BUSINESS COMBINATION AGREEMENT AMONG APPLIED INVENTIONS MANAGEMENT CORP. - and - HIGH STREET CAPITAL PARTNERS, LLC - and - ACREAGE FINCO B.C. LTD. - and - HSCP MERGER CORP.- and - - and - ACREAGE HOLDINGS AMERICA, INC .- and - ACREAGE HOLDINGS WC,...

Exhibit 99.28

Execution Copy

BUSINESS COMBINATION AGREEMENT

AMONG

APPLIED INVENTIONS MANAGEMENT CORP.

- and -

HIGH STREET CAPITAL PARTNERS, LLC

- and -

ACREAGE ▇▇▇▇▇ ▇.▇. LTD.

- and -

HSCP MERGER CORP.- and -

- and -

ACREAGE HOLDINGS AMERICA, INC

.- and -

ACREAGE HOLDINGS WC, INC.

DATED: SEPTEMBER 21, 2018

CAN: 28037112.10

TABLE OF CONTENTS

| ARTICLE I GENERAL | 2 | |

| 1.1 | Defined Terms | 2 |

| 1.2 | Business Combination - Reorganization | 2 |

| 1.3 | Business Combination - Financing of ▇▇▇▇▇ | 3 |

| 1.4 | Business Combination - USCo1 and USCo2 Contributions | 3 |

| 1.5 | Business Combination - Exchange of Subscription Receipts | 3 |

| 1.6 | Business Combination - Amalgamation | 3 |

| 1.7 | Business Combination - Share Exchange | 5 |

| 1.8 | Business Combination - Wind up of Amalco | 5 |

| 1.9 | Business Combination - Contribution of Financing Proceeds | 5 |

| 1.10 | U.S. Tax Matters | 6 |

| 1.11 | Canadian Tax Election | 6 |

| 1.12 | Board of Directors and Officers | 6 |

| ARTICLE II REPRESENTATIONS AND WARRANTIES OF ACREAGE | 7 | |

| 2.1 | Organization and Good Standing | 7 |

| 2.2 | Consents, Authorizations, and Binding Effect | 7 |

| 2.3 | Litigation and Compliance | 8 |

| 2.4 | Financial Statements | 8 |

| 2.5 | Taxes | 9 |

| 2.6 | Due Diligence Investigations | 9 |

| 2.7 | Brokers | 9 |

| 2.8 | Anti-Bribery Laws | 9 |

| ARTICLE III REPRESENTATIONS AND WARRANTIES OF ▇▇▇▇▇ | 10 | |

| 3.1 | Organization and Good Standing | 10 |

| 3.2 | Consents, Authorizations, and Binding Effect | 10 |

| ARTICLE IV REPRESENTATIONS AND WARRANTIES OF AIM AND SUBCO | 11 | |

| 4.1 | Organization and Good Standing | 11 |

| 4.2 | Consents, Authorizations, and Binding Effect | 12 |

| 4.3 | Litigation and Compliance | 13 |

| 4.4 | Public Filings; Financial Statements | 14 |

| 4.5 | Taxes | 15 |

| 4.6 | Pension and Other Employee Plans and Agreement | 15 |

| 4.7 | Labour Relations | 15 |

| 4.8 | Contracts | 16 |

| 4.9 | Absence of Certain Changes, Etc | 16 |

| 4.10 | Subsidiaries | 17 |

| 4.11 | Capitalization | 17 |

| 4.12 | Environmental Matters | 18 |

| 4.13 | Licence and Title | 18 |

| 4.14 | Indebtedness | 18 |

| 4.15 | Undisclosed Liabilities | 18 |

| 4.16 | Due Diligence Investigations | 19 |

| 4.17 | Brokers | 19 |

| 4.18 | Anti-Bribery Laws | 19 |

| ARTICLE V CONDITIONS TO OBLIGATIONS OF AIM | 19 | |

| 5.1 | Conditions Precedent to Completion of the Business Combination | 19 |

| ARTICLE VI CONDITIONS TO OBLIGATIONS OF ACREAGE, ▇▇▇▇▇, USCO1 AND USCO2 | 20 | |

| 6.1 | Conditions Precedent to Completion of the Business Combination | 20 |

| - 2 - |

| ARTICLE VII | 21 | |

| COVENANTS | 21 | |

| 7.1 | Covenants of AIM | 21 |

| ARTICLE VIII | 22 | |

| MUTUAL CONDITIONS PRECEDENT | 22 | |

| 8.1 | Mutual Conditions Precedent | 22 |

| ARTICLE IX CLOSING | 23 | |

| 9.1 | Closing | 23 |

| 9.2 | Termination of this Agreement | 23 |

| 9.3 | Survival of Representations and Warranties; Limitation | 24 |

| ARTICLE X MISCELLANEOUS | 24 | |

| 10.1 | Further Actions | 24 |

| 10.2 | Transaction Costs | 24 |

| 10.3 | U.S. Federal Law Exclusions | 24 |

| 10.4 | Entire Agreement | 25 |

| 10.5 | Descriptive Headings | 25 |

| 10.6 | Notices | 25 |

| 10.7 | Governing Law | 26 |

| 10.8 | Enurement and Assignability | 26 |

| 10.9 | Confidentiality | 26 |

| 10.10 | Remedies | 27 |

| 10.11 | Waivers and Amendments | 27 |

| 10.12 | Illegalities | 27 |

| 10.13 | Currency | 27 |

| 10.14 | Counterparts | 27 |

CAN: 28037112.10

BUSINESS COMBINATION AGREEMENT

THIS AGREEMENT dated September 21, 2018 is made

AMONG:

APPLIED INVENTIONS MANAGEMENT CORP., a corporation existing under the laws of the Province of Ontario,

(hereinafter referred to as “AIM”),

| - | and - |

HIGH STREET CAPITAL PARTNERS, LLC, a limited liability company existing under the laws of Delaware,

(hereinafter referred to as “Acreage”),

| - | and - |

ACREAGE ▇▇▇▇▇ ▇.▇. LTD., a corporation existing under the laws of the Province of British Columbia,

(hereinafter referred to as “▇▇▇▇▇”),

| - | and - |

HSCP MERGER CORP., a corporation existing under the laws of the Province of British Columbia,

(hereinafter referred to as “Subco”),

| - | and - |

ACREAGE HOLDINGS AMERICA, INC., a corporation existing under the laws of Delaware,

(hereinafter referred to as “USCo1”),

| - | and - |

ACREAGE HOLDINGS WC, INC., a corporation existing under the laws of Nevada,

(hereinafter referred to as “USCo2”).

WHEREAS AIM proposes to complete a reorganization comprised of (i) the Consolidation (as hereinafter defined); (ii) the Subdivision (as hereinafter defined); (iii) Share Amendments (as hereinafter defined), which, among other things, amend its authorized share capital to include Subordinate Voting Shares and Multiple Voting Shares; (iv) the Name Change; and (v) the Continuance (collectively, the “Reorganization”).

CAN: 28037112.10

| -2- |

AND WHEREAS the Parties (as hereinafter defined) have agreed, subject to the satisfaction of certain conditions precedent, that AIM (following completion of the Reorganization), ▇▇▇▇▇ and Subco will carry out a three-cornered Amalgamation (as hereinafter defined) pursuant to the statutory procedure under Section 269 of the BCBCA (as hereinafter defined) pursuant to which, among other things:

| (i) | each Subco Share (as hereinafter defined) will be exchanged for one Amalco Share (as hereinafter defined); and |

| (ii) | each ▇▇▇▇▇ Share (as hereinafter defined) held by ▇▇▇▇▇ Shareholders (as hereinafter defined), after cancellation of the Initial ▇▇▇▇▇ Share, will be exchanged for one Subordinate Voting Share (as hereinafter defined); |

AND WHEREAS the Parties have agreed, subject to the satisfaction of certain conditions precedent, to, in connection with the Amalgamation, carry out a share exchange (the “Share Exchange”) pursuant to which: (i) the Class A common shares of USCo1 held by all holders of USCo1 Class A common shares will be contributed to AIM in exchange for an aggregate of approximately 9,775,367 Subordinate Voting Shares, (ii) the Class B common shares of USCo1 held by all holders of USCo1 Class B common shares will be contributed to AIM in exchange for an aggregate of approximately 1,308,220 Proportionate Voting Shares, and (iii) the Class C common shares of USCo1 then held by the Acreage Founder along with approximately $205,000 will be contributed to AIM by the Acreage Founder in exchange for 150,000 Multiple Voting Shares;

AND WHEREAS, immediately following the Effective Time, (i) the changes to the board of directors of AIM contemplated in Section 1.12, and (ii) the adoption of a new equity and share-based incentive plan acceptable to Acreage (the “New Incentive Plan”), in its sole discretion, will each become effective;

NOW THEREFORE, in consideration of the mutual benefits to be derived from the Business Combination and the representations and warranties, conditions and promises herein contained and other good and valuable consideration (the receipt and sufficiency of which is hereby acknowledged) and intending to be legally bound hereby, the Parties agree as follows:

ARTICLE I

GENERAL

| 1.1 | Defined Terms |

Capitalized terms used herein and not otherwise defined have the meanings ascribed to such terms in Schedule A.

| 1.2 | Business Combination - Reorganization |

Prior to the Effective Time and as soon as reasonably practicable, AIM shall take all necessary steps to give effect to and implement the Consolidation, the Name Change, the Share Amendments, the Subdivision, and the Continuance upon and subject to the terms of this Agreement. AIM will have a valuation of $1,500,000 on a fully-diluted basis, including the conversion of all outstanding convertible or exchangeable indebtedness and securities, including the AIM Stock Options, AIM Warrants and AIM Convertible Debenture. Prior to the completion of the Consolidation, each of the AIM Stock Options, AIM Warrants, AIM Convertible Debentures and all convertible or exchangeable indebtedness of AIM shall be converted, exchanged or extinguished for no consideration.

