EX-10.3 4 a2201620zex-10_3.htm EX-10.3 PETROLEUM AGREEMENT AMONG GOVERNMENT OF THE REPUBLIC OF GHANA GHANA NATIONAL PETROLEUM CORPORATION AND TULLOW GHANA LIMITED SABRE OIL AND GAS LIMITED KOSMOS ENERGY GHANA HC IN RESPECT OF THE DEEPWATER TANO...

Exhibit 10.3

AMONG

GOVERNMENT OF THE REPUBLIC OF GHANA

GHANA NATIONAL PETROLEUM CORPORATION

![]()

AND

TULLOW GHANA LIMITED

SABRE OIL AND GAS LIMITED

KOSMOS ENERGY GHANA HC

IN RESPECT OF

THE DEEPWATER TANO

CONTRACT AREA

DATED MARCH 10, 2006

TABLE OF CONTENTS

|

ARTICLE 1 |

5 |

|

|

|

|

DEFINITIONS |

5 |

|

|

|

|

ARTICLE 2 |

12 |

|

|

|

|

SCOPE OF THE AGREEMENT, INTERESTS OF THE PARTIES AND CONTRACT AREA |

12 |

|

|

|

|

ARTICLE 3 |

15 |

|

|

|

|

EXPLORATION PERIOD |

15 |

|

|

|

|

ARTICLE 4 |

18 |

|

|

|

|

MINIMUM EXPLORATION PROGRAMME |

18 |

|

|

|

|

ARTICLE 5 |

22 |

|

|

|

|

RELINQUISHMENT |

22 |

|

|

|

|

ARTICLE 6 |

24 |

|

|

|

|

JOINT MANAGEMENT COMMITTEE |

24 |

|

|

|

|

ARTICLE 7 |

28 |

|

|

|

|

RIGHTS AND OBLIGATIONS OF CONTRACTOR AND GNPC |

28 |

|

|

|

|

ARTICLE 8 |

31 |

|

|

|

|

COMMERCIALITY |

31 |

|

|

|

|

ARTICLE 9 |

36 |

|

|

|

|

SOLE RISK ACCOUNT |

36 |

|

|

|

|

ARTICLE 10 |

39 |

|

|

|

|

SHARING OF CRUDE OIL |

39 |

|

|

|

|

ARTICLE 11 |

47 |

|

|

|

|

MEASUREMENT AND PRICING OF CRUDE OIL |

47 |

|

|

|

|

ARTICLE 12 |

50 |

|

|

|

|

TAXATION AND OTHER IMPOSTS |

50 |

|

|

|

|

ARTICLE 13 |

53 |

|

|

|

|

FOREIGN EXCHANGE TRANSACTIONS |

53 |

|

|

|

|

ARTICLE 14 |

55 |

|

|

|

|

SPECIAL PROVISIONS FOR NATURAL GAS |

55 |

|

PART I - GENERAL |

55 |

|

PART II -ASSOCIATED GAS |

55 |

|

PART III - NON-ASSOCIATED GAS |

56 |

|

PART IV NATURAL GAS PROJECTS |

58 |

|

ARTICLE 15 |

62 | |

|

|

| |

|

DOMESTIC SUPPLY REQUIREMENT (CRUDE OIL) |

62 | |

|

|

| |

|

ARTICLE 16 |

63 | |

|

|

| |

|

INFORMATION AND REPORTS : CONFIDENTIALITY |

63 | |

|

|

| |

|

ARTICLE 17 |

66 | |

|

|

| |

|

INSPECTION, SAFETY AND ENVIRONMENTAL PROTECTION |

66 | |

|

|

| |

|

ARTICLE 18 |

68 | |

|

|

| |

|

ACCOUNTING AND AUDITING |

68 | |

|

|

| |

|

ARTICLE 19 |

70 | |

|

|

| |

|

TITLE TO AND CONTROL OF GOODS AND EQUIPMENT |

70 | |

|

|

| |

|

ARTICLE 20 |

72 | |

|

|

| |

|

PURCHASING AND PROCUREMENT |

72 | |

|

|

| |

|

ARTICLE 21 |

73 | |

|

|

| |

|

EMPLOYMENT AND TRAINING |

73 | |

|

|

| |

|

ARTICLE 22 |

75 | |

|

|

| |

|

FORCE MAJEURE |

75 | |

|

|

| |

|

ARTICLE 23 |

76 | |

|

|

| |

|

TERM AND TERMINATION |

76 | |

|

|

| |

|

ARTICLE 25 |

82 | |

|

|

| |

|

ASSIGNMENT |

82 | |

|

|

| |

|

ARTICLE 26 |

83 | |

|

|

| |

|

MISCELLANEOUS |

83 | |

|

|

| |

|

ARTICLE 27 |

86 | |

|

|

| |

|

NOTICE |

▇▇ | |

|

|

| |

|

▇▇▇▇▇ ▇ - ▇▇▇▇▇▇▇▇ ▇▇▇▇ |

▇ | |

|

|

| |

|

ANNEX 2 - ACCOUNTING GUIDE |

4 | |

|

|

| |

|

SECTION 1 |

5 | |

|

1.1 |

GENERAL PROVISIONS |

5 |

|

1.2 |

STATEMENTS REQUIRED TO BE SUBMITTED BY CONTRACTOR |

5 |

|

1.3 |

LANGUAGE, MEASUREMENT, AND UNITS OF ACCOUNTS |

6 |

|

SECTION 2 |

8 | |

|

2.0 |

CLASSIFICATION AND ALLOTMENT OF COSTS AND EXPENDITURE |

8 |

|

2.1 |

ALL EXPENDITURE RELATING TO PETROLEUM OPERATIONS SHALL BE CLASSIFIED, AS FOLLOWS: |

8 |

|

SECTION 3 |

12 | |

|

3.0 |

COSTS, EXPENSES, EXPENDITURES AND CREDITS OF CONTRACTOR |

12 |

|

3.1 |

CONTRACTOR FOR THE PURPOSE OF THIS AGREEMENT SHALL CHARGE THE FOLLOWING ALLOWABLE COSTS TO THE ACCOUNTS: |

12 |

|

3.2 |

COST OF ACQUIRING SURFACE RIGHTS AND RELINQUISHMENT |

12 |

|

3.3 |

LABOUR AND ASSOCIATED LABOUR COSTS |

12 |

|

3.4 |

TRANSPORTATION COSTS |

13 |

|

3.5 |

CHARGES FOR SERVICES |

13 |

|

3.6 |

RENTALS, DUTIES AND OTHER ASSESSMENTS |

14 |

|

3.7 |

INSURANCE AND LOSSES |

14 |

|

3.8 |

LEGAL EXPENSES |

14 |

|

3.9 |

TRAINING COSTS |

15 |

|

3.10 |

GENERAL AND ADMINISTRATIVE EXPENSES |

15 |

|

3.11 |

UTILITY COSTS |

15 |

|

3.12 |

OFFICE FACILITY CHARGES |

15 |

|

3.13 |

COMMUNICATION CHARGES |

15 |

|

3.14 |

ECOLOGICAL AND ENVIRONMENTAL CHARGES |

15 |

|

3.15 |

ABANDONMENT COST |

16 |

|

3.16 |

OTHER COSTS |

16 |

|

3.17 |

COSTS NOT ALLOWABLE UNDER THE AGREEMENT |

16 |

|

3.18 |

ALLOWABLE AND DEDUCTIBILITY |

17 |

|

3.19 |

CREDITS UNDER THE AGREEMENT |

17 |

|

3.20 |

DUPLICATION OF CHARGES AND CREDITS |

18 |

|

SECTION 4 |

19 | |

|

4.0 |

MATERIAL |

19 |

|

4.1 |

VALUE OF MATERIAL CHARGED TO THE ACCOUNTS UNDER THE AGREEMENT |

19 |

|

4.2 |

VALUE OF MATERIAL PURCHASED FROM AN AFFILIATE |

19 |

|

4.3 |

CLASSIFICATION OF MATERIALS |

20 |

|

4.4 |

DISPOSAL OF MATERIALS |

20 |

|

4.5 |

WARRANTY OF MATERIALS |

20 |

|

4.6 |

CONTROLLABLE MATERIALS |

20 |

|

SECTION 5 |

22 | |

|

5.0 |

CASH CALL STATEMENT |

22 |

|

SECTION 6 |

23 | |

|

6.0 |

PRODUCTION STATEMENT |

23 |

|

SECTION 7 |

24 | |

|

7.0 |

VALUE OF PRODUCTION STATEMENT |

24 |

|

SECTION 8 |

25 | |

|

8.0 |

COST STATEMENT |

25 |

|

SECTION 9 |

26 | |

|

9.0 |

STATEMENT OF EXPENDITURES AND RECEIPTS |

26 |

|

SECTION 10 |

27 | |

|

10.0 |

FINAL END-OF-YEAR STATEMENT |

27 |

|

SECTION 11 |

28 | |

|

11.0 |

BUDGET STATEMENT |

28 |

|

SECTION 12 |

29 | |

|

12.0 |

LONG RANGE PLAN AND FORECAST |

29 |

|

|

|

|

|

ANNEX 3 - SAMPLE AOE CALCULATION |

31 |

THIS PETROLEUM AGREEMENT, made this day of 2006 by and among the Government of the Republic of Ghana (hereinafter referred to as “The State”), represented by the Minister for Energy (hereinafter referred to as the “Minister”), the Ghana National Petroleum Corporation, a public corporation established by Provisional National Defence Council Law 64 of 1983 (hereinafter referred to as “GNPC”), and Tullow Ghana Limited, a Jersey company (hereinafter referred to as “Tullow”), Sabre Oil and Gas Limited, a United Kingdom company (hereinafter referred to as “Sabre”) and Kosmos Energy Ghana HC, a Cayman Islands company (hereinafter referred to as “Kosmos”), (the three companies hereinafter collectively referred to as “Contractor”)

WITNESSETH:

1. All Petroleum existing in its natural state within Ghana is the property of the Republic of Ghana and held in trust by the State.

2. GNPC has by virtue of the Petroleum Law the right to undertake Exploration, Development and Production of Petroleum over all blocks declared by the Minister to be open for Petroleum Operations.

3. GNPC is further authorised to enter into association by means of a Petroleum Agreement with a contractor for the purpose of Exploration, Development and Production of Petroleum.

4. The Contract Area that is the subject matter of this Petroleum Agreement has been declared open for Petroleum Operations by the Minister and the Government of Ghana desires to encourage and promote Exploration, Development and Production within the said area. GNPC and the State have assured Contractor that all of said area is within the jurisdiction of the Republic of Ghana.

