grantors to indemnity, contribution or subrogation under applicable law or otherwise shall -19-

be fully subordinated to the payment in full in cash of the Secured Obligations. No failure on the part of the Borrower or any Grantor to make the payments required under applicable law or oth- erwise shall in any respect limit the obligations and liabilities of any Grantor with respect to its obligations hereunder, and each Grantor shall remain liable for the full amount of the obligations of such Grantor hereunder. (b) Each Grantor hereby agrees that upon the occurrence and during the con- tinuance of an Event of Default and after notice from the Administrative Agent, all Indebtedness owed to it by any other Grantor shall be fully subordinated to the payment in full in cash of the Secured Obligations. ARTICLE VI Miscellaneous SECTION 6.01 Notices. All communications and notices hereunder shall (ex- cept as otherwise expressly permitted herein) be in writing and given as provided in Section 10.02 of the Credit Agreement. All communications and notices hereunder to the Borrower or any other Grantor shall be given to it in care of the Borrower as provided in Section 10.02 of the Credit Agreement. SECTION 6.02 Waivers; Amendment. (a) No failure or delay by any Secured Party in exercising any right, remedy, power or privilege hereunder or under any other Loan Document shall operate as a waiver there- of, nor shall any single or partial exercise of any such right, remedy, power or privilege hereun- der preclude any other or further exercise thereof or the exercise of any other right, remedy, power or privilege. The rights, remedies, powers and privileges of the Secured Parties herein provided, and provided under each other Loan Document, are cumulative and are not exclusive of any rights, remedies, powers and privileges provided by Law. No waiver of any provision of this Agreement or consent to any departure by any Grantor therefrom shall in any event be effec- tive unless the same shall be permitted by paragraph (b) of this Section 6.02, and then such waiver or consent shall be effective only in the specific instance and for the purpose for which given. Without limiting the generality of the foregoing, the making of a Loan, the issuance of a Letter of Credit or the provision of services under Treasury Services Agreements or Secured Hedge Agreements shall not be construed as a waiver of any Default, regardless of whether any Secured Party may have had notice or knowledge of such Default at the time. (b) Neither this Agreement nor any provision hereof may be waived, amended or modified except pursuant to an agreement or agreements in writing entered into by the Ad- ministrative Agent and the Grantor or Grantors with respect to which such waiver, amendment or modification is to apply, subject to any consent required in accordance with Section 10.01 of the Credit Agreement. -20-

SECTION 6.03 Administrative Agent’s Fees and Expenses; Indemnification. (a) The parties hereto agree that the Administrative Agent shall be entitled to reimbursement of its reasonable out-of-pocket expenses incurred hereunder and indemnity for its actions in connection herewith as provided in Sections 10.04 and 10.05 of the Credit Agreement. (b) Any such amounts payable as provided hereunder shall be additional Se- cured Obligations secured hereby and by the other Collateral Documents. The provisions of this Section 6.03 shall remain operative and in full force and effect regardless of the termination of this Agreement or any other Loan Document, the consummation of the transactions contemplat- ed hereby, the repayment of any of the Secured Obligations, the invalidity or unenforceability of any term or provision of this Agreement or any other Loan Document, or any investigation made by or on behalf of the Administrative Agent or any other Secured Party. All amounts due under this Section 6.03 shall be payable within 30 days of written demand therefor. SECTION 6.04 Successors and Assigns. The provisions of this Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns. SECTION 6.05 Survival of Agreement. All covenants, agreements, representa- tions and warranties made by the Grantors hereunder and in the other Loan Documents and in the certificates or other instruments prepared or delivered in connection with or pursuant to this Agreement shall be considered to have been relied upon by the Secured Parties and shall survive the execution and delivery of the Loan Documents, the making of any Loans and issuance of any Letters of Credit and the provision of services under Treasury Services Agreements or Secured Hedge Agreements, regardless of any investigation made by any Secured Party or on its behalf and notwithstanding that any Secured Party may have had notice or knowledge of any Default at the time any credit is extended under the Credit Agreement, and shall continue in full force and effect as long as this Agreement has not been terminated or released pursuant to Section 6.11 be- low. SECTION 6.06 Counterparts; Effectiveness; Several Agreement. This Agree- ment may be executed in one or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. Delivery by facsimile or other electronic communication of an executed counterpart of a signature page to this Agreement shall be effective as delivery of an original executed counterpart of this Agreement. This Agreement shall become effective as to any Grantor when a counterpart hereof executed on be- half of such Grantor shall have been delivered to the Administrative Agent and a counterpart hereof shall have been executed on behalf of the Administrative Agent, and thereafter shall be binding upon such Grantor and the Administrative Agent and their respective permitted succes- sors and assigns, and shall inure to the benefit of such Grantor, the Administrative Agent and the other Secured Parties and their respective permitted successors and assigns, except that no Gran- tor shall have the right to assign or transfer its rights or obligations hereunder or any interest herein or in the Collateral (and any such assignment or transfer shall be void) except as expressly contemplated by this Agreement or the Credit Agreement. This Agreement shall be construed as a separate agreement with respect to each Grantor and may be amended, modified, supplement- -21-