CAN: 28037112.10

| -3- |

| 1.3 | Business Combination - Financing of ▇▇▇▇▇ |

▇▇▇▇▇ proposes to complete an offering of subscription receipts (the “Subscription Receipts”) for gross proceeds of up to USD $200 million. Certain investors will invest cash for the Subscription Receipts, with each Subscription Receipt representing the right of the holder thereof to receive, in certain circumstances set forth in the terms attached to the Subscription Receipts, one ▇▇▇▇▇ Share, without any further act or formality, and for no additional consideration.

| 1.4 | Business Combination - USCo1 and USCo2 Contributions |

Prior to the Amalgamation:

| (a) | Acreage will use its commercially reasonable efforts to cause: |

| (i) | each of the holders of Acreage Convertible Securities to convert in exchange for Class A units of Acreage; |

| (ii) | each of the holders of Acreage units (other than USCo1, holders of Acreage Class B units, Class C units and Profit Interests and the Future USCo2 Holders) to contribute their Acreage units to USCo1 in exchange for USCo1 voting common shares; and |

| (iii) | each of the Future USCo2 Holders to contribute their units of Acreage to USCo2 in exchange for non-voting redeemable common shares of USCo2. |

| 1.5 | Business Combination - Exchange of Subscription Receipts |

Immediately prior to the Effective Time:

| (a) | the Subscription Receipts will automatically be exchanged for common shares of ▇▇▇▇▇ pursuant to the terms and conditions of the Subscription Receipts and the Subscription Receipt Agreement, and |

| (b) | the Initial ▇▇▇▇▇ Share will be cancelled for no consideration. |

| 1.6 | Business Combination - Amalgamation |

| (a) | ▇▇▇▇▇ and Subco agree to effect the combination of their respective businesses and assets by way of a “three-cornered amalgamation” among AIM, Subco and ▇▇▇▇▇, pursuant to a statutory amalgamation under Section 269 of the BCBCA. |

| (b) | AIM has called the AIM Meeting and will prepare and mail the AIM Circular, in a form, and with content, acceptable to Acreage, to the AIM Shareholders. AIM shall not amend or supplement the AIM Circular without the prior written consent of Acreage, with such consent not to be unreasonably withheld or delayed. |

| (c) | (i) ▇▇▇▇▇ will obtain the written consent resolution of the ▇▇▇▇▇ Shareholder approving the Amalgamation; and (ii) AIM will execute a written consent resolution approving the Subco Amalgamation Resolution. |

| (d) | AIM shall complete the Continuance, concurrent with which the Consolidation, the Subdivision and the Share Amendments shall be completed. |

CAN: 28037112.10

| -4- |

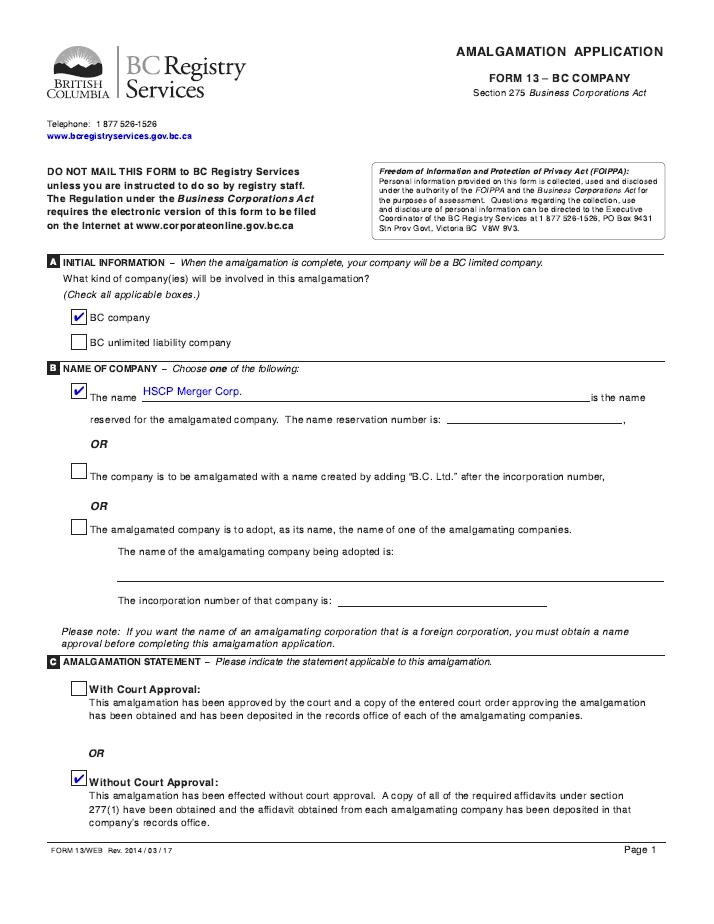

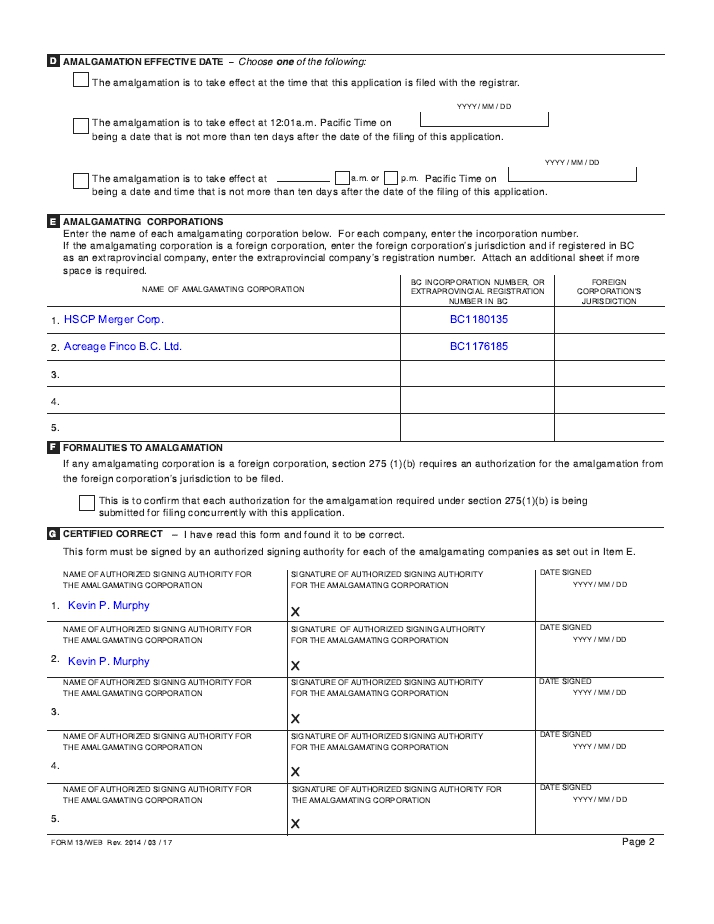

| (e) | Following the Continuance, and upon completion of the Name Change, Subco and ▇▇▇▇▇ shall jointly complete and file the Amalgamation Application with the British Columbia Registrar of Companies under the BCBCA. |

| (f) | Upon the issue of a Certificate of Amalgamation giving effect to the Amalgamation, Subco and ▇▇▇▇▇ shall be amalgamated and shall continue as one corporation effective on the date of the Certificate of Amalgamation (the “Effective Date”) under the terms and conditions prescribed in the Amalgamation Agreement. |

| (g) | At the Effective Time and as a result of the Amalgamation: |

| (i) | each holder of ▇▇▇▇▇ Shares shall receive one fully paid and non-assessable Subordinate Voting Share for each ▇▇▇▇▇ Share held, following which all such ▇▇▇▇▇ Shares shall be cancelled; |

| (ii) | AIM shall receive one fully paid and non-assessable Amalco Share for each one Subco Share held by AIM, following which all such Subco Shares shall be cancelled; |

| (iii) | each holder of ▇▇▇▇▇ Broker Warrants shall receive one AIM Broker Warrant for each ▇▇▇▇▇ Broker Warrant held, following which all such ▇▇▇▇▇ Broker Warrants shall be cancelled; |

| (iv) | in consideration of the issuance of Subordinate Voting Shares pursuant to Section 1.6(g)(i), Amalco shall issue to AIM one Amalco Share for each Subordinate Voting Share issued; |