5. Contractor, having the financial ability, technical competence and professional skills necessary for carrying out the Petroleum Operations herein described, desires to associate with GNPC in the Exploration for, and Development and Production of the Petroleum resources of the said area.

6. The Parties recognise that Ghanaian nationals should as soon as reasonably possible be engaged in employment at all levels in the Petroleum industry, including technical, administrative and managerial positions, and that to achieve this objective an adequate programme of training must be established as an integral part of this Agreement.

NOW THEREFORE, in consideration of the mutual covenants herein contained, it is hereby agreed and declared as follows:

ARTICLE 1

DEFINITIONS

1. In this Agreement:

1.1 “Accounting Guide” means the accounting guide which is attached hereto as Annex 2 and made a part hereof;

1.2 “Additional Interest” means the Additional Interest of GNPC provided for in Article 2.5 and Article 2.6;

1.3 “Affiliate” means any person, whether a natural person, corporation, partnership, unincorporated association or other entity:

a) in which one of the Parties hereto or one of the companies comprising Contractor directly or indirectly hold more than fifty percent (50%) of the share capital or voting rights;

b) which holds directly or indirectly more than fifty percent (50%) of the share capital or voting rights in a Party hereto or of the companies comprising Contractor;

c) in which the share capital or voting rights are directly or indirectly and to an extent more than fifty percent (50%) held by a company or companies holding directly or indirectly more than fifty percent (50%) of the share capital or voting rights in a Party hereto or in one of the companies comprising Contractor; or

d) which holds directly five percent (5%) or more of the share capital or voting rights in Contractor.

1.4 “Agreement” means this Agreement between the State, GNPC and Contractor, and includes the Annexes attached hereto;

1.5 “Appraisal Programme” means a programme carried out following a Discovery of Petroleum for the purpose of delineating the accumulation of Petroleum to which that Discovery relates in terms of thickness and lateral extent and estimating the quantity of recoverable Petroleum therein;

1.6 “Appraisal Well” means a well drilled for the purposes of an Appraisal Programme;

1.7 “Associated Gas” means Natural Gas produced from a well in association with Crude Oil;

1.8 “Barrel” means a quantity or unit of Crude Oil equal to forty-two (42) United States gallons at a temperature of sixty (60) degrees fahrenheit and at 14.65 psia pressure.

1.9 “Block” means an area of approximately 685 square kilometres as depicted on the reference map prepared by the Minister in accordance with the provisions of the Petroleum Law;

1.10 “Calendar Year” means the period of twelve (12) months of the Gregorian calendar, commencing on January 1 and ending on the succeeding December 31;

1.11 “Carried Interest” means an interest held by GNPC in respect of which Contractor pays for the conduct of Petroleum Operations without any entitlement to reimbursement from GNPC as expressly provided for in this Agreement;

1.12 “Commercial Discovery” means a Discovery which is determined to be commercial in accordance with the provisions of this Agreement;

1.13 “Commercial Production Period” means in respect of each Development and Production Area the period from the Date of Commencement of Commercial Production until the termination of this Agreement or earlier relinquishment of such Development and Production Area;

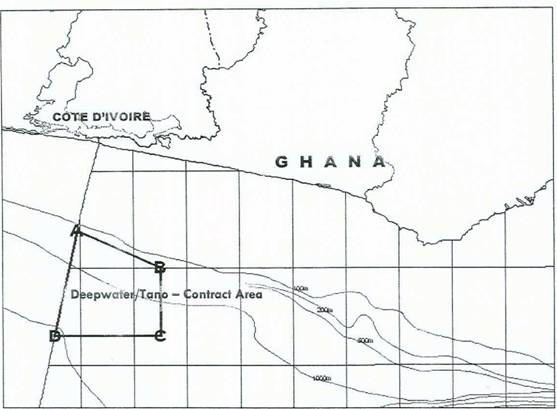

1.14 “Contract Area” means the area of 1,108 sq km covered by this Agreement in which Contractor is authorised to explore for, develop and produce Petroleum, which is described in Annex 1 attached hereto and made a part of this Agreement, but excluding any portions of such area in respect of which Contractor’s rights hereunder are from time to time relinquished or surrendered pursuant to this Agreement;

1.15 “Contractor” means Tullow Ghana Limited, Sabre Oil and Gas Limited and Kosmos Energy Ghana HC and their respective successors and assignees;

1.16 “Contract Year” means a period of twelve (12) Months, commencing on the Effective Date or any anniversary thereof;

1.17 “Crude Oil” means hydrocarbons which are liquid at 14.65 psia pressure and sixty (60) degrees Fahrenheit and includes condensates and distillates obtained from Natural Gas;

1.18 “Date of Commencement of Commercial Production” means, in respect of each Development and Production Area, the date on which production of Petroleum under a programme of regular production, lifting and sale commences;

1.19 “Date of Commercial Discovery” means the date referred to in Article 8.12;

1.20 “Delivery Point” shall have the meaning ascribed it in Article 10.5;

1.21 “Development” or “Development Operations” means the preparation of a Development Plan, the design, engineering, building and installation of facilities for Production, and includes drilling of Development ▇▇▇▇▇, construction and installation of equipment, pipelines, facilities, plants and systems, in and outside the Contract Area, which are required for achieving Production, treatment, transport, storage and lifting of Petroleum, and preliminary Production and testing activities carried out prior to the Date of Commencement of Commercial Production, and includes all related planning and administrative work, and also includes drilling and installation of ▇▇▇▇▇ and equipment for pressure maintenance and/or for increasing production rates and may also include the construction and installation of secondary and tertiary recovery systems, where these are included as part of the Development Plan;

1.22 “Development Costs” means Petroleum Costs incurred in Development Operations;

1.23 “Development and Production Area” means that portion of the Contract Area reasonably determined by Contractor (or by GNPC if a Sole Risk Operation pursuant to Article 9) on the basis of the available seismic and well data to cover the areal extent of an accumulation of Petroleum constituting a Commercial Discovery, enlarged in area by ten percent (10%), such enlargement to extend uniformly around the perimeter of such accumulation; and further enlarged by the area covering any extension of the accumulation which is revealed by further development work provided such extension is within the Contract Area;

1.24 “Development Period” means in respect of each Development and Production Area, the period from the Date of Commercial Discovery until the Date of Commencement of Commercial Production;

