PRODUCTION SHARING CONTRACT BETWEEN THE GOVERNMENT OF INDIA AND

BETWEEN

THE

GOVERNMENT OF INDIA

AND

GEOGLOBAL

RESOURCES (BARBADOS) INC.

WITH

RESPECT TO CONTRACT AREA

IDENTIFIED

AS

BLOCK

: DS-ONN-2004/1

(Frontier

Area Block)

TABLE

OF CONTENTS

|

ARTICLE

|

CONTENTS

|

PAGE

NO.

|

|

Preamble

|

1-2

|

|

|

1

|

Definitions

|

3-12

|

|

2

|

Participating

Interests

|

13

|

|

3

|

License

and Exploration Period

|

14-16

|

|

4

|

Relinquishment

|

17

|

|

5

|

Work

Programme

|

18-20

|

|

6

|

Management

Committee

|

21-25

|

|

7

|

Operatorship,

Operating Agreement and Operating Committee

|

26

|

|

8

|

General

Rights and Obligations of the Parties

|

27-29

|

|

9

|

Government

Assistance

|

30

|

|

10

|

Discovery,

Development and Production

|

31-35

|

|

11

|

Petroleum

Exploration License and Mining Lease

|

36-37

|

|

12

|

Unit

Development

|

38-41

|

|

13

|

Measurement

of Petroleum

|

40

|

|

14

|

Protection

of the Environment

|

41-45

|

|

15

|

Recovery

of Cost Petroleum

|

46-48

|

|

16

|

Production

Sharing of Petroleum

|

49-51

|

|

17

|

Taxes,

Royalties, Rentals, Duties etc.

|

52-55

|

|

18

|

Domestic

Supply, Sale, Disposal and Export of Crude Oil and

Condensate

|

56-57

|

|

19

|

Valuation

of Petroleum

|

58-60

|

|

20

|

Currency

and Exchange Control Provisions

|

61

|

|

21

|

Natural

Gas

|

62-67

|

|

22

|

Employment,

Training and Transfer of Technology

|

68

|

|

23

|

Local

Goods and Services

|

69

|

|

24

|

Insurance

and Indemnification

|

70

|

|

25

|

Records,

Reports, Accounts and Audit

|

71

|

|

ARTICLE

|

CONTENTS

|

PAGE

NO.

|

|

26

|

Information,

Data, Confidentiality, Inspection and Security

|

72-74

|

|

27

|

Title

to Petroleum, Data and Assets

|

75

|

|

28

|

Assignment

of Participating Interest

|

76-78

|

|

29

|

Guarantees

|

79-81

|

|

30

|

Term

and Termination of the Contract

|

82-84

|

|

31

|

Force

Majeure

|

85-86

|

|

32

|

Applicable

Law and Language of the Contract

|

87

|

|

33

|

Sole

Expert, Conciliation and Arbitration

|

88-89

|

|

34

|

Change

of Status of Companies

|

90

|

|

35

|

Entire

Agreement, Amendments and Waiver and miscellaneous

|

91

|

|

36

|

Certificates

|

92

|

|

37

|

Notices

|

93-94

|

|

APPENDICES

|

CONTENTS

|

PAGE

NO.

