JINKOSOLAR HOLDING CO., LTD SHARE SUBSCRIPTION AGREEMENT December 11, 2008

| Exhibit 4.12 | Execution Copy |

JINKOSOLAR HOLDING CO., LTD

December 11, 2008

TABLE OF CONTENTS

| Page | ||||

| 1. | Definitions. | 3 | ||

| 2. | Purchase and Sale of Series B Preferred Shares; Closing. | 3 | ||

| 2.1 | Authorization. | 3 | ||

| 2.2 | Issuance of Shares. | 3 | ||

| 2.3 | Closing. | 4 | ||

| 2.4 | Termination of Agreement. | 5 | ||

| 2.5 | Effect of Termination. | 5 | ||

| 3. | Representations and Warranties of the Company, the Founders, Paker and Jinko. | 5 | ||

| 3.1 | Organization, Good Standing; Due Authorization. | 6 | ||

| 3.2 | Authorization; Consents. | 6 | ||

| 3.3 | Valid Issuance of Shares; Consents. | 6 | ||

| 3.4 | Capitalization and Voting Rights. | 7 | ||

| 3.5 | Tax Matters. | 8 | ||

| 3.6 | Books and Records. | 9 | ||

| 3.7 | Financial Statements. | 9 | ||

| 3.8 | Changes. | 10 | ||

| 3.9 | Litigation. | 11 | ||

| 3.10 | Liabilities. | 11 | ||

| 3.11 | Commitments. | 12 | ||

| 3.12 | Compliance with Laws. | 13 | ||

| 3.13 | Title; Liens; Permits. | 14 | ||

| 3.14 | Subsidiaries. | 14 | ||

| 3.15 | Compliance with Other Instruments. | 14 | ||

| 3.16 | Related Party Transactions. | 15 | ||

| 3.17 | Intellectual Property Rights. | 15 | ||

| 3.18 | Entire Business. | 16 | ||

| 3.19 | Labor Agreements and Actions. | 17 | ||

| 3.20 | Business Plan and Budget. | 17 | ||

| 3.21 | Environmental and Safety Laws. | 17 | ||

| 3.22 | Disclosure. | 17 | ||

| 3.23 | Exempt Offering | 17 | ||

| 3.24 | Representations and Warranties Relating to the Founders | 18 | ||

| 4. | Representations and Warranties of the Investors. | 18 | ||

| 5. | Conditions of the Investors’ Obligations at Closing. | 20 | ||

| 5.1 | Representations and Warranties. | 20 | ||

| 5.2 | Performance | 21 | ||

| 5.3 | Authorizations. | 21 | ||

| 5.4 | Closing Certificate. | 21 | ||

| 5.5 | Proceedings and Documents. | 21 | ||

| 5.6 | Shareholders Agreement | 21 | ||

| 5.7 | Memorandum and Articles. | 21 | ||

| 5.8 | Legal Opinions. | 21 | ||

| 5.9 | Due Authorization of the Investors. | 22 | ||

| 5.10 | Employment Agreement | 22 | ||

| 5.11 | Non-Competition Agreement and Confidentiality Agreement, Proprietary Information and Inventions Assignment Agreement. | 22 | ||

| 5.12 | Financial Committee. | 22 | ||

| 5.13 | Executive Committee. | 23 | ||

| 5.14 | No Adverse Change. | 23 | ||

| 5.15 | Indemnification Agreement with Directors. | 23 | ||

| 6. | Conditions of the Company’s Obligations at Closing. | 23 |

i

| 7. | Termination of Certain Agreements. | 23 | ||

| 7.1 | Termination of Remaining Rights and Obligations Under Share Purchase Agreements. | 23 | ||

| 7.2. | Termination of Shareholders Agreement. | 24 | ||

| 8. | Confidentiality. | 24 | ||

| 8.1 | Disclosure of Terms. | 24 | ||

| 8.2 | Permitted Disclosures. | 24 | ||

| 8.3 | Legally Compelled Disclosure. | 24 | ||

| 8.4 | Other Exceptions | 25 | ||

| 8.5 | Press Releases, Etc. | 25 | ||

| 8.6 | Other Information. | 25 | ||

| 9. | Undertakings. | 25 | ||

| 9.1 | Use of Proceeds from the Sale of Series A Preferred Shares and Series B Preferred Shares of Paker. | 25 | ||

| 9.2 | Compliance by Founders. | 26 | ||

| 9.3 | Compliance by Company Group. | 26 | ||

| 9.4 | Filing of Memorandum and Articles. | 26 | ||

| 9.5 | Social Insurance. | 26 | ||

| 9.6 | Employee Stock Option Plan. | 26 | ||

| 9.7 | Shareholding Percentage Adjustment Based on Year 2008 Net Earnings or IPO Price. | 27 | ||

| 10. | Miscellaneous. | 29 | ||

| 10.1 | Survival of Representations and Warranties | 29 | ||

| 10.2 | Successors and Assigns | 29 | ||

| 10.3 | Indemnity | 30 | ||

| 10.4 | Subsequent Financing | 31 | ||

| 10.5 | Governing Law. | 31 | ||

| 10.6 | Counterparts. | 31 | ||

| 10.7 | Titles and Subtitles. | 31 | ||

| 10.8 | Notices. | 31 | ||

| 10.9 | Transaction Fees and Other Expenses. | 32 | ||

| 10.10 | Amendments and Waivers. | 32 | ||

| 10.11 | Severability. | 32 | ||

| 10.12 | Entire Agreement. | 32 | ||

| 10.13 | Dispute Resolution. | 32 | ||

| 10.14 | Rights Cumulative. | 33 | ||

| 10.15 | Interpretation. | 33 | ||

| 10.16 | No Waiver. | 34 | ||

| 10.17 | No Presumption. | 34 | ||

| SCHEDULE 1 |

||||

| SCHEDULE 2 |

||||

| EXHIBIT X-0 |

||||

| XXXXXXX X-0 |

||||

| EXHIBIT B |

||||

| EXHIBIT C |

||||

| EXHIBIT D |

||||

| EXHIBIT E |

||||

| EXHIBIT F |

||||

| EXHIBIT G |

||||

ii

THIS SHARE SUBSCRIPTION AGREEMENT (this “Agreement”) is made as of December 11, 2008, by and among the parties as follows:

| (1) | JINKOSOLAR HOLDING CO., LTD.(the “Company”), a company duly incorporated and validly existing under the Laws of the Cayman Islands; |

| (2) | PAKER TECHNOLOGY LIMITED (

,“Paker”), a company duly incorporated and validly existing under the Laws of Hong Kong Special Administrative Region (“Hong Kong”); ,“Paker”), a company duly incorporated and validly existing under the Laws of Hong Kong Special Administrative Region (“Hong Kong”); |

| (3) | JIANGXI JINKO SOLAR CO., LTD. (

, “Jinko”), a wholly foreign owned enterprise duly organized and validly existing under the Laws of the People’s Republic of China (“PRC”); , “Jinko”), a wholly foreign owned enterprise duly organized and validly existing under the Laws of the People’s Republic of China (“PRC”); |

| (4) | LI Xiande, XXXX Xxxxxxxx and XX Xxxxxxx, each a citizen of the PRC (collectively the “Founders” and each, a “Founder”); |

| (5) | WEALTH PLAN INVESTMENTS LIMITED (“Wealth Plan”), a company duly incorporated and validly existing under the Laws of British Virgin Islands; |

| (6) | FLAGSHIP DESUN SHARES CO., LIMITED.(“Flagship”), a company duly incorporated and validly existing under the Laws of Hong Kong; |

| (7) | EVERBEST INTERNATIONAL CAPITAL LIMITED (“Everbest”, collectively with Flagship, “Series A Investors” and each, a “Series A Investor”), a company duly incorporated and validly existing under the Laws of Hong Kong; |

| (8) | SCGC CAPITAL HOLDING COMPANY LIMITED (“SCGC”), a company duly incorporated and validly existing under the Laws of British Virgin Islands; |

| (9) | CIVC INVESTMENT LTD (“CIVC”), a company duly incorporated and validly existing under the Law of Cayman Islands; |

| (10) | PITANGO VENTURE CAPITAL FUND V, L.P. and PITANGO VENTURE CAPITAL PRINCIPALS FUND V, L.P. (together known as “Pitango”), limited partnerships under the Laws of Cayman Islands; |

| (11) | TDR INVESTMENT HOLDINGS CORPORATION (“TDR”), a company duly incorporated and validly existing under the Law of British Virgin Islands; and |

| (12) | NEW GOLDENSEA (HONG KONG) GROUP COMPANY LIMITED (“New Goldensea”, and collectively with SCGC, CIVC, Pitango and TDR, known as the “Series B Investors”, and each, a “Series B Investor”), a company duly incorporated and validly existing under the Law of Hong Kong. |

1

Each of the Company, the Founders, Wealth Plan, Jinko, Paker, the Series A Investors and the Series B Investors shall be referred to individually as a “Party” and collectively as the “Parties”. Wealth Plan, Series A Investors and Series B Investors shall be referred to collectively as “Investors” and individually, “Investor”.