| (v) | AIM shall add to the capital maintained in respect of the Subordinated Voting Shares an amount equal to the aggregate paid-up capital for purposes of the ITA of the ▇▇▇▇▇ Shares immediately prior to the Effective Time; |

| (vi) | Amalco shall add to the capital maintained in respect of the Amalco Shares an amount such that the stated capital of the Amalco Shares shall be equal to the aggregate paid-up capital for purposes of the ITA of the Subco Shares and ▇▇▇▇▇ Shares immediately prior to the Amalgamation; |

| (vii) | AIM shall be entitled to deduct and withhold from any consideration otherwise payable pursuant to the transactions contemplated by this Agreement to any holder of ▇▇▇▇▇ Shares such amounts as are required to be deducted and withheld with respect to such payment under the ITA or any provision of provincial, state, local or foreign tax law, in each case as amended; to the extent that amounts are so withheld, such withheld amounts shall be treated for all purposes hereof as having been paid to the holder of the ▇▇▇▇▇ Shares in respect of which such deduction and withholding was made, provided that such withheld amounts are actually remitted to the appropriate taxing authority; and |

| (viii) | Amalco will become a wholly-owned subsidiary of AIM. |

| (h) | At the Effective Time: |

CAN: 28037112.10

| -5- |

| (i) | subject to Section 1.6(g)(i), the registered holders of ▇▇▇▇▇ Shares shall become the registered holders of the Subordinate Voting Shares to which they are entitled, calculated in accordance with the provisions hereof. AIM shall deliver the Subordinate Voting Shares to former holders of ▇▇▇▇▇ Shares electronically or in physical form in accordance with the instructions of the former holder thereof, without the need for such holder to surrender certificates representing the ▇▇▇▇▇ Shares. Absent such instructions, AIM shall provide the Subordinate Voting Shares in the same form as such holder previously held the Subscription Receipts; and |

| (ii) | AIM shall become the registered holder of the Amalco Shares to which it is entitled, calculated in accordance with the provisions hereof, and shall be entitled to receive a share certificate representing the number of Amalco Shares to which it is entitled, calculated in accordance with the provisions hereof. |

| (i) | Immediately following the Effective Time, all unexercised Acreage Warrants shall be amended, in accordance with the terms thereof, to be exercisable to acquire Subordinate Voting Shares. |

| (j) | At the Effective Time, the registered holders of ▇▇▇▇▇ Broker Warrants shall become the registered holders of AIM Broker Warrants to which they are entitled in accordance with the provisions hereof. AIM shall deliver certificates representing the AIM Broker Warrants to former holders of ▇▇▇▇▇ Broker Warrants in accordance with the instructions of former holders thereof. |

| 1.7 | Business Combination - Share Exchange |

Concurrently with the consummation of the Amalgamation, the Share Exchange shall be completed.

| 1.8 | Business Combination - Wind up of Amalco |

Following the completion of the Amalgamation, Amalco will be wound up into AIM and the assets of Amalco (which will consist of the funds invested by the investors net of expenses) will be transferred to AIM by operation of Law.

| 1.9 | Business Combination - Contribution of Financing Proceeds |

Immediately following the wind-up of Amalco, AIM shall use certain proceeds of the Financing received by it to subscribe for voting common shares of USCo2 and voting common shares of USCo1 (together, the “Subscriptions”). Following the Subscriptions (i) the initial voting common share of USCo2 held by the Acreage Founder shall be redeemed at a redemption price equal to the fair market value of such initial voting common share, and (ii) the proceeds of the Financing received by USCo1 and USCo2 pursuant to the Subscriptions shall be contributed to Acreage in exchange for common units.

The Parties intend and agree that the transactions set forth in Sections 1.2 through 1.9 shall be completed as specified and that no single transaction of Sections 1.2 through 1.9 shall be completed without the intent of the Parties to complete the remaining transactions.

CAN: 28037112.10

| -6- |

| 1.10 | U.S. Tax Matters |

Each Party agrees that: (a) the contributions of certain Acreage units to USCo1, as contemplated in Section 1.4(a)(ii), are intended to constitute a single integrated transaction qualifying as a tax-deferred contribution pursuant to Section 351 of the Code; (b) the transactions set forth in Section 1.3, Section 1.5, Section 1.6, Section 1.7 and Section 1.8 are intended to constitute a single integrated transaction qualifying as a tax-deferred contribution pursuant to Section 351 of the Code; (c) the contributions of certain Acreage units to USCo2, as contemplated in Section 1.4(a)(iii), together with the contribution by AIM of certain proceeds of the Financing to USCo2, as contemplated in Section 1.9, are intended to constitute a single integrated transaction qualifying as a tax-deferred contribution pursuant to Section 351 of the Code; (d) such Party shall retain such records and file such information as is required to be retained and filed pursuant to Treasury Regulations section 1.351-3 in connection with each of the transactions set forth in subsections (a), (b) and (c); and (e) such Party shall otherwise use its best efforts to cause the transactions set forth in subsections (a), (b) and (c) to qualify as a tax-deferred contribution, in each case pursuant to Section 351 of the Code. In connection with the transactions described in subsection (b), the Parties agree to treat AIM as a United States domestic corporation for U.S. federal income tax purposes under Section 7874(b) of the Code. Except as otherwise required by this Agreement, no Party shall take any action, fail to take any action, cause any action to be taken or cause any action to fail to be taken that could reasonably be expected to prevent (1) the transactions described in subsections (a), (b) and (c) from each qualifying as a tax-deferred contribution within the meaning of Section 351 of the Code, or (2) AIM from being treated as a United States domestic corporation for U.S. federal income tax purposes under Section 7874(b) of the Code. Each Party hereto agrees to act in good faith, consistent with the terms of this Agreement and the intent of the Parties and the intended treatment of such transactions as set forth in this Section 1.10. Notwithstanding the foregoing, no Party makes any representation, warranty or covenant to any other Party or to any Acreage unitholder or other holder of Acreage securities (including, without limitation, stock options, warrants, subscription receipts, debt instruments or other similar rights or instruments) regarding the tax treatment of the transactions contemplated by this Agreement, including, but not limited to, whether the transactions described in subsections (a), (b) and (c) will each qualify as a tax-deferred contribution within the meaning of Section 351 of the Code or whether AIM will be treated as a United States domestic corporation for U.S. federal income tax purposes under Section 7874(b) of the Code as a result of the transactions set forth in subsection (b).

| 1.11 | Canadian Tax Election |

AIM will jointly elect with each Canadian Resident Shareholder who requests that AIM do so, in the form and within the time limits prescribed for such purposes, that the Canadian Resident Shareholder will be deemed pursuant to section 85 of the ITA to have disposed of his, her or its shares of USCo1 at an elected amount to be determined by the Canadian Resident Shareholder. AIM shall not be responsible for the proper completion of any section 85 election form nor, except for the obligation to sign and return duly completed election forms which are received within ninety (90) days after the Effective Date, for any taxes, interest or penalties resulting from the failure of a Canadian Resident Shareholder to complete or file such election forms properly in the form and manner and within the time prescribed by the ITA (or any applicable provincial legislation). In its sole discretion, AIM may choose to sign and return an election form received by it more than ninety (90) days following the Effective Date, but will have no obligation to do so.

| 1.12 | Board of Directors and Officers |

Each of the Parties hereby agrees that concurrently with the completion of the Business Combination, all of the current directors and officers of AIM shall resign without payment by or any liability to AIM or Amalco, and each such director and officer shall execute and deliver a release in favour of AIM, Acreage and Amalco, in a form acceptable to AIM and Acreage, and the board of directors of AIM shall consist of seven directors to be nominated by Acreage, in its sole discretion (collectively, the “New AIM Directors”).

CAN: 28037112.10

| -7- |

ARTICLE II

REPRESENTATIONS AND WARRANTIES OF ACREAGE

Acreage represents and warrants to and in favour of AIM and Subco and acknowledges that AIM and Subco are relying on such representations and warranties in connection with this Agreement and the transactions contemplated herein:

| 2.1 | Organization and Good Standing |

| (a) | Acreage is a limited liability company organized, validly existing, and in good standing under the Laws of the jurisdiction of its formation and is qualified to transact business and is in good standing as a foreign company in the jurisdictions where it is required to qualify in order to conduct its business as presently conducted, except where the failure to be so qualified would not have a Material Adverse Effect on Acreage. |

| (b) | Acreage has the corporate power and authority to own, lease or operate its properties and to carry on its business as currently conducted. |

| 2.2 | Consents, Authorizations, and Binding Effect |

| (a) | Acreage may execute, deliver and perform this Agreement without the necessity of obtaining any consent, approval, authorization or waiver, or giving any notice or otherwise, except: |

| (i) | consents, approvals, authorizations and waivers which have been obtained (or will be obtained prior to the Effective Date) and are not subject to any unfulfilled conditions, and in full force and effect, and notices which have been given on a timely basis; or |

| (ii) | those which, if not obtained or made, would not (A) prevent or materially delay the consummation of the Amalgamation or otherwise prevent Acreage from performing, in all material respects, its obligations under this Agreement, and (B) result in a Material Adverse Effect on Acreage. |

| (b) | Acreage has the necessary corporate power and authority to execute and deliver this Agreement and to perform its obligations hereunder. |

| (c) | This Agreement has been duly executed and delivered by Acreage and constitutes a legal, valid, and binding obligation of Acreage, enforceable against it in accordance with its terms, except as may be limited by bankruptcy, reorganization, insolvency and similar Laws of general application relating to or affecting the enforcement of creditors’ rights or the relief of debtors; and that the remedy of specific performance and injunctive and other forms of equitable relief may be subject to equitable defenses and to the discretion of the court before which any proceeding therefor may be brought. |