|

|

Appendix

A

|

Description

of the ▇▇▇▇▇▇▇▇ ▇▇▇▇

|

▇▇

|

|

▇▇▇▇▇▇▇▇

▇

|

Map

of the Contract Area

|

96

|

|

Appendix

C

|

Accounting

Procedure to the Contract

|

97-127

|

|

Appendix

D

|

Calculation

of the Investment Multiple for Production Sharing purposes

|

128-129

|

|

▇▇▇▇▇▇▇▇

▇▇

|

Form

of Parent company Financial and Performance Guarantee

|

130-131

|

|

Appendix

E2

|

Form

of Company Financial and Performance Guarantee

|

132-133

|

|

Appendix-F

|

Procedure

for acquisition of goods and services

|

134-137

|

|

Appendix-G

|

Performa

of Bank Guarantee to be provided pursuant to Article ▇▇

|

▇▇▇-▇▇▇

|

|

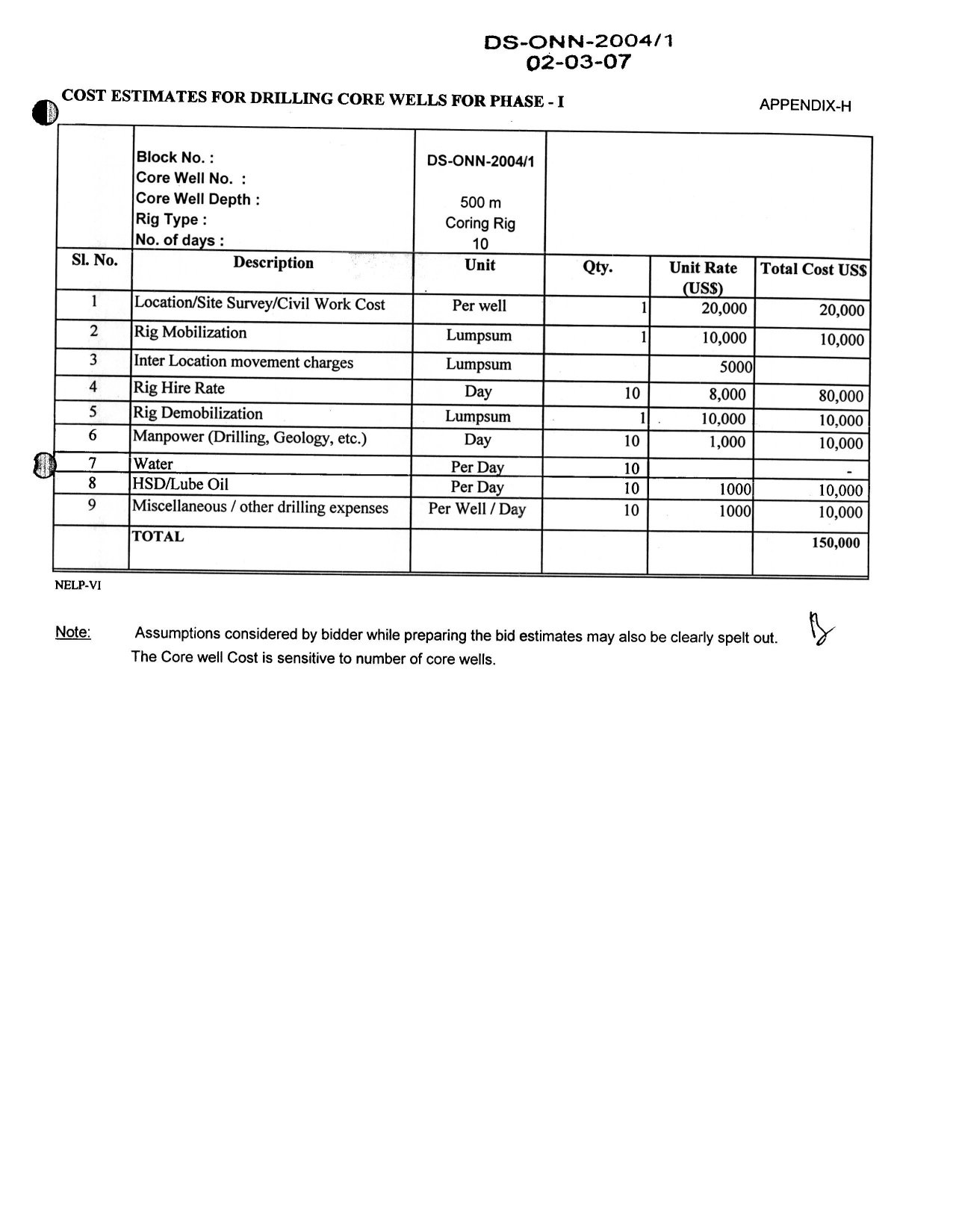

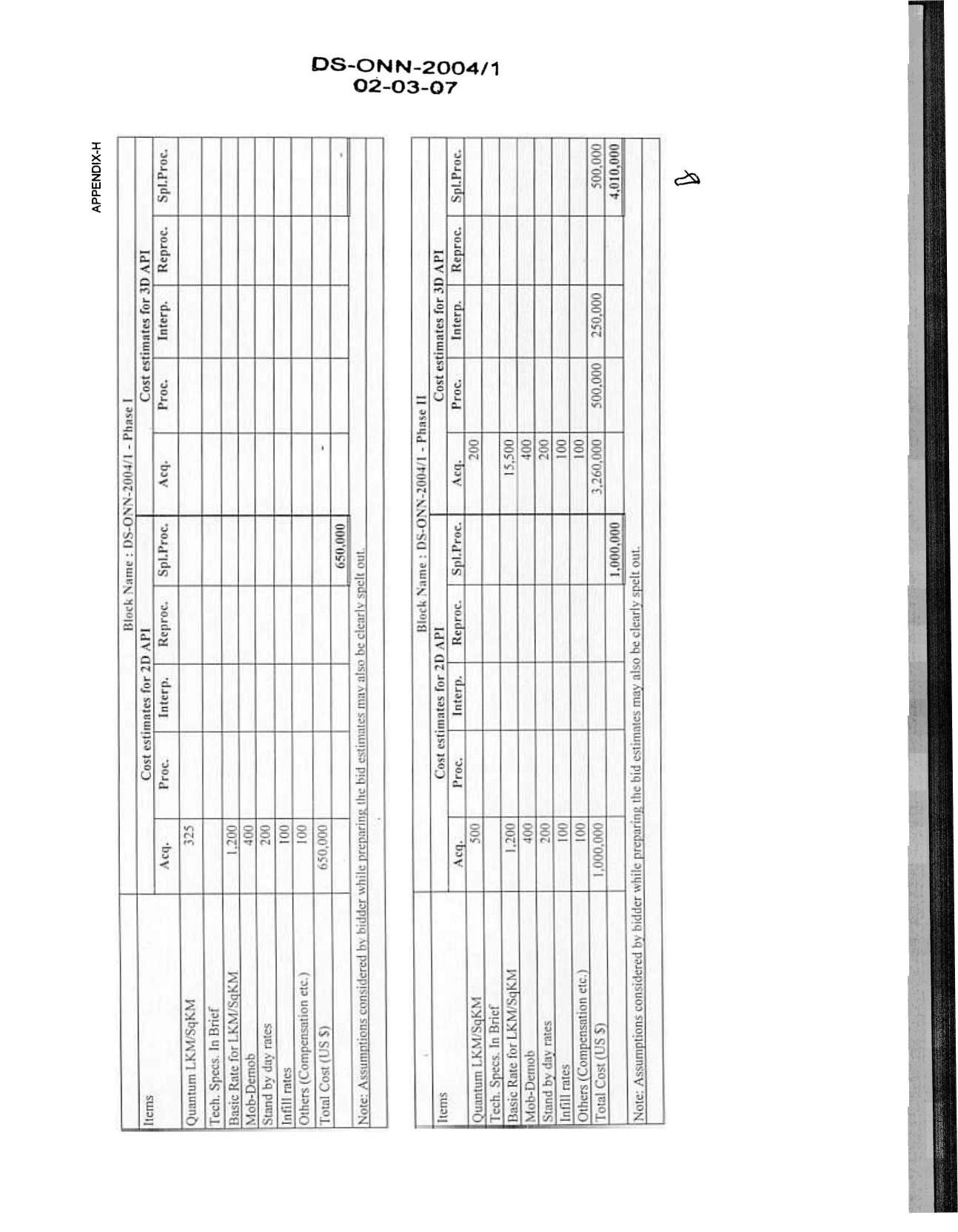

Appendix-H

|

Cost

estimates for Minimum Work Programme

|

141-

|

|

This

Contract made this 2nd day of March, 2007,

between:

|

|

1.

|

The

President of India, acting through the Joint Secretary, Ministry

of

Petroleum and Natural Gas (hereinafter referred to as “the Government”) of

the FIRST PART;

|

AND

|

M/s

GeoGlobal Resources (Barbados) Inc., a Company incorporated under

the laws

of Barbados, West Indies, (hereinafter referred to as “GGRB”) having its

registered office at ▇▇▇, ▇▇▇ - ▇▇▇

▇▇▇▇▇▇ ▇▇, ▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇, ▇▇▇▇▇▇, ▇▇▇ ▇▇▇ which expression shall

include its successors and such assigns as are permitted under Article

28

hereof, of the SECOND PART;

|

WITNESSETH:

WHEREAS

(1) The

Oilfields (Regulation and Development) Act, 1948 (53 of 1948) (hereinafter

referred to as "the Act") and the Petroleum and Natural Gas Rules, 1959, made

thereunder (hereinafter referred to as "the Rules") make provisions, inter

alia,

for the regulation of Petroleum Operations and grant of Licenses and Leases

for

exploration, development and production of Petroleum in India;

|

(2)

|

The

rules provide for the grant of Licenses and Leases in respect of

land

vested in a State Government by that State Government with the prior

approval of the Central Government;

|

|

(3)

|

Rule

5 of the Rules provides for an agreement between the Government and

the

Licensee or Lessee containing additional terms and conditions with

respect

to the License or Lease;

|

|

(4)

|

The

Government desires that the Petroleum resources which may exist in

India

be discovered and exploited with the utmost expedition in the overall

interest of India and in accordance with modern oilfield and petroleum

industry practices;

|

|

(5)

|

GGRB

have committed that it has/they have, or will acquire and make available,

the necessary financial and technical resources and the technical

and

industrial competence and experience necessary for proper discharge

and/or

performance of all obligations required to be performed under this

Contract in accordance

|

|

|

with

modern oilfield and petroleum industry practices and will provide

guarantees as required in Article 29 for the due performance of its

obligations hereunder; and

|

|

(6)

|

As

a result of discussions between representatives of the Government

and GGRB

on the proposal of GGRB, the Government has agreed to enter into

this

Contract with GGRB, with respect to the Contract Area identified

as

Frontier Area Block as specified in Notice Inviting Offer (NIO) block

DS-ONN-2004/1 and detailed in Appendix A and Appendix B, on the terms

and

conditions herein set forth.

|

NOW,

THEREFORE, in consideration of the premises and covenants and conditions herein

contained, IT IS HEREBY AGREED between the Parties as follows:

ARTICLE

1

DEFINITIONS

In

this

Contract, unless the context requires otherwise, the following terms shall

have

the meaning ascribed to them hereunder:

1.1 "Accounting

Procedure" means the principles and procedures of accounting set out in Appendix

C.

1.2 “Act”

means Oilfields (Regulation and Development) Act, 1948 as amended from time

to

time.

1.3 "Affiliate"

means a company or a body;

a) which

directly or indirectly controls or is controlled by a Company which is a Party

to this Contract; or

b) which

directly or indirectly controls or is controlled by a company which directly

or

indirectly controls or is controlled by a Company which is a Party to this

Contract.

For

the

purpose of this definition it is understood that “control” means:

i) ownership

by one company of more than fifty percent(50%) of the voting securities of

the

other company; or

ii) the

power

to direct, administer and dictate policies of the other company even where

the

voting securities held by such company exercising such effective control in

that

other company is less than fifty percent(50%) and the term “controlled” shall

have a corresponding meaning.

1.4 "Appendix"

means an Appendix attached to this Contract and made a part

thereof.

1.5

"Appraisal

Programme" means a programme, carried out following a Discovery in the Contract

Area for the purpose of appraising Discovery and delineating the Petroleum

Reservoirs to which the Discovery relates in terms of thickness and lateral

extent and determining the characteristics thereof and the quantity of

recoverable Petroleum therein.

1.6

"Appraisal

Well" means a Well drilled pursuant to an Appraisal Programme.

1.7

“Approved

Work Programme” and “Approved Budget” means a Work Programme or a Budget that

has been approved by the Management Committee pursuant to the provisions of

this

Contract.

1.8

"Arms

Length Sales" means sales made freely in the open market, in freely convertible

currencies, between willing and unrelated sellers and buyers and in which such

buyers and sellers have no contractual or other relationship, directly or

indirectly, or any common or joint interest as is reasonably likely to influence

selling prices and shall, inter alia, exclude sales (whether direct or indirect,

through brokers or otherwise) involving Affiliates, sales between Companies

which are Parties to this Contract, sales between governments and

government-owned entities, counter trades, restricted or distress sales, sales

involving barter arrangements and generally any transactions motivated in whole

or in part by considerations other than normal commercial

practices.

1.9

"Article"

means an article of this Contract and the term "Articles" means more than one

Article.

1.10

“Associated

Natural Gas” or “ANG” means Natural Gas produced in

association with Crude Oil either as free gas or in solution, if such Crude

Oil

can by itself be commercially produced.

1.11

"Barrel"

means a quantity or unit equal to 158.9074 litres (forty two (42) United States

gallons) liquid measure, at a temperature of sixty (60) degrees Fahrenheit

(15.56 degrees Celsius) and under one atmosphere pressure (14.70 psia).

1.12

"Basement"

means any igneous or metamorphic rock, or rocks or any stratum of such nature,

in and below which the geological structure or physical characteristics of

the

rock sequence do not have the properties necessary for the accumulation of

Petroleum in commercial quantities and which reflects the maximum depth at

which

any such accumulation can be reasonably expected in accordance with the

knowledge generally accepted in the international petroleum

industry.

| 1.13 |

“Budget”

means a budget formulated in relation to a Work

Programme.

|

1.14 “Business

Day” means any of the Calendar Day excluding holidays.

1.15 “Calendar

Day” means any of the seven (7) days of a week.

1.16 "Calendar

Month" means any of the twelve (12) months of the Calendar Year.

1.17 "Calendar

Quarter" or “Quarter” means a period of three (3) consecutive Calendar Months

commencing on the first day of January, April, July and October of each Calendar

Year.

1.18 "Calendar

Year" means a period of twelve (12) consecutive Months according to the

Gregorian calendar, commencing with the first (1st)

day of

January and ending with the thirty-first (31st)

day of

December.

1.19 "Commercial

Discovery" means a Discovery of Petroleum reserves which has been declared

as a

Commercial Discovery in accordance with the provisions of Article 10 and/or

Article 21.