RECITALS

As of the date hereof

| A. | The Company is an exempt company with limited liability incorporated under the Laws of the Cayman Islands, with an authorized capital of US$10,000, divided into 10,000,000 ordinary shares of par value US$0.001 each (“Ordinary Shares”); |

| B. | Brilliant Win Holdings Limited (“Brilliant Win”), a company organized under the Laws of the British Virgin Islands, 100% of whose shares are held by LI Xiande, holds 1,000 Ordinary Shares; Yale Pride Limited (“Yale Pride”), a company organized under the Laws of the British Virgin Islands, 100% of whose shares are held by XXXX Xxxxxxxx, holds 1,000 Ordinary Shares; and Peaky Investments Limited (“Peaky Investments”), a company organized under the Laws of the British Virgin Islands, 100% of whose shares are held by LI Xianhua, holds 1,000 Ordinary Shares; |

| X. | XX Xiande, XXXX Xxxxxxxx, LI Xianhua and Wealth Plan hold 500,000, 300,000, 200,000 and 14,629 Ordinary Shares in Paker, respectively; |

| D. | Flagship holds 67,263 Series A Preferred Shares in Paker for which it subscribed pursuant to the Flagship Purchase Agreement and Everbest holds 40,240 Series A Preferred Shares in Paker for which it subscribed pursuant to the Everbest Purchase Agreement; |

| E. | SCGC, CVIC, Pitango, TDR and New Goldensea hold 55,811, 21,140, 29,597, 12,684 and 29,597 Series B Preferred Shares in Paker, for which they subscribed pursuant to the Series B Purchase Agreement; and |

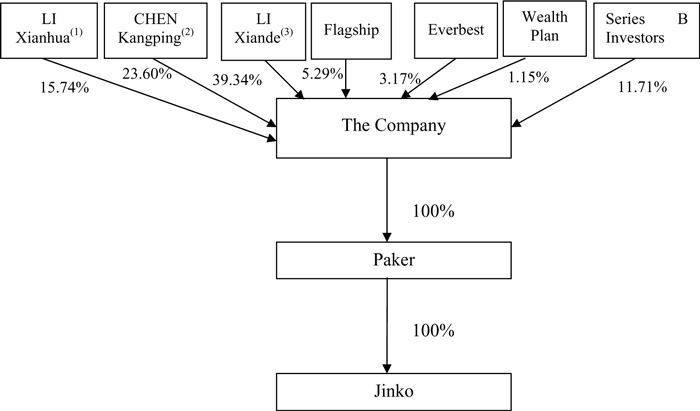

| F. | The Founders and Investors wish to subscribe for Shares in the Company and the Company wishes to issue Shares to the Founders and Investors in consideration of the shares they hold in Paker such that Paker will become a wholly-owned subsidiary of the Company. |

2

WITNESSETH

NOW, THEREFORE, in consideration of the premises and other good and valuable consideration that receipt and sufficiency of which is hereby acknowledged, the Parties hereby agree as follows:

| 1. | Definitions. |

Capitalized terms used herein shall have the meanings assigned to them in Schedule 1 attached hereto.

| 2. | Purchase and Sale of Series B Preferred Shares; Closing. |

| 2.1 | Authorization. |

As of the Closing, the Company shall have an authorized share capital of US$10,000, consisting of 9,743,668 Ordinary Shares of US$0.001 each, 107,503 Series A Preferred Shares of US$0.001 each and 148,829 Series B Preferred Shares of US$0.001 each. As of the Closing, the Company shall have authorized (a) the issuance at the Closing, pursuant to the terms and conditions of this Agreement of (i) 499,000 Ordinary Shares to LI Xiande, (ii) 299,000 Ordinary Shares to XXXX Xxxxxxxx, (iii) 199,000 Ordinary Shares to LI Xianhua and (iv) 14,629 Ordinary Shares to Wealth Plan, (b) the issuance at the Closing, pursuant to the terms and conditions of this Agreement, an aggregate of 107,503 Series A Preferred Shares to the Series A Investors in the respective numbers set out in Schedule 2, having the rights, preferences, privileges and restrictions as set forth in the Memorandum and Articles, (c) the issuance at the Closing, pursuant to the terms and conditions of this Agreement, of 148,829 Series B Preferred Shares to the Series B Investors in the respective numbers set out in Schedule 2, having the rights, preferences, privileges and restrictions as set forth in the Memorandum and Articles, (d) the reservation of 107,503 Ordinary Shares for the conversion of the Series A Preferred Shares, and (e) the reservation of 148,829 Ordinary Shares for the conversion of the Series B Preferred Shares.

| 2.2 | Issuance of Shares. |

| (i) | Subject to the terms and conditions of this Agreement, at the Closing, each of the Founders and Wealth Plan agrees to, severally and not jointly, subscribe for, and the Company agrees to issue and allot to the Founders and Wealth Plan such number of Ordinary Shares as set forth opposite their names on Schedule 2, an aggregate of 1,011,629 Ordinary Shares, par value US$0.001 in exchange for an aggregate of 1,014,629 Ordinary Shares in Paker as set forth in Schedule 2. |

| (ii) | Subject to the terms and conditions of this Agreement, at the Closing, each of the Series A Investors agrees to, severally and not jointly, subscribe for, and the Company agrees to issue and allot to Series A Investors such number of Series A Preferred Shares as set forth opposite their names on Schedule 2, an aggregate of 107,503 Series A Preferred Shares, par value US$0.001, each having the rights and privileges as set forth in the Memorandum and Articles, in exchange for an aggregate of 107,503 Series A Preferred Shares in Paker as set forth in Schedule 2. |

| (iii) | Subject to the terms and conditions of this Agreement, at the Closing, each of the Series B Investors agrees to, severally and not jointly, subscribe for, and the Company agrees to issue and allot to Series B Investors such number of Series B Shares as set forth opposite their names on Schedule 2, an aggregate of 148,829 Series B Preferred Shares, par value |

3

| US$0.001 per share, each having the rights and privileges as set forth in the Memorandum and Articles, in exchange for an aggregate of 148,829 Series B Preferred Shares of Paker. |

| (iv) | Each of the Founders and Investors hereby waives any pre-emptive rights or rights of first refusal if any arising pursuant to any contract, the Memorandum and Articles, applicable laws or any other such rights whatsoever that such Founder or Investor has with regard to issue and allotment of the Ordinary Shares, Series A Preferred Shares and Series B Preferred Shares pursuant to this Section 2.2. |

| 2.3 | Closing. |

| (i) | Subject to the satisfaction or waiver of each condition to the Closing set forth in Section 6 and Section 7, other than conditions that by their nature are to be satisfied at the Closing, but subject to the satisfaction or waiver of such conditions, the issue and allotment of the Shares to the Founders and Investors hereunder shall take place at the offices of Xxxxx & XxXxxxxx, 14th Xxxxx Xxxxxxxxx Xxxxx, 00 Xxxxxxxx Xxxx, Xxxxxxx, Xxxx Xxxx on or before December 16, 2008 or another time and date and at another location to be mutually agreed to by the Parties (which time, date and place are designated as the “Closing”). The date on which the Closing shall be held is referred to in this Agreement as the “Closing Date.” |

| (ii) | At the Closing, the Company shall (A) deliver a counterpart of the Shareholders Agreement in the form attached hereto as Exhibit B executed by the Company and the Founders to each of the Investors; (B) deliver to each of the Investors a share certificate representing the Shares subscribed by such Investors, (C) cause the Company’s register of members to be updated to reflect the Shares subscribed and purchased by the Founders and Investors; (D) cause the register of directors of the Company to be updated to reflect the director designated by the Investors; (E) deliver to the Investors a copy of the Company’s Board resolutions regarding (i) the allotment of Ordinary Shares, Series A Preferred Shares and Series B Preferred Shares to the Investors and (ii) the appointment of directors of the Company and members of the Financial Committee and Executive Committee of the Company; (F) deliver to the Investors a copy of the resolutions of the members of the Company regarding the approval for the classification of shares of the Company into Ordinary Shares, Series A Preferred Shares and Series B Preferred Shares and (ii) the adoption of the Memorandum and Articles as set forth in the forms attached here to as Exhibit A-1 and Exhibit A-2. |

| (iii) | At the Closing, each of the Investors shall (A) deliver an executed counterpart of the Shareholders Agreement in the form attached hereto as Exhibit B to the Company; and (B) deliver its share certificate representing its shares in Paker to the Company. |

| (iv) | At the Closing, Paker shall (A) deliver to the Company a copy of the resolutions of its members and board of directors approving the transaction hereunder; and (B) cause its register of members to be updated to reflect the transaction hereunder. |