1.25 “Development Plan” means the plan for development of a Commercial Discovery prepared by Contractor in consultation with the Joint Management Committee and approved by the Minister pursuant to Article 8;

1.26 “Development Well” means a well drilled in accordance with a Development Plan for producing Petroleum, for pressure maintenance or for increasing the Production rate;

1.27 “Discovery” means finding during Exploration Operations an accumulation of Petroleum not previously known or proven to have existed, which is recovered or recoverable at the surface in a flow measurable by conventional petroleum industry testing methods;

1.28 “Discovery Area” means that portion of the Contract Area, reasonably determined by Contractor (or by GNPC if a Sole Risk Operation pursuant to Article 9) on the basis of the available seismic and well data to cover the areal extent of the geological structure in which a Discovery is made. A Discovery Area may be modified at any time by Contractor (or by GNPC if applicable), if justified on the basis of new information, but may not be modified after the date of completion of the Appraisal Programme;

1.29 “Effective Date” shall have the meaning ascribed to it in Article 26.9;

1.30 “Exploration” or “Exploration Operations” means the search for Petroleum by geological, geophysical and other methods and the drilling of Exploration Well(s) and includes any activity in connection therewith or in preparation thereof and any relevant processing and appraisal work, including technical and economic feasibility studies, that may be carried out to determine whether a Discovery of Petroleum constitutes a Commercial Discovery;

1.31 “Exploration Costs” means all expenditures made and costs incurred, both within and outside Ghana, in conducting Exploration Operations hereunder determined in accordance with the Accounting Guide attached hereto an Annex 2;

1.32 “Exploration Period” means the period commencing on the Effective Date and continuing during the time provided for in Article 3.1 within which Contractor is authorised to carry out Exploration Operations and shall include any periods of extensions provided for in this Agreement. The period shall terminate with respect to any Discovery Area on the Date of Commercial Discovery in respect of such Discovery Area;

1.33 “Exploration Well” means a well drilled in the course of Exploration Operations conducted hereunder during the Exploration Period, but does not include an Appraisal Well;

1.34 “Extension Period” means any of the First Extension Period or Second Extension Period;

1.35 “First Extension Period” shall have the meaning ascribed to it in Article 3.1(a)(ii);

1.36 “First SubPeriod shall have the meaning ascribed to it in Article 3.1(a)(i);

1.37 “Force Majeure” means any event beyond the reasonable control of the Party claiming to be affected by such event which has not been brought about at its instance, including, but not limited to, earthquake, storm, flood, lightning or other adverse weather conditions, war, embargo, blockade, riot or civil disorder;

1.38 “Foreign National Employee” means an expatriate employee of Contractor, its Affiliates, or its Sub-contractors who is not a citizen of Ghana;

1.39 “Ghana” means the territory of the Republic of Ghana and includes the sea, seabed and subsoil, the continental shelf and all other areas within the jurisdiction of the Republic of Ghana;

1.40 “Gross Production” means the total amount of Petroleum produced and saved from a Development and Production Area during Production Operations which is not used by Contractor in Petroleum Operations and is available for distribution to the Parties in accordance with Article 10;

1.41 “Gross Negligence” means any act or failure to act (whether sole, joint or concurrent) which was in reckless disregard of or wanton indifference to harmful consequences such person or entity knew or should have known such act or failure would have on another person or entity;

1.42 “Initial Exploration Period” shall have the meaning ascribed to it in Article 3.1(a)(i);

1.43 “Initial Interest” means the interest of GNPC in all Petroleum Operations provided for in Article 2.4;

1.44 “Joint Management Committee (JMC)” means the committee established pursuant to Article 6.1 hereof;

1.45 “Market Price” shall have the meaning ascribed to it in Article 11.7;

1.46 “Minister” means Minister for Energy;

1.47 “Month” means a month of the Calendar Year;

1.48 “Natural Gas” means all hydrocarbons which are gaseous at 14.65 psia pressure and sixty (60) degrees fahrenheit temperature and includes wet gas, dry gas and residue gas remaining after the extraction of liquid hydrocarbons from wet gas;

1.49 “Non-Associated Gas” means Natural Gas produced from a well other than in association with Crude Oil;

1.50 “Operator” means Tullow or such other Party as may be appointed by Contractor with the approval of GNPC and the State, which approval shall not be unreasonably withheld or delayed;

1.51 “Participating Interest” means for GNPC, the interest held by GNPC in accordance with the provisions of Article 2.4 and Article 2.5 and for Contractor, the interest held by Contractor in accordance with the provisions of Article 2.9;

1.52 “Party” means the State, GNPC or Contractor, as the case may be;

1.53 “Paying Interest” means an interest held by GNPC in respect of which GNPC pays for the conduct of Petroleum Operations;

1.54 “Petroleum” means Crude Oil or Natural Gas or a combination of both;

1.55 “Petroleum Costs” means all expenditures made and costs incurred, both within and outside Ghana, in conducting Petroleum Operations hereunder determined in accordance with the Accounting Guide attached hereto as Annex 2;

1.56 “Petroleum Income Tax Law” means the Petroleum Income Tax Law, 1987 (PNDCL 188);

1.57 “Petroleum Law” means the Petroleum (Exploration and Production) Law, 1984 (PNDCL 84);

1.58 “Petroleum Operations” means all activities, both in and outside Ghana, relating to the Exploration for, Appraisal, Development, Production, handling and transportation of Petroleum contemplated under this Agreement and includes Exploration Operations, Development Operations and Production Operations and all activities in connection therewith;

1.59 “Petroleum Product” means any product derived from Petroleum by any refining or other process;

1.60 “Production” or “Production Operations” means activities not being Development Operations, undertaken in order to extract, save, treat, measure, handle, store, load and transport Petroleum to storage and/or loading points and to carry out any type of primary and secondary operations, including recycling, recompression, maintenance of pressure and water flooding and all related activities such as planning and administrative work and shall also include maintenance, repair and replacement of facilities, and well workovers, conducted after the Date of Commencement of Commercial Production of the respective Development and Production Area;

1.61 “Production Costs” means Petroleum Costs incurred in Production Operations;

1.62 “Quarter” means a period of three (3) Months, commencing January 1, April 1, July 1 or October 1;

1.63 “Rate of Return” shall have the meaning ascribed to it in Article 10;

1.64 “Second Extension Period” shall have the meaning ascribed to it in Article 3.1(a)(ii);

1.65 “Second Sub Period” shall have the meaning ascribed to it in Article 3.1(a)(i);

1.66 “Sole Risk Operation” means an operation conducted at the sole cost, risk and expense of GNPC referred to in Article 9;

1.67 “Specified Rate” means the rate which the National Westminster Bank, Plc, London, certifies to be the London Interbank offered rate (LIBOR) in the London Interbank Eurodollar market on thirty (30) day deposits, in effect on the last business day of the last respective preceding month, plus one point five percent (1.5%);

1.68 “Standard Cubic Foot” or “SCF” means the quantity of gas that occupies one (1) cubic foot at 14.65 psia pressure and sixty (60) degrees fahrenheit temperature;

1.69 “State” means the Government of the Republic of Ghana;

1.70 “Subcontractor” has the meaning assigned to that term in the Petroleum Income Tax Law;

1.71 “Termination” means termination of this Agreement pursuant to Article 23 hereof;

1.72 “Work Programme” means the annual plan for the conduct of Petroleum Operations prepared pursuant to Articles 4.3, 6.4 and 6.5;

ARTICLE 2

SCOPE OF THE AGREEMENT, INTERESTS OF THE PARTIES AND CONTRACT AREA

2.1 This Agreement provides for the Exploration for and Development and Production of Petroleum in the Contract Area by GNPC in association with Contractor.

2.2 Subject to the provisions of this Agreement, Contractor shall be responsible for the execution of such Petroleum Operations as are required by the provisions of this Agreement and subject to Article 9, is hereby appointed the exclusive entity to conduct Petroleum Operations in the Contract Area. GNPC shall at all times participate in the management of Petroleum Operations and in order that the Parties may cooperate in the implementation of Petroleum Operations GNPC and Contractor shall establish a Joint Management Committee, to conduct and manage Petroleum Operations.

2.3 In the event that no Commercial Discovery is made in the Contract Area, or that Gross Production achieved from the Contract Area is insufficient fully to reimburse Contractor in accordance with the terms of this Agreement, then Contractor shall bear its own loss; GNPC and the State shall have no obligations whatsoever to contractor in respect of such loss.