1.20 "Commercial

Production" means production of Crude Oil or Condensate or Natural Gas or any

combination of these from the Contract Area (excluding production for testing

purposes) and delivery of the same at the relevant Delivery Point under a

programme of regular production and sale.

1.21

"Company"

for the purpose of this Contract means a company which is a Party to this

Contract and, where more than one Company is Party to the Contract, the term

"Companies" shall mean all such Companies collectively, including their

respective successors and permitted assigns under Article 28.

1.22

"Condensate"

means those low vapour pressure hydrocarbons obtained from Natural Gas through

condensation or extraction and refers solely to those hydrocarbons that are

liquid at normal surface temperature and pressure conditions provided that

in

the event Condensate is produced from a Development Area and is segregated

and

transported separately to the Delivery Point, then the provisions of this

Contract shall apply to such Condensate as if it were Crude Oil.

1.23

"Contract"

means this agreement and the Appendices mentioned herein and attached hereto

and

made an integral part hereof and any amendments made thereto pursuant to the

terms hereof.

1.24

"Contract

Area" means, on the Effective Date, the area described in Appendix-A and

delineated on the map attached as Appendix B or any portion of the said area

remaining after relinquishment or surrender from time to time pursuant to the

terms of this Contract (including any additional area as provided under Article

11.3).

1.25

"Contract

Costs" means Exploration Costs, Development Costs and Production Costs as

provided in Section 2 of the Accounting Procedure and allowed to be cost

recoverable in terms of Section 3 of the Accounting Procedure.

1.26 "Contract

Year" means a period of twelve (12) consecutive months counted from the

Effective Date or from the anniversary of the Effective Date.

1.27 "Contractor"

means the Company(ies).

1.28

"Cost

Petroleum" means, the portion of the total value of Petroleum Produced and

Saved

from the Contract Area which the Contractor is entitled to take in a particular

period, for the recovery of Contract Costs as provided in Article

15.

1.29

"Crude

Oil" or “Oil” or “Crude” means all kinds of hydrocarbons and bitumen,

both

in

solid

and in liquid form, in their natural state or obtained from Natural Gas by

condensation or extraction, including distillate and Condensate when commingled

with the heavier hydrocarbons and delivered as a blend at the Delivery Point

but

excluding Natural Gas.

1.30 “Deepwater

Area” (for deepwater blocks/areas) means area falling beyond four hundred (400)

metre isobath.

1.31

"Delivery

Point" means, except as otherwise herein provided or as may be otherwise agreed

between the Parties having regard to international practice, the point at which

Petroleum reaches the outlet flange of the delivery facility, either offshore

or

onshore and different Delivery Point(s) may be established for purposes of

sales. Delivery Point(s) shall be approved by the Management Committee.

1.32 "Development

Area" means part of the Contract Area which encompasses one or more Commercial

Discovery(ies) and any additional area that may be required for proper

development of such Commercial Discovery(ies) and established as such in

accordance with the provisions of the Contract.

1.33 "Development

Costs" means those costs and expenditures incurred in carrying out Development

Operations, as classified and defined in Section 2 of the Accounting Procedure

and allowed to be recovered in terms of Section 3 thereof.

1.34 "Development

Operations" means operations conducted in accordance with the Development Plan

and shall include, but not be limited to the purchase, shipment or storage

of

equipment and materials used in developing Petroleum accumulations, the

drilling, completion and testing of Development ▇▇▇▇▇, the drilling and

completion of ▇▇▇▇▇ for Gas or water injection, the laying of gathering lines,

the installation of offshore platforms and installations, the installation

of

separators, tankages, pumps, artificial lift and other producing and injection

facilities required to produce, process and transport Petroleum into main Oil

storage or Gas processing facilities, either onshore or offshore, including

the

laying of pipelines within or outside the Contract Area, storage at Delivery

Point(s), the installation of said storage or Gas processing facilities, the

installation of export and loading facilities and other facilities required

for

the development and production of the said Petroleum accumulations and for

the

delivery of Crude Oil and/or Gas at the Delivery Point and also including

incidental operations not specifically referred to herein but required for

the

most efficient and economic development and production of the said Petroleum

accumulations

in accordance with modern oilfield and petroleum industry

practices.

1.35 "Development

Plan" means a plan submitted by the Contractor for the development of a

Commercial Discovery, which has been approved by the Management Committee or

the

Government pursuant to Article 10 or Article 21.

1.36 "Development

Well" means a Well drilled, deepened or completed after the date of approval

of

the Development Plan pursuant to Development Operations or Production Operations

for the purposes of producing Petroleum, increasing production, sustaining

production or accelerating extraction of Petroleum including production ▇▇▇▇▇,

injection ▇▇▇▇▇ and dry ▇▇▇▇▇.

1.37 “Directorate

General of Hydrocarbons or DGH” means an organisation, including its successors

under the Ministry of Petroleum and Natural Gas.

1.38

"Discovery"

means the finding, during Petroleum Operations, of a deposit of Petroleum not

previously known to have existed, which can be recovered at the surface in

a

flow measurable by conventional petroleum industry testing methods.

1.39

"Discovery

Area" means that part of the Contract Area about which, based upon Discovery

and

the results obtained from a Well or ▇▇▇▇▇ drilled in such part, the Contractor

is of the opinion that Petroleum exists and is likely to be produced in

commercial quantities.

1.40

"Effective

Date" means the later of the date on which this Contract is executed by the

Parties or the date of issue of License

or date from which License has been made effective by

the

Central Government or State Government(s) as the case may be.

1.41 "Environmental

Damage" means soil erosion, removal of vegetation, destruction of wildlife,

pollution of groundwater or surface water, land contamination, air pollution,

noise pollution, ▇▇▇▇ fire, disruption to water supplies to natural drainage

or

natural flow of rivers or streams, damage to archaeological, palaeontological

and cultural sites and shall include any damage or injury to, or destruction

of,

soil or water in their physical aspects together with vegetation associated

therewith, aquatic or terrestrial mammals, fish, avi-fauna or any plant or

animal life whether in the sea or in any other water or on, in or under

land.

1.42 "Exploration

Costs" means those costs and expenditures incurred in carrying out Exploration

Operations, as classified and defined in Section 2 of the Accounting Procedure

and allowed to be recovered in terms of Section 3 thereof.

1.43 "Exploration

Operations" means operations conducted in the Contract Area pursuant to this

Contract in searching for Petroleum and in the course of an

Appraisal

Programme and shall include but not be limited to aerial, geological,

geophysical, geochemical, palaeontological, palynological, topographical and

seismic surveys, analysis, studies and their interpretation, investigations

relating to the subsurface geology including structural test drilling,

stratigraphic test drilling, drilling of Exploration ▇▇▇▇▇ and Appraisal ▇▇▇▇▇

and other related activities such as surveying, drill site preparation and

all

work necessarily connected therewith that is conducted in connection with

Petroleum exploration.

1.44

"Exploration

Period" means the period mentioned in Article 3 during which Exploration

Operations may be carried out by the Contractor as provided in Article 3

hereof.

1.45 “Exploration

Phase” or “Phase” means any of the periods specified in Article 3 in which the

Contractor is required to complete the Minimum Work Programme specified

therein.

1.46 "Exploration

Well" means a Well drilled for the purpose of searching for undiscovered

Petroleum accumulations on any geological entity (be it of structural,

stratigraphic, facies or pressure nature) to at least a depth or stratigraphic

level specified in the Work Programme.

1.47 “Field”

means an Oil Field or a Gas Field or combination of both as the case may

be.

1.48 "Financial

Year" means the period from the first (1st)

day of

April to the thirty-first (31st)

day of

March of the following Calendar Year.

1.49 "Foreign

Company" means a Company within the meaning of Section 591 of the Companies

Act,

1956.

1.50 “Frontier

Area” means any area identified, demarcated and so notified by the Government or

its authorised agency(ies) for the purpose of exploration and exploitation

of

Oil and Gas, which is logistically and technically difficult and lacks

infrastructural and/or marketing facilities, etc.

1.51

"Gas"

means Natural Gas.

1.52 “Gas

Field” means, within the Contract Area, a Natural Gas Reservoir or a group of

Natural Gas Reservoirs within a common geological structure or

feature.

1.53 “Government”

or “Central Government” means Government of India unless otherwise stated.

1.54 “Investment"

shall have the meaning ascribed to that expression in paragraph 3 of Appendix

D.

1.55 "Investment

Multiple" means, the ratio of accumulated Net Cash Income to accumulated

Investment by the Contractor,

as

determined in accordance with Appendix D.

1.56 “Lease”

means a petroleum mining lease referred to in the Rules and shall, unless

otherwise stated therein, exclude right for exploration and exploitation of

coal/ lignite bed methane (CBM).

1.57 “Lessee”

means the Contractor to whom a Lease is issued under the Rules for the

purpose

of carrying out Petroleum Operations in a Development Area or Contract

Area.

1.58 "LIBOR"

means the London Inter-Bank Offer Rate for six-month maturates of United States

Dollars as quoted by the International Swaps and Derivative Association or such

other bank being a BBA LIBOR contributor panel bank as the Parties may agree.