4

| 2.4 | Termination of Agreement. |

This Agreement may be terminated before the Closing as follows:

| (i) | at the election of the Investors, the Founders or the Company, after the date of December 31, 2008 or another date to be mutually agreed by the Parties (the “Termination Date”), if the Closing shall not have occurred on or before such date; |

| (ii) | by mutual written consent of each of the Parties as evidenced in writing signed by each of the Parties; |

| (iii) | by the Investors in the event of any material breach or violation of any representation or warranty, covenant or agreement contained herein or in any of the other Transaction Documents by the Company, the Founders, Paker or Jinko; and |

| (iv) | by the Company or Founders in the event of any material breach or violation of any representation or warranty, covenant or agreement contained herein or in any of the other Transaction Documents by the Investors. |

| 2.5 | Effect of Termination. |

| (i) | In the event that this Agreement is validly terminated prior to the Closing pursuant to Section 2.4, then each of the Parties shall be relieved of their duties and obligations arising under this Agreement after the date of such termination and such termination shall be without liability to the Company, Xxxxx, Xxxxx, the Founders or the Investors, provided that no such termination shall relieve any party hereto from liability for any breach of this Agreement occurring prior to such termination. |

| (ii) | The provisions of this Section 2.5, Section 8, Section 10.8 and Section 10.13 hereof shall survive any termination of this Agreement. |

| 3. | Representations and Warranties of the Company, the Founders, Paker and Jinko. |

The Company and, assuming the completion of the transaction pursuant to this Agreement, Xxxxx, Xxxxx, and, to the extent only specifically set out herein, the Founders, jointly and severally, represent and warrant to the Investors that the statements contained in this Section 3 are true, correct and complete with respect to each member of the Company Group, on and as of the Execution Date and the Closing Date, except as set forth on the Disclosure Schedule attached hereto as Exhibit C (the “Disclosure Schedule”), which exceptions shall be deemed to modify the following representations and warranties. The Investors acknowledge that the Disclosure Schedule may be revised and delivered to the Investors prior to Closing. In the event that any such revision reflects a Material Adverse Effect in relation to any member of the Company Group, the Investors shall not be obligated to proceed with the Closing. In

5

the event that the Investors elect to proceed with the Closing, it will be deemed to waive their rights to xxx the Company, the Founders or any member of the Company Group or seek indemnification for any losses suffered as a result of such Material Adverse Effect.

| 3.1 | Organization, Good Standing; Due Authorization. |

Each member of the Company Group is duly organized, validly existing and in good standing under the laws of their respective jurisdiction of incorporation. Each member of the Company Group has all requisite legal and corporate power and authority to carry on its business as now conducted, and is duly qualified to transact business in each jurisdiction in which the failure to so qualify would have a Material Adverse Effect on such Person.

| 3.2 | Authorization; Consents. |

Each of the Company, the Founders, Paker and Jinko has all requisite legal and corporate power, and has taken all corporate action necessary, for each to properly and legally authorize, execute and deliver this Agreement and each of the Transaction Documents to which he/she/it is a party, and to carry out his/her/its respective obligations hereunder and thereunder. The authorization of all of (A) Ordinary Shares being issued and sold under this Agreement; (B) the Series A Preferred Shares being issued and sold under this Agreement; (C) the Series B Preferred Shares being issued and sold under this Agreement, (D) the Ordinary Shares issuable upon the conversion of the Series A Preferred Shares and (E) the Ordinary Shares issuable upon the conversion of the Series B Preferred Shares has been taken or will be taken prior to the Closing. This Agreement, each of the Transaction Documents to which the Company, the Founder, Paker and/or Jinko is a party, when executed and delivered by the Company, the Founders, Paker and/or Jinko, will constitute the valid and legally binding obligation of the Company, the Founders, Paker and/or Jinko, as the case may be, and enforceable against such Person in accordance with their respective terms, except (i) as limited by applicable bankruptcy, insolvency, reorganization, moratorium, and other laws of general application affecting enforcement of creditors’ rights generally, and (ii) as limited by laws relating to the availability of specific performance, injunctive relief, or other equitable remedies. The issuance of any Series A Preferred Shares, Series B Preferred Shares or Conversion Shares is not subject to any preemptive rights or rights of first refusal, or if any such preemptive rights or rights of first refusal exist, waiver of such rights has been obtained or will be obtained prior to the Closing from the holders thereof. For the purpose only of this Agreement, “reserve”, “reservation” or similar words with respect to a specified number of Series A Preferred Shares and Series B Preferred Shares of the Company shall mean that the Company shall, and the Board of Directors of the Company shall procure that the Company shall, refrain from issuing such number of shares so that such number of shares will remain in the authorized but unissued share capital of the Company until the conversion rights of the holders of any Convertible Securities exercisable for such shares are exercised in accordance with the Memorandum and Articles or otherwise.

| 3.3 | Valid Issuance of Shares; Consents. |

| (i) | The Series A Preferred Shares and Series B Preferred Shares of Paker, when issued and sold to the Series A Investors and Series B Investors in accordance with the terms of the Flagship Purchase Agreement, Everbest Purchase Agreement |

6

| and Series B Purchase Agreement, as the case may be, were duly and validly issued, fully paid and non-assessable, free from any Liens and will be free of restrictions on transfer (except for any restrictions on transfer under applicable securities laws). |

| (ii) | The Ordinary Shares, Series A Preferred Shares and Series B Preferred Shares, when issued and sold to the Investors in accordance with the terms of this Agreement, and the Conversion Shares, when issued upon conversion of the Series A Preferred Shares or Series B Preferred Shares, will be duly and validly issued, fully paid and non-assessable, free from any Liens and will be free of restrictions on transfer (except for any restrictions on transfer under applicable securities laws). The Ordinary Shares issuable upon conversion of the Series A Preferred Shares and Series B Preferred Shares, when issued and sold to the Series A Investors and Series B Investors in accordance with the terms of this Agreement and other relevant documents, have been or at the time of Closing will have been duly and validly reserved for issuance and, upon issuance in accordance with the terms of the Memorandum and Articles, will be duly and validly issued, fully paid and non-assessable, free from any liens and will be free of restrictions on transfer (except for any restrictions on transfer under applicable securities laws or the Shareholders Agreement). |

| (iii) | No consent, approval, order or authorization of, or registration, qualification, designation, declaration or filing with, any Governmental Authority on the part of the Company is required in connection with the valid execution, delivery and consummation of the transactions contemplated by the Transaction Documents. |

| (iv) | Subject to the truth and accuracy of the Investors’ representations set forth in Section 4 of this Agreement, the offer, sale and issuance of all Ordinary Shares, Series A Preferred Shares, Series B Preferred Shares and Conversion Shares as contemplated by this Agreement and the Ancillary Agreements, are exempt from the registration and prospectus delivery requirements of the Securities Act and any applicable securities laws. |

| (v) | Except as contemplated under the Transaction Documents, all presently outstanding Ordinary Shares were duly and validly issued, fully paid and non-assessable, and are free and clear of any liens and free of restrictions on transfer (except for any restrictions on transfer under applicable securities laws) and have been issued in compliance in all material respects with the requirements of all applicable securities laws and regulations, including, to the extent applicable, the Securities Act. |

| 3.4 | Capitalization and Voting Rights. |

| (i) | The Corporate Chart sets forth the complete and accurate shareholding structure of the Company Group after giving effect to the Closing, including but not limited, to: (i) all record and beneficial owners of each member of the Company Group; and, (ii) all share capital or registered capital holdings of each member of the Company Group. Except as set |