2.4 GNPC shall have a ten percent (10%) Initial Interest in all Petroleum Operations under this Agreement. With respect to all Exploration and Development Operations GNPC’s Initial Interest shall be a Carried Interest. With respect to all Production Operations GNPC’s Initial Interest shall be a Paying Interest.

2.5 GNPC shall have the option to acquire an Additional Interest of five percent (5%) in every Commercial Discovery. In order to acquire the Additional Interest, GNPC must notify Contractor within ninety (90) days after Contractor’s notice to the Minister that a Discovery is a Commercial Discovery, of its intention to acquire the Additional Interest. If within such ninety (90) day period GNPC does not give such notice, GNPC’s interest will remain as described in Article 2.4. If GNPC acquires the Additional Interest, GNPC shall be responsible for paying five percent (5%) of all future Petroleum Costs including Development and Production Costs as approved by the JMC. GNPC and Contractor shall agree on the mode of financing such Additional Interest.

In the event that Contractor decides to seek project finance from a bank or group of banks for the financing of Development Operations, Contractor shall offer GNPC

the opportunity (but not an obligation) to join in the said project financing with respect to its Additional Interest. GNPC shall not, by its action or inaction, impede or delay Contractor in its efforts to obtain such project financing.

If GNPC fails to pay for the costs associated with its Additional Interest and those associated with Production Operations as described in Article 2.4 and Article 2.6, then Contractor shall be entitled to recover the said costs, together with interest at the Specified Rate, from Production revenues.

In the event that GNPC, having acquired the Additional Interest, subsequently wishes to dispose of it (or part of it) to a third party, GNPC shall notify Contractor of such intent and shall inform Contractor of the price which is to be paid by such third party for the same, and Contractor shall have the right for a period of forty five days from receipt of such notice to inform GNPC that it wishes to acquire such interest at the price notified to it by GNPC, being the price at which it was to have been sold to the third party.

2.6 If GNPC opts to take an Additional Interest as provided for in Article 2.5 then within six (6) Months of its election, GNPC shall reimburse Contractor for all expenditures attributable to GNPC’s Additional Interest and incurred from the Date of Commercial Discovery to the date GNPC notifies Contractor of its election.

2.7 For the avoidance of doubt GNPC shall only be liable to contribute to Petroleum Costs:

a) incurred in respect of Development Operations in any Development and Production Area and to the extent only of any Additional Interest acquired in such Development and Production Area under Article 2.5; and

b) incurred in respect of Production Operations in any Development and Production Area both to the extent of:

i) its ten percent (10%) Initial Interest; and

ii) any Additional Interest acquired in such development and Production Area under Article 2.5

2.8 GNPC may during the Exploration Period assist Contractor in carrying out Contractor’s obligations expeditiously and efficiently as stipulated in Article 7.3. Upon completion of the work associated with said assistance, GNPC shall invoice the Contractor for the costs incurred and shall provide reasonable supporting documentation in respect of such costs. Contractor shall pay GNPC the invoiced amount within thirty (30) days of receipt of the invoice. The actual amount of the

invoice submitted by GNPC shall be at rates agreed by GNPC and the Contractor for such services.

2.9 Contractor’s Participating Interest in all Petroleum Operations and in all rights under this Agreement shall be ninety per cent (90%), reduced proportionately at any given time and in any given part of the Contract Area by the Additional Interest of GNPC pursuant to Article 2.5 or the Sole Risk Interest of GNPC pursuant to Article 9.

2.10 As of the Effective Date, the Contract Area shall cover a total of approximately one thousand one hundred and eight square kilometres (1,108 km2) as depicted by Annex 1 and shall from time to time during the term of this Agreement be reduced according to the terms herein. During the term of the Agreement, Contractor shall pay rentals to the State for that area included within the Contract Area at the beginning of each Contract Year according to the provisions of Article 12.2 (e) below provided that a pro-rata payment shall be made to cover a period of less than one (1) full Contract Year.

ARTICLE 3

EXPLORATION PERIOD

3.1 The Exploration Period shall begin on the Effective Date and shall not cover a period of more than six and one half (61/2) years except as provided for in accordance with this Agreement and the Petroleum Law.

a) The Exploration Period shall be divided as follows:

(i) an Initial Exploration Period of two and one half (21/2) years (“Initial Exploration Period”) further divided into Subperiods:

1. One (1) year (“First Subperiod”);

2. One and one half (11/2) years (“Second Subperiod”) plus

(ii) Two (2) extension periods totalling four (4) years:

1. Two (2) years for the first such period (“First Extension Period”); and

2. Two (2) years for the second of such periods ("Second Extension Period").

b) At the end of The First Subperiod, Contractor shall elect to drill a well during the Second Subperiod or relinquish the entire Contract Area. Contractor shall have the right to relinquish the entire Contract Area and withdraw from this Agreement upon the expiration of any of the First Subperiod, the Second Subperiod, the First Extension Period or the Second Extension period; subject only to notifying GNPC not less than thirty (30) days before expiration of the relevant period and provided Contractor has completed the applicable work obligation of the First Subperiod or Second Subperiod, or any of the Extension Periods (as applicable) during which such relinquishment and withdrawal is made.

c) Where Contractor has fulfilled its work and expenditure obligations set out in Article 4.3 before the end of a specific Subperiod or any of the Extension Periods and has exercised its option by applying to the Minister in writing for an extension into the next phase, the Minister will be deemed to have granted an extension into the Second Subperiod, First Extension Period or, Second Extension Period, as applicable.

d) For each well drilled by Contractor or with Contractor’s participation during the Initial Exploration Period (beyond those referred to in Article 4.3), the Initial Exploration Period shall be extended by three (3) Months and the commencement of subsequent periods shall be postponed in their entirety accordingly.

3.2 Following the end of the Second Extension Period, subject to the provisions of Article 3.4, Contractor will be entitled to an extension or extensions, by reference to Article 8, of the Exploration Period as follows:

a) Where at the end of the Second Extension Period Contractor is drilling or testing any well, Contractor shall be entitled to an extension for such further period as may be reasonably required to enable Contractor to complete such work and assess the results and, in the event that Contractor notifies the Minister that the results from any such well show a Discovery which merits appraisal, Contractor shall be entitled to a further extension for such period as may be reasonably required to carry out an Appraisal Programme and determine whether the Discovery constitutes a Commercial Discovery;

b) Where at the end of the Second Extension Period Contractor is engaged in the conduct of an Appraisal Programme in respect of a Discovery which has not been completed, Contractor shall be entitled to a further extension following the end of the Second Extension for such period as may be reasonably required to complete that Appraisal Programme and determine whether the Discovery constitutes a Commercial Discovery;

c) Where at the end of the Second Extension Period Contractor is in the process of completing an aspect of the Approved Work Programme not falling under paragraphs (a) or (b) in this Article 3.2 above, or under Article 4.3(c), Contractor will be entitled to such extension of time as the Minister considers reasonable for the purpose of completing such work;

d) Where pursuant to Article 8 Contractor has before the end of the Second Extension Period , including extensions under (a), (b) and (c) above, given to the Minister a notice of Commercial Discovery, Contractor shall, if the Exploration Period would otherwise have been terminated, be entitled to a further extension of the Exploration Period in which to prepare the Development Plan in respect of the Discovery Area to which that Development Plan relates until either:

i) the Minister has approved the Development Plan as set out in Article 8, or

ii) in the event that the Development Plan is not approved by the Minister as set out in Article 8 and the matter or matters in issue between the Minister and Contractor have been referred for resolution under Article 24, one (1) Month after the date on which the final decision thereunder has been given.

3.3 Where Contractor has during the Initial Exploration Period or, as the case may be, during the First Extension Period failed to fulfill its work and expenditure obligations under Article 4 in respect of that period but has made reasonable arrangements to remedy its default during the First Extension Period or, as the case may be, the Second Extension Period, Contractor shall be entitled to an extension subject to such reasonable terms and conditions as the Minister may stipulate to assure performance of the work.

3.4 Save in respect of a Discovery Area:

a) In the circumstances and subject to the limitations set forth in Section 12 (3) of the Petroleum Law; or

b) In a case falling within the provisions of Article 3.2 (d)

nothing in Article 3.2 shall be read or construed as requiring or permitting the extension of the Exploration Period beyond seven (7) years from the Effective Date except for reasons of Force Majeure.