1.59 “License”

means a petroleum exploration license referred to in the Rules.

1.60 "Licensee"

means the Contractor to whom a License is issued under the Rules for the purpose

of carrying out Petroleum Operations in the Contract Area.

1.61 “Minimum

Work Programme” means with respect to each Exploration Phase, the Work Programme

specified in Article 5 with respect to such Phase.

1.62 "Management

Committee" means the committee constituted pursuant to Article 6

hereof.

1.63 "Month"

means Calendar Month.

1.64 "Natural

Gas" means wet gas, dry gas, all other gaseous hydrocarbons, and all substances

contained therein, including sulphur, carbondioxide and nitrogen but excluding

extraction of helium, which are produced from Oil or Gas ▇▇▇▇▇, excluding those

condensed or extracted liquid hydrocarbons that are liquid at normal temperature

and pressure conditions, and including the residue gas remaining after the

condensation or extraction of liquid hydrocarbons from gas.

1.65 "Net

Cash

Income” shall have the meaning assigned in paragraph 2 of Appendix-

D.

1.66 "Non

Associated Natural Gas" or "NANG" means Natural Gas which is produced either

without association of Crude Oil or in association with such quantities of

Crude

Oil which by itself cannot be commercially produced.

1.67 “Oil

Field” means, within the Contract Area, an Oil Reservoir or a group of Oil

Reservoirs within a common geological structure or feature.

1.68 “Operator”

means one of the Parties comprising the Contractor, appointed as the Operator

pursuant to Article 7.

1.69 “Operating

Agreement” means the joint operating agreement entered by the constituents of

the Contractor in accordance with Article 7, with respect to conduct of

Petroleum Operations.

1.70 “Operating

Committee” means the Committee established by that name in the Operating

Agreement pursuant to Article 7.

1.71 "Participating

Interest" means, in respect of each Party constituting the Contractor, the

undivided share expressed as a percentage of such Party’s participation in the

rights and obligations under this Contract.

1.72 "Parties"

means the parties signatory to this Contract including their successors and

permitted assigns under this Contract and the term "Party" means any of the

Parties.

1.73 "Petroleum"

means Crude Oil and/or Natural Gas existing in their natural condition but

excluding helium occurring in association with Petroleum or shale.

1.74 "Petroleum

Operations" means, as the context may require, Exploration Operations,

Development Operations or Production Operations or any combination of two or

more of such operations, including construction, operation and maintenance

of

all necessary facilities, plugging and abandonment of ▇▇▇▇▇, safety,

environmental protection, transportation, storage, sale or disposition of

Petroleum to the Delivery Point, Site Restoration and any or all other

incidental operations or activities as may be necessary.

1.75 “Petroleum

Produced and Saved” means gross Petroleum produced minus impurities such as

water or solids produced along with Petroleum, Petroleum recycled to the

reservoir, Petroleum used in Petroleum Operations or flared or otherwise

unavoidably lost under the provisions of the Contract.

1.76 "Production

Costs" means those costs and expenditures incurred in carrying out Production

Operations as classified and defined in Section 2 of the Accounting Procedure

and allowed to be recovered in terms of Section 3 thereof.

1.77 "Production

Operations" means all operations conducted for the purpose of producing

Petroleum from the Development Area after the commencement of

production

from the Development Area including the operation and maintenance of all

necessary facilities therefor.

1.78 "Profit

Petroleum” means, the total value of Petroleum Produced

and Saved from the Contract Area in a particular period, as reduced by Cost

Petroleum and calculated as provided in Article 16.

1.79 “Recompletion”

means an operation whereby a completion in one zone is abandoned in order to

attempt a completion in a different zone within an existing Well bore.

1.80 "Reservoir"

means a naturally occurring discrete accumulation of Petroleum.

1.81 “Rules”

means the Petroleum and Natural Gas Rules, 1959 and any amendments made thereto

from time to time.

1.82 "Section"

means a section of the Accounting Procedure.

1.83 "Self-sufficiency"

means, in relation to any Year, that the volume of Crude Oil and Crude Oil

equivalent of Petroleum products exported from India during that Year either

equals or exceeds the volume of Crude Oil and Crude Oil equivalent of Petroleum

products imported into India during the same Year, as determined by

Government.

1.84 "Site

Restoration" shall mean all activities required to return a site to its state

as

of the Effective Date pursuant to the Contractor’s environmental impact study

and approved by the Government or to render a site compatible with its intended

after-use (to the extent reasonable) after cessation of Petroleum Operations

in

relation thereto and shall include, where appropriate, proper abandonment of

▇▇▇▇▇ or other facilities, removal of equipment, structures and debris,

establishment of compatible contours and drainage, replacement of top soil,

re-vegetation, slope stabilisation, in-filling of excavations or any other

appropriate actions in the circumstances.

1.85 "Statement"

or "Statements" refers to the statements required to be furnished in accordance

with Appendix-C of this Contract.

1.86 “State

Government” means any government of a state of the Union of India, which has

control over the Contract Area for the purpose of grant of Licenses/ Leases.

In

case the Contract Area covers more than one state, the State Government shall

include all such governments of those states.

1.87 "Subcontractor"

means any company or person contracted by the Contractor or Operator to provide

goods or services with respect to Petroleum Operations.

1.88 “US

$” or

“USD” or “US Dollar” or “United States Dollar” means the currency of the United

States of America.

1.89 "Well"

means a borehole, made by drilling in the course of Petroleum Operations, but

does not include a seismic shot hole.

1.90 "Work

Programme" means a work programme formulated for the purpose of carrying out

Petroleum Operations.

1.91 "Year"

means a Financial Year.

ARTICLE

2

PARTICIPATING

INTERESTS

| 2.1 |

The

initial Participating Interest of the Parties comprising the Contractor

shall be as follows:

|

GGR : 100%

(hundred per cent)

2.2

Except

as

provided in this Article or elsewhere in this Contract, the rights and

obligations of the Parties comprising the Contractor shall include but not

be

limited to:

|

(a)

|

the

right to take Cost Petroleum in accordance with the provisions of

Article

15;

|

|

(b)

|

the

right to take its Participating Interest share of Profit Petroleum

in

accordance with the provisions of Article

16;

|

|

(c)

|

the

right to receive its Participating Interest share of any incidental

income

and receipts arising from Petroleum Operations;

and

|

(d) the

obligation to contribute its Participating Interest share of costs and expenses

including Contract Costs.

ARTICLE

3

LICENSE

AND EXPLORATION PERIOD

| 3.1 |

The

Exploration Period shall begin on the Effective Date and shall consist

of

two (2) Exploration Phases, first exploration Phase shall be for

a period

not exceeding five (5) consecutive Contract Years and second Exploration

Phase shall be for a period not exceeding three (3) consecutive Contract

Years, for a total period not exceeding eight (8) consecutive Contract

Years unless extended pursuant to the terms of this

Contract.

|

| 3.2 |

Except

as otherwise provided in this Contract, the term of the first Exploration

Phase shall not exceed four (4) consecutive Contract Years (hereinafter

referred to as the first Exploration

Phase).

|

3.3

Except

as

otherwise provided in this Contract, the term of the second Exploration Phase

shall not exceed three (3) consecutive Contract Years from the end of the first

Exploration Phase (hereinafter referred to as the second Exploration

Phase).

3.4

At

the

expiry of any Exploration Phase of the Exploration Period, provided that the

Contractor has completed the Minimum Work Programme for that Exploration Phase,

the Contractor shall have the option, exercisable by giving a written notice

to

the Government at least thirty (30) days prior to the expiry of the relevant

Phase, either:

|

(a)

|

to

proceed to the next Exploration Phase on presentation of the

requisite guarantees

as provided for in Article 29; or

|

| (b) |

to

relinquish the entire Contract Area except for any Discovery Area

and any

Development Area and to conduct Development Operations and Production

Operations in relation to any Commercial Discovery in accordance

with the

terms of this Contract, and the Contractor shall have no further

obligation in respect of the Minimum Work Programme under Article

5 for

any subsequent Exploration Phases of the Exploration

Period.

|

If

neither of the options provided for in paragraphs (a) and (b) hereof is

exercised by the Contractor, this Contract shall terminate at the end of the

then current Exploration Phase and the License shall be automatically

cancelled.

|

3.5

|

If

at the end of an Exploration Phase the Minimum Work Programme for

that

phase is not completed, the time for completion of the said Minimum

Work

Programme shall be extended for a period necessary to enable completion

thereof but not exceeding six (6) months, provided that the Contractor

submits his request by giving a written notice to the Government

at least

thirty (30) days prior to the expiry of the relevant Phase and can

show

technical or other good reasons for non-completion of the Minimum

Work

Programme and the Management Committee gives its consent to the said

extension and provided further that the period of such extension

shall be

subtracted from the next succeeding Exploration Phase, if any. In

case the

Minimum Work Programme of any particular Exploration Phase is completed

before stipulated time as provided in the Article 3.2, the time so

saved

will be added to the next Exploration Phase, if so requested by the

Contractor giving a notice in writing to the Government thirty (30)

days

prior to such early completion of the Phase and in that event the

provision of the Article 3.4 (a) shall apply immediately after such

early

completion of the Phase.