7

| forth in Section 3.4 of the Disclosure Schedule, all share capital or registered capital of each member of the Company Group have been duly and validly issued (or subscribed for) and fully paid and are non-assessable. Except as disclosed in Section 3.4 of the Disclosure Schedule, all share capital or registered capital of each member of the Company Group is free of Liens and any restrictions on transfer (except for any restrictions on transfer under applicable laws and the Shareholders Agreement). No share capital or registered capital of any member of the Company Group was issued or subscribed to in violation of the preemptive rights of any person, terms of any agreement or any laws, by which each such Person at the time of issuance or subscription was bound. Except as set forth in Section 3.4 of the Disclosure Schedule and as contemplated under this Agreement or the Ancillary Agreements, (i) there are no resolutions pending to increase the share capital or registered capital of any member of the Company Group; (ii) there are no outstanding options, warrants, proxy agreements, preemptive rights or other rights relating to the share capital or registered capital of any member of the Company Group, other than as contemplated by this Agreement; (iii) there are no outstanding Contracts or other agreements under which any member of the Company Group or any other Person purchases or otherwise acquires, or has the right to purchase or otherwise acquire, any interest in the share capital or registered capital of any member of the Company Group; (iv) there are no dividends which have accrued or been declared but are unpaid by any member of the Company Group; and (v) there are no outstanding or authorized equity appreciation, phantom equity, equity plans or similar rights with respect to any member of the Company Group. |

| (ii) | Immediately prior to the Closing, the authorized capital of the Company shall consist of 10,000,000 authorized Ordinary Shares, of which 3,000 Ordinary Shares are issued and outstanding. |

| (iii) | The capitalization table attached hereto as Exhibit D sets forth an accurate and complete list of all of the holders (assuming the consummation of and upon the Closing pursuant hereto) of the Company’s Equity Securities with reasonable detail and includes all outstanding shares of the Company as well as all securities that are convertible into, or exercisable for shares of the Company as of the date hereof and on a pro-forma basis, giving effect to the Closing. |

8

| 3.5 | Tax Matters. |

Except as disclosed in Section 3.5 of the Disclosure Schedule:

| (i) | The provisions for taxes as shown on the balance sheet included in the Financial Statements (as defined in Section 3.7 below) are sufficient in all material respects for the payment of all accrued and unpaid applicable taxes of the Company Group as of the date of each such balance sheet, whether or not assessed or disputed as of the date of each such balance sheet. There have been no extraordinary examinations or audits of any tax returns or reports by any applicable Governmental Authority. Each member of the Company Group has filed or caused to be filed on a timely basis all tax returns that are or were required to be filed (to the extent applicable), all such returns are correct and complete, and each member of the Company Group has paid all taxes that have become due, except where the failure to make such payment would not cause a Material Adverse Effect. There are in effect no waivers of applicable statutes of limitation with respect to taxes for any year, except as disclosed. |

| (ii) | No member of the Company Group is, or (without taking into account the transactions contemplated in this Agreement or the Shareholders Agreement) expects to become, a “controlled foreign corporation” within the meaning of Section 957 of the Code. The Company does not expect to be a passive foreign investment company as described in Section 1297 of the United States Internal Revenue Code of 1986, as amended (the “Code”) for 2008 or for any subsequent year. |

| (iii) | No shareholder of any member of the Company Group, other than the Investors, solely by virtue of his/her/its status as shareholder of such member of the Company Group, has personal liability which, under local law, may result in the debts and claims of such member of the Company Group. There has been no communication from any tax authority relating to or affecting the tax clarification of any member of the Company Group, except as disclosed. |

| 3.6 | Books and Records. |

Each member of the Company Group maintains in all material respects its books of accounts and records in the usual, regular and ordinary manner, on a basis consistent with prior practice, and which permits its Financial Statements to be prepared in accordance with generally accepted accounting principles in the PRC , Hong Kong or U.S.

| 3.7 | Financial Statements. |

The Company has delivered to the Investors, (a) the draft restated consolidated financial statements (including income statement, balance sheet and cash flow statement) of Paker for the period from June 6, 2006 to December 31, 2006 and the year ended December 31, 2007 and as of December 31, 2006 and December 31, 2007 prepared in accordance with US GAAP, and (b) the draft unaudited consolidated financial statements (including income statement, balance sheet and cash flow statement) of the Company as of and for the six-month period ended June 30, 2008 (the “Statement Date”) prepared in accordance with US GAAP (collectively, the “Financial Statements”, attached hereto as Exhibit G). The Financial Statements are complete and correct in all material respects and present fairly the financial condition and position of the Company and its Subsidiary as of their respective dates, in each case except as disclosed therein and except for the absence of notes.

9

| 3.8 | Changes. |

Since the Statement Date, except as contemplated by this Agreement, Flagship Purchase Agreement, Everbest Purchase Agreement and Series B Purchase Agreement or as set out in Section 3.8 of the Disclosure Schedule or the Financial Statements, there has not been:

| (i) | any change in the assets, liabilities, financial condition or operations of any member of the Company Group from that reflected in the Financial Statements, other than changes in the ordinary course of business, or other changes which would not reasonably be expected to have a Material Adverse Effect on any member of the Company Group; |

| (ii) | any resignation or termination of any Key Employee of any member of the Company Group; |

| (iii) | any satisfaction or discharge of any Lien or payment of any obligation by any member of the Company Group, except those made in the ordinary course of business or those that are not material to the assets, properties, financial condition, or operation of such entities (as such business is presently conducted); |

| (iv) | any change, amendment to or termination of a Material Contract (as defined below in Section 3.11(i)) other than in the ordinary course of business or which would not reasonably be expected to have a Material Adverse Effect on any member of the Company Group; |

| (v) | any material change in any compensation arrangement or agreement with any Key Employee of any member of the Company Group; |

| (vi) | any sale, assignment or transfer of any Intellectual Property of any member of the Company Group, other than in the ordinary course of business or which would not reasonably be expected to have a Material Adverse Effect on any member of the Company Group; |

| (vii) | any declaration, setting aside or payment or other distribution in respect of any member of the Company Group’s capital shares, or any direct or indirect redemption, purchase or other acquisition of any of such shares by any member of the Company Group other than the repurchase of capital shares from employees, officers, directors or consultants pursuant to agreements approved by the board of directors of such Person; |

| (viii) | any failure to conduct business in the ordinary course, consistent with such member of the Company Group’s past practices which would have a Material Adverse Effect on any member of the Company Group; |

| (ix) | any damages, destruction or loss, whether or not covered by insurance, materially and adversely affecting the assets, properties, financial condition, operation or business of any member of the Company Group; |

10

| (x) | any event or condition of any character which might have a Material Adverse Effect on the assets, properties, financial condition, operation or business of any member of the Company Group; |

| (xi) | any agreement or commitment by any member of the Company Group to do any of the things described in this Section 3.8 except pursuant to this Agreement and the Ancillary Agreements; |

| (xii) | any incurrence or commitment to incur any indebtedness for money borrowed in excess of US$150,000 individually or in the aggregate that is currently outstanding; |

| (xiii) | any loan or commitment to make any loans or advances to any individual, other than prepayment in the ordinary course of business, ordinary advances for travel or other bona fide business-related expenses; |

| (xiv) | waiver or commitment to waive any material right of value. |

| 3.9 | Litigation. |

Except as disclosed in Section 3.9 of the Disclosure Schedule, to the best knowledge of the Company and the Company Group, there is no action, suit, or other court proceeding pending or threatened, against any member of the Company Group which involves an amount in dispute exceeding US$150,000. To the best knowledge of the Company, Paker and Jinko, there is no investigation pending or threatened in the PRC or Hong Kong against any member of the Company Group. To the best knowledge of the Company, Paker and Jinko, there is no action, suit, proceeding or investigation pending or threatened in the PRC or Hong Kong against any Key Employee of any member of the Company Group in connection with their respective relationship with such Person, as the case may be. To the best knowledge of the Company and the Company Group, there is no judgment, decree, or order of any court in the PRC or Hong Kong in effect and binding of any member of the Company Group or its assets or properties. There is no court action, suit, proceeding or investigation by any member of the Company Group which such Person intends to initiate against any third party. No Government Authority has at any time materially challenged or questioned in writing the legal right of any member of the Company Group to conduct its business as presently being conducted.

| 3.10 | Liabilities. |

Except as set forth in Section 3.10 of the Disclosure Schedule or arising under the instruments set forth in Section 3.11 of the Disclosure Schedule, any member of the Company Group has no liabilities of any nature, whether accrued, absolute, contingent or otherwise, and whether due or to become due, except for (i) liabilities set forth in the Financial Statements, (ii) trade or business liabilities incurred in the ordinary course of business, and (iii) other liabilities that do not exceed US$150,000 in the aggregate.