CAN: 28037112.10

| -8- |

| (d) | The execution, delivery, and performance of this Agreement will not: |

| (i) | constitute a violation of the constating documents of Acreage; |

| (ii) | conflict with, result in the breach of, or constitute a default or give to others a right of termination, cancellation, creation or acceleration of any material obligation under or the loss of any material benefit under or the creation of any benefit or right of any third party under any material Contract, material permit or material license to which Acreage is a party or as to which any of its property is subject which in any such case would have a Material Adverse Effect on Acreage; or |

| (iii) | constitute a violation of any Law applicable or relating to Acreage or its business. |

| 2.3 | Litigation and Compliance |

| (a) | There are no Proceedings or Governmental investigations pending or, to the knowledge of Acreage, threatened: |

| (i) | against or affecting Acreage or with respect to or affecting any asset or property owned, leased or used by Acreage; or |

| (ii) | which question or challenge the validity of this Agreement, or the Amalgamation or any action taken or to be taken pursuant to this Agreement, or the Amalgamation; |

| (iii) | except for actions, suits, claims or proceedings which would not, in the aggregate, have a Material Adverse Effect on Acreage. |

| (b) | Except as provided in Section 10.4 of this Agreement, Acreage has conducted and is conducting its business in compliance with, and is not in default or violation under, and has not received notice asserting the existence of any default or violation under, any Law applicable to its business or operations, except for non-compliance, defaults and violations which would not, in the aggregate, have a Material Adverse Effect on Acreage. |

| (c) | Neither Acreage, nor any asset of Acreage is subject to any judgment, order or decree entered in any lawsuit or proceeding which has had, or which is reasonably likely to have, a Material Adverse Effect on Acreage or which is reasonably likely to prevent Acreage from performing its obligations under this Agreement. |

| (d) | Acreage has duly filed or made all reports and returns required to be filed by it with any Governmental Authority and has obtained all permits, licenses, consents, approvals, certificates, registrations and authorizations (whether Governmental, regulatory or otherwise) which are required in connection with its business and operations, except where the failure to do so has not had and would not reasonably have a Material Adverse Effect on Acreage. |

| 2.4 | Financial Statements |

The financial statements (including, in each case, any notes thereto) of Acreage, based on the current drafts thereof as at the date hereof, for the years ended December 31, 2017 and 2016 and for the six month period ended June 30, 2018 were prepared in accordance with IFRS, applied on a consistent basis during the periods involved and fairly presented in all material respects the consolidated assets, liabilities and financial condition of Acreage as of the respective dates thereof and the consolidated earnings, results of operations and changes in financial position of Acreage for the periods then ended.

CAN: 28037112.10

| -9- |

| 2.5 | Taxes |

Each Acreage Group Member has timely filed, or has caused to be timely filed on its behalf, all material Tax Returns required to be filed by it prior to the date hereof, all such Tax Returns are complete and accurate in all material respects. All Taxes shown to be due on such Tax Returns, or otherwise owed, have been timely paid, other than those which are being contested in good faith and in respect of which adequate reserves have been provided in the financial statements of Acreage. No deficiency with respect to any Taxes has been proposed, asserted or assessed in writing against any Acreage Group Member, there are no actions, suits, proceedings, investigations or claims pending or threatened against any Acreage Group Member in respect of Taxes or any matters under discussion with any Government relating to Taxes, in each case which are likely to have a Material Adverse Effect on the Acreage Group. Each Acreage Group Member has withheld from each payment made to any of their past or present employees, officers or directors, and to any non-resident of Canada, the amount of all material Taxes required to be withheld therefrom and have paid the same to the proper tax or receiving officers within the time required under applicable Law. Each Acreage Group Member has remitted to the appropriate tax authorities within the time limits required all amounts collected by it in respect of Taxes. There are no material Liens for Taxes upon any asset of an Acreage Group Member except Liens for Taxes not yet due.

| 2.6 | Due Diligence Investigations |

All information relating to the business, assets, liabilities, properties, capitalization or financial condition of Acreage provided by Acreage or its Representatives to AIM is true, accurate and complete in all material respects and Acreage has not omitted to disclose in writing and provide materials in respect of any material fact or which would otherwise cause information provided to be untrue or incomplete in a material respect.

| 2.7 | Brokers |

Other than in connection with the Financing, neither Acreage nor, to the knowledge of Acreage, any of its Associates, Affiliates or Representatives has retained any broker or finder in connection with the Amalgamation or the other transactions contemplated hereby, nor have any of the foregoing incurred any liability to any broker or finder by reason of any such transaction.

| 2.8 | Anti-Bribery Laws |

Neither Acreage, nor to the knowledge of Acreage, any Representative of Acreage, has (i) violated any anti-bribery or anti-corruption laws applicable to Acreage, including but not limited to the U.S. Foreign Corrupt Practices Act and Canada’s Corruption of Foreign Public Officials Act, or (ii) offered, paid, promised to pay, or authorized the payment of any money, or offered, given, promised to give, or authorized the giving of anything of value, that goes beyond what is reasonable and customary and/or of modest value: (X) to any Government Official, whether directly or through any other person, for the purpose of influencing any act or decision of a Government Official in his or her official capacity; inducing a Government Official to do or omit to do any act in violation of his or her lawful duties; securing any improper advantage; inducing a Government Official to influence or affect any act or decision of any Governmental Authority; or assisting any Representative of Acreage in obtaining or retaining business for or with, or directing business to, any person; or (Y) to any person, in a manner which would constitute or have the purpose or effect of public or commercial bribery, or the acceptance of or acquiescence in extortion, kickbacks, or other unlawful or improper means of obtaining business or any improper advantage. Neither Acreage nor to the knowledge of Acreage, any director, officer, employee, consultant, Representative or agent of the foregoing, has (i) conducted or initiated any review, audit, or internal investigation that concluded Acreage or any director, officer, employee, consultant, Representative or agent of the foregoing violated such laws or committed any material wrongdoing, or (ii) made a voluntary, directed, or involuntary disclosure to any Governmental Authority responsible for enforcing anti-bribery or anti-corruption Laws, in each case with respect to any alleged act or omission arising under or relating to non-compliance with any such Laws, or received any notice, request, or citation from any person alleging non-compliance with any such Laws.

CAN: 28037112.10

| -10- |

ARTICLE III

REPRESENTATIONS AND WARRANTIES OF FINCO

▇▇▇▇▇ represents and warrants to and in favour of AIM and Subco and acknowledges that AIM and Subco are relying on such representations and warranties in connection with this Agreement and the transactions contemplated herein:

| 3.1 | Organization and Good Standing |

| (a) | ▇▇▇▇▇ is a corporation duly organized, validly existing, and in good standing under the Laws of the jurisdiction of its incorporation and is qualified to transact business and is in good standing as a foreign corporation in the jurisdictions where it is required to qualify in order to conduct its business as presently conducted, except where the failure to be so qualified would not have a Material Adverse Effect on ▇▇▇▇▇. There are no subsidiaries of ▇▇▇▇▇. |

| (b) | ▇▇▇▇▇ has the corporate power and authority to own, lease or operate its properties and to carry on its business as currently conducted. |

| 3.2 | Consents, Authorizations, and Binding Effect |

| (a) | ▇▇▇▇▇ may execute, deliver and perform this Agreement without the necessity of obtaining any consent, approval, authorization or waiver, or giving any notice or otherwise, except: |

| (i) | consents, approvals, authorizations and waivers which have been obtained (or will be obtained prior to the Effective Date) and are unconditional, and in full force and effect, and notices which have been given on a timely basis; |

| (ii) | the approval of the ▇▇▇▇▇ Amalgamation Resolution by the holders of the ▇▇▇▇▇ Shares; |

| (iii) | the filing of a Form 13 (Amalgamation Application) with the British Columbia Registrar of Companies under the BCBCA; or |

| (iv) | those which, if not obtained or made, would not prevent or delay the consummation of the Amalgamation or otherwise prevent ▇▇▇▇▇ from performing its obligations under this Agreement and would not be reasonably likely to have a Material Adverse Effect on ▇▇▇▇▇. |