|

|

3.6

|

If,

at the end of an Exploration Phase, execution of any Work Programme

is in

progress and which is in addition to the Minimum Work Programme,

such

Exploration Phase shall be extended for a period not exceeding six

(6)

months to enable completion thereof provided that the Minimum Work

Programme for such Phase has been completed and the

Management Committee gives its consent to the said extension as provided

in the Article 3.5. In the event of an extension as provided for

herein,

the notice referred to in Article 3.4 shall be given at least thirty

(30)

days prior to the expiry of the relevant

extension.

|

|

3.7

|

Where

sufficient time is not available prior to the expiry of the Exploration

Period to complete an Appraisal Programme, at the request of the

Contractor, the Government shall extend the Exploration Period for

such

period, not exceeding eighteen (18) months, as may be mutually agreed

between the Parties for the Appraisal Programme to be carried out

and for

the Contractor and the Management Committee, to comply with the provisions

of Article 10 and Article 21.

|

|

3.8

|

If

no Commercial Discovery has been made in the Contract Area by the

end of

the Exploration Period, the Contract shall

terminate.

|

3.9

If

this

Contract is terminated in accordance with its terms, the License shall be

automatically cancelled.

|

3.10

|

If

at the expiry of the Exploration Period a development plan for development

of a Commercial Discovery and an application for Lease is under

consideration by the Management Committee or Government, as the case

may

be, pursuant to Articles 10, 11 and 21 respectively, the License

shall

continue in force with respect to that part of the Contract Area

to which

the application for the Lease relates, pending a decision on the

proposed

development plan and the application for the Lease, but

|

shall

cease to be in force and effect with respect to the remainder of the Contract

Area.

ARTICLE

4

RELINQUISHMENT

|

4.1

|

If

at the end of the first Exploration Phase, the Contractor elects,

pursuant

to Article 3.4 to continue Exploration Operations in the Contract

Area in

the second Exploration Phase, the Contractor shall have the option

to

relinquish a part of Contract Area in simple geometrical shape. In

case,

the Contractor exercises its option to relinquish a part of the Contract

Area in simple geometrical shape. In case, the Contractor excercises

its

option to relinquish a part of the Contract area at the end of first

Exploration Phase, then such area to be relinquished shall not be

less

than twenty five percent (25%) of the original Contract Area and

the

Contractor shall be entitled to retain the balances area including

any

Development Area and Discovery Area in not more than three (3) areas

of

simple geometrical shapes. Notwithstanding the provision of this

Article

4.1, the Contractor shall be permitted to retain the Development

Areas and

Discovery Areas in accordance with Article

3.4.

|

|

4.2

|

At

the end of the second Exploration Phase, the Contractor shall retain

only

Development Areas and Discovery

Areas.

|

|

4.3

|

If

the Contractor exercises the option provided for in paragraph (b)

of

Article 3.4, the Contractor shall, after any Discovery Areas or

Development Areas have been designated, relinquish all of the Contract

Area not included within the said Discovery Areas or Development

Areas.

|

|

4.4

|

As

and when the Contract is terminated under the provisions of Article

3 or

in accordance with any other provisions of this Contract, the entire

Contract Area remaining with the Contractor shall be deemed to have

been

relinquished by the Contractor as on the date on which the Contract

is

terminated.

|

|

4.5

|

Relinquishment

of all or part of the Contract Area or termination of the Contract

shall

not be construed as absolving the Contractor of any liability undertaken

or incurred by the Contractor in respect of the Contract Area during

the

period between the Effective Date and the date of such relinquishment

or

termination.

|

|

4.7

|

Subject

to Article 14.9, the liability of the Contractor shall be limited

to any

liability undertaken or incurred in respect of, relating to or connected

with the Contract, and/or any claim arising out of or in relation

to the

act of negligence, misconduct, commission or omission in carrying

out

Petroleum Operations during the period between the Effective Date

and the

date of relinquishment of the Contract Area or termination or expiry

of

the Contract, as the case may

be.

|

ARTICLE

5

WORK

PROGRAMME

|

5.1

|

The

Contractor shall commence Petroleum Operations not later than six

(6)

months from the Effective Date.

|

|

5.2

|

In

addition to the Bid Work Programme Commitment in first Exploration

Phase

specified below in Article 5.2.1 and 5.3, the Contractor shall be

required

to undertake and completed the 2D seismic - API, in grid size for

32

(thirty two) KM x 32 (thirty two) KM

covering the entire Contract Area (herein after referred to as “Mandatory

Work Programme”) during first Exploration Phase. In case due to any reason

intrinsic to the Contract Area reason(s), the Contractor is not able

to

cover any part of the Contract Area by 2D seismic survey of grid

size

specified in this Article, the Contractor shall submit a proposal

for

substitution of the short fall in the Mandatory work Programme to

the

Management Committee for approval. The Management Committee shall

consider

and take a reasoned unanimously decision on the proposal of the Contractor

in a timely manner. The Management Committee may ask the Contractor

by

giving a reasonable time, any relevant information / details / data

to

enable it to take a decision on the proposal. The Management Committee

shall ensure that the substituted work programme shall be at least

to the

shortfall in the Mandatory Work Programme when evaluated in terms

of

efforts and expenditure. In case Management Committee is not able

to

decide unanimously, the matter may be referred for approval of the

Government. In case not proposal is received from the Contractor

for the

substitution and fails to complete Mandatory Work Programme the provision

of Article 5.6 shall apply.

|

|

5.2.1

|

During

the currency of the first Exploration Phase, as per Article 3.2,

the

Contractor shall complete the following Work

Programme:

|

|

(a)

|

(i)

|

A

seismic programme consisting of the acquisition, processing and

interpretation of 325

(three hundred twenty five)

line kilometres Of 2D[inclusive of mandatory work programme, 2D API

32

(thirty two)KM x 32 (thirty two)KM] seismic data in relation to the

exploration objectives;

|

| (ii) |

Gravity

magnetic survey (API) of 2500

(two thousand five hundred) stations;

|

| (iii) |

Geochemical

survey of 500

(five hundred)

stations;

|

| (iv) |

Core

holes to 500m. - 10(ten)

▇▇▇▇▇

|

| 5.3 |

During

the currency of the second Exploration Phase, as per Article 3.3,

the

Contractor shall complete the following Work

Programme:

|

| (a) |

(i)

A

seismic programme consisting of the acquisition, processing and

interpretation of 500

(five hundred) line

kilometers of 2D and 200

(two hundred) sq.

kms. of 3D seismic data in relation to the exploration

objectives;

|

| (b) |

(i)One

(1)

Exploration Well shall be drilled at least 2000

(two thousand) metres

of depth.

|

| (ii) |

to

Basement; and

|

| (iii) |

that

point below which further drilling becomes impracticable due to geological

conditions encountered and drilling would be abandoned by a reasonable

prudent operator in the same or similar circumstances. Abandonment

of

drilling under this provision by the Contractor, would require unanimous

approval of the Management Committee.

|

|

5.4

|

The

actual depth objective for each of the ▇▇▇▇▇ shall be determined

by the

Contractor in the light of the advice of the Management Committee

before

the commencement of the drilling. Each Well which reaches the geological

objective for which the depth objective was determined shall be deemed

to

have been drilled to the depth objective or to actual total depth,

whichever is greater. The Contractor shall ensure that all relevant

subsurface, geological, geochemical and geophysical information necessary

for the attainment of the exploration objectives in accordance with

modern

oilfield and petroleum industry practices is obtained during exploratory

drilling.

|

|

5.5

|

If

the depth/geological objective of the Well is not achieved for any

reason,

a substitute Well shall be drilled of the same specifications as

stipulated in and subject to Articles 5.2, & 5.3, as the case may

be.

|

|

5.6

|

Subject

to Article 31, the Contractor undertakes to complete the Mandatory

Work

Programme and Minimum Work Programme in accordance with Articles

5.2,

5.2.1, 5.3 and 5.5, as the case may be. In the event that the Contractor

fails to fulfill the said Mandatory Work Programme or Minimum Work

Programme or both by the end of the relevant Exploration Phase or

early

termination of the Contract by the Government for any reason whatsoever,

each Company constituting the Contractor shall pay to the Government,

within sixty (60) days following the end of the relevant Exploration

Phase

or early termination of the Contract, as may be the case, its

Participating Interest shall for an amount which, when evaluated

in terms

of the Mandatory Work Programme or Minimum Work Programme specified

for

the relevant Phase, is equal to the amount which would be required

to

completed the said Mandatory Work Programme or Minimum Work Programme

or

both. For determination of this amount, available relevant information

including the Budget and modern oilfield and petroleum industry practices

may be taken into account.

|

|

5.7

|

If

the Minimum Work Programme for the second Exploration Phase has been

completed earlier than eighteen months from the end of the Phase,

the

Contractor shall meet with the Government to discuss the possibility

of

early relinquishment, unless the Contractor undertakes further work

with

the approval of the Management

Committee.