11

| 3.11 | Commitments. |

| (i) | Section 3.11 of the Disclosure Schedule contains a complete and accurate list of all Contracts to which any member of the Company Group is bound that involve (a) obligations (contingent or otherwise) or payments to any member of the Company Group in excess of US$2,000,000 concerning the normal business of any member of the Company Group and (b) the license or transfer of Intellectual Property or other proprietary rights to or from any member of the Company Group in excess of US$250,000 (collectively, the “Material Contracts”) and (c) any other Contracts that affect the assets, properties, financial condition, operation or business of any member of the Company Group in material respects, including any Contract having an effective term of more than one (1) year or payments in excess of US$150,000. |

| (ii) | Except as set forth in Section 3.11 of the Disclosure Schedule and except for this Agreement or the Ancillary Agreements, there are no Contracts of any member of the Company Group containing covenants that in any material way purport to restrict the business activity of such member of the Company Group or limit in any material respect the freedom of such member of the Company Group to engage in any line of business that it is currently engaged in, to compete in any material respect with any entity or to obligate in any material respect such member of the Company Group to share, license or develop any product or technology. |

| (iii) | Except as disclosed in Section 3.11 of the Disclosure Schedule, all of the Material Contracts are valid, subsisting, in full force and effect and binding upon the respective member of the Company Group and to the other parties thereto except (a) as limited by applicable bankruptcy, insolvency, reorganization, moratorium, and other laws of general application affecting enforcement of creditors’ rights generally, and (b) as limited by laws relating to the availability of specific performance, injunctive relief, or other equitable remedies. |

| (iv) | Except as disclosed in Section 3.11 of the Disclosure Schedule, each member of the Company Group has in all material respects satisfied or provided for all of its liabilities and obligations under the Material Contracts requiring performance prior to the date hereof, is not in default in any material respect under any Material Contract, nor does any condition exist that with notice or lapse of time or both would constitute such a default. The Company, Paker and Jinko are not aware of any material default thereunder by any other party to any Material Contract or any condition existing that with notice or lapse of time or both would constitute such a material default, or give any Person the right to declare a material default or exercise any remedy under, or to accelerate the maturity or performance of, or to cancel, terminate, or modify, a Material Contract. |

| (v) | Except as disclosed in Section 3.11 of the Disclosure Schedule, no member of the Company Group has given to, or received from, any Person any notice or other communication (whether oral or written) regarding any actual, alleged, possible, or potential material violation or material breach of, or material default under, any Material Contract. |

12

| 3.12 | Compliance with Laws. |

| Except as disclosed in Section 3.12 of the Disclosure Schedule: |

| (i) | Each of the Founders or any member of the Company Group is in compliance with all Laws or regulations that are applicable to it, or to the conduct or operation of its business or the ownership or use of any of his/her/its assets or properties. |

| (ii) | No event has occurred and no circumstance exists that (with or without notice or lapse of time) (a) may constitute or result in a violation by any Founder or any member of the Company Group of, or a failure on the part of any Founder or any member of the Company Group to comply with, any Law or regulation applicable to such Founder or member of the Company Group, or (b) may give rise to any obligation on the part of any member of the Company Group to undertake, or to bear all or any portion of the cost of, any remedial action of any nature, except for such violations or failures by such Founder or member of the Company Group that, individually or in the aggregate, would not result in any Material Adverse Effect on such entity. |

| (iii) | No Founder or member of the Company Group has received any written notice from any Governmental Authority regarding (a) any actual, alleged, possible, or potential material violation of, or material failure to comply with, any Law, or (b) any actual, alleged, possible, or potential material obligation on the part of any Founder or member of the Company Group to undertake, or to bear all or any portion of the cost of, any remedial action of any nature. |

| (iv) | To the Company’s, the Founders’, Paker’s and Jinko’s best knowledge, no Founder or member of the Company Group, nor any director, agent, employee or any other person acting for or on behalf of any member of the Company Group, has directly or indirectly (a) made any contribution, gift, bribe, payoff, influence payment, kickback, or any other fraudulent payment in any form, whether in money, property, or services to any Public Official or otherwise, (A) to obtain favorable treatment in securing business for any member of the Company Group, (B) to pay for favorable treatment for business secured, or (C) to obtain special concessions or for special concessions already obtained, for or in respect of any member of the Company Group, in each case which would have been materially in violation of any applicable Law or (b) established or maintained any fund or assets in which any member of the Company Group shall have proprietary rights that have not been recorded in the books and records of such Person. |

| (v) | All consents, permits, approvals, orders, authorizations or registrations, qualifications, designations, declarations or filings by or with any governmental authority and any third party which are required to be obtained or made by each Company Group and each of the Founders in connection with the consummation of the transactions contemplated |

13

| hereunder shall have been obtained or made prior to and be effective as of the Closing. The Founders have obtained all approvals and registration required by the Laws of the PRC. |

| (vi) | Each of full time employees of Jinko has entered into an employment agreement with Jinko in accordance with PRC Law. |

| 3.13 | Title; Liens; Permits. |

Except as disclosed in Section 3.13 of the Disclosure Schedule:

| (i) | Each member of the Company Group has good and marketable title to all the tangible properties and assets reflected in its books and records, whether real, personal, or mixed, purported to be owned by such Person, free and clear of any Liens, other than Permitted Liens. With respect to the tangible property and assets it leases, each member of the Company Group is in compliance in all material respects with such leases and holds a valid leasehold interest free of any Liens, other than Permitted Liens. Each member of the Company Group owns or leases all tangible properties and assets necessary to conduct in all material respects its business and operations as presently conducted. |

| (ii) | Each member of the Company Group has all material franchises, authorizations, approvals, permits, certificates and licenses (“Permits”) necessary for its business and operations as now conducted or planned to be conducted under the Corporate Chart, the Business Plan and current budget, and believes that each member of the Company Group can renew and continue to hold such Permits without undue burden or expense, including but not limited to any special approval or permits required under the Laws of the PRC for Jinko to engage in its business. No member of the Company Group is in default in any material respect under any such Permits. |

| 3.14 | Subsidiaries. |

Except as indicated under the Corporate Chart, no member of the Company Group owns or Controls, directly or indirectly, any interest in any other Person and is not a participant in any joint venture, partnership or similar arrangement. In accordance with FIN 46R, as disclosed in the draft Registration Statement which was provided to the Investors on October 21, 2008, the Company consolidates the financial statements and results of all of the VIEs.

| 3.15 | Compliance with Other Instruments. |

Except as disclosed in Section 3.15 of the Disclosure Schedule:

| (i) | No member of the Company Group is in violation, breach or default of its articles of association except for such violation, breach or default that would not result in a Material Adverse Effect on such member. The execution, delivery and performance by any member of the Company Group of and compliance with each of the Transaction Documents, and the consummation of the transactions contemplated thereby, will not result in any such violation, breach or default, |