CAN: 28037112.10

| -11- |

| (b) | ▇▇▇▇▇ has the necessary corporate power and authority to execute and deliver this Agreement and to perform its obligations hereunder and to complete the Amalgamation, subject to the approval of the ▇▇▇▇▇ Amalgamation Resolution by the ▇▇▇▇▇ Shareholders. |

| (c) | The sole director of ▇▇▇▇▇ has: (i) approved the Business Combination and the execution, delivery and performance of this Agreement, and (ii) directed that the ▇▇▇▇▇ Amalgamation Resolution be submitted to the ▇▇▇▇▇ Shareholder. |

| (d) | This Agreement has been duly executed and delivered by ▇▇▇▇▇ and constitutes a legal, valid, and binding obligation of ▇▇▇▇▇, enforceable against it in accordance with its terms, except as may be limited by bankruptcy, reorganization, insolvency and similar Laws of general application relating to or affecting the enforcement of creditors’ rights or the relief of debtors; and that the remedy of specific performance and injunctive and other forms of equitable relief may be subject to equitable defenses and to the discretion of the court before which any proceeding therefor may be brought. |

| (e) | The execution, delivery, and performance of this Agreement will not: |

| (i) | constitute a violation of the notice of articles or articles, as amended, of ▇▇▇▇▇; |

| (ii) | conflict with, result in the breach of or constitute a default or give to others a right of termination, cancellation, creation or acceleration of any obligation under or the loss of any material benefit under or the creation of any benefit or right of any third party under any material Contract, material permit or material license to which ▇▇▇▇▇ is a party or as to which any of its property is subject which in any such case would have a Material Adverse Effect on ▇▇▇▇▇; or |

| (iii) | constitute a violation of any Law applicable or relating to ▇▇▇▇▇ or its business except for such violations which would not have a Material Adverse Effect on ▇▇▇▇▇. |

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF AIM AND SUBCO

Each of AIM and Subco hereby represents and warrants to Acreage, ▇▇▇▇▇, USCo1 and USCo2 as follows and acknowledges that each of Acreage, ▇▇▇▇▇, USCo1 and USCo2 is relying on such representations and warranties in entering into this Agreement and completing the transactions contemplated herein:

| 4.1 | Organization and Good Standing |

| (a) | Each of AIM and Subco is a corporation duly organized, validly existing, and in good standing under the Laws of the jurisdiction of its incorporation and is qualified to transact business and is in good standing as a foreign corporation (or the equivalent) in the jurisdictions where it is required to qualify in order to conduct its business as presently conducted, except where the failure to be so qualified would not have a Material Adverse Effect on AIM or Subco. Except for Subco, there are no other material subsidiaries of AIM and AIM does not have any equity or other interest or any rights convertible or exchangeable for, or otherwise entitling it to, any equity interests in any Person other than its holders of Subco Shares. |

CAN: 28037112.10

| -12- |

| (b) | Each of AIM and Subco has the corporate power and authority to own, lease, or operate its properties and to carry on its business as now conducted. |

| 4.2 | Consents, Authorizations, and Binding Effect |

| (a) | AIM and Subco may execute, deliver, and perform this Agreement without the necessity of obtaining any consent, approval, authorization or waiver, or giving any notice or otherwise, except: |

| (i) | the approval of the Subco Amalgamation Resolution by AIM as sole shareholder of Subco; |

| (ii) | the approval of the CSE for the listing of the Subordinate Voting Shares and, to the extent required, the other transactions contemplated hereby; |

| (iii) | consents, approvals, authorizations and waivers, which have been obtained (or will be obtained prior to the Effective Date), and are unconditional and in full force and effect and notices which have been given on a timely basis; |

| (iv) | the approval of the Continuance from AIM Shareholders and the filings required to complete the Continuance; |

| (v) | the filing of Articles of Amendment and a Form 13 (Amalgamation Application) with the British Columbia Registrar of Companies under the BCBCA; |

| (vi) | the filing of the documents prescribed under the BCBCA to effect the appointment of the New AIM Directors and the New AIM Management; and |

| (vii) | those which, if not obtained or made, would not prevent or delay the consummation of the Amalgamation or otherwise prevent AIM from performing its obligations under this Agreement and would not be reasonably likely to have a Material Adverse Effect on AIM or Subco. |

| (b) | Each of AIM and Subco has the necessary corporate power and authority to execute and deliver this Agreement and to perform its respective obligations hereunder and to complete the Amalgamation, subject to the approval of the matters set out in the AIM Circular by AIM Shareholders at the AIM Meeting and the Subco Amalgamation Resolution by AIM by written consent resolution. |

| (c) | The board of directors of AIM have unanimously: (i) approved the Business Combination and the execution, delivery and performance of this Agreement; (ii) directed that the matters set out in the AIM Circular be submitted to the AIM Shareholders at the AIM Meeting, and unanimously recommended approval thereof and (iii) approved the execution and delivery of the Subco Amalgamation Resolution by AIM. |

| (d) | The board of directors of Subco has unanimously approved the Amalgamation and the execution, delivery and performance of this Agreement. |

| (e) | This Agreement has been duly executed and delivered by AIM and Subco and constitutes a legal, valid, and binding obligation of AIM and Subco enforceable against each of them in accordance with its terms, except as may be limited by bankruptcy, reorganization, insolvency and similar Laws of general application relating to or affecting the enforcement of creditors’ rights or the relief of debtors; and that the remedy of specific performance and injunctive and other forms of equitable relief may be subject to equitable defences and to the discretion of the court before which any proceeding therefor may be brought. |

CAN: 28037112.10

| -13- |

| (f) | The execution, delivery, and performance of this Agreement will not: |

| (i) | constitute a violation of the notice of articles or articles of AIM or the notice of articles or articles of Subco; |

| (ii) | conflict with, result in the breach of or constitute a default or give to others a right of termination, cancellation, creation or acceleration of any material obligation under, or the loss of any material benefit under or the creation of any benefit or right of any third party under any Contract, permit or license to which either AIM or Subco is a party to or bound by or as to which any of its property is subject; |

| (iii) | constitute a violation of any Law applicable or relating to AIM or Subco or their respective businesses; or |

| (iv) | result in the creation of any Lien upon any of the assets of AIM or Subco. |

| (g) | Neither AIM or Subco nor any Affiliate or Associate thereof, nor to the knowledge of AIM, any Representative of AIM or Subco, beneficially owns or has the right to acquire a beneficial interest in any ▇▇▇▇▇ Shares. |

| 4.3 | Litigation and Compliance |

| (a) | There are no actions, suits, claims or proceedings, whether in equity or at law, or any Governmental investigations pending or, to the knowledge of AIM, threatened: |

| (i) | against or affecting AIM or Subco or with respect to or affecting any asset or property owned, leased or used by AIM or Subco; or |

| (ii) | which question or challenge the validity of this Agreement or the Amalgamation or any action taken or to be taken pursuant to this Agreement or the Amalgamation; |

and, to the knowledge of AIM, there is no basis for any such action, suit, claim, proceeding or investigation.

| (b) | Each of AIM and Subco has conducted and is conducting its business in compliance with, and is not in default or violation under, and has not received notice asserting the existence of any default or violation under, any Law applicable to the businesses or operations of AIM and/or Subco, except for non-compliance, defaults and violations that are historical in nature and have been remedied and no longer exist, and which would not, in the aggregate have a Material Adverse Effect on AIM and Subco. Neither AIM nor Subco currently carries on any active business. |

CAN: 28037112.10

| -14- |

| (c) | Neither AIM nor Subco nor any assets of AIM or Subco, is subject to any judgment, order or decree entered in any Proceeding. |

| (d) | Each of AIM and Subco has duly filed or made all reports and returns required to be filed by it with any Government and has obtained all permits, licenses, consents, approvals, certificates, registrations and authorizations (whether Governmental, regulatory or otherwise) which are required in connection with the business and operations of AIM and Subco. |

| 4.4 | Public Filings; Financial Statements |

| (a) | AIM has filed all documents required pursuant to applicable Canadian Securities Laws (the “AIM Securities Documents”). As of their respective dates, the AIM Securities Documents complied in all material respects with the then applicable requirements of the Canadian Securities Laws (and all other applicable securities laws) and, at the respective times they were filed, none of the AIM Securities Documents contained any untrue statement of a material fact (as defined in Canadian Securities Laws) or omitted to state a material fact required to be stated therein or necessary to make any statement therein, in light of the circumstances under which it was made, not misleading. AIM has not filed any confidential filings which have not at the date hereof become publicly available under AIM’s profile on SEDAR. |

| (b) | The consolidated financial statements (including, in each case, any notes thereto) of AIM for the years ended August 31, 2017 and 2016 and for the three and nine month periods ended May 31, 2018 included in the AIM Securities Documents were prepared in accordance with IFRS applied on a consistent basis during the periods involved (except as may be indicated therein or in the notes thereto) and fairly present in all material respects the consolidated assets, liabilities and financial condition of AIM and its consolidated subsidiaries as of the respective dates thereof and the consolidated earnings, results of operations and changes in financial position of AIM and its consolidated subsidiaries for the periods then ended (subject, in the case of unaudited statements, to the absence of footnote disclosure and to customary year-end audit adjustments and to any other adjustments described therein). Except as disclosed in the AIM Securities Documents, AIM has not, since August 31, 2017, made any change in the accounting practices or policies applied in the preparation of its financial statements. |

| (c) | AIM is now, and on the Effective Date will be, a “reporting issuer” (or its equivalent) under Canadian Securities Laws in the Province of Ontario. AIM is not currently in default in any material respect of any requirement of Canadian Securities Laws and AIM is not included on a list of defaulting reporting issuers maintained by any of the securities commissions or similar regulatory authorities in each of such Provinces. |

| (d) | There has not been any reportable event (within the meaning of National Instrument 51- 102 - Continuous Disclosure Obligations of the Canadian Securities Administrators) since August 31, 2017 with the present or former auditors of AIM. |

| (e) | No order ceasing or suspending trading in securities of AIM or Subco or prohibiting the sale of securities by AIM or Subco has been issued that remains outstanding and, to the knowledge of AIM, no proceedings for this purpose have been instituted, are pending, contemplated or threatened by any securities commission, self-regulatory organization, stock exchange or other Governmental Authority. |