|

|

5.8

|

In

the event that the Contractor has carried out work in excess of the

Minimum Work Programme in any Exploration Phase, the excess

exploration work

done shall be set off against the Minimum Work Programme for the

following

Exploration Phase.

|

|

5.9

|

As

soon as possible after the Effective Date and thereafter within ninety

(90) days before commencement of each following Year, the Contractor

shall

submit to the Management Committee the Work Programmes and the Budgets

relating to Petroleum Operations to be carried out during the relevant

Year. Work Programme and Budgets for the Exploration Period shall

include

work sufficient to meet the relevant Minimum Work Programme with

respect

to each Exploration Phase specified in this Article

5.

|

|

5.10

|

The

Contractor may propose modifications or revisions to the details

of a

reviewed or an approved Work Programme and Budget, as the case may

be, in

the light of the then existing circumstances and shall submit to

the

Management Committee modifications or revisions to the Work Programme

and

Budget referred to in Article 5.9.

|

|

5.11

|

Work

Programmes and Budgets and any modifications or revisions thereto

relating

to Exploration Operations shall be submitted to the Management Committee

for review and advice as provided in Article 6.5. Work Programmes

and

Budgets related to Development Operations and Production Operations

and

any modifications or revisions thereto shall be submitted to the

Management Committee for approval as provided in Article 10 and Article

21.

|

ARTICLE

6

MANAGEMENT

COMMITTEE

|

6.1

|

There

shall be constituted a committee to be called the Management Committee

with functions as stated herein below.

|

|

6.2

|

Government

shall nominate two (2) members representing Government in the Management

Committee, whereas each Company constituting the Contractor shall

nominate

one (1) member each to represent Company in the Management Committee

provided that in case the Contractor constitutes only one Company,

that

Company shall have two (2) members. The Parties shall nominate the

members

to the Management Committee within thirty (30) days of the Effective

Date.

|

|

6.3

|

Each

Party may nominate alternate members with full authority to act in

the

absence and on behalf of the members nominated under Article 6.2

and may,

at any time, nominate another member or alternate member to replace

any

member nominated earlier by notice to other members of the Management

Committee.

|

|

6.4

|

One

representative of the Government shall be designated as the Chairman

of

the Management Committee and the second representative of the Government

shall be designated as the Deputy Chairman. The member of the Operator,

or

the member designated by the Operator where Operator has two (2)

members

in the Management Committee shall be designated as the Secretary

of the

Committee.

|

|

6.5

|

Operator

on behalf of the Contractor with the approval of Operating

Committee,

if

constituted under the Article 7.4, or in case of a single Party

constituting the Contractor, then that Party shall submit following

matters to the Management Committee for review and it shall have

advisory

functions:

|

| (a) |

the

annual Work Programmes and Budgets in respect of Exploration Operations

and any revisions or modifications

thereto;

|

| (b) |

annual

work progress and costs incurred

thereon;

|

| (c) |

proposals

for surrender or relinquishment of any part of the Contract Area

by the

Contractor;

|

| (d) |

proposals

for an Appraisal Programme or revisions or additions thereto and

the

declaration of a Discovery as a Commercial

Discovery;

|

| (e) |

any

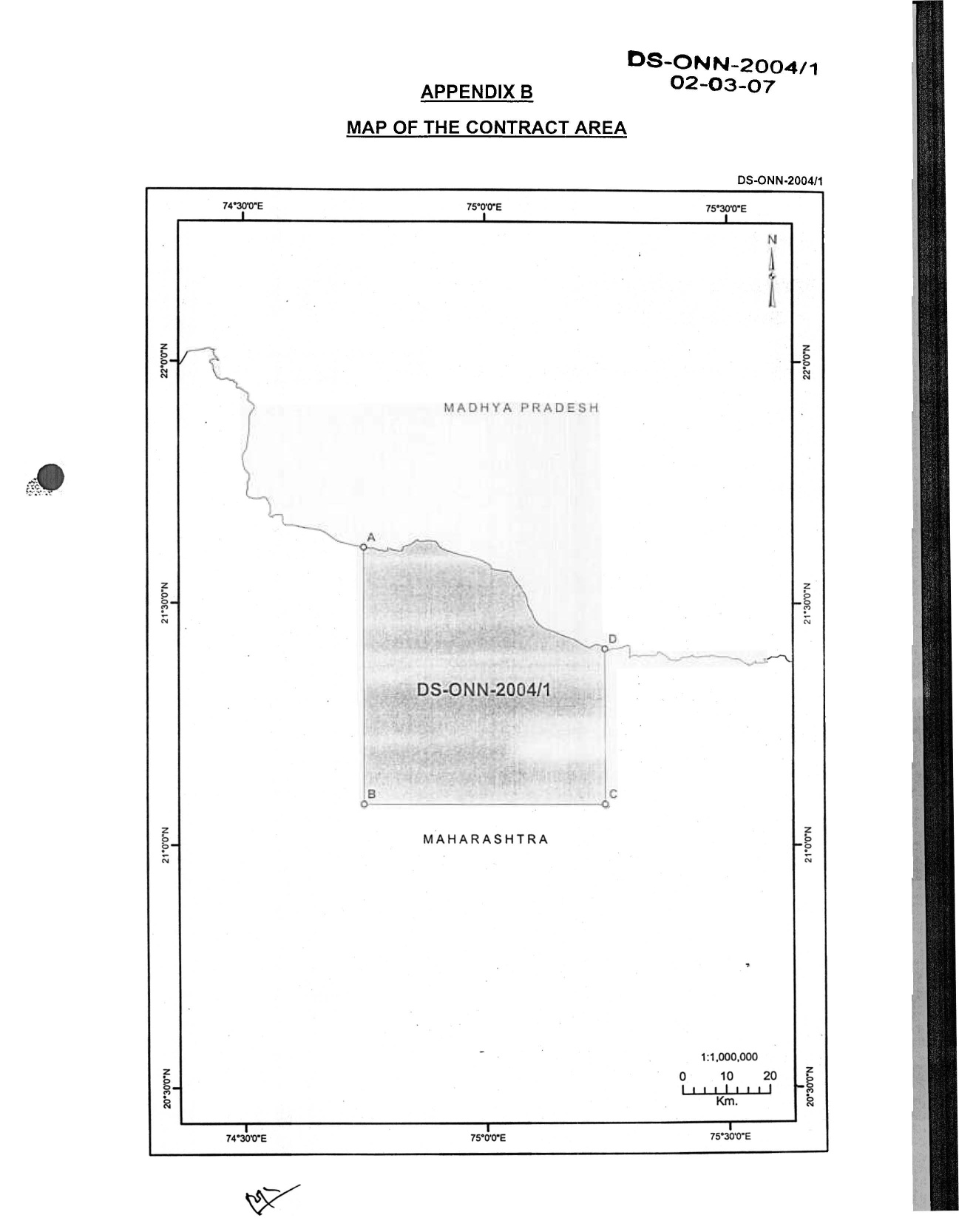

other matter required by the terms of this Contract to be submitted

to it

for review or advice; and

|

| (f) |

any

other matter which the Contractor decides to submit for review or

advice

including matters concerning inter-Party

relationships.

|

|

6.6

|

The

following matters shall be submitted by Operator on behalf of the

Contractor with the approval of Operating Committee, if constituted

under

the Article 7.4, or in case of single Party constituting the Contractor,

then by that Party to the Management Committee for

approval:

|

| (a) |

Annual

Work Programmes and Budgets in respect of Development Operations

and

Production Operations and any modifications or revisions

thereto;

|

(b)

proposals

for the approval of development plans as may be required under this Contract,

or

modifications or revisions to a Development Plan;

(c)

determination

of a Development Area;

(d)

appointment

of auditors along with scope of audit, approval and adoption of audited report

submitted under Article 25.4.3;

(e)

collaboration

with licensees or contractors of other areas;

(f)

claims

or

settlement of claims for or on behalf of or against the Contractor in excess

of

limits fixed by the Management Committee from time to time;

(g)proposal

about abandonment plan/Site Restoration as required to be submitted under

Article 14.10;

(h)

any

other

matter required by the terms of this Contract to be submitted for the approval

of the Management Committee;

(i)

any

other

matter which the Contractor decides to submit to it; and

(j)

any

matter, which Government refers to the Management Committee for its

consideration and reasoned opinion.

|

6.7

|

Unless

agreed otherwise by all the members of the Management Committee,

the

Management Committee shall meet at least once every six (6) months

during

the Exploration Period and thereafter at least once every three (3)

months

or more frequently at the request of any member. The Secretary, with

the

approval of the Chairman, shall convene each meeting by notifying

the

members twenty eight (28) days prior to such a meeting (or a shorter

period of notice if the members unanimously so agree) of the time

and

place of such meeting and the purpose thereof and shall include in

such

notice a provisional agenda for such meeting. The Chairman shall

be

responsible for processing the final agenda for such meeting and

the

agenda shall include all items of business requested by the members

to be

included, provided such requests are received by the Secretary at

least

ten (10) days prior to the date fixed for the meeting. The Secretary

shall

forward the agenda to the members at least seven (7) Business Days

prior

to the date fixed for the meeting. Matters not included in the agenda

may

be taken up at the meeting by any member with the unanimous consent

of all

the members whether present or not present at the

meeting.

|

|

6.8

|

The

Chairman or the Deputy Chairman, as may be the case, shall preside

over

the meetings of the Management Committee and, in their absence, any

other

member representing Government and present shall preside over the

meetings.

|

|

6.9

|

Secretary

to the Management Committee shall be responsible, inter alia, for

preparation of the minutes of every meeting in the English language

and

provision to every member of the Management Committee with two (2)

copies

of the minutes approved by the Chairman within three (3) Business

Days of

the meeting. Unless agreed otherwise by all the members of the Management

Committee, the minutes of a meeting shall be finalised by the Management

Committee within three (3) Business Days thereafter. Members shall

notify

the Chairman and the other members of their approval of the minutes

by

putting their signatures on one copy of the minutes and returning

the same

to the Chairman. Members may suggest any modification to the minutes

while

returning the signed copy. Members may also communicate with the

Chairman

through telex, cable, or facsimile or any other effective mode of

communication agreed by all the members of the Management Committee.