3.5 The provisions of Article 3.2 (a), (b) and (c) so far as they relate to the duration of the extension period to which Contractor will be entitled shall be read and construed as requiring the Minister to give effect to the provisions of Article 8 relating to the time within which Contractor must meet the requirements of that Article.

3.6 In the event that the Contractor is in the course of drilling or testing any well at the end of the Second Subperiod or the First Extension Period then it shall be permitted to complete the said drilling or testing without breaching this Agreement.

If Contractor elects thereafter to enter into the First Extension Period or the Second Extension Period, as the case may be, the commencement of the First Extension Period or the Second Extension Period shall not be affected by the duration of the period required for the completion of drilling or testing as referred to above, but shall remain as stated in Article 4.3 (b) or Article 4.3 (c) as applicable.

ARTICLE 4

MINIMUM EXPLORATION PROGRAMME

4.1 Exploration Operations shall begin as soon as practicable and in any case not later than sixty (60) days after the Effective Date.

4.2 GNPC shall, at the request of Contractor, make available to it such records and information relating to the Contract Area as are relevant to the performance of Exploration Operations by Contractor and are in GNPC’s possession, provided that Contractor shall reimburse GNPC for the costs reasonably incurred in procuring or otherwise making such records and information available to Contractor.

4.3 Subject to the provisions of this Article, in discharge of its obligations to carry out Exploration Operations in the Contract Area, Contractor shall during the several phases into which the Exploration Period is divided carry out the work specified hereinafter:

a) Initial Exploration Period: Commencing on the Effective Date and terminating at the end of the two and one half (21/2) Contract Years which is made up of the following;

First Subperiod (1 year):

Description of Work: By the end of the First Subperiod of the Initial Exploration Period Contractor shall have undertaken a work programme including the reprocessing of 3D seismic data and seabed logging.

Minimum Expenditure: Contractor’s minimum expenditure for the work in the First Subperiod of the Initial Exploration Period shall be two million United States dollars (U.S.$2,000,000).

Second Subperiod (11/2 years):

Description of Work: By the end of the Second Subperiod of the Initial Exploration Period, Contractor shall have drilled at least one (1) Exploration Well in the Contract Area.

Minimum Expenditure: Contractor’s minimum expenditure for the work in the Second Subperiod of the Initial Exploration Period shall be twenty million United States dollars (U.S.$20,000,000).

b) First Extension Period: Commencing at the end of the Initial Exploration Period and terminating at the end of a further two (2) Contract Years.

Minimum Expenditure: Contractor’s minimum expenditure for the work in the First Extension Period shall be twenty million United States dollars U.S.$20,000,000).

Description of Work: By the end of the First Extension Period, Contractor shall have drilled at least one (1) Exploration Well in the Contract Area.

c) Second Extension Period: Commencing at the end of the First Extension and terminating at the end of a further two (2) Contract Years.

Description of Work: By the end of the Second Extension Period, Contractor shall have drilled one (1) Exploration Well in the Contract Area.

Minimum Expenditure: minimum expenditure for work in the Second Extension Period shall be twenty million United States dollars (U.S.$20,000,000).

d) Work and expenditures accomplished in any Subperiod or Extension Period in excess of the above obligations may be applied as credit in satisfaction of obligations called for in any other Subperiod or Extension Period. The fulfillment of any work obligation shall relieve Contractor of the corresponding minimum expenditure obligation, but the fulfillment of any minimum expenditure obligation shall not relieve Contractor of the corresponding work obligation.

(e) The principle of Article 4 is that, the fulfillment of any minimum Work Programme supersedes its corresponding minimum expenditure. However, for any Extension Period or Subperiod, for which the entire minimum work obligation is not met by Contractor, the corresponding part of the minimum expenditure obligation relating to the unfulfilled work obligation shall be paid to GNPC whereupon Contractor shall be deemed to have fulfilled such minimum work obligation. However, Contractor’s entitlement to proceed to the next Extension Period or Subperiod shall be at the discretion of the Minister.

4.4 No Appraisal ▇▇▇▇▇ drilled or seismic surveys carried out by Contractor as part of an Appraisal Programme undertaken pursuant to Article 8 and no expenditure incurred by Contractor in carrying out such Appraisal Programme shall be treated as discharging the minimum work obligations under Article 4.3.

4.5 The seismic reprocessing and seabed logging programme in Article 4.3(a), when combined with existing data, shall be such as will enable a study of the regional

geology of the Contract Area and the preparation of a report thereon with appropriate maps, cross sections and illustrations, as well as a geophysical survey of the Contract Area which, when combined with existing data, shall provide:

a) a minimum seismic grid adequate to define prospective drill sites over prospective closures as interpreted from data available to Contractor; and

b) a seismic evaluation of structural and stratigraphic conditions over the remaining portions of the Contract Area.

4.6 Each Exploration Well shall be drilled at a location and to an objective depth determined by Contractor in consultation with GNPC. Except as otherwise provided in Article 4.7 and 4.8 below, the minimum depth of each obligatory Exploration Well shall be whichever of the following is first encountered:

a) the depth of 3,600 metres measured from the Rotary Table ▇▇▇▇▇ Bushing (RTKB);

b) the depth sufficient to penetrate 500 metres into the primary target;

c) the depth at which Contractor encounters geologic basement.

4.7 The minimum depth of the first obligatory Exploration Well in Article 4.3 shall be whichever of the following is first encountered:

a) the depth of 4,400 meters measured from the Rotary Table ▇▇▇▇▇ Bushing (RTKB);

b) the depth sufficient to penetrate 300 metres into the Santonian; or

c) the depth at which Contractor encounters geological basement.

4.8 If in the course of drilling an Exploration Well the Contractor concludes that drilling to the minimum depth specified in Article 4.6 or 4.7 above is impossible, impracticable or imprudent in accordance with accepted international petroleum industry drilling and engineering practice, then Contractor may plug and abandon the Exploration Well and GNPC shall have the option of either:

a) waiving the minimum depth requirement, in which case Contractor will be deemed to have satisfied the obligation to drill such Exploration Well; or

b) requiring Contractor to drill a substitute Exploration Well at a location determined by Contractor in consultation with GNPC and to the relevant

minimum depth set forth in Article 4.6 or 4.7, except that if in the course of drilling such substitute Exploration Well Contractor establishes that drilling to the relevant minimum depth specified in Article 4.6 or 4.7 above is impossible, impracticable or imprudent in accordance with accepted petroleum industry drilling and engineering practice, then Contractor may plug and abandon the substitute Exploration Well and will be deemed to have satisfied the obligation to drill one (1) Exploration Well to the minimum depth to which such well had been planned.

The above option shall be exercised by GNPC within thirty (30) days from the plugging and abandonment of the Exploration Well, and failure to exercise such option shall constitute a waiver of the minimum depth requirement pursuant to Articles 4.6 and 4.7 as the case may be.

4.9 During the Exploration Period, Contractor shall have the right to perform additional Exploration Operations, including without limitation performing gravity and magnetic surveys, drilling stratigraphic ▇▇▇▇▇ and performing additional geological and geophysical studies, provided the minimum work obligations are performed within the applicable period.

4.10 During the Exploration Period, Contractor shall deliver to GNPC and the Minister reports on Exploration Operations conducted during each Calendar Quarter within thirty (30) days following the end of that Quarter. Further requests for information by the Minister under Section 9(1) of the Petroleum Law shall be complied with within a reasonable time and copies of documents and other material containing such information shall be provided to GNPC.

4.11 If, upon completion of the minimum exploration programme set forth in Article 4.3, Contractor desires to conduct a further programme of Exploration on those retained areas that will be relinquished upon expiry of the Exploration Period, Contractor shall have a right of first refusal to the granting of a new petroleum agreement covering such retained areas. If Contractor elects to exercise this right, it must do so in writing to GNPC not less than one (1) year before the expiry of the Exploration Period. If GNPC receives such written election from Contractor, the Parties shall use best efforts to negotiate in good faith a new petroleum agreement to cover such retained areas, with the intention that if possible there shall be no lapse between the expiration of this Petroleum Agreement and the effective date of the new petroleum agreement.