CAN: 28037112.10

| -15- |

| (f) | AIM maintains a system of internal accounting controls sufficient to provide reasonable assurance that: (i) transactions are executed in accordance with management’s general or specific authorizations; (ii) access to assets is permitted only in accordance with management’s general or specific authorization; and (iii) the recorded accountability for assets is compared with the existing assets at reasonable intervals and appropriate action is taken with respect to any differences. |

| (g) | There are no contracts with AIM or Subco, on the one hand, and: (i) any officer or director of AIM or Subco; (ii) any holder of 5% or more of the equity securities of AIM; or (iii) an Associate or Affiliate of a person in (i) or (ii), on the other hand. |

| 4.5 | Taxes |

Each of AIM and Subco has timely filed, or has caused to be timely filed on its behalf, all Tax Returns required to be filed by it prior to the date hereof, all such Tax Returns are complete and accurate in all material respects. All Taxes shown to be due on such Tax Returns, or otherwise owed, have been timely paid, other than those which are being contested in good faith and in respect of which adequate reserves have been provided in the most recently published financial statements of AIM. AIM’s audited consolidated financial statements for the period ended August 31, 2017 reflect a reserve in accordance with IFRS for all Taxes payable by AIM for all taxable periods and portions thereof through the date of such financial statements. No deficiency with respect to any Taxes has been proposed, asserted or assessed in writing against AIM or Subco, there are no actions, suits, proceedings, investigations or claims pending or threatened against AIM or Subco in respect of Taxes or any matters under discussion with any Government relating to Taxes, and no waivers or written requests for waivers of the time to assess any such Taxes are outstanding or pending. Each of AIM and Subco has withheld from each payment made to any of their past or present employees, officers or directors, and to any non-resident of Canada, the amount of all Taxes required to be withheld therefrom and have paid the same to the proper tax or receiving officers within the time required under applicable Law. Each of AIM and Subco has remitted to the appropriate tax authorities within the time limits required all amounts collected by it in respect of Taxes. There are no Liens for Taxes upon any asset of AIM or Subco except Liens for Taxes not yet due.

| 4.6 | Pension and Other Employee Plans and Agreement |

Other than the AIM stock option plan, AIM does not maintain or contribute to any Employee Plan. The AIM Stock Option Plan has been approved by the AIM Shareholders and was adopted by AIM in accordance with the requirements of Canadian Securities Laws.

| 4.7 | Labour Relations |

| (a) | No employees of AIM are covered by any collective bargaining agreement. |

| (b) | There are no representation questions, arbitration proceedings, labour strikes, slow-downs or stoppages, material grievances, or other labour troubles pending or, to the knowledge of AIM, threatened with respect to the employees or former employees of AIM; and (ii) to the knowledge of AIM, there are no present or pending applications for certification (or the equivalent procedure under any applicable Law) of any union as the bargaining agent for any employees of AIM. |

| (c) | Subco has no employees and has not engaged any independent contractors. |

CAN: 28037112.10

| -16- |

| (d) | At the Closing, AIM shall not have any employees or independent contractors, and shall not have any liabilities in respect to any former employees or independent contractors. |

| 4.8 | Contracts |

| (a) | Neither AIM nor Subco is not a party to or bound by any Contract other than as set out on Schedule 4.8 hereto. |

| (b) | Each of AIM and Subco and, to the knowledge of AIM and Subco, each of the other parties thereto, is in material compliance with all covenants under all Contracts it has entered into, and no default has occurred which, with notice or lapse of time or both, would directly or indirectly constitute such a default. |

| (c) | No payment is required to be made, or obligation accrued that, if paid, by AIM as a result of the consummation of any of the matters contemplated by this Agreement that would result in AIM having a cash balance of less than $nil at the time of the completion of the Business Combination. |

| 4.9 | Absence of Certain Changes, Etc. |

Except as contemplated by the Business Combination and this Agreement, since August 31, 2017:

| (a) | there has been no Material Adverse Change to AIM; |

| (b) | AIM has not: |

| (i) | sold, transferred, distributed, or otherwise disposed of or acquired a material amount of its assets, or agreed to do any of the foregoing, except in the ordinary course of business; |

| (ii) | incurred any Liability (whether absolute, accrued, contingent or otherwise) other than those Liabilities set out in Schedule 4.14 or outside of the ordinary and usual course of business; |

| (iii) | prior to the date hereof, made or agreed to make any capital expenditure or commitment for additions to property, plant, or equipment; |

| (iv) | made or agreed to make any material increase in the compensation payable to any employee or director except for increases made in the ordinary course of business and consistent with presently existing policies or agreement or past practice; |

| (v) | conducted its operations other than in all material respects in the normal course of business; |

| (vi) | entered into any transaction or Contract, or amended or terminated any transaction or Contract, except transactions or Contracts entered into in connection with the Business Combination or which will form part of the settlement of its outstanding debts to be completed prior to the Effective Time as part of the Business Combination; and |

CAN: 28037112.10

| -17- |

| (vii) | agreed or committed to do any of the foregoing; and |

| (c) | there has not been any declaration, setting aside or payment of any dividend or other distribution to AIM Shareholders. |

| 4.10 | Subsidiaries |

| (a) | All of the outstanding shares in the capital of Subco are owned of record and beneficially by AIM free and clear of all Liens. AIM does not own, directly or indirectly, any equity interest of or in any entity or enterprise other than Subco, Applied Inventions Management Corp. USA (Delaware company) and Tour Technologies Inc. (Montana company). Neither Applied Inventions Management Corp. USA nor Tour Technologies Inc. has any assets or any liabilities (contingent or otherwise) nor does it carry on any business. |

| (b) | All outstanding Subco Shares have been duly authorized and are validly issued, fully paid and non-assessable. |

| 4.11 | Capitalization |

| (a) | The authorized capital of AIM consists of an unlimited number of class A subordinate voting shares, an unlimited number of class B multiple voting shares an unlimited number of class C preferred shares, issuable in series. As of the date hereof, there are 388,435 class A subordinate voting shares and 7,839,599 class B multiple voting shares issued and outstanding and no class C preferred shares outstanding. |

| (b) | All issued and outstanding shares in the capital of AIM have been duly authorized and are validly issued, fully paid and non-assessable, free of pre-emptive rights. |

| (c) | Other than the AIM Stock Options, AIM Warrants and AIM Convertible Debenture, there are no authorized, outstanding or existing: |

| (i) | voting trusts or other agreements or understandings with respect to the voting of any AIM Shares to which AIM or Subco is a party; |

| (ii) | securities issued by AIM or Subco that are convertible into or exchangeable for any AIM Shares; |

| (iii) | agreements, options, warrants, or other rights capable of becoming agreements, options or warrants to purchase or subscribe for any AIM Shares or securities convertible into or exchangeable or exercisable for any such shares, in each case granted, extended or entered into by AIM or Subco; |

| (iv) | agreements of any kind to which either AIM or Subco is party relating to the issuance or sale of any AIM Shares, or any securities convertible into or exchangeable or exercisable for any AIM Shares or requiring AIM to qualify securities of for distribution by prospectus under Canadian Securities Laws; or |

| (v) | agreements of any kind which may obligate AIM to issue or purchase any of its securities. |

CAN: 28037112.10

| -18- |

| 4.12 | Environmental Matters |

Each of AIM and Subco is in compliance with all applicable Environmental Laws and has not violated, at any time, any environmental laws. All operations of AIM, past or present, conducted on any real property, leased or owned by AIM or any entity in which AIM directs or indirectly has any interest, past or present, and such properties themselves while occupied by AIM or any entity in which AIM directs or indirectly has any interest, have been and are in compliance with all Environmental Laws. AIM is not is the subject of: (i) any proceeding, application, order or directive which relates to any environmental, health or safety matter; or (ii) any demand or notice with respect to any Environmental Laws, and no set of circumstances exists pursuant to which AIM may, directly or indirectly, have any liability for any such matters. AIM has no reclamation obligations and is not required to make any reserves for reclamation obligations pursuant to IFRS. Neither AIM nor any entity in which AIM has, directly or indirectly, had any interest, has caused or permitted the release of any hazardous substances on or to any of the assets or any other real property owned or leased or occupied, either past or present, (including underlying soils and substrata, surface water and groundwater) in such a manner as: (A) would be reasonably likely to impose liability for cleanup, natural resource damages, loss of life, personal injury, nuisance or damage to other property; (B) would be reasonably likely to result in imposition of a Lien, charge or other encumbrance on or the expropriation of any of the assets; or (C) at levels which exceed remediation and/or reclamation standards under any Environmental Laws or standards published or administered by those Governmental Authorities responsible for establishing or applying such standards. There is no environmental liability or factors likely to give rise to any environmental liability (i) affecting AIM; or (ii) retained in any manner by AIM in connection with any activities conducted prior to the date hereof.