If

the Chairman or any other member does not agree with the modification

to

the minutes suggested by any member, the matter shall be brought

to the

attention of the other members and resubmitted to the Management

Committee

at the next meeting and the minutes shall stand approved as to all

other

matters. If a member fails to respond within the aforesaid three

(3)

Business Day period, unless agreed otherwise by the Management Committee

as herein provided, the minutes shall be deemed to be approved by

such

member.

|

|

6.10

|

Any

member shall be entitled, if either he/she or his/her alternate is

unable

to attend a meeting, to cast his vote by telex, cable, facsimile

transmission or any other effective mode of communication agreed

by all

the members of the Management Committee and received by the Chairman

prior

to the date on which the vote is taken in the course of the meeting

or by

giving a prior written notice to all other members, appoint a member,

with

his/her prior consent, representing another Party in the Management

Committee as its proxy to attend a meeting and to exercise the appointing

member’s right to vote at the meeting whether as directed by the

appointing member or otherwise. A member appointed as a proxy and

attending a meeting shall be present in two separate capacities and

vote

accordingly. All such votes shall have the same effect as if that

member

had been present and so voted at the

meeting.

|

|

6.11

|

In

case of urgency, where Operating Committee has made a recommendation

together with reasons to the Chairman requiring consideration of

a matter

by the Management Committee without delay, Chairman, after being

satisfied

may waive the requirements of notice period for the meeting and

circulation of agenda to such extent as would be consistent with

the

urgency and consideration of the matter by the Management Committee.

Alternatively, Chairman may approve submission of notice and agenda

to

members by telex or facsimile transmission or any other effective

mode of

communication agreed by all the members of the Management Committee,

receipt of which shall be confirmed by telephone by the Chairman

requiring

the members to confirm their decision by these modes of communication

not

later than three (3) Business Days from confirmation

of

|

receipt

of notice and agenda by the member. Any member failing to convey the decision

within the time limits of three (3) Business Days shall be deemed to have voted

in favour of the proposal. The result of any such vote shall be notified by

the

Chairman to all the members.

|

6.12

|

The

meetings of the Management Committee shall be held in India, unless

otherwise mutually agreed by the members of the Management Committee.

All

expenses of the members of the Management Committee attending meetings

shall be borne by the respective Party and shall in no event be cost

recoverable.

|

|

6.13

|

All

matters requiring the approval of the Management Committee shall

be

generally approved by a unanimous vote of the members of the Management

Committee present as well as the views of the members received by

some

other mode of communication. In case, unanimity is not achieved in

decision making process within a reasonable period as may be required

under the circumstances, the decision of the Management Committee

shall be

approved by the majority Participating Interest of seventy percent

(70%)

or more with Government representative having a positive vote in

favour of

the decision.

|

|

6.14

|

There

shall be a quorum of the Management Committee for holding a meeting

and

making decisions with each Party to the Contract represented by at

least

one of its nominated members in the Management Committee either present

in

person or represented as per Article 6.10. If there is no quorum

in a

meeting, the meeting shall stand postponed to the same day and time

in the

next week and if quorum is not present or represented even in the

next

meeting and subject to a Government member being present, the members

present and represented will constitute the quorum and take decisions

and

decisions taken by such quorum shall be final and binding to all

the

absenting Parties or Parties not represented, notwithstanding the

provisions of Article 6.13.

|

|

6.15

|

The

Management Committee, if it considers necessary, may appoint legal,

financial or technical subcommittees comprised of such representatives

as

may be agreed by the Management Committee to consider any matter

requiring

approval or decision of the Management Committee. Such sub-committee

expenses shall form part of Contract Cost with relevant cost

classification as decided by the Management Committee pursuant to

the

Section 2 of the Accounting Procedure and will be cost

recoverable.

|

|

6.16

|

In

the event a Party to the Contract is not entitled to vote in the

Operating

Committee meetings being in default under the Operating Agreement,

and

Operator notifies Chairman of the default by the Party, then the

issue of

exercising voting right by such defaulting Party in the Management

Committee meetings shall be discussed by the Management Committee.

The

Management Committee excluding the defaulting Party, after duly hearing

the views of the defaulting Party on the matter of their default

under

Operating Agreement, shall

|

take

unanimous decision on exclusion or otherwise of the defaulting Party from voting

in the Management Committee meetings. For avoidance of any doubt, it is clearly

understood that unanimous decision by the Management Committee referred to

in

this Article 6.16 excludes defaulting Party from such decision. Accordingly,

if

the Management Committee decides to exclude the defaulting Party from voting

in

the Management Committee, then the said Party shall not be entitled to vote

in

the meetings of the Management Committee under Contract. In that event,

notwithstanding the provisions of Article 6.13, decisions of the Management

Committee shall be made by vote of the members of the Management Committee

excluding the member appointed by the said Party in default and any vote or

purported vote by such member in the Management Committee shall be ignored.

The

said Party in default shall be bound by all decisions of the Management

Committee. The non-defaulting Parties under the Operating Agreement shall

indemnify Government against any claims of whatsoever nature which may arise

due

to exclusion of defaulting Party from voting in the Management

Committee.

ARTICLE

7

OPERATORSHIP,

OPERATING AGREEMENTAND OPERATING COMMITTEE

|

7.1

|

GGRB

shall be the Operator for the purpose of carrying out Petroleum Operations

pursuant to this Contract during the term of the

Contract.

|

|

7.2

|

No

change in the operatorship shall be effected without the consent

of the

Government and such consent shall not be unreasonably

withheld.

|

|

7.3

|

The

functions required of the Contractor under this Contract shall be

performed by the Operator on behalf of all constituent(s) of the

Contractor subject to, and in accordance with, the terms and provisions

of

this Contract and generally accepted modern oilfield and petroleum

industry practices, provided, however, that this provision shall

not be

construed as relieving the constituent(s) of the Contractor from

any of

its obligations or liability under the

Contract.

|

7.4 Within

forty five (45) days of the Effective Date or such longer period as may be

agreed to by Government, the Companies constituting the Contractor shall execute

an Operating Agreement. The said agreement shall be consistent with the

provisions of this Contract and shall provide for, among other

things:

(a) the

appointment, resignation, removal and responsibilities of the

Operator;

(b) the

establishment of an Operating Committee comprising of an agreed number of

representatives of the Companies chaired by a representative of the

Operator;

|

(c)

|

functions

of the said Operating Committee taking into account the provisions

of the

Contract, procedures for decision making, frequency and place of

meetings;

and

|

|

(d)

|

contribution

to costs, default, sole risk, disposal of Petroleum and assignment

as

between the Parties to the Operating

Agreement.

|

|

7.4.1

|

Operator

shall provide to the Government a copy of the duly executed Joint

Operating Agreement within thirty (30) days of the Execution Date

or such

longer period as may be agreed to by the

Government.

|

|

7.4.2

|

In

case a single Company constitutes the Contractor, the provisions

of

Article 7.4 and 7.4.1 shall not be applicable. However, in case of

increase in the number of constituents of the Contractor, the provisions

of Article 7.4 and 7.4.1 shall apply from the date of such increase

in the

number of the constituents.

|

ARTICLE

8

GENERAL

RIGHTS AND OBLIGATIONS OF THE PARTIES

|

8.1

|

Subject

to the provisions of this Contract, the Contractor shall have the

following rights:

|

|

(a)

|

subject

to the provisions of Article 12, the exclusive right to carry out

Petroleum Operations to recover costs and expenses as provided in

this

Contract. The right shall exclude exploitation of coal/lignite bed

methane

(CBM) by the Contractor in the Contract

Area;

|

|

(b)

|

the

right to use, free of charge, such quantities of Petroleum produced

as are

reasonably required for conducting Petroleum Operations in the Contract

Area in accordance with generally accepted modern oilfield and petroleum

industry practices;

|

|

(c)

|

the

right to lay pipelines, build roads, construct bridges, ferries,

aerodromes, landing fields, radio telephones and related communication

and

infrastructure facilities and exercise other ancillary rights as

may be

reasonably necessary for the conduct of Petroleum Operations subject

to

such approvals as may be required and the applicable laws in force

from

time to time for the regulation and control

thereof;

|

|

(d)

|

the

right to use all available technical data, seismic and well information,

maps, samples etc. of the Contract Area as on the Effective Date,

free of

charge, subject to nominal copying/reproduction costs for further

Petroleum Operations. The Contractor shall submit the list of all

data

required by them to Directorate General of Hydrocarbons (DGH) based

on the

list of data provided in the information docket for the block pertaining

to the Contract Area as soon as possible but not later than one hundred

and eighty (180) days from the execution of the Contract and the

same, if

available and reproducible, shall be made available to the Contractor

in

the office of DGH within ninety (90) days from the submission of

such

request for data by the Contractor, provided the Effective Date of

the

Contract has commenced and the Contractor has furnished relevant

guarantees under Article 29 of the

Contract.