ARTICLE 5

RELINQUISHMENT

5.1 Except as provided in Article 8.3, 8.9, 14.9 and 14.14, Contractor shall relinquish portions of the Contract Area in the manner provided hereafter.

a) If on or before the expiration of the Initial Exploration Period, Contractor elects to enter into the First Extension Period pursuant to Article 3.1(c) then subject to Article 5.2 at the commencement of the First Extension Period the area retained shall be one hundred per cent (100%) of the original Contract Area as at the Effective Date;

b) If on or before the expiration of the First Extension Period, Contractor elects to enter into the Second Extension Period pursuant to Article 3.1(c) then subject to Article 5.2 at the commencement of the Second Extension Period the area retained shall not exceed fifty (50%) of the original Contract Area as at the Effective Date. Provided always that the area retained shall be permitted to exceed fifty percent (50%) of the original Contract Area but not to exceed seventy-five percent (75%) of the original Contract Area in the event that at that time, the Contractor commits to the drilling of a total of two (2) or more ▇▇▇▇▇ in the Second Extension Period in which case the provisions of Article 4.3(c) shall be deemed amended accordingly;

c) On the expiration of the Second Extension Period, Contractor shall subject to Article 5.2 relinquish the remainder of the retained Contract Area.

5.2 The Provisions of Article 5.1 shall not be read or construed as requiring Contractor to relinquish any portion of the Contract Area which constitutes or forms part of either a Discovery Area or a Development and Production Area.

PROVIDED HOWEVER THAT if at the end of the First Subperiod, Second Subperiod, First Extension Period or Second Extension Period as the case may be, Contractor elects not to enter into the Second Subperiod, the First Extension Period or the Second Extension Period, Contractor shall relinquish the entire Contract Area, other than any Discovery or Development and Production Area.

5.3 Each area to be relinquished pursuant to this Article shall be selected by Contractor and shall be measured as far as possible in terms of continuous and compact units of a size and shape which will permit the carrying out of Petroleum Operations in the relinquished portions.

5.4 Without prejudice to the foregoing provisions of this Article 5, in the event that, following the relinquishment of the Contract Area, the Contractor has retained one or more Development and Production Areas, and Contractor and GNPC have, after reviewing all the relevant technical data and information, determined that the field or reservoirs for which a Development and Production Area was granted covers Petroleum lying outside such Development and Production Area, and provided such outside areas are not under any contract, the Contractor and GNPC shall endeavour to reach an agreement on unitization between the Contractor (with respect to the Contract Area) and GNPC (as holder of the area outside of the Contract Area) to cover the full development of the reservoir or field.

ARTICLE 6

JOINT MANAGEMENT COMMITTEE

6.1 In order that the Parties may at all times cooperate in the implementation of Petroleum Operations, GNPC and Contractor shall not later than thirty (30) days after the Effective Date establish a Joint Management Committee (JMC). Without prejudice to the rights and obligations of Contractor for day-to-day management of the operations, the JMC shall oversee and supervise the Petroleum Operations and ensure that all approved Work Programmes and Development Plans are complied with and also that accounting for costs and expenses and the maintenance of records and reports concerning the Petroleum Operations are carried out in accordance with this Agreement and the accounting principles and procedures generally accepted in the international petroleum industry.

6.2 The composition of and distribution of functions within the JMC shall be as follows:

i) The JMC shall constitute of four (4) representatives of GNPC and four (4) representatives of Contractor. GNPC and Contractor shall also designate a substitute or alternate for each member. In the case of absence or incapacity of a member of the JMC, his alternate shall automatically assume the rights and obligations of the absent or incapacitated member;

ii) The Chairperson of the JMC shall be designated by GNPC from amongst the members of the JMC;

iii) Contractor shall be responsible in consultation with GNPC for the preparation of agenda and supporting documents for each meeting of the JMC and for keeping records of the meetings and decisions of the JMC (GNPC shall have the right to inspect all records of the JMC at any time);

iv) At any meeting of the JMC six (6) representatives shall form a quorum, provided that at least two (2) of such representatives shall be representatives of GNPC and at least two (2) of such representatives shall be representatives of the Contractor.

6.3 Meetings of the JMC shall be held and decisions taken as follows:

i) All meetings of the JMC shall be held in Accra, Dublin or London or such other place as may be agreed upon by members of the JMC;

ii) The JMC shall meet at least twice yearly and at such times as the members may agree;

iii) A meeting of the JMC may be convened by either GNPC or the Contractor giving not less than twenty (20) days notice to the other or, in a case requiring urgent action, notice of such lesser duration as the members may agree upon;

iv) Decisions of the JMC shall require unanimity provided, however, that decisions and approvals required for budgets and day-to-day operational matters associated with Appraisal, Development and Production Operations the expenditures, outlays or advances for which Contractor will be required to make on a one hundred percent (100%) basis shall require approval of the Contractor’s representatives only;

v) Any member of the JMC may vote by written and signed proxy held by another member;

vi) Decisions of the JMC may be made without holding a meeting if all representatives of both Parties notify their consent thereto in the manner provided in Article 27;

vii) GNPC and Contractor shall have the right to bring expert advisors to any JMC meetings to assist in the discussions of technical and other matters requiring expert advice;

viii) The JMC may also establish subcommittees it deems appropriate for carrying out its functions, such as:

a) a technical subcommittee;

b) an audit subcommittee; and

c) an accounting subcommittee,

ix) costs and expenses related to attendance by GNPC outside Ghana (e.g. business class travel, transportation, lodging, per diem and insurance), shall be borne by Contractor and treated as Petroleum Costs. Subject to GNPC providing to Contractor reasonable supporting documentation in respect of such costs and expenses, those costs and expenses shall be reimbursed by Contractor to GNPC.

6.4 The JMC shall oversee Exploration Operations as follows:

i) Not later than sixty (60) days after the Effective Date and thereafter at least ninety (90) days before the commencement of each subsequent Contract Year,

Contractor shall prepare and submit to the JMC for its review a reasonably detailed Work Programme and budget setting forth all Exploration Operations which Contractor proposes to carry out in that Contract year and the estimated cost thereof, and shall also give an indication of Contractor’s tentative preliminary exploration plans for the succeeding Contract year;

ii) Upon notice to the Minister and GNPC, Contractor may amend any Work Programme or budget submitted to the JMC pursuant to this Article which notice will state why in Contractor’s opinion the amendment is necessary or desirable. Any such amendment shall be submitted to the JMC for review;

iii) Every Work Programme submitted to the JMC pursuant to this Article 6.4 and every revision or amendment thereof shall be consistent with the requirements set out in Article 4.3 relating to minimum work and expenditure for the period of the Exploration Period in which such Work Programme or budget falls;

iv) Contractor shall report any Discovery to GNPC immediately following such Discovery and shall place before the JMC for review its Appraisal Programme prior to submission thereof to the Minister. Within thirty (30) days of completion of the Appraisal Programme a JMC meeting to discuss the results of the Appraisal Programme shall be convened to take place before submission of the detailed Appraisal Programme report provided for in Article 8.7;

v) The JMC will review Work Programmes and budgets and any amendments or revisions thereto, and Appraisal Programmes, submitted to it by Contractor pursuant to this Article 6, and timely give such advice as it deems appropriate which Contractor shall consider before submitting the Programme to GNPC and the Minister for their information;

vi) After the date of the first Commercial Discovery, Contractor shall seek the concurrence of GNPC’s JMC representatives, which concurrence shall not be unreasonably withheld, on any proposal for the drilling of an Exploration Well or ▇▇▇▇▇ not associated with the Commercial Discovery and not otherwise required to be drilled under Article 4.3. If concurrence is not secured by Contractor, Contractor may nevertheless elect to drill the Exploration Well or ▇▇▇▇▇ but the costs of such Well or ▇▇▇▇▇ shall be considered Petroleum Costs for AOE purposes and deductible cost for Ghana income tax purposes only in the event there is a subsequent Commercial Discovery associated with the Well or ▇▇▇▇▇.

6.5 From the first occurring Date of Commercial Discovery the JMC shall have supervision of Petroleum Operations as follows:

i. Within sixty (60) days after the Date of Commercial Discovery Contractor shall prepare and submit to the JMC for approval any revisions to its annual Work Programme and budget that may be necessary for the remainder of that Contract Year and for the rest of the Exploration Period;

ii. At least ninety (90) days before the Commencement of each subsequent Calendar Year Contractor shall submit to the JMC for review and approval a reasonably detailed Work Programme and budget setting forth all Development and Production Operations which Contractor proposes to carry out in that Calendar Year and the estimated cost thereof and shall also give an indication of Contractor’s plans for the succeeding Calendar Year;

iii. Within sixty (60) days of the Date of Commencement of Commercial Production and thereafter not later than one hundred and twenty (120) days before the commencement of each Calendar Year Contractor shall submit to the JMC for its review and approval an annual production schedule which shall be in accordance with good international oilfield practice, and shall be designed to provide the most efficient, beneficial and timely production of the Petroleum resources.