14

| or be in conflict with or constitute, with or without the passage of time or the giving of notice or both, a default under (a) the articles of association of any member of the Company Group, (b) any Material Contract, (c) any judgment, order, writ or decree or (d) to the best knowledge of the Company, the Founder, Paker and Jinko, any applicable Law. |

| (ii) | The execution and delivery of this Agreement do not, and the performance by the Founders of the transactions contemplated hereby or thereby will not violate, conflict with, or result in a violation or breach of, or constitute a default (with or without due notice or lapse of time or both) under, or give any party the right to terminate or accelerate any obligation under, any of the terms, conditions, or provisions of any agreement or other instrument or obligation to which any of the Founders is a party or by which such Founder may be bound except for violation, breach or default that would not result in a Material Adverse Effect on such member. |

| 3.16 | Related Party Transactions. |

Except as set forth in Section 3.16 of the Disclosure Schedule, no Founder, officer or director of any member of the Company Group or any “affiliate” or “associate” (as those terms are defined in Rule 405 promulgated under the Securities Act) of any of them (each of the foregoing, a “Related Party”), has any material agreement, understanding, proposed transaction with, or is materially indebted to, any member of the Company Group, nor is any member of the Company Group materially indebted (or committed to make loans or extend or guarantee credit) to any Related Party (other than for accrued salaries, reimbursable expenses or other standard employee benefits). Except as disclosed in Section 3.16 of the Disclosure Schedule, no Related Party has any material direct or indirect ownership interest in any firm or corporation with which any member of the Company Group is affiliated or with which any member of the Company Group has a business relationship, or any firm or corporation that competes with any member of the Company Group (except that Related Parties may own less than 1% of the stock of publicly traded companies that engage in the foregoing). Except as disclosed in Section 3.16 of the Disclosure Schedule, no Related Party has, either directly or indirectly, a material interest in: (a) any Person which purchases from or sells, licenses or furnishes to any member of the Company Group any goods, property, intellectual or other property rights or services; or (b) any Contract to which any member of the Company Group is a party or by which it may be bound or affected. For purposes of this Section 3.16 only, the term “material” or “materially” shall mean an obligation or interest in excess of US$50,000. In accordance with FIN 46R, as disclosed in the draft Registration Statement which was provided to the Series B Investor on August 17, 2008, the Company consolidates the financial statements and results of all of the VIEs.

| 3.17 | Intellectual Property Rights. |

Except as disclosed in Section 3.17 of the Disclosure Schedule:

| (i) | Each member of the Company Group owns or otherwise has the right or license to use all Intellectual Property material to their business as currently conducted without any violation or infringement of the rights of others, free and clear of all |

15

| Liens other than Permitted Liens except where any non-compliance with this subsection would not result in any Material Adverse Effect. Section 3.17(i) of the Disclosure Schedule contains a complete and accurate list of all Intellectual Property owned, licensed to or used by all members of the Company Group, whether registered or not, and a complete and accurate list of all licenses granted by any member of the Company Group to any third party with respect to any Intellectual Property. There is no pending or threatened, claim or litigation against any member of the Company Group, contesting the right to use its Intellectual Property, asserting the misuse thereof, or asserting the infringement or other violation of any Intellectual Property of any third party. All material inventions and material know-how conceived by employees of each member of the Company Group, including the Founders, and related in all its material aspects to the businesses of such Person were “works for hire,” and all right, title, and interest therein, including any applications therefore, have been or will be transferred and assigned to such member of the Company Group. |

| (ii) | No proceedings or claims in which any member of the Company Group alleges that any person is infringing upon, or otherwise violating, its Intellectual Property rights are pending, and none has been served, instituted or asserted by a member of the Company Group. |

| (iii) | None of the Key Employees or employees of any member of the Company Group or the Founders is obligated under any Contract (including a Contract of employment), or subject to any judgment, decree or order of any court or administrative agency, that would interfere with the use of his or her best efforts to promote the interests of the Company Group, or that would conflict with the business of any member of the Company Group as presently conducted. To the best knowledge of the Company, Paker and Jinko, it will not be necessary to utilize in the course of the any member of the Company Group’s business operations any inventions of any of the employees of any member of the Company Group made prior to their employment by such member of the Company Group, except for inventions that have been validly and properly assigned or licensed to such member of the Company Group as of the date hereof. |

| (iv) | Each member of the Company Group has taken necessary security measures that in the judgment of such Person are commercially prudent in order to protect the secrecy, confidentiality, and value of its material Intellectual Property. |

| 3.18 | Entire Business. |

Except as disclosed in Section 3.18 of the Disclosure Schedule, there are no material facilities, services, assets or properties shared with any entity other than the members of the Company Group which are used in connection with the business of any member of the Company Group.

16

| 3.19 | Labor Agreements and Actions. |

Except as required by Law or as set forth in Section 3.19 of the Disclosure Schedules, no member of the Company Group is a party to or bound by any currently effective employment contract, deferred compensation agreement, bonus plan, incentive plan, profit sharing plan, retirement agreement or other employee compensation agreement. Except as disclosed in Section 3.19 of the Disclosure Schedule, each member of the Company Group has complied in all material respects with all applicable Laws related to employment, and no member of the Company Group has any union organization activities, threatened or actual strikes or work stoppages or material grievances. Except as required by law, no member of the Company Group is bound by or subject to (and none of their assets or properties is bound by or subject to) any written or oral, express or implied, contract, commitment or arrangement with any labor union.

| 3.20 | Business Plan and Budget. |

The Founders have delivered to the Series B Investors on or before the Closing a business plan and budget for the twelve months following the Closing (the “Business Plan”). Such Business Plan was prepared in good faith based upon assumptions and projections which the Founders believe are reasonable and not materially misleading.

| 3.21 | Environmental and Safety Laws. |

Except as disclosed in Section 3.21 of the Disclosure Schedule, none of the Company Group is in violation of any applicable statute, law, or regulation relating to the environment or occupational health and safety which would have a Material Adverse Effect on any member of the Company Group and no material expenditures are or will be required in order to comply with any such existing statute, law or regulation.

| 3.22 | Disclosure. |

No representation or warranty of the Company, Paker, the Founders or Jinko contained in this Agreement (including the Disclosure Schedule), the Ancillary Agreements, or any certificate furnished or to be furnished to Wealth Plan, the Series A Investors and the Series B Investors at the Closing (when read together) contains any untrue statement of a material fact or omits to state a material fact necessary in order to make the statements contained herein or therein not misleading in light of the circumstances under which they were made.

| 3.23 | Exempt Offering |

Assuming the accuracy of the representations and warranties of the Wealth Plan, Series A Investors and Series B Investors, the offer and sale of the Ordinary Shares, Series A Preferred Shares and Series B Preferred Shares to Wealth Plan, the Series A Investors and Series B Investors pursuant to this Agreement are exempt from the registration requirements of the Securities Act and the issuance of the Conversion Shares in accordance with the Memorandum and Articles, will be exempt from such registration requirements.

17

| 3.24 | Representations and Warranties Relating to the Founders |

Except for those set forth in Section 3.24 of the Disclosure Schedule:

| (i) | Each Founder has the legal right and full power to enter into and perform this Agreement and any other documents to be executed by it pursuant to or in connection with the Transaction Documents. |

| (ii) | Except for the Company Group, Desun Energy Co., Ltd., Greencastle International Limited, Wholly Globe Investments Limited, Yale Pride, Peaky Investments and Brilliant Win, none of the Founders presently owns or Controls, and will as of the Closing own or Control, directly or indirectly, more than 3% of the entire issued and outstanding shares of a listed company or any interest in any other corporation, partnership, trust, joint venture, association, or other entity, and none of such Founder is a director, supervisor, a member of the senior management, general partner, trustee or Controlling person of any entity, or own or Control any interest in any entity competing with, or any material supplier or customer of, any member of Company Group. |

| (iii) | None of the Founders presently and will as of the Closing, own, manage, operate, finance, join, or Control, or participate in the ownership, management, operation, financing or Control of, or be associated as a director, senior management, partner, lender, investor or representative in connection with, any business or corporation, partnership, or organization which competes directly with the principal business conducted by the Company Group or with which a Company Group has a material business relationship. |

| (iv) | There is no action, suit, proceeding, claim, arbitration or investigation pending in PRC or Hong Kong against any of the Founders in connection with his involvement with any member of the Company Group. No Founder is a party to or subject to the provisions of any order, writ, injunction, judgment or decree of any court or government agency or instrumentality and there is no action, suit, proceeding, claim, arbitration or investigation which a Founder intends to initiate in connection with his involvement with any member of the Company Group. |

| 4. | Representations and Warranties of the Investors. |

Each of the Investors hereby represents and warrants to the Company and the Founders that the statements contained in this Section 4 with respect to itself are correct and complete as of the Execution Date and on and as of the Closing Date with the same effect as if made on and as of the Closing Date:

| (i) | it is an entity duly organized, validly existing and in good standing under the Laws of the jurisdiction of its incorporation or formation. |

| (ii) | it has the financial capability and other resources necessary for the consummation of the transactions contemplated in the Flagship Purchase Agreement, Everbest Purchase Agreement or Series B Purchase Agreement, as the case may be. |