|

|

(e)

|

such

other rights as are specified in this

Contract.

|

|

8.2

|

The

Government reserves the right to itself, or to grant to others the

right,

to prospect for and mine minerals or substances other than Petroleum

within the Contract Area; provided, however, that if after the Effective

Date, others are issued rights, or the Government proceeds directly

to

prospect for and mine in the Contract Area any minerals or substances

other than Petroleum, the Contractor shall use its best efforts to

avoid

obstruction to or interference with such operations within the Contract

Area and the third parties and/or the

Government,

|

as

the

case may be, shall use best efforts to ensure that operations carried out do

not

obstruct or unduly interfere with Petroleum Operations in the Contract

Area.

|

8.3

|

The

Contractor shall having due regard to modern oilfield and petroleum

industry practices :

|

|

(a)

|

except

as otherwise expressly provided in this Contract, conduct all Petroleum

Operations at its sole risk, cost and expense and provide all funds

necessary for the conduct of Petroleum Operations including funds

for the

purchase or lease of equipment, materials or supplies required for

Petroleum Operations as well as for making payments to employees,

agents

and Subcontractors;

|

|

(b)

|

conduct

all Petroleum Operations within the Contract Area diligently,

expeditiously, efficiently and in a safe and workmanlike manner pursuant

to the Work Programme formulated in accordance with

Contract;

|

|

(c)

|

ensure

provision of all information, data, samples etc. which may be required

to

be furnished under the applicable laws or under this

Contract;

|

|

(d)

|

ensure

that all equipment, materials, supplies, plant and installations

used by

the Contractor, the Operator, and Subcontractors comply with generally

accepted standards and are of proper construction and kept in safe

and

good working order;

|

|

(e)

|

in

the preparation and implementation of Work Programmes and in the

conduct

of Petroleum Operations, follow modern oilfield and petroleum industry

practices with such degree of diligence and prudence reasonably and

ordinarily exercised by experienced parties engaged in a similar

activity

under similar circumstances and

conditions;

|

|

(f)

|

the

procedure for acquisition of goods and services, as of the Effective

Date,

shall be as per the Appendix-F of this Contract. Based on economic

considerations and generally accepted practices in the international

petroleum industry with the objective of ensuring cost and operational

efficiency in the conduct of Petroleum Operations, the Appendix-F

to this

Contract may be modified or changed with the prior approval of the

Management Committee when circumstances so

justify;

|

|

(g)

|

after

the designation of a Development Area, pursuant to this Contract,

forthwith proceed to take all necessary action for prompt and orderly

development of the Development Area and for the production of Petroleum

in

accordance with the terms of this

Contract;

|

|

(h)

|

appoint

a technically competent and sufficiently experienced representative,

and,

in his absence, a suitably qualified replacement therefor, who shall

be

resident in India and who shall have full authority to take such

steps as

may be necessary to implement this Contract and whose name(s) shall,

on

appointment within ninety (90) days after commencement of the first

Contract Year, be made known to the

Government;

|

|

(i)

|

provide

acceptable working conditions, living accommodation and access to

medical

attention and nursing care for all personnel employed in Petroleum

Operations;

|

|

(j)

|

carry

out such other obligations as are specified in this Contract, in

particular those specified in Article 14; and

|

|

(k)

|

be

always mindful of the rights and interests of India in the conduct

of

Petroleum Operations.

|

ARTICLE

9

GOVERNMENT

ASSISTANCE

|

9.1

|

Upon

application in the prescribed manner, and subject to compliance with

applicable laws and relevant procedures, the Government or its nominee

will:

|

|

(a)

|

use

their good offices to provide the right of ingress and egress from

the

Contract Area and any facilities used in Petroleum Operations, wherever

located, and which may be within their

control;

|

|

(b)

|

use

their good offices, when necessary, to assist the Contractor in

procurement or commissioning of facilities required for execution

of Work

Programmes including necessary approvals, permits, consents,

authorisations, visas, work permits, Licenses including Licenses

and

Leases, rights of way, easement, surface rights and security protection

at

the Contractor’s cost, required pursuant to this Contract and which may be

available from resources within its control;

and

|

|

(c)

|

in

the event that onshore facilities are required outside the Contract

Area

for Petroleum Operations including, but not limited to, storage,

loading

and processing facilities, pipelines and offices, use their good

offices

in assisting the Contractor to obtain from the authorities of the

state in

which such facilities are required, such licenses, permits,

authorizations, consents, security protection at the Contractor’s cost,

surface rights and easements as are required for the construction

and

operation of the said facilities by the

Contractor.

|

ARTICLE

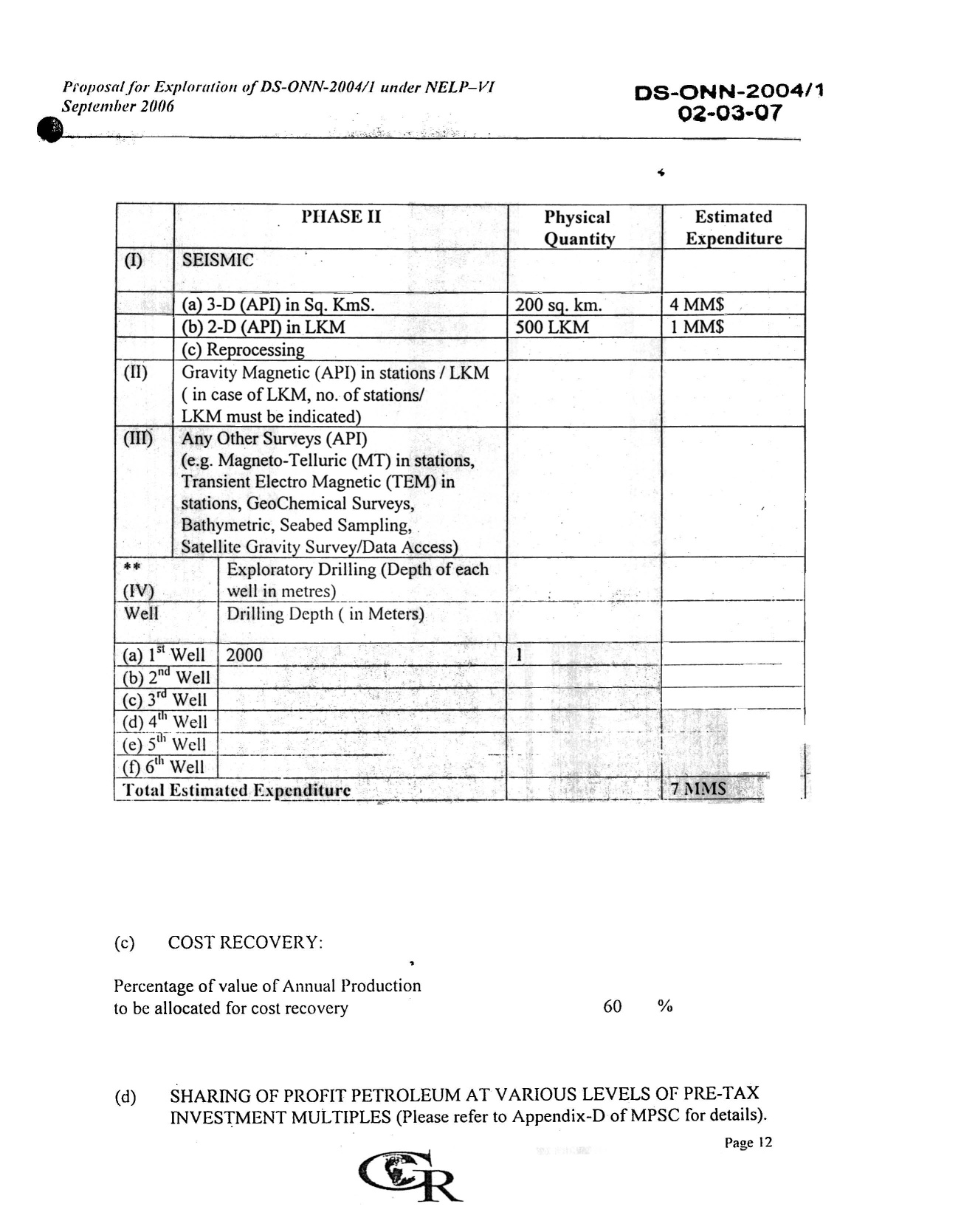

10