6.6 The JMC shall approve lifting schedules for Development and Production Areas as well as review all of Contractor’s reports on the conduct of Petroleum Operations.

6.7 The JMC shall approve Contractor’s insurance programme and the programmes for training and technology transfer submitted by Contractor and the accompanying budgets for such schemes and programmes.

6.8 If during any meeting of the JMC the Parties are unable to reach agreement concerning any of the matters provided for in Article 6.5 and 6.6, the matter shall be deferred for reconsideration at a further meeting to be held not later than fifteen (15) days following the original meeting. If after such further meeting the Parties are still unable to reach agreement, the matter in dispute shall be referred to the Parties forthwith. Failing agreement within fifteen (15) days thereafter, the matter in dispute shall, at the request of any Party, be referred for resolution under Article 24.

ARTICLE 7

RIGHTS AND OBLIGATIONS OF CONTRACTOR AND GNPC

7.1 Subject to the provisions of this Agreement, Contractor shall be responsible for the conduct of Petroleum Operations and shall:

a) conduct Petroleum Operations with utmost diligence, efficiency and economy, in accordance with accepted International Petroleum Industry practices, under the same or similar circumstances observing sound technical and engineering practices using appropriate advanced technology and effective equipment, machinery, materials and methods;

b) take all practicable steps to ensure compliance with Section 3 of the Petroleum Law including ensuring the recovery and prevention of waste of Petroleum in the Contract Area in accordance with accepted International Petroleum Industry practices under the same or similar circumstances;

c) prepare and maintain in Ghana full and accurate records of all Petroleum Operations performed under this Agreement;

d) prepare and maintain accounts of all Petroleum Operations under this Agreement in such a manner as to present a full and accurate record of the costs of such Petroleum Operations, in accordance with the Accounting Guide;

e) disclose to GNPC and the Minister any operating or other agreement among the Parties that constitute Contractor relating to the Petroleum Operations hereunder, which agreement shall not be inconsistent with the provisions of this Agreement.

7.2 In connection with its performance of Petroleum Operations, Contractor shall have the right within the terms of applicable law:

a) to establish offices in Ghana and to assign to those offices such representatives as it shall consider necessary for the purposes of this Agreement;

b) to use public lands for installation and operation of shore bases, and terminals, harbours and related facilities, pipelines from fields to terminals and delivery facilities, camps and other housing;

c) to receive licenses and permission to install and operate such communications and transportation facilities as shall be necessary for the efficiency of its operations;

d) to bring to Ghana such number of Foreign National Employees as shall be necessary for its operations, including employees assigned on permanent or resident status, with or without families, as well as those assigned on temporary basis such as rotational (rota) employees;

e) to provide or arrange for reasonable housing, schooling and other amenities, permanent and temporary, for its employees and to import personal and household effects, furniture and vehicles, for the use of its personnel in Ghana;

f) to be solely responsible for provision of health, accident, pension and life insurance benefit plans on its Foreign National Employees and their families; and such employees shall not be required to participate in any insurance, compensation or other employee or social benefit programs established in Ghana;

g) to have, together with its personnel, at all times the right of ingress to egress from its offices in Ghana, the Contract Area, and the facilities associated with Petroleum Operations hereunder in Ghana including the offshore waters, using its owned or chartered means of land, sea and air transportation;

h) to engage such Subcontractors, expatriate and national, including also consultants, and to bring such Subcontractors and their personnel to Ghana as are necessary in order to carry out the Petroleum Operations in a skillful, economic, safe and expeditious manner; and said Subcontractors shall have the same rights as Contractor specified in this Article 7.2 to the extent they are engaged by Contractor for the Petroleum Operations hereunder.

7.3 GNPC shall assist Contractor in carrying out Contractor’s obligations expeditiously and efficiently as stipulated in this Agreement, and in particular GNPC shall use its best efforts to assist Contractor and its Subcontractors to:

a) establish supply bases and obtain necessary communications facilities, equipment and supplies;

b) obtain necessary approvals to open bank accounts in Ghana;

c) subject to Article 21 hereof, obtain entry visas and work permits for such number of Foreign National Employees of Contractor and its Subcontractors engaged in Petroleum Operations and members of their families who will be

resident in Ghana, and make arrangements for their travel, arrival, medical services and other necessary amenities;

d) comply with Ghana customs procedures and obtain permits for the importation of necessary materials;

e) obtain the necessary permits to transport documents, samples or other forms of data to foreign countries for the purpose of analysis or processing if such is deemed necessary for the purposes of Petroleum Operations;

f) contact Government agencies dealing with fishing, meteorology, navigation and communications as required;

g) identify qualified Ghanaian personnel as candidates for employment by Contractor in Petroleum Operations; and

h) procure access on competitive commercial terms, to infrastructure owned by the State or GNPC or any Affiliate of or entity controlled by the State or GNPC or owned by any third party, required for the transportation and/or processing of Petroleum produced under this Agreement.

7.4 All reasonable expenses incurred by GNPC in connection with any of the matters set out in Article 7.3 above shall be borne by Contractor.

7.5 GNPC shall use its best efforts to render assistance to Contractor in emergencies and major accidents, and such other assistance as may be requested by Contractor, provided that any reasonable expenses involved in such assistance shall be borne by Contractor.

ARTICLE 8

COMMERCIALITY

8.1 Contractor shall notify the Minister and GNPC in writing as soon as possible after any Discovery is made, but in any event not later than thirty (30) days after any Discovery is made.

8.2 As soon as possible after the analysis of the test results of such Discovery is complete and in any event not later than one hundred (100) days from the date of such Discovery, Contractor shall by a further notice in writing to the Minister indicate whether in the opinion of Contractor the Discovery merits appraisal.

8.3 Where the Contractor indicates that the Discovery does not merit appraisal, Contractor shall, subject to Article 8.17 below, relinquish the Discovery Area associated with the Discovery.

8.4 Where Contractor indicates that the Discovery merits appraisal, Contractor shall submit to the Minister within one hundred and eighty (180) days from the date of Discovery, an Appraisal Programme to be carried out by Contractor in respect of such Discovery. After thirty (30) days following its submission the Appraisal Programme shall be deemed approved as submitted, unless the Minister has before the end of the said thirty (30) period given the Contractor a notice in writing stating:

i. that the Appraisal Programme as submitted has not been approved; and

ii. the revisions proposed by the Minister to the Appraisal Programme submitted, and the reasons therefor.

8.5 Unless Contractor and the Minister otherwise agree in any particular case, Contractor shall have a period of two (2) years from the date of Discovery to complete the Appraisal Programme.

8.6 Contractor shall commence to conduct the Appraisal Programme within one hundred and fifty (150) days from the date of approval or deemed approval of the Appraisal Programme by the Minister. Where the Contractor is unable to commence the conduct of the Appraisal Programme within one hundred and fifty (150) days from the date of approval or deemed approval of the Appraisal Programme by the Minister, GNPC shall be entitled to exercise the option provided for in Article 9.1 to enable prompt appraisal, provided however that after Contractor actually embarks on appraisal work or obtains an extension of time for such work, this option may not be exercised.

8.7 Not later than ninety (90) days from the date on which said Appraisal Programme relating to the Discovery is completed, Contractor will submit to the Minister a report containing the results of the Appraisal Programme. Such report shall include all available technical and economic data relevant to a determination of commerciality, including, but not limited to, geological and geophysical conditions, such as structural configuration, physical properties and the extent of reservoir rocks, areas, thickness and depth of pay zones, pressure, volume and temperature analysis of the reservoir fluids; preliminary estimates of Crude Oil and Natural Gas reserves; recovery drive characteristics; anticipated production performance per reservoir and per well; fluid characteristics, including gravity, sulphur percentage, sediment and water percentage and refinery assay pattern.

8.8 Not later than ninety (90) days from the date on which said Appraisal Programme is completed Contractor will, by a further notice in writing, inform the Minister whether the Discovery in the opinion of Contractor is or is not a Commercial Discovery.