| 4.13 | Licence and Title |

AIM is the absolute legal and beneficial owner of, and has good and marketable title to, all of its property or assets (real and personal, tangible and intangible, including leasehold interests) including all the properties and assets reflected in the balance sheet forming part of AIM’s financial statements for the year ended August 31, 2017, except as indicated in the notes thereto, and such properties and assets are not subject to any mortgages, Liens, charges, pledges, security interests, claims, demands or defect in title of any kind except as is reflected in the balance sheets forming part of such financial statements and in the notes thereto and AIM owns, possesses, or has obtained and is in compliance in all material respects with, all licences, permits, certificates, orders, grants and other authorizations of or from any Governmental Authority necessary to conduct its business as currently conducted, in accordance in all material respects with applicable Laws.

| 4.14 | Indebtedness |

As at the date of this Agreement, no indebtedness for borrowed money was owing or guaranteed by AIM or Subco and neither AIM nor Subco has any Liabilities (contingent or otherwise) other than obligations for the payment of Liabilities set out in Schedule 4.14 and those incurred in the ordinary course of business and in connection with the Business Combination.

| 4.15 | Undisclosed Liabilities |

There are no Liabilities of AIM, Subco or Amalco of any kind whatsoever, whether or not accrued and whether or not determined or determinable, in respect of which either AIM or Subco may become liable on or after the consummation of the transactions contemplated hereby other than the Liabilities set out in Schedule 4.14 and those incurred in the ordinary course of business and in connection with the Business Combination.

CAN: 28037112.10

| -19- |

| 4.16 | Due Diligence Investigations |

All information relating to the business, assets, liabilities, properties, capitalization or financial condition of AIM or Subco provided by AIM or its Representatives to Acreage, ▇▇▇▇▇, USCo1 or USCo2 is true, accurate and complete in all material respects and AIM has not omitted to disclose in writing and provide materials in respect of any material fact or which would otherwise cause information provided to be untrue or incomplete.

| 4.17 | Brokers |

Neither AIM nor Subco or, to the knowledge of AIM, any of their respective Associates, Affiliates or Representatives have retained any broker or finder in connection with the transactions contemplated hereby, nor have any of the foregoing incurred any Liability to any broker or finder by reason of any such transaction.

| 4.18 | Anti-Bribery Laws |

Neither AIM nor Subco nor to the knowledge of AIM or Subco, any Representative of the foregoing, has (i) violated any anti-bribery or anti-corruption laws applicable to AIM or Subco, including but not limited to the U.S. Foreign Corrupt Practices Act and Canada’s Corruption of Foreign Public Officials Act, or (ii) offered, paid, promised to pay, or authorized the payment of any money, or offered, given, promised to give, or authorized the giving of anything of value, that goes beyond what is reasonable and customary and/or of modest value: (X) to any Government Official, whether directly or through any other person, for the purpose of influencing any act or decision of a Government Official in his or her official capacity; inducing a Government Official to do or omit to do any act in violation of his or her lawful duties; securing any improper advantage; inducing a Government Official to influence or affect any act or decision of any Governmental Authority; or assisting any Representative of AIM or Subco in obtaining or retaining business for or with, or directing business to, any person; or (Y) to any person, in a manner which would constitute or have the purpose or effect of public or commercial bribery, or the acceptance of or acquiescence in extortion, kickbacks, or other unlawful or improper means of obtaining business or any improper advantage. Neither AIM nor Subco nor to the knowledge of AIM, any director, officer, employee, consultant, Representative or agent of foregoing, has (i) conducted or initiated any review, audit, or internal investigation that concluded AIM or Subco or any director, officer, employee, consultant, Representative or agent of the foregoing violated such laws or committed any material wrongdoing, or (ii) made a voluntary, directed, or involuntary disclosure to any Governmental Authority responsible for enforcing anti-bribery or anti-corruption Laws, in each case with respect to any alleged act or omission arising under or relating to non-compliance with any such Laws, or received any notice, request, or citation from any person alleging non-compliance with any such Laws.

ARTICLE V

CONDITIONS TO OBLIGATIONS OF AIM

| 5.1 | Conditions Precedent to Completion of the Business Combination |

The obligation of AIM and Subco to complete the Business Combination is subject to the satisfaction of the following conditions on or prior to the Effective Date, each of which may be waived by AIM and Subco:

| (a) | The representations and warranties of Acreage and ▇▇▇▇▇ set forth in Article II and Article III qualified as to materiality shall be true and correct, and the representations and warranties not so qualified shall be true and correct in all material respects as of the date of this Agreement and on the Effective Date as if made on the Effective Date, except for such representations and warranties made expressly as of a specified date which shall be true and correct in all material respects as of such date. |

CAN: 28037112.10

| -20- |

| (b) | Acreage and ▇▇▇▇▇ shall have performed and complied in all material respects with all covenants and agreements required by this Agreement to be performed or complied with by them prior to or on the Effective Date and AIM shall have received a certificate signed on behalf of Acreage by an executive officer thereof to such effect dated as of the Effective Date. |

| (c) | There shall not have occurred any Material Adverse Change in Acreage since the date of this Agreement. |

| (d) | The AIM Shareholders shall have approved the matters set out in the AIM Circular at the AIM Meeting. |

| (e) | Completion of the Financing by ▇▇▇▇▇. |

ARTICLE VI

CONDITIONS TO OBLIGATIONS OF ACREAGE, ▇▇▇▇▇, USCO1 AND USCO2

| 6.1 | Conditions Precedent to Completion of the Business Combination |

The obligation of Acreage, ▇▇▇▇▇, USCo1 and USCo2 to complete the Business Combination is subject to the satisfaction of the following conditions on or prior to the Effective Date, each of which may be waived by Acreage:

| (a) | The representations and warranties of AIM and Subco set forth in Article IV qualified as to materiality shall be true and correct, and the representations and warranties not so qualified shall be true and correct in all material respects as of the date hereof and on the Effective Date as if made on the Effective Date, except for such representations and warranties made expressly as of a specified date which shall be true and correct in all material respects as of such date. |

| (b) | AIM and Subco shall have performed and complied in all material respects with all covenants and agreements required by this Agreement to be performed or complied with by AIM and Subco, respectively, prior to or on the Effective Date and Acreage shall have received certificates signed on behalf of AIM and Subco, respectively, by an executive officer thereof to such effect dated as of the Effective Date. |

| (c) | There shall not have occurred any Material Adverse Change to AIM or Subco since the date of this Agreement. |

| (d) | The AIM Shareholders shall have approved the matters set out in the AIM Circular at the AIM Meeting, including the approval of the Continuance, Name Change, Consolidation, the Share Amendments, the Subdivision, the election of the New Board of Directors and the election of the new auditors. |

| (e) | The AIM Shareholders shall have approved all matters necessary for or ancillary to, the completion of the transactions and the CSE listing. |

CAN: 28037112.10

| -21- |

| (f) | AIM shall have completed and filed all necessary documents in accordance with the BCBCA in respect of the matters set out in the AIM Circular to be approved at the AIM Meeting and the Name Change shall be effective. |

| (g) | All of the current directors and officers of AIM and Subco shall have resigned without payment by or any liability to AIM, Acreage, ▇▇▇▇▇, Subco or Amalco, and each such director and officer shall have executed and delivered a release in favour of AIM, Subco, Acreage, ▇▇▇▇▇ and Amalco, in a form acceptable to Acreage, acting reasonably. |

| (h) | The Consolidation shall have been completed in a manner satisfactory to Acreage, ▇▇▇▇▇, USCo1 and USCo2. |

| (i) | The securityholders of Acreage shall have entered into a contribution agreement providing for the contribution of their interests to USCo1 and/or USCo2 to the extent contemplated herein. |

| (j) | Acreage shall be satisfied in its sole discretion that at the time of the completion of the Business Combination AIM and Subco have no Liabilities other than those made in connection with the Business Combination and agreed to be paid by Acreage pursuant to Section 10.2. |

ARTICLE VII

COVENANTS

| 7.1 | Covenants of AIM |

| (a) | AIM covenants and agrees with Acreage that AIM will not, from the date of execution hereof to and including the Effective Date, except with the prior written consent of Acreage or otherwise contemplated herein, which consent shall be in the sole discretion of Acreage and may be unreasonably withheld: |

| (i) | issue any securities, other than AIM Shares issuable upon the due and proper exercise of the AIM Stock Options, AIM Warrants, AIM Convertible Debenture or in connection with the settlement of any outstanding debts; |

| (ii) | split, combine or reclassify any of its capital stock or issue or authorize or propose the issuance or distribution of any other securities in respect of, in lieu of or in substitution for, shares of its capital stock, except for the Subdivision, Share Amendments and Consolidation; |

| (iii) | incur any expenditures, other than in connection with the matters contemplated herein, public company requirements, including the holding of the AIM Meetings; |

| (iv) | declare or pay any dividends or distribute any of its properties or assets to any Person; |

| (v) | enter into any contracts other than in connection with the transactions contemplated herein; |