18

| (iii) | it has all requisite legal and corporate power and authority, and has taken all corporate action necessary to properly and legally authorize, execute and deliver this Agreement and each of the Ancillary Agreements to which it is a party, and to carry out its respective obligations hereunder and thereunder, and this Agreement and each of the Ancillary Agreements to which it is a party, when executed and delivered by it, will constitute valid and legally binding obligations of such Investor, enforceable against it in accordance with their respective terms except (i) as limited by applicable bankruptcy, insolvency, reorganization, moratorium, and other Law of general application affecting enforcement of creditors’ rights generally and (ii) as limited by Law relating to the availability of specific performance, injunctive relief, or other equitable remedies. |

| (iv) | The Shares will be acquired or accepted for investment purposes for its own account, not as a nominee or agent, and not with a view to the resale or distribution of any part thereof, and it has no present intention of selling, granting any participation in, or otherwise distributing the same. By executing this Agreement, it further represents that it does not have any Contract with any Person to, directly or indirectly, sell, transfer or grant participations, with respect to any of the Shares and has not solicited any Person for such purpose. There is no contract or arrangement pursuant to which the equity interest, ownership or Control of such Investor will be transferred. |

| (v) | it understands and acknowledges that the offering of the Shares will not be registered or qualified under the Securities Act, or any applicable securities Laws on the grounds that the offering and sale of securities contemplated by this Agreement and the issuance of securities hereunder is exempt from registration or qualification, and that the Company’s reliance upon these exemptions is predicated upon such Investor’s representations in this Agreement. It further understands that no public market now exists for any of the securities issued by the Company and the Company has given no assurances that a public market will ever exist for the Company’s securities. |

| (vi) | it is an “accredited investor” within the meaning of SEC Rule 501 of Regulation D, as presently in effect, under the Securities Act. |

| (vii) | it understands that the Shares have been sold in an offshore transaction and accordingly have not been, and will not be, registered under the Securities Act in reliance on the exemption from registration provided by Regulation S under the Securities Act, and may not be resold, pledged or otherwise transferred except (i) pursuant to an effective registration statement under the Securities Act, (ii) pursuant to an available exemption from the registration requirements of the Securities Act and in accordance with applicable laws of any state of the United States of America, or (iii) outside the United States of America in an offshore transaction in compliance with Regulation S under the Securities Act. It acknowledges that the Company has no obligation to register or qualify the Shares or Conversion Shares for resale |

19

| except as set forth in the Shareholders’ Agreement. It further acknowledges that if an exemption from registration or qualification is available, it may be conditioned on various requirements including, but not limited to, the time and manner of sale, the holding period for the Shares, and on requirements relating to the Company which are outside such Investor’s control, and which the Company is under no obligation and may not be able to satisfy. It understands that this offering is not intended to be part of the public offering, and that it will not be able to rely on the protection of Section 11 of the Securities Act. |

| (viii) | It is not a U.S. person within the meaning of Rule 902 of Regulation S under the Securities Act. |

| (ix) | it understands that the certificates evidencing its Shares may bear the following legend: |

| “THESE SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), OR UNDER ANY OTHER APPLICABLE SECURITIES LAWS. THEY MAY NOT BE SOLD, OFFERED FOR SALE, PLEDGED OR HYPOTHECATED IN THE ABSENCE OF A REGISTRATION STATEMENT IN EFFECT WITH RESPECT TO THE SECURITIES UNDER THE ACT OR AN OPINION OF COUNSEL SATISFACTORY TO THE COMPANY THAT SUCH REGISTRATION IS NOT REQUIRED OR UNLESS SOLD PURSUANT TO RULE 144 OF THE ACT.” |

| 5. | Conditions of the Investors’ Obligations at Closing. |

The obligations of the Investors under Section 2 of this Agreement, unless otherwise waived in writing by the Investors, are subject to the fulfillment of each of the following conditions on or before the Closing:

| 5.1 | Representations and Warranties. |

Except as set forth in the Disclosure Schedule, the representations and warranties of the Company, the Founders, Paker and Jinko contained in Section 3 shall be true and correct in all material respects when made, and shall be true and correct in all material respects on and as of the Closing with the same effect as if such representations and warranties had been made on and as of the Closing Date, except in either case for those representations and warranties (i) that already contain any materiality qualification, which representations and warranties, to the extent already so qualified, shall instead be true and correct in all respects as so qualified as of such respective dates and (ii) that address matters only as of a particular date, which representations will have been true and correct in all material respects (subject to clause (i)) as of such particular date.

20

| 5.2 | Performance |

The Company, the Founders, Paker and Jinko shall have performed and complied in all material respects with all agreements, obligations and conditions contained in this Agreement that are required to be performed or complied with by him/her/it on or before the Closing.

| 5.3 | Authorizations. |

The Company, the Founders, Paker and Jinko shall have obtained all authorizations, approvals, waivers or permits of any Person or any Governmental Authority necessary for the consummation of all of the transactions contemplated by this Agreement and other Transaction Documents other than those that by their nature shall be obtained after the Closing. All such authorizations, approvals, waivers and permits shall be effective as of the Closing.

| 5.4 | Closing Certificate. |

The director of the Company shall have executed and delivered to the Investors at the Closing a certificate of the Company (i) stating that the conditions specified in Sections 5.1, 5.2 and 5.3 hereto with respect to the Company have been fulfilled, and (ii) attaching thereto a true and complete copy of (A) the Memorandum and Articles as then in effect and (B) all resolutions of the Company’s members and Board of Directors approving the transactions contemplated hereby.

| 5.5 | Proceedings and Documents. |

All corporate and other proceedings in connection with the transactions contemplated at the Closing and all documents incident thereto shall be reasonably satisfactory in form and substance to the Investors, and the Investors shall have received all such counterpart original or other copies of such documents as it may reasonably request.

| 5.6 | Shareholders Agreement |

The Shareholders Agreement shall have been duly executed by the Company and the Founders in the form attached hereto as Exhibit B.

| 5.7 | Memorandum and Articles. |

The Memorandum and Articles shall have been duly amended by all necessary action of the Board of Directors and/or the members of the Company, as set forth in the forms attached hereto as Exhibit A-1 and Exhibit A-2, respectively.

| 5.8 | Legal Opinions. |

The Investors shall have received from Xxxxxxx Xxxx & Xxxxxxx, the Cayman Islands counsel to the Company Group, an opinion, dated as of the Closing, in a form to be agreed with the Investors.

21

| 5.9 | Due Authorization of the Investors. |

Each of the Investors has duly authorized the execution of this Agreement and the other Transaction Documents and the transactions contemplated hereby and thereby and such approval remains valid at the Closing Date.

| 5.10 | Employment Agreement |

Each of the Key Employees as listed in Exhibit F and the Founders who are also employees of the Company Group shall have entered into an employment agreement with the Company or a member of the Company Group in compliance with applicable laws and regulations, and such employment agreements shall have a term of not less than three (3) years after the Qualified IPO. ZHANG Longgen shall have entered into such an employment agreement with the Company. Substantially all of the full time employees of the Company Group who have been employed by the Company Group on a full time basis for not less than one month shall have entered into employment agreements that are in compliance with applicable PRC laws with Jinko.

| 5.11 | Non-Competition Agreement and Confidentiality Agreement, Proprietary Information and Inventions Assignment Agreement. |

Each of the Key Employees as listed in Exhibit F and the Founders who are also employees of the Company Group shall have entered into a Non-Competition Agreement and Confidentiality Agreement with the member of the Company Group to which he or she has employment or service relationship, in which such employee shall undertake to the Company and the Series B Investors that he or she will not directly or indirectly get involved in any business competing with any member of the Company Group, and will devote his or her working time and attention exclusively to the business of the Company Group and use his or her best efforts to promote the interest of the Company’s shareholders until at least three (3) years after the Qualified IPO, each case in a form acceptable to the Series B Investors. Each of the Key Employees and the Founders shall have entered into a Proprietary Information and Inventions Assignment Agreement with the Company on terms and conditions satisfactory to the Series B Investors.

| 5.12 | Financial Committee. |

The Board of Director of the Company shall have established a financial committee (the “Financial Committee”), which shall consist of five (5) members, including one (1) director nominated by Flagship, one director nominated by SCGC or CIVC and three (3) directors nominated by the Founders. CIVC and Pitango may designate two observers, and TDR may designate one observer, to attend the meetings of the Financial Committee without voting rights. The Financial Committee shall be responsible for supervising the finance and accounting of the Company Group, including but not limited to budget, Related Party transactions, employee welfare planning and conducting internal audit provided however, that all actions of the Financial Committee relating to matters set out in Section 14.7 of the Shareholders Agreement shall require the affirmative vote of the directors nominated by Flagship and the Series B Investors. The Financial Committee shall meet on a regular basis at least once every quarter.