8.9 If Contractor informs the Minister that the Discovery is not a Commercial Discovery, then subject to Articles 8.17, Contractor shall relinquish such Discovery Area; provided, however, that in appropriate cases, before declaring that a Discovery is not a Commercial Discovery, Contractor shall consult with the other Parties and may make appropriate representations proposing minor changes in the fiscal and other provisions of this Agreement which may, in the opinion of Contractor, affect the determination of commerciality. The other Parties may, where feasible, and in the best interests of the Parties agree to make such changes or modifications in the existing arrangements.

8.10 If Contractor pursuant to Article 8.8 informs the Minister that the Discovery is a Commercial Discovery, Contractor shall not later than one hundred and eighty (180) days thereafter, prepare and submit to the Minister a Development Plan.

8.11 The Development Plan referred to in Article 8.10 shall be based on detailed engineering studies and shall include:

a) Contractor’s proposals for the delineation of the proposed Development and Production Area and for the development of any reservoir(s), including the method for the disposal of Associated Gas in accordance with the provisions of Article 14.4;

b) the way in which the Development and Production of the reservoir is planned to be financed;

c) Contractor’s proposals relating to the spacing, drilling and completion of ▇▇▇▇▇, the production, storage, transportation and delivery facilities required for the production, storage and transportation of the Petroleum, including without limitation:

i) the estimated number, size and production capacity of production platforms if any;

ii) the estimated number of Production ▇▇▇▇▇;

iii) the particulars of feasible alternatives for transportation of the Petroleum, including pipelines;

iv) the particulars of onshore installations required, including the type and specifications or size thereof; and

v) the particulars of other technical equipment required for the operations;

d) the estimated production profiles for Crude Oil and Natural Gas from the Petroleum reservoirs;

e) estimates of capital and Production Operation expenditures;

f) the economic feasibility studies carried out by or for Contractor in respect of alternative methods for Development of the Discovery, taking into account:

i) location;

ii) water depth (where applicable);

iii) meteorological conditions;

iv) estimates of capital and Production Operation expenditures; and

v) any other relevant data and evaluation thereof;

g) the safety measures to be adopted in the course of the Development and Production Operations, including measures to deal with emergencies;

h) the necessary measures to be taken for the protection of the environment;

i) Contractor’s proposals with respect to the procurement of goods and services obtainable in Ghana;

j) Contractor’s plan for training and employment of Ghanaian nationals; and

k) the timetable for effecting Development Operations.

8.12 The date of the Minister’s approval of the Development Plan shall be the Date of Commercial Discovery.

8.13 After thirty (30) days following its submission, the Development Plan shall be deemed approved as submitted, unless the Minister has before the end of the said thirty (30) day period given Contractor a notice in writing stating:

i) that the Development Plan as submitted has not been approved; and

ii) the revisions, proposed by the Minister, to the Development Plan as submitted, and the reasons thereof.

8.14 Where the Development Plan is not approved by the Minister as provided under Article 8.13 above, the Parties shall within a period of thirty (30) days from the date of the notice by the Minister as referred to under Article 8.13 above meet to agree on the revisions proposed by the Minister to the Development Plan. In the event of failure to agree to the proposed revisions, within fourteen (14) days following said meeting any matters in dispute between the Minister and the Contractor shall be referred for resolution in accordance with Article 24.

8.15 Where the issue in dispute referred for resolution pursuant to Article 24 is finally decided in favour of Contractor the Minister shall forthwith give the requisite approval to the Development Plan submitted by Contractor.

8.16 Where the issue in question referred for resolution pursuant to Article 24 is finally decided in favour of the Minister in whole or in part, Contractor shall forthwith:

i) amend the proposed Development Plan to give effect to the final decision rendered under Article 24, and the Minister shall give the requisite approval to such revised Development Plan; or

ii) subject to Article 8.19 below relinquish the Discovery Area.

8.17 Notwithstanding the relinquishment provisions of Articles 8.3 and 8.9 above, if Contractor indicates that a Discovery does not at the time merit appraisal, or after appraisal does not appear to be commercial but may merit appraisal or potentially become commercial at a later date during the Exploration Period, then Contractor need not relinquish the Discovery Area and may continue its Exploration Operations in the Contract Area during the Exploration Period provided that the Contractor shall explain what additional evaluations, including Exploration work or studies (within or outside the Discovery Area), are or may be planned in order to determine whether subsequent appraisal is warranted or that the Discovery is commercial. Such

evaluations shall be performed by Contractor according to a specific time table, subject to its right of earlier relinquishment of the Discovery Area. After completion of the evaluations, Contractor shall make the indications called for under Article 8.2 or 8.8 and either proceed with appraisal, confirm commerciality or relinquish the Discovery Area. In any case, if at the end of the Exploration Period Contractor has not indicated its intent to proceed with an Appraisal Programme or that the Discovery is a Commercial Discovery, then the Discovery Area shall be relinquished.

8.18 Before Contractor indicates that the Discovery will not merit appraisal, or after an Appraisal Programme, indicates it will not be a Commercial Discovery, Contractor may consult with the other Parties and may make appropriate representations proposing minor changes in the fiscal and other provisions of this Agreement which may, in the opinion of Contractor, affect the determination of commerciality. The other Parties may, agree to make such changes or modifications in the existing arrangements. In the event the Parties do not agree on such changes or modifications, then subject to Article 8.17 and Article 8.19 Contractor shall relinquish the Discovery Area.

8.19 Nothing in Article 8.3, 8.9, 8.16 or 8.17 above shall be read or construed as requiring Contractor to relinquish:

a) any area which constitutes or forms part of another Discovery Area in respect of which:

i) Contractor has given the Minister a separate notice indicating that such Discovery merits appraisal or confirmation; or

ii) Contractor has given the Minister a separate notice indicating that such Discovery is a Commercial Discovery; or

b) any area which constitutes or forms part of a Development and Production Area.

8.20 In the event a field extends beyond the boundaries of the Contract Area, the Minister may require Contractor if it so wishes, to exploit said Field in association with the third party holding the adjacent area, pursuant to unitization and engineering principles and practices in accordance with accepted international Petroleum industry practices.

ARTICLE 9

SOLE RISK ACCOUNT

9.1 Subject to Article 8.6, unless and until Contractor has notified GNPC that it wishes to appraise a Discovery, GNPC may notify Contractor that it will at its sole cost, risk and expense commence to appraise that Discovery, provided that within thirty (30) days of such notification from GNPC, Contractor may elect to commence to appraise that Discovery within its Work Programme.

9.2 Where an appraisal undertaken under Article 9.1 at the sole expense of GNPC results in a determination that a Discovery is commercial, Contractor may develop the Commercial Discovery upon reimbursement to GNPC of all expenses incurred in undertaking the appraisal and arranging with GNPC satisfactory terms for the payment of a premium equivalent to seven hundred per cent (700%) of such expenses. Such premium shall not be reckoned as cost of Petroleum Operations for the purpose of the Accounting Guide. In the event that Contractor declines to develop said Discovery, Contractor shall relinquish the Development and Production Area established by the Appraisal Programme conducted by GNPC under Article 9.1.

9.3 During the Exploration Period GNPC may, at its sole risk and expense, require Contractor to continue drilling to penetrate and test horizons deeper than those contained in the Work Programme of Contractor or required under Article 4. GNPC may also at its sole risk ask the Contractor to test a zone or zones which Contractor has not included in Contractor’s test programme. Notice of this shall be given to Contractor in writing as early as possible prior to or during the drilling of the well, but in any case not after Contractor has begun work to test, complete or abandon the well. The exercise by GNPC of this right shall be in an agreed manner which does not prevent Contractor from complying with its work obligations under Article 4.3.

9.4 At any time before commencing such deeper drilling or testing under Article 9.3, Contractor may elect to embody the required drilling or testing in its own Exploration Operations, in which case any resulting Discovery shall not be affected by the provisions of this Article 9.

9.5 Where any sole risk deeper drilling or testing results in a Discovery, GNPC shall have the right, at its sole cost, risk and expense, to appraise, develop, produce and dispose of all Petroleum from that deeper horizon, provided however that if at the time such Petroleum is tested from the well, Contractor’s Work Programme includes a well or ▇▇▇▇▇ to be drilled to the same producing horizon, and provided that that the well or ▇▇▇▇▇ result (s) in a Petroleum producing well producing from the same

horizon, Contractor shall, after reimbursing GNPC for all costs associated with its Sole Risk deeper drilling in said well, have the right to include production from that well in its total production for the purposes of establishing a Commercial Discovery, and, if a Commercial Discovery is subsequently established, to develop, produce and dispose of the Petroleum in accordance with the provisions of this Agreement.