CAN: 28037112.10

| -22- |

| (vi) | alter or amend its articles or by-laws, except as contemplated in the Reorganization; |

| (vii) | acquire, directly or indirectly, any assets, including but not limited to securities of any other company; and |

| (viii) | incur or commit to incur any indebtedness for borrowed money or issue any debt securities; and |

| (b) | From the date hereof to and including the Effective Date, AIM will, and will cause Subco to: |

| (i) | use all commercially reasonable efforts to obtain all necessary consents, assignments or waivers from third parties and amendments or terminations to any instrument or agreement and take such other measures as may be necessary or desirable to fulfil its obligations under and to carry out the transactions contemplated by this Agreement; |

| (ii) | make other necessary filings and applications under applicable federal and provincial Laws required on the part of AIM and Subco in connection with the transactions contemplated in this Agreement, including properly filing all materials and taking all steps necessary to obtain the approval to list the Subordinate Voting Shares on the CSE immediately following the Business Combination; |

| (iii) | use all commercially reasonable efforts to conduct its affairs so that all of the AIM and Subco representations and warranties contained herein shall be true and correct on and as of the Effective Date as if made on the Effective Date, except to the extent that such representations and warranties require modification to give effect to the transactions contemplated herein; |

| (iv) | take all steps, and provide all assistance, as reasonably requested by Acreage (and at Acreage’s cost) to complete the dissolution of Applied Inventions Management Corp. USA and Tour Technologies Inc.; and |

| (v) | notify Acreage immediately upon becoming aware that any of the representations and warranties of AIM contained herein are no longer true and correct in any material respect. |

ARTICLE VIII

MUTUAL CONDITIONS PRECEDENT

| 8.1 | Mutual Conditions Precedent |

The obligations of AIM, Subco, Acreage, ▇▇▇▇▇, USCo1 and USCo2 to complete the Business Combination are subject to the satisfaction of the following conditions on or prior to the Effective Date, each of which may be waived only with the consent in writing of AIM and Acreage:

| (a) | all consents, waivers, permits, exemptions, orders, consents and approvals required to permit the completion of the Business Combination, the failure of which to obtain, individually or in the aggregate, could reasonably be expected to have a Material Adverse Effect on Acreage or AIM or materially impede the completion of the Business Combination, shall have been obtained; |

CAN: 28037112.10

| -23- |

| (b) | no temporary restraining order, preliminary injunction, permanent injunction or other order preventing the consummation of the Business Combination shall have been issued by any federal, state, or provincial court (whether domestic or foreign) having jurisdiction and remain in effect; |

| (c) | the Subordinate Voting Shares to be issued pursuant to the Business Combination shall have been conditionally approved for listing on the CSE, subject to standard conditions on the Effective Date or as soon as practicable thereafter; |

| (d) | on the Effective Date, no cease trade order or similar restraining order of any other provincial securities administrator relating to the AIM Shares, the Subordinate Voting Shares, the Multiple Voting Shares, the Proportionate Voting Shares, the ▇▇▇▇▇ Shares, the Acreage membership units or the Amalco Shares shall be in effect; |

| (e) | there shall not be pending or threatened any suit, action or proceeding by any Governmental Entity, before any court or Governmental Authority, agency or tribunal, domestic or foreign, that has a significant likelihood of success, seeking to restrain or prohibit the consummation of the Business Combination or any of the other transactions contemplated by this Agreement or seeking to obtain from AIM, Subco or ▇▇▇▇▇ any damages that are material in relation to AIM, Subco and ▇▇▇▇▇ and their subsidiaries taken as a whole; |

| (f) | the distribution of Amalco Shares, Subordinate Voting Shares, Multiple Voting Share and Proportionate Voting Shares pursuant to the Business Combination shall be exempt from the prospectus and registration requirements of applicable Canadian Securities Law either by virtue of exemptive relief from the securities regulatory authorities of each of the provinces of Canada or by virtue of applicable exemptions under Canadian Securities Laws and shall not be subject to resale restrictions under applicable Canadian Securities Laws (other than as applicable to control persons) or pursuant to section 2.6 of National Instrument 45-102 - Resale of Securities of the Canadian Securities Administrators); and |

| (g) | this Agreement shall not have been terminated in accordance with its terms. |

ARTICLE IX

CLOSING

| 9.1 | Closing |

The Closing shall take place at the offices of Acreage’s counsel, DLA Piper (Canada) LLP at 8:00 a.m. (Toronto time) on the Effective Date or on such other date and time as Acreage and AIM may agree.

| 9.2 | Termination of this Agreement |

This Agreement may be terminated at any time prior to the Effective Time, whether before or after approval of the matters set out in the AIM Circular by the AIM Shareholders or any other matters presented in connection with the Business Combination:

CAN: 28037112.10

| -24- |

| (a) | by mutual written consent of the Parties; |

| (b) | by AIM or Acreage if there has been a breach of any of the representations, warranties, covenants and agreements on the part of the other Party (the “Breaching Party”) set forth in this Agreement, which breach has or is likely to result in the failure of the conditions set forth in Section 5.1, 6.1 or 7.1, as the case may, to be satisfied and in each case has not been cured within ten (10) Business Days following receipt by the Breaching Party of written notice of such breach from the non-breaching Party (the “Non- |

Breaching Party”); or

| (c) | by any Party if any permanent order, decree, ruling or other action of a court or other competent authority restraining, enjoining or otherwise preventing the consummation of the Business Combination shall have become final and non-appealable; |

| 9.3 | Survival of Representations and Warranties; Limitation |

The representations and warranties set forth in herein shall expire and be terminated on the earlier of the Effective Date or the termination of this Agreement.

ARTICLE X

MISCELLANEOUS

| 10.1 | Further Actions |

Each of the Parties shall use its commercially reasonable efforts to properly satisfy all of the conditions set out in this Agreement, take all actions to cause the transactions contemplated herein to be implemented and not take any action that would, directly or indirectly, cause any of the conditions set out in this Agreement to fail to be satisfied at or prior to the Effective Time. From time to time, as and when requested by any Party, the other Parties shall execute and deliver, and use all commercially reasonable efforts to cause to be executed and delivered, such documents and instruments and shall take, or cause to be taken, such further or other actions as may be reasonably requested in order to:

| (a) | carry out the intent and purposes of this Agreement; |

| (b) | effect the Amalgamation (or to evidence the foregoing); and |

| (c) | consummate and give effect to the other transactions, covenants and agreements contemplated by this Agreement. |

| 10.2 | Transaction Costs |

Each of the Parties shall be responsible for its own costs incurred in connection with the transactions contemplated herein, provided; however, that Acreage agrees to pay certain AIM costs and expenses as set out in the Letter of Intent and to make certain payments to AIM as contemplated by, in accordance with and subject to the provisions of, Section 16 of the Letter of Intent.

| 10.3 | U.S. Federal Law Exclusions |

Notwithstanding anything in this Agreement or the other documents contemplated hereby to the contrary, neither Acreage nor ▇▇▇▇▇, nor any of their directors, officers, shareholders, employees, affiliates or other agents make any representation or warranty, whether express or implied, written or oral, on behalf of Acreage or ▇▇▇▇▇ as to the applicability of and compliance with United States federal Law dealing with the possession, use, cultivation, and/or transfer of cannabis (i.e., marijuana) and any related drug paraphernalia (including but not limited to Title 21 of the United States Code, the U.S. Controlled Substances Act, and 26 U.S.C. § 280E) as it relates to the Acreage or any of its subsidiaries or affiliates or their assets or the transactions contemplated by this Agreement.

CAN: 28037112.10

| -25- |

| 10.4 | Entire Agreement |

This Agreement, which includes the Schedules hereto and the other documents, agreements, and instruments executed and delivered pursuant to or in connection with this Agreement, contains the entire Agreement between the Parties with respect to matters dealt within herein and, except as expressly provided herein, supersedes all prior arrangements or understandings with respect thereto, including the Letter of Intent.

| 10.5 | Descriptive Headings |

The descriptive headings of this Agreement are for convenience only and shall not control or affect the meaning or construction of any provision of this Agreement.

| 10.6 | Notices |

All notices or other communications which are required or permitted hereunder shall be in writing and sufficient if delivered personally or sent by electronic mail, nationally recognized overnight courier, or registered or certified mail, postage prepaid, addressed as follows:

| (a) | If to AIM: | |

| Applied Inventions Management Corp. | ||

| ▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇, ▇▇▇▇▇ ▇▇▇ | ||

| ▇▇▇▇▇▇▇, ▇▇ ▇▇▇ ▇▇▇ | ||

| Attention: | ▇▇▇▇▇▇▇ ▇▇▇▇▇ | |

| E-mail: | ▇▇▇▇▇▇▇.▇▇▇▇▇@▇▇▇▇▇▇.▇▇▇ | |

| with a copy (which shall not constitute notice) to: | ||

| WeirFoulds LLP | ||

| ▇▇ ▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇, ▇▇▇▇▇ ▇▇▇▇ | ||

| ▇.▇. ▇▇▇ ▇▇, TD Bank Tower | ||