22

| 5.13 | Executive Committee. |

The Board of Directors of the Company shall have established an executive committee (the “Executive Committee”), which shall consist of five (5) members, including one (1) director nominated by Flagship, one (1) director nominated by SCGC or CIVC and all the key management members designated by the Board of Directors, and the chairman of the Executive Committee shall be appointed by the Board of Directors. The three observers designated by CIVC, Pitango and TDR may attend the meetings of the Executive Committee without voting rights. The authority of the Executive Committee shall be determined by the Board of Directors, which shall, amongst others, include the authority of providing guidance, supervision and support to the management team of the Company Group, assessing the management team’s performance and conducting other activities in relation to the Company Group’s business operations. The Executive Committee shall meet on a regular basis at least once every month.

| 5.14 | No Adverse Change. |

There shall be no Material Adverse Effect on the Company or Company Group.

| 5.15 | Indemnification Agreement with Directors. |

At the Closing, the Company shall have entered into an indemnification agreement with each of the Company’s directors appointed by the Investors on terms and conditions satisfactory to the Investors.

| 6. | Conditions of the Company’s Obligations at Closing. |

The obligations of the Company under Sections 2 of this Agreement, unless otherwise waived in writing by them, are subject to the fulfillment of each of the following condition on or before the Closing: the representations and warranties of the Investors contained in Section 4 shall be true and correct in all material respects when made, and shall be true and correct in all material respects on and as of the Closing with the same effect as though such representations and warranties had been made on and as of the Closing Date.

| 7. | Termination of Certain Agreements. |

| 7.1 | Termination of Remaining Rights and Obligations Under Share Purchase Agreements. |

Any restrictions, rights that have not been exercised and obligations that have not been performed under Flagship Purchase Agreement, Everbest Purchase Agreement and Series B Purchase Agreement, including those relating to representations, warranties, covenants, undertakings and indemnity shall be terminated and without force or effect upon Closing.

23

| 7.2. | Termination of Shareholders Agreement. |

The Amended and Restated Shareholders Agreement among Xxxxx, Xxxxx, the Founders and Investors dated September 18, 2008 shall be terminated and without force or effect upon Closing.

| 8. | Confidentiality. |

| 8.1 | Disclosure of Terms. |

The terms and conditions of this Agreement, Flagship Purchase Agreement, Everbest Purchase Agreement and Series B Purchase Agreement, any term sheets or memoranda of understanding entered into pursuant to the transactions contemplated hereby and thereby, all exhibits and schedules attached hereto and thereto, and the transactions contemplated hereby and thereby (collectively, the “Financing Terms”), including their existence, shall be considered confidential information and shall not be disclosed by any Party hereto to any third party except as permitted in accordance with the provisions set forth below.

| 8.2 | Permitted Disclosures. |

Notwithstanding the foregoing, the Company may disclose (i) the Financing Terms to its bona fide prospective investors, employees, bankers, accountants, and legal counsels in relation to a transaction under Section 10.4, in each case, only where such persons or entities are under appropriate non-disclosure obligations substantially similar to those set forth in this Section 8.2, (ii) the existence of the investment to its bona fide prospective investors, employees, bankers, lenders, accountants, legal counsels and business partners, or to any person or entity to which disclosure is approved in writing by the respective Investor or Investors, and (iii) the Financing Terms to its current investors, employees, bankers, lenders, accountants and legal counsels, in each case only where such persons or entities are under appropriate nondisclosure obligations substantially similar to those set forth in this Section 8.2, or to any person or entity to which disclosure is approved in writing by the respective Investors. The Investors may disclose (i) the existence of the investment and the Financing Terms to any partner, limited partner, former partner, potential partner or potential limited partner of such Investors or other third parties and (ii) the fact of the investment to the public, in each case only if such disclosure is approved in advance in writing by the Company. Any Party hereto may also provide disclosure in order to comply with applicable Laws, as set forth in Section 8.3 below. The Company, the Founders and Investors agree that this Agreement, Flagship Purchase Agreement, Everbest Purchase Agreement and Series B Purchase Agreement and their exhibits and schedules will be filed as exhibits to the Registration Statement on Form F-1 to be filed by the Company with the United States Securities and Exchange Commission (“SEC”) in connection with the Qualified IPO, and available to the public on the SEC’s website.

| 8.3 | Legally Compelled Disclosure. |

In the event that any Party is requested or becomes legally compelled (including without limitation, pursuant to any applicable tax, securities, or other Laws and regulations of any jurisdiction) to disclose the existence of this Agreement or content of any of the

24

Financing Terms, such Party (the “Disclosing Party”) shall provide the other Parties with prompt written notice of that fact and shall consult with the other Parties regarding such disclosure. At the request of another Party, the Disclosing Party shall, to the extent reasonably possible and with the cooperation and reasonable efforts of the other Parties, seek a protective order, confidential treatment or other appropriate remedy. In any event, the Disclosing Party shall furnish only that portion of the information that is legally required and shall exercise reasonable efforts to obtain reliable assurance that confidential treatment will be accorded such information.

| 8.4 | Other Exceptions |

Notwithstanding any other provision of this Section 8, the confidentiality obligations of the Parties shall not apply to: (a) information which a restricted Party learns from a third party having the right to make the disclosure, provided the restricted Party complies with any restrictions imposed by the third party; (b) information which is rightfully in the restricted Party’s possession prior to the time of disclosure by the protected Party and not acquired by the restricted Party under a confidentiality obligation; or (c) information which enters the public domain without breach of confidentiality by the restricted Party.

| 8.5 | Press Releases, Etc. |

No announcements regarding the Investors’ investment in the Company or Paker may be made by any Party hereto in any press conference, professional or trade publication, marketing materials or otherwise to the public without the prior written consent of the Investors and the Company.

| 8.6 | Other Information. |

The provisions of this Section 8 shall terminate and supersede the provisions of any separate nondisclosure agreement executed by any of the Parties with respect to the transactions contemplated hereby.

| 9. | Undertakings. |

After the Execution Date or the Closing Date (as the case maybe), the Company, the Founders, Paker and Jinko agree as follows:

| 9.1 | Use of Proceeds from the Sale of Series A Preferred Shares and Series B Preferred Shares of Paker. |

The proceeds from the sale of the series A preferred shares and series B preferred shares by Paker pursuant to the Share Purchase Agreements shall be injected by Paker to Jinko for the purchase of raw material, manufacturing equipment and working capital.

25

| 9.2 | Compliance by Founders. |

Each of the Founders shall take all necessary actions, at his/her own expenses, to fully comply with all Applicable Laws and the requirements of the Governmental Authorities with respect to his/her direct and indirect holding of Equity

Securities in the Company on a continuing basis (including, but not limited to, all obligations imposed and all consents, approvals, registrations and permits required by the SAFE and by other PRC Governmental Authorities or under other Applicable

Laws of the PRC in connection therewith). In particular, the Founders shall obtain all approvals and registration required by the SAFE under the Circular of the State Administration of Foreign Exchange on Relevant Issues concerning Foreign Exchange

Administration of Financing and Inbound Investment through Offshore Special Purpose Companies by PRC Residents

issued by the SAFE on October 21, 2005 (“Circular 75”) and any of its implementing measures or guidelines with respect to the investment in the Company by Series B Investors within two

months after Closing.

issued by the SAFE on October 21, 2005 (“Circular 75”) and any of its implementing measures or guidelines with respect to the investment in the Company by Series B Investors within two

months after Closing.

| 9.3 | Compliance by Company Group. |